#corporate bond fund

Explore tagged Tumblr posts

Text

Should You Invest in 54EC Bonds?

It isn’t uncommon for Indian taxpayers to look for legitimate ways to save on taxes—after all, a rupee saved is a rupee earned. And one very popular method of saving taxes on long-term capital gains is to invest in 54EC bonds, also known as capital gain bonds.

What are 54EC Bonds?

54EC capital gain bonds are a type of investment vehicle, which enable its investors to save on taxes paid on long-term capital gains (LTCGs), provided the gains are invested within 6 months. For now, only the following bonds are eligible for LTCG exemption under 54EC:

National Highway Authority of India (NHAI) Bonds

Power Finance Corporation (PFC) Bonds

Rural Electrification Corporation (REC) Bonds

Indian Railway Finance Corporation (IRFC) Bonds

This is important because an LTCG is generally taxed at a flat of 20.6% (inclusive of cess) with the benefit of indexation.

To illustrate, let’s assume you have sold residential property and earned an LTCG of Rs. 40 lakhs on it. As a result, your tax liability will stand at Rs. 8.24 lakhs.

In order to save on this tax, investors can either invest the LTCG in its entirety in another residential property within a stipulated time period or invest it in 54EC capital gain bonds. While the former involves heavy due diligence costs and additional expenses, it is fairly straightforward to invest in 54 EC bonds.

What are the Benefits of Investing in 54EC Capital Gain Bonds?

In addition to being an effective-tax saving instrument, 54EC capital gain bonds are government-owned and AAA-rated, which makes them a safe and secure investment option.

Additionally, taxpayers can start investing in 54EC bonds with as little as Rs. 20,000, subject to a maximum of Rs. 50 lakhs in any given financial year. This limit of Rs. 50 lakh is separately available to all the joint owners of the asset held for over a long duration.

The Problem With 54EC Capital Gain Bonds

However, investments in 54EC bonds are subject to a minimum lock-in period of 5 years. Furthermore, these capital gain bonds offer a meagre interest of 5%, which is taxable for all investors. Also, 54EC bonds aren’t transferable during their term.

Does it Make Sense to Invest in 54EC Bonds?

There is no doubt that 54EC bonds help in saving LTCG taxes, but with policy rates rising, these bonds are no longer offering competitive interest rates. Besides, a five-year lock-in period can be an issue for some investors.

Many financial planners believe that a better option is to pay the LTCG tax and reinvest the capital gains in other investment vehicles that offer higher returns. This way, over a similar time horizon of five years, investors will have the opportunity to not only earn higher returns but also to recoup the LTCG taxes paid.

Besides, reinvestment of capital gains affords taxpayers more flexibility in their choice of investment vehicles. Taxpayers can choose to invest in equities, mutual funds, corporate bond funds, ETFs, etc., that offer higher returns. For instance, some of the top corporate bond funds offer returns exceeding 7% over a 5-year horizon versus only 5% for 54EC bonds.

Conclusion

Investors should carefully consider their return objectives, risk appetites, liquidity needs, and tax incidence before investing in 54EC bonds.

0 notes

Text

youtube

Wondering if the Mirae Asset Corporate Bond Fund is right for you? Join us as Mr. Amit Modani shares compelling reasons to consider this investment option! In this video, we delve into the benefits of investing in corporate bonds and how this fund can play a vital role in your investment portfolio.

0 notes

Text

#Corporate Bonds Risk#Capital Gain Bonds Risk#Government securties returns#Debt PMS returns#Flexi Cap Funds Returns#Index Funds Returns#Balanced Advantage Funds Risk#Multi Asset Allocation Returns#Gold ETF Returns#SGBs Returns#ULIP Returns

0 notes

Text

Setting foundations to make cat bonds a broadly accepted asset class: Guatteri, SRILIAC

New Post has been published on https://petn.ws/WNbdO

Setting foundations to make cat bonds a broadly accepted asset class: Guatteri, SRILIAC

Market developments are helping to set the foundations to make catastrophe bonds a much more broadly accepted asset class, according to MariaGiovanna Guatteri, CEO of Swiss Re Insurance-Linked Investment Advisors Corporation (SRILIAC), who feels the asset class remains attractive despite recent tightening.Speaking with Artemis in March 2024, Guatteri who took on the CEO role at […]

See full article at https://petn.ws/WNbdO #CatsNews #CatBond, #CatBondFund, #CatastropheBond, #CatastropheBondFund, #ILSFunds, #InsuranceLinkedSecurities, #InsuranceLinkedInvestments, #Reinsurance, #SwissReInsuranceLinkedInvestmentAdvisorsCorporation, #SwissReInsuranceLinkedInvestmentManagementLtd

#Cat bond#Cat bond fund#Catastrophe bond#Catastrophe bond fund#ILS funds#Insurance linked securities#Insurance-linked investments#reinsurance#Swiss Re Insurance-Linked Investment Advisors Corporation#Swiss Re Insurance-Linked Investment Management Ltd#Cats News

0 notes

Text

Unlocking Financial Success: Finding the Best Mutual Fund Distributor in Beawar

In the dynamic landscape of financial markets, making informed investment decisions is crucial for achieving long-term financial goals. For residents of Beawar, a key concern is often finding the right financial partner to guide them through the complex world of mutual funds. In this pursuit, identifying the best mutual fund distributor becomes paramount.

Navigating the Financial Maze: The Need for Expert Guidance

Beawar, like any other city, is home to a diverse population with varying financial aspirations. Many individuals face a common challenge: the lack of financial expertise to make sound investment decisions. This gap often leads to missed opportunities and suboptimal investment choices. Enter mutual funds – a popular and accessible investment avenue for those seeking to grow their wealth.

Why Do You Need a Mutual Fund Distributor in Beawar?

Choosing the right mutual fund distributor is akin to having a financial guide by your side. Here's why you need one:

Expertise Matters: Mutual funds can be complex, with various schemes catering to different risk appetites. An experienced mutual fund distributor in Beawar possesses the knowledge to align your investment goals with the most suitable funds.

Customized Solutions: A skilled distributor understands that one size does not fit all. Every individual has a unique financial situation, so he/she customizes the investment strategy and the portfolio according to the needs. It can be a short-term or long-term objective.

Risk Mitigation: Investing always involves an element of risk. A proficient mutual fund sip advisor in Beawar helps you navigate these risks by providing insights into market trends and adjusting your portfolio accordingly.

Benefits of Choosing the Best Mutual Fund Distributor

Optimized Returns: With a deep understanding of market dynamics, the best mutual distributor can identify opportunities that maximize returns while minimizing risks.

Portfolio Diversification: It is a key investment strategy to help individuals minimize the risk and improve returns. A skilled distributor helps you diversify across different asset classes, ensuring a well-balanced and resilient portfolio.

Regular Monitoring: Financial markets are dynamic, and staying updated is essential. Your chosen distributor keeps a vigilant eye on your investments, making timely adjustments to capitalize on emerging opportunities or mitigate potential losses.

Conclusion: Partnering for Financial Success

Choosing the best mutual fund distributor is not just a prudent decision; it's a step toward financial empowerment. At Ambition Finserve, we understand the unique financial landscape of Beawar and are committed to guiding you toward your financial aspirations. Explore the world of mutual funds with confidence, knowing that you have a trusted partner by your side.

Embark on your financial journey with Ambition Finserve – Your Gateway to Financial Excellence.

#best mutual fund distributor in Beawar#financial planning companies in Beawar#mutual funds services in Beawar#mutual fund sip advisor in Beawar#equity investment planner in Beawar#portfolio management services in Beawar#pms services in Beawar#retirement planning company in Beawar#goal based planning in Beawar#child education advisor in Beawar#marriage fund management planner in Beawar#corporate fixed deposit services in Beawar#bonds investment services in Beawar#sovereign gold bond planner in Beawar#govt of India bonds services in Beawar#tax planning agency in Beawar#alternative investment funds service in Beawar#aif service in Beawar#life insurance planning in Beawar#financial services in Beawar#Wealth management service in Beawar#tax consulting services in Beawar#financial goals planner in Beawar#portfolios management service in Beawar#portfolio advisory services in Beawar

1 note

·

View note

Text

Types of Debt Mutual Funds

Debt mutual funds primarily invest in debt instruments like treasury bills, certificate of deposits, government bonds, corporate bonds, money market instruments, etc. These funds can be categorized based on the securities they invest in and the maturity period of the underlying securities.

Overnight Funds

Investment mandate: Invest in debt securities with a maturity of one day. Risk: Low risk Suitability: To park idle cash Duration: 0 to 7 days

Liquid Funds

Investment mandate: Invest in money market instruments and high-grade debt securities with 91 days maturity period. Risk: Low risk Suitability: An alternative to a savings bank account Duration: 7 days to 3 months

Ultra Short Duration Funds

Investment mandate: Invest in money market instruments or debt securities with Macaulay Duration of the portfolio between 3 to 6 months. Risk: Low risk Suitability: To park surplus funds/create an emergency fund Duration: 3 to 6 months

Low Duration Funds

Investment mandate: Invest in money market instruments or debt securities with Macaulay Duration of the portfolio between 6 to 12 months. Risk: Low risk Suitability: To park short-term funds Duration: 6 to 12 months

Money Market Funds

Investment mandate: Invest in money market instruments with a maturity period of upto one year Risk: Low risk Suitability: An alternative to fixed deposit Duration: up to 1 year

Short Duration Funds

Investment mandate: Invest in money market instruments or debt securities with Macaulay Duration of the portfolio is between 1 to 3 years Risk: Low risk Suitability: To plan for short-term goals Duration: 1 to 3 years

Medium Duration Funds

Investment mandate: Invest in money market instruments or debt securities with Macaulay Duration of the portfolio is between 3 to 4 years. Risk: Low risk Suitability: To plan for medium-term goals Duration: 3 to 4 years

Medium to Long Duration Funds

Investment mandate: Invest in money market instruments or debt securities with Macaulay Duration of the portfolio is between 4 to 7 years. Risk: Moderate risk Suitability: To plan for medium-term goals Duration: 4 to 7 years

Long Duration Funds

Investment mandate: Invest in money market instruments or debt securities with Macaulay Duration of the portfolio of more than 7 years. Risk: Moderate risk Suitability: To plan for long-term goals Duration: More than 7 years

Dynamic Bond Funds

Investment mandate: Invest in debt securities with varying maturities based on interest rate scenarios. Risk: Moderate risk Suitability: Investors finding it difficult to understand interest movement Duration: 3 to 5 years

Corporate Bond Funds

Investment mandate: Invest a minimum of 80% of portfolio assets in high-rated corporate bonds (rated AA+ or higher) Risk: Low risk Suitability: Looking for regular income and capital protection Duration: 3 to 5 years

Credit Risk Funds

Investment mandate: Invest a minimum of 65% of portfolio assets in corporate bonds (rated AA or below) Risk: Low risk Suitability: Investors willing to take higher default risk Duration: 3 to 5 years

Banking and PSU Funds

Investment mandate: Invest a minimum of 80% of portfolio assets in debt securities issued by banks, PSUs and public financial institutions. Risk: Moderate risk Suitability: Investors seeking to balance yield, safety and liquidity Duration: 1 to 3 years

Gilt Funds

Investment mandate: Invest a minimum of 80% of portfolio assets in government securities with varying maturities (medium to long term) Risk: No risk Suitability: Investors seeking a safer investment option Duration: 3 to 20 years

Floater Funds

Investment mandate: Invest a minimum of 65% of portfolio assets in floating rate instruments Risk: Moderate risk Suitability: Investors willing to take advantage of interest rate movements Duration: 3 to 5 years

Fixed Maturity Plans

Investment mandate: Passively managed closed-ended fund where securities are held till maturity. Risk: Low risk Suitability: Alternative to fixed deposit investment for a fixed duration Duration: Varies depending on each FMP

#Debt Mutual Funds#Mutual Fund#Liquid Funds#Money Market Funds#Short Duration Funds#Overnight Funds#Floater Funds#Gilt Funds#Credit Risk Funds#Dynamic Bond Funds#Corporate Bond Funds#Fixed Maturity Plans#Sigfyn

0 notes

Text

Smart Investment Choices: Exploring India's Top 5 Secure and Stable Returns

#investment#finance#safe invest#Corporate Fixed Deposits#Bonds#Public Provident Fund#Debt Mutual Funds#National Pension System

0 notes

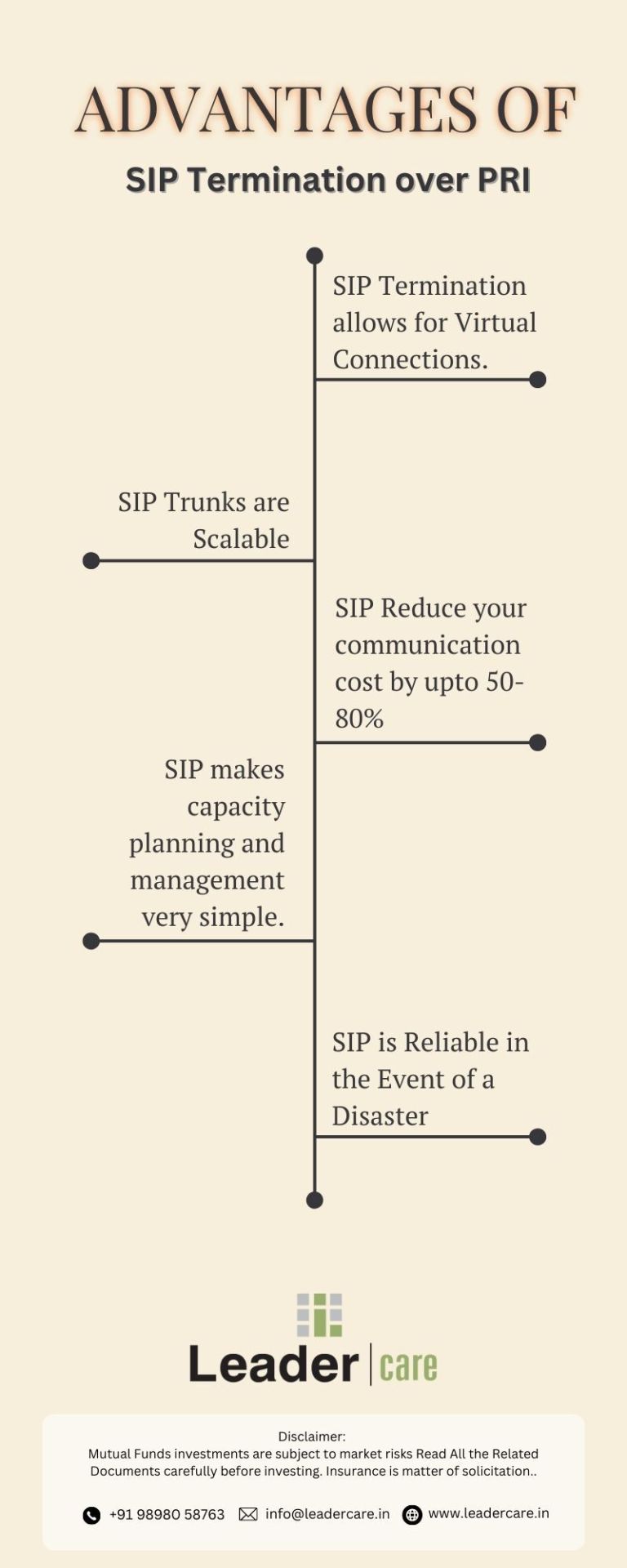

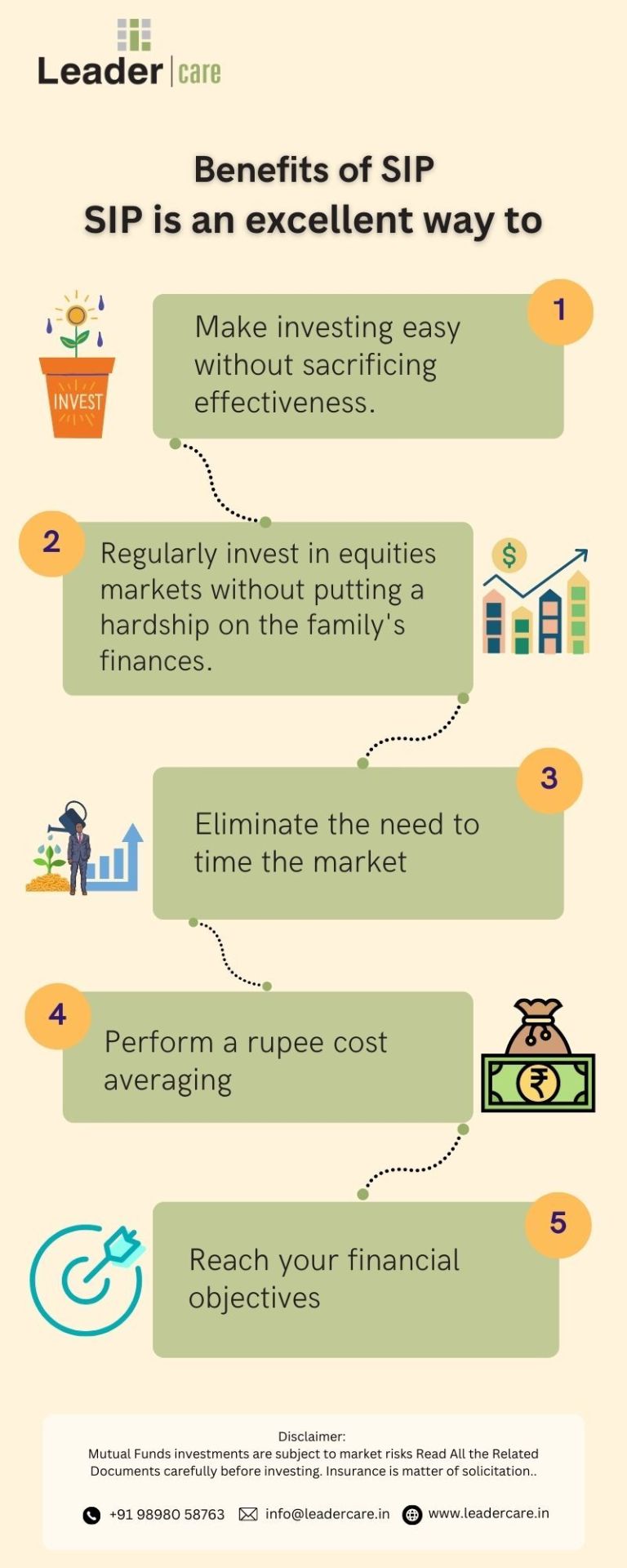

Photo

Financial Advice Services for Mutual Funds, Bonds, Equities, Annuities, Corporate Finance and Insurance along with Investment and Banking in india Leader Care

#securities market#equity mutual fund#general insurance#family health#mutual funds#bonds#equities#annuities#Corporate Finance and Insurance#sip return calculator#Leader care about us Securities#stocks#equity#health equity#equity capital#advisor#mutual fund advisor#leader care

1 note

·

View note

Text

Why are Bonds Known as Fixed Income Investments?

Savvy investors love to diversify their portfolios across several asset classes to protect themselves against unforeseen turns in the investment market. One of the ways they do this is through ownership of bonds.

Bonds have developed a reputation for being less volatile than other investment sources; they deliver a steady income stream while shielding the investor’s principal even in a falling market. This characteristic is no surprise, as bonds are generally classified as fixed-income investments. But what does the term ‘fixed-income’ mean, and what are the benefits of owning fixed-income assets? Read along to find out.

What are Fixed Income Investments?

Fixed-income investments pay their investors fixed interest or dividend payments until maturity. They tend to focus more on capital preservation and a steady income stream. They are typically low-risk, low-reward investments whose principal goal is to deliver as much income as possible with as little risk to the investor and the amount invested. Fixed income has three significant characteristics:

They are more focused on capital preservation.

They have an unwavering stipulated (fixed) interest payment at specified intervals.

The owners bear little to no risk of the business they invested in, nor do they own any part of the business.

Government and corporate bonds are prominent examples of fixed-income investments.

What are Fixed Income Bonds?

Bonds are debtor notes issued by either government or corporations to investors. Other investments usually pay out variable income securities based on underlying measures like short-term interest rates. Fixed-income bonds pay a fixed, predetermined rate that doesn’t change throughout the bond’s duration.

When many fixed-income bonds mature, the company pays the investors the equivalent of their principal and specified fixed interests. If the bond issuer defaults, the investor gets paid first before the stockholders.

Types of Fixed Income Bonds

Fixed-income bonds are an essential concept for both the issuer and the investor. The bond issuer gets to raise needed capital for projects or other operations without losing shares or control over its company. In contrast, the investor gets a regular fixed income with minimal risk of loss. Here are some common types of fixed-income bonds:

Government Bonds

Government bonds are fixed-income bonds entirely issued and backed by the government of a country or region. They are also called municipal bonds at the state or local government levels. They are considered among the safest bonds to undertake amongst investors, while the government uses the funds to embark on annual expenditures. Most of them are tax-free.

Corporate Bonds

Corporate bonds are issued and backed by private institutions; their value and risk assessment are based on their creditworthiness and the collateral to which the bond is tied. Corporations with higher credit ratings pay lower interest rates, and money obtained from bonds is helpful to a company’s expenditure.

Junk Bonds or High Yield Bonds

Because many bonds are low-risk investments, they usually come with lower returns. High-yield bonds come with higher returns but at a significantly higher risk. This increased risk results from being issued by corporations with low credit ratings or the assets tied to them being shaky. Investors who can manage more risks go for this bond type.

Certificate of Deposits

A certificate of deposit is a fixed deposit account with significantly higher profit rates, and financial institutions usually offer them a maturity of fewer than five years. Additionally, certificates of deposits come with National Credit Union Association (NCUA) protection.

Fixed Income Bonds to Buy in the United States

With a sound investment strategy, you can buy several fixed bonds in the United States. Here are some of the more prominent ones:

Treasury Bonds (T-Bonds)

Treasury bonds are issued at the Federal level and backed by the United States. They are considered one of the safest bonds and have 20 to 30 years of maturity. You can purchase them in multiples of $100.

Treasury Inflation-Protected Securities (TIPS)

One of the risks often associated with bonds is the depreciation of the principal’s value due to inflation. TIPS protect the investor from all that as the value adjusts with deflation and inflation.

Treasury Notes (T-Notes)

Treasury Notes are similar to treasury bonds but have a lower maturity length. While T-bonds mature in at least two decades, T-Notes have a much shorter time frame of two to ten years. Like T-bonds, however, they are acquired by an increment of $100.

Municipal and Private Corporate Bonds

Municipal bonds are issued at state and local government levels and can also be invested in the United States. In addition, several private corporations also offer bonds to investors when they wish to raise funds for a project or venture.

Fixed Income Investment Strategies

Although bonds are relatively safe for the investor, they still must be cautiously approached. Here are just a few strategies you might want to use:

Laddered Bond Portfolio Investment

The laddered investment strategy is focused on diversifying bond portfolios by acquiring bonds with different maturity dates. This strategy enables the investor to use the principal of lower rung bonds in higher rung bonds.

Bullet Bond Portfolio Investment

This investment strategy involves purchasing various bonds at different dates but with the exact maturity dates. The strategy works for investors who need massive amounts of cash at a future date.

Barbell Bond Portfolio Investment

The Barbell strategy requires investing in very short-term and long-term bonds. The investor has to pay attention to his investments to keep reinvesting the short-term bonds when they mature.

Benefits of Fixed Income Investments

Fixed-income investments are highly beneficial in many ways. Some of the advantages of this sort of investment include the following:

They make it easier to diversify your investment, especially when the market is very volatile.

They provide good returns and a steady stream of income.

Fixed income comes with a relatively lower risk exposure than other investment classes.

Fixed-income bonds are less likely to be affected by market volatility.

Conclusion

Bonds are known as fixed investments because they offer fixed interest returns and have significantly lower risk exposure than most investments. You can choose multiple bond investment types and strategies for these investment routes. Investing in fixed investment bonds is one way to save something for a rainy day. Contact REICG Real Estate Investment Fund.

#Real Estate Investment Fund#diversifying bond portfolios#Fixed Income Investments#Fixed Income Bonds#Government Bonds#Corporate Bonds#Benefits of Fixed Income Investments

1 note

·

View note

Text

You were promised a jetpack by liars

TONIGHT (May 17), I'm at the INTERNET ARCHIVE in SAN FRANCISCO to keynote the 10th anniversary of the AUTHORS ALLIANCE.

As a science fiction writer, I find it weird that some sf tropes – like space colonization – have become culture-war touchstones. You know, that whole "we were promised jetpacks" thing.

I confess, I never looked too hard at the practicalities of jetpacks, because they are so obviously either used as a visual shorthand (as in the Jetsons) or as a metaphor. Even a brief moment's serious consideration should make it clear why we wouldn't want the distracted, stoned, drunk, suicidal, homicidal maniacs who pilot their two-ton killbots through our residential streets at 75mph to be flying over our heads with a reservoir of high explosives strapped to their backs.

Jetpacks can make for interesting sf eyeball kicks or literary symbols, but I don't actually want to live in a world of jetpacks. I just want to read about them, and, of course, write about them:

https://reactormag.com/chicken-little/

I had blithely assumed that this was the principle reason we never got the jetpacks we were "promised." I mean, there kind of was a promise, right? I grew up seeing videos of rocketeers flying their jetpacks high above the heads of amazed crowds, at World's Fairs and Disneyland and big public spectacles. There was that scene in Thunderball where James Bond (the canonical Connery Bond, no less) makes an escape by jetpack. There was even a Gilligan's Island episode where the castaways find a jetpack and scheme to fly it all the way back to Hawai'i:

https://www.imdb.com/title/tt0588084/

Clearly, jetpacks were possible, but they didn't make any sense, so we decided not to use them, right?

Well, I was wrong. In a terrific new 99 Percent Invisible episode, Chris Berube tracks the history of all those jetpacks we saw on TV for decades, and reveals that they were all the same jetpack, flown by just one guy, who risked his life every time he went up in it:

https://99percentinvisible.org/episode/rocket-man/

The jetpack in question – technically a "rocket belt" – was built in the 1960s by Wendell Moore at the Bell Aircraft Corporation, with funding from the DoD. The Bell rocket belt used concentrated hydrogen peroxide as fuel, which burned at temperatures in excess of 1,000'. The rocket belt had a maximum flight time of just 21 seconds.

It was these limitations that disqualified the rocket belt from being used by anyone except stunt pilots with extremely high tolerances for danger. Any tactical advantage conferred on infantrymen by the power to soar over a battlefield for a whopping 21 seconds was totally obliterated by the fact that this infantryman would be encumbered by an extremely heavy, unwieldy and extremely explosive backpack, to say nothing of the high likelihood that rocketeers would plummet out of the sky after failing to track the split-second capacity of a jetpack.

And of course, the rocket belt wasn't going to be a civilian commuting option. If your commute can be accomplished in just 21 seconds of flight time, you should probably just walk, rather than strapping an inferno to your back and risking a lethal fall if you exceed a margin of error measured in just seconds.

Once you know about the jetpack's technical limitations, it's obvious why we never got jetpacks. So why did we expect them? Because we were promised them, and the promise was a lie.

Moore was a consummate showman, which is to say, a bullshitter. He was forever telling the press that his jetpacks would be on everyone's back in one to two years, and he got an impressionable young man, Bill Suitor, to stage showy public demonstrations of the rocket belt. If you ever saw a video of a brave rocketeer piloting a jetpack, it was almost certainly Suitor. Suitor was Connery's stunt-double in Thunderball, and it was he who flew the rocket belt around Sleeping Beauty castle.

Suitor's interview with Berube for the podcast is delightful. Suitor is a hilarious, profane old airman who led an extraordinary life and tells stories with expert timing, busting out great phrases like "a surprise is a fart with a lump in it."

But what's most striking about the tale of the Bell rocket belt is the shape of the deception that Moore and Bell pulled off. By conspicuously failing to mention the rocket belt's limitations, and by callously risking Suitor's life over and over again, they were able to create the impression that jetpacks were everywhere, and that they were trembling on the verge of widespread, popular adoption.

What's more, they played a double game: all the public enthusiasm they manufactured with their carefully stage-managed, canned demos was designed to help them win more defense contracts to keep their dream alive. Ultimately, Uncle Sucker declined to continue funding their boondoggle, and the demos petered out, and the "promise" of a jetpack was broken.

As I listened to the 99 Percent Invisible episode, I was struck by the familiarity of this shuck: this is exactly what the self-driving car bros did over the past decade to convince us all that the human driver was already obsolete. The playbook was nearly identical, right down to the shameless huckster insisting that "full self-driving is one to two years away" every year for a decade:

https://www.theverge.com/2023/8/23/23837598/tesla-elon-musk-self-driving-false-promises-land-of-the-giants

The Potemkin rocket belt was a calculated misdirection, as are the "full self-driving" demos that turn out to be routine, pre-programmed runs on carefully manicured closed tracks:

https://www.cbsnews.com/news/tesla-autopilot-staged-engineer-says-company-faked-full-autopilot/

Practical rocketeering wasn't ever "just around the corner," because a flying, 21 second blast-furnace couldn't be refined into a practical transport. Making the tank bigger would not make this thing safer or easier to transport.

The jetpack showman hoped to cash out by tricking Uncle Sucker into handing him a fat military contract. Robo-car scammers used their conjurer's tricks to cash out to the public markets, taking Uber public on the promise of robo-taxis, even as Uber's self-driving program burned through $2.5b and produced a car with a half-mile mean time between fatal collisions, which the company had to pay someone else $400m to take the business off their hands:

https://pluralistic.net/2022/10/09/herbies-revenge/#100-billion-here-100-billion-there-pretty-soon-youre-talking-real-money

It's not just self-driving cars. Time and again, the incredibly impressive AI demos that the press credulously promotes turn out to be scams. The dancing robot on stage at the splashy event is literally a guy in a robot-suit:

https://www.businessinsider.com/elon-musks-ai-day-tesla-bot-is-just-a-guy-in-a-bodysuit-2021-8

The Hollywood-killing, AI-produced video prompting system is so cumbersome to use, and so severely limited, that it's arguably worse than useless:

https://www.wheresyoured.at/expectations-versus-reality/

The centuries' worth of progress the AI made in discovering new materials actually "discovered" a bunch of trivial variations on existing materials, as well as a huge swathe of materials that only exist at absolute zero:

https://pluralistic.net/2024/04/23/maximal-plausibility/#reverse-centaurs

The AI grocery store where you just pick things up and put them in your shopping basket without using the checkout turns out to be a call-center full of low-waged Indian workers desperately squinting at videos of you, trying to figure out what you put in your bag:

https://pluralistic.net/2024/01/31/neural-interface-beta-tester/#tailfins

The discovery of these frauds somehow never precipitates disillusionment. Rather than getting angry with marketers for tricking them, reporters are ventriloquized into repeating the marketing claim that these aren't lies, they're premature truths. Sure, today these are faked, but once the product is refined, the fakery will no longer be required.

This must be the kinds of Magic Underpants Gnomery the credulous press engaged in during the jetpack days: "Sure, a 21-second rocket belt is totally useless for anything except wowing county fair yokels – but once they figure out how to fit an order of magnitude more high-explosive onto that guy's back, this thing will really take off!"

The AI version of this is that if we just keep throwing orders of magnitude more training data and compute at the stochastic parrot, it will eventually come to life and become our superintelligent, omnipotent techno-genie. In other words, if we just keep breeding these horses to run faster and faster, eventually one of our prize mares will give birth to a locomotive:

https://locusmag.com/2020/07/cory-doctorow-full-employment/

As a society, we have vested an alarming amount of power in the hands of tech billionaires who profess to be embittered science fiction fans who merely want to realize the "promises" of our Golden Age stfnal dreams. These bros insist that they can overcome both the technical hurdles and the absolutely insurmountable privation involved in space colonization:

https://pluralistic.net/2024/01/09/astrobezzle/#send-robots-instead

They have somehow mistaken Neal Stephenson's dystopian satirical "metaverse" for a roadmap:

https://pluralistic.net/2022/12/18/metaverse-means-pivot-to-video/

As Charlie Stross writes, it's not just that these weirdos can't tell the difference between imaginative parables about the future and predictions about the future – it's also that they keep mistaking dystopias for business plans:

https://www.scientificamerican.com/article/tech-billionaires-need-to-stop-trying-to-make-the-science-fiction-they-grew-up-on-real/

Cyberpunk was a warning, not a suggestion. Please, I beg you, stop building the fucking torment nexus:

https://knowyourmeme.com/memes/torment-nexus

These techno-billionaires profess to be fulfilling a broken promise, but surely they know that the promises were made by liars – showmen using parlor tricks to sell the impossible. You were "promised a jetpack" in the same sense that table-rapping "spiritualists" promised you a conduit to talk with the dead, or that carny barkers promised you a girl that could turn into a gorilla:

https://milwaukeerecord.com/film/ape-girl-shes-alive-documentary-november-11-sugar-maple/

That's quite a supervillain origin story: "I was promised a jetpack, but then I grew up discovered that it was just a special effect. In revenge, I am promising you superintelligent AIs and self-driving cars, and these, too, are SFX."

In other words: "Die a disillusioned jetpack fan or live long enough to become the fraudster who cooked up the jetpack lie you despise."

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/17/fake-it-until-you-dont-make-it/#twenty-one-seconds

#pluralistic#99pi#99 percent invisible#rocketeers#jetpacks#ai#full self-driving#fsd#absent indians#hoaxes#fake it until you dont make it#Bell Aircraft Corporation#Wendell Moore#podcasts

323 notes

·

View notes

Text

#NPS Asset Allocation#National Pension Scheme return#Corporate Bonds Risk#Capital Gain Bonds Risk#Government securties returns#Debt PMS returns#Flexi Cap Funds Returns#Index Funds Returns#Balanced Advantage Funds Risk#Multi Asset Allocation Returns

0 notes

Text

For US unions like the UAW — which has thousands of members in weapons factories making the bombs, missiles, and aircraft used by Israel, as well in university departments doing research linked to the Israeli military — the Palestinian trade union call to action is particularly relevant. When the UAW’s national leadership came out in support of a cease-fire on December 1, they also voted to establish a “Divestment and Just Transition Working Group.” The stated purpose of the working group is to study the UAW’s own economic ties to Israel and explore ways to convert war-related industries to production for peaceful purposes while ensuring a just transition for weapons workers.

Members of UAW Labor for Palestine say they have started making visits to a Colt factory in Connecticut, which holds a contract to supply rifles to the Israeli military, to talk with their fellow union members about Palestine, a cease-fire, and a just transition. They want to see the union’s leadership support such organizing activity.

“If UAW leaders decided to, they could, tomorrow, form a national organizing campaign to educate and mobilize rank-and-file towards the UAW’s own ceasefire and just transition call,” UAW Labor for Palestine members said in a statement. “They could hold weapons shop town halls in every region; they could connect their small cadre of volunteer organizers — like us — to the people we are so keen to organize with; they could even send some of their staff to help with this work.”

On January 21, the membership of UAW Local 551, which represents 4,600 autoworkers at Ford’s Chicago Assembly Plant (who were part of last year’s historic stand-up strike) endorsed the Palestinian trade unions’ call to not cooperate in the production and transportation of arms for Israel. Ten days later, UAW Locals 2865 and 5810, representing around forty-seven thousand academic workers at the University of California, passed a measure urging the union’s national leaders to ensure that the envisioned Divestment and Just Transition Working Group “has the needed resources to execute its mission, and that Palestinian, Arab and Muslim workers whose communities are disproportionately affected by U.S.-backed wars are well-represented on the committee.”

Members of UAW Locals 2865 and 5810 at UC Santa Cruz’s Astronomy Department have pledged to withhold any labor that supports militarism and to refuse research collaboration with military institutions and arms companies. In December, unionized academic workers from multiple universities formed Researchers Against War (RAW) to expose and cut ties between their research and warfare, and to organize in their labs and departments for more transparency about where the funding for their work comes from and more control over what their labor is used for. RAW, which was formed after a series of discussions by union members first convened by US Labor Against Racism and War last fall, hosted a national teach-in and planning meeting on February 12.

Meanwhile, public sector workers in New York City have begun their own campaign to divest their pension money from Israel. On January 25, rank-and-file members of AFSCME District Council (DC) 37 launched a petition calling on the New York City Employees’ Retirement System to divest the $115 million it holds in Israeli securities. The investments include $30 million in bonds that directly fund the Israeli military and its activities. “As rank-and-file members of DC 37 who contribute to and benefit from the New York City Employees’ Retirement System and care about the lives of working people everywhere, we refuse to support the Israeli government and the corporations that extract profit from the killing of innocent civilians,” the petition states.

In an election year when President Joe Biden and other Democratic candidates will depend heavily on organized labor for donations and especially get-out-the-vote efforts, rank and filers are also trying to push their unions to exert leverage on the president by getting him to firmly stand against the ongoing massacre in Gaza. NEA members with Educators for Palestine are calling on their union’s leaders to withdraw their support for Biden’s reelection campaign until he stops “sending military funding, equipment, and intelligence to Israel,” marching from AFT headquarters to NEA headquarters in Washington, DC on February 10 to assert their demand. Similarly, after the UAW International Executive Board endorsed Biden last month — a decision that sparked intense division within the union — UAW Labor for Palestine is demanding the endorsement be revoked “until [Biden] calls for a permanent ceasefire and stops sending weapons to Israel.”

#palestine#free palestine#labor#union strong#recommend reading the whole article bc as the author points out#us labor has had a long history of collaborating with israel and imperialist projects in general#pressure to stop the genocide is not going to come from union leadership#it’s coming from rank and files who are organizing their own initiatives and putting the heat on their leadership#uaw’s divestment and just transition group is intriguing to me bc it sets a precedent to pressure other machinist unions to follow#and bc part of their efforts involves building solidarity with palestine among rank and files nationwide

202 notes

·

View notes

Text

What Are the Challenges Investors Face When They Plan an Investment in Mutual Funds in Bhavnagar?

Investing can be a journey of both excitement and confusion, especially for newcomers in Bhavnagar. The financial market offers various avenues, and mutual funds stand out as an excellent starting point. However, the road to choosing the right funds is often riddled with challenges. Let's explore the obstacles investors face as they begin their journey of investment in mutual funds in Bhavnagar.

Addressing Investor Challenges

Information Overload: Navigating through countless mutual fund options can overwhelm newcomers, making decision-making daunting.

Defining Investment Objectives: Setting clear financial goals and understanding risk tolerance before diving into investments is crucial.

Assessing Fund Performance: Beyond past returns, evaluating risk-adjusted returns, consistency, and comparisons with peers is essential.

Grasping Fund Fees: Understanding various fees impacting returns, like management fees and sales loads, is key in assessing costs.

Emotional Decision-Making: Emotions often drive impulsive decisions, leading to short-term choices detrimental to long-term goals.

Lack of Expertise: New investors may lack financial knowledge, highlighting the importance of seeking guidance from advisors.

Expert Guidance for Bhavnagar Investors

Shri Money Matters, one of the best mutual fund distributors in Bhavnagar, understands the challenges investors face and offers reliable investments in mutual funds, helping investors gain a basic understanding of key concepts like risk, diversification, asset allocation and streamlining investments for them. Let's explore how investors can benefit from advanced tools and practices offered by them:

Streamlined Selection Process: Distributors utilize advanced tools to simplify fund selection, and investors can easily compare different funds based on crucial criteria.

Thorough Fund Analysis: In-depth research and analysis on mutual funds form the basis of well-informed recommendations, aligning with individual goals.

Tailored Recommendations: Understanding financial profiles and risk tolerance leads to personalized fund recommendations.

Ongoing Support: Ensuring continuous support, addressing concerns, and recommending adjustments as needed.

Fostering Rational Decisions: Guidance in developing a long-term investment mindset focused on rational decision-making.

Mitigating Risk: Encouraging diversification across asset classes to construct well-balanced portfolios.

Portfolio Rebalancing: Regular reassessment for portfolios to stay aligned with objectives.

Personalized Advice: Offering customized advice based on unique circumstances and financial objectives.

Conclusion

Starting your investment journey in mutual funds needs careful planning. While mutual funds are a good start, diversifying your investments is necessary. Shri Money Matters helps investors in Bhavnagar make smart choices, get ongoing help, and stick to a clear investment plan with all the above-listed tools and tactics.

#best mutual fund distributors in Bhavnagar#best insurance company in Bhavnagar#mutual funds investment services in Bhavnagar#life insurance agency in Bhavnagar#health insurance service in Bhavnagar#medical insurance policy in Bhavnagar#general insurance Bhavnagar#corporate bond services in Bhavnagar#loan against mutual funds in Bhavnagar#personal loan in Bhavnagar#national pension system in Bhavnagar#nps in Bhavnagar#private fixed deposit schemes in Bhavnagar

0 notes

Text

Gala (Anthony Bridgerton x Reader)

Anthony Bridgerton x fem!Reader Modern AU Rated: 18+, just lots of thirst and suggestiveness Word count: 1.9k

Summary: You attend a charity gala with your boss who really is too much trouble in a tux.

Author's Note: Requested by and dedicated to @queenofmean14 Bit cracky and intended to be humorous 😜 Also credit to @broooookiecrisp from whom I pilfered the job details of her modern Anthony.

“He’s here.” Security announced in your earpiece. Not that you needed them to. You knew the Jaguar as it pulled up. So did the line of paparazzi who started to jostle for the clearest shot. But when he stepped out, you didn’t even know your own name. Anthony Bridgerton, CEO of Bridgerton House Enterprises and your boss, was going to make tonight even more difficult for you.

He had talked to you about his planned outfit beforehand, but you hadn’t gotten a preview and hadn’t envisioned it like this. A perfectly tailored velvet tux jacket accented with a diamond bee brooch. Smart shoes, an effortlessly coiffed wave of hair and most arresting of all, a pair of sleek shades that he slid on as he exited the car even though it was long past sundown. An errant corner of your brain replayed some 80’s song lyrics, but you couldn’t deny that the entire look worked. It worked entirely too well for you as your body flushed with heat and breathing suddenly became a task. The man could wear the hell out of a tux.

Granted, he always looked mouthwatering no matter how he was dressed, and as his executive assistant for the span of eight months you had seen the spectrum of his wardrobe. Everything hung so perfectly on his muscled frame, exuding old money power with a currently fashionable touch. Clothes made the man, but you suspected Anthony Bridgerton could elevate a bin bag. It was a visual challenge you had adapted to in your job, over time finding it easier and easier to speak to him without choking on your tongue first. His arrogant playfulness had helped with that and the two of you had built a deep mutual trust, a friendship even. You had bonded in the trenches of corporate crises enough to sling endearing insults at each other and always be blatantly honest. Except about one thing. You could obviously never reveal to him how desperately you wanted to jump his bones. How your blood simmered when his voice dropped to a certain pitch. How you broke into gooseflesh whenever he shook your hand and met you with something caring in his deep umber eyes. The light flirtation you both fell into from time to time certainly didn’t help either. And now with him in black tie, you began to wonder if this job was hazardous to your health.

Tonight was the company’s annual charity gala. A star-studded event at one of London’s best hotels where celebrities and socialites donated funds for the hospitals partnered with BHE. Anthony would give the closing speech and as planned, was the last to arrive on the red carpet so that he would get unencumbered press focus. You had spent the entire day on site making sure everything was prepped to perfection and now you stood at the top of the entry stairs with the other staff, ready to welcome the MVP of the evening. Given the high profile of the event, you had dressed for the occasion too. You would be seated at his table and weren’t going to be photographed looking like an intern. You had found a dress you loved, a shimmering number that showed off your best assets, and splurged on a hair and makeup artist. Maybe your position made you more akin to the prince’s valet but if this was how you got into the ball, you were going to make the most of it.

You watched Anthony pausing for photos, realizing this was one of the rare times you could observe him from afar. He moved with such confidence, back straight and head held high. He would run his fingers through his greying temples or brush a thumb over his stubbled chin while flashing that killer smile and your legs wanted to give out. He knew how to work a camera. It was one of the many awful, wonderful things about him. But if the attention helped raise money for charitable causes it was all worth it. You supposed your undergarments could suffer for the greater good.

As he moved along, you noticed he was licking his lips. A peek of his tongue in the corner of his mouth as he faced your direction. He was probably hot under all the camera flashes. But that small gesture was infecting you with heat too. He really needed to stop or you were liable to tumble down the steps and really make a headline. It took all your strength not to fan yourself with the tablet you were holding until at last he ascended and gave you a dazzling smile, falling into step beside you as you moved indoors.

You hovered in his orbit as he was greeted by the first throng of attendees at the bar and you called for a flute of champagne. When he was alone at last for a moment, you pulled him into a quiet corner and offered him the drink.

“Thirsty?”

“Sorry?” He moved closer, inclining his head. He was curiously still wearing his sunglasses indoors. You could smell his cologne. Amber and smoke and spice and it made you want to sink your teeth into his neck.

“Are you thirsty?” You said louder, shoving the glass into his hand as he chuckled.

“Why do you ask?” He took a sip.

What a stupid question. Couldn’t you just offer him some refreshment? Didn’t humans need to hydrate? Now you had to answer him.

“I um…” You wavered. “I saw you. You were…licking your lips out there so I just figured…”

His brows show up over his frames and he grinned. “You’re very attentive.”

Something shot down your spine. His voice was getting close to that register. “It’s my job to take care of your needs.” You reminded him, though you laid on a heavy layer of sarcasm.

“And you are so very good at it.” He rumbled, reaching the danger pitch. Oh god, he was going to assault you both visually and aurally at the same time, wasn’t he? He was going to flirt with you while daring to look like that. He was cruel, and he knew exactly what he was doing.

He confirmed it by stepping even closer, turning so the front of his velvet jacket brushed your bare arm and he leaned down to murmur directly in your ear. “You look incredible by the way.”

You swallowed hard, instructing yourself to inhale and exhale. But that wasn’t really helping because his intoxicating scent was making things worse. You had to keep your head. You had to spar with him or else you were going to melt into the carpet. “So do you.” You pursed your lips and gave him an exaggerated once over as if you were only mildly impressed. “The glasses were a good choice.”

He smiled and you detected something genuine, like he was actually eager for your praise. He tapped the frames lightly. “Useful too. I don’t have to give anyone my undivided attention if I don’t want to. I could be talking to them while scanning the crowd and they would be none the wiser.”

This sounded like the setup for a joke. Something about not listening to you as you conducted him through his schedule for the evening. You were beginning to resent those glasses and you would let him know if he tried to get sassy with you.

“So what are you looking at?” You smirked, waiting for the punchline.

He took another sip of champagne, facing you but now you couldn’t be sure if he wasn’t staring directly over your head. “A beautiful woman who is driving me to distraction.”

You rolled your eyes. Of course. The man lived at the office and didn’t really have time for a social or romantic life. He would have to double up and treat a work event as an opportunity for a hookup. Especially at an event as glamorous as this, with so many swanlike women floating around and everyone dressed in their finest, you understood, despite the envy it flared in you.

“Ah, I see. Is there someone I should invite over to your table?”

He shook his head, downed the last of the champagne and set it aside with a decisive clink. “Unnecessary. You’re already at my table.”

He said it so matter-of-factly it took your brain several seconds to even comprehend its meaning. You must have been going mad. Your heart started to pound, fueled equally by embarrassed confusion and ridiculous hope. There was no way. Absolutely no way on earth he could have said what you thought he said. And even if he had, he was just toying with you, right?

“I’m not…” You stuttered, hoping he couldn’t see the blush you felt creeping up your neck. “You weren’t…you weren't looking at me.”

Then your breath caught in your throat as he rounded on you, standing directly before you so your back was pressed against the wall and all you could see was him. He loomed, black velvet and chestnut hair and perfect stubble. That scent was making you feral and now you could feel his hot breath across your skin. You could see yourself in the reflection of his dark lenses, peering up at him like trapped prey. This was how you died. Or lost your job. You were sure of it.

“How would you know?” He smiled wolfishly and tapped the glasses again. “All the better to see you with, my dear.”

You were hit by lightning. The gooseflesh rippled across your skin. Your underwear soaked. All you could do was stand there and tremble as he ran a finger idly up and down your arm. You were surprised sparks weren’t erupting out of your skin where he touched you.

“Why do you think I was licking my lips?” He asked in a low voice, finally removing the shades to pierce through you with his dilated, chocolate eyes. “I’m afraid even with the champagne, I’m still thirsty.” Then he did it again, flicking that weapon of mass destruction across his luscious bottom lip and staring at you pointedly.

Your brain functioned enough to realize that he was breathing just as heavy as you were. And that he was opening a door, giving you an option. The option you had been fantasizing about since the day you met him. It seemed too good to be true. You were half convinced you were dreaming in a coma after faceplanting down the steps outside thanks to his appearance. But the prickle of your electrified nerves and the river between your thighs felt real enough to persuade you that you were indeed still in your own body. You were not going to pass this up, whatever it might lead to. Really, you wanted to scream aloud like you had won the lottery.

But instead you whispered, “There’s water in the green room.”

He grinned broadly, creasing that dimple in his left cheek that you wanted to lick right off his face. “Excellent idea. I think we’ll need an emergency private conference to…go over my notes.”

His hand found the small of your back and you prayed that your legs would carry you that far. This was really going to throw off the itinerary but you were good at your job, you could adjust. You smiled back at him. “Whatever you say, sir. I’m here to take care of your needs.”

Tagging: @angels17324 @bridgertontess @broooookiecrisp @secretagentbucky @colettebronte @faye-tale

#bridgerton#bridgerton fanfiction#anthony bridgerton#anthony bridgerton fanfiction#bridgerton x reader#bridgerton x you#bridgerton x y/n#bridgerton imagine#anthony bridgerton x reader#anthony bridgerton x you#anthony bridgerton x y/n#anthony bridgerton imagine#female reader#modern au#thirst#met gala#jonathan bailey

519 notes

·

View notes

Text

Boycott!

Just fuck Disney and other corporations that support Israel

Now that I have your attention:

#gravity falls#palestina#israel#gaza#free gaza#palestine#cartoonist#cartoon#israel is a terrorist state#free palestine#the owl house#toh#eda clawthorne#eda the owl lady#edalyn clawthorne#save the children#save family#deadpool#deadpool and wolverine#deadpool 3#steven universe#su#gaza strip#fuck corporations#fuck colonizers#billford#the book of bill#disney

23 notes

·

View notes

Text

Three, four years ago I could have told you, and did tell people, that inflation would start steadily going up, and I said even then that it would likely be stubborn, meaning it wasn't going to be an easy fix.

I knew this back then because it was obvious, even years ago, that the BRICS countries, along with many African and South Asian countries and elsewhere were looking for ways to get around using the US Dollar for trade.

They were making moves to expand trade relations outside US dollar transactions and were for many years planning and building the infrastructure for a future Multipolar world.

And that process began rapidly picking up pace three or four years ago.

I began to say then, what I'm still saying now, as that process goes on and trade outside the US Dollar system grows exponentially year-on-year, that's going to begin to have an effect on inflation.

Why? Well, Imperialism really. Because the US for decades has depended on the steady demand for US Dollars to hold down inflation, allowing the US to use debt spending to finance wars, military bases and imperialistic ventures like Syria.

Remember, it was the US in its massively dominant position after WWII that built the Bretton Woods System that made the US Dollar the world reserve currency pegged to gold, and it was the US that unilaterally abandoned Bretton Woods 1 and took the dollar off Gold, allowing for the US to finance wars through debt spending, and created the Petro-Dollar with Saudi Arabia in the 1970's.

This debt spending is essentially the surplus value from the Global South and other poorer countries that must buy US Dollars to fund infrastructure projects, energy consumption, food and medicine imports, etc since it's the world reserve currency and if you wish to use the US Financial System at all, such as the World Bank, or SWIFT messaging system, well you have to use US Dollars.

Basically, it's the sucking of the wealth out of poorer countries to finance their own economic oppression.

But as these countries catch on and with new rising global powers like Russia, China and Iran building the infrastructure for an alternative system, the US Dollar is being abandoned faster than ever.

In 2000, more than 70% of Foreign Exchange Reserves were held in US Dollars. By 2020, that figure had dropped considerably to 59%. And the rate at which it's dropping is only increasing.

Knowing this, I said back in 2019 and 2020 that inflation was likely to become a problem. And if it did become a problem, then we knew exactly what the Fed would do as a result: dramatically increase benchmark Interest rates.

This didn't take any particularly specialized or secretive sources to figure out. It's been obvious for years to anyone seriously interested in economics and geopolitics.

And what happens when interest rates go up? The value of the bonds bought under lower interest rates suddenly go way down, while debts become more expensive. It's like gravity in economics.

So with all that being said, why then did all these banks (Signature Bank, First Republic Bank, and Silicon Valley Bank) continue buying troubled assets and Treasury bonds if they're so smart and educated and knew all this?

I mean, these guys are supposed to be the best of the best corporate bankers, right? On the cutting edge of investment banking, right? That's what everyone said even just months before Silicon Valley Bank failed. (CNBC host and moron of the year Jim Cramer literally praised Silicon Valley Bank less than a month before its failure)

So one of two things must be true here and neither one is good for YOU the average worker.

Either these bankers are idiots; complete morons who have little to no understanding of basic economics, geopolitics, and monetary policy, something that should be of concern to all of us.

I mean, I'm just a dude working for a small retailer in New Orleans and even I knew this inflation and higher interest rates were coming.

So why exactly are these people paid such exorbitant salaries? If I can understand the basics of their job better than they can, why am I a retailer, and he, a millionaire banker???

So that's one possibility, one I'm virtually certain is actually true, that our ruling Elite isn't particularly smart or well educated in reality, anymore than ordinary people I meet everyday, and any one of us could easily do their jobs just as well or better than they do given the opportunities afforded to them.

But even if in this case, that's not what happened. That these weren't idiots. Well then the alternative is something that should also be deeply disturbing to you: that these bankers knew they would be facing this situation, that they were well aware of the coming inflationary pressures and equally aware what the Feds response would be, interest rate hikes.

And instead of using the last couple of years to shed possibly dangerous assets and shore up the money the banks kept on hand, they continued to do what was personally making them so much profit, at the expense of tax payers, because they were absolutely certain that the government these bankers spend so much money on campaigns for, would swoop in regardless of the recklessness of their behavior, and bail them out no matter what.

These are not the signs of a healthy political, economic or banking system.

#bailout#bank bailout#bank bailouts#us corruption#economic corruption#political corruption#us imperialism#us hegemony#wall street#bankers and bailouts#fuck capitalism#neoliberal capitalism#neoliberalism#fuck neoliberalism#socialism#communism#marxism leninism#socialist politics#socialist worker#socialist news#socialist#communist#marxism#marxist leninist#progressive politics#politics#us banking crisis#us banking system#recession#economics

189 notes

·

View notes