#cpi inflation calculator

Explore tagged Tumblr posts

Text

So I was curious —

$1.00 each in quantities of 1000 in 1977. That's about $5.19 each in 2023.

A quick search on DigiKey, and today Red rectangular through-hole LEDs can be had for under $0.08 each in quantities of 1000.

That's the equivalent of about $0.02 each in 1977.

1977

#reblog#commodorez#yodaprod#retrotech#retro technology#LED#hewlett packard#DigiKey#cpi inflation calculator

321 notes

·

View notes

Text

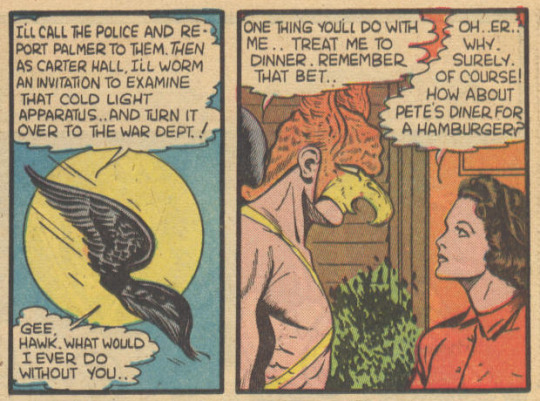

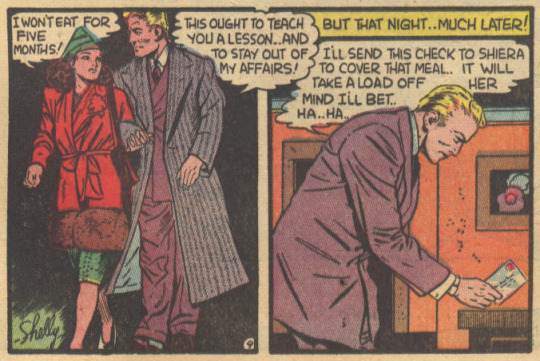

July 1941. Although she didn't become Hawkgirl until after this story in FLASH COMICS #19, Shiera Sanders was a regular presence in the Golden Age Hawkman strip from the start as Carter Hall's girlfriend and helper. In this story, he's bet her a dinner that he can wrap up the case within a week, which of course he does, to her dismay:

If you're wondering why Shiera looks so sick here, the CPI Inflation Calculator says $35 USD in mid-1941 is the equivalent of $730 USD now. Luckily, Carter, who is very rich, is not a complete ass:

It's not very clear in these stories what if anything Shiera does for a living. She and Carter are not married in any of their Golden Age appearances, and in principle they aren't living together, although in later stories, she's sometimes at his place for breakfast.

#comics#flash comics#hawkman#golden age hawkman#gardner fox#sheldon moldoff#carter hall#shiera sanders#hawkgirl#her first appearance in costume was in all-star comics 5#and then in flash comics 24 a few months later

17 notes

·

View notes

Text

oh cool, GNU units now has US bureau of labour CPI stats so you can do inflation calculations easily.

8 notes

·

View notes

Note

Real wages may have gone up, but I think rent growth and housing cost has outpaced inflation?

I don’t have a source, but my impression is that people are making more money and further from being able to acquire housing, at least in my information bubble.

rent is too damn high guy strikes again

granted, Trump is going to make it worse, but I don’t think people think about that. They look at the rent, they get mad, they vote against incumbents.

hot take: Walz VP pick was actually really good, I think Kamala significantly outperformed my expectations in the Midwest swing states despite losing anyway. Nobody will know for sure, but two coastal dems would’ve been a much worse look.

as an aside, I feel an absolutely instinctive level revulsion and distrust of JD Vance, and it’s wild that nobody else seems to notice. The guy is the one of the most transparently evil Yaley strivers I’ve ever seen, and people just fall for his massaged backstory without a second thought.

I think trump will do a bad job as president, but Vance and Thiel et. al. are actually dangerous

So "real wages" are a calculation of nominal wage increases that are ratio'd to increases in the prices of a basket of goods that households typically buy. That basket includes housing! It is about ~1/3rd of the CPI basket, and it changes as prices do. That doesn't mean "Real wages may have gone up, but I think rent growth and housing cost has outpaced inflation?" can't be true in a proportional sense - rent can be going up disproportionately and consuming a larger share, for example - but if rent was going up *so* much as to eat 100% of the wage gains....then real wages would not be going up. The calculation would show a decline.

Still, I get what you are saying - the housing market got incredibly hot in ~2022, and I think that is a big part of voter dissatisfaction. But two caveats on that. The first is that the majority of Americans own their home. That is most people's primary investment vehicle. So when housing prices go up for them...they benefit, they don't lose. 50% of the country got richer from that! No statement here on the economic justice or efficacy implications - I am only saying that elections are won by majorities. In this case, I think you can say people are often economically having their complaint cake and eating it too - they blame Biden for the increased grocery prices, but love that their house is now worth 20% more but don't give the admin any credit for that to offset the blame.

The other is that people rent and sell to consumers who buy homes. Housing in America is not being "left off the market by greedy speculators" or whatever, it is being bought by people to live in them, with money that they have. To the extent that "housing prices are going up" it is because american households are much richer and are putting that money into housing. If they weren't, the prices would go down.

Again, the economic justice angle is not my point - here I am quite confident that the specific dynamics of the housing market involved significant hardship for lower income Americans in a bunch of regions. Just again, elections are based on majorities, and the majority of Americans are not struggling to afford housing.

(I agree that this was politically rough for the dems of course! Just to make that clear)

5 notes

·

View notes

Text

Zoopla found that in London, first-time buyers would typically need a household income of £103,000.

In Wales, they would need £38,800 and in Scotland an income of £31,500 would be needed, according to the calculations.

Ezért költözik ide az összes angol

3 notes

·

View notes

Text

A new cost of living adjustment (COLA) prediction for Social Security has many seniors scratching their heads at how they'll stretch their benefits amid inflation.

The Senior Citizens League (TSCL) just predicted the COLA for 2025, saying beneficiaries can expect a 2.66 percent bump in benefits. Earlier in the year, the estimate was set at 2.6 and 2.4 percent.

If a 2.66 percent boost is implemented, it would likely increase monthly payments by around $50 for most recipients.

While the jump in monthly benefits would be better than the earlier predictions, many seniors were expecting a higher boost to deal with the impacts of inflation.

The Social Security Administration adjusts Social Security payment amounts every year based on the consumer price index, but not everyone feels the change would be enough to get by.

"While COLA payments will increase to offset the effects of inflation, the problem many have with the potential percentage jump is it won't get far enough to meet most of the financial needs of seniors," Alex Beene, a financial literacy instructor at the University of Tennessee at Martin, told Newsweek. "Obviously daily expenses for this age group continue to rise, but the uptick in healthcare costs are putting an additional strain on them, and COLA payments may not be enough to match that uptick."

Seniors will also likely be dealing with higher Medicare Part premiums, according to TSCL.

In the Medicare Trustee report from this month, Part B premiums were predicted to grow by $10.30 a month to a total of $185. That increase is on top of nationwide inflation on groceries, housing and transportation.

"For 2024, the average Social Security benefit rose by $50 and after subtracting $9.80 to cover Medicare Part B Premium increases, the total change in benefits came out to just $40.20 a month. With the forecast of a 2.66 percent COLA for 2025, it appears seniors will continue to suffer financial insecurity as much next year as they have this year," Shannon Benton, executive director of TSCL, said in a statement.

The COLA for each year depends on the rise of the consumer price index for urban wage earners and clerical workers (CPI-W) for the third quarter of the last year. That means the official COLA for 2025 won't be calculated until later in the year.

Many finance experts have questioned whether the CPI-W even stands as a good measure of what seniors can expect inflation wise, with many saying the consumer price index for the elderly (CPI-E)

In 2024, Social Security checks rose by 3.2 percent due to the COLA after a more generous increase of 8.7 percent last year. Many seniors, roughly 71 percent, reported in TSCL 2024 Senior Survey that the increase in household costs they saw went beyond the 3.2 percent jump from the COLA.

"The majority of seniors still feel like their costs are rising faster than those annual adjustments," Michael Ryan, a finance expert and founder/CEO of michaelryanmoney.com, told Newsweek. "So while the COLA certainly helps, it often still doesn't fully cover the real inflation draining seniors' buying power."

Due to the insufficient funds from Social Security for seniors, many will need additional income streams, including a 401(k), IRA or other investment accounts.

"At the end of the day, any COLA increase is better than none to prevent total Social Security stagnation," Ryan said. "But the 2.6 percent projection for 2025 underscores the need for policymakers to reexamine whether metrics like CPI-E would better serve seniors by more accurately reflecting their unique spending habits. We just want to make sure government benefits retain as much purchasing power over time as possible on those fixed incomes."

2 notes

·

View notes

Text

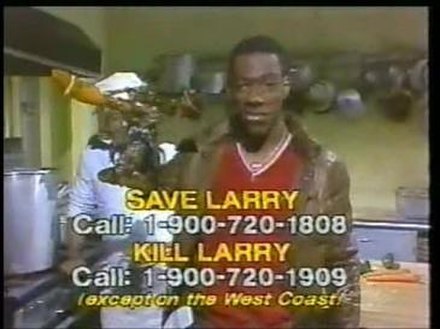

🦞SAVE LARRY, KILL LARRY🦞

The 1988 poll to kill Batman's child sidekick, Robin, was inspired by an early example of interactive television: a 1982 Saturday Night Live stunt starring Eddie Murphy and a live lobster.

The April 10, 1982 Saturday Night Live show opened with a chef grabbing a live lobster from its tank, making it dance while humming the Star Wars theme, and then laughing while lowering it into a pot of boiling water. Just before the lobster was placed into the pot, Eddie Murphy appeared, grabbed the lobster out from the way of certain death, and turned to address the audience.

Rather than being boiled alive without protest, Larry the Lobster's fate was submitted to the arena of popular opinion and disposable money. The show's audience was presented with two premium-rate "900" phone numbers"—one for those who wanted to spare Larry, and another for those who wanted to see it boiled alive. Each call cost $0.50, and each caller could call multiple times.

The lobster's televised ordeal can be seen below in a compilation video. (Warning for human cruelty toward an animal.)

Updates on the vote count were given by other cast members throughout the live broadcast; by the end of the show, viewers had made over 400,000 calls. Ultimately the "Save Larry" supporters managed a narrow win against the "Kill Larry" supporters.

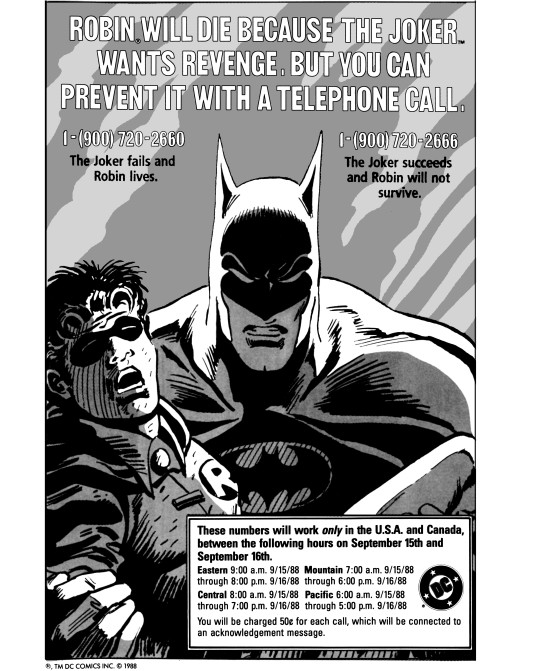

To kill a Robin

The SNL stunt stuck with DC Comics editor Denny O'Neil, and he proposed to fellow editor Jenette Kahn that they could reserve a similar stunt for killing off a high-profile DC Comics character. By the time of 1988, Batman's colorful child sidekick Robin had been considered a divisive character among the creative forces behind Batman and among Batman fans. After Batman writer Jim Starlin's unsuccessful campaign to kill off Robin in a HIV/AIDS storyline, O'Neil decided the problematic Robin was the perfect candidate for a "Larry the Lobster" stunt. Sales manager John Pope began calling AT&T to secure the two 900 numbers on October 1, 1987; it took him until March 1988 to reserve them.

Like in Larry's case, the voting results were extremely close. Unlike Larry, the outcome supported Robin's death over his survival.

Fun facts!

Larry the Lobster predates Jason Todd's existence. "Larry the Lobster" aired on 10 April 1982. Jason Todd first appeared in the Batman comic in 1983, and he made his first appearance as Robin several months later. This might add credence to the idea that the idea for a DC Comics death poll wasn't specifically conceived with Robin in mind.

Within a span of a single SNL show, a total of 466,548 premium-rate calls were made to decide Larry's fate.

Within a span of 35 hours, a total of

At a cost of $0.50 per call, callers spent a total of $233,274.00 on Larry's poll. (After adjusting for inflation since 1982, this amount would be about $751,420.05 in 2023 dollars.)

At a cost of $0.50 per call, callers spent a total of $5,307 on Robin's poll. (After adjusting for inflation since 1988, this amount would be about $13,541.75 in 2023 dollars.)

Larry was spared by a margin of 11,644 votes. These votes cost a total of $5,822.00.

Robin was condemned to death by a margin of 72 votes. These votes cost a total of $36.00.

Both polls were decided by a margin of less than 1%.

A lobster's probable end

In the aftermath of the sketch, Murphy received letters protesting Larry's treatment. One letter made a racist jab at Murphy: "that man is sick, and I thought those people didn't like seafood."

youtube

To spite this racist comment, Murphy ensured that Larry's stay of execution was only temporary.

Credits

Thanks to the Internet Archive @internetarchive for access to old SNL episodes. https://archive.org/details/saturday-night-live-s-07-e-16-daniel-j-travanti-john-cougar-mellencamp

"Larry the Lobster" on Wikipedia

"A Death in the Family" (comics) on Wikipedia

CPI Inflation Calculator https://data.bls.gov/cgi-bin/cpicalc.pl

#Saturday Night Live#Jason Todd#DC Robin#DC Comics#Robin DC#Batman comics#SNL#Eddie Murphy#Larry#Larry the Lobster#Batman#Batfam#Batfamily#Batkids#Robin#thekillingvote#Dennis O'Neil#1982#1988#Dark Age of Comics#Batboys#animal abuse CW#animal cruelty CW#animal death mention CW#seafood#food#This post has everything. Animal cruelty. Donkey from Shrek. Racism. Likely insensitive depictions of HIV. Murderous clowns.#not transcribed

10 notes

·

View notes

Text

Joe Did That: Inflation Costs Americans an Extra $1000 Monthly

CATHERINE SALGADO | 5:14 PM ON APRIL 12, 2024

Thanks to the wonders of Bidenomics, the average American is spending over a thousand dollars extra a month. Fortunately, Biden is focused on important things — like funding jihad supporters in Gaza and paying off student loans with taxpayer money the government cannot spare.

Fox Business highlighted the $1,069 cost increase compared to three years ago before Joe Biden’s disastrous economic policies drove up inflation higher than Hunter Biden smoking Parmesan cheese. Inflation has allegedly fallen since 2022, but the context for that statement is that inflation is still rising, just at a supposedly slower rate — inflation went up about 18% under Biden. You still have to shell out more money for the basic costs of living than you did two or three years ago, which is why Americans are increasingly burdened with credit card debt.

As of February, two-thirds of full-time American workers said that their income had not kept pace with inflation. Real wages have been steadily dropping since Biden took office.

From Fox Business:

The typical U.S. household needed to pay $227 more a month in March to purchase the same goods and services it did one year ago because of still-high inflation, according to calculations from Moody's Analytics chief economist Mark Zandi shared with FOX Business. Americans are paying on average $784 more each month compared with the same time two years ago and $1,069 more compared with three years ago, before the inflation crisis began… when compared with January 2021, shortly before the inflation crisis began, prices remain up a stunning 18.94%.

Food, child care, and rent — the necessities — are devastatingly expensive under the Biden administration. Fox quoted Bright MLS chief economist Lisa Sturtevant, “Inflation has not just stalled, but it is moving in the wrong direction.” Unfortunately, low-income Americans — those who can least afford to spend more — are of course hardest hit by rising costs.

The Consumer Price Index (CPI), which measures the costs of what is supposed to be a representative “basket of goods,” continues to be well above the rate that the U.S. had before the economically damaging COVID-19 pandemic, Fox explained. The necessities mentioned above (food, rent, child care) are significantly more expensive than they were just a year ago.

“Housing and gasoline costs were the biggest drivers of inflation last month, accounting for more than half of the total monthly increase,” Fox added. Food and auto insurance costs also went up, with the latter at a sobering 22.2% increase over the same time in 2023. Inflation is causing Americans to use up savings and increasingly rack up credit card debt to meet expenses, a situation that is both risky and unsustainable.

Credit card debt in America reached a new record high by the end of December 2023, Fox Business noted, citing data from the New York Federal Reserve.

Bidenomics has been nothing but a catastrophe for ordinary Americans, costing them ever more money even as their real wages decrease.

2 notes

·

View notes

Text

RT @KaironLabs: 1/4 With Last week's new #CPI calculation method. CPI still came in showing over expectations - signaling that #inflation is picking up again. #cryptomarketmaker #cryptocurrencies #alt #Ethereum #USDT #CryptoInvestor #CryptoInvestor https://t.co/b0zLRTryYk

RT @KaironLabs: 1/4 With Last week’s new #CPI calculation method. CPI still came in showing over expectations – signaling that #inflation is picking up again. #cryptomarketmaker #cryptocurrencies #alt #Ethereum #USDT #CryptoInvestor #CryptoInvestor https://t.co/b0zLRTryYk — Patrick Rooney (@patrickrooney) Feb 20, 2023 https://platform.twitter.com/widgets.js from Twitter…

View On WordPress

2 notes

·

View notes

Text

The Insider's Guide to Medium-Term News Trading: Strategies the Pros Won’t Tell You Why Most Traders Get It Wrong (And How You Can Avoid It) If you've ever tried news trading and felt like you were playing a game of "guess the candle," you're not alone. Many traders approach news events like a Black Friday sale—rushing in, grabbing whatever looks shiny, and then realizing they bought something utterly useless (like a $5 toaster that only works on alternate Tuesdays). Here’s the thing: Most traders treat news trading like a short-term, knee-jerk reaction game, completely ignoring the medium-term impact of economic releases. They get caught in the initial spike, forget the big picture, and miss out on sustained, profitable moves that unfold over days and weeks. So, how do the pros do it? Welcome to the insider's guide to medium-term news trading—where we ditch the impulsive gambling and uncover strategic, calculated approaches that lead to consistent wins. The Hidden Patterns That Drive the Market Economic news isn’t just about the headlines—it’s about how the market reacts to them over time. While retail traders obsess over the first 5-minute candle after an NFP release, institutional traders are already plotting multi-day moves. The real opportunities in medium-term news trading lie in understanding how news events reshape market sentiment, trend structures, and liquidity over a period of days and weeks. Here’s what most traders miss: ✅ Delayed Reaction Phenomenon – Some of the biggest moves don’t happen instantly. Markets often take 12-72 hours to fully price in economic news, creating prime opportunities for trend traders who know what to watch for. ✅ Market Repricing & Narrative Shifts – When major data surprises the market (think an unexpected Fed rate cut), traders and analysts spend days recalibrating expectations. This fuels multi-day trends that offer cleaner, more predictable trade setups. ✅ Positioning & Stop Hunts – Smart money often engineers fake-outs before riding the real trend. Understanding order flow dynamics around news events gives you an edge over the crowd. The Medium-Term News Trading Playbook Now that we’ve established why short-term news traders are missing out, let’s break down the actual game plan for capitalizing on economic news the smart way. Step 1: Identify the High-Impact News Events That Matter Not all news events are created equal. If you’re reacting to every little blip in the economic calendar, you’re setting yourself up for whiplash. Focus on high-impact releases that truly move the market: 📌 Central Bank Rate Decisions (Federal Reserve, ECB, BOE, etc.) – Medium-term trends often emerge based on the guidance central banks provide. 📌 Inflation Reports (CPI, PPI) – Persistent inflation trends force markets to reprice interest rate expectations over weeks, not just minutes. 📌 Employment Data (NFP, Unemployment Rate) – A single surprise NFP report can send ripples across FX pairs for several trading sessions. 📌 GDP Growth Reports – Sustained economic growth shifts investor sentiment and drives medium-term positioning. 📌 Geopolitical & Policy Shifts – Trade policies, sanctions, or unexpected political changes can reshape market trends for weeks. 👉 Pro Tip: Don’t just look at the numbers—analyze market expectations vs. actual results. A “bad” number that’s better than expected can be bullish, while a “good” number that disappoints expectations can be bearish. Step 2: Let the Dust Settle – The 12-72 Hour Rule Most traders think immediate price action reflects the final verdict on a news event. Wrong. 📌 Institutional traders digest news over multiple trading sessions. They adjust positions, re-evaluate forecasts, and gradually shift market sentiment. 📌 Smart traders wait for liquidity grabs (stop hunts) before entering trades. The first move after a news release is often a trap before the real trend emerges. ✅ Wait 12-72 hours after major news before committing to a medium-term trade. ✅ Use price action and sentiment analysis to confirm where the market is actually headed—not just where it spiked initially. ✅ Look for trend continuation or reversal patterns once volatility stabilizes. Step 3: Use Sentiment and Positioning as Confirmation The pros don’t just look at charts���they analyze what traders are actually doing behind the scenes. Here’s what to check: 📌 COT Reports (Commitments of Traders) – Are hedge funds increasing their longs or shorts after a major news event? 📌 Options Market Activity – Look at open interest and positioning to gauge medium-term expectations. 📌 Retail Sentiment Tools – If 80% of retail traders are short after a bullish news event, it’s probably time to go long. Step 4: Ride the Institutional Wave Once the medium-term trend is in play, here’s how to trade it like a pro: ✅ Enter on pullbacks, not spikes – Market makers love shaking out weak hands before the real move begins. ✅ Target 2-5x ATR (Average True Range) for take-profits – Medium-term news-driven trends tend to last several sessions. ✅ Use trailing stops to lock in profits as the trend unfolds. ✅ Monitor news follow-ups – New data releases can either reinforce or invalidate your trade thesis. Conclusion: Why Medium-Term News Trading Wins Most traders overcomplicate news trading by chasing short-term noise instead of focusing on the big picture. 🔹 The key to winning with medium-term news trading is understanding market psychology, institutional positioning, and delayed reactions. 🔹 Instead of gambling on the initial spike, wait for confirmation, ride the sustained trend, and let the pros show their hand first. Want to master this approach? Get access to expert analysis, live insights, and premium trading tools at StarseedFX and start trading like an insider today! —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

What's the difference between us today and indentured servants?

We seek the rite of passage into the "adult world" of our parents with schooling and some sort of housing, but those things have been contractualized with pay walls that will take years to pay off. Heaven forbid you get sick or lose your job

Wages are all over the place or not mentioned (most likely minimum). The federal minimum wage has not risen since 2009. It would be 10.84 in December 2024 if it kept up with inflation. It is not a living wage, which would be around $21/hr in my area. This disparity lenthens the amount of time needed to pay debts off, the same as increasing interest rates

Hours are cut to 35 a week and branded as better, but it's probably to avoid overtime pay after 40 hours. They also tend not to mesh well with other jobs, "we need a flexible schedule" and bosses will absolutely mess with it

Rent is sky high. There's computer programs that calculate how to profit from renting, I have seen attic spaces advertising for $1,600

Somehow, we've got to eat, sleep, and clean our abodes too

0 notes

Text

Understanding the 2023 Federal Retiree COLA: A Guide for FERS Retirees| Smarter Feds

Introduction

For federal retirees, the annual Cost-of-Living Adjustment (COLA) is a crucial aspect of their retirement income. This adjustment helps retirees maintain their purchasing power in the face of inflation. In 2023, federal retirees experienced a significant COLA increase, offering much-needed relief from rising costs. This article will delve into the details of the 2023 federal retiree COLA, focusing specifically on those under the Federal Employees Retirement System (FERS).

What is the 2023 Federal Retiree COLA?

The 2023 federal retiree COLA was a substantial 8.7%. This increase was implemented to help retirees keep pace with the rising cost of living, as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Who is Eligible for the 2023 FERS COLA?

Generally, all FERS retirees are eligible for the COLA. However, there are some exceptions:

Retirees under 62: FERS retirees who are under 62 years old on December 1, 2023, are typically not eligible for the COLA.

Certain disability annuitants: Some disability annuitants may not be eligible.

How is the FERS COLA Calculated?

The COLA is calculated based on the percentage increase in the CPI-W over the 12-month period ending in September of the previous year.

Key Considerations for FERS Retirees

SF-182: Retirees should review their SF-182 form carefully to understand their specific eligibility and any applicable limitations to their COLA.

Tax Implications: The COLA may have tax implications. Consult with a tax advisor to understand how the increase may affect your tax liability.

Planning for Future COLAs: While the 2023 COLA was significant, it's important to plan for future COLAs, which may vary depending on inflation rates.

Conclusion

The 2023 federal retiree COLA provided much-needed financial relief for many retirees. By Smarter Feds understanding the eligibility criteria, calculation methods, and potential implications, FERS retirees can effectively manage their retirement finances and navigate the complexities of the COLA system.

0 notes

Text

Inflation eases in Pakistan, falls to 4.1% in December 2024

On a month-on-month basis, inflation creeps up slightly by 0.1% A shopkeeper using a calculator in this undated picture. — Reuters/File CPI inflation fell down from 29.7% in December 2023. In urban areas, CPI inflation decreased to 4.4% YoY. Rural areas also saw reduction in YoY inflation to 3.6% in Dec. KARACHI: Inflation trajectory showed signs of easing in December 2024, although persistent…

0 notes

Text

CPI base year revision: MOSPI floats discussion paper on treatment of PDS items & other free social transfers

Should free social transfers, as well as food grains provided under the public distribution system, be taken into account in India’s retail inflation calculation? This is the question the Department of Statistics is grappling with in its effort to revise the base year of the Consumer Price Index (CPI), update the weights of different items in the CPI basket and possibly improve the compilation…

0 notes

Text

According to the CPI Inflation Calculator, $475 in June of 1963 is equivalent to $4,787.52 in January of 2024.

1963 Refrigerator 🤔

75K notes

·

View notes

Text

CPI annual base update: MOSPI floats discussion paper on treatment of PDS items and other free public transfers

Should free social transfers as well as grains provided under the public distribution system be included in India’s inflation calculations? This is the question faced by the Ministry of Statistics, in their efforts to update the base year in the Consumer Price Index (CPI) and to update the weights of the different items in the CPI basket and to improve the aggregation method. The CPI is an…

0 notes