#Company valuation methods

Explore tagged Tumblr posts

Link

#Business valuation services#Company valuation methods#Company valuation consulting#Company valuation experts#Company valuation models#Company valuation for startups#Company valuation for mergers and acquisitions#Company valuation for financial reporting#Company valuation for tax purposes#Company valuation for business planning

0 notes

Text

Methods of Company Valuation: A Look into the World of Business Assessment

Determining the value of a company is a critical aspect of financial analysis. It helps stakeholders, investors, and entrepreneurs make informed decisions regarding buying, selling, or investing in businesses. Multiple methods are used to calculate a company's value, each offering unique insights into its worth. One platform that offers comprehensive courses on company valuation is Quest by Finology. The platform's valuation courses equip individuals with the skills and knowledge necessary to understand and apply these techniques effectively.

Here are some commonly used methods of company valuation:

Market Capitalization: Market capitalization is a straightforward and widely recognized method. It calculates a company's value by multiplying its stock price by the total number of outstanding shares. However, it's important to note that market capitalization might not always accurately reflect a company's intrinsic value due to market sentiment and investor behaviour.

Earnings Multiples: This method assesses a company's value by comparing its earnings (such as EBITDA or net income) to similar companies in the industry. By applying a multiple to the earnings, an estimate of the company's worth can be derived. However, it is essential to consider industry average multiples and other relevant factors to ensure an accurate valuation.

Asset-Based Approach: The asset-based approach focuses on the net value of a company's assets and liabilities. It involves subtracting liabilities from assets to determine the company's net worth. This method is particularly useful for companies with significant tangible assets, such as manufacturing firms. However, it might not adequately capture intangible assets and future earnings potential.

Discounted Cash Flow (DCF) Analysis: DCF analysis is a popular valuation method that projects a company's future cash flows and discounts them to their present value. This approach considers the time value of money and provides a comprehensive assessment of a company's intrinsic value. However, it requires accurate cash flow projections and the selection of an appropriate discount rate.

Comparable Transactions: Comparable transactions involve analyzing previous transactions involving companies within the same industry or with similar characteristics. By examining the terms and prices of these transactions, one can gain insights into the market value of the company being valued. However, it is crucial to consider the comparability of transactions and adjust for any differences.

Quest by Finology offers courses on company valuation that delve into these methods and provide individuals with a comprehensive understanding of the techniques. The courses go beyond theoretical knowledge and include practical case studies and best practices in the field. By exploring these courses, individuals can enhance their financial analysis skills and make well-informed decisions based on accurate valuations.

In conclusion, understanding the methods of company valuation is crucial for assessing a business's worth. Each method offers a unique perspective on a company's value, taking into account various factors such as financial performance, market dynamics, and industry trends. Platforms like Quest by Finology provide individuals with an opportunity to gain insights into these valuation techniques and acquire the skills necessary to perform accurate assessments.

0 notes

Text

Why startup valuation slides are important?

Startup valuations can be a tricky subject. As an early-stage startup seeking investment, you need to understand how investors view valuation and what factors impact their perception. Your valuation slide deck is a key tool for clearly communicating your company’s worth to potential investors. Here’s why your valuation slides matter and how to create an effective deck:

Importance of Valuation Slides

– Sets expectations for investment terms. Your valuation sets the stage for the percentage of equity investors will require and the valuation caps for convertible notes. An unrealistically high valuation can turn off investors.

– Demonstrates your understanding of valuation methods. Using standard valuation methods like discounted cash flow analysis and comparable transactions shows investors you have a solid grasp of how startup valuations work.

– Supports your assumptions. Your valuation is based on certain assumptions about the market, your traction, future growth, etc. Investors will scrutinize these assumptions closely.

– Allows investors to benchmark you. Investors will compare your valuation to other startups at your stage in your industry. Your valuation needs to be defensible within this peer group.

Key Elements to Include

– Valuation history. Cover previous valuation events, like seed funding rounds, showing the progression of your valuation over time.

– Revenue growth forecasts. Project your revenue growth month-by-month or quarter-by-quarter for the next 3-5 years. Tie your assumptions to drivers like customer acquisition costs.

– Market size estimates. Include TAM (total addressable market) analysis to quantify your potential market opportunity. Refer to market research reports.

– Comparable transactions. Identify 3-5 startups in your space at a similar stage who have been acquired or gone public. Show their valuations at those liquidity events.

– Valuation methods. Use 2-3 standard methods like discounted cash flow, multiples of revenue, etc. to derive a sensible valuation range.

– Capitalization tables. Include cap tables showing the breakdown of equity ownership between founders, investors and stock option pools.

Download Sample Valuation Report

Valuation slide deck

Remember, your valuation slide deck is a key tool for demonstrating your startup’s progress and potential. Build persuasive slides that clearly communicate all the elements that drive your valuation. With a compelling deck in hand, you can have more productive conversations with investors.

#Sample Valuation Report#Valuation slide deck#valuation methods#startup valuation#startup valuation tool#online startup valuation calculator#startup valuation calculator#valuation calculator startup#early-stage startups with no revenue#valuating early-stage companies

0 notes

Text

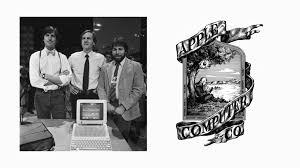

The Evolution of Apple’s Brand: A Strategy Built on Trust and Innovation

Apple Inc. Is one of the maximum successful and recognizable brands inside the global, consistently ranking at the top of global logo valuation lists. Its branding approach is a textbook instance of the way to build and preserve a robust, revolutionary, and emotionally resonant emblem. Below is an analysis of the important thing additives of Apple’s branding method and the way they make a contribution to its dominance within the marketplace.

Apple branding strategy analysis for 2024

1. Simplicity in Design and Messaging

One of the cornerstones of Apple’s branding method is its commitment to simplicity. From its product design to its marketing campaigns, Apple specializes in turning in a easy, sincere, and stylish experience. This ethos is evident in its minimalist product designs, intuitive person interfaces, and uncluttered advertising.

For instance, Apple’s classified ads regularly function the product in opposition to a undeniable heritage, with minimal textual content and a focus on the tool’s capabilities and aesthetics. This approach emphasizes the product itself in preference to overwhelming the viewer with information. Simplicity also extends to the naming conventions of its products—iPhone, iPad, MacBook—which might be clean to understand and recall.

This emphasis on simplicity allows Apple to face out in a crowded marketplace where many competition depend on technical jargon or function-heavy advertising. By focusing at the necessities, Apple appeals to clients who price clarity and elegance.

2. Consistency Across Touchpoints

Apple’s brand is meticulously regular across all touchpoints, inclusive of its retail shops, packaging, advertising and marketing, and customer support. This consistency reinforces the emblem’s identity and builds accept as true with with clients.

Apple’s retail stores are a high example. Each keep is designed to offer a continuing and immersive enjoy, with open layouts, clean strains, and uniform aesthetics. The body of workers is educated to embody Apple’s values, offering informed and pleasant customer service that enhances the general brand enjoy.

The packaging of Apple products is some other touchpoint in which consistency shines. The unboxing enjoy is cautiously curated to awaken a feel of exhilaration and top class first-rate. Every detail, from the in shape of the container to the association of the additives, displays Apple’s meticulous interest to element.

3. Focus on Innovation

Innovation is at the coronary heart of Apple’s brand strategy. The company positions itself as a pioneer in era, constantly pushing obstacles and setting enterprise standards. This reputation for innovation is a large motive force of Apple’s logo fairness.

Products just like the iPod, iPhone, and iPad had been progressive on the time of their release, redefining their respective classes and establishing Apple as a frontrunner in innovation. Even whilst entering set up markets, such as wearables with the Apple Watch or streaming with Apple TV+, Apple differentiates itself through specific features, seamless integration with its ecosystem, and superior person experience.

Apple’s emphasis on studies and improvement ensures a consistent pipeline of progressive products and services, retaining the logo at the vanguard of purchaser technology. This consciousness on innovation additionally fosters a belief of Apple as a ahead-wondering and modern-day business enterprise.

Four. Emotional Branding

Apple’s branding approach goes beyond practical blessings to hook up with clients on an emotional stage. The business enterprise’s advertising often specializes in how its products enhance users’ lives instead of just highlighting technical specifications.

Campaigns like “Think Different” and “Shot on iPhone” have fun creativity, individuality, and human connection. By associating its emblem with these aspirational features, Apple creates a deep emotional bond with its clients. This emotional resonance encourages logo loyalty and fosters a experience of community amongst Apple users.

5. Premium Positioning and Pricing

Apple positions itself as a top class logo, with pricing strategies that mirror its terrific and modern products. By keeping a higher price factor, Apple reinforces its picture as a luxury logo and differentiates itself from competition that compete on value.

This top class positioning is supported by Apple’s constant shipping of advanced design, functionality, and user revel in. Consumers perceive Apple products as really worth the investment due to their great, reliability, and the fame related to owning an Apple device.

6. Seamless Ecosystem

A key issue of Apple’s branding approach is its seamless surroundings of services and products. Devices just like the iPhone, iPad, MacBook, Apple Watch, and AirPods are designed to paintings together effects, developing a cohesive and incorporated user enjoy.

This environment strategy now not best complements patron delight however additionally fosters brand loyalty. Once a purchaser enters the Apple ecosystem, they may be much more likely to buy additional Apple services and products because of the ease and interoperability they provide. The environment also creates a barrier to entry for competitors, as switching to any other emblem would disrupt the person’s revel in.

7. Focus on Storytelling

Apple excels at storytelling, using its marketing campaigns to inform compelling narratives that resonate with clients. These tales often attention on how Apple products empower customers to reap their goals, express their creativity, or stay connected with loved ones.

For instance, Apple’s vacation classified ads regularly function heartfelt memories that highlight the emotional effect of its merchandise. By framing its era as an enabler of meaningful reviews, Apple strengthens its reference to customers and reinforces its logo values.

8. Strong Visual Identity

Apple’s visual identity is a important component of its branding method. The logo’s iconic brand, smooth typography, and consistent colour palette contribute to its robust and recognizable identity.

The Apple brand—a easy, glossy, and universally identified image—embodies the brand’s values of simplicity and innovation. The constant use of smooth and contemporary typography, along side a restricted coloration palette, ensures that all Apple communications are right away recognizable and aligned with its logo picture.

9. Word-of-Mouth and Brand Advocacy

Apple leverages word-of-mouth advertising and marketing and logo advocacy to extend its reach. Loyal customers often become logo ambassadors, sharing their advantageous stories with others and recommending Apple merchandise to pals and family.

The corporation’s attention on delivering high-quality merchandise and reviews creates a strong foundation for organic advocacy. Apple additionally encourages person-generated content, along with the ��Shot on iPhone” campaign, which showcases the creative potential of its gadgets and amplifies its message thru real-global examples.

10. Cultural Relevance

Apple stays culturally relevant by aligning its brand with societal traits and values. The employer often highlights topics like sustainability, privacy, and diversity in its advertising and company initiatives.

For example, Apple emphasizes its dedication to environmental sustainability by using showcasing its efforts to apply recycled substances, reduce carbon emissions, and transition to renewable power. Similarly, its attention on person privateness differentiates Apple from competition and appeals to consumers who prioritize information protection.

By addressing these cultural and societal concerns, Apple positions itself as a responsible and ahead-thinking logo that aligns with the values of its target audience.

2 notes

·

View notes

Text

How to Sell Your eCommerce Business in 2024 | Imagency Media

The eCommerce landscape in 2024 is more competitive and dynamic than ever. As a business owner, you may have decided that now is the right time to sell your eCommerce business and capitalize on your hard work. Whether you're looking to pursue new ventures, retire, or simply cash in on your investment, selling your eCommerce business can be a lucrative opportunity. However, it requires careful planning and execution. In this guide, Imagency Media will walk you through the key steps to successfully sell your eCommerce business in 2024.

1. Prepare Your Business for Sale

Before you put your eCommerce business on the market, it's crucial to ensure it's in the best possible shape. Buyers are looking for profitable, well-managed businesses with growth potential. Here's how to prepare:

Financials: Make sure your financial records are up-to-date, accurate, and easy to understand. Buyers will scrutinize your profit margins, revenue trends, and expenses. Consider working with an accountant to organize your financials and identify any areas for improvement.

Operations: Streamline your operations to make your business more appealing. This includes optimizing your supply chain, automating processes where possible, and ensuring that your inventory management is efficient. A well-run business is more attractive to potential buyers.

Brand Strength: Evaluate your brand's online presence. This includes your website, social media, and customer reviews. A strong, reputable brand can significantly increase your business's value. Consider investing in professional web design and branding services to enhance your business's appeal.

Legal Documentation: Ensure all your legal documents, such as business licenses, contracts, and intellectual property rights, are in order. Potential buyers will conduct due diligence, and any legal discrepancies could derail the sale.

2. Determine the Value of Your Business

Valuing an eCommerce business is a complex process that involves multiple factors. The most common valuation method is a multiple of your annual net profit, but other factors can influence the final price:

Revenue and Profit: Consistent and growing revenue, along with healthy profit margins, are key indicators of value.

Customer Base: A large, loyal customer base with low churn rates adds significant value to your business.

Market Position: How well does your business stand out in its niche? A strong market position with potential for growth can attract higher offers.

Growth Potential: Buyers are interested in the future potential of your business. Demonstrating a clear path for growth, such as expanding product lines or entering new markets, can increase your valuation.

Consider hiring a professional business broker or valuation expert to help you determine a realistic asking price.

3. Find the Right Buyer

Finding the right buyer is critical to the success of the sale. There are several types of buyers to consider:

Strategic Buyers: These are companies or individuals in your industry looking to expand their market share or acquire new capabilities. They may pay a premium for businesses that complement their existing operations.

Financial Buyers: Private equity firms or investors looking for profitable businesses with growth potential fall into this category. They typically focus on the financial performance of your business.

Individual Buyers: These are entrepreneurs or aspiring business owners who see value in taking over an established business.

To find potential buyers, consider listing your business on online marketplaces, reaching out to your industry network, or working with a business broker who can connect you with qualified buyers.

4. Negotiate the Sale

Once you’ve found a potential buyer, the negotiation process begins. This phase is crucial, as it will determine the final terms of the sale. Key aspects to negotiate include:

Purchase Price: This is the most obvious point of negotiation, but it’s not the only one. Be prepared to justify your asking price based on your business’s financials and growth potential.

Payment Terms: You may receive the full payment upfront, or the buyer might propose an installment plan. Consider the tax implications and risks associated with different payment structures.

Transition Period: Many buyers will request a transition period where you stay on to help manage the business during the handover. Define the duration and scope of your involvement during this period.

Non-Compete Agreement: Buyers may ask you to sign a non-compete agreement, which would prevent you from starting a similar business in the same industry. Ensure the terms are reasonable and won’t limit your future opportunities.

5. Close the Deal

Once all the terms are agreed upon, it's time to finalize the sale. This involves:

Drafting the Purchase Agreement: Work with a lawyer to draft a purchase agreement that outlines all the terms of the sale, including the purchase price, payment terms, and any contingencies.

Due Diligence: The buyer will conduct a thorough review of your business, including financials, operations, and legal documentation. Be prepared to provide all requested information promptly.

Transfer of Ownership: After due diligence is complete and both parties are satisfied, the final step is the transfer of ownership. This includes transferring all business assets, such as inventory, intellectual property, and customer data, to the buyer.

Post-Sale Transition: If a transition period was agreed upon, ensure a smooth handover by providing the necessary training and support to the new owner.

6. Celebrate Your Success

Selling your eCommerce business is a significant achievement. Take the time to celebrate your success and reflect on the journey that brought you here. Whether you're moving on to a new venture or enjoying the fruits of your labor, you’ve accomplished something remarkable.

Conclusion

Selling your eCommerce business in 2024 requires careful planning, strategic thinking, and a clear understanding of the market. By following these steps, you can maximize the value of your business and ensure a successful sale. At Imagency Media, we understand the importance of a well-executed exit strategy. If you're considering selling your business and need assistance with branding, web design, or preparing your business for sale, we're here to help.

Take the next step today. Contact Imagency Media to learn how we can support you in maximizing the value of your eCommerce business and ensuring a successful sale.

This article serves as a valuable resource for eCommerce business owners looking to navigate the complexities of selling their business in 2024. By following these guidelines, sellers can approach the process with confidence and increase their chances of securing a profitable and smooth transaction.

2 notes

·

View notes

Text

Car Removal Services in Newcastle Simplified by reputed companies

The process of parting ways with an old or unwanted car can be a daunting task, often involving complexities and hassles. Fortunately, residents in Newcastle can now benefit from the simplified and efficient services offered by reputed car removal companies. In this exploration, we delve into the world of car removal services in Newcastle, shedding light on the streamlined processes provided by reputable companies, making the experience of selling a car more straightforward and stress-free.

I. The Evolution of Car Removal Services:

Car removal services have evolved significantly over the years, transitioning from traditional methods to more modern and customer-friendly approaches. The emergence of professional car removal companies in Newcastle has revolutionized the way individuals sell their cars, offering a range of benefits that extend beyond mere monetary transactions.

II. Streamlined Processes for Sellers:

One of the primary advantages of engaging with reputable car removal services in Newcastle is the streamlined process they provide for sellers. Unlike conventional methods that involve advertising, negotiations, and potential complications, professional car removal services have simplified the entire experience. Sellers can now enjoy a straightforward and efficient process, saving time and eliminating unnecessary stress.

III. Instant Valuations and Cash Offers:

Reputed car removal companies understand the importance of providing quick and fair valuations for the vehicles they acquire. Sellers in Newcastle can benefit from the convenience of receiving instant cash offers, eliminating the need for prolonged negotiations. This transparent and straightforward approach contributes to the trustworthiness of these companies and ensures that sellers are fairly compensated for their vehicles.

IV. Eco-Friendly Disposal Practices:

In an era where environmental responsibility is a growing concern, many reputable car removal services in Newcastle prioritize eco-friendly disposal practices. These companies specialize in environmentally conscious car recycling, ensuring that end-of-life vehicles are disposed of in a responsible manner. By choosing such services, sellers not only simplify the process but also contribute to sustainable and eco-friendly practices.

V. Comprehensive Range of Services:

Beyond the core service of removing and buying cars, reputable car removal companies in Newcastle often offer a comprehensive range of services. This includes the removal of junk or damaged vehicles, providing sellers with an all-encompassing solution. The versatility of their services ensures that individuals looking to sell their cars, regardless of the make, model, or condition, can find a reliable and convenient solution.

VI. Customer-Centric Approach:

The success of reputable car removal companies is often attributed to their customer-centric approach. These companies prioritize building strong and lasting relationships with their clients, emphasizing professionalism and integrity throughout the entire process. From the initial inquiry to the final transaction, a customer-centric approach ensures that the needs and concerns of sellers are addressed, creating a positive and trustworthy experience.

VII. Industry Knowledge and Expertise:

Reputed car removal companies in Newcastle boast extensive industry knowledge and expertise. Their experienced teams understand market dynamics, allowing them to stay ahead of industry trends and provide the best possible deals to sellers. This expertise instills confidence in sellers, knowing that they are dealing with professionals who possess a deep understanding of the automotive market.

VIII. Testimonials and Positive Reviews:

A significant testament to the effectiveness of car removal services in Newcastle is the plethora of positive testimonials and reviews from satisfied customers. Real-life experiences shared by individuals who have engaged with these services serve as powerful endorsements. These testimonials highlight the consistent delivery on promises, further solidifying the reputation of reputable car removal companies as the preferred choice for car sellers in Newcastle.

IX. Competitive Market Position:

In a competitive market, reputable car removal companies in Newcastle have successfully established themselves as leaders in the industry. Their ability to adapt to changing market dynamics, coupled with a commitment to innovation and customer satisfaction, positions them as formidable players. As the automotive landscape continues to evolve, these companies remain reliable and preferred options for individuals seeking hassle-free car removal services in Newcastle.

Conclusion:

Car removal services in Newcastle have come a long way, with reputable companies offering simplified and efficient solutions for sellers. The streamlined processes, instant valuations, eco-friendly disposal practices, comprehensive services, customer-centric approaches, industry expertise, and positive testimonials collectively contribute to the success of these companies. For residents in Newcastle looking to part ways with their vehicles effortlessly, engaging with a reputable car removal service ensures a smooth and stress-free experience.

2 notes

·

View notes

Text

📢A Current Appraisal Supports Your Asking Price🏡

If you're selling your home, how can you be sure the asking price is accurate? Did you take the advice of a real estate agent, ask around in the neighborhood, or even check the most current tax assessment? While all of these methods can be helpful, the most reliable way to know is to get a listing appraisal.

A listing appraisal from Tight & Right Real Estate Valuation is a full appraisal of your property similar to one a buyer would receive on the purchase of your home, but with a few additional benefits for you:

You'll know the most realistic asking price so you don't lose out on potential profits or sit on the market longer than necessary

You'll make yourself aware of any problems and eliminate last-minute repair hassles that might delay a closing

You'll have all the current market data with verified status of all the comparable sales so you can differentiate your property from other properties on the market A listing appraisal from Tight & Right Real Estate Valuation gives you an expert opinion, an opinion that is unbiased.

Call us to learn more about our company and to place your order online.

We look forward to doing business with you.

Tight & Right Real Estate Valuation Cardwell Thaxton, New Jersey 📲(908) 456-1593 📧[email protected]

#appraiser#realestateappraiser#realestateappraisal#Moneyneversleeps#nareb#businesspassion#realtors#divorce#realestatelife#houses#property#newjerseyrealestate#foreclosures#realestateconsultant#GardenState#NewJersey

3 notes

·

View notes

Text

What is the valuation of goodwill by Sapient Services?

Goodwill is an intangible asset that arises when a company is purchased for a price that is higher than the sum of its individual assets and liabilities. In other words, goodwill represents the value of the "good name" and reputation of a business, as well as any other intangible assets that are not reflected in the balance sheet. The valuation of goodwill in India is important for a number of reasons, including financial reporting, tax planning, and mergers and acquisitions.

Visit: Hire the best business valuation specialist in Mumbai

Methods of Valuation of Goodwill: Sapient Services

- There are several methods that can be used to value goodwill, including the income approach, the market approach, and the asset approach.

The income approach involves estimating the future economic benefits that are expected to arise from the acquisition of a business. This is typically done by forecasting the future cash flows that are expected to be generated by the business and then discounting these cash flows back to their present value. The present value of the expected future cash flows is then used to estimate the value of the goodwill.

The market approach involves comparing the business being valued to similar businesses that have been recently sold in the market. This method relies on the principle of "comparable worth," which suggests that businesses with similar characteristics should have similar values. The value of the goodwill is then determined by adjusting the value of the comparable business for any differences in size, location, and other relevant factors.

The asset approach involves valuing the individual assets and liabilities of a business and then subtracting the liabilities from the assets to arrive at the value of the goodwill. This method is generally used when the income and market approaches are not applicable or when the business being valued has a large number of intangible assets.

There are a number of factors that can affect the value of goodwill, including the stability and growth prospects of the business, the strength of its brand and reputation, the quality of its management team, and the condition of the industry in which it operates.

There are several benefits to valuing Goodwill:

Mergers and Acquisitions: Valuation of goodwill is important when a company is considering merging with or acquiring another company. The value of the goodwill can help determine the overall value of the company and how much the acquiring company should pay for it.

Internal Decision-Making: Valuing goodwill can help a company make internal decisions, such as how to allocate resources and whether to divest certain assets.

Financial Reporting: Goodwill is recorded on a company's balance sheet and must be periodically reviewed and tested for impairment. Valuation of goodwill is necessary for this process and helps ensure that the company's financial statements are accurate.

Taxation: In some cases, the value of goodwill can affect a company's tax liability. For example, if a company sells a division with significant goodwill, the sale may result in a large capital gain or loss that could affect the company's tax bill.

Overall, the valuation of goodwill is important for understanding the overall value of a company and for making informed business decisions.

Few ways in which Goodwill can be important in a Business:

Brand recognition: A strong brand and reputation can help a business to attract and retain customers, which can lead to increased sales and profits. Goodwill can be a key driver of brand recognition, as it reflects the value of the "good name" and reputation of the business.

Customer loyalty: Goodwill can also help to build customer loyalty, as customers are more likely to continue doing business with a company that they perceive as trustworthy and reliable.

Competitive advantage: Goodwill can also give a business a competitive advantage in the market. For example, if a company has a strong brand and reputation, it may be able to charge a premium price for its products or services.

Improved valuation: Goodwill can also have an impact on the valuation of a business. If a company has a strong brand and reputation, it may be valued at a higher price when it is sold or when it raises capital.

Goodwill is an important factor in a business's overall value and can have a significant impact on the financial performance of the company. It is often considered to be a key intangible asset that contributes to the success of the business.

About Sapient Services

We educate clients in all perspectives regarding finance and our skill lies in the space of obligation, value and exchange warning. The firm lays major areas of strength for proficient authority and has a top to bottom comprehension of key business drivers.

Our administration succeeds in area information, and capital partnership options with astounding exchange execution capacities and has laid out a network with driving confidential value reserves, banks and monetary organizations and valuation of goodwill in India.

We offer free guidance on obligation and capital raising, consolidations and securing, monetary recreating, valuation and an expected level of investment for our clients.

4 notes

·

View notes

Text

Stock Market Valuation Guide

Learn how to assess the value of any stock in the market and make better investment decisions with this stock market valuation guide.

Do you want to learn how to assess the value of any stock in the market? Do you want to know whether a stock is overvalued, undervalued, or fairly valued? Do you want to discover the best methods and metrics to measure stock market valuation? If you answered yes to any of these questions, then this article is for you.In this article, you will learn everything you need to know about stock market…

View On WordPress

#how to assess stock market valuation#how to do stock market valuation#how to measure stock market valuation#how to value a business#how to value a company#how to value a stock#how to value any stock in the market#how to value shares#how to value stocks and shares#stock market valuation#stock market valuation analysis#stock market valuation examples#stock market valuation guide#stock market valuation guide 2023#stock market valuation methods#stock market valuation metrics#stock market valuation tips

0 notes

Text

Revitalize Your Property with Expert Masonry Restoration Services in Boston

Masonry restoration is essential to preserving the structural integrity and aesthetic appeal of Boston's historic and modern properties. Whether you have a charming brownstone or a contemporary commercial space, investing in masonry restoration services ensures your building remains functional and visually stunning.

Understanding Masonry Restoration

Masonry restoration involves repairing and rejuvenating existing brick, stone, or concrete structures to extend their lifespan and restore their original beauty. Over time, weather conditions, age, and wear can result in cracks, discoloration, and structural damage. Professional restoration addresses these issues, protecting your property from further deterioration.

Key Benefits of Masonry Restoration

Enhanced Structural Integrity: Restoration strengthens the foundation and structure, and prevents hazards caused by weak materials.

Improved Aesthetic Appeal: Restored masonry brings back the original charm of your property, enhancing its overall curb appeal.

Increased Property Value: A well-maintained building attracts higher property valuation and resale potential.

Energy Efficiency: Properly sealed and restored masonry helps improve insulation, which reduces energy costs.

Signs Your Building Needs Masonry Restoration

If your property displays any of the following signs, it’s time to consider masonry restoration services:

Cracks appear in brick or stone walls.

Faded or deteriorating mortar.

Water stains or moisture leakage.

Raised or uneven surfaces on walls or facades.

Comprehensive Masonry Restoration Services

When selecting a company for masonry restoration, make sure they offer a comprehensive range of services designed to meet Boston's unique architectural standards. Key services include:

Tuckpointing and Repointing: These methods replace damaged mortar, ensuring a clean and consistent finish that matches the original design.

Brick and Stone Replacement: Professional restoration involves replacing damaged brick or stone to maintain structural integrity and aesthetics.

Waterproofing and Sealing: Waterproofing protects masonry from harsh weather conditions, preventing water damage and freeze-thaw cycles.

Facade Cleaning and Restoration: This process removes grime, pollutants, and stains to revitalize the building's exterior.

Chimney Restoration: Essential for safety and functionality, chimney repair addresses cracks and deterioration in masonry chimneys.

Choosing the Right Masonry Restoration Experts

For exceptional results, it’s vital to select a skilled and experienced team for your project. Here’s what to consider when choosing the right professionals:

Experience and Expertise: A company with a proven track record in masonry restoration can handle the unique challenges of Boston’s historic and modern buildings.

Licensed and Insured: Ensure the team is fully licensed and insured to guarantee high-quality work and protection against liabilities.

Portfolio and Reviews: Review completed projects and client testimonials to assess the company’s reliability and craftsmanship.

Personalized Solutions: The best providers offer customized services to address your building’s specific needs.

Why Choose JWG Building Restoration for Masonry Restoration Services?

As a trusted company in Boston, JWG Building Restoration specializes in top-tier masonry restoration services that provide lasting results. Their team of experts combines traditional craftsmanship with modern techniques, ensuring each project is completed to the highest standard.

Key Features of JWG Building Restoration:

Over 30 years of industry experience.

Expertise in restoring Boston’s historic properties.

Commitment to using sustainable, high-quality materials.

Customer-centric approach with tailored solutions.

By choosing JWG Building Restoration, you’re investing in a team dedicated to preserving your property's beauty and durability.

Preserve Your Property's Charm and Strength with Expert Masonry Restoration

Masonry restoration is not just a repair—it’s an investment in the longevity, safety, and appeal of your building. Choosing experienced professionals like JWG Building Restoration ensures your property receives the care and expertise it deserves. With their comprehensive masonry restoration services, you can revitalize your Boston property and safeguard its future for generations.

Also Read:

How to Choose the Right Building Restoration Company in Boston, MA

Expert Boston Parking Garage Repairs for Safety and Longevity

How Building Restoration Services Can Enhance Your Boston Property

Enhance Your Property's Longevity with Surface Cleaning in Boston, MA

#masonry restoration services boston#masonry restoration services#masonry restoration services boston ma#masonry restoration

0 notes

Text

Are You Looking for Second hand gold buyers in Coimbatore?

Sri Sakthi Gold, Coimbatore. We understand that no one needs to sell gold unless there’s some urgent would like or emergency and so we tend to stand with you in adversity and supply you the whole help and support in guiding you the best method. People once need instant money, they become worried and though they need gold, they usually don’t like selling it because of the worry that they’re going to not get the suitable price of it. In Coimbatore, Sri Sakthi Gold has established itself as one of the most trusted names for Second hand gold buyers in Coimbatore. Individuals have apprehensions that they may be fooled by the buyer once he will perceive that there’s associate degree urgency. Several negative thoughts and questions create the person disquieted and anxious. Well, all you have got to do it’s to offer us a call and that we can make you understand.

CASH FOR GOLD: Sri Sakthi gold provides instant cash for gold in Coimbatore, We as leading old gold buyers in Coimbatore offer instant cash for gold and silver jewellery with easy and simple documentations. The method of selling gold is simple and quick and we settle for any reasonably damaged, second-hand or unused jewellery and we settle for any quantity of jewellery. We are one among the quickest emerging gold buying company. Our valuable customers will get instant cash against unused/old/damaged gold ornaments by selling at the best market value. Customers are free to sell any quantity of recent, used or damaged gold alternative jewellery to us however we prefer to have minimum 2 gm of gold.

OLD GOLD BUYERS: Some old gold jewellery lying around that hasn’t been worn in years. Well you can currently get some further cash! With gold prices at record levels at the instant there has never been a better time to cash in your unwanted gold with Jewels Planet. We will now offer you fantastic prices for your gold!!! SRI SAKTHI GOLD is one of the leading Second hand gold buyers in Coimbatore, offering an expert and correct gold valuation service to its customers in city. we provide a fast and economical coin valuation service As our wonderful reputation is based on trust, responsiveness and quality of service, you can be confident that your coin valuation will be of the best accuracy and the second jewellery .

When it comes to selling old gold, finding a reliable and trustworthy buyer is crucial to ensuring fair valuation and a hassle-free experience, Renowned for its transparent practices, expert appraisal, and excellent customer service, Sri Sakthi Gold provides a seamless process for anyone looking to sell their gold at competitive rates.

Why Choose Sri Sakthi Gold?

1. Accurate Gold Valuation: Sri Sakthi Gold is committed to offering fair prices for your old gold. The company uses advanced testing methods, such as: XRF Technology: A non-invasive technique to assess gold purity without damaging the jewellery. Digital Weighing Scales: Ensures precise weight measurement for accurate pricing. This scientific approach ensures that you receive the best value for your gold based on its purity and weight.

2. Transparency in Transactions: Transparency is a cornerstone of Sri Sakthi Gold’s operations. The entire appraisal process is conducted in front of the customer, ensuring complete trust and confidence. They provide detailed explanations of how the value is calculated, leaving no room for doubts or hidden charges.

3. Competitive Market Rates: Sri Sakthi Gold offers rates that align with the current market trends. Customers can expect: Instant price quotes based on real-time gold rates. No hidden deductions or unfair practices.

4. Instant Cash Payments: One of the standout features of Sri Sakthi Gold is its quick and hassle-free payment process. Once the gold valuation is complete and agreed upon, customers receive immediate payment through: Cash, Bank transfer, other convenient modes as per the customer’s preference

5. Buying All Types of Gold: Sri Sakthi Gold accepts various forms of gold, including: Old and broken jewellery, Coins and bars, Antique gold pieces, Scrap gold, No matter the condition, Sri Sakthi Gold ensures a fair evaluation. A Customer-Centric Approach, Sri Sakthi Gold prioritizes customer satisfaction by offering: Confidential Services: Every transaction is handled with discretion to respect the customer’s privacy. Friendly Staff: The experienced team provides guidance and answers any queries throughout the selling process. Convenient Location: Strategically located in Coimbatore, the shop is easily accessible, making it simple for customers to drop in.

Advantages of Selling to Sri Sakthi Gold: Stress-Free Process: No lengthy procedures or complicated paperwork. Trusted Reputation: A well-established name in Coimbatore with positive customer reviews. Safe and Secure Environment: All transactions are conducted in a professional and secure setting.

Testimonials from Satisfied Customers: Numerous customers have expressed their satisfaction with Sri Sakthi Gold, praising the company for its fair dealings, professionalism, and prompt service. Many highlight the transparency and ease of the process as standout features.

Conclusion: For anyone in Coimbatore looking to sell their old gold, Sri Sakthi Gold is the perfect choice. Combining advanced technology, competitive pricing, and exceptional customer service, they provide a seamless and trustworthy experience. Visit Sri Sakthi Gold today to turn your old gold into instant cash with confidence and peace of mind!

0 notes

Text

The Valuation Slide That Wins Investors

The Valuation Slide That Wins Investors

In the glitzy world of startups, where innovation meets ambition, there’s one slide in a pitch deck that can command the attention of everyone in the room – the valuation slide. Whether you’re an early-stage startup or merely gauging the potential of a business idea, presenting the perfect valuation can set the stage for a successful fundraising effort. But how do you nail this slide, especially if you have no revenue yet? Let’s delve deeper.

Why Valuation Matters

The valuation of a startup isn’t just about numbers or potential revenue. It’s a narrative of the company’s potential, vision, and the value it aims to deliver to stakeholders. For investors, valuation serves as a compass – it guides them to ascertain the risk associated with your startup and the potential return on their investment. While revenue is a straightforward measure for established companies, startups often operate in the realm of vision, potential, and innovation. This makes the valuation slide not only about the worth but also about the story behind that worth.

Crafting the Perfect Valuation Slide

1. Simplicity is Key: Don’t overwhelm your audience with complex calculations or jargon. Present a clear, concise valuation figure and back it up with 3-4 key metrics or reasons that support it.

2. Storytelling: Numbers, on their own, can be lifeless. Weave a compelling story around your valuation. How did you arrive at this figure? What milestones or potential growth does this number represent?

3. Visual Appeal: A picture is worth a thousand words. Use charts, graphs, or infographics to represent data. It aids in comprehension and retention.

4. Be Prepared for Questions: The valuation slide will undoubtedly raise eyebrows and questions. Be ready to defend your valuation with data, research, and comparables from the industry.

The Role of Valuation Tools

Not everyone is a financial wizard, and that’s okay. In today’s tech-driven age, tools like ValuationGenius can give you an edge. These platforms provide an approximate valuation based on a range of factors, eliminating the need for deep financial know-how. While this shouldn’t be the sole basis of your valuation, it can serve as a starting point or a validation tool. When combined with market research and industry benchmarks, tools like these can make your valuation slide more credible and robust.

Case Study: Litemeup and the Power of AI in Valuation

Meet Litemeup, a fledgling startup on the brink of transforming the packaging industry with AI-driven design. While they had a groundbreaking concept, they faced a common challenge many early-stage startups grapple with: how to place a valuation on an idea when there’s no product or revenue in play?

Enter ValuationGenius

Without a product, without revenue, and seemingly without the necessary data points that typically inform valuation, Litemeup turned to our tool. ValuationGenius didn’t just spit out a random number. Instead, it provided a range of estimates based on different valuation methods. But what truly stood out was the grounding of these estimates. Each was justified not just by data, but by the wisdom of business development and an inherent understanding of the startup landscape.

So, when Litemeup pitched to investors, they had more than just a vision. They presented a detailed valuation slide that wasn’t built on optimistic projections or vague assumptions but on a solid foundation provided by ValuationGenius. The result? They secured the trust and, subsequently, the investment from stakeholders, proving that even in a world where numbers often dominate, there’s always room for common sense and astute business acumen.

Conclusion

While a startup’s journey is riddled with challenges, presenting the right valuation shouldn’t be one of them. Remember, your valuation is more than just a number. It’s a representation of your startup’s vision, potential, and promise. Craft it with care, back it up with data, and present it with confidence. Value startup with no revenue

#startup valuation#startup#business valuation#online startup valuation calculator#startup valuation calculator#startup valuation tool#valuation calculator startup#online valuation platform

2 notes

·

View notes

Text

Gaming Peripheral Market Analysis: $5.2B in 2022 to $13.1B by 2031

Astute Analytica, a prominent market research firm, has recently published a comprehensive report that offers an extensive analysis of the global Gaming Peripheral market. This report goes beyond mere statistics, providing deep insights into various critical aspects such as market segmentation, key players, market valuation, and regional overviews. It serves as a valuable resource for businesses and stakeholders seeking to navigate this evolving industry landscape.

Market Valuation

The report includes a thorough evaluation of the market valuation, drawing from historical data, current trends, and future projections. By employing rigorous analytical methods, it effectively captures the growth trajectory of the market. This detailed assessment allows businesses to understand the factors driving growth and make informed decisions regarding investments and strategic initiatives.

The global gaming peripheral market was valued at US$ 5,219.1 million in 2022 and is expected to see a revenue opportunity worth US$ 13,113.8 million by 2031 at a CAGR of 10.9% from 2023-2031.

A Request of this Sample PDF File@- https://www.astuteanalytica.com/request-sample/gaming-peripheral-market

Comprehensive Market Overview

Astute Analytica's report provides a holistic overview of the global Gaming Peripheral market. It encapsulates a wide array of information related to market dynamics, including growth drivers, challenges, and opportunities. Stakeholders can leverage these insights to formulate effective strategies and maintain a competitive edge in the market.

Key Players in the Market

The report identifies and profiles the major players who are influencing the global Gaming Peripheral market. Through meticulous research, it presents a clear view of the competitive landscape, detailing the strategies, market presence, and significant developments of leading companies. This section is vital for stakeholders who wish to understand the positioning and actions of their competitors.

Key Companies:

Alienware

Anker Innovations Limited

Cooler Master Technology, Inc.

Corsair Components, Inc.

Eastern Times Technology Co., Ltd. (Redragon)

Gamdias

Guillemot Corporation S.A

HyperX

Kingston Technology Company, Inc.

Logitech International S.A

Mad Catz

Razer, Inc.

GIGA-BYTE Technology Co., Ltd.

Sades

Sennheiser Electronic GmbH & Co. KG

Sharkoon Technologies

Shenzhen Rapoo Technology Co., Ltd.

SteelSeries

Thermaltake Technology Co., Ltd.

Turtle Beach Corporation

Other Prominent Players

For Purchase Enquiry: https://www.astuteanalytica.com/industry-report/gaming-peripheral-market

Segmentation Analysis

A crucial component of the report is the segmentation analysis, which delves into various market segments based on industry verticals, applications, and geographic regions. This detailed examination provides stakeholders with a nuanced understanding of market dynamics, enabling them to identify opportunities for growth and areas for investment.

Market Segmentation:

By Device

Input Device

Controller

Gamepads

Gaming Mice

Headsets

Joysticks

Keyboards

Steering Wheel

Web Camera

Others

Output Device

AR/VR Headsets

Gaming Headsets

Head-mounted Display

Printer

Speakers

TFT and CRT Monitor

Others (Graphics Card, Digital Camera, etc.)

By Platform

Gaming Consoles

PC (Desktop/Laptop)

By Connectivity

Wired

Wireless

Bluetooth

Wi-Fi

Others

By Distribution Channel

Offline

Online

By End-User

Individual

Enterprises

Commercial

Game Parlors

Theme Parks/ Amusement Centers

By Region

North America

The U.S.

Canada

Mexico

Europe

The UK

Germany

France

Italy

Spain

Poland

Russia

Asia Pacific

CHINA

TAIWAN

India

Japan

Australia & New Zealand

ASEAN

Rest of Asia Pacific

Middle East & Africa (MEA)

UAE

Saudi Arabia

South Africa

Rest of MEA

South America

Brazil

Argentina

Rest of South America

Research Methodology

Astute Analytica is recognized for its rigorous research methodology and dedication to delivering actionable insights. The firm has rapidly established a solid reputation by providing tangible outcomes to clients. The report is built on a foundation of both primary and secondary research, offering a granular perspective on market demand and business environments across various segments.

Beneficiaries of the Report

The insights presented in this report are invaluable for a range of stakeholders, including:

Industry Value Chain Participants: Those directly or indirectly involved in the Gaming Peripheral market need to stay informed about leading competitors and current market trends.

Analysts and Suppliers: Individuals seeking up-to-date insights into this dynamic market will find the report particularly beneficial.

Competitors: Companies looking to benchmark their performance and assess their market positions can leverage the data and analysis provided in this research.

Astute Analytica's report on the global Gaming Peripheral market is an essential resource that empowers stakeholders with the knowledge needed to navigate and thrive in this competitive landscape.

Download Sample PDF Report@- https://www.astuteanalytica.com/request-sample/gaming-peripheral-market

About Astute Analytica:

Astute Analytica is a global analytics and advisory company that has built a solid reputation in a short period, thanks to the tangible outcomes we have delivered to our clients. We pride ourselves in generating unparalleled, in-depth, and uncannily accurate estimates and projections for our very demanding clients spread across different verticals. We have a long list of satisfied and repeat clients from a wide spectrum including technology, healthcare, chemicals, semiconductors, FMCG, and many more. These happy customers come to us from all across the globe.

They are able to make well-calibrated decisions and leverage highly lucrative opportunities while surmounting the fierce challenges all because we analyse for them the complex business environment, segment-wise existing and emerging possibilities, technology formations, growth estimates, and even the strategic choices available. In short, a complete package. All this is possible because we have a highly qualified, competent, and experienced team of professionals comprising business analysts, economists, consultants, and technology experts. In our list of priorities, you-our patron-come at the top. You can be sure of the best cost-effective, value-added package from us, should you decide to engage with us.

Get in touch with us

Phone number: +18884296757

Email: [email protected]

Visit our website: https://www.astuteanalytica.com/

LinkedIn | Twitter | YouTube | Facebook | Pinterest

0 notes

Text

How Can a Business Broker Help Me Sell My Business?

Selling a business is a major decision that requires careful planning, strategic thinking, and expert guidance. Whether you're looking to retire, move on to a new venture, or simply cash out, the process can be complex and time-consuming. One of the most effective ways to ensure that you get the best value for your business is to engage a professional business broker. If you're in Brisbane, QLD, partnering with a qualified business broker in Brisbane, such as Baton Advisory, can make a significant difference in how smoothly and successfully the sale of your business unfolds.

What is a Business Broker?

A business broker is a professional intermediary who helps business owners sell their businesses. They are experienced in negotiating deals, finding qualified buyers, and managing the intricate details involved in business transactions. Business brokers can be invaluable resources throughout the entire process, from evaluating your business’s value to finalizing the sale and transferring ownership.

In Brisbane, QLD, where the market for buying and selling businesses is competitive, working with a reputable business broker like Baton Advisory can give you an edge and ensure your sale is seamless and successful.

How Can a Business Broker Help Sell My Business?

Here are some ways a business broker in Brisbane can assist you in selling your business:

Valuation of Your Business

One of the first things a business broker will do is evaluate your business to determine its market value. This is a crucial step, as selling a business without understanding its worth can lead to undervaluing your company or setting an unrealistic price. A professional business broker in Brisbane, like Baton Advisory, uses various valuation methods to provide an accurate assessment of your business’s value.

They will consider factors such as revenue, profitability, assets, industry trends, and market conditions to arrive at a fair price. A proper valuation will also help you avoid setting a price that is either too high, which could scare off potential buyers, or too low, which could result in leaving money on the table.

Finding Qualified Buyers

Once your business has been valued, a business broker will begin the process of identifying and reaching out to potential buyers. Business brokers have access to a network of pre-qualified buyers who are actively looking for opportunities in the market. Their expertise and connections enable them to target individuals or companies that are the right fit for your business, making the process more efficient and productive.

A business broker in Brisbane also understands the local market dynamics, which is critical in identifying buyers who are not just interested but also capable of completing the purchase. For example, Baton Advisory’s team has local knowledge that allows them to connect sellers with buyers who have the right financial resources and strategic vision for taking over the business.

Marketing Your Business for Sale

A business broker handles all the marketing efforts, from creating professional listings to advertising through appropriate channels. This includes listing the business on national and international business-for-sale platforms, leveraging their network, and reaching out to potential investors who may be interested in your type of business.

In Brisbane, QLD, the business landscape is diverse, and a business broker like Baton Advisory knows how to tailor marketing efforts to the right audience. Whether you have a small business or a larger enterprise, they will ensure that your business is presented in the best possible light to attract serious buyers.

Confidentiality

Maintaining confidentiality during the sale process is critical. If employees, competitors, or customers learn that your business is for sale prematurely, it could negatively impact operations, staff morale, and client relationships. A business broker in Brisbane understands the importance of keeping your sale confidential and will manage all inquiries discreetly.

Baton Advisory ensures that sensitive information about your business is only shared with serious, qualified buyers after they have signed confidentiality agreements. This reduces the risk of disrupting your business while it’s still being sold.

Negotiation Expertise

Negotiating the terms of a sale can be challenging, especially when it comes to determining price, payment terms, and post-sale arrangements. A skilled business broker acts as a buffer between you and potential buyers, helping to navigate the often-emotional process of negotiation.

Business brokers have years of experience negotiating deals and know how to structure agreements that are fair and beneficial to both parties. They can also help you identify when an offer is too low or when a buyer is not serious about closing the deal. Baton Advisory, with its deep expertise in business brokerage Brisbane, will ensure that you receive a fair offer while helping buyers feel confident in the purchase.

Handling the Legal and Financial Details

The sale of a business involves various legal and financial complexities that require the expertise of professionals. A business broker in Brisbane coordinates with your legal and financial advisors to ensure that all paperwork is in order and that the transaction complies with relevant laws and regulations.

Baton Advisory works closely with legal and financial professionals to ensure that your business sale is structured in a way that minimizes tax liability, protects your interests, and complies with all regulatory requirements. They can also help manage the transition of assets, intellectual property, and any other critical components of the business.

Minimizing Stress and Saving Time

Selling a business can be an emotionally taxing and time-consuming process. The intricacies of valuation, marketing, and negotiations can quickly become overwhelming. By hiring a business broker, you free yourself from the day-to-day responsibilities of managing the sale, allowing you to focus on running your business or transitioning to your next phase of life.

A business broker in Brisbane, such as Baton Advisory, acts as a trusted partner who handles the heavy lifting. They guide you through each step of the process, offering peace of mind and reducing stress. The broker ensures that no details are overlooked, allowing you to confidently move forward with the sale.

Conclusion

When it comes to selling your business, partnering with a qualified business broker is an investment in your success. A business broker in Brisbane, such as Baton Advisory, offers a wealth of experience, local knowledge, and strategic insight to ensure that your business is sold at the best possible price, to the right buyer, and in the least amount of time.

The process of selling a business is complex, and having an expert by your side can make all the difference. Whether you're in the early stages of considering a sale or ready to put your business on the market, Baton Advisory can provide the guidance you need to make the process as smooth and profitable as possible.

1 note

·

View note

Text

Top 4 Ways About How Inventory Management Impacts Financial Statements

Inventory management is one of the most crucial aspects of any organization since it forms the basis of its operations. It guarantees that the products to be used are available when needed to address clients’ needs without incurring unnecessary expenses.

However, in addition to operational efficiency, inventory management is vital in the development of a company’s financial statements. From affecting profit to affecting cash flow, the way inventory is handled can significantly affect the financial health of a company. Let’s explore four ways inventory management affects financial statements.

1. Impact on Cost of Goods Sold (COGS)

The Cost of Goods Sold (COGS) is the best way of determining the exact cost incurred for producing or acquiring the goods sold by the firm. Inventory is directly related to this figure, which is indicated on the income statement.

1.1 Inventory valuation methods

The manner that is used to value inventories, which includes the first-in-first out basis, last in-first-out basis, and the weighted average cost, has a powerful impact on the cost of goods sold.

1. FIFO

It results in lower COGS during periods of rising prices, boosting net income but increasing taxes.

2. LIFO

It leads to higher COGS, reducing net income but offering tax advantages.

1.2 Stock management

Excessive inventories or stock is a great danger since they entail more holding costs, which may include deterioration and or obsolescence, which will increase the cost of goods sold. On the other hand, stockouts can affect sales productivity as well as revenues since stockouts trigger sales losses. Adequate and accurate stock management help in presenting the exact picture of business operations through calculation of the COGS.

2. Influence on balance sheet components

Inventory is another important current asset that must be on the balance sheet. Inefficient stock management is capable of annoying the balance sheet which leads to inefficient, impaired or unsafe finances.

2.1 Overstocking

High inventory levels increases the value of current assets which is actually a loss because the money used is tied up and unavailable for strategic investments. This also leads to increased levels of obsolete stock hence write offs and write downs therefore is a factor that contributes to the increase in the cost of goods sold.

2.2 Understocking

Stock out situation is the most costly situation to the overall supply chain for it results in reduced sales and revenues. Of course, it can be disguised as a decline in assets, but left unsolved, the lost sales and dissatisfied consumers are damaging in the long run.

Hence, inventory turnover ratios obtained based on inventory levels and COGS represent one more aspect of inventory management; in addition, they affect the perception of investors and creditors about the company’s operational efficiency.

3. Effects on cash flow statements

Inventory purchases directly affect the cash flow statement under operating activities. Mismanagement can cause much imbalance in the sources and uses of funds.

Excessive purchases Aggressive procurement, such as before full stocks to capture a bargain or to cover for a certain vacuum may well sound wise, but it leads to cash constraint and funds lockup.

Slow-moving inventory Items that take longer to sell delay cash inflows, impacting the company’s ability to meet short-term obligations.

When the inventories are well replenished, companies are in a position to finance other productive areas within their operations.

4. Impact on net income and profit margins

Net income, a key figure on the income statement, is heavily influenced by inventory management. Poor practices can erode profit margins, even if sales are robust.

Shrinkage and obsolescence Inventory losses due to theft, damage, or spoilage reduce gross profit. Regular audits and implementing robust tracking systems can mitigate these losses.

Discounting Overstocked inventory often leads to markdowns to clear excess stock, directly impacting profit margins.

Efficient inventory management ensures optimal stock levels, minimizing losses and maintaining healthy profit margins.

The broader implications for financial statements

Inventory management not only affects individual components like COGS, current assets, and cash flow but also shapes a company’s overall financial health. For instance, poor inventory practices can lead to

Lower Earnings Per Share (EPS) Reduced profitability impacts EPS, making the company less attractive to investors.

Credit challenges High inventory levels relative to sales can deter creditors, signaling inefficiency and potential cash flow issues.

On the other hand, effective inventory management enhances financial transparency, builds investor confidence, and supports long-term growth.

Conclusion

Inventory management goes beyond being a logistic function as it is a financial decision that impacts several factors in financial statements. In other words, cost management, cash flow and profitability can be made optimal when inventory is controlled effectively.

When one wants to learn more about how financial choices such as inventory control affect financial reports, taking an accounting course online is useful.

At Super 20 Training Institute, we offer top-notch accounting courses designed to empower aspiring professionals and entrepreneurs. Learn from industry experts, master critical accounting principles, and take your career to the next level. Visit us today and transform your understanding of finance!

0 notes

Text

Debt Collection Software Market: Valuation to Reach USD 11.5 Billion by 2033, Driven by Efficiency Gains – FMI

The Debt Collection Software Market is currently estimated at US$ 4.3 billion in 2023 and is poised for substantial growth, projected to reach US$ 11.5 billion by 2033. This remarkable expansion reflects a robust Compound Annual Growth Rate (CAGR) of 10.2% over the forecast period from 2022 to 2032.

Debt collection software aids in the automatic and daily monitoring of customers’ accounts, as well as the provision of loan installation notifications and alerts. This enables financial institutions to provide timely updates and cautions about loan Equated Monthly Instalments (EMI).

Debt collection software also assists financial institutions in complying with consumer protection regulations by recognizing bankruptcy status and litigious customers. As a result, the debt collection software market is fast growing.

Read More @ https://www.fmiblog.com/2024/09/26/debt-collection-software-market-valuation-to-reach-us-11-5-billion-by-2033-driven-by-efficiency-gains-fmi-3/

Debt collection services are gaining popularity as a result of their ability to assist businesses with strategy formulation, software deployment, and implementation based on their unique needs. As a result, a rise in the use of debt collection software across various industries, such as collection agencies, financial institutions, government, telecom & utilities, real estate, commerce, and healthcare, is supporting the growth in the sales of debt collection software.

As per the recent debt collection software market study, several firms from various industry verticals are rising in demand for multichannel communication solutions to communicate with debtors and advance their collection methods using cutting-edge automated technologies. This reason is increasing the sales of debt collection software, which is propelling the debt collection software market’s growth.

The adoption of debt collection services is expanding among major businesses, as opposed to small and medium-sized businesses, due to economies of scale and pricing. This indicates that the market is expected to attract excellent sales opportunities from significant corporations around the world.

Key Takeaways

Data analytics with debt collection solutions is a trend that is projected to gain pace in North America, particularly in the United States, shortly. Debt collection software providers understand the importance of big data analytics and predictive analytics in debt collection, as well as the advantages of data visibility in terms of compliance.

The software component segment of the debt collection software market is expected to rise at a CAGR of 9.3% throughout the forecast period.

The increasing willingness of businesses to use debt collection software to streamline the debt recovery process is expected to drive demand for debt collection software solutions in the Asia Pacific.

The US debt collection software market size is projected to reach a valuation of US$ 3.3 Bn by 2032.

Competitive Landscape

As per the debt collection software market analysis by FMI, the global debt collection software market appears to be moderately fragmented in character. Furthermore, the presence of a large number of vendors demonstrates that the market for debt collection software is highly competitive.

As a result, to keep ahead of the competition, key market players are implementing various strategies such as mergers, acquisitions, partnerships, and collaborations. Companies are also benefiting from these techniques as they expand regionally.

Many organizations in the debt collection software market are boosting their research and development spending. One of the main goals of these studies is to improve the quality of the services they offer. These initiatives are expected to help the debt collection software market grow in the coming years.

FIS, Nucleus Software Exports Ltd., Scorto, Inc., Temenos Headquarters SA, CGI, Inc., TransUnion LLC, Sentinel Development Solutions, Inc., Debtcol Software Pty Ltd., Intellect Design Arena Ltd., and Chetu Inc. are some of the key companies operating in the global debt collection software market.

Key Segments

By Component:

Software

Services

By Deployment:

Cloud-based

On-premise

By Organization Size:

SMEs

Large Enterprises

By End user:

Healthcare

Financial Institution

Collection Agencies

Government

Telecom & Utilities

Other

By Region:

North America

Europe

APAC

MEA

Latin America

0 notes