#bookkeeping services for CPA

Text

Ready to streamline your accounting processes and focus on growing your business? Partner with a trusted outsourced bookkeeping company today. Contact us to learn more about our comprehensive bookkeeping services tailored for outsourcing for CPA firms. Let us handle your financial tasks so you can concentrate on what you do best. Get in touch now and take the first step towards efficient and secure bookkeeping!

#Outsourced Bookkeeping Companies for CPA firms#bookkeeping firms#hire bookkeeping experts from India#bookkeeping for CPAs#bookkeeping service providers#bookkeeping services for businesses#outsourced bookkeeping services#outsourced bookkeeping solutions#remote bookkeeping services#unison globus#bookkeeping outsourcing firms#bookkeeping services for CPA

0 notes

Text

CPA firms face evolving challenges: data overload, manual processes, and regulatory compliance. IBN Technologies offers smart solutions, automating key tasks, enhancing accuracy, and boosting efficiency. Our AI-driven tools streamline workflows, ensuring CPAs can focus on high-value client services.

for more information---https://www.ibntech.com/cpa-outsourcing/

0 notes

Text

Outsource Bookkeeping Services to India: A Smart Business Move

In today’s competitive business environment, companies are constantly looking for ways to streamline operations and reduce costs. One effective strategy is to outsource bookkeeping services to India. This approach not only provides access to skilled professionals but also offers significant cost savings. Let's explore why outsourcing bookkeeping services to India can be a game-changer for your business.

Why Outsource Bookkeeping Services?

1. Cost-Effectiveness

Delegating your bookkeeping tasks to an external provider can result in significant financial savings. By choosing to outsource bookkeeping services to India, businesses can reduce overhead expenses associated with hiring in-house staff, such as salaries, benefits, and training costs. Indian firms offer competitive pricing due to lower labor costs, providing high-quality services at a fraction of the cost.

2. Access to Expertise

India is known for its vast pool of highly skilled and qualified professionals. When you outsource bookkeeping services, you gain access to experts who are proficient in international accounting standards and practices. These professionals are equipped with the latest tools and technologies to ensure accurate and efficient bookkeeping.

3. Focus on Core Business Activities

By outsourcing bookkeeping services, companies can focus more on their core business activities. This allows management and staff to dedicate their time and resources to areas that directly impact growth and profitability, such as sales, marketing, and product development.

Benefits of Outsourcing Bookkeeping Services in India

1. High-Quality Services

Indian bookkeeping firms are known for their commitment to quality. They employ stringent quality control measures and adhere to international accounting standards. This ensures that the financial records are accurate, reliable, and compliant with regulatory requirements.

2. Scalability

Outsourcing bookkeeping services in India offers flexibility and scalability. Whether you are a small business or a large corporation, Indian service providers can scale their services to meet your specific needs. This flexibility is particularly beneficial during periods of growth or seasonal fluctuations in business activity.

3. Time Zone Advantage

The time zone difference between India and Western countries can be leveraged to your advantage. By outsourcing bookkeeping services to India, you can benefit from round-the-clock operations. Work can be completed overnight, providing you with updated financial information by the start of your business day.

How to Choose the Right Bookkeeping Service Provider

1. Experience and Expertise

When outsourcing bookkeeping services, it’s crucial to choose a provider with extensive experience and expertise in the field. Seek out companies that have a history of success and favorable reviews from their clients. Ensure they have experience in your specific industry and are familiar with relevant regulations.

2. Technology and Security

Ensure the service provider uses the latest accounting software and technologies. Data security is paramount, so choose a provider that implements robust security measures to protect your financial information from unauthorized access and cyber threats.

3. Transparent Pricing

Opt for a service provider with a transparent pricing model. Avoid firms with hidden fees and unclear contracts. A clear understanding of the costs involved will help you make an informed decision and avoid any unexpected expenses.

4. Communication and Support

Effective communication is essential when outsourcing bookkeeping services. Choose a provider that offers reliable customer support and maintains clear and consistent communication channels. This guarantees that any problems or questions will be handled quickly and efficiently.

Conclusion

Outsourcing bookkeeping services to India is a strategic decision that can offer numerous benefits, including cost savings, access to expertise, and improved focus on core business activities. By carefully selecting the right service provider, businesses can enjoy high-quality, scalable, and secure bookkeeping services. Embrace this opportunity to enhance your business efficiency and drive growth.

In summary, outsourcing bookkeeping services to India is not just a cost-saving measure; it is a smart business strategy that can lead to improved operational efficiency and long-term success.

#Outsource bookkeeping services to India#outsourcing bookkeeping services in India#outsource bookkeeping services#outsourcing bookkeeping services#offshore bookkeeping services#CPA outsourcing services#outsourced accounting firms#finance#accounting#bookkeeping

2 notes

·

View notes

Text

Elevate Your Financial Strategy: CPA Firms in India from Mas LLP

In the intricate landscape of financial management, businesses seek expertise and reliability to navigate complex regulations and optimize their financial strategies. That's where Certified Public Accountant (CPA) firms play a crucial role. At Mas LLP, we offer top-notch CPA services tailored to meet the diverse needs of businesses in India. Let's delve into the significance of CPA firms and how Mas LLP stands out in delivering exceptional financial solutions. Why Choose CPA Firms in India?

1. Expertise and Accreditation: Certified Public Accountants are professionals with extensive training and accreditation in accounting, auditing, taxation, and financial management. Choosing a CPA firms in India ensures access to highly skilled professionals who can provide expert advice and guidance on a wide range of financial matters.

2. Comprehensive Financial Services: CPA firms in India offer a comprehensive suite of financial services, including audit and assurance, tax planning and compliance, financial reporting, and advisory services. Whether you're a small startup or a large corporation, CPA firms provide tailored solutions to address your specific financial needs and challenges.

3. Regulatory Compliance: In today's regulatory environment, compliance with accounting and tax regulations is essential for businesses to avoid penalties and legal repercussions. CPA firms help businesses stay compliant with applicable laws and regulations, ensuring accurate financial reporting and tax filings.

4. Strategic Planning: Beyond compliance, CPA firms in India assist businesses in strategic financial planning and decision-making. By analyzing financial data and market trends, CPAs help businesses identify growth opportunities, mitigate risks, and optimize their financial performance for long-term success.

5. Audit and Assurance Services: For businesses requiring independent assurance on their financial statements, CPA firms in India provide audit and assurance services to verify the accuracy and reliability of financial information. Audited financial statements enhance transparency and credibility, instilling confidence among stakeholders and investors. Mas LLP: Your Trusted CPA Firms in India At Mas LLP, we combine expertise, experience, and dedication to deliver unparalleled CPA services to businesses across India. Here's why Mas LLP stands out as your premier choice:

1. Expert Professionals: Our team comprises highly skilled and experienced CPAs who possess in-depth knowledge of Indian accounting standards, tax laws, and regulatory requirements.

2. Customized Solutions: We understand that every business is unique, which is why we offer personalized solutions tailored to meet your specific financial needs and objectives.

3. Commitment to Excellence: We are committed to delivering excellence in everything we do, from providing expert advice and guidance to delivering timely and accurate financial services.

4. Client-Centric Approach: At Mas LLP, we prioritize client satisfaction and strive to exceed expectations by delivering exceptional service and value.

5. Industry Experience: With years of experience serving clients across various industries, we have the expertise to address the unique challenges and opportunities facing your business. In conclusion, choosing a CPA firm like Mas LLP can help businesses in India navigate complex financial landscapes, achieve compliance, and optimize their financial performance. Contact us today to learn more about our CPA firms in India and how we can help elevate your financial strategy.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#CPA firms in India

3 notes

·

View notes

Text

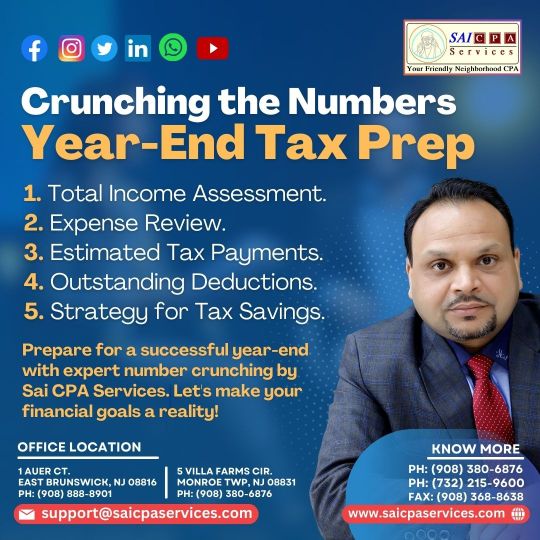

Smart Finances, Bright Future: ‘SAI CPA Services' Year-End Tax Planning Strategies

Introduction:

As the year winds down, it's time to ensure your financial house is in order. SAI CPA Services is here to equip you with straightforward and effective year-end tax planning strategies. Let's simplify the process, so you can confidently navigate the path to financial success in the coming year.

Financial Health Check:

Begin by reviewing your income and expenses for the year. Identify opportunities to manage your cash flow strategically, setting the stage for a solid year-end tax plan.

Fortify Your Future with Retirement Savings:

Boost your retirement savings by maximizing contributions to your retirement accounts. Beyond securing your financial future, this step offers immediate tax advantages by reducing your taxable income.

Uncover Tax Credits:

Explore available tax credits tailored to your situation. Whether it's education-related credits or incentives for energy-efficient upgrades, these credits can significantly impact your year-end tax liability.

Investment Smart:

If your investment portfolio includes losses, consider employing tax-loss harvesting. Selling investments with losses can help offset gains and potentially reduce your overall tax burden.

Healthy Savings with HSAs and FSAs:

Review your contributions to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). These accounts not only promote health but also provide valuable tax benefits.

Give and Receive:

If you plan to make charitable contributions, do so before the year concludes. Beyond supporting causes you believe in, charitable giving can result in valuable tax deductions.

Stay Informed on Tax Changes:

Keep yourself updated on recent tax law changes that may impact your financial situation. Staying informed enables you to make proactive decisions aligned with the current tax landscape.

Consult SAI CPA Services:

For personalized guidance, schedule a consultation with SAI CPA Services. Our experienced team is ready to assist you in crafting a tailored year-end tax plan that suits your unique circumstances.

Conclusion:

Year-end tax planning doesn't have to be complex. With these simple yet effective strategies and the support of SAI CPA Services, you can take control of your financial destiny. Maximize your returns, minimize your tax liability, and stride into the new year with confidence in your financial well-being.

Contact Us:- https://www.saicpaservices.com/

https://www.facebook.com/AjayKCPA

https://www.instagram.com/sai_cpa_services/

https://twitter.com/SaiCPA

https://www.linkedin.com/in/saicpaservices/

(908) 380-6876

1 Auer Ct, East Brunswick,

New Jersey 08816

#SAI CPA SERVICES#Year & Tax Planning#CPA Firm#Payroll Services#Accounting & Bookkeeping Services#New Jersey#Tax Services

2 notes

·

View notes

Text

Our #experts can help your business reach new heights. Contact us and #thrive! Get in touch! Visit our website www.thebookkeepersrus.com

#reliablecpas#bookkeepingservicesla#recordkeeping#healthcare bookkeeping#affordable accounting service;#smallbusinesssolutions#cpa california#los angeles

2 notes

·

View notes

Text

Maximizing Growth with OpenTeQ NetSuite B2C Portals for E-commerce Businesses

Success in the fiercely competitive world of e-commerce depends on effective management of client relations, operations, and data flow. Businesses want reliable solutions to improve client experiences and manage operations as they grow. For e-commerce companies, NetSuite integration provides a complete solution that can optimize everything from customer interaction to inventory management. Leading NetSuite solution provider OpenTeQ is committed to assisting e-commerce businesses in utilizing this effective technology to achieve long-term success.

The Role of NetSuite in E-commerce

NetSuite's comprehensive suite of solutions empowers e-commerce businesses to centralize operations, improve customer service, and gain valuable insights through advanced analytics. With tools that automate and simplify everything from order management to financial tracking, NetSuite is the perfect fit for fast-growing e-commerce companies.

One essential element is the NetSuite Customer Portal, which enables businesses to offer customers real-time access to order history account information, and support services. OpenTeQ specializes in setting up and customizing NetSuite Customer Portals, ensuring that customers enjoy a seamless experience while reducing the burden on support teams.

Expanding Global Reach with NetSuite Offshore Partner

In the globalized e-commerce market, working with the right technology partner is critical. OpenTeQ acts as a trusted NetSuite Offshore Partner, helping e-commerce businesses expand their reach and improve operational efficiency. Through its offshore services, OpenTeQ supports businesses with customized NetSuite implementations, ensuring smooth global operations and continuous optimization.

OpenTeQ’s offshore team also helps businesses scale faster by providing expert NetSuite development and support, all while keeping costs manageable. This collaboration allows businesses to focus on growing their core operations while leaving the technical aspects to a trusted NetSuite Offshore Partner.

Enhancing Customer Experience with NetSuite B2C Portals

One of the biggest challenges e-commerce businesses faces is providing a seamless and personalized shopping experience. NetSuite B2C Portals offer a solution to this by allowing companies to create customized shopping experiences for their customers. With personalized interfaces, businesses can offer product recommendations, streamlined checkout processes, and a cohesive brand experience.

OpenTeQ assists e-commerce companies in implementing and customizing NetSuite B2C Portals to enhance customer engagement and increase conversion rates. By offering real-time product updates, stock availability, and order tracking, these portals give customers the information they need to make purchasing decisions while maintaining a strong connection with the brand.

Streamlining Data Management with NetSuite Data Migration

For any e-commerce business, data is a critical asset. Ensuring that data from multiple platforms is seamlessly transferred and integrated into a central system is key to maintaining operational efficiency. NetSuite Data Migration plays a pivotal role in this process by ensuring smooth transition and consolidation of data from legacy systems to the NetSuite platform.

OpenTeQ's expert team specializes in managing NetSuite Data Migration for e-commerce businesses. Whether a company is migrating product catalogs, customer data, or historical transaction records, OpenTeQ ensures that the data migration process is seamless, accurate, and secure. This migration helps businesses avoid potential disruptions and maintain full control over their data, enabling them to make better-informed decisions and grow their operations effectively.

Conclusion

The integration of NetSuite into e-commerce operations is a game-changer for businesses looking to scale and optimize their processes. With the expertise of OpenTeQ as a NetSuite Offshore Partner, e-commerce businesses can leverage the full power of tools like the NetSuite Customer Portal, NetSuite B2C Portals, and smooth NetSuite Data Migration to streamline operations and enhance customer satisfaction.

Whether your goal is to improve customer engagement, manage global operations, or optimize your data handling, NetSuite integration for e-commerce businesses offers a reliable and scalable solution. OpenTeQ is here to ensure that your e-commerce business achieves long-term success through strategic NetSuite implementations tailored to your needs. Contact Us: [email protected], +1-469 623 5106.

#NetSuite for Construction#NetSuite Solutions for Construction#NetSuite for Private Equity Firms#NetSuite Solutions for Private Equity Firms#NetSuite for hospitality#NetSuite solutions for hospitality management#NetSuite solutions for hospitality industry#NetSuite for Oil & gas Companies#NetSuite Bookkeeping Services#CPA On-Demand#Fractional CFO Services#NetSuite Mobile Apps#NetSuite Mobile App Development#NetSuite Mobile App Services#NetSuite Application Development#NetSuite Mobile Applications#NetSuite Advanced Dunning Solution#Advanced NetSuite Dunning Module#NetSuite Bulk Upload#Payment Orchestration for NetSuite#NetSuite Connectors#NetSuite Revision Management#NetSuite Advanced MRO#NetSuite Advanced Reconciliation#NetSuite RECONATOR#NetSuite for Small Business#Best NetSuite Consultants#NetSuite Managed Services#NetSuite Offshore Partner#NetSuite Customer Portal

0 notes

Text

5 Essential Benefits Of Hiring A CPA For Your Business

Hiring a CPA for your business ensures accurate financial management, tax compliance, and strategic advice. CPAs help with bookkeeping, tax planning, and navigating complex financial regulations, saving time and reducing errors. Their expertise supports better decision-making, enhances financial stability, and can lead to cost savings, making them an invaluable asset for business growth and sustainability. To know more visit here https://www.straighttalkcpas.com/cpa-services

0 notes

Text

youtube

You may maximize your company's probability by utilizing the several services that Advantage CPA supplies. From tactical financial design to correct tax composing, our skilled staff offers express solutions to maximize your business's performance and ensure consent. Survey our vast array of services planned to boost your income, ease your growth, and graceful your accounting work. Join us to proceed with your business with acute guidance and unusual experience. See how Advantage CPA can help you prosper right now!

#Accounting#Payroll#Tax Preparation#QuickBooks Pro Advisor#Bookkeeping#New Business Formation#Business Consultation#Bank Financing#Internal Controls#Strategic Business Planning#Succession Planning#Tax Planning#Tax Problems#State Sales Tax#IRS Tax Problems Resolution#Accounting Firm#CPA Firm#Payroll Services#Tax Services#Business Services#Youtube

0 notes

Text

Maximize Savings with Rose Group CPA Tax Services

At Rose Group CPA, we specialize in providing expert CPA tax services to individuals and businesses alike. Our team of certified public accountants ensures your tax filings are accurate, compliant, and optimized for savings. Trust us to navigate complex tax codes, minimize liabilities, and maximize your returns. Let Rose Group CPA handle the details so you can focus on what matters most.

#cpa tax services#tax and accounting services#professional bookkeeping#tax preparation and planning#tax services usa

0 notes

Text

#bookkeeping services in san antonio#uhlenbrockcpa#tax preparation services san antonio#bookkeeping san antonio#cpa services in san antonio

0 notes

Text

2024 and Beyond: The Top Accounting Trends to Watch

Introduction:

The accounting landscape is undergoing significant transformation, driven by advancements in technology and shifts in business practices. For CPAs, EAs, and accounting firms across the United States, staying abreast of these changes is more than just a necessity—it’s an opportunity to enhance services and streamline operations. As we look toward 2024, several key trends are set to shape the future of accounting, from the rise of outsourced bookkeeping and accounting servicesin the USA to the integration of cutting-edge technologies.

Artificial Intelligence (AI) & Machine Learning (ML)

AI and ML are no longer just emerging technologies; they have become essential tools in the accounting sector, significantly impacting how firms operate. According to recent studies, over 60% of large accounting firms in the United States are already utilizing AI to enhance their services. This trend is rapidly expanding to small and medium-sized firms, with adoption rates expected to increase by 30% over the next two years.

By automating routine tasks such as data entry, reconciliation, and invoice processing, AI can reduce the time spent on these activities by up to 80%. This automation not only saves time but also minimizes human error, which accounts for nearly 75% of data entry mistakes in traditional accounting practices. As a result, CPAs and EAs can reallocate their time to more strategic activities, such as advisory services and client relationship management, thereby increasing their value to clients.

Firms offering outsourced accounting services and outsourced bookkeeping for CPAs are leveraging AI technologies to deliver more precise and efficient services. For instance, AI-driven analytics enable firms to analyze vast amounts of financial data quickly, providing deeper insights that can be used for better financial forecasting and risk assessment. This capability is particularly valuable for CPAs, as clients have indicated a preference for accountants who can provide predictive insights and strategic guidance based on data-driven analysis.

Moreover, AI can significantly enhance client satisfaction and trust. According to a survey by the American Institute of CPAs (AICPA), clients expressed greater confidence in firms that use AI and advanced technologies, as these tools reduce the likelihood of errors and ensure more accurate financial reporting. This trust translates into higher client retention rates, with firms that utilize AI reporting to increase in client loyalty compared to those that do not.

Data and Analytics: Transforming Accounting Practices

Data analytics is revolutionizing the accounting profession, enabling firms to make smarter, more informed decisions. For US-based CPAs, EAs, and accounting firms, leveraging data analytics trends in accounting means turning vast amounts of financial data into actionable insights. Advanced accounting and bookkeeping software allows firms to quickly analyze large datasets, uncovering patterns that help predict cash flows, assess risks, and optimize strategies.

Firms specializing in outsourced bookkeeping and accounting for American CPAs can significantly benefit from big data analytics in accounting by providing deeper insights into financial trends. This data-driven approach enhances audit accuracy, improves client trust, and allows for more proactive, strategic advice. With real-time data analytics, firms can deliver timely financial insights, staying ahead of client needs in a rapidly changing environment.

Embracing these data analytics trends not only boosts efficiency but also positions accounting firms as innovative leaders. By adopting big data tools, firms can enhance their service offerings, maintain robust data security, and build stronger client relationships.

Cloud-Based Accounting: Enhancing Efficiency and Security

The shift to cloud-based accounting solutions is revolutionizing how accounting firms operate. For US-based CPAs, EAs, and firms providing accounting outsourcing services, cloud technology offers unparalleled benefits, including remote access, enhanced collaboration, and real-time updates. These platforms enable seamless integration of client data, streamlining processes and significantly reducing the time required for financial reporting.

Cloud-based systems also enhance transparency, allowing accountants to provide clients with up-to-date financial information at any time. This real-time access is crucial for firms that specialize in outsourced accounting and bookkeeping services, enabling them to deliver timely and accurate insights that drive better decision-making.

Security is a primary concern for all accounting firms, and cloud providers prioritize robust protection against data breaches and unauthorized access. By adopting cloud-based solutions, firms can ensure data security while benefiting from scalable resources that adapt to changing needs. This shift not only improves operational efficiency but also positions firms as forward-thinking, tech-savvy partners in the eyes of their clients.

Remote Work: Adapting to a New Era in Accounting

The rise of remote work is reshaping the accounting industry, offering flexibility and access to a global talent pool. For US-based CPAs, EAs, and firms specializing in outsourcing services for CPA firms and CPA firm outsourcing solutions, remote work solutions like cloud accounting software and virtual communication platforms are game-changers. These tools enable firms to deliver high-quality services from anywhere, eliminating the need for a physical office.

By embracing remote work, firms can reduce overhead costs while maintaining strong client relationships and efficient workflows. This adaptability not only enhances service delivery but also positions firms as innovative and resilient, ready to meet the challenges of a dynamic business environment.

Blockchain Technology: Redefining Accounting Integrity and Security

Blockchain technology is more than just a buzzword—it's reshaping how financial transactions are recorded and verified. With its unparalleled transparency and security, blockchain has the potential to significantly impact accounting practices. For firms specializing in outsourced accounting and bookkeeping services, the impact of blockchain on accounting practices is profound, offering a way to ensure the accuracy and integrity of financial records.

By using blockchain for secure financial transactions, firms can reduce the risk of fraud and enhance compliance with regulatory standards. This technology creates a tamper-proof ledger of all financial activities, making it easier to audit and verify transactions. For accounting firms, embracing blockchain means adopting a tool that not only protects client data but also builds trust through its commitment to transparency and reliability.

Real-Time Payments: Streamlining Financial Operations in Accounting

The shift towards real-time payment systems in accounting is revolutionizing how businesses manage their finances. These systems enable instant payment processing, significantly improving cash flow management and reducing delays in transactions. For accounting firms that specialize in outsourced bookkeeping and accounting solutions, adopting real-time payments means optimizing invoicing and payment systems for maximum efficiency and accuracy.

By leveraging real-time payment technologies, firms can help their clients enhance operational efficiency, minimize errors, and maintain a steady cash flow. This proactive approach not only supports better financial management but also positions firms as forward-thinking partners capable of navigating the evolving financial landscape.

Agile Accounting: Enhancing Flexibility and Responsiveness

Agile accounting is becoming a vital approach for firms aiming to be more responsive to client needs and rapidly changing market conditions. By embracing agile methodologies in accounting firms, professionals can adapt quickly to new information and shifts in the financial landscape. This flexibility is crucial for firms providing outsourcing services for accounting firms, as it allows them to deliver more dynamic, client-focused services.

Implementing agile project management in accounting encourages continuous improvement, fostering stronger client relationships and achieving better outcomes. This approach not only enhances service delivery but also positions firms as adaptable and innovative leaders in the accounting industry.

Third-Party Involvement: Maximizing Efficiency Through Outsourcing

As businesses aim to streamline operations, the use of third-party providers in accounting is growing. Outsourcing functions like payroll and bookkeeping enables firms to focus on their core strengths while reducing costs. However, for firms offering outsourced bookkeeping & accounting services, effective management of these third-party relationships is vital. Ensuring robust communication and oversight helps maintain high service quality and compliance, allowing firms to fully reap the benefits of outsourcing.

Data Security: Protecting Client Information in the Digital Age

With the increasing adoption of digital tools, safeguarding sensitive financial data has become a top priority for accounting firms. This is especially crucial for firms providing outsourced bookkeeping and accounting services, where the risk of data breaches is significant. To protect client information, firms must implement best practices for data protection and stay current with the latest security technologies. Prioritizing data security not only prevents potential breaches but also reinforces trust and compliance, ensuring long-term client relationships.

Forensic Accountants: Navigating Financial Fraud with Expertise

The demand for forensic accounting is growing as financial fraud becomes more complex. Forensic accountants are essential for detecting fraudulent activities and offering litigation support, making them invaluable to firms facing intricate financial discrepancies. Accounting firms specializing in outsourced accounting services for CPAs can expand their offerings by providing forensic accounting services, thereby adding value and helping clients mitigate financial risks. This expertise enhances the firm's reputation as a comprehensive service provider equipped to handle diverse client needs.

Preparing for the Future of Accounting

As 2024 approaches, the accounting profession faces transformative changes driven by technology and evolving business needs. For CPAs, EAs, and accounting firms, staying ahead means embracing emerging trends like outsourced accounting for American CPAs, leveraging AI tools, and prioritizing data security. These strategies provide opportunities to innovate, enhance services, and strengthen client relationships.

By adapting to these trends and understanding their potential impact, accounting professionals can position themselves as forward-thinking leaders, ready to navigate the complexities of a dynamic landscape. Embracing these changes not only ensures resilience but also sets the stage for continued growth and success in the years to come.

About Unison Globus

Unison Globus is a premier provider of outsourced accounting and taxation services, dedicated to supporting CPAs, EAs, and accounting firms across the USA. With a focus on delivering high-quality, reliable, and efficient solutions, Unison Globus empowers firms to optimize their operations and drive growth. Our comprehensive services range from outsourced bookkeeping and accounting to tax preparation and advisory, all tailored to meet the specific needs of our clients.

At Unison Globus, we combine expertise in accounting outsourcing with a commitment to leveraging the latest technologies, such as AI, cloud-based platforms, and blockchain. This innovative approach allows us to offer seamless integration, enhanced data security, and superior accuracy, ensuring that our clients stay ahead in an evolving industry.

Partnering with Unison Globus means gaining a trusted ally who understands the challenges and opportunities facing modern accounting firms. We are dedicated to helping our clients navigate the complexities of today's financial landscape with confidence and agility, ensuring their continued success and growth.

Explore more about how Unison Globus can elevate your accounting practice by visiting Unison Globus.

Original Source: https://unisonglobus.com/the-top-accounting-trends-to-watch-in-2024-beyond/

#accounting industry challenges#CPA firm growth strategies#accounting software trends#future of accounting#accounting industry updates#CPA trends 2024#latest accounting changes#outsourced accounting services#outsourced bookkeeping and accounting services#Accounting Trends#unison globus

0 notes

Text

Transform your financial management with our ALL-IN-ONE Bookkeeping services. Streamline your accounting with ease. Ready to take control? Book a call with us today-

#bookkeeping services online#accounting & bookkeeping services#bookkeeping services outsourcing#bookkeeping services texas#accounting services and bookkeeping services#e commerce bookkeeping services#offshore bookkeeping services#bookkeeper outsourcing#outsourcing bookkeeping benefits#accounting service outsourcing#outsourcing companies in usa#bookkeeping services company#outsource bookkeeping services for your small business#outsource bookkeeping for cpas#bookkeeping for cpas#bookkeeping services for cpa

1 note

·

View note

Text

0 notes

Text

Choosing Between QuickBooks Online and QuickBooks Desktop

In today's digital world, picking the right accounting software can make a big difference for a business. One common challenge is choosing between QuickBooks Online and QuickBooks Desktop. Each has its strengths depending on what your business needs.

QuickBooks Online lets you work in the cloud, which means you can access your financial info from anywhere with internet. This is great if you work with accountants who aren't in the same place as you, or if you need to work from different locations.

QuickBooks Desktop, on the other hand, is for businesses that prefer to keep their software on their own computers. It's good if you have complex needs, like managing lots of inventory, and you want the stability of having everything stored on your own system.

Understanding these differences can help you decide which one is best for your business, based on what you need to achieve and how you like to work.

Necessity in Different Businesses: QuickBooks Online vs. QuickBooks Desktop

QuickBooks Online: QuickBooks Online lets you access your financial info through the internet, which is great if you need to work with accountants who aren't in the same place as you. It allows you to share data in real-time and you can use it from anywhere with internet. There's also a mobile app for doing things like sending invoices and tracking expenses on the go, which makes it flexible for businesses.

Advantages of QuickBooks Online:

Access Anywhere: You can reach your financial data and collaborate with others in real-time.

Flexible Pricing: Offers different price options and has features for tracking projects and managing inventory.

Automatic Sales Tax: Automatically calculates sales tax rates, making it easier to stay compliant.

QuickBooks Desktop: QuickBooks Desktop is for businesses that prefer to have their software on their own computers rather than in the cloud. It's good for businesses with complex inventory needs because it has advanced features like tracking inventory across multiple locations and using barcodes, which are important for industries that need detailed control over their inventory.

Advantages of QuickBooks Desktop:

Works Offline: You can use it without needing internet, so you always have access to your financial data.

Advanced Inventory Features: Includes tools for tracking inventory in multiple places and using barcodes, which are helpful for managing detailed inventory.

Industry-Specific Tools: Has specialized features for different industries like manufacturing, retail, and professional services.Bottom of Form

Comparing Preferences: QuickBooks Online vs. QuickBooks Desktop

The comparison between QuickBooks Online and QuickBooks Desktop reveals distinct differences across various aspects.

User Interface: QuickBooks Online features a user-friendly interface that simplifies managing customers and vendors, while QuickBooks Desktop employs a traditional interface that may require more training to navigate effectively.

Accessibility: QuickBooks Online is cloud-based, allowing access from anywhere with an internet connection. In contrast, QuickBooks Desktop requires installation on a local computer, limiting accessibility to specific locations.

File Sharing: QuickBooks Online enables effortless sharing with accountants, streamlining bookkeeping tasks. On the other hand, QuickBooks Desktop's file sharing may be less seamless, dependent on local network configurations.

Invoicing: QuickBooks Online offers strong invoicing capabilities, supporting on-the-go invoicing needs. Meanwhile, QuickBooks Desktop provides comprehensive invoicing features suitable for detailed invoicing requirements.

Managing Multiple Companies: QuickBooks Online shows limited effectiveness in managing multiple companies compared to QuickBooks Desktop, which is capable of efficiently handling multiple company accounts.

Project Costing: QuickBooks Online provides basic project costing capabilities, while QuickBooks Desktop offers more advanced tools for detailed project costing needs.

Integration: QuickBooks Online integrates well with various online applications, enhancing flexibility and connectivity. QuickBooks Desktop, however, may face challenges in integrating with other software solutions, potentially complicating interoperability.

Conclusion

Deciding between QuickBooks Online and QuickBooks Desktop depends on what your business really needs. QuickBooks Online is great if you want flexibility—you can access it from anywhere using the internet, and it's good value, especially for smaller businesses.

On the other hand, QuickBooks Desktop is faster and more reliable because it doesn't need the internet to work. It's better for businesses that need advanced features like detailed inventory tracking. However, it costs more per user.

In the end, if you prioritize being able to work from anywhere, teamwork, and getting good value, QuickBooks Online is probably best for you. But if your business needs strong offline capabilities and specific advanced tools, QuickBooks Desktop might be worth the higher cost. Thinking about these things carefully will help you choose the right one for your business

How Braj Aggarwal, CPA, P.C Can Help in Accounting?

Braj Aggarwal, CPA, P.C. provides specialized expertise in offering bookkeeping and accounting services through both QuickBooks Online and QuickBooks Desktop, tailored to meet the unique needs and demands of each client. Our experienced team excels in resolving complexities and technical challenges efficiently. Partnering with us ensures strategic benefits for your company, including cost and time savings, enhanced financial analysis, scalability, and improved data security.

Feel free to reach us and let us be your partner in success – contact Braj Aggarwal, CPA, P.C. today!

#QuickBooks Online#QuickBooks Desktop#QuickBooks#Accounting Services#Bookkeeping Services#Braj Aggarwal CPA PC

0 notes

Text

Transform Your CPA Firm with Outsourced Accounting and Bookkeeping Services

Outsourcing accounting and bookkeeping services can be a game-changer for CPA firms. By leveraging external expertise, CPA firms can focus on core functions like advisory and tax planning. Outsourced bookkeeping ensures accuracy and compliance with the latest regulations, while reducing overhead costs. This approach provides access to specialized skills and advanced technology without the need for continuous in-house training. With outsourcing, firms can scale operations efficiently, manage workloads better, and improve client satisfaction. Embrace outsourcing for streamlined processes, enhanced productivity, and sustainable growth. Explore the benefits and elevate your firm's performance with reliable bookkeeping partners.

#Accounting Services#Bookkeeping Services#Outsourcing Services#CPA Bookkeeping#Bookkeeping Solutions#Small Business#Business Management#Money Management

0 notes