#ThinPrep

Explore tagged Tumblr posts

Photo

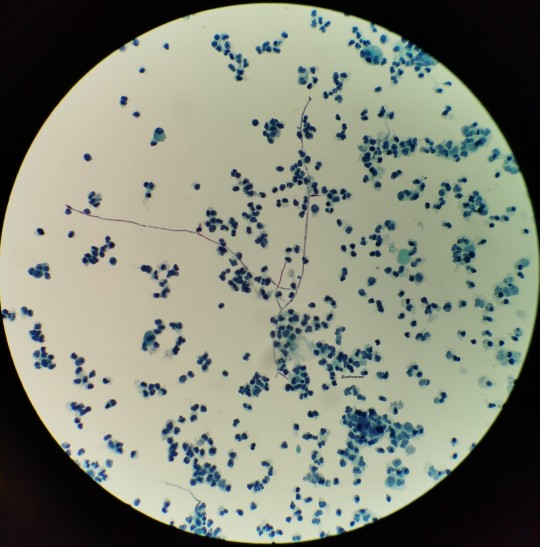

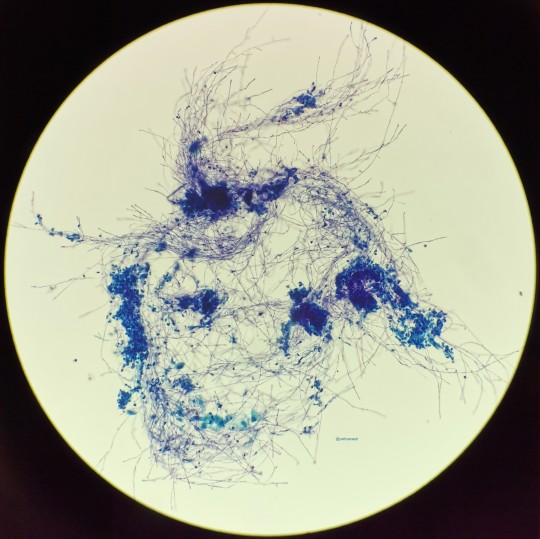

The top photo is Candida in a urine from a case I had (if memory serves), the bottom from my friend who was cyto fellow then. Needless to say, hers was much more impressive. That’s a lotta pseudohyphae!

2 notes

·

View notes

Text

In Vitro Diagnostics (IVD) Industry Size, Trends, Value, Sales and Forecast 2030

The global in vitro diagnostics (IVD) market was valued at approximately USD 77.92 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2030. This growth can be attributed to several factors, including the increasing adoption of IVD technologies due to the rising prevalence of infectious and chronic diseases. The development and integration of automated IVD systems in laboratories and hospitals, which aim to deliver more efficient, accurate, and error-free diagnoses, are also expected to significantly drive market growth. Additionally, the continuous introduction of new IVD products by key industry players contributes to this positive trend. For instance, in November 2023, ARUP Laboratories obtained a CE mark under the EU-IVDR for the AAV5 DetectCDx, a companion diagnostic test that determines the eligibility of patients with severe hemophilia A for BioMarin's gene therapy, Roctavian.

Technological advancements in IVD systems, particularly improvements in accuracy, portability, and cost-effectiveness, are among the high-impact factors influencing this market. Innovations in highly accurate clinical laboratory tests are fostering global adoption of novel IVD diagnostics. For example, in June 2023, Japan's Ministry of Health, Labour, and Welfare granted marketing approval to Toray Industries, Inc. for its Toray APOA2-iTQ, a diagnostic tool used for pancreatic cancer detection. Similarly, in March 2023, Abbott received U.S. FDA clearance for its novel laboratory blood test for Traumatic Brain Injury (TBI). These developments highlight the increasing approval of IVD tests targeting life-threatening diseases, which is expected to create significant opportunities in untapped market segments.

Gather more insights about the market drivers, restrains and growth of the In Vitro Diagnostics (IVD) Market

Leading companies in the IVD market are adopting diverse strategies to strengthen their positions, often introducing new products and forming partnerships to attract more customers and meet evolving diagnostic needs. For instance, in March 2023, BD received 510(k) clearance from the U.S. FDA for its BD Vaginal Panel on the BD COR System, aimed at detecting infectious causes of vaginitis. In August 2023, the Precision Medicine Centre (PMC) partnered with the Regional Molecular Diagnostic Service (RMDS) to implement genomic technology for cancer diagnosis in Northern Ireland. These strategic collaborations and product launches are critical for companies seeking to leverage cutting-edge technologies in diagnostics.

Product Segmentation Insights:

In terms of products, the reagents segment accounted for the largest market share, representing 65.88% of total revenue in 2023. This segment is expected to maintain its dominance, growing at the fastest CAGR from 2024 to 2030. The growth of the reagents segment is driven by extensive research and development (R&D) efforts by key players aimed at developing novel reagents and test kits. For example, in February 2023, BD received market approval for its BD Onclarity HPV Assay, which is used with the ThinPrep Pap Test in the U.S. Ongoing R&D efforts focused on faster cancer detection and precision medicine are prompting companies to concentrate on specialized, profitable areas of the IVD market. In March 2023, QIAGEN formed a partnership with Servier to develop a companion diagnostic test for TIBSOVO, which is indicated for the treatment of acute myeloid leukemia, a type of blood cancer.

The growing demand for precision medicine is expected to further boost the overall demand for these novel reagents and consumables. The instruments segment held the second-largest share of the IVD market in 2023. Increasing approvals of novel IVD instruments are likely to contribute to the segment's growth. For instance, in April 2023, bioMérieux SA submitted a 510(k) application to the U.S. FDA for VITEK REVEAL, a rapid antimicrobial susceptibility testing (AST) system. Moreover, companies are aligning their instrument launches to meet the increasing demand for genetic tests globally. In March 2022, Thermo Fisher Scientific introduced the Ion Torrent Genexus Dx Integrated Sequencer for both research and diagnostic purposes, showcasing the alignment of technological advancements with the growing needs of genetic testing.

In conclusion, the global IVD market is poised for substantial growth, driven by the increasing incidence of infectious and chronic diseases, rising demand for precision medicine, and ongoing advancements in diagnostic technologies. Companies are continuously innovating, launching new products, and forming strategic partnerships to meet the evolving needs of healthcare providers and patients, which will further accelerate market expansion.

Order a free sample PDF of the In Vitro Diagnostics (IVD) Market Intelligence Study, published by Grand View Research.

#In Vitro Diagnostics (IVD) Industry#In Vitro Diagnostics (IVD) Market Share#In Vitro Diagnostics (IVD) Market Trends#In Vitro Diagnostics (IVD) Market Growth

0 notes

Text

In Vitro Diagnostics (IVD) Market Growth Analysis & Forecast Research Report, 2030

The global in vitro diagnostics (IVD) market was valued at approximately USD 77.92 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2030. This growth can be attributed to several factors, including the increasing adoption of IVD technologies due to the rising prevalence of infectious and chronic diseases. The development and integration of automated IVD systems in laboratories and hospitals, which aim to deliver more efficient, accurate, and error-free diagnoses, are also expected to significantly drive market growth. Additionally, the continuous introduction of new IVD products by key industry players contributes to this positive trend. For instance, in November 2023, ARUP Laboratories obtained a CE mark under the EU-IVDR for the AAV5 DetectCDx, a companion diagnostic test that determines the eligibility of patients with severe hemophilia A for BioMarin's gene therapy, Roctavian.

Technological advancements in IVD systems, particularly improvements in accuracy, portability, and cost-effectiveness, are among the high-impact factors influencing this market. Innovations in highly accurate clinical laboratory tests are fostering global adoption of novel IVD diagnostics. For example, in June 2023, Japan's Ministry of Health, Labour, and Welfare granted marketing approval to Toray Industries, Inc. for its Toray APOA2-iTQ, a diagnostic tool used for pancreatic cancer detection. Similarly, in March 2023, Abbott received U.S. FDA clearance for its novel laboratory blood test for Traumatic Brain Injury (TBI). These developments highlight the increasing approval of IVD tests targeting life-threatening diseases, which is expected to create significant opportunities in untapped market segments.

Gather more insights about the market drivers, restrains and growth of the In Vitro Diagnostics (IVD) Market

Leading companies in the IVD market are adopting diverse strategies to strengthen their positions, often introducing new products and forming partnerships to attract more customers and meet evolving diagnostic needs. For instance, in March 2023, BD received 510(k) clearance from the U.S. FDA for its BD Vaginal Panel on the BD COR System, aimed at detecting infectious causes of vaginitis. In August 2023, the Precision Medicine Centre (PMC) partnered with the Regional Molecular Diagnostic Service (RMDS) to implement genomic technology for cancer diagnosis in Northern Ireland. These strategic collaborations and product launches are critical for companies seeking to leverage cutting-edge technologies in diagnostics.

Product Segmentation Insights:

In terms of products, the reagents segment accounted for the largest market share, representing 65.88% of total revenue in 2023. This segment is expected to maintain its dominance, growing at the fastest CAGR from 2024 to 2030. The growth of the reagents segment is driven by extensive research and development (R&D) efforts by key players aimed at developing novel reagents and test kits. For example, in February 2023, BD received market approval for its BD Onclarity HPV Assay, which is used with the ThinPrep Pap Test in the U.S. Ongoing R&D efforts focused on faster cancer detection and precision medicine are prompting companies to concentrate on specialized, profitable areas of the IVD market. In March 2023, QIAGEN formed a partnership with Servier to develop a companion diagnostic test for TIBSOVO, which is indicated for the treatment of acute myeloid leukemia, a type of blood cancer.

The growing demand for precision medicine is expected to further boost the overall demand for these novel reagents and consumables. The instruments segment held the second-largest share of the IVD market in 2023. Increasing approvals of novel IVD instruments are likely to contribute to the segment's growth. For instance, in April 2023, bioMérieux SA submitted a 510(k) application to the U.S. FDA for VITEK REVEAL, a rapid antimicrobial susceptibility testing (AST) system. Moreover, companies are aligning their instrument launches to meet the increasing demand for genetic tests globally. In March 2022, Thermo Fisher Scientific introduced the Ion Torrent Genexus Dx Integrated Sequencer for both research and diagnostic purposes, showcasing the alignment of technological advancements with the growing needs of genetic testing.

In conclusion, the global IVD market is poised for substantial growth, driven by the increasing incidence of infectious and chronic diseases, rising demand for precision medicine, and ongoing advancements in diagnostic technologies. Companies are continuously innovating, launching new products, and forming strategic partnerships to meet the evolving needs of healthcare providers and patients, which will further accelerate market expansion.

Order a free sample PDF of the In Vitro Diagnostics (IVD) Market Intelligence Study, published by Grand View Research.

#In Vitro Diagnostics (IVD) Industry#In Vitro Diagnostics (IVD) Market Share#In Vitro Diagnostics (IVD) Market Trends#In Vitro Diagnostics (IVD) Market Growth

0 notes

Text

In Vitro Diagnostics Market Size and Regional Outlook Analysis 2024 - 2030

The global in vitro diagnostics market size is expected to reach USD 101.58 billion by 2030, according to a new report by Grand View Research, Inc. It is estimated to register a CAGR of 4.4% over the forecast period driven by the increasing geriatric population, COVID-19 pandemic, and technological advancements in diagnostics that are supporting its adoption. Technological advancements in terms of portability, accuracy, and cost-effectiveness are projected to be one of the high-impact rendering drivers. Technological advancements were further accelerated by the launch of COVID-19 IVD diagnostics and enhanced the adoption of instruments and consumables for technologies, such as PCR. Competitors in the market are increasingly adopting agreement and partnership strategies to maintain a constant flow of business for manufacturers & diagnostics for users.

These agreements are also a result of the harsh price containment strategies for government laboratories, which lowers the price in government settings. For instance, in April 2021, the Italian subsidiary of Seegene, Inc. received a USD 108.25 million tenders for public procurement for the supply of extraction reagents, as well as 7.15 million SARS-CoV-2 diagnostic tests. However, it increases the multiparty nature and complexity of the supply chain. The high prevalence of cancer and Cardiovascular Diseases (CVDs) globally is anticipated to drive diagnostic innovation to facilitate early diagnosis and meet the constantly evolving needs of consumers. Novel technologies, such as plasmonic PCR, are anticipated to commercially enter the market during the forecast period, influencing the business of existing products adversely.

Gather more insights about the market drivers, restrains and growth of the In Vitro Diagnostics Market

Detailed Segmentation:

Market Characteristics

Market growth stage is medium, and the pace of the market growth is decelerating. Decreasing demand for COVID-19 tests is hampering the growth. The market is characterized by a high degree of innovation owing to the increasing introduction of novel molecular diagnostics and immunoassay tests for multiple disease indications. Moreover, increasing demand for patient-centric tests is encouraging market players to develop technologically advanced products.

Product Insights

The reagents segment held the largest share of 65.88% of the overall revenue in 2023. The segment is expected to retain its dominance growing at the fastest CAGR from 2024 to 2030 owing to the extensive R&D initiatives undertaken by major players to develop novel reagents and test kits. For instance, in February 2023, BD received the market approval for the BD Onclarity HPV Assay to be used with the ThinPrep Pap Test in the U.S. The increasing R&D activities to enable faster cancer detection and precision medicine are allowing companies to focus on niche profitable areas in the IVD business. For instance, in March 2023, QIAGEN partnered with Servier to develop a companion diagnostic test for TIBSOVO, indicated for treating the blood cancer acute myeloid leukemia.

Technology Insights

The immunoassay segment accounted for the largest revenue share in 2023. Increasing incidence of chronic & communicable diseases and rising need for early diagnosis are among the key factors leading to an increase in demand for immunological methods, including different types of Enzyme-Linked Immunosorbent Assays (ELISAs). Moreover, key players are focused on R&D pertaining to development of new immunological diagnostic instruments and tests for IVD applications. For instance, in October 2023, Sysmex Corporation and Fujirebio Holdings, Inc. collaborated to enhance their R&D, production, clinical development, and marketing activities in immunoassay.

End-use Insights

The hospitals segment held the largest revenue share in 2023 owing to a rise in the rate of hospitalizations that require support from faster diagnostics. Moreover, the ongoing development of healthcare infrastructure and favorable initiatives taken by government bodies are anticipated to enhance the existing hospital facilities. Thus, the demand for hospital-based IVD tests is increasing. Most IVD devices are purchased by hospitals and used in significant volumes. In 2023, there are over 6,129 hospitals in the U.S. that require constant aid from IVD for critical decision-making, as IVD tests provide faster and more accurate results.

Test Location Insights

The others (lab-based tests) segment accounted for the largest revenue share in 2023. A large number of test analyses at one time and the higher accuracy of laboratory-based tests make them more reliable compared to PoC and home tests, giving segment a competitive edge over the other two segments. Moreover, the availability of tests that allow for sample collection at home and sending it to the laboratories for testing makes testing highly convenient for patients.

Application Insights

The infectious diseases segment dominated the market in 2023. The outbreak of the COVID-19 pandemic increased the segment share significantly in recent years. Moreover, key players are introducing novel testing products to improve access to high-quality, innovative laboratory services for patients & healthcare providers. For instance, in February 2023, BD received EUA from the U.S. FDA for a new molecular diagnostic combination test for SARS-CoV-2, Influenza A+B, and Respiratory Syncytial Virus (RSV). Such initiatives by key players to strengthen their presence are expected to drive market growth.

Regional Insights

North America dominated the market and accounted for a share of 42.28% in 2023. The region is estimated to retain its leading market position throughout the forecast period. The market in this region is collectively driven by factors, such as the rising incidence of chronic diseases, presence of strong players, increasing number of novel test launches, and supportive government funding. For instance, in January 2023, BD and CerTest Biotec received EUA from the U.S. FDA for a PCR test for Mpox virus detection in the U.S. Moreover, the increasing requirement for genetic testing for personalized health care, such as that for diabetes and cancer, is expected to drive market growth in North America.

Browse through Grand View Research's Clinical Diagnostics Industry Research Reports.

• The global hepatitis diagnostic market size was valued at USD 3.82 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2030.

• The global hematology diagnostics market size was valued at USD 7.54 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2030.

Key Companies & Market Share Insights

Some of the key players operating in the in vitro diagnostics market include F. Hoffmann-La Roche Ltd.; Abbott; Quest Diagnostics Inc.; and Danaher. Market players are adopting various strategies, such as new product launches, mergers & acquisitions, and partnerships, to strengthen their product portfolios and offer diverse technologically advanced & innovative products.

Key In Vitro Diagnostics (IVD) Companies:

• Abbott

• bioMérieux SA

• QuidelOrtho Corporation

• Siemens Healthineers AG

• Bio-Rad Laboratories, Inc.

• Qiagen

• Sysmex Corporation

• Charles River Laboratories

• Quest Diagnostics Incorporated

• Agilent Technologies, Inc.

• Danaher Corporation

• BD

• F. Hoffmann-La Roche Ltd.

In Vitro Diagnostics Market Segmentation

Grand View Research has segmented the global in vitro diagnostics (IVD) market report based on product, technology, application, end-use, test location, and region:

IVD Product Outlook (Revenue, USD Million, 2018 - 2030)

• Instruments

• Reagents

• Services

IVD Technology Outlook (Revenue, USD Million, 2018 - 2030)

• Immunoassay

o Instruments

o Reagents

o Services

• Hematology

o Instruments

o Reagents

o Services

• Clinical Chemistry

o Instruments

o Reagents

o Services

• Molecular Diagnostics

o Instruments

o Reagents

o Services

• Coagulation

o Instruments

o Reagents

o Services

• Microbiology

o Instruments

o Reagents

o Services

• Others

o Instruments

o Reagents

o Services

IVD Application Outlook (Revenue, USD Million, 2018 - 2030)

• Infectious Diseases

• Diabetes

• Oncology

• Cardiology

• Nephrology

• Autoimmune Diseases

• Drug Testing

• Others

IVD Test Location Outlook (Revenue, USD Million, 2018 - 2030)

• Point of Care

• Home-care

• Others

IVD End-use Outlook (Revenue, USD Million, 2018 - 2030)

• Hospitals

• Laboratory

• Home-care

• Others

IVD Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

o Spain

o Italy

o Russia

o Denmark

o Sweden

o Norway

• Asia Pacific

o Japan

o China

o India

o South Korea

o Australia

o Thailand

o Singapore

• Latin America

o Brazil

o Mexico

o Argentina

• Middle East and Africa (MEA)

o South Africa

o Saudi Arabia

o UAE

o Kuwait

Order a free sample PDF of the In Vitro Diagnostics Market Intelligence Study, published by Grand View Research.

Recent Developments

• In December 2023, ARUP Laboratories and Medicover collaborated to provide diagnostic and healthcare services in Europe. ARUP Laboratories has developed AAV5 DetectCDx in collaboration with BioMarin Pharmaceutical Inc. to select therapies for severe hemophilia A patients

• In November 2023, Veracyte joined Illumina to develop molecular tests for decentralized IVD applications. Companies are focusing on the development of Prosigna breast cancer and Percepta nasal swab tests of Veracyte

• In October 2023, Promega Corporation announced its plan to develop and commercialize companion diagnostics kits with GSK Plc to identify cancer patients with MSI-H solid tumors

• In February 2023, Unilabs announced investing over USD 200 million in Siemens Healthineers' technology and acquiring more than 400 laboratory analyzers to strengthen its laboratory infrastructure

• In February 2023, F. Hoffmann-La Roche Ltd. collaborated with Janssen Biotech Inc. to develop companion diagnostics for targeted therapies. Companion diagnostic technologies include digital pathology, NGS, PCR, immunoassays, and immunohistochemistry

#In Vitro Diagnostics Market#In Vitro Diagnostics Market size#In Vitro Diagnostics Market share#In Vitro Diagnostics Market analysis#In Vitro Diagnostics Industry

0 notes

Text

Thinprep Pap Test Trong Chẩn Đoán Và Tầm Soát Ung Thư Cổ Tử Cung

0 notes

Text

tct檢查結果有幾種 所有結果都在這裡

tct檢查是由英文Thinprep cytologic test縮寫而來的,我們知道它是目前先進的一種宮頸癌細胞檢查技術,並且廣泛在全世界應用。 那麼tct的檢查結果有幾種? 分別代表了什麼意思呢? 接下來小編就給大家介紹關於tct檢查的相關內容,讓我們一起往下看吧。婦科炎症

人體宮頸本是一個有菌的環境,當環境發生改變時影響了宮頸細胞而發生的異常改變,多數情況下這是屬於正常的。 醫生下一步要做的是醫師通常依據炎症程度進行相應治療以減輕炎症的癥狀。黴菌病毒感染

春藥 春藥效果 春藥副作用 春藥哪裡買 春藥是什麼 春藥成分 媚藥 乖乖水 春藥坊 催情迷幻催情 外用春藥 日本春藥 RUSH 壯陽助勃 老中醫

黴菌、滴蟲、皰疹病毒感染屬於多發性感染性疾病,醫生下一步要做的是通常是根據微生物感染的種類進行相應的治療,以緩解癥狀。

ASC-US不能明確意義的非典型鱗狀細胞

意思是宮頸細胞發生輕微的變化,但是不足以達到低度病變(LSIL)的程度。 醫生下一步要做的是綜合個人以往的健康情況,通常建議您3-6個月複查tct。

LSIL低度鱗狀上皮內病變

這是指檢查到了一些疑似的癌變細胞,但是又已經確定並不是癌細胞。 這個情況的話多數都會自信消退,所以你不用過於緊張。 醫生下一步要做的是通常建議3-6個月複查tct檢查,或立即進行陰道鏡檢查。 如果安排你複查,請一定要的按照安排的時間到醫院,不要拖拉。

HSIL高度鱗狀上皮內病變

韓國奇力片 鱷魚增大軟膏 黑馬Dark Hors 美國BIG PENIS 孟婆湯 極樂水 Hulk綠巨人 RISE防爆玩家 英國Golden拳交 美國增大丸 黃金瑪卡 迷心醉 夢幻失身水

意思是有可疑癌前病變細胞,如不進一步明確診斷,採取相應治療,發展為癌的可能性較大。 醫生下一步要做的是立即進行陰道鏡檢查。

AGC非典型腺細胞

這種結果是比較嚴重的一種了,如果你的tct檢查是這個結果請務必要注意。 它代表宮頸管內的細胞發生了病變,而且非常有可能是癌症前兆。 出現這個結果之後,醫生一般會立即開始陰道鏡檢查,並取出部分宮頸管的組織加以分析確認。

0 notes

Photo

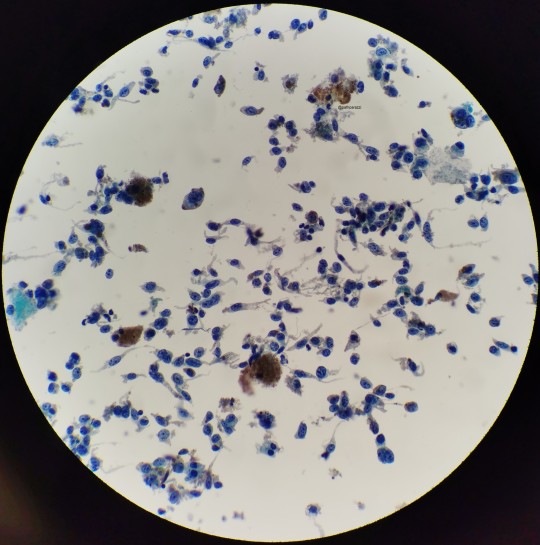

Thin prep sample for a pap smear under the lab microscope.

22 notes

·

View notes

Text

Papanicolaou smear (Pap smear, cervical smear) is a safe, noninvasive cytological examination for early detection of cervical cancer. During the 1900s, cervical cancer was one of the leading cause of death among women. It was until the year 1928, where a greek physician George Nicholas Papanicolaou was able to discover the difference between normal and malignant cervical cells by viewing the samples microscopically, hence Pap smear was invented.

For women ages 30 and above, this procedure can be done in conjunction with a test on Human papillomavirus (HPV), the most common sexually transmitted disease and primary causative agent for cervical cancer. The American Cancer Society recommends a Pap smear at least once every three years for women ages 21 to 29 who are not in a high-risk category and who have had negative results and who have had negative results from three previous Pap tests. While a Pap test and an HPV test is recommended every five years for women ages 30 to 65 years old. If a Pap smear is positive or suggests malignancy, a cervical biopsy can confirm the diagnosis.

Nurses play an important role in promoting public health awareness to inform, encourage and motivate the public in considering health screening such as pap smear. This pap smear study guide can help nurses understand their tasks and responsibilities during the procedure.

[toc]

Indications of Pap Smear

Pap smear is indicated for the following reasons:

Identify the presence of sexually transmitted disease such as human papillomavirus (HPV), herpes, chlamydia, cytomegalovirus, Actinomyces spp., Trichomonas vaginalis, and Candida spp.

Detect primary and metastatic neoplasms

Evaluate abnormal cervical changes (cervical dysplasia)

Detect condyloma, vaginal adenosis, and endometriosis

Assess hormonal function

Evaluate the patient’s response to chemotherapy and radiation therapy

Interfering Factors

These are factors or conditions that may alter the outcome of the study

Delay in fixing a specimen, allows the cells to dry therefore destroying the effectiveness of the stain and makes cytologic interpretation difficult

Improper collection site may cause rejection of the specimen. Samples for hormonal evaluation are taken from the vagina while samples for cancer screening are obtained from the vaginal fornix

Use of lubricating jelly on the speculum that may affect the viability of some organisms

Specimen collection during normal menstruation since blood can contaminate the sample

Douching, using tampons, or having sexual intercourse within 24 hours before the exam can wash away cellular deposits

Existing vaginal infections that may interfere with hormonal cytology

Pap Smear Procedure

Pap smear is performed by a practitioner and takes approximately about 5 to 10 minutes. The step-by-step procedure is as follows:

The patient is positioned. The client is assisted in a supine, dorsal lithotomy position with feet in stirrups.

A speculum is inserted. The practitioner puts on gloves and inserts an unlubricated plastic or metal speculum into the vagina and is opened gently to spread apart the vagina to access the cervix. The speculum may be moistened with saline solution or warm water to make insertion easier.

Cervical and vaginal specimens collection. After positioning the speculum, specimen from the vagina and cervix are taken. A cytobrush is inserted inside the cervix and rolls it firmly into the endocervical canal. The brush is then rotated one turn and removed. A plastic or wooden spatula is utilized to scrape the outer opening of the cervix and vaginal wall.

Collection technique (Using the conventional collection). The specimen from the brush and spatula is wiped on the slide and fixed immediately by immersing the slide in equal parts of 95% ethanol or by using a spray fixative.

Collection technique (Using the ThinPrep collection). The brush and spatula are immediately immersed in a ThinPrep solution with a swirling motion to release the material. The brush and spatula are then removed from the solution and the bottle lid is replaced and secured.

Label the specimen The slides are properly labeled with the patient’s name, age, initials of the health care provider collecting the specimen, date, and time of collection.

Specimens are sent to the laboratory The specimens are transported to the laboratory for cytologic analysis.

Bimanual examination may follow. After the removal of the speculum, a bimanual examination may be performed wherein the health care provider will insert two fingers of one hand inside the vaginal canal to feel the uterus and ovaries with the other hand on top of the abdomen.

Nursing Responsibility for Pap Smear

The following are the nursing interventions and nursing care considerations for a patient indicated for Pap smear.

Before the procedure

The following are the nursing interventions prior to pap smear:

Secure patient’s consent. The test must be adequately explained and understood by the patient before a written, and informed consent is obtained.

Obtain the patient’s health history. These include parity, date of last menstrual period, surgical status, contraceptive use, history of vaginal bleeding, history of previous Pap smears, and history of radiation or chemotherapy.

Ask lists of the patient’s current medications. If a patient is taking a vaginal antibiotic, the pap smear is delayed for one month after the treatment has been completed.

Explain that Pap smear is painless. The test requires that the cervix may be scraped and may experience minimal discomfort but no pain from the insertion of the speculum.

Avoid interfering factors. Having sexual intercourse within 24 hours, douching within 48 hours, using a tampon, or applying vaginal creams or lotions is avoided before the test since it can wash away cellular deposits and change the ph of the vagina.

Empty the bladder. Pap smear involves the insertion of the speculum into the vagina and could press down the lower abdomen.

After the procedure

The nurse should note the following nursing interventions after pap smear:

Cleanse the perineal area. Secretions or excess lubricant from the vagina are removed and cleansed.

Provide a sanitary pad. Slight spotting may occur after the pap smear.

Provide information about the recommended frequency of screening. The American Cancer Society recommends screening every three years for women aged 21 to 29 years old and co-testing for HPV and cytological screening every five years for women aged 30 to 65 years old.

Answer any questions or fears by the patient or family. Anxiety related with the pending test results may occur. Discussion of the implications of abnormal test results on the patient’s lifestyle may be provided to the patient.

Results

Normal findings in a Pap smear will indicate a negative result which means that no abnormal, malignant cells or atypical cells are found. While a positive result signifies that there are abnormal or unusual cells discovered, it is not synonymous to having cervical cancer.

The Bethesda System (TBS) is the current method for interpreting cervical cytology and it includes the following components.

1. Adequacy of specimen

Satisfactory for evaluation: Describe the presence or absence of endocervical transformation zone component and other quality indicators such as partially obscuring blood, inflammation.

Unsatisfactory for evaluation: Specimen is rejected (specify reason) or the specimen is processed and examined but unsatisfactory for evaluation of epithelial abnormalities (specify reason)

2. Interpretation/result

Negative for intraepithelial lesion or malignancy

Showing evidence of organism causing infection:

Trichomonas vaginalis; fungal organisms morphologically consistent with Candida spp.; a shift in flora indicative of bacterial vaginosis (coccobacillus); bacteria consistent with Actinomyces spp.; cellular changes consistent with herpes simplex virus.

Other non-neoplastic findings:

Reactive cellular changes related to inflammation (includes repair), radiation, intrauterine device use, atrophy, glandular cell status after hysterectomy.

Epithelial cell abnormalities

Squamous cell abnormalities

Atypical squamous cells of undetermined significance (ASC-US) cannot exclude HSIL (ASC-H):

Low-grade squamous intraepithelial lesion (LSIL) encompassing HPV, mild dysplasia, cervical intraepithelial neoplasm (CIN) grade 1

High-grade squamous intraepithelial lesion (HSIL) encompassing moderate and severe dysplasia, CIS/CIN grade 2 and CIN grade 3 with features suspicious for invasion (If invasion is suspected).

Squamous cell carcinoma: indicate the presence of cancerous cells.

Glandular cell

Atypical glandular cells (not otherwise specify)

Atypical glandular cells, favor neoplastic (not otherwise specify)

Endocervical adenocarcinoma in situ

Adenocarcinoma

Others

Endometrial cells (in woman >=40 years of age)

Gallery

Related images to help you understand pap smear better.

This slideshow requires JavaScript.

References and Sources

Additional resources and references for the Pap Smear study guide:

Adele Pillitteri. Maternal and Child Health Nursing:Care of the Childbearing and Childrearing Family. Lippincott Williams & Wilkins.

Anne M. Van Leeuwen, Mickey Lynn Bladh. Laboratory & Diagnostic Tests with Nursing Implications: Davis’s

Solomon, D., Davey, D., Kurman, R., Moriarty, A., O’connor, D., Prey, M., … & Young, N. (2002). The 2001 Bethesda System: terminology for reporting results of cervical cytology. Jama, 287(16), 2114-2119. [Link]

Suzanne C. Smeltzer. Brunner & Suddarth’s Handbook of Laboratory and Diagnostic Tests: Lippincott Williams & Wilkins

Pap Smear Nursing Care Planning and Responsibilities – Diagnostic and Procedure

Pap Smear (Papanicolaou Smear) Papanicolaou smear (Pap smear, cervical smear) is a safe, noninvasive cytological examination for early detection of cervical cancer.

#Actinomyces spp.#American Cancer Society#Atypical squamous cells of undetermined significance (ASCUS)#Candida spp#Carcinoma in situ (CIS)#cervical cancer#cervical dysplasia#cervical smear#chlamydia#cytomegalovirus#Diagnostic Procedure#George Papanicolaou#Herpes#High-grade squamous intraepithelial lesions (HSIL)#human papillomavirus#Low-grade squamous intraepithelial lesions (LSIL)#Pap smear#Papanicolaou smear#ThinPrep#Trichomonas vaginalis#vaginal speculum

1 note

·

View note

Photo

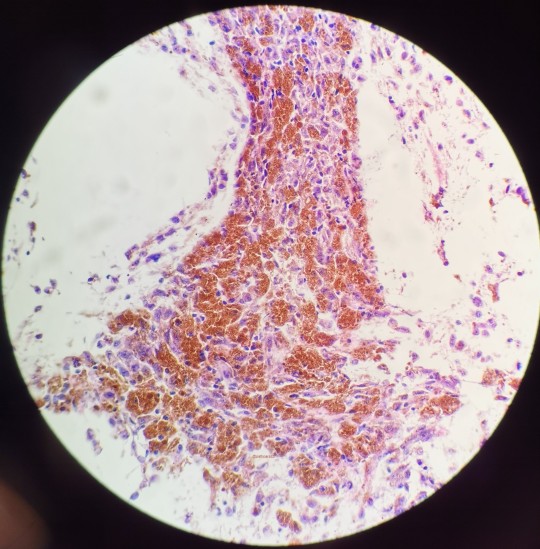

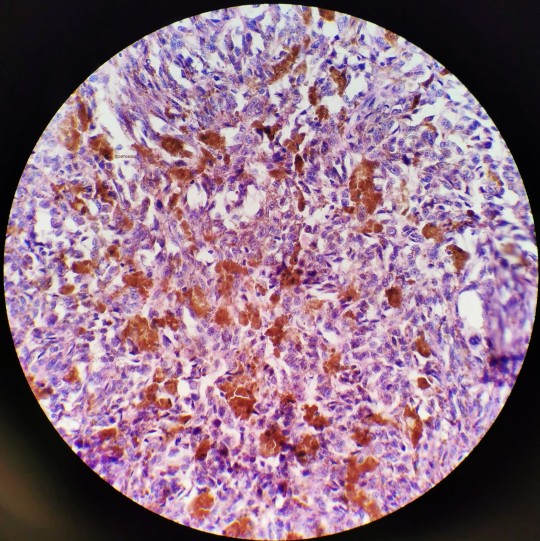

I believe all three of these images belong to the same case I had as a cyto fellow.

This is a pretty slam dunk case of melanoma that had metastasized to the hilar lymph nodes. I remember my attending asking for the history before he saw the slide, to which I told him to just look. Naturally, you’d want to make sure that it isn’t just hemosiderin but given the history of melanoma in the patient’s chart, no stains were needed. Sad case though.

0 notes

Text

Performing a Pelvic Exam

Preparation

First, elevate the head of the exam table to 30 to 45 degrees and assist the patient in placing her heels in the footrests, adjusting the angle and length as needed.

Carefully cover the patient's abdomen and legs down to her knees with a sheet.

Ask patient to slide down to the edge of the table and relax her knees outward just beyond the angle of the footrests.

External inspection and palpation

Look for any redness, swelling, lesions or masses.

Inspect the labia, the folds between them, and the clitoris, paying attention to any redness, swelling, lesions, or discharge.

Speculum exam

Use a warm and lubricated speculum for the examination. (There is some controversy about whether gel-based lubricants distort cytologic assessment. For this reason, the speculum is lubricated with warm tap water or a thin layer of gel lubricant, avoiding the tip of the speculum. You should know what is recommended by the laboratory in your area.)

Inform the patient that you are about to begin the speculum exam.

Expose the introitus by spreading the labia from below using the index and middle fingers of the non-dominant hand (peace sign).

Insert the speculum at a 45-degree angle, pointing slightly downward being careful to avoid contact with the anterior structures.

Once past the introitus, rotate the speculum to a horizontal position and continue insertion until the handle is almost flush with the perineum.

Open the "bills" of the speculum 2 or 3 cm using the thumb lever until the cervix can be visualized between the bills.

Obtaining a Pap Test

In this example, the sample is obtained using an extended tip spatula and then a cytobrush. There are also several other collection devices commonly used in practice.

First, the spatula is rotated several times to obtain a sample from the ectocervix. The cytobrush is then inserted into the os and rotated 180 degrees.

Care is taken to make sure that the squamo-columnar junction (the area of the endocervix where there is rapid cell division and where dysplastic cells originate) is adequately sampled.

The sample is then placed into a liquid medium.

Using the liquid-based system over the conventional Pap smear technology allows for later testing of the sample for the presence of human papilloma virus (HPV) if the Pap comes back abnormal.

Currently two liquid-based systems are approved by the FDA. You should check with your lab to find out which system is preferred.

Once the sample is obtained, let the patient know the speculum is about to be withdrawn.

Then, withdraw the speculum slightly to clear the cervix, loosen the speculum and allow the "bills" to fall together, and continue to withdraw while rotating the speculum to 45 degrees.

Two Methods of Obtaining Cytological Specimens

In a conventional Pap smear, cells are obtained from the ectocervix by using an Ayers spatula and the endocervix by using a cytobrush. The specimen is then rolled (cytobrush) and smeared (spatula) onto a slide and then rapidly fixed to prevent air-drying. A single slide is used for both the ectocervical and endocervical samples. In the newer liquid-based systems, the sample is collected in a similar fashion, except an extended tipped plastic spatula is recommended along with the cytobrush.

The sample is obtained using the broom-like device alone or both the extended tip spatula and then a cytobrush. The samples are then quickly placed into an alcohol based preservative solution. There are currently two liquid based systems approved by the FDA; the ThinPrep system and the Sure Path system. Both liquid based systems appear to be as good as, or better than, conventional technology in diagnosing intraepithelial lesions and for obtaining adequate specimens. The liquid-based technology has the advantage of being able to co-test for HPV.

Performing a Bimanual Exam

Screening for ovarian cancer with a bimanual exam is not recommended, however this is the technique you would use should you need to do the exam for a symptomatic patient.

First, explain to your patient what you are going to do.

Next, apply lubricant (e.g., K-Y jelly) to the index and middle fingers of your non-dominant gloved hand and insert them into the patient's vagina.

Move cervix side to side (laterally) to ensure that it is non-tender and mobile.

Place your non-gloved hand [I’d recommend wearing gloves on both hands] on the abdomen just superior to the symphysis pubis, feeling for the uterus between your two hands. This gives you an idea of its size and position.

Then, moving your pelvic hand to each lateral fornix, try to capture each ovary between your abdominal and pelvic hands. The ovaries are usually palpable in slender, relaxed women, but are difficult or impossible to feel in obese women.

Cervical Cancer Screening Guidelines

In 2012, the American College of Obstetrics and Gynecology (ACOG), the American Cancer Society (ACS), American Society for Colposcopy and Cervical Pathology (ASCCP) and USPSTF came to a consensus on cervical cancer screening.

The guidelines recommend that:

At age 21: cervical cancer screening should begin.

Between ages 21 and 29: screening should be performed every three years.

Between ages 30 and 65: screening can be done every five years if co-tested for HPV (preferred) or every three years with cytology alone (acceptable).

However, they stipulate that certain risk groups need to have more frequent screening. They include women with compromised immunity, who are HIV positive, have a history of cervical intraepithelial neoplasia grade 2, 3 or cancer, or have been exposed to diethylstilbestrol (DES) in utero (DES is a nonsteroidal estrogen that was given to pregnant women to prevent miscarriages. However, it was linked to clear cell adenocarcinoma of the vagina and was discontinued in 1971).

Women older than 65 years who have had adequate screening within the last ten years may choose to stop cervical cancer screening. Adequate screening is three consecutive normal pap tests with cytology alone or two normal pap tests if combined with HPV testing.

Women who have undergone a total hysterectomy for benign reasons do not require cervical cancer screening.

Sexual behaviors associated with an increased cervical cancer risk include:

Early onset of intercourse

A greater number of lifetime sexual partners

Other risk factors include:

Diethylstilbestrol (DES) exposure in utero.

Cigarette smoking, which is strongly correlated with cervical dysplasia and cancer, independently increasing the risk by up to fourfold.

Immunosuppression, which also significantly increases the risk of developing cervical cancer.

The Pap test generally shows one of the following:

-normal results

-low-grade squamous epithelial cells (LSIL)

-high-grade squamous epithelial cells (HSIL)

-atypical glandular cells of undetermined significance (AGUS)

-atypical squamous cells of undetermined significance (ASC-US)

ASC-US is considered an inconclusive pap test result that requires follow-up testing to determine appropriate patient management. An ASC-US Pap test result is often triaged by HPV testing when using liquid-based cytology.

Reflex HPV testing is easily performed as a follow-up test by utilizing residual cells from the liquid-based Pap test vial to test for the presence or absence of high-risk HPV.

3 notes

·

View notes

Photo

Keep calm and pap on! #GIANTmicrobes #stds #stis #gettested #healthywomen #safesex #condoms #hpv #syphilis #chlamydia #gonorrhea #herpes #humanpapillomavirus #happy #giantmicrobesplush #vagwhisperer #dnpmere #drmeredith #womenshealth #gynexam #gardisil #papillex #dnpmom #drmeredith #drmere #drmerry #thinprep

#womenshealth#papillex#vagwhisperer#drmere#herpes#syphilis#giantmicrobes#thinprep#chlamydia#happy#healthywomen#hpv#dnpmom#drmerry#safesex#condoms#stis#gettested#humanpapillomavirus#gonorrhea#dnpmere#gardisil#drmeredith#gynexam#giantmicrobesplush#stds

0 notes

Text

Life Goes On Here in DC...

Had a nice time yesterday w/Edwina, who came over for take-out and Gin Rummy (she kicked my butt)

I got some test results back in my patient portal (see below), but I have no idea what they mean. I will wait to find out on the 7th. Yesterday I was out of breath alot, if it continues I’ll bring it up to my doctor.

Study Result

Narrative

Department of Pathology The George Washington University Hospital 900 23rd Street, NW Washington, DC 20037 Pathology Office Phone: 202-715-4665 Pathology Reports (by Component) ACCESSION: 55-CM-22-001351 COLLECTED DATE/TIME: 10/27/2022 15:42 EDT RESPONSIBLE PATHOLOGIST: M### MD, RECEIVED DATE/TIME: 10/28/2022 08:26 EDT Cytology Non-GYN Report - 10/31/2022 15:57 EDT - Auth (Verified) Diagnosis Urine: - Marked acute inflammation with reactive urothelial cells. - Hematuria. - Negative for high grade urothelial carcinoma. This report was electronically signed on 10/31/2022 15:57 PM I attest to the fact that I have personally reviewed the materials in this case and agree with the above interpretation. I## M## MD MD Specimen Source A. URINE CYT 1: URINE FOR CYTOLOGY CIT @ 1542 Clinical Information 64yo M with elevated PSA, microscopic hematuria and negative CT urogram. Gross Description Date specimen collected: 10/27/22 Date specimen processed: 10/28/22 Fluid received: Volume: 100ml (equally split) Color: golden Appearance: cloudy Number of Thinprep slides prepared: 1 pap Total number of slides per case: 1 Tech: as Microscopic Description A. Atypical urothelial cells seen as single cells and in groups with enlarged hyperchromatic nuclei, nucleoli and scant cytoplasm.

0 notes

Text

I'll start my blog with an oldie - I took this on my Huawei P30 Pro during fellowship. It's a ThinPrep and it's not often that you see a mitosis that actually has individual chromosomes. Usually they're in anaphase or telophase, so it's nice to see them relatively unspooled.

2 notes

·

View notes

Text

Meet The Company Offering An Innovative Medication-Free Approach To Better Pelvic Floor Health, Bringing Female Urinary Incontinence Out Of The Closet

Almost 50% of women over 50 live with urinary incontinence, research shows

getty

Urinary incontinence rarely gets our attention unless we have problems with it. It rarely gets attention unless there is a medical problem associated with it. Still, almost 50% of women over 50 live with it. What’s worse, 24% also suffer from stool loss known as fecal incontinence. While urinary incontinence is terrible and can limit activity, fecal incontinence has been linked to shame, social isolation, and higher rates from nursing homes.

There is, of course, a do-it-yourself treatment for urinary incontinence backed by medical data – Kegels: the pelvic floor exercises women are encouraged to do after giving birth. However, the data shows that only 25% of kegel enthusiasts get them right.

That’s why Renovia – the first digital health care provider to bring therapeutic and diagnostic devices to women with pelvic floor disease – has brought together some of the leading clinical and business leaders in women’s health to change the history of pelvic floor health.

Eileen Maus, CEO of Renovia

Renovia

“Our mothers and grandmothers have been told that leakage of urine or a sudden urge to walk that they cannot control is a normal part of aging or a necessary consequence of childbirth. Our generation – and depending on their age – our daughters, nieces and granddaughters still hear this message. Urinary incontinence is common – and has been normalized – but it is not normal, ”said Eileen Maus, CEO of Renovia. Maus is a healthcare veteran and femtech with more than 20 years of experience as a sales and marketing director in the healthcare industry.

Prior to Renovia, she was Chief Commercial Officer of Constitutional Medical Investors, a Warburg Pincus portfolio company acquired by Roche Diagnostic. In 1996, Maus was part of the Cytyc team that replaced the Pap smear with the FDA-cleared ThinPrep Pap test, which was the first improvement in cervical cancer screening in 70 years (another area of women’s health caused by 5,000 deaths ignored by cervical cancer) one year was “considered acceptable”).

The company’s first product is Leva Therapeutic – an FDA-cleared device, a small vaginal probe that can help women exercise their pelvic floor muscles to treat urine leakage. It combines a patented sensor and app technology that enables women to perform their pelvic floor muscle exercises correctly and consistently and without medication.

Renovia’s first product is Leva Therapeutic – an FDA cleared device, a small vaginal probe that … [+] can help women exercise their pelvic floor muscles to treat urine leakage.

Renovia

“Part of our mission is to educate women about this area of their health. For too long, insert and adult diaper manufacturers have tried to treat bladder problems as a normal part of a woman’s aging. We will change this narrative by providing better care and educating women. Women want education and information on how to meet the challenge of urinary incontinence. A healthy torso is not just about flat abdominal muscles, but about a healthy pelvic floor that keeps our bladder, uterus and rectum in place and functions optimally, ”explains Maus.

The Leva therapeutic is prescribed by a gynecologist, followed by guidance through the Leva app, then its use and compliance are supported by the Renovia Women’s Center, and progress reports are sent to the prescribing clinician. This full-stack approach is also based on science and evidence – Maus and her team are dedicated to clinical research and always work with leading research centers to build on their evidence. “We recently completed a large, multicenter clinical trial with great results. I can’t say more yet, but we’re thrilled with the result and can’t wait to publish the results later this year, ”added Maus.

It would be wrong to assume that the innovative process behind a device like Leva is short and simple. The first generation Leva device was invented a few years ago by Renovia’s clinical founder, a urogynecologist. This first-generation product shared the same sensor and app mechanism of action, but needed an improved form factor and a more interactive app – to support patient loyalty. Adhering to any treatment regimen is absolutely critical to improving symptoms, so the Renovia team worked hard to make the product more appealing, discreet and engaging.

“We launched the current generation of Leva therapeutic in the third quarter of 2020. Introducing a new prescription product in the midst of a pandemic has not been easy, but the response from patients and prescribers has been tremendous. With patients between the ages of 20 and the mid-80s, it is clear that we are offering something innovative in an environment that is ripe for disruption. “

With more than $ 70 million in funding to date, Maus can’t look to the future any more excitedly: The company will expand its sales, conduct more clinical trials, and develop new FDA-cleared indications for Leva in pelvic floor health.

“I think 2020 showed how flexible, adaptable and resilient women are. Women have taken everything the pandemic threw on them and grown bigger. However, women have also borne a disproportionate share of the socio-economic impact of the pandemic and continue to take care of everyone else first. So each of us has to think about the future. We need to take the time to make sure we are as healthy as possible in the future, and pelvic floor health should be part of that plan, ”concludes Maus.

source https://dailyhealthynews.ca/meet-the-company-offering-an-innovative-medication-free-approach-to-better-pelvic-floor-health-bringing-female-urinary-incontinence-out-of-the-closet/

0 notes

Text

Mối liên quan giữa virus HPV và bệnh ung thư cổ tử cung Update 06/2021

Bài viết Mối liên quan giữa virus HPV và bệnh ung thư cổ tử cung Update 06/2021 được chia sẻ bởi website Blog-Health #bloghealth #suckhoe #lamdep #sinhly

Ung thư cổ tử cung là loại bệnh nguy hiểm nhất khi nhiễm HPV ảnh hưởng nghiêm trọng đến sức khỏe sinh sản, gây tử vong cao ở phụ nữ.

1. Mối liên quan giữa virus HPV và Ung thư cổ tử cung

Một trong những nguyên nhân lớn nhất gây ra ung thư cổ tử cung là do nhiễm trùng dai dẳng hay mãn tính với nhiều chủng virus gây u nhú và virus HPV là nhóm có khả năng gây ra ung thư cao nhất.

Chủng HPV 16 và HPV 18 là 2 chủng có khả năng gây ung thư cổ tử cung cao nhất, chúng được tìm thấy ở 70% trong tất cả các trường hợp ung thư cổ tử cung. Các chủng khác như HPV 31, 33, 45 và 58 có khả năng gây ung thư thấp hơn và gây bệnh ở các vùng khác nhau. Hai chủng HPV 6 và HPV 11 không gây ung thư nhưng lại là nguyên nhân chính gây ra mụn cóc ở vùng sinh dục.

Nguy cơ nhiễm virus HPV phổ biến ở cả nam và nữ đã có quan hệ tình dục, ở những người có nhiều bạn tình, có quan hệ tình dục với nhiều người. Phụ nữ trẻ trong độ tuổi dưới 25 là nhóm người có nguy cơ nhiễm virus HPV cao nhất. Nguy cơ nhiễm virus HPV sẽ giảm dần theo độ tuổi.

Virus HPV có liên quan mật thiết đến bệnh ung thư cổ tử cung

2. Virus HPV gây ra ung thư cổ tử cung nhanh hơn khi nào?

Mặc dù HPV có nguy cơ cao dẫn đến ung thư cổ tử cung nhưng hầu hết phụ nữ bị nhiễm loại virus này thường không phát triển thành ung thư. Chúng sẽ phát triển nhanh chóng thành tiền ung thư hoặc ung thư xâm lấn nếu có thêm các yếu tố khác tác động, bao gồm:

Các yếu tố liên quan đến sự lây nhiễm HPV:

Gồm các loại virus.

Cùng lúc nhiễm nhiều chủng HPV gây ung thư.

Số lượng virus trong cơ thể nhiều.

Các yếu tố liên quan đến cơ địa từng người đó là tình trạng suy giảm miễn dịch do bị HIV. Những trường hợp này HPV sẽ dai dẳng hơn, tiến triển nhanh hơn tới ung thư.

Các yếu tố bên ngoài:

Những người hút thuốc lá.

Cùng nhiễm HIV hoặc các bệnh lây nhiễm qua đường tình dục.

Những người sử dụng thuốc tránh thai trong thời gian dài (trên 5 năm).

Sử dụng thuốc tránh thai trong thời gian dài gia tăng nguy cơ gây bệnh

3. Ung thư cổ tử cung có chữa được không?

Ung thư cổ tử cung càng để lâu thì khả năng chữa khỏi càng thấp. Do vậy các chuyên gia khuyến cáo rằng, các bé gái có độ tuổi từ 9 - 26 tuổi, những phụ nữ chưa lập gia đình, chưa quan hệ tình dục nên ��i tiêm vắc xin phòng ngừa virus HPV.

Những người đã có quan hệ tình dục, đã có gia đình từ 21 - 65 tuổi thì cần khám sức khỏe định kỳ 12 tháng/lần. Bên cạnh đó cần tự biết cách bảo vệ sức khỏe của bản thân bằng cách có lối sống lành mạnh, không quan hệ tình dục với nhiều người. Luôn vệ sinh vùng kín sạch sẽ vào các thời điểm nhạy cảm như thời gian hành kinh, sau hành kinh, sau vận động thể lực, sau quan hệ tình dục.

Đặc biệt với nữ giới không nên hút thuốc lá, phải có chế độ dinh dưỡng hợp lý. Nên có nguồn dinh dưỡng giàu vitamin và các khoáng chất cho cơ thể.

Biện pháp được coi là hiệu quả nhất trong việc phòng ngừa ung thư cổ tử cung hiện nay đó là sàng lọc ung thư cổ tử cung. Các chuyên gia bác sĩ khuyên rằng phụ nữ đã có quan hệ tình dục nên đi xét nghiệm tầm soát và phát hiện sớm ung thư phụ khoa. Khi phát hiện sớm những dấu hiệu bất thường sẽ có biện pháp điều trị kịp thời tránh những hậu quả nghiêm trọng.

Tại Bệnh viện Đa khoa Quốc tế Vinmec hiện nay đang áp dụng gói sàng lọc và phát hiện sớm ung thư phụ khoa được rất nhiều khách hàng tin tưởng lựa chọn. Đặc biệt, tại Vinmec phương pháp được sử dụng ở đây là xét nghiệm Thinprep Pap Test - một phương pháp hiện đại nhất hiện nay trong việc phát hiện ung thư sớm. Được sử dụng rộng rãi ở các nước phát triển trên thế giới như Mỹ, Nhật Bản, các nước khu vực Châu Âu.

Với đội ngũ chuyên gia bác sĩ giàu kinh nghiệm chuyên môn cùng phương pháp hiện đại và các thủ thuật đảm bảo vô khuẩn giúp cho kết quả thăm khám chính xác nhất. Bác sĩ sẽ tư vấn và có các khuyến cáo cụ thể với riêng trường hợp của từng bệnh nhân.

Để được tư vấn trực tiếp, Quý Khách vui lòng bấm số HOTLINE hoặc đăng ký trực tuyến TẠI ĐÂY. Ngoài ra, Quý khách có thể Đăng ký tư vấn từ xa TẠI ĐÂY

source https://blog-health.com/moi-lien-quan-giua-virus-hpv-va-benh-ung-thu-co-tu-cung/

0 notes

Text

Global Tissue Imaging Market – Analysis and Forecast (2020-2025)

The global tissue imaging market is anticipated to reach 27.3 billion USD by 2025, up from an expected 14.3 billion USD in 2020 at 8.3% CAGR for the said period. This growth of the tissue imaging market can be said, would be a result of factors such as raising application in infectious diseases, oncology, neurological diseases, immunological diseases, and cardiovascular diseases; increasing chronic disease incidence, increasing incidence of infectious diseases, rising healthcare spending, and the demand for early detection of diseases. However, in the coming years, the high costs associated with some tissue imaging systems could hamper the growth of the market.

For Free Sample Report- https://www.vynzresearch.com/healthcare/tissue-imaging-market/request-sample

DRIVERS

Increasing occurrence of disorders inciting tissue imaging usage along with Digital device integration with Imaging Technologies and decent shifting attention to the value-oriented model of healthcare are some of the vital drivers of the global tissue imaging market. The GelDoc Go Imaging System was introduced by Bio-Rad Laboratories, Inc. to record protein colorimetric bolts, gels & nucleic acids, and stain-free gels & bolts.

In 2019, Hologic received CE approval for ThinPrep Genesis Processor.

Roche (Switzerland) is one of the key players in the market for tissue diagnosis. The organization has a large product range across the world. The firm has retained its leading position in the sector over the years.

OPPORTUNITIES

• Analytics Adoption and Artificial Intelligence in Diagnostic Imaging. • High potential for growth in innovative novel technologies: technology for spatial transcriptomics. • In identifying patients with elevated cardiovascular complication risks, direct visualization/imaging of diseased tissues is helpful, allowing physicians to provide personalized risk-based care. • Strategic alliances offer a way to strengthen creativity and market supremacy.

COMPETITIVE ANALYSIS

Synergistic practices such as alliances and collaborations are primarily favored by the leading contributors to the global tissue imaging market to improve their operations across the globe and to boost their respective dominance. In addition to it, many industry leaders partner with start-ups focused on innovations or with emerging players to acquire technology expertise.

Some of the Key Players are:

• Abcam PLC • Bio-Rad Laboratories • Becton, Dickinson, and Company • Fluidigm Corporation • Abbott Laboratories • Agilent Technologies • Biocare Medical • Danaher Corporation • F. Hoffmann-La Roche Ltd. • Nikon Corporation • Roche (Switzerland) • Danaher (US) • Thermo Fisher Scientific (US) • Abbott (US) • Agilent Technologies (US) • ABCAM (UK) • Merck KGAA (Germany)

Among others are:

• BD (US) • Hologic (US) • Bio-Rad (US) • Biomeriux (France) • Sakura Fientek Japan (Japan) • BioSB (US), Biogenex (US) • Cell Signaling Technology (US) • Histoline Laboratories (Italy) • Slee Medical GMBH (Germany) • Amos Scientific Pty Ltd (Australia) • Jinhua Yidi Medical Appliance Co.Ltd (China) • Medite GMBH (Germany) • Cellpath Ltd(UK) • Dipath S.P.A. (Italy)

For Customization Request - https://www.vynzresearch.com/healthcare/tissue-imaging-market/customize-report

VynZ Research

Call: +91-996-028-8381

Toll Free (U.S. and Canada): +1-888-253-3960

Email: [email protected]

Web: https://www.vynzresearch.com

Connect with Us: LinkedIn | Facebook | Twitter

VynZ Research is a global market research firm offering research, analytics, and consulting services on business strategies. We have a recognized trajectory record and our research database is used by many renowned companies and institutions in the world to strategize and revolutionize business opportunities. The company focuses on providing valuable insights on various technology verticals such as Chemicals, Automotive, Transportation, Energy, Consumer Durables, Healthcare, ICT, and other emerging technologies. READ MORE…

0 notes