#councilhousing

Explore tagged Tumblr posts

Text

Council House Credits in the UK: What You Need to Know

What Are Council House Credits? Key Features of Council House Credits: A Detailed Breakdown1. Rental Assistance 2. Means-Tested Support 3. Linked to Universal Credit Eligibility for Council House Credits1. Income-Based Criteria 2. Savings Threshold 3. Tenancy Type 4. Personal Circumstances 5. Renting Conditions How to Apply for Council House Credits How Council House Credits Impact the UK Housing Market Challenges and Future Outlook Conclusion Council House Credits in the UK: What You Need to Know In the UK, council housing plays a crucial role in providing affordable accommodation for millions of people. Over the years, the government has introduced various schemes to assist tenants, including council house credits. These credits offer financial relief to those struggling to meet their housing costs, ensuring that vulnerable members of society have access to secure, affordable housing. In this article, we’ll explore the concept of council house credits, eligibility requirements, and their impact on the housing market.

What Are Council House Credits? Council house credits, often referred to as Housing Benefit or part of the Universal Credit scheme, are payments made to help cover the cost of rent for those living in council or social housing. Introduced to ensure that low-income households can afford decent accommodation, these credits are designed to prevent homelessness and provide stability to individuals and families in need. They are typically administered by local authorities and funded by the government. Key Features of Council House Credits: A Detailed Breakdown Understanding the key features of council house credits is essential for tenants and landlords alike. Council house credits are a vital component of the UK welfare system, helping low-income households maintain secure housing. These features highlight how the credits function, who can receive them, and how they fit into the broader welfare landscape. 1. Rental Assistance Council house credits are primarily designed to ease the financial burden of rent for low-income households. These credits may cover part or all of a tenant’s rent, depending on their financial situation and other specific criteria. - Partial or Full Coverage: Tenants with very low or no income might receive full rent coverage, whereas those with some income (for example, part-time workers) may receive only partial rent assistance. The credit is adjusted based on the individual’s income, which is means-tested to ensure that support is targeted at those who need it most. - Direct Payments to Landlords: In many cases, the housing credit is paid directly to the landlord, ensuring that rent is paid without delay. However, tenants may also receive the payment themselves, especially when the credit is bundled with other welfare payments through Universal Credit. - Support for Vulnerable Groups: Those who are unemployed, disabled, or elderly often rely heavily on this assistance. In these cases, the credit covers the majority, if not all, of their rent, helping them to live independently and preventing homelessness. 2. Means-Tested Support The means-tested nature of council house credits ensures that they are distributed based on financial need. This system evaluates a household’s income, savings, and financial status to determine eligibility. - Income Thresholds: The credits are designed for those with low incomes, and the amount one can receive is directly influenced by their earnings. Individuals who are unemployed, earning minimum wage, or working part-time may receive higher levels of support compared to those with higher incomes. The system accounts for income from employment, pensions, and other benefits. - Savings Cap: Households with savings exceeding £16,000 are typically not eligible for council house credits, as they are considered financially capable of supporting themselves without government aid. For those with savings between £6,000 and £16,000, the amount of credit they receive is reduced, as their savings are considered when assessing need. - Dependents and Household Size: Families with children or other dependents often receive larger credits to cover higher living expenses. This includes single parents, caregivers, or those looking after disabled family members, who may need additional support. 3. Linked to Universal Credit In recent years, the UK welfare system has undergone substantial changes, particularly with the introduction of Universal Credit. Council house credits are now commonly integrated into Universal Credit payments, simplifying the process of receiving financial support. - Universal Credit Integration: Universal Credit replaces several separate welfare payments (such as housing benefit, jobseeker’s allowance, and income support) with a single monthly payment. This consolidated approach simplifies the system, allowing individuals to manage all their benefits through one application. - Impact on Payments: As housing benefit is part of Universal Credit, it is paid directly to tenants along with their other entitlements. While this can offer more flexibility for tenants in managing their finances, it also requires careful budgeting, as recipients must ensure that rent is prioritized within their overall Universal Credit payment. - Delays and Adjustments: While the integration into Universal Credit has streamlined the welfare process, it has also caused some challenges, including delays in payments and the need for recipients to adjust to receiving a single monthly sum. This can result in temporary financial hardship for some, particularly for those unaccustomed to budgeting over a longer period. Eligibility for Council House Credits The eligibility criteria for council house credits are crucial in determining who qualifies for financial assistance. Several factors influence whether an individual or household can receive these credits, including income, savings, personal circumstances, and tenancy conditions. 1. Income-Based Criteria Council house credits are primarily aimed at individuals and families with low incomes. The lower a household’s income, the more financial support they are likely to receive. - Unemployed Individuals: Those without employment, especially if receiving other forms of welfare support, are among the primary recipients of council house credits. The credits help ensure that even without income from work, individuals can remain in secure housing. - Part-Time and Low-Wage Workers: Many part-time workers or individuals earning minimum wage can still struggle to afford rent. The credits are available to supplement their income, ensuring they can afford their housing costs without falling into financial distress. - Fluctuating Income: For individuals with fluctuating or unstable incomes (e.g., freelancers or those on zero-hour contracts), the amount of council house credit can vary month by month. This system aims to ensure that support is adjusted in line with real-time financial circumstances. 2. Savings Threshold As mentioned, savings play a significant role in determining eligibility for council house credits. The system uses a tiered approach to assess whether a household with savings should receive credits. - Savings Below £6,000: Those with savings under £6,000 are eligible to receive full council house credits, as they are deemed to be in financial need. - Savings Between £6,000 and £16,000: Households with savings in this range are subject to a sliding scale, where the amount of credit they receive decreases as their savings increase. - Savings Above £16,000: Households with savings exceeding £16,000 are generally not eligible for housing benefit, as they are expected to use their savings to cover living expenses, including rent. 3. Tenancy Type To qualify for council house credits, tenants must have a valid tenancy agreement with either a local council, housing association, or private landlord. - Council and Housing Association Tenants: Those living in council or social housing are the primary recipients of these credits. The rent in such properties is typically lower than in private rentals, but the credits ensure that those with low incomes can still afford these reduced rates. - Private Rental Sector: Although primarily intended for those in social housing, council house credits are also available to private tenants if their rent is below a certain threshold and they meet other eligibility criteria. 4. Personal Circumstances The personal circumstances of an applicant are also taken into account when determining eligibility and the amount of council house credit they can receive. - Age and Disability: Elderly or disabled individuals often qualify for higher levels of assistance. Additional support may be offered to cover the costs of accommodations that meet specific accessibility needs or the cost of carers. - Number of Dependents: Families with children or dependents are likely to receive more credit due to their higher living expenses. Single parents, in particular, may be eligible for larger payments. 5. Renting Conditions To be eligible for council house credits, tenants must have a formal tenancy agreement and must be actively paying rent. This ensures that the credits are directed towards covering legitimate housing costs, preventing misuse of the system. Council house credits serve as a cornerstone of the UK’s social safety net, providing essential financial support to low-income households. By understanding the key features and eligibility criteria, tenants can better navigate the system, ensuring they receive the assistance they need to maintain stable housing. This system, while not without challenges, continues to play a critical role in preventing homelessness and ensuring access to affordable housing for the most vulnerable in society. How to Apply for Council House Credits Applying for council house credits can be done through your local council’s website or, for those on Universal Credit, through the government’s online Universal Credit portal. Applicants must provide personal details, information on income, rent, and their tenancy agreement to process the application. Once verified, eligible tenants will begin receiving housing benefit either directly or as part of their Universal Credit payment. How Council House Credits Impact the UK Housing Market Council house credits have a significant impact on the social housing sector in the UK. For many, these credits provide the only means to afford stable housing. This system, though vital, faces some criticisms and challenges: - Reducing Rent Arrears: Council house credits help tenants stay up to date with their rent payments, reducing the risk of arrears and eviction. For councils and housing associations, this means greater financial stability. - Encouraging Tenant Retention: By providing rental assistance, council house credits encourage tenants to remain in their homes long-term, fostering community stability. - Housing Availability: However, some argue that these credits can indirectly contribute to housing shortages. When credits are extended to private renters, it increases demand in both the social and private sectors, which may raise rental prices for non-eligible tenants. - Welfare Reform: Recent changes to welfare, particularly the integration of housing benefit into Universal Credit, have raised concerns about delays in payment, leading to short-term financial stress for tenants. Such reforms have been a point of contention in political discourse on housing policy. Challenges and Future Outlook The landscape of council housing and housing credits continues to evolve. The demand for affordable housing in the UK far exceeds supply, putting significant pressure on the government to reform social housing policies and increase the construction of council homes. As welfare reform progresses, ensuring timely payment of housing credits and preventing homelessness remain critical challenges. In the future, there may be discussions about increasing council house credits, given rising rental costs and economic pressures. Moreover, policymakers may need to reconsider the balance between social and private sector housing to alleviate the strain on both tenants and the market. Conclusion Council house credits are a lifeline for many UK residents, offering critical financial support in a challenging housing market. Understanding how they work, who is eligible, and their broader impact on the housing sector can help tenants, landlords, and policymakers navigate the evolving landscape of social housing. As housing demands grow, it will be vital to ensure that council house credits remain an effective tool in maintaining affordable housing and preventing homelessness. FAQs: - Can I receive council house credits if I’m working? Yes, council house credits are available to those working part-time or on low incomes, though the amount may be reduced based on your earnings. - How are council house credits paid? If you’re receiving Universal Credit, the housing benefit component is included in your monthly Universal Credit payment. - What happens if I stop being eligible? Your council or the Universal Credit office will notify you of any changes in eligibility, and your payments may stop or decrease accordingly. Read the full article

0 notes

Photo

#mywork #builtlegacy #councilhousing #forclients @lutoncouncil #1989 #homesforpeople #housingshortagerelief https://www.instagram.com/p/CpsbCZvozwx/?igshid=NGJjMDIxMWI=

0 notes

Text

For more information call us on 📞0333 242 0857,📱07865331668 or submit an enquiry for information on 🌐www.drdamp.co.uk to book a damp surveys.

RESTORING HEALTH AND RESTORING HAPPINESS 😊

⭐️5* reviews Yell.com

⭐️5* reviews Google

0 notes

Text

Housing fraudster evicted following lengthy legal battle

A three-bedroom council house has been freed-up for a family in need after Hillingdon Council discovered in 2018 a fraudster had been living there illegally for years. The result follows a long-running legal battle with a Bangladeshi national who'd entered the UK in 1993 on a stolen identity, using someone else's passport. Uxbridge County Court had been told the resident, who cannot be named for legal reasons, had presented to the council as homeless, along with her four children, back in 2002. She was offered temporary accommodation, then placed on the council's waiting list, where she later made a successful bid for a three-bedroom property in Uxbridge, in August 2003. In 2018 the council's housing team was made aware the resident was under investigation by the council's counter fraud team for deception and that criminal proceedings were being brought against her and her husband. In 2019 she was charged with, and later admitted, claiming social security benefits that she wasn't entitled to, totalling more than £234,000 and was later sentenced to three and a half years in prison. Following her conviction, the council instructed its legal services team to obtain possession of the property, however the tenant refused to give it back and a legal wrangle ensued which lasted four years. She was finally evicted on 19 April this year. #housing #fraudster #evicted #councilhouse #councilhousing Read the full article

#Bangladeshinational#benefits#CabinetMemberforFinance#CllrMartinGoddard#councilhouse#evicted#fraudster#Hillingdoncouncil#housing#illegally#legalbattle#living#passport#socialsecurity#stolenidentity#temporaryaccommodation#UxbridgeCountyCourt

0 notes

Photo

Carnbrook Road, Greenwich, Peter Barber Architects

#carnbrookroad#peterbarber#greenwich#councilhousing#architecture#construction#london#photography#brick

4 notes

·

View notes

Photo

Balconies of the huge (and gorgeous) Aubert Court in Highbury. One of early post-war council developments, built between 1947-1953.

26 notes

·

View notes

Text

15.10.2019

On the way home, I decided to take a look at a tv programme Stuart recommended - George Clarke's Council House Scandal.

It was only an hour long but extremely insightful and gave me a lot of information on The Addison Act, Permitted Development rights and the Right to Buy Scheme. As I mentioned before, I do not have a lot of responsibilities relating to social housing, and even less for council housing.

It really opened my eyes to the current status of council housing and also a history of how it began and continued through to today. George Clarkes puts forward a great argument for reform within the housing sector, and it is definitely something I recommend watching.

George Clarke also has a dedicated website for his petition, which includes a blog and feed with people's opinions and stories on.

https://www,councilhousescandal.co.uk

As property managers, we see a lot of different homes; the good, the bad and the ugly. This has reminded me to never forget how necessary it is to have a good home in working order that gives us what we need. The job we do allows people to have that, and the knowledge I am going throughout this apprenticeship is making me even more motivated to do the best I can in my work and my course.

#apprenticeship#cih#charteredinstituteofhousing#irpm#catch22#propertymanagement#councilhousing#cihhousing

1 note

·

View note

Link

Social landlords and local housing authorities deliver residential units to homeless people where the council uses a set of rules to prioritize the applications based on who needs a home urgently.

#councilhousing#applyforcouncilhouse#howtogetacouncilhouse#Council House#house#realestate#property#ukproperty

1 note

·

View note

Photo

Karl Marx Hof, Heiligenstadt, Vienna #socialhousing #councilhousing #gemeindebau #karlmarxhof #heiligenstadt #vienna (at 12 Februar-Platz) https://www.instagram.com/p/CdtYtP2KbUQ/?igshid=NGJjMDIxMWI=

1 note

·

View note

Photo

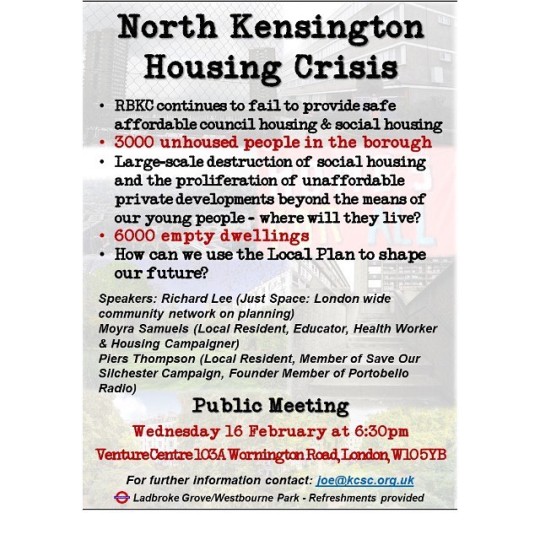

Join us on Wednesday 16 February at 6:30-8pm @ Venture Centre 103A Wornington Road, London, W10 5YB NORTH KENSINGTON HOUSING CRISIS COMMUNITY MEETING 1st in a series of meetings with the aim of building a platform for the community in NK to come together. As a united force, rather than as silos, we can collectively challenge, advocate, and campaign for safe affordable council/social housing. The least affluent residents are being forced out of their homes, our young people are being disenfranchised, to make way for new unaffordable private housing developments. RBKC continue to put profits before people, they have failed to keep promises made in 2017 to listen to the voices of NK residents and to stop estate 'regeneration'; they have failed to learn the lessons from the Grenfell atrocity. This is an opportunity to discuss the issues that matter to us and to plan how to move forward and change our future. Refreshments provided - Covid safety guidelines will be followed FOR FURTHER INFORMATION CONTACT: [email protected] #housing #unhoused #housingcrisis #peoplebeforeprofit #nogentrification #northkensington #socialrents #socialhousing #councilhousing #environmentalcrisis #rbkc https://www.instagram.com/p/CaCiDVRo5SR/?utm_medium=tumblr

#housing#unhoused#housingcrisis#peoplebeforeprofit#nogentrification#northkensington#socialrents#socialhousing#councilhousing#environmentalcrisis#rbkc

0 notes

Photo

#councilestate #councilhousing #roehampton #daneburyavenue #architecture (at Roehampton Danebury Avenue) https://www.instagram.com/p/CU2bpvpIDiz/?utm_medium=tumblr

1 note

·

View note

Video

chelmer road 2012 by chris dorley-brown Via Flickr: corner of chelmer road & glyn road homerton hackney london uk ©chris dorley-brown My latest book “The Longest Way Round” available here my website

#after#alienation#architecture#archive#art#artist#beforeafter#blocks#bricklayer#bricks#chimney#chrisdorleybrown#cityscape#clapton#club#community#council#councilhousing#d200#desolation#disused#e5#e9#eastend#estate#europe#flats#fog#hackney#hall

0 notes

Photo

Carnbrook Road, Greenwich, Peter Barber Architects

#carnbrookroad#peterbarber#greenwich#councilhousing#architecture#construction#london#photography#brick

3 notes

·

View notes

Photo

Park Hill Flats. I know people have mixed feelings about Park Hill. I used to think they were an eyesore and should be pulled down. However, I think they have become an icon of our city and when you see them, there’s no doubt where you are. They were built between 1957 and 1961, and in 1998 were given Grade II listing status. The next phase of refurbishment is currently ongoing, with prices starting at £135,000. Ouch! #parkhill #sheffield #parkhillflats #brutalistarchitecture #brutalist #refurbished #derelict #gradeiilisted #parkhillsheffield #uglybuildings #councilhousing #apartmentbuilding #iconic #architecturephotography #iconicarchitecture #sheffieldheritage #sheffieldhistory (at Park Hill, Sheffield) https://www.instagram.com/p/B-Eait7FWG0/?igshid=h58018sr7znq

#parkhill#sheffield#parkhillflats#brutalistarchitecture#brutalist#refurbished#derelict#gradeiilisted#parkhillsheffield#uglybuildings#councilhousing#apartmentbuilding#iconic#architecturephotography#iconicarchitecture#sheffieldheritage#sheffieldhistory

0 notes

Photo

One of the campaign leaders from Focus E15 called Sylvia talking about the campaign and the housing issues which occur to this present day all over the UK and the world.

Taken in February 2018

Canon EOS 100D

F-Stop F/18

Exposure Time1/60 seconds

ISO Speed 1SO-3200

Exposure Bias 0 step

Focal Length 18mm

#focuse15#housing crisis#eviction#injustice#social divisions#richandpoor#unstability#activism#newham#stratford#eastlondon#publicstall#homeless#political#documentaryphotography#facts#councilhousing#poverty#overcrowded

0 notes

Photo

World’s End, Chelsea... • • #worldsend #theworldsend #worldsendestate #worldsendchelsea #chelsea #chelseaandkensington #brutalist #brutalistarchitecture #kingsroad #kingsroadchelsea #councilhousing #towerblock #highrise #flats #london #londonarchitecture #londonflats #chelseaborough #publichousing #housingestate #iphonex (at World's End, Kensington and Chelsea) https://www.instagram.com/p/BuZS5ONlq-T/?utm_source=ig_tumblr_share&igshid=1053wozb1iob

#worldsend#theworldsend#worldsendestate#worldsendchelsea#chelsea#chelseaandkensington#brutalist#brutalistarchitecture#kingsroad#kingsroadchelsea#councilhousing#towerblock#highrise#flats#london#londonarchitecture#londonflats#chelseaborough#publichousing#housingestate#iphonex

0 notes