#banking for beginners

Explore tagged Tumblr posts

Note

Hi! I want to open up a bank account, but I do not in any way want interest (even if it benefits me)...how could I avoid it?

That's easy enough, pumpkin!

Want you want from a bank is a checking account. Checking accounts generally do NOT offer interest, but they are very user friendly if your goal is to put your money somewhere where you have instant access to it through what's called a debit card.

Here's our how-to guide:

How the Hell Does One Open a Bank Account? Asking for a Friend.

Did this help you out? Tip us!

151 notes

·

View notes

Text

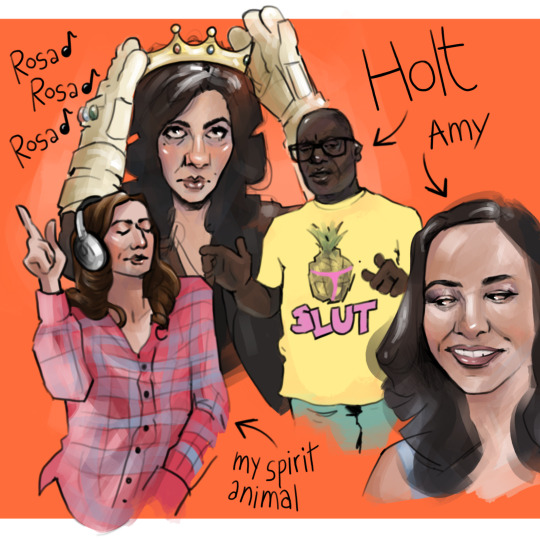

LOVE THEM SMMMM !!!!!! i’m so nostalgic of my old self discovering brooklyn 99 for the first time 🥲

i’m taking commissions btw!

#digital painting#artists on tumblr#digital artist#digital illustration#digital fanart#commissions open#digital commisions#taking commisions#tumblr commissions#my commissions#poor artist#my art#i have one dollar left on my bank account#small artist#beginner artist#digital commissions open#digital arwork#my artwork#b99 fandom#b99 fanart#b99 meme#source: b99#b99#b99 quotes#oh boy do i have to tag everything#brooklyn nine nine#brooklyn 99#peraltiago#jake peralta#amy santiago

27 notes

·

View notes

Text

Although options trading is a bit more complex than stock trading, it helps make more significant profits when the security’s price rises and restricts losses when it goes down. Options in stock market are powerful as they can enhance a person’s portfolio through added income, leverage, and protection.

What is options trading?

Option trading allows traders to buy or sell stocks, ETFs, etc., at a specified price and within a specific date. It also gives the flexibility to wait to purchase the stocks at the decided price or date. Options trading allows investors to judge the future course of direction of the stock market or individual securities like bonds, stocks, etc.

When considering options trading, one should know what options are and their various types. If you are looking for tips and strategies for options trading for beginners, this article will help you find answers to each of your queries.

What are options?

Options are tradable contracts that give the bearer the right but not the obligation to buy or sell an asset at a predetermined price on or before the contract expires. Although options trading is a bit more complex than stock trading, it helps make more significant profits when the security’s price rises and restricts losses when it goes down. Options in stock market are powerful as they can enhance a person’s portfolio through added income, leverage, and protection. It can be used as –

Leverage – When the security price rises, options trading helps you grab more enormous profits as you don’t have to put down the total price of the share. It lets you have control over the shares without buying them outright.

Hedging – When the price of a share fluctuates, options trading protects the investor by allowing you to buy or sell the shares at a pre-determined price for a specified period.

Types of stock options trading

Options trading can be categorized into two types – call option and put option. Below is a detailed insight into the two categories.

Call options – When the underlying security rises in price, it gives the opportunity to buy. Call option allows the trader to buy stocks at a pre-determined price within a specified period. The price paid is the strike price, and the last date of exercising the call option is known as the expiration date.

There are two ways to earn profit from the call option: Close your position (sell the call option) when the asset’s price surpasses the break-even price and make the difference between the paid and current premium. Or you can buy the asset at the agreed strike price.

Put options – Unlike call options, where the trader has the opportunity to buy, the put option allows people to sell the underlying stock at the strike price on or before the date of expiry.

If you are willing to earn profits through put options, either close your position (sell the options contract) when the asset price is below the break-even level and make

the difference between the premium paid and the current premium. Or sell the underlying asset at the agreed strike price.

If the underlying asset’s price moves in the opposite direction to the desired call or put options, wait for the contract to expire, and your losses will equate to the amount you paid for the option.

Types of option trading strategies

There are multiple types of trading in the stock market. There are numerous options trading strategies, but if you are a beginner, you should initially be well-versed in these five for effective trading.

Long calls (Buying calls) – A bullish trader should take this strategy. When the price of an asset is expected to rise, you can buy a call option using less capital than the asset. Also, if the price falls, the losses are limited to just the premium paid and no more.

Long puts (Buying puts) – Bearish traders prefer this buying options strategy. It gives the holder the right to sell the particular stock at the strike price. Short selling is the only way a trader can benefit from this strategy.

Covered calls – This strategy is preferred during a moderate or neutral market. Out of all other option trading strategies, covered calls are one of the safest options trading strategies. Here the investor sells a call option while also owning the underlying asset.

Protective puts – It is a risk management strategy that guards against the downside movement of an asset. Although put options are a bearish strategy, protective puts are favored when the trader is still in a bullish trend but wishes to hedge against potential losses.

Long straddles – It is one of the best stock options trading strategies in the Indian stock market. Here the trader purchases both a long call and a long put on the same underlying stock having the same expiration date and strike price.

Profitability in options trading

There are various types of trading in stock market, but every kind has some profitability scenarios, which make it worth opting for. Below is a list of the three significant situations that may lead to profitable trading outcomes.

In-the-money option (ITM) – When the current index value is greater than the strike price, it is said to be an in-the-money option. It leads to a positive cash flow being exercised immediately.

At-the-money option (ATM) – When the current index value is equal to the strike price, it is said to be an at-the-money option. It leads to no profit and loss, i.e., zero cash flow being exercised immediately.

Out-of-the-money option (OTM) – When the index value is lower than the strike price, it is said to be an out-of-the-money option. It leads to a negative cash flow being exercised immediately.

#ashutosh bhardwaj#bank nifty#finance#finance education#financial market#investment research#investments#logical nivesh#option trade#option trading#Options trading for beginners#sebi#strategies

6 notes

·

View notes

Text

What is neo banking and how does it work?

Neo banks are digital banks. Neo banks can be simply accessed by devices such as smartphones, computers and so on with internet connection. These neo banks are majorly active in digital apps and websites. Neo banks are alternatives to traditional banks. It provides high interest rate on fixed deposits and low processing fee since it is completely digital and does not require any maintenance charge as traditional banks.

Neo banks mainly target millennials and generation Z because they are almost digital natives and they are more technically advanced. Neo bank provides all their technological needs in banking services. Here are some more details about the working process,technical advancement of neo banking.

WORKING PROCESS OF NEO BANK

Moreover neo banks work similar to that of traditional banks but on a digital platform. Neo banks are initiated by a tie up process with traditional or established banks. Those tied traditional bank handels all the background processes such as depositing and lending the funds. With the background assistance of established banks, neo bank develops digital banking platforms such as mobile apps and websites.

The neo banks deal with the user interface and other customer services such as checking bank balance, debit card, ATM access and loans digitally with the help of artificial intelligence. And the tied partner bank deals with all other background fund activities. Transactions namely withdrawal, transfer, deposit are started via the neo banking platform and processed by the partner traditional banks.

The revenue generated as a result of transactions in the neo banking platform are shared between the partner bank and the neo banking platform.

TRADITIONAL BANK VS NEO BANK

Traditional banks are built with bricks and mortar and available physically. But neo banks are digital platforms and cannot be physically available.

Traditional banks can be accessed mostly by the physical branches though it has online accessibility. But neo banks can be accessed by anyone anywhere with an internet connection.

Traditional banks do not target any audience but neo banks target the people belonging to post millennial or generation z because they are digital natives and expect more advancement in all services.

Traditional banks provide low interest rates on deposits when compared with neo banks. Since, neo banks are completely digital platforms and do not need much maintenance charge.

Opening a bank account in a traditional bank is an arduous and time taking process. But opening an account in neo bank is a much simpler process and can be maintained smoothly.

Neo banks provide more personalized and advanced services to users in comparison with traditional banks.

ADVANTAGES OF NEO BANKS

Neo banks are more appropriate and can be easily accessed with a simple internet connection. Establishing an account is a much simpler process which involves choosing a neo banking platform, documents submission and KYC verification. One can maintain zero balance in neo banks.

Neo banks provide various advanced services and loan offers for new entrepreneurs and freelancers to support them. Neo banks become the alternatives for traditional banks in countries, where the accessibility of physical banks are low and mobile and internet penetration is high.

Neo banks become an engaging option for immigrants. Since neo bank does not require residential status and offers lower service charge for international money transfer.

DISADVANTAGES OF NEO BANKS

Though neo banks have various advantages, it has some drawbacks such as, It lacks some financial services such as, certain loans, insurance and so on. And it shortfalls on personal interactions. Since neo-banks are completely digital, any flaws in internet connection slow down its accessibility.

In this constantly changing world, people need more advancement in the services which interrupts all the day to day activities. Neo banks act as advanced banking solutions for all their banking needs. Clarisco is one of the leading neo banking solution providers. Which builds customized neo banking platforms for their 1000+ clients successfully. If you are interested in building a neo banking platform and need other services on neo banking do contact us without any regrets.

Skype - live:62781b9208711b89

Email Id - [email protected]

#leading neo banking solution provider#what is neo banking and how it works#neo banking for beginners#neo banking app development

0 notes

Text

TCS Secures 15-Year Contract with Ireland: A Boost for Tech Stocks and Pension Systems

#tricks and tips for competitive exams 2023#stock market for beginners#the hindu daily anlaysis for law entrance exams#indian economy for upsc#best current affairs class for bank exams#current affairs classes for bank exams#current affairs for mba entrance exams#best current affairs for bank exam#fundamental analysis of stock#gk questions and answers#current affairs for railways#current affairs for bank exams#daily current affairs in hindi for bank exam

0 notes

Text

shot in the dark but does anyone have any resources on tuning v6 ai banks? theyre super finicky (probably part of the reason not a lot of people bought v6 in the first place) and vocaloid tuning is already difficult for me but like, its been hard even finding tuned vprs for ai banks to study, um. im super sick wuth a fever rn and ive been up since 4 am so if this is dumb its cause my brains being slowly cooked in my skull

#yk the vsqs/vprs for non-ai banks don't really translate well#im fascinated by finding out people dont tune their v6ai covers much though#cause its not like synthv where its got decent tuning by default. v6ai by default sounds both flat and shaky#i feel kinda awkward asking if theres like something obvious im missing but afaik i dont rly have anyone i could personally ask#im still very much a beginner with vocaloid tuning in general#its probably gonna come down to “try your best” but just in case#vocal synth#vocaloid6

1 note

·

View note

Note

Let's say $10 could make a difference in my life. Please help me

Hello, I am Lina from Gaza. The Israeli occupation destroyed my art gallery and burned my drawings, thus destroying my hopes and dreams. Please donate to me and help me buy back my art tools to rebuild my art gallery 🍉🍉🍉

I live in a tent made of fabric, and we are now on the verge of winter🌨️🌨️. We will drown if we continue to live in it. Please help me so that I can buy a tent made of nylon or leather so that I can protect myself and my family from the rain. The cost of the tent is $1,500🍉🍉🍉🍉😭

Please donate a dollar to me so I can protect myself and my family from the cold and rain of winter, kindly of you 🍉🍉🍉🍉😭

https://gofund.me/33e0c09b

Donate and share!!!

#writing#poets on tumblr#poetry#free free palestine#fuck israel#poem#x files#chris carter#dana scully#fox mulder#eclipse#pisces#eclipse pisces 2024#writers#women#weather#wolverine#black and white#amy winehouse#anne with an e#beginner writer#black witch#black women#dean winchester#dear white people#doctor who#earth wind and fire#free west bank

1 note

·

View note

Text

Transform Spare Change into Wealth with Acorns!

Discover why having acorns in your pocket can transform your spare change into a powerful investment tool. Meet Acorns, the app that rounds up your purchases—like that $3.50 coffee—to the nearest dollar and invests the extra 50 cents for you. It’s like a smarter piggy bank!

Imagine turning daily habits into a diversified portfolio of ETFs effortlessly. With options for recurring investments and retirement planning through IRAs, Acorns simplifies investing for everyone—from beginners to experts. Don’t let your change sit idle; make it work hard for you! Download Acorns today and start growing your wealth one coffee at a time.

#InvestSmart #AcornsApp

#acorns app#invest spare change#investment app#round up investing#coffee investment#diversified portfolio#ETFs explained#retirement planning#IRA accounts#money management#financial education#passive investing#easy investing#wealth growth#investment tips#beginner investing#technology finance#smart savings#financial independence#app for investing#investment strategies#savings app#grow your wealth#financial literacy#investing made simple#personal finance tips#money growth#digital piggy bank#recurring investments#financial tools

0 notes

Text

Transform Spare Change into Wealth with Acorns!

Discover why having acorns in your pocket can transform your spare change into a powerful investment tool. Meet Acorns, the app that rounds up your purchases—like that $3.50 coffee—to the nearest dollar and invests the extra 50 cents for you. It’s like a smarter piggy bank!

Imagine turning daily habits into a diversified portfolio of ETFs effortlessly. With options for recurring investments and retirement planning through IRAs, Acorns simplifies investing for everyone—from beginners to experts. Don’t let your change sit idle; make it work hard for you! Download Acorns today and start growing your wealth one coffee at a time.

#InvestSmart #AcornsApp

#acorns app#invest spare change#investment app#round up investing#coffee investment#diversified portfolio#ETFs explained#retirement planning#IRA accounts#money management#financial education#passive investing#easy investing#wealth growth#investment tips#beginner investing#technology finance#smart savings#financial independence#app for investing#investment strategies#savings app#grow your wealth#financial literacy#investing made simple#personal finance tips#money growth#digital piggy bank#recurring investments#financial tools

0 notes

Text

Mutual Funds SIP 2024 : करोड़पति बनने का आसान रास्ता, शुरू करें ₹1500 की SIP और पाए 10 सालो के बाद कुल इतने रूपये…?

Mutual Funds SIP 2024 : सिस्टेमैटिक इन्वेस्टमेंट प्लान (SIP) की लोकप्रियता बढ़ती जा रही है, और इसे अधिक लोग चाहते हैं। यदि आप इसमें ₹1500 प्रति महीने बचत करके पैसे जमा करते हैं, तो आपको मैच्योरिटी पर शानदार रिटर्न मिल��ा है। SIPP में आप 100 रुपये या 500 रुपये से शुरू कर सकते हैं, और आप एक बार में मासिक, तिमाही, छमाही या सालाना भुगतान कर सकते हैं। ध्यान रहें कि SIP में निवेश करने पर आपको 12 प्रतिशत…

#0 exit load mutual fund#100 rs sip mutual funds 2024#2024 best mutual funds top sip plans#4 mutual funds#5000 investment in mutual funds#6 month mutual fund#8 mutual funds you should never buy#axis bank best sip mutual funds 2024#best 100 rs sip mutual funds 2024#best 6 month mutual funds#best equity funds for sip#best equity mutual funds for 2023#best fund to invest in sip 2023#best large cap mutual funds for sip 2024#best midcap mutual funds 2024 for sip#best mutual fund sip in 2024#best mutual funds for 2024#best mutual funds for 2024 for sip 500#best mutual funds for 2024 for sip beginners#best mutual funds for 2024 sip kannada#best mutual funds for 2024 sip malayalam#best mutual funds for 2024 sip telugu#best mutual funds for long term sip 2024#best mutual funds for sip in 2024#best mutual funds for sip in 2024 sagar sinha#best mutual funds for sip long term 2024#best mutual funds sip 2024#best mutual funds sip for 2024#best mutual funds to invest in 2024 for sip#best mutual funds to start sip in 2024

0 notes

Text

Feeling like your money's slipping away? Get control of your finances with these 10 practical budgeting tips! Learn how to track your spending, cut costs, and save for your goals. This video is for YOU whether you're new to budgeting or looking for ways to improve your current system.

#budgeting#personal finance#money saving tips#finance tips#budgeting for beginners#expense tracking#saving money#financial goals#frugal living#budget cuts#millennial money management#debt payoff tips#Banking#Jobs#Banking Career#IPB#10 Effective Budgeting Strategies for Saving Money#budgeting tips for beginners#budgeting tips to save money#10 ways to save money#modern ways of saving money#realistic ways to save money

0 notes

Text

The Ultimate Beginner's Guide to Stablecoins

Stablecoins represent a revolutionary development in the cryptocurrency landscape, providing a stable alternative to the highly volatile nature of traditional digital assets like Bitcoin. By pegging their value to fiat currencies, commodities, or other assets, stablecoins offer a reliable means of transaction and investment within the crypto ecosystem. Fiat-backed stablecoins such as Tether (USDT) and USD Coin (USDC) are supported by real-world reserves, ensuring their stability. Meanwhile, crypto-collateralized stablecoins like DAI are backed by other cryptocurrencies, offering greater decentralization and transparency. Despite their benefits, stablecoins are subject to regulatory scrutiny and technological risks, as demonstrated by past incidents like the Terra UST collapse.

Stablecoins bridge the gap between cryptocurrencies and traditional finance by providing a stable and liquid asset that can be used for trading, payments, and as a buffer against market volatility. They are integral to the functioning of decentralized finance (DeFi) platforms, enabling activities such as lending, borrowing, and yield farming. However, the success and reliability of stablecoins depend on robust regulatory frameworks, security measures, and technological advancements. As these aspects continue to evolve, stablecoins are expected to play an increasingly important role in the global financial system.

Intelisync is at the forefront of this financial innovation, offering services to help you navigate and leverage stablecoin technology effectively. Whether you are an investor, builder, or consumer, we can assist you in understanding Learn more....

#Algorithmic Stablecoins#Benefits of stablecoin#Can stablecoins lose their value#Challenges and Risks Crypto-collateralized stablecoins#FIAT-backed Vs Algorithmic Stablecoins#Fiat-Collateralized Stablecoinsn#How to Store Stablecoins Safely#How to Use Stablecoins in DeFi Platforms#Popular Stablecoins in the Market#The future of stablecoins#Types of Stablecoins#What is a Stablecoin A Complete Guide for Beginner#What is a stablecoin#What is the difference between Stablecoins vs. Central Bank Digital Currencies (CBDCs)?#Why Are Stablecoins So Important Intelisync blockchain development intelisync web3 agency

0 notes

Text

#blockchain#what is blockchain#blockchain explained#blockchain technology#introduction to blockchain#blockchain tutorial#introduction to blockchain technology#blockchain tutorial for beginners#how does blockchain work#blockchain technology explained#how to create a blockchain wallet#how to use blockchain#what is blockchain technology#how to create a blockchain account#how to use blockchain wallet#blockchain developer#blockchain wallet to bank account

0 notes

Text

Index Options tips | Nifty option tips | Bank Nifty option tips | Option Trading | option tips

Unlock the potential of Index Options with expert insights! Explore valuable Nifty option tips, Bank Nifty option tips, and master the art of Option Trading. Elevate your trading strategy with comprehensive option tips to navigate the dynamic market. Whether you're a seasoned trader or a beginner, our curated Index Options tips provide actionable advice to enhance your financial success. Stay ahead of market trends and make informed decisions with our specialized guidance. Discover the power of strategic option trading and maximize your returns. Gain confidence in your trades with our dedicated tips designed for success in the world of options. Take control of your financial future and optimize your trading portfolio with our precise and reliable advice. Start your journey to financial prosperity today!

#Index Option tips#stock option#option trading tips#options trading tips#nifty option tips#bank nifty option tips#nifty options tips#future and option tips#banknifty option tips provider#option trading tips free#option tips#option trading#options trading#option trading strategies#option trading strategy#option strategy#option strategies#option buying strategy#option trading for beginners#best option strategy#zero loss option strategy#what is option trading#option trading in hindi#best strategy for option trading#how to learn option trading#stock cash tips#stock future tips#hni trading tips#btst tips for today

0 notes

Text

Financial Stability Board: Crypto-assets regulators directory

The Financial Stability Board (FSB) is established to coordinate at the international level the work of national financial authorities and international standard-setting bodies in order to develop and promote the implementation of effective regulatory, supervisory and other financial sector policies. Its mandate is set out in the FSB Charter, which governs the policymaking and related activities of the FSB. These activities, including any decisions reached in their context, shall not be binding or give rise to any legal rights or obligations under the FSB’s Articles of Association.

Crypto-assets regulators directory The purpose of this directory, which the FSB has delivered to the April 2019 G20 Finance Ministers and Central Bank Governors meeting, is to provide information on the relevant regulators and other authorities in FSB jurisdictions and standard-setting bodies who are dealing with crypto-assets issues, and the aspects covered by them. Contacts information with regard to the below functions has been shared among the authorities mentioned.

DOWNLOAD THE PDF HERE:

BEST CRYPTO PLATFORMS

#cbdc#cryptocurrency#cryptocurrency market#crypto#fsb#crypto currency#crypto community#crypto for beginners#crypto industry#crypto laws#crypto latest news#central bank#digital currency#xrp coin#xrp#xrpcommunity

0 notes

Text

Mastering the Share Market: A Comprehensive Basic Guide for Share Market Beginners

Introduction: The Indian share market is a dynamic landscape offering abundant opportunities for investors. This blog aims to demystify the complexities of the market, empowering readers with insights and strategies for informed decision-making. Section 1: Understanding the Share Market 1. What is the Share Market? The share market, also known as the stock market, is a platform where the buying,…

View On WordPress

#How to invest in the stock market#infosys company share price#national stock exchange#nse national stock exchange#punjab national bank stock price#rate of share of reliance industries#reliance industries stock price#sensex index today#sensex sensex today#sensex today#share market basics#share market news#share price punjab national bank#state bank of india stock price#stock market analysis#stock market for beginners#Stock market investing strategies#Stock market trends in India#tatasteel share price today#Tips for investing in the stock market#todays sensex

0 notes