#instant payment

Explore tagged Tumblr posts

Text

A Payout API Software Application UI

2 notes

·

View notes

Text

7 Proven Ways to Work Online and Get Paid Instantly in India

Work online and get paid instantly in India is a goal many aspire to achieve in today’s digital world. With the rise of technology and the internet, numerous opportunities have emerged that allow individuals to earn money from the comfort of their homes. This article will guide you through effective methods to start your online journey, ensuring you can earn money quickly and efficiently.…

0 notes

Text

#UPI Payment Gateway#UPI Verification#Instant Payment Settlement#UPI Payment#UPI Gateway#Instant payment

0 notes

Text

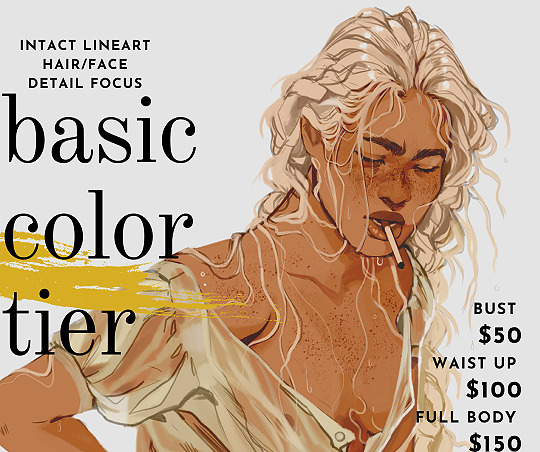

hello horreurscopesheads commissions are still closed for the foreseeable future but i have one (1) emergency slot for a sketch or simple color commission, minimum $60. send me an ask if interested!

#hit slow delivery and not instant on my funds on accident and now they're stuck in the banking limbo and i REALLY need to make some payments#today. wheeze#edit: extremely funny that it was the b/w pic that tumblr was censoring. and that i fixed it by adjusting the brightness a tiny bit

36 notes

·

View notes

Photo

[open] wolf adoptable designs

purchase a design here: https://ko-fi.com/hellgirlfirefly/shop ^^^^^^^^^^^ thunderbolt // brightbill // vontra fink // roz // paddler

Posted using PostyBirb

#wolf#dog#canine#canid#adopt#adoptable#for#sale#sales#paypal#payment#instant#adopter#coyote#semirealistic#somnoire

7 notes

·

View notes

Text

minor repeated annoyance: when you make a payment to paypal credit even for the same day it's just "scheduled" and doesn't even put a hold on money in your bank account/card/funding source 3-5 business days later when they decide to take it only then are funds withheld. so you make a payment and have to like. manually hold the funds back for when they decide they finally want to take it if something else happens in the meantime and some of that balance goes on something else it's "sorry we couldnt process your payment due to insufficient funds" well have you fucking considered processing it when you are fucking asked, mayhaps

#this is the ONLY instance i know of this#literally ANYTHING ELSE if you make a payment on something or buy something#the funds are put on INSTANT hold in your bank#the payment is not fully completed and processed for a couple days sure#but you cant USE the funds because they are in that held processing stage#paypal do not even initiate the held processing stage at the time#'scheduled for today' why is it SCHEDULED just take it! i want you to take my money! take the fucking money!

29 notes

·

View notes

Text

Join Wise and get £50. It's simple, quick, and rewarding!

Wise Money, Wise choices!

Looking for a smarter way to handle your money across borders? Wise.com is the answer. And here’s an even better reason to join—sign up with my invite, and you’ll get £50!

Smart Transfers, Happy Wallets!

Wise.com makes sending, receiving, and converting money internationally fast, easy, and affordable. With real exchange rates and low fees, you’ll save more on every transaction. Plus, their platform is user-friendly, so you can manage your money with confidence.

Save More, Send Smarter!

Signing up is simple. Just use my invite link, create your account, and you’ll get £50 to kickstart your journey with Wise. It’s a win-win—secure your bonus and start saving today!

Your Money, Your Way—Easily!!!

#payment gateway#payment gateway for website#what is a payment gateway#best payment gateway#white label payment gateway#online payment gateway#what is payment gateway#own payment gateway#create payment gateway#cashfree payment gateway#money transfer#wire transfer#transfer payments#wise transfer#transfer money#payments#wise money transfer#transfer#paypal transfer#money transfer service#transfer payments economics#payment#transferwise money transfer#transfer payments macroeconomcis#bank transfer#how to transfer money#paypal instant transfer#neft transfer#transfer money from stripe to bank#transferwise money transfer review

2 notes

·

View notes

Text

💓

3 notes

·

View notes

Text

To the person who sent me 20 bucks: thank you so so so much 🥺🥺 it seriously means the world to me

#keroa#they just took my internet payment today and i was so scared i was gonna overdraft#cuz i have to wait for the transfer cuz i can't afford to spend the instant transfer fee#and i only had 42 cents in my account and i was scared it wouldn't transfer in time#and i need a job but i cant get one until i come back from my grandpas funeral next week#and im trying v hard to be positive but positive doesnt pay the bills

7 notes

·

View notes

Text

I am actually so annoyed w reselling my shit online it’s unreal. Ppl on depop are decently nice usually and have manners but I swear every other website is a hellscape of ppl straight up ignoring my descriptions ��� sure I need the money but …ppl not reading that I’m not willing to go lower than the listed price on my camera, (which is already a huge discount from the value) offering $200 for a $700-900 value (when again, it’s not listed for that much but is 100% worth it!!) is SO insulting I actually can’t believe it 😭 where do they get the audacity….

#if I had the audacity of a man on mercari.#I’d list it on depop if cameras and batteries were allowed#weirdly it seems some ARE but not the kind I’m trying to sell?? only those cheaper instant cams I think#it’s just frustrating I have to keep saying NO. PRICE IS FIRM.when that has been in the description from the start 🤨#I might take it to a local store and see if they won’t take it for the price I think it’s worth loool my anxiety tho 😖 I’d rather sell it#online but yk….#tbh I don’t even wanna sell it but I don’t use it enough to justify keeping it when I am unemployed and have bills and payments I can’t#miss on payments for 😓#I keep having stress dreams hghdbgfv I have been applying to online remote jobs w no success yet#gritting my teeth telling myself it’ll work out 💪😤 I just#I miss her so much (steady income) sob#ik I complain about this a lort but consider.? whining online reduces the stress meter#sanchoyorambles

2 notes

·

View notes

Text

All Your Payout Solution on a Single Platform Waayupay

3 notes

·

View notes

Text

Get Rs.10 FREE PayTM Cash Instantly

Get Rs.10 FREE PayTM Cash Instantly Free Rs. 10 Free PayTM cash By Just Giving Misscall (Hurry Up! ) Rs 10 Free PayTM cash , Instant Rs 10 Free PayTM Cash , Rs 10 Free PayTM Cash By Miss Call , Earn Rs 10 Free PayTM Cash – Hi Guys , Here is Another Method To Earn Free PayTM Cash Loot , All You Have to Do is Just Give Miss call On Number & You Will Have Rs.10 Instant Free PayTM cash We Have…

View On WordPress

#Bill Payments#Earn Free PayTM Cash#Easy Earnings#Extra Money#Financial Benefits.#Financial Flexibility#freebies#Get Rs.10 FREE PayTM Cash Instantly#Hassle-Free Earnings#Instant Credit#Missed Call Offer#Mobile Recharge#No Strings Attached#online shopping#PayTM Wallet#Pocket Money#Quick Process#Student Expenses#Supplement Income

2 notes

·

View notes

Text

payment gateway services in india

Experience seamless transactions with Haoda Pay's reliable payment gateway services in India. Secure, efficient, and designed for your business success.

0 notes

Text

Explore UPI Transaction Limits: Find Out Your Maximum Transfer Capacity

UPI has grown in popularity throughout India, with over 250 million users. This extensive popularity reflects its ease of use and convenience, which has made it the favored payment method for numerous transactions. Whether paying for groceries, transferring funds, or paying bills, the seamless integration of the UPI money transfer app into daily life highlights its importance in modern financial operations. However, knowing the limits of UPI transactions can be important to managing your payments effectively. Curious about how much you can actually transfer? Stay here to learn the UPI transaction limits.

How Much Amount Can Be Transferred Through UPI?

When using UPI, it is important to know the transaction limits to manage your payments effectively. The NPCI has set a daily transaction limit of ₹1 lakh for UPI payments. However, this UPI limit can vary depending on the bank. Some banks may impose additional weekly or monthly caps on UPI transactions. The daily limit is the maximum amount you can send using UPI in a single day. The payment limits may also differ based on the type of transaction, whether it is a bill payment, merchant payment, or wallet transfer. Understanding these limits helps ensure that you stay within the permissible range for smooth and uninterrupted transactions.

Transaction Limit for Education and Healthcare

Excellent news for students, parents, and patients! The Reserve Bank of India has proposed significantly increasing the transaction limit for UPI payments to educational institutions and hospitals. This means you can now use UPI to make payments of up to Rs 5 lakh rather than the prior maximum of Rs 1 lakh. This feature intends to speed up larger transactions, making it easier to pay tuition, medical bills, and other major expenses via UPI. This approach is expected to significantly help those dealing with large payments in the education and healthcare sectors.

Benefits of Increased UPI Transaction Limits for Education and Healthcare

The increase in the UPI transaction limit to Rs 5 lakh is expected to significantly improve the convenience and ease of making payments for education and healthcare services. Here is how it benefits different stakeholders:

Students and Parents:

Better Higher Education Payments: Easily pay for higher education fees without the need for multiple transactions.

Large Payment Management: Handle large payments for boarding schools or tuition fees in one go, reducing hassle.

Increased Flexibility: Enjoy greater flexibility and convenience when managing various educational expenses.

Hospitals and Patients:

Efficient Handling of Medical Bills: Pay larger medical bills without the need for cash or breaking the payment into smaller transactions.

Smooth Emergency Payments: Make emergency payments quickly and efficiently during critical situations.

Enhanced Patient Experience: Improve the overall experience for patients by reducing payment-related stress and improving hospital efficiency.

Final Words Understanding UPI quick money transfer limits and using the increased cap for education and healthcare can greatly enhance your financial management. With the ability to make larger payments seamlessly, you can handle significant expenses more efficiently. Stay informed about these limits to ensure smooth, hassle-free transactions, and enjoy the benefits of greater flexibility in your daily financial activities.

#easy net banking app#account check karne wala app#instant fd account setup#online fd app#digital banking india#bank balance check karne wala app#quick fd account creation#bank best fixed deposit rates#open fd#upi transaction tracking#transfer payment mobile#quick fd account#best fd account interest rate#current fd rates#current fixed deposit rates#net banking money transfer#highest bank fixed deposit rates#upi transfer app#upi registration#create new upi id#upi money transfer app#upi money#rtgs money transfer app#upi create

0 notes

Text

love when customers send me a message and then two minutes later (WHILE I AM TYPING) they go "are you still there?" like. sorry. i'm not a computer. i'm not chat gpt. you have to wait for me to read your message, research your answer, and type out your answer, which may be a whole paragraph long. That whole process is going to take more than 30 seconds. So maybe like. learn some goddamn patience or something idk

#system message#its always the older people too#the ''kids and their damn technology'' and ''everyone wants instant gratification these days'' people#betty i am looking at your entire account payment history to figure out why you have a balance from 2021.#thats going to take me a few minutes#go make a coffee and come back

0 notes

Text

The Future of Mobile Payment Apps: What to Expect Next?

Mobile payment apps have already transformed how we pay, and their future looks even brighter. With features like biometric security, AI, and voice-activated payments, they’ll become faster, safer, and more user-friendly. The growth of super apps that offer more than just payments will make managing daily tasks seamless.

The evolution of Mobile payment apps have completely changed how we handle money, making everyday transactions faster, easier, and safer. Imagine paying for your groceries, sending money to a friend, or splitting a dinner bill—all with just a few taps on your phone. Sounds convenient, right? But what’s next for these smart tools? Let’s explore the exciting trends and technologies that are shaping the future of mobile payments and how they’ll make our lives even easier.Let’s dive into the trends, technologies, and possibilities that will shape the next chapter of mobile payments.

Current State of Mobile Payment Apps:

Services provided by popular apps like Apple Pay, Google Pay, and Samsung Pay have made them household names. They offer a variety of convenient features, including:contact

Contactless Payments - Secure and fast transactions with just a tap.

Integration with Wearables - Payment options via smartwatches and fitness bands.

Loyalty Rewards - Cashback and discounts for frequent usage.

Global Reach - The ability to pay seamlessly while traveling abroad.

Despite their popularity, there’s still room for growth and innovation in this space, driven by advancements in technology and changing consumer preferences.

Emerging Trends in Mobile Payments:

Here are some key trends that will define the future of mobile payment apps:

1. Biometric Authentication

Security remains a top concern for mobile payments solution. Biometric authentication, like fingerprint scanning, facial recognition, and even voice recognition, will become more sophisticated and widespread. These technologies provide an extra layer of security while enhancing user convenience.

2. Artificial Intelligence (AI) Integration

AI will play a significant role in personalizing the payment experience. Features like predictive analytics, expense tracking, and fraud detection powered by AI will make payment apps smarter and more intuitive.

3. Cryptocurrency Payments

As cryptocurrencies like Bitcoin and Ethereum gain mainstream acceptance, mobile payment apps are likely to incorporate crypto wallets. This will allow users to make transactions in digital currencies effortlessly.

4. Voice-Activated Payments

Imagine paying for your coffee by simply saying, “Pay for my order,” to your smart device. Voice-activated payments, driven by virtual assistants like Alexa and Siri, will make transactions even more hands-free and seamless.

5. Super Apps

The future of mobile payment apps lies in becoming "super apps." These are platforms that combine payments with other services like shopping, travel bookings, food delivery, and more, creating an all-in-one ecosystem.

Read more..

#Mobile payment apps in UAE#Instant payment processing#Contactless payment in uae#Voice activated Payments sharjah#mobile payments solution#digital wallet abu dhabi#Payment method Dubai#Fintech solution

0 notes