#Unilever Financials

Explore tagged Tumblr posts

Text

Unilever PLC – Comprehensive Financial Analysis

Unilever PLC is a British multinational consumer goods company, headquartered in London, England. With a diverse portfolio of products ranging from food and beverages to personal care and household items, Unilever Financials is a significant player in the global market. Founded in 1929 through the merger of Lever Brothers and Margarine Unie, Unilever has grown to become one of the world's leading suppliers of fast-moving consumer goods (FMCG).

To know about the assumptions considered for the study, Download for Free Sample Report

Financial Performance Overview

Unilever’s financial performance highlights its resilience, strategic growth, and commitment to delivering shareholder value. The company’s extensive product range and global reach have enabled it to maintain strong financial health.

Revenue and Growth

Unilever’s revenue generation is robust, supported by its diversified product lines and geographical presence. The company’s revenue streams are well-distributed across its three main divisions: Beauty & Personal Care, Foods & Refreshment, and Home Care.

Total Revenue: Unilever reported total revenue of €52.4 billion in the most recent fiscal year, reflecting steady growth across its key markets.

Geographic Distribution: Europe accounts for 31% of revenue, the Americas contribute 34%, and the Rest of the World (including Asia, Africa, and the Middle East) represents 35%.

Category Breakdown: Beauty & Personal Care accounts for 41% of revenue, Foods & Refreshment for 37%, and Home Care for 22%.

Profitability

Unilever’s profitability underscores its effective cost management, operational efficiency, and strategic pricing initiatives.

Operating Profit: The company reported an operating profit of €8.3 billion, translating to an operating margin of 15.8%.

Net Profit: Unilever achieved a net profit of €6.1 billion, with a net profit margin of 11.6%.

Earnings Per Share (EPS): The EPS for the fiscal year was €2.27, demonstrating consistent profitability.

0 notes

Text

in addition to being prone to an obvious naturalistic fallacy, the oft-repeated claim that various supplements / herbs / botanicals are being somehow suppressed by pharmaceutical interests seeking to protect their own profits ('they would rather sell you a pill') belies a clear misunderstanding of the relationship between 'industrial' pharmacology and plant matter. bioprospecting, the search for plants and molecular components of plants that can be developed into commercial products, has been one of the economic motivations and rationalisations for european colonialism and imperialism since the so-called 'age of exploration'. state-funded bioprospectors specifically sought 'exotic' plants that could be imported to europe and sold as food or materia medica—often both, as in the cases of coffee or chocolate—or, even better, cultivated in 'economic' botanical gardens attached to universities, medical schools, or royal palaces and scientific institutions.

this fundamental attitude toward the knowledge systems and medical practices of colonised people—the position, characterising eg much 'ethnobotany', that such knowledge is a resource for imperialist powers and pharmaceutical manufacturers to mine and profit from—is not some kind of bygone historical relic. for example, since the 1880s companies including pfizer, bristol-myers squibb, and unilever have sought to create pharmaceuticals from african medicinal plants, such as strophanthus, cryptolepis, and grains of paradise. in india, state-created databases of valuable 'traditional' medicines have appeared partly in response to a revival of bioprospecting since the 1980s, in an increasingly bureaucratised form characterised by profit-sharing agreements between scientists and local communities that has nonetheless been referred to as "biocapitalism". a 1990 paper published in the proceedings of the novartis foundation symposium (then the ciba foundation symposium) spelled out this form of epistemic colonialism quite bluntly:

Ethnobotany, ethnomedicine, folk medicine and traditional medicine can provide information that is useful as a 'pre-screen' to select plants for experimental pharmacological studies.

there is no inherent oppositional relationship between pharmaceutical industry and 'natural' or plant-based cures. there are of course plenty of examples of bioprospecting that failed to translate into consumer markets: ginseng, introduced to europe in the 17th century through the mercantile system and the east india company, found only limited success in european pharmacology. and there are cases in which knowledge with potential market value has actually been suppressed for other reasons: the peacock flower, used as an abortifacient in the west indies, was 'discovered' by colonial bioprospectors in the 18th century; the plant itself moved easily to europe, but knowledge of its use in reproductive medicine became the subject of a "culturally cultivated ignorance," resulting from a combination of funding priorities, national policies, colonial trade patterns, gender politics, and the functioning of scientific institutions. this form of knowledge suppression was never the result of a conflict wherein bioprospectors or pharmacists viewed the peacock flower as a threat to their own profits; on the contrary, they essentially sacrificed potential financial benefits as a result of the political and social factors that made abortifacient knowledge 'unknowable' in certain state and commercial contexts.

exploitation of plant matter in pharmacology is not a frictionless or infallible process. but the sort of conspiratorial thinking that attempts to position plant therapeutics and 'big pharma' as oppositional or competitive forces is an ahistorical and opportunistic example of appealing to nominally anti-capitalist rhetoric without any deeper understanding of the actual mechanisms of capitalism and colonialism at play. this is of course true whether or not the person making such claims has any personal financial stake in them, though it is of course also true that, often, they do hold such stakes.

539 notes

·

View notes

Text

BREAKING NEWS -

THE ROYAL FOUNDATION BUISNESS TASKFORCE FOR EARLY CHILDHOOD RELEASES NEW REPORT!

Business investment in early childhood could unlock £45.5bn in value a year for the UK economy, according to a report by a taskforce created by the Princess of Wales.

In the report, CEOs from eight leading companies urged “businesses of all sizes across the UK, to join us and help build a healthy, happy society for everyone”.

The report by the Royal Foundation Business Taskforce for Early Childhood, set up by the princess in March 2023, said the figure included £12.2bn from equipping people with improved social and emotional skills in early childhood, £16.1bn from reducing the need to spend public funds on remedial steps for adverse childhood experiences and £17.2bn from supporting parents and caregivers of under-fives who work.

The princess, who announced in March she was undergoing preventive chemotherapy after a cancer diagnosis, was said to be “excited” by the report.

A Kensington Palace spokesperson said the release of the report should not be seen as the princess returning to work, but she has been kept fully up to date and seen the report.

Taskforce members announced new initiatives, including:

The Co-operative Group creating a specific early childhood fund as part of its unique apprenticeship levy share scheme, and committing to raise £5m over the next five years, creating more than 600 apprenticeships.

Deloitte focusing its ongoing investment in Teach First to include the early years sector for the first time, supporting 366 early years professionals in 2024.

NatWest Group extending its lending target for the childcare sector to £100m, launching an early years accreditation scheme to its staff and producing a financial toolkit for childcare providers to help them grow and succeed.

Ikea UK and Ireland expanding its contribution of support, design expertise and products for babies and young children to six new locations across the UK to help families with young children experiencing the greatest disadvantage.

The Lego Group donating 3,000 LEGO® Education Build Me “Emotions” sets, supported by training materials, to early years providers in the UK.

Christian Guy, the executive director of the Royal Foundation Centre for Early Childhood, said it was a “rallying cry” to business leaders to “transform the way our country supports the vital early years”.

The princess, Guy said, “feels passionately about the transformational impact of getting this right, together with business, both for the current generation and many more to come. She is looking forward to seeing momentum grow in the coming months and years.” The work of the centre was “rolling on while she recovers”, he added.

The Royal Foundation Business Taskforce for Early ChildhoodThe taskforce – comprising CEOs from the Co-operative Group, NatWest, Unilever, Ikea, Iceland Foods, Aviva, Deloitte and Lego – identifies five areas in which businesses can make the greatest impact for children under five, the adults around them, the economy and wider society.

These are: building a culture prioritising early childhood within businesses, local communities, and wider society; helping the families facing the greatest challenges access the basic support and essentials they need; offering parents and carers greater support, resources, choice, and flexibility with their work; prioritising and nurturing social and emotional skills in young children and the adults in their lives; and supporting initiatives that increase access to quality, affordable and reliable early childhood education and care.

#news#princess of wales#the princess of wales#princess catherine#princess kate#21052024#british royal family#british royals#royalty#royals#brf#royal#british royalty#kate middleton#catherine middleton

93 notes

·

View notes

Text

I don't know who needs to hear this but supporting a brand that says they support a cause you believe in means nothing when their parent company is taking those profits to fund the the thing you are in opposition to.

"Sephora supports Palestine." Sephora is owned by LVMH which gives money to Israel. "Ben & Jerry's supports Palestine." Ben & Jerry's is owned by Unilever who, after being sued by the board of Ben & Jerry's and having had the case thrown out, said that they own the financials and the branding and therefore will do whatever they want. Unilever gives money to Israel.

This shit is on the internet. On Wikipedia. For free. Use your search engine and your brain. If you have disposable income to go hard as a motherfucker at Sephora and on some $9 pints of ice cream, maybe donate it to the Palestinian Children's Relief Fund. Or donate to Palestinian creators and artists who are taking their profits from their small businesses to send to the appropriate charities they are affiliated with that gets resources to their loved ones in Gaza.

When you are boycotting and trying to choke money away from companies that fund things you are in direct opposition to, please look at their parent company. The parent company controls the stocks and the finances. Boycotting does not work if you continue to fund the parent companies that control where those profits go.

20 notes

·

View notes

Text

Building Your Tax-Free Nest Egg: Stock Selection for Roth IRAs

Investing in a Roth IRA for retirement? Picking the right stocks is key! This post explores:

* Goal-based investing: Growth, income, or stability? Choose your focus.

* Diversification is king: Spread your bets across sectors and regions to minimize risk.

* Research is crucial: Analyze financials, valuation, and industry trends.

* Know your risk tolerance: Are you young and aggressive or nearing retirement?

* Long-term view wins: Focus on stocks with long-term growth potential.

* Regular reviews are essential: Adapt your portfolio as your goals and market conditions change.

Example Balanced Portfolio:

* Growth: Amazon, Apple, Tesla

* Dividend Income: Johnson & Johnson, P&G, Coca-Cola

* International: Alibaba, Nestle, Toyota

* Sector Diversification: Tech (Microsoft), Healthcare (Pfizer), Consumer Staples (Unilever), Financials (JPMorgan Chase)

Pro Tip: Consider ETFs/Index Funds for broader market exposure!

Ready to learn more? Check out our full blog post for a deeper dive into stock selection for Roth IRAs! Link below ⬇️

Disclaimer: This is not financial advice. Please conduct your own research and seek professional guidance if needed.

#rothira #investing #stocks #retirementplanning

2 notes

·

View notes

Text

LUX RADIO THEATRE presents FANCY PANTS

September 10, 1950

Lux Radio Theatre (1935-55) was a radio anthology series that adapted Broadway plays during its first two seasons before it began adapting films (”Lux Presents Hollywood”). These hour-long radio programs were performed live before studio audiences in Los Angeles. The series became the most popular dramatic anthology series on radio, broadcast for more than 20 years and continued on television as the Lux Video Theatre through most of the 1950s. The primary sponsor of the show was Unilever through its Lux Soap brand.

Fancy Pants was broadcast live from Hollywood on CBS Radio in front of a live audience.

Produced and Hosted by William Keighley

Written by Edmund Hartman, who also wrote the screenplay

Libby Collins is billed as a "Hollywood Reporter" during the Act One commecial break and Joan Taylor is guest for the Act Two commerical break.

THE CAST

Lucille Ball (Agatha Floud, American Debutante) was born on August 6, 1911 in Jamestown, New York. She began her screen career in 1933 and was known in Hollywood as ‘Queen of the B’s’ due to her many appearances in ‘B’ movies. With Richard Denning, she starred in a radio program titled “My Favorite Husband” which eventually led to the creation of “I Love Lucy,” a television situation comedy in which she co-starred with her real-life husband, Latin bandleader Desi Arnaz. The program was phenomenally successful, allowing the couple to purchase what was once RKO Studios, re-naming it Desilu. When the show ended in 1960 (in an hour-long format known as “The Lucy-Desi Comedy Hour”) so did Lucy and Desi’s marriage. In 1962, hoping to keep Desilu financially solvent, Lucy returned to the sitcom format with “The Lucy Show,” which lasted six seasons. She followed that with a similar sitcom “Here’s Lucy” co-starring with her real-life children, Lucie and Desi Jr., as well as Gale Gordon, who had joined the cast of “The Lucy Show” during season two. Before her death in April 1989, Lucy made one more attempt at a sitcom with “Life With Lucy,” also with Gordon, which was not a success and was canceled after just 13 episodes. She died on April 26, 1989 at the age of 77.

Bob Hope (Mr. Arthur Tyler / ‘Humphrey’ aka ‘Oliver Grimes’ aka ‘Fancy Pants’) was born Lesley Townes Hope in England in 1903. During his extensive career in virtually all forms of media he received five honorary Academy Awards. In 1945, Desi Arnaz was the orchestra leader on Bob Hope’s radio show. Ball and Hope did three other films together. He appeared as himself on the season 6 opener of “I Love Lucy.” He did a brief cameo in a 1964 episode of “The Lucy Show.” He died in 2003 at age 100.

Norma Varden (Gwendolyn Fairmore / ‘Lady Maude Brinstead’) is probably best known for playing Frau Schmidt, the somewhat circumspect housekeeper at the Von Trapp mansion in 1965′s The Sound Of Music. Lucy fans will remember her as weepy Mrs. Benson, who Lucy Ricardo convinces to swap apartments in “The Ricardos Change Apartments” (ILL S2;E26) in 1953. The London-born actress turned up on an episode of “The Lucy Show”.

Gail Bonney was seen in two 1950 films featuring Lucille Ball. In March 1950, she played an uncredited bicyclist in A Woman of Distinction in which Lucille Ball had a cameo as herself. In September 1950, Bonney was seen in the Lucille Ball film The Fuller Brush Girl. Two years later, Gail Bonney played Mrs. Hudson in "The Amateur Hour," (ILL S1;E14) hiring Lucy Ricardo to babysit her twin boys. She returned to do a 1965 episode of "The Lucy Show” titled “Lucy and The Ceramic Cat” (TLS S3;E16). Bonney’s final appearance on a Lucy sitcom was in a 1968 episode of "Here’s Lucy” titled “Lucy and Eva Gabor” (HL S1;E7).

Also featuring: Constance Cavendish (Effie Floud), Charlie Lung, Edwin Max, Robert O, and Dan O'Herlihy.

Fancy Pants is a 1950 American romantic comedy western film directed by George Marshall and starring Bob Hope and Lucille Ball. It is a musical adaptation of Ruggles of Red Gap. The Paramount film premiered on July 19, 1950.

Synopsis: In 1905, an American actor (Arthur Tyler) impersonating an English butler named Humphry is hired by a nouveau riche woman (Effie Floud) from New Mexico to refine her husband and her headstrong daughter (Aggie). Complications ensue when the town believes Arthur to be an Earl, and President Roosevelt decides to pay a visit.

Music: The Fancy Pants theme by Jay Livingston and Ray Evans is used at the broadcast's act openings. Although in the film Lucille Ball's vocals were dubbed by Annette Warren, here Ball does her own singing of the title tune.

As in the film, Bob Hope sings "Home Cookin'" by Jay Livingston and Ray Evans.

Exit music is from "Round-up on the Prairie" by Aaron Kenny.

FANCY TRIVIA

Bob Hope tended to ad-lib dialogue, sometimes based on current events or his whim. These 'mentions' by Hope may have been unscripted. It is often difficult to determine if it is Bob Hope, Humphrey the butler, or actor Arthur Tyler speaking. Most of the references are anachronistic as the action takes place in 1905.

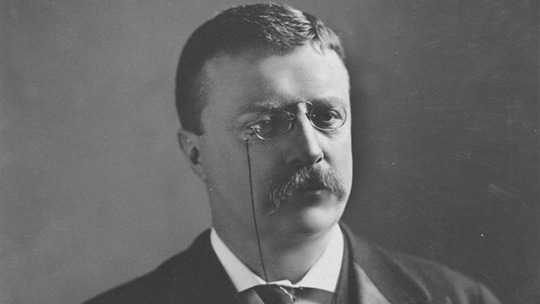

THEODORE 'TEDDY' ROOSEVELT ~ was the 26th President of the United States from 1901 to 1909. The youngest man ever to be elected President at age 42, he was a statesman, conservationist, and soldier. The action of “Lucy Wins A Racehorse” (1958) is set at the now defunct Roosevelt Raceway on Long Island. The raceway is named after the village of Roosevelt, which was named for him.

Bob Hope mentions Stopette, an underarm deodorant sold from 1941 until 1956. It was a longtime sponsor of the CBS game show "What's My Line?". Lucille Ball made six appearances on the show, one alongside Bob Hope. Time Magazine called Stopette "the best-selling deodorant of the early 1950s"

After a joke about being pelted with tomatoes, Bob Hope mentions Red Skelton, a comic actor who appeared with him in 17 film and television projects, six of which also included Lucille Ball. Skelton appeared as himself on "The Lucy-Desi Comedy Hour" in 1959.

Hope mentions Jergens Lotion, a product marketed by the Andrew Jergens Company, founded in 1882 in Cincinatti, Ohio.

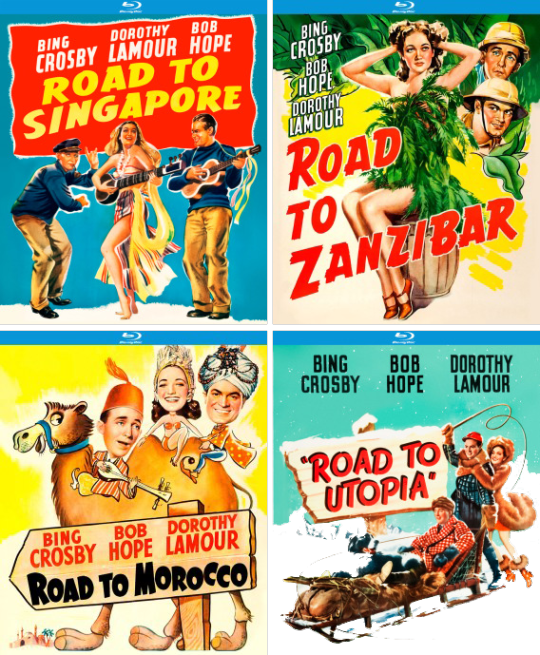

Bing Crosby is winkingly mentioned by Bob Hope. Hope and Crosby were screen partners, filming seven 'Road' pictures between 1940 and 1962.

The Act One commercial for bath size Lux Soap refers to the RKO film His Kind of Woman, starring Robert Mitchum and Jane Russell, who is said to be a Lux girl. The film is set in Mexico and produced by Howard Hughtes. The film wouldn't be released for 11 months after the broadcast.

Telling a dramatic story, Bob Hope mentions Lipton Tea ("They cut off our Liptons!"). During the story, Hope starts to laugh and momentarily pauses before getting back on script. Historically, Thomas Lipton started selling tea in Scotland in 1871, his name eventually becoming synonymous with the product.

Talking about poor western hospitality, Hope mentions Spade Cooley, a musician and actor from Oklahoma who found success in Hollywood. Cooley was part Cherokee Indian. His biggest hit was "Shame On You". Ten years after this broadcast, he was convicted of murdering his wife.

CART BELKNAP: "What happened to that big elephant you were riding?" HUMPHREY: "He'd gone to Washington to get ready for '52." (Hope ad libs after audience laughs) "I never dreamed of that!"

Hope is referring to the elephant that is the symbol of the Republican party. In 1950, it was expected that Democratic President Harry S. Truman would seek a third term. Truman had become President after the death of Franklin Roosevelt and then went on to win his first full term in 1948. In 1952, America would have had a Republican in the White House since 1933. As it turned out, Truman decided not to run in 1952, despite being exempt from term limit legistlation he himself signed into law. The winner was indeed a Republican, Dwight Eisenhower.

HUMPHREY: "Water! Water! Anything that'll save my life! A packet of Chesterfields!" Hope was a spokesperson for the cigarette. The brand was manufactured by a subsidiary of Philip-Morris, the tobacco company that sponsored "I Love Lucy" in 1951. The studio audience laughs at this ad-lib.

HUMPHREY: "I'm no Earl. I'm not even Humphrey. I'm an Arthur Tyler, an actor: AFTRA, AGVA, and SAG. And paid up!"

Hope's ad-lib refers to the performers unions American Federation of Television and Radio Artists (AFTRA), American Guild of Variety Artists (AGVA), and the Screen Actors Guild (SAG). At the time of broadcast, Ronald Reagan was president of SAG. Recently, SAG and AFTRA merged to create SAG-ATRA. Needless to say, these labor unions did not exist in 1905.

During the second act commercial break, Joan Taylor and William Keighley mention Paramount's Here Comes the Groom starring Jane Wyman and Alexis Smith, both said to be "Lux Lovely". The Frank Capra film was released September 20, 1951 and won a 1952 Oscar for Best Song: "In the Cool, Cool, Cool of the Evening." Coincidentally, Gail Bonney, who is heard in this radiocast, appears uncredited as a telephone operator in the film.

After singing "Home Cookin'" with Ball, Hope quickly quips "Thank you, Margaret." In June 1950, Hope had joined songstress Margaret Whiting and the Starlighters to release a single of the song - sans Lucy. The mention of Margaret causes the studio audience to erupt in laughter, and the actress playing Effie has to say: "Listen! I'm talkin' to you!"

HUMPHREY: "I've been practicing the royal sneer all morning. I'll soon be getting fan mail from Basil Rathbone."

Basil Rathbone was an actor best known for his portrayal of Sherlock Holmes in a series of films. In 1954, Hope and Rathbone starred together in the light comedy Casanova's Big Night. Rathbone had previously guest starred on Hope's 1941 radio show.

HUMPHREY: "The whole day on horseback! I may find a new place to put my Dr. Scholl's foot pads!"

Dr. William Mathias Scholl was born on June 22, 1882 in La Porte, Indiana. He learned about foot care and shoes thanks to his grandfather, who was a shoemaker in Germany. He founded the Dr. Scholl’s company in 1906.

HUMPHREY: "Listen Aggie, I can't ride a horse. I can't even ride a jack ass. Even after all those road pictures we did together."

Hope is making a snide joke about Bing Crosby, who (at that point) starred with him in five "Road To..." films, most with Dorothy Lamour. Two more would follow in 1952 and 1962.

After Act Three, Libby Collins and Mr. Keighley announce a contest to identify a mystery Hollywood Lux girl. They say that her first name is June. [It was later revealed to be June Allyson.]

At the conclusion of the story, Bob Hope and Lucille Ball are briefly interviewed by Mr. Keighley. Hope mentions a contest to win a world premiere of his next film, My Favorite Spy, in the listener's hometown. The film premiered on Christmas Day 1952.

Keighley promotes next week's Lux Radio Theatre, Sunset Boulevard, starring the original film stars Gloria Swanson and William Holden, and featuring Nancy Gates.

A final commercial suggests washing stockings in Lux.

#Fancy Pants#Lucille Ball#Bob Hope#Lux Radio Theatre#1950#Radio#Spade Cooley#Jergens Lotion#Teddy Roosevelt#His Kind of Woman#Norma Varden#Lipton Tea#Bing Crosby#Red Skelton#Stopette#Chesterfield#Basil Rathbone#Lux Soap#June Allyson#Sunset Boulevard#My Favorite Spy

4 notes

·

View notes

Text

Brazil's Richest Man Loses Billions as His M&A Machine Breaks Down

It wasn’t too long ago that Jorge Paulo Lemann was arguably the most respected—and feared—corporate baron on Earth. The Brazilian billionaire and his two longtime business partners were scooping up multinational giants at a frenetic clip and folding them into the vast empire they built from Rio de Janeiro.

In 2008 it was Anheuser-Busch InBev. In 2010, Burger King. Then came H.J. Heinz, Tim Hortons, Kraft Foods Group and, finally, in 2016, the biggest of them all: brewer SABMiller. With each new acquisition, Lemann, inspired by his idol, former General Electric Co. Chief Executive Officer Jack Welch, would order up deep cost cuts. Perks were eliminated, payrolls slashed, factories shuttered.

It was excruciating for rank-and-file employees but thrilling for Lemann’s financial backers, who pocketed windfall gains as the new, leaner companies churned out ever-bigger profits. The 3G model, as it was dubbed on Wall Street in honor of Lemann’s principal investment company, 3G Capital Inc., was so ruthlessly effective that it began to revolutionize thinking in C-suites across America. Even Warren Buffett, who invested in a couple of the deals Lemann struck, seemed mesmerized. “Jorge Paulo and his associates are extraordinary managers,” he gushed in 2013.

But then, just like that, it all went wrong for Lemann. In early 2017 he was rebuffed when he tried to acquire European conglomerate Unilever Plc for $143 billion and merge it with Kraft Heinz Co. This exposed a fundamental flaw: 3G’s obsessive focus on costs, rather than on expanding the business, meant it needed a never-ending pipeline of big targets that it could buy and squeeze savings from so it could keep boosting profits. Starved of fresh acquisitions, 3G faltered. The prices of the stocks of Kraft Heinz and Anheuser-Busch (which is technically outside of 3G) cratered, Lemann and his partners’ collective fortune shrank by $14 billion, and the vaunted 3G model had, for all intents and purposes, died.

So Lemann, now 83, already had a distinct lion-in-winter feel to him when Americanas SA, a Brazilian retail giant that he and his partners have been major shareholders for decades, collapsed into bankruptcy last month after a $3.8 billion hole was discovered in the company’s balance sheet.

Continue reading.

#brazil#politics#brazilian politics#economy#americanas#mod nise da silveira#image description in alt#jorge paulo lemann

2 notes

·

View notes

Text

Those who run corporations have names and addresses. Our spending at the grocery store make them wealthy. I'm always amazed how the names of people making the decisions and setting the prices stays out of the press. These are the people who read reports on how much the market (people) will spend and devise methods to push up profits. Reading about a company's leadership informs you about their products which usually are known by another name.

Danone: Shane Grant is our Group Deputy CEO, CEO Americas and EVP Dairy, Plant-Based and Global Sales. Shane oversees North America and Latin America

General Mills: Jeffrey L. Harmening is Chairman and Chief Executive Officer of General Mills, Inc. The Board: R. Kerry Clark, Benno O. Dorer, C. Kim Goodwin, Maria G. Henry, Jo Ann Jenkins, Elizabeth C. Lempres, John C. Morikis, Diane L. Neal, Steve Odland, Maria A. Sastre, Eric D. Sprunk, Jorge A. Uribe

Mondelez: Dirk Van de Put is Chairman and CEO of Mondelēz International, a global snacking leader

Unilever: Fabian Garcia "My purpose: providing means to those around me, to find fulfilment and happiness." Quote from his webpage. Means=$$$ (and fulfillment is misspelled)

Pepsi: Ram Krishnan oversees all aspects of PepsiCo's beverage business in North America. Ramon Laguarta is the Chairman of the Board of Directors and Chief Executive Officer of PepsiCo.

CocaCola: James Quincey. Chairman and Chief Executive Officer; John Murphy. President and Chief Financial Officer

Nestle: Steve Presley is Executive Vice President and Chief Executive Officer, Zone North America, and Market Head for the U.S.

Source

#america#groceries#food prices#corporate profits#price gouging#nestle#coke#pepsi#general mills#mondelez#unilever#danone#boycott#frankenfood#processed food

975 notes

·

View notes

Text

Innovating Supply Chain Management Through Legal and Ethical Compliance

In an increasingly interconnected world, supply chain management has evolved from a functional necessity to a strategic differentiator for businesses. As companies face heightened expectations to deliver goods faster, cheaper, and more sustainably, legal and ethical compliance has emerged as a critical cornerstone of innovation in supply chain operations. This article explores how businesses are leveraging compliance to drive innovation, foster sustainability, and enhance their global competitiveness.

The Role of Legal and Ethical Compliance in Supply Chains

Supply chains operate in a complex regulatory environment shaped by trade policies, environmental standards, labor laws, and anti-corruption measures. Legal compliance ensures businesses adhere to these requirements, avoiding fines, reputational damage, and disruptions. Ethical compliance, on the other hand, encompasses voluntary commitments to human rights, fair labor practices, and sustainability. Together, these principles provide a foundation for businesses to innovate and differentiate themselves.

1. Strengthening Trust and Transparency

Legal and ethical compliance enables businesses to establish transparent supply chains. Digital technologies like blockchain are being adopted to provide traceability, ensuring compliance with laws such as the Modern Slavery Act and environmental standards. Companies like Nestlé have implemented blockchain to trace coffee beans from farmers to consumers, ensuring ethical sourcing and boosting consumer trust.

2. Driving Sustainability Through Innovation

Compliance with environmental regulations has encouraged companies to develop sustainable practices. For instance, the European Union's carbon-neutral goals have driven businesses to innovate in energy-efficient transportation and packaging. Companies like Unilever have adopted circular economy models, reusing materials and reducing waste in compliance with these laws, creating both cost savings and environmental benefits.

3. Streamlining Processes with Digital Transformation

Compliance often necessitates process improvements, leading to operational innovation. Regulatory requirements around data privacy, such as the General Data Protection Regulation (GDPR), have pushed companies to innovate in data security and logistics systems. Digital platforms now integrate compliance checks, automate documentation, and monitor supplier practices, reducing administrative burdens while improving efficiency.

Challenges and Opportunities

Challenges

Complexity Across Jurisdictions: Navigating diverse legal frameworks in global supply chains can be challenging.

Cost of Compliance: Meeting stringent regulations often involves significant financial investment.

Opportunities

Public-Private Partnerships: Collaborating with governments can foster compliance-friendly policies that encourage innovation.

Competitive Advantage: Ethical and legal compliance enhances brand value and attracts socially conscious consumers.

Conclusion

Innovating supply chain management through legal and ethical compliance is no longer an option—it is a business imperative. Companies that integrate compliance into their strategies not only mitigate risks but also unlock new opportunities for efficiency, sustainability, and growth. By embracing technologies like blockchain and prioritizing transparency, businesses can ensure compliance while fostering innovation, strengthening their position in a competitive global market.

Under the Poddar Business School's exclusive ‘Students Development Program’ at the esteemed IIM Indore, the PGDM program students underwent rigorous training on Business Simulation, Case Studies and Innovative Research. Poddar Business School is a leading management institution in Jaipur. With many years of excellence, the management institute offers the best PGDM and MBA programs.

0 notes

Text

Explore Exceptional Opportunities At NL Dalmia Institute

When it comes to pursuing a career in management, choosing the right institute plays a crucial role. One of the most prestigious institutions in India, NL Dalmia Institute, has been a leader in providing quality education and creating professionals ready to tackle the corporate world. Located in Mumbai, the institute offers a range of programs, including the highly sought-after PGDM in HRM, which focuses on developing future HR leaders equipped with cutting-edge skills and knowledge.

Why Choose PGDM In HRM At NL Dalmia?

The Post Graduate Diploma in Management (PGDM) with a specialisation in Human Resource Management (HRM) at NL Dalmia Institute is designed to equip students with a deep understanding of organisational behaviour, talent acquisition, leadership development and HR analytics. The curriculum is updated regularly to reflect the latest trends in the industry, ensuring students are job-ready upon graduation.

Students also gain practical experience through internships and real-world projects, helping them bridge the gap between academic learning and professional application. The program’s holistic approach prepares students for diverse roles in HR, from recruitment and training to strategic planning and workforce management.

Placement Success At NL Dalmia

One of the key reasons students choose this institute is its outstanding placement record. NL Dalmia Placements have consistently set benchmarks, with top companies from various sectors recruiting its graduates. The highest package offered in recent years has reached INR 25.5 LPA, while the average CTC stands at an impressive INR 10.5 LPA.

Prominent recruiters include industry giants like KPMG, JP Morgan, Morgan Stanley, Hindustan Unilever Limited, Godrej Capital Limited and Aditya Birla Capital. These companies offer opportunities in HR, finance, marketing and analytics, ensuring that graduates have a wide range of career options.

State-of-the-Art Facilities

To enhance the learning experience, the institute boasts cutting-edge facilities, including South Asia’s largest standalone Bloomberg Finance Lab with 24 terminals. This lab allows students to gain hands-on experience with global financial data and insights. Additionally, the library, equipped with thousands of books and journals, supports advanced research and learning.

The institute’s partnership with the University of Wisconsin-Parkside, USA, through the Global MBA program, also provides students with opportunities for international exposure, making them globally competitive professionals.

Why NL Dalmia Is Your Gateway To Success

In conclusion, NL Dalmia Institute stands as a beacon of excellence in management education. Its robust programs, including the PGDM in HRM, focus on developing versatile professionals ready to take on the challenges of the modern workplace. The institute’s commitment to academic rigor, coupled with its excellent placement record, makes it a top choice for aspiring managers.

Whether you’re looking to specialise in HR or any other domain, NL Dalmia Placements ensures that your efforts culminate in a rewarding career. By choosing NL Dalmia, you are not just joining an institution; you are becoming a part of a legacy of excellence, innovation and success. Make the smart choice today and take the first step towards a brighter future.

#nl dalmia institute#nldimsr mumbai#nl dalmia pgdm#pgdm course#nl dalmia placements#pgdm in hr management#pgdm in hrm#nl dalmia institutes

0 notes

Text

Sustainability in Business: Lessons from IMI Kolkata's Case Studies

Sustainability has become a defining factor for long-term success in a world where businesses are expected to do more than just generate profits. At IMI Kolkata, the emphasis on sustainability is not just theoretical—it’s deeply embedded in the case studies and real-world examples that form the backbone of our learning.

Looking at how IMI Kolkata equips future managers to integrate sustainability into their decision-making processes -

Understanding the Triple Bottom Line

Through case studies on companies like Patagonia and Unilever, we learn how businesses can balance people, planet, and profit. These discussions challenge us to think beyond financial gains and consider the social and environmental impact of our decisions.

Real-World Problem Solving

IMI Kolkata’s curriculum includes case studies that address pressing global issues like climate change, resource scarcity, and waste management. For instance, analyzing IKEA’s shift to renewable energy and circular production models teaches us how to align business goals with sustainability initiatives.

Local Context, Global Impact

India faces unique sustainability challenges, and IMI Kolkata ensures that students are well-versed in addressing them. Case studies on Indian companies like Tata Steel and ITC demonstrate how businesses can lead the way in sustainable practices while navigating local market complexities.

Innovative Strategies for Sustainability

The case discussions often highlight innovative solutions, such as the adoption of green technologies, zero-waste policies, and sustainable supply chains. These examples inspire us to think creatively and find scalable solutions for sustainability challenges.

The Role of Leadership

Sustainability is impossible without visionary leadership. IMI Kolkata’s case studies emphasize how leaders can drive change, foster a culture of sustainability, and align their teams toward achieving a shared vision.

Lessons Beyond the Classroom

The case studies at IMI Kolkata are more than academic exercises—they’re a call to action. They teach us that sustainability is not just a corporate responsibility but also a competitive advantage. The insights gained here empower us to build businesses that contribute to a better world.

Sustainability in business is no longer optional; it’s essential. Therefore, IMI Kolkata prepares us to face this reality head-on, equipping us with the knowledge, skills, and mindset to lead the charge.

If you’re passionate about creating a positive impact through business, IMI Kolkata is the place to start. The lessons learned here will stay long beyond the classroom.

0 notes

Text

SEBI's Investigation into Quant Mutual Fund: Should Investors Worry?

Quant Mutual Fund has expanded rapidly over the last five years, going from Rs 100 Crore to Rs 90,000 Crore. Regretfully, SEBI searches on their operations in Hyderabad and Mumbai have uncovered possible front-running, leading them to open a probe into this growth.

Recognizing Front Running

Brief explanation: It's against the law to front run. Insider trading happens when someone make money off of proprietary knowledge before big trades affect stock values.

For example, let's say a fund decides to put Rs 500 crore into a lesser-known company's stock, which could raise the stock price. When the price rises after the fund invests, the person who is aware of this scheme and buys shares early will profit.

Results of the SEBI Study

What Could Take Place: Investors may become uneasy due to the probe and withdraw their capital. This would make it tough for Quant Mutual Fund to keep operating smoothly and growing.

Impact on Small-cap Stocks: Quant has a large part of its money, over 20%, in smaller companies. These stocks might now see more price ups and downs, which could worry investors.

Recent Investments by Quant Mutual Fund

Commodities Sector: They’ve invested in big names like Shree Cement, Gujarat Mineral Development Corporation, and Tata Steel.

Consumer Sector: They’ve bought shares in Aditya Birla Fashion & Retail, Asian Paints, and Indiabulls Real Estate.

FMCG Sector: The fund has shares in Marico and Hindustan Unilever.

Financial Sector: Quant has significant investments in HDFC Bank and HDFC Life Insurance.

Healthcare and IT: Shares in Dr Reddy’s Laboratories and Zydus Lifesciences, along with HCL Technologies and Infosys, are part of their portfolio.

click here to read more

0 notes

Text

Top 5 Challenges CPGs Face in Achieving Sustainable Packaging Goals by 2025

The commitment to achieving sustainable packaging goals by 2025 has been made by many consumer packaged goods (CPG) companies, reflecting their dedication to reducing environmental impact. However, various challenges have impeded these efforts, and addressing them has proven crucial for success. This blog explores the top five challenges faced by CPGs, providing insights into strategies and solutions.

1. Limited Availability of Sustainable Raw Materials

The availability of sustainable materials has often been a bottleneck in packaging innovation. The demand for recyclable or biodegradable materials continues to surpass the supply, creating intense competition in the market.

Sustainable alternatives, such as bio-based plastics, are in limited production.

Cost and scalability have restricted smaller players from accessing these resources.

To bridge the gap, CPG, recyclers are partnering with bottle and container suppliers like Regent Plast, specializing in sustainable plastic bottle manufacturing.

Such constraints make the switch to greener materials challenging, especially when high-quality and durable options are required.

2. Recycling Infrastructure Deficiencies

Global recycling rates remain inconsistent due to inadequate infrastructure, especially in developing countries.

Recycling facilities often lack the capacity to process clean materials like HDPE for which multi-layer technology to accept recycled polymers (PCR) is required.

Non-standardized collection systems hinder efficient processing.

A lack of awareness among consumers about segregating waste adds complexity.

For companies relying on advanced materials, collaborations with HDPE bottle manufacturers and local recyclers are being explored to improve collection and processing networks.

3. High Costs of Transition

Shifting from traditional to sustainable packaging is associated with significant costs. These expenses include:

Research and development (R&D) for innovative packaging solutions.

Re-tooling existing machinery for compatibility with newer materials.

Absorbing increased material costs.

Despite these hurdles, CPG companies have sought affordable solutions by partnering with plastic bottle manufacturers that prioritize innovation, can provide a proven solution and ease the financial strain of paying a premium for recycled polymers. Regent Plast is deploying state of an art multi-cavity blow moulding machine to manufacture bottles in high quantities and reduce the manufacturing cost, and to some extent, off-set the cost of recycled polymers.

4. Regulatory Hurdles and Compliance

Governments worldwide have enacted regulations to curb single-use plastics and promote sustainable practices. However, these policies vary widely by region, creating challenges for global CPG companies.

Diverging standards for material recyclability in different markets.

Conflicting requirements for labeling, material composition, and waste management protocols.

Rising compliance costs in emerging markets.

Collaborating with specialized plastic packaging suppliers such as Regent Plast, which ensures compliance with local and international standards, has been identified as an effective strategy.

5. Consumer Behavior and Perception

Consumer preferences significantly influence packaging decisions, yet educating consumers about sustainability remains a challenge.

Misunderstandings around recyclable versus compostable materials create confusion.

Perceived inferior quality of eco-friendly packaging deters adoption.

Price sensitivity often leads consumers to prefer conventional packaging.

CPGs have responded by offering recyclable options like bottles made out of recycled plastics/ ocean plastics that align with both sustainability goals and consumer expectations. Related Article: Why Recyclable Bottles & Containers are in demand?

Brands Leading and Lagging in Sustainable Packaging Goals

Brands Making Strides:

Unilever: The company has committed to halving its use of virgin plastics and achieved significant milestones in recycled content packaging.

Nestlé: Launched a $2 billion fund to invest in sustainable packaging innovation.

Coca-Cola: Progressed toward its “World Without Waste” goal, aiming to collect and recycle one bottle for every one sold by 2030.

READ MORE- https://regentplast.com/top-5-challenges-cpgs-face-in-achieving-sustainable-packaging-goals-by-2025/

0 notes

Text

Philippine Job Market Soars: Global Companies Offering Dream Careers with Six-Figure Salaries

The Philippines has emerged as a premier destination for global companies, with JOBYODA reporting a stunning 45% increase in high-paying positions across various sectors in 2025. Major employers like Google, Amazon, Meta, and Microsoft have significantly expanded their Philippine operations, creating thousands of new opportunities for local talent.

Job opportunities in Philippines have reached unprecedented levels, with Accenture leading the charge by announcing 5,000 new positions in their Manila and Cebu offices. JP Morgan Chase has similarly expanded its presence, offering positions with salaries ranging from ₱60,000 to ₱200,000 monthly for specialized roles in finance and technology.

JOBYODA's innovative job finder Philippines platform has become the go-to destination for career seekers, connecting talented professionals with industry giants like Shell, Unilever, and Procter & Gamble. These multinational companies are actively recruiting for positions across management, research and development, and digital transformation.

The landscape of job hiring Philippines has been transformed by tech giants like Google and Meta, who are establishing major operational hubs in the country. These companies are offering competitive packages that include international benefits, stock options, and flexible work arrangements. IBM's recent expansion has created over 2,000 new positions in artificial intelligence and cloud computing.

For those utilizing job search Philippines platforms, JOBYODA stands out by exclusively featuring verified positions from established companies like Samsung, LG, and Toyota. These manufacturers are investing heavily in their Philippine operations, creating opportunities in engineering, supply chain management, and quality assurance.

The BPO sector continues to thrive, with industry leaders like Concentrix, Teleperformance, and TaskUs offering positions that combine competitive salaries with comprehensive benefits packages. These companies are moving beyond traditional customer service roles, creating specialized positions in healthcare, IT support, and financial services.

Global banks including HSBC, Citibank, and Deutsche Bank have strengthened their Philippine presence, offering roles in investment banking, risk management, and financial technology. These institutions are particularly interested in Filipino talent for their global operations.

E-commerce giants Shopee and Lazada are aggressively expanding their Philippine teams, creating opportunities in digital marketing, data analytics, and logistics management. Their competitive packages include performance bonuses and stock options.

Visit JobYoda.com today to explore thousands of verified positions from these industry leaders. Our platform features advanced search filters, instant application systems, and direct communication with hiring managers. Join over 2 million Filipino professionals who have found their dream careers through JOBYODA.

The city's tourism revival has triggered a wave of hiring in the hospitality industry. Hotels, restaurants, and tourism-related businesses are seeking talented individuals for both full-time and part-time positions. Many of these roles offer attractive incentives, including service charge sharing and performance bonuses.

For young professionals and recent graduates, Davao's job market presents unique opportunities. Companies are increasingly offering management trainee programs and accelerated career paths, recognizing the need to develop local talent for leadership positions.

The manufacturing sector is another bright spot in Davao's employment landscape. With new factories and processing plants opening, skilled workers and engineers are in high demand. These positions typically offer above-average compensation and comprehensive benefits packages.

Don't wait to take advantage of these opportunities. Visit our job portal now to explore hundreds of verified positions across Davao City. Our platform offers real-time job notifications, direct application systems, and professional support to help advance your career.

Join the thousands of professionals who have already found their ideal positions in Davao's dynamic job market. The future is bright, and it's happening right here in Davao City.

#jobopportunitiesinphilippines #jobfinderphilippines #jobhirin Philippines #jobsearchphilippines

0 notes

Text

大家好! Meals have gotten more fun now that I'm experimenting with hummus! It helps that we have a variety of flavours to choose from, such as red pepper, coriander, avocado, dukkah, chilli and caramelised onions on top of the original plain one. For a quick, easy, moderately healthy lunch, I blanched tau kwa (firm tofu), spread caramelised onion hummus on 9-grain bread, topped it with salad greens and tau kwa, then added a dollop of hummus on each piece of tofu. For added fibre, I had the open-faced sandwich with celery sticks and a dip of more caramelised onion hummus.

youtube

youtube

youtube

During these lean times, what we look for when dining out is value, like this bowl chockful of tender fresh fish, an egg, crunchy cabbage and noodles topped with crispy anchovies. Priced at $5.50, it was a nutritious, moderately healthy and very filling return to office lunch. Dining establishments, from hawkers to restaurants and cafes which continue to deliver high value meals still enjoy decent business. Those of us who grew up in the 1980s remember what life was like when our country was still considered a developing nation. It was much more basic.

youtube

youtube

youtube

Back then, if your household could afford fish, meat, seafood, eggs, tofu as well as vegetables for daily meals, you'd be considered financially comfortable. We prepared foods that were easily made at home instead of eating out, such as sandwiches, soft-boiled/fried/scrambled eggs, omelettes, panfried fish, sauteéd veggies and simple soups. When we socialised at a restaurant, we chose menu items that weren't easy and convenient to make, we didn't know how to, or which provided better value. Now that food is so expensive and dining out even more so, we fall back on what we knew when life was simpler in the 1980s - prepare meals that we can easily make at home and eat out at places as well as choose menu items that are difficult to whip up by ourselves.

youtube

As for the little Japanese restaurant near the office, well, it ticks off 2 boxes: I don't know how to prepare sashimi AND, at $8.80, their kaisen donburi lunch deal, chockful of fresh fish and seafood on top of delicious vinegary rice, is excellent value. Colleagues and I sometimes visit. This week, I caught up with FL there. We ordered our mains and shared a side of sashimi. WL has asked me to introduce him to the restaurant when he returns from overseas. Even wealthy folks love a good deal when they see one! This is why some food businesses continue to thrive even in these challenging times whereas others that cannot deliver value to their customers flounder and whine about it.

youtube

Times are lean but I'm grateful that we eat well, especially when there're reports of starvation in Gaza. Palestinians don't get to enjoy a decent meal whereas, by not visiting cafes, I can make 3 nutritious and healthy sandwiches at home for the price of 1 cafe sandwich. Our lifestyles are not lavish, but we can afford the basics and go to bed with full bellies. Living standards have plummeted across the globe and that's our new reality. But Palestinians are still smiling so warmly at the world in spite of their immense suffering. Who are we to complain? I can only smile along with them and offer them sympathy and compassion. 下次见!

0 notes