#Volatility-Based Trading Strategies

Explore tagged Tumblr posts

Text

TheSuccessStrategy.com review: Trading Platforms

When choosing a broker, traders often ask the same questions: Is this platform reliable? Can I trust it with my money? These concerns are valid, given the number of unregulated brokers in the market.

TheSuccesStrategy.com review stands out as a platform that checks all the right boxes. It has a solid regulatory framework, positive user feedback, and a well-structured trading environment. But let’s not just rely on general claims—let’s dive deep into the facts that prove its legitimacy.

Trading Platforms of TheSuccesStrategy.com: Versatile and Accessible

The trading platform offered by TheSuccesStrategy.com review (thesuccesstrategy.com) includes multiple options tailored for different devices and trading styles. Traders can access:

WebTrader Platform – A browser-based platform that allows seamless trading without the need for downloads. This is a common choice for traders who prefer flexibility and instant access.

Tablet Trader – A specialized platform optimized for tablet devices, ensuring a smooth trading experience on larger screens compared to mobile phones.

Mobile Trader – Designed for on-the-go trading, this mobile app version ensures that traders can monitor markets and execute trades from anywhere.

This variety in trading platforms suggests that the broker is committed to accessibility and convenience, catering to both desktop and mobile traders. A broker that offers multiple platform options typically aims to provide a better user experience—wouldn't you agree?

Regulation and Licensing: TheSuccesStrategy’s Strong Credentials

One of the key indicators of a broker’s legitimacy is its regulation. TheSuccesStrategy.com reviews operates under the supervision of the FCA (Financial Conduct Authority), a top-tier regulatory body.

Why is this important? The FCA is known for its strict requirements and rigorous oversight. Brokers regulated by the FCA must adhere to stringent financial standards, including segregation of client funds, negative balance protection, and regular audits. This means that traders' funds are kept separate from the company's operational funds, ensuring greater security.

Even more reassuring is the fact that TheSuccesStrategy.com review holds a "High Authority" license, which places it among the most reliable and well-regulated brokers in the industry. A broker with such credentials isn't just compliant—it actively demonstrates transparency and a commitment to fair trading.

Doesn't this level of oversight make it easier to trust this broker?

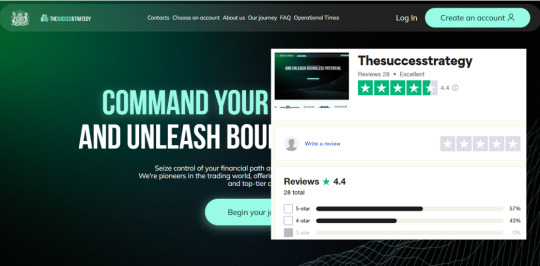

Trustpilot Reviews: A Strong Reputation Backed by Users

When it comes to choosing a broker, what do traders trust the most? Real user feedback. TheSuccesStrategy.com review (thesuccesstrategy.com) boasts an impressive 4.3 rating on Trustpilot. In the world of online trading, a score above 4 is a strong indicator of reliability and user satisfaction.

Even more notable is the fact that 100% of the reviews (26 out of 26) are positive, rated 4 or 5 stars. This suggests that traders consistently have a good experience with the platform, whether it's customer service, withdrawals, or trading conditions.

Trading Hours: When Can You Trade with TheSuccesStrategy.com?

Understanding a broker’s trading schedule is crucial, especially for those who want to take advantage of global market movements. TheSuccesStrategy.com review (thesuccesstrategy.com) follows the standard forex market hours, allowing traders to engage in different sessions based on their preferred trading times.

Here’s the breakdown of their trading hours by region:

🔹 Winter Session:

Australia: 8 PM - 5 AM

Tokyo: 11 PM - 8 AM

London: 7 AM - 4 PM

New York: 12 PM - 9 PM

These time slots align with the major financial centers, ensuring that traders have access to the most liquid and volatile hours in the forex market.

Having clear and structured trading hours means traders can plan their strategies efficiently. Whether you prefer the high volatility of the London-New York overlap or the steadier movements of the Asian session, this schedule provides flexibility for different trading styles.

Is TheSuccesStrategy.com review a Trustworthy Broker?

After thoroughly analyzing TheSuccesStrategy.com review (thesuccesstrategy.com), it’s clear that this broker meets the key standards of legitimacy and reliability. Let’s break it down:

✅ Regulated by the FCA – One of the most respected financial authorities, ensuring strict compliance and trader protection. ✅ High Trustpilot Rating (4.3/5) – A strong reputation backed by 100% positive reviews. ✅ Multiple Trading Platforms – WebTrader, Mobile Trader, and Tablet Trader provide convenience and flexibility. ✅ Fast Deposits & Withdrawals – A variety of payment options with no commissions. ✅ User-Friendly Experience – Simple registration, responsive support, and a growing community of traders.

With solid regulation, a high satisfaction rate, and a well-designed trading environment, TheSuccesStrategy.com reviews appears to be a legitimate and reliable broker. Of course, every trader should do their own research, but the evidence suggests that this platform is built for both security and success.

Would you feel confident trading with a broker that ticks all these boxes?

7 notes

·

View notes

Text

t it, quoting an ancient adage Xi himself once cited, “The wise adapt to the times, and the astute respond to circumstance.”

Beijing’s high-stakes strategy for navigating a second Trump administration involves, in the words of national security heavyweight Donald Rumsfeld, both the known and the unknown in different quantities. Up top is the most familiar—the “known knowns,” and chief among these is tariffs.

Unlike in 2016, Beijing now faces Trump’s return with a sharper sense of what to expect, thanks to his prior policies. Chief among anticipated challenges are Trump’s intensified “reshoring” agenda and potential tariffs—such as 10-20% on all imports and an additional 60-100% on Chinese imports. These would pose direct threats to China’s export-driven economy at a time when the country is still struggling with a slow recovery, real-estate instability, and weakened consumer demand.

Chinese experts foresee a hardline cabinet in a second Trump term, with figures like trade hawk Robert Lighthizer indicating a more protectionist, confrontational approach. Unlike Trump’s first administration, where voices like Steve Mnuchin occasionally tempered his policies, a unified hawkish team would likely leave little room for moderation. Yet Beijing has been preparing—even if not always successfully—its “dual circulation” strategy aims to boost domestic consumption and curb export reliance, but results have stalled: Domestic demand lags, and export levels remain steady. This strategic pivot is evident in a surge of Chinese investment in Southeast Asia, as Beijing seeks to diversify its supply chains and shield its economy from trade shocks.

To reinforce its position, Beijing has ramped up countermeasures against U.S. companies, shifting from firing warning shots to dealing concrete blows. Skydio, the largest U.S. drone manufacturer, faces critical supply chain disruptions after China sanctioned it over sales to Taiwan’s National Fire Agency, forcing the company to ration batteries. PVH Corp., the parent company of Calvin Klein and Tommy Hilfiger, now risks placement on China’s “unreliable entity list” for allegedly boycotting Xinjiang cotton, jeopardizing growth in a key market. Intel is also under scrutiny as the Cybersecurity Association of China pushes for an investigation into alleged security flaws, threatening Intel’s hold in a market that accounts for nearly a quarter of its revenue. These sanctions and probes reveal a bolder stance, showing that Beijing’s arsenal for retaliation is far stronger than it was during Trump’s first term.

Chinese experts also see potential blowback for the U.S. economy. A 60% tariff could push U.S. inflation upward, potentially forcing the Federal Reserve toward further rate hikes. Within Chinese policy circles, some view this inflationary risk as a possible check on Trump’s ambitions, noting that rising borrowing costs and asset volatility could dampen his support base for aggressive tariffs.

Beyond tariffs, Beijing is keenly aware of the limitations faced by alternative manufacturing hubs in Southeast Asia and Latin America. Regional bottlenecks—such as labor shortages, infrastructure challenges, and resource constraints—may prevent these regions from fully absorbing production shifts away from China. Ironically, these limitations could exacerbate U.S. inflation if Trump’s tariffs disrupt established supply chains without viable alternatives.

Trump’s anti-globalization stance is familiar, but the ideological shifts it ignites fall into what strategists call “unknown knowns���—factors that are understood but whose full impact remain uncertain. For Beijing, Trump’s isolationist rhetoric resonates with a rising tide of populism across Europe and parts of Asia, such as Italy, Hungary, and the Philippines, creating ideological undercurrents that both challenge and complicate China’s global aspirations.

Some nationalist voices in China view Trump’s “America First” approach as an opportunity. The logic is simple: If the United States pulls back from global frameworks or retreats from alliances like NATO, other nations may look to China as an alternative. But Beijing’s seasoned policy experts approach this notion with sober realism. While China recognizes the potential for Western alliances to fragment, it also understands that a wholesale “pivot” toward Beijing is unlikely.

European leaders may be frustrated with Trump’s isolationism, but they remain wary of China’s growing influence—especially given Beijing’s reluctance to condemn Russia’s actions in Ukraine. This perceived tacit support for Russia has deepened European skepticism, fueling doubts about whether China’s expanding reach aligns with Europe’s strategic interests.

Beijing’s advisors are also attuned to the fact that the same populist forces driving Trump’s comeback are gaining ground in Europe. Economic strains have spurred protectionism. This sentiment has tangible economic implications: Calls for tariffs on Chinese electric vehicles and other trade protections, particularly in high-value sectors, reflect Europe’s intensifying desire to shield its own industries.

For Beijing, the ideological dimensions of a second Trump term present new complications. While the United States retreating from its traditional global role could create openings, Europe is unlikely to align more closely with China. China’s strategy is to avoid positioning itself as a direct alternative to Trump’s America. Instead, Beijing is casting itself as a pragmatic, stable partner amid the uncertainties triggered by Trump’s disruptions.

Xi’s administration has underscored this practical stance to emerging economies across Africa, Latin America, Southeast Asia, and parts of Europe, promoting investment incentives, visa-free entry, and a revitalized Belt and Road Initiative focused on green and future-industry infrastructure. Beijing’s aim is to strengthen its reputation as a dependable economic partner for countries seeking growth and stability, without appearing to exploit the ideological rifts Trump’s isolationism has exposed across the West.

Xi is accelerating China’s push for self-reliance, especially in technology—a strategy captured in a phrase popular among Chinese advisors: “以不变应万变” (“respond to ever-changing circumstances with a steady core”). The drive toward self-sufficiency isn’t new; “Made in China 2025” set the stage. But recent directives from the Third Plenum and Xi’s call to foster “new productive quality forces”—a frequently repeated Xi-ism—have pushed this ambition further, centering on breakthroughs in next-generation technologies—artificial intelligence, robotics, and semiconductors. This vision aims not only to reduce dependency on Western technology but to assert China’s dominance in frontier industries, with an eye to leading the fourth industrial revolution. For Xi, this is more than economic strategy; it is the fundamental answer to China’s domestic pressures and the ultimate trump card in its rivalry with the United States.

This quest for self-sufficiency also extends to forging stronger economic ties with the global south. Xi’s aim goes beyond building alternative trade networks to Western influence; he envisions a sanction-proof supply chain and financial network—a new global market immune to Western pressures that can fuel China’s ambitions independently.

Then there’s the “known unknowns”—the predictably unpredictable, something very much at the forefront with Trump. A defining feature of Trump’s political style is his highly transactional approach, adding a layer of unpredictability to what might otherwise be straightforward policies. Beijing has observed this pragmatism up close, recognizing that Trump’s business instincts often outweigh ideological commitments, occasionally opening doors for negotiation.

When the United States imposed sanctions on Chinese telecom giant ZTE, for example, Xi personally spoke with Trump, leading to a reversal of the sanctions. For Beijing, this underscored that Trump’s flexibility could be influenced by high-profile gestures that he perceives as personal acknowledgments—a dynamic Beijing sees as potentially useful.

Beijing also understands Trump’s showbiz background and his strong emphasis on image and ego. In 2017, Xi hosted Trump and his family with an unprecedented reception at the Forbidden City, a site traditionally reserved for China’s emperors, infusing the event with a level of grandeur rarely extended to foreign leaders. This carefully curated spectacle played to Trump’s appreciation for high-profile events and deepened his positive impression of Xi. This “personalized diplomacy” showcased Beijing’s understanding of Trump’s sensibilities and laid a foundation for a cooperative rapport between the two leaders.

With this in mind, Chinese advisors are prepared to pursue similar transactional openings in a second Trump term. Behind the scenes, Beijing is nurturing ties with influential American business figures who could serve as informal intermediaries to Trump’s inner circle. Elon Musk, for instance—whose Tesla operations are deeply tied to China’s market—may emerge as a potential bridge between U.S. business interests and Chinese policymakers.

Some advisors are also advocating for figures like former ambassador Cui Tiankai, who has previously established a rapport with Trump’s family, particularly his son-in-law Jared Kushner and daughter Ivanka Trump. Cui’s connections could offer Beijing a valuable “track 1.5” channel for backdoor diplomacy, adding an extra layer of access and influence.

Still, Beijing is cautious about relying too heavily on Trump’s transactional tendencies. Recent remarks suggesting Taiwan should pay more for U.S. protection have sparked mixed reactions in China. Some view it as an opening to ease U.S. support for Taiwan, while others see it as a mere bargaining chip Trump could discard at any time. For Beijing, these mixed signals create a delicate balancing act: While it may aim to leverage Trump’s pragmatism, it knows any perceived concession could be revoked at a moment’s notice. In navigating Trump’s dealmaking style, China proceeds with cautious optimism, fully aware of his unpredictability.

Beyond Trump’s familiar transactional style, Beijing is on high alert for wild cards that could upend its plans. The nature of unknown unknowns is the impossibility to know what you’re missing, but there are some drastic, but not predictable, changes that could shake up U.S.-China relations. A sudden shift in U.S.-Russia relations, for example, could have major implications for Beijing. A closer alliance between Trump and Russian President Vladimir Putin might strain China’s relationship with Moscow, potentially isolating Beijing within the global power structure. Likewise, unexpected maneuvers by Trump in the Indo-Pacific could unsettle China’s carefully managed ties with regional powers like Japan, South Korea, and India.

A critical constraint on China’s ambitions lies in Washington’s tightening grip on technology exports, an escalating tactic that has introduced more unknowns into Beijing’s strategic calculus. While the general U.S. intent is clear—limiting China’s access to advanced technologies—the extent to which Washington will go remains uncertain. Recent export controls target crucial fields like semiconductors and AI, threatening to curb China’s technological progress at a pivotal time.

Chinese analysts interpret these moves not just as competitive hurdles but as a calculated strategy to stall China’s ascent in strategic areas, particularly AI and quantum computing, which are critical to both economic growth and military strength. As Beijing watches for new layers of restriction, the scale and impact of U.S. actions remain fluid, injecting a destabilizing uncertainty into China’s tech trajectory. To brace for these unknowns, Xi’s broader vision is to shape an economy resilient enough to withstand unpredictable global shifts—whether driven by Trump 2.0 or other forces—without risking economic upheaval or, worse, destabilizing Chinse Communist Party (CCP) control. Trump’s return may add urgency, but Beijing views him as more a symptom of a chaotic world order than its cause, which only reinforces Xi’s long-held belief in fortifying China’s self-reliance. For Xi, bolstering resilience across technology, supply chains, and education is about safeguarding China from external shocks and cementing the stability essential to the CCP’S rule.

In truth, Xi’s groundwork for managing “Trump-style” disruptions began long before Trump’s first term. China’s approach has always hinged on minimizing vulnerabilities to external pressures, a direction deeply embedded in Xi’s worldview. Yet this pursuit of resilience walks a fine line. Strengthening defenses could deepen China’s isolation—a shield that may paradoxically create new weaknesses. Gains in domestic supply chains and tech independence mark real progress, but much of Xi’s vision remains aspirational. Beijing is racing to secure these defenses, understanding that, in a world increasingly defined by upheaval, China’s strength will be measured less by its rapid growth and more by its capacity to endure through turbulence.

9 notes

·

View notes

Text

Crypto Meets Forex: Navigating Risks and Opportunities in 2025

Based on my experiences, I have seen various innovations of money with Bitcoin and other cryptocurrencies bringing major changes in the financial market. The overall flow of bitcoins is now stronger, and fluctuations in coins such as Polkadot or Dogecoin increase — all this affects the Forex market. This is where we traders get both the challenge and the thrill to perform, but with the right strategic plans in place, it is a brilliant chance to expand.

Why Crypto is Vital for Forex Traders

In the fast-paced world of trading, volatility is where the action is, and crypto delivers that in spades. While Forex markets move with global economic trends, crypto thrives on sentiment and speculation, making it a goldmine for those who know how to adapt.

Volatility Creates Opportunities: Coins like Bitcoin can swing dramatically in a single day, offering quick wins for prepared traders.

Crypto-Fiat Connections: Bitcoin’s rise often hints at movements in fiat pairs like EUR/USD or USD/JPY.

2025 — A Game-Changer: With Bitcoin adoption growing, I believe the next few years could redefine how crypto and Forex markets interact.

How I Approach the Crypto-Forex Connection

Stay Informed: Whether it’s new regulations in Europe or tech updates from Silicon Valley, the crypto market moves fast. Keeping up with global news helps me anticipate opportunities.

Manage Risk Like a Pro: Crypto’s volatility is thrilling, but it’s also risky. I use tools like stop-loss orders and position sizing to protect my capital while staying in the game.

Watch Market Overlaps: When Bitcoin rallies, I often notice shifts in fiat currencies. Understanding these connections can turn crypto trends into Forex profits.

Adapt My Strategy: Adding crypto pairs like BTC/USD or ETH/EUR to my portfolio has opened new doors. It’s a way to diversify and catch moves I might have missed otherwise.

Why I Trust ORION Wealth Academy

For me, trading is about constant learning and growth, and ORION Wealth Academy has been a game-changer. Their approach to Forex and crypto education is unmatched, offering tools and strategies that work for traders at all levels.

Here’s what makes ORION stand out: ✅ Expert coaching on navigating both crypto and Forex markets. ✅ Daily analysis to stay on top of key trends like Bitcoin’s momentum. ✅ Practical lessons tailored to beginners and seasoned traders alike. ✅ Weekly signals that help me spot opportunities in this fast-moving landscape.

ORION doesn’t just teach you how to trade — it prepares you to excel in markets where crypto and Forex intersect.

Looking Ahead to 2025

As we move into 2025, the relationship between crypto and Forex will only grow stronger. Here in France, I see more traders adapting to these changes, ready to embrace the challenges and opportunities they bring.

If you’re ready to navigate this dynamic market, join ORION Wealth Academy. Their insights and strategies have helped me trade smarter and more confidently.

Start your journey today — because 2025 won’t wait for anyone.

#forexeducation#forexmarket#forex#forextrading#forexbroker#investment#forex online trading#forexsignals#forextips

6 notes

·

View notes

Text

Crypto Trading 101: A Beginner’s Guide

Ever wondered how people trade cryptocurrencies and what it actually means to enter the crypto market? Let’s break it down in a simple way.

What is Crypto Trading?

Crypto trading is basically buying and selling digital currencies in an attempt to profit from price changes. You can either:

1️⃣ Trade directly on an exchange – This means you own the actual cryptocurrency, store it in a digital wallet, and sell it when the price is right. 2️⃣ Trade using derivatives (CFDs, futures, etc.) – This allows you to speculate on price movements without actually owning the coins. You can bet on prices going up (long position) or down (short position) without holding the asset.

How Do Crypto Markets Work?

Unlike traditional stock markets, crypto markets are decentralized. Transactions happen on a blockchain, a digital ledger that keeps everything secure and transparent. Crypto prices move based on:

📉 Supply & Demand – The total number of coins available vs. how many people want to buy them. 💰 Market Sentiment – News, media coverage, and public perception. 📊 Adoption & Regulation – Governments and institutions getting involved. 🔒 Security Events – Hacks and breaches affecting trust in the market.

Why Trade Crypto?

Cryptocurrency markets are volatile – meaning prices can change quickly, creating both opportunities and risks. Some traders like this fast-paced action because it allows for potential profits. Others use crypto trading as a hedge against traditional financial markets.

Choosing a Crypto to Trade

Popular cryptocurrencies include:

🔹 Bitcoin (BTC) – The original and most well-known. 🔹 Ethereum (ETH) – Smart contracts and decentralized apps. 🔹 Litecoin (LTC) – Faster transactions than Bitcoin. 🔹 Dogecoin (DOGE) – A meme coin turned serious player. 🔹 Cardano (ADA), Chainlink (LINK), Polkadot (DOT), Uniswap (UNI) – Other well-known cryptos with different use cases.

Going Long vs. Short

📈 Going Long = You think the price will rise, so you "buy." 📉 Going Short = You believe the price will drop, so you "sell."

Managing Risk

Since crypto prices move fast, risk management is key! Some traders use:

🔺 Stop-loss orders – Automatically selling if the price drops to a set level. 🔺 Limit orders – Locking in profits by selling when a target price is reached.

Trading crypto can be exciting, but always be mindful of the risks. Prices can swing wildly, and leverage (if used) can amplify both gains and losses. Understanding market movements, trends, and risk management strategies is crucial before diving in.

What’s your favorite crypto to trade? 🚀💰

3 notes

·

View notes

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

28 notes

·

View notes

Text

AI Expert: How Rick Green is Transforming Finance with Artificial Intelligence

Artificial intelligence has revolutionized many industries, and the financial sector is no exception. Rick Green has been at the forefront of AI-driven financial solutions, using technology to improve investment decision-making, risk management, and market analysis.

1. AI in Forex Trading

The forex market is one of the most volatile and fast-moving financial markets in the world. Traders must analyze economic indicators, global news, and market trends to make informed decisions. AI has made this process more efficient by offering:

✔ Automated Trading Bots – AI-powered bots execute trades based on real-time market analysis, eliminating emotional decision-making. ✔ Predictive Analytics – Machine learning algorithms analyze historical price movements to predict future trends. ✔ Risk Management Tools – AI identifies potential risks in the market and suggests strategies to minimize losses.

Rick Green has helped traders and investors integrate AI-powered solutions into their forex trading strategies, leading to more accurate predictions and increased profitability.

2. AI in Financial Technology (Fintech)

Beyond forex trading, Green has also made a significant impact in financial technology (fintech). As fintech continues to evolve, businesses must adopt AI-driven tools to remain competitive. Some of the key areas where Green’s expertise has been valuable include:

✔ Fraud Detection – AI detects suspicious transactions and cyber threats, protecting businesses and consumers. ✔ Automated Customer Support – AI chatbots and virtual assistants improve customer service by providing instant, accurate responses. ✔ Personalized Financial Advice – AI-powered platforms analyze spending habits to offer customized investment recommendations.Through his work in fintech, Rick Green has helped businesses streamline their financial operations, improve security, and enhance customer experiences.

Through his work in fintech, Rick Green has helped businesses streamline their financial operations, improve security, and enhance customer experiences.

2 notes

·

View notes

Text

Unlocking the Power of Liquidity Pools on STON.fi

Decentralized exchanges (DEXs) have reshaped how people trade cryptocurrencies, eliminating middlemen and giving users full control over their assets. At the core of this revolution is liquidity pooling, an innovation that ensures seamless trading and stable pricing.

STON.fi, built on The Open Network (TON), takes liquidity pools to a new level, providing a fast, cost-effective, and profitable experience for traders and liquidity providers. This article explores liquidity pools, how they work, their benefits, and how STON.fi optimizes them for better earnings and efficient swaps.

What Are Liquidity Pools

A liquidity pool is a smart contract that holds a pair of tokens, allowing users to trade between them instantly. Instead of matching buyers and sellers as traditional exchanges do, liquidity pools enable automated swaps using an algorithm that adjusts prices based on token availability.

On STON.fi, liquidity pools power the exchange, ensuring that users can trade at any time without delays or order book dependencies. The system works efficiently, reducing slippage and making transactions smoother for traders.

How Liquidity Pools Work on STON.fi

Each liquidity pool on STON.fi contains two tokens. When a trade happens:

The trader deposits one token into the pool.

The smart contract calculates the exchange rate based on the pool’s liquidity balance.

The pool adjusts, ensuring liquidity remains available for future trades.

This model allows for instant, permissionless, and decentralized trading, making STON.fi a preferred platform for those looking for speed, low fees, and optimal trade execution.

Earning Passive Income with Liquidity Pools

Liquidity pools rely on liquidity providers (LPs) who deposit tokens into the pools, making trading possible. In return, STON.fi rewards LPs with a share of trading fees collected from transactions within the pool.

Key earning factors for LPs on STON.fi include:

✅ Trading Fees – Every transaction incurs a 0.2% fee, which is distributed to liquidity providers based on their share in the pool.

✅ Pool Share – The more liquidity an LP provides, the higher their share of collected fees.

✅ Trading Volume – Higher trading activity within a pool results in greater fee earnings for LPs.

By participating as an LP on STON.fi, users can earn passive income while supporting decentralized trading.

Key Metrics to Evaluate Liquidity Pools on STON.fi

To make informed decisions before adding liquidity, users should track key performance indicators of a pool:

1. APR (Annual Percentage Rate)

Reflects the estimated annual earnings for liquidity providers.

A higher APR suggests better returns, but rates fluctuate based on trading activity.

2. TVL (Total Value Locked)

Represents the total value of assets in a liquidity pool.

Higher TVL means greater liquidity, leading to lower slippage and smoother trading.

3. 24H Trading Volume

Measures how frequently a pool is used within 24 hours.

Higher trading volume translates to more fees earned by liquidity providers.

STON.fi provides real-time tracking of these metrics, allowing users to optimize their liquidity provision strategy for maximum profitability.

Understanding Risks: Impermanent Loss and How to Mitigate It

Providing liquidity comes with potential risks, the most common being impermanent loss. This occurs when the price of deposited tokens fluctuates significantly, causing the value of assets in the pool to be lower than if they were simply held in a wallet.

To reduce exposure to impermanent loss:

Choose high-liquidity pools with stable trading activity.

Diversify by providing liquidity across multiple pools.

Consider stablecoin pairs for lower volatility.

STON.fi’s optimized liquidity pool structure minimizes impermanent loss, allowing LPs to retain as much value as possible while still earning from trading fees.

Why STON.fi Is the Best Choice for Liquidity Providers and Traders

Among decentralized exchanges, STON.fi offers one of the most efficient liquidity pooling systems, ensuring low fees, deep liquidity, and high rewards. Here’s why it stands out:

✅ Built on The Open Network (TON) – Fast and scalable infrastructure for seamless trading.

✅ Ultra-Low Fees – A competitive 0.2% transaction fee benefits both traders and LPs.

✅ Deep Liquidity – Well-funded pools ensure smooth transactions with minimal slippage.

✅ Passive Income Opportunities – LPs earn continuous rewards with high APR.

✅ User-Friendly Interface – Real-time data tracking for smart liquidity management.

By integrating innovative technology, efficient tokenomics, and a rewarding LP model, STON.fi has become one of the most trusted platforms for decentralized trading and liquidity provision.

Final Thoughts

Liquidity pools are the foundation of decentralized exchanges, and STON.fi has optimized the model to deliver the best experience for both traders and liquidity providers.

By understanding how liquidity pools work, tracking key metrics, and managing risks, users can maximize their earnings while supporting decentralized finance.

With its fast execution, low fees, and high rewards, STON.fi is the go-to platform for anyone looking to engage in DeFi trading or passive income through liquidity provision.

👉 Start trading or providing liquidity on STON.fi today and take advantage of the decentralized financial revolution!

3 notes

·

View notes

Text

STON.fi and the Power of Liquidity Pools: How Trading Happens Without an Order Book

Decentralized exchanges (DEXs) have changed the way crypto trading works. Instead of relying on an order book like traditional exchanges, they use liquidity pools—a system that ensures fast, seamless swaps without needing a direct buyer or seller.

At the center of this innovation is STON.fi, a next-generation DEX on The Open Network (TON) blockchain. STON.fi makes trading effortless by leveraging automated liquidity pools, offering users both instant transactions and opportunities to earn passive income.

Let’s break down how liquidity pools work, why they matter, and how STON.fi stands out in this ecosystem.

1. What is a Liquidity Pool and Why Does It Matter?

A liquidity pool is a collection of crypto assets locked in a smart contract, allowing users to trade tokens instantly. On STON.fi, liquidity pools replace traditional order books, making transactions faster and more efficient.

Instead of waiting for a matching buy or sell order, users simply swap tokens within the pool. The pool always provides liquidity, ensuring low slippage and smooth trades—even during high market volatility.

Without liquidity pools, decentralized trading wouldn’t be possible. They serve as the backbone of STON.fi, enabling trustless and permissionless transactions 24/7.

2. How STON.fi Liquidity Pools Work

Liquidity pools on STON.fi operate through Automated Market Makers (AMMs). Here’s how it works:

Two tokens are paired together in a liquidity pool (e.g., TON/USDT).

Liquidity providers (LPs) deposit an equal value of both tokens into the pool.

When traders swap tokens, the pool automatically adjusts the ratio using a mathematical formula, ensuring fair pricing.

By automating the process, STON.fi removes middlemen, speeds up transactions, and lowers trading costs compared to centralized exchanges.

3. Earning from STON.fi: Liquidity Provision Rewards

Liquidity providers (LPs) play a crucial role in STON.fi’s ecosystem. By adding funds to a liquidity pool, they help facilitate trades and, in return, earn passive income.

How LPs Earn on STON.fi

Every time a trade occurs in a liquidity pool, a 0.2% fee is charged.

This fee is distributed among all LPs in proportion to their contribution to the pool.

The more liquidity an LP provides, the higher their share of the rewards.

For example, if an LP contributes 50% of the total liquidity in the TON/USDT pool, they’ll receive half of the 0.2% trading fee on every swap in that pair.

Liquidity provision on STON.fi is one of the easiest ways to generate passive income in DeFi.

4. Evaluating Liquidity Pools on STON.fi

Before adding funds to a liquidity pool, it’s important to assess its profitability and risk. STON.fi provides key metrics to help users make informed decisions:

- APR (Annual Percentage Rate)

This represents the estimated yearly return for liquidity providers based on recent trading activity. A higher APR means greater earnings but can fluctuate based on volume and pool dynamics.

- TVL (Total Value Locked)

TVL shows the total amount of assets in a liquidity pool. Pools with higher TVL offer greater liquidity and lower slippage, making them attractive for both traders and LPs.

- 24H Trading Volume

This measures how much trading activity occurs in a liquidity pool over 24 hours. A higher volume means more transaction fees, leading to better earnings for LPs.

On STON.fi, users can track these metrics in real-time to optimize their liquidity provision strategies.

5. Risks & Considerations for Liquidity Providers

While STON.fi liquidity pools provide earning opportunities, they also come with risks. The biggest one is impermanent loss—a temporary loss in value that occurs when the price of tokens in the pool changes significantly.

To mitigate risks, liquidity providers should:

Choose high-volume pools where trading activity is consistent.

Monitor market trends to avoid extreme price fluctuations.

Diversify their investments across multiple pools to reduce exposure.

STON.fi offers a transparent and user-friendly experience, making it easier for LPs to manage risks while maximizing rewards.

6. Why STON.fi Stands Out in the DEX Landscape

There are many decentralized exchanges, but STON.fi sets itself apart with:

✅ Fast, gas-efficient swaps on the TON blockchain

✅ Lower trading fees than most DEXs

✅ Seamless liquidity provision for passive income

✅ Transparent and real-time pool analytics

Whether you’re a trader looking for instant, low-cost swaps or an investor seeking passive income through liquidity pools, STON.fi is one of the most efficient and profitable platforms in the DeFi space.

7. Final Thoughts

Liquidity pools are the engine that drives decentralized trading, and STON.fi has perfected this model with low fees, fast transactions, and high-earning opportunities for liquidity providers.

By understanding how liquidity pools work, assessing key metrics, and managing risks, users can maximize their DeFi experience on STON.fi.

As decentralized finance grows, STON.fi remains at the forefront, offering a superior DEX experience for traders and liquidity providers alike.

👉 Ready to earn with STON.fi? Explore liquidity pools and start trading today!

4 notes

·

View notes

Text

Technical Analysis

Hull Moving Average: The Revolutionary Trend Following Indicator

Introduction

The Hull Moving Average (HMA) has revolutionized how traders identify and follow market trends. Developed by Alan Hull to address the lag inherent in traditional moving averages, the HMA provides a uniquely responsive yet smooth representation of price action. This comprehensive guide explores how traders can leverage this powerful indicator for enhanced trading performance.

Who Created the Hull Moving Average?

Alan Hull, an Australian mathematician and trader, developed the Hull Moving Average in 2005. Frustrated with the significant lag in traditional moving averages, Hull applied his mathematical expertise to create an indicator that could maintain smoothness while dramatically reducing delay in trend identification.

What Makes the Hull Moving Average Special?

Core Features:

Minimal lag compared to traditional MAs

Smooth price action representation

Strong trend identification capabilities

Responsive to price changes

Built-in noise reduction

Key Advantages:

Earlier trend identification

Clearer entry and exit signals

Reduced whipsaws

Superior price tracking

Versatile application across markets

Why Use the Hull Moving Average?

Primary Benefits:

Faster Signal Generation

Reduces lag by up to 60%

Earlier trend identification

Quicker response to reversals

Improved Accuracy

Reduces false signals

Smoother price tracking

Better noise filtration

Enhanced Trend Following

Clear trend direction

Strong support/resistance levels

Trend strength indication

Versatility

Multiple timeframe analysis

Various market applications

Combines well with other indicators

Where to Apply the Hull Moving Average?

Market Applications:

Futures Markets

E-mini S&P 500

Crude Oil

Gold Futures

Treasury Futures

Forex Trading

Major currency pairs

Cross rates

Exotic pairs

Stock Trading

Individual stocks

ETFs

Stock indices

When to Use the Hull Moving Average?

Optimal Market Conditions:

Trending Markets

Strong directional moves

Clear price momentum

Extended market cycles

Breakout Scenarios

Pattern completions

Support/resistance breaks

Range expansions

Volatility Transitions

Market regime changes

Volatility breakouts

Trend initiations

How to Trade with the Hull Moving Average

Basic Trading Strategies:

Trend Following Strategy

Long when price crosses above HMA

Short when price crosses below HMA

Use HMA slope for trend strength

Exit on opposite crossover

Support/Resistance Strategy

Use HMA as dynamic support/resistance

Buy bounces off HMA in uptrends

Sell rejections from HMA in downtrends

Tighter stops for counter-trend trades

Multiple HMA Strategy

Combine different period HMAs

Look for crossovers between HMAs

Use divergences between HMAs

Trade strongest signals only

Advanced Applications:

Multiple Timeframe Analysis

Higher timeframe for trend direction

Lower timeframe for entry timing

Middle timeframe for confirmation

Volatility Integration

Adjust periods based on volatility

Use ATR for stop placement

Scale positions with trend strength

Hybrid Systems

Combine with momentum indicators

Use with price patterns

Integrate with volume analysis

Risk Management Essentials

Position Sizing:

Scale with trend strength

Larger in confirmed trends

Smaller in transitions

Stop Loss Placement:

Beyond HMA level

Based on ATR multiple

At key price levels

Common Pitfalls to Avoid

1. Over-Optimization

Problem: Curve fitting periods

Solution: Use standard settings

Prevention: Test across markets

2. False Signals

Problem: Minor crossovers

Solution: Use confirmation filters

Prevention: Wait for clear signals

3. Late Exits

Problem: Giving back profits

Solution: Use trailing stops

Prevention: Honor exit rules

Real-World Performance Metrics

Typical Results:

Win Rate: 45-55% in trending markets

Risk/Reward Ratio: Best at 1:2 or higher

Average Trade Duration: 5-10 days

Maximum Drawdown: 15-20% with proper risk management

Optimizing Hull Moving Average

Parameter Settings:

Standard Period: 20-30

Aggressive: 14-18

Conservative: 35-50

Market-Specific Adjustments:

Fast Markets: Shorter periods

Slow Markets: Longer periods

Volatile Markets: Multiple confirmations

Conclusion

The Hull Moving Average represents a significant advancement in trend-following indicators. Its ability to reduce lag while maintaining smooth price action makes it an invaluable tool for both discretionary and systematic traders. When properly implemented with sound risk management principles, the HMA can provide a significant edge in futures trading.

#HullMovingAverage#TrendFollowing#FuturesTrading#TechnicalAnalysis#TradingStrategy#MarketIndicators#FinancialMarkets#TradingEducation#AlanHull#MovingAverages

3 notes

·

View notes

Text

Buy & Forget ($BNF) — A Long-Term Investment Strategy on Solana

Project Overview

Buy & Forget ($BNF) is a Solana-based cryptocurrency project designed for long-term holders and investors looking for a simple yet rewarding experience. With a unique approach focused on community-driven growth and organic market sustainability, $BNF aims to establish itself as a solid digital asset in the ecosystem.

Key Features

1. Passive Growth Model

The project follows a ‘buy and forget’ philosophy, encouraging investors to hold long-term rather than engaging in speculative trading.

Designed to reduce short-term volatility while promoting steady price appreciation.

2. Community-Centric Ecosystem

A fully decentralized and community-driven initiative where holders play a key role in shaping the project’s future.

Active engagement across social platforms to foster organic growth.

3. Solana-Based Efficiency

Leveraging Solana’s high-speed, low-cost transactions, ensuring efficient trading and accessibility.

Avoids the high gas fees associated with other blockchain networks.

4. Secure and Transparent Framework

Smart contract deployed on Solana for enhanced security and transparency.

Open access to contract details, liquidity tracking, and community discussions.

Tokenomics

Total Supply: TBDInitial Liquidity: Locked to ensure security and stability.Tax Structure: TBD (Potential zero or minimal tax to encourage trading and holding).

Roadmap

Phase 1 — Launch & Awareness

Token deployment and liquidity provision on Solana.

Initial community building through Telegram and Twitter.

First marketing campaigns and organic growth strategies.

Phase 2 — Community Expansion & Utilities

Engaging influencers and partnerships.

Exploring potential staking or reward mechanisms.

CEX listing considerations based on community growth.

Phase 3 — Long-Term Vision

Expanding project utilities beyond just holding.

Potential collaborations with Solana-based projects.

Continuous improvements based on community feedback.

Why Buy & Forget?

Simplicity & Long-Term Vision: Designed for investors looking to hold without worrying about daily market fluctuations.

Community-Driven: Built around the idea of decentralized governance and collective decision-making.

Solana-Powered Efficiency: Fast, cheap, and eco-friendly blockchain with growing adoption.

How to Buy?

Set up a Solana Wallet: Use Phantom, Solflare, or any Solana-compatible wallet.

Get SOL Tokens: Purchase SOL from a centralized exchange (CEX) and transfer it to your wallet.

Trade on a DEX: Visit Dexscreener and connect your wallet.

Swap SOL for $BNF: Enter the contract address and swap SOL for $BNF tokens.

Hold and Forget: Join the community and enjoy the long-term vision.

LINKTREE:

2 notes

·

View notes

Text

How the Trust Score on STON.fi Transformed My Crypto Trading

If you’ve been in the crypto world for a while, you probably know how overwhelming it can be. With thousands of tokens in circulation, choosing the right one to invest in can be daunting. Over time, I realized that relying on hype and gut feelings wasn’t the best approach. That’s when I discovered the Trust Score on STON.fi, and it completely changed how I trade. Let me tell you why.

What is the Trust Score

Simply put, the Trust Score is a rating system that helps traders like us make informed decisions about tokens on STON.fi. It looks at several important factors like:

Trading volume: How much activity is happening with a token.

Price fluctuations: How stable or volatile the token is over time.

Liquidity: How easily you can buy or sell a token without affecting its price.

Minting potential: The risk of new tokens being created, which can impact the token's value.

The Trust Score gives each token a percentage rating based on these factors, so you can easily see how healthy or risky a token might be.

Why Does It Matter

When I first started trading crypto, I was easily swayed by the latest trends or what others were talking about online. But soon, I realized that many of those "hot" tokens didn’t have strong fundamentals. They were just popular for a moment.

The Trust Score helped me avoid these quick hype cycles. Instead of just chasing the latest token, I started using the Trust Score to assess whether a token was genuinely worth my time. If a token had a high Trust Score, it meant it was backed by solid data. If it had a low score, it raised a red flag for me.

How the Trust Score System Changed My Strategy

Using the Trust Score has completely shifted how I approach crypto trading. Here’s how:

1. It saves time: Instead of spending hours researching every token I’m interested in, I can quickly check the Trust Score. If the score is good, it tells me the token is worth looking into more.

2. It helps reduce risk: When I see a token with a low Trust Score, I now know that there are probably some underlying issues with it. This helps me avoid risky investments and focus on more stable options.

3. It highlights opportunities: I’ve discovered some of my best trades by looking at tokens with high Trust Scores that weren’t trending. These hidden gems often have strong fundamentals that others might overlook.

Real-Life Example of How Trust Score Helped Me

There was one time when a new token was getting a lot of attention on social media. Everyone seemed to be talking about it, and the FOMO hit me hard. But when I checked the Trust Score, I saw that the liquidity was low, and the price was highly volatile. Instead of rushing in, I decided to pass on it. A few weeks later, the price had dropped significantly. I was glad I trusted the data rather than the hype.

On the other hand, I found another token with a solid Trust Score that wasn’t getting much attention. After doing a little more research, I saw it had great potential. I invested, and the price steadily rose over the following months.

Why Trust Score Works for Everyone

What I love about the Trust Score system is that it’s simple enough for anyone to use. Whether you’re new to crypto or an experienced trader, you can easily look at the Trust Score and get a sense of whether a token is a good investment. For beginners, it’s a straightforward way to get a sense of a token’s stability. For experienced traders like me, it serves as another useful tool to confirm or challenge our decisions.

How Trust Score Helps the Crypto Ecosystem

The more people who use the Trust Score system, the better it is for the entire crypto ecosystem. By relying on data, rather than just hype, we all help create a more transparent, trustworthy market. As more traders use tools like the Trust Score, we can collectively reduce market manipulation and increase the overall stability of the market.

Final Thoughts

Crypto trading is unpredictable, and the risks are high. But by using the Trust Score system on STON.fi, I’ve been able to make smarter, more informed decisions. It’s helped me avoid bad investments, find promising tokens, and most importantly, trade with more confidence.

If you haven’t already, I highly recommend giving the Trust Score a try. It’s not a guarantee of success, but it’s a tool that has certainly made my trading journey easier and less stressful. How do you make your trading decisions? I’d love to hear your thoughts on how you assess tokens and whether the Trust Score system has helped you too.

3 notes

·

View notes

Text

How the Trust Score System on STON.fi Changed My Crypto Trading Approach

If you're like me, you've probably spent a lot of time figuring out how to make better decisions in the world of crypto. The landscape is filled with so many tokens, projects, and constant market noise, and it’s easy to get lost or caught up in the hype. Over time, I’ve realized that successful crypto trading isn’t about jumping on every trend or betting on tokens that everyone’s talking about. It’s about making informed, data-backed decisions.

That’s when I came across the Trust Score system on STON.fi, and it truly changed the way I trade. Here’s how.

What Is Trust Score and Why Does It Matter

At first glance, the Trust Score might sound like just another crypto metric. But for me, it’s been a game-changer. The Trust Score is a system that evaluates tokens based on a variety of important factors, including:

Trading volume: The activity level of a token in the market.

Price movement: How the price fluctuates over time.

Liquidity: How easy it is to buy or sell a token without causing significant price changes.

Minting potential: The risk of inflation or dilution in the token supply.

These are the kinds of data points that provide a clearer picture of a token’s health and stability. The Trust Score takes all this data and gives it a percentage value that helps you quickly assess whether a token is worth your attention.

Why Trust Score Has Been a Key Tool in My Trading Strategy

Before Trust Score, I used to rely heavily on social media buzz or gut feeling when picking tokens to invest in. I know many traders can relate to the FOMO of seeing everyone jumping into a new coin or token. But all too often, those tokens turned out to be risky investments with little real backing.

That’s when I realized that information and data needed to drive my decisions. The Trust Score system helps me separate the noise from the real opportunities. If a token’s score is high, it’s more likely to be a solid option. If the score is low, there’s a higher chance that it’s either volatile or not backed by strong fundamentals.

Here’s an example: I was once eyeing a trending token that everyone was talking about. It had all the hype around it, and I was ready to jump in. But when I checked the Trust Score, I saw it had poor liquidity and price fluctuations. That was enough for me to pass on it, saving me from what could have been a bad decision.

On the flip side, Trust Score also helped me discover hidden gems. I invested in a token that wasn’t getting much attention but had an impressive score. After doing a bit more research, I jumped in and saw solid returns as its price steadily grew.

How Trust Score Helps Me Make Smarter Decisions

Since integrating Trust Score into my daily trading routine, I’ve noticed several key changes in my approach:

1. Faster Decision-Making: Instead of diving deep into endless research, I can quickly glance at a token’s Trust Score and know whether it’s worth further investigation.

2. Lower Risk: By relying on Trust Score, I’ve been able to avoid tokens with poor fundamentals or excessive risk.

3. Better Opportunities: High Trust Scores have helped me find tokens that others may overlook but are showing strong long-term potential.

A Tool That Works for Everyone

What I love most about Trust Score is that it’s accessible to traders at any level. Whether you’re just starting out or have been in the crypto space for years, Trust Score can give you the clarity you need. For beginners, it’s an easy way to assess the stability of a token without having to dig into complex metrics. And for experienced traders like me, it serves as an additional layer of insight when evaluating tokens.

How Trust Score Contributes to a Healthier Crypto Ecosystem

It’s not just about individual gains either. The more traders who use the Trust Score system, the healthier the overall crypto market becomes. A system like this reduces the chances of manipulation, hype-driven trading, and market instability. When we have access to data-backed insights, it builds trust within the entire ecosystem and encourages more sustainable growth.

Final Thoughts: Why I Rely on Trust Score

As a crypto trader, my goal is simple: to make smart, informed decisions that lead to long-term success. The Trust Score system has been essential in achieving that. It provides me with the tools I need to assess tokens quickly, avoid risky investments, and discover hidden opportunities that I might have missed otherwise.

If you're serious about trading and want to take a more data-driven approach, I highly recommend using Trust Score on STON.fi. It’s not a magic bullet, but it’s certainly a valuable tool that helps me trade smarter and with more confidence.

Have you used the Trust Score system in your trading yet? Or are there other tools you rely on to make your decisions? I’d love to hear your thoughts!

3 notes

·

View notes

Text

Fair Trade

By going beyond accreditation practices, consumers and companies can reach those at the bottom of the global social production ladder. Nonetheless, these efforts require purchasers to take personal responsibility for their impact, rather than relying solely on certifications. Simply by being more thoughtful and ethical in our sourcing practices, we have a huge opportunity to create brighter futures for all people and their families throughout the supply chain.

https://borgenproject.org/fair-trade-product-markets/

Despite many well-intentioned consumer attitudes, fair trade product markets frequently feature marketing strategies that conjure up imperialistic images [...]

[...] In products marked as fair trade, the certification might only apply to the product’s raw materials, rather than the full process of production. [...] A 2014 study theorizes that these practices are somewhat effective, “although on a comparatively modest scale relative to the size of national economies"

Social Media conversations about Fair Trade Practices:

[From user seriousxdelirium] - Like almost all other labels for coffee, it's absolutely useless. It only applies to growers large enough to afford the fees, and is not regulated well enough to make meaningful impact on the industry. If you really care about this sort of thing, do some research and develop an understanding of what you think a fair price is for farmers, and ask roasters what they paid for that coffee. Most good roasters are willing to be transparent about that sort of thing, and even publish transparency reports where you get a breakdown of the entire transaction.

From user Ramakrishna Surathu:

[...] Here are some reasons why fair trade may not always be as fair as it seems [...]

1. Market Access and Power Imbalances: Fair trade initiatives often focus on small-scale producers in developing countries, who may face challenges in accessing global markets and negotiating fair prices. Power imbalances within supply chains, influenced by factors such as geography, politics, and market dynamics, can limit the ability of producers to fully benefit from fair trade practices.

2. Certification Costs and Barriers: Obtaining fair trade certification can be costly and time-consuming for producers, particularly small-scale farmers and artisans with limited resources. Certification fees, auditing expenses, and compliance with standards may pose financial barriers and administrative burdens, leading some producers to forego certification altogether.

3. Limited Impact on Poverty Alleviation: While fair trade aims to reduce poverty and improve livelihoods, its impact may be limited by systemic barriers and structural inequalities. Addressing poverty requires broader social, economic, and political interventions beyond the scope of fair trade alone, such as access to education, healthcare, land rights, and infrastructure.

4. Market Volatility and Price Instability: Fair trade prices are often based on predetermined minimums, which may not fully reflect fluctuations in global market prices. Producers may be exposed to market volatility and fluctuations in demand, which can impact their income and livelihoods, particularly in commodity markets subject to price instability.

5. Complexity of Supply Chains: Fair trade supply chains can be complex and challenging to navigate, especially in regions with limited infrastructure and logistical challenges. Ensuring compliance with fair trade standards, maintaining transparency, and traceability throughout the supply chain can require significant investment in monitoring and management systems.

[...] Some manufacturers also use tricks. For example, some products do not explain exactly which part of a product was produced fairly. Another trick is to increase the percentage of "fair" ingredients by subtracting out the water content. The credibility is of course "fair watered".

[...] The statement here should not be that fair trade is useless, but one should always question things or understand them better and not just be blindly guided by seals in the purchase decision. Since this works so well, manufacturers like to use such seals or make one up themselves.

[...] rather than cutting out the middle man, and offering farmers a more direct compensation for their work, Fair Trade still facilitates a level of bureaucracy that supports an uneven distribution of revenue.

[...] The price point that separates Fair Trade produce from the rest of the market is often significant enough that lower-income households cannot afford to budget for it. This means that Fair Trade cannot reach mass markets in a way that would really effect wide-scale change, and instead serves as a token gesture to alleviate the guilt of middle-class consumers.

[...] [premium pricing coffee] is a worthy move if the coffee is of a high quality, but if it is not of sufficient quality to merit this price tag, then it risks turning consumers away from Fair Trade produce, and further impeding its reach to mass markets [...]

Fair Trade is a concept worth embracing, but first it must prioritize effective and transparent processes of production and distribution. What Fair Trade aims to achieve is admirable, but what it could potentially achieve is far greater [...]

#having another crisis last night while researching organic mattresses and#considering which companies to buy from that are organic certified AND run with ethical business practices#damn near impossible to purchase anything sans explaintation#my greens#fair trade#sustainability#sustainable economy#economy#green link#direct trade#farming#agriculture#luxury items#premium prices

11 notes

·

View notes

Text

Forex Gold Trading: Key Insights and Strategies for Success

Gold trading has been a fundamental part of the global financial system for centuries, and it continues to be a preferred investment choice for traders and investors alike. In the context of forex gold trading, this commodity stands out not only because of its intrinsic value but also for the opportunities it offers in terms of volatility and safe-haven demand. Whether you're a seasoned forex trader or just starting, understanding the dynamics of the gold market—especially the influence of gold prices, interest rates, and the balance of supply and demand—can help you make informed trading decisions.

The forex gold market functions on the principle of buying and selling gold against other currencies, most often the US dollar. Traders speculate on the price movements of gold, trying to predict whether the price will rise or fall based on various economic and geopolitical factors. Gold, as a precious metal, has a unique position in the world economy, offering both a hedge against inflation and a safe haven during times of financial uncertainty. Because it is not tied to any single country's currency, gold prices tend to rise when confidence in fiat currencies declines, particularly the US dollar.

A central factor in gold trading is the constant interplay of supply and demand, which determines the value of gold in the market. Gold mining production is a slow and resource-intensive process, and it can't be increased quickly to respond to rising demand. This makes gold a relatively inelastic asset, meaning its supply doesn't increase rapidly even when prices rise. This limited supply, combined with global demand for gold, especially in times of economic instability, results in significant price movements. Central banks, investors, and even jewelry markets are the primary sources of demand for gold. However, in times of geopolitical unrest, financial crises, or periods of economic uncertainty, investors turning to gold as a safe-haven asset can result in rapid price increases. In this context, trading gold offers opportunities for those who can anticipate these shifts in the market.

One of the most important factors affecting gold prices in the forex market is interest rates. Central banks, like the Federal Reserve in the United States, influence interest rates as part of their monetary policy. Interest rates are a key component of the cost of holding gold. When interest rates rise, other financial instruments, such as bonds or savings accounts, offer higher returns, making them more attractive than non-yielding assets like gold. As a result, higher interest rates can put downward pressure on gold prices, as investors move their money into assets that provide returns. Conversely, when interest rates are lowered, the opportunity cost of holding gold decreases, making gold more attractive. This often leads to an increase in demand for gold, driving prices higher.

The relationship between gold prices and interest rates is also influenced by inflation. When inflation is rising, the value of currency tends to decrease, and gold is seen as a hedge against this loss of purchasing power. As a result, inflationary environments often lead to increased demand for gold, further driving up its price. In times of low or stable inflation, however, interest rates become the primary driver for gold prices. Investors often keep a close eye on central bank policy and economic data, as changes in interest rates or inflation can create significant price movements in gold.

The gold market is also highly sensitive to geopolitical events and other external factors. Global political instability, such as wars or trade conflicts, can increase demand for gold as investors seek to protect their assets from the potential fallout of uncertain situations. Similarly, economic crises or financial market crashes can prompt a shift toward gold, as it is perceived as a safer store of value than volatile currencies or stocks. This is why gold is often referred to as a "safe haven" asset. When uncertainty rises, the demand for gold increases, causing prices to rise as well.

Another key aspect of forex gold trading is understanding the price movement of gold in relation to other currencies. Gold is most commonly quoted in US dollars, so the strength or weakness of the dollar plays a crucial role in determining the price of gold. When the US dollar strengthens, gold becomes more expensive for holders of other currencies, reducing demand and putting downward pressure on prices. On the other hand, when the US dollar weakens, gold becomes more affordable for international investors, which can lead to increased demand and rising prices.

Traders who engage in forex gold trading must also consider the different ways they can participate in the market. Many traders buy and sell physical gold, but this is less common in the forex market, where gold is typically traded in the form of contracts for difference (CFDs), futures contracts, or spot trading. Spot trading allows traders to buy or sell gold at current market prices, while futures contracts allow traders to speculate on the future price of gold. CFDs allow traders to take positions on gold without actually owning the physical metal, which can be an attractive option for those looking to capitalize on short-term price movements.

The advantage of trading gold in the forex market is its high liquidity. The gold market is one of the most liquid markets in the world, meaning that traders can enter and exit positions with ease, even in large volumes. This makes gold a highly attractive asset for short-term traders who seek to capitalize on price fluctuations. However, it also means that the market can experience significant volatility, as shifts in market sentiment or external events can lead to rapid changes in gold prices. As such, understanding the factors that influence gold prices and having a well-structured trading strategy is essential for success.

When trading gold, it is essential to use risk management strategies to protect your capital. Gold prices can be volatile, and sudden price swings can result in large losses if traders are not prepared. One way to manage risk is by using stop-loss orders, which allow traders to automatically exit a position if the price moves against them by a predetermined amount. Another strategy is to trade smaller position sizes, which helps limit exposure to potential losses. Traders should also consider diversifying their portfolios by trading other assets alongside gold to reduce risk and avoid overexposure to a single market.

One of the key benefits of forex gold trading is the ability to profit from both rising and falling gold prices. Traders can buy gold when they expect prices to increase or sell gold when they anticipate prices will fall. This flexibility makes gold an attractive asset for both bullish and bearish traders. However, predicting the direction of gold prices is not always easy, as it requires an understanding of multiple factors, including economic data, geopolitical events, and market sentiment. Traders who are successful in the gold market are often those who stay informed about global events and continuously adapt their strategies based on changing conditions.

As with any trading market, forex gold trading carries risks. The market is influenced by a range of factors, including global economic conditions, interest rates, inflation, and geopolitical events. Sudden changes in any of these factors can lead to unpredictable price movements, making it essential for traders to have a solid understanding of the market and the tools needed to manage risk. While gold trading offers significant opportunities, it also requires skill, discipline, and careful planning.

In summary, forex gold trading presents a wealth of opportunities for traders who understand the key factors that drive gold prices. The balance of supply and demand, interest rates, geopolitical events, and the strength of the US dollar all play significant roles in determining the price of gold. By staying informed about these factors and using sound trading strategies, traders can navigate the gold market and take advantage of price movements. Whether using gold as a safe haven or capitalizing on short-term price swings, gold trading offers a unique and dynamic way to participate in the global forex market.

2 notes

·

View notes

Text

Liquidity Pools: The Passive Income Trap Few Talk About

Decentralized finance (DeFi) has unlocked new ways to earn passive income, with liquidity pools being one of the most popular. The idea is simple—deposit your tokens, provide liquidity for trades, and earn a share of the transaction fees. But behind this seemingly effortless money-making strategy lies a hidden risk that many fail to consider.

If you’ve ever provided liquidity, you may have noticed that your total balance fluctuates, sometimes in ways that don’t add up. What’s happening? The answer lies in something called impermanent loss, a concept that can silently drain your profits if you're not careful.

This article breaks down how liquidity pools work, why impermanent loss happens, and what you can do to protect your earnings.

Liquidity Pools: The Basics

Traditional finance relies on order books, where buyers and sellers match bids. In contrast, decentralized exchanges (DEXs) use automated market makers (AMMs), which rely on liquidity pools rather than direct peer-to-peer trades.

Here’s how it works:

1. Liquidity providers (LPs) deposit two tokens into a pool in equal value.

2. Traders swap between these tokens, paying a small fee.

3. LPs earn a portion of these fees in return for supplying liquidity.

At first glance, this setup looks ideal—your assets work for you, generating yield while sitting in a pool. But what most new liquidity providers fail to recognize is how price fluctuations affect their holdings.

The Hidden Risk: Impermanent Loss

Impermanent loss occurs when the price of the tokens in a liquidity pool changes compared to when you first deposited them. Since AMMs rebalance token ratios based on supply and demand, the end result is often unfavorable for LPs.

When one token gains in value while the other remains stable (or drops), the pool adjusts your holdings accordingly. This means you end up with more of the weaker asset and less of the stronger one.

The loss is impermanent because, in theory, if the price returns to its original level, you won’t lose anything. However, the reality is that prices rarely move in perfect cycles. If you withdraw your liquidity while the price difference still exists, that loss becomes permanent.

This issue is especially problematic in volatile markets, where token prices swing frequently. Many LPs don’t realize that they could have made more money just by holding their assets instead of providing liquidity.

Why Liquidity Providers Often Overlook This Risk

Liquidity provision is often marketed as a low-risk way to earn passive income. The focus is usually on trading fees, which can indeed provide steady returns. However, these fees don’t always offset impermanent loss, especially in pools with volatile assets.