#black-scholes

Explore tagged Tumblr posts

Text

In 1981 my partner and I bought 2 IBM 8088 computers, paid extra for the 8087 math co-processor, cost $5000 each.

The main function we used them for was printing out theoretical prices for options using the Black-Scholes formula. We’d input the data around 5 pm daily and the results would generally be printed out by 8am the next morning.

Now of course when you pressed ‘enter’ the results would come instantly.

9 notes

·

View notes

Text

Literary theorists being AHs to women and PoCs

‘cause if I have to suffer, then you should also know how much of an AH these people are, so you can examine if their theories are even worth believing or if you SHOULD pay attention to their blind spots instead of saying it’s irrelevant to literary discussion. Personally, I think the fact they are unwilling to mention PoCs, particularly Black people and willing to actively dump on women is very relevant to current academic discourse. You can’t ignore Kant’s views on women, and see that the majority of the people who won in the end were people who showed hatred towards women.

Robert Scholes being an AH, Page 26-page 28 (Hilarious, but also homophobic and misogynistic) For context, EM Forster is gay, which makes this really homophobic.

Picture credit: https://www.brownalumnimagazine.com/articles/2017-03-03/memories-of-bob-scholes

‘Cause you see folks, the only decent writers in the world are men, cishet men. (notice the sharp sarcasm here).

E.M. Forster on Gertrude Stein (From Aspects of a Novel, a series of lectures he gave)

Credit: Getty Images https://encrypted-tbn0.gstatic.com/licensed-image?q=tbn:ANd9GcSjNW-FA-n5bkXFk2MFmMGMcBy1SJtQj185hrMceQN_8rK2L-6f2cu7Ct-PooBt8M6Mt7ffTDt5SPHpj00

https://www.gutenberg.org/cache/epub/70492/pg70492-images.html

Granted, a Modernist (and gay himself, openly so at the time he gave this lecture), but still, the dumping on Gertrude Stein seems to be a tradition that extends to other people afterwards (Rowe did it sideways, Lajos Egri, directly). Seriously? Dump on the lesbian Jew trying to encourage ways to describe TRAUMA. OMG, we shouldn’t talk about trauma.

But I disagree heartily--we have entire story structures devoted to dreams that play with sense of time and reality *because* of Gertrude Stein. I mean, how could you conceivably get Inception without Gertrude Stein’s theories of how to move language and time? Besides that, you have Dream Diaries (Japanese), Dream Record (First Chinese then Korean--not imported into Japan because there was a war), and then the whole of Dream Time from Aboriginals which predate her. Non-linear storytelling has and can work--but you need thematic plotting to be stronger and tone plotting to really be tight (pacing helps, but isn’t as critical as the other two). Thank the Modernists for the European white version. I mean, Magic realism, anyone???

If you want to find ways to break linear time and describe trauma itself, and the feeling of missing time--Modernists are your best bet to find techniques to get you there. (Kinda Post Modernists, though I resent the focus on readers a lot--I heartily disagree, BTW, that Structuralists and Post Modernists are the same thing... as argued in this paper here: https://www.sciencedirect.com/science/article/abs/pii/B0080430767039516.

Post Modernists tried to find further ways to break the rules and structure by bending to the reader.

Structuralists tried to impose a bunch of rules and binary. Like say, the panopticon and prison system/School system. There’s rigidity everywhere with Structuralists and Eurocentricism.) Or as the Raw and Cooked put it, a binary of acceptable and unacceptable, when some cultures don’t work off the Bible. So I think this paper here: https://www.sciencedirect.com/science/article/abs/pii/B0080430767039516

is more likely.

John Gardner, The Art of Fiction for Young Writers, published 1983

Picture credit: https://blog.bookstellyouwhy.com/john-gardner-and-the-art-of-fiction

No one is surprised that its all men mentioned, right?

But what makes ignoramuses bad writers is not just their inexperience in fair argument. All great writing is in a sense imitation of great writing. Writing a novel, however innovative that novel may be, the writer struggles to achieve one specific large effect, what can only be called the effect we are used to getting from good novels. However weird the technique, whatever the novel’s mode, we say when we have finished it, “Now that is a novel!” We say it of Anna Karenina and of Under the Volcano, also of the mysteriously constructed Moby-Dick. If we say it of Samuel Beckett’s Watt or Malone Dies, of Italo Calvino’s The Baron in the Trees, or Kobo Abe’s The Ruined Map, we say it because, for all their surface oddity, those novels produce the familiar effect. It rarely happens, if it happens at all, that a writer can achieve effects much larger than the effects achieved in books he has read and admired. Human beings, like chimpanzees, can do very little without models. One may learn to love Shakespeare by reading him on one’s own—the ignoramus is unlikely to have done even this—but there is no substitute for being taken by the hand and guided line by line through Othello, Hamlet, or King Lear. This is the work of the university Shakespeare course, and even if the teacher is a person of limited intelligence and sensitivity, one can find in universities the critical books and articles most likely to be helpful, the books that have held up, and the best of the new books. Outside the university’s selective process, one hardly knows which way to turn. One ends up with some crank book on how Shakespeare was really an atheist, or a Communist, or a pen-name used by Francis Bacon. Outside the university it seems practically impossible to come to an understanding of Homer or Vergil, Chaucer or Dante, any of the great masters who, properly understood, provide the highest models yet achieved by our civilization. Whatever his genius, the writer unfamiliar with the highest effects possible is virtually doomed to search out lesser effects.

Gardner, John (2010-05-20T23:58:59.000). The Art of Fiction . Knopf Doubleday Publishing Group. Kindle Edition.

OMG, give this guy a prize, he managed to mention a Japanese man Kobo Abe. /s https://literariness.org/2019/04/15/analysis-of-kobo-abes-novels/ But then fails to mention the names of the authors of some of the novels he’s talking about (I’m literally begging Writer’s Digest, Knopf, etc to force these people to give better citations)

The closest he gets to noting a Black person is noting American Jazz on the page where Chapter 2 starts, and then fails to mention Jazz musicians. No, I’m serious. What makes a person an AH? The inability to mention a single work in 1983 by a female author?

Though the fact is not always obvious at a glance when we look at works of art very close to us in time, the artist’s primary unit of thought—his primary conscious or unconscious basis for selecting and organizing the details of his work—is genre. This is perhaps most obvious in the case of music. A composer writes an opera, a symphony, a concerto, a tone poem, a suite of country dances, a song cycle, a set of variations, or a stream-of-consciousness piece (a modern psychological adaptation of the tone poem). Whatever genre he chooses, and to some extent depending on which genre he chooses, he writes within, or slightly varies, traditional structures—sonata form, fugal structure, ABCBA melodic structure, and so forth; or he may create, on what he believes to be some firm basis, a new structure. He may cross genres, introducing country dances into a symphony or, say, constructing a string quartet on the principle of theme and variations. If he’s looking for novelty (seldom for any more noble reason), he may try to borrow structure from some other art, using film, theatrical movement, or something else. When new forms arise, as they do from time to time, they rise out of one of two processes, genre-crossing or the elevation of popular culture. Thus Ravel, Gershwin, Stravinsky, and many others blend classical tradition and American jazz—in this case simultaneously crossing genres and elevating the popular. Occasionally in music as in the other arts, elevating popular culture must be extended to mean recycling trash. Electronic music began in the observation that the beeps and boings that come out of radios, computers, and the like might sound a little like music if structure were imposed—rhythm and something like melody. Anything, in fact—as the Dadaists, Spike Jones, and John Cage pointed out—might be turned into something like music: the scream of a truck-tire, the noise of a windowshade, the bleating of a sheep.

Gardner, John (2010-05-20T23:58:59.000). The Art of Fiction . Knopf Doubleday Publishing Group. Kindle Edition.

Iunno, is it glaring to you? It’s glaring to me. Avoid talking about Black people challenge. I can name at least a few off the top of my head. Dizzy Gillespie? Billie Holiday? Ella Fitzgerald? And then he mentions white people before then? I’m groaning.

And that’s the thing, particularly about Black authors/Black people, they are either not mentioned by name, but their work is--WTF, or totally skipped, probably because the whole of Black literature goes against these white men’s structuralism, and postulations. On one hand, I’m glad they left them alone, but on the other, the saying this is the only way, while glaringly missing the obvious really is sickening.

As for dumping on women--well... should we go back to Aristotle being an ass and starting the whole anti-choice campaigns because somehow Aristotle is Jesus, even though Jesus didn’t say anything about Ensoulment at conception? And then indoctrinated white women trying to rescue Aristotle from taking the axe because all of his scientific ideas were wrong? (Just axe him--he was popular with the Victorians for a reason--he was a misogynistic asshole and that reinforced their worldview very well.) (And if you think I don’t have references for the anti-choice statement... oh wait for it... I so have it)

https://en.wikipedia.org/wiki/Ensoulment Wikipedia, but I found scholarly articles too--not sure you want to be buried with that. Aristotle is not Jesus. !@#$ And Aristotle thought women got their soul later than men, because, as I said, royal asshole, to the point I want to do a whole long rant about how much of an irrelevant ah he was.

#fuck misogyny#misogyny in academia#anti-blackness in academia#story structure and misogyny#structuralists#em forster#robert scholes#John gardner#aristotle is a misogynistic ah

3 notes

·

View notes

Text

My questions reg. Southport incident: Why is a children's yoga teacher Leanne Lucas organising Taylor Swift themed events for young children? Does she not know Taylor is a top MKUltra slave & moneymaker for the elite? How appropriate is to condition small kids with her music?

Why is she using bee symbology on her website? A known Freemasons

Freemasonic symbol? Is she just gullible or is she just another chaos agent?

Why is one of the murdered children wearing a white bridal dress and the other one displaying witch symbology on her t-shirt? (Elphaba and Galinda, the two witches from the “#Wicked” musical). There are child bride rituals within Mkultra training.

(It was recently revealed that Ariana Grande is a practicing witch. No wonder she was so heartless to those serial killer victims' family)

Why does no MSM account mention how the 17 y old killer gained entry into the venue which caters for pregnant women, babies etc.? Why does the logo of the venue- The #HartSpace feature a triangle made out of letter A? Why is the Hart spelled without the e?

By the way the company was set up on 13.10.2023 & is #LGBTQ+ friendly. Owner is Jennifer Louise Scholes. It is not a dance studio as #MSM mentioned, it is an antenatal, hypnobirthing, baby massage etc. venue.

Glad to see others questioning the #psyops "

https://thehartspace.co.uk/about-the-space/

https://open.substack.com/pub/miri/p/the-whole-of-the-moon?r=2wm6gf&utm_campaign=post&utm_medium=email

#Southport#MKULTRA PSYOPS#Victims Dressed As Brides And Wearing Wicked T Shirt#The Hart Space#LGBTQ Organization Opened In 2023#Taylor Swift#MKULTRA SLAVE & MONEYMAKER#ERAS EQUALS ERASEERAS TOUR#Tom Cruise CIA#Ephaba and Galinda#Ariana Grande Practices Witchcraft#Leanne Lucas#Jennifer Louise Scholes#London Riots#Axel Rudakabana#Black Doctor Who Six Years Before Ncuti Gatwa Hire To Taunt The Public#BBC#Children In Need#Derren Brown#The Programmer#BBC Sherlock#Keir Starmer and Jimmy Savile

0 notes

Note

your carraville fic is sooo excellent I keep rereading it, I can’t stop

hope you continue it, you’re writing is beautiful xx

Thank you so much for the kind words! I am, the chapter is about 10k now, I've unfortunately just writing at a slower pace than I have in a long time. I was hoping to sit on this ask until I could finish up-- it's not done yet, but do know that I'm plugging along slowly but steadily.

Here's just a little snippy from Chapter 8:

[Scene: Jamie's arrived at Salford FC home ground for a Saturday match, along with Gary and Paul Scholes.]

They park around back, and Gary leads the way through a door and up a set of stairs to a hospitality box in the South stand. It feels a bit like the inside of a big metal shoebox, but all done up with a big tv on one wall, a black leather banquette in the corner, and a table full of catered food. Gary’s in his businessman mode already, buzzing around giving out hugs and handshakes to everyone, staff included. Ryan Giggs and Nicky Butt are there, and they shake Jamie’s hand in a disinterested way, and go back to chatting about ownership things Jamie’s got no clue about. A staffer comes up and offers him a cup of tea, which he accepts, resigned to the next two hours of standing around the food table like a spare prick at a wedding.

Thank god, Roy comes in five minutes to kick-off.

“Come on,” he nods over to where Gary, Scholes, and Gary’s mate Chris Casper were already huddled together in front of the plexiglass windows. “You don’t want to watch with them, they never stop talkin’.”

Which is how Jamie finds himself sat shoulder-to-shoulder with Roy in the little swathe of reserved seats butted up against the owner’s box. Roy crosses his arms and squints out across the pitch as the players emerge from the tunnel. Jamie recognizes a name or two, players who’ve played in the Championship or League One— but Roy knows all the player names, knows who Salford brought in and for what purpose and who’s working out and who isn’t.

“It’s been a rough start this season,” he grimaces. “The manager keeps sayin’ he wants to play on the floor, but I don’t think he knows who he’s kiddin’. It’s just big man hoofball, at this level.”

“You love this, don’t you?” Jamie grins.

Roy frowns deeply. “It’s alright. The fans are good here. They don’t bother you too much.”

The whistle blows, and Roy doesn’t speak for the next ten minutes or so, besides the occasional commentary: ‘That one up front for Crewe, Baker-Richardson, he’s a handful,’ or ‘Kelly N’Mai, I like him, he’s young, from the academy, a good lad.’ Salford play sluggishly, a bit clueless. The Crewe players just look better, they get up and down the pitch better, press high, and they score on the break at minute 27.

The home crowd lets out a collective groan and the Crewe players celebrate. A voice crackles over the tannoy to glumly announce the goal. Jamie turns over his shoulder, and finds Gary looking ghostly and drawn through the window of the box. Gary’s eyes drop down to Jamie, briefly, then back up to the pitch.

He remembers a moment from last night: crossing the darkened room and kneeling down in the space between Gary’s knees; how Jamie had felt all his troubled thoughts wash away, total relief, like a plunge into cold water on a hot summer’s day.

Roy groans, and points out some kind of objectionable behaviour as play resumes. “Jesus! Are you seeing this?!”

“Yeah,” Jamie says, even though he’s not; caught up in later, in visions of skin, the sound of a voice shaping his name (James, James) over and over again.

18 notes

·

View notes

Text

youtube

Superb Bird-of-Paradise | The Cornell Lab of Ornithology

youtube

Superb Bird-of-Paradise: Psychedelic Smiley Face | The Cornell Lab of Ornithology

When you See a Superb Bird-of-Paradise Display, it Doesn't Look Like a Bird at All. The Change is so Complete that Females Just See a Jet-Black Disk With a Electric-Blue "Smiley Face" Pattern. A Close Look at the Transformation Reveals how Modified Feathers on the Head, Back & Flank Combine Un-Expectedly to Create a Spectacular Effect.

Film & Photograpy - by Tim Laman & Ed Scholes.

youtube

A New Species? The Vogelkop Superb Bird-of-Paradise | The Cornell Lab of Ornithology

#feathered friends#birds#exotic birds#avian enrichment#bird#avian friends#feathered friendz#bird-of-paradise#bird of paradise#Youtube

4 notes

·

View notes

Text

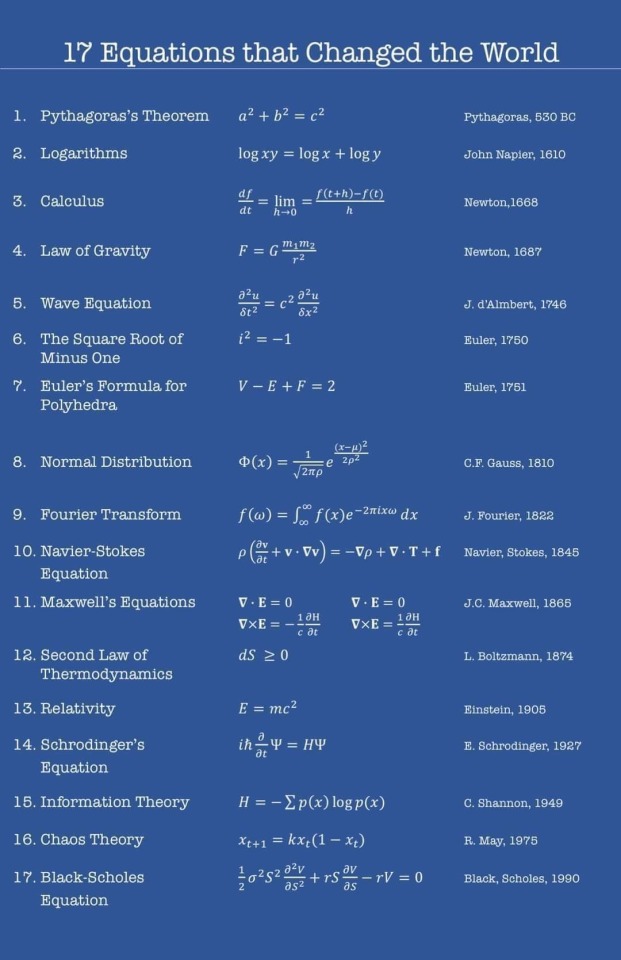

17 ECUACIONES QUE CAMBIARON EL MUNDO

1. Teorema de Pitágoras: El cuadrado de la hipotenusa de un triángulo rectángulo es igual a la suma de los cuadrados de sus catetos.

2. Logaritmos: Multiplica números agregando números relacionados, fueron revolucionarios, lo que hace que el cálculo sea más rápido y preciso para ingenieros y astrónomos.

3. Cálculo: Permite el cálculo de una tasa de cambio instantánea, es esencial en nuestra comprensión de cómo medir sólidos, curvas y áreas.

4. Ley de la gravedad: Calcula la fuerza de la gravedad entre dos objetos.

5. Ecuación de onda: Es una ecuación diferencial que describe el comportamiento de las ondas, como el comportamiento de una cuerda de violín vibrante.

6. Raíz cuadrada de menos uno: Los matemáticos pueden ampliar la idea de qué números son introduciendo las raíces cuadradas de los números negativos.

7. Fórmula de Euler para poliedros: Describe una relación numérica que es verdadera para todas las formas sólidas de un tipo particular.

8. Distribución normal: Define la distribución normal estándar, una curva en forma de campana en la que la probabilidad de observar un punto es mayor cerca del promedio y disminuye rápidamente a medida que uno se aleja.

9. Transformada de Fourier: Describe los patrones en el tiempo como una función de la frecuencia.

10. Ecuaciones de Navier-Stokes: Ecuaciones física fundamental que describe cómo funcionan los fluidos.

11. Ecuaciones de Maxwell: Son mapas de la relación entre los campos eléctricos y magnéticos. Ayudó a comprender las ondas electromagnéticas, ayudando a crear la tecnología eléctrica y electrónica más moderna.

12. Segunda Ley de termodinámica: La energía y el calor se disipan con el tiempo.

13. Teoría de la Relatividad: La energía y la materia son dos caras de la misma moneda. Es quizá la ecuación más famosa de la historia. Cambió completamente nuestra visión de la materia y la realidad.

14. Ecuación de Schrödinger: Esta es la ecuación principal en física cuántica, los modelos importan como una onda, en lugar de una partícula.

15. Teoría de la información: Calcula la cantidad de datos en un fragmento de código según las probabilidades de sus símbolos componentes.

16. El modelo logístico para el crecimiento de la

población: Estima el cambio en una población de criaturas a través de generaciones con recursos limitados.

17. El modelo Black-Scholes: Describe cómo el precio de un derivado financiero cambia en el tiempo, basándose en el principio de que cuando el precio es correcto, el derivado no conlleva riesgo y nadie puede sacar beneficio vendiéndolo a un precio diferente.

14 notes

·

View notes

Text

Volatility Smile in the Commodity Market

The volatility smile is a phenomenon observed in the options market where implied volatility tends to be higher for out-of-the-money (OTM) options compared to at-the-money (ATM) options. It refers to the graphical shape of the volatility curve, resembling a smile when plotted against the strike prices of options. The volatility smile suggests that options traders are willing to pay higher premiums for OTM options, indicating a higher perceived risk of extreme price movements in the underlying asset. This departure from a flat volatility curve challenges the assumptions made by the Black-Scholes option pricing model, which assumes constant and symmetric volatility across different strike prices.

Reference [1] proposed to use the new method developed by Carr and Wu in order to study the volatility smile of commodities. Specifically, the authors examined the volatility smile of the United States Oil ETF, USO. They pointed out,

In this paper, we study the information extracted from the no-arbitrage Carr and Wu (2020) formula based on a new option pricing framework in the USO option market and investigate the predictability of the information in forecasting the future USO returns. The risk-neutral variance and covariance estimates can be obtained from the no-arbitrage formula under the new framework. We document the term structure and dynamics of the risk-neutral estimates which lead to a “U”-shaped implied volatility smile with a positive curvature.

The figure below shows the volatility term structure for the United States Oil ETF,

[caption id="attachment_9704" align="aligncenter" width="427"] Volatility smile of the United States Oil ETF, USO[/caption]

Usually, an equity index such S&P 500 exhibits a downward-sloping implied volatility pattern, i.e. a negative implied volatility skew. Oil, on the other hand, possesses a different volatility smile. This is because while equities are typically associated with crash risks, oil prices exhibit both sharp spikes and crashes, leading to a different implied volatility pattern. This highlights the importance of considering the specific characteristics and dynamics of different asset classes when analyzing and interpreting implied volatility patterns.

Let us know what you think in the comments below or in the discussion forum.

References

[1] Xiaolan Jia, Xinfeng Ruan, Jin E. Zhang, Carr and Wu’s (2020) framework in the oil ETF option market, Journal of Commodity Markets, Volume 31, September 2023, 100334

Originally Published Here: Volatility Smile in the Commodity Market

from Harbourfront Technologies - Feed https://ift.tt/dBFR1Yf

6 notes

·

View notes

Note

Solve the Black-Scholes equation analytically by transforming it to the heat equation and solving by the method of convolution. Then solve the B-S equation numerically by means of an implicit method and an efficient sparse band matrix solver. Choose the appropriate boundary conditions in order to solve in both cases.

And look hot doing it.

The sad part is I really read this and thought, oh okay that's not bad. Black-Scholes is a decently easy derivation 😅

3 notes

·

View notes

Text

Monday 1 January 1838

7 40

12 20

fine morning F43° at 8 40 – A- off to Cliff hill soon after 9 – I looking over Rough books letters Journal etc. respecting A-‘s bill (handsome letter to her respecting it from Mr. Watson last night) = £83.4+ thought this bill was paid in the deduction from the £7000 paid to me the end of last May (vide Journal and rough book of 1 June last) – but I see that the deduction = £148.6.6 was on account of interest due from A- and that I received from her 14 July last £100 being £64.10.0 due from her to G- up to 15 July last and £35.10.0 that she gave me over – I myself to pay on my own account up to 15 July last £71.17.2 – all this search took me till 10 ¼ - then breakfast in about ½ hour – Edward Waddington at the blacksmiths’ shop – finished the chimney and plastered the room inside and made it very tidy – the 2 Sharpes John and Robert flagged kitchen court – no Robert Mann and his men – the latter would have a holiday – about a little while – then before 12 off by the back Lodge road to H- - Joseph Mann at the platform – the whole length of walling against the Wakefield road finished – very well round-topped with lime – stood a long while talking to Joseph M- then down the old bank to Mr. Parker’s office – about ¼ hour there – P- says the bill to be brought into parliament is not yet drawn up – will get one for me as soon as it is – want to get off the branch-roods because some of the towns refused to do statute duty till the branches are made – the commoners have therefore no idea of making any new road to Southowram and what they think of doing is in Scholes to avoid Brikby lane, and will come near here – P- advised not to take any more notice of the agreement about the corn-mill – it would only make Aquilla Green think it of more importance and Kershaw had been advising to hold out – but P- had told K- that he (K-) had nothing to do with it, and that the utmost AG. could get would be very small damages for the time that passed (a few weeks) between the signing of the agreement and the giving notice that I should not build the mill – P- is right and so I find was I when I from the beginning suspected what Mr. AG. had in his mind – but it will not do him very much good? – P- thinks Holdsworth of the 3 Pigeons, a respectable man and he P- would let him an Inn – I said he had applied for the Black horse – from P-‘s to the Bank – got order on the Yorkshire district Bank York for A- payable to William Gray Esquire = £83.5.0 on a sheet of letter paper – for which paid the amount £83.5.0+ 2/6 for the order and this evening returned A- the 2/6 left out of the £84. she gave me this morning Times mending – said Mr. Mackean – from the Bank to Whitley’s – stood reading there a long while – the Manual a very nice little information-full 12mo – bought and gave it as a new year’s to A- on my return home – then sometime at Northgate with Greenwood – he would now advise letting the ground off at the [fair]! rather in gardens – might £60 or £70 a year of it the former way – Mr. Crossland would be glad of it – had thought of calling the hotel the Lister Arms! I begged G- to explain my wish to have it called simply the Northgate hotel kept by Mr. C- returned up the new bank – by the Lodge –

SH:7/ML/E/21/0024

George farmer brought William Pollard a load of coals this afternoon from Mr. Emmett’s pit – (12 loads i.e. ‘a dozen’ more than the 14 loads the other day from Wilson’s pit) – WP. thinks they will last till the beginning of April – says they burn a load a week – just the same they used to burn at the conery – sometime in the stables and about – came in at 4 ¾ - sitting with A- when Mr. Jubb came between 5 and 6 for about ¼ hour – Sarah not well – to keep her a few days longer before sending her home – might not live well enough or take exercise enough at home – a case of obstructed catamenia – went upstairs at 6 – dressed – read a few pages of Goldsmiths’ Greece – dinner at 7 – A- read French and said vocabulary the 1st time for this 12th month? no! says A- not 6 months – sure she was very attentive in March and April last – tea – had just written all the above of today so far till 11 – just after breakfast this morning had William Green – said he must go to Mr. Parker for money – might he have a little Interest – yes! whatever Mr. P- said was right – hoped I would allow him (WG.) something when the money was done – has only about £10 left – I told him to keep up his spirits – that something must be done – he had best go to the poor house where he must be comfortably kept for I could not keep him – but I would mention the case to Mr. Parker and see what could be done – it would be useless to give WG. money for his unprincipled daughter to get from him – said A- would think of him, and give him a sheet or something – very fine day till rain about 4 pm and rained a little all the way home and afterwards – came upstairs at 11 ¼ - all gone to bed – A-‘s fire out – relighted it in 10 minutes – F36° at 11 ½ and fine (fair) night – in the course of this morning cousin came very gently

3 notes

·

View notes

Text

Understanding Option Chain: A Comprehensive Guide

An option chain is a listing of all available options contracts for a specific underlying asset. It provides crucial data for traders to analyze and make informed decisions about trading options. Here's a detailed explanation of the components, formulas, and usage of an option chain.

Key Components of an Option Chain:

Strike Price (K): The fixed price at which the holder of the option can buy (call) or sell (put) the underlying asset.

Expiry Date: The date on which the option contract expires.

Premium: The cost of buying the option.

Call and Put Options: Listed side-by-side in the option chain, calls are on the left, and puts are on the right.

Open Interest (OI): The total number of outstanding contracts for a particular strike price and expiration date.

Implied Volatility (IV): The market’s expectation of future volatility of the underlying asset, expressed as a percentage.

Delta (Δ\Delta): Measures the rate of change of the option’s price concerning the price change in the underlying asset.

Volume: The number of contracts traded during a given period.

How to Read an Option Chain:

Choose the Underlying Asset: Select the stock or index for which you want to trade options.

Look at the Expiry Date: Identify the relevant expiry date for your strategy.

Examine Strike Prices: Compare premiums, open interest, and volume for different strike prices.

Analyze Open Interest and Volume: High open interest indicates strong market activity.

Check Implied Volatility (IV): Use IV to gauge the expected price movement of the underlying asset.

Important Formulas Used in Option Chain Analysis:

Intrinsic Value of Call Option:Intrinsic Value=max(S−K,0)\text{Intrinsic Value} = \max(S - K, 0)

SS: Spot price of the underlying asset

KK: Strike price

Intrinsic Value of Put Option:Intrinsic Value=max(K−S,0)\text{Intrinsic Value} = \max(K - S, 0)

Time Value:Time Value=Option Premium−Intrinsic Value\text{Time Value} = \text{Option Premium} - \text{Intrinsic Value}

Option Pricing Using Black-Scholes Formula:C=SN(d1)−Ke−rtN(d2)C = SN(d_1) - Ke^{-rt}N(d_2)

CC: Price of call option

SS: Current stock price

KK: Strike price

rr: Risk-free interest rate

tt: Time to expiration

N(d)N(d): Cumulative standard normal distribution

For puts, use:P=Ke−rtN(−d2)−SN(−d1)P = Ke^{-rt}N(-d_2) - SN(-d_1)Where:d1=ln(S/K)+(r+σ2/2)tσtandd2=d1−σtd_1 = \frac{\ln(S/K) + (r + \sigma^2/2)t}{\sigma\sqrt{t}} \quad \text{and} \quad d_2 = d_1 - \sigma\sqrt{t}

σ\sigma: Volatility of the stock

Advantages of Using an Option Chain:

✓ Provides a clear view of market sentiment through OI and volume.

✓ Helps identify liquidity and activity at various strike prices.

✓ Enables traders to select the best strike price and expiry based on premium and IV.

Practical Tips for Analyzing an Option Chain:

Focus on Open Interest (OI): High OI at specific strike prices indicates key support or resistance levels.

Track Implied Volatility (IV): Use IV to identify whether options are cheap or expensive.

Monitor Volume: High volume often points to significant market activity and liquidity.

Compare Call vs. Put Data: Evaluate the call/put ratio to assess bullish or bearish sentiment.

Understanding the option chain is fundamental for traders aiming to profit from options trading. By analyzing components such as open interest, volume, and implied volatility, and applying relevant formulas, you can make informed trading decisions and better manage risk. Options trading requires skill and knowledge, but mastering the option chain is a crucial step toward success.

0 notes

Text

“Ian Stewart, “In Pursuit of the Unknown: 17 Equations that Changed the World”, 2012, PART SIX (6)

Here I present: Ian Stewart, “In Pursuit of the Unknown: 17 Equations that Changed the World”, 2012, PART SIX (6). INTRODUCTION.“A picture is worth a thousand words; but a formula is worth a thousand pictures”. Convection-diffusion equations are ubiquitous in applied mathematics. The Black-Scholes equation is an example of a “convection-diffusion” equation. The listed 17 equations of Ian…

0 notes

Text

Black-Scholes Option Pricing Model: Overview, Formula, Assumptions, Examples, and Limitations

In the realm of financial markets, options are versatile instruments that offer investors opportunities for hedging, speculation, and income generation. However, accurately pricing these options is a complex endeavor. Enter the Black-Scholes Option Pricing Model—a groundbreaking framework that revolutionized the way options are valued. This article delves into the intricacies of the Black-Scholes model, exploring its overview, underlying principles, core assumptions, practical applications, and inherent limitations.

Overview of the Black-Scholes Model

Developed in 1973 by economists Fischer Black, Myron Scholes, and later expanded by Robert Merton, the Black-Scholes model provides a systematic method for determining the fair price or theoretical value of European-style options. European options differ from their American counterparts in that they can only be exercised at expiration, not before. The model's introduction marked a significant advancement in financial economics, earning Scholes and Merton the Nobel Prize in Economic Sciences in 1997.

At its core, the Black-Scholes model seeks to quantify the factors influencing an option's price, such as the underlying asset's current price, the option's strike price, time to expiration, volatility, and the risk-free interest rate. By synthesizing these variables, the model offers a robust framework that has become a cornerstone in options trading and risk management.

Core Components of the Black-Scholes Model

While avoiding mathematical expressions, it's essential to understand the key elements that the Black-Scholes model considers:

Underlying Asset Price: The current price of the asset on which the option is based, such as a stock or commodity.

Strike Price: The predetermined price at which the option holder can buy (call option) or sell (put option) the underlying asset.

Time to Expiration: The duration until the option contract expires. Longer time frames generally increase the option's value due to the greater potential for the underlying asset's price to move favorably.

Volatility: A measure of the asset's price fluctuations. Higher volatility implies a greater likelihood of substantial price movements, thereby increasing the option's value.

Risk-Free Interest Rate: The theoretical return on an investment with zero risk, often approximated by government bond yields. It influences the present value of the option's strike price.

Dividends: For assets that pay dividends, the expected dividend payouts impact the option's price, as they affect the asset's overall return.

Underlying Assumptions of the Black-Scholes Model

The Black-Scholes model operates under several key assumptions that simplify the complex dynamics of financial markets. Understanding these assumptions is crucial for appreciating both the model's strengths and its limitations:

Efficient Markets: The model assumes that financial markets are efficient, meaning that asset prices fully reflect all available information. Consequently, there are no arbitrage opportunities—situations where risk-free profits can be made without investment.

Lognormally Distributed Returns: Asset prices are presumed to follow a lognormal distribution, implying that while prices can rise indefinitely, they cannot fall below zero. This characteristic ensures that volatility captures the relative changes in price rather than absolute changes.

Constant Volatility and Interest Rates: The model assumes that the underlying asset's volatility and the risk-free interest rate remain constant over the option's life. In reality, both can fluctuate due to market conditions and economic factors.

No Dividends: Originally, the model did not account for dividends. However, extensions of the Black-Scholes framework have incorporated dividend payouts, recognizing their impact on option pricing.

No Transaction Costs or Taxes: The model operates under the premise of frictionless markets, where buying and selling assets incur no costs and taxes do not influence trading decisions.

Continuous Trading and No Early Exercise: It assumes that trading of the underlying asset can occur continuously and that options are European-style, meaning they cannot be exercised before expiration.

Ability to Borrow and Lend at the Risk-Free Rate: Investors can borrow and lend money at the constant risk-free interest rate, facilitating the replication of option payoffs.

Practical Applications and Examples

The Black-Scholes model has widespread applications in financial markets, serving as a foundational tool for traders, investors, and financial institutions. Here are some practical examples of its use:

Option Valuation: Traders use the model to determine whether an option is fairly priced, overvalued, or undervalued relative to the market. This assessment informs trading strategies such as buying undervalued options or selling overvalued ones.

Risk Management: Financial institutions employ the model to hedge against potential losses. By understanding the sensitivity of option prices to various factors (known as the "Greeks"), they can construct portfolios that mitigate risks associated with price movements, volatility changes, and interest rate fluctuations.

Portfolio Optimization: Investors incorporate option pricing into portfolio management to optimize returns relative to risk. The model aids in selecting the right mix of assets and derivatives to achieve desired investment outcomes.

Strategic Decision-Making: Companies use the model to make informed decisions about employee stock options, mergers and acquisitions, and other strategic initiatives involving equity-based instruments.

Example Scenario:

Imagine an investor considering purchasing a call option on a tech company's stock. The current stock price is relatively high, but the investor anticipates significant growth due to an upcoming product launch. Using the Black-Scholes model, the investor inputs the stock's current price, the option's strike price, the time remaining until expiration, the stock's volatility, and the prevailing risk-free interest rate to estimate the option's fair value. If the model suggests that the option is undervalued compared to its market price, the investor might decide it's a worthwhile investment, expecting the stock's price to rise above the strike price before expiration.

Limitations of the Black-Scholes Model

Despite its widespread adoption and foundational status in financial theory, the Black-Scholes model has notable limitations that practitioners must consider:

Assumption of Constant Volatility: In reality, volatility is not static; it fluctuates over time due to market conditions, economic events, and shifts in investor sentiment. This variability can lead to inaccuracies in option pricing, especially during periods of market turbulence.

Inapplicability to American Options: The model is tailored for European-style options, which cannot be exercised before expiration. American options, however, allow early exercise, adding complexity that the Black-Scholes framework does not address. While extensions exist, they often require more sophisticated mathematical techniques.

Neglect of Transaction Costs and Taxes: Real-world trading involves brokerage fees, bid-ask spreads, and taxes, all of which can impact the profitability of option strategies. The absence of these factors in the model can lead to discrepancies between theoretical and actual option prices.

Assumption of Lognormal Distribution: The model's reliance on a lognormal distribution for asset prices may not capture extreme events or "fat tails" observed in financial markets. Such deviations can result in underestimating the probability of significant price movements, affecting risk assessments and pricing accuracy.

Interest Rate Sensitivity: The assumption of a constant risk-free interest rate is often unrealistic, as rates can change due to monetary policy shifts and economic developments. Fluctuating interest rates can influence option prices in ways not accounted for by the model.

Exclusion of Dividends (in Original Model): While extensions to the Black-Scholes model incorporate dividends, the original framework does not account for them. Ignoring dividends can lead to mispricing, particularly for options on dividend-paying stocks.

Complexity in Parameter Estimation: Accurately estimating inputs like volatility and the risk-free rate can be challenging. Volatility, in particular, is not directly observable and must be inferred from historical data or implied from market prices, introducing potential estimation errors.

Market Conditions and Behavioral Factors: The model assumes rational behavior and efficient markets, which may not hold true in all scenarios. Behavioral biases, market sentiment, and liquidity constraints can influence option prices in ways that the model does not capture.

Advancements and Alternatives

In response to the Black-Scholes model's limitations, financial theorists and practitioners have developed various extensions and alternative models. These include the Black-Scholes-Merton model, which accounts for dividends, and stochastic volatility models that allow volatility to change over time. The Binomial Options Pricing Model, for instance, provides a more flexible framework by constructing a price tree that can accommodate American options and varying volatility.

Moreover, numerical methods like Monte Carlo simulations and finite difference methods offer alternative approaches for option pricing, especially in complex scenarios where analytical solutions are unattainable. These methods leverage computational power to model a wide range of variables and interactions, providing more nuanced and adaptable pricing mechanisms.

Conclusion

The Black-Scholes Option Pricing Model stands as a monumental achievement in financial economics, offering a systematic and elegant approach to valuing options. Its introduction has profoundly influenced trading strategies, risk management practices, and the broader understanding of derivative markets. By distilling the complexities of option pricing into a coherent framework, the model provides invaluable insights into the interplay of various financial factors.

However, the model's assumptions and limitations underscore the importance of contextual awareness and critical analysis in its application. While the Black-Scholes model serves as a foundational tool, it is not infallible. Practitioners must complement it with other models, empirical data, and qualitative assessments to navigate the multifaceted landscape of financial markets effectively.

As markets continue to evolve and financial instruments become increasingly sophisticated, the Black-Scholes model remains a testament to the power of mathematical modeling in finance. Its enduring relevance is a reflection of its foundational role, even as ongoing advancements seek to address its shortcomings and expand its applicability. Understanding both its strengths and limitations equips investors, traders, and financial professionals with the knowledge to leverage the model effectively while remaining attuned to the dynamic nature of the markets.

0 notes

Text

THE GARG PARTICLE-1: TARGETING OF DR. RAM S. GARG, MD., VICTIM OF THE SURVAILANCE STATE OF BLUE CROSS BLUE SHIELD OF MICHIGAN AND THE BLACK-SCHOLES (BS) EQUATION WORM OR THE FUNERAL MARCH OF MEDICINE (A MARIONETTE) 2024

After over fifty years of practicing medicine, Dr. Garg’s life’s work was swept up in a four-year investigation, culminating in the dramatic raids of his clinic in Taylor, Michigan, and his mansion in West Bloomfield. But this isn’t just about stopping illegal prescriptions, it’s about stripping a man of his assets, livelihood, and reputation under the guise of justice.

THE BLACK-SCHOLE WORM aka BS-WORM 1872 CHARLES GOUNOD THE FUNERAL MARCH OF MEDICINE (A MARIONETTE) 2024 REPUBLISHED FROM DOCTORSOFCOURAGE.ORG IN YOUAREWITHINTHENORMS.COM NORMAN J CLEMENT RPH., DDS, NORMAN L. CLEMENT PHARM-TECH, MALACHI F. MACKANDAL PHARMD, BELINDA BROWN-PARKER, IN THE SPIRIT OF JOSEPH SOLVO ESQ., INC.T. SPIRIT OF REV. IN THE SPIRIT OF WALTER R. CLEMENT BS., MS, MBA. HARVEY…

View On WordPress

0 notes

Text

Booked Review – Other People’s Money, by John Kay: award-winning exploration of the financial crisis.Why the system crashed and and how we can avoid it happening again. Seven years after the onset of the financial crisis, John Kay recalls the events and offers an analysis of their precipitation. He proposes remedies to repair what went wrong and to install robust frameworks to prevent recurring crises, and offers convincing detail to support his arguments.

So, maybe you’ve decided you need a quick reminder of how bad was the financial crisis which began in 2007, and a little bit of a reminder of how we got there in the first place. Or maybe you’re just looking for some late night reading to keep the would-be central banker in the family awake at night.

In either case, John Kay’s Other People’s Money will do very nicely. Well-written, authoritative and insightful, Kay exposes the extraordinary circus that is the global financial system as a shambles run far too often for the benefit of those who work in it rather than that of those they are supposed to be working for.

He opens with a reminder of how banking used to be in the middle of last century in order subsequently to show to what extent it has changed over the past six decades or so. A key aspect of this has been the financialisation of the world economy with the development of a plethora of financial derivatives becoming increasingly removed from the assets underlying them whilst simultaneously relying on those assets’ viability to maintain their own, despite the fact that those assets are barely understood by derivatives traders.

In the sixties, he reminds us, the people who went to work for banks were still relatively low-qualified and, it might be said, often the less interesting of your peers. People at universities in those days did not want to work for banks.

In order to secure a loan it was still necessary to discuss your needs face-to-face with your bank manager (even in the seventies, as a student, I remember being dragged into my local branch to discuss a small overdraft with the manager). Readers of a certain age may remember an advertisement run by one of the banks in which it showed its bank managers in customers’ wardrobes, implying a close relationship (and no doubt scaring a few children at the prospect also).

Then there was what one book I was given as a text for Financial Economics back in the nineties a “revolution in finance”, using a plethora of Nobel-winning models and theories which originated in the Chicago School: Markowitz’s portfolio allocation; Black-Scholes; the Capital Asset Pricing Model; and Fama’s Efficient Market Hypothesis. These were key building blocks for the financial system’s development during which working for banks suddenly became sexier, or at least obscenely more lucrative, and they started employing “quants”, the rocket scientists of popular parlance, in order to build and maintain ever more complex quantitative models.

Only the deluded nowadays take these theories seriously, and the models built by the quants turned out to be only as good as the data uploaded to them, that is, flaky. A house of cards. A hall of mirrors. A den of thieves. A ship of fools. All of these expressions and more come to mind in reading Kay’s account. It is not true that the disastrous denouement was unforeseen. Kay cites, for example, Raghuram Rajan, then at the IMF, in 2005 questioning the value of the financial innovations being made. He was laughed out of court by other economists engrossed in the groupthink of the time. But the groupthink was underpinned by the burgeoning short-termism of the financial industry, exacerbated by the rapidly receding level of personal responsibility held by those engaged in it, meaning that when the crunch came they had mostly already made their money and did not suffer. In any other industry it is likely that the negligence demonstrated would have resulted in jail sentences. The fallout from 2007-8 has resulted in virtually none, just some tokenistic stripping of knighthoods and what have you.

While accepting that many in the financial industry are well-intentioned and trustworthy, Kay nevertheless lines up a rogues’ gallery of villains for pillory. In no particular order: Worldcom, Enron, Skilling, Blodget, Northern Rock, Goldman Sachs, JP Morgan, RBS, Diamond, Fuld, HBOS, Goodwin. All, to some extent at least, are held up as exemplars of how the system has served its own at the expense of those it was supposed to be serving.

Two further failings of the industry and its related institutions identified by Kay are worth a mention.

The first is regulatory capture. Kay shows how, as in other industries in the past such as railroads and airlines, regulators have tended to side with those they are supposed to be regulating: wittingly or not they are coopted by the industry and become oblivious of the failings they are allowing. Coupled with this is the perception of many, probably most, nowadays, that what is needed is not more regulation but better regulation.

The other failing is excessive complexity. As Kay says, whilst other industries have sought to simplify and modularise, and build in redundancy to protect against failures, in the finance industry the opposite has happened, with convoluted interconnections and interdependencies built in that often not even their creators understand. This in turn transforms into an inherent obfuscation which allows financial executives to justify their six- and seven-figure salaries on the basis of the “responsibilities” they carry, responsibilities they are all too happy to treat like hot potatoes as soon as things go wrong. It appears that it was this complexity which meant that, whilst it was assumed that all the risks of the sub-prime market had been diversified away, they had in fact been reconsolidated at the end of the process, leading to the collapse and near-collapse of a few “strategically important” institutions, some of which were rescued, some of which, notably Lehman, were allowed to collapse, with catastrophic consequences (although there’s no saying rescuing it would have ultimately seen a better outcome).

0 notes

Text

CHAPTER 4: Best Broker : 1996-2003 My life had gone to plan I thought. By the year 2000, I was 27 and my own boss, respected by all my clients and starting to make some real money.

By 2003 I was not so sure. I had come to Asia seeking wealth and here I was, rolling in it. I had the pad and, I thought, the girl. Problem was I was depressed, underneath, I hid it, but my life had become a continuous nightmare. The job was getting to me. This one client especially. I had proof this guy tried to take me down. He was just a jealous prick. Got bullied at School, for sure. He did not attack me physically, but he had attacked my only baby up until that time. My baby was my business. Funny thing is this guy works now at the firm I created with my partners back in 2010 De Riva HK ltd. I named it like that because the name contains the first 6 letters of the products we were broking; derivatives and because Da River card in texas hold’em decides the game and this company was going to be my last play in finance.

To most of you, saying equity derivatives probably makes as much sense as saying gobble-di-gook. Nothing. Indeed to most people in finance, derivatives remain incomprehensible. Futures are simple derivatives. They can be based on a stock, a stock index, a commodity, a currency or an interest rate. They follow the price of the underlying instrument, for example if Oil goes up by 5 percent the price of the futures based on that product should go up by a similar amount. You can short them, sell them hoping they go down, as easily as you can buy them, I brokered these which just involved placing orders on the exchange. Options are less liquid than futures on indices and have wider prices (the bid offer spread is wider), so banks that need to do size generally use a broker. Options, give the right to the buyer to purchase a particular financial instrument at a particular price for a stated period of time. I was principally a broker specialising in exchanged traded listed options in Asia, I also did futures and I brokered the odd OTC trade.

There is a widely used equation to price these instruments known as Black and Scholes. The equation is brilliant but ultimately flawed. The equation does not take into account "Black Swans" as famously talked about by Mr. Taleb in his book of the same name. The two Professors who came up with this equation Mr. Black and Mr. Scholes eventually won the Nobel prize for the equation that they came up with in the 1970s. It had revolutionised finance. In the 1990s they created a fund called Long Term Capital Management with the help of friends. Long Term Capital Management ended up to be a fund which became very short term turning the Long Term in the funds name on its head. The fund famously blew up and had to be rescued by the federal reserve in 1998 after Russia defaulted on its debt. From inception to destruction it did not even last 5 years. In those five years, the managers became extremely rich while their shareholders were less fortunate. Brilliant men, clearly, but flawed, like the rest of us.

Anyway I did not care about the formula. I was a broker, it was important to know where volatility was sometimes but not essential. I was the guy who put prices together. Say a bank wants to buy Hang Seng Index options (the equivalent in America would be options on the SP500, the Hang Seng is the Hong Kong equivalent), they call me, I ask a market maker which are generally small firms that make bids and offers for banks and the market in general. In return they get a preferential fee schedule from the exchange . Now I have a buy price and a sell price. My job is to put them together and trade. I would go back to the trader at the bank which asked me for the price and he would give me a bid or an offer if he wanted to sell the option. I would try and find a counterparty for the other side. Everyone knew where the fair value was because traders were basically working off the same formula. I would make a lot of calls. I was the broker with the best contacts in the market. This was important because I could probably get the best price for the guy or gal who had asked me for the price on the option. That’s why traders dealt through me. To be a good options broker, you had to be a good guy. People could always take their business elsewhere.

I was basically the best listed options broker on one exchange, in one country in the world, China. I was an IBD. Inter-Bank dealer. I had no retail clients, only institutional. Karim had taught me the job at Fimat but when he left for Japan for a similar position on the Japanese market, I had single handedly opened all but three of the accounts for KGI Asia Ltd. These included JP Morgan, Lehman Brothers, Morgan Stanley, Goldman Sachs, HSBC, UBS, Merrill Lynch, Societe Generale, BNP, Bear Stearns amongst others. There were three agreements already signed when I joined KGI Asia ltd. A broker called Dun Lee had begun opening the accounts until he decided his best bet was to start an internet shop in 1999 with his mates.

I opened the rest 40+, this included around 5 market makers and small funds. I managed to do this by always being forthright with clients, sure there were tricks of the trade that I used when broking, but on the whole, people passed orders through me because I was the most trustworthy and best broker in Hong Kong. I had done this through a combination of consistency, charm and humbleness. My British School of Brussels education had primed me to be good at this kind of work. The school where I had grown up had over 100 nationalities among its students. I had no racist bone in my body.

I knew I was the best not because I said so, but because clients regularly told me and they voted with their order volume. I knew the game, It was a game of respect, this was the game of equity derivatives broking, the same 'game' I had played on the street and in School. Being a straight shooter. Not always straight with the law when I was growing up, but straight with my friends.

People talk in finance and they obviously liked my story. Whenever a new trader came to town I would invite them for lunch, drinks or dinner. Normally lunch. I would always try and make the first meeting one on one. People are different in groups; They watch their words more carefully. One on one you can really get a sense of a person. People tended to like me.

When I was starting out on the Hong Kong Options desk at Fimat, it was 1996 and they gave me one real client. I spoke to the market makers. But these weren’t real clients as they generally did not cross the bid offer spreads, the other brokers all guarded their clients, the banks, from each other like precious cargo. I was 24. It was the middle of the Asian financial crisis. This guy who worked for Chase Manhattan bank was a prick, an English prick. Now I think of him, he reminds me of David Brent from ‘The Office’ (UK office series) but with none of the humanity. Anyway, he rarely traded, no one wanted him as a client. So they gave him to me. This one day, we had 100 lots on the offer on some option product. It was a regular sized order the problem was everyone wanted to buy. In this case it was normal practice to split the size up and not give it all to the first one who said buy them. We split the order into 4, the smallest size we allotted was 25 on trades. Anyway he wanted to buy, as did about 8 other clients. I managed to secure 25 for this guy, from the 4 batches we were giving out. This bloke turns round and says “give them to your grandmother”. He was insulted by the size he was allotted. Anyway, without a moment's hesitation, I said to him “if you mention my grandmother again I will cut your line”. At the time, as I mentioned, I had one client, one line. He tried to laugh it off. I wasn’t laughing. After that story made the round of the market. I was kind of a hero. Apparently, no one liked him. Later, he was leaving Hong Kong to go to work in London and tried to sell me his car, a Saab. I did not have a parking space and did not make enough to justify owning a car in Hong Kong. I met him by chance in a club in Hong Kong a week later, just before he was about to leave. He goes into this story about how he really got one over on some guy who bought his car cause it had all these malfunctions. As I said, he was a prick, he probably didn’t even remember trying to sell it to me.

By the end of 1998 the volume really started to die on the listed options market. The Asian financial crisis was in full swing by this time. The authorities had tightened the rules on warrant trading which was where most of the order flow from the banks originated. Volume collapsed and the good brokers on the desk had moved on. There was only Karim left. He seemed more interested in playing computer games than broking. He let me talk to his clients which was basically the whole market. He would go to lunch with the clients, I would tag along. I got to know all of them. He got an offer from a Japanese IBD and moved to Tokyo. By then I was the best broker in town, I had been on the desk for 5 years and knew the game inside out. David Friedland (Sherphardic Jew), a top man at interactivebrokers in Hong Kong which had a market making arm, and was a friend, told me about a possible deal at KGI, a Taiwanese bank. It was commission only, I had to put a deposit down to insure against my losses. I did the maths. Even if I did 50 percent of current volume, I would make more than the shitty money Fimat was paying me and I would be my own de facto boss. I jumped all over it.

When my boss at Fimat found out I was leaving, he asked me what deal they offered, he said he wanted to see if maybe he could match it. The deal basically let me keep 70 percent of what I made, it was one of the best deals for brokers in equity derivatives in the world. Still now, the best brokers only get 50 percent and they have all these charges added to them (for example, rent of their seat, telephone costs, back office costs etc). I gave him a chance, I told him what KGI was offering, he said he could not match it and I left. A couple of weeks later I found out he was going round Hong Kong telling people he had planned to make me a star. What a buffoon. I was already a star. Before moving on, when Karim was sick or took the day off I had to sit next to my boss on the dealing desk. There was an empty seat between us. I will always remember when we closed a deal and he spoke to one client and I had the opposing client on the other side. He would yell at me. Instead of saying calmly I will buy them from you or just simply done. He would yell it, like we were on the floor of the exchange or in a movie or something. When we had company get-togethers, he would have it at his exclusive country club. These so called get togethers pissed me off. He introduced his wife to me three times and every time he would tell me her uncle was the CEO of BNP Paribas. Awkward for me, I can only imagine what she thought. Poor woman. She did not have much of a personality, if truth be told. I only had one-on-one lunch with him twice and both times this prick would talk about money and only money. That’s the only thing he ever talked about. Talk about a boring asshole. A few years after I left. Rumour had it that they found some discrepancy in Fimat’s accounting. He was fired. Of course, they never took him to the authorities, bad publicity. A lot of that goes on in finance.

In the markets my day would really start when traders asked for a market on an options structure. Around 10am, when the stock market opened, we would check prices of various options structures from market makers or when it turned electronic, more often than not, straight from the screen and show them around in the hope of getting a bank to show some interest. If traders showed an interest straight from the off in a particular structure we would not have to show random markets around. This was better but it was slow going from 1998-2000, so more often than not we had to check structures we had recently traded previously or ‘invent’ structures to check we thought people would have an interest in. Anyway, barring orders coming in this is what I did at Fimat. I was also responsible for covering the Japanese and Taiwanese futures markets. Japan would open at 8am Hong Kong time. This was generally orders coming from the Fimat london office. So from 8am to 9:45am when the HK market opened I generally read a book or the South China Morning Post, the most prominent English newspaper in Hong Kong. There was a young reporter there who would call me up to find out about market action. When he first did it I was only 24. It gave me a kick to see my name in the paper. I would say ridiculous things and they would appear in print the next day. Like he asked me why the market went up and I would say there were more buyers than sellers. We went out together a few times, a young Australian guy. Good bloke. My old boss, not the one from the previous paragraph, put a stop to me quoting for the newspapers after he got wind of it. When my boss guy arrived from the Fimat Tokyo office, the guy from the previous paragraph, he would bother me literally every morning. Standing next to me and saying “well” (the french equivalent, “alors”), so this ‘tool’ expected me to turn round and entertain him as if I was some kind of lackey. Something else that pissed me off about him. He would not bother Karim as Karim was a lebanese christian and they did not get along. He was a French Ashkenazi jew who probably followed the Talmud. Not that I have anything against jews in general but there seemed to be a lot of them in finance in Hong Kong and most seemed to be of the Talmudic variety (The Talmud is a truly disgusting document which refers to Gentiles as pigs). As far as I could tell at all the French banks, the bosses in equity derivatives were all French jews. Weird.

There are a couple of moments that stood out in the first couple of months after I had joined KGI. It was the end of the year 2000 and the market had crashed again, this time with the internet bubble. Volumes had fallen. Even so, in my first month I made 12,000 USD with only 75 percent of regular accounts open and this included a big loss on my error account.

The first moment that stood out was involving one of my best friends at the time and, who also was one of my best clients, worked at Bear Stearns, an American lady called Susan Chan, she headed a group of traders out of Tokyo. She placed orders on the Hang Seng futures market through me. KGI had given me a direct link to the exchange. I only had 50k USD (400k HKD) to guarantee my trades, this represented most of the money I had been able to save after 5 years at Fimat. This was the insurance money KGI requested to cover any losses I might produce. I had never had a loss of more than 10k USD on any brokered deal through my five years at Fimat so I thought that 50k USD was more than enough to cover any losses I might have over any given month. One day in the summer of 2000, Susan placed an order to buy 100 Hang Seng futures contracts at 11,000. The market was trading a couple of hundred points higher. Not anticipating any other orders (it was quiet), I had already checked a few markets, no interest. I leaned back and started reading the paper. The market was electronic, one window showed my open orders, the other filled/executed orders. After five to ten minutes of reading, I glanced at the screen to see what the markets were doing. 11,060 they were approaching my buy level. I looked at my open orders window, nothing. I looked at my filled orders screen, fuck. I had inputted the order wrong. I had bought 100 at 11,100 instead of 11,000. In the three years that the market had been electronic I had never made a mistake of this magnitude. I calculated my loss quickly 40 points x 50 HKD per point x 100 contracts, 200k HKD (around 25k USD gone in a few minutes), half of what I had managed to accumulate in 5 years. The market was moving fast and it was illiquid. If I sold my position at the market it could easily drop another 40 points wiping out the entirety of my 5 years of savings. I considered calling Susan to see if she would take them but then I would look like a fool. I sold 20 at 11,060, the market rose I sold another 20 at 11,080, it rose again, I sold the balance of 60 at 11100 where I had bought them. My loss ended up being only 30 points on 40 contracts representing 60k HKD (or around 8k USD). The funny thing is that it never touched 11,000 after it went back up to 11,100 it kept on going. It finished the day up a 1000 points. If I had not checked my screen for another 5 minutes I would have been in the money big time. The market ended up having one of the biggest rallies of the year that day 11,060 was the low. Weird. I was proud of myself though. I had done the right thing. I had shaved a third off my net earnings for the first month but I had survived. I was in the game for the long term and for that, survival was key. Also, I had not gone to Susan telling her about my error and asking her to take the futures off my hands like a beggar. I had swallowed the loss and could hold my head high. Years later, after she was no longer a client of mine, I told her about that day. She turned to me and said “why didn’t you call me, I would have taken them” “honour” I said. This was true but I had also considered that maybe her impression of me would have changed if I had called her for her help. You never know how people will act if you ask them for favours. Or how they will view you afterwards. Also, if they refuse, they might feel guilty about it and that is not conducive to a good business relationship.

The other moment involved a trade I placed on the exchange literally in the last second of trading. I think it was in the second month I was there. A bit of background first. They were straight shooters at the Taiwanese bank and I liked my bosses and the people there. Never cheated me on the original deal I made with them. I was the only white guy in a dealing room full of Chinese. The office was open plan. I sat in the corner of a massive trading floor. Maybe 300 retail brokers worked there, but I was the only institutional broker. This also meant I had one of the only phones systems with direct lines to my most important clients. They could call me by pressing a button and it would come over the speakers. I could do the same to them. They put me close to the senior traders at the bank so they could watch me. I was the only white guy working at KGI but they never made me feel uncomfortable. Most of the other brokers dealt only with retail clients. The only other foreigner was a Japanese guy who made a lot of money apparently. He had Japanese clients and he had set up some sort of legal tax dodge for his rich Japanese clients. Not quite sure how it worked, his English was bad and we were on opposite sides of the trading floor. Anyway, back in the day the stock exchange closed at 4pm, so the floor was deadly quiet at that time, including our trading floor. The other brokers would be doing their end of day paperwork. My market, the options and futures market only closed at 4:15pm. I had been negotiating a deal for about 15 minutes after a furious day of broking options. At 4:14pm I closed the deal verbally but I still had to post it on the exchange, doing so the next day was complicated and would have led to a lot of phone calls between my clients and I, with explanations and so on. I typed furiously into the exchange’s computer, I had to adjust the delta, the details aren’t important. Anyway, I clicked on the send button not having looked at the time but knowing I had maybe seconds left. I looked over at the executed/filled window. It had gone through. I looked at the exchange ticker, 4:15:00 I was the last trade on the exchange. I had never been the last trade on the exchange. I stood up, not thinking about where I was. I yelled “Ya motherfucker” real loud, pumping the air with my fist, I scanned the room and saw three hundred heads and eyes turned my way. Shit, I quickly ducked. Embarrassed but still happy.

#salvation#jesus christ#jesusreborn#jesusgloriouscoming#christisking#olympics 2024#2024 olympics#candaceowens#tucker carlson#trump 2024

1 note

·

View note

Text

Why Every Investor Should Use an Options Calculator: An Essential Guide

When diving into the world of options trading, it's easy to get swept away by the thrill of potential profits. However, navigating the complexities of options contracts requires more than just intuition; it demands precision and informed decision-making. This is where an options calculator becomes an indispensable tool for traders at all levels. Here’s why every investor should embrace this essential resource.

Understanding the Basics: What is an Options Calculator?

An options calculator is a tool designed to help traders evaluate the various financial metrics associated with options contracts. These metrics typically include the option’s theoretical price, Greeks (like Delta, Gamma, Theta, and Vega), implied volatility, and more. By inputting factors such as the underlying asset price, strike price, time to expiration, and interest rates, traders can get a clearer picture of an option's potential profitability and risk.

Why Use an Options Calculator?

1. Accurate Pricing

One of the primary functions of an options calculator is to determine the fair value of an option. This is crucial because buying or selling options at the wrong price can significantly impact your returns. The calculator uses models like the Black-Scholes or Binomial model to provide a theoretical price based on market conditions. This helps traders avoid overpaying or underselling options.

2. Assessing Risk and Reward

Options trading inherently involves risk. An options calculator allows traders to evaluate potential outcomes and risks by calculating the Greeks. These metrics help in understanding how different factors (like changes in the underlying asset's price or volatility) impact an option's price. For example:

Delta measures how much the option price is expected to move per $1 change in the underlying asset.

Theta indicates how much value an option loses as it approaches expiration.

Vega reflects how sensitive the option’s price is to changes in volatility.

By analyzing these metrics, traders can make more informed decisions about their trades.

youtube

3. Optimizing Strategies

Options calculators can also be used to test and optimize various trading strategies. Whether you’re looking at simple calls and puts or more complex strategies like spreads, straddles, or butterflies, these tools help in evaluating the potential profitability and risk associated with each strategy. This allows traders to refine their strategies and adapt to changing market conditions.

4. Time Management

For many traders, time is of the essence. Calculating options metrics manually can be time-consuming and prone to errors. An options calculator streamlines this process, providing quick and accurate results. This efficiency allows traders to focus on other critical aspects of their trading strategy and market analysis.

5. Enhancing Confidence

Trading without a clear understanding of the numbers behind your options can be daunting. By using an options calculator, you gain a deeper insight into your trades, which can boost your confidence in making informed decisions. Knowing that your analysis is backed by solid calculations helps reduce uncertainty and second-guessing.

How to Use an Options Calculator Effectively

Input Accurate Data: Ensure that the data you input into the calculator is up-to-date and accurate. This includes the current price of the underlying asset, strike price, time to expiration, and market volatility.

Understand the Metrics: Familiarize yourself with the different metrics the calculator provides. Understanding what each Greek represents and how it affects the option’s price will enhance your trading strategy.

Use Multiple Models: Different models might yield slightly different results. If possible, use multiple models to get a more comprehensive view of the option’s pricing and potential.

Incorporate Other Tools: An options calculator is a powerful tool, but it should be used in conjunction with other analysis methods and market research to make well-rounded trading decisions.

Conclusion

An options calculator is more than just a convenience; it’s a critical component of a successful options trading strategy. By providing accurate pricing, assessing risk and reward, optimizing strategies, and saving time, it empowers traders to make more informed and confident decisions. Whether you’re a seasoned trader or just starting, integrating an options calculator into your trading toolkit can make a significant difference in your trading success.

So, the next time you’re preparing to make an options trade, remember the importance of using an options calculator. It’s a small step that can lead to smarter trades and potentially greater returns. Happy trading!

1 note

·

View note