#bail money financer in california

Explore tagged Tumblr posts

Text

Discover why Acme Bail's services are your top choice for securing freedom in 2024 with reliable and efficient bail bond solutions. Get the help you need now!

#bail bonds in california#bail bonds services#bail bondsman in california#bail money financer in california#bail bonds company california#acme bail bonds

0 notes

Text

A federal lawsuit filed Tuesday alleges The Church of Jesus Christ of Latter-day Saints investment arm misused hundreds of thousands of dollars donated by three men by investing the money instead of using it for charitable purposes as they claim was promised.

The legal action brings more scrutiny about how the faith, known widely as the Mormon church, handles its vast financial holdings bolstered by so-called “tithing” from by members who contribute 10% of their income. The church doesn't publicly disclose details about its finances.

This new lawsuit against the business and investment entities under the church in U.S. District Court in Salt Lake City is similar to one filed in federal court in California by James Huntsman, brother of former Utah Gov. Jon Huntsman, Jr., that recently scored a partial success on appeal and remains pending. That lawsuit seeks the return of $5 million he donated before he left the church.

In February, the U.S. Securities and Exchange Commission fined the church and Ensign Peak $5 million for using shell companies to obscure the size of the investment portfolio under church control. The church agreed to pay $1 million and Ensign Peak will pay $4 million.

Church officials didn’t immediately respond for comment on the lawsuit.

The church has previously defended how it handles member contributions, calling Huntsman’s claims baseless while claiming contributions go to a variety of religious purposes including missionary work, education, humanitarian causes and construction of churches, temples and other buildings important to church work.

At issue in both lawsuits is whether the church's investments in stocks, bonds, real estate and agriculture reflect the wishes of its donors.

The church's corporate arm, the Corporation of the President of the Church of Jesus Christ of Latter-day Saints, solicits donations for humanitarian relief with promises that all donations are used to help those in need. But those promises are untrue, the latest lawsuit argues.

Instead, the church allegedly hid the fact that some if not all donations are permanently invested in accounts never used for charitable work. That includes tithes; regular donations amounting to 10% of a person’s income expected from members of the church. The money instead has gone to Ensign Peak Advisors, a nonprofit created in 1997 that has grown to over $100 billion in value, the lawsuit alleges.

The lawsuit is filed by Daniel Chappell, of Virginia, and Masen Christensen and John Oaks, both of Utah. They claim the three of them combined have donated about $350,000 to the church over the past decade. Their lawsuit seeks class-action certification, potentially involving millions of church members, and an independent entity to oversee collection and use of church donations.

Like the lawsuit filed by Huntsman, the lawsuit filed by the three men leans on allegations by whistleblower David Nielsen, a former Ensign Peak investment manager who this year submitted a 90-page memorandum to the U.S. Senate Finance Committee demanding oversight into the church’s finances.

Ensign Peak has spent funds only twice in its 26-year history, according to both lawsuits. In 2009, Ensign Peak spent $600 million to bail out a failing church-owned, for-profit life insurance company. From 2010-2014 it put $1.4 billion to build a mall near Temple Square in downtown Salt Lake City.

A judge ruled in favor of the church in Huntsman's case but in August the U.S. Ninth Circuit Court of Appeals disagreed in part and sent the case back to district court for further proceedings. The church has filed for a rehearing in the appeals court, saying the church president had explained the project would be paid for through investment earnings and not tithing funds.

4 notes

·

View notes

Text

In 2022, FTX crypto exchange filed for bankruptcy, sending shockwaves through the crypto community. Legal actions against its former management have persisted. Nearly a year later, founder Sam Bankman-Fried faces an impending trial. The trial of the disgraced businessman will begin on October 3 and will last at least 21 days until November 9 inclusive. At least until sentencing, Bankman-Fried will be held in custody in the Brooklyn prison where he was sent on August 11. Sam is accused of seven counts of fraud. According to investigators, the former head of the trading platform illegally seized the assets of FTX clients. For the scams committed, he faces a penalty of imprisonment for a term of 110 years. I made a lot of big mistakes this year.But this wasn't one of them. There's no evidence, because it didn't happen. Please, please, focus on your own house. https://t.co/tlcQu9zFdf— SBF (@SBF_FTX) December 9, 2022 Who is affected by the FTX collapse? Many companies in which FTX and Alameda Research invested suffered catastrophic business consequences. The collapse of FTX and the loss of Sam’s reputation was a tragedy for the industry not only because of the multi-billion dollar losses. Bankman-Fried was a prominent figure in US political circles, speaking in Congress and sponsoring political campaigns. The collapse of its exchange significantly damaged the reputation of cryptocurrencies in the eyes of regulators. Because authorities have accused Bankman-Fried of misusing customer money, other centralized exchanges rushed to release proof of reserves to ensure that users’ funds were safe. New management is trying to get customers’ money back FTX owed customers $8.7 billion after allegedly embezzling and misusing customer deposits. This was covered up by senior management back in August 2022. John J. Ray III is a CEO trying to pay back creditors. According to Ray, FTX has so far recovered US$7 billion in liquid assets and is continuing to pursue the remaining assets. In a second interim report, FTX debtors said the company concealed its actions with the help of FTX Group’s lawyer. At the same time, FTX spends millions of dollars every month on lawyers who are trying to unravel the financial fraud of the company’s former management. Representatives of the form also asked politicians to return donations from Bankman-Fried. What awaits SBF? On November 11, Bankman-Fried resigned from his post as head of the exchange. Ten days later, he was extradited from the Bahamas to New York. He pleaded not guilty to any of the eight charges, including fraud and violating campaign finance laws. 1) Hi all:Today, I filed FTX, FTX US, and Alameda for voluntary Chapter 11 proceedings in the US.— SBF (@SBF_FTX) November 11, 2022 Bankman-Fried was under house arrest at his parents’ home in California; he was able to avoid arrest by posting bail of $250 million. However, the court ruled that the FTX founder had repeatedly tried to influence prosecution witnesses and revoked the bail. As a result, in August, a New York court arrested the founder of the FTX cryptocurrency exchange, Sam Bankman-Fried, who is accused of stealing investor funds. Does SBF have a chance to win? Prosecutors are likely to portray Bankman-Fried as a money-hungry child of privilege, facilitated by his parents’ connections, while defense attorneys will highlight his intense work habits, philanthropy, and determination to try to pay clients what they were owed. However, Sam Bankman-Fried’s chances of winning the case are probably low. First, the top management of FTX and Alameda Research changed their minds and decided to cooperate with the prosecutor’s office. They include his ex-girlfriend Caroline Alison, who ran Alameda Research, and Gary Wang, the co-founder of the collapsed crypto exchange. The lead prosecutor on the case, Nicholas Roos, worked on cases against Steve Bannon and Michael Cohen; the other, Danielle Sassoon, was a Supreme Court law clerk for Justice Antonin Scalia.

Judge Lewis A. Kaplan is used to high-profile cases: He oversaw E. Jean Carroll’s defamation case against former President Donald Trump, which Carroll won; a civil lawsuit against Kevin Spacey for sexual harassment, in which the actor was found not guilty; and the terrorism trial of Osama bin Laden’s son-in-law and senior al-Qaeda official, who was convicted. In addition, SBF has provided too much information to the press about the trials. This makes it difficult for lawyers, as they usually advise their clients not to discuss ongoing cases with the media. An examination of documents and depositions in multiple FTX cases reveals an extravagant world, from how the company paid one executive for a yacht, to spending millions on hotels in one month, to business practices such as approving expenses using emojis through Slack, to paying for the house in the Bahamas where Bankman-Fried’s parents lived, to the head of the charity FTX, discussing with Bankman-Fried’s younger brother the possibility of buying the Micronesian island nation of Nauru. Therefore, most lawyers believe that Sam Bankman Freed will be found guilty of several crimes. They also expect him to spend decades in federal prison. For example, Bernie Madoff, who ran the largest Ponzi scheme in the world, was jailed for 150 years.

0 notes

Text

What Does Silicon Valley Bank’s Collapse Mean For The Financial System? A Big Lender To American Startups Goes Under

— March 10th 2023 | Washington, DC | Finance & Economics | Siligone

Signage Outside Silicon Valley Bank Headquarters in Santa Clara, California, USA, on Thursday, March 9, 2023. SVB Financial Group bonds are plunging alongside its shares after the company moved to shore up capital after losses on its securities portfolio and a slowdown in funding. Photographer: David Paul Morris/Bloomberg via Getty Images

Two ways. Gradually, then suddenly. That is how Silicon Valley Bank (svb), the 16th-largest lender in America, with about $200bn in assets, went bust. Its financial position deteriorated over several years. But just two days elapsed between the San Francisco-based bank’s announcement on March 8th that it was seeking to raise $2.5bn to plug a hole in its balance-sheet, and the declaration by the Federal Deposit Insurance Corporation, which regulates American bank deposits, that svb had failed.

svb’s share price plunged by 60% after the capital raise was revealed. Greg Becker, its chief executive, urged clients to “support us as we have supported you”. Unpersuaded, some venture capitalists told portfolio companies to run. Bill Ackman, a hedge-fund manager, suggested that the government should bail out the bank. By the morning of March 10th its shares had slid another 70% or so in pre-market trading, before a halt was called. cnbc, a television network, reported that svb’s capital-raising efforts had failed and that the bank was seeking to sell itself to a larger institution. Then came the announcement from the regulators.

These events raise two questions. The first is how svb got into this position. The second is whether its troubles are simply an anomaly, or a harbinger of doom for financial institutions writ large.

Start with the first. svb is a bank for startups. It opened accounts for them, often before larger lenders would bother. It also lent to them, which other banks are reluctant to do because few startups have assets for collateral. As Silicon Valley boomed over the past five years, so did svb. Its clients were flush with cash. They needed to store money more than to borrow.

Thus svb’s deposits more than quadrupled—from $44bn at the end of 2017 to $189bn at the end of 2021—while its loan book grew only from $23bn to $66bn. Since banks make money on the spread between the interest rate they pay on deposits (often nothing) and the rate they are paid by borrowers, having a far larger deposit base than loan book is a problem. svb needed to acquire other interest-bearing assets. By the end of 2021, the bank had made $128bn of investments, mostly into mortgage bonds and Treasuries.

Then the world changed. Interest rates soared as inflation became entrenched. This killed off the bonanza in venture capital and caused bond prices to plummet, leaving svb uniquely exposed. Its deposits had swollen when interest rates were low and its clients were flush with cash. Since the bank made investments during this time, it purchased bonds at their peak price. As venture-capital fundraising dried up, svb’s clients ran down their deposits: they fell from $189bn at the end of 2021 to $173bn at the end of 2022. svb was forced to sell off its entire liquid bond portfolio at lower prices than it paid. The losses it took on these sales, some $1.8bn, left a hole it tried to plug with the capital raise. When it went under the bank held some $91bn of investments, valued at their cost at the end of last year.

Were svb’s troubles an anomaly? The bank appears to have been uniquely susceptible to a run. Federal insurance, put in place after a series of panics that felled the American economy in the 1930s, covers deposits up to $250,000. This protects all the cash that most individuals would stash in a bank account. But it is unlikely to cover the funds a company would keep. svb is a bank not just for companies, but a narrow subsection of them that have suffered tougher times than most. Some 93% of its deposits were uninsured. Its customers, unlike those at most banks, had a real incentive to run—and they responded to it.

That said, nearly all banks are sitting on unrealised losses in their bond portfolios. If svb is the bank most likely to have been put in the position of having to stock up on bonds at their peak price, it is probably not the only one struggling with the whiplash in prices. Janet Yellen, the treasury secretary, says she is monitoring several banks in light of the events in Silicon Valley. Thankfully, loan books make up a much larger share of assets at most other institutions. And with rates rising, they are earning more.

The question now is whether there will be a bail-out and, if so, how big it would need to be to make depositors whole. svb “is the lifeblood of the tech ecosystem,” notes Ro Khanna, a congressman from California’s 17th district, which includes some of the valley. “They can’t let the bank fail. Whether that means that it should be acquired by another company…or get assistance from or even a statement from the Treasury department so that the depositors feel secure—I will leave that to the experts.”

Intervention would be unpopular. But short of stiffing depositors it may be the only option, since svb clearly did not hold enough to cover the losses it was being forced to take on assets. Larry Summers, a former treasury secretary, has said that so long as the state steps in, there is no reason to worry that svb will harm other parts of the financial system. Lots of people will be hoping that it does, and that he is right. ■

0 notes

Text

The doctrine of dynastic wealth

The biggest news story of the moment Propublica's reporting on the Secret IRS Files, a trove of leaked tax data on the wealthiest people in America that show that they pay effectively no tax, through perfectly legal means.

https://pluralistic.net/2021/06/15/guillotines-and-taxes/#carried-interest

The Bootlicker-Industrial Complex has completely missed the point of this reporting and its followup, like the revelation that an ultrarich candidate for Manhattan DA was able to pay no tax in many years where her family booked millions in revenue.

https://pluralistic.net/2021/06/17/quis-custodiet-irs/#trumps-taxes

The apologists for super-rich tax-evaders lean heavily on the fact that America has a tax-code that substantially reduces the spending power (and thus political power) of people who work for a living, while enhancing the wealth of those who own things for a living.

The rich are obeying the law, so there is nothing wrong here. But what Propublica documented is that America has a different set of laws for the super-rich than for the merely rich, and that these laws are in a wholly different universe from the laws for the rest of us.

It's another example of America's unequal justice system - a subject that includes long prison sentences for crack possession and wrist-slaps for powder cocaine, long jail terms created by the cash bail system, and a host of other race- and class-based inequities.

It's more proof, in other words, that America isn't a republic where we are all equal before the law, but rather a caste system where inherited privileges determine how the law binds you, how it punishes you and how it protects you.

One person well-poised to describe how this system perpetuates itself is Abigail Disney, granddaughter of Roy Disney and great-niece of Walt Disney, inheritor of a vast family fortune shielded from tax by a generation-skipping trust contrived solely to avoid taxation.

Writing in The Atlantic, the heiress describes how she was inducted and indoctrinated into the system of American dynastic wealth, surrounded by brilliant accountants who treated their exotic financial vehicles as completely ordinary.

https://www.theatlantic.com/ideas/archive/2021/06/abigail-disney-rich-protect-dynastic-wealth-propublica-tax/619212/

Personally, these financial enablers were "decent, good, kind men," and they gave Disney 40 years' worth of gospel about protecting the capital, growing it, and passing it on to the next generation.

As a credible 21 year old, Disney had no frame of reference. The creation of a dynastic, ever-growing fortune through legal but frankly bizarre accounting fictions was treated as normal.

To the extent that these tactics raised any doubts, they were addressed through doctrine: the idea that government bureaucrats can't be trusted to spend money wisely.

Disney doesn't say this, but a common trope in these discussions is that the government is ever tempted to give money to poor people, and must be protected from this impulse.

This racism and classism are dressed up as "meritocracy" - the tautology that the rich are worthy, the worthy are rich, and anyone who isn't rich is therefore unworthy.

In the first generation, this doctrine is merely sociopathic, but when passed on to a new generation, it is eugenic. Walt and Roy demonstrated their worth by founding a studio and navigating it through the challenges of the market, and that is why the market made them rich.

But their children - and grandchildren - didn't get their wealth by founding or running a studio. They got their wealth by emerging from the correct orifice. If their wealth is deserved, those deserts are a matter of blood, not toil.

In other words, they were born to be rich, not just as a matter of sound tax planning, but as a matter of genetic destiny. They are part of a hereditary meritocracy.

https://pluralistic.net/2021/02/13/data-protection-without-monopoly/#inequality

Disney describes what it's like to be indoctrinated into the hereditary meritocracy: her family told her that the appearance of philanthropy is good, but actually giving money to poor people is a foolish enterprise, "unseemly and performative."

And they urged her to marry her own class, "to save yourself from the complexity and conflict that come with a broad gulf in income, assets, and, therefore, power." Power should be in the hands of "successful" people, because they know how to wield it.

Accept this ideology and you will be showered with wonderful gifts: like private jet trips, which quickly become necessities ("once you’ve flown private, wild horses will never drag you through a public airport terminal again").

It's a subject that is well-documented in Mike Mechanic's 2021 book JACKPOT, on the daily lives, dysfunctions, and above all, ideology of the super-rich:

https://pluralistic.net/2021/04/13/public-interest-pharma/#affluenza

As to the seductiveness of the ideology, I had my own experience with the "decent, good, kind" professionals of the finance sector. When I moved to London in 2003, I opened a checking account at Barclays, a giant high-street bank.

I quickly discovered that part of Barclays' legendary profitability came from understaffing its branches; when I had to see a teller, I could end up waiting in line for an hour.

When I complained about this, a teller told me that for a nominal annual sum, I could get a "premier" account that came with a host of benefits, including priority tellers. I signed up and was inducted into the premiership by my branch manager.

He asked me if I needed any help with tax preparation, and boy did I ever. I was filing tax returns in Canada, the US, California, and the UK - it was a mess: not just expensive but confusing, and I couldn't make heads or tails of the paperwork.

A week later, a very smartly turned out Barclays "tax specialist" came by the academic research center where I'd borrowed a desk to meet with me. She was wildly excited to discover that I was on a work visa and not a UK citizen.

She told me that this made me eligible to become a "non-dom" - someone living in the UK, but not "domiciled" there - and therefore not subject to any tax at all.

She laid out a whole plan for me: I could establish residence in one of the Channel Islands (Jersey, I think?), incorporate a shell company there, and continue to get free health care from the NHS, use the public roads, etc - all without paying a penny to HM Exchequer.

And when I was ready to buy a house, the whole thing would only get better: I could buy it through the shell company, reverse-mortgage it, rent it to myself, take fabulous deductions on the way, and pass it on tax-free by transfering the shell company rather than the house.

It was dizzying, and I kept asking her to go back and explain it again. She assured me that it was legal and normal, what every non-Briton living in the UK should do, and really poured the pressure on.

It was weirdly spellbinding, like a wizard was demonstrating an interdimensional portal to me and asking if I wanted to go through it to a magical land - a magical land that "everyone else" was already visiting on the reg.

I told her I'd think about it. Five minutes after she left the office, I snapped out of the trance. I never called her back. I figured out my UK taxes.

But today, reading Disney's account of having reasonable-seeming, friendly experts tell you something bizarre and indefensible is normal, I was powerfully reminded of my own brush with the dynasty-creation industry.

297 notes

·

View notes

Text

A Month of Islam in America: July 2020

The jihad didn’t stop just because the government shut down your schools, your churches, your parks, and most every other aspect of your life. No, the jihad is a process. We start with some historical context for that ongoing process.

What is Islamization?

Islam: “It’s a creeping thing, one big, long war” (VIDEO)

The Battle of Hattin: Islam’s July 4 Triumph

Click any link below for more details and a link to the original source.

Jihad in America:

Arizona: Woman arrested at Phoenix airport en route to join al Qaeda

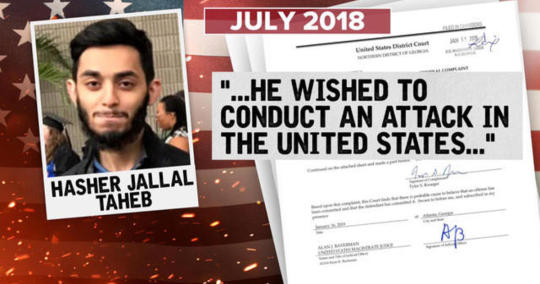

Georiga: Muslim gets 15 years for jihad plots on White House, Statue of Liberty, Washington Monument, Lincoln Memorial, and synagogue

Missouri: Bosnian Muslim Refugee Gets 8 Years for Providing Material Support to Islamic Terrorists

North Carolina: Man who wanted to join Islamic State (ISIS), use girlfriend’s “Buddy Pass” to aid jihad, gets 5 year sentence

Hawaii: Man who proclaimed allegiance to ISIS charged for threats to kill teachers and students, bomb police

Florida: Muslim woman who attacked cop left note declaring it was jihad for her jihadi brother - police shooting ruled justified

Minnesota: Lebanese immigrant gets 42 months for sending drone tech to Hizbollah

Florida: Lebanese Hizbollah narco-money launderer extradited to Miami

Islamic - Black Lives Matter - Antifa-related Jihad in America

New York: Muslim invaders call for “death to America”, “abolish the U.S. government” and incite violence against NYPD (VIDEOS)

Minnesota: Muslim Charged with Arson of St. Paul High School During BLM Riots

American convert to Islam runs Twitter poll on most ‘satisfying’ way to destroy Lincoln Memorial...using captured, non-Muslim slaves

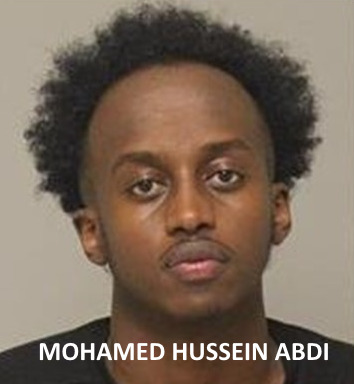

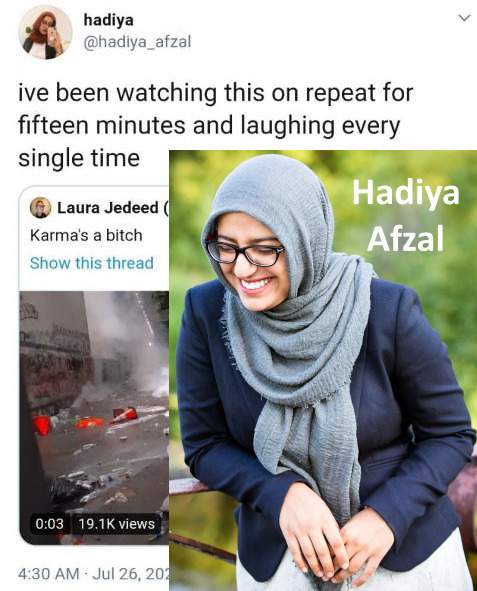

Illinois: Muslim Democrat nominee who tweeted about watching assault of federal officer on repeat & “laughing every single time” drops out of race

Philadelphia: Black “liberation” groups demand release of Muslim who killed cop

Kentucky: 10 arrested for jewelery store burglary during BLM riots

Maine: Man arrested in drive-by shooting at police headquarters, assaulting a cop and an FBI agent

Michigan: Fugitive with Islamic face tattoo who escaped Virginia jail captured in Battle Creek

Previous monthly reports here.

Immigration Jihad also known as Hijra:

Texas: Illegal immigrants from Iran caught at Texas border; Iranians arrested for fraud & on FBI Most Wanted List

California: Syrian immigrant (refugee?) arrested after importing looted ancient Hercules mosaic

Virginia: Muslim arrested in home invasion robbed family, fled from and smashed cops... with his child in car

Rape Jihad:

Arizona: Muslim arrested for kidnapping, raping and trying to kill a woman in Gilroy

Fraud for Jihad:

Ohio: Muslim sentenced for illegal halal slaughterhouse and discharge of animals into waterways

Virginia: Four Muslims arrested in cigarette trafficking bust in Chesterfield

Terrorist Financing Targeting Center Sanctions Network of ISIS-Linked Financial Facilitators and Money Services Businesses

Mosque Jihad:

Illinois: Bolingbrook imam forced to resign over sexist, racist (n-word) social media posts

Turkey converting buildings to mosques across the U.S.

Government collusion with and failure to prevent jihad:

California: Muslim convicted in Mumbai Massacre granted early release due to coronavirus is rearrested, faces extradition to India

NYC: Conspirator in 1993 jihad plot to bomb NYC landmarks released to Manhattan homeless shelter

New York: Pakistani Muslim lawyer who fire-bombed NYPD vehicle is released on bail, again

California: Sentencing for man who plotted with, purchased guns for San Bernardino jihadis delayed to late October

Maryland: Obama judge delays trial, extends hospitalization for Muslim immigrant arrested prior to ISIS truck jihad attack at National Harbor

Joe Biden’s Jihad:

Biden Hires Islamic Supremacist as Islamic Influence Operations Target His Campaign

Joe Biden to speak to the nation’s largest Muslim [Brotherhood] American PAC

Muslim Brotherhood group gets Joe Biden to quote hadith calling for jihad against unbelievers (e.g., America)

VIDEO: Joe Biden Calls for Jihad against America Democrat

VIDEO: Joe Biden wishes “we taught more in our schools about the Islamic faith”

VIDEO: Joe Biden will end travel restrictions from Islamic terror hotspots (so-called ‘Muslim ban’) “on Day One”

Bonus: Stories of Muslim diversity we did not have time to post:

Virginia: Honor Killing? Ball Salim Ahmed Ball charged with murder of Reston woman in her home

Virginia: High School - Mohamed Aly - Student Charged for Double Homicide of Northwest Graduates

Virginia: Animal cruelty charges dropped, assault case against Mohamed Fahmy-Arape moves forward

Mohammed Nasim arrested after fatally striking woman then fleeing scene in Brooklyn

Colorado: Greeley police arrest Abdirahman Hussein Mohamed in aggravated robbery at Target

Victories? Or losses due to unregulated immigration (i.e., the Jihad Tax)?

Wyoming: Bill to ban female genital mutilation (FGM) passes despite pushback by radical trans activists

Massachusetts House passes bill to establish criminal and civil penalties for female genital mutilation (FGM)

Previous monthly reports here.

Please share this and other posts on your social media sites.

8 notes

·

View notes

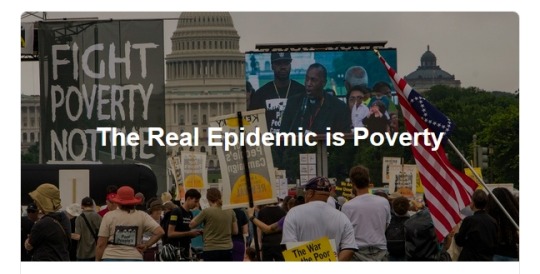

Photo

“The moral crisis of poverty amid vast wealth is inseparable from the injustice of systemic racism, ecological devastation, and our militarized war economy.” by Rev. Dr. William Barber II, March 30, 2020. (complete text below)

***

The United States is the wealthiest nation in the history of the world, yet millions of American families have had to set up crowdfunding sites to try to raise money for their loved ones’ medical bills. Millions more can buy unleaded gasoline for their car, but they can’t get unleaded water in their homes. Almost half of America’s workers—whether in Appalachia or Alabama, California or Carolina—work for less than a living wage. And as school buildings in poor communities crumble for lack of investment, America’s billionaires are paying a lower tax rate than the poorest half of households.

This moral crisis is coming to a head as the coronavirus pandemic lays bare America’s deep injustices. While the virus itself does not discriminate, it is the poor and disenfranchised who will experience the most suffering and death. They’re the ones who are least likely to have health care or paid sick leave, and the most likely to lose work hours. And though children appear less vulnerable to the virus than adults, America’s nearly forty million poor and low-income children are at serious risk of losing access to food, shelter, education, and housing in the economic fallout from the pandemic.

The underlying disease, in other words, is poverty, which was killing nearly 700 of us every day in the world’s wealthiest country, long before anyone had heard of COVID-19.

The moral crisis of poverty amid vast wealth is inseparable from the injustice of systemic racism, ecological devastation, and our militarized war economy. It is only a minority rule sustained by voter suppression and gerrymandering that subverts the will of the people. To redeem the soul of America—and survive a pandemic—we must have a moral fusion movement that cuts across race, gender, class, and cultural divides.

The United States has always been a nation at odds with its professed aspirations of equality and justice for all—from the genocide of original inhabitants to slavery to military aggression abroad. But there have been periods in our history when courageous social movements have made significant advances. We must learn from those who’ve gone before us as we strive to build a movement that can tackle today’s injustices—and help all of us survive.

In the aftermath of the Civil War, African Americans who had just escaped slavery joined with white allies to form coalitions that won control of nearly every southern legislature. These Reconstruction-era political alliances enacted new constitutions that advanced moral agendas, including, for the first time, the right to public education.

During the Great Depression, farmers, workers, veterans, and others rose up to demand bold government action to ease the pain of the economic crisis on ordinary Americans. This led to New Deal policies, programs, and public works projects that we still benefit from today, such as Social Security and basic labor protections.

Pushed by these movements, President Franklin Delano Roosevelt even called in 1944 for an economic bill of rights, declaring: “We cannot be content, no matter how high that general standard of living may be, if some fraction of our people—whether it be one-third or one-fifth or one-tenth—is ill-fed, ill-clothed, ill-housed, and insecure.”

During what I like to call the “Second Reconstruction” over the following decades, a coalition of blacks and progressive whites began dismantling the racist Jim Crow laws and won key legislative victories, including the Civil Rights Act, the Voting Rights Act, and the Fair Housing Act.

With each period of advancement has come a formidable backlash. This is how we find ourselves today, in the year 2020, with levels of economic inequality as severe as during the original Gilded Age a century ago. Since the Supreme Court’s 2013 Shelby decision, Americans have had fewer voting rights protections than we did fifty-five years ago, while thanks to the earlier Citizens United ruling, corporations can invest unlimited sums of money to influence elections.

In response to fair tax reforms, the wealthy have used their economic clout to slash their IRS bills, cutting the top marginal income tax rate from more than 90 percent in the 1950s to 37 percent today. In response to the hard-fought wins of the labor movement, corporate lobbyists have rammed through one anti-worker law after another, slashing the share of U.S. workers protected by unions nearly in half, from 20.1 percent in 1983 to just 10.5 percent in 2018.

Decades after Depression-era reforms, Wall Street fought successfully to deregulate the financial system, paving the way for the 2008 financial crash that caused millions to lose their homes and livelihoods. And the ultra-rich and big corporations have also managed to dominate our campaign finance system, making it easier for them to buy off politicians who commit to rigging the rules against the poor and the environment, and to suppress voting rights, making it harder for the poor to fight back.

Our military budgets continue to rise, now grabbing more than fifty-three cents of every discretionary federal dollar to pay for wars abroad and pushing our ability to pay for health care for all, for a Green New Deal, for jobs and education, and infrastructure, further and further away.

In short, the official measure of poverty doesn’t begin to touch the depth and breadth of economic hardship in the world’s wealthiest nation, where 40 percent of us can’t afford a $400 emergency.

The wars that those military budgets fund continue to escalate. They don’t make us safer, and they’ve led to the deaths of thousands of poor people in Afghanistan, Syria, Somalia, and beyond, as well as the displacement of millions of refugees, the destruction of water sources, and the contamination of the environments of whole countries.

The only ones who benefit are the millionaire CEOs of military companies, who are getting richer every year on the more than $350 billion—half the military budget—that goes directly to their corporations. In the meantime 23,000 low-ranking troops earn so little that they and their families qualify for food stamps.

Key to these rollbacks: controlling the narrative about who is poor in America and the world. It is in the interest of the greedy and the powerful to perpetuate myths of deservedness—that they deserve their wealth and power because they are smarter and work harder, while the poor deserve to be poor because they are lazy and intellectually inferior.

It’s also in their interest to perpetuate the myth that the poverty problem has largely been solved and so we needn’t worry about the rich getting richer—even while our real social safety net is full of gaping holes. This myth has been reinforced by our deeply flawed official measurements of poverty and economic hardship.

The way the U.S. government counts who is poor and who is not, frankly, is a sixty-year-old mess that doesn’t tell us what we need to know. It’s an inflation-adjusted measure of the cost of a basket of food in 1955 relative to household income, adjusted for family size—and it’s still the way we measure poverty today.

But this measure doesn’t account for the costs of housing, child care, or health care, much less twenty-first-century needs like internet access or cell phone service. It doesn’t even track the impacts of anti- poverty programs like Medicaid or the earned income tax credit, obscuring the role they play in reducing poverty.

In short, the official measure of poverty doesn’t begin to touch the depth and breadth of economic hardship in the world’s wealthiest nation, where 40 percent of us can’t afford a $400 emergency.

In a report with the Institute for Policy Studies, the Poor People’s Campaign found that nearly 140 million Americans were poor or low-income—including more than a third of white people, 40 percent of Asian people, approximately 60 percent each of indigenous people and black people, and 64 percent of Latinx people. LGBTQ people are also disproportionately affected.

Further, the very condition of being poor in the United States has been criminalized through a system of racial profiling, cash bail, the myth of the Reagan-era “Welfare Queen,” arrests for things such as laying one’s head on a park bench, passing out food to unsheltered people, and extraordinary fines and fees for misdemeanors such as failing to use a turn signal, and simply walking while black or trans.

We are a nation crying out for security, equity, and justice. We need racial equity. We need good jobs. We need quality public education. We need a strong social safety net. We need health care to be understood as a human right for all of us. We need security for people living with disabilities. We need to be a nation that opens our hearts and neighborhoods to immigrants. We need safe and healthy environments where our children can thrive instead of struggling to survive.

With the coronavirus pandemic bringing our country’s equally urgent poverty crisis into stark relief, we cannot simply wait for change. It must come now.

America is an imperfect nation, but we have made important advancements against interconnected injustices in the past.

We can do it again, and we know how. Now is the time to fight for the heart and soul of this democracy.

***

Rev. Dr. William Barber II is a co-chair of the Poor People’s Campaign: A Call for Moral Revival.

Read more by Rev. Dr. William Barber II

Source: https://progressive.org/magazine/real-epidemic-poverty-barber/

Note: the title of this article, and the purpose of this post, is not meant to diminish the seriousness of the coronavirus pandemic in any way.

29 notes

·

View notes

Link

via Politics – FiveThirtyEight

Graphics by Jasmine Mithani

Congress is back in session, and it has a weighty task before it — figuring out what to do about the economy as COVID-19 infections spike across the country and states roll back their reopenings. One central point of tension: the $600-per-week supplemental unemployment insurance benefit that was enacted in March as part of the CARES Act and is set to expire on July 31.

Democrats have proposed extending the payment until jobless rates in states fall below a certain threshold. Republicans, meanwhile, are leery of continuing the full payments, saying they will discourage people from returning to work. And it’s true that research has shown that many workers are making more money on the beefed-up benefits than they would be at their old jobs.

But in the latest installment of our regular survey of quantitative macroeconomic economists,1 conducted in partnership with the Initiative on Global Markets at the University of Chicago Booth School of Business, the 33 economists in our study collectively thought there was a 59 percent chance that either keeping the payment steady or increasing it to above $600 per week would be most beneficial to the economy. They said there was about a 33 percent chance that reducing the weekly payment to less than $600 would most benefit the economy, and only a 7 percent chance that letting the program completely lapse would be most beneficial. This makes sense considering that another recent IGM survey found that most economists blamed high unemployment on companies that weren’t hiring — not on people choosing not to work because of unemployment payments.

Jonathan Wright, an economics professor at Johns Hopkins University who has been consulting with FiveThirtyEight on the design of the survey, pointed out that some extension of unemployment insurance is important because many workers are still out of a job. States can continue to offer benefits regardless of what the federal government does, but those don’t last forever, either — and some states are less generous than others.

How should Congress handle unemployment insurance?

Likelihood that each federal policy choice would most benefit the entire economy over the rest of 2020, according to economists

Option Probability Keep the weekly payment at $600 37% Reduce the weekly payment to less than $600 33 Increase the weekly payment to more than $600 22 Allow federal pandemic unemployment insurance to completely lapse 7

The survey of 33 economists was conducted July 17-20.

Source: FIVETHIRTYEIGHT/IGM COVID-19 ECONOMIC SURVEY

Of course, the perspectives on Congress’s response are nuanced, and many of the economists think the benefits should ideally be phased out as the economy improves, assuming there are no logistical hurdles. When we drilled into some of the ways that federal policymakers could aid jobless workers, the experts thought there was a 37 percent chance that the best strategy would be to continue paying jobless workers $600 weekly for now but peg federal unemployment benefits to key economic indicators so they become gradually less generous as the economy improves. They said there was a 26 percent chance it would benefit the economy more if the workers were paid less than $600 per week for a fixed period of time, and a 22 percent probability that it would be better to continue paying jobless workers $600 a week even if it meant some would make more than they did while working.

Deborah Lucas, an economist at MIT, said she would opt for temporarily leaving the weekly payment at $600, or even increasing it a bit, although she said the payments should ramp down if the economy improved enough. “The fact that a considerable number of people are making more this way than when they were working seems like a good thing,” she said, adding that this will only be true for low earners, who might otherwise feel pressure to take jobs that would endanger their health. “In effect, it enhances social insurance protections and is a step towards universal basic income, both policies I think would improve social welfare even in the absence of a pandemic.”

Not all of the economists were a fan of expanding or maintaining the $600 weekly payment, though. Annette Vissing-Jørgensen, an economist at the University of California, Berkeley, said it was fundamentally unfair that some essential workers were making less money than nonessential workers who were out of a job. She added that while she’s concerned overall about making it more financially attractive for workers to stay home from their jobs, particularly if hiring starts to pick up again, there “could be a role for continuing some level of extra benefits” in states that are less generous. Others noted that while the extra payment made sense as a short-term stimulus measure, economists might approach the long-term consequences of such a generous supplement differently.

Still, it was notable that the least popular response to the question above was an alternative to the $600-per-week payment that’s been floated by some Republicans, who have proposed a “back to work bonus” for people who return to their jobs instead of continuing to supplement workers’ unemployment benefits. Economists thought there was only a 16 percent chance this would do the most to benefit the economy.

“Continued unemployment support has the twin benefits of alleviating poverty for jobless workers and sustaining consumer demand in the economy,” said Allan Timmermann, professor of finance and economics at the University of California, San Diego. Timmermann has also been consulting with us on the survey. “[It] is viewed as a highly effective tool to prevent the economy from stalling.”

Along similar lines, we asked economists how they would allocate $1 trillion in a hypothetical COVID-19 stimulus package if they wanted to do the most good for the entire economy (with the assumption that the health crisis itself would be addressed with a separate bill). The economists ranked their top three priorities and gave unemployment insurance the highest share of No. 1 responses. But though that benefit was in the top three of priorities for a majority of the experts, at 67 percent, it didn’t see the highest share of overall top-three responses. By that measure, the clear priority according to economists was funding state and local governments — which is consistent with a previous survey in which they thought one of the most likely causes of economic disaster would be an unwillingness to bail out those governments. In this week’s survey, 85 percent of respondents thought that should be among lawmakers’ top three priorities, and 36 percent said it should be No. 1.

What should be the priorities of a federal stimulus?

Priorities for a hypothetical federal stimulus package in order to have the greatest overall economic benefit, ranked by economists

Share of economists who ranked it as priority … Category No. 1 No. 2 No. 3 In Top 3 State and local governments 36% 21% 27% 85% Jobless workers (via unemployment insurance) 39 15 12 67 Small businesses 6 21 21 48 Public K-12 schools 12 15 18 45 Individuals (via stimulus checks) 3 21 12 36 Health care institutions 0 6 9 15 Other 3 0 0 3 Higher education 0 0 0 0 Large corporations 0 0 0 0

The survey of 33 economists was conducted July 17-20.

Source: FIVETHIRTYEIGHT/IGM COVID-19 ECONOMIC SURVEY

“State and local is going to be a huge drag on the economy because they are a sizable share of spending, cannot really run much in the way of deficits, their tax revenue is badly hit and Congress has done little to help so far,” Wright said. So cushioning states and localities could do a lot to support the economy, he said.

Other areas of focus that frequently came up among the economists’ top three priorities were funding for small businesses (48 percent) and public K-12 schools (45 percent) and another round of individual stimulus checks (36 percent). None of our economists, however, thought funding either large corporations or colleges and other institutions of higher learning was a priority.2

In addition to our usual questions about gross domestic product in the second and fourth quarters, we asked the economists to forecast third-quarter real GDP growth in this installment of the survey. The results shed some light on just how much the prospect of a true “second wave” of coronavirus in the winter could slow down economic growth.

On average, economists thought real GDP in the second quarter of 2020 — which ended June 30, with an advance GDP estimate set to be released later this month — declined by an annualized rate of 27 percent compared with the first quarter. They also thought real GDP would grow by about 8 percentage points quarter-over-quarter in the third quarter, with an upper-bound estimate of 17 percent and little chance of negative growth again. But their forecasts looked bleaker for the fourth quarter, with a median forecast of 3 percent growth, a 90th-percentile forecast of 9 percent and a 10th-percentile forecast in the red again (at -3 percent) — all more pessimistic than in the third quarter.

Some of that reflects the increased economic activity of the summer (relative to the early spring), even with the virus circulating around the country; the likelihood of some kind of third-quarter bounce back was high, given how bad economists think second-quarter GDP will end up. But the forecast also speaks to the uncertain course that the virus — and therefore, the economy — might take over the rest of 2020.

Robert Barbera, an economist at Johns Hopkins University, said part of the problem in forecasting quarterly shifts is that month-to-month change can be so extreme. His forecast for the third quarter was less optimistic because he expected most of the initial bounce back to happen in May and June, which are both part of the second quarter. The third quarter might see an uptick in August and September and look quite a bit better than the second quarter, he said, but that’s partially because the second quarter was so bad. Predicting the fourth quarter is even more difficult — in part because a bounce back in the economy is so dependent on Americans’ willingness to resume ordinary life.

However the course of the recession plays out, our economists think America could be due for a massive wave of personal bankruptcies in the second half of the year. During the first half of 2020, total bankruptcy filings — the vast majority of which were by individuals — were actually down 23 percent relative to the first half of 2019, according to court data from Epiq AACER. But don’t be fooled: That was almost certainly because of the heavy use of grace periods and extensions by creditors, which will eventually expire (if they haven’t already). In our survey, 67 percent of economists thought total filings would increase significantly in the second half of 2020 relative to the second half of 2019; only 6 percent thought they would see the same kind of year-over-year decrease in the second half of 2020 that they saw in the first half.

Taken as a whole, the economic picture painted by this week’s survey is no brighter than in previous installments. The panel’s predictions for future GDP have scarcely budged over the past two weeks, and the experts remain wary that whatever gains the economy is making over the summer could be wiped out by the virus before year’s end. But they also clearly think Congress has a few tools at its disposal to avoid making the recovery harder than it needs to be. The big question is — will policymakers use them?

3 notes

·

View notes

Text

Explore why people choose bail bonds services in Los Angeles, California. Understand the benefits and reasons for using bail bonds in this infographic

#bail bonds in california#acme bail bonds#bail money financer#fast bail bonds in california#bail money financer in california#bail bonds#california

0 notes

Text

A California man has pled guilty to concealing his mother's death for three decades and collecting more than $800,000 in benefits meant for her.

Donald Felix Zampach, 65, of Poway, California, faces up to 25 years in prison after pleading guilty in federal court this week to money laundering and Social Security fraud, admitting he hid the death of his mother, who died in 1990, and forged her signature on documents and income tax returns to continue getting her government benefits, according to the U.S. Attorney's office for the Southern District of California.

“This crime is believed to be the longest-running and largest fraud of its kind in this district,” said U.S. Attorney Randy Grossman in a news release. “This defendant didn’t just passively collect checks mailed to his deceased mother. This was an elaborate fraud spanning more than three decades that required aggressive action and deceit to maintain the ruse."

Zampach told authorities that before his mother died in Japan in 1990, he fraudulently conveyed her home to himself and filed for bankruptcy. After she died, he forged her signature on eligibility certificates to continue receiving her widow’s pension from the Social Security Administration and an annuity from the Department of Defense Finance Accounting Service, the attorney's office said.

Zampach also said he used his mother’s identity to open credit accounts with at least nine different financial institutions, causing them to suffer a loss of more than $28,000, authorities said. Zampach said he laundered the stolen money to pay off the mortgage on his Poway home. Overall, Zampach said he received at least $830,238 in stolen public money between November 1990 and September 2022.

"He filed false income tax returns, posed as his mother and signed her name to many documents, and when investigators caught up to him, he continued to claim she was still alive," Grossman said. "As a result of this fraud, he received more than $800,000 in stolen public money."

Under the plea agreement, Zampach has agreed to pay more than $830,000 and forfeit his Poway home in restitution. He was released on bail pending a Sept. 20 sentencing hearing.

6 notes

·

View notes

Text

Sam Bankman-Fried, the controversial founder of the FTX Cryptocurrency exchange, has once more thrust himself into the spotlight, seeking his release from incarceration at the Metropolitan Detention Center in Brooklyn. This development has ignited significant public and media Interest, shedding light on the ongoing legal and personal challenges he faces. Last Friday, legal counsels representing Bankman-Fried submitted a fresh communication to the judge, alleging that the prosecution has not adequately supplied the defendant with the essential computer resources required for him to analyze the massive volume of documents linked to the dramatic downfall of the Cryptocurrency exchange in November of last year. Bankman-Fried’s trial involves a range of serious charges, including wire fraud, campaign finance violations, and money laundering. The case is highly complex and involves millions of pages of evidence that prosecutors have gathered over several months. Jail Internet Is Horrible, Sam Bankman-Fried Lawyers Claim The unreliable internet connection within the federal jail has led Sam Bankman-Fried’s legal team to reiterate their request for his early release. “The defendant cannot prepare for trial with these kinds of limitations,” Bankman-Fried’s attorneys said in a letter, which also includes complaints the defendant cannot bring food and water to the visitor access room. bitcoin yet to make a significant move to regain footing on $26K level. Chart: TradingView.com In a legal case overseen by Judge Lewis Kaplan, there have been ongoing disagreements between both parties regarding Sam Bankman-Fried’s computer access. These disputes involve issues such as battery life and the logistics of escorting him to the courthouse twice a week so he can use an internet-connected device. Based on the statements made by his lawyers, the government had given assurances that Bankman-Fried would be granted News/sam-bankman-fried-demands-pre-142805890.html" target="_blank" rel="noopener nofollow">access to a laptop on weekdays between 8 a.m. and 7 p.m. However, in practice, these promised hours have not been provided. Sam Bankman-Fried departs from court in New York, Feb. 16, 2023. Image credit: Stephanie Keith/Bloomberg/Getty Images On Football Games & Long Prison Time Bankman-Fried faced DOJ charges and agreed to extradition from the Bahamas, where his company FTX was based. He was initially granted bail to live in Palo Alto in California with his parents but violated bail conditions by allegedly tampering with witnesses and using a VPN to watch football games. His bail was revoked after he leaked an FTX executive’s private diary to a reporter, leading to his detention in Brooklyn. The extensive evidence reflects the intricate nature of the case that Sam Bankman-Fried is facing, requiring in-depth analysis of digital trails, financial records, and transactions across various individuals and entities. He could be sentenced to up to 115 years behind bars if he is convicted and given the maximum sentence.

0 notes

Text

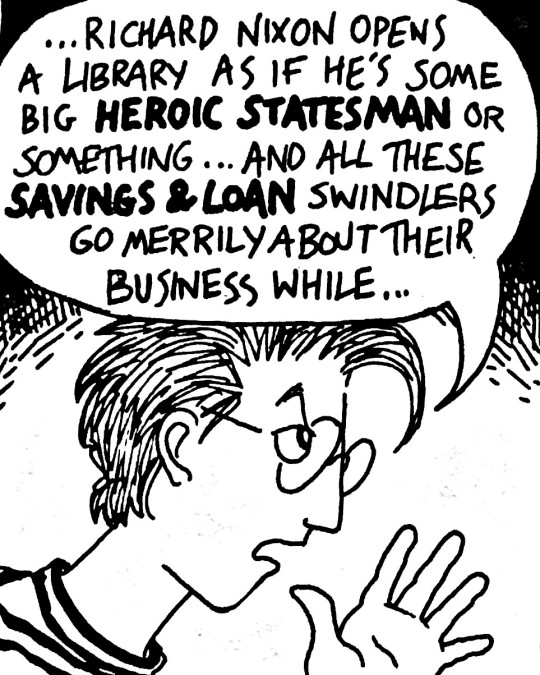

The S&L crisis perfected finance crime

When the Great Financial Crisis hit, suddenly there was a lot of talk about the Savings & Loan crises of the 1980s and 90s. I was barely a larvum then, and all I knew about S&Ls I learned from half-understood dialog in comics like Dykes to Watch Out For and Bloom County.

As the GFC shattered the lives of millions, I turned to books like Michael W. Hudson’s THE MONSTER to understand what was going on, and learned that the very same criminals who masterminded the S&L crisis were behind the GFC gigafraud:

https://memex.craphound.com/2011/03/07/the-monster-the-fraud-and-depraved-indifference-that-caused-the-subprime-meltdown/

Hudson’s work forever changed my views of Orange County, CA, a region I knew primarily through Kim Stanley Robinson’s magesterial utopian novel PACIFIC EDGE, not as the white-hot center of the global financial crime pandemic.

https://memex.craphound.com/2015/01/15/pacific-edge-the-most-uplifting-novel-in-my-library/

That realization resurfaced today as I read the transcript of UMKC Law and Econ prof Bill Black’s interview with Paul Jay on The Analysis, when Black says, “Orange County is the financial fraud capital of the world, not America, the world.”

https://www.youtube.com/watch?v=jFH5-5D5_Lc

Black is well-poised to tell the tale of the S&L crisis. He served as a bank regulator during the crisis, and his notes on the “Keating 5” meeting were the turning point for public and Congressional attention to the crime:

https://theanalysis.news/economy/the-best-way-to-rob-a-bank-is-to-own-one-bill-black-pt-1/

In 1998, he finished a criminology doctorate at UC Irvine (in Orange County!) on the S&L frauds, entitled “The Best Way to Rob a Bank is to Own One,” a title he used for his 2005 book (updated in 2013) on the scandal:

https://utpress.utexas.edu/books/blab2p

The S&L crisis shares a lot in common with today’s financial crimes, but it had one key difference: ultimately (with Black’s help), more than 30,000 criminal referrals were made against the bankers involved in the crisis, and more than 1,000 were convicted of felonies.

The story of the S&L crisis is both a roadmap for holding finance criminals to account (a roadmap we threw away and forgot about) and a roadmap for committing gross acts of financial crime with impunity (which the finance sector studied carefully and keeps close its heart).

Black calls finance a “crimogenic environment,” in where deregulated institutions become pathogenic, “like a cesspool that produces lots of bacteria and viruses and such and causes lots of infections.”

The S&L crisis began with the Carter-Ronald deregulatory blitz. Both presidents assumed that because S&Ls (a kind of bank) in California and Texas were doing really well after deregulation, that meant CA and TX had nailed it and their example could be expanded nationwide.

In reality, the rosiness of the California and Texas S&Ls’ books was the result of “control fraud,” when a person who controls the bank is stealing from it.

Black likens this to a homeowner who commits insurance fraud — an ultimate insider, who knows the code to de-activate the alarm system and also knows just where the most valuable items are kept.

The major control fraudster of the S&L crisis was Charles Keating, a “top 100 granter” who was among the 100 highest donors to Reagan and Bush I. Keating has stolen a vast fortune from Lincoln Savings, and he was able to trade some of that loot for political cover.

Keating hired Alan Greenspan (!) to lobby for him, and Greenspan suborned five senators (the “Keating Five”) who threatened regulators with dire consequences if they didn’t stop digging into S&Ls.

This was also a priority for Reagan, whose plan for vast tax-cuts for the wealthy might stumble if it the public found out that the US government needed billions to bail out these walking-dead fraud zombies.

Reagan turned to Ed Gray, a PR guy, to run the S&L operation. Gray was hand-picked by the S&L’s trade association, and they told him flat out that he was there to make S&Ls look good — not to blow them up by investigating their balance-sheets.

The problem is that Gray — who was a hardcore Reaganite partisan and deregulation true believer — was honest, and the fraud was so obvious. The Texas S&Ls were originating fraudulent loans to build housing tracts that didn’t exist.

When Gray went out to look at these building sites, he just found endless rows of desolate concrete pads — he called them “Martian landing pads” — and abandoned ruins. These were the collateral on billions in loans!

Gray is a believer in sound finance, and this is undeniable evidence that deregulation has led to catastrophically unsound practices, so he starts imposing regulation on the S&L sector.

Keating pulls strings to sideline Gray, but Gray keeps pushing. Keating gets the leadership of both parties in the House to sponsor legislation ordering him to stop. He keeps going.

Donald Regan — an ex-Marine who went from CEO of Merrill Lynch to Reagan’s Chief of Staff — leans hard on Gray, but Gray won’t stop.

The Office of Management and Budget swears out a criminal complaint against Black for closing too many S&Ls. He won’t stop.

They go after Gray’s guy in Texas, Joe Selby, a former acting Comptroller of the Currency with impeccable credentials, demanding that Gray fire Selby. Democratic Speaker Jim Wright says Selby should be fired because he’s gay. Gray won’t budge.

Homophobia turns out to be a powerful weapon for criminal impunity. Keating sued Black and the Federal Home Loan Bank of San Francisco, claiming the bank’s gay employees had conspired against Keating because Keating was an evangelical Christian.

Gray took finance crime seriously. He had two priorities: one, eject anyone committing fraud from working at any financial institution, and; two, criminally and civilly charge those former execs and take back all the money they stole and ruin them financially.

Black and colleagues took this to heart, making thousands of criminal referrals. When law enforcement refused to act on these, they started publishing their referrals, and newspapers published stories about how none of these criminal referrals were leading to prosecutions.

Gray eventually gets sidelined by a “team player,” the disgraceful Danny Wall, who studiously ignores all the crime that has been uncovered. But then Bush I replaces him with Tim Ryan, whose marching orders are to root out finance crime.

Ryan ultimately made over 30,000 criminal referrals over the S&L scandal, and brought prosecutions against elite criminals, including Neil Bush, the son of the President of the United States of America.

Black: “Tim Ryan sacrificed his career for the public knowingly…he’s been unemployable since.”

And as for Bush I, his first major legislative priority became the removal of financial crime from the jurisdiction of independent watchdogs, so this would never happen again.

This is as far as the interview gets (it’s part one of nine!), but it’s already answering some of the most important questions the Great Financial Crisis raised, like, “Why didn’t any of the bankers who stole trillions from the world go to jail?”

Image: Dykes to Watch Out For strip #90 (1990), “The Solution,” Alison Bechdel https://forums.somethingawful.com/showthread.php?threadid=3908728&userid=99998&perpage=40&pagenumber=10

298 notes

·

View notes

Text

~When Love & Hate Collide -- Ch.1~

Moodboard made by myself @badwolf-in-the-impala. I do not own or take credit for any photos used.

Edit to add: So I’m a ditz and forgot to change the ‘82 to ‘81, after doing the research and realizing that Crüe was touring in Canada in ‘82...and I had wanted this to start this off before they got actively into touring and became a huge deal...So keeping it in ’81 when they were just getting popular and shit...So yeah, thanks for coming to my TED talk on why I’m an idiot lol enjoy!

A/N: So this is by no means going to be perfect, I’m sure...I’ve already re-written it twice, cause I’m a nitpick **insert nervous laughter here** But this is based off the movie ((The Dirt)) version of the band. Iwan!Mick needs more love/appreciation! Anywho, I hope you guys like it.

Pairings: Iwan Rheon!Mick Mars x OC ((Faceclaim - Alison Mosshart))

Rating: Mature/18+

Chapter Warnings: Language, smoking, mentions of drug use, implied abuse...

Word Count: 5,267

---------------------------------------

Summer - 1981

Roxanna Hale traveled South, down I-5 to West Hollywood, CA, from Seattle WA. The old 1969 -- Black with White racing stripes -- Chevelle SS that she drove, rumbled along loudly, headlights illuminating the dark stretch of blacktop as Dawn slowly began to break and light the sky. The muscle car blowing around another line of cars with ease, the windows down and rock music blaring from the speakers as she fought to keep herself awake, lighting what felt like her hundredth cigarette.

She exhaled a cloud of smoke from the long drag she took, letting it trail from her red lips slowly as her thumb flicked against the filter, ashing it out the open window. The nicotine did little to quell the anger that still surged through every fiber of her body, as she sped towards her destination.

The last thing she had expected to happen when she woke up yesterday morning, was to walk in on her ex screwing some other chicks brains out...The fact that chick had turned out to be her best friend, and fellow band mate, only added insult to injury. Leading Roxxy to pack all of her shit -- music material and demo included -- before taking off for good; the incident occurring at a less than convenient time.

They had been scheduled, for today as a matter of fact, to audition for a spot as ‘Opening Act’ for another, more well known, band that was getting ready to kick off a tour. Nothing huge, but it was a long awaited opportunity that Roxxy had been waiting on for a very long time. She had headed over to the apartment where her -- now -- ex finance lived to start packing up their gear in preparation for the 18 hr drive to California, they had ahead of them when she walked in on the situation in question.

“C’mon, Baby!” Her ex begged as she continued shoving what she could fit into her backpack. “It- It was just an accident. I swear!” He added, still clinging to the sheet wrapped around his waist as he took a step back; Roxxy rounding on him.

“So what? You just like slipped and accidentally landed with your dick in her vagina?! Is that what you’re trying to tell me?” She nearly screamed, getting in his face. Roxxy’s anger only worsening as she watched him stutter over his words, trying to come up with some bullshit way to justify what he had done, but it was far too late for that as Roxxy cut him off before he could even finish. “I’m not a fucking moron, Kyle!

“Please, Baby, don’t do this! Not now, not with the audition tomorrow!”

“Yeah? Well maybe you should’ve thought that over better before you stuck your cock in my best fucking friend, the lead goddamn singer of MY band!” Roxxy seethed as she slung the backpack over her shoulder and picked up her guitar case as she turned for the door; stopping abruptly as Kyle grabbed her roughly by the upper arm and tried to drag her back. “Let go of me!” She rounded on him as she yanked her arm free, more than a little caught off guard by the sting of his hand as it connected with the right side of her face.

“You don’t get to fuckin’ talk too me like that, bitch--” Kyle had started but was cut off by the cold laugh that fell from Roxxy’s lips as she sneered up at him, wiping at the small trickle of blood from her lower lip with the back of her hand.

“Why, because you think you’re somebody fucking important now? Newsflash, you better think again, Baby.” Roxxy replied, making sure to emphasise the sarcasm in her voice as she called him ‘Baby’. “Because I built this, all of it!” She gestured around his living room at all the band equipment and gear laying around. “You, and this fucking shithole of a band, are nothing without me. So, you know, have fun playing dive bars and garage gigs for the rest of your life. ‘Cause I’m out!”

~

Her blood boiled as the memory of the argument replayed over and over in her mind. She had spent the last three and half years busting her ass for that band; HER band -- working two jobs and pinching pennies just to be able to play shitty dive bars and even shittier backyard parties, on the weekends.

Roxxy had been through hell and back, bending herself over backwards nearly her whole entire miserable, fucking life to try and achieve her dreams; and just when they were about to finally get their break...The whole fucking world comes crashing down on her. Just like it always does.

Now here she was, right back at square one with no money, no band, and the fucking audition of a lifetime that was now hanging in the balance...And as if her life couldn’t get any worse, what ever higher power that had been shitting on her life, apparently decided that now was the perfect moment for her car to blow a head gasket; still some 20-30 miles outside of her destination.

“You have got to be fucking kidding me.” Roxxy whined as she hit her hazard lights and coasted the car off onto the shoulder of the road before cutting the engine and popping the hood as she bailed out to take a look. Waving her hand in front of her face with a cough as she lifted the hood and a cloud of white smoke from the overheated engine rolled up into her face, causing her to she take a step back.

“Son of a bitch!” She slammed the hood shut, too dark still to see much of anything, but already knowing the engine was fucked as she rested her hands against the car, attempting several deep breaths so she didn’t lose her shit, completely; not that it helped. Roxxy picking up the nearest rock and chucking it into oncoming traffic as she screamed out angrily, fisting both hands into her dark hair before tossing them up entirely.

“Seriously! What the fuck have I done in my life to deserve this fucking shit?!” Roxxy yelled up at the sky. “Because I sure as shit don’t fucking remember!” She added, standing there for a few seconds longer, as if she would actually receive some kind of answer. But only the sounds of passing traffic surrounded her. Leaving her to heavily sigh as she grabbed her bag and guitar case from the backseat before locking up her beloved car, and began walking.

Praying that this day didn’t get any worse...Someone clearly taking that as a challenge as the next 8 hrs of walking only brought more hell down on her life. From being pelted by rocks kicked up by passing cars, too nearly being run over by an 18-wheeler that had veered off the road at one point -- causing her to bail off into the bar ditch in order to avoid being turned into roadkill; the gravel biting into her skin, scraping up her arms and hands.

But the icing on the cake had been the sudden surprise of a thunderstorm that now had her drenched. Leaving her exhausted and more than a little irritable as she finally made it to the Bar she and her band has been signed up to audition at...Four hours earlier. Roxxy made her way into the nearest restroom as she pushed her way inside and through the groups of people that crowded the place -- for what appeared to be some kind of open mic deal. Doing her best once making into the bathroom to clean herself up before finding an empty booth in a dark corner to hide herself in for a while; after putting in a phone call to towing service.

“Can I get’cha something, Sweetheart?” A pretty blonde woman -- that Roxxy assumed to be a bartender -- asked as she made her rounds on the floor; breaking Roxxy’s attention away from the man up on stage she had been watching, as she dug around in the back pocket of her jeans for her wallet, a frown tugging down the corners her mouth as she opened it to reveal her last five dollars.

“Um...Just a coffee, please?” Roxxy forced a soft smile as she pulled a couple dollars out and tried to hand them over, but the woman simply shook her head and held up her hand with a polite smile as she gave Roxxy a wink and said, “Keep it, Doll. Coffee’s on the house.” Roxxy heaved a sigh as the woman disappeared, returning only a few minutes later with a hot cup of coffee and a clean, dry, bar towel.

“Thank you.” Roxxy gave a genuine smile this time around as she accepted the towel and brought it up to her dark hair, the woman giving her a polite nod before turning to head back to her post behind the bar; Stopping when Roxxy spoke up again, catching her attention. “Hey, what does one need to do to go up on stage?”

“Nothin’ special.” The woman shrugged, glancing over to notice the guitar case that sat propped up against the booth. “Open mic. First come, first serve. Just give that man up there by the stage your name and he’ll put you in the line up.” She smiled before returning behind the bar, leaving Roxxy to contemplate if she was up for it or not. But at this point, what more did she have to lose? Aside from her dignity, maybe.

~

The first thing that caught Mick’s attention was the sound of the guitar and the heavy riff that fell effortlessly from it as her fingers changed over the strings with ease. The smoky, alluring sound of her voice filling the bar speakers as the words from Pat Benatar’s, ‘Heartbreaker’, fell from her lips, capturing the attention of the small audience that had gathered -- as well as his own band, who had been enjoying drinks. The room falling silent for a brief moment before people got into the rhythm of the song and actually started enjoying themselves; unlike with most of the prior participants whose performances had gone ignored. Save for a few of the die hard local fans that cheered them on.

They had seen their fair share of dive bar performers before, but never someone as confident as the dark haired woman up on stage now, who was venturing into territory few women had dared to dive into, yet, in this industry. Her rough, road worn appearance only adding to the edge she already had over most of tonight's participants; which drew the crowd further in as their curiosity peaked. It being easy enough to tell that she wasn’t a local by her ballsy taste in music.

“Hooooly shit!” Tommy was the first to speak up -- over the music -- among their group as he glanced excitedly between his friends and fellow bandmates, and the woman up on stage. “Are you dudes seeing this?!”

Mick simply rolled his eyes behind the pair of dark aviators he worse, shaking his head at the obviously stupid question...wondering for a moment why he ever agreed to put up with these dumb asses he called friends. The rest of the guys smirking and giving their drummer shit before ordering another round of drinks and returning to their conversation. But not Mick; no. He never took his eyes off the woman up on stage.

There were a few things he found intriguing about her and not all of it had to do with her looks; not that he was complaining. She was very easy on the eyes, as far as he could tell from his seat at the end of the bar. Her dark, layered, mess of feathered hair hung down in her face as she sung. Hiding behind it the striking features of her face. Full lips, high cheekbones, sharp jawline...it was like staring at God’s greatest creation. She was clad in a pair of ripped slim fit denims, a cropped muscle tank, that showed plenty of midriff, and a pair of combat boots. Rings and leather cuffs adorned her fingers and wrists.

What truly caught his attention though, was the guitar she played, or rather, the fact that she played it left handed...and upside down. But with her level of skill and confidence, you would never have been able to tell the difference, unless you knew exactly what you were looking at; as Mick did, obviously having played for enough years himself to know. She was good, to good in fact. Which left him to ponder how a woman with that kind of natural talent was still playing the bar/nightclub scene.

“Bitch has some pipes.” Vince mused with an impressed smirk as he passed Mick a shot, forcing him out of his thoughts as he finally tore his gaze away from the stage, give a curt nod to Vince in reply before he said, “She’s got some experience, that’s for sure.” before knocking back the contents of his shot glass. “She plays with a confidence not many possess...especially chicks.” Mick added.

“Yeah, dude, she may even be better than you are.” Tommy joked drunkenly, flinching as Nikki’s hand connected with the back of his head, and Mick rolled his eyes again in return.

“Maybe in your fuckin’ dreams...fuckin’ drummer.” Mick scoffed with a mildly irritated sneer. “She’s good, but not that good.” Mick added with half a lie. Because she really did have talent and with the right person to teach her, she could definitely go places.

“Don’t listening to him, Mick.” Nikki chuckled. “We’re jus’ givin’ you shit.” He added, earning a mumbled, “Whatever...fuckin’ teenagers.” From Mick as he turned his attention back to the woman on stage. Watching with great intent as she closed out the song with the it’s Solo; playing right over the top of other guitarist. The bar erupted into applause once she finished, giving a brief, yet humble bow, before unplugging the Fender Starcaster she played, that she carefully placed it back into its case before jumping off the stage and retreating back to the far corner booth she had been hiding in earlier. Mick and his group watching her for a bit out of curiosity and talking among themselves about her performance.

“Dude’s, we should like totally invite her the party later!” Tommy stated before taking another shot, the rest of the guys giving a mutual nod of agreement; even Mick. Though his aviator covered blue eyes never left the mysterious woman who sat alone, just across the bar.

~

An hour or so had passed since Roxxy returned to hiding in her booth; going through two more cups of coffee, intending on staying until they closed and had to kick her out. Not looking forward to having to potentially spend a night outside, especially if the weather didn’t straighten up before then. A small jolt of anxiety surging through her as the bartender approached her booth, again; fearful that was about to become a possibility.

Roxxy was just about to speak up -- shit, she’d beg if she had too -- in order to stay as long as possible, when the woman set a whiskey in front of her on the table. Earning a very confused look from Roxxy as she looked up.

“From the gentleman, at the end of the bar.” The blonde yelled over the music, vaguely gesturing to a group of men who had their backs turned, up at the bar. “He said you looked like you could use something a little stronger than the coffee.” Roxxy’s lips curved down in a slight frown as she looked down at herself, giving a sigh.