#The Stakeholders

Explore tagged Tumblr posts

Text

Chegamos à edição 39 do programa: "Eu Recomendo, com Luiz Domingues” pela Webradio Orra Meu, com mais artistas contemporâneos da cena Rock do Brasil.

Desta feita eu falo a respeito dos seguintes artistas: Cristiano Varisco, Nihilo, TioMonstro, The Stakeholders, Bagapirata, Ventre, Vini Duarte e Gilson's Band.

Terça-Feira, dia 10 de setembro de 2024, às 19 horas. Repetição nas terças posteriores (17, 24 e 30, além de 1º de outubro).

Versão televisiva aos domingos, nos dias 15, 22 e 29 de setembro, além de 6 de outubro, às 20:20 horas. No YouTube, a partir do dia 16 de setembro.

Pauta e apresentação: Luiz Domingues. Edição e produção geral: Emmanuel Barreto.

#Programa Eu Recomendo com Luiz Domingues pela Webradio Orra Meu#Programa Eu Recomendo com Luiz Domingues#Webradio Orra Meu#Rock Brasileiro#Cristiano Varisco#Nihilo#TioMonstro#The Stakeholders#Bagapirata#Ventre#Vini Duarte#Gilson's Band#Luiz Domingues

0 notes

Text

GONE WITH THE WIND (1939), dir. Victor Fleming

#everyone@stakeholders#vivien leigh#clark gable#gone with the wind#scarlett o'hara#rhett butler#oldhollywoodedit#classicfilmedit#filmedit#classicfilmsource#classicfilmblr#filmgifs#moviegifs#userstream#chewieblog#film#gif#1939#1930s#i tried to do less editing on this creatively and just fix how yellow the prints of this scene are

331 notes

·

View notes

Text

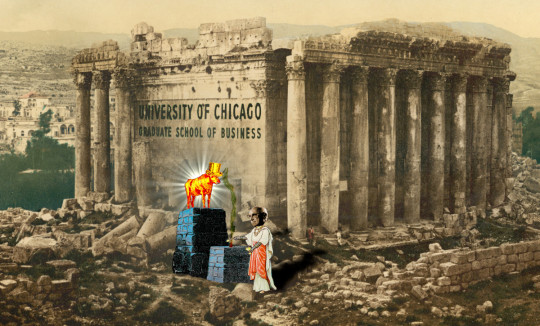

There’s no such thing as “shareholder supremacy”

On SEPTEMBER 24th, I'll be speaking IN PERSON at the BOSTON PUBLIC LIBRARY!

Here's a cheap trick: claim that your opponents' goals are so squishy and qualitative that no one will ever be able to say whether they've been succeeded or failed, and then declare that your goals can be evaluated using crisp, objective criteria.

This is the whole project of "economism," the idea that politics, with its emphasis on "fairness" and other intangibles, should be replaced with a mathematical form of economics, where every policy question can be reduced to an equation…and then "solved":

https://pluralistic.net/2023/03/28/imagine-a-horse/#perfectly-spherical-cows-of-uniform-density-on-a-frictionless-plane

Before the rise of economism, it was common to speak of its subjects as "political economy" or even "moral philosophy" (Adam Smith, the godfather of capitalism, considered himself a "moral philosopher"). "Political economy" implicitly recognizes that every policy has squishy, subjective, qualitative dimensions that don't readily boil down to math.

For example, if you're asking about whether people should have the "freedom" to enter into contracts, it might be useful to ask yourself how desperate your "free" subject might be, and whether the entity on the other side of that contract is very powerful. Otherwise you'll get "free contracts" like "I'll sell you my kidneys if you promise to evacuate my kid from the path of this wildfire."

The problem is that power is hard to represent faithfully in quantitative models. This may seem like a good reason to you to be skeptical of modeling, but for economism, it's a reason to pretend that the qualitative doesn't exist. The method is to incinerate those qualitative factors to produce a dubious quantitative residue and do math on that:

https://locusmag.com/2021/05/cory-doctorow-qualia/

Hence the famous Ely Devons quote: "If economists wished to study the horse, they wouldn’t go and look at horses. They’d sit in their studies and say to themselves, ‘What would I do if I were a horse?’"

https://pluralistic.net/2022/10/27/economism/#what-would-i-do-if-i-were-a-horse

The neoliberal revolution was a triumph for economism. Neoliberal theorists like Milton Friedman replaced "political economy" with "law and economics," the idea that we should turn every one of our complicated, nuanced, contingent qualitative goals into a crispy defined "objective" criteria. Friedman and his merry band of Chicago School economists replaced traditional antitrust (which sought to curtail the corrupting power of large corporations) with a theory called "consumer welfare" that used mathematics to decide which monopolies were "efficient" and therefore good (spoiler: monopolists who paid Friedman's pals to do this mathematical analysis always turned out to be running "efficient" monopolies):

https://pluralistic.net/2022/02/20/we-should-not-endure-a-king/

One of Friedman's signal achievements was the theory of "shareholder supremacy." In 1970, the New York Times published Friedman's editorial "The Social Responsibility of Business Is to Increase Its Profits":

https://www.nytimes.com/1970/09/13/archives/a-friedman-doctrine-the-social-responsibility-of-business-is-to.html

In it, Friedman argued that corporate managers had exactly one job: to increase profits for shareholders. All other considerations – improving the community, making workers' lives better, donating to worthy causes or sponsoring a little league team – were out of bounds. Managers who wanted to improve the world should fund their causes out of their paychecks, not the corporate treasury.

Friedman cloaked his hymn to sociopathic greed in the mantle of objectivism. For capitalism to work, corporations have to solve the "principal-agent" problem, the notoriously thorny dilemma created when one person (the principal) asks another person (the agent) to act on their behalf, given the fact that the agent might find a way to line their own pockets at the principal's expense (for example, a restaurant server might get a bigger tip by offering to discount diners' meals).

Any company that is owned by stockholders and managed by a CEO and other top brass has a huge principal-agent problem, and yet, the limited liability, joint-stock company had produced untold riches, and was considered the ideal organization for "capital formation" by Friedman et al. In true economismist form, Friedman treated all the qualitative questions about the duty of a company as noise and edited them out of the equation, leaving behind a single, elegant formulation: "a manager is doing their job if they are trying to make as much money as possible for their shareholders."

Friedman's formulation was a hit. The business community ran wild with it. Investors mistook an editorial in the New York Times for an SEC rulemaking and sued corporate managers on the theory that they had a "fiduciary duty" to "maximize shareholder value" – and what's more, the courts bought it. Slowly and piecemeal at first, but bit by bit, the idea that rapacious greed was a legal obligation turned into an edifice of legal precedent. Business schools taught it, movies were made about it, and even critics absorbed the message, insisting that we needed to "repeal the law" that said that corporations had to elevate profit over all other consideration (not realizing that no such law existed).

It's easy to see why shareholder supremacy was so attractive for investors and their C-suite Renfields: it created a kind of moral crumple-zone. Whenever people got angry at you for being a greedy asshole, you could shrug and say, "My hands are tied: the law requires me to run the business this way – if you don't believe me, just ask my critics, who insist that we must get rid of this law!"

In a long feature for The American Prospect, Adam M Lowenstein tells the story of how shareholder supremacy eventually came into such wide disrepute that the business lobby felt that it had to do something about it:

https://prospect.org/power/2024-09-17-ponzi-scheme-of-promises/

It starts in 2018, when Jamie Dimon and Warren Buffett decried the short-term, quarterly thinking in corporate management as bad for business's long-term health. When Washington Post columnist Steve Pearlstein wrote a column agreeing with them and arguing that even moreso, businesses should think about equities other than shareholder returns, Jamie Dimon lost his shit and called Pearlstein to call it "the stupidest fucking column I’ve ever read":

https://www.washingtonpost.com/news/wonk/wp/2018/06/07/will-ending-quarterly-earnings-guidance-free-ceos-to-think-long-term/

But the dam had broken. In the months and years that followed, the Business Roundtable would adopt a series of statements that repudiated shareholder supremacy, though of course they didn't admit it. Rather, they insisted that they were clarifying that they'd always thought that sometimes not being a greedy asshole could be good for business, too. Though these statements were nonbinding, and though the CEOs who signed them did so in their personal capacity and not on behalf of their companies, capitalism's most rabid stans treated this as an existential crisis.

Lowenstein identifies this as the forerunner to today's panic over "woke corporations" and "DEI," and – just as with "woke capitalism" – the whole thing amounted to a a PR exercise. Lowenstein links to several studies that found that the CEOs who signed onto statements endorsing "stakeholder capitalism" were "more likely to lay off employees during COVID-19, were less inclined to contribute to pandemic relief efforts, had 'higher rates of environmental and labor-related compliance violations,”' emitted more carbon into the atmosphere, and spent more money on dividends and buybacks."

One researcher concluded that "signing this statement had zero positive effect":

https://www.theatlantic.com/ideas/archive/2020/08/companies-stand-solidarity-are-licensing-themselves-discriminate/614947

So shareholder supremacy isn't a legal obligation, and statements repudiating shareholder supremacy don't make companies act any better.

But there's an even more fundamental flaw in the argument for the shareholder supremacy rule: it's impossible to know if the rule has been broken.

The shareholder supremacy rule is an unfalsifiable proposition. A CEO can cut wages and lay off workers and claim that it's good for profits because the retained earnings can be paid as a dividend. A CEO can raise wages and hire more people and claim it's good for profits because it will stop important employees from defecting and attract the talent needed to win market share and spin up new products.

A CEO can spend less on marketing and claim it's a cost-savings. A CEO can spend more on marketing and claim it's an investment. A CEO can eliminate products and call it a savings. A CEO can add products and claim they're expansions into new segments. A CEO can settle a lawsuit and claim they're saving money on court fees. A CEO can fight a lawsuit through to the final appeal and claim that they're doing it to scare vexatious litigants away by demonstrating their mettle.

CEOs can use cheaper, inferior materials and claim it's a savings. They can use premium materials and claim it's a competitive advantage that will produce new profits. Everything a company does can be colorably claimed as an attempt to save or make money, from sponsoring the local little league softball team to treating effluent to handing ownership of corporate landholdings to perpetual trusts that designate them as wildlife sanctuaries.

Bribes, campaign contributions, onshoring, offshoring, criminal conspiracies and conference sponsorships – there's a business case for all of these being in line with shareholder supremacy.

Take Boeing: when the company smashed its unions and relocated key production to scab plants in red states, when it forced out whistleblowers and senior engineers who cared about quality, when it outsourced design and production to shops around the world, it realized a savings. Today, between strikes, fines, lawsuits, and a mountain of self-inflicted reputational harm, the company is on the brink of ruin. Was Boeing good to its shareholders? Well, sure – the shareholders who cashed out before all the shit hit the fan made out well. Shareholders with a buy-and-hold posture (like the index funds that can't sell their Boeing holdings so long as the company is in the S&P500) got screwed.

Right wing economists criticize the left for caring too much about "how big a slice of the pie they're getting" rather than focusing on "growing the pie." But that's exactly what Boeing management did – while claiming to be slaves to Friedman's shareholder supremacy. They focused on getting a bigger slice of the pie, screwing their workers, suppliers and customers in the process, and, in so doing, they made the pie so much smaller that it's in danger of disappearing altogether.

Here's the principal-agent problem in action: Boeing management earned bonuses by engaging in corporate autophagia, devouring the company from within. Now, long-term shareholders are paying the price. Far from solving the principal-agent problem with a clean, bright-line rule about how managers should behave, shareholder supremacy is a charter for doing whatever the fuck a CEO feels like doing. It's the squishiest rule imaginable: if someone calls you cruel, you can blame the rule and say you had no choice. If someone calls you feckless, you can blame the rule and say you had no choice. It's an excuse for every season.

The idea that you can reduce complex political questions – like whether workers should get a raise or whether shareholders should get a dividend – to a mathematical rule is a cheap sleight of hand. The trick is an obvious one: the stuff I want to do is empirically justified, while the things you want are based in impossible-to-pin-down appeals to emotion and its handmaiden, ethics. Facts don't care about your feelings, man.

But it's feelings all the way down. Milton Friedman's idol-worshiping cult of shareholder supremacy was never about empiricism and objectivity. It's merely a gimmick to make greed seem scientifically optimal.

The paperback edition of The Lost Cause, my nationally bestselling, hopeful solarpunk novel is out this month!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/09/18/falsifiability/#figleaves-not-rubrics/a>

#pluralistic#chevron deference#loper bright#scotus#stakeholder capitalism#boeing#economism#economics#milton friedman#shareholder supremacy#fiduciary duty#business#we cant have nice things#shareholder capitalism

363 notes

·

View notes

Text

I understand why they decided to kill Tony in Endgame, because there was no way to have him live and show him proceeding not to fuck Steve Rogers after what they had going on in that movie.

So for the sake of keeping them straight because Disney, I understand that it had to be done, then again I earnestly think that Marvel is a coward for not having them fuck at least once.

(if one of them was a girl they would have canonically fucked on Clint's farm in AoU and probably got married)

#stony#tony stark#steve rogers#marvel#superhusbands#age of ultron#born to fuck but forced to coexist in a world in which being queer is frowned upon by disney stakeholders#i mean technically#natasha stark exists#so its kinda canon

43 notes

·

View notes

Text

why the FUCK should I, a medical student, have to learn about AI's IMPLICATIONS FOR STAKEHOLDERS? how is this ANY OF MY PROBLEM?

#this lecture in-person was worse - they managed to intimate that#we should be thinking of stakeholders' interests as much as if not more than those of the patient.#i wanted to leap over my seat and scold the lecturer out of their skin. we're not in the us buddy#tristan rambles

7 notes

·

View notes

Text

sometimes i catch a glance at the boys shaking their heads in dismay and despair on the bench and I'm like. do they also just really hate their jobs. they're just like me fr

#hockey but its just like a regular tuesday at the office#incompetent coworkers and annoying external stakeholders#oilers lb

8 notes

·

View notes

Text

After reading the Blake Lively lawsuit, I understand why so many female celebs get hate out of nowhere.

Angelina Jolie, Anne Hathaway, Taylor Swift, Monica Lewinsky, Rachel Zegler, and now Blake Lively... The list goes on and on.

If a woman is successful, the media perceives them as "annoying", "slut", "mean", "cold", etc. All it takes is a viral hate tweet to turn the tide against them. A bunch of thinkpieces about the woman's behaviour and bam, she's hated for no reason.

Insane tactics, I swear.

#the reveal that 🛴 is a major stakeholder in that PR company was crazyyy#i see like 10 viral hate tweets on the bird app about taylor everyday#im not even on stan twt#that jerk is obsessed and jealous#taylor swift#blake lively#anjelina jolie#anne hathaway#rachel zegler

13 notes

·

View notes

Text

session starts in a month and a half and I am back at it again in spreadsheet hell, folks

#personal#bri's job adventures#screaming crying etc about being on deadline for bill draft requests (Monday) and people aren't communicating with us#begging stakeholders via email like PLEASE GIVE ME YOUR DRAFT LANGUAGE. MY CROPS ARE DYING AND MY SPREADSHEETS ARE INCOMPLETE

7 notes

·

View notes

Text

How does hayashida put this much detail into his abs showing THROUGH his cloak and expects me to attend work meetings the next day and discuss finance this is insane

11 notes

·

View notes

Text

but also that post does bring up a fundamental point (by being wrong about it) that the workers are not the only parties with interests at stake in many industries so when decisions are made about production and distribution under socialism clearly other parties such as the people who need said products (esp in the case they would die otherwise…) or people who live by the production facility and could be affected by pollution etc also need to be part of the decisionmaking process!

#iso.txt#this is an argument against anarchism and *pure* coop market socialism in my book#ie the system should have some way to include the other mentioned stakeholders#there are multiple ways of doing it that would work imo#but op of the post literally said that it should NOT be the case lmao

10 notes

·

View notes

Text

I know that Bea's parents being diplomats is why (or one reason why) she has such poise and etiquette, but a diplomat's day-to-day job is really more about slide decks than cocktail parties.

By which I mean: I think Beatrice 'PowerPoint gremlin' Dalton-Lee is a distinct possibility.

#consider: she has a PowerPoint for everything#at any time she will appear with a briefing note#father vincent a traitor? boom slide deck#adriel's cult spreading? she's already chairing a stakeholder engagement meeting on OCS strategic communications#warrior nun#sister beatrice#avatrice

52 notes

·

View notes

Text

11 notes

·

View notes

Text

Union pensions are funding private equity attacks on workers

On October 7–8, I'm in Milan to keynote Wired Nextfest.

If end-stage capitalism has a motto, it's this: "Stop hitting yourself." The great failure of "voting with your wallet" is that you're casting ballots in a one party system (The Capitalism Party), and the people with the thickest wallets get the most votes.

During the Cultural Revolution, the Chinese state would bill the families of executed dissidents for the ammunition used to execute their loved ones:

https://www.quora.com/Is-it-true-the-Chinese-government-makes-the-families-of-executed-people-pay-for-the-cost-of-bullets

In end-stage capitalism, the dollars we spend to feed ourselves are used to capture the food supply and corrupt our political process:

https://pluralistic.net/2023/10/04/dont-let-your-meat-loaf/#meaty-beaty-big-and-bouncy

And the dollars we save for retirement are flushed into the stock market casino, a game that is rigged against us, where we are always the suckers at the table:

https://pluralistic.net/2020/07/25/derechos-humanos/#are-there-no-poorhouses

Everywhere and always, we are financing our own destruction. It's quite a Mr Gotcha moment:

https://thenib.com/mister-gotcha/

Now, anything that can't go on forever will eventually stop. We are living through a broad, multi-front counter-revolution to Reaganomics and neoliberal Democratic Party sellouts. The FTC and DOJ Antitrust Division are dragging Big Tech and Big Meat and Big Publishing into court. We're seeing bans on noncompete clauses, and high-profile government enforcers are publicly pledging never to work for corporate law-firms when they quit public service:

https://pluralistic.net/2023/09/09/nein-nein/#everything-is-miscellaneous

And of course, there's the reinvigoration of the labor movement! Hot Labor Summer is now Perpetual Labor September, with 75,000 Kaiser workers walking out alongside the UAW, SAG-AFTRA and 2,350 other groups of workers picketing, striking or protesting:

https://striketracker.ilr.cornell.edu/

But capitalism still gets a lick in. Union pension plans are some of the most important investors in private equity funds. Your union pension dollars are probably funding the union-busting, child-labor-employing, civilization-destroying Gordon Gecko LARPers who are also evicting you from the rental they bought and turned into a slum, and will then murder you in a hospice that they bought and turned into a slaughterhouse:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Writing for The American Prospect, Rachel Phua rounds up the past, present and future of union pension funds backing private equity monsters:

https://prospect.org/labor/2023-10-04-workers-funding-misery-private-equity-pension-funds/

Private equity and hedge funds have destroyed 1.3 million US jobs:

https://united4respect.org/press-release/people-who-work-at-walmart-sears-amazon-formerly-toys-r-us-more-join-forces-together-as-united-for-respect-2-2-2-2-5-3/

They buy companies and then illegally staff them with children:

https://www.dol.gov/newsroom/releases/whd/whd20230217-1

They lobby against the minimum wage:

https://pestakeholder.org/wp-content/uploads/2021/04/Insire-Brands-memo-on-15-wage.pdf

They illegally retaliate against workers seeking to unionize their jobsite:

https://www.hoteldive.com/news/dc-hotel-workers-enlist-us-representatives-to-fight-sofitel-union-busting/650396/

And they couldn't do it without union pension funds. Public service union pensions have invested $650 million with PE funds. In 2001, the share of public union pensions invested in PE was 3.5%; today, it's 13%:

https://docs.google.com/spreadsheets/d/1B0vv26VEFmwtfw5ur6dSDMY8NftvZKij/

Giant public union funds like CalPERS are planning massive increases in their contributions to PE:

https://www.calpers.ca.gov/page/newsroom/calpers-news/2023/calpers-preliminary-investment-return-fiscal-year-2022-23

This results in some ghastly and ironic situations. Aramark used funds from a custodian's union to bid against that union's members for contracts, in an attempt to break the union and force the workers to take a paycut to $11/hour:

https://www.bloomberg.com/news/articles/2012-11-20/pension-fund-gains-mean-worker-pain-as-aramark-cuts-pay

Blackstone's investors include the California State Teachers Retirement System (CalSTRS). The PE ghouls who sucked Toys R Us dry were funded by Texas teachers.

Then there's KKR, one of the most rapacious predators of the PE world. Half of the investors in KKR's Global Infrastructure Investors IV fund are public sector pension funds. Those workers' money were spent to buy up Refresco (Arizona Iced Tea, Tropicana juices, etc), a transaction that immediately precipitated a huge spike in on-the-job accidents as KKR cut safety and increased tempo:

https://www.osha.gov/ords/imis/establishment.inspection_detail?id=1675674.015

Petsmart is the poster-child for PE predation. The company uses TRAPs ("TrainingRepaymentAgreementProvision") clauses to recreate indentured servitude, forcing workers to pay thousands of dollars to quit their jobs:

https://pluralistic.net/2022/08/04/its-a-trap/#a-little-on-the-nose

Why would a Petsmart employee want to quit? Petsmart's PE owner is BC Partners, and under BC's management, workers have been forced to work impossible hours while overseeing cruel animal abuse, including starving sick animals to death rather than euthanizing them, and then being made to sneak them into dumpsters on the way home from work so Petsmart doesn't have to pay for cremation. 24 of BC Partners' backers are public pension funds, including CalSTRS and the NYC Employees' Retirement System:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

PE buyouts are immediately followed by layoffs. One in five PE acquisitions goes bankrupt. Unions should not be investing in PE. But the managers of these funds defend the practice, saying they "facilitate dialog" with the PE bosses on workers' behalf.

This isn't total nonsense. Once upon a time, public pension fund managers put pressure on investees to force them to divest from Apartheid South Africa and tobacco companies. Even today, public pensions have successfully applied leverage to get fund managers to drop Russian investments after the invasion of Ukraine. And public pensions pulled out of the private prison sector, tanking the valuation of some of the largest players.

But there's no evidence that this leverage is being applied to pensions' PE billions. It's not like PE is a great deal for these pensions. PE funds don't reliably outperform the market, especially after PE bosses' sky-high fees are clawed back:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3623820

Pension funds could match or beat their PE returns by sticking the money in a low-load Vanguard index tracker. What's more, PE is getting worse, pioneering new scams like inflating the value of companies after they buy and strip-mine them, even though there's no reason to think anyone would buy these hollow companies at the price that the PE companies assign to them for bookkeeping purposes:

https://www.institutionalinvestor.com/article/2bstqfcskz9o72ospzlds/opinion/why-does-private-equity-get-to-play-make-believe-with-prices

To inject a little verisimilitude into this obvious fantasy, PE companies sell their portfolio companies to themselves at inflated prices, in a patently fraudulent shell-game:

https://www.ft.com/content/646d00f4-af5d-4267-a436-54fb3bc1697b

What's more, PE funds aren't just bad bosses, they're also bad landlords. PE-backed funds have scooped up an appreciable fraction of America's housing stock, transforming good rentals into slums:

https://pluralistic.net/2022/01/27/extraordinary-popular-delusions/#wall-street-slumlords

PE is really pioneering a literal cradle-to-grave immiseration strategy. First, they gouge you on your kids' birth:

https://pluralistic.net/2021/10/27/crossing-a-line/#zero-fucks-given

Then, they slash your wages and steal from your paycheck:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3465723

Then, they evict you from your home:

https://pluralistic.net/2023/06/05/vulture-capitalism/#distressed-assets

And then they murder you as part of a scam they're running on Medicare:

https://pluralistic.net/2023/08/05/any-metric-becomes-a-target/#hca

As the labor movement flexes its muscle, it needs to break this connection. Workers should not be paying for the bullet that their bosses put through their skulls.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/05/mr-gotcha/#no-ethical-consumption-under-capitalism

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

#pluralistic#labor#pensions#finance#private equity#toys r us#Rachel Phua#kkr#bain capital#calpers#aramark#Private Equity Stakeholder Project#RefrescoArizona Iced Tea#CalSTRS#Roark Capital#child labor#blackstone#PSSI

174 notes

·

View notes

Text

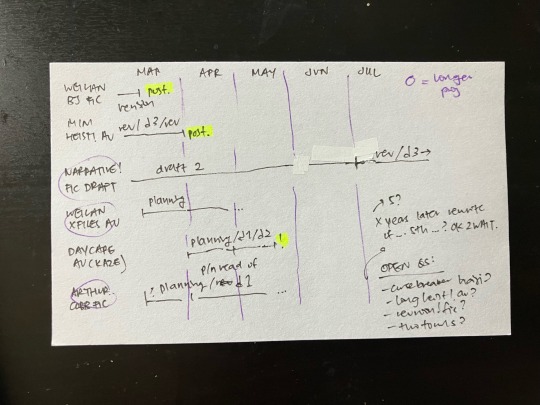

well, instead of doing my job i have made a roadmap of my fic for the next couple months of this year

i am slightly embarassed to be like this but actually it's proving to be immediately super helpful?? like its way easier to see when i can pick up projects that have been om the back burner, it means im forced to assign priorities to different projects, AND it means that eventually i can review this and go "huh okay wow this did not happen in the timeframe i expected, what happened?"

not sure this will stick or whether i will remember to revisit this like. ever. but OMG SUDDENLY ITS SO EASY TO HOLD ALL MY PROJECTS IN MY HEAD AT ONE TIME (mainly bc i can consign like 5 of them to the "wait what about this guy?" corner haha

#SUDDENLY I UNDERSTAND SO MUCH ABOUT WHY WE DO PRODUCT PLANNING THE WAY WE DO ON MY TEAM#THIS IS SO HELPFUL! WOW.#like it IS a really clear and easy way to communicate things to stakeholders!#it IS a much more organized way of thinking about how to manage several projects at once!#I AM GOING TO GO DO WORK TASKS NOW. IM RESPONSIBLE AND SHOULD REMAIN EMPLOYED FOR SURE#hidey speaks#hidey talks fic

13 notes

·

View notes

Text

idk i just hope the tournament organizers see this (and tbh probably inevitably rome also) as a real wakeup call as to how scheduling goes and how they need to give them a goddamn break. i honestly doubt it because i do not think any organizers really give a shit about the actual players (otherwise this would probably not have happened tbh) but i hope they get it together

#this is unprecedented how many injuries we have like genuinely is this not terrifying to atp??#i think i heard rumour of dubai or someone being given a 1000 level tournament. NO!!! WE DONT NEED ANOTHER ONE!!!#and i know that no city will want to give up their tournament#but somethings gotta give we cant be putting these ppl through the fucking ringer every goddamn week#i think if tennis had a more unified business model (aka novak’s players union or something)#and players had a base salary (the way literally every other sport does) rather than only getting money if you play and win#then players would be allowed to have more breaks#and not rely on pushing themselves because they have to pay coaches equipment flights doctors etc etc#idk. i think about the logistics and business and economic end of tennis A Lot#also more standardized courts/balls etc is needed but i really dont know enough about the physical aspect as much#like obv i like having three different surfaces i think its unique and fun and the adjustment period for the players is not the worst thing#but even still theres so much variation between courts of the same surface even at the same event#and balls are different too i think#idk everything in tennis is so fragmented and disconnected#like atp and wta and then each tournament has vastly different organizations so theres so many competiting stakeholders#again. novaks players union is sorely needed#whoops i wrote an essay in the tags about sports business again whateverrrrr#tennis

8 notes

·

View notes

Text

[...] Ahab was now entirely conscious that, in so doing, he had indirectly laid himself open to the unanswerable charge of usurpation; and with perfect impunity, both moral and legal, his crew if so disposed, and to that end competent, could refuse all further obedience to him, and even violently wrest from him the command. From even the barely hinted imputation of usurpation, and the possible consequences of such a suppressed impression gaining ground, Ahab must of course have been most anxious to protect himself.

LAW TIME!

this is so interesting to me bc it calls back to the fact that ahab doesn't actually own the pequod! he's captaining it and he does own a share in it, but the real owners are peleg and bildad, and on shore he's accountable to them. even though on the sea he is master of the ship, he still answers to the owners, and in derailing the voyage from "hunting whales and making money" to "hunting moby-dick specifically", he is usurping authority! he doesn't (well, in the sense of ownership, which will come up later) actually have the right to do this! and if the crew were to mutiny against him (say, if a certain mate who isn't keen on the quest and prioritizes the commercial interests of the voyage over ahab's goal convinced them), legally they'd be in the right to do it, and arguably it'd be their duty to do it. (nautical law side of tumblr do correct me if i'm wrong) (the idea of whether ahab actually has ultimate authority over the pequod comes up later and it's all very interesting!)

this is extra fun since ahab knows this and is genuinely nervous that the crew might rise up against him. right now starbuck stands alone, and even he gave way to peer pressure in the end! the entire crew is enthusiastic about the quest, but if that wanes and they start to consider it, ahab will be in genuine danger! he can't actually answer to the charge of usurpation, he undeniably did it (within the framework of ownership of the whaling industry ofc) which is something that isn't really obvious in pop culture perceptions of him, he's not just some dictator, he's pragmatic about things!

#whale weekly#ahab#moby dick#fr this is so interesting#and the callbacks to this in later chapters are so fascinating to me#esp in chapter 109 where it's most obvious#any people who know big water law do add onto this#like if ahab were any less charismatic and brilliant and pragmatic he mightve fallen prey to this but he DIDNT#and [REDACTED]#and that's something really interesting bc ishmael mentions how the incompetence/traits of the mates made them unable to stand up to ahab#and given that [REDACTED] iit's !!! to thinka bout ishmael recalling all of this after#also also the EVERYTHING abt ahab not actually owning the ship and being painfully conscious abt that#and how he reframes it in 109#same energy as 'a king is he who can hold his own'#yeah thingol you say you own all beleriand but maedhros is actualy holding it#yeah bildad and peleg you technically own the pequod but ahab is actually captaining it#ALSO cannot believe i forgot to mention but something something means of production#ahab and the crew are doing the labor (and to be fair they do get shares) but they don't get the shares that the big stakeholders like pele#g and bildad do even though they're the ones doing the grueling labor

80 notes

·

View notes