#climatetech

Explore tagged Tumblr posts

Text

Powering Sustainability: The Rise of Carbon and Energy Management Software

Carbon and Energy Software empowers businesses to track emissions, monitor energy usage, and meet sustainability goals with precision. By turning data into actionable insights, it helps drive greener operations and regulatory compliance.

#CarbonManagement#EnergySoftware#SustainableTech#GreenBusiness#NetZeroGoals#ClimateTech#EnergyEfficiency#ESGSolutions#CarbonTracking#CleanTech

0 notes

Text

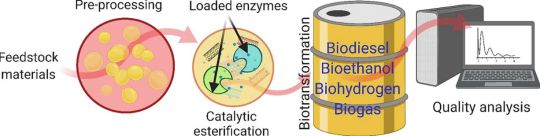

⚗️ Powering the Green Revolution: Nanomaterials Accelerate Biofuel Production from Lignocellulosic Biomass

By Hafiz Muhammad Husnain Azam Researcher, Brandenburg University of Technology Cottbus-Senftenberg 📘 Published 🔗 Read Full Study on Elsevier

The Biofuel Bottleneck—and the Nanotech Breakthrough

With fossil fuel dependency driving climate change, geopolitical instability, and economic volatility, the world is racing to scale up renewable energy solutions. Among these, biofuels—biodiesel, bioethanol, biogas, bio-oil, and biohydrogen—are gaining momentum as scalable, low-carbon alternatives.

However, biofuel production from lignocellulosic biomass—agricultural waste, forestry residues, and organic by-products—has historically been hampered by complex conversion processes and low yields. Our latest article addresses this challenge with a cutting-edge solution: nanomaterials.

How Nanomaterials Are Revolutionizing Biofuel Efficiency

Nanomaterials possess extraordinary physicochemical properties—high surface area, catalytic efficiency, and tunable morphology. These qualities make them ideal for enhancing biomass-to-biofuel conversion processes like:

Transesterification (for biodiesel)

Hydrolysis and fermentation (for bioethanol and biogas)

Pyrolysis and gasification (for bio-oil and biohydrogen)

They act as nano-catalysts, replacing harsh chemicals and enabling cleaner, faster, and more efficient transformations. This drastically improves both yield and cost-efficiency while reducing environmental impact.

Bridging the Gap Between Energy Demand and Sustainability

With global leaders striving to meet Net-Zero targets, biofuels play a critical role in the transition from fossil fuels to renewable energy. Yet, for biofuels to become a backbone of this transition, the production systems must be radically optimized. This is where nanotechnology emerges as a strategic enabler.

Our review reveals:

Enhanced metabolic and catalytic activity via nanomaterials

Improved thermal stability and recyclability of catalysts

Lower activation energy for biomass breakdown

Reduced process time and chemical waste

Future Outlook: Opportunities and Challenges

Despite their game-changing potential, the commercial deployment of nanomaterials faces hurdles:

High production costs

Limited scalability

Safety and environmental concerns

Regulatory gaps

Addressing these through targeted research, policy frameworks, and interdisciplinary collaboration will be key to unlocking the full potential of nanotech in renewable energy.

Let’s Drive the Conversation Forward

This research is a call to action for materials scientists, chemical engineers, policy leaders, and energy stakeholders. Nanomaterials are not just a lab innovation—they are a viable industrial solution in the making.

📖 Explore the full article: Elsevier – Nanomaterials in Biofuel Production

https://doi.org/10.1016/j.fuel.2021.122840

https://go.nature.com/4j0ywq

#Nanomaterials#Biofuels#Biodiesel#Bioethanol#Biogas#Biohydrogen#LignocellulosicBiomass#GreenEnergy#CleanTech#SustainableEnergy#Nanotechnology#Catalysis#RenewableEnergy#EnvironmentalEngineering#EnergyTransition#CircularEconomy#CarbonNeutral#WasteToEnergy#FutureFuels#AdvancedMaterials#ClimateTech#Decarbonization#GreenInnovation#FuelTheFuture#ScienceForSustainability#EnergyResearch#ZeroCarbonFuels#NetZero2050#NanoCatalysts#BiomassConversion

1 note

·

View note

Link

0 notes

Text

#SolarEnergy#CleanTech#RenewableEnergy#NigeriaEnergy#Arnergy#GreenEnergy#EnergyTransition#SustainablePower#FuelSubsidyRemoval#EnergyAccess#ClimateTech#AfricaInnovation#BillGates#ZLite#SolarForAll#PowerSolutions#EnergySavings#LeaseToOwn

0 notes

Text

Carbon Capture and Storage (CCS) Market - Forecast(2025 - 2031)

Carbon Capture and Storage (CCS) Market Overview:

Request sample:

Governments worldwide are implementing policies to facilitate CCS adoption as part of broader climate strategies. In the UK, the government approved the country’s first commercially viable carbon storage facility, led by BP and Equinor, marking a significant step toward achieving net-zero emissions. This project is expected to capture millions of tonnes of CO₂ and store it under the North Sea, demonstrating strong policy support for CCS initiatives. Such regulatory developments are essential for providing the necessary framework and confidence for large-scale CCS investments. These factors positively influence the Carbon Capture and Storage (CCS) industry outlook during the forecast period.

COVID-19 / Ukraine Crisis — Impact Analysis:

• The COVID-19 pandemic disrupted global industries, including the CCS market. Lockdowns and economic slowdowns led to decreased industrial activities, reducing carbon emissions and diminishing the immediate demand for CCS technologies. Additionally, supply chain interruptions and deferred investments hindered project timelines. However, as economies recover, there’s a renewed emphasis on sustainable practices, positioning CCS as a pivotal component in achieving long-term carbon neutrality goals.

The geopolitical tensions arising from the Ukraine crisis have significantly influenced the global energy landscape. Europe’s efforts to reduce dependence on Russian energy sources have accelerated investments in alternative energy solutions, including CCS technologies. This shift aims to enhance energy security and meet climate objectives. Consequently, there’s an increased focus on developing CCS infrastructure to support a diversified and resilient energy system.

Inquiry Before Buying:

Key Takeaways:

Asia Pacific is Projected as Fastest Growing Region

Asia Pacific is projected as the fastest growing region in Carbon Capture and Storage (CCS) Market with CAGR of 28.7% during the forecast period 2024–2030. The Asia-Pacific region is actively advancing Carbon Capture and Storage (CCS) technologies, driven by several key factors. Rapid industrialization has led to increased carbon emissions, prompting governments to implement stringent environmental regulations and adopt sustainable technologies. For instance, Japan has set ambitious net-zero emissions targets, fostering the development of CCS projects to meet these goals. The international collaborations are enhancing the development and deployment of CCS technologies. For instance, in 2024, Indonesia has signed agreements with neighboring countries to facilitate cross-border CO₂ storage, aiming to accelerate the growth of its CCS industry.

Oxyfuel Combustion Segment to Register the Fastest Growth

Oxyfuel Combustion segment is projected as the fastest growing segment in Carbon Capture and Storage (CCS) Market with CAGR of 26.1% during the forecast period 2024–2030. Oxyfuel combustion is a pivotal technology in the Carbon Capture and Storage (CCS) market, driven by several key factors. Primarily, it offers a more concentrated CO₂ stream, facilitating efficient capture and storage. Additionally, it reduces nitrogen oxide emissions, addressing environmental concerns. The technology’s adaptability to existing power plants enhances its appeal, enabling retrofitting and reducing implementation costs. Furthermore, its potential for integration with other CCS technologies, such as chemical looping combustion, presents opportunities for improved efficiency and cost-effectiveness. These drivers collectively position oxyfuel combustion as a promising solution for mitigating greenhouse gas emissions.

Schedule A Call:

Power Generation is Leading the Market

Power Generation held the largest market valuation in 2023. Governments worldwide are implementing stringent environmental regulations to meet climate goals. CCS technologies enable power plants to reduce carbon emissions, aligning with national and international commitments to mitigate climate change. For instance, the UK’s commitment to achieving net-zero emissions by 2050 has spurred investments in CCS projects, such as the Teesside gas-fired power station, which aims to capture and store CO₂ emissions. These factors collectively contribute to the growing adoption of CCS technologies in the power generation sector, facilitating the transition to a more sustainable energy landscape.

Environmental and Climate Commitments

Environmental and climate commitments are pivotal drivers in the Carbon Capture and Storage (CCS) market. Governments worldwide are implementing stringent regulations and policies to reduce greenhouse gas emissions, thereby incentivizing industries to adopt CCS technologies. For instance, the U.S. Department of Energy announced a $3.5 billion program to create large-scale regional direct air capture hubs, underscoring the nation’s dedication to climate goals. Similarly, the European Union aims to capture and store at least 450 million tons of CO₂ annually by 2050, highlighting the critical role of CCS in achieving decarbonization objectives. These initiatives reflect a global consensus on the necessity of CCS in mitigating climate change impacts.

Buy Now :

High Operational Costs

Implementing Carbon Capture and Storage (CCS) technology entails substantial financial investment, encompassing the installation of capture systems, transportation infrastructure, and secure storage facilities. These significant expenses often deter companies from adopting CCS solutions, especially in the absence of robust financial incentives or regulatory mandates. The International Energy Agency (IEA) notes that the high costs associated with CCS are a primary factor limiting its widespread deployment. Without sufficient economic support mechanisms, such as tax credits or subsidies, the financial burden remains a formidable barrier to the integration of CCS technologies into industrial operations.

Key Market Players:

Product/Service launches, approvals, patents and events, acquisitions, partnerships, and collaborations are key strategies adopted by players in the Carbon Capture and Storage (CCS) Market. The top 10 companies in this industry are listed below: 1. General Electric Company 2. Royal Dutch Shell PLC 3. Aker Solutions ASA 4. Fluor Corporation 5. Mitsubishi Heavy Industries, Ltd 6. Halliburton Company 7. Siemens AG 8. Equinor ASA 9. Exxon Mobil Corporation 10. Schlumberger NV

0 notes

Text

Starlink Signal Science

Scientists from TU Graz have developed a groundbreaking method to extract climate and Earth observation data from Starlink and similar satellite communication signals using the Doppler effect. Despite challenges like lack of signal structure information and orbit data, they've successfully measured satellite positions with surprising accuracy (within 54 meters) using constant signal tones. This technique opens up new opportunities for real-time monitoring of sea levels, weather events, and gravitational shifts—critical for climate research. Future improvements could increase accuracy to a few meters, revolutionizing global Earth observation using existing satellite megaconstellations.

website: https://popularscientist.com/

#ClimateTech#EarthObservation#Starlink#Geodesy#SatelliteScience#DopplerEffect#SpaceInnovation#RealTimeMonitoring#EnvironmentalData#MegaConstellations

0 notes

Text

Transforming Agriculture in the Global South - The South-South Agriculture Alliance

We strongly believe that innovative AgTechs can address some of the most pressing problems of the smallholder farmers and small producers. India has been a hub of AgTech innovation and several solutions that have proven themselves in India are now looking to take their solutions to other global south countries.As part of South South Agriculture Alliance (SSAGA) we are working on innovation and…

View On WordPress

0 notes

Text

Your city is turning into a climate superhero. Sounds wild, right?

BUT SMART CITIES CAN DO IT.

🚀 Sensors can track pollution and air quality in real time.

⚡ Solar panels, wind turbines, and energy recycling can power buildings sustainably.

With that all our city can’t only just grow— but it can learn, adapt, and protect the planet.

Let me know if you are ready to live in a city that fights for you 👀

Contact us: https://cizotech.com

#ai#cizotechnology#innovation#mobileappdevelopment#appdevelopment#ios#techinnovation#app developers#iosapp#mobileapps#ClimateTech#GreenFuture#SustainableLiving#IoT#SmartCities#FutureTech#urbaninnovation

0 notes

Text

India’s Next Energy Boom: Why Biofuels Are the Smartest Investment Today

India’s Clean Energy Transformation: 7 Scalable Solutions for a Hydrogen-Powered Future Imagine a world where crop waste powers buses, sunlight fuels factories, and villages thrive on self-made energy. This isn’t science fiction—it’s India’s blueprint for a green hydrogen revolution. Forget empty pledges; here’s how actionable strategies are rewriting the rules of sustainable development. 1.…

0 notes

Text

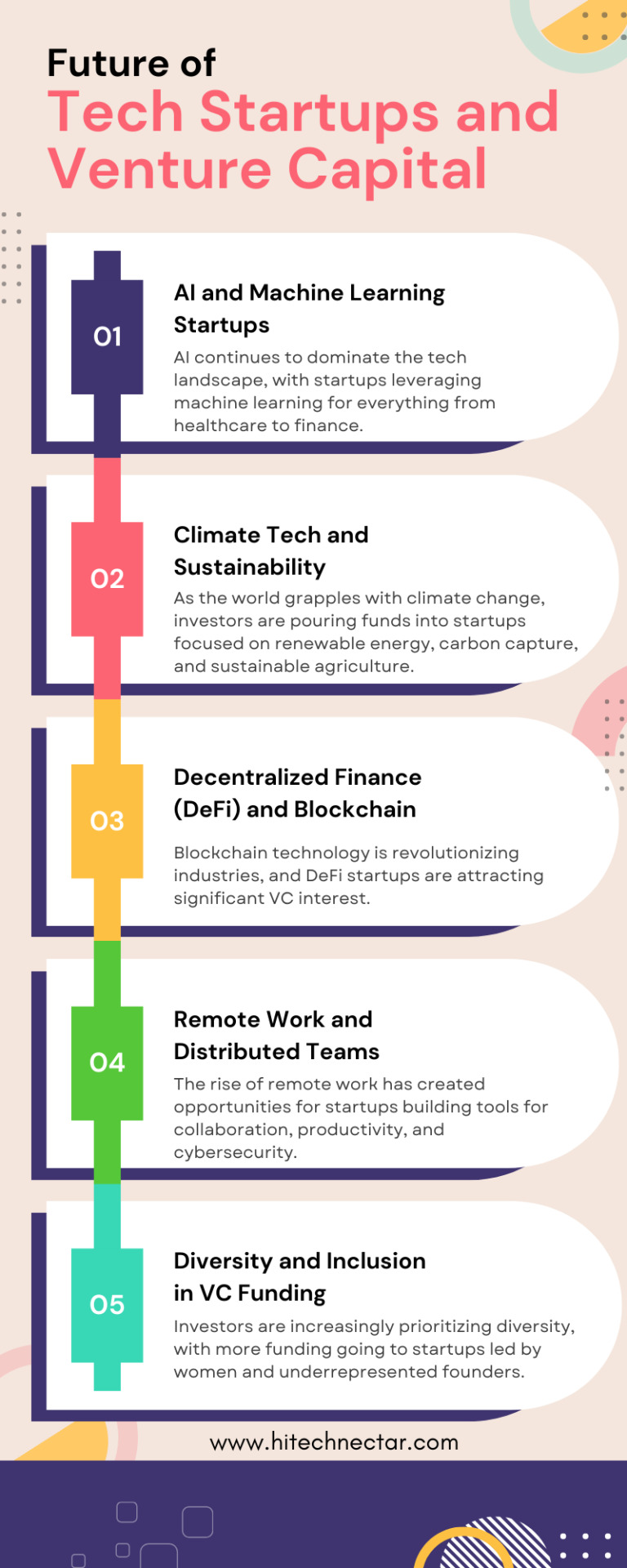

The Future of Tech Startups and Venture Capital: Trends to Watch in 2025

The tech startup ecosystem is constantly evolving, and venture capital is at the forefront of this transformation. Here are the top trends shaping the future of tech startups and VC funding in 2025.

Staying ahead of these trends can help your startup attract funding and thrive in a competitive market.

0 notes

Text

Legion 44 screening in NYC during Climate Week.

The first film on CDR - and full of heroic people tackling real climate change solutions.

https://www.legion44.world/film

0 notes

Text

🌍 Can AI Save Our Soil? 🌱

Soil isn’t just dirt—it’s the planet’s largest carbon bank, storing more carbon than the atmosphere and all plants combined. But here’s the problem: climate change and unsustainable farming are pushing our soil to its limits.

Enter AI tools like the SOC Copilot—game-changers in agriculture. These tools analyze soil health, detect damaging practices like over-tillage, and suggest sustainable solutions to preserve precious Soil Organic Carbon (SOC).

It’s a big leap forward for farmers and the environment. But here’s the real question: can AI truly revolutionize agriculture, or is it just another tech trend?

💡 What do you think? Are we ready to trust AI with the future of our soil? Share your thoughts in the comments or reblog to spark a conversation!

0 notes

Text

Role of Climate Data in Assessing Portfolio Risk

Here are some key ways financial institutions can use their climate data to inform portfolio risk analysis:

1. Geographical and Physical Risk Analysis: The insights provided by climate data allow investors to assess the exposure and vulnerability of their assets. With advanced tools, portfolio managers, investors, or financial institutions can identify the location of their investments and compare these with climate forecasts. For example, the risk of rising sea levels can be understood in terms of the vulnerability of a real estate portfolio. The possibility of assessing these impacts may allow managers to hedge against potential risks, divest from assets at risk, or explore insurance options to curtail their financial exposure.

2. Carbon Footprint and Transition Risk Analysis: As governments and regulatory bodies move toward aligning with a low-carbon economy, there is high transition risk for businesses, and consequently for portfolios that are fossil fuel reliant. In such cases, climate data can help assess the carbon footprint of companies and sectors within a portfolio. An investor can then analyze the extent to which a company will face future regulatory pressures, higher carbon taxes, or stranded assets as fossil fuels become less viable, and evaluate the efficacy of its current transition strategies.

3. Climate Scenario Analysis: Portfolio managers can conduct scenario analysis to validate how different climate pathways may impact the financial performance of companies. For instance, in a 2°C rise scenario, firms that are closer to a low-carbon economy, such as renewable energy-based ventures, may perform better, potentially rewarding those equity exposures. Such analysis can be key to understanding the positioning of a portfolio and developing energy transition pathways.

Read More: Role of Climate Data in Assessing Portfolio Risk

#ClimateRisk#ESGInvesting#PortfolioManagement#SustainableFinance#ClimateData#RiskAssessment#GreenInvestment#ClimateTech#InvestmentStrategy#FinancialRisk#ClimateAction#SustainableInvesting#PortfolioAnalysis#ClimateChange#RiskManagement#FinancialMarkets#ESGMetrics#InvestmentDecisions#EnvironmentalRisk#DataAnalytics

0 notes

Link

#AgTech#Asset-BackedLending#climatetech#GreenFinancing#LatinAmerica#RegulatoryIncentives#RenewableEnergy#VentureDebt

0 notes

Text

Ecodrisil is excited to be part of GITEX Impact 2024 — where innovation meets sustainability! Join us as we showcase our cutting-edge solutions for driving a sustainable future.

📍 Dubai Harbour 🏢 Hall 9, Stand No: C-62

Don’t miss out on this opportunity to see how Ecodrisil’s ESG Xpress platform is shaping the future of ESG reporting! We can’t wait to meet you there! 🙌

#GITEXImpact#ClimateTech#Sustainability#ESG#SustainablePractices#SustainableInnovation#SustainableBusiness#ESGStrategies#SustainabilityTech#NetZero#GreenTech#CarbonEmission#ClimateChange#SustainableInvestment#GITEXGlobal

1 note

·

View note