#annual enrollment period for medicare

Text

How to Sign Up - A Guide to Medicare Enrollment

Discover how to enroll in Medicare with a step-by-step guide featuring Access Health Care Physicians, LLC. Simplify your Medicare sign-up process today.

#When to Sign Up for Medicare If Still Working#When to Sign Up for Medicare Before Turning 65#Sign Up for Medicare#How to Sign Up for Medicare#annual enrollment period for medicare#medicare enrollment period

0 notes

Photo

Medicare Annual Enrollment Period Guide

Having trouble reading infographic here?

Check out the full size infographic at - https://infographicjournal.com/medicare-annual-enrollment-period-guide/

2 notes

·

View notes

Text

Medicare Annual Election Period Soon

Medicare Annual Election Period Soon

For all existing and (hopefully future clients), here is what you should do in order to retain our free Medicare guidance. We do not make outgoing phone calls because we do not want to be wrongfully accused of aggressive marketing and I am personally dismayed when I hear of tactics that have been deployed by my counterparts. Gross.

Our Medicare Enrollment…

View On WordPress

#Benefits#Subscriber#Comprehensive Financial Planning#Paid Subscriber#Part D#Guidance#Paid Subscribers#Medicare Enrollment#Financial#Medicare Annual Election Period#Financial Planning#Medicare#Medicare Advantage#enrollment#AI#PPO

0 notes

Text

Medicare Open Enrollment Guide

Medicare Open Enrollment period kicks off October 15 and continues through December 7. During this time-frame, most Medicare beneficiaries can make necessary changes to their health and drug coverage options.

If you missed your Initial Enrollment Period in October or qualify for a Special Enrollment Period, now is your only chance to enroll for Parts A and B this year.

Medicare Open Enrollment…

View On WordPress

#AEP#annual enrollment period#change medicare supplement#changing medicare coverage#Medicare#Medicare eligibility#open enrollment#Original Medicare

0 notes

Text

By Jake Johnson

Common Dreams

Oct. 4, 2023

"Medicare Advantage is just another example of the endless greed of the insurance industry poisoning American healthcare," says a new report from Physicians for a National Health Program.

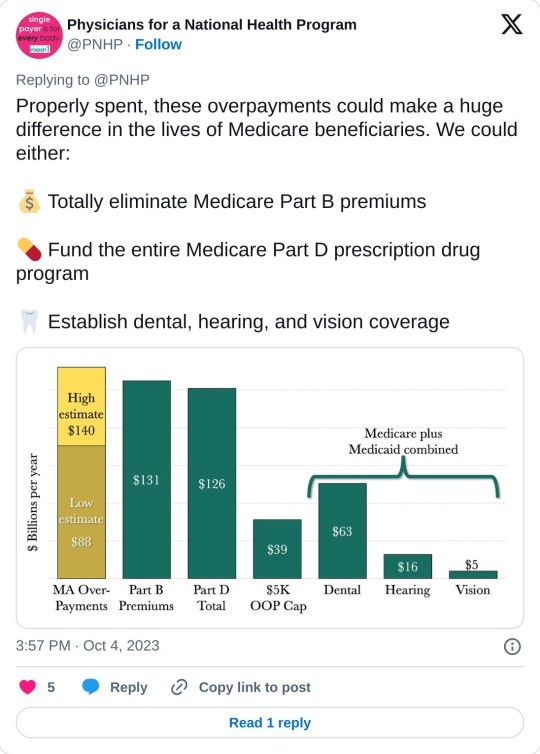

A report published Wednesday estimates that privately run, government-funded Medicare Advantage plans are overcharging U.S. taxpayers by up to $140 billion per year, a sum that could be used to completely eliminate Medicare Part B premiums or fully fund Medicare's prescription drug program.

Physicians for a National Health Program (PNHP), an advocacy group that supports transitioning to a single-payer health insurance system, found that Medicare Advantage (MA) overbills the federal government by at least $88 billion per year, based on 2022 spending.

That lower-end estimate accounts for common MA practices such as upcoding, whereby diagnoses are piled onto a patient's risk assessment to make them appear sicker than they actually are, resulting in a larger payment from the federal government.

But when accounting for induced utilization—"the idea that people with supplemental coverage are likely to use more health care because their insurance pays for more of their cost"—PNHP estimated that the annual overbilling total could be as high as $140 billion.

"This is unconscionable, unsustainable, and in our current healthcare system, unremarkable," says the new report. "Medicare Advantage is just another example of the endless greed of the insurance industry poisoning American healthcare, siphoning money from vulnerable patients while delaying and denying necessary and often lifesaving treatment."

Even if the more conservative figure is accurate, PNHP noted, the excess funding that MA plans are receiving each year would be more than enough to expand traditional Medicare to cover dental, hearing, and vision. Traditional Medicare does not currently cover those benefits, which often leads patients to seek out supplemental coverage—or switch to an MA plan.

The Congressional Budget Office has estimated that adding dental, vision, and hearing to Medicare and Medicaid would cost just under $84 billion in the most costly year of the expansion.

"While there is obvious reason to fix these issues in MA and to expand traditional Medicare for the sake of all beneficiaries," the new report states, "the deep structural problems with our healthcare system will only be fixed when we achieve improved Medicare for All."

Bolstered by taxpayer subsidies, Medicare Advantage has seen explosive growth since its creation in 2003 even as it has come under fire for fraud, denying necessary care, and other abuses. Today, nearly 32 million people are enrolled in MA plans—more than half of all eligible Medicare beneficiaries.

Earlier this year, the Biden administration took steps to crack down on MA overbilling, prompting howls of protest and a furious lobbying campaign by the industry's major players, including UnitedHealth Group and Humana. Relenting to industry pressure, the Biden administration ultimately agreed to phase in its rule changes over a three-year period.

Leading MA providers have also faced backlash from lawmakers for handing their top executives massive pay packages while cutting corners on patient care and fighting reforms aimed at rooting out overbilling.

As PNHP's new report explains, MA plans are paid by the federal government as if "their enrollees have the same health needs and require the same levels of spending as their traditional Medicare counterparts," even though people who enroll in MA plans tend to be healthier—and thus have less expensive medical needs.

"There are several factors that potentially contribute to this phenomenon," PNHP's report notes. "Patients who are sicker and thus have more complicated care needs may be turned off by limited networks, the use of prior authorizations, and other care denial strategies in MA plans. By contrast, healthier patients may feel less concerned about restrictions on care and more attracted to common features of MA plans like $0 premiums and additional benefits (e.g. dental and vision coverage, gym memberships, etc.). Insurers can also use strategies such as targeted advertising to reach the patients most favorable to their profit margins."

A KFF investigation published last month found that television ads for Medicare Advantage "comprised more than 85% of all airings for the open enrollment period for 2023."

"TV ads for Medicare Advantage often showed images of a government-issued Medicare card or urged viewers to call a 'Medicare' hotline other than the official 1-800-Medicare hotline," KFF noted, a practice that has previously drawn scrutiny from the U.S. Senate and federal regulators.

PNHP's report comes days after Cigna, a major MA provider, agreed to pay $172 million to settle allegations that it submitted false patient diagnosis data to the federal government in an attempt to receive a larger payment.

Dr. Ed Weisbart, PNHP's national board secretary, toldThe Lever on Wednesday that such overpayments are "going directly into the profit lines of the Medicare Advantage companies without any additional health value."

"If seniors understood that the $165 coming out of their monthly Social Security checks was going essentially dollar for dollar into profiteering of Medicare Advantage, they would and should be angry about that," said Weisbart. "We think that we pay premiums to fund Medicare. The only reason we have to do that is because we're letting Medicare Advantage take that money from us."

13 notes

·

View notes

Text

Guiding Your Medicare Journey: Exploring Medicare Nationwide

Introduction: Accessible Healthcare Solutions with Medicare Nationwide

Medicare Nationwide serves as a guiding light for individuals navigating the complexities of Medicare across the United States. Committed to providing accessible healthcare solutions, Medicare Nationwide offers a comprehensive range of services and resources to empower beneficiaries in making informed decisions about their healthcare options.

Comprehensive Coverage Understanding

Understanding the nuances of Medicare coverage is essential for maximizing healthcare benefits. Medicare Nationwide provides extensive information on each aspect of Medicare. From Medicare Part A, which covers hospital stays and inpatient care, to Medicare Part B, encompassing outpatient services and medical supplies, Medicare Nationwide ensures beneficiaries have a thorough understanding of their coverage options.

Enrollment Assistance

Enrolling in Medicare can be overwhelming, especially for newcomers. Medicare Nationwide offers enrollment assistance to guide beneficiaries through the process with ease. Whether individuals are enrolling for the first time or exploring coverage options during the annual enrollment period, Medicare Nationwide provides guidance and support. By explaining enrollment periods, eligibility criteria, and coverage options, Medicare Nationwide empowers beneficiaries to make well-informed decisions.

Comparing Medicare Advantage Plans

Medicare Advantage plans, or Medicare Part C, provide an alternative way for beneficiaries to receive their Medicare benefits. Medicare Nationwide helps beneficiaries compare available Medicare Advantage plans in their area. By evaluating plan features, costs, and coverage options, beneficiaries can choose the plan that best fits their healthcare needs and financial situation.

Understanding Prescription Drug Coverage

Prescription drug coverage, known as Medicare Part D, is crucial for many beneficiaries. Medicare Nationwide offers valuable insights into Medicare Part D plans, including coverage details, formularies, and costs. Understanding prescription drug coverage options allows beneficiaries to access necessary medications affordably.

Exploring Supplemental Coverage Options

In addition to Original Medicare and Medicare Advantage plans, beneficiaries may consider Medicare Supplement Insurance (Medigap) policies. Medicare Nationwide provides guidance on selecting the appropriate Medigap plan, including coverage options, costs, and enrollment requirements. This supplemental coverage fills gaps in Medicare coverage, providing added peace of mind.

Conclusion: Empowering Healthcare Decision-Making

In conclusion, Medicare Nationwide is a trusted resource for navigating the complexities of Medicare. By providing comprehensive coverage understanding, enrollment assistance, and support in exploring coverage options, Medicare Nationwide empowers beneficiaries to make informed decisions about their healthcare coverage. With Medicare Nationwide's guidance, beneficiaries can confidently navigate the Medicare landscape and access the healthcare they need.

2 notes

·

View notes

Text

Senior Insurance Services in Florida

Whether you are looking for the latest Medicare plan information, or are considering Medicare Supplements, Senior Insurance Services in Florida can help you get the information you need. This company provides assistance with Claim and Carrier issues, and offers information on Medicare Part C (Medicare Advantage Plans) and Medicare Part D (prescription drug coverage).

Senior Life Services is an insurance company that offers final expense insurance. These plans pay medical bills that are incurred when a policyholder dies. They can also cover the cost of non-emergency medical transportation. These plans usually have affordable premiums, and have no health requirements. However, they are not the only options. In fact, there are many other life insurance companies that offer policies for the mature market.

Medicare Advantage plans are private insurance plans that combine Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) into one plan. These plans are usually offered through private insurance companies, and they offer nearly the same benefits as Original Medicare. These plans have a variety of eligibility requirements.

Medicare Advantage plans typically have a limited enrollment period. In addition, you may have to be enrolled in Original Medicare to apply. There are also different kinds of plans available, including health maintenance organizations (HMOs) and preferred provider organizations (PPOs). These plans stack multiple benefits onto a single plan, and have different out-of-pocket costs and referral rules.

Medicare Advantage plans have been very popular in Florida. The benefits of this type of insurance include nearly the same benefits as Original Medicare, along with valuable extra services. They can help pay for preventive health screenings and lab tests, and they may also cover services delivered during an inpatient hospital stay. In addition, they can offer additional benefits that are not included with Original Medicare, such as senior health sessions. However, Medicare Advantage plans are not free, and the cost can vary by ZIP code.

Medicare Advantage plans are often available as preferred provider organizations (PPOs) or health maintenance organizations (HMOs). However, there are also plans that are offered as free Medicare Advantage plans, such as those offered by the State of Florida. These plans may also offer additional benefits, such as non-emergency medical transportation and senior health sessions. However, these plans are not available in every county in Florida.

Medicare Advantage plans are a good choice for those who are on a fixed income. The monthly premiums can be affordable, and they can help pay for a variety of services. However, the annual out-of-pocket maximums vary, and most Part C plans have a maximum out-of-pocket limit. You may also be required to purchase a Medicare supplement, which will reduce your patient's portion of the bill to a near-zero amount.

This company is based in Vero Beach, Florida, and has more than 15 carriers to choose from. They offer products that cover the cost of long-term care, critical illness insurance, and annuities. They also provide free educational seminars, participate in community events, and offer free counseling.

2 notes

·

View notes

Text

Medicare Open Enrollment | Why 1 Shouldn’t Ignore

What is Medicare Open Enrollment ?

Medicare open enrollment – is also known as Annual Election Period (AEP) or annual coordinated election period – which is an enrollment window that takes place every year. In period beneficiaries can opt for making changes in Medicare plan by re- evaluating and comparing with their extant plans of Medicare Coverage — whether it’s Original Medicare with , Medicare Advantage or supplemental drug coverage — and make changes if they want to do so. This guide is all about Medicare’s annual selection period.

If you’re interested in learning about additional opportunities to enroll or change your Medicare coverage, we’ve covered those here. Federal health insurance program, which provides coverage for about 56.5 million individuals in the 65-and-older crowd. And, whether you’re reaching the eligibility age of 65 or you are older and switching from workplace insurance to Medicare, there are some important factors to consider that affect your wallet.

Medicare beneficiaries can enroll using the link https://Medicare.gov like to improve their coverage option and potentially save money for 2023 during open enrollment. One can sign up till December 7 2022, to switch or drop the plan to get the new coverage which will resume from January 2023. As Kaiser Family Foundation Data out of 7 out of 10 about 65 millions dint compare their existing plans with latest one and many will miss to upgrade the same. Every year from October 15 till December 7 is the enrollment period for Medicare Open Enrollment , needs to review the coverage and change as per available options in open window.

Medicare beneficiaries with can compare their traditional plans with opt to join single Medicare Advantage plans or any other plan as per ever changing health needs. One easily opt for changes in premium , value of coverage, pharmacy networks, cost out of pocket for other medical related but people neglects like anything. One can easily buy costly outfits but ever thing to spend on Medicare Open Enrollment.

2 notes

·

View notes

Text

#healthcare#akron ohio#medicare#cleveland ohio#cincinnati ohio#ohio#columbus ohio#open enrollment#somewhere in ohio#springfield ohio

1 note

·

View note

Text

Understanding the Different Parts of Medicare: A, B, C, and D

Medicare is a federal health insurance program primarily for individuals aged 65 and older, though it also covers certain younger individuals with disabilities and those with End-Stage Renal Disease (ESRD). Understanding the different parts of Medicare—Parts A, B, C, and D—is crucial to making informed decisions about your healthcare coverage.

Medicare Part A: Hospital Insurance

Medicare Part A is often referred to as hospital insurance. It covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care services. Most people do not pay a premium for Part A because they or their spouse paid Medicare taxes while working. However, there are deductibles and coinsurance costs associated with the services Part A covers. Part A is essential for anyone who may require hospital care, whether for surgery, illness, or rehabilitation.

Medicare Part B: Medical Insurance

Medicare Part B covers two types of services: medically necessary services and preventive services. Medically necessary services include outpatient care, doctor visits, laboratory tests, x-rays, mental health services, and durable medical equipment. Preventive services include screenings, vaccines, and yearly wellness visits. Unlike Part A, Part B requires a monthly premium, which is determined by your income. There is also an annual deductible and coinsurance for services. Part B is critical for managing ongoing health issues, visiting doctors, and receiving preventative care.

Medicare Part C: Medicare Advantage Plans

Medicare Part C, also known as Medicare Advantage, is an alternative to Original Medicare (Parts A and B). Medicare Advantage Plans are offered by private insurance companies approved by Medicare and cover everything that Original Medicare covers. However, they often include additional benefits, such as vision, dental, hearing, and even fitness programs. Many Medicare Advantage Plans also include Medicare Part D prescription drug coverage. Enrolling in a Medicare Advantage Plan may involve paying an additional premium, but the potential for extra benefits and lower out-of-pocket costs makes it an attractive option for many beneficiaries.

Medicare Part D: Prescription Drug Coverage

Medicare Part D provides prescription drug coverage. Part D plans are offered by private insurance companies and help cover the cost of prescription medications. While Medicare Parts A and B cover a wide range of healthcare services, they do not include most outpatient prescription drugs, making Part D necessary for those who rely on medications to manage chronic conditions or illnesses. Part D plans have a monthly premium, and out-of-pocket costs can vary depending on the specific plan and medications used.

Medicare Age Requirement

The standard medicare age requirements to be eligible for Medicare is 65. Individuals can enroll in Medicare during their Initial Enrollment Period, which begins three months before their 65th birthday, includes the month they turn 65, and ends three months after. However, some people qualify for Medicare before age 65 if they have certain disabilities or conditions, such as ESRD or Amyotrophic Lateral Sclerosis (ALS).

Conclusion

Navigating Medicare's various parts can be complex, but understanding the differences between Parts A, B, C, and D is essential for choosing the right coverage for your needs. Each part covers different aspects of healthcare, from hospital stays and doctor visits to prescription drugs and additional benefits offered through Medicare Advantage Plans. By knowing the Medicare age requirement and the specific services covered by each part, you can make informed decisions that ensure comprehensive healthcare coverage as you age.

0 notes

Text

Benefits and Flexibility of Cigna Medicare Plans

Cigna Medicare provides flexibility and an array of benefits that can be tailored to meet the specific needs of its members. With Cigna Medicare Advantage, enrollees receive not only the standard Medicare Parts A and B coverage but also additional services such as routine vision, hearing, and dental care. Many plans even include wellness programs, gym memberships, and discounts on health-related services. Cigna’s extensive network of healthcare providers ensures that members have access to quality care, and depending on the plan, out-of-pocket expenses can be significantly lower than with Original Medicare. For those seeking supplemental coverage, Cigna’s Medigap plans offer peace of mind by covering expenses that Medicare may not. This includes services such as overseas emergency care, which can be essential for frequent travelers. Additionally, the flexibility of being able to choose any Medicare-approved provider, without network limitations, is a key advantage. With Cigna’s Prescription Drug Plans (Part D), members can also access a wide selection of pharmacies and enjoy the convenience of home delivery services for their medications.

Saving on Healthcare Costs with Cigna Medicare

One of the primary concerns for Medicare beneficiaries is managing healthcare costs. Cigna Medicare offers plans that are designed to reduce out-of-pocket expenses. Medicare Advantage plans often come with lower premiums and copayments than Original Medicare, while Cigna Medicare Supplement plans help cover deductibles and coinsurance. Additionally, Cigna Medicare Prescription Drug Plans provide significant savings on medications. By offering cost-effective solutions, Cigna Medicare helps beneficiaries manage their healthcare expenses without compromising on the quality of care.

Cigna Medicare’s Network of Healthcare Providers

Cigna Medicare has an extensive network of healthcare providers, ensuring that members can access quality care no matter where they live. Medicare Advantage plans include in-network doctors, specialists, and hospitals, which can result in lower healthcare costs. Meanwhile, Cigna Medicare Supplement plans allow beneficiaries to see any provider that accepts Medicare, offering flexibility and choice. Whether you prefer a more structured network or the freedom to choose any doctor, Cigna Medicare provides solutions to fit your healthcare preferences.

Cigna Medicare: A Holistic Approach to Healthcare

Cigna Medicare takes a holistic approach to healthcare, providing more than just medical coverage. With wellness programs, fitness memberships, and additional services like dental, vision, and hearing care, Cigna Medicare plans are designed to support every aspect of a member’s health. These extra services help members lead healthier lives, reducing the need for medical interventions and improving overall well-being. Cigna Medicare’s holistic approach ensures that beneficiaries have access to comprehensive care that meets their physical, mental, and emotional health needs.

The Enrollment Process for Cigna Medicare

Enrolling in Cigna Medicare is a simple process that can be done during the annual Medicare enrollment period. Beneficiaries can review the different Cigna Medicare plans available, compare benefits, and select the option that best suits their healthcare needs. Cigna offers online tools to help individuals find the right plan and provides customer support to guide enrollees through the process. With a straightforward enrollment process, Cigna Medicare makes it easy for individuals to access the healthcare coverage they need without unnecessary complications.

How Cigna Medicare Promotes Health and Wellness?

Cigna Medicare goes beyond standard healthcare coverage by offering wellness programs that encourage healthy living. Members of Cigna Medicare Advantage plans can enjoy access to gym memberships, nutritional counseling, and health screenings, all designed to promote overall wellness. Additionally, Cigna Medicare offers discounts on wellness-related products and services, making it easier for beneficiaries to maintain a healthy lifestyle. By focusing on wellness and prevention, Cigna Medicare helps individuals stay healthy and active, improving their quality of life.

Cigna Medicare Dental and Vision Coverage

Unlike Original Medicare, Cigna Medicare Advantage plans often include additional coverage for dental and vision services. Routine dental check-ups, cleanings, and even more advanced procedures like fillings and extractions may be covered. For vision, beneficiaries can receive coverage for eye exams, glasses, and contact lenses. These services are essential for maintaining overall health, and Cigna Medicare ensures that members have access to the care they need. With comprehensive dental and vision coverage, Cigna Medicare provides added value and convenience to its members.

The Role of Cigna Medicare in Chronic Condition Management

Cigna Medicare plays a vital role in managing chronic health conditions such as diabetes, heart disease, and arthritis. Cigna Medicare Advantage plans offer disease management programs that provide support and resources to help members manage their conditions more effectively. These programs include regular check-ups, medication management, and lifestyle counseling. By offering specialized care for chronic conditions, Cigna Medicare helps individuals manage their health more proactively, improving their quality of life and reducing the need for costly emergency care.

Conclusion

Cigna Medicare stands out as a trusted provider for seniors and individuals seeking comprehensive healthcare coverage. Offering flexibility through various plan options, including Medicare Advantage, Supplement, and Prescription Drug Plans, Cigna Medicare ensures that every individual’s health needs are met. With a focus on preventive care, chronic condition management, and additional services like wellness programs, Cigna Medicare goes beyond traditional healthcare. It provides financial protection and support for a healthier lifestyle. For those seeking a reliable, cost-effective, and flexible healthcare plan, Cigna Medicare is the ideal choice.

0 notes

Text

Understanding the Basics: What You Need to Know About Automatic Enrollment in Medicare

Automatic enrollment in Medicare is a topic that often confuses beneficiaries. At Access Health Care Physicians, LLC, we believe that understanding the fundamentals of this process is crucial, especially in the context of the 2023 Annual Enrollment Period (AEP). In this article, we will break down the essentials of automatic enrollment in Medicare, helping you navigate your healthcare options with confidence.

What Is Automatic Enrollment in Medicare?

Automatic enrollment is a process by which some individuals are enrolled in Medicare Part A and/or Part B without having to apply manually. This typically happens when you meet specific eligibility criteria, such as turning 65 and receiving Social Security or Railroad Retirement Board (RRB) benefits.

Key Points to Know About Automatic Enrollment:

1. Eligibility for Automatic Enrollment

Automatic enrollment primarily applies to individuals who are already receiving Social Security or RRB benefits. You will be automatically enrolled in Medicare Part A and Part B starting the first day of the month you turn 65.

2. Receiving Your Medicare Card

Once you are automatically enrolled, you will receive your Medicare card by mail approximately three months before your 65th birthday. It will include important information about your coverage and how to use it.

3. Choosing Your Coverage

While automatic enrollment simplifies the process for many, it's essential to understand your coverage options. You can keep the automatic enrollment coverage or make changes during the Annual Enrollment Period (AEP) if you prefer a different plan, such as a Medicare Advantage Plan or Medicare Part D prescription drug coverage.

4. The Role of the Annual Enrollment Period (AEP)

The AEP, which runs from October 15th to December 7th, is the time to make changes to your Medicare coverage. If you're automatically enrolled but wish to switch to a different plan, this is the window of opportunity to do so.

5. Access Health Care Physicians, LLC, Your Trusted Partner

Access Health Care Physicians, LLC, understands that Medicare can be overwhelming. Our team of experts is here to assist you in navigating the complexities of automatic enrollment and making informed decisions during the AEP. Whether you want to explore different coverage options or have questions about your automatic enrollment, we're just a call away.

Conclusion

Automatic enrollment in Medicare is a valuable benefit for many individuals approaching the age of 65. It ensures that you have essential healthcare coverage as you enter your senior years. However, it's equally important to be aware of your options and the Annual Enrollment Period (AEP), which allows you to customize your Medicare coverage to better suit your needs.

At Access Health Care Physicians, LLC, we are committed to simplifying the Medicare process and helping you make the best choices for your healthcare. As you navigate the 2023 AEP, remember that we are your trusted partner in achieving the healthcare coverage that aligns with your preferences and requirements. Contact us today for personalized guidance and support.

#annual enrollment period medicare#annual enrollment period medicare 2023#annual enrollment period 2023#when is annual enrollment period#when is annual enrollment period for medicare#access to health care#annual enrollment period for medicare#access in healthcare#access health care#access medical centers#access health#access health patient portal#accesshealth patient portal

1 note

·

View note

Text

OUR COMMUNITY: Miriam Ramos, MINT HEALTH INSURANCE on MEDICARE CHANGES

https://www.podbean.com/media/share/pb-gfzks-16cae63

Meet Miriam Ramos, CEO and Founder of MINT HEALTH INSURANCE AGENCY. And hear about her work making Medicare (in all its complexity) clearer to our community. And all the changes taking place in this program (ahead of the upcoming annual enrollment period). #medicare #healthcare #healthinsurance #ochcc #octalkradio

0 notes

Text

Empowering Yourself Through Informed Medicare Open Enrollment Decisions

The Medicare Open Enrollment Period (OEP) is a crucial time for millions of Americans to reassess their health insurance needs. This annual event typically runs from October 15 to December 7, and it provides beneficiaries with the opportunity to make informed decisions about their healthcare coverage. Empowering yourself through this process can significantly impact your health and finances, ensuring you get the best possible care and services.

Understanding Medicare

Before diving into the enrollment decisions, it's essential to understand the basics of Medicare. Medicare is a federal health insurance program primarily for individuals aged 65 and older, though it also covers some younger people with disabilities or specific health conditions. The program consists of different parts:

Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facility care, hospice, and some home health care.

Part B (Medical Insurance): Covers outpatient care, doctor visits, preventive services, and some home health care.

Part C (Medicare Advantage): Offered by private companies, this plan includes coverage from both Part A and Part B, often with additional benefits such as vision or dental care.

Part D (Prescription Drug Coverage): Provides coverage for prescription medications, helping to reduce the out-of-pocket costs for essential drugs.

Assessing Your Current Coverage

Before making changes during the OEP, take the time to review your current Medicare plan. Consider the following factors:

Healthcare Needs: Evaluate any changes in your health status, such as new diagnoses or treatment plans, and think about how these changes may affect your healthcare needs.

Costs: Review your premiums, deductibles, copayments, and out-of-pocket maximums. Are your current costs manageable, or do they strain your budget?

Preferred Providers: Ensure your preferred doctors and healthcare facilities are still in-network if you’re considering switching plans.

Medications: Analyze your current prescription drug coverage and compare it with other plans. Some plans may offer better coverage for specific medications, which can lead to significant savings.

Researching Options

Once you've assessed your current coverage, it's time to explore your options. The Medicare Plan Finder tool on the official Medicare website is a valuable resource for comparing plans based on your specific healthcare needs. Additionally, consider consulting with a licensed Medicare agent or attending informational workshops in your community. These resources can provide personalized assistance and help clarify any questions you may have about your choices.

Making Informed Decisions

When evaluating your options, make a list of your healthcare priorities. What matters most to you? Is it lower out-of-pocket costs, access to specialists, or additional benefits like wellness programs? Create a comparison chart to visualize the differences between plans, helping you make an informed choice that aligns with your healthcare goals.

Enrolling or Changing Plans

Once you've made your decision, you can enroll in or change your Medicare plan online, by phone, or through a local Social Security office. Ensure you complete your enrollment by the December 7 deadline to avoid any potential gaps in coverage.

Conclusion

The Medicare Open Enrollment Period is your opportunity to empower yourself with informed decisions about your healthcare coverage. By understanding your needs, researching your options, and making thoughtful comparisons, you can ensure that you select the best plan for your circumstances. This proactive approach not only enhances your healthcare experience but also supports your overall well-being and financial health as you navigate your golden years.

0 notes

Text

HealthPartners and UnitedHealthcare Part Ways on Medicare Advantage Plans

A significant change is happening as HealthPartners ends its partnership with UnitedHealthcare, affecting 30,000 users who now must find new insurers or providers. This separation is due to HealthPartners' allegations of high denial rates and delays in payments by UnitedHealthcare. The split impacts Medicare Advantage, Medicaid, and employer plans, raising concerns about equitable healthcare access. UnitedHealthcare claims it offered solutions, but HealthPartners decided to end the partnership, putting patients in a difficult position. This breakup highlights broader issues in the healthcare industry, with hospitals and insurers frustrated by Medicare Advantage plans' approval processes. Patients are encouraged to explore new Medicare options during the annual enrollment period from October 15 to December 7. As negotiations continue, the focus remains on finding affordable, effective health options for seniors while addressing the inconsistencies in coverage decisions. For more detailed updates, visit Distilinfo.

Read more: https://distilinfo.com/healthplan/healthpartners-unitedhealthcare/

Discover the latest payers’ news updates with a single click. Follow DistilINFO HealthPlan and stay ahead with updates. Join our community today!

0 notes

Text

The Ultimate Guide to Finding the Best Medicare Plan in California

Choosing the best Medicare plan in California can be overwhelming due to the numerous options available. With varying costs, coverage, and benefits, it's essential to understand your choices to make an informed decision that suits your health needs and budget.

Types and Categories

Original Medicare (Part A and Part B)

Part A: Hospital insurance covering inpatient care, skilled nursing facility care, hospice, and home health services.

Part B: Medical insurance covering outpatient care, preventive services, and medical supplies.

Medicare Advantage (Part C)

Combines Part A and Part B benefits, often includes additional services like vision, dental, and prescription drug coverage.

Medicare Part D

Prescription drug coverage, available as a standalone plan or included in Medicare Advantage plans.

Medicare Supplement (Medigap)

Additional coverage to help pay costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

Symptoms and Signs

Choosing the wrong Medicare plan can lead to:

High Out-of-Pocket Costs: Unforeseen medical expenses not covered by your plan.

Limited Access to Providers: Not all plans cover every doctor or hospital.

Inadequate Coverage: Essential services may be excluded from your plan.

Causes and Risk Factors

Several factors influence the best Medicare plan for you:

Health Status: Chronic conditions or frequent healthcare needs.

Budget: Monthly premiums, deductibles, and out-of-pocket maximums.

Location: Availability of plans and providers in your area.

Preferences: Need for additional services like dental, vision, or hearing.

Diagnosis and Tests

Assessing Your Needs

Health Evaluation: Consult with your healthcare provider to assess your medical needs.

Financial Review: Analyze your budget to determine how much you can afford for premiums and other costs.

Comparing Plans

Use tools like the Medicare Plan Finder to compare plans based on coverage, costs, and provider networks.

Treatment Options

Original Medicare

Benefits: Wide acceptance, no need for referrals, standard benefits.

Drawbacks: No cap on out-of-pocket costs, does not cover vision, dental, or hearing.

Medicare Advantage

Benefits: Comprehensive coverage, often includes additional services, caps out-of-pocket costs.

Drawbacks: Limited provider networks, may require referrals.

Medicare Part D

Benefits: Covers prescription drugs, choice of plans.

Drawbacks: Monthly premiums, coverage gaps.

Medigap

Benefits: Lowers out-of-pocket costs, freedom to choose any doctor that accepts Medicare.

Drawbacks: Additional monthly premiums, does not cover prescription drugs.

Preventive Measures

Annual Reviews

Review your plan annually during the open enrollment period to ensure it still meets your needs.

Health Maintenance

Regular check-ups and preventive care to minimize the need for more expensive treatments.

Personal Stories or Case Studies

Case Study: John's Journey to Finding the Right Plan

John, a 68-year-old retiree in San Diego, switched from Original Medicare to a Medicare Advantage plan due to its lower out-of-pocket costs and additional benefits like dental and vision coverage.

Expert Insights

Dr. Sarah Johnson, Medicare Specialist

"Understanding your healthcare needs and financial situation is crucial in selecting the right Medicare plan. Consulting with a licensed Medicare agent can provide personalized guidance."

Conclusion

Selecting the best Medicare plan in California requires careful consideration of your health needs, budget, and preferences. By understanding the types of plans available and regularly reviewing your options, you can find a plan that offers the best coverage and value for your situation.

2305 Historic Decatur Rd Suite 100 San Diego, CA 92106

619-952-3380

Open Hours:

Monday-Friday 9am 4PM PST, Saturday 9am-1pm PST, Sunday: CLOSED

0 notes