#US tax filing in UK

Explore tagged Tumblr posts

Text

Episode of extremely intense anxiety lately, premonitions of disaster, convinced bad things are going to happen. There are external stressors but the situation seems unusually intense even considering those. Was trying to figure out why, and then realized that last April/May we got basically laid off from work (unexpectedly, and right after a long period of worrying about taxes) and the April/May before that I was preparing to move to the UK (after months of worrying about whether I would get a visa) and the April/May before that I was preparing to graduate my PhD (after months of worrying about if I would get feedback from my advisor and do okay on the defense). And to be fair, on top of that this is historically finals season. So, okay. I see it now.

#book's life#also I've always spent the first two-three months of the year worried about taxes#this is worse now because I can't do them until after the us deadline#because the uk season only starts like a week before that#and i do have til june to get them done and can (and have) file an extension#but my body doesn't know this#my body knows that spring = HAVE YOU DONE TAXES?????#but it's just been way worse than I'd expected given the scope of the external stressors#yesterday i felt on the verge of fainting for several hours

14 notes

·

View notes

Text

US Expat Tax Return Filing Made Simple

US expatriates residing in the UK face a unique set of challenges when it comes to tax obligations. Navigating the complexities of US expat taxes UK while living abroad can be daunting, but with proper guidance, it can be simplified. Understanding the requirements and procedures for US expat tax return filing is crucial for compliance and peace of mind. For Know more visit our website.

0 notes

Text

Lina Khan’s future is the future of the Democratic Party — and America

On OCTOBER 23 at 7PM, I'll be in DECATUR, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

On the one hand, the anti-monopoly movement has a future no matter who wins the 2024 election – that's true even if Kamala Harris wins but heeds the calls from billionaire donors to fire Lina Khan and her fellow trustbusters.

In part, that's because US antitrust laws have broad "private rights of action" that allow individuals and companies to sue one another for monopolistic conduct, even if top government officials are turning a blind eye. It's true that from the Reagan era to the Biden era, these private suits were few and far between, and the cases that were brought often died in a federal courtroom. But the past four years has seen a resurgence of antitrust rage that runs from left to right, and from individuals to the C-suites of big companies, driving a wave of private cases that are prevailing in the courts, upending the pro-monopoly precedents that billionaires procured by offering free "continuing education" antitrust training to 40% of the Federal judiciary:

https://pluralistic.net/2021/08/13/post-bork-era/#manne-down

It's amazing to see the DoJ racking up huge wins against Google's monopolistic conduct, sure, but first blood went to Epic, who won a historic victory over Google in federal court six months before the DoJ's win, which led to the court ordering Google to open up its app store:

https://www.theverge.com/policy/2024/10/7/24243316/epic-google-permanent-injunction-ruling-third-party-stores

Google's 30% App Tax is a giant drag on all kinds of sectors, as is its veto over which software Android users get to see, so Epic's win is going to dramatically alter the situation for all kinds of activities, from beleaguered indie game devs:

https://antiidlereborn.com/news/

To the entire news sector:

https://www.eff.org/deeplinks/2023/06/save-news-we-must-open-app-stores

Private antitrust cases have attracted some very surprising plaintiffs, like Michael Jordan, whose long policy of apoliticism crumbled once he bought a NASCAR team and lived through the monopoly abuses of sports leagues as an owner, not a player:

https://www.thebignewsletter.com/p/michael-jordan-anti-monopolist

A much weirder and more unlikely antitrust plaintiff than Michael Jordan is Google, the perennial antitrust defendant. Google has brought a complaint against Microsoft in the EU, based on Microsoft's extremely ugly monopolistic cloud business:

https://www.reuters.com/technology/google-files-complaint-eu-over-microsoft-cloud-practices-2024-09-25/

Google's choice of venue here highlights another reason to think that the antitrust surge will continue irrespective of US politics: antitrust is global. Antitrust fervor has seized governments from the UK to the EU to South Korea to Japan. All of those countries have extremely similar antitrust laws, because they all had their statute books overhauled by US technocrats as part of the Marshall Plan, so they have the same statutory tools as the American trustbusters who dismantled Standard Oil and AT&T, and who are making ready to shatter Google into several competing businesses:

https://www.theverge.com/2024/10/8/24265832/google-search-antitrust-remedies-framework-android-chrome-play

Antitrust fever has spread to Canada, Australia, and even China, where the Cyberspace Directive bans Chinese tech giants from breaking interoperability to freeze out Chinese startups. Anything that can't go on forever eventually stops, and the cost of 40 years of pro-monopoly can't be ignored. Monopolies make the whole world more brittle, even as the cost of that brittleness mounts. It's hard to pretend monopolies are fine when a single hurricane can wipe out the entire country's supply of IV fluid – again:

https://prospect.org/health/2024-10-11-cant-believe-im-writing-about-iv-fluid-again/

What's more, the conduct of global monopolists is the same in every country where they have taken hold, which means that trustbusters in the EU can use the UK Digital Markets Unit's report on the mobile app market as a roadmap for their enforcement actions against Apple:

https://assets.publishing.service.gov.uk/media/63f61bc0d3bf7f62e8c34a02/Mobile_Ecosystems_Final_Report_amended_2.pdf

And then the South Korean and Japanese trustbusters can translate the court documents from the EU's enforcement action and use them to score victories over Apple in their own courts:

https://pluralistic.net/2024/04/10/an-injury-to-one/#is-an-injury-to-all

So on the one hand, the trustbusting wave will continue erode the foundations of global monopolies, no matter what happens after this election. But on the other hand, if Harris wins and then fires Biden's top trustbusters to appease her billionaire donors, things are going to get ugly.

A new, excellent long-form Bloomberg article by Josh Eidelson and Max Chafkin gives a sense of the battle raging just below the surface of the Democratic Power, built around a superb interview with Khan herself:

https://www.bloomberg.com/news/features/2024-10-09/lina-khan-on-a-second-ftc-term-ai-price-gouging-data-privacy

The article begins with a litany of tech billionaires who've gone an all-out, public assault on Khan's leadership – billionaires who stand to personally lose hundreds of millions of dollars from her agency's principled, vital antitrust work, but who cloak their objection to Khan in rhetoric about defending the American economy. In public, some of these billionaires are icily polite, but many of them degenerate into frothing, toddler-grade name-calling, like IAB's Barry Diller, who called her a "dope" and Musk lickspittle Jason Calacanis, who called her an all-caps COMMUNIST and a LUNATIC.

The overall vibe from these wreckers? "How dare the FTC do things?!"

And you know, they have a point. For decades, the FTC was – in the quoted words of Tim Wu – "a very hardworking agency that did nothing." This was the period when the FTC targeted low-level scammers while turning a blind eye to the monsters that were devouring the US economy. In part, that was because the FTC had been starved of budget, trapping them in a cycle of racking up easy, largely pointless "wins" against penny-ante grifters to justify their existence, but never to the extent that Congress would apportion them the funds to tackle the really serious cases (if this sounds familiar, it's also the what happened during the long period when the IRS chased middle class taxpayers over minor filing errors, while ignoring the billionaires and giant corporations that engaged in 7- and 8-figure tax scams).

But the FTC wasn't merely underfunded: it was timid. The FTC has extremely broad enforcement and rulemaking powers, which most sat dormant during the neoliberal era:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

The Biden administration didn't merely increase the FTC's funding: in choosing Khan to helm the organization, they brought onboard a skilled technician, who was both well-versed in the extensive but unused powers of the agency and determined to use them:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

But Khan's didn't just rely on technical chops and resources to begin the de-olicharchification of the US economy: she built a three-legged stool, whose third leg is narrative. Khan's signature is her in-person and remote "listening tours," where workers who've been harmed by corporate power get to tell their stories. Bloomberg recounts the story of Deborah Brantley, who was sexually harassed and threatened by her bosses at Kavasutra North Palm Beach. Brantley's bosses touched her inappropriately and "joked" about drugging her and raping her so she "won’t be such a bitch and then maybe people would like you more."

When Brantley finally quit and took a job bartending at a different business, Kavasutra sued her over her noncompete clause, alleging an "irreparable injury" sustained by having one of their former employees working at another business, seeking damages and fees.

The vast majority of the 30 million American workers who labor under noncompetes are like Brantley, low-waged service workers, especially at fast-food restaurants (so Wendy's franchisees can stop minimum wage cashiers from earning $0.25/hour more flipping burgers at a nearby McDonald's). The donor-class indenturers who defend noncompetes claim that noncompetes are necessary to protect "innovative" businesses from losing their "IP." But of course, the one state where no workers are subject to noncompetes is California, which bans them outright – the state that is also home to Silicon Valley, an IP-heave industry that the same billionaires laud for its innovations.

After that listening tour, Khan's FTC banned noncompetes nationwide:

https://pluralistic.net/2024/04/25/capri-v-tapestry/#aiming-at-dollars-not-men

Only to have a federal judge in Texas throw out their ban, a move that will see $300b/year transfered from workers to shareholders, and block the formation of 8,500 new US businesses every year:

https://www.npr.org/2024/08/21/g-s1-18376/federal-judge-tosses-ftc-noncompetes-ban

Notwithstanding court victories like Epic v Google and DoJ v Google, America's oligarchs have the courts on their side, thanks to decades of court-packing planned by the Federalist Society and executed by Senate Republicans and Reagan, Bush I, Bush II, and Trump. Khan understands this; she told Bloomberg that she's a "close student" of the tactics Reagan used to transform American society, admiring his effectiveness while hating his results. Like other transformative presidents, good and bad, Reagan had to fight the judiciary and entrenched institutions (as did FDR and Lincoln). Erasing Reagan's legacy is a long-term project, a battle of inches that will involve mustering broad political support for the cause of a freer, more equal America.

Neither Biden nor Khan are responsible for the groundswell of US – and global – movement to euthanize our rentier overlords. This is a moment whose time has come; a fact demonstrated by the tens of thousands of working Americans who filled the FTC's noncompete docket with outraged comments. People understand that corporate looters – not "the economy" or "the forces of history" – are the reason that the businesses where they worked and shopped were destroyed by private equity goons who amassed intergenerational, dynastic fortunes by strip-mining the real economy and leaving behind rubble.

Like the billionaires publicly demanding that Harris fire Khan, private equity bosses can't stop making tone-deaf, guillotine-conjuring pronouncements about their own virtue and the righteousness of their businesses. They don't just want to destroy the world - they want to be praised for it:/p>

"Private equity’s been a great thing for America" -Stephen Pagliuca, co-chairman of Bain Capital;

"We are taught to judge the success of a society by how it deals with the least able, most vulnerable members of that society. Shouldn’t we judge a society by how they treat the most successful? Do we vilify, tax, expropriate and condemn those who have succeeded, or do we celebrate economic success as the engine that propels our society toward greater collective well-being?" -Marc Rowan, CEO of Apollo

"Achieve life-changing money and power," -Sachin Khajuria, former partner at Apollo

Meanwhile, the "buy, strip and flip" model continues to chew its way through America. When PE buys up all the treatment centers for kids with behavioral problems, they hack away at staffing and oversight, turning them into nightmares where kids are routinely abused, raped and murdered:

https://www.nbcnews.com/news/us-news/they-told-me-it-was-going-be-good-place-allega-tions-n987176

When PE buys up nursing homes, the same thing happens, with elderly residents left to sit in their own excrement and then die:

https://www.politico.com/news/magazine/2023/12/24/nursing-homes-private-equity-fraud-00132001

Writing in The Guardian, Alex Blasdel lays out the case for private equity as a kind of virus that infects economies, parasitically draining them of not just the capacity to provide goods and services, but also of the ability to govern themselves, as politicians and regulators are captured by the unfathomable sums that PE flushes into the political process:

https://www.theguardian.com/business/2024/oct/10/slash-and-burn-is-private-equity-out-of-control

Now, the average worker who's just lost their job may not understand "divi recaps" or "2-and-20" or "carried interest tax loopholes," but they do understand that something is deeply rotten in the world today.

What happens to that understanding is a matter of politics. The Republicans – firmly affiliated with, and beloved of, the wreckers – have chosen an easy path to capitalizing on the rising rage. All they need to do is convince the public that the system is irredeemably corrupt and that the government can't possibly fix anything (hence Reagan's asinine "joke": "the nine most terrifying words in the English language are: 'I'm from the Government, and I'm here to help'").

This is a very canny strategy. If you are the party of "governments are intrinsically corrupt and incompetent," then governing corruptly and incompetently proves your point. The GOP strategy is to create a nation of enraged nihilists who don't even imagine that the government could do something to hold their bosses to account – not for labor abuses, not for pollution, not for wage theft or bribery.

The fact that successive neoliberal governments – including Democratic administrations – acted time and again to bear out this hypothesis makes it easy for this kind of nihilism to take hold.

Far-right conspiracies about pharma bosses colluding with corrupt FDA officials to poison us with vaccines for profit owe their success to the lived experience of millions of Americans who lost loved ones to a conspiracy between pharma bosses and corrupt officials to poison us with opioids.

Unhinged beliefs that "they" caused the hurricanes tearing through Florida and Georgia and that Kamala Harris is capping compensation to people who lost their homes are only credible because of murderous Republican fumble during Katrina; and the larcenous collusion of Democrats to help banks steal Americans' homes during the foreclosure crisis, when Obama took Tim Geithner's advice to "foam the runway" with the mortgages of everyday Americans who'd been cheated by their banks:

https://www.salon.com/2014/05/14/this_man_made_millions_suffer_tim_geithners_sorry_legacy_on_housing/

If Harris gives in to billionaire donors and fires Khan and her fellow trustbusters, paving the way for more looting and scamming, the result will be more nihilism, which is to say, more electoral victories for the GOP. The "government can't do anything" party already exists. There are no votes to be gained by billing yourself as the "we also think governments can't do anything" party.

In other words, a world where Khan doesn't run the FTC is a world where antitrust continues to gain ground, but without taking Democrats with it. It's a world where nihilism wins.

There's factions of the Democratic Party who understand this. AOC warned party leaders that, "Anyone goes near Lina Khan and there will be an out and out brawl":

https://twitter.com/AOC/status/1844034727935988155

And Bernie Sanders called her "the best FTC Chair in modern history":

https://twitter.com/SenSanders/status/1843733298960576652

In other words: Lina Khan as a posse.

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/11/democracys-antitrust-paradox/#there-will-be-an-out-and-out-brawl

#pluralistic#ftc#lina khan#democratic party#elections#kamala harris#billionaires#trustbusting#competition#labor#noncompetes#silicon valley#aoc

407 notes

·

View notes

Text

McDon't Rollout Timeline

Here, let's simplify the timeline for those of you having a hard time staying caught up with the tug-of-war that appears to be going on. I'll keep my analysis to a minimum and let the facts speak for themselves, but I doooooooo have thoughts on these "coincidences." 👀

December 2024

December 21st, 2024

Louis randomly checks in on us on Twitter. No chat. Just: "Hope everyone’s doing alright! Have a good day"

December 25th, 2024

Sam and Zara spend Christmas separately, but Zara shows off gifts between the two of them on social media.

Zara reposts a TikTok saying: "When you still go to your own family Christmases" (implying they were only apart because they chose to spend Christmas with their separate families).

December 31st, 2024

Louis does a pub crawl in Doncaster wearing a Pleasures cardigan that says: "What happened to you? What happened to me? Pleasures is pain."

The tag for the cardigan says: "I can't have the one that I want."

Articles come out about Zara and Sam officially being over. Her "friends" say: "Things have been tricky for her the past 18 months."

January 2025

Sometime in January

The celebrity scout responsible for connecting Zara to Strictly Come Dancing is hired as the scout for SoccerAid.

January 4th, 2025

Tabloid articles report Zara spending NYE in Paris. Sources say: "She just wants to try to focus on work and get herself together."

January 13th, 2025 (approximately)

Harry is spotted in Germany.

January 21st, 2025

Jade Thirlwall (PR by Simon Jones) says on a podcast that Harry ghosted her after a date back in 2010.

January 28th, 2025

Louis tweets: "Hope everyone’s doing alright!" and "Big year incoming!"

January 29th, 2025

Louis attends Zayn's LA show and leaves with him.

January 30th, 2025

Despite multiple rumors and the event showcasing nearly everyone on the A*off roster, Harry does not attend FireAid.

January 31st, 2025

Walls 5th anniversary promo from Sony. However, merch is distributed through LT Merch.

February 2025

February 1st and 3rd, 2025

Harry is in Rome with Alessandro for his birthday. Rumors swirl about him and a woman with long brunette hair.

February 1st–27th, 2025

Zara is filming in Thailand.

February 3rd, 2025

Louis re-uploads Two of Us Acoustic to his YouTube but leaves off the Sony/Syco copyright.

The original version stays listed.

February 6th, 2025

Louis is in New Orleans for the Super Bowl. He goes to bars wearing a German football club jersey and posts a picture of a dartboard.

On the same day, Pleasing posts their Valentine’s Day Instagram reel featuring darts and two fish named Romeo and Julio.

February 7th, 2025

For a Super Bowl pre-party, Louis wears an "Endless Runner" shirt.

February 8th–9th, 2025

Harry is back in Berlin.

February 9th, 2025

Louis attends the Super Bowl (possibly as an ambassador for NFL UK).

February 15th, 2025

A user discovers Louis’ profile on Raya (a dating app for celebrities and influencers). This makes the tabloids.

February 18th, 2025

Louis follows Zara on Instagram.

February 26th, 2025

Articles emerge about Harry’s companies being behind in tax filings. (Note: As of this post, they are still behind, but the strike has been removed. It is normal and nothing to panic over.)

February 27th, 2025

Zara wraps filming in Thailand.

An article drops claiming that Harry’s team told him not to associate with the band. "A source told The Sun: 'Thousands of hours of blood, sweat and tears have gone into making Harry a superstar and he has spent a decade getting to a place of respect and legitimacy in the music business. He has won awards and hit new heights away from the band. Any return would be a major step back. Harry knows it already but his team have been very clear that it would be a bad idea at any point in the foreseeable future.'"

February 28th, 2025

Louis tweets 28 and hosts a launch party for the latest 28 drop.

This drop is handled much differently than previous ones:

Tons of PR around it.

A physical launch.

Journalists are invited to attend.

Interviews are done.

Louis finally admits that he remembers his tattoos were obtained to mark specific memories.

He also says clothes hold memories and likens them to his tattoos.

Dirty Blonde plays a set.

March 1st, 2025

Zara attends the Brits. Louis likes her photo.

Articles emerge about Zara being "cozied up" with Lucien Laviscount.

Louis announces a surprise pop-up show on March 6th with Dirty Blonde as the opening act. The show will support Music Venue Trust.

March 1st–4th, 2025

Harry runs the Tokyo Marathon! He is later pictured in Tokyo with friends.

March 4th, 2025

Harry is announced to be taking part in Live Odyssey to support Music Venue Trust.

March 6th, 2025

Zara appears on Loose Women to discuss her documentary.

Harry returns to London and is photographed in Soho just hours before Louis' show.

Louis performs the pop-up show in Brixton.

March 7th, 2025

Louis flies to India.

Articles begin swirling about Harry being in talks to perform a residency at The Sphere.

March 8th, 2025

Zara and Harry are seen in the same box at the Sabrina Carpenter concert at the O2 in London (with Rchel Chnouriri).

Louis likes R*chel's Instagram post about the concert.

March 9th, 2025

Louis is photographed wearing a Yohji Yamamoto x NEIGHBORHOOD T-Shirt (a piece from the WILDSIDE Yohji Yamamoto store, designed by Kunichi Nomura) and Dries Van Noten Printed Swim Shorts during an interview.

He comments that he sees everything online from a "bird's eye view."

Zara joins the live stream of a well-known Larrie.

March 10th, 2025

Tabloid articles claim fans suspect Zara and Louis are dating.

Note: All quotes are pulled from a Larry subreddit. No other sources or information online connect the two at this point.

Louis and Sam are both announced as participants in Soccer Aid.

March 11th, 2025

Tabloids speculate about a possible Soccer Aid rivalry between Sam and Louis, based entirely on the Reddit theory article about Zara and Louis.

Articles note Louis and Zara liking each other's photos on Instagram.

Harry is seen in Rome.

(I don’t blame you, babes. Get out of town during all this. Go to some art shows with your friends and let it die down before you come home.)

March 12th, 2025

Articles claim Zara purchased a new house in the same neighborhood as Sam.

The London Standard releases an article about Louis' February 28th 28 fashion drop.

The fashion brand is ridiculed, Louis is painted in a bad light, and the journalist includes quote that will later be circulated by every single media outlet possible: "I am told sternly before we sit down to, please, forgo any questions on the topic. ‘The Sun has been running a story that the boys are going to reunite at the Brits for Liam,’ a PR manager tells me. ‘Louis just despairs. He could never get up there and sing as part of the band after what has happened.’ One Direction did not perform during the awards, which took place the night after our interview."

March 13th, 2025

Harry's team denies the Sphere residency rumors.

March 16th, 2025

Articles somehow link Harry and Taylor S*ift again.

March 17th, 2025

Articles surface about Harry "not being over" Oivia Wide.

Sam appears on a podcast and makes comments seemingly shading Zara: "A lot of people look for validation in other people and they look for the next person instantly . . . It's like, 'I need to find someone else to fill that hole and I need to find that excitement.'"

Late that night, The Sun releases a paid article with three blurry photos of Zara and Louis at a restaurant.

The article claims Louis took time to take photos with fans, but no fan photos have been released.

The photos appear to have been taken from outside, peering through a window by the rubbish bins.

Fans point out several inconsistencies:

For a millionaire, the date seems cheap.

For someone who values privacy and can stay completely off the radar for months, it’s strange to be photographed.

Zara was just seen "loved up" with someone else at the Brits.

March 18th, 2025 (This was a big news day, so buckle up!)

The Daily Mail picks up the restaurant story and finds a "source" to address fans' doubts: "They have only been together a short time, but they clearly get on really well and are enjoying one another's company. They didn't want it to come out this soon – and didn't think it would. Louis made sure they went somewhere understated in the hope that they wouldn't be seen. He is an expert [at staying anonymous], and has been photographed relentlessly since he was a teenager."

Additional articles include:

A source close to Zara says about Sam: "He's a loose cannon, as we saw with his comments so soon after Zara's relationship was made public. It's really quite pathetic of him. It feels like it always has to be about him." "Zara put a lot into her relationship with Sam: she did everything she could to make it work for five years, but in the end, she just couldn't."

Information claiming Zara and Louis have been dating for "two and a half weeks" (putting the start of their relationship around March 1st).

A "former colleague" of Louis says: "This is so lovely for Louis. Liam dying really hit him hard. He was still close to him, so that was a very difficult time. Louis thought of Liam as a brother, and the circumstances around his death were just awful." "Louis has had an unfair amount of grief to deal with – so those around him have been really hoping he would find someone to settle down with. It's great that Zara understands fame like he does. Watch this space." (Note: "Watch this space" is a call to action, hinting at more stories from The Sun.)

Articles reissue claims that Zara's new house is a "love nest."

Direct quotes: "She bought it two weeks ago under her company name. It’s a two-bed flat in a nice area and, weirdly, not that far from where she lived with Sam." "Earlier this month, Zara set tongues wagging with Lucien Laviscount after they were spotted getting cozy at the BRIT Awards."

An article about Sam holding "no hard feelings toward Louis" drops: "When he meets Louis at Soccer Aid, he'll treat him like any other teammate. There's no bad blood," the source added.

An article claims Zara wants to become a pop star and is "using Louis to do so." "Her true passion—music—has taken a back seat." "A relationship with Louis would allow her to submerge herself into music and let her focus on her passion that she has neglected in recent years."

A note on this article. This is the first and only one to name the man Zara cheated on Sam with. "Formerly an International A&R Manager for Cowell’s label Syco, Zara’s ill-judged tryst with Fouradi hinted at her desire to fall for the bright lights and trappings of the music biz." (Note: I don't want to have to put this here but it's important. Fouradi is the X-Factor exec who SA'ed Katie Waisel in 2010.)

Articles about Louis insulting Love Island in the past start circulating.

The Daily Mail headline reads: "Louis Tomlinson reveals REAL feelings about Zara McDermott amid dating rumors"

The article focuses entirely on how Louis has expressed disdain for Love Island.

March 19th, 2025

Articles about Zara’s "glow-up," plastic surgery, and health journey start circulating.

The Daily Mail posts another article using only Reddit quotes about Zara being both a stunt and a Brexit supporter.

Quotes include: "I think it’s genuine" "Who knows, maybe Zara is his perfect partner."

Zara posts a video playing with her friend’s child.

Articles surface about Sam being back on dating apps after allegedly being blindsided by Zara’s romance.

March 20th, 2025

The Senior Editor of The Sun’s Bizarre (celebrity) column begins arguing with Larries on Twitter unprompted.

Without being tagged or contacted, he defends Zara and Louis, claiming: "Speculating about people’s sexuality can be harmful, and Zara and Louis are dating."

He likes a tweet that says: "As someone yawning with this whole charade, please know my DMs are open if anyone (especially newer Larries, but anyone really) is upset or freaking out."

An article is released claiming Sam’s sister Louise once went on a date with Niall and spent the night at Louis’ home.

A full article about One Direction "affairs" is published, including the alleged connection between Sam’s sister and Niall.

A previously released article from December resurfaces, claiming Zara (or her business) is now a millionaire.

March 21st, 2025

The Sun runs an article saying Zara and Sam have gained thousands of followers since the dating rumors, while Louis has lost 80k followers.

Another article claims Zara and Sam’s friends are "taking sides."

Yet another article speculates about a "rivalry" between Sam and Louis.

March 22nd, 2025

The Sun publishes an article about a reporter receiving death threats from One Direction fans.

No new information is provided—it’s an old story being resurfaced for no apparent reason.

March 23rd, 2025

The Sun runs two articles:

One about Sam’s "boys’ trip."

Another about Zara walking to the gym.

Both heavily reference her rumored date with Louis and how hard Sam is taking the breakup.

The Sun makes an error in an article, claiming Zara had "met Louis’ parents."

(Note: Louis’ mother passed in 2016, and his father is not in his life.)

The article is quickly corrected to say she met his "family": "Zara has already met all the family, and they can tell that she has made Louis giddy. It's the first time in a long time that they have seen him happy."

The source adds: "They think Zara is super wholesome and health-conscious, so they are happy he is with someone who shuns the party life." (Note: Over the past few years, Louis has mentioned doing yoga and eating more seafood—similar to Harry’s pescatarian diet and yoga practice. It seems like they need an explanation for this rather than the obvious.)

Sam’s Raya profile makes it into the tabloids.

March 24th, 2025

A letter signed by Harry (along with others, led by Ed Sheeran) urging the UK government to fund music education is released.

March 25th, 2025

Louis posts pictures from inside Real World Studios, where George Michael and Harry have previously recorded.

March 26th, 2025

A full minute-long clip of Harry’s Two Ghosts music video (from 2017) is leaked online. (Note: This isn’t the first leak, but it’s the longest one so far.)

March 28th, 2025

All of Those Voices begins uploading clips of the documentary to TikTok in small parts.

Originally planned as 14 parts, it’s later extended to 28 parts.

March 31st, 2025

The Sun runs an article on Briana and Freddie for the first time in years.

It’s an exclusive behind a paywall, featuring photos of Briana and Freddie grocery shopping (Freddie’s face is blurred).

The article appears to be sourced from Briana herself.

It mentions Briana was 28 when she got engaged to her former fiancé (unrelated) and posted: "10 years of knowing you, and I knew all along you were my soulmate. I love you!"

The article also notes she gave birth in 2016 at age 23—an inconsistency that fans pick up on immediately.

April 1st, 2025

On the third anniversary of As It Was, Louis posts “Favorite” by Fontaines D.C.—a song about loving someone for a long time despite all the changes around you. (Note: Harry is a huge Fontaines D.C. fan, attended their show, and celebrated their win at the 2024 BRITs.)

Louis posts an Instagram story of a guitar by a pool, which is deleted after 10 minutes.

Important details about the photo:

It was apparently taken in Malibu in October (before Liam passed).

The rental was unoccupied that day.

The guitar is covered in sharpie drawings, seemingly in Louis’ handwriting. Symbols include:

28, 1991 (his birth year), smiley faces with X’s for eyes, the anarchy symbol, 369, the Eye of Providence (also seen on Harry’s leather journal during 1D), a #5 tally mark (same as his tattoo), a skull, a tornado, the words why and yes, an asterisk, a question mark, and his initials, LT.

Zara posts pictures of her family holiday in Dubai.

April 2nd, 2025

The Sun releases an article titled: "Inside Louis Tomlinson’s unbreakable bond with the woman who has supported him through unthinkable tragedy – & it’s not Zara."

The article focuses on his sisters.

Louis likes an Instagram post by a random man with very few followers. The caption reads (in Spanish): "Silence can say or express much more 😎"

The man had accidentally tagged Zara instead of a company called Zara.

Louis’ like is removed after fans notice and post about it on Twitter.

Harry is papped walking around London.

Articles speculate about Sam growing close to another reality show star.

Don’t Worry Darling is released on Netflix.

All of Those Voices TikTok account uploads the 4:15 clip of Louis with Freddie from the documentary.

Briana unfollows Louis on Instagram.

April 3rd, 2025

Sam Thompson reveals he’s co-parenting cats he shared with Zara McDermott—while "growing close to" another reality star.

Harry is pictured in London again.

Louis tweets and chats with fans, sharing the following:

"Fountain DC" (spelled wrong, but clearly referencing Fontaines D.C.).

"We’re waiting for LT3 (his next album)" — "It’s cooking."

"Like medium rare or well done?" — "Medium rare. Cooked to perfection."

"Any hints/lyric tease from the album?" — "Yeah."

"Describe the vibes of the new album" — "Sunny." (Likely referencing the Malibu guitar photo.)

"High in California vibes?" — "Always."

"With a sprinkle of?" — "Chaos."

"Give me a word that you use in one of your songs." — "You." (Note: Back in 2017, Louis posted the word “Always” on Twitter and captioned an Instagram post with “you” at the same time—hinting at the song Always You. It seems like he’s referencing that here as well.)

"Are you feeling ready for Soccer Aid?" — "Not yet but I will be. Need alllllll the support I can get though." (Note: There are 7 L’s in this.)

"Any advice for a bad day?" — "Don’t just assume tomorrow will be a bad day too. Who knows what the future has in store for you!"

"Can we expect any collabs on this album?" — "I was hoping for one maybe, but nothing has come up yet that makes sense."

April 7th, 2025

Articles resurface about interviewer Dan Walker once receiving death threats from One Direction fans back in 2020.

(Note: These threats happened after he inappropriately grilled Louis about losing his mother and sister. No new information is provided, and there’s no apparent reason for this story to be resurrected now.)

Articles claim Harry is "deeply hurt" by Taylor R*ssell moving on.

April 8th, 2025 (US Time)

Louis posts an Instagram story from a Stereophonics concert.

The lyrics playing are from "Maybe Tomorrow," a song Louis once tweeted about in 2021.

The clip shows the lyrics: "Maybe tomorrow I'll find my way home."

Zara also posts an Instagram story from the same concert, tagging the band and the venue.

Articles report that Barnett has approved Harry’s long-planned renovations to merge his Hampstead Heath houses.

April 9th, 2025 (so far)

UK tabloids pick up on Louis and Zara’s Instagram stories about the concert.

They incorrectly use pictures from Zara’s recent Dubai holiday as if they were taken in LA.

Pap photos of Harry in London surface, showing him wearing Dries Van Noten Suede Sneakers.

An Instagram story from Kunichi Nomura shows Harry and Kunichi together in Tokyo in early March.

Articles about Olva W*lde began circulating, focusing on her role in a new episode of a TV show as a director caught in on-set drama reminiscent of the Don’t Worry Darling fiasco.

Louis’ sisters, Daisy and Phoebe, are announced as supporting members (not players) for Soccer Aid.

Final Thoughts as of Now

Reverse-Engineering the Narrative: PR Goals

Rebuild Louis’ Public Image

Focus on presenting Louis as approachable and mature, highlighting his journey of overcoming tragedies, fighting as the underdog, and being a responsible brother.

Shift public perception away from the "teeny-boybander" stereotype to a more grounded, independent artist.

Leverage a Fabricated Rivalry Between Louis and Sam

The supposed rivalry generates free publicity for Soccer Aid while positioning Louis as a central figure in the event.

Zara’s previous relationship with Sam adds layers of drama to keep the story alive.

Boost Zara’s Career

Zara benefits from the association with Louis, gaining access to his fanbase and increased media coverage.

The narrative about Zara wanting to become a pop star and Louis "helping her" aligns her with a larger career trajectory.

This arrangement also provides Louis’ PR team with a "safe" and heteronormative pairing to push.

Drive Engagement Through Easily Shareable Drama

Stories about blurry date photos, Zara buying a "love nest," Sam shading Zara, and the "rivalry" between Louis and Sam are classic tabloid tactics.

These stories spark online debates, generating clicks and keeping both Louis and Zara trending, even if the narrative feels contrived.

Negative attention (e.g., fans doubting the relationship) still serves its purpose by maintaining relevance for both parties.

Connect Harry to Every Ex-Girlfriend He’s Had

Articles linking Harry to Taylor S*ift, Oivia Wi*de, and others are a transparent attempt to push a heteronormative narrative.

Make One Direction Fans Look Dangerous and Irrational

Resurface old stories of "death threats" against journalists, like Dan Walker, and amplify fan theories as though they’re harmful.

This frames fans (especially Larries) as unhinged, discrediting their ability to question the PR narrative.

Expand Louis’ Appeal to a Broader Audience:

The association with Zara makes Louis more appealing to casual fans or those outside his core audience, particularly those who follow Zara’s reality TV background.

This helps Louis appeal to a more mainstream audience, positioning him as more than just a musician but as a cultural figure with crossover appeal.

Breaking the PR Narrative

The Tabloid Error About Zara "Meeting Louis’ Parents" (March 23rd)

The story originally claimed Zara met Louis’ parents, despite his mother passing away in 2016.

Timing of Leaks and Posts

Louis’ Instagram story posts (e.g., Fontaines D.C., the Malibu guitar) subtly allude to Harry rather than Zara.

Louis’ "Need alllllll the support" Tweet on April 3rd

7 L’s in this tweet.

Coordinated Symbolism with Clothing

On March 9th, Louis wears a Yohji Yamamoto x NEIGHBORHOOD shirt (from a store designed by Kunichi Nomura).

On April 9th, a photo surfaces of Harry with Kunichi in Tokyo, taken back in early March.

Louis Wearing the Endless Runner Shirt at the Super Bowl (February 6th)

Louis wears a shirt reading "Endless Runner" during a Super Bowl pre-party. Just days later (March 1st–4th), Harry runs the Tokyo Marathon.

Briana Unfollows Louis (April 2nd)

Briana unfollows Louis the same day All of Those Voices uploads a clip of Louis with Freddie to TikTok.

Briana and Freddie Article Inconsistencies (March 31st)

An article about Briana and Freddie mentions “She gave birth in 2016 when she and Louis were just 23 years old.” And then immediately mentions the caption of her old engagement post to ex-fiance (only 5 years later) “Briana was 28 at the time and wrote on Instagram. “10 years of knowing you and I knew all along you were my soulmate”. The timeline doesn’t add up, undermining the credibility of the story.

Yes, I left all of the blue-greening out of this because: A. There was a lot of it. B. I know several of us don't consider blue-greening signaling anymore.

A collection of sources:

Jade Thirlwall

Harry's team told him not to be associated with the band.

Harry runs the Tokyo marathon!

Harry being in talks to perform a residency at the Sphere.

Fans speculate about Louis/Zara

Articles about them liking each others photos on Instagram.

Harry's team denies the Sphere rumors.

Articles somehow weirdly link Harry and Taylor S*ift again.

Articles about Harry not being over O*ivia Wi*de.

The Sun releases an exclusive (paid) article

Spotted getting cosy at the BRIT Awards.

Zara wants to become a popstar

Articles about Louis insulting Love Island

Articles about Sam being back on dating apps after being blindsided by Zara's romance.

Another article about the rivalry between Sam and Louis.

Zara walking to the gym

Sam's Raya profile

A letter Harry signed

The Sun runs an article on Briana and Freddie

Inside Louis Tomlinson’s unbreakable bond with woman who has supported him through unthinkable tragedy – & it’s not Zara

Articles about Sam growing close to another reality show star.

Don't Worry Darling is released to Neflix.

Articles come out that interviewer Dan Walker once received death threats from One Direction fans back in 2020.

Article saying that Harry is deeply hurt by Taylor R*ssell moving on.

Articles are released saying that Barnett has approved Harry to merge the houses he has in Hamstead Heath and finally begin the renovations hes been planing for years.

UK tabloids pick up on the Instagram stories. They incorrectly use pictures of her recent Dubai holiday as pictures of her in LA.

Pap photos of Harry

Olv*a W*lde stars as an director caught in on-set drama reminicent of the DWD escapade in The Studio.

143 notes

·

View notes

Text

Editing (Fan)fiction Like a Pro

Yes, most of us write fanfiction for ourselves, in our free time, and as a way to release stress. This means that, more often than not, we do not have the will or energy to spend hours editing our latest one-shot or the newest chapter for that longfic we updated...uh...has it already been five months??

While I wholeheartedly agree that we shouldn't strive to be perfect in the things we do for pleasure (and what counts as perfection in a highly subjective field such as literature?), you don't need to spend tens of hours on your World, Doc, or Scrivener file to apply some crucial edits.

Even a quick second read-through can be enough to spot those little mistakes and inconsistencies that don't let your writing shine as it deserves. And yes, beta readers are a wonderful thing to have as a fanfic (and pro) writer, but not all of us have access to one (or we may be too shy to individually share our stories with people we know).

So, how should we go about this and what can we spot in a 15/20-minute reread?

Any good revision begins with a fresh, impartial eye, meaning: WAIT. Even an hour or two will do. Do not start editing immediately after writing. I know you really want to post your story or start the next section, but trust me, your brain is so synced with what you just wrote that it can recite it like a top-notch Shakespearean actor. Take a break from it, go run some errands, go to the gym, read a book, or even edit a completely different piece. Then, come back to it and wait for the "Oh my, what on Earth was I thinking?" eureka moment to come.

Punctuation matters. It may seem like it doesn't in the grand scheme of things, but it does. Why? Because when we read, even unconsciously, we fall into the flow of the text. As readers, we follow the words to guide us into the scenes they depict, and a misplaced comma or semicolon can disrupt that flow and make us do a double take. It makes the story feel clunky and hard to read, potentially causing readers to DNF. Once the flow is gone, it can be hard to get back into it.

Spelling matters, too. Similar to the point above, spelling mistakes can be harmful to readers' enjoyment of the story. One here and there is not a huge issue, but if you consistently misspell words, the text will feel clunky and hard to get through, especially for non-native speakers. I'd recommend the Merriam-Webster (for US English) or the Cambridge (UK English) dictionaries, they are free, easy to search, and have great thesauruses and writing tips.

Dialogue tags. "He said," "she shouted," "they laughed," etc. They're great until they aren't. While they are good at emphasizing who is speaking, they can become overwhelming for readers if overused. They also risk making the text repetitive and flat. I'll tackle ways to adapt these tags in a later post, but for now, if you think you have too many speech tags in your story, try to highlight which character is talking with their actions and behaviors. Make it clear enough so readers know without the need to have it spelled out for them.

Repeated words VS synonyms fest. As mentioned in the point above, word repetition can make your story feel flat. What do I mean by that? That readers feel as if they are reading a legal document or a tax return where only specific terms can be used. Fiction is magnificent because there are literally billions of words at your disposal across so many languages! If you're brave enough, you can even pull a Tolkien and make up your own (an excellent tool for immersion, especially in fantasy and sci-fi). So, if you spot the same word or character name being used multiple times within 10/15 lines, get rid of it. Either find a suitable synonym or rephrase the sentence so it doesn't include that term anymore. Just be careful not to swing too far to the other end and turn your story into a glorified thesaurus.

These are 5 quick proofreading and editing tips that do not take too long but can elevate your writing to match your amazing ideas!

What do you think? Are you already doing any or all of these? Do you have issues with any of them? I'd love to know your thoughts!

#writing#writers on tumblr#editing#proofreading#fanfiction#writing resources#creative writing#writerscommunity#writeblr#writing community#writers of tumblr

21 notes

·

View notes

Text

Get to know your moots!

Thank you for the tag, @djarinmuse! I love these little questionnaires 😊. Challenging myself to be more succinct in my answers for once (yeeeah, don’t all hold your breath 😅)

What’s the origin of your blog title?

In a stunning lack of originality, I just used my writing pseudonym for my blog title: Jyar’ika. If it’s not obvious, that’s the Mando’a word cyar’ika (sweetheart) with a J for Jem replacing the C. It’s pronounced JAH-ree-kah, with emphasis on the first syllable (like Jessica or Erika). And on my sideblog, since it’s a rec blog, I’ve just titled it “Jyar’ika enjoyed…” because apparently WYSIWYG with me 🤗.

OTP(s) + shipname:

Oh man, there’ve been many over the years. I was an early X-Files fan, so MSR in real-time, of course. I shipped both Bangel and Spuffy at different points. Big on Polivia in the first few seasons of Fringe (when I discovered fanfiction existed). Fell completely down the fanfic rabbit hole with Carter/O’Neill from Stargate SG-1 (who unsatisfyingly never seemed to get a portmanteau ship name). Those are probably the main ones.

Favourite colour:

Teal; all shades thereof.

Favourite game:

It’s gotta be the old point n’ click PC games I played as a kid in the 90s, but I can’t pick one favourite. Big fan of the Monkey Island games, the Indiana Jones games, Maniac Mansion and Day of the Tentacle – basically anything LucasArts. Also, every game in the Broken Sword series, the Gabriel Knight series, and the Tex Murphy series. These are a fraction of the titles I played and loved.

Song stuck in your head:

I was doom-scrolling on Twitter the other day and saw (didn’t even hear!) a tweet saying Take That’s song ‘Shine’ was released 18 years ago, and it’s so iconic that my brain immediately played it to me. It’s been in there for days now! I was recently shocked and saddened to learn that most Americans don’t know about Take That 😱😭. I was never a massive fan or anything, but they are UK pop legends.

Weirdest habit/trait:

People at work think it’s weird that I don’t like speaking on the phone. If I have to have a phone call, I need to know what time it’ll be so I can prepare. But it’s because, without a visual of the other person, I find reading between the lines of neurotypical conversation more difficult. I can do it, but it’s an effort, and I need time to prepare for that kind of brain-taxing interaction.

Hobbies:

The Mandalorian, duh. Writing fics about it, mainly.

If you work, what’s your profession?

I’m in criminal law, basically doing the lawyers’ jobs for them because I have a critical eye for detail and can catch stuff they miss when preparing cases. But I never did my LPC, so I don’t have to go to court and do all the scary legal argument stuff. Win.

If you could have any job you wish, what would it be?

Author of a well-loved fiction series. I aim to make this happen one day, though at the rate I’m going, I’ll probably be retired when it finally happens! It comforts me to know that Douglas Adams always found writing to be a slow and arduous process, too.

Something you’re good at:

The English language, I guess. I have a good understanding of the technical side of writing.

Something you’re bad at:

In contrast to the above, the poetry of writing. I often struggle to ensure my writing is sufficiently dynamic and beautiful, and I have to go over things many times to try and inject more soul into my words. I’m glad I’m aware of this weakness, though – every day’s a school day, and there’s plenty of time and space to improve.

Something you love:

The Mandalorian, duh. Specifically Din Djarin.

Something you could talk about for hours off the cuff:

The Mandalorian, duh. Specifically Din Djarin.

Something you hate:

I try not to hate; this world needs more love. And if I can’t avoid hating, I do it quietly and won’t share it. So, I’ll pass on this question, thanks.

Something you collect:

Words. I love learning new ones. I love learning additional definitions and nuances of ones I already know. I can never have enough words.

Something you forget:

The time. Seriously, I have no sense of time whatsoever and am late for everything. I’ve just looked at the clock and realised it’s coming up 6:00am, and I haven’t gone to bed yet because I didn’t realise how late it is.

What’s your love language?

Of the five, mine is definitely the ‘acts of service’ one. I show love by trying to ease the burdens of others, and I feel loved when people do the same for me. At the other end of the scale is the ‘receiving gifts’ one… I can’t pick out gifts to save my life, and I always feel awkward receiving a gift I haven’t asked for and don’t need. Gifts are almost a hate language for me!

Favourite movie/show:

The Mandalorian, duh.

Favourite food:

I’m gonna say pizza. I don’t get to have it much anymore because I’m eating healthier these days, but I still indulge in the occasional Domino’s order.

Favourite animal:

Can I say Din Djarin when he’s been dosed with sex pollen? 😏

Are you musical?

I guess this is a yes because I’ve played a variety of musical instruments since the age of 5 (starting with the humble recorder, then violin, piano, guitar and other random stuff like the harmonica and ukulele) and was in choirs for the whole of my childhood and adolescence. I performed in several big shows, including a performance at the Royal Albert Hall of Carl Orff’s Carmina Burana (even if you don’t know the name, you’ll likely know one particular movement of the cantata; it’s been overused in ads, etc). But it’s been years since I played or sang anything, so maybe notsomuch anymore.

What were you like as a child?

As a very young child: unknowingly autistic. This mainly manifested in me ruining family vacations by refusing to step foot on a beach if there was any sign of seaweed, or enter a restaurant with ceiling fans, or get in a swimming pool if there was a mosaic on the pool floor. Anything outside my regular routine was terrifying to me, but nobody knew about autism in the 80s, so my parents just thought I was overly sensitive. I learned how to mask pretty early, though, so by the time I went to school, I’d figured out how to fit in. Despite that, I was always the kid who had intense hyperfixations (boys, TV shows, bands, hobbies). I still am, really!

Favourite subject at school?

English literature. Fiction was (and still is) my happy place. I also had a massive crush on my maths teacher when I was 13-14, so I was a maths nerd for a whole year. I still remember the quadratic equation!

Least favourite subject?

Religious education. It was the one subject I failed my exams in, mainly because I’m an atheist, and as a kid, I couldn’t see the point of learning about something I didn’t believe in. Later, I realised that exploring different worldviews helps us better understand ourselves and how to respect and appreciate diversity, so as an adult, I’ve made an effort to make up for my childish ignorance by learning as much as possible.

What’s your best character trait?

My autism. It heightens my attention to detail and makes me especially concerned about others’ happiness and well-being.

What’s your worst character trait?

My autism. It frustrates neurotypicals who don’t understand why I act or respond in particular ways.

If you could change any detail of your day right now, what would it be?

I would’ve gone to bed earlier. It’s 6:31am, and I’m tired.

If you could travel in time, who would you like to meet?

I’m not interested in going backwards, so nobody really. I’d probably go forward simply to check that the world didn’t end and that the USA didn’t turn into the Free American Independent Theocratic Hegemony (F.A.I.T.H.) or anything. (That’s a Bobiverse reference for anyone who’s never read Dennis E. Taylor… which, TBF, is probably most of you since his novels are pretty niche. I recommend reading them, though – super fun and packed with geeky pop culture references).

Recommend one of your favourite fanfics (spread the love!):

I finally got around to reading You Were Marked by @handspunyarns last week, and let me tell you, I could not stop binging it. It’s been a long time since I was last addicted to a fic to this degree. I’d had it on my TBR list for a while, but I’d prioritised others because I wasn’t sure if it would resonate with me since I don’t see any of myself in the main character… but boy, was I wrong! It’s extraordinary, compelling, and at times heartbreaking and agonising, but so well-written with exquisite worldbuilding and a daringly original plot, all of which seared it into my mind forever because I’ve never read anything like it. I implore you all to try it if you haven’t already. It’s a masterpiece 💜.

I usually check to see if the people I tag have already done the game, but I’ve really gotta sleep, so I’m just gonna tag at random here. I’m really sorry if any of you have done this already.

@604to647 @cheekychaos28 @cw80831 @darthbeebles @desert-fern

@dindenimchicken @frickatives @here-briefly @ishabull @jessthebaker

@lilac-boo @mosssbawls @nervoushottee @papurgaatika @qunariagenda

@roughdaysandart @the-color-is-black @the-mandawhor1an @toomanytookas @zaddymandalorian

28 notes

·

View notes

Text

Philip Low is founder and CEO of Neurovigil, and has been a MIT research affiliate, an adjunct professor at Stanford, an oncology researcher at Harvard, and earned his PhD in computational neuroscience at USDC. He is also personally familiar with Elon Musk. These are his words, not mine. I'm going to share the thesis he published yesterday. It echoes the same themes I've been warning of, but paints a more precise picture of a defined plan. It's a heady read, so buckle up:

MY THESIS

1. The Panama Canal was just an excuse to invade Panama;

2. The tariffs were just a way to soften up Canada and Mexico before invading them both;

3. National Security was just an excuse to invade Greenland;

4. The Alien Enemies Act was just an excuse to detain Canadians and British citizens, including the tourists held in custody without due process, and have leverage over Canada and the UK before attacking Canada;

5. Grok was programmed to reveal very little about chatter regarding the invasion of Canada despite there actually being significant chatter about it on X;

6. The censorship on Social Media was to keep the People from being outraged, thus limiting their influence on Congress and making the tyranny of the executive possible. There was also specific censorship for people living in Canada to keep them in the dark before the attack on Canada which is the same reason they want to remove Canada from Five Eyes;

7. The attacks on universities and the free press were just a way to scare the public into silence and submission before calling for Martial Law and instituting a draft, which is also why senior commanders and JAGS were removed, in case Trump used the Insurrection Act against ordinary citizens. Waiving the Epstein files, having a copy of everyone’s tax returns, reminding current and former officials he could remove their security by doing that with a number of them, were ways to intimidate the “ruling class” and keep them quiet and pliable (incidentally, Putin used such techniques to initially scare rivals and detractors);

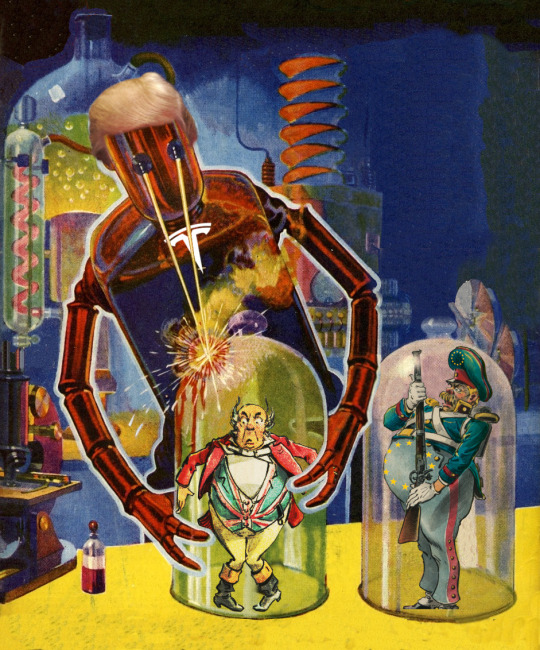

8. The President is deeply compromised. Trump does not work for the American people. He works for Elon Musk. That was also evident from the Tesla infomercial he did at the White House;

9. The Vice President who he met through Peter Thiel was chosen by Elon and works for him too. He is the one who first scolded Zelenskyy and who snubbed the German chancellor to meet the AfD which Elon is supporting;

10. Putin spoke to Elon repeatedly and Elon gave him access to Starlink terminals over Ukraine against dirt (money laundering, Epstein, past or current affiliations with Russia, etc.) on / control over Trump. USAID had paid for these terminals and was investigating Starlink. DOGE was an excuse to kill USAID and a number of other agencies regulating Elon’s companies, including CFPB which was overseeing the Tesla loan program and was to regulate X’s payment system. Elon used Trump to burn classified USAID records;

11. Putin and Elon made a deal whereby Elon would use X and his money, with assistance of JD Vance, to push nationalists in Europe and fracture the EU, help Trump get elected and use their partnership with / influence on / control of Trump to get the US out of NATO, have it abandon Ukraine militarily, without even military guarantees, and leave it and the rest of Europe at the mercy of Russia. Elon would use Trump to end American democracy, abolish the Constitutional Republic and invade Panama and Greenland and at least every place in between, including Canada and Mexico (and again use X and his wealth to prop up any foreign leader in favor of annexation), thereby achieving his fascist’s grandfather fantasy of a version of the “Technate” and rule it as Dictator like Sulla, the Roman Dictator he admires. Trump would not endorse Vance and would support Elon’s political ambitions (by merging the US with Canada, which Elon is also a citizen of, a new constitution would remove the requirement for a US born head of state);

12. The purge of the intelligence agencies, the removal of officers investigating whether Trump was a Russian asset and whether there was election interference, the confiscation of their data, and the placement of some leaders sympathetic to Russia was, among other things, precisely to prevent the Public, Congress and the Armed Forces from finding any of this out until it would be too late.

Bottom line: Elon Musk is Donald Trump’s Russian handler, and he is working alongside JD Vance to destroy Europe, and with Trump to end democracy, abolish the Constitutional Republic, and invade at least all of Central and North America, collectively the “Technate” — sympathetic to Russia and her expanding even beyond the boundaries of the former Soviet Union to subsume Europe — which he intends to rule as Dictator.

Philip Low

PS. I am an award-winning computational neuroscientist and entrepreneur. I strategically design discrete physical tools and mathematical techniques to capture, unmask, leverage or create super stealth patterns in a wide spectrum of domains ranging from non-invasive brain scanning to cryptography. The technologies I have invented are worth billions of dollars, and I am their largest financial owner. I stand to benefit absolutely nothing financially from Elon’s peaceful removal from the White House. As an independent and foreign citizen, I stand to benefit nothing politically from any impeachment of Trump and Vance. I take no pleasure in writing a thesis on any Technocratic Coup. Elon became my older brother when I met him and I always regarded Elon as much closer than my own siblings. However, given how well I know him, and how dangerous he truly is, I feel, as a concerned world citizen, a sense of moral responsibility to speak out, for The People, for Freedom, despite multiple threats to my life.

#Donald Trump#jd Vance#Elon musk#valdimir Putin#Putin#peter thiel#USA#united states#Europe#Russia#philip low

20 notes

·

View notes

Note

Madam Haitch please marry me im gonna be your pretty wife i can cook and do taxes and laundry and i can be your personal proofreader 😞💍

I'm married to a big gorgeous guy, who won awards for his coffees, cooks me lovely meals, does the laundry with a baby on his hip without being asked, and is a literal English teacher.

And we don't need to file our own taxes in the UK. It's called HMRC; they do it for us. For free.

And @mrhaitch has a dick and knows how to use it.

Which is a lot of bonus for me.

Love, and grateful for your noble attempts,

-- Haitch xxx

33 notes

·

View notes

Note

So you know how you can't really sell stuff in the US right now because of the tariffs? This is just an idea, so feel free to turn it down, but I have some sticker paper and laminating sheets, could I print off some of your art into stickers and then give you some money for it? Surely they can't tax an image file.

That's very sweet of you to offer, but I'd rather keep my business and financial stuff to myself as not to complicate things. If I have stickers, keychains, etc manufactured here in the UK I'll be able to sell them without tariff bullshit as they'll be under the de minimis. It's just a matter of finding somewhere that makes stuff of the same quality at an affordable price

My problem is all my current stock is made in China which is excempt from the de minimis rules and being taxed heavily. Making more stuff or not, I still have a big box of keychains and plushies that I currently can't sell to people the US

#shut up beth#i really should get everything up and listed on etsy anyways for non us buyers#the tariff thing just massively demotivated me + being busy + executive dysfunction kicked in hard

11 notes

·

View notes

Text

Zionism will never be viewed the same after the Gaza genocide

How do you wrap your head around genocide? As one numb week follows another, our leaders blind themselves to massacre and famine.

Joe Biden can see no “compelling alternative to how Israel [wages] a war in these circumstances without doing grievous harm to civilians,” Aaron David Miller writes in the New York Times, excusing the president’s support for genocide. So, Israel isn’t being deliberately cruel and sadistic. The Times coverage would just have you believe they just have no choice– as Donald Johnson wrote in a letter to the paper. “There is no middle ground between what Israel is doing and Gandhian pacifism: They just had to use 2000 lb bombs in urban settings. They have to torture captives and cut off food.”

Miller and other liberal Zionists have adopted that stance, but they are having little influence on Democrats. Polls show that the American people favor giving humanitarian aid to Gaza in far greater numbers than they do giving military aid to Israel, and the progressive base of the Democratic Party has started a political “firestorm” over U.S. support for genocide. The Zionist group J Street postponed its 2024 conference, surely because its own rank and file are enraged by Israel.

James Carville said on MSNBC this week that if Biden loses, it’s Israel’s fault, because the catastrophe in Gaza is an issue “all across the country.”

“This Gaza stuff, this is not just a problem with some snot-nosed Ivy League people…This is a problem all across the country. And I hope the president and Blinken can get this thing calmed down because if it doesn’t get calmed down before the Democratic convention, it’s going to be a very ugly time in Chicago. I promise you that. No matter what happens, I know it’s a huge problem.”

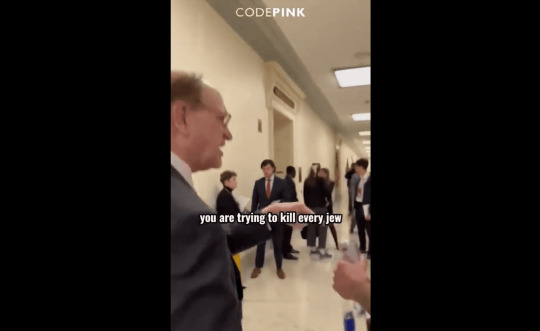

Last week, Brad Sherman, the Israel-loving Congress member from Los Angeles, fought back, accusing “anti-Israel forces” of an “attempt to penetrate and muddy our national discourse.”

Protesters affiliated with the antiwar group Code Pink seek to ask Rep. Brad Sherman about his support for the massacres of Palestinians in Gaza, in a video posted March 20, 2024. The congressman from Los Angeles/Malibu ran away from the protesters and accused them of seeking the genocide of Jews. Screenshot.

Sherman accused them of antisemitism. “There’s blood on your hands for the genocide—you’re trying to kill every Jew.”

That is the chief refuge for Democrats who excuse Israel’s actions. To say that critics of genocide are motivated by antisemitism.

But even liberal media are giving a platform to progressive critics. “The United States is complicit in genocide,” Mehdi Hasan said this week on New York public radio, and when the host pushed back and said Hasan was not blaming Hamas, Hasan said of course he denounces Hamas, but his tax dollars are not going to support Hamas. He also pointed out the inevitable consequences of military occupation. “The oppressed will always rise against the oppressor.”

And in wonderful media news this week, Atlantic editor Jeffrey Goldberg withdrew from a speaking engagement in Kentucky after students questioned his record in the Israeli military nearly 40 years ago.

Jeffrey Goldberg, Editor-in-Chief of The Atlantic, withdrew from a scheduled speaking event at the University of Kentucky (UK) Wednesday, citing a last-minute schedule change, amidst concerns from students about his past as a former Israel Defense Forces (IDF) prison guard and his views on Zionism…. “We were informed that students expressed concern as to why a former IDF prison guard would be speaking on democracy and journalism at an event celebrating the integration of UK. Students were told he withdrew to not cause harm on campus,” the representative [of a Palestinian solidarity group] stated.

The event was billed as “The Future of Journalism and the Health of Our Democracy.” That’s a little bit of accountability. The editor of the Atlantic is finally being called out for his service for Israel. The writer Yakov Hirsch repeatedly explained on our site that Netanyahu could not have maintained his faultless reputation in the U.S. mainstream without Goldberg fostering “hasbara culture.”

And bear in mind, that Goldberg used to brag about his military service. He wrote a whole memoir about it. Now, times are changing. And other editors who carried water for Israel will surely be called on to defend that work.

This process is just beginning. Zionists still have esteem in the U.S. discourse. The view that Israel supporters promote bigotry against Palestinians is still off-limits. Even as mainstream Jewish organizations assert that those who support Palestinian rights are bigoted against Jews.

“Israel supporters should be seen as on the same moral level as supporters of Bull Connor, but in the U.S. and Western mainstream you can only point to antisemitism— you can never point to anti-Palestinian racism on the Israel side,” Donald Johnson has written on our site.

“We cannot make progress on this issue if the extreme racism of the pro-genocide side is never discussed. People have to be able to say that any group, whether white southerners or South Africans or Nation of Islam members or Christian evangelical Zionists or Germans or, yes, Jewish supporters of Israel, can be racists. They can make racism central to their ideology. But Zionist racism is still a taboo subject, automatically branded as antisemitic, because fundamentally Palestinians are seen as lesser.”

#gaza#israel#gaza strip#gazaunderattack#genocide#israel is a terrorist state#free gaza#free palestine#palestine#jerusalem#news#world news#breaking news#latest news#palestine news#war on gaza#war news#news update#support palestine#rafah#save rafah#free rafah#keep eyes on rafah#rafah under attack#all eyes on rafah#tel aviv#current events#yemen#al quds#khan younis

49 notes

·

View notes

Note

I'm not familiar with how things are done in the US, but in the UK any dodgy charities would be investigated by the Charity Commission, and action taken against those involved with running scam charities, or even legitimate ones that aren't honest or transparent about where the money goes.

They can be sanctioned and even banned from running charities again. I'm wondering if there is a similar system in place over there, because surely RA should be reported.

The FBI has a Charity and Fraud scam department, but I believe they only investigate only the most egregious frauds. And as far as I can tell, technically, RA isn't breaking any laws, and up until 2021, were pretty transparent. (They haven't filed taxes since then, so it's hard to know what's going on now.)

And while RA may be complying with US tax law (again... when they filed taxes), there is still very little transparency for any one person to know where their donations go. Charities can hold funds in reserve for future use. So, RA has a Natural Disaster Fund where donations are deposited, and since the funds are designated for natural disasters, as long as some of those funds get used, the charity continues. The non-ethical part occurs where it's likely the majority of donations sit in the designated fund earning interest/investment dividends, which can be used by Misha for non-charitable purposes.

Eventually, the actual donations will have to be used for a charitable cause, but there's no timeline requirement. The only timeline that RA should be concerned about is their tax deadline. If they go three years without paying taxes (their last filing was for 2021), they are in danger of having to pay taxes.

#ask box#anti random acts#anti misha#give your money towards actual charities#and not misha's slush fund

7 notes

·

View notes

Text

Need advice please. Although I have not lived in the US for over 20 years and have no plans to return, I am still required to file tax returns on my income and submit a foreign bank account report (FBAR) annually. I planned not to submit either this year because I don't want to comply with fascists. I never actually owe taxes because I don't earn anywhere near the foreign income exemption limit.

However, I am also at this point very very likely to renounce my citizenship this year (or as soon as possible, idk how long the waiting list is.) To do this I will likely need to have all my tax and financial info in perfect order so they will allow me to leave.

The prevailing wisdom is that renouncing citizenship is foolish unless needed for financial reasons (eg if you own a business or are being locked out of bank accounts, pensions, or investments). I've been considering it for a long time now because psychologically I feel it may benefit me to make an official break with the US and put it all behind me. Now that the US is openly threatening the country where I live and the country where my best friend lives (among others) I don't think my two nationalities are compatible any longer.

In my heart of hearts I'd have said I was American, and not British even though I've lived here longer now. Frankly I don't even like the UK much. But now I have to choose, it has to be Britain. It hurts how much it isn't even close.

So what's the best and most ethical call here? File forms and renounce? File and don't renounce, status quo? Don't file and try renouncing anyway? (Likely means blacklisting so I could never return even to visit but at this point I don't feel safe doing that anyway.) Or don't file but also don't renounce, and just eat the $129,000 fine for not submitting my FBAR? (I don't have that much but maybe we could sell our flat or get help from someone. Or refuse to pay and fight extradition or claim asylum when it gets to prison time.)

I wish I could help you all over there but from here I can't. I can't do mutual aid with people eight times zones away from me. I have no survival or military skills. I have to try to focus on helping here or quite honestly I will die. (Am highly suicidal atm.) Maybe this is all an empty gesture but I can barely live with myself as it is.

Any advice greatly appreciated.

#personal#citizenship renunciation#mutuals#do not reblog#please don't share widely i just want people i trust to help me figure out what is the best choice#I'm pretty sure they're all bad choices#but maybe one is less or more bad

8 notes

·

View notes

Note

I seriously hilarious how after a year people are still treating Engage like it burned their spouses and fucked their crops. If they love "moral grayness writing" that much, they have tons of other rpgs with similar themes to play, 8 seasons of Game of Thrones to watch and lots of grimdark fantasy books to read.

Seriously, there's only 3 times (if we want to count 3h that badly) where this franchise has tried to explote more nuanced and complex plots, and those games were the Tellius duology and the Jugdral games. The rest have milquetoast fantasy rpg plots. Why they sticking with FE when it's clearly not the franchise for these kinds remains an enigna.

Mmh,

I wouldn't say GOT's seasons are grim d4rk, imo they're trash in the same vein as the Kadarshians TV show, you're watching it to see how ruined things will be

(c'est quoi l'équivalent US/UK de l'émission "les marseillais"? )

I feel like Martin's books were more in the lines of "deconstruction then reconstruction" of the "traditional" fantasy tropes, with his own choice of depicting very grim and dark things that participate in the "deconstruction" side of his works... even if at times it borders on misery porn and, tbh, misogyny.

Fantasy settings, in general, always have some sort of monarchy and morale of "the good/rightful king returns home and everything is better!" - you can add some twists here and there, but in general, and especially FE, it's that kind of frame. We're not in game where Bob and John feel like Hector charges them too much for the sewer tax, and file a claim to his court to be discharged from paying said tax.