#bulk payout api

Explore tagged Tumblr posts

Text

Bulk Payout API & its role in simplifying finances

Bulk Payout API is a kind of an API that provides a convenient way to disburse payment to multiple recipients in a single transaction. Here we are going to throw some light on the structure and benefits of bulk payout APIs & how they can revolutionize your financial operations.

Understanding Bulk Payout APIs:

Bulk Payout APIs are software interfaces that enable businesses to send payments to multiple recipients in a single transaction in just one minute. These APIs work by integrating with the company's existing systems, allowing for seamless transfer of funds to multiple accounts at once. Key components of Bulk Payout APIs include authentication mechanisms, transaction processing engines, and reporting tools to track payment statuses.

Benefits of Bulk Payout APIs:

One of the primary advantages of Bulk Payout APIs is their time-saving potential. By automating the payment process, businesses can significantly reduce the manual efforts. This automation not only saves time but also minimizes the risk of errors.

Additionally, Bulk Payout APIs offer cost-effective solutions by consolidating multiple payments into a single transaction. This consolidation results in lower transaction fees and reduced administrative expenses, leading to significant cost savings for businesses.

In the age of digital commerce, efficiency is the currency of success. Embracing Bulk Payout APIs not only streamlines financial transactions but also unlocks the potential for businesses to focus on growth and innovation, leaving behind the constraints of manual payment processing.

Your Gateway to Efficient Financial Management in India

Discover the top providers of Bulk Payout APIs in India, including industry leaders like Razorpay, Cashfree, Waayupay and more. Unlock the potential of streamlined financial transactions and find the perfect solution to meet your business needs.

Use Cases:

Bulk Payout APIs find applications across various industries and business models. E-commerce platforms, for instance, leverage these APIs to streamline vendor payments, affiliate commissions, and supplier transactions. By automating the payout process, e-commerce businesses can enhance efficiency and build trust with their partners.

Implementation Considerations:

When implementing Bulk Payout APIs, businesses must consider several factors to ensure successful integration and operation. Integration ease, for example, is crucial, as businesses seek APIs that seamlessly integrate with their existing systems and infrastructure. Additionally, compliance with regulatory requirements such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations is paramount.

Furthermore, customization options play a vital role in tailoring Bulk Payout APIs to specific business needs and branding requirements. Businesses should seek APIs that offer flexibility and customization capabilities to align with their unique preferences and workflows.

Case Studies:

To illustrate the effectiveness of Bulk Payout APIs in real-world scenarios, let's consider a few case studies. Company A, an e-commerce platform, implemented a Bulk Payout API to automate its vendor payments. By consolidating multiple payments into a single transaction, Company A reduced its administrative workload by 50% and achieved significant cost savings on transaction fees.

In both cases, the implementation of Bulk Payout APIs resulted in tangible benefits, including increased efficiency, cost savings, and improved user experience.

Conclusion:

Bulk Payout APIs offer a powerful solution for businesses seeking to streamline their financial operations. By automating the process of disbursing payments to multiple recipients, these APIs save time, reduce costs, and enhance security. With applications across various industries, Bulk Payout APIs have become indispensable tools for optimizing financial workflows and driving business growth. As businesses continue to embrace digital transformation, Bulk Payout APIs will play a central role in shaping the future of financial transactions.

#payout api#instant payment#instant payout api#bulk payout#payment gateways#bulk payment api#bulk payout api

1 note

·

View note

Text

What are Payout Solutions and How Do They Simplify Business Payments?

In today’s rapidly evolving financial landscape, businesses are constantly looking for efficient, reliable, and cost-effective ways to manage payments. Whether it’s paying employees, suppliers, or customers, seamless and error-free payment processes are critical for operational success. This is where payout solutions come into play. A payout solution is an advanced payment processing system that automates and simplifies bulk payments, ensuring businesses can send funds securely and quickly.

What are Payout Solutions?

Payout solutions refer to platforms or systems that enable businesses to distribute payments to multiple beneficiaries seamlessly and efficiently. These beneficiaries can include employees, vendors, freelancers, customers, or even stakeholders. By leveraging modern technology, payout solutions allow businesses to process bulk payments through a single interface, eliminating manual processes and reducing the chances of errors.

Payout solutions are particularly essential for businesses that deal with large volumes of transactions daily. Sectors such as e-commerce, fintech, gig economy platforms, and other industries rely heavily on streamlined payout systems to ensure their financial operations run smoothly.

For example, companies can use a payout solution to disburse salaries, refunds, commissions, incentives, or vendor payments at scale with minimal human intervention.

How Do Payout Solutions Work?

A payout solution works as a bridge between a business and its payment recipients. It integrates with the business’s financial system or software and streamlines the process of transferring funds. Here’s a step-by-step breakdown of how payout solutions operate:

Integration: The payout system integrates with the business’s existing financial software or banking platform to access required data, such as payment amounts and recipient details.

Bulk Upload: Businesses upload payment details, including beneficiary names, account information, and amounts, into the platform. This can often be done via a file upload or API integration.

Payment Processing: The payout solution processes the payments using multiple payment modes, such as bank transfers, UPI, NEFT, IMPS, wallets, or card-based systems.

Verification and Approval: Before releasing funds, the system verifies all recipient details to avoid errors or payment failures. Businesses can also set up approval workflows to ensure security and compliance.

Disbursement: Payments are disbursed instantly or as scheduled, depending on the system’s configuration and business requirements.

Notifications: Once payments are completed, recipients are notified via email, SMS, or other communication channels. Additionally, businesses receive confirmation reports to maintain records.

How Payout Solutions Simplify Business Payments

Payout solutions offer a variety of features that help businesses simplify their payment processes. Some of the key benefits include:

Automation of Payments One of the most significant advantages of payout solutions is automation. Businesses no longer need to process payments manually, which can be time-consuming and prone to errors. Automated solutions allow bulk payments to be processed quickly and accurately.

Multiple Payment Modes Modern payout systems provide businesses with flexibility by supporting various payment methods, including bank transfers, UPI, mobile wallets, and more. This ensures payments can be sent according to the preferences of recipients.

Real-Time Processing Traditional payment methods often involve delays, especially when dealing with bulk transactions. Payout solutions offer real-time or near-instant payment processing, ensuring recipients receive funds promptly.

Cost and Time Efficiency Manual payment processes require significant time and resources, leading to operational inefficiencies. By using a payout solution, businesses can reduce administrative costs and save valuable time that can be allocated to core operations.

Improved Accuracy and Security Errors in payment processing can cause delays, mistrust, and additional costs. Payout solutions use robust verification mechanisms to minimize errors and enhance security. Additionally, many systems comply with financial regulations, ensuring safe transactions.

Seamless Reconciliation Payout solutions simplify the reconciliation of payments by providing detailed transaction records and reports. Businesses can easily track completed, pending, or failed transactions, making financial management more transparent and organized.

Enhanced Customer and Vendor Experience Fast and error-free payments improve the overall experience for customers, vendors, and employees. For instance, e-commerce platforms can use payout systems to ensure quick refunds, leading to improved customer satisfaction and loyalty.

Payment Solution Providers and Their Role

Payment solution providers play a crucial role in the success of payout systems. These providers offer the technology and infrastructure needed for businesses to handle complex payment processes efficiently. By offering robust platforms, they enable organizations to send bulk payments with speed, accuracy, and security.

Companies like Xettle Technologies are leading players in the payout solutions ecosystem. They provide advanced payout platforms designed to cater to businesses of all sizes, ensuring streamlined payment operations and financial management. With such providers, businesses can focus on growth while leaving their payment challenges to trusted experts.

Key Industries Benefiting from Payout Solutions

Several industries rely heavily on payout solutions to manage their financial operations, including:

E-commerce: Automating refunds, vendor payments, and cashbacks.

Fintech: Handling instant disbursements for loans and digital wallets.

Gig Economy Platforms: Paying freelancers, contractors, and service providers seamlessly.

Insurance: Disbursing claim settlements quickly to enhance customer trust.

Corporate Sector: Managing salaries, incentives, and reimbursements.

Conclusion

Payout solutions have revolutionized the way businesses manage their financial transactions. By automating and simplifying payment processes, businesses can save time, reduce costs, and improve accuracy while ensuring recipients receive funds promptly. Whether it’s paying employees, vendors, or customers, payout solutions offer a scalable and secure way to handle bulk payments effortlessly.

As payment solution providers like Xettle Technologies continue to innovate, businesses can look forward to more efficient and seamless financial operations. For organizations aiming to streamline their payouts, adopting a reliable payout solution is a step toward achieving operational excellence and enhanced financial management.

2 notes

·

View notes

Text

Best Payment Gateways 2025: Secure & Fast Transactions - Quick Pay

In today's fast-moving digital world, online payments are the backbone of businesses. Whether you're a small business owner, a freelancer, or an e-commerce giant, choosing the right payment gateway is essential for smooth transactions and customer satisfaction. As we step into 2025, the demand for faster, safer, and smarter payment systems has reached a new level. That’s why we’ve created this guide to the Best Payment Gateways of 2025—starting with the best of them all, Quick Pay.

🌟 What is a Payment Gateway?

Before we dive into the list, let’s quickly understand what a payment gateway is. A payment gateway is a technology that allows your business to accept payments online. It connects your website or app to a bank or credit card network, securely processes customer data, and completes the transaction in seconds.

The best payment gateways help your business grow by making online payments easy, secure, and seamless.

🥇 1. Quick Pay – The Best Payment Gateway of 2025

When it comes to the Best Payment Gateways in 2025, Quick Pay stands out as the number one choice. Built with cutting-edge technology, user-friendly design, and strong security, Quick Pay offers everything a business needs to succeed in the digital payment space.

🔐 Key Features of Quick Pay:

Fast Transactions: Get lightning-speed processing in under 2 seconds.

Secure Payments: PCI DSS compliant, SSL encryption, and real-time fraud detection.

Multiple Payment Modes: Accept credit/debit cards, UPI, net banking, wallets, and more.

Easy Integration: Works smoothly with platforms like Shopify, WooCommerce, and custom websites.

Affordable Pricing: Transparent and competitive transaction charges.

24/7 Support: Round-the-clock help for businesses of all sizes.

Real-Time Reports: Powerful dashboard to track your payments and refunds.

Quick Pay is trusted by thousands of Indian businesses in 2025—from small shops to large enterprises—because of its speed, security, and simplicity.

🥈 2. Razorpay

Razorpay is another big name in the Indian payment gateway industry. Known for its wide range of features and ease of use, Razorpay offers:

Support for various payment modes

Recurring billing and subscriptions

Strong analytics dashboard

However, Razorpay can be a bit expensive for small businesses, and customer service is sometimes a concern.

🥉 3. PayU

PayU is widely used by large companies and e-commerce brands. It supports:

International payments

EMI options for customers

High-level fraud protection

While it's a solid gateway, integration can be more complex compared to Quick Pay.

🏅 4. Cashfree Payments

Cashfree is known for its fast payouts and excellent bulk payment support. It’s popular for:

Vendor payouts

Instant settlements

Integration with bank APIs

But for small merchants looking for a simple solution, Cashfree may offer more features than needed.

🏆 5. CCAvenue

CCAvenue is one of the oldest payment gateways in India. It supports:

200+ payment options

Multilingual checkout pages

International card payments

Though feature-rich, the interface feels outdated and less intuitive than Quick Pay’s clean dashboard.

🧾 Why Choosing the Right Payment Gateway Matters?

If your business accepts payments online, choosing the Best Payment Gateway is not just about processing money—it’s about giving your customers a fast and secure experience. A good payment gateway can:

Increase trust and reduce cart abandonment

Improve your cash flow through fast settlements

Help you expand internationally

Protect your business from fraud and chargebacks

This is where Quick Pay truly shines—it does all of this and more, without any tech headaches or hidden fees.

💼 Who Should Use Quick Pay?

Quick Pay is built for all kinds of businesses:

Online Stores – Accept payments instantly with secure checkout.

Educational Institutions – Collect fees, issue receipts, and track dues easily.

Subscription Services – Automate recurring payments with ease.

Service Providers – Send payment links and invoices for quick settlements.

Startups & Freelancers – Enjoy low fees and easy setup with no coding required.

No matter what industry you're in, Quick Pay can help your business scale in 2025.

💬 Customer Reviews

“We switched to Quick Pay in early 2025 and saw an immediate improvement in payment success rates and settlement times.” – Rohit Verma, E-commerce owner

“The Quick Pay dashboard is incredibly simple to use. I can see every transaction in real time.” – Neha Kapoor, Freelance Designer These kinds of reviews are the reason Quick Pay leads the list of the Best Payment Gateways this year.

🏁 Conclusion: Why Quick Pay is the Best Payment Gateway in 2025

There are many great payment gateways in India, but none combine speed, simplicity, and security like Quick Pay.

Here’s why Quick Pay is #1 in our list of the Best Payment Gateways:

Blazing fast and 99.9% uptime

Advanced security features and fraud detection

Easy integration with any website or app

Affordable pricing with no hidden charges

24/7 customer support and real-time tracking

Flexible payment options to support all customers

If you're looking for a payment gateway that grows with your business and helps you deliver a great customer experience, Quick Pay is the clear winner in 2025.

1 note

·

View note

Text

What Is a UPI Verification API and Why It’s Crucial for Your Business

With the explosive growth of UPI (Unified Payments Interface) in India, businesses of all sizes are embracing digital transactions. But with this convenience comes a growing need for security, fraud prevention, and seamless customer experiences. That’s where a UPI Verification API becomes a game-changer.

What Is a UPI Verification API?

A UPI Verification API is a powerful tool that allows businesses to validate a user's UPI ID (Virtual Payment Address or VPA) in real-time. It helps confirm whether the UPI ID is active, valid, and matches the rightful account holder’s name—without initiating any money transfer.

This is especially valuable for fintech platforms, loan apps, e-commerce businesses, gig economy platforms, and any service that relies on digital payments via UPI.

How UPI Verification API Works

The customer enters their UPI ID on your platform.

The API instantly checks the validity of the UPI ID with banking networks.

It returns verified information like the account holder’s name.

You can then use this data to verify users, autofill information, and prevent fraud.

Key Benefits of UPI Verification API for Businesses

1. ✅ Prevents Payment Fraud

Validating UPI IDs before processing transactions ensures the UPI ID actually belongs to the user, reducing the risk of fraud and misdirected payments.

2. ⚡ Faster Customer Onboarding

Use verified data to auto-fill account names, saving customers time and reducing drop-offs during sign-up.

3. 📈 Boosts Payment Accuracy

Avoid failed transactions due to incorrect or fake UPI IDs by verifying details upfront.

4. 🔐 Enhances Trust & Compliance

Use verified account data for KYC (Know Your Customer) purposes and to build trust with users and partners.

5. 🔄 Automates Manual Work

Eliminates the need for human verification and accelerates workflows, especially when processing bulk payments or onboarding users at scale.

Use Cases for UPI Verification API

Fintech apps validating borrower or lender UPI IDs

E-commerce stores streamlining refund and payout processes

Gig platforms verifying worker UPI details

NBFCs & financial institutions running background checks

P2P payment platforms preventing UPI-based scams

Final Thoughts

In a UPI-first economy, verifying UPI IDs in real-time is no longer optional—it’s essential. A Verify UPI API like the one offered by Gridlines empowers businesses to build secure, fast, and trustworthy payment systems. Whether you're dealing with user onboarding, payouts, or compliance, UPI verification gives you a competitive edge.

Ready to secure your UPI transactions? Explore Gridlines' Verify UPI API to get started today.

0 notes

Text

Flexible Payout API for All Businesses

Explore Laraware

Why Choose Laraware’s Payout API?

1. Speed: Instant & Efficient Payouts

Delayed payments can impact business credibility and customer satisfaction. Laraware’s Payout API ensures:

Real-time payment processing

Automated bulk payouts

Instant settlements to bank accounts, digital wallets, or UPI

With our optimized infrastructure, businesses can process high-volume transactions with minimal delays.

2. Security: Enterprise-Grade Protection

Security is non-negotiable when handling financial transactions. Our payout API is built with:

End-to-end encryption for secure data transmission

Multi-layer authentication to prevent fraud

Compliance with major regulatory standards

This ensures that your payouts are processed safely and without vulnerabilities.

3. Simplicity: Developer-Friendly Integration

Integrating a payout API shouldn’t be a hassle. Laraware offers:

Easy-to-use RESTful API

Comprehensive documentation for quick setup

SDKs and plug-and-play solutions for seamless integration

0 notes

Text

10 Best Payment Gateways for eCommerce in India (2025) – Secure & Reliable Solutions

Choosing the right payment gateway is crucial for the success of your eCommerce business. A smooth and secure payment experience boosts customer trust and reduces cart abandonment rates. In 2025, Indian eCommerce businesses have access to several reliable payment gateways that offer security, seamless integration, and multi-currency support. If you're investing in Shopify website development or eCommerce website design, selecting the right payment gateway is essential for a seamless user experience.

What is an eCommerce Payment Gateway?

An eCommerce payment gateway is a service that processes online payments by securely encrypting and transmitting customer payment data. It ensures that transactions are completed safely between the buyer, merchant, and bank. If you're planning Shopify website development or eCommerce website design, integrating a secure and efficient payment gateway should be a top priority.

Key Considerations for Choosing a Payment Gateway

Security: Ensure PCI DSS compliance for data protection.

Fees: Evaluate setup, transaction, and maintenance costs.

Multi-Currency Support: Expand globally with international payment acceptance.

Settlement Speed: Choose gateways with fast fund settlements.

Mobile Optimization: A mobile-friendly gateway improves conversions.

Best Payment Gateways for eCommerce in India

1. PayPal

Global trust and easy integration.

Secure transactions with buyer protection.

2. Stripe

Developer-friendly API for customization.

Ideal for subscription-based businesses.

3. Amazon Pay

Leverages Amazon’s vast customer base.

Fast and secure checkout experience.

4. Razorpay

Supports UPI, cards, and wallets.

Designed for Indian businesses.

5. Apple Pay

High security with biometric authentication.

Seamless mobile transactions.

6. InstaMojo

Low fees, quick setup.

Ideal for small businesses and freelancers.

7. Cashfree Payments

Fast settlements and bulk payouts.

Supports multiple payment modes.

8. PayU

Strong fraud detection measures.

Handles international transactions.

9. Paytm Business

Wide adoption in India.

Easy mobile integration.

10. CCAvenue

Multi-currency support.

Reliable customer service.

Conclusion

Selecting the right payment gateway can improve customer trust, streamline transactions, and boost sales. Whether you're focused on Shopify website development or eCommerce website design, integrating a secure and efficient payment gateway ensures a seamless shopping experience and higher conversions.

#eCommerce#PaymentGateway#OnlinePayments#ShopifyDevelopment#eCommerceWebsite#DigitalPayments#IndiaBusiness

0 notes

Text

Cashfree Payment Gateway API Integration by Infinity Webinfo Pvt Ltd : Benefits, Characteristics, and Key Features

In the dynamic world of online payments, Cashfree Payments Gateway has emerged as a leader in providing secure, efficient, and user-friendly payment solutions for businesses. Recognizing its potential, INFINITY WEBINFO PVT LTD, a technology-driven company specializing in software solutions and API integrations, offers seamless integration services for Cashfree’s APIs. This article explores the importance, benefits, and the integration process of Cashfree’s payment gateway by INFINITY WEBINFO PVT LTD.

Introduction to Cashfree Payment Gateway

Cashfree is a versatile payment gateway offering businesses a unified platform for accepting payments and making payouts. With features like instant payments, multiple payment modes, and secure transactions, it caters to industries such as e-commerce, fintech, travel, and more.

Benefits:

Faster Transactions: Instant processing of payouts and collections ensures smooth financial operations.

Wide Payment Options: Supports UPI, cards, wallets, net banking, and international payments, catering to diverse customer preferences.

Customizable Solutions: Offers tailored APIs and SDKs for seamless integration with business workflows.

Improved Cash Flow: Instant settlements for merchants help maintain a steady cash flow.

Enhanced User Experience: Simplified checkout processes reduce cart abandonment.

Secure and Compliant: Adheres to PCI DSS compliance and industry standards to ensure secure transactions.

Scalability: Flexible for businesses of all sizes, from startups to enterprises.

Automation-Friendly: Automates tasks like reconciliation, payouts, and subscriptions, saving operational time and effort.

Characteristics:

API-First Platform: Cashfree is designed for developers, offering easy-to-integrate APIs for payments and payouts.

Cloud-Based: Operates on cloud infrastructure, ensuring high availability and reliability.

Cross-Border Support: Handles international payments for global businesses.

Custom Workflows: Allows businesses to design workflows for specific payment needs (e.g., recurring payments, vendor payouts).

Real-Time Analytics: Provides insights and reports for better financial decision-making.

Omnichannel Capabilities: Supports online and offline payment modes for versatility.

Key Features:

1. Payment Gateway:

Accepts payments via cards, UPI, wallets, EMI, and net banking.

Seamless integration with websites, apps, or CRM platforms.

Smart routing for higher success rates.

2. Payouts:

Instant transfers to bank accounts, UPI IDs, or cards.

Bulk payouts for vendors, employees, and refunds.

Integrated API for automated payouts.

3. Subscription Management:

Automates recurring billing for subscription-based businesses.

Supports payment retries and notifications for failed payments.

4. Auto Collect:

Assigns virtual accounts to customers for direct payment tracking.

Enables real-time reconciliation.

5. Global Payments:

Accepts international payments in multiple currencies.

Complies with local regulatory standards.

6. Marketplace Settlements:

Splits payments between vendors and merchants automatically.

Supports escrow-based settlements.

7. Instant Refunds:

Enables businesses to process refunds instantly, improving customer satisfaction.

8. UPI Stack:

Custom UPI integrations for faster and secure payments.

9. Developer Tools:

APIs, SDKs, and plugins for seamless integration.

Sandbox environment for testing.

10. Security & Compliance:

PCI DSS Level 1 certified for data protection.

Tokenization and encryption for secure transactions.

Industries Served:

E-commerce

EdTech

Healthcare

Travel and Hospitality

Financial Services

SaaS and Subscription Platforms

Why Choose INFINITY WEBINFO PVT LTD for Cashfree Integration?

INFINITY WEBINFO PVT LTD has a proven track record in delivering robust API integrations tailored to business requirements. The company specializes in building reliable solutions that ensure smooth financial operations.

Key reasons to choose their services:

Expertise: Proficient in integrating Cashfree’s APIs with diverse platforms, including websites, mobile apps, and enterprise software.

Customization: Tailors payment workflows to fit unique business needs.

Support: Offers end-to-end support from implementation to maintenance.

Compliance: Ensures integration meets security and regulatory standards.

Conclusion

By leveraging Cashfree’s powerful APIs, businesses can revolutionize their payment and payout processes. INFINITY WEBINFO PVT LTD ensures that the integration process is seamless, secure, and tailored to specific business needs. With expertise in advanced API integrations, they enable businesses to focus on growth while handling their payment workflows effortlessly.

For businesses looking to integrate Cashfree or other payment gateways, INFINITY WEBINFO PVT LTD is your trusted partner for innovative and scalable solutions.

Mobile: - +91 9711090237

#cashfree#cashfree payments#cashfree payments gateway#cashfree payment gateway api integration#cashfree payment gateway API Integration by INFINITY WEBINFO PVT LTD#payment gateway#api integration#infinity webinfo pvt ltd

1 note

·

View note

Text

UPI Payout API

Rainet Technology has introduced an innovative service known as the UPI Payout API Service, revolutionising how businesses handle transactions in India. The UPI Payout service leverages the Unified Payments Interface (UPI) system, which is renowned for its seamless, real-time payment capabilities. This service is designed to facilitate bulk disbursements, making it an ideal solution for businesses that need to manage mass payouts efficiently.

The UPI Payout API enables companies to integrate this powerful payment solution directly into their existing systems, allowing for the automated processing of transactions. This integration significantly reduces the time and effort required to manage large-scale payments, whether for vendor payments, employee salaries, or customer refunds. By using the UPI Payout API, businesses can ensure that their transactions are secure, fast, and reliable, thus enhancing their operational efficiency and customer satisfaction.

Rainet Technology's UPI Payout API service stands out due to its robustness and ease of integration. The API is designed to be user-friendly, providing comprehensive documentation and support to assist businesses in the integration process. Moreover, it supports various types of transactions, ensuring flexibility and adaptability to different business needs. With the UPI Payout API, businesses can benefit from the extensive reach of UPI, which is widely accepted across India, ensuring that transactions can be made to virtually any bank account in the country.

In summary, the UPI Payout API service by Rainet Technology offers a cutting-edge solution for businesses looking to streamline their payment processes. By integrating the UPI Payout API, companies can automate and expedite their financial transactions, leading to improved efficiency and customer experience. This service not only underscores Rainet Technology's commitment to innovation but also highlights the transformative potential of UPI in the digital payment landscape.

Visit Website: https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out#bbps api provider#bbps login#paytm upi integration api#upi api integration#upi integration#education portal development company#bbps#upi payment gateway#upi integration api#upi payment gateway integration

0 notes

Text

How Can Businesses Automate Payouts Efficiently?

Managing payouts efficiently is a critical aspect of any business, especially for companies handling multiple transactions daily. Automating payouts not only saves time but also reduces errors, enhances security, and improves overall financial management. With the right payout solution, businesses can streamline their payment processes, ensuring timely and accurate fund disbursement. Partnering with a reliable payment solution provider can further enhance efficiency and scalability.

1. Understanding the Need for Automated Payouts

Businesses that rely on manual payment processing often face delays, errors, and increased administrative costs. Manually managing payouts for employees, vendors, or partners can be time-consuming and inefficient. By automating payouts, businesses can eliminate these issues while ensuring smoother financial operations.

A well-integrated payout solution allows businesses to:

Process payments faster and more accurately

Reduce transaction costs

Minimize the risk of fraud and errors

Improve cash flow management

Ensure compliance with financial regulations

2. Choosing the Right Payout Solution

Selecting the right payout solution is crucial for achieving efficiency in automation. Businesses must consider the following factors when choosing a solution:

Integration Capabilities: The payout solution should integrate seamlessly with existing accounting and financial management software.

Payment Methods: It should support various payment options such as direct bank transfers, digital wallets, and prepaid cards.

Security Features: A robust payment solution provider will offer strong encryption, fraud detection, and compliance with financial regulations.

Scalability: As businesses grow, the payout solution should be able to handle increasing transaction volumes without issues.

Multi-Currency Support: For global businesses, the ability to process international payouts in multiple currencies is essential.

3. Leveraging Payment APIs for Automation

Many modern payment solution providers offer APIs that enable businesses to automate payout processing. Payment APIs allow companies to:

Schedule and execute payments automatically

Track and reconcile payments in real time

Customize payout workflows based on business needs

Reduce the reliance on manual processing

By integrating a payout solution with APIs, businesses can enhance their financial infrastructure, ensuring smooth transactions with minimal manual intervention.

4. Bulk Payments for Greater Efficiency

For businesses managing high volumes of transactions, bulk payment features are essential. A reliable payout solution allows companies to send multiple payments in one go, reducing processing time and administrative workload.

Bulk payments are particularly beneficial for:

Payroll processing

Vendor and supplier payments

Affiliate and partner commissions

Refunds and customer reimbursements

5. Real-Time Payment Processing

In today’s fast-paced digital economy, businesses need real-time payment capabilities to stay competitive. A high-quality payout solution provides instant or same-day payments, ensuring that recipients receive funds without unnecessary delays. This improves relationships with vendors, employees, and partners while enhancing financial stability.

6. Ensuring Compliance and Security

Automating payouts comes with the responsibility of ensuring compliance with financial regulations. A reputable payment solution provider helps businesses meet compliance standards such as:

Know Your Customer (KYC) regulations

Anti-Money Laundering (AML) laws

Data protection and financial security protocols

By working with a secure payout solution, businesses can reduce the risks of fraud, data breaches, and regulatory penalties.

7. Improving Cash Flow Management with Scheduled Payouts

Effective cash flow management is essential for business success. Automating payouts allows companies to schedule payments in advance, ensuring that funds are disbursed at optimal times. This prevents cash shortages and helps businesses maintain financial stability.

A well-designed payout solution provides:

Automated scheduling of recurring payments

Alerts and notifications for upcoming transactions

Real-time tracking of outgoing payments

8. Enhancing User Experience with Self-Service Payout Portals

Many businesses offer self-service payout portals where users, such as freelancers, affiliates, or vendors, can manage their payment preferences. A modern payout solution should provide:

Secure login for users

Customizable payout options

Instant access to payment history and status

By providing a seamless user experience, businesses can improve satisfaction and retention among their payment recipients.

9. Cost Reduction and Operational Efficiency

Manual payment processing often involves hidden costs such as labor, transaction fees, and administrative expenses. Automating payouts with an efficient payout solution helps businesses cut down on these costs by:

Reducing manual errors that lead to financial discrepancies

Minimizing bank transfer fees through optimized transaction routing

Freeing up employees to focus on strategic tasks rather than administrative work

10. Case Study: How Xettle Technologies Enhances Payout Automation

Many businesses have successfully automated their payouts using advanced solutions provided by leading payment solution providers like Xettle Technologies. By integrating Xettle’s payout solution, companies have experienced:

Faster payment processing times

Improved security and fraud prevention

Greater flexibility in handling multi-currency payouts

Enhanced financial transparency with real-time reporting

This demonstrates how a well-designed payout solution can drive efficiency and improve overall business operations.

Conclusion

Automating payouts is essential for businesses looking to streamline financial operations, reduce errors, and improve cash flow management. By leveraging a reliable payout solution and working with a trusted payment solution provider, companies can achieve greater efficiency, security, and scalability. Implementing automation through bulk payments, real-time processing, and scheduled payouts ensures that businesses remain competitive in an increasingly digital economy. With solutions like those offered by Xettle Technologies, businesses can transform their payout processes and achieve long-term financial success.

0 notes

Text

Optimizing Payouts: Managing Delhi's Payout Service Provider Market

Efficient payout solutions are critical in Delhi, a dynamic metropolis where trade thrives and never sleeps. Whether it's disbursing salaries to employees, distributing incentives to sales teams, or facilitating vendor payments, businesses in Delhi rely on seamless and reliable payout services to streamline their financial operations. This thorough investigation explores the wide range of payment service providers in Delhi, putting the spotlight on the major companies, their products, and the part they play in promoting financial growth and efficiency in the nation's capital.

Comprehending Delhi's Payout Environment:

Delhi, the nation's capital and a significant economic center, has a thriving business community with a wide range of industries represented. From multinational corporations to small and medium enterprises (SMEs), businesses in Delhi operate across sectors such as IT, manufacturing, retail, hospitality, and more. In every industry, there is a clear need for effective payout solutions because of the size and diversity of the labor force as well as the prominence of vendors and suppliers.

The Significance of Effective Payout Systems: Payout systems are essential for enabling prompt and easy transactions for vendors, employees, and companies alike. Efficient payout services help firms to release payments swiftly and securely, thereby ensuring employee happiness, vendor reliability, and overall operational efficiency. By leveraging technology and streamlined processes, payout service providers help businesses minimize manual efforts, reduce errors, and optimize cash flow management.

Exploring Payout Service Providers in Delhi:

The varied needs of businesses are met by a number of payout service providers in Delhi's dynamic business environment. These suppliers provide a variety of services, such as processing reimbursement requests, paying vendors, processing salaries, and disbursing commissions. While some providers focus on traditional banking channels, others leverage innovative fintech solutions to offer digital payout solutions that are fast, secure, and cost-effective.

Important Players in the Payout Service Provider Landscape of Delhi:

Banks: Traditional banks play a significant role in providing payout solutions to businesses in Delhi. In order to make salary payments, vendor settlements, and other financial transactions easier, they provide services including direct deposit, wire transfers, and electronic fund transfers (EFTs).

Payment Gateways: Payment gateways enable businesses to accept online payments from customers and disburse funds to vendors and partners securely. To speed up payout procedures, they provide features like bulk payments, API integrations, and real-time reporting.

Fintech Companies: Using technology, fintech companies provide creative payout options that are suited to the requirements of contemporary organizations. They provide services such as digital wallets, prepaid cards, peer-to-peer transfers, and mobile payment apps, offering businesses greater flexibility and control over their payout processes.

Providers of Specialized Payout Services: Some businesses focus on offering tailored payout solutions for particular markets or use cases. These suppliers offer specialized services such as payroll processing, incentive management, expenditure reimbursements, and more, responding to the unique requirements of enterprises in Delhi.

IndicPay: A Leading Payout Service Provider in Delhi:

IndicPay is a prominent participant in the payout service industry in Delhi, providing creative and effective payment solutions to companies of all kinds. With the use of state-of-the-art technology and a customer-focused methodology, IndicPay assists companies in streamlining their payout procedures, cutting expenses, and improving their financial performance.

IndicPay's Offerings:

Payroll Processing: IndicPay simplifies the payroll process for businesses by automating salary computations, tax deductions, and direct deposit payments to employees' bank accounts.

Vendor Payments: IndicPay helps businesses to make timely and secure payments to vendors and suppliers, helping preserve solid relationships and guaranteeing the seamless functioning of supply chains.

Incentive Management: To encourage performance and boost motivation, IndicPay makes it easy to distribute commissions, bonuses, and incentives to staff members and sales teams.

Expense Reimbursements: IndicPay streamlines the reimbursement process for businesses by digitizing expense claims, verifying receipts, and disbursing funds directly to employees' accounts.

Benefits of Choosing IndicPay:

Efficiency: IndicPay's automated payout solutions help businesses save time and effort by streamlining manual processes and reducing administrative overheads.

Security: IndicPay places a high priority on data security and compliance, making sure that transactions are carried out in a secure environment and that sensitive financial information is safeguarded.

Cost-Effectiveness: IndicPay's digital payout solutions offer cost savings compared to traditional banking channels, with competitive pricing and transparent fee structures.

Customer Support: To ensure a seamless and trouble-free experience, IndicPay offers specialized customer support to help businesses with any questions or problems.

Future Outlook: As Delhi's business landscape continues to evolve and grow, the demand for efficient payout solutions is expected to increase further. IndicPay, with its innovative offerings and commitment to customer satisfaction, is well-positioned to meet this demand and continue driving financial efficiency and growth in the capital city.

In conclusion, efficient payout solutions are essential for businesses in Delhi to manage their financial operations effectively and drive growth. Businesses have a wide range of options to choose from because there are numerous payout service providers that cater to different industries and use cases. Among these providers, IndicPay stands out as a leading player, offering innovative and efficient payout solutions that help businesses streamline their processes, reduce costs, and enhance financial efficiency. As Delhi's business landscape continues to grow, IndicPay remains a valued partner for businesses seeking trustworthy and creative payout solutions.

0 notes

Text

Revolutionizing Financial Processes with Winsoft Technologies

When it comes to financial technology, Winsoft Technologies stands at the forefront, offering cutting-edge solutions to optimize various aspects of financial operations. Two standout offerings, SmartASBA and SmartPayout are crafted to deliver precision in primary market operations and brokerage payout reconciliation.

SmartASBA: Enhancing Primary Market Operations

Optimizing the Primary Market Workflow:

With its all-inclusive web-based platform, SmartASBA, primary market operations are revolutionized by digitizing the processing of applications for IPOs, FPOs, DEBT/NCD, NFOs, and rights issues. IPO application processing systems are made easy and efficient this way. Financial distributors gain from an automated and smooth system that guarantees correctness throughout the whole allocation process.

Integrated SmartASBA Suite

- Back Office: Manages primary market schemes, integrates with Core Banking Systems, and supports bulk uploads.

- Branch Office: Supports bidding and fixed-price issues, offering a dashboard for monitoring the entire application process.

- ASBA On-Net: Features scheme and application dashboards, beneficiary registration, and seamless integration with retail banking portals.

- Business Reports: Generates a variety of reports, including MIS, audit, posting, SEBI, and compliance reports.

Benefits of SmartASBA:

- Supports bulk imports for efficient handling of application requests.

- Fully automated web-based architecture ensures scalability and accessibility.

- API-based architecture facilitates integration with various channels for seamless application processing.

- Granular level user access control enhances security and data confidentiality.

- Web-responsive user interface for a seamless and user-friendly experience.

- Supports both SMS and email alerts to keep stakeholders informed.

SmartPayout: Streamlining Brokerage Payout Reconciliation

Automated Brokerage Payout Reconciliation:

SmartPayout, Winsoft's advanced solution, revolutionizes brokerage payout reconciliation for Asset Management Companies. This automated system ensures reconciliation at the transaction level for distributors, handling different broker categories and commission types.

Key Features of SmartPayout:

- Transaction-level brokerage payout calculation and reconciliation.

- AUM calculation and reconciliation of folio scheme-level across distributors.

- Reconciliation based on regulatory, statutory, and business rules.

- Calculations performed directly on RTA Data, ensuring customer-sensitive data is not shared.

- Customized reports and dashboards as per business requirements.

Benefits of SmartPayout:

- Controls excess payout with meticulous reconciliation of all transactions across brokers.

- Improves operational efficiency with adaptability to handle all types of brokerages.

- Offers an intuitive user interface for ease of navigation.

These innovative tools empower financial institutions to navigate intricate financial landscapes with unparalleled efficiency, providing precise solutions for the complexities of primary market applications and brokerage payout processes. With a commitment to transparency and operational excellence, Winsoft's SmartASBA and SmartPayout stand as benchmarks for the evolution of financial technology, promising a future where institutions can navigate intricate financial terrains with confidence and ease.

Winsoft's SmartASBA and SmartPayout redefine the efficiency, accuracy, and adaptability of financial processes in the primary market and brokerage payout reconciliation, respectively. These innovative solutions empower financial institutions to navigate complex financial landscapes with precision, transparency, and unparalleled operational efficiency.

Winsoft Technologies' groundbreaking solutions, SmartASBA and SmartPayout, herald a new era in financial efficiency and precision. SmartASBA transforms primary market operations, streamlining the processing of IPOs, FPOs, and more with unprecedented accuracy. Meanwhile, SmartPayout revolutionizes brokerage payout reconciliation, ensuring transaction-level precision and adaptability for Asset Management Companies.

#IPO application processing systems#winsoft tehnologies#wealth managment software#brokerage payout reconciliation

0 notes

Text

APIs at N2N Systems – Mobile Recharge API, Hotel & Flight Booking API, Bulk Payout API & Money Transfer API

When it comes to an API, N2N Systems is one of the best platform where you can get the best API services with an ease. Our team is capable to offer our clients the best version of any API whether it is mobile recharge API, hotel and flight booking API, money transfer API or even bulk payout API. N2N Systems is outstanding at offering these services to their clients. API stands for Application Programming Interface and its aim is to provide a wide range of services or functionalities in a single or unified interface. These kinds of API are specifically designed to simplify the development by simply offering a great comprehensive set of features via single integration point.

Mobile Recharge API

When it comes to mobile recharge API, our team is capable to integrate mobile phone recharge and top-up services into our applications, systems and websites as well. Our team at N2N Systems offers these APIs that helps users to easily recharge their prepaid mobile balances and also pay their postpaid mobile bills directly from within the application or websites. Our API services have some great features that attract several customers

#mobile recharge software#mobile app development#api service provider#api testing services#api development services#api integration services#software

0 notes

Text

Mastering Business Payouts: Navigating Modern Finances with Instantpay

Table of Content | Understanding Business Payouts with Instantpay

What are Payouts and who actually needs them?

Different Payouts for Businesses

How Various Industries Rely on Payouts: Key Use Cases

Challenges Associated with Payouts

Payouts Your Business Needs - Instantpay Payouts

Diving into the Payout APIs with Instantpay

In the vast realm of financial transactions, payouts have emerged as a crucial component, especially for businesses. At its core, a payout is the disbursement of funds from one entity to another. Whether it's a company compensating its suppliers, an e-commerce platform refunding its customers, or a tech startup rewarding its affiliates, the underlying principle remains the same – the timely and accurate transfer of money.

With the digital revolution, the nature of payouts has undergone a significant transformation. Gone are the days of tedious paperwork and long waiting periods. Today's payout systems, bolstered by fintech innovations, promise speed, efficiency, and flexibility. Businesses can now execute bulk payouts, ensuring multiple recipients receive their dues simultaneously, saving time and reducing errors.

Moreover, the integration of analytics in modern payout platforms offers businesses insights into their transactions, aiding in financial planning and decision-making. The transparency and security these platforms provide further instill trust among stakeholders.

In this age, as businesses aim for global reach, having an efficient payout system isn't just an advantage—it's a necessity. It's an embodiment of a company's commitment to its partners, suppliers, and customers, ensuring relationships built on trust and reliability.

Understanding Business Payouts with Instantpay

Every business, whether a large enterprise or an SME, has to process payments. These payments, known as payouts, have become the lifeblood of modern commerce. But what exactly is a payout in the world of payments?

What are Payouts and who actually needs them?

At its essence, a payout is the process of disbursing funds from a business to another entity. This entity could be an individual, such as an employee receiving their salary, a vendor getting paid for their services, or even a customer receiving a refund.

Every business, from small startups to large multinational corporations, requires a system to process these disbursements. E-commerce platforms, for example, need to refund customers. Affiliate marketers require a system to pay their partners. Manufacturers have to compensate their suppliers. In essence, if a business has any monetary obligations outside of its operational costs, it will need a reliable payout system.

Introducing the Payout Product

In the evolving landscape of digital payments, businesses need more than just a method to send money. They require an entire system—a payout product. This system is designed to manage, schedule, and process multiple payouts seamlessly. The aim is to make transactions as smooth and hassle-free as possible, especially when dealing with bulk transactions like bulk payouts.

Why is a Good Payout Solution Essential?

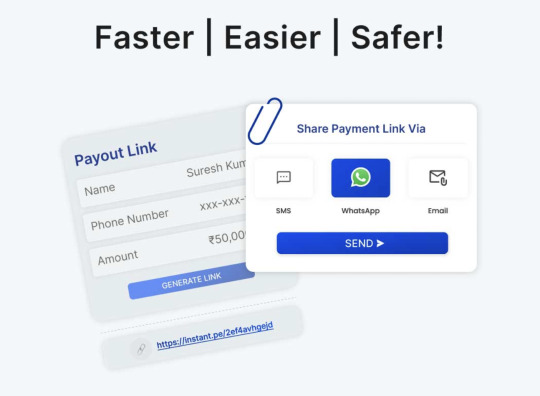

A robust payout solution like Instantpay's Payout Link ensures businesses can meet their financial commitments promptly.

In a digital age, delays can harm reputation, affect trust, and even lead to financial penalties in some sectors. An efficient payout solution:

Reduces Errors: Automated and streamlined processes decrease the chances of transactional errors.

Improves Cash Flow: Faster transactions ensure that funds are available when needed, aiding in better financial planning.

Enhances Trust: Consistent and timely payments foster trust among stakeholders.

How do businesses use a payout solution?

The traditional method of writing checks or making manual bank transfers is cumbersome and fraught with potential errors. Enter modern payout solutions, designed to simplify, streamline, and secure the process. Here's how businesses leverage these systems:

Bulk Payments: When disbursing payments to multiple recipients, businesses can use Bulk Payouts, ensuring each entity is compensated simultaneously, without the hassle of individual transactions.

Refunds: E-commerce platforms and online service providers can efficiently process customer refunds, enhancing customer satisfaction and trust.

Affiliate Compensation: Online platforms can automatically calculate and disburse commissions to partners, ensuring timely payments and maintaining healthy partnerships.

Supplier Compensation: Businesses can ensure their suppliers are paid on time, fostering long-term relationships and smooth operations.

Miscellaneous Payments: From compensating freelancers to disbursing cashbacks, modern payout solutions offer flexibility for a variety of payment needs.

Why is a good payout solution important for business?

Having an efficient payout solution isn't just a convenience—it's a business necessity.

Here's why:

Enhanced Efficiency: Automated processes reduce manual interventions, minimizing errors and speeding up transactions.

Improved Cash Flow: Efficient systems ensure that funds are available when needed, aiding in better financial planning.

Strengthened Trust: Timely payouts foster trust among stakeholders, be they employees, suppliers, or customers.

Scalability: As businesses grow, so do their payout requirements. Modern solutions can handle increasing transaction volumes without hiccups.

What to Expect from a Payout Solution?

When considering a payout solution, businesses should ensure the platform offers:

Speed & Reliability: Solutions like Instantpay's Payout Link ensure payments are processed swiftly, without delays.

Flexibility: Can it handle both individual and bulk payouts efficiently?

Security: Ensuring each transaction's safety is paramount. Top-tier encryption and secure protocols are essential.

Transparency: Businesses should have clear visibility into each transaction, with robust reporting and analytics features.

Integration: The solution should easily integrate with existing business systems, ensuring a unified workflow.

Different Payouts for Businesses

Every business, regardless of its size or sector, engages in some form of payout. These can vary significantly based on the nature and operations of the enterprise. Here’s a breakdown:

Vendor Payments: This includes payments made to suppliers, manufacturers, and other vendors who facilitate the operational needs of a company.

Salary Disbursements: One of the most common payout forms, businesses must ensure timely and accurate salary payments to their employees.

Affiliate and Commission Payouts: For businesses that operate with partners, affiliates, or on a commission basis, regular payouts are a necessity to maintain good relationships.

Customer Refunds: E-commerce and service-based businesses need a streamlined system to manage and process customer refunds efficiently.

Loyalty and Rewards: Many businesses run loyalty programs where they reward customers with cashbacks, points, or other incentives.

Bulk Payouts: Large organizations often need to send out a vast number of payments simultaneously. Platforms like Instantpay's Bulk Payouts make this task seamless.

How Various Industries Rely on Payouts: Key Use Cases

Financial transactions are the lifeblood of modern business, and payouts play an essential role across varied sectors.

Let's explore industries and their unique payout use cases:

E-commerce: E-commerce platforms, with their sprawling network of vendors and vast customer base, have to manage an array of financial transactions daily. From vendor payments and affiliate commissions to customer refunds, the sheer volume and frequency require an effective payout solution like Instantpay's Payouts. This ensures smooth business operations and maintains trust among stakeholders.

Logistics: In the fast-paced world of logistics, timeliness is paramount. Companies need to swiftly disburse payments to drivers, warehouse workers, and third-party vendors. They also handle refunds or compensations for lost or damaged shipments. Leveraging solutions like Instantpay's Bulk Payouts can streamline these processes, ensuring that payments are made promptly and accurately.

Healthcare: Healthcare institutions often juggle various payouts, from insurance reimbursements to patient refunds and vendor payments for medical supplies. With the increasing digitization in healthcare administration, it's essential to have a reliable payout solution that can seamlessly integrate with other systems, making tools like Instantpay's Payout Link indispensable.

SAAS (Software as a Service): SaaS companies often operate on global scales, dealing with international customers, partners, and affiliates. Regular subscription renewals, customer refunds, and affiliate commissions necessitate a robust payout mechanism. Integrating solutions like Instantpay Payouts ensures that transactions occur without hitches, solidifying the company's reputation.

Peer-to-Peer Lending Solutions: These platforms revolutionize the lending landscape by connecting individual lenders and borrowers directly, bypassing traditional banks. As intermediaries, they manage both loan disbursals to borrowers and repayments to lenders. Given the financial stakes and the need for transparent operations, an efficient payout system, such as Instantpay's suite of solutions, becomes pivotal.

Pharma: The pharmaceutical industry, characterized by its vast research initiatives, collaborations, and distribution networks, requires a robust payout system. From compensating clinical trial participants to settling payments with suppliers and distributors, a streamlined solution like Instantpay's Payouts ensures timely and accurate transactions.

Institutes: Educational institutes, ranging from schools to universities, deal with numerous transactions, including faculty salaries, vendor payments, and scholarship disbursements. They can benefit immensely from Instantpay's Bulk Payouts, which allows for mass payments, ensuring that stakeholders are compensated promptly.

Insurtech: As technology disrupts the insurance sector, insurtech companies are at the forefront of innovation. Payouts here include claim settlements, affiliate commissions, and vendor compensations. An efficient solution like Instantpay's Payout Link provides a hassle-free experience for policyholders and partners alike, solidifying the company's trustworthiness.

Digital Share Broker: The world of digital share trading is fast-paced. Brokers need to ensure that dividends, profits, and withdrawals reach their clients swiftly. Additionally, they handle payouts to partners, affiliates, and service providers. Implementing a reliable system like Instantpay's Payouts ensures that traders and partners receive their dues on time, fostering confidence in the platform.

Regtech (Regulatory Technology): Regtech companies, which offer solutions to help businesses comply with regulations efficiently, often work with a plethora of clients, partners, and service providers. Their payout needs span client refunds, affiliate commissions, and vendor payments. Integrating a solution like Instantpay's Bulk Payouts ensures that these transactions are handled efficiently, upholding the company's commitment to excellence.

Challenges Associated with Payouts

While the digital age has eased many aspects of business operations, it has also brought its own set of challenges, especially in the domain of payouts:

Delay in Transactions: One of the most common issues, a delay can occur due to various reasons – from technical glitches to errors in the entered details. Such delays can disrupt the cash flow and strain business relationships.

Security Concerns: With cyber-attacks on the rise, ensuring that the payment platform is secure is paramount. Businesses face the constant challenge of protecting sensitive financial information from potential threats.

Inflexibility: Traditional banking systems might not be equipped to handle diverse payout needs, especially when it comes to bulk transactions or international payments.

Regulatory Hurdles: Different regions have varied regulations concerning financial transactions. Navigating these can be complex and often requires a deep understanding of local laws.

Operational Overhead: Managing payouts manually can be a time-consuming process, especially for businesses with a large volume of transactions. It also increases the chance of human error.

Integration Issues: Businesses often struggle with integrating their payout systems with their existing operational tools, leading to disjointed processes.

Payouts Your Business Needs - Instantpay Payouts

Every business has its unique financial ecosystem, comprising vendors, customers, employees, and partners. Each of these stakeholders requires timely and accurate payments. The traditional methods of bank transfers, with their delays and often complex procedures, simply don't cut it anymore.

With Instantpay's Bulk Payouts, businesses can harness the power of bulk transactions without the hassle.

This system is tailor-made for scenarios where multiple transactions are the order of the day. Whether you're an e-commerce platform settling with numerous vendors or an NGO dispersing funds to beneficiaries, Instantpay's Bulk Payouts ensures it happens smoothly.

How is Payouts different from using banks for bulk payouts?

While banks have been the cornerstone of financial transactions for centuries, there are certain limitations when it comes to bulk payouts:

Time: Traditional bank transfers can take several days, especially for large volumes. With Instantpay's Bulk Payouts, transactions are almost instantaneous, ensuring businesses can operate without monetary delays.

Flexibility: Banks often have fixed operating hours. With Instantpay, you have the flexibility to send and receive payouts 24/7/365, catering to businesses that operate outside conventional hours.

Ease of Use: Setting up bulk payouts with banks can be a cumbersome process with a lot of paperwork. Instantpay provides a streamlined online interface, making the setup process a breeze.

Real-time Tracking: Instantpay offers real-time tracking of transactions, something that many traditional banks lack, giving businesses better control and visibility over their funds.

Send money to multiple recipients with Payouts

Handling payouts for a large number of recipients can be a logistical nightmare. Be it vendor payments, affiliate commissions, or salary disbursements; businesses often grapple with the challenge of ensuring timely and accurate payouts.

With Instantpay's system, sending money to multiple recipients is simplified:

User-friendly Dashboard: Easily add beneficiary details and track the status of each payout.

Multiple Transfer Modes: Whether it's bank transfers, UPI, or wallets, businesses can choose how they want to send money, ensuring recipients receive funds in their preferred manner.

Automated Payouts: Set up automated rules and schedules, so you don’t have to initiate payouts manually every time.

How can I get started? What documents are needed for Instantpay Payouts?

Diving into the realm of modern payout systems with Instantpay is straightforward. To get started, you would typically require:

Identity Verification: This usually involves standard KYC (Know Your Customer) documents such as PAN card, Aadhaar card, or other government-approved IDs.

Bank Account Details: Ensure you have the details of the bank account where you want the funds to be transferred.

Business Registration Proof: This could be your incorporation certificate or any relevant legal documentation that authenticates your business's existence.

Instantpay's platform provides a user-friendly interface, guiding you through every step of the submission process.

Does Instantpay support payouts to all banks and bank accounts?

Yes, with Instantpay, flexibility is at the core of their offering. Businesses can transact with almost all major banks and numerous types of bank accounts, be it savings, or current accounts. This universality ensures that no matter your bank or account type, Instantpay's bulk payouts have you covered.

Can you transfer funds on Sundays and bank holidays?

In today's fast-paced business environment, financial operations don't stick to the traditional 9-5. Recognizing this, Instantpay enables businesses to transfer funds 24*7*365. So whether it's a Sunday, a bank holiday, or late at night, you can rest assured that your transactions will go through without a hitch.

Does the payout transfer happen instantly?

In most scenarios, yes. Instantpay is designed to facilitate swift transfers. Payouts for IMPS, NEFT, UPI, and Wallets are processed instantly. However, in the case of RTGS, which is mostly used for high-value transactions, it can take 1-2 hours to ensure secure processing.

What if my transaction is pending or under process under payouts?

Kindly allow a brief period for the transfer's conclusive status to be determined. Upon completion of the processing, either the bank or NPCI will notify you about the payout status through an email. This notification will confirm whether the transaction was successful or if a refund has been initiated.

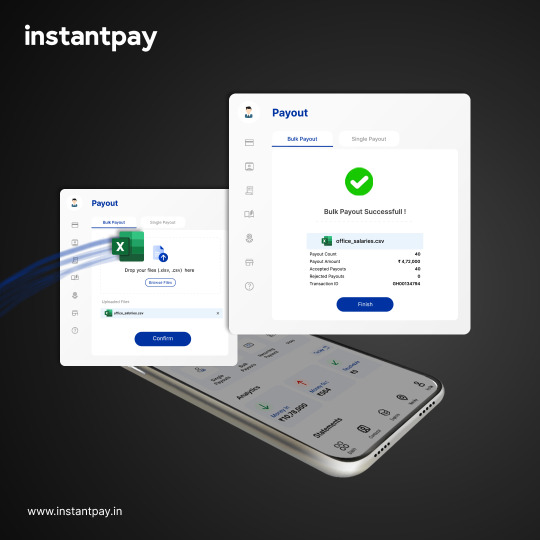

Is it simpler to send bulk payouts via file uploads or APIs?

Both file uploads and APIs have their unique advantages when it comes to sending bulk payouts. File uploads, for instance, are straightforward for businesses that already have payment details documented in spreadsheets. Just a simple upload and the process is initiated.

On the other hand, using APIs offers more flexibility and automation. With APIs, businesses can integrate their systems directly with the payout service for seamless transfers. For businesses aiming for scalability and automation, API-based bulk payouts might be the way forward.

How does Instantpay bulk payouts work?

The efficacy of Instantpay Bulk Payouts lies in its simplicity and efficiency. Businesses can choose between the file upload method or the API integration, depending on their preference. After choosing the method:

Prepare your bulk payout details in a specified file format.

Upload or send this data to Instantpay.

The Instantpay system processes these transactions securely and swiftly, ensuring that each recipient gets their due amount without hitches.

What is the maximum number of payouts that can be processed using Instantpay Bulk Payouts?

One of the distinguishing features of Instantpay Bulk Payouts is its capability to handle a large volume of transactions. Depending on your business subscription and package, the platform can process thousands of transactions in a single batch. This means, even if you're a large enterprise with numerous payouts, Instantpay ensures timely and accurate disbursements. Using the Bulk Payouts feature, you can process up to 10,000 payouts at once.

How can I check the transaction status for Instantpay Bulk Payouts?

Once you've finalized your Bulk Payouts, navigate to the Bulk Payout page for a comprehensive summary of your latest transactions. This overview displays the quantity of files uploaded, the cumulative number of payouts, those that have been processed, and the overarching transaction status. This page serves as a handy dashboard to seamlessly monitor the trajectory and current standing of your bulk payouts.

What is Instantpay’s Scheduled Payouts for Payments?

At the heart of Instantpay’s innovative offerings is their Scheduled Payouts system. Think of it as a set-it-and-forget-it system where businesses can program their transactions in advance. Whether it's disbursing employee salaries, vendor payments, or handling customer refunds, Scheduled Payouts lets businesses automate their recurring payments, ensuring punctuality and eliminating the hassle of manual interventions.

Is it Possible to Schedule Payouts in Advance?

Absolutely! One of the standout features of Instantpay's Bulk Payouts is the capability to pre-set transactions. This foresight ensures businesses are always a step ahead, providing reliability not just for the company itself but for those on the receiving end of these transactions. By simply inputting the necessary details and setting the desired transaction date, businesses can rest easy knowing their financial obligations will be met.

Can I Check the Status of Instantpay’s Scheduled Transactions?

Transparency is crucial when dealing with finances. With Instantpay, you're never in the dark. Once your payouts are scheduled, you can easily track and monitor the status of each transaction. Every scheduled payout comes with a detailed status report, giving businesses the confidence and assurance that their funds are being processed correctly and timely.

Diving into the Payout APIs with Instantpay

An innovative payout platform tailored to modern business needs. But beyond its core features, how does its API stand out?

Let's dive in!

Payouts Overview - API

The Instantpay API serves as the backbone for developers and businesses aiming to integrate seamless payouts into their platforms. Whether you're a burgeoning startup or a well-established conglomerate, understanding this API can revolutionize how you handle transactions.

Why an API for Payouts?

Traditional methods of processing payments can be cumbersome, particularly for businesses that handle a high volume of transactions. Manual interventions, the risk of errors, and time-consuming procedures are just some challenges. An API-driven approach, like that of Instantpay, streamlines these processes, enabling businesses to automate payouts, reduce errors, and improve efficiency.

Key Features of the Instantpay Payout APIs

Automation: With the API, businesses can set up automated workflows for payments. Whether it's paying suppliers at the end of every month or disbursing salaries, the API ensures timely, error-free transactions.

Real-time Tracking: The Instantpay Developer API allows businesses to track the status of their payments in real-time. No more waiting or guessing – get instant updates on your dashboard.

Bulk Payments: Handling mass payouts? No problem. With the API, businesses can manage bulk payments efficiently, ensuring all beneficiaries receive their dues promptly.

Enhanced Security: The API is built with robust security protocols, ensuring that all transactions are encrypted and secure.

Integration and Flexibility: Another advantage of the Instantpay API is its ease of integration. Developers can quickly embed it into their platforms, thanks to well-documented resources and support from the Instantpay team. Moreover, its flexibility means it can be tailored to various industries, be it e-commerce, healthcare, or finance.

Conclusion

In a competitive market, businesses need every edge they can get. Streamlined financial processes are more than just a convenience; they're an essential part of modern business operations. Instantpay's innovative payout solutions, be it their Bulk Payouts, Scheduled Payouts, or the Payout APIs, offer businesses that crucial edge.

Leveraging these tools ensures not just operational efficiency but also fosters trust among clients, employees, and vendors, reinforcing a brand's credibility and reliability.

0 notes

Text

Trakaff.com : Powerful Affiliate Tracking Software

Trakaff is a Powerful & Trustworthy Affiliate Tracking Software that enables CPA Networks, Affiliate Networks & E-Commerce Companies to do advanced tracking and overall affiliate management.

Create your own affiliate network

Optimize your Campaigns Performance

Boost and Scale your CPA Network

Increase your ROI for your network

It’s not just about an efficient performance marketing tool for tracking clicks, conversions, sales, leads, app install, payouts, and revenue from affiliates who work with your network but also the User Interface (UI), Latest Technology, Automation and Affordability of Software. That’s why Trakaff is best to fill all these needs. Service Type: Cloud-BasedTrial Period: 14-day without any cardBasic Plan Starts From: 59 USD/monthKnowledge Center: YesLanguage Support: EnglishCustomer Type: Small, Large Enterprise, Medium Business

Trakaff doesn’t end here, as it offers Smart-Links, Anti-Fraud Tool, 75+ Advanced Business Reports, Campaign Automation, Offer sync API, Smart Analytics, Multiple Themes for Affiliates, URL Builder tool and many more…

Get Your Free Trial Here.

Trakaff Pricing Model

Trakaff offers best-in industry pricing packages. To provide services to all cpa network & affiliate networks worldwide, Trakaff offers a 14-day Free Trial, with no credit/debit card required.

All the Features and Add-ons available in any plan can be customized according to affiliate network needs with most payment methods available like PayPal, Payoneer, MasterCard, Maestro, Visa Card, American Express Card, RazorPay, Webmoney and more. Our Direct Customer Service team can assist you with any payment method you require.

Individual Pricing Plans

Trakaff Key Benefits

Customizable Interface

Smart Links

Smart Caps

Real-Time Data

Advanced Tracking & Reporting

Pixel & Postback Integration

Campaign Automation

Powerful Fraud Detection Tool

Advance Targeting & Control

Scalable & Stable Service

Smart Optimization

Ad Networks Integration

Two-Way API

Bulk Upload Offline Campaigns

Offer Sync API

Link Builder Tool

Publisher Specific Payout Tool

GEO Specific Payout

Goals Tracking

TIER based & Group Based Payout for Publisher

Complete White Label Solution

Smart Links: Smart-link manage Your Traffic in a very smart way so you will get Max Revenue.Monetize and forward your traffic to the right place using our smart algorithms.

Fraud Detection: Anti-Fraud is a High-Security Tool that helps you Filter Unwanted Traffic to Your Network. Avoid Fraud Traffic like Fake Conversions, Fake Traffic Source, Fake Hits or Clicks. Alerts the user so that No Fraud Activity passes through Your Network.

Automation: Scale your network with automatic affiliate invoice creation, Smart Alert System that shows important changes in network instantly.

Advanced Targeting: Options like Geo based, Operating system base, Device based & Country Based which enables you to make use of your traffic well.

Offer Management: Get Offer Access control, Redirection Management System, Offer Approval System to highly Verified Trusted Publishers and many more…

Publisher Management: Use our smart communication & management tools, for publishers you can automate anything from Dynamic & Percentage based Payouts, Automated Emails, Multi Currency & Cap Limit Functions.

Reporting: Choose between 75+ comparison reports to gain a deeper understanding of your marketing efforts and develop strategies to drive growth. We got everything covered with Real Time Data in our affiliate marketing software.