#what is payment gateway

Explore tagged Tumblr posts

Text

Join Wise and get £50. It's simple, quick, and rewarding!

Wise Money, Wise choices!

Looking for a smarter way to handle your money across borders? Wise.com is the answer. And here’s an even better reason to join—sign up with my invite, and you’ll get £50!

Smart Transfers, Happy Wallets!

Wise.com makes sending, receiving, and converting money internationally fast, easy, and affordable. With real exchange rates and low fees, you’ll save more on every transaction. Plus, their platform is user-friendly, so you can manage your money with confidence.

Save More, Send Smarter!

Signing up is simple. Just use my invite link, create your account, and you’ll get £50 to kickstart your journey with Wise. It’s a win-win—secure your bonus and start saving today!

Your Money, Your Way—Easily!!!

#payment gateway#payment gateway for website#what is a payment gateway#best payment gateway#white label payment gateway#online payment gateway#what is payment gateway#own payment gateway#create payment gateway#cashfree payment gateway#money transfer#wire transfer#transfer payments#wise transfer#transfer money#payments#wise money transfer#transfer#paypal transfer#money transfer service#transfer payments economics#payment#transferwise money transfer#transfer payments macroeconomcis#bank transfer#how to transfer money#paypal instant transfer#neft transfer#transfer money from stripe to bank#transferwise money transfer review

2 notes

·

View notes

Text

What is a Payment Gateway and How Does It Work?

#What is a Payment Gateway and How Does It Work?#payment gateway#what is a payment gateway#payment gateway for website#what is payment gateway#payment gateway api#how payment gateway works#white label payment gateway#own payment gateway#how a payment gateway works#best payment gateway in india#create payment gateway#how does a payment gateway work#build payment gateway#what is payment gateway in hindi#online payment gateway#payment gateway explained#best payment gateway#payment gateway tutorial

1 note

·

View note

Text

Discover how NMI Payment Gateway and 5Star Processing can streamline your business transactions. Learn about features, benefits, and integration options in this comprehensive guide.

#5Star Processing#nmi credit card processing#nmi gateway#nmi payment gateway#nmi virtual terminal#what is nmi payment

0 notes

Text

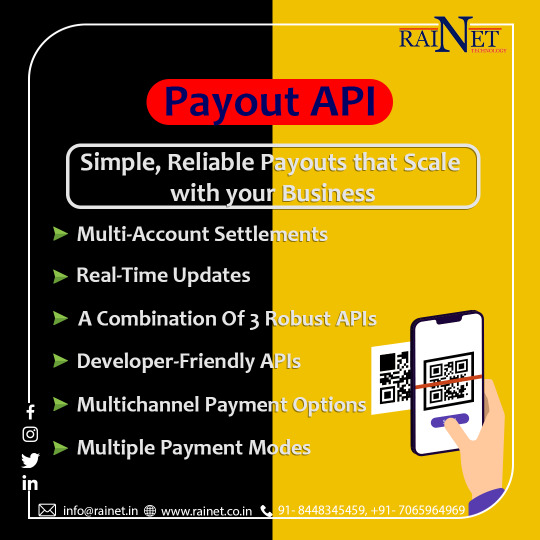

Payout API Provider

Rainet Technology has established itself as the best Payout API Provider company through its exceptional services and commitment to customer satisfaction. With its user-friendly interface, seamless integration, and reliable payout solutions, Rainet Technology has proven to be a reliable partner for businesses looking to streamline their payment processes. The company's dedication to innovation and continuous improvement sets it apart from its competitors, ensuring that clients receive the most advanced and efficient payout solutions available. As businesses continue to evolve and seek more efficient payment solutions, Rainet Technology remains at the forefront of the industry, ready to meet their needs. So, why settle for anything less than the best? Choose Rainet Technology for all your payout API requirements and experience the difference for yourself.

Visit Website: https://rainet.co.in/upi-collection-api.php

#upi integration api#upi api integration#upi payment gateway#paytm upi integration api#upi integration#upi payment gateway integration#api service#mobile app development company#ios app development#api provider#rainet technology private limited#bbps service#education portal development company#android app developer company#what is bbps#android app development company

0 notes

Text

finished our self portrait, "this is what i look like". acrylic paint & paint markers on an 8"x10"x flat panel canvas!

we are open for commissions, please check out our Ko-Fi or our Etsy to purchase one for yourself!

we also accept paypl, cshapp, vnmo and others! feel free to DM and ask about alternative payment gateways!

#queer artist#furry artist#trans artist#furry#sfw furry#therian#wolf therian#wolfkin#illustration#art#painting#commissions#open commissions#gay artist#lesbian artist#furry art#furry fandom#werewolf#our art#our shop

364 notes

·

View notes

Text

i hate how prostitution advocates act like there is no objective state of abuse. they ask the victims, do you feel abused? and when they say no, they call it a day and say its not their business.

if you see a man hit his wife, and you ask her, are you okay? and she says yes, would you stop caring? say well, if most battered wives stay with their husbands, if most abused women stay with their partner, the abusers shouldnt be punished?

ive talked about this before on my old blog, but prostitution follows similar patterns as abusive relationships: in those, women stay due to dependency (the kids, shared home, joint bank account, lack of safety net etc), just like prostitutes (family dependent on them, living in the brothel, sole provider, lack of options, etc); or the cycle of abuse and amends, apologies and gestures of love after the abuse, which in prostitution is the payment.

using your money to get others to perform the sexual acts you want disregarding their own desires and boundaries is abuse. prostitution advocates are not advocating for women‘s agency, they are advocating for men legally abusing impoverished women and other marginalised people who are the majority of prostitutes.

focussing on the woman‘s choice is a gateway to victim-blaming: if she voluntarily entered prostitution, she knew what she was getting into. if she gets traumatised, that‘s on her. „why is she staying with her abusive partner? why is she defending him after everything he‘s done to her?“ sounds the same to me as „why does she stay in prostitution and even defends it if it‘s so bad?“ and the conclusion: it cant be that bad then. none of my business. and the abusers keep getting away with it

989 notes

·

View notes

Text

+

Call it by its name: A coup.

February 1, 2025

Robert B. Hubbell

On Friday, January 31, 2025, Trump moved to complete the coup he began on January 6, 2021. Trump failed the first time, and he will fail again—because he has underestimated the American people. We must steel ourselves because things will get worse before they get better--but they will get better. It is a fool’s bet to assume that the American people will sit idly by as their freedoms are stolen by a corrupt oligarch and a convicted felon destroying the government to promote their selfish interests.

Speaking the truth about what is happening is difficult and unpleasant. Hearing the truth is also difficult and unpleasant. But the longer we fail to recognize the current situation for what it is—a slow-rolling coup attempt—the longer it will take for us to recover.

I know this is a challenging time and that many readers are outraged, fearful, and dispirited. Join me in community on Saturday morning at 9am Pacific / 12 Noon Eastern on the Substack App for a livestream discussion. There is no link; just open the app at the scheduled time, and you will receive a notification that I am going live on Substack. I will send an email reminder 15 minutes in advance.

I am speaking more directly and using stronger words to describe the situation than many of the mainstream media outlets. CBS, CNN, and NYT are reporting on bits and pieces of Trump's actions as if they are mere political stories. But those outlets are not addressing the obvious coordinated nature of the unprecedented attacks on the DOJ, FBI, Office of Personnel Management, Treasury Department, and dozens of other agencies.

Taken together, those actions amount to a hostile takeover of the US government by those who are loyal to Trump rather than to the US Constitution. The only word that accurately describes that situation is “coup.” Any other description is a sign of fear, submission, or surrender.

Usually, coups occur between political adversaries competing for control of the government. Here, the coup is an effort by Trump to overthrow the Constitution and establish himself as the unbounded dictator of the United States. The only word that accurately describes that situation is “coup.” Any other description is a sign of fear, submission, or surrender.

Fortunately, many independent political commentators are raising the alarm in ways the legacy media is not. BlueSky has become an indispensable source of resistance and information. Facebook is also emerging as a source of statements and leaks by government insiders.

To the extent you can, amplify those voices and add your own to the swelling chorus of alarm and indignation that will eventually stop Trump's unfolding coup. We stopped Trump's initial attempt to “freeze” grants and loans, and we can do it again.

Here is a partial list of what is happening:

Elon Musk and a team of DOGE infiltrators have taken over the Office of Personnel Management (OPM) by connecting non-government computer servers to the US personnel mainframe computers. They have reportedly seized private information about millions of federal employees. They have locked the senior managers of the OPM out of their agency’s computers. They have moved “sofa beds” into the OPM offices and put the offices into a “lockdown mode.” See Reuters, Exclusive: Musk aides lock government workers out of computer systems at US agency, sources say.

The hostile takeover of OMP allowed Musk to send an unauthorized memo inviting millions of federal employees to resign in exchange for eight months of “non working paid employment.” [Two unions representing federal workers have filed a lawsuit challenging Trump's plan to reclassify and terminate hundreds of thousands of federal workers.]

Elon Musk and a team of DOGE infiltrators have attempted to seize control of the US Treasury payments system—the gateway through which ALL funds from the federal government flow. When a senior manager at the Treasury asked why Musk needed access to the highly sensitive system, the manager was immediately placed on leave. He chose to quit, instead. See The New Republic, Top Official to Quit as Musk Tries to Get Hands on Key Payment System

As of Friday evening, the Acting US Attorney for Washington, D.C., fired about 30 US Attorneys who prosecuted January 6 insurrectionists. See Politico, DOJ fires dozens of prosecutors who handled Jan. 6 cases. Think about that for a moment: The convicted felons who attacked the Capitol have been pardoned and the loyal servants of the Constitution who prosecuted them have been fired. That fact should outrage every American.

Also on Friday evening, the FBI told eight of its most senior leaders to resign or be fired on Monday. Those senior officials head divisions of the DOJ responsible for cybersecurity, national security, and criminal investigations. Senior FBI leaders ordered to retire, resign or be fired by Monday | CNN Politics

The FBI has fired dozens of agents who worked on investigations of January 6 insurrectionists and has asked for a list of every agent across the US who worked on the largest criminal investigation in the history of the FBI. That list will include hundreds—possibly thousands of FBI agents. The implication of the memo ordering the compilation of the list is that those agents may be fired. See Reuters, Trump's DOJ launches purge of Jan. 6 prosecutors, FBI agents.

Also on Friday, the FBI told the senior agents in charge of field offices in Miami, Philadelphia, Washington, New Orleans, Las Vegas, and Los Angeles to resign or be fired on Monday. Reuters.

Readers alerted me to postings on Facebook and elsewhere (that I cannot authenticate) claiming to be from current government employees describing an atmosphere of chaos and fear as DOGE infiltrators ominously demand lists of employees who are apparently “next” to be fired.

Dozens of government websites were taken offline on Friday, ostensibly to be scrubbed for references to diversity, gender, or human attributes that are not white, male, and Christian. The effort was brutish, clumsy, and ignorant. The Census Bureau website was offline as DOGE infiltrators attempted to remove references to the fact that America includes people who are not white male Christians. Websites relating to LGBTQ equality, women’s health, transgender issues, and scientific knowledge in general were taken down.

The Pentagon has advised NBC, NYT, NPR, and other mainstream media outlets that they would be “rotated out of the building (i.e., the Pentagon)” to make room for NYPost, Brietbart, and OANN. See @DefenseBaron.bsky.social.

And as all of the above is happening, Republicans in the Senate will vote to confirm a Director of National Intelligence with suspiciously warm views toward Putin and an FBI Director who published an “enemies list” that included dozens of politicians, journalists, military officers, and career government officials.

Oh, and the Republican Party is facilitating the rolling coup. No, that’s not quite right. They are cheering it on.

As with the freeze on grants and loans, it will take a few days for the American public to understand the implications of what is happening. It is up to us to help spread the word.

What can we do? Here’s what we can do: Trump's rolling coup is (mistakenly) predicated on his belief that the American people are sheep. He believes that we will sit still while he does whatever he wants.

He is wrong.

America is based on the consent of the governed, and its economic health requires the cooperation of the participants in the economy. If Americans withhold their political consent and economic cooperation, both the political and financial systems in America will grind to a halt.

What does withholding consent and cooperation look like? That is difficult to predict given the fluid situation, but the citizens of other nations that have grappled with similar challenges have used sustained and massive street protests, national work strikes, work slowdowns, taxpayer strikes, business boycotts, and transportation boycotts. To be clear, I am simply making an observation about how aspiring dictators in other countries have been brought to heel and held to account.

Soon, very soon, Americans will be called upon to leave the comfort of their homes and the anonymity of their computer screens to engage in massive, coordinated action to remind Trump and Musk that they are servants of the people, not vice-versa.

Coda: Trump announced 25% tariffs on goods from Mexico and Canada. As one Canadian official noted on Friday, the Canadian auto industry—which is a major parts supplier to the US auto industry—cannot survive for a week with 25% tariffs. The Canadian supply chain will shut down, the American car industry will be severely damaged, and tens of thousands of US autoworkers will be laid off. We aren’t talking about inflation increasing or the cost of eggs. We are talking about tens of thousands of job losses and an economic shock likely to lead to a recession.

The point is that Trump's anti-democratic blitz is occurring in an environment in which he is making the stupidest economic moves made by any president since Herbert Hoover. That background will provide fertile soil for massive action by Americans who are fed up with Trump and Musk acting like dictators.

I believe in the strength and resiliency of the American people. It may take longer than some of us would like, but they will awaken, like the sleeping giant that German spies warned Hitler about on the eve of WWII.

I understand those who are frustrated and angry over the seeming flat-footed response of Democratic leadership. But complaining is not a strategy. Issue spotting is not a strategy. Assigning blame is not a strategy. Taking action is a strategy. Spreading the truth is a strategy. Making the daily phone calls recommended by Jessica Craven is a strategy.

So, to the extent you can, direct all your anxious energy and anger toward action. The first time you learn of a protest march near you, show up. And the next time. And the time after that. In many nations, small protest marches gain momentum in a matter of weeks.

I will talk to you tomorrow. Join me at 9 am PST / 12 noon EST on Substack

[Robert B. Hubbell Newsletter]

42 notes

·

View notes

Text

🔍 What Makes IGpay Different? At IGpay, we're not just another payment gateway — we're built for businesses that demand more.

✅ Trusted & Vetted Security 💾 Data Vault Protection 👥 Responsive Support Team 📈 Trusted by 150+ Merchants Worldwide

Whether you're in iGaming, Forex, or other high-risk industries — we've got the tools and trust to help you grow.

💡 Your business deserves a payment partner that gets it.

25 notes

·

View notes

Text

CALL IT BY ITS NAME: A COUP -and it's happening now.

An excerpt: "Here is a partial list of what is happening:

Elon Musk and a team of DOGE infiltrators have taken over the Office of Personnel Management (OPM) by connecting non-government computer servers to the US personnel mainframe computers. They have reportedly seized private information about millions of federal employees. They have locked the senior managers of the OPM out of their agency’s computers. They have moved “sofa beds” into the OPM offices and put the offices into a “lockdown mode.” See Reuters, Exclusive: Musk aides lock government workers out of computer systems at US agency, sources say.

The hostile takeover of OMP allowed Musk to send an unauthorized memo inviting millions of federal employees to resign in exchange for eight months of “non working paid employment.” [Two unions representing federal workers have filed a lawsuit challenging Trump's plan to reclassify and terminate hundreds of thousands of federal workers.]

Elon Musk and a team of DOGE infiltrators have attempted to seize control of the US Treasury payments system—the gateway through which ALL funds from the federal government flow. When a senior manager at the Treasury asked why Musk needed access to the highly sensitive system, the manager was immediately placed on leave. He chose to quit, instead. See The New Republic, Top Official to Quit as Musk Tries to Get Hands on Key Payment System

As of Friday evening, the Acting US Attorney for Washington, D.C., fired about 30 US Attorneys who prosecuted January 6 insurrectionists. See Politico, DOJ fires dozens of prosecutors who handled Jan. 6 cases. Think about that for a moment: The convicted felons who attacked the Capitol have been pardoned and the loyal servants of the Constitution who prosecuted them have been fired. That fact should outrage every American.

Also on Friday evening, the FBI told eight of its most senior leaders to resign or be fired on Monday. Those senior officials head divisions of the DOJ responsible for cybersecurity, national security, and criminal investigations. Senior FBI leaders ordered to retire, resign or be fired by Monday | CNN Politics

The FBI has fired dozens of agents who worked on investigations of January 6 insurrectionists and has asked for a list of every agent across the US who worked on the largest criminal investigation in the history of the FBI. That list will include hundreds—possibly thousands of FBI agents. The implication of the memo ordering the compilation of the list is that those agents may be fired. See Reuters, Trump's DOJ launches purge of Jan. 6 prosecutors, FBI agents.

Also on Friday, the FBI told the senior agents in charge of field offices in Miami, Philadelphia, Washington, New Orleans, Las Vegas, and Los Angeles to resign or be fired on Monday. Reuters.

Readers alerted me to postings on Facebook and elsewhere (that I cannot authenticate) claiming to be from current government employees describing an atmosphere of chaos and fear as DOGE infiltrators ominously demand lists of employees who are apparently “next” to be fired.

Dozens of government websites were taken offline on Friday, ostensibly to be scrubbed for references to diversity, gender, or human attributes that are not white, male, and Christian. The effort was brutish, clumsy, and ignorant. The Census Bureau website was offline as DOGE infiltrators attempted to remove references to the fact that America includes people who are not white male Christians. Websites relating to LGBTQ equality, women’s health, transgender issues, and scientific knowledge in general were taken down.

The Pentagon has advised NBC, NYT, NPR, and other mainstream media outlets that they would be “rotated out of the building (i.e., the Pentagon)” to make room for NYPost, Brietbart, and OANN. See @DefenseBaron.bsky.social.

And as all of the above is happening, Republicans in the Senate will vote to confirm a Director of National Intelligence with suspiciously warm views toward Putin and an FBI Director who published an “enemies list” that included dozens of politicians, journalists, military officers, and career government officials.

It is up to us to help spread the word."

24 notes

·

View notes

Text

Why Would a Business Need a Merchant Account?

(Human directed ai content.)

In today's digital age, where cash transactions are becoming increasingly rare, having a merchant account has become essential for businesses of all sizes. Whether you're a small boutique shop or a large online retailer, a merchant account opens up a world of opportunities for accepting payments and expanding your customer base. But what exactly is a merchant account, and why is it so crucial for businesses? Let's delve into the details.

What is a Merchant Account?

A merchant account is a type of bank account that allows businesses to accept payments via debit or credit cards. It serves as an intermediary between the merchant (the business owner) and the acquiring bank, facilitating the transfer of funds from the customer's bank to the merchant's account.

Seamless Payment Processing

One of the primary reasons why a business needs a merchant account is for seamless payment processing. With a merchant account, businesses can accept payments through various channels, including in-store terminals, e-commerce websites, mobile apps, and even over the phone. This flexibility enables merchants to cater to the diverse preferences of their customers and provide a convenient and hassle-free payment experience.

Expand Customer Base

By accepting credit and debit card payments, businesses can attract a broader customer base. Many consumers prefer the convenience and security of paying with cards over cash or checks. Without a merchant account, businesses risk losing out on potential sales from customers who prefer card payments. Additionally, accepting card payments can attract impulse buyers who may not have enough cash on hand but are willing to make a purchase using their cards.

Build Trust and Credibility

Having the ability to accept card payments can also enhance a business's credibility and trustworthiness in the eyes of consumers. Customers tend to perceive businesses that accept card payments as more legitimate and established compared to those that accept cash only. Furthermore, the security measures implemented in card transactions, such as encryption and fraud detection, provide an added layer of protection for both merchants and customers, further boosting trust and confidence in the business.

Streamline Accounting and Reporting

Merchant accounts often come with advanced reporting tools and features that help businesses streamline their accounting processes. Transaction data is recorded electronically, making it easier to track sales, reconcile accounts, and generate financial reports. This level of automation not only saves time and reduces errors but also provides valuable insights into customer purchasing patterns and trends, which businesses can use to make informed decisions and improve their overall operations.

Facilitate Online Sales

For businesses operating in the e-commerce space, having a merchant account is indispensable. An online merchant account enables businesses to securely accept payments for goods and services sold over the internet. With the exponential growth of online shopping, especially in light of recent global events, businesses without an online payment gateway are at a significant disadvantage. By leveraging a merchant account for online transactions, businesses can tap into the vast potential of the digital marketplace and reach customers beyond geographical boundaries.

Conclusion

In conclusion, a merchant account is a vital tool for businesses looking to thrive in today's competitive marketplace. From facilitating seamless payment processing and expanding customer reach to enhancing credibility and streamlining operations, the benefits of having a merchant account are manifold. Whether you're a brick-and-mortar store or an online retailer, investing in a merchant account is a strategic decision that can propel your business forward and pave the way for long-term success.

#merchant account#what is a merchant account#merchant account fees#merchant account pricing#merchant account providers#merchant account rates#merchant services#high risk merchant account#merchant account for high risk business#merchant account processing#merchant accounts#high risk merchant account fees#high risk merchant accounts#merchant accounts vs business account#high risk merchant account approval#merchant account vs payment gateway

1 note

·

View note

Note

how do you deal with the disappointment when a spirit takes your payment and then doesn't do the work?

A certain % of spells will always fail. I tend to approach it systematically.

Ritual work:

Did you explicitly state that spirits may only partake of the offering if they agree to do this job for you?

Did you limit access to the offerings to only spirits who are capable of carrying out the required task?

Did you plan your ritual around spirit gateways, such as certain astrological timings, days of week, or at natural spiritual gateways? Or, did you engage in acts of witchcraft to create spirit doors? All of these things make it easier to correctly contact and "call through" spirits.

Did you provide a "due by" date for the work to be completed?

Did you accurately and plainly describe exactly what it is you wanted to have happen?

Spirit work:

Did you correctly evoke the spirit? I.e., are you relatively sure the spirit was actually properly called into the ritual?

Did you evoke a single spirit, or many? If you only evoked one spirit, what steps did you take to ensure it would agree to do the job for you?

If you only evoked one single spirit, what steps did you take to ensure that the spirit is capable of doing the task at hand?

Is the spirit, or categories of spirits, known in lore to be able to deliver the kind of results you want? Are they related to, or do they dwell within, the domain where you want your results to occur?

Is that spirit(s) known to help people such as yourself? I.e., if you don't have a personal relationship with the spirit, are they known to help strangers?

Sorcerous strategy:

Did you perform divination before the spell to find out if there are blockages or problems you should address beforehand?

Did you perform divination before the spell to find out if evoking that spirit for that task would be effective?

Be reasonable with yourself:

Have you done many spirit evocations, and they usually succeed? If so, this may be a fluke.

Is this a new spirit you're working with, while other spirits usually deliver results? If so, you may have not yet learned how to correctly evoke that spirit, or how to engage with them for mutually satisfactory results.

If you're brand new to trafficking with spirits in order to work magic, then you may have just not learned all of the requisite skills necessary, or how to harmoniously put them together.

Have you successfully cast many spells in the past? If so, compare your spirit working rituals to prior, successful spells. See what aspects may be missing.

If you're new to magic and have had few or no successful manifestations, be patient with yourself. Magic is a complex, multifacited skillset with many variables.

98 notes

·

View notes

Text

Today one of my coworkers in customer service couldn't get the barcodes (which shipping uses to quickly pull up orders) to load on our invoices. Only that computer was having the issue, and it didn't have the issue the day before.

So I'm standing up there talking to that coworker, discussing troubleshooting steps, when a stranger walks in looking for our brick and mortar shop which no longer exists. I explain that we're currently online only (which is how we started up) but might have a shop again at some point in the future, if the right place presents itself.

My manager asks what sort of items he's interested in, and runs back to the warehouse to grab him some options to look at. Meanwhile I continue discussing troubleshooting with my coworker (also I offer the friendly stranger some candy while he waits).

Manager comes back with some options for him to browse, and we put together an order for him. I pull up the payment gateway, and he hops onto my coworker's computer to enter his credit card information. While he's at it, he jokingly offers to do some troubleshooting for us.

He can't get his card to go through, and ends up paying us in cash (he refuses my offer to go get him change from the cash box). He leaves, and my coworker opens up an invoice. Lo and behold, the barcode appears!!

So basically the friendly stranger was some sort of chill deity of troubleshooting, and luckily we were kind and helpful and gave him candy when he stopped by.

36 notes

·

View notes

Text

The Courier Pt: 1

(My own musing in writing fanfic. Short read, hope you enjoy. SFW. Please reblog if you like the story 🙂)

(Part 2: https://www.tumblr.com/levi-ackerman-ds/744174236448538624/the-courier-pt-2?source=share)

As the moonlight cast eerie shadows across the city, Levi stalked silently through the dimly lit streets of Mitras. With his gray long-sleeved shirt, black pants, and a dark hooded cloak, he blended effortlessly into the somber backdrop of the district. His keen eyes were fixed on the figure ahead, their features hidden beneath their own hooded cloak as they moved through the streets. Dark pants clung to their legs, emphasizing their swift and calculated steps. A heavy satchel hung from their side, ominously hinting at the burdens it held. Money? Illicit substances? It could all be hidden within that satchel.

He couldn't help but feel a sense of anticipation building within him. This was it, the moment he had been waiting for. Erwin's intel had pointed to this mysterious courier, and he was determined to uncover the truth. Adjusting the hood of his cloak, ensuring it concealed his face, he padded after the figure. As he wove through the shadows, keeping a careful distance between himself and the figure, his mind raced with thoughts and conjectures, meticulously analyzing every detail, every possible explanation for the courier's actions. Was this person affiliated with a wealthy council member? Was there a deep political conspiracy happening beneath their unsuspecting society?

Making their way towards the entrance of the Underground, he constantly assessed his surroundings. The covered stairway loomed before him, a passage into the depths that promised to reveal the hidden secrets. He descended into the Underground's realm, leaving behind the world above and its moonlight and stars. As Levi neared the bottom of the stairway that led to the gateway entrance of the Underground City, he could see the figures of the gatekeepers stationed at their posts. Their imposing presence radiated an unspoken authority, signaling that entry into the secretive realm of the Underground would not come without a cost.

His eyes remained fixed on the familiar silhouette of the hooded figure as they approached the gate. Maintaining a discreet distance, he silently observed the upcoming encounter. Without uttering a word, the figure presented a pass to the gatekeepers, their satchel clutched tightly at their side. The gatekeepers begrudgingly stepped aside at the sight of the pass, allowing the courier to pass through the gateway unimpeded. Levi's brows furrowed. This individual had established favor or made substantial payments to earn such privilege.

Levi quickened his pace, intending to slip through before the gatekeepers could fully register his presence. However, his attempt was soon thwarted as the gatekeepers turned their hostile gazes towards him. One, a burly man with a grizzled beard, stepped forward, blocking Levi's path. As an officer in the Scouts, he was well aware of the disdain that accompanied their presence in the forsaken depths of the Underground. The gatekeepers, their expressions laced with contempt, regarded him with an air of condescension.

"Another one of Erwin's lapdogs, I presume?" the apparent leader sneered. "You know we don't particularly welcome your kind down here."

Levi's eyes narrowed as he responded in a sarcastic tone. "What's the matter? Afraid a Scout might discover the rot lurking within the confines of your 'precious' Underground? And here I thought we were all just one big happy family. Guess I'll have to bring the welcome party myself then."

The exchange ignited a spark between them, the hostility emanating with each word. Levi was accustomed to these confrontations, his confrontational nature conflicting with the gatekeepers' inherent suspicion towards the Survey Corps. For many in the Underground, the Scouts symbolized fleeting hope, a beacon in the darkness. But for others, they were seen as intruders, pests that disturbed the fragile equilibrium.

The leader towered over him, a sneer of superiority etched into his face. "You may have the title of Captain, but we don't bow to your orders down here, Levi," he snapped, emphasizing Levi's name with disdain.

Levi's eyes gleamed with a dangerous glint as his patience waned. He relished the thought of shutting down these mob-like gatekeepers, thoroughly despising their exploitation of the innocent populous trapped below. "You're right, I should behave. I wouldn't want to remind you of the rightful ass-kicking I'm more than capable of delivering."

The exchange brimmed with tense electricity, fueled by Levi's desire to protect the defenseless citizens of the Underground. As much as the gatekeepers resented him they knew better than to truly challenge Levi. Reluctantly, the leader motioned for the others to step aside, granting him passage. "Don't make any trouble. We wouldn't want the Scouts tarnishing their supposed reputation down here," he sneered.

Levi muttered a brief thanks before striding past, deliberately shouldering against one with a subtle nudging force. He suppressed the urge to outright lash out at their insolence. The delay had cost him precious time, and he had lost sight of the courier during their confrontation, an irritating setback that exasperated his frustration. As he pressed on into the depths of the Underground City, he refocused his attention, determined to track down the courier and unravel the threads of corruption that ensnared this forsaken city beneath the surface.

#levi ackerman#shingeki no kyojin#levi#captain levi#aot fanfiction#levi fanfiction#levi snk#attack on titan#aot

32 notes

·

View notes

Text

API For UPI

Introduction

In today's fast-paced digital world, businesses are constantly seeking innovative ways to streamline their operations and enhance customer experience. One such solution that has gained immense popularity is the use of API for UPI (Unified Payments Interface). This technology allows businesses to seamlessly integrate UPI payments into their applications or websites, providing a convenient and secure payment method for customers. However, with numerous options available in the market, it can be challenging to choose the right API provider that meets your specific business needs. That's where Rainet Technology comes in. With its exceptional expertise and comprehensive features, Rainet Technology stands out as the best choice for API for UPI solutions. In this article, we will explore how Rainet Technology can help your business thrive in the digital payment landscape and why you should consider them as your trusted partner. So let's dive in and discover the endless possibilities that await you with Rainet Technology's API for UPI services.

Rainet Technology is the best choice for api for upi.

When it comes to choosing the best API for UPI (Unified Payments Interface), Rainet Technology is undoubtedly the top choice. With years of experience and expertise in the field, Rainet Technology has established itself as a reliable and trusted provider of UPI APIs.

What sets Rainet Technology apart from its competitors is its commitment to delivering high-quality and seamless solutions. The team at Rainet Technology understands the importance of a smooth and secure payment process for businesses, and their UPI API is designed with this in mind. By integrating Rainet Technology's API into your business operations, you can ensure that your customers have a hassle-free experience when making payments through UPI.

Rainet Technology's UPI API offers a wide range of features that are tailored to meet the specific needs of businesses. From easy integration to real-time transaction updates, their API provides all the necessary tools to streamline your payment processes. Whether you are a small startup or an established enterprise, Rainet Technology's UPI API can help you enhance your business operations and provide a seamless payment experience for your customers.

In conclusion, if you are looking for the best choice in API for UPI, look no further than Rainet Technology. Their expertise, commitment to quality, and comprehensive feature set make them the ideal partner for businesses seeking efficient and secure payment solutions. Don't miss out on the opportunity to take your business to new heights – choose Rainet Technology today!

How can api for upi can help your business?

In today's digital age, businesses are constantly looking for ways to streamline their operations and provide convenient solutions to their customers. One such solution that has gained immense popularity is the use of API for UPI (Unified Payments Interface).

API for UPI allows businesses to integrate the UPI payment system into their own applications or websites, providing a seamless and secure payment experience for their customers. This means that your customers can make payments directly from your platform without the need for any additional steps or redirects.

But how exactly can API for UPI help your business? Well, it offers several advantages. Firstly, it enables you to offer a wide range of payment options to your customers. With UPI becoming increasingly popular in India, integrating this payment method into your platform can attract more customers and increase conversions.

Secondly, API for UPI ensures a smooth and hassle-free payment process. Customers no longer have to enter their card details or go through multiple authentication steps. They can simply authorize the transaction using their UPI credentials, making the checkout process quick and convenient.

Furthermore, API for UPI provides enhanced security measures. Transactions made through UPI are encrypted and require two-factor authentication, ensuring that both you and your customers are protected against fraud.

By implementing an API for UPI in your business, you can offer a seamless payment experience to your customers while also improving efficiency and reducing manual efforts. It's a win-win situation that can significantly boost your business growth.

At Rainet Technology, we understand the importance of staying ahead in this competitive market. That's why we offer top-notch API for UPI services that are tailored to meet your specific business needs. Our team of experts will guide you through the integration process and ensure that everything runs smoothly.

So why wait? Embrace the power of API for UPI today and take your business to new heights with Rainet Technology by your side!

What features provide Rainet Technology in api for upi?

Rainet Technology offers a comprehensive range of features in its API for UPI that can greatly benefit your business. Our API is designed to provide seamless integration with the UPI platform, allowing you to easily incorporate UPI payments into your existing systems and applications.

One of the key features of our API is its robust security measures. We understand the importance of protecting sensitive financial data, which is why we have implemented industry-standard encryption protocols and authentication mechanisms. This ensures that all transactions made through our API are secure and protected from any unauthorized access.

In addition to security, our API also offers advanced functionality such as real-time transaction tracking and reporting. With this feature, you can easily monitor the status of each transaction, track payments in real-time, and generate detailed reports for analysis and reconciliation purposes. This level of transparency allows you to have complete visibility into your payment processes and make informed decisions based on accurate data.

Furthermore, Rainet Technology's API for UPI supports multiple payment modes, including QR code-based payments, mobile number-based payments, and VPA (Virtual Payment Address) based payments. This flexibility enables your customers to choose their preferred payment method, enhancing their overall experience with your business.

Overall, Rainet Technology's API for UPI provides a wide range of features that can streamline your payment processes and enhance customer satisfaction. By choosing our API, you can ensure secure transactions, real-time tracking capabilities, and support for various payment modes - all essential components for a successful UPI integration.

Why Chhose Rainet Technology for api for upi?

When it comes to choosing the right API for UPI (Unified Payments Interface), Rainet Technology stands out as the best choice. With our expertise and experience in developing APIs, we have built a strong reputation in the industry for delivering top-notch solutions that cater to the specific needs of businesses.

One of the key reasons why you should choose Rainet Technology for your API for UPI requirements is our commitment to providing seamless integration and functionality. Our team of skilled developers understands the intricacies of UPI and can create an API that seamlessly integrates with your existing systems, ensuring smooth transactions and a hassle-free user experience.

Moreover, Rainet Technology offers a wide range of features in our API for UPI. From easy payment initiation and verification to secure transaction processing, we have got you covered. Our API allows businesses to accept payments from multiple UPI apps, making it convenient for customers to transact using their preferred payment method.

In addition to our technical expertise, what sets us apart is our dedication to customer satisfaction. We prioritize understanding your business requirements and tailor our solutions accordingly. Our team works closely with you throughout the development process, ensuring that your API for UPI aligns perfectly with your business goals.

So why wait? Choose Rainet Technology today and experience the difference we can make in streamlining your payment processes through our reliable and efficient API for UPI.

Hire us today.

If you're looking to integrate UPI functionality into your business, look no further than Rainet Technology. Our team of experts has extensive experience in developing and implementing API for UPI solutions that can take your business to new heights. By hiring us today, you can ensure that you are partnering with a company that understands the intricacies of UPI and can provide you with a seamless integration process.

At Rainet Technology, we pride ourselves on our commitment to delivering high-quality services tailored to meet the unique needs of each client. Our API for UPI solutions are designed to enhance your business operations by enabling secure and convenient transactions through the UPI platform. With our expertise, you can rest assured that your customers will have a smooth payment experience while enjoying the benefits of UPI's fast and reliable payment system.

By choosing Rainet Technology as your API for UPI provider, you gain access to a range of features that will give your business a competitive edge. Our APIs offer real-time transaction updates, secure authentication protocols, and easy integration with existing systems. We understand the importance of customization, so our team will work closely with you to tailor the API solution according to your specific requirements.

Don't miss out on the opportunity to leverage the power of UPI for your business. Hire Rainet Technology today and let us help you unlock the full potential of this revolutionary payment system.

Conclusion

In conclusion, the use of API for UPI can greatly benefit businesses in today's digital age. Rainet Technology stands out as the best choice for implementing this technology due to its exceptional features and reliable services. By integrating API for UPI into your business operations, you can streamline payment processes, enhance customer experience, and increase efficiency. Rainet Technology offers a wide range of features in their API for UPI solution, including secure transactions, real-time notifications, and seamless integration with existing systems. Choosing Rainet Technology as your provider ensures that you will receive top-notch support and expertise in implementing API for UPI. So why wait? Take the leap and hire Rainet Technology today to unlock the full potential of API for UPI and propel your business towards success in the digital realm.

Visit Website: https://rainet.co.in/upi-collection-api.php

#upi integration api#upi api integration#upi payment gateway#paytm upi integration api#upi integration#upi payment gateway integration#api service#rainet technology private limited#mobile app development company#android app developer company#api provider#education portal development company#bbps service#ios app development#android app development company#what is bbps

0 notes

Text

it's sad jordie hours again so I'm thinking about kaz and grief. about how he is putting it off and refusing to process it, and it's going to be worse and messy when he does. about how his grief is a direct comparison to what happened to his leg, which is to say—something was broken and he didn't/couldn't rest long enough for it to mend, so he just pushed onwards and ended up with a bad job of healing and a pain he couldn't shake.

I don't think he ever really stopped to feel or consider just how much he'd lost, though I also don't think he ever had the chance. he has never thought about it with sadness or longing, only anger as he counts the cost of what he's going to take as payment, as revenge.

and it's what makes jordie so omipresent that he's practically a main character. we never meet him and yet he's There the whole time. but I almost don't think that's really jordie anymore. he's a symbol and a gateway and a gravestone and a reason and he lost every chance of becoming at thirteen. so now he doesn't really exist anymore. he's not his own person. he's kaz's brother. he's on the other side of the balanced scale that decides the weight of brick by brick.

I will never shut up about how "he doesn't say goodbye. he just lets go." because kaz let go of jordie in the harbor to save himself from drowning, but he won't be free until he says goodbye.

in this essay...wait that was the essay whoops

40 notes

·

View notes

Text

do i buy from scalpers or nah?

2009: nagtext yung tito ko sa mommy ko na buksan yung tv and manood ng myx kasi nandon si sandara park. turns out she debubet in a kpop girl group. (naalala daw ng tito ko na lagi ako napapagalitan noon noon pa kasi nauubos yung regular load ni mommy as i use it to vote for dara at scq). my fan girl self was born and what was funny was it wasnt dara who became my bias, it was bommie.

2010: natuto ako maging keyboard warrior kasi madaming hate comments against 2ne1 specially from the snsd fans. if youve been a kpop fan since this era, youd know how funny the online bardagulan was at the time. hahaha. also met online friends i still talk to until this day.

2011: first concert ng 2ne1 dito. may bago kaming bahay so walang extra funds and i didnt mind not watching, i was really young and in my head, i know i could watch them again when they come back.

2012: binubully ako sa school because i like kpop and also dress like kpop. and totoo naman hahaha kpop fashion at the time was the vibrant colored skinny jeans/leggings + even brighter tops. looking back, mukha naman talaga akong tanga sa suot ko ko lagi noon!? hahaha

2013: eto ewan ko but for some reason, nagstart na maging acceptable yung kpop sa school namin pero mostly boy groups ata yon. the bullying about 2ne1 stopped pero bullied kid pa din ako bcs of other things i would kwento some other time haha this year ko lang din nakilala yung only friend ko nung high school and was able to influence 2ne1 with her. dalawa na kami!!

2014: concert ulit ng 2ne1 dito!! birthmonth ko pa???! still wasnt able to attend. magstart na ko sa university so madaming gastos noon. i didnt want to ask for more money. if you follow 2ne1 and sokor's timeline, you know this was a bad crazy year.

2015: influenced my college bestie into kpop!! 2ne1's hiatus began.

2016: buong byahe ako umiiyak sa jeep from blumentrit to nova kasi na-announce yung disbandment ng 2ne1 + winner taehyun's (boy group) departure from the group at the same day. nanalo sa debate contest yung college bestfriend ko pero i couldnt be happy for her hahahaha si oa. umiiyak na ko kumakain pa lang kami sa mcdo sa pnoval.

2017: naconfine ako sa feu pero ang soundtrip ko is 2ne1. medyo napagsabihan pa ko ng nurse na di ako makakapagpahinga kung maingay.

ang tagal na ng tumblr ko, may idea na kayo sa mga nangyari sakin noon noon pa but my love for 2ne1 remained the same. i literally grew up to their music!

4 excruciating days of ticket selling, 3 days din ako umiiyak hahaha. yung d1 na exclusive selling, hindi ko masyadong dinamdam kasi may ibang days pa naman. yung d4, 8 minutes pa lang nasa checkout page na kami. lahat ng tiers, unavailable na yung nakalagay. kahit anong tier wala na kaming pake, from gen ad to vip sc so, basta makasecure lang sana ng ticket. 4 days na ganon!! either walang macheckout or nageerror yung payment gateway!! its so frustrating because im now capable to buy the ticket with my hard-earned money, like i have always dreamed to do, but couldnt get a chance to any seat. hirap nyo kalaban, scalpers :((

7 notes

·

View notes