#centralized crypto exchange provider

Explore tagged Tumblr posts

Text

How Blockchain Technology Powers In-Game Economies and Cryptocurrencies

The digital landscape is continuously evolving, and one of the most exciting developments is the integration of economies and cryptocurrencies into online platforms. From gaming to trading, this integration is transforming how people interact with virtual environments, offering them real-world value in digital spaces. This trend has enabled players and users to buy, sell, and own digital assets like never before, and it's redefining how online ecosystems operate.

In this article, we will explore how economies and cryptocurrencies are shaping various sectors, especially gaming, and discuss the benefits, challenges, and future prospects of this exciting transformation. Additionally, we’ll delve into how crypto exchange development is fueling this revolution by providing secure and efficient platforms for trading digital assets.

Why Economies and Cryptocurrencies Are Changing Digital Experiences

The rise of economies and cryptocurrencies is much more than a passing trend—it's a revolution that is altering the fundamental structure of online ecosystems. By allowing digital assets to have real-world value, cryptocurrencies have blurred the line between virtual and physical economies. This change empowers users to trade digital items, currency, and services for real money, adding unprecedented value to their online activities.

Whether you're an investor or a gamer, the inclusion of economies and cryptocurrencies creates endless possibilities. For instance, players can now earn in-game assets with real value, which they can trade across platforms or even convert into fiat currencies. This seamless interaction between digital and real-world assets is one of the reasons crypto exchange development plays a crucial role, as it provides the necessary infrastructure for these transactions.

Benefits of Economies and Cryptocurrencies in Gaming and Beyond

Stats of Blockchain Technology Powers In-Game Economies and Cryptocurrencies

Increased Accessibility to Global Markets

One of the significant benefits of economies and cryptocurrencies is their accessibility. Players and users from around the world can engage in online platforms without the traditional barriers imposed by fiat currency transactions. With cryptocurrency, users can easily access global markets, trade goods and services, or even participate in virtual economies without worrying about exchange rates or international transfer fees.

Moreover, the involvement of a centralized cryptocurrency exchange development company helps facilitate smoother transactions. These companies offer user-friendly platforms that make it easier for new and experienced users alike to trade and convert cryptocurrencies securely. By enabling centralized exchanges, they allow users to trade digital currencies across a range of markets, all from a single platform.

Decentralization and Security

Incorporating economies and cryptocurrencies brings enhanced security and decentralization. Transactions on blockchain networks are transparent and immutable, ensuring that all exchanges are secure. For gaming, this means players can confidently trade or sell their assets knowing that ownership is recorded on the blockchain. This not only improves the user experience but also fosters trust among players, creating a more stable digital economy.

Crypto exchange development also plays a key role here, as the success of digital economies depends on secure exchanges where users can safely trade their assets. By building secure and transparent platforms, developers ensure the integrity of these transactions, protecting both the users and the ecosystem as a whole.

Challenges Faced by Economies and Cryptocurrencies in Digital Spaces

Technical Barriers in Implementing Economies and Cryptocurrencies

Despite the numerous advantages of integrating economies and cryptocurrencies, there are several technical challenges to consider. Implementing cryptocurrency-based economies requires sophisticated development and security measures. Developers must ensure that transactions are smooth across different devices and platforms, as a poor user experience could limit the adoption of cryptocurrencies in digital spaces.

In this context, centralized cryptocurrency exchange development companies often take the lead in providing robust and scalable platforms. These companies ensure that users can engage with cryptocurrencies in a way that is both intuitive and secure, addressing many of the technical issues that come with implementing decentralized systems.

Regulatory Compliance Across Jurisdictions

Another significant challenge for economies and cryptocurrencies is regulatory compliance. Cryptocurrency is still in its early stages in terms of widespread adoption, and regulations can vary widely across countries. Ensuring that online platforms comply with local laws while still offering a seamless user experience can be complex. For instance, some jurisdictions may have specific requirements for using cryptocurrencies, while others may outright ban their use.

Crypto exchange development must also navigate these regulatory landscapes. Exchanges must meet compliance standards and ensure their platforms are legally sound while providing the best possible user experience. Without careful attention to these regulatory requirements, platforms may struggle to operate across different regions.

The Future of Economies and Cryptocurrencies in Gaming and Digital Platforms

Blockchain Technology Powers In-Game Economies and Cryptocurrencies

Emerging Trends in Economies and Cryptocurrencies

As technology continues to evolve, the future of economies and cryptocurrencies is bright. One emerging trend is the increasing integration of virtual reality (VR) and augmented reality (AR) into these economies. Imagine participating in a virtual world where the digital currency you earn can be used not only in-game but also in other real-world applications. This cross-functionality is set to become more common as developers find innovative ways to blend virtual and physical assets.

Another exciting trend is cloud gaming. With cloud technology, players no longer need high-end hardware to participate in virtual economies. Instead, they can stream their games and continue to engage in economies and cryptocurrencies without worrying about system requirements. This opens the door to broader participation in digital platforms and increases the reach of cryptocurrency-based economies.

For these advancements to thrive, centralized cryptocurrency exchange development companies will need to stay ahead of the curve. They will be key in creating platforms that integrate seamlessly with new technologies, ensuring that the trading of cryptocurrencies remains smooth, secure, and accessible.

Player Engagement Through Economies and Cryptocurrencies

One of the key benefits of integrating economies and cryptocurrencies is how it improves player engagement. Through the use of digital currency, players can actively participate in a growing economy, giving them more reasons to return to the game or platform. Whether it's through trading, earning rewards, or investing in in-game assets, cryptocurrencies provide added incentives that keep players engaged for longer periods.

Furthermore, loyalty programs and real-time notifications enhance user experience. Players can receive instant updates on market trends, trades, or new items available for purchase, making the experience more dynamic and rewarding. As the use of economies and cryptocurrencies expands, it will lead to even greater levels of interaction and participation from users around the globe.

Conclusion: The Growing Role of Economies and Cryptocurrencies in the Digital World

In conclusion, economies and cryptocurrencies are fundamentally transforming how we interact with digital platforms, particularly in gaming. The integration of real-world value into virtual economies brings new opportunities for players, investors, and developers alike. Whether it's through enhanced accessibility, decentralized transactions, or increased player engagement, the benefits of incorporating economies and cryptocurrencies are clear.

As technology continues to advance, crypto exchange development will remain at the heart of this revolution, providing the infrastructure that enables these digital economies to flourish. Furthermore, centralized cryptocurrency exchange development companies will play an essential role in ensuring that these platforms are secure, scalable, and compliant with global regulations.

While challenges such as technical hurdles and regulatory concerns remain, the future of digital economies is bright. As technology continues to advance, we can expect even more innovative uses of economies and cryptocurrencies, from immersive virtual worlds to seamless cross-platform experiences. For both players and developers, the continued integration of these elements offers endless possibilities and will likely define the next era of digital interactions.

#game development#crypto exchange development#centralized cryptocurrency exchange development company#centralized crypto exchange Software development#centralized crypto exchange provider

0 notes

Text

Fintech Consultancy in Turkey

FinTech consultancy paves the way for a progressive change in terms of banking, technology and digitalization. An efficient FinTech consultancy will provide the compliance of FinTech-led engagements with national and international law-centric standards and rules. That will directly increase legalized integration of FinTech ecosystem into daily banking.

What is the meaning of FinTech?

The term “FinTech” describes emerging electronic payment methodologies based on the automation and facilitation of payment systems. The word FinTech contains a broad form of money transfer models such as electronic money institutions, payment institutions, digital banks, online insurance agencies, and crowdfunding platforms. The term of “Financial Technology (FinTech)” is used to refer to integration of technology into the exchange of goods and services. FinTech, dedicated to the development of faster and better delivery of financial services, is very different in many ways from traditional financial services.

What is the main objective of Turkish FinTech ecosystem?

The main objective of FinTech ecosystem is to facilitate and accelerate shopping and trade. There are several advantages of alternative virtual payment methods. There is a growing agreement that FinTech will play a substantial role in the payment ecosystems across the world. By virtue of those benefits, as of February 2023, 739 FinTech-led companies have been formed in Turkey according to recent studies by the Presidency of Republic of Turkey as a part of Turkish FinTech ecosystems. That displays the growing impact of FinTech Turkey.

What are main challenges of Turkish FinTech ecosystem?

The usage of FinTech presents a broad range of challenges especially where it touches on the use of crypto-currencies such as bitcoin. The invention of digital money and digital payment services platforms have newly caused severe problems in capital markets.

Data privacy and the protection of personal information has been a matter of concern in the field of FinTech intellectual property. Data privacy implies the right to make any decision on when, how and to what extent personal and|private information can be communicated to outsiders. Generally speaking, the collection, processing, the supervision, and protection of the confidentiality of personal data are guaranteed by domestic legislation across jurisdictions. The right to data privacy is recognized to cover a broad range of rights including the right to access to their data, a right to portability, a right to be forgotten, and a right to share or not.

For more discussion about data privacy take a look at our article on the Right to Data Privacy and Respect for Private Life

FinTech ecosystem is particularly used for banking and FinTech restructuring services. For more discussion for banking and finance, take a look at our article on Banking and Finance Law in Turkey

What is the most recent developments for the 2024 Turkish crypto business environment?

Regulatory ecosystem has been improved step by step by Turkish policy and law makers. Such revisions will pave the way for adaptation of Turkish legal and operational structure with blockchain. In this context, it is notable that the digital participation banking system is accepted by Turkish lawmakers in Turkey.

As a second step, the recognition of digital wallets was completed through new regulation of the Central Bank of the Republic of Türkiye. In this way, a Digital Wallet Era in Turkey was started in Turkey.

As a third step, we should take into account new facilitating step for Capital Markets system. Indeed, the 2024 New Electronic Submission System for Turkish Capital Markets was instituted by the Capital Markets Board of Türkiye.

It is critical to note that Turkey accepted its commitment of the full compliance of the emerging capital markets system in line with the Financial Task Force benchmarks dedicated to the prevention of money laundering and terrorist financing. In line with the FATH principles, as a fourth step, the Law Numbered 7518 on Amendments to the Capital Markets Law Numbered 6362 has been enacted. The Law Numbered 7518 is named as Crypto Law of Turkey and entered into force following its publication in the Official Gazette dated July 2, 2024.

Take a look at our up-to-date article on the 2024 FATF Decision on Turkey

Turkish Capital Markets Board is granted a wide margin of appreciation to govern newly-born blockchain system in Turkey. In this context, fiftly, the first decision on the 2024 Announcement for the Rejected Crypto Asset Platforms was delivered by the Board dated 23 August 2024.

Last but not least, the Resolution by Turkish Capital Markets dated 19 September 2024 was published particularly in relation to the legal status of NFTs and P2Ps in Turkey. The Resolution in question explains the meaning of Non-Fungible Tokens [NFTs] [nitelikli fikri tapu in Turkish] as “crypto assets that will be used to record the representation and ownership of digital assets, a non-replicable and unique nature”. When it comes to Peer to Peer [P2P] [eşler arası in Turkish], it is used to refer to digital marketplaces allowing the buying, selling and exchanging of crypto assets directly between direct|main users.The same Resolution also identifies the standards for the accounts to be opened in the name of customers under Article 35/C. Any account to be opened in the name of customers cannot be used for purposes other than their intended purpose. Additionally, customer cash cannot be received by the platforms, cannot be delivered to the customer by hand and cannot be stored in any way with the platforms.

Which authorities are competent for Turkish FinTech ecosystem?

The Banking Regulation and Supervision Agency is granted an authority to ensure the compliance of the banking activities in line with the Banking Law and other applicable regulations. According to Article 93 of the Banking Law, the Agency is granted certain powers and duties for the implementation of the Banking Law.

Secondly, the Turkish Revenue Administration carries out certain duties dedicated to regulating payment systems.

Thirdly, the Personal Data Protection Authority, engaging in the protection of personal data processing in line with internationally recognized human rights standards.

Besides, the Payment and Electronic Money Institutions Association carries out a broad range of duties in Turkey under Article 1 of the Law Numbered 6493.

With regard to the design and implementation of FinTech norms applicable in Turkey, take a look at our article on FinTech Guide in Turkey.

What is the role of FinTech consultancy services?

Innovative approach needs to be improved in order to handle current legal challenges regarding FinTech. FinTech consulting firms must be good at producing FinTech legal guidance.

Pi Legal Consultancy provides comprehensive guidance to global digital leaders, companies, business owners and consumers for particularly risky sides of Turkish FinTech ecosystem. Our FinTech legal and business consultants focus on understanding and using specialized software instruments through computers and smartphones.

Our FinTech consultancy service assists our clients particularly in the following areas of expertise:

Electronic money (e-money) and cryptocurrencies, digital foreign exchange platforms,

Digital (participation) banking, electronic payment or loan services,

Data protection and privacy, information security,

The prevention of money laundering,

The prevention of cybercrimes,

Electronic commerce and online shopping,

The protection of the right to copyright and intellectual property.

#fintech#investment#bankinglaw#banking#turkey#lawyer#istanbul#ankara#financial#companies#economy#business

3 notes

·

View notes

Text

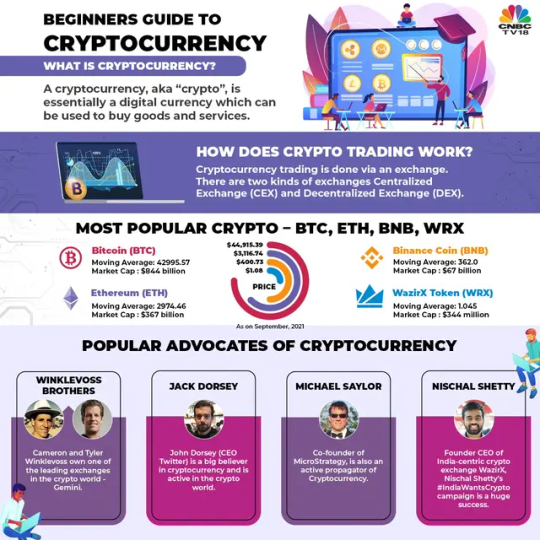

A Primer for Beginners in Cryptocurrency

Cryptocurrency has taken the financial world by storm, a phenomenon held in equal parts awe and scepticism. What is cryptocurrency, and why should beginners care? This guide will answer all these questions and provide a true definition of cryptocurrency, for the uninitiated.

What is Cryptocurrency?

At its most basic, cryptocurrency is any type of digital or virtual currency that uses cryptography for security. Cryptocurrencies — which are not issued by a central government (like the US dollar or Euro), operate on networks known as blockchains. This decentralization means that it is not owned by a single entity, like the central bank of each country.

How Does Cryptocurrency Work?

Decentralization, Transparency and Immutability are the killer features of blockchain technology which is being utilized by cryptocurrencies. A blockchain is a distributed ledger that keeps track of all transactions across a network of computers. When a block of transactions is added to the blockchain, it means that every new transaction in completion (e.g., money moving from one account to another) makes an update on all ledgers for their users.

The opaque and unreliable centralized system is avoided, allowing the data to be secure (distributed AND only YOU hold access), prompt & transparent. Bitcoin, the first and most famous cryptocurrency is a case in point: Bitcoin uses blockchain technology to enable peer-to-peer transactions without an intermediary (like a bank).

Popular Cryptocurrencies

Bitcoin, is the best-known cryptocurrency and there are thousands of other cryptocurrencies with various uses and functionality. Here are a few notable ones:

Ethereum (ETH): Ethereum is a decentralized platform that runs smart contracts (like dApps) on its platform.

Ripple (XRP): While Ripple is designed as a digital payment protocol, it still serves the same use case of enabling instant and cheap across borders.

Litecoin (LTC): Often dubbed as silver to Bitcoin's gold, Litecoin has faster transaction confirmation times.

Why Invest in Cryptocurrency?

There are few reasons for which a realization of benefits can seem attractive in investing this digital currency.

High upside: Cryptocurrencies can also gain value by huge percentages. For example, the early investors of Bitcoin and Ethereum are currently smiling to their bank-account.

2. Diversification: Cryptocurrencies can be added to an investment portfolio in order to diversify it thereby decreasing the risk.

3. Innovation and Technology: Investing in cryptocurrencies is an investment into the underlying blockchain technology, a revolutionary tool with many uses beyond digital currencies.

Risks and Considerations

But of course, as with all investment opportunities there are risks when it comes to digital currencies:

Volatility: Cryptocurrency is known for its price volatility; prices fluctuate rapidly and dramatically.

Regulatory Risks: The regulatory backdrop for cryptocurrencies is definitely a work in progress and future regulations may affect the value of these digital currencies as well as how they can be used.

Security Risks: The blockchain is secure, the platform and exchange on which cryptocurrencies are stored can be hacked.

How to Start with Cryptocurrency

There are some guidelines to help beginners who want to start investing in cryptocurrency.

Do your homework — It is important to be familiar with what you are investing; important to know what you're putting your money into, services like Coursera and NerdWallet provide thorough lessons on cryptocurrency.

Pick a Secure Exchange: Go for the most secure cryptocurrency exchange to purchase and offer cryptos Common exchanges such as Coinbase, Binance and Kraken.

Protect your investments: Store cryptocurrencies in secure wallets. Online wallets are less secure whereas hardware wallets provide advanced security to store.NEO.

4. Start Small — With all the volatility in this market, it would also be prudent to instead make a small investment and then scale into your position from there as you get more comfortable with these markets.

Conclusion

Cryptocurrency is a titanic heavy weight knocking the financial industry off its axis; it opens new doors for wealth and disaster as well. These are the basics of cryptocurrency that beginners need to understand and with a responsible, well-informed entering into it can lead them being successful. successful investment. Besides, due-diligence and strategic thinking at every stage are defining factors for anyone who wants to dive into the roller-coaster world of crypto-investing.

6 notes

·

View notes

Text

The Critical Importance of Financial Education in the Age of Bitcoin

Imagine a world where you have complete control over your money, free from banks and government interference. This isn't a far-off dream—it's the reality that Bitcoin is creating. But with great power comes great responsibility, and that's where financial education becomes crucial. In this post, we'll explore why understanding Bitcoin is essential in today's rapidly evolving financial landscape.

The Current State of Financial Education

Financial literacy rates paint a sobering picture. According to a 2020 FINRA study, only 34% of Americans could answer 4 out of 5 basic financial literacy questions correctly. This lack of understanding often leads to poor financial decisions, leaving people vulnerable to economic uncertainties. As digital currencies gain prominence, this knowledge gap becomes even more critical.

Why Bitcoin Requires Financial Education

Bitcoin, the world's first decentralized digital currency, operates on a complex blockchain network. While its potential benefits are significant, understanding its unique characteristics is crucial:

Volatility: Bitcoin's price can fluctuate wildly. In 2021 alone, it saw a 64% increase followed by a 50% drop within months.

Security: Transactions are secured through cryptography, with ownership maintained via private keys.

Decentralization: Unlike traditional currencies, Bitcoin isn't controlled by any central authority.

Benefits of Understanding Bitcoin

Hedge Against Inflation: With a fixed supply of 21 million coins, Bitcoin is designed to be inflation-resistant.

Investment Opportunities: While volatile, Bitcoin has shown significant long-term growth potential.

Financial Freedom: Bitcoin enables peer-to-peer transactions without intermediaries, offering unprecedented financial autonomy.

Real-World Applications

Bitcoin isn't just a speculative asset. In countries like El Salvador, it's legal tender. Remittance services like BitPesa use Bitcoin to reduce transaction costs for international money transfers in Africa.

Common Misconceptions

Let's debunk some myths:

"Bitcoin is only used for illegal activities": While cryptocurrencies have been used illicitly, legitimate uses far outweigh illegal ones.

"Bitcoin has no intrinsic value": Its value comes from its utility as a decentralized, borderless payment system and its scarcity.

Environmental Concerns

It's important to address the energy consumption debate surrounding Bitcoin mining. While Bitcoin does consume significant energy, innovations in renewable energy mining are addressing these concerns.

Comparison with Other Cryptocurrencies

While Bitcoin was the first, thousands of cryptocurrencies now exist. Ethereum, for example, offers smart contract functionality, while Litecoin aims for faster transaction speeds.

Challenges in Bitcoin Education

Complexity: The technology can be daunting for newcomers.

Misinformation: The crypto space is rife with unreliable information.

Regulatory Uncertainties: Regulations vary widely across jurisdictions.

Strategies for Improving Bitcoin Literacy

Educational Resources: Leverage reputable online courses and books. Websites like Bitcoin.org offer comprehensive guides.

Community Engagement: Join forums like r/Bitcoin or attend local meetups.

Practical Experience: Start with small transactions to build familiarity.

Expert Insight

"Bitcoin is not just an asset, it's a new financial system with its own rules. Understanding these rules is crucial for anyone looking to participate in the future of finance," says Andreas Antonopoulos, a leading Bitcoin educator.

Practical First Steps

Set up a small Bitcoin wallet (try Exodus or Green Wallet).

Buy a small amount of Bitcoin on a reputable exchange like Coinbase or Kraken.

Try making a small transaction to experience how it works.

The Role of Influencers and Educators

Platforms like Unplugged Financial play a crucial role in demystifying Bitcoin. By providing clear, accurate information, these educators help bridge the knowledge gap and empower individuals.

Conclusion

As Bitcoin continues to reshape the financial landscape, understanding its principles, benefits, and challenges is vital. By investing time in financial education, you can make informed decisions and potentially harness the power of Bitcoin to achieve greater financial freedom. Remember, in the world of Bitcoin, knowledge truly is power.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#FinancialEducation#Crypto#Cryptocurrency#DigitalCurrency#Blockchain#FinancialFreedom#Investment#Decentralization#BitcoinEducation#CryptoCommunity#Money#Finance#FinancialLiteracy#BitcoinInvesting#CryptoKnowledge#BitcoinBenefits#FutureOfFinance#FinancialIndependence#unplugged financial#globaleconomy#financial education#financial empowerment#financial experts

4 notes

·

View notes

Text

SOURCE PROTOCOL

SOURCE is building limitless enterprise applications on a secure and sustainable global network. Defi white-labelled services, NFT markets, RWA tokenization, play-to-earn gaming, Internet of Things, data management and more. SOURCE is providing blockchain solutions to the real world and leveraging the power of interoperability.

SOURCE competitive advantages over other blockchain projects

For builders & developers — Source Chain’s extremely high speeds (2500–10000+ tx / per second), low cost / gas fees ($0.01 average per tx), and scalability (developers can deploy apps in multiple coding languages using CosmWasm smart contract framework), set it apart as a blockchain built to handle mass adopted applications and tools. Not to mention, it’s interoperable with the entire Cosmos ecosystem.

For users — Source Protocol’s DeFi suite is Solvent and Sustainable (Automated liquidity mechanisms create a continuously self-funded, solvent and liquid network), Reduces Complexity (we’re making Web 3.0 easy to use with tools like Source Token which automate DeFi market rewards), and we’ve implemented Enhanced Security and Governance systems (like Guardian Nodes), which help us track malicious attacks and proposals to create a safer user environment.

For Enterprises — Source Protocol is one of the first to introduce DeFi-as-a-Service (DaaS) in order for existing online banking and fintech solutions to adopt blockchain technology with ease, and source also provides Enterprise Programs which are complete with a partner network of OTC brokerages, crypto exchanges, and neobanks that create a seamless corporate DeFi experience (fiat onboarding, offboarding, and mutli-sig managed wallets)

Why Source Protocol

Firstly, many protocols are reliant on centralized exchanges for liquidity, limiting their ability to scale independently. This creates a lot of the same issues traditional finance has been plagued with for decades.

Next — slow tx speeds, high costs, limited scalability, and inability to collaborate with other chains, has created severe limitations in Gen 2 blockchain infrastructure.

Lastly, there still exists a level of complexity in blockchain applications that remains a barrier to entry for the average user, and there is not enough focus on building “bridges” for the enterprise to adopt this technology easily and quickly.

In summary, consumers are eager for a blockchain ecosystem that can securely and sustainably support mass adopted applications. That’s why we’ve built Source!

Source Protocol’s ecosystem

Source Protocol’s ecosystem includes a full DeFi Suite, a members rewards program and white-label integration capabilities with existing online Web 2.0 enterprises:

Source Swap — An Interchain DEX & AMM built on Source Chain for permission-less listing of $SOURCE-based tokens, native Cosmos SDK assets, cw-20’s, and wrapped Binance Smart Chain (BEP-20) assets.

Source One Market — A peer to peer, non-custodial DeFi marketplace for borrowing, lending, staking, and more. Built on Binance Smart Chain with bridging to Source Chain & native Cosmos SDK assets.

Source Token $SRCX (BEP-20) — the first automated liquidity acquisition and DeFi market participation token built on Binance Smart Chain.

Source One Token $SRC1 (BEP-20) — a governance and incentivized earnings token that powers Source One Market.

Source USX $USX (BEP-20) — Source One Market stablecoin backed and over collateralized by a hierarchy of blue chip crypto assets and stablecoins.

Source Launch Pad — Empowering projects to seamlessly distribute tokens and raise liquidity. ERC-20 and BEP-20 capable.

Source One Card & Members Rewards Program — users can earn from a robust suite of perks and rewards. In the future, Source One Card will enable users to swipe with their crypto assets online and at retail locations in real time.

DeFi-as-a-Service (DaaS) — Seamless white-label integration of Source One Market, Source Swap, Source Launch Pad, and/or Source One Card with existing online banking and financial applications, allowing businesses to bring their customers DeFi capabilities.

Source Protocol Key Components

Sustainable Growth model built for enterprise involvement and mass application adoption

Guardian Validator Nodes for enhanced network security

Integration with Source Protocol’s Binance Smart Chain Ecosystem and Decentralized Money Market, Source One Market

Source-Drop (Fair community airdrop and asset distribution for ATOM stakers and SRCX holders)

Interoperable smart contracts (IBC)

High speed transaction finality

Affordable gas fees (average of $0.01 per transaction)

Highly scalable infrastructure

Open-source

Permission-less Modular Wasm + (EVM)

Secured on-chain governance

Ease of use for developers

conclusion

SOURCE is a comprehensive blockchain technology suite for individuals, enterprises and developers to easily use, integrate and build web3.0 applications. It is a broad-spectrum technology ecosystem that transforms centralized web tools and financial instruments into decentralized ones. Powering the future of web3,

Next — slow tx speeds, high costs, limited scalability, and inability to collaborate with other chains, has created severe limitations in Gen 2 blockchain infrastructure.

Lastly, there still exists a level of complexity in blockchain applications that remains a barrier to entry for the average user, and there is not enough focus on building “bridges” for the enterprise to adopt this technology easily and quickly.

In summary, consumers are eager for a blockchain ecosystem that can securely and sustainably support mass adopted applications. That’s why we’ve built Source!

For More Information about Source Protocol

Website: https://www.sourceprotocol.io

Documents: https://docs.sourceprotocol.io

Twitter: https://www.twitter.com/sourceprotocol_

Instagram: https://www.instagram.com/sourceprotocol

Telegram: https://t.me/sourceprotocol

Discord: https://discord.gg/zj8xxUCeZQ

Author

Forum Username: Java22

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3443255

SOURCE Wallet Address: source1svnzfy5fafuskeaxmf2sgvgcn6k3sggmssl8d7

2 notes

·

View notes

Text

The Top 10 Web3 Crypto Coins Set to Explode by 2025

In the dynamic world of cryptocurrencies, investors are always on the lookout for the next big thing. As we approach 2025, the focus is shifting towards Web3 crypto coins that promise explosive growth. These digital assets are not only volatile but also have the potential to reshape industries. Let's delve into the top 10 Web3 crypto coins that are set to explode and make waves by 2025.

1.Filecoin

Filecoin stands out as a beacon of innovation in the world of cryptocurrency. Developed by Protocol Labs, Filecoin operates as an open-source, public cryptocurrency and digital payment system. Its primary purpose is to establish a blockchain-based cooperative digital storage and data retrieval method. Transactions within the network are facilitated using FIL, the native currency of the blockchain.

2.Theta

Theta, a blockchain-based network founded in 2018, is a game-changer for video streaming enthusiasts. Operating on a decentralized network, Theta allows users to exchange bandwidth and processing resources peer-to-peer. The goal is clear: enhance video streaming quality, making it more efficient and cost-effective. As the demand for high-quality streaming rises, Theta positions itself as a key player in the industry.

3.Chainlink

Co-founded in 2014 by Sergey Nazarov and Steve Ellis, Chainlink has emerged as a pioneer in connecting off-platform sources to smart contracts. With a robust foundation in decentralized systems, Chainlink is a dominant force in a growing market. Investing in Chainlink is akin to putting trust in a technology that seamlessly integrates data into smart contracts.

4.Internet Computer

Internet Computer (ICP) plays a crucial role as a utility token, enabling users to participate in and govern the Internet Computer blockchain network. Designed to assist developers in creating websites, enterprise IT systems, internet services, and DeFi applications, ICP offers versatility. Notably, ICP can be staked or converted into cycles, powering computation for decentralized applications (dApps) and traditional applications alike.

5.BitTorrent

BitTorrent, a popular peer-to-peer distributed communication technology, revolutionizes data distribution. By eliminating the need for a central server, BitTorrent ensures reliable simultaneous distribution of large files to multiple clients. The protocol's efficiency and decentralized nature make BitTorrent a cornerstone in the era of massive data sharing.

6.Uniswap

Uniswap, an Ethereum token, drives the automated liquidity provider designed for exchanging Ethereum (ERC-20) tokens. Unlike traditional exchanges, Uniswap operates without an order book or central facilitator. Token exchanges occur through liquidity pools defined by smart contracts, providing a decentralized and efficient trading experience.

7.Ethereum

Ethereum, the second-largest cryptocurrency by market capitalization, has witnessed a remarkable surge in value, reaching as high as 800% in the last year. Ethereum's significant role in expanding decentralized finance (DeFi) contributes to its widespread acceptance and substantial investments. As the crypto landscape evolves, Ethereum continues to play a pivotal role in shaping the future of finance.

8.Decentraland

Decentraland, a 3D virtual reality platform built on the Ethereum blockchain, offers a unique space where users can create and monetize content and applications. Functioning as a shared metaverse, Decentraland allows users to purchase virtual plots of land. Its immersive experience and user-owned network contribute to its growing popularity.

9.Polkadot

Polkadot distinguishes itself by seamlessly connecting heterogeneous blockchain networks. Its capability to facilitate communication between diverse blockchain projects positions it as a promising investment. The Polkadot ecosystem is witnessing a surge in projects built on its foundation, making it a reliable choice for investors seeking decent returns.

10Cardano

Cardano stands out as a digital currency with impressive growth, driven by its commitment to optimizing transaction time and energy consumption. As the crypto community emphasizes sustainability, Cardano's approach aligns with the evolving preferences of investors. Its growth trajectory indicates a promising future in the competitive cryptocurrency landscape.

FAQs----------------------------------------

How Can I Start Investing in Web3 Crypto Coins?

To invest in Web3 crypto coins, start by creating an account on a reputable cryptocurrency exchange. Purchase popular coins like Ethereum or Binance Coin and explore emerging projects with potential.

Is Web3 Technology Safe for Investments?

Web3 technology introduces enhanced security features through decentralized frameworks. While risks exist, thorough research and due diligence can mitigate potential issues, making it a relatively safe investment avenue.

What Sets Web3 Apart from Previous Crypto Generations?

Web3 introduces decentralization on a broader scale, emphasizing user control and security. It aims to address scalability, interoperability, and sustainability, marking a significant evolution from previous crypto generations.

Which is the Best Blockchain Development Company In Mohali, Punjab ?

Wisewaytec stands at the forefront of cutting-edge blockchain development, offering innovative solutions that redefine the digital landscape. As the Best Blockchain Development Company in Mohali, Punjab we are committed to empowering businesses with transformative technologies that enhance security, transparency, and efficiency.

Can Web3 Coins Replace Traditional Financial Systems?

While Web3 coins aim to revolutionize finance, complete replacement of traditional systems is a gradual process. They coexist, offering diverse options for users seeking decentralized alternatives.

Are Web3 Crypto Coins Suitable for Long-Term Investments?

Many Web3 projects demonstrate potential for long-term growth. However, due diligence is crucial. Research each project's fundamentals, team, and community support to make informed decisions.

Conclusion

The top 10 Web3 crypto coins mentioned above are poised to explode by 2025. Each coin represents a unique value proposition, catering to the evolving needs of investors and enthusiasts. As the market embraces innovation, these cryptocurrencies stand as beacons of potential growth and transformation.

Disclaimer: Any financial and crypto market information written for informational purpose only and is not an investment advice. The readers are further advised that Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Conduct your own research by contacting financial experts before making any investment decisions. The decision to read hereinafter is purely a matter of choice and shall be construed as an express undertaking/guarantee in favour of being absolved from any/ all potential legal action, or enforceable claims. I do not represent nor own any cryptocurrency, any complaints, abuse or concerns with regards to the information provided shall be immediately informed here.

5 notes

·

View notes

Text

Best Bitcoin Alternatives: Exploring Top Cryptocurrencies for 2024 by Simplyfy

Bitcoin, the pioneering cryptocurrency, has long been the standard-bearer in the world of digital currencies.

However, the crypto market has grown exponentially, and several preferences to Bitcoin now provide special points and benefits. This article, promoted via Simplyfy, targets to information you via the fantastic Bitcoin choices for 2024, supporting you make knowledgeable choices in the evolving panorama of digital assets.

Introduction to Bitcoin and Its Alternatives

Bitcoin, introduced in 2009 by the pseudonymous Satoshi Nakamoto, revolutionized the financial world by introducing a decentralized form of currency.

Its meteoric upward shove in fees and massive adoption have paved the way for lots of different cryptocurrencies. These alternatives, frequently referred to as altcoins, serve a number of purposes, from improving privateness and enhancing transaction speeds to imparting revolutionary structures for decentralized purposes (DApps).

Why Look Beyond Bitcoin?

While Bitcoin remains a cornerstone of the crypto market, there are several reasons why investors and enthusiasts might seek alternatives:

1. Scalability: Bitcoin's transaction speed and scalability have been points of contention.

Some selections provide quicker and extra scalable solutions.

2. Transaction Fees: As Bitcoin's network becomes busier, transaction fees can rise.

Some altcoins supply less expensive transaction costs.

3. Utility: Many altcoins are designed with specific use cases in mind, from smart contracts to privacy features.

4. Investment Diversification: Diversifying one's portfolio with multiple cryptocurrencies can mitigate risk and potentially increase returns.

Top Bitcoin Alternatives in 2024

1. Ethereum (ETH)

Overview: Launched in 2015 by Vitalik Buterin, Ethereum is more than just a cryptocurrency.

It’s a decentralized platform that allows builders to construct and set up clever contracts and decentralized purposes (DApps).

Key Features:

Smart Contracts: Self-executing contracts with the terms of the agreement directly written into code.

Decentralized Applications (DApps): Applications that run on a decentralized network.

Ethereum 2.0: The ongoing improvement to Ethereum goals to enhance scalability, security, and sustainability via a shift from Proof of Work (PoW) to Proof of Stake (PoS).

Pros:

- Highly versatile platform with numerous use cases.

- Strong developer community.

- Continuous improvement and scalability through Ethereum 2.0.

Cons:

- High transaction fees (gas fees) during network congestion.

- Complex for new users compared to simpler cryptocurrencies.

2. Binance Coin (BNB)

Overview: Binance Coin is the native cryptocurrency of the Binance Exchange, one of the largest cryptocurrency exchanges in the world. Initially launched as an ERC-20 token on the Ethereum blockchain, BNB has since transitioned to the Binance Chain.

Key Features:

Exchange Utility: Primarily used to pay for trading fees on Binance, offering discounts to users.

Binance Smart Chain (BSC): Supports smart contracts and is known for its low transaction fees and high throughput.

Pros:

- Strong backing and integration with the Binance Exchange.

- Low transaction fees on BSC.

- Continuous development and use cases expanding beyond the Binance platform.

Cons:

The centralized nature of Binance raises concerns among decentralization purists.

- Regulatory scrutiny due to its association with Binance.

3. Cardano (ADA)

Overview: Cardano is a third-generation blockchain platform founded by Charles Hoskinson, a co-founder of Ethereum. It aims to provide a more balanced and sustainable ecosystem for cryptocurrencies.

Key Features:

Proof of Stake (PoS): Uses the Ouroboros PoS protocol, which is energy efficient.

Research-Driven: Development is backed by peer-reviewed academic research.

Scalability and Interoperability: Designed to improve scalability and interoperability compared to previous generations of blockchain.

Pros:

- Strong focus on security and sustainability.

- Continuous updates and improvements.

- Active community and developer involvement.

Cons:

- Slow development process due to its research-driven approach.

- Still in the early stages compared to some competitors.

4. Solana (SOL)

Overview: Solana is a high-performance blockchain supporting builders around the world creating crypto apps that scale today. It aims to provide decentralized finance solutions on a scalable and user-friendly blockchain.

Key Features:

Proof of History (PoH): A unique consensus algorithm that provides high throughput.

Low Transaction Fees: Designed to offer low-cost transactions.

Scalability: Capable of handling thousands of transactions per second.

Pros:

- Extremely fast and scalable.

- Low transaction costs.

- A growing ecosystem of DApps and DeFi projects.

Cons:

- Relatively new and still proving its stability.

- Centralization concerns due to the small number of validators.

5. Polkadot (DOT)

Overview: Founded by Dr. Gavin Wood, another co-founder of Ethereum, Polkadot is a heterogeneous multi-chain framework.

It approves a number of blockchains to switch messages and fees in a trust-free fashion.

Key Features:

Interoperability: Connects multiple blockchains into a single network.

Scalability: Enables parallel processing of transactions across different chains.

Governance: Decentralized governance model allowing stakeholders to have a say in the protocol's future.

Pros:

- Focus on interoperability and connecting different blockchains.

- High scalability potential.

- Strong developer and community support.

Cons:

The complexity of the technology might pose a barrier to new users.

- Competition with other interoperability-focused projects.

6. Chainlink (LINK)

Overview: Chainlink is a decentralized oracle network providing reliable, tamper-proof data for complex smart contracts on any blockchain.

Key Features:

Oracles: Bridges the gap between blockchain and real-world data.

Cross-Chain Compatibility: Works with multiple blockchain platforms.

Decentralized Data Sources: Ensures data reliability and security.

Pros:

- Unique and crucial role in enabling smart contracts to interact with external data.

- Strong partnerships with major companies and blockchains.

- Growing use cases and applications.

Cons:

- Highly specialized use cases might limit broader adoption.

- Dependence on the success of the smart contract ecosystem.

7. Ripple (XRP)

Overview: Ripple aims to enable instant, secure, and low-cost international payments.

Unlike many different cryptocurrencies, Ripple focuses on serving the desires of the monetary offerings sector.

Key Features:

RippleNet: A global network for cross-border payments.

XRP Ledger: A decentralized open-source product.

Speed and Cost: Provides fast transactions with minimal fees.

Pros:

- Strong focus on financial institutions and cross-border payments.

- Low transaction fees and fast settlement times.

- Significant partnerships with banks and financial institutions.

Cons:

- Centralization concerns due to Ripple Labs’ control.

- Ongoing legal issues with regulatory authorities.

8. Litecoin (LTC)

Overview: Created by Charlie Lee in 2011, Litecoin is often considered the silver to Bitcoin’s gold.

It targets to supply fast, low-cost repayments by way of the usage of a one-of-a-kind hashing algorithm.

Key Features:

Scrypt Algorithm: Allows for faster transaction confirmation.

SegWit and Lightning Network: Implements advanced technologies for scalability.

Litecoin Foundation: Active development and community support.

Pros:

- Faster transaction times compared to Bitcoin.

- Lower transaction fees.

- Active development and widespread adoption.

Cons:

- Limited additional functionality beyond being a currency.

- Competition from newer and more versatile cryptocurrencies.

9. Stellar (XLM)

Overview: Stellar is an open network for storing and moving money.

Its aim is to allow monetary structures to work collectively on a single platform.

Key Features:

Stellar Consensus Protocol (SCP): Allows for faster and cheaper transactions.

Anchor Network: Connects various financial institutions to the Stellar network.

Focus on Remittances: Facilitates cross-border payments and remittances.

Pros:

- Low transaction fees and high speed.

- Focus on financial inclusion and connecting global financial systems.

- Strong partnerships and adoption in the financial sector.

Cons:

- Competition from other payment-focused cryptocurrencies.

- Centralization concerns regarding development control.

10. Monero (XMR)

Overview: Monero is a privacy-focused cryptocurrency that aims to provide secure, private, and untraceable transactions.

Key Features:

Privacy: Uses advanced cryptographic techniques to ensure transaction privacy.

Decentralization: Emphasizes decentralization and security.

Fungibility: Every unit of Monero is indistinguishable from another.

Pros:

- Strong privacy and security features.

- Active community focused on maintaining privacy.

- Continuous development and improvements.

Cons:

- Privacy focus attracts regulatory scrutiny.

- Not as widely accepted as other cryptocurrencies.

Conclusion

The cryptocurrency market affords a plethora of options to Bitcoin, every with its special features, advantages, and viable downsides.

Whether you're looking for faster transaction speeds, lower fees, advanced functionalities like smart contracts, or enhanced privacy, there is likely a cryptocurrency that meets your needs. Ethereum, Binance Coin, Cardano, Solana, Polkadot, Chainlink, Ripple, Litecoin, Stellar, and Monero are among the top contenders worth considering in 2024.

As with any investment, it is quintessential to behavior thoroughly lookup and reflect on consideration on your monetary dreams and hazard tolerance. The crypto market is quite risky and can be unpredictable. Diversifying your investments and staying knowledgeable about market tendencies and technological developments can assist you navigate this.

#simplyfy#news#bitcoin#cryptocurrency#crypto#blockchain#digitalcurrency#cryptonews#cryptotrading#simplyfycrypto#simplyfynews

3 notes

·

View notes

Text

How To Get Rich With Bitcoin Even If You Have No Clue About Technology

1. Introduction to Bitcoin

Bitcoin is more than just a buzzword in today's financial world; it's a revolutionary concept that has reshaped the way we think about money. Conceived in 2008 by an enigmatic figure known as Satoshi Nakamoto, Bitcoin has evolved from a niche digital currency to a mainstream financial asset. Understanding Bitcoin's role in the modern economy is key to appreciating why it has become a popular avenue for those seeking wealth.

1.1 The Birth of a Digital Currency

The inception of Bitcoin occurred during a time of financial turmoil, right after the 2008 global economic crisis. It was designed to be a decentralized form of currency, free from government control and traditional banking systems. This autonomy has been a significant draw for individuals who are disenchanted with conventional financial institutions.

1.2 Why Bitcoin Matters in Today's Economy

Bitcoin's significance lies in its decentralized structure, which empowers individuals to have control over their wealth. As traditional currencies face inflation and government regulation, Bitcoin offers an alternative that can be traded, stored, and used globally without the need for intermediaries. This autonomy has attracted investors and innovators alike.

2. Understanding the Basics of Bitcoin

To grasp how to get rich with Bitcoin, it's crucial to understand its basic mechanics and why it's so unique in the financial world

You can also try this course : Crypto Quantum Leap

2.1 What Is Bitcoin and How Does It Work?

Bitcoin is a digital currency that relies on a technology called blockchain. This technology is a public ledger that records all transactions made with Bitcoin. Unlike traditional currencies, Bitcoin is not printed or minted; it is "mined" through complex mathematical processes. This mining process validates transactions and maintains the integrity of the blockchain.

2.2 The Decentralized Nature of Bitcoin

Decentralization is a cornerstone of Bitcoin. It means that no single entity, government, or organization controls it. This lack of central authority provides a level of freedom and security that traditional currencies cannot match. Transactions are peer-to-peer, and the entire system is maintained by a network of nodes and miners distributed across the globe.

3. Bitcoin as an Investment

Bitcoin's rise in value has drawn significant attention from investors seeking high returns. But what makes it so attractive, and how does it compare to other investments?

3.1 Bitcoin vs. Traditional Investments

Bitcoin's rapid appreciation in value has outstripped many traditional investments like stocks, bonds, and real estate. While these conventional investments are generally tied to broader economic trends, Bitcoin's value is influenced by supply and demand dynamics within the digital currency ecosystem. This unique characteristic allows Bitcoin to sometimes act as a hedge against inflation and other economic uncertainties.

3.2 The Potential for High Returns

Bitcoin's potential for high returns is not without risks, but the rewards can be substantial. Early adopters who bought Bitcoin when it was worth pennies have seen their investments grow exponentially. This potential for remarkable gains has led to increased interest from both individual investors and institutional entities.

4. Starting Your Bitcoin Journey

Investing in Bitcoin might seem daunting, especially if you have no technical background. However, getting started is easier than you might think.

4.1 Setting Up a Bitcoin Wallet

The first step in your Bitcoin journey is setting up a Bitcoin wallet. This digital wallet allows you to store, send, and receive Bitcoin. There are several types of wallets, including software wallets, hardware wallets, and online wallets. Each has its advantages and disadvantages, but hardware wallets are generally considered the most secure.

4.2 Choosing the Right Exchange

To buy Bitcoin, you'll need to choose a cryptocurrency exchange. These platforms allow you to trade traditional currency for Bitcoin. When selecting an exchange, consider factors such as fees, security features, and user-friendliness. Popular exchanges like Coinbase and Binance offer intuitive interfaces and robust security measures.

5. Diversifying with Bitcoin

Diversification is a fundamental principle in investing, and Bitcoin can play a key role in a diversified portfolio.

5.1 Why Diversification Is Key

Diversifying your investments reduces risk and enhances stability. By including Bitcoin in your portfolio, you can benefit from its growth potential while mitigating risks associated with traditional investments. Bitcoin's uncorrelated nature means it can act as a buffer against market fluctuations.

5.2 Using Bitcoin to Expand Your Investment Portfolio

Bitcoin can be used to diversify not only across asset classes but also within the cryptocurrency market itself. Investing in other cryptocurrencies or blockchain-related projects can further broaden your investment scope. This strategy allows you to capitalize on emerging trends within the digital asset space.

6. Bitcoin Trading and Speculation

Trading Bitcoin can be lucrative, but it requires a deep understanding of market dynamics and a tolerance for volatility.

You can also try this course : Crypto Quantum Leap

6.1 Understanding Market Volatility

Bitcoin is known for its price swings, which can be both thrilling and unsettling. This volatility is due to a combination of factors, including news events, regulatory changes, and market sentiment. To navigate these fluctuations, it's essential to stay informed and develop a strategy that aligns with your risk tolerance.

6.2 Strategies for Successful Trading

Successful Bitcoin trading involves more than just buying low and selling high. It requires a comprehensive understanding of technical analysis, chart patterns, and market indicators. Common trading strategies include day trading, swing trading, and long-term holding. Each approach has its merits, and the best strategy depends on your individual goals and risk appetite.

7. Earning Bitcoin Through Other Means

While trading and investing are popular methods of acquiring Bitcoin, there are other ways to earn this digital currency without extensive technical knowledge.

7.1 Bitcoin Mining: Pros and Cons

Bitcoin mining involves using computational power to solve complex mathematical problems, earning Bitcoin in the process. However, mining requires significant upfront investment in hardware and energy costs, making it less accessible to beginners. The competitive nature of mining also means that profitability can vary widely.

7.2 Earning Bitcoin Through Freelancing and Services

Another way to earn Bitcoin is by offering goods or services in exchange for cryptocurrency. Many platforms allow freelancers to be paid in Bitcoin, providing an alternative revenue stream for those with skills to offer. This method is an excellent option for individuals who prefer to earn Bitcoin through work rather than investment.

8. Staying Safe in the Bitcoin World

As with any valuable asset, safety and security are paramount when dealing with Bitcoin.

8.1 Protecting Your Bitcoin Wallet

Your Bitcoin wallet is like your digital bank account, and keeping it secure is crucial. Use strong passwords, enable two-factor authentication, and regularly back up your wallet. Hardware wallets provide an additional layer of security by keeping your private keys offline, reducing the risk of hacking or theft.

8.2 Avoiding Scams and Frauds

The popularity of Bitcoin has led to an increase in scams and fraudulent schemes. Common scams include phishing attacks, Ponzi schemes, and fraudulent exchanges. To avoid falling victim to these scams, always verify the legitimacy of any platform or individual before engaging in transactions. Be wary of promises of guaranteed returns or schemes that sound too good to be true.

9. Tax Implications and Legal Considerations

Owning and trading Bitcoin comes with certain tax and legal responsibilities. It's essential to understand these implications to avoid any legal trouble.

9.1 Understanding Bitcoin Taxation

In many jurisdictions, Bitcoin is considered property for tax purposes, meaning that buying, selling, or trading it can trigger taxable events. Keeping accurate records of all transactions is crucial for compliance. Consult with a tax professional to ensure you're meeting your obligations and to understand any applicable deductions or credits.

9.2 Legal Aspects of Owning and Trading Bitcoin

Laws regarding Bitcoin vary from country to country. Some nations have embraced it, while others have imposed strict regulations or outright bans. Before investing or trading Bitcoin, familiarize yourself with the legal landscape in your region. This knowledge will help you avoid legal complications and ensure you're operating within the bounds of the law.

10. Long-Term Prospects for Bitcoin

Despite its volatility and regulatory challenges, Bitcoin has established itself as a formidable force in the financial world. The question many ask is: What does the future hold for Bitcoin?

10.1 The Future of Bitcoin

Bitcoin's future depends on various factors, including regulatory developments, technological advancements, and broader market trends. As blockchain technology evolves, Bitcoin's role in the global economy may expand. Some experts predict that Bitcoin could become a standard digital currency, while others foresee continued fluctuations and regulatory hurdles.

10.2 How Bitcoin Is Changing the Financial Landscape

Bitcoin's impact goes beyond its monetary value. It has challenged traditional financial systems and sparked innovation in the way we conduct transactions. Concepts like decentralized finance (DeFi) and non-fungible tokens (NFTs) have emerged, offering new opportunities for wealth generation and reshaping the financial landscape. Bitcoin's journey is far from over, and its influence continues to grow.

11. Conclusion

Bitcoin offers a unique pathway to wealth, even for those with limited technical knowledge. From understanding the basics to exploring advanced trading strategies, the journey to financial success with Bitcoin is filled with possibilities.

You can also try this course : Crypto Quantum Leap

11.1 Key Takeaways

To get rich with Bitcoin, you need to:

Understand the fundamentals of Bitcoin and blockchain technology.

Explore various investment and trading strategies.

Ensure the security of your Bitcoin assets.

Stay informed about regulatory and tax implications.

Embrace the volatility while diversifying your portfolio.

11.2 Encouragement for Newcomers

For newcomers to the world of Bitcoin, the journey can seem daunting. However, with the right approach, anyone can tap into the potential of this digital currency. Start small, stay informed, and remain open to learning. The road to wealth with Bitcoin is open to those willing to embrace the possibilities it offers.

DISCLAIMER

There are an affiliate link of a best course in this article which may makes some profits for me

You can also try this course : Crypto Quantum Leap

#1950s#bitcion#binance#rwby#halving#ethlyn#crypto news#star wars#ryan gosling#coinbase#ethereum#bitcoin#blockchain#investment#altcoin#crypto#defi

2 notes

·

View notes

Text

Exploring The Advantages Of A Decentralized Crypto Wallet

Crypto currency has brought about a plethora of options for storing and managing digital assets in the realm of digital finance. Among these options, decentralized crypto wallets have gained significant popularity owing to their unique advantages and user-centric features. In this article, we will explore the advantages of using a decentralized crypto wallet and why it is becoming the preferred choice for many crypto enthusiasts.

What is a Decentralized Crypto Wallet?

A decentralized crypto wallet, also known as a non custodial wallet crypto, is different from traditional online crypto wallets in one fundamental aspect: control. Unlike custodial wallets, where a third party holds the user's private keys and, hence, control over their funds, decentralized wallets empower users with complete control over their digital assets. This means that users are solely responsible for safeguarding their private keys and managing their funds securely.

Advantages of a Decentralized Crypto Wallet:

1. Enhanced Security:

One of the primary advantages of decentralized crypto wallets is enhanced security. As they eliminate the need to entrust private keys to a centralized entity, users mitigate the risk of potential hacks or security breaches. With complete control over their private keys, users can rest assured knowing that their funds are protected against unauthorized access.

2. Sovereignty and Control:

Decentralized wallets embody the core ethos of cryptocurrency - decentralization. Users retain sovereignty and complete control over their funds, free from the constraints of centralized intermediaries. This autonomy aligns with the foundational principles of blockchain technology, fostering trust and transparency within the ecosystem.

3. Flexibility and Compatibility:

Many decentralized wallets, such as The Connecter's Multichain Crypto Wallet, offer support for multiple blockchain networks. This versatility enables users to manage a diverse range of digital assets from a single interface, streamlining the user experience and eliminating the need for multiple wallets.

4. Privacy Protection:

Decentralized wallets prioritize user privacy by minimizing the collection of personal information. Unlike centralized exchanges or custodial wallets that may require extensive KYC (Know Your Customer) verification processes, decentralized wallets offer a level of anonymity that appeals to privacy-conscious users.

5. Access Anytime, Anywhere:

With decentralized wallets, users are not bound by geographical limitations or reliance on third-party services. As long as users have access to the internet, they can manage their digital assets anytime, anywhere, without being subject to downtime or service interruptions.

In conclusion, decentralized crypto wallets offer a host of advantages that cater to the evolving needs of cryptocurrency users. From enhanced security and privacy protection to sovereignty and compatibility, these wallets embody the principles of decentralization while providing a user-friendly experience. As the digital asset landscape continues to evolve, decentralized wallets, such as The Connecter's multichain crypto wallet, stand at the forefront of innovation, empowering users with control, security, and flexibility in managing their digital assets. For more information visit the website: https://www.theconnecter.io/.

#Online Crypto Wallet#Multichain Crypto Wallet#Decentralized Crypto Wallet#Non Custodial Wallet Crypto

2 notes

·

View notes

Text

From Traditional to Trailblazing: Python50's Next-Gen Referral Revolution

Introduction:

Welcome to Python50, the revolutionary decentralized referral program that is set to change the way people earn rewards for their referrals. In this blog post, we'll delve into what Python50 is all about, how it works, and why you should join now to start earning more.

What is Python50?

Python50 is a next-generation referral program built on blockchain technology. It provides a transparent, secure, and efficient way for individuals to earn rewards by referring others.

How Does Python50 Work?

Unlike traditional referral programs that are centralized and often opaque, Python50 leverages the power of blockchain technology to create a decentralized network where referrals are tracked securely and transparently. Here's how it works:

Decentralization: Python50 operates on a decentralized network of nodes, ensuring that there is no single point of control or failure. This decentralized structure guarantees transparency and security for all participants.

Smart Contracts: Python50 utilizes smart contracts, self-executing contracts with the terms of the agreement directly written into code. Smart contracts automatically enforce the referral program's rules, ensuring that rewards are distributed fairly and transparently.

Token Rewards: Participants in the Python50 referral program earn rewards in the form of tokens, which can be exchanged for various goods and services within the Python50 ecosystem or traded on supported cryptocurrency exchanges in future.

Immutable Ledger: All referral activities and rewards are recorded on the blockchain, creating an immutable ledger that cannot be tampered with. This transparency builds trust among participants and ensures the integrity of the referral program.

Why Join Python50?

There are several compelling reasons to join Python50:

Higher Rewards: Python50 offers generous rewards for successful referrals, allowing participants to earn more than traditional referral programs.

Transparency: With Python50, all referral activities and rewards are recorded on the blockchain, providing full transparency to participants.

Security: The decentralized nature of Python50 ensures that participant data and rewards are secure from hacking or manipulation.

Community: By joining Python50, you become part of a vibrant community of like-minded individuals who are passionate about blockchain technology and earning rewards through referrals.

How to Join Python50

Joining Python50 is easy and straightforward:

Visit the Python50 website and create an account. Start referring friends, family, and colleagues. Earn rewards in the form of tokens for successful referrals. Redeem tokens for goods and services or trade them on supported cryptocurrency exchanges in the future.

Conclusion

Python50 is the next generation of decentralized referral programs, offering higher rewards, transparency, and security to participants. Join now to start earning more through referrals and become part of a thriving blockchain community.

Don't miss out on this opportunity – join Python50 today!

2 notes

·

View notes

Text

youtube

This video is about how to buy crypto anonymously. It covers various methods for anonymous crypto purchases, including P2P exchanges, cash meetups, private trades, anonymous prepaid cards, decentralized exchanges (DEXs), coin mixers, VPNs, mobile wallets, and multiple wallets.

The video also highlights the importance of responsible crypto practices and staying informed about evolving legal landscapes. It emphasizes that anonymity is not a shield and that users should always prioritize security and confidentiality.

Here are some key points from the video:

P2P exchanges: The video mentions that P2P exchanges like LocalBitcoins offer cash meetups and private trades for anonymous crypto purchases. However, it also warns that users should be careful when using P2P exchanges, as there is a risk of fraud.

Cash meetups and private trades: The video mentions that cash meetups and private trades can be a good way to buy crypto anonymously, but it is important to take safety precautions, such as meeting in a public place and bringing a friend.

Anonymous prepaid cards: The video mentions that anonymous prepaid cards can be used to fund P2P transactions, but it is important to source secure options and ensure responsible crypto purchases.

Decentralized exchanges (DEXs): The video mentions that DEXs can be a good way to buy crypto anonymously, as they do not require KYC verification. However, it also warns that DEXs can be more complex to use than centralized exchanges.

Coin mixers: The video mentions that coin mixers can be used to mask transaction history, but it is important to use reputable services and be aware of the potential drawbacks.

VPNs: The video mentions that VPNs can be used to encrypt your activity and conceal your IP address, but it is important to choose a reputable VPN provider.

Mobile wallets: The video mentions that mobile wallets can be a good way to store crypto anonymously, but it is important to choose a wallet with robust privacy features.

Multiple wallets: The video mentions that spreading your crypto holdings across multiple wallets can help to increase anonymity.

Legal considerations: The video mentions that it is important to stay informed about evolving legal landscapes and seek guidance from experienced advisers.

Overall, this video provides a helpful overview of the different methods that can be used to buy crypto anonymously. However, it is important to remember that anonymity is not a shield and that users should always prioritize security and confidentiality.

2 notes

·

View notes

Text

The 2024 Announcement for the Rejected Crypto Asset Platforms

The 2024 Announcement for the Rejected Crypto Asset Platforms has been newly made by the Capital Markets Board (hereinafter as the Board) dated 23 August 2024. That decision was published in the Board Bulletin No: 2024/42.

Table of Contents

Introduction

What is the meaning of Financial Technologies?

What is the news for the 2024 Announcement for the Rejected Crypto Asset Platforms?

Recent Progress for the 2024 Turkish Crypto Business Environment in Turkey

Conclusion

Introduction

The 2024 Turkish Crypto Law is in effect as of July 2, 2024. A new term was started after the adoption of the Law Numbered 7518 “known as the Turkish Crypto Law” revising the Capital Markets Law Numbered 6362 as of July 2, 2024. All legal practitioners including Turkish business lawyers have focused on main features of crypto asset platforms and upcoming benchmarks and standards by the Board. This article will present a useful summary of the recent Board decision on the 2024 Announcement for the Rejected Crypto Asset Platforms.

What is the meaning of Financial Technologies?

Financial technologies (FinTech) environment has improved very quickly over the last 20 years across the globe. The term “FinTech” is used to refer to emerging electronic payment methodologies and systems such as electronic money institutions, payment institutions, digital banks, online insurance agencies, and crowdfunding platforms and blockchain such as crypto currencies. It is very significant to underscore at this juncture that the terms for crypto wallet, crypto asset, crypto asset storage service and crypto asset exchange platform as well as crypto assets service provider were made in Article 1 of the Law Numbered 7518. It is mandatory to obtain a permission from the Board for the establishment and operation of crypto service providers.

For our work and all legal services on the matter of financial technologies, please click our “Practice Areas”, titled, FinTech For a comprehensive discussion on the FinTech Environment in Turkey, take a look at our article on FinTech Guide in Turkey For more discussion for the importance of FinTech for banking and finance, take a look at our article on Banking and Finance Law in Turkey

What is the news for the 2024 Announcement for the Rejected Crypto Asset Platforms?

There is recent progress on the 2024 Announcement for the Rejected Crypto Asset Platforms. The Board announced its decision for the list of crypto platforms whose declaration applications have not been considered or have been directly rejected. The announcement is available in Board Bulletin 2024/42. The applications of 32 crypto providers have been removed from processing on the grounds of incomplete or insufficient submission of the requested explanations and documents. The applications of 32 more crypto asset platforms have not been processed on the grounds of the lack of any customers and/or customer storage balances as of the application date.

See also our previous article on New Turkish Crypto Law 2024

Recent Progress for the 2024 Turkish Crypto Business Environment in Turkey

In Turkey there has been a broad range of developments for the improvement of financial technologies. As a first step, the digital participation banking system is accepted by Turkish lawmakers in Turkey.

As a second step, the recognition of digital wallets has also been completed by means of new regulation of the Central Bank of the Republic of Türkiye. In this way, a Digital Wallet Era in Turkey started.

As a third step, the 2024 New Electronic Submission System for Turkish Capital Markets was instituted by the Capital Markets Board of Türkiye.

Turkish policy-makers took a commitment of the full compliance of the emerging capital markets system in line with the Financial Task Force standards and principles designed for the prevention of money laundering and terrorist financing. Therefore, fourthly, the Law Numbered 7518 on Amendments to the Capital Markets Law Numbered 6362 has been enacted. The Law Numbered 7518 is regarded as Crypto Law of Turkey and enters into force following its publication in the Official Gazette dated July 2, 2024.

Take a look at our up-to-date article on the 2024 FATF Decision on Turkey

Fiftly, the first decision on the 2024 Announcement for the Rejected Crypto Asset Platforms has been delivered by the Board dated 23 August 2024.

Conclusion