#Theater Market Revenue

Explore tagged Tumblr posts

Text

Top Trends Shaping the Theater Industry Share in 2024

The world of theater, a timeless form of artistic expression, has faced numerous challenges and transformations over the centuries. From the grandeur of ancient Greek amphitheaters to the intimate settings of modern black box venues, theater has continually evolved to reflect societal changes and technological advancements. In recent years, particularly post-pandemic, the theater industry has witnessed a significant resurgence, embracing change and innovation to captivate modern audiences.

Latest Trends and Statistics

1. Post-Pandemic Recovery: The COVID-19 pandemic had a profound impact on the theater industry, with many theaters worldwide shutting down temporarily or permanently. However, as restrictions have lifted, the industry has shown remarkable resilience. According to the Broadway League, Broadway theaters in New York City experienced a 92% increase in attendance in the 2022-2023 season compared to the previous year, signaling a robust recovery .

2. Embracing Digital Platforms: Theater companies have increasingly adopted digital platforms to reach a wider audience. The National Theatre in London reported that its NT at Home streaming service attracted over 13 million viewers globally in 2023, a significant increase from previous years. This shift to digital has made theater more accessible, breaking geographical barriers and offering performances to those who might not have had the opportunity to attend in person .

3. Diversity and Inclusion: There has been a growing emphasis on diversity and inclusion within the theater community. In 2023, 45% of Broadway shows featured leading roles played by actors of color, up from 28% in 2019. This shift reflects a broader societal push towards representation and equity in the arts .

4. Innovative Productions: Innovation in theater production has reached new heights with the integration of advanced technologies. The use of augmented reality (AR) and virtual reality (VR) has enhanced storytelling, offering immersive experiences to the audience. A recent survey by the International Association of Theatrical Stage Employees (IATSE) found that 60% of theaters are exploring the use of AR and VR in their productions .

5. Financial Performance: Despite the challenges posed by the pandemic, the financial performance of theaters has shown improvement. In 2023, the global theater market was valued at approximately $40 billion, a 15% increase from the previous year. This growth is attributed to both a return to live performances and the monetization of digital content .

Conclusion

The theater industry is experiencing a dynamic resurgence, marked by increased attendance, technological innovation, and a commitment to diversity and inclusion. The post-pandemic recovery has highlighted the resilience of theaters and their ability to adapt to changing circumstances. The integration of digital platforms and advanced technologies has expanded the reach and appeal of theater, making it more accessible and engaging for modern audiences.

#theater market#movie theater market#movie theater industry#theater industry#theater industry research reports#movie theater market research reports#theater market size#theater market research reports#theater market top players#global theater market#theater market revenue#movie theater industry research reports#theater market share#theater market growth#theater market companies#theater market trends#global theater industry#theater market challenges#theater market future outlook#movie market size#global movie market#cinema industry revenue#cinema market market#Saudi Arabia Movie Theater Market Outlook#Saudi Arabia Movie Theater Market#Saudi Arabia Movie Theater Industry#Saudi Arabia Movie Theater Sector#Saudi Arabia Theater Industry#Saudi Arabia Theater Market#Saudi Arabia Theater Sector

0 notes

Text

Global Theater Industry Trends, Players, and Future Projections

The magic of the silver screen endures, and the theater market continues to captivate audiences globally. In 2024, the industry is not just surviving but thriving, navigating challenges and evolving with the times. Let's take a deep dive into the current state of the theater market, examining its size, growth trajectory, notable trends, key players, and future outlook.

Market Size and Growth:

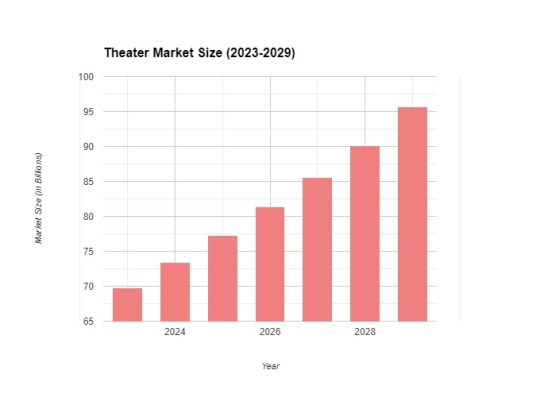

As of 2023, the theater market was valued at an impressive USD 69.78 billion. it is set to reach a staggering USD 95.66 billion in 2029, reflecting a robust compound annual growth rate (CAGR) of 5.24%. Despite the surge in home entertainment options, the theater market is evidently expanding.

Technological advancements, including 3D, 4DX, and IMAX, contribute significantly to this growth. These innovations provide audiences with a more immersive cinematic experience, attracting those seeking a break from the ordinary. Rising disposable income, particularly in developing regions, further fuels the growth, allowing audiences to indulge in leisure activities such as moviegoing. The popularity of blockbuster releases also plays a pivotal role, with audiences flocking to theaters to witness the grandeur of big-budget franchises.

Theater Market Trends:

The global theater industry is witnessing several trends that are shaping its future:

Focus on Premium Experiences: Theaters are differentiating themselves by emphasizing premium formats such as luxury recliners, in-seat dining, and personalized services, offering a unique experience not easily replicated at home.

Experiential Marketing: Creative marketing strategies are employed to generate excitement around films. Interactive events, themed concessions, and engaging social media campaigns are becoming integral to the moviegoing experience.

Evolving Distribution Models: The traditional windowing system, where movies are exclusively released in theaters before hitting streaming platforms, is undergoing changes. Studios are experimenting with different release strategies, impacting traditional theater attendance.

Theater Market Players:

Key players dominate the theater market:

AMC Entertainment Holdings, Inc.: The largest movie theater chain globally, boasting over 900 theaters across 11 countries.

Cinemark Holdings, Inc.: A major player with a strong presence in the United States and Latin America.

Comcast Corporation: Owner and operator of the Universal Pictures movie studio and various theater chains under the NBCUniversal umbrella.

The Walt Disney Company: Operates Walt Disney Studios Motion Pictures and owns several theater chains, including Disney Theatres.

Theater Market Research Reports:

Understanding the theater market necessitates insights from research reports, providing:

Market Size and Growth Forecasts: Offering a comprehensive snapshot of the current market state and predicting its trajectory.

Consumer Trends: Identifying audience preferences and evolving behaviors, aiding businesses in adapting their offerings.

Competitive Landscape: Analyzing the strengths and weaknesses of key players, enabling businesses to develop effective competitive strategies.

Prominent research firms publishing reports on the movie theater market. These reports are indispensable for investors, businesses, and stakeholders seeking a nuanced understanding of the theater market.

Theater Market Outlook:

While the theater market faces competition from streaming services, the allure of a unique social and immersive experience remains strong. With increasing disposable income, technological advancements, and strategic marketing initiatives, the industry is poised for continued growth. The ability to adapt to changing consumer preferences and distribution models will be crucial for the theater market's long-term success. The flickering flame of the theater market continues to burn bright, promising a compelling future amid the evolving entertainment landscape.

#Theater Market Research Reports#Theater Market Future Outlook#Leisure and Entertainment Market#Leisure and Entertainment Industry#Entertainment and Media market#Theater Industry research reports#Global Theater Market#Global Theater Industry#Cinema Market#Cinema Industry#Cinema Market Research Reports#theater market#movie theater industry#movie theater market#movie market size#theater industry#cinema industry revenue#Theater Market Challenges#Theater Market Companies#Theater Market Top Players#Theater Market Growth#Theater Market Revenue#Theater Market Trends#Theater Market Share#Theater Market Size#movie theater industry research reports#movie theater market research reports

1 note

·

View note

Text

WonderGirls: Ch. 1

Summary: Daisy Johnson is cast in her first big starring role as a superhero in a Wonder comic-book action film after her long-running TV show ends. She's out as bisexual in the industry and to her show's devoted fanbase, but it's hardly newsworthy in comparison to the A-list celebrity stardom of her idol-turned-new-costar, Carol Danvers. America's Sweetheart has a secret and she's under a lot of pressure to keep it that way as Wonder Studios tries to market their characters as love interests for Pride clout without infuriating the haters and bigots. Will rainbow capitalism land on their side toward real progress or will fear win out over love, both in the movie and behind the scenes?

Read on Ao3

---------------------

“Cut!”

Daisy relaxed as the director conferred with the assistants. It was their third straight day of shooting and Daisy still hadn’t met her co-star in this superhero film, aside from a group Zoom for script read-throughs. Carol Danvers, a gorgeous blonde bombshell, was a Hollywood darling of the moment with her previous work on a historical romance, an all-female Top Gun remake, a beloved sci-fi instant cult classic, and a charming family-reunited comedy. Daisy, however, had spent the last decade in a spy TV series. She was grateful for her big break going on so long, of course, but it was time to show she had more to offer as an actress than being the IT-geek-turned-action-hero sidekick. The TV show writers had eventually given her more than teen genius comedic relief lines as she had grown into a young adult, but as sad as she was to say goodbye to the cast that had become a family, it was time to spread her wings.

Her action scenes in the spy show had landed her a spot in the next big superhero film, WonderGirls, from the Wonder comic-book movie franchise. She was playing one of the four titular girls and Carol played another. Specifically, Carol’s character and her own were supposed to fall in love, in a groundbreaking, much-hyped will-they-won’t-they romance. Wonder had limited the script to a vague love confession and embrace so they could still distribute the movie overseas where a sapphic storyline would be frowned upon or even banned completely.

Instead of “taking five” and drinking expensive bottled water alone on set between awkward stunts, Daisy had wanted to ask Carol how she felt about it, both the scene and the politics of it. And she wanted to strategize for their promo tour during Pride month next year, designed to turn the film into a lauded progressive summer blockbuster without losing any international revenue.

But so far all Daisy had done was train with a personal trainer from the studio and her stunt double, attend script readings with the whole cast, and film flying scenes in a harness in front of a green screen. Her character didn’t technically have the power of flight the way Carol’s character did, but she could jump high enough that it resulted in a similar effect, so only one of them could use the harnessed set at a time. Daisy was scheduled first for everything since she was now technically otherwise unemployed with the conclusion of her TV series and Comic-Con behind her. She had her own diehard fans at the cons, but even she hadn’t been able to get close to Carol’s panel and signing table. She’d barely glimpsed her future co-star before Carol was swept off to another studio to shoot a promo for her latest family comedy, coming soon to theaters.

Between brand deals, international film festivals, promo spots, and only the most prestigious con panels, Carol had been wrapping late reshoots and starting her press tour. Daisy, meanwhile, had come home to an empty house after a very emotional trip to San Diego full of closure and ice cream. And she didn’t know what to do next. Scripts from her agent started to come in after a few days, but the parts for moms (she was only 28!) and eye-candy love interests of male main characters depressed her, and the parts for spy/crime show tech support felt too type-casted.

This part, a WonderGirl, seemed too good to be true. Not just a sexy side character or a quirky support role, but a film starring hero. It was somewhat familiar with the action, yet also totally different, a broader audience, and a chance to inspire queer girls everywhere. And, of course, working with Carol Danvers was a huge draw. Daisy might have had a bit of a celebrity crush on her, if it were cool for celebrities to have crushes on bigger celebrities.

More importantly, her career was not dead—despite having to hang in the air from a wire while pretending to be unconscious from the blast of a villain’s weapon, all of which would be added in postproduction.

At the end of the day, Daisy grabbed some pizza from craft services and headed back to her trailer to eat dinner alone and study her lines. She had one night shoot scene tonight and then she could go home. And then back to the studio again early in the morning for more.

—------------------------

Carol Danvers was exhausted. She was constantly surrounded by people telling her she was running late, needing more things from her, and trying to get her to sign pieces of paper or pose for a photo. The fans were not the exhausting part so much as just the general busyness of it all. The lights flashing and the international flights and the relentless pace of everyone’s success and futures riding on her.

It was her name on the billboards, her face on the latest issues of all the magazines, but in reality, she had a team of people financially depending on her ability to charm and impress.

Today’s New York rain had slowed down the day considerably, plus mobs of press and fans. Her agent, publicist, assistant, and bodyguard worked together to keep everything on schedule for today’s photo shoots and publicity videos and more, but some things couldn’t be helped.

“Shoots on WonderGirls start tomorrow,” her assistant reminded her as the small entourage ducked into a restaurant they knew would keep out the paparazzi.

“Yeah, I have some concerns about the script,” Carol admitted. They were seated and confirmed their “usuals” would be fine. “It’s not so much what’s there as what… isn’t.”

Her publicist sighed. “You have that look. The one where you’re about to get serious with unserious people. It’s Wonder. It’s comic book movies. Don’t overthink it.”

Carol frowned in thought. “But they are trying to make it a breakthrough film for queer representation. That’s how they pitched it to me. So, where is it? Where’s the queer scenes or lines?”

“I’ll talk to my people at Wonder,” her agent promised. “I’ll see what we can do to make it more explicitly stated, but I don’t know that they can push it much more between the protests of Concerned Moms for American Values and the political climate, especially in the international market right now…”

The waiter brought out some champagne samples for them to try and approve for Carol’s official endorsement. As he passed out the glasses, he explained each brand too fast for Carol to remember any of them and disappeared back into the kitchen.

As soon as he was gone, Carol’s agent kept talking, but Carol’s attention wandered. She looked around to the people who knew her best and realized that they were all her employees. She didn’t think of them like that. She thought of them as a team, and they were each the best in the business. But at the end of the day, this was a professional business dinner, not friends venting together without real-world consequences on the table. Even drinking champagne together was about a business decision.

So instead of unburdening her heart about what it was like to be “an open secret” and “Hollywood out” and being told now wasn’t the time to be visibly queer or that it would hurt box office sales to talk about LGBTQIA+ issues, she nodded along and ate her meal. By the time they finished, the crowd outside the restaurant had been driven away by pounding rain, and the entourage rushed to the waiting luxury SUV with dark coats held up and open like umbrellas to shield Carol and themselves from the worst of the storm.

As they drove back to their hotel to pick up their luggage and head to the airport, Carol watched the rain against the window and wondered what it would be like to twirl an umbrella in it as long as she wanted, maybe even to kiss a real girlfriend in real rain—not a male co-star with a practical effects machine dumping water on them.

Unfortunately, reality was not on the schedule. Tomorrow, she’d be back in LA and acting her way through the day, not just as her character but as the perfect, shiny, Hollywood star from dawn to midnight with coworkers who’d be doing exactly the same and then plotting her downfall behind her back. When she’d had her big break at 16, it hadn’t seemed so different from high school. Now at 30, boarding yet another red-eye flight, she was ready for a change.

#daisy johnson#carol danvers#aos#agents of shield#the marvels#captain marvel#daisy x carol#carol x daisy#wlw#sapphic fic#femslash#lesbian carol danvers#bisexual daisy johnson#skywriting#hollywood AU#actors AU#welcome to my new multichapter! Subscribe for updates on Ao3#short chapters to start with

9 notes

·

View notes

Note

Box office expetations are usually attached to the Production Budget (PB) of the movie.

*It End with Us: with a PB of $25 M., getting $340 M at the box office is a huge/unexpected success. This movie can't be compared to the following blockbusters.

*Twisters 2: with a PB of $155 M and getting $371 M. at the box office is a disappointment and probably not profitable. The first movie cost $92 M. and earned $495 M.

*Furiosa: with a PB $168 M and $174 M at the box office is a huge flop.

Then you have Uncharted, Budget $120 M, Box Office $407 M. : The critics reviews weren't good, dumped in february, compared to these movies released in the summer. Uncharted didn't have a proper press tour because of Covid was a thing again, some countries put limited seatings again in theaters, Tom was wearing mask, the movie didn't have a red carpet premiere. Against all odds the movie was a success.

Important to remember that the Production Budget doesn't include the marketing costs that are around 40-to 50% of the PB.

Some had said that because there are streaming revenues and VOD revenues, box office don't tell the complete story, but people has to remember that when studio spends millions in marketing is because they expect Box office results, movies that goes to streaming doesn't have weeks of promo and in different countries.

VERY good points Anon on all of this!👏🏾

Y'all are bringing out receipts and numbers! I love it lol 😆

And I do agree that the more it costs to make a movie, the more the studios hope (or are relying) on that film to be a success.

I actually think films should cost LESS to make (even if you have to cut some corners and do things on a cheaper budget) and then that way more films would be box office successes, and Hollywood would be gaining money instead of losing it.

But hey, what do I know? 🤷🏾♀️

9 notes

·

View notes

Text

Breaking Barriers: "Manjummel Boys" Captivates Tamil Nadu and Redefines Regional Cinema Success

Manjummel Boys Shatter Box Office Records in Tamil Nadu

The Malayalam cinema industry has reason to celebrate as the movie Manjummel Boys emerges as a sleeper hit, shattering box office records in Tamil Nadu. This motion picture, helmed by the proficient Soubin Shahir, has swiftly ascended beyond the illustrious 15-crore mark, underscoring its commercial success and audience appeal beyond linguistic barriers. Drawing crowds with its unique blend of humor and heartwarming narratives, Manjummel Boys showcases an impeccable ensemble cast, enacting a storyline that resonates with a wide audience. The film's triumph at the box office isn't just a win for the creators but also an indicator of the quality and potential reach of regional cinema.

Critical Acclaim and Audience Fervor

Critics have lauded Manjummel Boys for its engaging script and the superb performances by the cast, particularly celebrating Soubin Shahir's nuanced portrayal of his character. Audiences too have been swept up in the film's charm, flocking to theaters and sharing their praise on social media platforms, contributing to a robust word-of-mouth promotion that has undoubtedly played a role in the film's impressive box office journey. With such a potent mix of critical and commercial acclaim, the film has proven that content-driven cinema has the power to transcend regional boundaries and language differences, reaching into the hearts of movie-goers from all walks of life.

A Milestone for Regional Cinema

The runaway success of Manjummel Boys vindicates the dedicated efforts of regional filmmakers to craft universally appealing stories. The film’s earnings have set a new benchmark for Malayalam films within the competitive Tamil Nadu market, once dominated by local giants and occasionally Bollywood titles. The newfound fortunes at the revenue counters speak volumes of the shifting dynamics within the Indian cinematic landscape, where variety and relatability in storytelling are gaining unparalleled momentum. With the film industry often focused on star-studded vehicles, Manjummel Boys serves as a refreshing reminder that at the core of any successful movie is a good story, relatable characters, and the kind of authentic touch that resonates with viewers.

The Road Ahead

While it is still too early to predict the full extent of this film's impact, what's certain is that Manjummel Boys has carved a niche for itself, potentially opening doors for more films from the Malayalam industry to venture into and captivate adjacent markets. The film's performance is a testament to the timeless appeal of well-told stories and innovative storytelling techniques, coupled with potent marketing strategies. As Manjummel Boys continues its cinematic run, one thing is clear - the landscape of Indian regional cinema will never be the same again. In closing, this blockbuster from the south reminders creators and investors alike that good cinema knows no borders, and given the right platform, can leave a footprint in areas hitherto uncharted. As for movie enthusiasts, it's time to revel in the diverse cinematic experience that Manjummel Boys promises - a highlight in regional cinema's evolving storyline. Read the full article

5 notes

·

View notes

Text

I know there's all the Normal Factors regarding more movies being seen as theater flops these days - less people who can safely go to theaters due to the effects of an ongoing deadly pandemic, theaters jacking up ticket prices, anything that isn't an existing IP being treated as more and more of a risk and getting less marketing, even if it's the kind of film that typically does well - but I think The Fall Guy really demonstrates that standards surrounding theatrical releases have gotten absolutely insane. It's only been in theaters for 2 weeks and the studios are ready to cut their losses after a worse-than-expected opening weekend and are releasing the film to streaming services early.

Like, I know theaters start to pull films when they stop meeting a certain revenue threshold, I get that, I really do. But like. It came short of projections for opening weekend, but theaters haven't even started pulling it yet, it's still showing at every theater within an hour's drive of me, and that's at least 10 theaters. That means it's still making them money, which means people ARE seeing it, they just weren't prioritizing it because it wasn't The Next Big Blockbuster or whatever.

Like, are we seriously at a point where a film is declared a flop if it doesn't make back its budget and then some on just opening weekend? We can't wait until the end of the theatrical run? 4 weeks is too long these days? Like, is that seriously where we're at? We can't have faith that a movie based on a novel that sold well enough for its movie rights to be worth anything, an action comedy starring Ryan Gosling and Emily Blunt, with a classic "actor is suddenly expected to do their character role in real life to save the day" setup? We can't just wait and see if it makes its money back even at the global box office? Is that seriously where we're at?

3 notes

·

View notes

Text

Abigail has made only 28.5 million, it made it's budget back so it's a success right? No!

The marketing cost 30 million and theaters back roughly 50% of the revenue so it's only made about 16 million. And will need to make 116 million to be considered a success. It is a big flop

It's hilarious to me because Melissa stans kept saying it was gonna make more money than Scream 7 and look at what happened. Karma is a real thing.

4 notes

·

View notes

Note

No, they shouldn't because the math simply does not math. So, say the production budget is about 300M... that's before you tack on the budget for promo/advertising. For the big releases lately those campaigns are clocking in at about 200M(!) on their own. So, you're already in the hole HALF A BILLION DOLLARS US before you sell a single ticket. In order to make a profit off that you'd have to hope for about 1.5B in box office revenue, and that's simply not happening much these days. For instance, the leading money maker this year so far is still Dune part 2 with a worldwide box office take of $711M. It's getting harder and harder to break the 1B mark at the box office. //

Why are they continuing to make movies that cost this much then? Why aren’t they budgeting better? Is it to sell stocks?

I recently watched the documentary ‘MoviePass, MovieCrash’. For about half of the documentary, I screamed at my tv ‘how are they making money?? This makes no sense’. MoviePass was that subscription service back in 2018. Like $10 a month for unlimited movies at the theater. It made no sense how they could sell a monthly subscription service for a product they did not own. Especially because the math didn’t math: one time purchase of the product costed more than the monthly subscription. In the documentary they eventually get to the fact that the data of their subscriber base was very valuable and that they will use it to make profits by marketing products to their subscriber base. But then they did so bad. FINALLY, they get to the point: the value for profits wasn’t to sell movies to customers. It was to drive up the share price by faking they had a successful soon-to-be-profitable business to sell stocks instead, which is illegal to do so.

So based on watching this documentary recently, why are studios spending 300 million in production costs + 200 million advertising when the successful movies are only making about 700 million? That’s a huge risk for spending so much.

Is it because of merchandising and licensing deals help them to recoup the production costs? Anymore it feels like they make movies as commercials for merchandising and licensing. What’s your thoughts?

In the case of Gladiator 2, we do have to give the caveat that the production budget ballooned that much because of a fire on one of the filming sets, and the strikes that shut down production. To stop and start a film like that eats a lot of money and you have to add more in to get it going again.

And, while box office is very important, we're not seeing how much the production companies get paid for the streaming rights to films, or the residuals off that. I think that's where the money is these days.

3 notes

·

View notes

Text

one thing that happens when you get a little more literacy in a topic, is that when you see a monocausal explanation for a phenomenon, you realize that it's almost certainly wrong. in the case of disney studios, for example, one phrase that's often invoked to explain everything that's going on with the company right now is "go woke, go broke". people aren't showing up to the movies because they went woke. the streaming service is losing subscribers because they went woke. traffic to disney parks is down because they went woke, etc etc. the problem with doing everything either through the lens of disney's fight with ron desantis or their diverse cinematic releases is that it obscures all the market forces at play.

so, when bob iger cancelled a planned development plan in FL, that cost thousands of jobs and billions in planned spending, iger was pretty happy to let the press spin it one way or the other. truth is, iger hated the development and wanted to cut that out of the bottom line. or if you look at disney plus subscribers, they lost low revenue accounts in india because they didn't want to drop billions on cricket rights. and people love to point to the box office sales, but that's they're fault for poisoning the well and promoting disney plus so heavily and pivoting a lot to streaming over the pandemic and its aftermath. why would you spend $100 to take you and your family to a theater when it will be on disney plus, which you already pay for anyway, in a month and a half?

it just drives me nuts when all these facts are on the ground and yet still think their personal political preferences influence every business decision made in hollywood.

11 notes

·

View notes

Text

So I realize I'm late to talking about this, but...

Although I personally find Snow White (2024) to be just as pointless as all of the other recent Disney live action remakes -- even the ones I think have some value like The Little Mermaid (2023) -- I haven't hated everything I've heard about it. I really like Greta Gerwig's work overall -- I mean, heck, she worked on that recent Barbie movie that everyone's gone gaga for, and I also loved her take on Little Women. Gal Gadot is a striking choice for the Evil Queen. Even Rachel Ziegler herself I had no problem with, considering she previously was in the remake of West Side Story playing Maria, which means she has the vocal range to perform the role of Snow, unlike some of the other actors chosen to play the leads in these remakes. *side-eyes the hell out of Emma Watson, Dan Stevens, and Mena Massaud*

That being said...I hope Snow White (2024) does finally spark a real conversation about how to truly embrace a film's legacy. Because here's the thing -- there are issues one can point out with the original Snow White and the Seven Dwarfs that could be addressed in a new adaptation. The Prince is woefully underdeveloped as a character, to the point that the Dwarfs honestly are the real heroes of the story. You could give the Dwarfs more depth and backstory, so as to give the actors playing them more to work with. (As much as Peter Dinklage’s comments about the original Seven Dwarfs were controversial and arguably resulted in other actors with dwarfism being shut out of the parts, I would like to write roles that can really showcase these actors’ abilities outside of comedy, so they like Dinklage can score more roles besides just as fairy tale Dwarfs.) And Snow is a bit young to be thinking about a committed romantic relationship if she's truly 14, let alone a romance with a full-grown man.

Even with these critiques, though, the idea that this film is somehow antiquated and unrelatable to modern audiences because it came out in 1937 is just flat-out not true. This film has been re-released to theaters seven times since its initial release, oftentimes when Disney was in financial trouble. 1944? Used to raise revenue during WWII when Disney was only able to release pro-American propaganda projects. 1952? Three years before Walt's expensive Disneyland project was opened. 1958? One year before one of Walt's most expensive films, Sleeping Beauty, was released. 1967? One year after Walt's death and arguably the beginning of Disney's "Dark Age." 1983? In the midst of Disney's "Dark Age" -- it wouldn't release another animated film until two years later, and that film was The Black Cauldron. 1987? Once again in the midst of Disney's Dark Age -- Disney's hand-drawn animation studio was on its last legs, with its heroic release of The Little Mermaid still two years away. Even Snow White's final release in 1993 made it the very first film to be entirely scanned to digital, restored, and then re-recorded to film. And every single time it came back to theaters, this film made bank. It was profitable every single time, even after over fifty years. And this doesn't even touch the home video/DVD/Blu-Ray or streaming markets.

On a personal note, I recently unearthed an old home movie of myself at age three, on Christmas. I was so excited about one particular present I'd received that I wouldn't let go of it for a good chunk of the home movie. You want to know what that gift was? A VHS copy of Snow White and the Seven Dwarfs, which had only just been put out on home video two months prior. My mum presumes that I'd known Snow White only as one of our storybooks and/or as a CD, and I was so, so excited to finally get to watch the full movie. The following year at a dance recital, I was asked to talk about myself, and when asked about my favorite movie, I boldly said Snow White, and when I was asked who my favorite dwarf was, without skipping a beat I said, "Grumpy!" This is all -- for the record -- coming from a child who was never as much into romance as magic, music, and adventure and would eventually come out as asexual (though still romantic) as an adult. I certainly never saw the original Snow White as just being about waiting for a Prince or True Love's Kiss. I saw it as being about a girl who has to go through some really scary stuff, but gets through it by being kind and befriending creatures and people who help her, and the wicked woman who takes her jealousy out on her and ultimately pays the price for choosing cruelty over kindness. And I don't think I was the only one who saw the story that way.

I don't think there's necessarily anything wrong with taking a new angle on a classic story, let alone offering good-faith criticism to an older, classic film. But I think the best way to honor Snow White's legacy is not to just take the original film and rip it apart in order to prop up a "new and improved" version. I look at how Guillermo Del Toro's Pinocchio doesn't take pot-shots at Disney's Pinocchio, or how the multiple TV movie productions of Rodgers' and Hammerstein's Cinderella or the film Ever After don't take cheap shots at Disney's animated film. Sure, I think one would be foolish to act like those filmmakers weren't at least somewhat inspired by Disney's work in places -- the 1997 version of R&H's Cinderella was even produced by Disney -- but they still did their own thing, often taking a completely different direction than Disney's film in places, even despite any possible inspiration. They didn't try to copy Disney's work. They didn't try to "fix" these already beloved films. They just tried to stand on their own merits. They told the original story the way they wanted to tell it, with their own characters, plots, music, themes, and distinctive tone, rather than take someone else’s adaptation of the material and pick and choose what they wanted to copy from it so as to leech off that adaptation’s fanbase. And I truly wish more Disney "remakes" would do that, as opposed to taking these pre-established films and then either ripping them apart and putting them back together Frankenstein-style or adding a whole bunch of insubstantial, fluffy whipped cream to an already perfect sundae. Then maybe we could have two special, unique films to enjoy as two separate entities -- the way we can enjoy films like Disney's Peter Pan and Peter Pan (2003), or Tangled and Barbie as Rapunzel, or (most relevantly of all) Disney's Cinderella and Rodgers' and Hammerstein's Cinderella simultaneously -- rather than having to act like we're "fixing" or even "replacing" old classics that a lot of people still really love and Disney clearly doesn't want to stop marketing.

10 notes

·

View notes

Text

(Long Post, Sorry) Hitting Theater Hard: The Loss of Subscribers Who Went to Everything

The subscription model, in which theatergoers buy a season’s worth of shows at a time, had long been waning, but it fell off a cliff during the pandemic.

As a group of stagehands assembled train cars for the set of “Murder on the Orient Express,” Ken Martin looked grimly at his email. His first year as artistic director at the Clarence Brown Theater in Knoxville, Tenn., was coming to an end, and the theater had missed its income goals by several hundred thousand dollars, largely because it had lost about half its subscribers since the start of the pandemic.

“I’ve already had to tear up one show, because of a combination of cost and I don’t think it’s going to sell,” he said. “I’m in the same boat as a lot of theater companies: How do I get the audience back, and once I get them in the door, how do I keep them for the next show?”

The nonprofit theater world’s industrywide crisis, which has led to closings, layoffs and a reduction in the number of shows being staged, is being exacerbated by a steep drop in the number of people who buy theater subscriptions, in which they pay upfront to see most or all of a season’s shows. The once-lucrative subscription model had been waning for years, but it has fallen off a cliff since the pandemic struck.

It is happening across the nation. Seattle’s 5th Avenue Theater had 13,566 subscribers last season, down from 19,770 before the pandemic. In Atlanta, the Alliance Theater ended last season with 3,208, down from a prepandemic 5,086, while Northlight Theater, in Skokie, Ill., is at about 3,200, down from 5,700.

Theaters are losing people like Joanne Guerriero, 61, who dropped her subscription to Paper Mill Playhouse in Millburn, N.J., after realizing she only liked some of the productions there, and would rather be more selective about when and where she saw shows.

“We haven’t missed it,” she said, “which is unfortunate, I suppose, for them.”

Many artistic leaders believe the change is permanent.

“The strategic conversation is no longer ‘What version of a membership brochure is going to bring in more members,’ but how do we replace that revenue, and replenish the relationship with audiences,” said Jeremy Blocker, the executive director of New York Theater Workshop, an Off Broadway nonprofit that has seen its average number of members (its term for subscribers) drop by 50 percent since before the pandemic.

Why do subscribers matter?

“No. 1, it reduces your cost of marketing hugely — you’re selling three or five tickets for the cost of one,” said Michael M. Kaiser, the chairman of the DeVos Institute of Arts Management at the University of Maryland. “No. 2, you get the cash up front, which helps fund the rehearsal period and the producing period. And No. 3, subscriptions give you artistic flexibility — if people are willing to buy all the shows, some subset of the total can be less familiar and more challenging, but if you don’t have subscribers, every production is sold on its own merits, and that makes taking artistic risk much more difficult.”

There’s also a strong connection between subscriptions and contributions. “Most donors are subscribers,” said Maggie Mancinelli-Cahill, the producing artistic director of Capital Repertory Theater in Albany, N.Y., “so there’s a cycle here.”

Theaters are simultaneously trying to retain — or reclaim — subscribers, and also reduce their dependence on them. Many are experimenting with ways to make subscriptions more flexible, or more attractive, but also seeing an upside in the need to find new patrons.

Programming is clearly on the mind of lapsed subscribers around the country. Even as subscriptions have fallen sharply at regional nonprofits whose mission is to develop new voices and present noncommercial work, they have remained steadier at venues that present touring Broadway shows with highly recognizable titles.

“There’s so much going on with the ‘ought-to-see-this-because-you’re-going-to-be-taught-a-lesson’ stuff, and I’m OK with that, but part of me thinks we’re going a little overboard, and I need to have some fun,” said Melissa Ortuno, 61, of Queens. She describes herself as a frequent theatergoer — she has already seen 17 shows this year — but finds herself now preferring to purchase tickets for individual shows, rather than subscriptions. “I want to take a shot, but I don’t want to be dictated to. And this way I can buy what I want.”

But there are other reasons subscribers have stepped away, including age. “We’re all old, that’s the problem,” said Happy Shipley, 77, of Erwinna, Pa., who decided to renew her subscription at the Bucks County Playhouse, but sees others making a different choice. “Many of them don’t stay up late anymore; they’re anxious about parking, walking, crime, public transportation, increased need of restrooms, you name it.”

Arts administrators say that many people who were previously frequent theatergoers remain fans of the art form, but now attend less frequently, a phenomenon confirmed in interviews with supersubscribers — culture vultures who had multiple subscriptions — who say they are scaling back.

Lisa-Karyn Davidoff, 63, of Manhattan, subscribed to 10 theaters before the pandemic; now she is far more choosy, citing a combination of health concerns and reassessed priorities. “If there’s a great cast or something I can’t miss,” she said, “I will go.” Rena Tobey, a 64-year-old New Yorker, had at least 12 theater subscriptions before the pandemic, and now has none, citing an ongoing concern about catching Covid in crowds, a new appreciation for television and streaming, and a sense that theaters are programming shows for people other than her. “For many years, I’ve pushed my boundaries, and I’m just at a point where I don’t want to do it anymore.”

And Jeanne Ryan Wolfson, a 67-year-old from Rockville, Md., who had four performing arts subscriptions prepandemic, is just finding she likes an à la carte approach to ticket purchasing; she kept two of her previous subscriptions, dropped two, and added a new one. “I was paying a lot of money for the subscriptions, and some of the productions within those packages were a bit disappointing or might not have the wow factor I was looking for,” she said. “I think what I want to do is pick and choose.”

Martin said the Knoxville theater’s staff has spent much of the summer discussing the drop in subscriber numbers — the theater had about 3,000 before the pandemic, but 1,500 last season — and hired a marketing firm to study the situation.

Then comes “Kinky Boots,” the kind of uplifting musical comedy many of today’s audiences seem to want. (“Kinky Boots,” with a plot that involves drag queens, also makes a statement for a theater in Tennessee, where lawmakers have attempted to restrict drag shows.) There will be more adventurous productions, but in a smaller theater: “The Moors” by Jen Silverman, and “Anon(ymous)” by Naomi Iizuka.

But selling tickets show by show, instead of as a package, is challenging and expensive.

“It takes three times as much money, time and effort to bring in someone new,” said Tom Cervone, the theater’s managing director. He said the theater is trying everything it can — print advertising, public radio sponsorships, social media posts, plus appearances at local street fairs and festivals where the theater’s staff will hand out brochures and swag (branded train whistles to promote “Murder on the Orient Express,” for example) while trying to persuade passers-by to come see a show.

The theater, which is on the flagship campus of the University of Tennessee, is less dependent than some on ticket revenue, because, like a number of other regional nonprofits, it is affiliated with a university that subsidizes its operations. Still, the money it earns from ticket sales is essential to balancing the budget.

“It’s been scary some days,” Cervone said, “like, where is everybody?”

Michael Paulson is the theater reporter. He previously covered religion, and was part of the Boston Globe team whose coverage of clergy sexual abuse in the Catholic Church won the Pulitzer Prize for Public Service. More about Michael Paulson

#refrigerator magnet#for educational purposes only#theater#theatre#subscription model#stage#drama#demise of the american theater

4 notes

·

View notes

Text

The Strikes, and How the Studios Created This Mess On Purpose

A rant I made on Bluesky the other day:

Here's the thing about Hollywood's payment system: it was working for everybody, and executives saw streaming as a way to fuck everyone else over and make it work exclusively for them. Because that's what executives do. And they convinced everyone to take a bad deal to "test out" the new system.

Then, they threw everything into streaming and, in doing so, eviscerated traditional revenue streams like reruns and home video, both of which had better deals for talent. And they were hoodwinked by tech bros who convinced them the path to profitability was MUCH shorter than it is.

Now those execs, who went all in on streaming SPECIFICALLY as a predatory scheme to take more money, are crying poverty because they say it's a losing proposition. And they want people to take a bad deal to underwrite their recovery from self-inflicted wounds.

But at this point, the talent have been living with the previous bad deal for so long a lot of people are being starved out of the industry. So they strike for a fair deal, and what do execs say? "We're going to starve them for this!" You complete fucking CHUDs, what did you think you did before?

Okay, sorry. Got a little off-track there.

Yeah, numbers for streaming are ROUGH. Just like basically every tech startup in the last 15 years, most streamers are nowhere near profitable and living on the largesse of VC money with the promise that if they decimate the market enough that they're the only option, they'll start to make money...but that's really hard for your employees to believe or sympathize with, when they have seen you dump hundreds of millions of dollars into it for a decade. Executives insist they're the smart ones. Why would they throw good money after bad for YEARS?

Meanwhile, stockholders and VC douchebros have been rewarding the gamble for years, living on promises of "we'll be profitable soon" and approving massive CEO pay packages to reward them for finding a way to pay the talent less.

This is all exacerbated by the long history of "Hollywood accounting." Long before the strikes were happening, Ed Solomon was tweeting about the HIGH-larious joke Sony has been playing on talent for years that insists they somehow lost money on 'Men in Black' and so don't owe any residuals.

So when you see companies pouring tons of money into a system, and executives being handsomely rewarded for that system, but you aren't getting paid? Well, it's hard to believe it isn't profitable. After all, these same companies have said for years theaters aren't profitable. VHS isn't. DVD isn't.

This history of obscuring the numbers so that those at the top can sneak away with an ever-growing slice of the pie is epitomized by streamers that refuse to give anyone ANY kind of clarity when it comes to their numbers. There's only one reason to hide that kind of data, and people know it.

I think this is the end of my rant for now. I just feel like one of the things reporters have not done well is communicating clearly what's going on, and why they should care about white collar workers striking. The answer for me is, they're striking against employers who are stealing them blind.

5 notes

·

View notes

Text

Stone's indictment of the majors focuses on two types of crimes, which, to use his terms, might be divided into Thievery and Thuggery, although there seems to be some overlap. In the Thievery category is the formula the studios use to apportion the vast new millions that come from the videocassette market. The dastardly formula which perpetrates the thievery, Stone says, is called the "videocassette override."

"Major, major thievery," he says. "It's $12 million on [my film] Wall Street."

Twelve million dollars is a large sum to have been lost to "theft," even by Hollywood standards. I ask him how he calculated that.

"The majors declare that only 20 percent of a film's videocassette revenues are allocated back to the film's gross."

"I thought gross was gross," I say, relieved to have seen Speed-the-Plow.

Gross isn't gross when it comes to tape revenues because of the override formula, he says. "They keep 80 percent," which means that profit participants on the creative end—like the director and screenwriter, who start collecting only if the gross is massive—can end up shut out of the tape-revenue windfall. "They say they're treating videocassettes as a separate entity. It's been going on for years, but it's a complete misunderstanding of the way that videocassettes were originally supposed to be distributed. Wall Street's video revenues were more than $16 million in sales. They will allocate around $4 million. Ripping off $12 million." (Nick Counter, president of the Alliance of Motion Picture and Television Producers, calls this account "confused." He says that "the formula is an industrywide negotiated figure which is the minimum and can be negotiated higher. The economics of the marketplace—marketing costs and the like— have justified the formula.")

Stone calls the other category of crime committed by the cocksucker vampires at the major studios Thuggery: using monopolistic muscle to strangle the once promising growth of nonmajor independents and boutique studios such as Hemdale (which brought out Salvador and Platoon when no one else would). "It's an incredible struggle that's going on," he says. "It's very subtle. Critics don't pick up on it. In 1985-86, the independent films started to break through. The Salvadors, the Room with a Views, the Platoons."

He contends the majors reacted to this by increasing the quantity of the films they release, which resulted in the independents' being squeezed out, because they're locked out of distribution to movie theaters. "Hemdale, Cannon, Dino [De Laurentiis], all of them have been hurting. They're hurting because they can't get the theater time." (In fact, a recent Variety story confirmed a "screen crunch'' for indies, although collusion is another question.)

-Oliver Stone to Vanity Fair, January 1989 [x]

Commenting on the ongoing 11-week WGA strike, Stone suggested the roots of the current industrial action lie in the deal brokered to end the five-month writers strike in 1988. “There was a basic miscarriage of justice way back when, when Brian Walton was the head of the WGA, when we gave in. I wasn’t on the front line, but I supported that strike,” said Stone. “We gave in to the producers. They got away with murder on one of these deals where all that DVD money was deferred. They claimed they were in the hole, in the red, and that they had to get their money back from DVD. “I forgot what the percentage was, but they took something like the first 75% off the top. The DVD business was huge, especially for my films. So, the gross was never divided fairly.” Stone said this trend had continued with residuals and profits. “Not so much residuals, as profits really. Residuals are important for some of the writers who don’t make as much money. But people who do make money, they don’t touch the profits from the film, the studio does,” he said. “The studio is always telling you that they’re losing money, but they always find a way to make a new level of profit for 10, 15 years. … It’s that perpetual industrial problem with a capitalist group that pays its executives more and more money and screws the average writer.”

-Oliver Stone to Deadline, Jul 14 2023

#oliver stone#vanity fair#sag aftra strike#sag strike#wga strike#writers strike#then and now#residuals#profits

2 notes

·

View notes

Text

pg-13 got invented so you no longer had to choose between a "high school seniors and up" R and a "this better be acceptable for weird conservative parents taking their 10 year olds" PG

this took a while to shake out but it was very clear that the newly open space for "all teenagers can see this and most adults will too" was blatantly a profitable angle to go to

separately it got way easier and cheaper to issue "special unrated edition" versions of movies so that a studio could double dip with more mature audiences who'd buy the vhs/dvd/whatever uncut versions of an otherwise cut-down-for-pg-13 movie, which tons of people were willing to put up with.

lastly, total ticket sales in the domestic market peaked in 2002. that's also the high water market for box office earnings, inflation-adjusted, for all time - even tho nominal box office take has risen since 2002, it's risen slower than inflation the whole time, so theater attendance and revenue have been declining for 21 years now. every movie seeking wide release is in a consistently shrinking market with shrinking real revenue.

at the same time all of this is happening in the theatrical biz where you have to worry about ratings, we have the rise of first cable/satellite tv and then the internet as places where you can get sizable budgets, and can deal with subject matter that would be rated R or even nc-17 depending on your particular tv/streaming venue. you get increasing attention on film projects that mostly see festival/arthouse release before going home video, no wide release where ratings really interfere.

why bother having to push hard to get into the wide release market with a challenging film? you have so many other options for where that can go. that's why it's declined. heres a graph and a chart that illustrate the theater decline btw:

note that figures given for 2023 on both images are based on projections from how things have progressed so far this year, and since we're not even a full 2 months in they're currently pretty unreliable.

lets also examine the distribution of wide release movies at all:

the "big 6" (though of course now its really big 5, since disney bought fox) make up a decreasing amount of what actually comes to theaters each year.

the peak year for total wide release movies (since 1995 anyway, significantly more movies were released each year in the midcentury heyday) is 2007: 168 movies. 2022 saw 109 and 2023 is supposed to receive 118. even before the pandemic hit and cancelled/delayed a lot of releases, we were only getting 130 in 2019.

finally heres some random other stats:

despite R movies rarely topping the charts anymore, they do whole a solid second place. 2020 had a particularly outsized presence, since R rated movies were more likely to at least try for a presence in the greatly reduced operating times. Incidentally, it's the only year since before 1995 where an R rated movie was also the top in the box office for the year, with Bad Boys For Life!

We can also see that R rated films are the second most released type after not rated (not rated films are usually documentaries played at museums and the like, or foreign films). PG-13 films are less frequent but tend to sweep up the money. Traditional G rated films are increasingly rare, and PG films are kinda uncommon, even though they do make substantially more per film than R does.

Kinda interesting the spread between what movies they make the most of and what movies are more likely to make a lot of money, isn't it?

movies used to be rated R and make so much fucking money man what happened

6K notes

·

View notes

Text

Boost Your Popcorn Sales with Caramel Powder: Here’s Why

Popcorn is a universally loved snack that appeals to people of all ages. However, if you want to elevate your offerings and stand out in a competitive market, there’s a game-changing ingredient you might be overlooking: caramel powder for popcorn.

Whether you operate a grocery store, a specialty food shop, or even a movie theater, introducing caramel-flavored popcorn can give you a competitive edge. Here’s why caramel powder for popcorn could be the perfect addition to your store.

1. Simple, Convenient, and Consistent Caramel powder is incredibly easy to use. Unlike traditional caramel syrups, which require heating and careful attention, the powder simply needs to be sprinkled over freshly popped kernels. No special equipment is necessary��just a shaker, a little oil, and a few minutes. This ensures less mess, fewer steps, and consistent results, so your customers will always get an evenly coated, delicious snack.

2. Enhances the Flavor Experience Caramel popcorn is a classic favorite, thanks to its perfect balance of sweet and buttery flavors that complement the salty crunch of popcorn. By offering caramel powder, you provide customers with a quick and easy way to enjoy this irresistible treat without the hassle of making it from scratch. It’s the perfect solution to satisfy those craving a rich, caramelized popcorn snack.

3. Endless Flavor Possibilities Though caramel is a fan-favorite, caramel powder isn’t just limited to one flavor. It can serve as a base for creative popcorn blends. You can easily experiment by mixing it with chocolate, a sprinkle of sea salt, or even incorporating nuts. The versatility of caramel powder makes it easy to offer exciting new flavors without having to reinvent your menu.

4. Cost-Effective for Your Business Caramel powder for popcorn is an affordable option for businesses aiming to boost profit margins. It has a long shelf life and doesn’t need refrigeration, making it easy to store and stock up on. You can purchase it in bulk and sell it at a reasonable price, providing a high-quality snack to your customers while increasing your revenue.

5. Increased Customer Satisfaction Offering variety is key to keeping customers happy, and caramel popcorn is a timeless treat that’s always in demand. By introducing caramel powder for popcorn, you're giving customers the opportunity to enjoy a premium snack, whether at home or in-store. Plus, the sweet aroma of caramel popcorn will naturally draw people in, making your business a go-to destination for snack lovers.

6. Perfect for Popcorn Stations and Events If you operate a cinema, event space, or food court, incorporating a caramel powder popcorn station can create a memorable experience for your customers. People love the interactive fun of making their own caramel popcorn, whether they’re at a party, fair, or just hanging out in your store. It’s a simple, delicious, and engaging way to elevate the customer experience.

7. A Unique Marketing Opportunity Caramel popcorn can be a powerful marketing tool. With its wide appeal and versatility, you can use it to create buzz around new promotions, seasonal flavors, or special events. Offering limited-time caramel popcorn options can excite customers and encourage them to return for more, fostering customer loyalty and keeping your store at the forefront of their minds.

Conclusion Incorporating caramel powder for popcorn into your product lineup can be a game-changer for your business. It helps attract new customers, adds variety to your menu, and makes popcorn preparation quick and hassle-free. Whether you're enhancing the in-store experience or expanding your product offerings, caramel powder is the secret ingredient your store needs to succeed.

0 notes

Video

youtube

January 31, 2025: Linzy's music career is so extensive and her compositions so prolific that those compositions are like tree rings for us.

We know the year, the place in her personal narrative, the conditions under which a specific song was written. Not every one. But definitely her hits across the years.

That insight is definitely more obvious to us anytime she deep dives into her catalogue, anytime she pulls one out of the vault as she did last night at the Rabbit Box Theater, Pike Place Market, performing with Amanda Winterhalter and Sean Kelly with everyone letting loose their songwriting prowess on stage to fans of all three who filled this wonderful venue.

There's definitely an overlap between all three songwriters and, because of age and life experience, the differences in each one's approach to the same human story is profound. Sean Kelly zeroes in on the transition from teen to young adulthood. Amanda Winterhalter is inspired by a literary tradition, who's style definitely evokes Americana or "gothic" Americana or Melancholy Americana as suggested by an audience member. And then there’s Linzy, filling in the narrative and emotional space inbetween.

All in all, the evening represented a breathtaking spectrum of experience and insight from down at the dark end of the pool of human experience.

We’ve been to the Rabbit Box before for an incredible Midnight High show. This is, hands down, a city treasure, this venue. What we didn’t realize... is that this evening would take us by surprise as no other Linzy performance has in recent memory. Don’t get me wrong, we’re incredibly energized by all her shows. Blown away by her performances as a member of The Little Lies. When she's on stage with Midnight High. When she's presenting pop/rock covers from the sixties to this decade at restaurants and lounges and wineries as Linzy Collins on acoustic guitar. Even the rare occasion her brand and band, Dream Patrol, makes a public appearance with its wild mix of techno, pop, club, and sound design.

Last night, though, Linzy took us back to the time before these professional pursuits, these different revenue streams (as managers call them). Back to a time when she was writing... but not performing at the level of or with the performing schedule she currently wields.

These were songs from a particular slice of her narrative. From her Cornish College of the Arts years to just before she joined The Little Lies.

These songs are all acoustic pieces. If I remember correctly, as many on guitar as on piano, both kinds of which she presented last night. The Rabbit Box Theatre actually had an upright piano on stage with which she accompanied herself.

It really was a trip down memory lane. Mostly a lovely one because even those songs born of heartbreak or betrayal no longer bear the terrible pain of that heartbreak or betrayal. They are experiences observed from extended time and emotional distance. And the compositions that persist in the aftermath of those experiences, well, in some ways it’s as if they’re safely displayed behind glass.

As far as music sets go, this one was one of her strongest. You see, some of these songs, the ones she performed on piano, were meant for a musical she intended to compose while in college. What happened instead is that she wrote a lot of the music without ever getting around to the story. So there are all these orphaned songs that, because they were meant for a stage with cast and sets and orchestra, are more epic in scale. These are songs written on a huge canvas. And the music, and the lyrics, reflect this higher plane of existence. I don’t know how else to put it.

Somehow, these songs are more. They imply a larger universe at work.

And it’s been a long, long time since we heard them.

What’s very sweet about this evening is that Linzy took my suggestion to perform one of the most heartbreaking songs she’s ever written. It’s a song about standing by someone in the midst of depression. And what’s fascinating about the song is that it was a classroom exercise. An exercise, assigned by the teacher, to write a song without choruses. Verses only.

And so she wrote the song, at the time titled “For You”.

Was it drawn from her own life or someone she knew at the time?

No.

She simply composed it, performed it for her teacher, and moved on with her life.

Over the years, though, I continued to listen to it because it’s just so incredibly deep and moving. And so with a songwriter’s show coming up, I asked Linzy if she’d consider it.

And she said yes.

Oof. BIG mistake.

Wait. Why?

Because even though the song isn’t about a single experience... it attaches readily to every experience with depression whether that experience is personal or through close relationship. And, on any given day, someone we know will come to mind when a song like this shines a spotlight.

For Linzy, this happened on stage at The Rabbit Box in front of an audience.

She was shaken by the song she was singing as she was singing it. The tears flowed of their own accord.

I didn’t catch it right away. I realized she dropped a line at the end of the first verse. It was only during the second verse that I and everyone else realized she was struggling right there on stage... which captured the song in a way it could not otherwise be presented.

I’ve only heard one other performance like this. A long time ago I saw Mandy Patinkin perform “I Dreamed a Dream”. It’s a song that's incredibly heartbreaking and normally invested with a vocal power that carries an audience along with it as it scales emotional heights. Patinkin’s performance goes the other way. He lets the brokenness written into the music inform a fragile emotion that sustains... just barely.

His interpretation doesn’t carry you. His interpretation draws you in.

It definitely drew me in.

And I think this is the experience of Linzy’s performance on stage last night. The power she invests here doesn't come from emotional heights. It doesn't come from crescendo or full-throated expression. It comes from sustaining… just barely. It comes from teetering along an emotional edge. It comes from the awfulness of human moments in which we’re either captured or someone we love is captured by depression and we don't know.

We don't know...

What's gonna happen because this is a hostage taking without ransom and there’s little we can do about it.

When Linzy wrote this song back in college, she titled it “For You”. From this performance moving forward, she calls it

“There's A War”

youtube

There's a war that I can't fight for you There's a storm comin' pretty soon And I can't make you stand your ground But I'll be there to hold you when you're down There's a war that I can't fight for you

There's a song that I can't sing for you There's a melody but I can't hold the tune And I'll try my best 'cause I can't say no But darlin' you gotta let it go There's a song that I can't sing for you

There's a home that I can't be for you There's a road that I can't find my way to And I can't really change your mind But if you've gotta grieve we'll give it time There's a home that I can't be for you

There's a heart that I can't know for you There's an ocean well that you have fallen into But I'll pull you out of the dark and deep And I'll try to give you what you need There's a heart that I can't know And a home that I can't be There's a song that I can't sing There's a war That I can't fight

#linzy collins#rabbit box theatre#amanda winterhalter#sean kelly#acoustic guitar#piano#emotional experience#songwriting#depression#emotional scars#empathy#compassion#love#friendship#trying to help#mental health

0 notes