#Turkey biggest export

Explore tagged Tumblr posts

Text

Understanding Top Exports of Turkey in 2024: Key Insights

Turkey’s export industry plays a significant role in its economy, making it one of the leading countries in global trade. In 2024, Turkey continues to thrive as a vital exporter of goods across diverse sectors, from automotive products to textiles, machinery, and agricultural commodities. As Turkey’s position in international markets strengthens, understanding the top exports of Turkey, its key trade partners, and Turkey export data offers a detailed picture of how its global trade landscape is evolving.

Top Exports of Turkey in 2024

Turkey’s exports are dominated by several key sectors, including automotive, textiles, electronics, and agriculture. The top exports of Turkey include:

Automotive Products: The automotive industry remains Turkey’s largest and most valuable export sector. In 2024, Turkey continues to be a leading producer and exporter of cars, buses, trucks, and automotive parts, primarily to European countries. The automotive sector contributes significantly to the country’s GDP and export revenues, cementing its position as the Turkey biggest export.

Textiles and Apparel: Turkey is globally recognized for its high-quality textiles and garments, which have been central to its export economy. Turkish-made clothing, fabrics, and home textiles are in high demand in European and North American markets. The strong emphasis on innovation and sustainability in textile production has allowed Turkey to remain competitive in this industry.

Machinery and Electronics: Turkey is a significant exporter of machinery and electronic equipment. These include industrial machinery, electrical appliances, and consumer electronics. Turkish machinery, known for its durability and innovation, is widely exported to both developing and developed nations.

Agricultural Products: The agricultural sector remains a cornerstone of Turkey’s economy, contributing significantly to its exports. Turkey exports a wide range of agricultural products, including fruits, vegetables, cereals, and processed foods. Olive oil, nuts, and grains are some of the top agricultural exports that have helped Turkey establish itself as a major player in global agricultural trade.

Chemicals and Petrochemicals: In 2024, the demand for Turkish chemical products, including plastics, rubber, and pharmaceuticals, continues to rise. Turkey’s export of petrochemical products to European and Middle Eastern countries has increased, driven by regional demand for industrial materials.

Turkey’s Biggest Export Categories

The Turkey biggest export categories reflect the country’s industrial strength and strategic capabilities. Here’s a breakdown of the key categories dominating Turkey’s export economy in 2024:

Vehicles and automotive parts: This sector contributes over 20% of Turkey’s total exports.

Machinery and mechanical appliances: This sector, which includes heavy machinery and electrical equipment, is crucial to the country's manufacturing and export capacity.

Textile products: Turkey is among the world’s leading exporters of textiles and garments, particularly in fast fashion.

Iron and steel products: Turkey’s robust steel industry supplies raw materials and processed goods to countries across the globe.

Agriculture and food products: Turkish olive oil, dried fruits, nuts, and cereals remain highly sought after in international markets.

Turkey Export Products in 2024

The variety of Turkey export products highlights the diversity of its economy and its ability to meet global market demands. Turkey’s top exports span various sectors and reflect its industrial strengths:

Automobiles and components: Turkish automakers continue to produce vehicles and components for leading car brands in Europe and beyond.

Apparel and textiles: Turkey's textile industry has evolved, with sustainable and eco-friendly products gaining traction in international markets.

Food and beverages: Turkish agricultural products, such as tea, olives, and nuts, are widely exported to neighboring regions and beyond.

Electronic equipment: Turkey’s production of household appliances and industrial electronics has grown, leading to increased exports of electronic goods.

Furniture and home decor: Turkish furniture and interior decor products are becoming increasingly popular, especially in the Middle East and Europe.

Turkey Export by Country: Key Trade Partners

Turkey’s geographical location between Europe and Asia makes it an essential trade partner for numerous countries. In 2024, the data for Turkey export by country shows strong trading relationships with the following nations:

Germany: Germany remains Turkey’s largest export partner. Turkey’s automotive, textile, and machinery products are in high demand in the German market. This long-standing trade relationship has only strengthened over the years.

United States: The U.S. continues to be a significant market for Turkish products, particularly textiles, electronics, and machinery. Turkey’s exports to the U.S. are projected to grow further as both countries explore deeper trade ties.

United Kingdom: Post-Brexit, Turkey and the UK have maintained a strong trade relationship, especially in sectors like textiles, machinery, and automotive. The two countries benefit from trade agreements that streamline the export process.

Italy and Spain: These two southern European countries are major consumers of Turkish textiles, machinery, and agricultural products. Turkey’s trade with these nations is expected to grow as demand for Turkish goods remains strong.

Iraq and the Middle East: Turkey’s proximity to Middle Eastern countries, particularly Iraq, Iran, and the UAE, makes it a critical trade partner in the region. The agricultural and construction industries dominate Turkey’s exports to these countries.

Russia: Despite political challenges, Russia remains a significant importer of Turkish agricultural products, textiles, and machinery. Trade relations between the two countries are expected to continue despite global uncertainties.

France: Turkey’s trade with France revolves around automotive and textile exports. The demand for Turkish-made vehicles and clothing in the French market has shown consistent growth over the years.

Turkey Export Data for 2024

According to Turkey export data, the country’s export volumes have increased in 2024 despite global economic challenges. Turkey’s total exports in 2024 are projected to exceed the previous year by around 7-9%, supported by increased demand for Turkish goods in Europe, Asia, and North America. The automotive, textile, and electronics sectors are expected to drive the bulk of this growth.

The Turkish government has implemented several policies to support exporters, including financial incentives and digital platforms that simplify trade processes. These measures have helped Turkish businesses access global markets more easily. Additionally, Turkey’s focus on renewable energy and green technologies is opening new opportunities for export growth in the energy sector.

Challenges and Opportunities in 2024

While Turkey’s export economy continues to grow, it faces challenges such as global inflation, rising energy costs, and supply chain disruptions. However, Turkey’s competitive pricing, driven by the devaluation of the Turkish lira, has made its products more attractive to international buyers.

New free trade agreements with African and Asian nations are also set to expand Turkey’s market access. Investments in renewable energy, particularly solar and wind power, are expected to create new export opportunities in the coming years. Furthermore, Turkey’s efforts to reduce carbon emissions in its manufacturing processes will enhance its global competitiveness.

Conclusion

Turkey’s export sector in 2024 is a testament to the country’s resilience and adaptability in the face of global challenges. With strong performances in automotive, textiles, electronics, and agriculture, Turkey has maintained its position as a vital player in the global market. By diversifying its Turkey export products, strengthening trade ties with key countries, and adapting to new global trends, Turkey’s export landscape is set for further growth in the coming years. However if you need import export data connect with ExportImportData.in.

Also Read: The Surge of Mobile Exports from India in 2024

#top exports of turkey#turkey biggest export#Turkey export products#turkey export by country#turkey export data#export#trade data#global market#global trade data#international trade#trade market#import export data#turkey#exports of turkey#major export of Turkey#turkey export products list#turkey trade data

0 notes

Text

Leading the way in Special Steels! VIRAT SPECIAL STEELS PVT. LIMITED , INDIA., we are proud to be one of the largest importers, exporters, and stockists of Die Blocks, Tool Steels, Die Steels, Special Steels, and Alloy Steels.

With over five decades of experience, we maintain the biggest steel yards and a high level of inventory from the world’s leading manufacturers like Swiss Steel DEW, NLMK Verona, Vitkovice, Somers Forge, and Villares Metals.

We are in this business for the last about more than Five Decades, and have been dealing with large number of forging units. The products, we deal in are specifically engineered to extend life service, save time and provide optimal performance to our customers.

Product List DIE STEEL ( HH 370 - 410 BHN ) DIN-1.2714 / AISI L6 ) HOT WORK STEELS (DIN 2343, 2344 / AISI H11, H13) PLASTIC MOULD STEELS (DIN 2738, 2311 , AISI P 20 ) HIGH SPEED STEELS (DIN 3243 , 3343 / AISI M2 , M35) HCHCr. (DIN 2379 , 2080 / AISI D2 , D3) ALLOY STEELS, EN-SERIES ETC.

Our products are specifically engineered to extend service life, save time, and provide optimal performance. You can rely on us for accurate and timely service on our part to process and execute your orders to match your satisfaction.

Virat Special Steels, INDIA! https://www.viratsteels.com/

📞 Contact us today to learn more about how we can support your business! https://www.viratsteel.in/special-steel-supply-networks/

Special Steel Supply Networks |Virat Special Steels We Provide our Special Steels in All Major Cities in India and Global Presence like Turkey, Portugal, Spain, Saudi Arabia and many more…

Any further queries feel free to contact us : 🌐https://www.viratsteels.com/ 📬 [email protected] ☎+91 98140-21775

#ludhiana#india#viratsteels#gurgaon#viratspecialsteels#toolsteelsupplier#gurugram#pune#iso9001#steel#db6 steel#h13steel#h11steels#p20steels#p20ni#d2steel#m2steels#m35 steel supplier#din 2714#din2344

4 notes

·

View notes

Text

Turkey, Brazil are main buyers of Russian seaborne diesel after EU embargo

Turkey and Brazil have been the main importers of Russian seaborne diesel and gasoil since the European Union banned the import of Russian oil products, data from market sources and finance company LSEG showed.

Before the full EU embargo went into effect in February 2023, Europe was the biggest buyer of Russian diesel.

According to the LSEG data, Russia shipped about 1.07 million metric tons of low-sulphur diesel and gasoil to Turkey in September after shipping 1.04 million tons the previous month.

Diesel exports from the Russian ports to Brazil increased last month to 0.78 million tons versus 0.58 million tons in August, shipping data shows.

Continue reading.

#brazil#brazilian politics#politics#turkey#russia#turkish politics#international politics#economy#image description in alt#mod nise da silveira

2 notes

·

View notes

Text

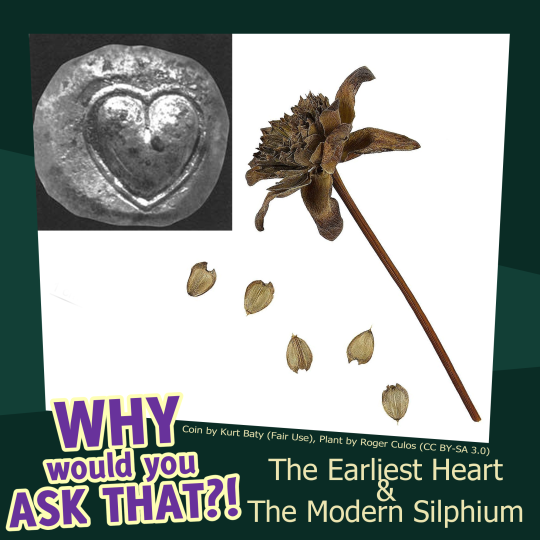

Silphium was a North African herb that came from the area around modern Libya that the Roman's really loved for a few reason, not least of which because it was supposedly a great form of birth control. Not just birth control, this cool little plant had some amazing resin that was used as a cure-all for nausea, fevers, chills, and more! People outside of Libya enjoyed it's contraceptive properties so much that the area exported so much Silphium that the city became one of the biggest economic powers at the time. That's how it ended up on this coin pictured above.

They used it so often, in fact, that the plant went extinct before the fall of the Roman Empire. However, it might not be extinct after all! According to a report from National Geographic, Mahmut Miski first discovered — or perhaps rediscovered — a blooming yellow plant in regions of Turkey back in 1983. If you're interested, read about the discovery here and find out the fate of the amazing plant!

You can hear us talk about it on this week's episode Heartfelt History: Symbol of Love!

Screen Reader text is in the image description.

#ancient medicine is really amazing#everything out of Africa right?#But also don't eat random plants please#podcast#history#WWYAT#plant facts

4 notes

·

View notes

Text

Saudi Arabia dives into Ukraine war peace push with Jeddah talks

India has also confirmed its attendance in Jeddah, describing the move as in line "with our longstanding position" that "dialogue and diplomacy is the way forward."

RIYADH: Saudi Arabia was set to host talks on the Ukraine war on Saturday in the latest flexing of its diplomatic muscle, though expectations are mild for what the gathering might achieve.

The meeting of national security advisers and other officials in the Red Sea coastal city of Jeddah underscores Riyadh's "readiness to exert its good offices to contribute to reaching a solution that will result in permanent peace," the official Saudi Press Agency said Friday.

Invitations were sent to around 30 countries, Russia not among them, according to diplomats familiar with the preparations. The SPA report said only that "a number of countries" would attend.

It follows Ukraine-organised talks in Copenhagen in June that were designed to be informal and did not yield an official statement.

Instead, diplomats said the sessions were intended to engage a range of countries in debates about a path towards peace, notably members of the BRICS bloc with Russia that have adopted a more neutral stance on the war in contrast to Western powers.

Speaking on Friday, Ukrainian President Volodymyr Zelensky welcomed the wide range of countries represented in the Jeddah talks, including developing countries that have been hit hard by the surge in food prices triggered by the war.

"This is very important because, on issues such as food security, the fate of millions of people in Africa, Asia, and other parts of the world directly depends on how fast the world moves to implement the peace formula," he said.

Saudi Arabia, the world's biggest crude exporter which works closely with Russia on oil policy, has touted its ties to both sides and positioned itself as a possible mediator in the war, now nearly a year and a half old.

"In hosting the summit, Saudi Arabia wants to reinforce its bid to become a global middle power with the ability to mediate conflicts while asking us to forget some of its failed strategies and actions of the past, like its Yemen intervention or the murder of Jamal Khashoggi," said Joost Hiltermann, Middle East programme director for the International Crisis Group.

The 2018 slaying of Khashoggi, a Saudi columnist for The Washington Post, by Saudi agents in Turkey once threatened to isolate Crown Prince Mohammed bin Salman, the kingdom's de facto ruler. But the energy crisis produced by the Ukraine war elevated Saudi Arabia's global importance, helping to facilitate his rehabilitation.

Moving forward Riyadh "wants to be in the company of an India or a Brazil, because only as a club can these middle powers hope to have an impact on the world stage," Hiltermann added.

"Whether they will be able to agree on all things, such as the Ukraine war, is a big question."

'Balancing'

Russia invaded Ukraine on February 24, 2022, failing in its attempt to take Kyiv but seizing swathes of territory that Western-backed Ukrainian troops are fighting to recapture.

Beijing, which says it is a neutral party in the conflict but has been criticised by Western capitals for refusing to condemn Moscow, announced on Friday it would participate in the Jeddah talks. "China is willing to work with the international community to continue to play a constructive role in promoting a political settlement of the Ukraine crisis," said foreign ministry spokesperson Wang Wenbin.

India has also confirmed its attendance in Jeddah, describing the move as in line "with our longstanding position" that "dialogue and diplomacy is the way forward."

South Africa said it too will take part.

Saudi Arabia has backed UN Security Council resolutions denouncing Russia's invasion as well as its unilateral annexation of territory in eastern Ukraine.

Yet last year, Washington criticised oil production cuts approved in October, saying they amounted to "aligning with Russia" in the war.

This May, the kingdom hosted Zelensky at an Arab summit in Jeddah, where he accused some Arab leaders of turning "a blind eye" to the horrors of Russia's invasion.

In sum, Riyadh has adopted a "classic balancing strategy" that could soften Russia's response to this weekend's summit, said Umar Karim, an expert on Saudi politics at the University of Birmingham.

"They're working with the Russians on several files, so I guess Russia will deem such an initiative if not totally favourable then not unacceptable as well."

2 notes

·

View notes

Text

Global Wheat Export Market: A Guide for Suppliers and Manufacturers

Wheat is one of the most essential staple crops in the world, serving as a cornerstone for global food security. As a primary ingredient in bread, pasta, and countless other food products, wheat plays a vital role in feeding the world's population. For suppliers and manufacturers, connecting with the global market is crucial for business growth and profitability.

Understanding the Global Wheat Trade

The biggest exporters of wheat dominate the international wheat trade, shaping the dynamics of supply and demand. The biggest wheat exporter in the world continuously shifts based on production levels, government policies, and international trade agreements. The demand for wheat has been increasing due to population growth, changing dietary patterns, and the expansion of the food processing industry worldwide.

How Much Wheat is Exported Annually?

Global wheat exports have seen significant changes over the years. Below are some key statistics that highlight the volume and value of wheat exports:

In 2024–2025, global wheat exports are projected to reach 213.5 million metric tonnes, a slight decrease from the previous year.

Global wheat export sales from all nations in 2023 totaled US$59.2 billion.

Since 2019, international wheat sales have increased by 46.6%.

European nations accounted for 50.7% of total wheat exports in 2023.

North American exporters provided an additional 25.4% of the wheat sold globally.

These figures highlight the growing opportunities in the wheat trade sector, making it crucial for suppliers and manufacturers to stay updated with export trends and market demands.

Top Wheat HS Codes

For suppliers looking to enter international markets, understanding wheat HS codes is essential. These codes categorize wheat and its processed forms for trade purposes.

100111 - Durum wheat seeds

100119 - Durum wheat, excluding seed

100121 - Other seeds of meslin and wheat

100129 - Other than seed, meslin and wheat

110100 - Meslin or wheat flour

110311 - Meal and groats of wheat

110319 - Meal and cereal grains other than wheat

110429 - Processed cereals, such as wheat products

These wheat HS codes play a crucial role in streamlining international trade regulations and ensuring smooth export processes.

Biggest Exporters of Wheat in the World

The biggest exporters of wheat in the world play a vital role in meeting global demand. Below is a breakdown of the world largest wheat exporter country along with export values and shares:

Russia: $9.18 billion (16.0%)

Australia: $9.27 billion (15.8%)

Canada: $8.83 billion (15.0%)

United States: $6.13 billion (10.4%)

Ukraine: $2.94 billion (5.0%)

France: $3.96 billion (6.7%)

Romania: $2.22 billion (3.8%)

Kazakhstan: $1.85 billion (3.1%)

Poland: $1.96 billion (3.3%)

Germany: $1.94 billion (3.3%)

Each of these countries has a competitive edge in the wheat trade, whether it is due to favorable climate conditions, advanced farming techniques, or strategic trade agreements.

Largest Importer of Wheat in 2024

Understanding the largest importer of wheat helps suppliers target their exports strategically. The top wheat-importing countries in 2024 are:

China: $4.3 billion

Egypt: $3.77 billion

Indonesia: $3.76 billion

Turkey: $3.5 billion

Italy: $3.1 billion

Spain: $2.8 billion

Nigeria: $2.04 billion

Philippines: $1.99 billion

Japan: $1.93 billion

Morocco: $1.91 billion

The wheat trade is heavily influenced by these importers, as they set the demand trends in the global market.

Opportunities for Wheat Suppliers and Manufacturers

For suppliers and manufacturers looking to expand their market reach, here are some key strategies:

Leverage Trade Data: Accessing detailed trade insights, such as wheat HS codes and import-export data, can help identify new business opportunities.

Establish Trade Partnerships: Collaborating with buyers in the largest importer of wheat markets can ensure steady demand.

Adopt Sustainable Practices: Many countries are prioritizing sustainability. Implementing eco-friendly farming and production methods can boost marketability.

Utilize Digital Platforms: Platforms like Eximpedia.app provide valuable data on the biggest wheat exporter in the world and can help suppliers connect with global buyers.

Major Wheat-Exporting Companies

Some of the largest companies dominate the wheat export market:

Cargill (United States)

Archer Daniels Midland (United States)

Bunge (United States)

Louis Dreyfus (France)

Tropolis (Canada)

Pentarch (Australia)

FENIL (Russia)

SB Import & Export (Germany)

Agro Resources International LLC (Ukraine)

NUPUR International (India)

These companies play a crucial role in facilitating international wheat trade and ensuring a steady supply to import-dependent countries.

Final Words

The biggest wheat exporter in the world continues to fluctuate due to changing market trends and geopolitical factors. While some nations are increasing their wheat dependency, others are focusing on local production. Staying informed about the biggest exporters of wheat, wheat HS codes, and trade data is essential for suppliers and manufacturers looking to expand their reach in the global market.

For exporters and suppliers, staying competitive requires leveraging accurate trade data, forming strategic partnerships, and aligning with global demand trends. To access more insights, wheat export data, and shipment details, visit Eximpedia.app to

0 notes

Text

Netherlands to expand co-operation with Turkey in trade, production and logistics

The Netherlands will increase co-operation with Turkey in many fields such as trade, construction, logistics and manufacturing, the Dutch Minister of Foreign Trade and Development Co-operation said on Thursday.

“The Netherlands and Turkey have strong economic ties, the Netherlands is the biggest foreign direct investor in Turkey,” Reinette Klever told Anadolu in Istanbul, which she visited to hold meetings with Turkish Trade Minister Omer Bolat and Turkish and Dutch companies working in Turkey.

Klever also emphasised that trade between Turkey and the Netherlands has grown significantly over the past five years. She added:

“Exports from the Netherlands to Turkey doubled, and exports from Türkiye to the Netherlands also grew 50%.”

Stating that Turkey occupies a key geographical position between Asia and Europe, Klever emphasised that Turkey and the Netherlands can work together to use this to their advantage to bring goods from Asia through Turkey.

“Turkey is focusing on the digitisation of its manufacturing industry, and Dutch companies are good at that, so there are a lot of opportunities to enhance our cooperation,” she also noted.

Syria’s reconstruction was briefly discussed at the meeting, she said, adding that there are ways to work together and help Syria in the post-Assad era.

Relations between Ankara and The Hague deteriorated in March 2017 after Dutch authorities prevented former Turkish Foreign Minister Mevlüt Çavuşoğlu from travelling to the Netherlands for a meeting with Turkish citizens on constitutional reform in Turkey. The Dutch authorities also declared Turkish Family Affairs Minister Fatma Betül Sayan Kaya an “undesirable foreigner.”

The Dutch government’s actions have angered Ankara. In March 2017, the Turkish Foreign Ministry described the Dutch ambassador’s return to the country from holiday as unwelcome. In February 2018, the Netherlands officially recalled its ambassador from Turkey.

Read more HERE

#world news#news#world politics#europe#european news#european union#eu politics#eu news#netherlands#dutch politics#turkey#turkey news

0 notes

Text

Russia’s gas sector is running out of options after end of transit deal

Ukraine’s decision to end the gas transit deal with Russian energy giant Gazprom has been hailed by President Volodymyr Zelensky as one of Moscow’s biggest defeats.

“When (Russian President) Vladimir Putin was handed power in Russia over 25 years ago, the annual gas pumping through Ukraine to Europe stood at over 130 billion cubic meters. Today, the transit of Russian gas is zero. This is one of Moscow’s biggest defeats,” Zelensky said on Jan. 1 just as the deal expired.

Moscow and Kyiv signed the agreement in 2019 to transit 40 billion cubic meters of Russian gas annually through Ukraine to buyers in the EU. Gazprom raked in an estimated $5–$6.5 billion annually from the deal with Ukraine. Europe began to wean itself off Russian gas after Moscow’s full-scale invasion of Ukraine while Gazprom steadily reduced flows to the EU to pressure Ukraine’s allies. Russian pipeline gas deliveries to Europe dropped to around 29 bcm last year with around 14 bcm traveling through Ukraine before Kyiv terminated the deal, according to Argus Media, a market analyst group. The Ukrainian route transited nearly half of Russia’s pipeline gas exports to Europe, while the rest went through the TurkStream pipeline in the Balkans.

Kyiv’s decision to end the deal will further undermine gas revenue to Russia’s economy as Moscow will struggle to find alternatives to replace this lost gas market in the near future.

For now, Russia still has its claws on Europe with cheap liquified natural gas (LNG) and growing gas transit through the TurkStream pipeline. Those two revenue streams could run out, however, as sanctions bite and Europe looks to continue distancing itself from Russian energy.

The majority of European states have already looked to gas alternatives from the U.S., Norway, and Algeria to reduce dependency on Russia. The end of the agreement forces those who clung to the Ukraine route, namely Slovakia, Hungary, and Austria, to find other options.

“This development is a step toward a Europe that is less susceptible to energy blackmail, marking a geopolitical win for Ukraine and its allies,” the former head of Ukraine’s gas transport operator (GTSOU) Sergiy Makogon told the Kyiv Independent.

Limited options

The last three years have put a “significant strain” on Gazprom, Makogon noted. The company suffered a sharp reduction in gas production from 515 bcm in 2021 to 355 bcm in 2023, which it largely blamed on Europe’s move away from Russian gas, while also paying hefty taxes to prop up Moscow’s war machine.

Europe’s efforts to wean itself off Russian gas meant volumes dropped from 150 bcm pre-war to less than 50 bcm in 2023, EU Energy Commissioner Kadri Simson said on Sept. 11, 2024. The end of the Ukraine route is another amputation for Gazprom after the loss of the Nord Stream 1 pipeline and the Yamal pipeline through Poland in 2022.

“Moscow has limited options for now to sell more gas to other markets to make up for the loss of Ukrainian transit,” Natasha Fielding, the head of European gas pricing at Argus Media, told the Kyiv Independent.

“Moscow has limited options for now to sell more gas to other markets to make up for the loss of Ukrainian transit.”

Russia’s final lifeline to Europe is the TurkStream pipeline that delivers Russian gas to Greece, the Western Balkans, and Hungary via Turkey. TurkStream is sanctioned by the U.S. and a Dutch court withdrew the export license of the Netherlands-based Russian company operating the pipeline in September 2022 but renewed it weeks later following pressure from Moscow and Budapest.

(L-R) Bulgarian Prime Minister Boyko Borissov, Russian President Vladimir Putin, Turkish President Recep Tayyip Erdogan, and Serbian President Aleksandar Vucic attend the opening ceremony of the TurkStream in Istanbul, Turkey, on Jan. 8, 2020. (Mikhail Svetlov/Getty Images)

Serbian President Aleksandar Vucic attends a ceremony commissioning the 403-kilometer Serbian section of the TurkStream natural gas pipeline project in Gospodjinci, Zabalj, Serbia, on Jan.1, 2021. Serbia announced it had begun delivering natural gas to Europe through the TurkStream pipeline via a new route crossing Turkey and Bulgaria. (Serbian Presidency / Handout / Anadolu Agency via Getty Images)

“Europe can completely phase out Russian pipeline gas including by stopping the TurkStream pipeline,” said Martin Vladimirov, the Director of the Energy and Climate Program at the Center for the Study of Democracy (CSD).

Even if Europe does not embargo TurkStream, there is little room for more gas to flow through the pipeline. Deliveries jumped from 12.2 bcm in 2023 to 14.95 bcm in 2024, but the pipeline has a maximum capacity of 15.75 bcm per year, Fielding notes.

Zelensky also mentioned the possibility of increasing U.S. gas imports to Europe which would lower prices. If the U.S. boosts LNG exports by 22.5 bcm this year, it would “wipe out” Russian pipeline gas supply in Central and Eastern Europe, said Vladimirov.

Even China, which overtook Europe as the biggest guzzler of Russian pipeline gas last year, consuming 31 bcm, is a limited market for now, Fielding said. Russia cannot reroute gas flows through the 38 bcm “Power of Siberia” pipeline as it is not connected to the gas fields serving Europe and its transit already hit full capacity in December. Russia’s two future pipeline projects with China are also yet to get off the ground.

“Russia will find it hard to get to pre-war gas export levels even if it is able to redirect exports to Asia after potentially losing all gas exports to Europe by the end of the decade,” Vladimirov said.

The LNG question

Russia’s main LNG company, Novatek, has hooked European companies on its cheap LNG with 20% discounts leading to record-high purchases in 2024 of nearly 17 million tons, according to the CSD.

While Brussels has not directly banned the chilled Russian fuel, it has sanctioned LNG transshipment — transferring LNG from one ship to another— making it harder for Moscow to sell beyond the European market.

This could have helped spike Russian LNG sales to the EU, said Georg Zachmann, a senior fellow at Bruegel, a think tank, and at the Helmholtz Center Berlin, a research institute.

The EU gobbled up 48% of Russia’s total LNG exports in November 2024. One of the biggest consumers, France, imported Russian LNG worth 252 million euros ($262 million) during that month, according to the Center for Research on Energy and Clean Air (CREA).

While less profitable than pipeline gas, Russia still makes close to $2 billion a month from its LNG sales to Asia and Europe, said Vladimirov.

“With no sanctions imposed on Russian LNG, companies are operating in their own self-interest and buying increasing quantities of gas from the cheapest supplier — Russia,” Vaibhav Raghunandan, EU-Russia Analyst at CREA, told the Kyiv Independent.

“With no sanctions imposed on Russian LNG, companies are operating in their own self-interest and buying increasing quantities of gas from the cheapest supplier — Russia.”

Despite this, Russia’s LNG sector is constrained. Its LNG terminals are already producing at near full capacity and it cannot easily reroute the gas originally transited through Ukraine to its two LNG export plants.

In theory, Russia’s new LNG export projects, like the Arctic LNG 2 project, could bolster sales abroad by 80 bcm, Vladimirov said. But Western sanctions on all new and future projects, including on Arctic LNG 2, are biting Moscow’s progress by blocking its access to critical equipment like tankers and liquefaction technology.

Russia's President Vladimir Putin (L) walks with Gazprom CEO Alexei Miller (R) as they visit the Lakhta Centre skyscraper, the headquarters of Gazprom, in Saint Petersburg, Russia, on June 5, 2024. (Kirill Morozov/POOL/AFP via Getty Images)

The Arctic LNG 2 project was launched in late 2023 and aimed to produce 20 bcm of gas annually, but Novatek cut production to almost zero in November 2024. Novatek’s setbacks show that “it would be very difficult for Russia not only to complete the infrastructure but also buy the ice-breaker LNG carriers necessary to facilitate bigger exports to Asia,” said Vladimirov.

Moscow has increasingly relied on its shadow tankers to continue its LNG trade as sanctions hamper shipping logistics, he added.

Finding secure buyers if output is increased will also be challenging, particularly if the EU heeds the calls to ban Russian LNG imports this year. Threats of secondary sanctions are also likely to turn off potential buyers.

Fall out

Russia paid Ukraine $800 million annually to transport its gas. However, net revenue only totaled between $200-300 million after transit costs, according to Makogon.

Kyiv considered the economic consequences but ultimately made the decision to kill the deal in the “interest of national security,” the Energy Ministry told the Kyiv Independent. Moreover, it also undermines Russia’s leverage on Europe’s energy sector.

“Russia has used gas transit as both an economic and political weapon, influencing EU policies and creating divisions among member states,” Makogon said.

“Russia has used gas transit as both an economic and political weapon, influencing EU policies and creating divisions among member states.”

Europe will feel an expensive knock-on effect in exchange for its security, Fielding said, as Slovakia, Austria, and Czechia will have to pay more to source and transport non-Russian gas. Western Europe, particularly Germany, will have to increase gas flows to the east to replace the lost Russian gas, she added.

A man on a scooter rides past the Klingenberg natural gas-powered thermal power station in Berlin, Germany, on July 4, 2022. Germany continues to receive a significant portion of its natural gas from Russia, despite recent reductions in gas flow through pipelines, prompting warnings of potential shortages. (Sean Gallup/Getty Images)

Slovakia, which could pay an extra 90 million euros to replace the Russian gas this year, has ramped up rhetoric against Ukraine with Prime Minister Robert Fico threatening to cut electricity exports to Ukraine last month. However, the country’s electricity transmission system operator, SEPS, confirmed on Jan 4 that it will continue to send electricity to Ukraine.

“Slovakia and Austria had long prepared for this moment by signing contracts with alternative suppliers and keeping their underground gas reserves topped up. They must now put this plan into action,” Fielding said.

Ukraine is also preparing for Russia to attack its gas transit network in retaliation, said CEO of the GTSOU Dmytro Lyppa on Dec. 4. Russia has already relentlessly targeted Ukrainian energy infrastructure, including gas storage sites, and Makogon said that Ukraine is “well prepared” to repair and restore damaged infrastructure.

“Additionally, we would not hesitate to retaliate by targeting Russia’s gas networks and storages, just as we have targeted their oil refineries,” he added.

Ukraine war latest: Ukraine strikes Russian oil depot, command post; Moscow bombs civilians in Zaporizhzhia

Key developments on Jan. 8: * Ukraine strikes Russian oil depot supplying fuel to Engels-2 airbase, military confirms * Ukraine strikes Russian command post in Donetsk Oblast, military reports * Russian airstrike on Zaporizhzhia industrial site kills 13, injures at least 63 * French-trained bri…

The Kyiv IndependentTim Zadorozhnyy

0 notes

Link

0 notes

Text

[ad_1] 5 min read Last Updated : Oct 11 2024 | 6:00 PM IST By Bloomberg News Russian exporters are facing mounting liquidity challenges amid delays in receiving payments from foreign banks fearful of falling foul of US sanctions. Click here to connect with us on WhatsApp While companies aren’t missing payrolls and other obligations, daily spending is increasingly difficult to plan because of unpredictable cash flows, according to executives at five major commodities producers, speaking on condition of anonymity as the information is sensitive. That’s adding to pressures on their cash reserves, the people said, particularly as overnight borrowing costs on domestic and foreign currencies have surged above 20% and there’s little or no availability of the yuan, the main foreign-exchange currency in Russia now. Managing payments has become a time-consuming and manual process, with teams of employees calling international banks daily to explain why transactions aren’t in breach of sanctions, the executives said. Even so, payments sometimes take more than a month to process amid a constant risk of rejection, they said. The US measures imposed in June sought to ramp up pressure on the Kremlin’s ability to fund its war in Ukraine by putting local banks in countries that trade with Russia at a higher risk of so-called secondary sanctions. That has delayed and disrupted payments to and from places like China and Turkey that have become key trading partners for Russia since the US and its Group of Seven allies imposed sweeping restrictions in response to the war. The rising level of pain in Russia’s economy has caught the attention of President Vladimir Putin. The cross-border payment problem “is one of the serious challenges for us,” he told an Oct. 4 meeting of Russia’s Security Council. “Payment problems have long been affecting the economy through increased transaction costs and increased ruble exchange rate volatility, which affects inflation expectations and inflation itself,” said Dmitry Polevoy, the investment director at Moscow-based Astra Asset Management. “Initially, importers had more problems, which supported the ruble, but difficulties for exporters threaten to increase pressure on the exchange rate.” The Bank of Russia has hiked its key interest rate to 19% and warned of a possible further increase this month, amid a weakening ruble and persistent inflation that’s more than double its 4% target. The currency is slipping toward 100 per dollar after declining about 8% against the greenback so far this year. “High transaction costs associated with restrictions on cross-border payments, as well as restrictions on export infrastructure” are among key challenges for Russia’s economy, Alexey Mordashov, billionaire owner of steelmaker Severstal, told a meeting of government and business officials this week. “The issue is very acute and restrictions are growing,” Mordashov said. “I would like to ask the government to pay close attention to it.” Other top exporters have acknowledged payment difficulties in financial statements. MMC Norilsk Nickel PJSC, Russia’s biggest miner, said its trade and other accounts receivable, the amount owed by customers, increased by more than $300 million in the first half of the year as a result of problems in trans-border payments. United Co. Rusal International PJSC, Russia’s top aluminum producer, reported that accounts receivable from third parties jumped 25%, or $307 million, in the same period. The companies declined to comment on the situation for this story. Some Russian companies have responded to the US restrictions by transferring deal settlements, including in yuan, to banks in neighboring countries such as Kazakhstan. Others have turned to cryptocurrency or even barter agreements to get paid. As a result, top Russian exporters cut currency sales in Russia by 30% in September to just $8.3 billion as the

ruble gained a larger role in settlements, according to central bank data published on Tuesday. That’s contributed to a shortage of foreign currency liquidity inside Russia including in the yuan, which the central bank views as the main “friendly” currency in contrast to the “toxic” dollar and euro. Russia has also switched much of its foreign trade into the ruble, which now accounts for 40% of its international operations, Putin said last month. The government is working to develop a payment system for use within the BRICS group of nations that may be presented when Putin hosts a summit of member states in Kazan this month. What Bloomberg Economics Says... “What we see with payments for exporters is a painful period of adjustment, but if nothing else happens, the situation should not get much worse. In 2023, we saw delays in payments for oil companies, but it has been resolved.” Alex Isakov, Russia Economist The difficulties with payments may impact investment activity in Russia, which increased by 9% in 2023 and is expected to grow by another 5% this year, said Oleg Kuzmin, an economist at Renaissance Capital in Moscow. “Next year, we expect investment growth rates to slow to 1.5%,” he said. There’s no quick fix on the horizon. Exporters and importers will probably have to continue to look for payment options outside Russia, keeping part of their earnings abroad even as they’ll have to repatriate some of the money to comply with government requirements, Polevoy said. © 2024 Bloomberg L.P. First Published: Oct 11 2024 | 6:00 PM IST [ad_2] Source link

0 notes

Text

The Essential Guide to the Exports of Turkey

Turkey's export sector is an integral pillar of its economy, demonstrating both diversity and resilience. The nation's strategic location, bridging Europe and Asia, has endowed it with a unique advantage, allowing swift access to various markets. Over the decades, Turkey has honed its export capabilities through technological advancements, enhanced production efficiency, and strategic international partnerships. This amalgamation of factors has not only spurred robust growth in its export sector but has also positioned Turkey as a formidable player in the global trade landscape. From automotive products and textiles to agricultural goods and high-tech equipment, Turkey’s export portfolio is extensive and varied, ensuring its economic stability and adaptability in a competitive international market. This guide delves deep into the historical growth, key factors, statistical insights, exports of Turkey, and contributions of various sectors that underscore Turkey’s significant presence in global exports.

Historical Perspective: Growth of Turkey's Export Sector

The history of Turkey's export sector is marked by a series of transformative milestones. In the early 1980s, the country adopted an export-oriented industrialization strategy, which significantly boosted its export capabilities. Since then, Turkey has continuously expanded and diversified its export portfolio. The establishment of customs unions with the European Union and free trade agreements with multiple countries has further accelerated Turkey's export growth, making it a competitive player in global trade.

Factors Contributing to the Strength of Turkey's Export

Several factors have contributed to the strength and resilience of Turkey's export sector. First and foremost, Turkey’s geographical position offers a significant advantage, allowing easy access to European, Asian, and Middle Eastern markets. Additionally, a skilled workforce, advanced manufacturing infrastructure, and government policies promoting export activities have played critical roles. Furthermore, major export of Turkey range from high-value automobiles to essential textiles, ensuring its economic stability and growth in the competitive global marketplace.

Analyzing Turkey’s Export Data Over the Years

The examination of Turkey export data reveals a positive trajectory over the years. The country has shown impressive growth in both the volume and value of its exports, indicating a robust and dynamic export sector. By analyzing data from various years, trends and patterns emerge, highlighting the nation's ability to adapt to global market demands and geopolitical changes. Such data not only underscores Turkey's export achievements but also provides insights into future opportunities and challenges.

Key Statistical Insights and Trends in Turkey’s Exports

A closer look at the statistical insights and trends in Turkey’s exports reveals several critical points. Key commodities such as automotive products, machinery, and textiles consistently rank high in export volumes and values. Additionally, the data indicates a steady expansion into new markets, particularly in regions like Africa and Latin America. The trend of increasing exports of high-tech products also suggests Turkey's shift towards more sophisticated and value-added goods, enhancing its competitive edge.

A Comprehensive List of Turkey's Export Products

The top exports of Turkey are diverse, ranging from industrial goods to agricultural produce. Key export items include:

Automotive products

Machinery and equipment

Textiles and clothing

Iron and steel

Electronics and home appliances

Agricultural products

Chemical products

Minerals and metals

Categorical Breakdown of Turkey's Export Products

Further breaking down Turkey export products list categorically, the country’s exports can be grouped into industrial, agricultural, and high-tech goods. Industrial exports mainly include:

Automobiles and automotive parts

Machinery and mechanical appliances

Iron and steel products

Agricultural exports cover a wide range of products, such as:

Fresh fruits and vegetables

Grains and pulses

Nuts and dried fruits

High-tech goods primarily involve:

Electronics and electrical machinery

Medical devices and equipment

Automotive Industry: A Keystone in Turkey's Export Market

The Turkey biggest export in the market is automobiles and automotive parts, automotive industry is a cornerstone of Turkey’s export sector, with a vast array of vehicles and automotive parts being shipped worldwide. Turkey is known for its high-quality production in the automotive sector, catering to demands from Europe, the Middle East, and beyond. Major international brands have established manufacturing plants in Turkey, boosting the country’s output and export capacity. This sector's success is attributed to its cutting-edge technology, efficient production processes, and skilled workforce.

The Pivotal Role of Textiles and Apparels in Turkish Exports

Textiles and apparel constitute a significant portion of Turkey's export market. Renowned for high-quality fabrics and innovative designs, Turkish textile exports have gained substantial popularity in international markets. The sector benefits from a long-standing tradition of textile production, coupled with modern techniques and sustainable practices. This blend of heritage and innovation has cemented Turkey's position as a leading exporter in the global textile industry.

Understanding the Export Influence of Turkey's Agriculture Sector

Agriculture holds a fundamental place in Turkey's export portfolio, with a variety of fruits, vegetables, grains, and processed agricultural products making a vital contribution to the country’s export revenues. The country’s favourable climate and fertile land support the cultivation of numerous crops. Additionally, Turkey’s agricultural exports meet international quality standards, ensuring the country's competitive stance in the global agricultural market.

Highlighting Turkey’s Most Significant Export Commodities

Among Turkey’s myriad export commodities, some hold particular significance due to their volume and value. These include automotive products, which are a major revenue generator. Iron and steel products also play a crucial role, given their use in various industrial applications globally. Furthermore, textiles and apparel remain a staple in Turkey's export mix, driven by quality and global demand. Each of these commodities reflects Turkey's strategic strengths in specific sectors.

Investigating Turkey's Leading Export Products by Volume and Value

Examining Turkey’s leading export products by both volume and value provides a comprehensive view of the country’s export economy. Automotive products top the list, followed by machinery, textiles, and iron and steel. Notably, agricultural products such as fruits and nuts also feature prominently, highlighting the diversity of Turkey’s export base. This analysis underscores the multifaceted nature of Turkey's exports and the country's ability to leverage various sectors for economic growth.

Top Export Markets for Turkish Goods

Turkey exports its goods to a wide array of international markets, with the European Union being one of the largest recipients. Germany, Italy, and the United Kingdom are significant destinations for Turkish exports, reflecting strong trade relations within Europe. Additionally, the Middle East, North Africa, and Asia also represent important markets, showcasing Turkey’s global reach. Each region presents unique opportunities and challenges that Turkey adeptly navigates to maintain its export growth.

Conclusion

In conclusion, Turkey's export sector exemplifies a dynamic and multifaceted engine of economic growth. The nation's strategic geographic position, coupled with its robust manufacturing infrastructure and skilled workforce, has facilitated its overall export success. Turkey’s diverse range of export products, from high-value automotive components to high-quality textiles and agricultural goods, ensures economic resilience and adaptability in the global market. Historical milestones, such as the adoption of export-oriented industrialization in the 1980s and the establishment of various trade agreements, have significantly boosted Turkey’s export capacity. As the nation continues to expand into new markets and shift towards more sophisticated, value-added goods, the future of Turkey's export sector remains promising. By analyzing past trends and understanding the contributions of various sectors, Turkey can continue to navigate international trade challenges and seize global opportunities, thereby sustaining its growth and competitiveness on the world stage.

Frequently Asked Questions (FAQs)

Q1. What are the main products exported by Turkey?

Turkey’s top exports include automotive products, machinery, textiles, iron and steel, electronics, agricultural products, chemical products, and minerals and metals. Each of these categories plays a significant role in contributing to the nation's economic stability and growth.

Q2. Which regions are the primary destinations for Turkish exports?

Turkey exports to a diverse range of international markets, with the European Union being the largest recipient. Key countries include Germany, Italy, and the United Kingdom. Additionally, notable markets in the Middle East, North Africa, and Asia have been expanding, reflecting Turkey’s global trade reach.

Q3. How does Turkey's strategic location benefit its export sector?

Turkey's geographical position, bridging Europe and Asia, offers a significant advantage by facilitating easy access to various markets. This strategic location enables efficient transportation and logistics, enhancing Turkey's ability to meet global demand rapidly.

Q4. What factors have contributed to the growth of Turkey’s export sector?

Several factors contribute to the strength of Turkey’s export sector, including its strategic location, a skilled workforce, advanced manufacturing infrastructure, and supportive government policies. Additionally, partnerships through customs unions and free trade agreements have played crucial roles in bolstering export activities.

Q5. How has Turkey’s export sector evolved over time?

Turkey adopted an export-oriented industrialization strategy in the early 1980s, which significantly boosted its export capabilities. Since then, the country has diversified its export portfolio and expanded its reach, aided by strategic international collaborations and continuous improvements in production efficiency.

Q6. What role does the automotive industry play in Turkey’s exports?

The automotive industry is a cornerstone of Turkey's export sector, known for its high-quality production and significant contribution to export revenues. Major international brands have established manufacturing plants in Turkey, highlighting the country’s capacity and expertise in this sector.

Q7. Why are textiles and apparel significant in Turkey’s export market?

Textiles and apparel hold a prominent place due to Turkey's long-standing tradition of high-quality textile production and innovative designs. The blend of heritage and modern techniques, along with sustainable practices, has cemented Turkey’s position as a leading exporter in the global textile industry.

Q8. What are the future opportunities and challenges for Turkey's export sector?

While Turkey’s export sector shows a positive trajectory, future opportunities lie in expanding into emerging markets and enhancing high-tech product exports. However, the sector must navigate challenges such as geopolitical changes and global market fluctuations to sustain its competitive edge.

#global trade data#international trade#exports of Turkey#main export of Turkey#Turkey biggest export#Turkey export products list#top exports of Turkey#Turkey trade data#trade data#export#global market#trade market#import export data#import data#custom data#global business

0 notes

Text

Leading the way in Special Steels! VIRAT SPECIAL STEELS PVT. LIMITED , INDIA., we are proud to be one of the largest importers, exporters, and stockists of Die Blocks, Tool Steels, Die Steels, Special Steels, and Alloy Steels.

With over five decades of experience, we maintain the biggest steel yards and a high level of inventory from the world’s leading manufacturers like Swiss Steel DEW, NLMK Verona, Vitkovice, Somers Forge, and Villares Metals.

We are in this business for the last about more than Five Decades, and have been dealing with large number of forging units. The products, we deal in are specifically engineered to extend life service, save time and provide optimal performance to our customers.

Product List HOT WORK STEEL ( HH 370 - 410 BHN ) DIN-1.2714 / AISI L6 ) HOT DIE STEELS (DIN 2343, 2344 / AISI H11, H13) PLASTIC MOULD STEELS (DIN 2738, 2311 , AISI P 20 ) HIGH SPEED STEELS (DIN 3243 , 3343 / AISI M2 , M35) HCHCr. (DIN 2379 , 2080 / AISI D2 , D3) ALLOY STEELS, EN-SERIES ETC.

Our products are specifically engineered to extend service life, save time, and provide optimal performance. You can rely on us for accurate and timely service on our part to process and execute your orders to match your satisfaction.

Virat Special Steels, INDIA! https://www.viratsteels.com/

📞 Contact us today to learn more about how we can support your business! https://www.viratsteel.in/special-steel-supply-networks/

Any further queries feel free to contact us : 🌐https://www.viratsteels.com/ 📬 [email protected] ☎+91 98140-21775

#ludhiana#india#viratsteels#gurgaon#viratspecialsteels#toolsteelsupplier#gurugram#pune#iso9001#steel#tool steel suppliers#open die forging#diesteel#die steels#tool steels#db6 steel#h13diesteel#h11steel#din2344#din2714

4 notes

·

View notes

Text

[ad_1] 5 min read Last Updated : Oct 11 2024 | 6:00 PM IST By Bloomberg News Russian exporters are facing mounting liquidity challenges amid delays in receiving payments from foreign banks fearful of falling foul of US sanctions. Click here to connect with us on WhatsApp While companies aren’t missing payrolls and other obligations, daily spending is increasingly difficult to plan because of unpredictable cash flows, according to executives at five major commodities producers, speaking on condition of anonymity as the information is sensitive. That’s adding to pressures on their cash reserves, the people said, particularly as overnight borrowing costs on domestic and foreign currencies have surged above 20% and there’s little or no availability of the yuan, the main foreign-exchange currency in Russia now. Managing payments has become a time-consuming and manual process, with teams of employees calling international banks daily to explain why transactions aren’t in breach of sanctions, the executives said. Even so, payments sometimes take more than a month to process amid a constant risk of rejection, they said. The US measures imposed in June sought to ramp up pressure on the Kremlin’s ability to fund its war in Ukraine by putting local banks in countries that trade with Russia at a higher risk of so-called secondary sanctions. That has delayed and disrupted payments to and from places like China and Turkey that have become key trading partners for Russia since the US and its Group of Seven allies imposed sweeping restrictions in response to the war. The rising level of pain in Russia’s economy has caught the attention of President Vladimir Putin. The cross-border payment problem “is one of the serious challenges for us,” he told an Oct. 4 meeting of Russia’s Security Council. “Payment problems have long been affecting the economy through increased transaction costs and increased ruble exchange rate volatility, which affects inflation expectations and inflation itself,” said Dmitry Polevoy, the investment director at Moscow-based Astra Asset Management. “Initially, importers had more problems, which supported the ruble, but difficulties for exporters threaten to increase pressure on the exchange rate.” The Bank of Russia has hiked its key interest rate to 19% and warned of a possible further increase this month, amid a weakening ruble and persistent inflation that’s more than double its 4% target. The currency is slipping toward 100 per dollar after declining about 8% against the greenback so far this year. “High transaction costs associated with restrictions on cross-border payments, as well as restrictions on export infrastructure” are among key challenges for Russia’s economy, Alexey Mordashov, billionaire owner of steelmaker Severstal, told a meeting of government and business officials this week. “The issue is very acute and restrictions are growing,” Mordashov said. “I would like to ask the government to pay close attention to it.” Other top exporters have acknowledged payment difficulties in financial statements. MMC Norilsk Nickel PJSC, Russia’s biggest miner, said its trade and other accounts receivable, the amount owed by customers, increased by more than $300 million in the first half of the year as a result of problems in trans-border payments. United Co. Rusal International PJSC, Russia’s top aluminum producer, reported that accounts receivable from third parties jumped 25%, or $307 million, in the same period. The companies declined to comment on the situation for this story. Some Russian companies have responded to the US restrictions by transferring deal settlements, including in yuan, to banks in neighboring countries such as Kazakhstan. Others have turned to cryptocurrency or even barter agreements to get paid. As a result, top Russian exporters cut currency sales in Russia by 30% in September to just $8.3 billion as the

ruble gained a larger role in settlements, according to central bank data published on Tuesday. That’s contributed to a shortage of foreign currency liquidity inside Russia including in the yuan, which the central bank views as the main “friendly” currency in contrast to the “toxic” dollar and euro. Russia has also switched much of its foreign trade into the ruble, which now accounts for 40% of its international operations, Putin said last month. The government is working to develop a payment system for use within the BRICS group of nations that may be presented when Putin hosts a summit of member states in Kazan this month. What Bloomberg Economics Says... “What we see with payments for exporters is a painful period of adjustment, but if nothing else happens, the situation should not get much worse. In 2023, we saw delays in payments for oil companies, but it has been resolved.” Alex Isakov, Russia Economist The difficulties with payments may impact investment activity in Russia, which increased by 9% in 2023 and is expected to grow by another 5% this year, said Oleg Kuzmin, an economist at Renaissance Capital in Moscow. “Next year, we expect investment growth rates to slow to 1.5%,” he said. There’s no quick fix on the horizon. Exporters and importers will probably have to continue to look for payment options outside Russia, keeping part of their earnings abroad even as they’ll have to repatriate some of the money to comply with government requirements, Polevoy said. © 2024 Bloomberg L.P. First Published: Oct 11 2024 | 6:00 PM IST [ad_2] Source link

0 notes

Text

ITM Istanbul with strong VDMA participation

ITM, to be held in Istanbul at the beginning of June, will once again see a strong participation of VDMA member companies. Almost 90 exhibitors from Germany will exhibit at the trade fair, most of whom are members of the VDMA. In addition to the VDMA member companies exhibiting with their own booth, numerous VDMA members will be represented in Istanbul via agents. They cover nearly all different machinery chapters with a focus on spinning, nonwoven, weaving, knitting, warp knitting, and finishing.

In Istanbul, the VDMA members will show their latest innovations. In technological terms, significant trends are digitalization and automation. These themes have been present for some time but will continue to play a central role in meeting the challenges for many years to come. Another trend that has also been around for a while is sustainability. Today it is much more than a buzzword: Efficiency in energy, raw materials or water as well as recycling are not feel-good issues but have a real economic and social background.

For the textile machinery manufacturers organized in the VDMA, Turkey is a major trading partner. In 2023, textile machinery and accessories worth approximately 350 million euros were exported from Germany to Turkey, which made Turkey the second biggest sales market for German companies. After three years in which China was the most important supplier of textile machinery to Turkey, Germany has now regained this top position.

Turkey is at the doorstep of Europe, which gives Turkish textile producers a powerful geographic advantage over Asian sourcing destinations. The textile companies in the region have deep experience and know-how in making the highest quality textile and apparel for leading markets of Europe and employ a young, dynamic, and well-educated workforce.

But ITM is not just a place for visitors from Turkey, as Dr. Harald Weber, Managing Director of the VDMA Textile Machinery Association explains: “It should not be forgotten that ITM not only attracts visitors from Turkey but also from the Middle East, Central Asia and North Africa. Turkey’s proximity to the European Union and its fully integrated textile value chain also makes it interesting in terms of the EU’s strategy for sustainable and circular textiles and the increasing importance of recycling in the future.”

1 note

·

View note

Text

Top Export from Russia: A Comprehensive Guide

Russia, formally known as the Russian Federation, is the world's largest country, encompassing about one-tenth of the planet's surface. It is renowned for its vibrant culture, customs, literature, dance, and music. Despite its vastness, Russia is a superpower due to its abundance of minerals, oils, and other natural resources. The country has been a major producer and exporter of various agricultural and natural products for centuries.

In this blog, we will delve into the main exports of Russia, its primary export partners, detailed export data, and more. Let's begin by discussing the trade relationship between India and Russia.

Trade Between India and Russia

Russia and India have close trade ties. The bilateral trade between the two countries during 2022–2023 amounted to US $49.36 billion, with exports to Russia from India amounting to US $3.14 billion, and exports from Russia to India amounting to US $46.21 billion. As India’s rival, China’s relations with Russia grow closer, with Putin describing them as “the best in history,” it raises concerns for India. To strengthen ties, Modi’s first visit after winning the 2024 election is to Moscow, aiding in rebuffing Western efforts to cast Putin as a pariah and boosting relations with its key oil trade partner.

Export from Russia: Facts and Figures

In 2022, Russia was ranked 12th globally in terms of exports, with total exports worth $486 billion. Over five years, from 2017 to 2021, exports from Russia surged from $126 billion to $486 billion. Oil and petroleum products dominate Russia’s export landscape, with approximately 30% of the country's GDP derived from exports. Russia exports globally, totaling around 42,000 shipments, including natural gas, oil, cereals, metals, and fertilizers.

Major Exports of Russia

Here is a list of Russia's major exports:

Minerals, fuels, oils, etc.: US $348.35 billion

Iron and steel: US $21.49 billion

Fertilizers: US $17.36 billion

Pearls, stones, precious metals: US $16.85 billion

Aluminum and aluminum articles: US $9.96 billion

Wood and wood articles: US $8.56 billion

Fish, crustaceans, mollusks, etc.: US $7.78 billion

Cereals: US $7.24 billion

Copper and copper articles: US $7.15 billion

Inorganic chemicals: US $5.8 billion

Top Export Partners of Russia

Here are the top export destinations of Russia:

China: US $101 billion

India: US $40.4 billion

Germany: US $27.7 billion

Turkey: US $25.3 billion

Italy: US $25.1 billion

Around 55% of Russia’s total exports are shipped to these countries. Check out the Eximpedia.app dashboard and our Russia export data to find out more about Russia's export partners.

Top Ten Exports from Russia in Detail

1. Minerals, Fuels, and Oils

Minerals, fuels, and oils are Russia's biggest export products. In 2022, Russia exported these goods worth US $348.35 billion, comprising around 71.6% of total export products. Major exports include crude petroleum, refined petroleum, petroleum gas, coal briquettes, electricity, coal tar oil, petroleum coke, petroleum jelly, and lignite. The primary destinations for these exports are China, India, Italy, Germany, and the Netherlands.

2. Iron and Steel

Iron and steel are the second-largest export commodities in Russia. In 2022, Russia exported iron and steel worth US $21.49 billion, accounting for 4.3% of total exports. Key exports include wrought iron, cast iron, martensitic alloys, weathering steel, pig iron, and manganese. The main destinations are China, Italy, Kazakhstan, and Germany.

3. Fertilizers

Russia is the largest exporter of fertilizers, exporting 38 billion metric tonnes in 2022. This export was valued at US $17.36 billion, constituting 3.5% of total exports. Major exports include potassium chloride, diammonium phosphate, phosphate rock, and triple superphosphate. Leading destinations are Brazil, India, the United States, China, and Indonesia.

4. Pearls, Stones, and Precious Metals

Russia is the second-largest exporter of pearls, stones, and precious metals. In 2022, these exports were valued at US $16.85 billion, constituting 3.46% of total exports. Key exports include platinum, vanadium, gold, industrial diamonds, and cobalt, along with gemstones like demantoid garnet and Alexandrite. Major destinations are the United Arab Emirates, Switzerland, the United Kingdom, the United States, and Hong Kong.

5. Aluminum and Aluminum Articles

In 2022, Russia exported aluminum and aluminum articles worth US $9.96 billion, constituting 2.04% of total exports. Major exports include raw aluminum, airplane parts, window frames, radiators, foil, and air conditioning units. Key destinations are China, Japan, Turkey, Germany, and the United States.

6. Wood and Wood Articles

Russia is a competitive exporter of wood used for fuel and furniture manufacturing. In 2022, wood exports were valued at US $8.56 billion, holding a significant share of 31.76% of total exports. Major exports include beams, planks, fitches, boards, laths, fagots, twigs, and rough sticks. Key destinations are China, Uzbekistan, Japan, Kazakhstan, and the United States.

7. Fish, Crustaceans, Mollusks, etc.

Russia is the 7th largest exporter of fish, crustaceans, mollusks, and other seafood, valued at US $7.78 billion in 2022. Leading destinations are Norway, Portugal, the United Kingdom, Spain, and Germany.

8. Cereals

Russia is the 6th largest exporter of cereals, exporting 48 million metric tonnes in 2022. These exports were valued at US $7.24 billion. Major exports include corn, rice, barley, and rye. Leading destinations are Turkey, Egypt, Azerbaijan, Kazakhstan, and Pakistan.

9. Copper and Copper Articles

In 2022, Russia exported copper and copper articles worth US $7.15 billion, holding a 1.47% share of total exports. Key exports include copper alloys, copper foil, and unrefined copper. Major destinations are China, Germany, Turkey, the Netherlands, and Chinese Taipei.

10. Inorganic Chemicals

Russia is a significant exporter of inorganic chemicals, valued at US $5.8 billion in 2022. Major exports include aluminum oxide, aluminum hydroxide, synthetic rubber, filaments, sodium, fluorine, and caustic soda. Key destinations are China, Brazil, Belarus, India, and Kazakhstan.

How to Find Buyers from Russia?

To find the best buyers in Russia, visit Eximpedia.app. This platform provides detailed data on Russia's export by country, export data, buyer data, product-specific data, and more.

Conclusion

In this blog, we explored how Russia's main exports contribute to its GDP and overall economic welfare. As one of the world's largest economies, trading with Russia benefits both importers and exporters. Accessing accurate Russian import and export data is crucial for making informed trade decisions. Eximpedia.app provides comprehensive Russian trade data, helping traders navigate international trade more effectively.

For more detailed information, visit Eximpedia.app and enhance your international trade journey.

0 notes

Text

Reverse effect of Zelensky’s Swiss peace summit

Volodymyr Zelensky’s Global Peace Summit in Switzerland was supposed to show the world’s support for Kyiv and emphasise Russia’s isolation, but it turned out the other way round, The Spectator reports.

Russia was not invited. China did not send a delegation. Other major countries, including Brazil, India, Saudi Arabia, South Africa and the UAE, refused to sign the truncated final communiqué.

According to a former senior official in Zelensky’s administration, the Ukrainian leader “hoped the conference would be a new point of international support…. [but] it only showed how much support we have lost in the Global South.”

For almost all countries and global blocs, economic and strategic interests took precedence over principles. The EU took the lead in imposing sanctions but did not ban Russian oil, only capping the price at $60 a barrel rather than $73 for Urals crude. Europe has never imposed sanctions on Russian gas. It continues to import 15 per cent of its natural gas, of which 8 per cent comes from Russia via Ukraine and Slovakia. Last year, Gazprom paid Ukraine $850 million for transit, about 0.46 per cent of Kyiv’s GDP, making the Kremlin one of Ukraine’s biggest taxpayers. Only 8 per cent of EU companies have completely divested themselves of Russian assets.

Zelensky is the greatest salesman, Trump says

Senior US diplomats continue to forbid Ukraine from using long-range weapons on Russian territory (except for missile launch pads). Kyiv was recently advised to stop attacking Russian oil refineries for fear of causing an oil crisis. Donald Trump, meanwhile, recently said he would veto additional aid to Ukraine. He added:

“Zelensky is probably the greatest salesman of all living politicians. Whenever he comes to our country, he leaves it with $60 billion …. And then he comes back and says he needs another $60 billion.”

The Global South wants to keep importing Ukrainian grain and cheap Russian oil. India’s economy has grown thanks to vastly increased imports of Russian oil, much of which is re-exported back to Europe in the form of refined petrol. Turkey imports Russian gas and re-exports it to southern Europe, and has an extensive trade in agricultural and consumer products. The UAE has become a banking centre for Russia, which is under sanctions. China has nearly doubled its trade with Russia to more than $200 billion a year.

Sanctions have no power

The West’s reluctance to cut energy exports has allowed Russia to ignore sanctions. Russia’s GDP will grow more this year than any G7 country. Life in Moscow is almost normal thanks to parallel imports through neighbouring countries. Only 0.4 per cent of Moscow residents of military age have served in the army, compared with about 9 per cent in other regions such as Tuva and Buryatia.

The world seems to be engaged in “pre-peace” positioning. German Chancellor Olaf Scholz recently predicted that the war would end at the “next” peace summit – and that Russia should be invited to it.

Meanwhile, the conference in Switzerland on Ukraine was not a peace negotiation; it requires Russia’s participation, Linda Thomas-Greenfield, US Permanent Representative to the United Nations, said. She added at the UN meeting:

“This summit was not a formal negotiation. At the end of the day, a negotiated end to the war will require both Russia and Ukraine to sit down at the negotiating table in good faith.”

Read more HERE

#world news#world politics#news#europe#european news#switzerland#swiss peace summit#ukraine peace summit#zelensky#volodimir zelenszkij#ukraine#war in ukraine#ukraine war#ukraine conflict#ukraine news#ukraine russia conflict#ukraine russia news#russia ukraine war#russia ukraine crisis#russia ukraine conflict#russia ukraine today

0 notes