#Use of Blockchain in business

Explore tagged Tumblr posts

Text

The Role Of Blockchain In Business Operations (2023

The use of blockchain in business has revolutionized the economy in the world. Several companies have adopted its transactional & financial services facilities. More and more businesses are considering blockchain technology to streamline their business operations. The technology offers them several opportunities to reduce their business risk and costs. Blockchain supports more security and makes…

View On WordPress

#Benefits of blockchain in business#The blockchain in business#The Blockchain technology#Use of Blockchain in business

0 notes

Text

Empower Yourself: Harness the Power of Technology with These Handy Tips and Tutorials

Introduction: In today’s digital age, technology plays a crucial role in our daily lives. From smartphones and laptops to smart home devices and wearable technology, there are countless ways to utilize technology to enhance productivity, efficiency, and overall well-being. In this article, we will explore various tips and tutorials to help you harness the power of technology and empower yourself…

#advancements in artificial intelligence#cybersecurity best practices#emerging tech innovations#future of blockchain technology#guide to cloud computing#how to choose tech solutions for businesses#how to use new tech gadgets#impact of technology on business#Latest technology trends 2024#reviews of the latest tech products#tech tips and tutorials.#technology for smart homes#technology in healthcare#top technology startups#trends in mobile technology

0 notes

Text

Discover the top 10 website development trends in 2025, from AI, voice search, and blockchain to immersive designs and enhanced user experiences.

#Site It Now#Website Development Trends#2025#Web Development Company#Custom Website Development#AI#blockchain#augmented reality#virtual reality#voice search optimization#united states#voice search seo#seo company#web design trends#US Businesses#Web Technology#New Web Development Technology

0 notes

Text

Achieve 100% Growth with Top Crypto PR Tactics

In the dynamic realm of cryptocurrency, effective PR strategies are crucial for startup success. Learn how targeted Crypto PR can propel your project to new heights.

Navigating the competitive landscape of blockchain and cryptocurrency requires a strategic approach to public relations. Crypto PR focuses on enhancing and managing your startup’s reputation through a variety of tactics. Central to this approach is crafting a compelling brand story that resonates with your audience and clearly communicates your startup’s mission, values, and achievements. This narrative not only sets you apart from competitors but also builds a strong connection with investors and partners.

Community engagement is a critical element of successful Crypto PR. By maintaining regular communication, hosting interactive events, and actively responding to feedback, you can build a dedicated and engaged community around your project. Establishing relationships with key influencers in the crypto space and participating in industry events further amplifies your startup’s reach and credibility. These efforts help in attracting investor interest and increasing your project’s visibility.

To maximize the impact of your PR efforts, it’s essential to measure and analyze performance metrics. Tracking media coverage, social media engagement, and community growth provides valuable insights that help in refining your strategies. By continuously adapting and optimizing your approach, you can ensure long-term success and significant growth for your blockchain startup.

Partner with Intelisync to implement innovative Crypto PR strategies tailored to your blockchain startup. Contact us to explore how our expertise can accelerate your growth and enhance your Learn more...

#7 Crypto PR Strategies#7 Crypto PR Strategies to Boost business#7 Crypto PR Strategies to Boost Startup#7 Crypto PR Strategies to Boost Startup Growth 100% in 2024#Best Top 7 Crypto PR tactics#Best Top 7 Crypto PR tactics for tech startups#building a Strong Community Engagement#conference#Create Effective Press Content#Crypto#Crypto PR#Crypto PR Strategies to Boost Startup#Establishing connections with media and cryptocurrency influencers#How can Intelisync help blockchain startups with their PR strategies?#How do I choose a reliable public relations firm?#How is Crypto PR Different From Traditional PR?#or Web3 Project?#Participate in Events#PR Strategies to Boost Startup Growth#Public Relations Important for Your Blockchain#Use Social Media and create Video Content#What is Crypto PR?#Why are PR strategies important for blockchain and crypto startups?#Why Is Public Relations Important#Why Is Public Relations Important for Your Blockchain#Write an Engaging Brand Story#intelisync web3 marketing service inteliysnc web3 marketing agency intelisync growth marketing

0 notes

Text

Can Artificial Intelligence Make Insurance More Affordable?

New Post has been published on https://thedigitalinsider.com/can-artificial-intelligence-make-insurance-more-affordable/

Can Artificial Intelligence Make Insurance More Affordable?

AI rapidly transforms industries by optimizing processes, enhancing data analytics and creating smarter, more efficient systems. Traditionally, the insurance sector determines pricing by manually analyzing various factors — including coverage type — to calculate risk and set premiums.

Imagine harnessing AI’s power to sift through massive datasets more accurately and efficiently. It promises faster service and potentially fairer pricing for policyholders. This shift could revolutionize how insurers calculate premiums to make the process more transparent and tailored to individual risk profiles.

Basics of Insurance Pricing

Insurance companies traditionally determine premiums by analyzing age, location and the type of coverage clients seek. For instance, premiums might increase as policyholders age, primarily because being older typically corresponds with more health complications or a shorter life span. These aspects increase the risk to insurers.

Companies also consider where customers live because different areas have varying risk levels due to crime rates or environmental hazards. Insurers face the challenge of balancing accurate risk assessment with competitive pricing when selecting coverage. They must offer attractive rates to their clients while still covering potential costs. This balance is crucial for their business viability and the policyholders’ financial protection.

AI in Insurance

Currently, 80% of insurance companies utilize AI and machine learning to manage and analyze their data. This widespread adoption underscores its critical role in modernizing and streamlining the industry.

Integrating AI technology allows insurers to handle large volumes of information with unprecedented precision and speed. This capability lets them assess risk, set premiums and detect fraud more effectively than before. It means quicker service and more accurate pricing that reflects actual risk rather than a one-size-fits-all estimate.

The potential of AI to enhance decision-making processes in the insurance sector is immense. Advanced algorithms enable companies to predict outcomes, personalize policies and optimize claims management. This approach can also reduce human error and increase efficiency.

These improvements bolster the insurers’ bottom lines and enhance the policyholder experience. They benefit from more tailored coverage options and more responsive service. As AI evolves, it can significantly impact and offer smarter, more adaptable insurance solutions.

AI-Driven Changes in Insurance Pricing Models

AI and machine learning significantly enhance the accuracy of risk assessment by integrating and analyzing vast datasets. These technologies study complex patterns that human analysts might overlook and enable a deeper understanding of risk factors specific to each policyholder. It means insurers can tailor their offerings more precisely, reflecting actual risk rather than a generalized model.

Its ability to process large volumes of data accelerates claims processing and ensures clients receive compensation more quickly when needed. Additionally, these tools are adept at detecting fraudulent activities, which protects the insurer and policyholders from potential financial losses.

AI technologies manifest in various innovative forms, such as telematics, wearables and IoT devices. These contribute to more accurate risk assessments and premium calculations.

Telematics devices in vehicles track driving behaviors, providing insurers with data on how safely clients drive, which can lead to personalized premium rates or discounts. Wearables, like fitness trackers, offer insights into their health and lifestyle, potentially lowering health insurance costs by demonstrating active and healthy habits.

Similarly, IoT devices in houses can monitor risks — like fire or theft — to improve safety and potentially reduce home insurance premiums. These technologies collectively enhance the interaction with insurers and offer benefits for maintaining safer practices and a healthier lifestyle.

Benefits of AI-Enhanced Pricing for Insurers

The increased accuracy in premium calculation through AI mitigates risk, leading to potential cost reductions for insurance companies and policyholders.

This is significant because insurers can streamline operations and pass these savings onto clients through lower premiums. Moreover, the precision of AI analyses dramatically diminishes the likelihood of over- or underpricing risk. It ensures policyholders pay a fair rate corresponding to their actual risk level.

AI also enhances customer segmentation, creating personalized insurance products tailored to individual needs. This personalization happens through analyzing detailed data points, which allows insurers to understand various client segments more profoundly and offer products that more accurately fit different lifestyles and risk profiles.

Additionally, it automates routine tasks and analyses — like data entry and claim processing — which speeds up these operations and reduces the chance of human error. It results in faster service and more reliable insurance coverage because AI helps companies manage policies and claims precisely and efficiently.

Implications for Policyholders

The advent of AI in insurance has led to a significant shift toward fairer, usage-based premiums, which could be a game-changer for policyholders. In 2023, the average annual health insurance premiums were $8,435 for single coverage and $23,968 for family coverage, a considerable expense for many.

However, by incorporating AI, insurers can tailor premiums more closely to actual usage and risk level, lowering costs. This personalized approach makes insurance more accessible and rewards policyholders for healthy lifestyles or safe driving practices with reduced rates. It aligns their costs more directly with their personal risk factors.

Conversely, integrating AI into insurance raises valid privacy and data security concerns. As insurers collect and analyze more personal data to fine-tune policy offerings and streamline claims, the risk of breaches or misuse increases.

They must invest heavily in securing data in addition to using AI to process claims faster and settle disputes more accurately. This means implementing robust cybersecurity measures and transparent data usage policies to protect clients’ sensitive information. Likewise, policyholders must stay informed about how organizations handle their information and understand their rights to navigate these changes confidently.

Challenges and Ethical Considerations

As AI becomes integral to the insurance industry, it brings ethical issues concerning data use, algorithm biases and transparency. Clients’ personal information is crucial for tailoring policies, but there is a fine line between use and misuse. It emphasizes the need for precise data handling and consent policies.

Bias in AI algorithms can lead to unfair policy rates or claim denials if developers don’t monitor and correct them. On top of these concerns, the regulatory landscape struggles to keep pace with AI’s rapid development, necessitating new frameworks to ensure its positive and well-regulated impact.

Additionally, generative AI is reshaping the workforce and is the second leading cause of job losses after industrial and humanoid robots. This shift prompts a need for reskilling and transitioning strategies within the sector to mitigate employment impacts. It makes it essential for insurers to stay informed and adaptable as the industry evolves.

The Future of AI in Insurance Pricing

AI will continue to transform the insurance landscape. Industry experts estimate that generative AI could contribute approximately $7 trillion to the global GDP over the next decade. This significant economic impact underscores the potential for groundbreaking innovations and emerging technologies within the insurance experience.

Insurers can also use sophisticated AI applications to further personalize premium calculations, risk assessments and claims processing. Innovations — like real-time risk modeling, blockchain for transparent and secure policy management, and AI-driven virtual assistants for customer service — are likely to become standard features. These advancements will refine how people interact with insurance providers and ensure greater accuracy and efficiency in managing needs.

Navigating the AI Revolution in Insurance Responsibly

Policyholders and industry leaders must engage with AI responsibly as it reshapes the insurance landscape. Embrace AI’s potential to enhance the insurance experience while advocating for transparency, fairness and security in its deployment to ensure it benefits everyone involved.

#2023#ai#algorithm#Algorithms#analyses#Analytics#applications#approach#artificial#Artificial Intelligence#assessment#Bias#Blockchain#Business#challenge#Companies#crime#customer service#cybersecurity#data#data analytics#data security#data usage#data use#datasets#deployment#developers#development#devices#economic

0 notes

Text

Practical Use Cases: 7 Ways To Leverage Blockchain For Business

Discover the benefits and practical use cases of implementing blockchain in business, revolutionizing traditional processes, and unlocking new opportunities.

0 notes

Text

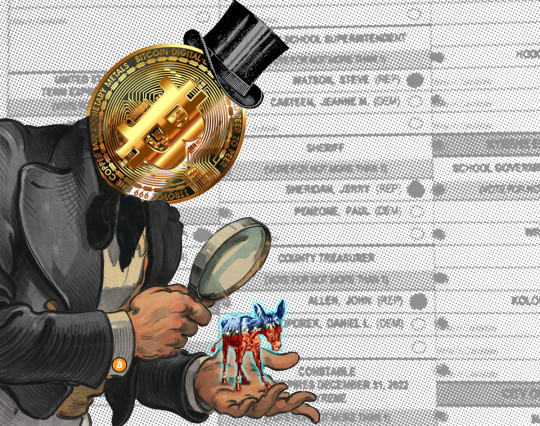

The largest campaign finance violation in US history

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Earlier this month, some of the richest men in Silicon Valley, led by Marc Andreesen and Ben Horowitz (the billionaire VCs behind Andreesen-Horowitz) announced that they would be backing Trump with endorsements and millions of dollars:

https://www.forbes.com/sites/dereksaul/2024/07/16/trump-lands-more-big-tech-backers-billionaire-venture-capitalist-andreessen-joins-wave-supporting-former-president/

Predictably, this drew a lot of ire, which Andreesen tried to diffuse by insisting that his support "doesn’t have anything to do with the big issues that people care about":

https://www.theverge.com/2024/7/24/24204706/marc-andreessen-ben-horowitz-a16z-trump-donations

In other words, the billionaires backing Trump weren't doing so because they supported the racism, the national abortion ban, the attacks on core human rights, etc. Those were merely tradeoffs that they were willing to make to get the parts of the Trump program they do support: more tax-cuts for the ultra-rich, and, of course, free rein to defraud normies with cryptocurrency Ponzi schemes.

Crypto isn't "money" – it is far too volatile to be a store of value, a unit of account, or a medium of exchange. You'd have to be nuts to get a crypto mortgage when all it takes is Elon Musk tweeting a couple emoji to make your monthly mortgage payment double.

A thing becomes moneylike when it can be used to pay off a bill for something you either must pay for, or strongly desire to pay for. The US dollar's moneylike property comes from the fact that hundreds of millions of people need dollars to pay off the IRS and their state tax bills, which means that they will trade labor and goods for dollars. Even people who don't pay US taxes will accept dollars, because they know they can use them to buy things from people who do have a nondiscretionary bill that can only be paid in dollars.

Dollars are also valuable because there are many important commodities that can only – or primarily – be purchased with them, like much of the world's oil supply. The fact that anyone who wants to buy oil has a strong need for dollars makes dollars valuable, because they will sell labor and goods to get dollars, not because they need dollars, but because they need oil.

There's almost nothing that can only be purchased with crypto. You can procure illegal goods and services in the mistaken belief that this transaction will be durably anonymous, and you can pay off ransomware creeps who have hijacked your personal files or all of your business's data:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Web3 was sold as a way to make the web more "decentralized," but it's best understood as an effort to make it impossible to use the web without paying crypto every time you click your mouse. If people need crypto to use the internet, then crypto whales will finally have a source of durable liquidity for the tokens they've hoarded:

https://pluralistic.net/2022/09/16/nondiscretionary-liabilities/#quatloos

The Web3 bubble was almost entirely down to the vast hype machine mobilized by Andreesen-Horowitz, who bet billions of dollars on the idea and almost single-handedly created the illusion of demand for crypto. For example, they arranged a $100m bribe to Kickstarter shareholders in exchange for Kickstarter pretending to integrate "blockchain" into its crowdfunding platform:

https://finance.yahoo.com/news/untold-story-kickstarter-crypto-hail-120000205.html

Kickstarter never ended up using the blockchain technology, because it was useless. Their shareholders just pocketed the $100m while the company weathered the waves of scorn from savvy tech users who understood that this was all a shuck.

Look hard enough at any crypto "success" and you'll discover a comparable scam. Remember NFTs, and the eye-popping sums that seemingly "everyone" was willing to pay for ugly JPEGs? That whole market was shot through with "wash-trading" – where you sell your asset to yourself and pretend that it was bought by a third party. It's a cheap – and illegal – way to convince people that something worthless is actually very valuable:

https://mailchi.mp/brianlivingston.com/034-2#free1

Even the books about crypto are scams. Chris Dixon's "bestseller" about the power of crypto, Read Write Own, got on the bestseller list through the publishing equivalent of wash-trading, where VCs with large investments in crypto bought up thousands of copies and shoved them on indifferent employees or just warehoused them:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

The fact that crypto trades were mostly the same bunch of grifters buying shitcoins from each other, while spending big on Superbowl ads, bribes to Kickstarter shareholders, and bulk-buys of mediocre business-books was bound to come out someday. In the meantime, though, the system worked: it convinced normies to gamble their life's savings on crypto, which they promptly lost (if you can't spot the sucker at the table, you're the sucker).

There's a name for this: it's called a "bezzle." John Kenneth Galbraith defined a "bezzle" as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it." All bezzles collapse eventually, but until they do, everyone feels better off. You think you're rich because you just bought a bunch of shitcoins after Matt Damon told you that "fortune favors the brave." Damon feels rich because he got a ton of cash to rope you into the con. Crypto.com feels rich because you took a bunch of your perfectly cromulent "fiat money" that can be used to buy anything and traded it in for shitcoins that can be used to buy nothing:

https://theintercept.com/2022/10/26/matt-damon-crypto-commercial/

Andreesen-Horowitz were masters of the bezzle. For them, the Web3 bet on an internet that you'd have to buy their shitcoins to use was always Plan B. Plan A was much more straightforward: they would back crypto companies and take part of their equity in huge quantities of shitcoins that they could sell to "unqualified investors" (normies) in an "initial coin offering." Normally, this would be illegal: a company can't offer stock to the general public until it's been through an SEC vetting process and "gone public" through an IPO. But (Andreesen-Horowitz argued) their companies' "initial coin offerings" existed in an unregulated grey zone where they could be traded for the life's savings of mom-and-pop investors who thought crypto was real because they heard that Kickstarter had adopted it, and there was a bestselling book about it, and Larry David and Matt Damon and Spike Lee told them it was the next big thing.

Crypto isn't so much a financial innovation as it is a financial obfuscation. "Fintech" is just a cynical synonym for "unregulated bank." Cryptocurrency enjoys a "byzantine premium" – that is, it's so larded with baffling technical nonsense that no one understands how it works, and they assume that anything they don't understand is probably incredibly sophisticated and great ("a pile of shit this big must have pony under it somewhere"):

https://pluralistic.net/2022/03/13/the-byzantine-premium/

There are two threats to the crypto bezzle: the first is that normies will wise up to the scam, and the second is that the government will put a stop to it. These are correlated risks: if the government treats crypto as a security (or worse, a scam), that will put severe limits on how shitcoins can be marketed to normies, which will staunch the influx of real money, so the sole liquidity will come from ransomware payments and transactions with tragically overconfident hitmen and drug dealers who think the blockchain is anonymous.

To keep the bezzle going, crypto scammers have spent the past two election cycles flooding both parties with cash. In the 2022 midterms, crypto money bankrolled primary challenges to Democrats by absolute cranks, like the "effective altruist" Carrick Flynn ("effective altruism" is a crypto-affiliated cult closely associated with the infamous scam-artist Sam Bankman-Fried). Sam Bankman-Fried's super PAC, "Protect Our Future," spent $10m on attack-ads against Flynn's primary opponent, the incumbent Andrea Salinas. Salinas trounced Flynn – who was an objectively very bad candidate who stood no chance of winning the general election – but only at the expense of most of the funds she raised from her grassroots, small-dollar donors.

Fighting off SBF's joke candidate meant that Salinas went into the general election with nearly empty coffers, and she barely squeaked out a win against a GOP nightmare candidate Mike Erickson – a millionaire Oxy trafficker, drunk driver, and philanderer who tricked his then-girlfriend by driving her to a fake abortion clinic and telling her that it was a real one:

https://pluralistic.net/2022/10/14/competitors-critics-customers/#billionaire-dilletantes

SBF is in prison, but there's no shortage of crypto millions for this election cycle. According to Molly White's "Follow the Crypto" tracker, crypto-affiliated PACs have raised $185m to influence the 2024 election – more than the entire energy sector:

https://www.followthecrypto.org/

As with everything "crypto," the cryptocurrency election corruption slushfund is a bezzle. The "Stand With Crypto PAC" claims to have the backing of 1.3 million "crypto advocates," and Reuters claims they have 440,000 backers. But 99% of the money claimed by Stand With Crypto was actually donated to "Fairshake" – a different PAC – and 90% of Fairshake's money comes from a handful of corporate donors:

https://www.citationneeded.news/issue-62/

Stand With Crypto – minus the Fairshake money it falsely claimed – has raised $13,690 since April. That money came from just seven donors, four of whom are employed by Coinbase, for whom Stand With Crypto is a stalking horse. Stand With Crypto has an affiliated group (also called "Stand With Crypto" because that is an extremely normal and forthright way to run a nonprofit!), which has raised millions – $1.49m. Of that $1.49m, 90% came from just four donors: three cryptocurrency companies, and the CEO of Coinbase.

There are plenty of crypto dollars for politicians to fight over, but there are virtually no crypto voters. 69-75% of Americans "view crypto negatively or distrust it":

https://www.pewresearch.org/short-reads/2023/04/10/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/

When Trump keynotes the Bitcoin 2024 conference and promises to use public funds to buy $1b worth of cryptocoins, he isn't wooing voters, he's wooing dollars:

https://www.wired.com/story/donald-trump-strategic-bitcoin-stockpile-bitcoin-2024/

Wooing dollars, not crypto. Politicians aren't raising funds in crypto, because you can't buy ads or pay campaign staff with shitcoins. Remember: unless Andreesen-Horowitz manages to install Web3 crypto tollbooths all over the internet, the industries that accept crypto are ransomware, and technologically overconfident hit-men and drug-dealers. To win elections, you need dollars, which crypto hustlers get by convincing normies to give them real money in exchange for shitcoins, and they are only funding politicians who will make it easier to do that.

As a political matter, "crypto" is a shorthand for "allowing scammers to steal from working people," which makes it a very Republican issue. As Hamilton Nolan writes, "If the Republicans want to position themselves as the Party of Crypto, let them. It is similar to how they position themselves as The Party of Racism and the Party of Religious Zealots and the Party of Telling Lies about Election Fraud. These things actually reflect poorly on them, the Republicans":

https://www.hamiltonnolan.com/p/crypto-as-a-political-characteristic

But the Democrats – who are riding high on the news that Kamala Harris will be their candidate this fall – have decided that they want some of that crypto money, too. Even as crypto-skeptical Dems like Jamaal Bowman, Cori Bush, Sherrod Brown and Jon Tester see millions from crypto PACs flooding in to support their primary challengers and GOP opponents, a group of Dem politicians are promising to give the crypto industry whatever it wants, if they will only bribe Democratic candidates as well:

https://subscriber.politicopro.com/f/?id=00000190-f475-d94b-a79f-fc77c9400000

Kamala Harris – a genuinely popular candidate who has raised record-shattering sums from small-dollar donors representing millions of Americans – herself has called for a "reset" of the relationship between the crypto sector and the Dems:

https://archive.is/iYd1C

As Luke Goldstein writes in The American Prospect, sucking up to crypto scammers so they stop giving your opponents millions of dollars to run attack ads against you is a strategy with no end – you have to keep sucking up to the scam, otherwise the attack ads come out:

https://prospect.org/politics/2024-07-31-crypto-cash-affecting-democratic-races/

There's a whole menagerie of crypto billionaires behind this year's attempt to buy the American government – Andreesen and Horowitz, of course, but also the Winklevoss twins, and this guy, who says we're in the midst of a "civil war" and "anyone that votes against Trump can die in a fucking fire":

https://twitter.com/molly0xFFF/status/1813952816840597712/photo/1

But the real whale that's backstopping the crypto campaign spending is Coinbase, through its Fairshake crypto PAC. Coinbase has donated $45,500,000 to Fairshake, which is a lot:

https://www.coinbase.com/blog/how-to-get-regulatory-clarity-for-crypto

But $45.5m isn't merely a large campaign contribution: it appears that $25m of that is the largest the largest illegal campaign contribution by a federal contractor in history, "by far," a fact that was sleuthed out by Molly White:

https://www.citationneeded.news/coinbase-campaign-finance-violation/

At issue is the fact that Coinbase is bidding to be a US federal contractor: specifically, they want to manage the crypto wallets that US federal cops keep seizing from crime kingpins. Once Coinbase threw its hat into the federal contracting ring, it disqualified itself from donating to politicians or funding PACs:

Campaign finance law prohibits federal government contractors from making contributions, or promising to make contributions, to political entities including super PACs like Fairshake.

https://www.fec.gov/help-candidates-and-committees/federal-government-contractors/

Previous to this, the largest ever illegal campaign contribution by a federal contractor appears to be Marathon Petroleum Company's 2022 bribe to GOP House and Senate super PACs, a mere $1m, only 4% of Coinbase's bribe.

I'm with Nolan on this one. Let the GOP chase millions from billionaires everyone hates who expect them to promote a scam that everyone mistrusts. The Dems have finally found a candidate that people are excited about, and they're awash in money thanks to small amounts contributed by everyday Americans. As AOC put it:

They've got money, but we've got people. Dollar bills don't vote. People vote.

https://www.popsugar.com/news/alexandria-ocasio-cortez-dnc-headquarters-climate-speech-47986992

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/31/greater-fools/#coinbased

#pluralistic#coinbase#crypto#cryptocurrency#elections#campaign finance#campaign finance violations#crimes#fraud#influence peddling#democrats#moneylike#bubbles#ponzi schemes#bezzles#molly white#hamilton nolan

427 notes

·

View notes

Note

Hey Tracy! Have you heard about the new Ai called Sora? Apparently it can now create 2D and 3D animations as well as hyper realistic videos. I’ve been getting into animation and trying to improve my art for years since I was 7, but now seeing that anyone can create animation/works in just a mare seconds by typing in a couple words, it’s such a huge slap in the face to people who actually put the time and effort into their works and it’s so discouraging! And it has me worried about what’s going to happen next for artists and many others, as-well. There’s already generated voices, generated works stolen from actual artists, generated music, and now this! It’s just so scary that it’s coming this far.

Yeah, I've seen it. And yeah, it feels like the universe has taken on a 'fuck you in particular' attitude toward artists the past few years. A lot of damage has already been done, and there are plenty of reasons for concern, but bear in mind that we don't know how this will play out yet. Be astute, be justifiably angry, but don't let despair take over. --------

One would expect that the promo clips that have been dropping lately represent some of the best of the best-looking stuff they've been able to produce. And it's only good-looking on an extremely superficial level. It's still riddled with problems if you spend even a moment observing. And I rather suspect, prior to a whole lot of frustrated iteration, most prompts are still going to get you camera-sickness inducing, wibbly-wobbly nonsense with a side of body horror.

Will the tech ultimately get 'smarter' than that and address the array of typical AI giveaways? Maybe. Probably, even. Does that mean it'll be viable in quite the way it's being marketed, more or less as a human-replacer? Well…

A lot of this is hype, and hype is meant to drive up the perceived value of the tech. Executives will rush to be early adopters without a lot of due diligence or forethought because grabbing it first like a dazzled chimp and holding up like a prize ape-rock makes them look like bleeding-edge tech geniuses in their particular ecosystem. They do this because, in turn, that perceived value may make their company profile and valuations go up too, which makes shareholders short-term happy (the only kind of happy they know). The problem is how much actual functional value will it have? And how long does it last? Much of it is the same routine we were seeing with blockchain a few years ago: number go up. Number go up always! Unrealistic, unsustainable forever-growth must be guaranteed in this economic clime. If you can lay off all of your people and replace them with AI, number goes up big and never stops, right?

I have some doubts. ----------------------

The chips also haven't landed yet with regards to the legality of all of this. Will these adopters ultimately be able to copyright any of this output trained on datasets comprised of stolen work? Can computer-made art even be copyrighted at all? How much of a human touch will be required to make something copyright-able? I don't know yet. Neither do the hype team or the early adopters.

Does that mean the tech will be used but will have to be retrained on the adopter's proprietary data? Yeah, maybe. That'd be a somewhat better outcome, at least. It still means human artists make specific things for the machine to learn from. (Watch out for businesses that use 'ethical' as a buzzword to gloss over how many people they've let go from their jobs, though.)

Will it become industry standard practice to do things this way? Maybe. Will it still require an artist's sensbilities and oversignt to plan and curate and fix the results so that it doesn't come across like pure AI trash? Yeah, I think that's pretty likely.

If it becomes standard practice, will it become samey, and self-referential and ultimately an emblem of doing things the cookie-cutter way instead of enlisting real, human artists? Quite possibly.

If it becomes standard industry practice, will there still be an audience or a demand or a desire for art made by human artists? Yes, almost certainly. With every leap of technology, that has remained the case. ------------------ TL;DR Version:

I'm not saying with any certainty that this AI blitz is a passing fad. I think we're likely to experience a torrential amount of generative art, video, voice, music, programming, and text in the coming years, in fact, and it will probably irrevocably change the layout of the career terrain. But I wouldn't be surprised if it was being overhyped as a business strategy right now. And I don't think the immensity of its volume will ever overcome its inherent emptiness.

What I am certain of is that it will not eliminate the innate human impulse to create. Nor the desire to experience art made by a fellow soul. Keep doing your thing, Anon. It's precious. It's authentic. It will be all the more special because it will have come from you, a human.

920 notes

·

View notes

Text

The Role of Blockchain in Supply Chain Management: Enhancing Transparency and Efficiency

Blockchain technology, best known for powering cryptocurrencies like Bitcoin and Ethereum, is revolutionizing various industries with its ability to provide transparency, security, and efficiency. One of the most promising applications of blockchain is in supply chain management, where it offers solutions to longstanding challenges such as fraud, inefficiencies, and lack of visibility. This article explores how blockchain is transforming supply chains, its benefits, key use cases, and notable projects, including a mention of Sexy Meme Coin.

Understanding Blockchain Technology

Blockchain is a decentralized ledger technology that records transactions across a network of computers. Each transaction is added to a block, which is then linked to the previous block, forming a chain. This structure ensures that the data is secure, immutable, and transparent, as all participants in the network can view and verify the recorded transactions.

Key Benefits of Blockchain in Supply Chain Management

Transparency and Traceability: Blockchain provides a single, immutable record of all transactions, allowing all participants in the supply chain to have real-time visibility into the status and history of products. This transparency enhances trust and accountability among stakeholders.

Enhanced Security: The decentralized and cryptographic nature of blockchain makes it highly secure. Each transaction is encrypted and linked to the previous one, making it nearly impossible to alter or tamper with the data. This reduces the risk of fraud and counterfeiting in the supply chain.

Efficiency and Cost Savings: Blockchain can automate and streamline various supply chain processes through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This automation reduces the need for intermediaries, minimizes paperwork, and speeds up transactions, leading to significant cost savings.

Improved Compliance: Blockchain's transparency and traceability make it easier to ensure compliance with regulatory requirements. Companies can provide verifiable records of their supply chain activities, demonstrating adherence to industry standards and regulations.

Key Use Cases of Blockchain in Supply Chain Management

Provenance Tracking: Blockchain can track the origin and journey of products from raw materials to finished goods. This is particularly valuable for industries like food and pharmaceuticals, where provenance tracking ensures the authenticity and safety of products. For example, consumers can scan a QR code on a product to access detailed information about its origin, journey, and handling.

Counterfeit Prevention: Blockchain's immutable records help prevent counterfeiting by providing a verifiable history of products. Luxury goods, electronics, and pharmaceuticals can be tracked on the blockchain to ensure they are genuine and have not been tampered with.

Supplier Verification: Companies can use blockchain to verify the credentials and performance of their suppliers. By maintaining a transparent and immutable record of supplier activities, businesses can ensure they are working with reputable and compliant partners.

Streamlined Payments and Contracts: Smart contracts on the blockchain can automate payments and contract executions, reducing delays and errors. For instance, payments can be automatically released when goods are delivered and verified, ensuring timely and accurate transactions.

Sustainability and Ethical Sourcing: Blockchain can help companies ensure their supply chains are sustainable and ethically sourced. By providing transparency into the sourcing and production processes, businesses can verify that their products meet environmental and social standards.

Notable Blockchain Supply Chain Projects

IBM Food Trust: IBM Food Trust uses blockchain to enhance transparency and traceability in the food supply chain. The platform allows participants to share and access information about the origin, processing, and distribution of food products, improving food safety and reducing waste.

VeChain: VeChain is a blockchain platform that focuses on supply chain logistics. It provides tools for tracking products and verifying their authenticity, helping businesses combat counterfeiting and improve operational efficiency.

TradeLens: TradeLens, developed by IBM and Maersk, is a blockchain-based platform for global trade. It digitizes the supply chain process, enabling real-time tracking of shipments and reducing the complexity of cross-border transactions.

Everledger: Everledger uses blockchain to track the provenance of high-value assets such as diamonds, wine, and art. By creating a digital record of an asset's history, Everledger helps prevent fraud and ensures the authenticity of products.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin integrates blockchain technology to ensure transparency and authenticity in its decentralized marketplace for buying, selling, and trading memes as NFTs. Learn more about Sexy Meme Coin at Sexy Meme Coin.

Challenges of Implementing Blockchain in Supply Chains

Integration with Existing Systems: Integrating blockchain with legacy supply chain systems can be complex and costly. Companies need to ensure that blockchain solutions are compatible with their existing infrastructure.

Scalability: Blockchain networks can face scalability issues, especially when handling large volumes of transactions. Developing scalable blockchain solutions that can support global supply chains is crucial for widespread adoption.

Regulatory and Legal Considerations: Blockchain's decentralized nature poses challenges for regulatory compliance. Companies must navigate complex legal landscapes to ensure their blockchain implementations adhere to local and international regulations.

Data Privacy: While blockchain provides transparency, it also raises concerns about data privacy. Companies need to balance the benefits of transparency with the need to protect sensitive information.

The Future of Blockchain in Supply Chain Management

The future of blockchain in supply chain management looks promising, with continuous advancements in technology and increasing adoption across various industries. As blockchain solutions become more scalable and interoperable, their impact on supply chains will grow, enhancing transparency, efficiency, and security.

Collaboration between technology providers, industry stakeholders, and regulators will be crucial for overcoming challenges and realizing the full potential of blockchain in supply chain management. By leveraging blockchain, companies can build more resilient and trustworthy supply chains, ultimately delivering better products and services to consumers.

Conclusion

Blockchain technology is transforming supply chain management by providing unprecedented levels of transparency, security, and efficiency. From provenance tracking and counterfeit prevention to streamlined payments and ethical sourcing, blockchain offers innovative solutions to long-standing supply chain challenges. Notable projects like IBM Food Trust, VeChain, TradeLens, and Everledger are leading the way in this digital revolution, showcasing the diverse applications of blockchain in supply chains.

For those interested in exploring the playful and innovative side of blockchain, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

#crypto#blockchain#defi#digitalcurrency#ethereum#digitalassets#sexy meme coin#binance#cryptocurrencies#blockchaintechnology#bitcoin#etf

274 notes

·

View notes

Text

In the story of "Peter Pan," the fairy Tinkerbell only exists if people believe in her and clap for her. Once we stop believing in her magic, she starts fading away. It’s at this point she implores Peter Pan — and the broader audience — to clap as loud as they can. Tinkerbell is sustained by our attention. A new piece of emerging tech can be a lot like Tinkerbell. When it's still trying to shift from speculative ideas based on buggy demos to real material things that are normal parts of our daily lives and business practices, its existence depends on our belief in the magic of possibility. At this point, they still only exist when we believe hard enough and clap loud enough. If we stop believing and clapping, then they can start fading away, becoming more intangible by the moment until they disappear — remember 3D televisions? Just like with Tinkerbell, audience participation is necessary. That faith in the eventual power of progress can buy time for emerging tech like AI and blockchain — which can feel more like impressive parlor tricks desperately searching for useful purposes and business models — to establish more concrete anchors in reality. Their transparency level can be set at 50 percent for a long time if there are enough people in the audience believing and clapping for them.

[...]

AI depends on vital support from people hard at work in the futurism factory. These are the executives, consultants, journalists, and other thought leaders whose job is the selling of things to come. They craft visions of a specific future — such as ones where AI models built by companies like OpenAI or Microsoft are undeniable forces of progress — and they build expectations in the public about the inevitable capabilities and irresistible outcomes of these tech products. By flooding the zone with an endless stream of new partnerships, new products, new promises, the tech industry makes us feel disoriented and overwhelmed by a future rushing at us faster than we can handle. The desire to not be left behind — or taken advantage of — is a powerful motivator that keeps us engaged in the AI sales pitch. The breathless hype surrounding AI is more than just a side-effect of over-eager entrepreneurs; it’s a load-bearing column for the tech sector. If people believe hard enough in the future manufactured by Silicon Valley, then they start acting like it already exists before it happens. Thus the impacts of technologies like AI become a self-fulfilling prophecy. We should think of AI futurism as a sophisticated form of check kiting — cashing a check today and hoping the money will be in the account later. In other words, the business of expectations is based on producing scenarios about what might happen in the future and using them to extract speculative value in the present. It’s our belief that these promissory notes are worth anything that allows the tech industry to keep floating until the big payday finally hits.

11 January 2025

59 notes

·

View notes

Text

Tech Made Easy: Simple Tips and Tricks for Navigating the Digital Landscape

Introduction In today’s fast-paced digital world, navigating the ever-changing landscape of technology can be daunting. However, with the right tips and tricks, mastering tech can be made easy. Whether you’re a beginner looking to improve your digital skills or a seasoned tech enthusiast seeking to stay on top of the latest trends, this guide will provide you with valuable insights to help you…

#advancements in artificial intelligence#cybersecurity best practices#emerging tech innovations#future of blockchain technology#guide to cloud computing#how to choose tech solutions for businesses#how to use new tech gadgets#impact of technology on business#Latest technology trends 2024#reviews of the latest tech products#tech tips and tutorials.#technology for smart homes#technology in healthcare#top technology startups#trends in mobile technology

0 notes

Text

Hackdra - Pro+

Cybersecurity is becoming an increasingly important aspect of businesses, as the threats of malicious actors increase. As a result, organizations are turning to smart contract audit, penetration testing, bug bounty programs, blockchain security and cybersecurity consulting services to protect their systems and data from being compromised. These services can help organizations identify vulnerabilities in their systems and networks before they can be exploited by malicious actors. Smart contract audit helps organizations ensure that their contracts are secure and compliant with industry standards. Penetration testing helps companies detect potential weaknesses in their networks that could be exploited by attackers. Bug bounty programs allow companies to reward ethical hackers for finding vulnerabilities in their systems before they can be exploited. Blockchain security provides an extra layer of protection for companies that use distributed ledger technology (DLT). Finally, cybersecurity consulting services provide advice and guidance on how to improve the overall security posture of an organization.

2K notes

·

View notes

Text

Pluto in Aquarius: Brace for a Business Revolution (and How to Ride the Wave)

The Aquarian Revolution

Get ready, entrepreneurs and financiers, because a seismic shift is coming. Pluto, the planet of transformation and upheaval, has just entered the progressive sign of Aquarius, marking the beginning of a 20-year period that will reshape the very fabric of business and finance. Buckle up, for this is not just a ripple – it's a tsunami of change. Imagine a future where collaboration trumps competition, sustainability dictates success, and technology liberates rather than isolates. Aquarius, the sign of innovation and humanitarianism, envisions just that. Expect to see:

Rise of social impact businesses

Profits won't be the sole motive anymore. Companies driven by ethical practices, environmental consciousness, and social good will gain traction. Aquarius is intrinsically linked to collective well-being and social justice. Under its influence, individuals will value purpose-driven ventures that address crucial societal issues. Pluto urges us to connect with our deeper selves and find meaning beyond material gains. This motivates individuals to pursue ventures that resonate with their personal values and make a difference in the world.

Examples of Social Impact Businesses

Sustainable energy companies: Focused on creating renewable energy solutions while empowering local communities.

Fair-trade businesses: Ensuring ethical practices and fair wages for producers, often in developing countries.

Social impact ventures: Addressing issues like poverty, education, and healthcare through innovative, community-driven approaches.

B corporations: Certified businesses that meet rigorous social and environmental standards, balancing profit with purpose.

Navigating the Pluto in Aquarius Landscape

Align your business with social impact: Analyze your core values and find ways to integrate them into your business model.

Invest in sustainable practices: Prioritize environmental and social responsibility throughout your operations.

Empower your employees: Foster a collaborative environment where everyone feels valued and contributes to the social impact mission.

Build strong community partnerships: Collaborate with organizations and communities that share your goals for positive change.

Embrace innovation and technology: Utilize technology to scale your impact and reach a wider audience.

Pluto in Aquarius presents a thrilling opportunity to redefine the purpose of business, moving beyond shareholder value and towards societal well-being. By aligning with the Aquarian spirit of innovation and collective action, social impact businesses can thrive in this transformative era, leaving a lasting legacy of positive change in the world.

Tech-driven disruption

AI, automation, and blockchain will revolutionize industries, from finance to healthcare. Be ready to adapt or risk getting left behind. Expect a focus on developing Artificial Intelligence with ethical considerations and a humanitarian heart, tackling issues like healthcare, climate change, and poverty alleviation. Immersive technologies will blur the lines between the physical and digital realms, transforming education, communication, and entertainment. Automation will reshape the job market, but also create opportunities for new, human-centered roles focused on creativity, innovation, and social impact.

Examples of Tech-Driven Disruption:

Decentralized social media platforms: User-owned networks fueled by blockchain technology, prioritizing privacy and community over corporate profits.

AI-powered healthcare solutions: Personalized medicine, virtual assistants for diagnostics, and AI-driven drug discovery.

VR/AR for education and training: Immersive learning experiences that transport students to different corners of the world or historical periods.

Automation with a human touch: Collaborative robots assisting in tasks while freeing up human potential for creative and leadership roles.

Navigating the Technological Tsunami:

Stay informed and adaptable: Embrace lifelong learning and upskilling to stay relevant in the evolving tech landscape.

Support ethical and sustainable tech: Choose tech products and services aligned with your values and prioritize privacy and social responsibility.

Focus on your human advantage: Cultivate creativity, critical thinking, and emotional intelligence to thrive in a world increasingly reliant on technology.

Advocate for responsible AI development: Join the conversation about ethical AI guidelines and ensure technology serves humanity's best interests.

Connect with your community: Collaborate with others to harness technology for positive change and address the potential challenges that come with rapid technological advancements.

Pluto in Aquarius represents a critical juncture in our relationship with technology. By embracing its disruptive potential and focusing on ethical development and collective benefit, we can unlock a future where technology empowers humanity and creates a more equitable and sustainable world. Remember, the choice is ours – will we be swept away by the technological tsunami or ride its wave towards a brighter future?

Decentralization and democratization

Power structures will shift, with employees demanding more autonomy and consumers seeking ownership through blockchain-based solutions. Traditional institutions, corporations, and even governments will face challenges as power shifts towards distributed networks and grassroots movements. Individuals will demand active involvement in decision-making processes, leading to increased transparency and accountability in all spheres. Property and resources will be seen as shared assets, managed sustainably and equitably within communities. This transition won't be without its bumps. We'll need to adapt existing legal frameworks, address digital divides, and foster collaboration to ensure everyone benefits from decentralization.

Examples of Decentralization and Democratization

Decentralized autonomous organizations (DAOs): Self-governing online communities managing shared resources and projects through blockchain technology.

Community-owned renewable energy initiatives: Local cooperatives generating and distributing clean energy, empowering communities and reducing reliance on centralized grids.

Participatory budgeting platforms: Citizens directly allocate local government funds, ensuring public resources are used in line with community needs.

Decentralized finance (DeFi): Peer-to-peer lending and borrowing platforms, bypassing traditional banks and offering greater financial autonomy for individuals.

Harnessing the Power of the Tide:

Embrace collaborative models: Participate in co-ops, community projects, and initiatives that empower collective ownership and decision-making.

Support ethical technology: Advocate for blockchain platforms and applications that prioritize user privacy, security, and equitable access.

Develop your tech skills: Learn about blockchain, cryptocurrencies, and other decentralized technologies to navigate the future landscape.

Engage in your community: Participate in local decision-making processes, champion sustainable solutions, and build solidarity with others.

Stay informed and adaptable: Embrace lifelong learning and critical thinking to navigate the evolving social and economic landscape.

Pluto in Aquarius presents a unique opportunity to reimagine power structures, ownership models, and how we interact with each other. By embracing decentralization and democratization, we can create a future where individuals and communities thrive, fostering a more equitable and sustainable world for all. Remember, the power lies within our collective hands – let's use it wisely to shape a brighter future built on shared ownership, collaboration, and empowered communities.

Focus on collective prosperity

Universal basic income, resource sharing, and collaborative economic models may gain momentum. Aquarius prioritizes the good of the collective, advocating for equitable distribution of resources and opportunities. Expect a rise in social safety nets, universal basic income initiatives, and policies aimed at closing the wealth gap. Environmental health is intrinsically linked to collective prosperity. We'll see a focus on sustainable practices, green economies, and resource sharing to ensure a thriving planet for generations to come. Communities will come together to address social challenges like poverty, homelessness, and healthcare disparities, recognizing that individual success is interwoven with collective well-being. Collaborative consumption, resource sharing, and community-owned assets will gain traction, challenging traditional notions of ownership and fostering a sense of shared abundance.

Examples of Collective Prosperity in Action

Community-owned renewable energy projects: Sharing the benefits of clean energy production within communities, democratizing access and fostering environmental sustainability.

Cooperatives and worker-owned businesses: Sharing profits and decision-making within companies, leading to greater employee satisfaction and productivity.

Universal basic income initiatives: Providing individuals with a basic safety net, enabling them to pursue their passions and contribute to society in meaningful ways.

Resource sharing platforms: Platforms like carsharing or tool libraries minimizing individual ownership and maximizing resource utilization, fostering a sense of interconnectedness.

Navigating the Shift

Support social impact businesses: Choose businesses that prioritize ethical practices, environmental sustainability, and positive social impact.

Contribute to your community: Volunteer your time, skills, and resources to address local challenges and empower others.

Embrace collaboration: Seek opportunities to work together with others to create solutions for shared problems.

Redefine your own path to prosperity: Focus on activities that bring you personal fulfillment and contribute to the collective good.

Advocate for systemic change: Support policies and initiatives that promote social justice, environmental protection, and equitable distribution of resources.

Pluto in Aquarius offers a unique opportunity to reshape our definition of prosperity and build a future where everyone thrives. By embracing collective well-being, collaboration, and sustainable practices, we can create a world where abundance flows freely, enriching not just individuals, but the entire fabric of society. Remember, true prosperity lies not in what we hoard, but in what we share, and by working together, we can cultivate a future where everyone has the opportunity to flourish.

#pluto in aquarius#pluto enters aquarius#astrology updates#astrology community#astrology facts#astro notes#astrology#astro girlies#astro posts#astrology observations#astropost#astronomy#astro observations#astro community#business astrology#business horoscopes

121 notes

·

View notes

Text

2024's Game-Changing Technologies for Metaverse Development

Picture a universe where virtual and physical worlds blend seamlessly, allowing you to interact with digital elements in real-time. As 2024 draws near, groundbreaking technologies are shaping this metaverse, making such interactions more immersive and dynamic than ever.

The metaverse, an expansive network of virtual environments, is evolving rapidly as we approach 2024, driven by several key technologies. Virtual Reality (VR) and Augmented Reality (AR) are at the forefront, enabling immersive experiences that blend the physical and digital worlds. VR technology has advanced significantly, offering users enhanced graphics, realistic simulations, and responsive feedback that create fully immersive digital environments.

AR enhances the physical world by overlaying digital information, enriching experiences in retail, healthcare, and entertainment through interactive and engaging environments.

Blockchain technology is essential for the metaverse, providing a secure and transparent method for managing digital assets and transactions. Non-fungible tokens (NFTs) allow users to own unique digital assets like virtual real estate and art, while smart contracts facilitate automated and secure transactions. The decentralized nature of blockchain promotes trust and reliability, making it a crucial component of the metaverse's infrastructure.

Artificial Intelligence (AI) further enhances user experiences by creating intelligent virtual agents, personalized interactions, and realistic simulations. AI-driven non-player characters (NPCs) provide engaging and adaptive experiences, and AI technologies enable natural language processing and speech recognition for seamless communication between users and virtual environments.

Edge computing and 5G technology are critical for the seamless operation of the metaverse. By bringing data processing closer to users, edge computing reduces latency and improves the responsiveness of virtual environments. 5G networks provide the high-speed internet required for real-time interactions, supporting scalable and complex virtual environments.

The Internet of Things (IoT) and spatial computing further enhance the metaverse by capturing physical movements and translating them into virtual actions, creating realistic and immersive experiences.

Elevate your business with Intelisync's cutting-edge metaverse solutions. Reach out to Intelisync today and learn how our advanced technologies in VR, AR, AI, and blockchain can revolutionize your operations, enhance customer engagement, and drive your Learn more...

#AI-driven NPCs#AR/VR for interactive product experiences#Artificial Intelligence (AI)#Augmented Reality (AR)#Blockchain#blockchain for secure transactions#Blockchain Technology#Edge Computing and 5G Technology#How Intelisync Uses this Technology for Growing Client Business#Increase in Engagement#Intelisync’s Metaverse Solution for Retail Business#Internet of Things (IoT) and Spatial Computing#IoT devices#Market Expansion#Metaverse Development#Metaverse development company#metaverse game development#Operational Efficiency#Personalization with AI#Sales Growth#Secure Transactions with Blockchain#smart contracts#social VR platforms and games.#Top 5 Technologies for Metaverse Development in 2024#Virtual Reality (VR)#Virtual Reality (VR) and Augmented Reality (AR)#Virtual Showroom#What is the Metaverse?

0 notes

Text

The Four Horsemen of the Digital Apocalypse

Blockchain. Artificial Intelligence. Internet of Things. Big Data.

Do these terms sound familiar? You have probably been hearing some or all of them non stop for years. "They are the future. You don't want to be left behind, do you?"

While these topics, particularly crypto and AI, have been the subject of tech hype bubbles and inescapable on social media, there is actually something deeper and weirder going on if you scratch below the surface.

I am getting ready to apply for my PhD in financial technology, and in the academic business studies literature (Which is barely a science, but sometimes in academia you need to wade into the trash can.) any discussion of digital transformation or the process by which companies adopt IT seem to have a very specific idea about the future of technology, and it's always the same list, that list being, blockchain, AI, IoT, and Big Data. Sometimes the list changes with additions and substitutions, like the metaverse, advanced robotics, or gene editing, but there is this pervasive idea that the future of technology is fixed, and the list includes tech that goes from questionable to outright fraudulent, so where is this pervasive idea in the academic literature that has been bleeding into the wider culture coming from? What the hell is going on?

The answer is, it all comes from one guy. That guy is Klaus Schwab, the head of the World Economic Forum. Now there are a lot of conspiracies about the WEF and I don't really care about them, but the basic facts are it is a think tank that lobbies for sustainable capitalist agendas, and they famously hold a meeting every year where billionaires get together and talk about how bad they feel that they are destroying the planet and promise to do better. I am not here to pass judgement on the WEF. I don't buy into any of the conspiracies, there are plenty of real reasons to criticize them, and I am not going into that.

Basically, Schwab wrote a book titled the Fourth Industrial Revolution. In his model, the first three so-called industrial revolutions are:

1. The industrial revolution we all know about. Factories and mass production basically didn't exist before this. Using steam and water power allowed the transition from hand production to mass production, and accelerated the shift towards capitalism.

2. Electrification, allowing for light and machines for more efficient production lines. Phones for instant long distance communication. It allowed for much faster transfer of information and speed of production in factories.

3. Computing. The Space Age. Computing was introduced for industrial applications in the 50s, meaning previously problems that needed a specific machine engineered to solve them could now be solved in software by writing code, and certain problems would have been too big to solve without computing. Legend has it, Turing convinced the UK government to fund the building of the first computer by promising it could run chemical simulations to improve plastic production. Later, the introduction of home computing and the internet drastically affecting people's lives and their ability to access information.

That's fine, I will give him that. To me, they all represent changes in the means of production and the flow of information, but the Fourth Industrial revolution, Schwab argues, is how the technology of the 21st century is going to revolutionize business and capitalism, the way the first three did before. The technology in question being AI, Blockchain, IoT, and Big Data analytics. Buzzword, Buzzword, Buzzword.

The kicker though? Schwab based the Fourth Industrial revolution on a series of meetings he had, and did not construct it with any academic rigor or evidence. The meetings were with "numerous conversations I have had with business, government and civil society leaders, as well as technology pioneers and young people." (P.10 of the book) Despite apparently having two phds so presumably being capable of research, it seems like he just had a bunch of meetings where the techbros of the mid 2010s fed him a bunch of buzzwords, and got overly excited and wrote a book about it. And now, a generation of academics and researchers have uncritically taken that book as read, filled the business studies academic literature with the idea that these technologies are inevitably the future, and now that is permeating into the wider business ecosystem.

There are plenty of criticisms out there about the fourth industrial revolution as an idea, but I will just give the simplest one that I thought immediately as soon as I heard about the idea. How are any of the technologies listed in the fourth industrial revolution categorically different from computing? Are they actually changing the means of production and flow of information to a comparable degree to the previous revolutions, to such an extent as to be considered a new revolution entirely? The previous so called industrial revolutions were all huge paradigm shifts, and I do not see how a few new weird, questionable, and unreliable applications of computing count as a new paradigm shift.

What benefits will these new technologies actually bring? Who will they benefit? Do the researchers know? Does Schwab know? Does anyone know? I certainly don't, and despite reading a bunch of papers that are treating it as the inevitable future, I have not seen them offering any explanation.

There are plenty of other criticisms, and I found a nice summary from ICT Works here, it is a revolutionary view of history, an elite view of history, is based in great man theory, and most importantly, the fourth industrial revolution is a self fulfilling prophecy. One rich asshole wrote a book about some tech he got excited about, and now a generation are trying to build the world around it. The future is not fixed, we do not need to accept these technologies, and I have to believe a better technological world is possible instead of this capitalist infinite growth tech economy as big tech reckons with its midlife crisis, and how to make the internet sustainable as Apple, Google, Microsoft, Amazon, and Facebook, the most monopolistic and despotic tech companies in the world, are running out of new innovations and new markets to monopolize. The reason the big five are jumping on the fourth industrial revolution buzzwords as hard as they are is because they have run out of real, tangible innovations, and therefore run out of potential to grow.

#ai#artificial intelligence#blockchain#cryptocurrency#fourth industrial revolution#tech#technology#enshittification#anti ai#ai bullshit#world economic forum

31 notes

·

View notes

Text

Tires cost a fortune. You can buy a car for $200, or at least you used to be able to, and easily spend double that on a set of rock-hard ditch-finders from the local tire shop. When I asked a tire company executive about it, they weasel-worded some mouth grease about tires being “expensive to ship.” Obviously, the only way I was going to get through this was to open a tire factory of my own.

This isn’t unusual. Tire factories used to dot this proud nation in a time before AliExpress and Amazon Secondus. Folks just like you and I would go to work and eke out a reasonable, middle-class existence – with a pension – putting high-quality tires under our neighbours’ cars, for cheap. Eventually, some spreadsheet said this was no longer cost-effective, and now we have to order our tires from another country.

I’m sure they have lots of good reasons for this. Tires are a lot better since the sixties and seventies: for instance, when it starts to snow, not everyone within a 50 mile radius of your car is instantly killed. You can brake harder into corners and also take them at greater speed, without them getting all greasy and knobbly as they heat up. You would expect this improved technology to cost more money, which means that the big tire executives needed to outsource it in order to make the final price more affordable.

Of course, this is patented bullshit. If you’re not interested in profit, you can make inexpensive, good tires all day long. Switch Tire Company, being technically a subsidiary of Switch Investment Corporation, is run entirely at a loss. We simply bet against ourselves every day, shorting our stock on the open market. People take the other side of it, maybe because we keep renaming our company to things like “Switch Blockchain Expressions” or “Switch Artificially Intelligent Hookerbots,” the sort of names that make the casual Wall Street Tier 1 investment bank think that we’re up-and-comers. Then we pour the money we made off their backs into running off a new set of race tires.

Sure, I could have used this kind of business acumen to do something other than lose money making tires for shit-box cars. How else was I going to be able to find 13-inch tires that are 10 inches wide?

207 notes

·

View notes