#The Fed

Explore tagged Tumblr posts

Text

Title/Name: Rage Wojaks printing money at the Fed - GIFs Wojak Series: Rage (Variants) Images by: Unknown Main Tag: Rage GIF Wojaks

#Wojak#Rage#Rage Wojak#The Fed#FRS#Rage GIF Wojaks#Wojaks#Rage Wojaks#Rage Gif#Gif#White#Red#Pink#Green#Gray#The Federal Reserve System Wojaks#The Federal Reserve System Rage Wojaks#Rage Series#Money Rage Wojaks#Family Group

745 notes

·

View notes

Text

#fox news#donald j. trump#kamala harris#democrats#donald trump#trump#president trump#dan bongino#pardon#joe biden#biden administration#hunter biden#president biden#biden#government corruption#corruption kink#ukraine#ukrainian tumblr#zelensky#wuhan#covid 19#anti vaxxers#bill gates#vaccine#the fed#nancy pelosi#bill clinton#hillary clinton#the clintons#jimmy carter

206 notes

·

View notes

Note

hey big JP if trump fires you for refusing to raise rates just know we're here for you. that gofundme will fill right up

Thank you for your kind thoughts 🙏🏻 he’s stuck with me, unfortunately for him. He has to live with the consequences of his own actions (appointing me in 2018).

34 notes

·

View notes

Text

Captain Crunch. http://Newsday.com/matt

* * * *

LETTERS FROM AN AMERICAN

April 21, 2025

Heather Cox Richardson

Apr 22, 2025

Yesterday, on Easter Sunday, Pope Francis performed his final public act when he waved to worshippers in St. Peter’s Square. He died today at 88. Born in Argentina, he was the first Pope to come from the Americas. He was also the first Jesuit to serve as Pope, bringing new perspectives to the Catholic Church and hoping to focus the church on the poor.

The stock market plunged again today after President Donald J. Trump continued to harass Federal Reserve chair Jerome Powell. The threat of instability if Trump tries to fire Powell, added to the instability already created by Trump’s tariff policies, saw the Dow Jones Industrial Average fall 971.82 points, or 2.48%; the S&P 500 dropped 2.36%, and the Nasdaq Composite fell 2.55%. The dollar hit a three-year low, while the value of gold soared. Journalist Brian Tyler Cohen noted that since Trump took office, the Dow has fallen 13.8%, the S&P 500 is down 15.5%, and the Nasdaq is down 20.5%.

Hannah Erin Lang of the Wall Street Journal reported that “[t]he Trump rout is taking on historic dimensions.” She noted that the Dow Jones Industrial Average “is headed for its worst April performance since 1932,” when the country was in the midst of the Great Depression. Scott Ladner, chief investment officer at Horizon Investments, told Lang: “It’s impossible to commit capital to an economy that is unstable and unknowable because of policy structure.”

The Trump administration announced on April 11 that it would withhold from Harvard University $2.2 billion in grants already awarded and a $60 million contract unless Harvard permitted the federal government to control the university’s admissions and intellectual content. Today, Harvard sued the government for violating the First Amendment and overstepping its legal authority under the guise of addressing antisemitism.

The complaint notes the “arbitrary and capricious nature” of the government’s demands, and says, “The government has not—and cannot—identify any rational connection between antisemitism concerns and the medical, scientific, technological, and other research it has frozen that aims to save American lives, foster American success, preserve American security, and maintain America’s position as a global leader in innovation.”

University president Alan Garber explained that the freeze would jeopardize research on “how cancer spreads throughout the body, to predict the spread of infectious disease outbreaks, and to ease the pain of soldiers wounded on the battlefield.” He continued: “As opportunities to reduce the risk of multiple sclerosis, Alzheimer’s disease, and Parkinson’s disease are on the horizon, the government is slamming on the brakes. The victims will be future patients and their loved ones who will suffer the heartbreak of illnesses that might have been prevented or treated more effectively. Indiscriminately slashing medical, scientific, and technological research undermines the nation’s ability to save American lives, foster American success, and maintain America’s position as a global leader in innovation.”

Harvard is suing the departments of Health and Human Services, Justice, Education, Energy, and Defense, the General Services Administration (GSA), the National Institutes of Health, National Science Foundation, NASA, and the leaders of those agencies.

After news broke yesterday that Defense Secretary Pete Hegseth had disclosed classified information on a second unsecure Signal chat—this one on on his unsecure personal cell phone—and his former spokesperson told Politico the Pentagon was in “total chaos,” and he fired three of his top aides, media articles today wrote that officials were looking for a new Secretary of Defense.

But Hegseth blamed the media for the exposure of his Signal chats, and Trump stood by Hegseth. According to Dasha Burns, Eli Stokols, and Jake Traylor of Politico, the president doesn’t want to validate the stories about disarray at the Pentagon by firing Hegseth. “He’s doing a great job,” the president told reporters. “It’s just fake news.”

While the visible side of the administration appears to be floundering, new stories suggest that the less visible side—the “Department of Government Efficiency”—has dug into U.S. data in alarming ways.

On April 15, Jenna McLaughlin of NPR reported on an official whistleblower disclosure that as soon as members of the “Department of Government Efficiency” (DOGE) arrived at the National Labor Relations Board (NLRB), they appeared to be hacking into secure data. While they claimed to be looking for places to cut costs, the behavior of the DOGE team suggested something else was going on. They demanded the highest level of access, tried to hide their activities in the system, turned off monitoring tools, and then manually deleted the record of their tracks, all behaviors that cybersecurity experts told McLaughlin sounded like “what criminal or state-sponsored hackers might do.”

Staffers noticed that an IP address in Russia was trying to log in to the system using a newly created DOGE account with correct username and password, and later saw that a large amount of sensitive data was leaving the agency. Cybersecurity experts identified that spike as a sign of a breach in the system, creating the potential for that data to be sold, stolen, or used to hurt companies, while the head of DOGE himself could use the information for his own businesses. “All of this is alarming," Russ Handorf, who worked in cybersecurity for the FBI, told McLaughlin. "If this was a publicly traded company, I would have to report this [breach] to the Securities and Exchange Commission.” When the whistleblower brought his concerns to someone at NLRB, he received threats.

“If he didn’t know the backstory, any [chief information security officer] worth his salt would look at network activity like this and assume it’s a nation-state attack from China or Russia,” Jake Braun, former acting principal deputy national cyber director at the White House, told McLaughlin.

McLaughlin noted that the story of what happened at the NLRB is not uncommon. When challenged by judges, DOGE has offered conflicting and vague answers to the question of why it needs access to sensitive information, and has dismissed concerns about cybersecurity and privacy. The administration has slashed through the agencies that protect systems from attack and Trump has signed an executive order urging government departments to “eliminate…information silos” and to share their information.

Sharon Block, the executive director of Harvard Law School's Center for Labor and a Just Economy and a former NLRB board member, told McLaughlin: “There is nothing that I can see about what DOGE is doing that follows any of the standard procedures for how you do an audit that has integrity and that's meaningful and will actually produce results that serve the normal auditing function, which is to look for fraud, waste and abuse…. The mismatch between what they're doing and the established, professional way to do what they say they're doing...that just kind of gives away the store, that they are not actually about finding more efficient ways for the government to operate.”

On April 18, Makena Kelly and Vittoria Elliott of Wired reported that DOGE is building a master database that knits together information from U.S. Customs and Immigration Services, the Internal Revenue Service (IRS), the Social Security Administration, and voting data from Pennsylvania and Florida. This appears to be designed to find and pressure undocumented immigrants, Kelly and Elliott reported, but the effects of the consolidation of data are not limited to them.

On April 15 the top Democrat on the House Committee on Oversight and Government Reform, Gerald Connolly of Virginia, asked the acting inspector general at the Department of Labor and the inspector general at the NLRB to investigate “any and all attempts to exfiltrate data and any attempts to cover up their activities.” Two days later, he made a similar request to the acting inspector general for the Social Security Administration.

Connolly wrote: “I am concerned that DOGE is moving personal information across agencies without the notification required under the Privacy Act or related laws, such that the American people are wholly unaware their data is being manipulated in this way.”

On April 17, Christopher Bing and Avi Asher-Schapiro of ProPublica reported that the administration is looking to replace the federal government’s $700 billion internal expense card program, known as SmartPay, with a contract awarded to the private company Ramp. Ramp is backed by investment firms tied to Trump and Musk.

While administration officials insist that SmartPay is wasteful, both Republican and Democratic budget experts say that’s wrong, according to Bing and Asher-Schapiro. “SmartPay is the lifeblood of the government,” former General Services Administration commissioner Sonny Hashmi told the reporters. “It’s a well-run program that solves real world problems…with exceptional levels of oversight and fraud prevention already baked in.”

“There’s a lot of money to be made by a new company coming in here,” said Hashmi. “But you have to ask: What is the problem that’s being solved?”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#political cartoons#Matt Davies#Letters From An American#Heather Cox Richardson#DOGE#tariffs#Jerome Powell#The Fed#Harvard University

11 notes

·

View notes

Text

okay so let’s talk about high interest rates. because everyone keeps saying “the fed raised rates again” like we’re all supposed to just get it.

basically: interest rates are the cost of borrowing money. when the federal reserve (the u.s. central bank) raises them, it gets more expensive to take out loans — like for houses, cars, credit cards, or starting a business.

why would they do that? because inflation got too high (you’ve seen those grocery prices, right?). so the fed raises the federal funds rate, which is what banks charge each other for overnight loans. this rate heavily influences broader interest rates (like those for mortgages, car loans, credit cards, etc.).

they want to slow down spending. when people and businesses borrow less and spend less, prices (hopefully) stop rising so fast.

but here’s the downside: -getting a job after school or over the summer? harder. businesses start cutting hours or freezing hiring because they’re paying more to stay open. -college? all loans, including student loans get more expensive. you could end up paying way more over time for the same degree. -people buy fewer homes or cars -stuff like phones, clothes, concerts — anything bought on credit — might get pricier or happen less often.

and if they keep rates high for too long? boom. recession.

basically: high interest rates tighten the whole economy. and even if you're not directly in the money game yet, you’re absolutely playing on the same field.

#interest rates#economy#finance#economic#federal reserve#the fed#latest updates#economic crisis#mintconditioned

11 notes

·

View notes

Text

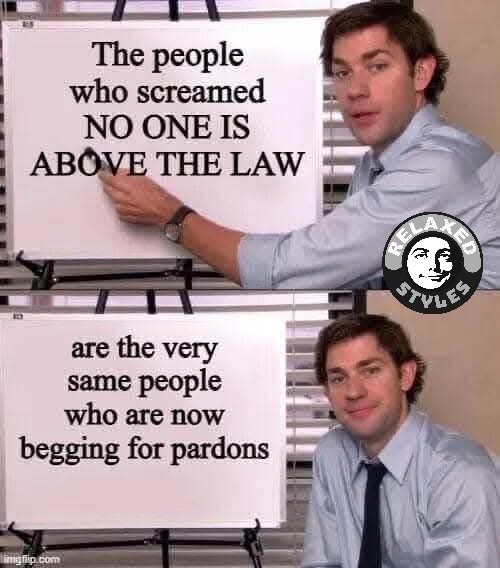

Bidenomics is a fucking success. Period.

But then the lies will pour out:

- “The Fed skewed its figures for the elections”

- “Real American are suffering”

- “Inflation is out of control!”

The GQP struggles with the truth.

#election 2024#trump 2024#donald trump#gqp#politics#trump#kamala harris#republicans#economy#bidenomics#america#usa#the fed

11 notes

·

View notes

Text

Paul Krugman has an amazing ability to explain very technical economic issues to lay people such as me. This is a very good explanation of why the US Federal Reserve ("Fed") is doing what it's doing, despite 47's insistence. I've learned something from every article written by Mr. Krugman. Well worth your time

2 notes

·

View notes

Text

The Federal Reserve Act of 1913 transferred the U.S. money supply and banking system controls from Congress to a private banking elite, who could then create money from nothing, loan it to our government and charge interest.

5 notes

·

View notes

Text

Tune in to our latest podcast featuring WiseWolfGold CEO, Tony Arterburn, where we uncover the hidden history of the Federal Reserve. Learn how an international banking cartel seized control of the U.S. money supply, using inflation and dollar devaluation to keep Americans economically trapped.

Apple Podcasts: https://podcasts.apple.com/us/podcast/guest-tony-arterburn-mastering-money-how-to-outsmart/id1439014279?i=1000677319630

Spotify: https://open.spotify.com/episode/29TlOQrbxJuuHtt08yAzHj

#TheFreeThoughtProjectPodcast

#the free thought project#tftp#podcast#gold#silver#crypto#banking cartel#fiat#wise wolf gold#tony arterburn#the free thought project podcast#the fed#the federal reserve#federal reserve

3 notes

·

View notes

Video

youtube

'DRASTICALLY DISMANTLE': Senator reintroduces bill to 'audit the Fed'

2 notes

·

View notes

Text

2 notes

·

View notes

Text

It's getting real out there ...

#cars#automotive#autos#suv#money management#money problems#old money#money making#money#debt consolidation#debt relief#debtmanagement#debt#credit cards#credit score#business loan#home loan#personal loans#student loans#loans#spending#bankers#banks#interest rates#the fed#central bank#payments#wtf#wth#huh

9 notes

·

View notes

Note

-50 beeps??? I dont know what to say...

How about “thank you”?

#you’re welcome#federal reserve#the fed#interest rates#federal open market committee#jay answers#jay speaks

23 notes

·

View notes

Text

7/27/23

The Fed raised the interest rate by 0.25% to 5.25-5.50% overall, the highest it's been in decades and Chairman Powell said they're still open to another raise in September. Despite fears of a recession due to the rates, the US GDP grew at 2.4% during Q2. Unemployment fell to 221K last week. The ECB also raised its rates a quarter percentage to 4.25%, although it's now signalling it's ready to pause.

We're currently on track for 2023 topping 2016 as the hottest year on record. What is worrying is there is a current system in the Atlantic Ocean that helps regulate weather, and it may collapse some time this century.

The army decided to side with the Nigerien presidential guard, so we now have a coup in Niger.

The Ukraine is starting another counteroffensive in the south. They have not made much progress against Russian defenses.

Hunter Biden's situation became much more murky yesterday. Biden was charged with failure to pay taxes and illegal possession of a weapon. Prosecutors made a plea agreement for two years probation if he pled guilty, but when this was presented to the judge, she did not like some of the terms, particularly for the gun charge, so Biden withdrew the guilty plea and stated not guilty. Republicans have been howling that Biden was given lesser punishment for being the president's son. I've talked to some people about it and they said with a plea agreement it's not unusual, but it's possible prosecutors immediately leaned toward preferential treatment.

Mitch McConnell randomly stopped talking for twenty seconds during a press conference yesterday. Considering he's 81 and has fallen a few times this year, one resulting in a concussion, it's pretty worrying.

1) Reuters, WSJ, The Hill 2) France24 3) Al Jazeera 4) Washington Post 5) AP 6) NYT

6 notes

·

View notes

Text

Federal Reserve's Federal Open Market Committee (FOMC) Minutes from the May meeting just dropped today, content is largely what was expected — depending on what you were expecting.

WSJ using air quotes around "cautious approach" in their analysis, which alleges that the Fed is being reckless. WSJ want the 1970's hyper-inflation, which was caused by the Fed's response to the threat of Stagflation at the time — raising interest rates. Trump wants lower interest rates, and will do anything to get the Fed to do that — but lowering the Fed Funds Rate won't be great for Americans either.

The Fed's toolbox has changed only a little since then but their economic strategy and analysis has iterated well beyond The Great Inflation of 1965 - 1982

In 1979, with the help and urging of Jimmy Carter's administration, the FOMC began to target Reserve Growth rather than the Fed Funds Rate. Carter further strengthened credit controls and signed the Monetary Control Act ...however finally lowering rates caused more unemployment, which shows that it's not a simple cause-effect.

Powell has navigated the Trumpandemic economy from 2020 and managed well; the Fed is pivoting to a strategic outlook where rates are unlikely to be lower for longer anymore. But as Trump on his end is now pushing the US into a Trumpcession with both stagnant jobs and much higher inflation, who the fuck knows? ¯\_(ツ)_/¯

You can read the Minutes yourself, from the Fed:

#stagflation#trumpcession#trumpflation#trump slump#trumponomics#jerome powell#the fed#interest rates#interesting#trump tariffs#imho

2 notes

·

View notes