#but student loans are still going to be paid for a good few more years

Explore tagged Tumblr posts

Text

The good news: i paid off my car today.

The bad news: the money that WOULD have been used to continue my car payment had i decided to continue doing monthly payments instead of just paying off the last 2 grand in one go, now gets to go to my student loans.

Eventually, I will be debt free!

#leslie speaks#car loan is done so yay#but student loans are still going to be paid for a good few more years#hopefully no more than five ir six?#my dads helping me a lot and i still have my loans seperated#i pauly the federal and hes doing the private because i havent refinanced them yet#might not have to if i can get this done quickly#student loans#go to college they said#it would be fun they said

0 notes

Text

.

#the good news is I finished paying off my student loans back in 2020#the bad news is my husband still has $16k in them#we’re pushing buying a house/moving to another state again#which sucks#but I’m also tired of the way I’ve been treated at work for fucking years now#and we’ve already had to push buying a house and moving back several times#I was mostly staying cause I’ve been there so damn long and that looks good to a mortgage company#but enough is enough#I don’t get paid enough for what I put up with so after my surgery in a few months I’m job hunting#nervous about it but I am in a leadership position and that always looks good on a resume#realistically if I can find something that lays a few more dollars per hour it would be good#I think I figured that as long as that happens then I can be the sole one saving and my husband can focus on laying down his student loans#and also he can save for a new car cause we only have one right now#I figure in two years he should have laid off the loan + gotten a car and then he can go back to helping to save#we’re not that far off from having enough now for the down payment but like things would be tight after buying with his loans and the car#two more years with my parents sucks but it is nice that they’re not charging us rent#so we’ve been shoving as much of our paychecks as possible into savings#we got pushed out of the area we were hoping to go look in when inflation skyrocketed#we were figuring we’d probably end up like 45 mins to an hour away#but if we save for two more years we’d wind up back in our target area and we’d have more of a cushion#or we could pick like a closer area like 15-ish mins away and have even more of a cushion#eh#it kinda sucks but I feel like it’ll all work out in the end#my life for so long has felt like it’s been hurry up and wait#what’s two more years at this point if after that things are way better?

0 notes

Note

Okay okay soooooo this is my request. You totally do not have to but I thought it was cute. So Harry is himself and YN is a teacher at an art teacher at a school and he comes to visit them and the kids react to them being a relationship with himmmmm👀

Also I love your writing and I think you’re amazing❤️❤️

Idk about art that much. But music counts as art as well. Hope you don't mind.

Lunch Time

Synopsis: One where YN's students are shocked to see her husband (WC 1365)

More of my work

"Oh my god! Ms. YLN, Harry Styles literally has the same jumper as you!" Mary, one of YN's students exclaimed as soon as she walked in.

"Oh my— that's literally the same thing!" John, the other one from the very corner of the classroom.

YN was a highschool Music teacher, she was a big part of the art department of her school. All students loved her for some reason she never can pin point.

Today she wore one of her husband's jumper, a old brown one with green designs on the hem and the above the cuffs of the sleeves. When she originally picked it out of her husband's side of the closet she never thought it was something he wore in public where he was pictured.

She's been having symptoms of common flu lately after she visited her mum who had flu as well. Her husband being away on a tour from past six weeks. Though he's returning home later today she still felt the meed to put on one of his jumpers. They are soft, they're warm and they smell like him even though they've been washed.

She could not take few days off as she had already taken all her paid leaves to go see her husband at his Manchester shows. She needed that money to pay off her students loans.

YN never in a million years thought her students, who are bery obviously her husband's hardcore fans to recognise his clothes. It wasn't her first time wearing his clothes to work, that's all she wears om days she doesn't feel like dressing up.

"Oh thank you Mary, it's a gift." YN said. "Okay class settle down now." She began with her class her music history lessons. Taking a small five minutes break to go bring her water bottle she forgot at her office like an idiot.

Just as was about to leave her office, she got a text from her husband. He was coming home early when she told him a yesterday that she was starting to feel sick. He'd seen her be sick just once and it was just awful. He took the first flight home immediately after his show last night from France, which was very late in his opinion.

Mister��

- Hiya my love.

- I just landed in London

- Will bring your fave lunch today and we can go see a doctor.

- I love you so much! xx

It warmed her heart to see that. She sent him her lunch time.

- Yes, please.

- I'll ask later if I can take rest of the day off.

Mister⭐

- Yeah, do that baby.

- See you soon!

YN went back to her class but dismissed them early to move onto her next class with her headache boring holes into her skull from inside out. Again she had her students pointing out her jumper.

......................................................................

"How is Mrs. Styles doing?" Harry asked as soon as he stepped into her office with a bag of food from her favourite place, he carefully placed it on her desk.

It had been over a good six months of them getting married and he's still obsessed with her calling that name, especially since she had been so adamant about wanting to take up his last name. He's smitten like a little baby kitten.

"I took a painkiller for my headache but I think I still need to sleep on it." She explained, getting up from her chair and metting him halfway around her desk to take upto his welcoming hug.

"Yeah? We'll go home soon, okay?" He caressed her hair feeling her shake her head in agreement to him. "Gimme a kiss before we eat and I take you to go see doctor."

"I'm sick, don't want you to get sick." She lifted her head up to look at him.

"I literally won't get sick." He counter and got his kiss, smearing his lips onto her.

"We can actually go now, I already talked about taking a sick leave for the rest of the day and tomorrow." She shared.

"We can eat first, I know you skipped your breakfast." He made her sit down and eat as he talked about the shows she misses, which were all of them except for the London and Manchester shows. About the One Direction shirts someone threw at him which he brought with him, the other one he saved for her. Just as she was about say something, there was a knock on her door.

"Ms. YLN do you mind if I come in?" It was Mary, from the class earlier.

YN's head shot to look at her husband who looked completely unphased chowing down his noodles with his best chopsticks using abilities.

"What?" He shrugged.

"She's your fan!" She whispered. Having him caught off guard.

"Go on, I don't mind." Was his answer to her surprise.

"You sure?"

"Positive."

"Come in, Mary." YN called but not before taking another glance at Harry.

"I'm so sorry to interrupt your lunch time, Ms. YLN, I needed help with this assignment that—" the girl with blue dyed hair was completely froze to surprise seeing someone at her professor's office she never could have expected. "Oh my god!"

Harry actually chuckled earning a glance from his wife though he had his shy kode switched on there, "What do you need help with, Mary?"

"I, uhhh... I actually forgot..." She stuttered looking back and forth between the couple, printed notes in her hands, "this, this assignment— I'll come in tomorrow."

"No it's alright, I'm taking a day off tomorrow." YN shared, "don't want your assignment to be delayed."

"Oh— okay." She gulped nervously.

YN went back to her chair behind the desk and had her students doubts cleared up. Though it took her long time to realise she probably did not get a thing.

"Email me your doubts, I'll and refer to the sites I recommended." YN said, writing down a couple of referrals for online sites. "It's okay, you can talk to him."

"Oh my god, Harry! I'm such a huge fan!" Mary bursted out pointing at her Fine Line hoodie.

"Thank you so much." Harry smiled shyly.

"Can, can I ask for a picture?" Mary asked but regretted it as soon as she spoke.

"Actually do you mind if we don't? I can write you up a note." Harry suggested instead.

"That's totally fine! Oh my god, I'm so sorry!" She freaked out.

"It's alright." Harry assured her. YN smiled and handed him a pen and her sticky note pad. Harry scribbled a sweet note for the girl and signed it for her. "Thank you."

"No, thank you so much." Mary smiled accepting the note Harry gabe her.

"Mary, please don't tell anyone just yet about this if you can." Harry spoke. "Maybe wait for a few days.

"Yeah, no I won't. I really won't." The girl was freaking out, she waved at him before leaving.

"She won't tell anyone Harry, don't worry." YN assured him getting back on her previous seat next to him.

"You think so?"

"I know so." She affirmed, "I've known her for quite a long time now. She's one of the nicest students I have."

"I'm gonna take your word on that." He smiled.

"Oh, and I got my new professor's ID today." YN reached for the ID kept on her desk face down. It had her name changed on her to Prof. YN Styles which had Harry smirking.

"Still won't be able to fathom we're actually married!" His cheek muscles ached from smiling so much in the moment seeing the ID card.

"Neither can I." She chuckled.

They'd known each other for only a year when he proposed and they got married a few months later. It wasn't rushed. But it was still surreal.

Harry was still anxious about Mary trying to post about their little interactions but she didn't. Harry never saw anything on the internet about them. He was relieved to say the least.

YN students liked her enough to not talk shit about her. Plus they needed their good grades to pass out of school.

......................................................................

Tag list:

@vrittivsanghavi @buckymydarlingangel @sweetwritingfanficfriend @theroosterswife24 @sleutherclaw @melllinaa @michellekstyles @sunshinemoonsposts @marialikescherries @japanchrry @onlyangelrain @harrysgirl-1d

Lemme know if you want to added to the tag list

#harry styles#harry styles fanfiction#fanfic#fanfiction#harry styles x reader#harry styles x you#x reader#harry styles x y/n#harry fanfiction#harry styles one shot#harry edward styles#harry styles fic#harry smut#harry styles blurb#harry styles concept#harry styles fluff#harry styles imagine#harry styles smut#harry styles writing#husband!harry#husbandrry#boyfriendrry#boyfriend!harry

2K notes

·

View notes

Note

i love your shiv nsfw fic!!! you're so good at writing them, could you write another shiv roy x female reader smut fic? it's so hard finding them these days

no strings

a shiv roy x reader.

your time studying abroad is nearly over, and you luck out with a job working for a luxury boating service. this summer the billionaire roy family is vacationing, and the youngest daughter gives you an exciting proposal.

wc : 1.391

contains : fluff. semi angst. smut. talks of fxfxm threesome. exhibitionism : tom watches you and shiv go at it. oral and penetrative sex (receiving).

a/n : anon why did i literally have a dream with tom and shiv the night you sent this...and you are so right why is the shiv tag so dead omg i came a year after the show ended thinking i’d be fed 💔 also thanks for saying i’m good every time i write smut i laugh bc i’m a big baby.

when you signed up for a summer job, you sure as hell weren't expecting this.

at least you had the excuse of this not being a very croatian or italian custom. coming here to study was something you did on a whim, and wouldnt be the first time you made a crazy decision just because, you still had flashbacks to the time you skinny dipped with people who you had just met at a bar an hour earlier.

thankfully over the years your exploring ways had toned down to a reasonable amount. after all, you couldnt be a luxury stewardess who was always getting in to trouble. the clients did insane background checks, seriously, one old bastard asked what it was like going to such an average kindergarten.

but for now, it was fine. it paid well, you only had to serve rich pricks for a few days at a time, and it was helping pay off your student loans. plus if you bat your eyes at the right people you got a considerable tip.

your coworker and friend, petra, suggested you do a little more for some extra money, but you shrugged it off with a laugh each time. the last thing you wanted was to have some crazy millionaire getting too attached to you and causing trouble in your normal life.

but your final semester has ended, you’ve made plans to move back home to jersey at the end of the summer, and that only leaves you with a few more jobs until you’re done with this job. you tried, you really really tried to keep your wits about you, but one of the clients is contacting you before the family lands to the boat with an offer.

a threesome. with her and her husband. no strings attached.

the service you worked for normally declined telling you the names of who your team will be working for, even going as far as to lock your phones on the boats to make sure you weren’t posting them during their private time.

but even you, now living halfway across the world, knew about this family. the roys, owners of one of the biggest media conglomerates of the past era. it was hard not to see reports in the morning from atn news, or the insane amount of advertising you’d see about their international mediterranean cruises.

(well, after their recent scandal about sexual misconduct in the fucking senate, you had a feeling you wouldn’t be seeing too many ads anymore.)

you were sure it was the daughter of the family calling you, recognizing her voice over the phone and being confirmed when she met up with you before she got on the boat. she was gorgeous and a little scary, enjoying the scent of her perfume when she slides the nda over to you to sign.

it was exciting, working on the boat and seeing her eyes occasionally trailing your figure. maybe it would’ve been more enticing if every time her husband looked at you he didn’t look like one of those hanging cat posters. shame, he was cute.

you’re cleaning up one of the tables after the family had eaten a crazy short dinner. you’re still reeling after witnessing how dysfunctional these people were when your phone buzzes on your pocket, courtesy of shiv pulling a few strings. the text from her is just her cabin number and a time that’s ten minutes ahead. short and to the point.

when you knock on the door you can hear a conversation on the other side come to halt, fast footsteps coming to the door before yanking it open. you’d seen her earlier in the day but got did shiv look gorgeous, ginger hair framing her face as the soft lighting of the room illuminated her bare shoulders.

she’s smiling at you, all sickly sweet as she leads you into the room before locking the door behind you, telling you to just sit on the bed. the bed is large and soft, and your mind wanders about how these people can have whole hotel rooms on the ocean and still be so unhappy when a throat clearing knocks you out of your thoughts, the husband sitting in a chair across the bed to your left. he gives a little smile and a wave and you do it back.

“this is tom. he’s just gonna watch us for a while, ok?” she checks in with you, crossing her legs as she sits next to you, softly moving your hair behind your shoulder. you nod. “good. tel us if you don’t like something.”

you try to nod again but her palm is on your cheek and bringing your face to hers, soft lips kissing you like she’s starving. her tounge is in your mouth, and when you try to move your body to sit on her lap she’s pushing you back, resting your back on the bed. you can faintly hear the fabric of tom’s clothes as he moves on his seat.

she urges your pants down your legs, barely waiting for you to kick off your shoes before she’s rubbing you through your panties, biting and nipping at the skin of your neck as you left out small moans into the air.

“sure you don’t wanna touch her, tom? she’s so soft, so pretty.” she licks a line up your throat and to your mouth, swallowing your moan in her mouth. her husband doesn’t reply and you don’t dwell on it for long. you’ve heard of exhibitionists before, looks like her husband is one of them.

you bite her bottom lip and revel in the groan you feel in her mouth and chest, your own muffled noise escaping when she stuffs a finger inside you. she’s using her thumb to rub at your clip while she thrusts, pulling away from the kiss to look at your face.

it feels good but it’s not enough, which you make clear when you beg her under your breath to give you more of anything. thankfully she doesn’t seem to be in a teasing mood, not thanking any time to push her second finger inside of you.

“oh, fuck-“ your leg kicks out and you fist the sheets as you focus on the pleasure. it’s clear she’s done this before, skilled in the way she hits your g spot at just the right angle and rubs your clit. her head turns to likely look at her husband, while yours flops on the bedsheets.

you’re so distracted you don’t notice them having a small chat, mind on cloud nine. you do notice when she dips her head to kiss your chest that’s exposed after she unbuttoned your shirt, then dips lower, and lower, and lower-

when you feel her mouth circle your clit in your mouth you let out an airy moan, feeling the ball in the pit of your stomach grow. she eats you out just like she kisses you, sloppier than you expected for someone that’s looks as polished as she does. her hands are squishing the fat of your thighs, and when she shakes her head from side to side in your pussy you cum, trying to soundproof your moans into your arms as the other clutches at her head.

she helps ease you down from your high, placing kisses on your clit and your thighs and even cleaning you up with her mouth as you let out fast shaky breaths. you’re given maybe a few minutes of relaxation before she’s tugging your pants back up, buttoning up your shirt before giving a quick pat to the top of your thigh.

“that was fun, huh?”

you laugh, nodding your head since you can’t find the words. you push yourself up on your arms, staring up at the woman above you as she smiles down at you. your eyes drift to her husband who’s still sitting on the armchair, face flushed and taking in quick breaths like he’s the one who just got fucked instead of you.

“yeah, yeah it was fun.”

you collect yourself, fixing up your hair in the mirror on the wall as shiv leads you to the door.

“saw in your file you’re from jersey. maybe we’ll call you sometime once all this shit blows over, yeah?”

this summer couldn’t end fast enough.

#succession hbo#succession#succession x reader#shiv#shiv roy#siobhan roy#shiv roy x reader#siobhan roy x reader#tom wambsgans

82 notes

·

View notes

Video

youtube

The Biggest Economic Lies We’re Told

In America, it’s expensive just to be alive.

And with inflation being driven by price gouging corporations, it’s only getting more expensive for regular Americans who don’t have any more money to spend.

Just look at how Big Oil is raking it in while you pay through the nose at the pump.

That’s on top of the average price of a new non-luxury car — which is now over $44,000. Even accounting for inflation, this is way higher than the average cost when I bought my first car — it’s probably in a museum by now.

Even worse, the median price for a house is now over $440,000. Compare that to 1972, when it was under $200,000.

Work a full-time minimum wage job? You won’t be able to afford rent on a one-bedroom apartment just about anywhere in the U.S.

And when you get back after a long day of work, you’ll likely be met with bills up the wazoo for doctor visits, student loans, and utilities.

So what’s left of a paycheck after basic living expenses? Not much.

You can only reduce spending on food, housing, and other basic necessities so much. Want to try covering the rest of your monthly costs with a credit card? Well now that’s more expensive too, with the Fed continuing to hike interest rates.

All of this comes back to how we measure a successful economy.

What good are more jobs if those jobs barely pay enough to live on?

Over one-third of full time jobs don’t pay enough to cover a basic family budget.

And what good are lots of jobs if they cause so much stress and take up so much time that our lives are miserable?

And don’t tell me a good economy is measured by a roaring stock market if the richest 10 percent of Americans own more than 80 percent of it.

And what good is a large Gross Domestic Product if more and more of the total economy is going to the richest one-tenth of one percent?

What good is economic growth if the way we grow depends on fossil fuels that cause a climate crisis?

These standard measures – jobs, the stock market, the GDP – don’t show how our economy is really doing, who is doing well, or the quality of our lives.

People who sit at their kitchen tables at night wondering how they’re going to pay the bills don’t say to themselves

“Well, at least corporate profits are at record levels.”

In fact, corporations have record profits and CEOs are paid so much because they’re squeezing more output from workers but paying lower wages. Over the past 40 years, productivity has grown 3.5x as fast as hourly pay.

At the same time, corporations are driving up the costs of everyday items people need.

Because corporations are monopolizing their markets, they don’t have to worry about competitors. A few giant corporations can easily coordinate price hikes and enjoy bigger profits.

Just four firms control 85% of all beef, 66% of all pork, and 54% of all poultry production.

Firms like Tyson have seen their profit margins skyrocket as they jack up prices higher than their costs — forcing consumers who are already stretched thin to pay even more.

It’s not just meat. Weak antitrust enforcement has allowed companies to become powerful enough to raise their prices across the entire food industry.

It’s the same story with household goods. Giant companies like Procter & Gamble blame their price hikes on increased costs – but their profit margins have soared to 25%. Hello? They care more about their bottom line than your bottom, that’s for sure.

Meanwhile, parents – and even grandparents like me – are STILL struggling to feed their babies because of a national formula shortage. Why? Largely because the three companies who control the entire formula industry would rather pump money into stock buybacks than quality control at their factories.

Traditionally, our economy’s health is measured by the unemployment rate. Job growth. The stock market. Overall economic growth. But these don’t reflect the everyday, “kitchen table economics” that affect our lives the most.

These measures don’t show the real economy.

Instead of looking just at the number of jobs, we need to look at the income earned from those jobs. And not the average income.

People at the top always bring up the average.

If Jeff Bezos walked into a bar with 140 other people, the average wealth of each person would be over a billion dollars.

No, look at the median income – half above, half below.

And make sure it accounts for inflation – real purchasing power.

Over the last few decades, the real median income has barely budged. This isn’t economic success.

It's economic failure, with a capital F.

And instead of looking at the stock market or the GDP we need to look at who owns what – where the wealth really is.

Over the last forty years, wealth has concentrated more and more at the very top. Look at this;

This is a problem, folks. Because with wealth comes political power.

Forget trickle-down economics. It’s trickle on.

And instead of looking just at economic growth, we also need to look at what that growth is costing us – subtract the costs of the climate crisis, the costs of bad health, the costs of no paid leave, and all the stresses on our lives that economic growth is demanding.

We need to look at the quality of our lives – all our lives. How many of us are adequately housed and clothed and fed. How many of our kids are getting a good education. How many of us live in safety – or in fear.

You want to measure economic success? Go to the kitchen tables of America.

404 notes

·

View notes

Note

This is a bit of a silly question, but you honestly seem to know a lot about political, business, and economics, so I thought I would ask.

So I’m seventeen, soon to be applying to universities, but I’m already so disillusioned with the world. Like, don’t get me wrong, I still have hope in collective action and volunteering and voting and all that, it just makes me sad that the entire world has kind of gone to hell. I like english literature and I like history and I like studying them, so I used to hop to study both at uni. I wanted to get a job as a teacher, because I want to make a difference in the world and have more variety than a typical desk job.

However. Being on Tumblr since the age of thirteen has taught me that no matter how kind or good or hardworking one person is, or even a lot of people are, one politician can still screw things up for entire groups of people. I mean… a few politicians overturned Roe Vs Wade and that sort of thing. The disability benefits bank account thing. Politicians have an enormous amount of sway over the world, and that area seems to be where someone could make the most difference.

From what I’ve seen of a political science degree, I genuinely don’t think I would enjoy it much, but I could get through it. I want to make a difference in the world very badly — it’s the only sort of legacy I care about leaving behind. And I thought being a teacher could do that for me, but the scale of being a teacher and a politician are on entirely different levels, and Tumblr has really shown me that.

So I guess I’m just asking, since you seem to be passionate making the world better too. Do you think I should study politics, so that I can try and change things on a large scale? Or study what I love and make a much smaller impact.

I honestly don't think I'm the best person to ask this question. A lot of how I ended up where I am was a matter of luck, including the luck of having parents who let me live with them rent free while I put together some savings (and even while I was unemployed).

I don't know a whole lot about polisci. I was a business major and, honestly, that major did not come in useful when hunting for a job after college... partly because all the jobs it was a foot in the door for were uhhhhhh let's go with Not The Right Fit. Most polisci majors are... I guess probably pre-law and intending to become lawyers, and lawyers do in fact often become politicians, so there's that.

My first instinct is actually 'learn a trade and join a union.' The last few years have been pretty evidential of the impact that unions can still have on both the business world and politics in general: see the impact that UAW is having, at least in the media, on the presidential election. Unions are also a pretty solid option for local networking, which is pretty key when it comes to having an impact on local or regional politics. A trade job is also something that is in high demand, stable, and pays reasonably well in most places, including paid apprenticeships, so it would give you the financial stability to focus your free time on what you want instead of on stretching to pay the bills, or having to worry about student loans. It also gives you an expertise or specialty that you can then leverage as 'evidence' of understanding the working class as a unit when engaging in something like a town hall.

Being in a union or other local organization will also give you a more hands-on understanding of how politics and things like that work, as you'll have things like contract negotiations, union votes, and policy debates going on regularly.

If you aren't the kind of person who thinks they're a fit for trade work (I'm definitely not), then college might be the right fit! But I'd definitely consider going into it with a plan for how you want to impact the world. Look up some charities or impact organizations and see what it is that they need. A lot of places are looking for grants writers or financial coordinators, or just someone who can do the accounting. It's not glamorous, and it's not like you'll be held up as a hero the way a doctor in a warzone is, but keeping track of funds or writing letters requesting funding from the government, for something like Doctors Without Borders or Planned Parenthood or Coalition for the Homeless is still an important part of the process.

Local volunteer work is also often a lot more personally satisfying and requires less overhead, so more of the money goes directly into the community you want to help, e.g. the grant writers and accountants do need a salary in a huge organization, but a local soup kitchen can probably just hire someone from the local tax office once every few months and call it good. Doing volunteer work once a month, for a soup kitchen or a homeless shelter or summer childcare program, can make way more of an impact than maybe getting a position as a staffer for a politician you may not even like that much.

That said, if you think you're good at polisci, that you'd be good at law, or that you can get a different degree with polisci as a minor that would then help you enter politics directly... maybe college for polisci is the right choice for you. Maybe you have the finances to not worry about loans, you have parents that would be supportive, and you can find an effective position after you graduate.

I can't make that decision for you. If you have a guidance counselor and they're any good--not a guarantee, but let's hope--talk to them. If you don't have a guidance counselor, maybe find a trusted teacher, or a local librarian, something like that. I don't really know you or your situation well enough to tell you what to do, but hopefully I've given you something to think about.

49 notes

·

View notes

Note

Pls tell me more about ur news experience while protesting the Ford gov and their shitty choices?

I was going to UofT at the time when the ford government gutted OSAP, the ontario student aid program for those out of the know. They converted all grants into loans and no longer gave money to cover living expenses, and they struck down the 6 month grace period ontario students had after graduation to find well-paying jobs before their repayment started.

For the americans here, i should contextualize that student loans in canada do not at all work like they do in the US. We take out loans from a combination of the federal government (known as NSLSC loans) and our provinces of residence specifically. When we apply, we fill out our financial info including our income and if we are considered an "independent" student or not, the legal definition of which differs depending on your province of residence. The main difference being that independent students dont include their parents' incomes when they first apply, theyre considered their sole and only breadwinner. Depending on that income and a few other personal points, you get a combination of loans and grants that cover both tuition and partial living expenses, and when you graduate, the federal government takes all your loan and income info and doles you out a personalized regular payment plan so you have it completely paid off after 10 years if you follow it. And you have 6 months after you graduate uni to find a job and get settled where you don't pay anything. Theres also other options if you still cant pay like the repayment assistance program that freezes your payments entirely if you prove youre below a certain wealth bracket, but thats the gist of it.

Now that everyone knows the context i can tell the story. The ford government of ontario circa 2019 decided that ontario university students dont need living expense coverage, that it would universally be loans regardless of any low income status, and that the post-grad grace period wasnt necessary. And being in one of the most expensive cities in the country, that was not going to fly with my peers.

I personally took out my provincial loans from alberta student aid that has all those benefits, so the OSAP gut didnt actually affect me at all, but injustice is still injustice even if it doesnt affect me, so i joined the student protests against the ford government that people were bussing in from the other side of the province to attend. At some point along the line, other folks noticed that i was comfortable around the news cameras and my main strengths were in public speaking, so when cameras were around asking for interviews i was pushed in front of them a lot to be trusted to explain our grievances and goals without getting noticeably hotheaded, so i did a lot of live interviews for CTV and citynews toronto during those few months.

And they were kinda right to do that. Im really good at interviews and public speaking and arguing points in general, and not the best at more hands-on things when it comes to activism. And like, you do need PR people to get support for a cause, contrary to what a lot of tumblr users seem to think. Like you need people whose jobs are to present your grievances and reasons for marching in a way that presents you as respectful and worth listening to and considering the points of. So that was mainly my role in those protests. I dont know if you can still easily find those interviews buried in their broadcast archives but if you want to look for me be my guest

7 notes

·

View notes

Note

May not by your wheelhouse, but regarding ever-increasing college tuition, where does the money go? Why is college so much more expensive than it was a few decades ago?

I have indeed written several posts about the college affordability crisis, which are probably to be found in my "ronald reagan burn in hell" tag. This is because, as with most of the batfuckery of the American economy since the 1980s, it is indeed Ronald Reagan's fault. The overall causes of college skyrocketing in cost include, but are not limited to:

1) Huge tax cuts for corporations and the wealthy, gutting the funding that public education systems/public universities previously received from the government;

2) This in turn increased the costs at private universities, which had always been more expensive than public universities anyway, and besides, they were now free to put up their prices as far as they wanted;

3) The "unregulated free market trickle-down capitalism for everyone!!" Reagan-era mentality led to the explosion of costs in healthcare, housing, education, etc etc., and drastically widened the level of income inequality between rich and poor;

4) The replacement of grants (which you don't have to pay back) with loans (which you do), which incentivized unscrupulous loan companies to increase the burden of debt on students and for colleges to charge more and more tuition in the form of loans;

5) A bachelor's degree was once supposed to guarantee you a job, and now does nothing of the sort, and because the market has become so crowded and oversaturated with generally unsatisfactory and unstable job options, you are expected to pay for multiple degrees and go even DEEPER into debt;

6) Obviously, because of this total rejiggering of the economic landscape, everything costs a fuckton more than it used to 40 years ago, so colleges can't return to their 1970s-era fee structure;

7) As an academic, I can promise you that very little of this money is actually going to faculty salaries or the development/sustainment of new programs. Yes, obviously it costs money to run a quality educational institution, and I also obviously want all universities to be funded properly and for academics to be paid what they deserve. But the actual distribution of this money is... less clear.

8) Schools with giant well-known Division I sports programs tend to get all or most of the money that comes into their institutions, leaving relatively little for academic or faculty development;

9) For example: I work at a large, fairly prestigious, private university with very high research activity/classification, and we don’t even have a football team sucking up the money. But still, every single quarter, my department has to go through the budget with a magnifying glass, cut low-enrolled courses, argue constantly with the dean about which courses we do get to teach, etc. Our adjuncts also get paid literal peanuts for taking on a lot of work, and because we're so low on core faculty and just had to cancel another faculty search because of budget reasons, probably 50% of our schedule in the upcoming quarter is being taught by adjuncts. This is... not ideal.

10) Student debt is now such a lucrative part of the American commodities market, is so embedded in the financial system, and constitutes (at last glance) up to $1.8 trillion of outstanding debt, that when Biden tried to cancel even some of it, the Republicans immediately lost their minds and sued him to stop it. As of now, that case is still pending before SCOTUS, and because they're the literal worst, nobody hold your breath for a good outcome.

In short: college is one of the areas that has suffered the most from unregulated Reagonomics over the last 40 years, has been repeatedly incentivized to become and to stay extremely expensive and to represent a long-term burden of debt, and while you would hope that the money was being responsibly reinvested into actual faculty hiring/retention/academic program development etc, that is... not usually the case. The big Division I universities that serve as farm team training programs for the NFL, with a little academics on the side, also tend to have tons of investment in sports and not nearly as much in the classroom. But I'm sure this is fine!

48 notes

·

View notes

Text

Notes on being 30

I’m turning 31 in a week, I’m excited, I love my birthday and I love growth and change. Before my birthday I like to reflect about the year I’m leaving behind in hopes of entering the new year with perspective. It has been an emotional rollercoaster to say the least,a lot of good came in too and I’m learning from my mistakes, recovering from the pain and grateful for everything else.

Here are some thoughts, notes and humble advice on being 30:

I often tell my younger friends “make sure you get to your 30s with savings if you can”. I give this advice not in a “finance bro” type of way but in a “have money that can buy you some freedom” type of way. Freedom can be getting psychological/psychiatric help, a solo trip abroad, swimming classes, a year off work, whatever freedom is to you, save for it.

In my case, I landed here with no money, but since the universe works in perfect mysterious ways, I got fired from work and with the severance money, I bought myself 3 months off. I paid my credit card, I paid my student loan 3 months in advance, I started going both to the therapist and the psychiatrist to get the help I so desperately needed. It was the biggest blessing since I’ve been burnt out from work and life since summer 2022 and allowing myself time off without worrying about my live-hood was just exactly what I needed.

“Your new life will cost you your old one”

On a karmic level, your past comes creeping at you, all the lessons get back to check if you finally learned. I repeated a lesson from a decade ago. This time it took me less time to remove myself from the equation, even though it was even more heartbreaking than the first time. I learned my lesson the hardest way possible, it cost me blood and tears, but I did and for that I’m grateful. Life keeps showing us the same lessons until we learn, and it is important we do so or else we suffer.

On a lighter note, personally I feel very authentic at 30, I carry myself and all my past versions with honor and respect. Almost everyday I think teenage me would absolutely adore me, I’ve become the woman 12-17 years old me wanted to be. The greatest gift is that I like myself a lot, I like my own company, my sense of humor, my integrity, I like myself and the woman I’m constantly becoming plus I feel way cooler and more interesting than I did at 20.

I still have many fears but they are different now, I'm in less of a rush with everything, I started enjoying things more. I kind of understand why my mom made me say hi to people that met me as a baby. Life is about little moments, sharing with others and acts of kindness.

5 years ago I also realized something that has helped me navigate life and my 30s since: the most interesting thing about people isn't their job, their socioeconomic status, the money in their bank account, but the person they are and how genuine and kind they are. So I focus on that on being a better version of me.

Life is a journey to self and awareness, carry yourself with grace, be kind and fair, I wont say nice, but fair, because nice doesn’t really get you anywhere.

Anyhow, I’m alive so my life is in constant progress until the day I die. I'm not fully healed, I’m not fully aware, I’m not fully there, I’m just living. I have insecurities issues, self worth issues, I hold grudges, I’m bitchy and mean, I say hurtful things, I’m not a guru or guide of anything, I’m just a girl a few years older that wanted to share all of this.

30 is not an ending, it is a beginning and it is actually the right time to start over. Do not be afraid. Welcome life and every year on this beautiful earth with grace and try your hardest to find some joy in all of the small things.

2 notes

·

View notes

Note

The cries of the people who have to repay their loans cus they spent all the money during the pandemic on clothes/food/cars/bullshit their cries are music to my ears

Got a friend that took advantage of the situation and paid theirs off a few years ahead of schedule, also for a couple months at one point took advantage of not having to worry about them when money got a little tight.

Very proud of them for pulling that off, there were some over payments on the monthly payments in order to go even faster at times, was a very responsible and good way to go, getting the debt gone and cutting total payments down because no interest accruing.

You'd be amazed at the number of degrees that qualify for student loan forgiveness, still got to pay some back, minimum payments for 10 years from the time payments start. So like my brother that did law school on $250,000+ in loans and grants will I think in the end pay 10% of that back and the rest goes poof because he's working in the public sector, public defender for a bit and legal council for some county now I think it is. Pay cut from not going to a firm but when you factor in the $225,000 not so much of a pay cut.

Less extreme options available and I'd love to see that program expanded not sure what all is involved in it but I bet there's places for it to grow that would provide a benefit both to the student and the public.

That said though I'm not gonna laugh at people that skipped out on payments that have to pay now because they bought food and clothes, depending on what those items were, not going to begrudge people a succulent Chinese meal and a pair of Levi's.

Iphone 87 on the other hand.........

You're an idiot and I will chuckle at you, folks that tried to catch up on others during the breather are different and not the ones you mentioned.

I still think the fed should get out of the student loan business and let the various colleges use their endowments to do the loans, it would lower enrollment and lean out administration and all that because if Pepperdine or yale or duke or any of them want to keep on going they need to churn out students with degrees that will allow them the ability to pay back their loans, so underwater feminist interpretive dance is canceled as a degree.

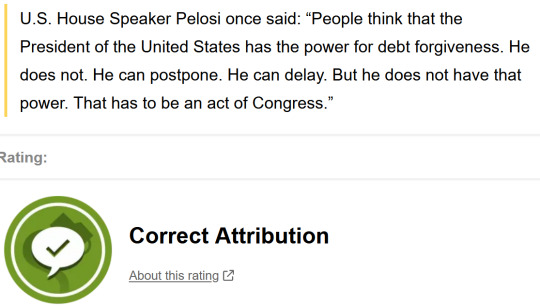

In the end the ones I'm laughing the most at would be the ones that squandered the opportunity because they actually believed that biden was going to forgive all of that debt, which anyone that had paid attention would have known

Peep the date too, this is more than a full year before the midterm elections, when team blue controlled both houses of congress and the white house.

nancy and joe knew, so did aoc and the rest of team democratic socialist knew I'll guarantee you that. That sat on that until they lost the house and then tried to lay the blame on everyone but themselves, wild how many people bought it too.

Funniest/saddest part of the whole thing is Justice Roberts quoting nancy in the majority opinion.

I may not be laughing at them but there is next to zero sympathy for them.

You got new rims for your car or something else frivolous then sucks to be you.

4 notes

·

View notes

Text

Ok this post started as a reply to another post about how numbers were fake and got away from me a bit, strap in.

EDIT: Public Service loan forgiveness is a federal program in the US where if you work in government for 10 years the government will pay off the remainder of your student loans. This is way more important than the rest of this godforsaken screed and I'd appreciate a reblog to get out information on that.

This is a facebook group run by my dad(!) among others with a ton of useful information in case student loans are something you are struggling with and have a public service job or are looking to change careers.

Ok, Autism time.

TLDR: Companies are incentivized to borrow money because they can reliably only pay back a fraction of it while using it to inflate their stock price. You are disincentivized from borrowing money because you will pay back 120-130% of what you borrowed unless (and sometimes even if) you file for bankruptcy. We actually do need a financial sector but it's badly under regulated, and also international finance has no rules and is an imperial power-fest. Also anti-finance is an antisemitic dogwhistle.

Debt is one of the fuckiest things on the planet and I wrote this for my own edification but in case it helps someone make sense of a new concept that'd be pretty cool.

Proof the numbers in the economy are fake:

No debt is repaid in exact numbers. You borrow 10k, and probably you pay back 11-13k over a number of years. The government borrows 1 trillion dollars and pays back 1.1 trillion dollars over a number of years. A company borrows 1 million dollars, they pay back 1.1 million dollars over a number of years. The numbers almost always go up, this is one reason we have inflation. You can pay less than you borrowed, but only under certain conditions. Inflation is one, such that you pay relatively less though absolutely more. Typically the numbers only go down if someone defaults, but that's usually the worst case scenario because it breaks the kind of promise that the whole economy is based on.

If you default, your debt is sold by the bank to someone else. Not for 10k, or whatever is left on the balance, but for probably 1-2k, a fraction of what it's "worth" and then the person who bought it tries to get you to pay the rest of the balance while the bank reports the loss as part of their tax deductible operating expenses.

Then, you're still on the hook for the 11-13k plus whatever fees the debt collector wants to charge. And if you don't pay those, they do it again, selling what they bought for 1-2k for 4-5 hundred, and so on, until you file for chapter 11 bankruptcy and are no longer legally obliged to pay all of the debt. In practice, this means the government negates the lender's right to collect the full balance in exchange for you going on a payment plan based on a new agreement the government brokers between you and the lender.

After this, because you failed to pay back the full balance, you will find it almost impossible to find banks to loan you money, even if in the end you paid way more than the 11-13k you would have paid back if you had made your payments on time.

In general, if you file for bankruptcy, you lose.

This sort of works in reverse with the stock market: You buy stock and the company pays you back with interest because you are loaning them your money. Companies sell stock at an initial price, auctioning it off in lots to find out what people think it's worth, and what it's worth is based on a) its capacity to increase in value and b) the monthly/yearly interest repayment which is based on the IPO price. Higher price means more money raised for the company but only at the IPO rate because once it's on the secondary market the company doesn't actually see any of the money except as good publicity.

The interest payouts are called dividends, although only a few companies actually care about paying them out anymore. Many companies ignore their dividends and instead just try to pump the price of their stock on the secondary market, aka the stock market. The ratio between stock price and dividends gives you an interesting picture of how the company sees its long term strategy: Car companies which don't really grow tend to have low ratios between stock price and dividend. Tech companies, which are looking to blow up and act like they don't know nobody, tend to have very high stock prices and very low dividends.

Crucially, companies tend to see the stock price as a reflection of the company's health, or "consumer confidence" or something, and a lot of executive pay is tied to it because most of them get paid in stock.

But the number doesn't mean anything concrete (to the company) after the IPO.

The upshot of all this is that while you are expected to borrow and pay your balance back with interest, companies are rewarded for borrowing and then artificially increasing the size of their own debt (stock price) because that's how the people making the decisions get paid.

Crucially, and this is also the assumption when an individual takes on debt, the debt is supposed to enable the debtor to make more money than they would have without it. However, unlike the kind of debt most individuals take out, the debt from issuing stock doesn't (usually) pay off the principle. This is why companies can (sometimes) get away with taking on debt without actually paying it off. You could in principle do this too if you registered as an LLC and issued stock for yourself, but this would be weird and paying strangers dividends might be a big financial burden. Or it might work out, go wild. I'd say the odds of this working are fairly comparable to minting yourself as an NFT and trying to sell it, albeit without needing to use the blockchain. Please ask a lawyer first though.

Also, companies can take on way more debt with way less risk because it is significantly less punishing for a company to file for bankruptcy than a person. The LLC in LLC is short for Limited Liability Corporation. If a company files for bankruptcy, it usually gets to keep most of its assets, because the government in general wants it to keep producing whatever it was producing and its debts are restructured accordingly. Sometimes, however, the assets are sold and the creditors just lose out on any debt over and above the selling price of the assets. Companies can try to shed debts by selling their assets for cheap to a new company, filing for bankruptcy, and then leaving creditors with the losses. This is fraud, but sometimes they get away with it and the "limited liability" part means that even if it is fraud it is legally difficult to go after the people responsible. LLCs are why if your company goes bust, you as an employee cannot be sued, which is generally a good thing. However, the structure of LLCs make it very easy for a company to take on more and riskier debt while you, as an individual are expected to pay off everything you borrow.

In general, if a company files for bankruptcy, the creditors lose.

The Government, apart from regulations, mostly cares about finance for two reasons: Economic stability and Retirement savings.

All this shit is made up. It's a game with very complicated rules, but there's no natural reason for it to work in the particular way that it does. In fact, there are countries like Turkey where it works completely differently, mostly because of religious laws about interest collection. Both Christianity and Islam have complicated histories with finance, but I digress. The point it that finance is almost entirely held up by agreements between extremely fickle parties. Like, there are contracts, agreements, balance sheets, and so on but none of this is pegged to any real asset. (This is a good thing, people who tell you that we should go back to the gold standard are morons) What that means is that the government can decide at any time to forgive people's debts. They can just void the contracts, who's going to stop them? (Be careful if you have a banking system powerful enough to go toe to toe with the government. JP Morgan and a bunch of other wall street people actually tried to overthrow the US Government in 1933.) They need to be careful about this because being able to borrow money when you need it is a net positive, and doing it too often disincentivizes people from lending money making borrowing more expensive. But overwhelmingly, rather than forgiving small dollar loans to people, the government forgives giant loans to companies.

This is partially because the stability of the system, ie creditors getting paid in order to keep a steady supply of creditors, matters more than the fate of any particular player within it, and partially because big fish can manipulate the system to insulate themselves from consequence.

For example, in 2008, tons of first time homeowners had gotten "subprime mortgages," meaning they had borrowed more money than they could afford to repay in order to buy a first home. Increased buying meant prices went up, borrowers were unable to afford the increased property taxes from their suddenly valuable homes, and then were forced to sell, producing even more subprime borrowers. These debts were defaulted on, sold, and then bundled into packages where debt buyers could not see the insolvency of the loans. Then, the bubble burst. People suddenly realized that they had taken out a million dollar mortgage, which they could not afford the monthly payments on, on a house that would only sell for 400k. And they were on the hook for the entire million plus interest.

At this point, the government had a choice: they had to do something about the fact that millions of people had borrowed more money than they could afford. They could have bought the debt, and helped the homeowners pay in a situation similar to a chapter 11 bankruptcy where some assets are protected in order to prevent massive foreclosures, or they could have done what they did which was buy out the debt buyers and help the creditors recoup their losses. Instead of virtually slashing housing prices by forgiving mortgage debt in order to help people stay housed, they assumed the debts of the people who had bought subprime mortgage bundles, mostly banks, while refusing to go after the architects of the scheme who had issued the bad mortgages and sold them under false pretenses.

The biggest reason why this stuff really matters is that at least how the US does things right now, almost all retirement securities are tied to stock price. That's your 401ks, your Roth IRAs, etc. With the exception of Social Security and Medicare, almost all the income seniors have is based on the performance of the stock market. This isn't the worst idea, as compared to previous systems like large savings banks or just having parents cared for by their kids this is A) somewhat resistant to inflation and B) does not shackle predominantly young women to permanent unpaid elder care as was the case under past more patriarchal systems. It's good that in general inflation can't wipe out the savings of someone who saved 100,000 1970 dollars only to have that barely cover a week of cancer treatment. Finance makes that happen.

Also, people want to do things that cost more money than they have, like buy houses, start businesses, and go to college. Businesses also want to do things that cost more money than they have, like build factories, conduct research and development, and offer benefits to employees. Finance makes that happen.

We would still need finance even if (like under communism) the government paid for these things, and whether finance should be entirely public (communism) entirely private (anarcho-capitalism) or semi-private (status quo) is a really complicated question. Finance is not this intrinsically evil thing.

Also because of the aforementioned history of Christians making collecting interest illegal most demonization of finance is directly connected to the Jews, who under medieval law were forced into being bankers in order to avoid forcing Christians from committing the sin of usury (interest collection). Much history of antisemitism in Europe is directly connected to these sorts of laws. The stereotype of the greedy jew, for example, comes from the fact that when medieval governments wanted to raise money, such as for a crusade, they would increase taxes but only on the jews. This forced the jews who were legally forbidden from doing any other job to increase interest rates in order to stay financially solvent, demanding higher rates on borrowing and lower interest on savings. This effectively raised taxes on everyone, but looked like the lord was being generous while the jew was being greedy. Anyone who talks about the intrinsic evils of global finance, whether they know it or not, is parroting Nazi talking points. Bear in mind that the Nazis did the same shit as the medieval lords: by raising taxes on Jews and only Jews, as well as seizing the assets of Jewish refugees, expropriating Jewish owned businesses, and using the Jews as slave labor they funded significant social welfare programs and their invasions of neighboring European countries without significantly increasing taxes on anyone but the Jews, at least until ~1940.

But there are still perverse incentives.

Whenever finance (making money by moving money around) overshadows production (making shit people actually need) bad things happen. Enron was a prime example of this: it was a "holding company" (they owned property that other people used for production without being directly involved in that production) that used an asset shell game to boost their stock price to hundreds of times their dividend, then sold out leaving investors with worthless stock they had bought for thousands of dollars.

Crashes can usually be predicted in advance: the problem is that the government is usually lax with enforcing financial crime. Journalists and economists saw 2008, Enron, the Dot Com bubble, the Asian Financial Crisis, and many other financial disasters coming. Karl Marx argued that Capitalism exists in a permanent cycle of boom and bust as a result of its systematic incentives. There is a history of financial crisis going back to the story of Joseph in Genesis. However, even when governments can see it coming, financial prophylaxis, such as regulation, is usually seen as too expensive even when it is cheaper to prevent a disaster than to clean up after one. Worse, the fact that the bankers almost never get prosecuted means that financial mismanagement and crime continue to exacerbate what might be a natural tendency of markets to rise and fall. This is direct consequence of the structure of LLCs. The higher the highs, the lower the lows, but if you're trying to jump out of the market at the top and then buy up everyone else's assets for pennies at the bottom, you want the cycles to be as extreme as possible. That's the position major companies find themselves in, and it's basically only good for them.

I'm not enough of an expert to have specific policy recommendations, except that in the 90s Bill Clinton overturned a law which separated savings banks from investment banks. Savings banks rely on high interest rates, both on loans they issue such as for mortgages, cars, and so on, and on the personal savings you receive from depositing money in them. Once upon a time (the 90s) you could put your money in a normal bank and get 5-6% interest in a savings account. This no longer happens. Investment banks make their money by taking your money, putting it on the stock market, and collecting the difference. Investment banks are more profitable (mostly for the bank) but more risky (mostly for you), like having someone start a casino with your money. House advantage is there, but they can still lose. Before the 90s, it was illegal for your bank to gamble with your savings on the stock market. Now it is not, and this law is something I think we should bring back.

When it comes to governments and the international system things are weirder.

It's really hard to make a government keep a promise, so they get to flaunt these rules. Also, as a rule, Governments only care about their citizens (sometimes defined very narrowly as non-immigrant, non-prisoner, white, etc) and not anybody else. Anything they do on behalf of any other group is only because it also benefits their citizens for some reason. The only real way to make a government keep a promise is by lawsuit, which they can ignore if they don't like, or war, which most people can't really do for fun. This is why The US Debt strategy for its entire history going back to Alexander Hamilton is to run up the credit card like it's Christmas. The plan as far as the USA is concerned is to borrow money and only pay off the interest rather than the principle. The only way someone is going to get the USA to pay off the principle is by beating them in a war. However, those interest payments are the most reliable debt interest payments in the world, unless the republicans in the house are real fucking numbskulls come June. I'm not exactly smart enough to understand the nuance of why all the other countries on earth let us do this but I think it has something to do with beating everyone on the planet in a war in the last century. However, the US always pays its debts in full, even if as a result of inflation what they're paying back is only part of what it was worth when they borrowed it. This is normal, though whether or not it's ethical depends on your views on american empire.

What's important about this is that things like the US debt clock are shameless right wing propaganda. Someone somewhere will tell you that the government has borrowed like three hundred thousand dollars on your behalf and that they expect you to pay it back. This is then used to argue against government spending. I won't get into fiscal policy but this is a lie, and it's better to keep borrowing and paying off debt than to try to achieve fiscal or financial independence internationally.

International finance is also directly used as an oppressive tool for reproducing capitalism in developing countries. The last thing I'll say on the subject is this: countries with less economic power than the G7 are subject to bullying by larger economies. Every country in the world borrows money, and this is generally a good thing. However, Unicef, the World Bank, and other international institutions set terms on the loans that they offer to countries that were robbed under colonialism and refuse to lend money to them unless they comply with various international standards. This sometimes includes things like requiring girls to be able to go to school, and sometimes requires forcing governments to pay license fees for US patents on things like insulin and oh boy if your prescription drug costs are high in the US just imagine how much money you have to pay for drugs with US patents on them after converting non-US money to dollars. Whether or not you agree with these sorts of policy requirements, they are neo-colonialism and do contribute to American domination over these countries. Just because we're loan sharking them for insulin money instead of invading their country for oil doesn't mean that isn't what it is. Intellectual property is one of the most contentious parts of these sorts of fights, where a country would be happy to void a US patent on behalf of its citizens but it can't without losing access to international loans.

There are lots of problems with finance and it's dialed into the entire modern political system so it's extra fucky to understand in greater detail than this, and while it is strictly speaking politically neutral, the more power you have the more you can manipulate it. There unfortunately aren't great tools the average person has to do about the state of the world financially, but I think it's helpful to know and I hope you enjoyed reading this. Maybe you smack a fascist with something from this if they start talking about how globalists run the banks.

#I was inspired by that BDG video about Healthcare#I swear I'm not an econ bro tho#Also this is what I did instead of writing grad school papers#God international relations is fucking depressing it's like a train wreck that started under the fucking mesopotamians and has not stopped#But actually don't worry about the debt though#unless it's your debt in which case vote democrat if you want to see more student loan forgiveness#How the fuck did I black out and write 3500 words about this#That's 10 fucking pages#This is half a journal article

8 notes

·

View notes

Note

If I'm making just over 14k a year and my student loans are around 25k, what repayment option would be best for me? I know you went to college so a girl needs some help. I know that the income based repayment has LOTS of interest tacked on and I won't be paying rent after september, so maybe I should just go with a repayment plan that doesn't have a lot of interest but costs a bit more?? However, I know that like 10% is a good place to start.

Also, how do repayment plans work? Do I have to apply for a certain plan on the FSA website? I figured I could just set up a monthly flat rate fee to pay and that was it.... I'm still in my grace period til this week so nothing is really showing up for me.

you'd be a lifesaver if you could offer some help/advice. thank you so much christina!! i'm the only one in my family to attend college so no one else really knows how to help me.

So it depends a bit on what kind of loans you took our and a couple of other factors. I also want to caveat this by saying I'm not an expert in this at all, so I don't want to promise that this is the absolute best approach or anything. That said, here's what I would do:

Compare your options with the student loan repayment simulator. This should help you identify which loan repayment options fit your situation best.

Look into the SAVE plan. It is an income based repayment plan, but it should lower your payments. With the SAVE plan, if you make your full monthly payment, but it is not enough to cover the accrued monthly interest, the government covers the rest of the interest that accrued that month. That means that your balance won't continue to grow due to unpaid interest. Plus, if you originally borrowed $12,000 or less, your debt is forgiven after 10 years. And if I understand it correctly, if you make less than $32,800 a year, your monthly payment is $0, so my guess is that this is the best option for you at the moment. There are more benefits that are set to roll out in July this year. In this scenario, my understanding is that you could start paying down your principle balance without accruing any interest. So for example, you could take what you would have paid towards rent (say $500 a month), and reduce your debt from $25k to $19k by the end of the year without needing to pay any additional interest (I think). You can apply for SAVE here.

You may also want to look into other debt forgiveness plans. If you work for government or for a nonprofit, you may be eligible for Public Service Loan Forgiveness. And if you're a teacher, you may be eligible for Teacher Loan Forgiveness.

I would also consider talking to your loan servicer, who is a person that you can talk to (for free). They're supposed to help you figure out which repayment plan is best for your situation, although some are better than others. If you go this route, I would make sure to know exactly which plan you think you need or to have pre-set questions you want to ask them so that it's less likely they'll try to sell you on a plan that's not in your best interest.

If you're looking for a new job, I would consider applying to companies that have student loan repayment as part of their benefit package. These are a few companies that offer that as an option, but they're not the only ones. You can also do programs like AmeriCorps, Teach For America, and PeaceCorps that will help you to repay your loans if you serve with them.

You can also apply for scholarships or grants to pay off your student loans. These are typically between $500 and $1000, and can help you shorten the amount of time you're paying the loan for.

At the end of the day, this is a suuuuuuper broken system, and it's unfair that you have to think about this at all. But the SAVE plan is a step in the right direction, and hopefully we'll see more movement on student debt forgiveness in the future.

1 note

·

View note

Text

I'm really conflicted now about my career options. I'm graduating in June. I've applied to a few places--mostly FQHCs and one private practice. I really like the private practice and one of the FQHCs in Boston. I also like my current clinic. Pros of going to the private practice include better administrative help, having more time to see patients, and the vibe is good. If I stayed at my current clinic, I'd know people since I've worked with them in residency, I'd have access to the same faculty I trained with, and they will give me more prenatal training on the job (even though I probably won't do much prenatal, I still want to at least know how to). Plus, NH has no state income tax. If I go to the FQHC in Boston, I love the practice and the location, but it's expensive in Boston. Private practice offers better work/life balance and seems very accommodating, but then I wouldn't be able to take advantage of the federal loan forgiveness program. I just want to be paid fairly and have a not super stressed lifestyle.

I was talking to one of the pain doctors I'm rotating with and she told me she likes the VA. If you work for the VA for 20 years, you get a pension and they pay a certain percentage of your salary for the rest of your life. If you work for the VA, you can also take advantage of the EDRP program and get an extra $40,000 a year!

I think all residents who go on to do primary care, whether they're in private practice or not, should just have all student loan debt forgiven. We need more primary care doctors and we don't get compensated enough. It's ridiculous.

Anyway, this is the site with the loan forgiveness thing I would do if I worked for an FQHC:

Loan Repayment | NHSC (hrsa.gov)

1 note

·

View note

Text

Life is about balance. I’ve struggled with finding balance for quite some time. Ten years at the very least, if not longer. Finding that happy medium where all aspects of life fall into place and create a level lifestyle has been eluding me. Especially this last year and change. It doesn’t have to be perfect nirvana bliss. Just the right mix to be the person God wants me to be. Happy, healthy, wealthy, and wise I guess.

I’m not complaining in any way, shape, or form about my life. I truly live a life second to none. I can honestly say in looking back at my almost 48 years on this earth that I wouldn’t want to trade places with anyone. I wouldn’t trade my journey’s past, present, or future. I’m honestly living the life that I was meant to live. Good, bad, and ugly. I’ll take it. I got sober for a reason, and it’s been beyond my wildest expectations, dreams, mistakes, and whatever else.

That being written, I can’t find my place RIGHT NOW. I’m stuck. I’m off balance. Out of sorts. Lost. One step forward, two steps back. However you define it. I don’t know what to do with myself professionally . I truly don’t. I want to cover hockey. I took on student loan debt to achieve this goal. I can’t quit. I can’t give up on my dream, or give up on myself.

I got fired from the T over five years ago. I was ok with it. It sucked but I had a plan. I was back in college to get my degree and was going to write about ice hockey for a living. I was doing it, I just wasn’t getting paid. But that “internship” (as I looked at it) got old last season. I lost the spark. I was tired of going to rinks and spending time away from my family for writing experience or making connections, etc. I needed to make money, I still need to! And believe me I know it’s not a lucrative occupation, but I want it. My wife, Katie, has been tremendously patient, supportive, and believes in me. She sees what it can be even when I don’t. I’m beyond thankful for that. I want to reward her for her faith in me.

I still want to write about hockey but I can’t bring myself to go to games. Even recently, North Dakota was at Boston University and this series was what rekindled my love of college hockey a decade ago. I had no desire to go, but back then I chased it. I put it all together and was living it. But I lost the fire. On multiple occasions I drove over 10+ hours one-way to catch a game. Now, the thought of trekking into Allston/Brighton to catch that BU game, dealing w/ City Sq. before a Bruins game, or a four hour round-trip to Amherst to catch my Minutemen, has all become meh. Even watching the game on TV hits me different now. That feeling that I should be doing something when I’m not. Maybe it’s regret. I don’t know.

I’ve applied for multiple jobs over the course of the last few years. Journalism jobs, public works jobs, and god knows what else. I don’t want to drive a bus at some local company. I don’t want to go back to swinging a hammer and getting screamed at in broken English by Italian or Portuguese foremen. I’ve put in my time. I don’t know what the fuck I want, but I do know what I don’t want. 9-5, a 45+ minute commute, a cubicle, coupled w/ doing something unfulfilling for 40+ hours a week.

If it’s not one thing it’s another. I know that’s pretty much everyone’s experience with life. I don’t go to Alcoholics Anonymous meetings like I should. I go to the gym plenty of times a week, but I’m eating like crap again. I work on one thing about myself to see another thing fall by the wayside. Hence the balance… But now, I’m just stuck. I have more free time than I need and I do shit with it. Zero. It’s pathetic. I can go to Bruins practices. Write a book. Walk my dog. I do fuck-all. Laundry, dishes, vacuum, and nap. That’s obviously not good for my mental well-being. In some ways the pandemic and the lockdown helped. It showed what’s important and what isn’t. I’m tired of it now. But I can’t get out of my own way.

I go on social media, which I know, I know, I know, (I KNOW!) is phony but I see people writing the stories I know I can write, taking the pics I can take, or making the videos I can do. All these thoughts and ideas that I had and just let pass me by because of complacency, laziness, or whatever. I’m not crying over spilt milk. I can still do whatever I set out to do. I may be a lot of things but diffident I am not.

It’s time to put up or shut up. I’ve said it multiple times, Katie can, and will, attest to that. I’m writing this to hold myself accountable. I’m going to post it on my PuckingOff site and link it to my X and Facebook accounts so it’s out there in the universe motivating me to succeed.

I just needed to vent and put it out there. I’m calling myself out. I need direction, a push, or whatever. I’ve prayed on it enough and asked for signs. Shit, once I asked for a sign and that day’s Wordle was “WRITE.”

I love that I’ve been able to spend time at home with my kids but they’re teen-aged girls and a young man now. It’s now or never. And I want to be able to say I tried, at the very least.

#sober #grateful #family #ncaaicehockey #nhl #puckingoff #insidehockey #umass

0 notes

Text

While I do sincerely believe that all prior Batmans could work with the Muppets, and you are free to headcanon whatever Batman you like, I'm now firmly in camp Battison because, let me tell you, Robert Pattinson would serve absolute fucking cunt next to the Muppets.

I can't decide if he'd do a Michael Caine and treat it like he's in Shakespeare or pull a Tim Curry and become an honorary muppet, but that feral bastard would bounce off them so well you'd think he was made of rubber.

And it's even funnier in-universe because, unlike other iterations, this is not a smooth-talking playboy who smiles easily and dons the glitz and glamor like a sparkling facade of misdirection. This is a sopping wet, shut-in, scrungly cat of a man who isn't even trying to hide the several shades of mental illness plaguing him or the dark, sleepless bruises under his eyes. (Maybe he's born with it; maybe it's Maybelline trauma.)