#marketwizards

Explore tagged Tumblr posts

Text

In-Depth Exploration of Trading Strategies: Trend Following, Range Trading, Scalping, Mean Reversion, and Momentum Trading

The world of trading is vast and dynamic, with numerous strategies available for traders to exploit the financial markets. Among these strategies, five stand out due to their popularity and effectiveness: Trend Following, Range Trading, Scalping, Mean Reversion, and Momentum Trading. Each strategy involves a unique approach to market behavior, risk management, and decision-making. In this essay, we will explore these trading strategies in detail, providing real-life examples and evidence of their applications in various markets.

1. Trend Following

Trend following is one of the most widely used trading strategies, based on the simple premise that markets move in identifiable trends over time. Traders using this strategy seek to capitalize on sustained price movements in a particular direction, whether upward (bullish) or downward (bearish). The basic principle behind trend following is that "the trend is your friend" until it shows signs of reversing.

How It Works:

A trader identifies a prevailing trend using technical indicators such as moving averages, Relative Strength Index (RSI), or trendlines. Once the trend is confirmed, the trader enters a position in the direction of the trend, holding it as long as the price continues to move favorably.

Real-World Example:

During the COVID-19 pandemic, tech stocks like Amazon and Apple experienced a clear bullish trend as the world became more reliant on technology for remote work and e-commerce. Trend-following traders who identified this upward momentum early and entered positions enjoyed significant profits as these stocks rallied throughout 2020 and into 2021. Similarly, Bitcoin's historic rally from $10,000 to over $60,000 between 2020 and early 2021 offered substantial opportunities for trend followers in the cryptocurrency market.

Evidence:

The Turtle Traders Experiment in the 1980s, initiated by legendary traders Richard Dennis and William Eckhardt, demonstrated the effectiveness of trend following. Dennis trained a group of novices, and by applying simple trend-following rules, many of them became highly successful traders, turning significant profits from the futures market.

2. Range Trading

Range trading is a strategy focused on identifying assets that move within a well-defined price range over a certain period. In this strategy, traders aim to buy at the support level (the lower boundary of the range) and sell at the resistance level (the upper boundary), capturing profits from the asset's oscillation within that range.

How It Works:

Range traders use tools such as Bollinger Bands or horizontal support and resistance levels to identify the boundaries of a range. They then execute trades by buying when the price approaches support and selling when it nears resistance. This strategy assumes that price will revert to the mean when reaching these extremes.

Real-World Example:

Gold often trades in a range when there is no significant geopolitical or economic news driving its price. For instance, between mid-2018 and mid-2019, gold prices fluctuated between $1,200 and $1,350 per ounce. Traders using range trading strategies during this period could have profited from buying at the lower bound and selling at the upper bound of the range.

Evidence:

According to research by Ince and Porter (2006) on range-bound trading in the foreign exchange market, currency pairs like the EUR/USD often exhibit range-bound behavior during periods of market uncertainty. Range trading is especially effective in sideways markets where trends are not dominant.

3. Scalping

Scalping is a high-frequency trading strategy that aims to capture small price movements within a very short time frame. Scalpers enter and exit trades rapidly, often holding positions for only seconds to minutes. This strategy requires precision, quick decision-making, and the ability to manage risks effectively.

How It Works:

Scalpers typically rely on advanced technical analysis tools such as level 2 order book data, volume indicators, and short-term moving averages. They often use leverage to amplify returns, but due to the high frequency of trades, they must also be vigilant about transaction costs and slippage.

Real-World Example:

In the forex market, scalping is particularly popular due to its high liquidity and low spreads. Traders might take advantage of micro-movements in the EUR/USD pair during volatile news releases. For instance, during a significant U.S. economic data release (such as Non-Farm Payroll), scalpers may make multiple trades within a few minutes, capitalizing on short bursts of volatility.

Evidence:

Scalping is most commonly associated with high-frequency traders (HFT), who use algorithms to execute trades in milliseconds. Firms like Citadel Securities and Virtu Financial, some of the largest market makers, employ similar strategies to scalp profits in a range of markets, from equities to foreign exchange.

4. Mean Reversion

Mean reversion is a trading strategy that assumes asset prices tend to revert to their historical average or mean over time. Traders using this strategy seek to profit by buying assets that are undervalued or oversold and selling assets that are overvalued or overbought, expecting the price to return to its historical mean.

How It Works:

Traders use technical indicators such as Bollinger Bands, RSI, or moving averages to identify when an asset has strayed too far from its historical mean. When the price is considered oversold (below the mean), traders buy, and when it is overbought (above the mean), they sell.

Real-World Example:

A classic example of mean reversion can be observed in the S&P 500 index. After significant declines during market corrections or crashes (e.g., the 2008 financial crisis or the March 2020 COVID-19 crash), the index historically reverts to its upward trend, offering opportunities for mean reversion traders to buy during dips and profit from the recovery.

Evidence:

Academic research supports the concept of mean reversion, particularly in the bond and stock markets. In his study, Narayan et al. (2013) found that bond yields tend to revert to their historical means after deviating significantly, especially during periods of economic stress.

5. Momentum Trading

Momentum trading is based on the idea that assets that have shown strong price momentum in the past will continue to perform well in the future. Momentum traders capitalize on assets that exhibit significant upward or downward momentum, assuming that these price trends will persist for some time.

How It Works:

Momentum traders use technical indicators like the Moving Average Convergence Divergence (MACD), RSI, and rate of change (ROC) to identify assets with strong price momentum. The strategy is particularly effective in trending markets, as it seeks to ride the wave of strong price movements.

Real-World Example:

During the GameStop short squeeze in January 2021, momentum traders flocked to the stock after it showed explosive upward momentum driven by a short squeeze initiated by retail traders on platforms like Reddit. Traders who entered positions during the initial momentum phase reaped massive gains as the stock surged from under $20 to over $300 in a matter of days.

Evidence:

Research by Jegadeesh and Titman (1993) demonstrated that stocks exhibiting high returns over the past three to 12 months tend to outperform in the future, providing empirical support for momentum strategies. Their findings have been widely cited in the literature on behavioral finance and technical trading.

Conclusion

Each of these trading strategies—Trend Following, Range Trading, Scalping, Mean Reversion, and Momentum Trading—offers unique ways to exploit market behavior. Trend following is ideal for traders seeking to profit from long-term price movements, while range trading is suitable for markets that fluctuate within predictable boundaries. Scalping requires quick execution and low latency, making it suitable for fast-paced markets, while mean reversion caters to those looking to capitalize on price corrections. Momentum trading thrives in environments where price movements are sharp and sustained.

The key to success in any of these strategies lies in understanding the underlying market conditions and using appropriate risk management techniques. Traders should also be aware of transaction costs, market liquidity, and the emotional discipline required to execute these strategies effectively. With careful planning and execution, these strategies can provide consistent returns across various asset classes.

#TradingStrategies#TrendFollowing#RangeTrading#Scalping#MeanReversion#MomentumTrading#RiskManagement#DecisionMaking#FinancialMarkets#TradingApproaches#MarketAnalysis#Investing#FinancialLiteracy#TradingPsychology#MarketWizards#LegendaryTraders#RealLifeApplications#MarketInsights#FinancialMarketsEducation

0 notes

Photo

Trauriger Anlass. Aber durch den Angriffskrieg Russlands wurden einige Rüstungsaktien ganz schön gepusht. Ich bin bisher nicht in dieser Branche investiert. Auch spannend zu sehen, dass die amerikanischen Werte nicht so gut abschneiden wie die europäischen Aktien. Ist logisch, weil der Markt davon ausgeht, dass Europa für die eigene Sicherheit mehr investieren wird als zuvor. Die Unternehmen mit teilweiser ziviler Luftfahrt können weniger profitieren. Insgesamt ein Sektor mit vielen Fragezeichen für mich. Niemand wünscht sich Krieg, aber wenn man realistisch ist, wird es Krieg wohl zukünftig immer wieder und vielleicht sogar verstärkt geben. Will man davon profitieren? Und sind die Renditen besser als in anderen Branchen, also lohnt sich ein Investment überhaupt? Bin gespannt, ob ihr in der Branche investiert seid. Wie ist eure Meinung? ⚠️ Werbung, da Markennennung. Keine Anlageberatung. ⚠️ #investingeducation #stockmarketinvesting #marketcrash #investingforbeginners #investing101 #markminervini #marketwizards #marketwatch #stockstotrade #stocktrading #passiveincome #investmentstrategies #stockstowatch #buythedip #cutloss #aktien #techaktien #börse #finanziellefreiheit #ziele #zieleerreichen #performance #monetarypolicy #Tapering #federalreserve #stocks #investmenttips #investment #finance https://www.instagram.com/p/CeMJ0fXsVJ5/?igshid=NGJjMDIxMWI=

#investingeducation#stockmarketinvesting#marketcrash#investingforbeginners#investing101#markminervini#marketwizards#marketwatch#stockstotrade#stocktrading#passiveincome#investmentstrategies#stockstowatch#buythedip#cutloss#aktien#techaktien#börse#finanziellefreiheit#ziele#zieleerreichen#performance#monetarypolicy#tapering#federalreserve#stocks#investmenttips#investment#finance

0 notes

Photo

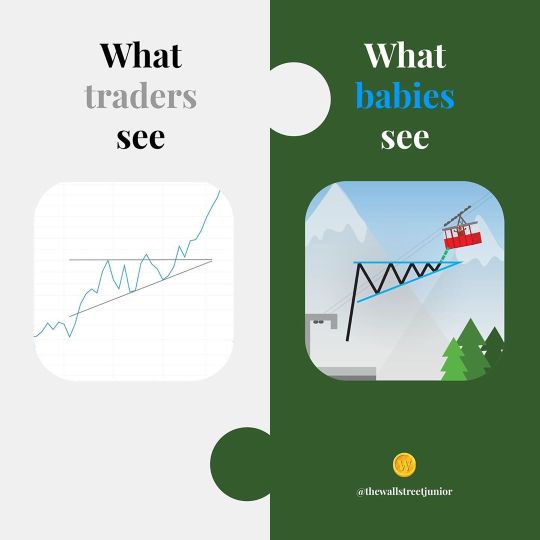

🤔 💭 💡 If there’s a children’s book on Astrophysics for Babies by Chris Ferrie; if there’s another one on ABC Biochemistry by Cara Florence, and another on Computer Coding by Ruth Spiro, or even Hip Hop culture by Jessica Chiba... then why can’t there be a book on Chart Patterns and trading? These wonderful books are no longer a novelty to show off to other parents. These books are for our children. These books are a way to simplify, explain, and inspire even the littlest of babies the most complex of subjects we have in the world. Because if a child can get excited, be inspired, or at the very least—be aware of such things... imagine how better off they will be instead of us parents? That’s why we are here. Inspire your future millionaire! Don’t be Buffet, be better. Start going, play long. #financialliteracy #readabook #readabookchallenge #bookchallenge #moneyforbaby #peterlynch #warrenbuffet #benjamingraham #marketwizards #charliemunger #linechart #technicalanalysis #tradingplan #ascendingtriangle #thewallstreetjunior #tradingforbabies #fidelityinvestments #charlesschwab #robinhoodapp #webull #thinkorswim #forextrading #binance #coinmarketcap #commoditiestrading #acorn #acornsapp (at Murren, Switzerland) https://www.instagram.com/p/CE31GvQH_np/?igshid=1dgeq3861vkui

#financialliteracy#readabook#readabookchallenge#bookchallenge#moneyforbaby#peterlynch#warrenbuffet#benjamingraham#marketwizards#charliemunger#linechart#technicalanalysis#tradingplan#ascendingtriangle#thewallstreetjunior#tradingforbabies#fidelityinvestments#charlesschwab#robinhoodapp#webull#thinkorswim#forextrading#binance#coinmarketcap#commoditiestrading#acorn#acornsapp

0 notes

Photo

📚📚📚Continuing the Study Theme: Rolex Submariners 5513 Metres First & 16610 Tritium Dial in Melbourne with Mondani Book. #rolex #pallettoni #bicchierini #5513 #submariner #metresfirst #metersfirst #mattedial #tritium #submarinerdate #vintagesubmariner #rolexdiver #horology #1680 #bearmarket #vintagerolex #investinwatches #luxurywatches #marketwizard #daytona #webuyrolex #rolexbuyer #vintagewatch #luxury #dialvariations #16610 #16800 #watchdealer #gilt #buyrolex @giorgiamondani @mondanibooks @mondaniweb @mondanidoc @hodinkee @phillipswatches @rolex @timedealerhotmail @wristporn @wristwatchporn @andychanrolex @rolexcollectorsaustralia @rolexknowledge @rolexinformation @andychanrolex @rolexpassionreport @bobswatches @rolexdiver @rolexpassionmarket @d.rolexero @ifuckinglovewatches @rolex_lover @rolexaholics @watchfinderofficial @federicotalkswatches @baselworldofficial @rolexworld_ @rolex.passion @submarinerpassion @orchi_palar (at Melbourne, Victoria, Australia) https://www.instagram.com/p/B98YA0HnvFw/?igshid=7kj8k2tob9dq

#rolex#pallettoni#bicchierini#5513#submariner#metresfirst#metersfirst#mattedial#tritium#submarinerdate#vintagesubmariner#rolexdiver#horology#1680#bearmarket#vintagerolex#investinwatches#luxurywatches#marketwizard#daytona#webuyrolex#rolexbuyer#vintagewatch#luxury#dialvariations#16610#16800#watchdealer#gilt#buyrolex

3 notes

·

View notes

Text

Timeless trading lessons from reclusive market wizard Ed Seykota

While the names of market gurus like Benjamin Graham, Warren Buffett and Peter Lynch are known by nearly everyone in the investing community, there are several traders who generate exceptional returns but do not want to come in the limelight. One such name is Ed Seykota, who may be one of the only traders who also wrote and starred in musical performance of his trading strategy " The Whipsaw Song".

Although almost completely unknown to the investment world, Seykota’s achievements rank him as one of the best trend followers and traders of his time. Seykota believes a trader’s psychology is the most important part of operating any trading system.

As a trend follower and money manager, he amassed millions in the 1970s and 1980s for his investors. He is basically a mechanical trend following trader who built the majority of his systems around exponential moving averages, with some reliance on pattern recognition. Seykota has always kept a low profile and caught the public eye only after his interview in Jack Schwager’s 'Market Wizards' books. He began his trading career in the 1970s, when he was hired by a major brokerage firm. It was in that brokerage firm that Seykota developed one of the first commercialized trading systems for managing money in the futures market.

After a few disagreements regarding the way management was interfering with his system, Seykota decided to part ways with them. Investors over the years have learnt many invaluable lessons by following his trading philosophy. Let's look at some of the trading rules that he mentioned in an interview with Jack Schwager.

Cut your losses Seykota believes that the most important trading rule is to cut losses because protecting one's capital is the primary job of a trader. He feels making money should be the secondary goal in the priority list of traders and they should embrace trading losses. He believes to stay ahead in the trading business, traders need to learn to lose like winners which means accepting losses the moment the market refutes their trade idea.

"If you make the mistake of hoping for the market to turn around in your favor, you’ve already lost. The best way to embrace trading losses is to have a plan. Combine that with small bets and you’ll be lightyears ahead of other traders. If you can’t take a small loss, sooner or later you will take the mother of all losses," he said in an interview in Jack Schwager’s 'Market Wizards' book series.

Seykota also believes that losing a trading position is aggravating, whereas losing one's nerve is devastating for a trading portfolio.

"The best way to ensure you never lose your nerve is to cut losses early. It’s one of the simplest ways to maintain your discipline and avoid emotional decision-making," he said.

Ride your winners

Seykota is of the view that trading isn’t about having a win rate of 70% or 80% but it comes down to how much investors make when they’re right and how much they lose when they’re wrong.

He feels the only way to achieve asymmetrical returns is to ride one's winners. Seykota feels trends tend to persist in all parts of life, and they also exist in the stock market.

"Successful trend following is buying when you recognize a trend, and holding on until that trend has finally come to fruition and begins to change. Of course, once in a while, a trader is going to end up buying nearly the exact top in a market, but that's where risk management and stop losses come into play. The key to enjoying enormous returns in the stock market is riding out your winners, and being stubborn enough to hold onto positions to capture as much of the trend as possible," he said.

Seykota believes that investors make the mistake of holding on to their losers as it's uncomfortable to sell them. On the other hand, they sell their winners before they ever get big as they don't want those gains to erode.

Seykota is of the view that investors shouldn't get influenced by soothsayers and prognosticators as they provide fanatical calls that are often way out in the future and turn out to be eventually wrong.

"I usually ignore advice from other traders, especially the ones who believe they are on to a “sure thing”. The old timers, who talk about 'maybe there is a chance of so and so,' are often right and early," he said.

Keep bets small

Seykota feels that one of the best ways to keep emotions at bay while trading is to keep bets small by speculating with less than 10% of one's liquid net worth.

"Risk less than 1% of your speculative account on a trade. This tends to keep the fluctuations in the trading account small, relative to net worth. Risk no more than you can afford to lose, and also risk enough so that a win is meaningful. The solution is to risk just enough that a profitable outcome is meaningful but not so much that a loss forces you to lose your nerve," he said.

Follow your trading rules

According to Seykota trading rules are vital and are critical to one's success. He feels when traders sit down to place a trade, nobody tells them how much to risk or whether to buy or sell.

Seykota is also a huge believer in rules and everything he does is based on strict trading rules he’s outlined for himself which helps him stay calm even when things aren’t going his way.

"It’s a rule that defines how much you’re allowed to risk or what you’re supposed to do during a losing streak. They help keep you disciplined in a world without many boundaries," he said.

Know when to break the rules

Seykota is of the view that a balance between following rules and breaking them is very important.

"Sometimes I trade entirely off the mechanical part, sometimes I override the signals based on strong feelings, and sometimes I just quit altogether. If I didn’t allow myself the freedom to discharge my creative side, it might build up to some kind of blowout. Striking a workable ecology seems to promote trading longevity, which is one key to success," he said.

Seykota believes that the win rate for any trader is insignificant and what really matters is having an asymmetrical profit to loss ratio.

He feels finding a trading approach that fits one's personality is vital and sometimes intuition and “gut feel” can become one's most useful assets.

"I don’t think traders can follow rules for very long unless they reflect their own trading style. Eventually, a breaking point is reached and the trader has to quit or change or find a new set of rules he can follow. This seems to be part of the process of evolution and growth of a trader," he says.

Reduce your trading risk

Seykota is of the view that the three primary components of trading are (1) the long-term trend, (2) the current chart pattern, and (3) picking a good spot to buy or sell.

"Trading requires skill at reading the markets and at managing your own anxieties. Risk is the uncertain possibility of loss. If you could quantify risk exactly, it would no longer be a risk. Risk control has to do with your willingness to allow your stop to do its job," he said.

Have a winning mindset

Seykota believes a losing trader can do little to transform himself into a winning trader as a losing trader is not going to want to transform himself.

But a winning trader will always be wanting to learn and would like to transform every bet into a profitable one.

Seykota is of the view that in the recipe for success investors shouldn't forget commitment and a deep belief in the inevitability of success.

Leave emotions aside while trading

Seykota feels investors shouldn't get emotionally attached to their trading bets as it may lead to huge losses.

“Dramatic and emotional trading experiences tend to be negative. Pride is a great banana peel, as are hope, fear, and greed. My biggest slip-ups occurred shortly after I got emotionally involved with positions,” he said.

Seykota is of the view that the market is always right and investors should make their trading bets without letting their emotions get the better of them.

“If you want to know everything about the market, go to the beach. Push and pull your hands with the waves. Some are bigger waves, some are smaller. But if you try to push the wave out when it’s coming in, it’ll never happen. The market is always right,” he said.

(Disclaimer: This article is based on Ed Seykota's interview with Jack Schwager in the Market Wizards books series)

#trade#investing#brainmasstraders#brainmassfinance#tradewithraj#learnwithraj#investinglessons#tradingquotes#marketwizard#edseykota#greed#psychology#bet#emotions#cutloss#ridewinners#benjamingraham#warrenbuffet#peterlynch

0 notes

Photo

When there is no good trading opportunities spend your time with good books #marketwizards,#whatyouarereadingsg

0 notes

Photo

This is one of my favorite Jim Rogers quotes. I pulled it out of Market Wizards, perhaps the single most valuable investing book series I've read. This guy is truly a legend and recently gave a terrific master class interview over at RealVisionTV.com. If you have any interest in the markets I highly recommend you check it out. I get nothing for the rec. (The Mark Hart master class is fabu, too.) #investing #marketwizards #stockmarket #commodities #forex

1 note

·

View note

Photo

Verluste begrenzen. Sich der Angst nicht hingeben. Fehler einsehen. Für mich die wichtigsten Lehren aus den letzten Monaten. Und seit Anfang des Jahres versuche ich, diese Regeln auch konsequent umzusetzen. Man sollte sich immer vor Augen führen, was für eine Performance eigentlich notwendig ist, um den Verlust wieder wettzumachen. Dies kann teils Jahre dauern. Wie siehts bei euch aus? Begrenzt ihr Verluste? Könnt ihr euch eigene Fehler eingestehen? ⚠️ Werbung, da Markennennung. Keine Anlageberatung. ⚠️ #investingeducation #stockmarketinvesting #marketcrash #investingforbeginners #investing101 #norddeutsch #markminervini #marketwizards #marketwatch #stockstotrade #stocktrading #passiveincome #investmentstrategies #stockstowatch #buythedip #cutloss #aktien #techaktien #börse #finanziellefreiheit #ziele #zieleerreichen #performance #monetarypolicy #Tapering #federalreserve #stocks #investmenttips #investment #finance https://www.instagram.com/p/CeGMyvCMD6l/?igshid=NGJjMDIxMWI=

#investingeducation#stockmarketinvesting#marketcrash#investingforbeginners#investing101#norddeutsch#markminervini#marketwizards#marketwatch#stockstotrade#stocktrading#passiveincome#investmentstrategies#stockstowatch#buythedip#cutloss#aktien#techaktien#börse#finanziellefreiheit#ziele#zieleerreichen#performance#monetarypolicy#tapering#federalreserve#stocks#investmenttips#investment#finance

0 notes

Photo

📚📚📚Continuing the Study Theme since I’m stuck at home...😩🥺 Rolex Submariners 5513 Metres First & 16610 Tritium Dial in Melbourne with Mondani Book. #rolex #pallettoni #bicchierini #5513 #submariner #metresfirst #metersfirst #mattedial #tritium #submarinerdate #vintagesubmariner #rolexdiver #horology #1680 #bearmarket #vintagerolex #investinwatches #luxurywatches #marketwizard #daytona #webuyrolex #rolexbuyer #vintagewatch #luxury #dialvariations #16610 #16800 #watchdealer #gilt #buyrolex @giorgiamondani @mondanibooks @mondaniweb @mondanidoc @hodinkee @phillipswatches @rolex @timedealerhotmail @wristporn @wristwatchporn @andychanrolex @rolexcollectorsaustralia @rolexknowledge @rolexinformation @andychanrolex @rolexpassionreport @bobswatches @rolexdiver @rolexpassionmarket @d.rolexero @ifuckinglovewatches @rolex_lover @rolexaholics @watchfinderofficial @federicotalkswatches @baselworldofficial @rolexworld_ @rolex.passion @submarinerpassion @orchi_palar @guidomondani @francamondani (at Melbourne, Victoria, Australia) https://www.instagram.com/p/B98Y-LvHZ0u/?igshid=175byaktppoj

#rolex#pallettoni#bicchierini#5513#submariner#metresfirst#metersfirst#mattedial#tritium#submarinerdate#vintagesubmariner#rolexdiver#horology#1680#bearmarket#vintagerolex#investinwatches#luxurywatches#marketwizard#daytona#webuyrolex#rolexbuyer#vintagewatch#luxury#dialvariations#16610#16800#watchdealer#gilt#buyrolex

1 note

·

View note

Photo

🌞Rolex Submariners 5513 “Metres First” in Melbourne. #rolex #pallettoni #bicchierini #5513 #submariner #metresfirst #metersfirst #mattedial #tritium #submarinerdate #vintagesubmariner #rolexdiver #horology #1680 #bearmarket #vintagerolex #investinwatches #luxurywatches #marketwizard #daytona #webuyrolex #rolexbuyer #vintagewatch #luxury #dialvariations #16610 #16800 #watchdealer #gilt #buyrolex @giorgiamondani @mondanibooks @mondaniweb @mondanidoc @hodinkee @phillipswatches @rolex @timedealerhotmail @wristporn @wristwatchporn @andychanrolex @rolexcollectorsaustralia @rolexknowledge @rolexinformation @andychanrolex @rolexpassionreport @bobswatches @rolexdiver @rolexpassionmarket @d.rolexero @ifuckinglovewatches @rolex_lover @rolexaholics @watchfinderofficial @federicotalkswatches @baselworldofficial @rolexworld_ @rolex.passion @submarinerpassion (at Melbourne, Victoria, Australia) https://www.instagram.com/p/B-6Vqo_HNz-/?igshid=1l3v3cy7u4k3

#rolex#pallettoni#bicchierini#5513#submariner#metresfirst#metersfirst#mattedial#tritium#submarinerdate#vintagesubmariner#rolexdiver#horology#1680#bearmarket#vintagerolex#investinwatches#luxurywatches#marketwizard#daytona#webuyrolex#rolexbuyer#vintagewatch#luxury#dialvariations#16610#16800#watchdealer#gilt#buyrolex

0 notes

Photo

The Theme Continues... Rolex GMT-MASTER 1675 Gilt Dial in Melbourne with Mondani Books. 📚📚📚 #rolex #1675 #6542 #16750 #submariner #gilt #giltdial #tropicaldial #tritium #7206 #vintagegmt #panam #horology #pilotswatch #bearmarket #vintagerolex #investinwatches #luxurywatches #marketwizard #daytona #116710 #rolexbuyer #vintagewatch #luxury #glossdial #glossy #16710 #watchdealer #126710 #buyrolex @giorgiamondani @mondanibooks @mondaniweb @mondanidoc @hodinkee @phillipswatches @rolex @timedealerhotmail @wristporn @wristwatchporn @andychanrolex @rolexcollectorsaustralia @rolexknowledge @rolexinformation @andychanrolex @rolexpassionreport @bobswatches @rolexdiver @rolexpassionmarket @d.rolexero @ifuckinglovewatches @rolex_lover @rolexaholics @watchfinderofficial @federicotalkswatches @baselworldofficial @rolexworld_ @rolex.passion @submarinerpassion @orchi_palar @vintage_watch_company (at Melbourne, Victoria, Australia) https://www.instagram.com/p/B9-6ed_HY7W/?igshid=1dq84o6tckivj

#rolex#1675#6542#16750#submariner#gilt#giltdial#tropicaldial#tritium#7206#vintagegmt#panam#horology#pilotswatch#bearmarket#vintagerolex#investinwatches#luxurywatches#marketwizard#daytona#116710#rolexbuyer#vintagewatch#luxury#glossdial#glossy#16710#watchdealer#126710#buyrolex

0 notes

Photo

📚📚📚The Theme Continues... Rolex GMT-MASTER 1675 Gilt Dial in Melbourne with Mondani Book. #rolex #1675 #6542 #16750 #submariner #gilt #giltdial #tropicaldial #tritium #7206 #vintagegmt #panam #horology #pilotswatch #bearmarket #vintagerolex #investinwatches #luxurywatches #marketwizard #daytona #116710 #rolexbuyer #vintagewatch #luxury #glossdial #glossy #16710 #watchdealer #126710 #buyrolex @giorgiamondani @mondanibooks @mondaniweb @mondanidoc @hodinkee @phillipswatches @rolex @timedealerhotmail @wristporn @wristwatchporn @andychanrolex @rolexcollectorsaustralia @rolexknowledge @rolexinformation @andychanrolex @rolexpassionreport @bobswatches @rolexdiver @rolexpassionmarket @d.rolexero @ifuckinglovewatches @rolex_lover @rolexaholics @watchfinderofficial @federicotalkswatches @baselworldofficial @rolexworld_ @rolex.passion @submarinerpassion @orchi_palar (at Melbourne, Victoria, Australia) https://www.instagram.com/p/B9-5yDKn9aO/?igshid=w8yru8319k10

#rolex#1675#6542#16750#submariner#gilt#giltdial#tropicaldial#tritium#7206#vintagegmt#panam#horology#pilotswatch#bearmarket#vintagerolex#investinwatches#luxurywatches#marketwizard#daytona#116710#rolexbuyer#vintagewatch#luxury#glossdial#glossy#16710#watchdealer#126710#buyrolex

0 notes

Video

instagram

Rolex Submariners 5513 “Metres First” in Melbourne. #rolex #pallettoni #bicchierini #5513 #submariner #metresfirst #metersfirst #mattedial #tritium #submarinerdate #vintagesubmariner #rolexdiver #horology #1680 #bearmarket #vintagerolex #investinwatches #luxurywatches #marketwizard #daytona #webuyrolex #rolexbuyer #vintagewatch #luxury #dialvariations #16610 #16800 #watchdealer #gilt #buyrolex @giorgiamondani @mondanibooks @mondaniweb @mondanidoc @hodinkee @phillipswatches @rolex @timedealerhotmail @wristporn @wristwatchporn @andychanrolex @rolexcollectorsaustralia @rolexknowledge @rolexinformation @andychanrolex @rolexpassionreport @bobswatches @rolexdiver @rolexpassionmarket @d.rolexero @ifuckinglovewatches @rolex_lover @rolexaholics @watchfinderofficial @federicotalkswatches @baselworldofficial @rolexworld_ @rolex.passion @submarinerpassion (at Melbourne, Victoria, Australia) https://www.instagram.com/p/B-6U90BHGXK/?igshid=cgax13nwnn4f

#rolex#pallettoni#bicchierini#5513#submariner#metresfirst#metersfirst#mattedial#tritium#submarinerdate#vintagesubmariner#rolexdiver#horology#1680#bearmarket#vintagerolex#investinwatches#luxurywatches#marketwizard#daytona#webuyrolex#rolexbuyer#vintagewatch#luxury#dialvariations#16610#16800#watchdealer#gilt#buyrolex

0 notes

Video

instagram

🧐📚📚📚 Rolex GMT-MASTER 1675 Gilt Dial in Melbourne with Mondani Book. #rolex #1675 #6542 #16750 #submariner #gilt #giltdial #tropicaldial #tritium #7206 #vintagegmt #panam #horology #pilotswatch #bearmarket #vintagerolex #investinwatches #luxurywatches #marketwizard #daytona #116710 #rolexbuyer #vintagewatch #luxury #glossdial #glossy #16710 #watchdealer #126710 #buyrolex @giorgiamondani @mondanibooks @mondaniweb @mondanidoc @hodinkee @phillipswatches @rolex @timedealerhotmail @wristporn @wristwatchporn @andychanrolex @rolexcollectorsaustralia @rolexknowledge @rolexinformation @andychanrolex @rolexpassionreport @bobswatches @rolexdiver @rolexpassionmarket @d.rolexero @ifuckinglovewatches @rolex_lover @rolexaholics @watchfinderofficial @federicotalkswatches @baselworldofficial @rolexworld_ @rolex.passion @orchi_palar @vintage_watch_company @mondanivintage (at Melbourne, Victoria, Australia) https://www.instagram.com/p/B9-7YFinsgS/?igshid=170sc7vev3hfw

#rolex#1675#6542#16750#submariner#gilt#giltdial#tropicaldial#tritium#7206#vintagegmt#panam#horology#pilotswatch#bearmarket#vintagerolex#investinwatches#luxurywatches#marketwizard#daytona#116710#rolexbuyer#vintagewatch#luxury#glossdial#glossy#16710#watchdealer#126710#buyrolex

0 notes