#Valuation Expert Services

Explore tagged Tumblr posts

Text

The Tax Expert Has The Answers

The Tax Expert Has The Answers When It Comes To Taxes! Do you have questions about your individual tax situation? Howard Dagley, CPA is the expert you need to get through your taxes this year. Don’t put off doing your taxes until the last minute. Let Howard handle the complicated parts of taxes. Call Howard Dagley today at 1-661-255-8627 and get your questions answered today! Howard Dagley, CPA…

View On WordPress

#Accountant Santa Clarita#best cpa in Santa Clarita#book keeping#business valuations#certified#college of the canyons#CPA San Fernando Valley#CPA Santa Clarita#CPA SCV#CPA SFV#filing taxes in Santa Clarita#Tax Preparation#tax services Santa Clarita#The Tax Expert Has The Answers

0 notes

Text

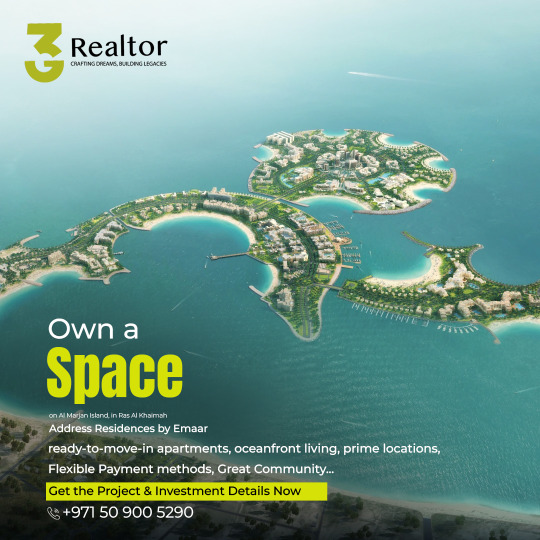

#Unlock your path to prosperity with the best real estate investment opportunities in the UAE! 🏡 Explore strategic property investments in Du#property valuation#and portfolio management services for profitable ventures. 💰 Discover the best residential and commercial real estate investments#guided by the top 10 investment planning strategies. 📊 Mitigate risks with our expert risk assessment in property investments. 🛡️ Explore r#RealEstateInvestment#PropertyConsultants#InvestmentAdvisors#RealtyExperts#StrategicInvestments#ProfitableVentures#InvestmentOpportunities#ResidentialInvestments#CommercialRealEstate#MarketAnalysis#PropertyValuation#PortfolioManagement#InvestmentPlanning#RiskAssessment#WealthBuilding#RentalProperty#MarketTrends#AssetGrowth#PropertyDevelopment#InvestmentStrategies#DubaiRealEstate#UAERealty 🌟

1 note

·

View note

Text

Monte-Carlo Simulation for Performing Valuations - Val Advisor

Monte Carlo Simulation is a valuable tool used in valuations required for financial reporting, enabling investors and analysts to make better decisions by quantifying uncertainties and assessing risks.

#business valuation#valuation#valuation services#business#businessgrowth#expert analysis#finance#finance management#financial consulting#financial reporting

0 notes

Text

To all our esteem clients and prospective tenants, we wish to remind us that we are still in business of properties ;

Consultancy,

Development,

Management,

Sales, lease/ Letting

And the main core: VALUATION FOR ALL PURPOSES

..................................................................................

We've properties of different sizes & types and at different locations within Nigeria.

1.) Sales properties; Both finished, under-construction & distress sales.

2.) Lease/Letting; yearly, Service Apartment/ShortLet.

FOR ENQUIRY ON PROPERTIES; 1, 2, 3, 4, (BEDROOMS)... LOCATION & PICTURES:

0 notes

Text

Property valuation is the process of estimating the value of a property based on a variety of factors. Property valuation is important for a number of reasons, including buying and selling property, obtaining financing, and assessing property tax.

In this guide, we will provide a complete overview of property valuation, including the methods used, factors considered, and the role of a property valuer.

#Property valuation#Property valuation near me#Property valuation nz#Property valuation online#Online Property valuation#canterbury appraisals#canterbury property appraisal#canterbury mortgage advisor#Experienced property valuation company#Top-rated appraisal services#Affordable house valuations#artists on tumblr#property valuation christchurch#canterbury mortgage advisor near me#canterbury property#Expert property appraisals#Property valuation companies Christchurch#Home appraisal cost New Zealand#House valuations Canterbury#Property appraisals Christchurch

0 notes

Link

#Business valuation services#Company valuation methods#Company valuation consulting#Company valuation experts#Company valuation models#Company valuation for startups#Company valuation for mergers and acquisitions#Company valuation for financial reporting#Company valuation for tax purposes#Company valuation for business planning

0 notes

Text

[“Many years ago when the Channel Tunnel—connecting England and France—was being built (1986–1992), I got the chance to talk to a nurse working on the project on the English side. The project was big, deadlines were tight, and the workers, she told me, were suffering terrible conditions in the tunnel (a total of ten workers died during the construction (Smith 2015)). I wondered how complicated her job was as part of the onsite health personnel for such a large project. Not very. “The men mostly come to me complaining of terrible headaches,” she explained, “my job is to give them two aspirin and get them back down the tunnel as quickly as possible.”

Speaking of medicine under capitalism, Waitzkin (2000: 37) notes the fundamental contradiction between the perception of health as the ultimate “caring profession” and a society which establishes obstacles to the goal of alleviating “needless suffering and death,” for “[t]he social organization of medicine also fosters patterns of oppression that are antithetical to medicine’s more humane purposes. These patterns within medicine mirror and reproduce oppressive features of the wider society as well.”

Marxist scholars of medicine have theorised this replication of the wider class struggle within the health system in a number of ways. First, the priorities of the institution favour those of capitalism and the ruling class. For example, the modern system of health care emerged out of the need for a healthier and more reliable industrial workforce (Waitzkin 2000: 48); concern for the health of the working classes has tended to peak when there are imperialist wars to be fought, while the majority of current medical research prioritises lifestyle and “me too” cosmetic treatments for the global market rather than research on life-saving treatments for cancer and infectious diseases (see, e.g., Rapaport 2015). Second, the exploitative work relations within capitalist societies are replicated within the rigid hierarchy of medicine, with high-waged, upper middle-class consultants holding a great amount of decision-making power at the top, the lower middle-class nursing managers administering consultants’ needs in the middle, and—holding no power whatsoever and subject to the whims of health managers—the low-earning working-class orderlies and auxiliary staff at the bottom of the pyramid. Navarro (1976: 446) also notes the tendency of the medical profession to maintain and reinforce these class relations through “both the distribution of skills and knowledge and the control of technology” within the health service. Third, the health system functions as an institution of social control. That is, it reinforces the dominant values and norms of capitalism through its surveillance and labelling practices. In the words of Freidson (1988: 252), medicine acts as a “moral entrepreneur” to the extent that illness is viewed negatively and as something to be “eradicated or contained.” Even cancer, he states, is a social valuation by the profession, a moral rather than an objective judgement of the body, even if it is one “on which most people happen to agree” (Freidson 1988: 252).

Taking a Marxist approach to medicine includes recognising the policing function of the health professions to label and “medicalise” social deviance as illness, as well as reinforce the ideological prerogatives of capitalism as natural and common sense (for instance, through biomedical interventions focused on the individual rather than the wider social environment).

The social control function within psy-professional work practices and knowledge claims is reasonably easy to identify and has been a major focus of critical scholars—Marxist and otherwise—since the 1960s (see, e.g., Conrad 1975; Goffman 1961; Rosenhan 1973; Scheff 1966). The moral judgements that mental health experts make of people’s behaviour under the claims of scientific neutrality and objectivity allow them to sanction forms of deviance which run contrary to the prevailing social order. For example, Szasz (cited in Freidson 1988: 249) stated in 1964 that “agoraphobia is illness because one should not be afraid of open spaces. Homosexuality is an illness because heterosexuality is the social norm. Divorce is illness because it signals failure of marriage.”

Specifically, Marxist contentions of the psy-professions as agents of social control focus on the ways in which these experts contribute to the alienation of people from their own creative abilities. These experts utilise their knowledge claims on human behaviour to depoliticise attempts at social transformation at the group and community level, in turn acknowledging only individual solutions as possible. Consequently, states Parker (2007: 2), this “psychologisation of social life” performed by mental health workers “encourages people to think that the only possible change they could ever make would be in the way they dress and present themselves to others.”]

bruce m.z. cohen, from psychiatric hegemony: a marxist theory of mental illness, 2016

48 notes

·

View notes

Text

Navigating the Mortgage Market: Finding the Best Mortgage Company in UAE

Navigating the mortgage market in the UAE can be challenging, given the numerous options available. This guide will help you find the best mortgage company for your needs, ensuring you secure favorable mortgage terms and rates.

For more insights into Dubai's real estate market, visit home loan dubai.

Understanding the UAE Mortgage Market

Market Overview: The UAE mortgage market is diverse and competitive, with a wide range of local and international banks offering various mortgage products. Understanding the market landscape is essential for making the right choice.

Types of Mortgages: Mortgages in the UAE can be classified into fixed-rate and variable-rate mortgages. Fixed-rate mortgages provide stability with consistent monthly payments, while variable-rate mortgages fluctuate based on market conditions.

Eligibility Criteria: Each mortgage company has its own eligibility criteria, including income requirements, employment status, and credit history. Understanding these criteria will help you identify which companies you qualify for.

For more investment options, explore Buy Commercial Properties in Dubai.

Key Features of Mortgage Companies

Competitive Interest Rates: Leading mortgage companies offer competitive interest rates, helping you save money over the loan term. Compare the rates offered by different companies to find the best deal.

Flexible Loan Terms: Look for mortgage companies that offer flexible loan terms, including various repayment periods and options for early repayment without penalties.

Customer Service: Excellent customer service is essential when dealing with mortgage companies. Choose a company with a strong reputation for providing responsive and helpful support.

Quick Approval Process: The approval time for mortgages can vary between companies. Select a company known for its quick and efficient approval process to avoid delays in your property purchase.

Additional Services: Some mortgage companies offer additional services such as mortgage insurance, property valuation, and financial planning advice. These services can add value and convenience to your mortgage experience.

For mortgage services, visit Mortgage Financing in Dubai.

Steps to Finding the Right Mortgage Company

Research and Compare: Start by researching various mortgage companies in the UAE. Use online platforms, read customer reviews, and compare their mortgage products and services.

Seek Recommendations: Ask friends, family, or colleagues for recommendations. Personal experiences can provide valuable insights into the reliability and efficiency of different mortgage companies.

Consult a Mortgage Broker: A mortgage broker can provide expert advice and help you find the best mortgage deals. They can also assist with the application process and negotiations.

Pre-Approval: Get pre-approved for a mortgage to understand your borrowing capacity and increase your chances of securing a good deal. Pre-approval also makes you a more attractive buyer to sellers.

Meet with Representatives: Schedule meetings with representatives from different mortgage companies to discuss your needs and ask questions. This will help you gauge their responsiveness and willingness to assist.

Review Terms and Conditions: Carefully review the terms and conditions of the mortgage offers. Pay attention to interest rates, loan terms, fees, and any other conditions that may affect your mortgage.

For property management services, visit Apartments For Rent in Dubai.

Popular Mortgage Companies in UAE

HSBC: Known for its competitive interest rates and flexible mortgage options, HSBC is a popular choice for homebuyers in the UAE.

Emirates NBD: Emirates NBD offers a range of mortgage products tailored to different needs, along with excellent customer service and quick approval times.

Mashreq Bank: Mashreq Bank provides personalized mortgage solutions with attractive rates and minimal fees, making it a preferred choice for many buyers.

ADCB: Abu Dhabi Commercial Bank (ADCB) offers comprehensive mortgage products with competitive rates and flexible repayment options.

Dubai Islamic Bank: For those seeking Sharia-compliant mortgage solutions, Dubai Islamic Bank offers a variety of Islamic mortgage products with favorable terms.

For property sales, visit Property For Sale in Dubai.

Real-Life Success Story

Consider the case of Noor and Hadi, who recently purchased their dream home in Dubai. By working with a reputable mortgage company, they secured a mortgage with favorable terms. The mortgage company provided expert advice, handled the paperwork, and ensured a smooth process from start to finish. This allowed Noor and Hadi to focus on finding their perfect home without worrying about the complexities of securing a mortgage.

For more insights into Dubai's real estate market, visit home loan dubai.

Future Trends in the UAE Mortgage Market

Digitalization: The UAE mortgage market is embracing digitalization, with many companies offering online application processes, digital document submission, and virtual consultations. This trend is making the mortgage process more efficient and convenient.

Sustainable Mortgages: There is a growing demand for sustainable mortgages that support environmentally friendly and energy-efficient homes. Mortgage companies are beginning to offer products that cater to this demand.

Flexible Mortgage Products: Mortgage companies are increasingly offering flexible mortgage products that cater to the diverse needs of homebuyers. This includes options for expatriates, first-time buyers, and investors.

For property sales, visit Sell Your Apartments in Dubai.

Conclusion

Navigating the mortgage market in the UAE involves careful research, comparison, and consideration of various factors. By understanding the market, seeking recommendations, and evaluating your options, you can secure a mortgage that meets your needs and financial goals. For more resources and expert advice, visit home loan dubai.

6 notes

·

View notes

Text

A UCLA professor was suspended for not providing special treatment to black students in the light of George Floyd's death. The professor is suing the University of California Los Angeles for more than $19 million over the well-publicized incident that garnered national notoriety.

Gordon Klein – a lecturer of accounting at the Anderson School of Management – made headlines in June 2020 when he refused to give preferential treatment to black students.

As Blaze News previously reported, Klein was asked by a student if black students would be given special accommodations because of George Floyd's death and the subsequent Black Lives Matter protests.

"The student requested a no-harm and shortened final exam, and extended deadlines for final assignments and projects in consideration of black students' well-being in light of nationwide protests against police brutality," the Daily Bruin reported.

Klein responded by writing:

Thanks for your suggestion in your email below that I give black students special treatment, given the tragedy in Minnesota. Do you know the names of the classmates that are black? How can I identify them since we've been having online classes only? Are there any students that may be of mixed parentage, such as half black-half Asian? What do you suggest I do with respect to them? A full concession or just half?

Klein asked the student if "a white student" from Minneapolis "might be possibly even more devastated" by the death of George Floyd.

Klein then quoted Martin Luther King Jr., and asked, "Remember that MLK famously said that people should not be evaluated based on the 'color of their skin.' Do you think that your request would run afoul of MLK's admonition?"

A student took a screenshot of the email conversation, and it quickly circulated online.

UCLA students claimed Klein's email was "backhandedly racist" and that it undermined the Black Lives Matter movement.

The same day as Klein wrote the email, a Change.org petition was launched, and it demanded Klein be "terminated for his extremely insensitive, dismissive, and woefully racist response to his students’ request for empathy and compassion during a time of civil unrest."

The petition — with more than 21,000 signatures — read, "His behavior is not reflective of the equity, respect, and justice that UCLA stands for as an institution."

Two days later, Anderson School Dean Antonio Bernardo announced that Klein was suspended and an investigation was initiated into the "troubling conduct."

"Providing a safe, respectful and equitable environment in which students can effectively learn is fundamental to UCLA’s mission," Bernardo declared. "We share common principles across the university of integrity, excellence, accountability, respect, and service. Conduct that demonstrates a disregard for our core principles, including an abuse of power, is not acceptable."

"I deeply regret the increased pain and anger that our community has experienced at this very difficult time," Bernardo added. "We must and will hold each other to higher standards."

Klein was reinstated less than a month after the incident.

However, Klein alleges that the public backlash had caused irreparable damage.

Klein derives significant income from his expert witness practice.

The College Fix reported, "He has testified, for example, in several high-profile court cases, including Michael Jackson’s wrongful death, Apple’s acquisition of Dr. Dre’s Beats headphones, and the valuation of General Motors’ assets in bankruptcy."

Klein’s attorney – Steve Goldberg – told the College Fix this week, "He was one of the top damages experts in the country who was historically bringing in well over $1 million dollars a year and trending upwards when it happened."

"That practice went to ashes right after he was suspended," said Goldberg, a member of the Markun, Zusman & Compton law firm.

Klein, who continues to teach as a full-time lecturer at UCLA, is suing the university for "well over $19 million in damages."

Klein's lawsuit is scheduled to go to trial on March 4 at the Santa Monica Courthouse.

Klein, who joined the UCLA Anderson School of Management in 1981, first filed a lawsuit against the school in September 2021.

UCLA did not respond to repeated requests for comment by The College Fix.

15 notes

·

View notes

Text

Physical Verification of Fixed Assets by MASLLP: Ensuring Accuracy and Accountability

For businesses, maintaining an accurate record of fixed assets is crucial for financial reporting, compliance, and operational efficiency. MASLLP, a trusted name in the financial consulting domain, offers expert services for the physical verification of fixed assets, ensuring your business stays organized, compliant, and secure.

What is Physical Verification of Fixed Assets? Physical verification of fixed assets involves systematically checking and validating the existence, condition, and location of assets owned by a business. It is a critical process to:

Identify discrepancies between physical assets and records. Ensure compliance with accounting standards and regulations. Protect against theft, loss, or mismanagement of assets. Why Choose MASLLP for Fixed Asset Verification? MASLLP’s team of experienced professionals ensures a seamless and accurate verification process. Here’s why businesses trust MASLLP:

Comprehensive Asset Audits MASLLP’s experts conduct thorough physical inspections, cross-referencing assets with financial records to identify inconsistencies.

Advanced Tools and Technology Using cutting-edge tools like barcoding, RFID, and asset tracking software, MASLLP ensures precision in the verification process.

Customized Solutions Every business is unique, and MASLLP tailors its asset verification services to align with your organization’s specific needs and objectives.

Compliance Expertise With MASLLP’s expertise in financial regulations, your business stays compliant with statutory requirements and accounting standards.

Key Benefits of Physical Verification by MASLLP Accurate Financial Reporting Eliminate discrepancies in your financial statements by ensuring all assets are accounted for.

Enhanced Asset Management Identify underutilized, misplaced, or obsolete assets to improve efficiency and cost-effectiveness.

Risk Mitigation Reduce the risk of theft, fraud, or mismanagement by maintaining an accurate and up-to-date asset register.

Regulatory Compliance Ensure adherence to legal and accounting standards, avoiding penalties and audits.

MASLLP’s Fixed Asset Verification Process

Planning and Preparation Understanding the client’s asset management system. Defining the scope of the verification process.

On-Site Physical Verification Conducting a detailed inspection of assets. Tagging and labeling assets where required.

Reconciliation Comparing physical records with the asset register. Identifying and addressing any discrepancies.

Reporting Providing a comprehensive report with findings and recommendations. Why Regular Fixed Asset Verification is Essential Businesses often overlook the importance of regular physical verification, which can lead to:

Inaccurate asset valuation. Missed opportunities for tax benefits. Increased risks of fraud or theft. By partnering with MASLLP, businesses can maintain a robust asset management system and safeguard their investments.

Get in Touch Ensure your fixed assets are accounted for and secure with MASLLP’s Physical Verification of Fixed Assets services.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation#ap management services#auditor

5 notes

·

View notes

Text

Tax Expert 2024

Howard Dagley Is Your #1 Tax Expert In 2024. The Best CPA In SoCal Can Help You With Your Taxes! Do you have questions about your tax situation? Give Howard Dagley, CPA a call today! When it comes to tax and business matters, Howard Dagley is the expert you need. Get in touch with Howard by calling 1-661-255-8627 today California Business owners with 1099 associates, filing Deadline for Form 1099…

View On WordPress

#Accountant Santa Clarita#best cpa in Santa Clarita#business valuations#certified#CPA San Fernando Valley#CPA SCV#CPA SFV#Howard Dagley#Howard Dagley CPA SCV#Tax Expert 2024#Tax Preparation#Tax Returns#tax season#tax services Santa Clarita

0 notes

Text

OpenAI launches Sora: AI video generator now public

New Post has been published on https://thedigitalinsider.com/openai-launches-sora-ai-video-generator-now-public/

OpenAI launches Sora: AI video generator now public

OpenAI has made its artificial intelligence video generator, Sora, available to the general public in the US, following an initial limited release to certain artists, filmmakers, and safety testers.

Introduced in February, the tool faced overwhelming demand on its launch day, temporarily halting new sign-ups due to high website traffic.

youtube

Changing video creation with text-to-video creation

The text-to-video generator enables the creation of video clips from written prompts. OpenAI’s website showcases an example: a serene depiction of woolly mammoths traversing a desert landscape.

In a recent blog post, OpenAI expressed its aspiration for Sora to foster innovative creativity and narrative expansion through advanced video storytelling.

The company, also behind the widely used ChatGPT, continues to expand its repertoire in generative AI, including voice cloning and integrating its image generator, Dall-E, with ChatGPT.

Supported by Microsoft, OpenAI is now a leading force in the AI sector, with a valuation nearing $160 billion.

Before public access, technology reviewer Marques Brownlee previewed Sora, finding it simultaneously unsettling and impressive. He noted particular prowess in rendering landscapes despite some inaccuracies in physical representation. Early access filmmakers reported occasional odd visual errors.

What you can expect with Sora

Output options. Generate videos up to 20 seconds long in various aspect ratios. The new ‘Turbo’ model speeds up generation times significantly.

Web platform. Organize and view your creations, explore prompts from other users, and discover featured content for inspiration.

Creative tools. Leverage advanced tools like Remix for scene editing, Storyboard for stitching multiple outputs, Blend, Loop, and Style presets to enhance your creations.

Availability. Sora is now accessible to ChatGPT subscribers. For $200/month, the Pro plan unlocks unlimited generations, higher resolution outputs, and watermark removal.

Content restrictions. OpenAI is limiting uploads involving real people, minors, or copyrighted materials. Initially, only a select group of users will have permission to upload real people as input.

Territorial rollout. Due to regulatory concerns, the rollout will exclude the EU, UK, and other specific regions.

Navigating regulations and controversies

It maintains restricted access in those regions as OpenAI navigates regulatory landscapes, including the UK’s Online Safety Act, the EU’s Digital Services Act, and GDPR.

Controversies have also surfaced, such as a temporary shutdown caused by artists exploiting a loophole to protest against potential negative impacts on their professions. These artists accused OpenAI of glossing over these concerns by leveraging their creativity to enhance the product’s image.

Despite advancements, generative AI technologies like Sora are susceptible to generating erroneous or plagiarized content. This has raised alarms about potential misuse for creating deceptive media, including deepfakes.

OpenAI has committed to taking precautions with Sora, including restrictions on depicting specific individuals and explicit content. These measures aim to mitigate misuse while providing access to subscribers in the US and several other countries, excluding the UK and Europe.

Join us at one of our in-person summits to connect with other AI experts.

Whether you’re based in Europe or North America, you’ll find an event near you to attend.

Register today.

AI Accelerator Institute | Summit calendar

Be part of the AI revolution – join this unmissable community gathering at the only networking, learning, and development conference you need.

Like what you see? Then check out tonnes more.

From exclusive content by industry experts and an ever-increasing bank of real world use cases, to 80+ deep-dive summit presentations, our membership plans are packed with awesome AI resources.

Subscribe now

#ai#AI video#America#artificial#Artificial Intelligence#artists#bank#billion#Blog#chatGPT#Community#conference#content#creativity#dall-e#deepfakes#development#Editing#eu#Europe#event#Featured#gdpr#generations#generative#generative ai#generator#Impacts#Industry#Inspiration

2 notes

·

View notes

Text

A Deep Dive into the Valuation of Blockchain Companies

Read our blog for a deeper understanding of the factors to consider, methodologies to use or challenges to overcome when valuing blockchain companies. 📊📈 Feel free to share this valuable post with your network.

At ValAdvisor, we use various advanced models and simulation techniques to deliver reliable and accurate valuations. Contact us at to schedule a consultation! 🤝💼

#business valuation#valuation#valuation services#business#businessgrowth#expert analysis#finance#finance management#financial consulting#financial reporting#blockchain

0 notes

Text

We are in business of provision of accomodations and investment consultant/ adviser

#Real Estate investment consultant & Valuation expert. let be at your service today and you will be glad indeed.#property TOLET. 2 bedroom flat @ lugbe district Abuja FCT.

0 notes

Text

vimeo

Canterbury Appraisals is a FREE online service that provides FREE House Market Appraisal by connecting homeowners with local real estate experts.

#Canterbury Appraisals#Canterbury Appraisals near me#FREE online service#FREE House Market Appraisal#House Market Appraisal#House Market#local real estate experts#local real estate expert#canterbury appraisals#canterbury mortgage advisor#property valuation christchurch#canterbury property#canterbury property appraisal#Expert property appraisals#Trusted property valuations#Affordable house valuations#Real estate appraisal near me#Property valuation companies Christchurch#House valuations Canterbury#Residential property valuations Christchurch#Vimeo

0 notes

Text

The Trump Defense is completely unhinged.

I will no longer be able to comment.

We’ll need a Rod Serling guide us through this Twilight Zone.

FINAL CONSIDERATION:

The Trump Derangement game plan may be to throw up stuff that is an obvious waste of the court’s time. Assume the Plaintiff objects; then the Judge rules for the Plaintiff; then the Trump team files a bizzaro pleading or motion for mistrial by the Defense.

Engoron let the Trump team jerk off the Court all day Monday with Don Jr’s presentation**.

Trump’s team still filed a bizarro motion for mistrial.

On Wednesday the State objected to the above expert propounding a novel opinion of a value greater than market value. The Judge let Direct Examination proceed.

Today the Plaintiff eviscerated the Defense Witness.

The Judge has previously he’s going to listen to specious Defense testimony If only so as not to give a basis for an appeal.

••••••••••••••••••••••

** The Trump family and Attorney Habba are fixated on the “State’s under-valuation” and the “Judge’s under-valuation” of the Trump properties.

Evidently they are unable to process that the “under-valuation” numbers are from documents from the Trump files.

It is a waste of the Court’s time for the Trump Prganization to attack values from the Trump Organization files. Particularly as those documents contained material facts that the Trumps were obligated to disclose on SFCs but ‘neglected’ to do so.

Neither the Trump family nor any attorneys in any motion have addressed the other frauds: Valuing 20,000 NONEXISTANT square feet at $600million. Claiming $75million of investor money committed to another project was available to service a new loan for a different project. Failing to disclose a myriad of material facts undercutting the valuation as required by law to be disclosed. Omitting to disclose loans that would negatively affect cash flow available to service the new loan. Overstating cash flow from projects.

18 notes

·

View notes