#benjamingraham

Explore tagged Tumblr posts

Text

Bears growl, investors rise!📈

#stocks#stockmarket#stocktonontees#stockmarkettips#stockmarketnews#stockmarketcrash#stockmarketindia#stockmarketinvesting#stockmarketeducation#bearmarket#SmartInvesting#WealthWisdom#StockMarketTips#InvestmentStrategy#FinancialFreedom#MoneyMindset#BenjaminGraham#ValueInvesting#StockMarketEducation#GrowYourWealth#InvestWisely#TradingMindset#FinanceQuotes#InvestorMindset#MarketInsights

0 notes

Text

Introducing our Benjamin Graham Calculator

Excited to share something new that I’ve been working on—our very own Benjamin Graham Calculator. If you’re interested in value investing, this tool might just become your new best friend.

For those who might not know, Benjamin Graham is often referred to as the “father of value investing.” He believed that by calculating the intrinsic value of a stock, investors could make smarter decisions, buying stocks that are undervalued by the market. This method helps reduce risk and maximize potential returns.

Our Benjamin Graham Calculator is designed to do just that—help you estimate the intrinsic value of a stock based on the principles laid out by Graham himself. All you need to do is enter the current share price, EPS (Earnings Per Share) for the last four quarters, the expected growth rate, and the current yield on AAA corporate bonds. The calculator will then provide you with an estimated intrinsic value per share and tell you whether the stock might be overvalued.

This tool is perfect for those who want to dive deeper into their investment research and make more informed decisions. It’s straightforward, easy to use, and built with value investors in mind.

If you’re curious about how it works or want to give it a try, head over to our Tools section and check it out. I’d love to hear your thoughts and see how it’s helping you on your investing journey! Check out: https://www.bearsavings.com/tools/benjamin-graham-calculator/

0 notes

Text

Discover The Intelligent Investor by Benjamin Graham

"The Intelligent Investor" is a classic book written by Benjamin Graham, considered the father of fundamental analysis and a legendary investor. First published in 1949, the book is still widely read and studied today because of its timeless principles on investing.

Graham's approach focuses on the intrinsic value of stocks and the reduction of risk. Here are some of the key concepts discussed in the book:

Investor vs. Speculator: Graham emphasises the distinction between an investor and a speculator. An investor seeks to buy stocks with a margin of safety based on thorough analysis, while a speculator bets on price fluctuations without necessarily understanding the intrinsic value of the securities.

Margin of safety: Graham stresses the importance of margin of safety, which involves buying shares at a price significantly below their intrinsic value. This offers protection against valuation errors and market fluctuations.

Fundamental analysis: The author encourages investors to focus on company fundamentals, such as financial statements, financial ratios and growth prospects. This approach aims to assess the financial strength and stability of companies.

Mr. Market: Graham uses the metaphor of "Mr. Market" to illustrate the irrational fluctuations of the stock market. He suggests that investors should treat the market as an irrational trading partner rather than reacting emotionally to its movements.

Defensive investing: Graham also recommends a defensive approach to investing, diversifying portfolios and avoiding overly speculative investments.

Graham's work has had a significant influence on many investors over the decades, including Warren Buffett, who considers "The Intelligent Investor" to be one of his favourite books and wrote the foreword to the revised edition. The book remains essential reading for those seeking to understand the fundamentals of long-term investing.

#conseil#book#investment#stock market#thefrenchtimes#amazon#benjamingraham#theintelligentinvestor#crypto#startup#finance

0 notes

Text

Summary of "The Intelligent Investor" by Benjamin Graham

“The Intelligent Investor” by Benjamin Graham is a widely acclaimed investment guide that has stood the test of time. Known as the “Bible of Investing,” the book provides timeless principles and strategies for successful investing. Graham’s approach emphasizes the importance of value investing, risk management, and a long-term perspective. This summary explores the key concepts and takeaways from…

View On WordPress

#BenjaminGraham#FinancialFreedom#FinancialLiteracy#investing#MoneyManagement#StockMarket#TheIntelligentInvestor#ValueInvesting#wealthmanagement

0 notes

Text

Bei Arbitrage Investment AG bemühen wir uns, die inneren Kämpfe eines Anlegers zu entschärfen, wie Benjamin Graham es so treffend formulierte: "Das Hauptproblem des Anlegers - und sogar sein schlimmster Feind - ist wahrscheinlich er selbst. Durch disziplinierte Strategien und einfühlsame Beratung versuchen wir, die emotionalen und kognitiven Verzerrungen zu überwinden, damit unsere Anleger einen klaren, objektiven Weg zu ihren finanziellen Zielen finden. Unser erfahrenes Team macht sich die Essenz dieses Zitats zu eigen, indem es Sie über die üblichen internen Hürden hinwegführt und Ihnen eine reibungslosere Reise in die Finanzwelt ermöglicht.

Kontaktieren Sie uns unter: 📞 +49 221 29247310 📩 [email protected] 🌐 www.arbitrage-investment.de

#InvestmentWeisheit#BenjaminGraham#ArbitrageInvestmentAG#finance#investment#money#stocks#trade#fintech#benjamin graham#quotes

0 notes

Photo

Esse livro é um divisor de águas no mundo dos investimentos tanto para os pequenos quanto para os grandes investidores. Em “O investidor de bom senso”, John C. Bogle (@sextante), de forma clara e objetiva, mostra as vantagens de se ter um fundo de índice de baixo custo numa carteira de investimentos com objetivo de acumular ativos. E o faz com algumas lições que nos deixa como legado: o fundo de índice elimina os riscos de ações individuais, setores de mercado e seleção do administrador (permanece apenas o risco do mercado de ações); os ganhos dos acionistas precisam corresponder aos ganhos da empresa; prever com exatidão as oscilações de curto prazo nas emoções dos investidores não é possível, mas prever a economia dos investimentos no longo prazos tem tido chances notadamente altas de sucesso; o mercado de ações é uma grande distração para o negócio dos investimentos; faça sua aposta nos negócios; os custos importam; selecionar fundos de ações com base no seu desempenho passado de longo prazo não funciona; os retornos dos fundos regridem à média; contar mesmo com a mais bem-intencionada consultoria funciona apenas esporadicamente; prefira fundos indexados de baixo custo tradicionais que acompanhem o mercado de ações; o valor dos fundos indexados de títulos de dívida é criado pelas mesmas forças que geram valor para os fundos de ações; e como alocar de forma adequada seus ativos. #InvestidorDeBomSenso #JohnBogle #WarrenBuffett #BenjaminGraham #PeterLynch #Investiment #Investimento #Investimentos #Livro #Book #Bok #Money #Dinheiro #Alocation #Fund (at Muzema) https://www.instagram.com/p/CNzopwzsrw7/?igshid=16jyzamvocb6d

#investidordebomsenso#johnbogle#warrenbuffett#benjamingraham#peterlynch#investiment#investimento#investimentos#livro#book#bok#money#dinheiro#alocation#fund

7 notes

·

View notes

Photo

Brain Food 🌌💡

#booksbooksbooks #bookstagram #brainhealth #thoughtprovoking #bookrecommendations #stephenhawking #benjamingraham #thealchemist #theartofwar #paulocoelho #suntzu https://www.instagram.com/p/CPCRE9tl5C8/?utm_medium=tumblr

#booksbooksbooks#bookstagram#brainhealth#thoughtprovoking#bookrecommendations#stephenhawking#benjamingraham#thealchemist#theartofwar#paulocoelho#suntzu#jjohnt84

1 note

·

View note

Photo

“Do not take yearly results too seriously. Instead, focus on four or five-year averages.” -Benjamin Graham #investing #investingqoutes #intelligentinvesting #patienceisprogress #successfulinvestment #successfulinvestment #benjamingraham #fatherofvalueinvesting #successmeasure https://www.instagram.com/p/B_hhkXMHI8X/?igshid=kauravdwp626

#investing#investingqoutes#intelligentinvesting#patienceisprogress#successfulinvestment#benjamingraham#fatherofvalueinvesting#successmeasure

1 note

·

View note

Photo

Safety of principal and adequate return. These are Benjamin Graham‘s famous investing principles. They can be applied equally to stocks or stacking opportunities. Whether you are stacking with the intent to liquidate through buying groups, retail arbitrage, or simply looking to stay on your family’s budget, the few points that you can make on stacking are nothing compared to your principal “investment” amount. Gift cards do not carry the same protections that credit cards do. Shopping portals can fail to track. And frivolous spending is frivolous spending, even if the item is really really cheap. Investigate the risks of stacking well, and hold Ben Graham’s principals close to your heart. Always. #Deals #CreditCardPoints #BuyingGroups #MultipleIncomeStreams #SideHustle #PassiveIncome #Stack4CashBack #Stack #Money #Family #Investing #ValueInvesting #BenjaminGraham #WarrenBuffet #TheIntelligentInvestor (at Brooklyn, New York) https://www.instagram.com/p/ByGqXsqhJCK/?igshid=13q87d1qrmx27

#deals#creditcardpoints#buyinggroups#multipleincomestreams#sidehustle#passiveincome#stack4cashback#stack#money#family#investing#valueinvesting#benjamingraham#warrenbuffet#theintelligentinvestor

1 note

·

View note

Photo

🔥🔥🔥🔥🔥 EPISODE 1 7 Kriteria Screening Saham ala Benjamin Graham Benjamin Graham merupakan guru dari Warrent Buffet, memberikan kepada kita cara mudah screening saham pasti cuan, lengkap dengan tool dan cara screeningnya. Simak detail penjelasan videonya disini : https://youtu.be/GNdWqx9AD7k or klik link di BIO #saham #sahamindonesia #analisasaham #sahampemula #sahamsyariah #sahamprofit #sahamgorengan #sahamonline #sahamipo #sahampilihan #belajarsaham #tradingsaham #sahambluechip #investasisaham #sahamhariini #benjamingraham #warrentbuffet #valueinvesting #valueinvestor #belajarfundamental https://www.instagram.com/p/CgGocplpUtN/?igshid=NGJjMDIxMWI=

#saham#sahamindonesia#analisasaham#sahampemula#sahamsyariah#sahamprofit#sahamgorengan#sahamonline#sahamipo#sahampilihan#belajarsaham#tradingsaham#sahambluechip#investasisaham#sahamhariini#benjamingraham#warrentbuffet#valueinvesting#valueinvestor#belajarfundamental

0 notes

Photo

Bodenständigkeit. Bei all den Daten zu Warren Buffett - ich habe auch seine Biografie gelesen - habe ich immer an Bodenständigkeit gedacht. Kein Penthouse in New York City, keine Luxusyachten, nicht mal teures Essen. Und wieso das ganze Investieren? Weil es ihm einfach unglaublich Spaß macht. Auf der letzten Hauptversammlung von Berkshire ist mir besonders aufgefallen, wie humorvoll er ist, und wie wichtig es ihm ist, das Geld der Aktionäre gut anzulegen. Er möchte das Vertrauen, dass die Berkshire Aktionäre in ihn setzen, nicht entt��uschen. Keine leeren Versprechungen. Ihm geht es um Werte. Menschliche Werte. 👍🏻🙂 Was haltet ihr von Warren Buffett? ⚠️ Werbung, da Markennennung. Keine Anlageberatung. ⚠️ #warrenbuffett #berkshirehathaway #charliemunger #valuestocks #valueinvesting #valuationmatters #valuation #omaha #cocacola #benjamingraham #marketcrash #nasdaq100 #sp500 #performance #stockstrader #stocktrading #passiveincome #investmentstrategies #stockstowatch #buythedip #cutloss #buyandhold #bearmarket #fed #finiancialeducation #stockmarket #wealthbuilding #investments #finance #oracleofomaha # https://www.instagram.com/p/CeoculEsEQb/?igshid=NGJjMDIxMWI=

#warrenbuffett#berkshirehathaway#charliemunger#valuestocks#valueinvesting#valuationmatters#valuation#omaha#cocacola#benjamingraham#marketcrash#nasdaq100#sp500#performance#stockstrader#stocktrading#passiveincome#investmentstrategies#stockstowatch#buythedip#cutloss#buyandhold#bearmarket#fed#finiancialeducation#stockmarket#wealthbuilding#investments#finance#oracleofomaha

0 notes

Text

Timeless trading lessons from reclusive market wizard Ed Seykota

While the names of market gurus like Benjamin Graham, Warren Buffett and Peter Lynch are known by nearly everyone in the investing community, there are several traders who generate exceptional returns but do not want to come in the limelight. One such name is Ed Seykota, who may be one of the only traders who also wrote and starred in musical performance of his trading strategy " The Whipsaw Song".

Although almost completely unknown to the investment world, Seykota’s achievements rank him as one of the best trend followers and traders of his time. Seykota believes a trader’s psychology is the most important part of operating any trading system.

As a trend follower and money manager, he amassed millions in the 1970s and 1980s for his investors. He is basically a mechanical trend following trader who built the majority of his systems around exponential moving averages, with some reliance on pattern recognition. Seykota has always kept a low profile and caught the public eye only after his interview in Jack Schwager’s 'Market Wizards' books. He began his trading career in the 1970s, when he was hired by a major brokerage firm. It was in that brokerage firm that Seykota developed one of the first commercialized trading systems for managing money in the futures market.

After a few disagreements regarding the way management was interfering with his system, Seykota decided to part ways with them. Investors over the years have learnt many invaluable lessons by following his trading philosophy. Let's look at some of the trading rules that he mentioned in an interview with Jack Schwager.

Cut your losses Seykota believes that the most important trading rule is to cut losses because protecting one's capital is the primary job of a trader. He feels making money should be the secondary goal in the priority list of traders and they should embrace trading losses. He believes to stay ahead in the trading business, traders need to learn to lose like winners which means accepting losses the moment the market refutes their trade idea.

"If you make the mistake of hoping for the market to turn around in your favor, you’ve already lost. The best way to embrace trading losses is to have a plan. Combine that with small bets and you’ll be lightyears ahead of other traders. If you can’t take a small loss, sooner or later you will take the mother of all losses," he said in an interview in Jack Schwager’s 'Market Wizards' book series.

Seykota also believes that losing a trading position is aggravating, whereas losing one's nerve is devastating for a trading portfolio.

"The best way to ensure you never lose your nerve is to cut losses early. It’s one of the simplest ways to maintain your discipline and avoid emotional decision-making," he said.

Ride your winners

Seykota is of the view that trading isn’t about having a win rate of 70% or 80% but it comes down to how much investors make when they’re right and how much they lose when they’re wrong.

He feels the only way to achieve asymmetrical returns is to ride one's winners. Seykota feels trends tend to persist in all parts of life, and they also exist in the stock market.

"Successful trend following is buying when you recognize a trend, and holding on until that trend has finally come to fruition and begins to change. Of course, once in a while, a trader is going to end up buying nearly the exact top in a market, but that's where risk management and stop losses come into play. The key to enjoying enormous returns in the stock market is riding out your winners, and being stubborn enough to hold onto positions to capture as much of the trend as possible," he said.

Seykota believes that investors make the mistake of holding on to their losers as it's uncomfortable to sell them. On the other hand, they sell their winners before they ever get big as they don't want those gains to erode.

Seykota is of the view that investors shouldn't get influenced by soothsayers and prognosticators as they provide fanatical calls that are often way out in the future and turn out to be eventually wrong.

"I usually ignore advice from other traders, especially the ones who believe they are on to a “sure thing”. The old timers, who talk about 'maybe there is a chance of so and so,' are often right and early," he said.

Keep bets small

Seykota feels that one of the best ways to keep emotions at bay while trading is to keep bets small by speculating with less than 10% of one's liquid net worth.

"Risk less than 1% of your speculative account on a trade. This tends to keep the fluctuations in the trading account small, relative to net worth. Risk no more than you can afford to lose, and also risk enough so that a win is meaningful. The solution is to risk just enough that a profitable outcome is meaningful but not so much that a loss forces you to lose your nerve," he said.

Follow your trading rules

According to Seykota trading rules are vital and are critical to one's success. He feels when traders sit down to place a trade, nobody tells them how much to risk or whether to buy or sell.

Seykota is also a huge believer in rules and everything he does is based on strict trading rules he’s outlined for himself which helps him stay calm even when things aren’t going his way.

"It’s a rule that defines how much you’re allowed to risk or what you’re supposed to do during a losing streak. They help keep you disciplined in a world without many boundaries," he said.

Know when to break the rules

Seykota is of the view that a balance between following rules and breaking them is very important.

"Sometimes I trade entirely off the mechanical part, sometimes I override the signals based on strong feelings, and sometimes I just quit altogether. If I didn’t allow myself the freedom to discharge my creative side, it might build up to some kind of blowout. Striking a workable ecology seems to promote trading longevity, which is one key to success," he said.

Seykota believes that the win rate for any trader is insignificant and what really matters is having an asymmetrical profit to loss ratio.

He feels finding a trading approach that fits one's personality is vital and sometimes intuition and “gut feel” can become one's most useful assets.

"I don’t think traders can follow rules for very long unless they reflect their own trading style. Eventually, a breaking point is reached and the trader has to quit or change or find a new set of rules he can follow. This seems to be part of the process of evolution and growth of a trader," he says.

Reduce your trading risk

Seykota is of the view that the three primary components of trading are (1) the long-term trend, (2) the current chart pattern, and (3) picking a good spot to buy or sell.

"Trading requires skill at reading the markets and at managing your own anxieties. Risk is the uncertain possibility of loss. If you could quantify risk exactly, it would no longer be a risk. Risk control has to do with your willingness to allow your stop to do its job," he said.

Have a winning mindset

Seykota believes a losing trader can do little to transform himself into a winning trader as a losing trader is not going to want to transform himself.

But a winning trader will always be wanting to learn and would like to transform every bet into a profitable one.

Seykota is of the view that in the recipe for success investors shouldn't forget commitment and a deep belief in the inevitability of success.

Leave emotions aside while trading

Seykota feels investors shouldn't get emotionally attached to their trading bets as it may lead to huge losses.

“Dramatic and emotional trading experiences tend to be negative. Pride is a great banana peel, as are hope, fear, and greed. My biggest slip-ups occurred shortly after I got emotionally involved with positions,” he said.

Seykota is of the view that the market is always right and investors should make their trading bets without letting their emotions get the better of them.

“If you want to know everything about the market, go to the beach. Push and pull your hands with the waves. Some are bigger waves, some are smaller. But if you try to push the wave out when it’s coming in, it’ll never happen. The market is always right,” he said.

(Disclaimer: This article is based on Ed Seykota's interview with Jack Schwager in the Market Wizards books series)

#trade#investing#brainmasstraders#brainmassfinance#tradewithraj#learnwithraj#investinglessons#tradingquotes#marketwizard#edseykota#greed#psychology#bet#emotions#cutloss#ridewinners#benjamingraham#warrenbuffet#peterlynch

0 notes

Photo

Este libro es uno de los mejores que leí, y casi que diría que es un indispensable para cualquier inversor. Conocías este libro? . . #elinversorinteligente #benjamingraham #warrenbuffett #bestseller #inteligenciafinanciera #contadorinversor https://www.instagram.com/p/CQ8Ua1Ujx30/?utm_medium=tumblr

#elinversorinteligente#benjamingraham#warrenbuffett#bestseller#inteligenciafinanciera#contadorinversor

0 notes

Photo

@jeffbezos “[…] Como dijo el célebre inversor Benjamin Graham: «A corto plazo, el mercado de valores es una máquina de votar, a largo plazo actúa como una báscula». […]”. #CreayDivaga #JeffBezos #silaempresaestá #mejorposicionada #hoyquehaceunaño #porquélacotizaciónanual #cotizaciónactualenbolsa #muchomásbajaqueentonces #comodijoelcelebre #célebreinversor #BenjaminGraham #acortoplazo #elmercadodevalores #maquinadevotar #alargoplazo #actúacomo #comounabáscula #esobvioque #elprosperoaño #1999 #hubomuchavotación #muchomenospesaje #somosunaempresa #pasarporlabáscula #coneltiempoloharemos #todaslasempresaslohacen #mientrastanto #nuestrosesfuerzossedirigen #crearunaempresa #cadavezmássólida “No obstante, si la empresa está mejor posicionada hoy que hace un año, ¿por qué la cotización actual en bolsa es mucho más baja que entonces? Como dijo el célebre inversor Benjamin Graham: «A corto plazo, el mercado de valores es una máquina de votar, a largo plazo actúa como una báscula». Es obvio que en el próspero año 1999 hubo mucha votación y mucho menos pesaje. Somos una empresa que quiere pasar por la báscula, y con el tiempo lo haremos; a largo plazo, todas las empresas lo hacen. Mientras tanto, nuestros esfuerzos se dirigen a crear una empresa cada vez más sólida”. LAS CARTAS A LOS INVERSORES Adoptar una perspectiva a largo plazo 2000 PG70:PR5—0031-15/01/21 https://instagram.com/stories/christianrafaelruiz/2497213481674470262?utm_source=ig_story_item_share&igshid=8mz3ifrq8c4e https://www.instagram.com/p/CKqT8bWh3Ng/?igshid=1f5gl316a7ee6

#creaydivaga#jeffbezos#silaempresaestá#mejorposicionada#hoyquehaceunaño#porquélacotizaciónanual#cotizaciónactualenbolsa#muchomásbajaqueentonces#comodijoelcelebre#célebreinversor#benjamingraham#acortoplazo#elmercadodevalores#maquinadevotar#alargoplazo#actúacomo#comounabáscula#esobvioque#elprosperoaño#1999#hubomuchavotación#muchomenospesaje#somosunaempresa#pasarporlabáscula#coneltiempoloharemos#todaslasempresaslohacen#mientrastanto#nuestrosesfuerzossedirigen#crearunaempresa#cadavezmássólida

0 notes

Photo

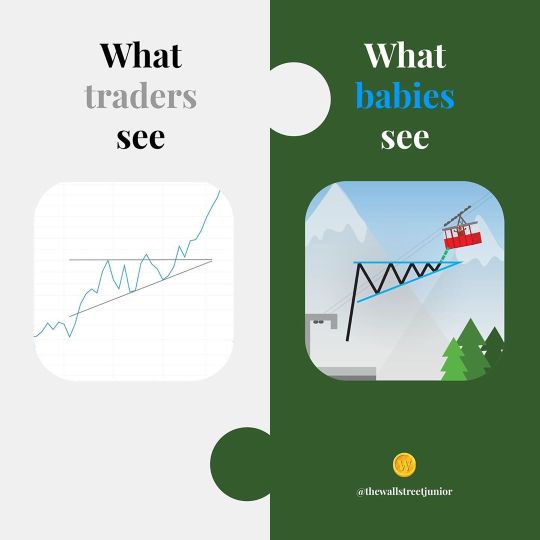

🤔 💭 💡 If there’s a children’s book on Astrophysics for Babies by Chris Ferrie; if there’s another one on ABC Biochemistry by Cara Florence, and another on Computer Coding by Ruth Spiro, or even Hip Hop culture by Jessica Chiba... then why can’t there be a book on Chart Patterns and trading? These wonderful books are no longer a novelty to show off to other parents. These books are for our children. These books are a way to simplify, explain, and inspire even the littlest of babies the most complex of subjects we have in the world. Because if a child can get excited, be inspired, or at the very least—be aware of such things... imagine how better off they will be instead of us parents? That’s why we are here. Inspire your future millionaire! Don’t be Buffet, be better. Start going, play long. #financialliteracy #readabook #readabookchallenge #bookchallenge #moneyforbaby #peterlynch #warrenbuffet #benjamingraham #marketwizards #charliemunger #linechart #technicalanalysis #tradingplan #ascendingtriangle #thewallstreetjunior #tradingforbabies #fidelityinvestments #charlesschwab #robinhoodapp #webull #thinkorswim #forextrading #binance #coinmarketcap #commoditiestrading #acorn #acornsapp (at Murren, Switzerland) https://www.instagram.com/p/CE31GvQH_np/?igshid=1dgeq3861vkui

#financialliteracy#readabook#readabookchallenge#bookchallenge#moneyforbaby#peterlynch#warrenbuffet#benjamingraham#marketwizards#charliemunger#linechart#technicalanalysis#tradingplan#ascendingtriangle#thewallstreetjunior#tradingforbabies#fidelityinvestments#charlesschwab#robinhoodapp#webull#thinkorswim#forextrading#binance#coinmarketcap#commoditiestrading#acorn#acornsapp

0 notes

Photo

Book Review 📚 Book - Intelligent Investor Author- Benjamin Graham Review: This book teaches you about Value Investing.Warren Buffett described this book as "Best book ever written on investing ". Graham's objective was to provide an Investment policy book for ordinary investors. According to Graham, investors are of two types. Theirs Do's and Don'ts were discussed in the book in detail. . . KEY TAKEAWAYS FROM THIS BOOK 📕 1️⃣Minimize the odds of suffering losses and maximize Gains . . 2️⃣Disciplined approach will prevent errors in your portfolio. . . 3️⃣Never trust Mr.Market (stock market). He will play with your emotions. Protect yourself. . . 4️⃣Don't consider companies that donot pay dividends. . . 5️⃣Don't put all eggs in one basket (Diversify your investments). . . . My opinion: 🔴Eventhough this book is for beginner investors , you should have some touch with the terms used in the book. You will not understand in the first read itself. . 🔴Commentary is added to every chapter in this book which will help you to understand the concept. . 🔴Principles discussed in this book is very helpful to every investor even today. . 🔴If you could only buy one book in your lifetime, this would probably be the one. . 🔴If you can't read whole book atleast read chapter 8&20 (Warren Buffett suggestion) ................Thanks for reading..................... . . #ismartinfo #books #book #bookstagram #intelligentinvestor #warrenbuffett #benjamingraham https://www.instagram.com/p/CD0JYlUnD7t/?igshid=h1q4caa95ql3

0 notes