#Term Money Market

Explore tagged Tumblr posts

Text

Indian Financial System

The Indian Financial System is at the heart of the country's economic development. Read More.....

The Indian Financial System is at the heart of the country’s economic development. The prime function of the Indian financial system is to mobilise savings and make them available for investments and capital formation to accelerate economic growth in the country. The financial system in a country comprises various intermediaries who play a crucial role in sourcing funds from the surplus segment…

View On WordPress

#Call Money Market#Certificate of Deposits#Commercial papers#Gilt-Edged Market#Government Bond#Government Security Markets#Indian Capital Market#Indian Financial System#Indian Money Market#Indian Security Market#Notice Money Market#Security Market#Term Money Market#Treasury Bills#Types of Government Bonds

0 notes

Text

I love Sims drama because I am so uninvolved in all of it that I feel like I'm in a theatre, watching a movie with popcorn and my feet kicked up. Don't mind me while I sit from the sidelines and watch nonsense unfold before my eyes. Seeing factions break out over who gets to make more off the back of a multi-million dollar corpo.

#i love the sims community#not because of anything to do with the high school level drama#but more so to do with the fact that i have free daily content that allows me to watch other people's lives fall into disarray#all because they got a lil greedy :/#rule of thumb if you're looking for an income source:#dont market to an audience of primarily college students and people that still live with their parents. they have no money.#they WILL find a way to download your shit for free#and some rinky dink “terms of use” will not hold up in any court in the world

14 notes

·

View notes

Text

i just booked to view two flats (to buy) (i'm probably not going to buy them) (i would only be co-buying them even if i did bc i can't afford a mortgage) (they're in a good location though it would be way nearer to useful things even if there's still no bus) and they asked me no questions beyond contact details when i called them about a viewing. is that normal. shouldn't they have tried to check i'm serious. i had all my answers prepared re: the finances and they didn't care

#essentially my parents had a flat but they hate being a landlord so they've sold it (subject to contract)#and in terms of what to do with the money etc at their age it makes more sense to co-buy somewhere manageable and accessible with me#and then in future if they get old and decrepit and i want to move north (and particularly if there's only one of them tho i hate that idea#they can live in the smaller accessible house/flat instead of their larger and less manageable house#so i wouldn't be tied to it but also in the meantime only have to contribute like 30k ('only') which is <3 years' rent#since my current house is 950/mo and smaller than the flats we're looking at#the rental market here is so awful and my accessibility needs are increasing so buying somewhere is beginning to look like my only option#bc i can't make changes to my rented house to make it wheelchair accessible (it has a FUCKING SPIRAL STAIRCASE)#so we're looking at ground-floor flats without carpet and i could get a ramp for the front doorstep and stuff#essentially future-proofing for my disabilities is also future-proofing for my parents getting old#the only thing i don't like about these flats is that they don't have a garden#they've got communal gardens which is something. but still nowhere private to hang your pants to dry

18 notes

·

View notes

Text

first time people tell a content creator GIVE US MORE ADS

#i dont think they are greedy corporate monsters. i think they are creators trying to run a business with no knowledge on how to do that#icarus flying too close to the sun and all that#is just so clear they didn't make any kind of market research#a youtube poll would have helped them#is just a shitty thing because they clearly just want to have more creative freedom and do bigger things#but if you are running a business then you also need to think about your audience. which i don't think they did#and the international issue with dollars in this economy#+ the need to use a vpn in order to watch in certain countries apparently#+ an audience of mostly 20 somethings and younger people who have other priorities#and like nearly every single person that i've seen that actually likes this idea. has also said that are not paying#because they can't afford it. so even if people were on board with this. is just not viable with their audience#like sorry. but 'streaming service' is not plan b on the list of things to if you dont wanna rely so much on ads#and them doing a 14min long video that is edited like a shitty corporate apology video#in which you say 'if you can't give us money. bye ig' while promoting#a show about people traveling to dif places and paying expensive meals#while also saying you have no money to pay your 25!!! employees#not to mention not clarifying anything and leaving everything in vague terms#like international issues. whether you are deleting your previous youtube content or not (they don't say anything about this on the vid....#.... Variety said they were gonna do it. but then they did the pinned comment so it feels like they are backtracking...#...even if they were never gonna delete it)#what newer content you want to make. the pros you get subscribing#broken record with this. but watch the og dropout ad. its clear. adresses concerns. tells you what shows would be available#and the one moment that they use sad piano music is used with irony#ok. no further comments until they say something lol#watcher#my post

18 notes

·

View notes

Text

somehow i got an interview at a finance company can anyone explain the inner workings of the stock market to me like i’m 5 years old

#the listing was like we’ll train you!! you don’t have to be a finance expert!! and then the interview reviews are like#they asked me about the stock market and to define these finance terms like#ok the qualifications were bachelors degree and customer service experience not to be the wolf of wall street so#i’m stressin#it’s just a phone interview and i’ll do it because it’s a good company and the pay is actually good well good for me anyway and it’s remote#but like. girl. lmao the last thing i know anything about is money#i mean obviously#clearly

4 notes

·

View notes

Text

One of my favorite dutch words is the term we use for "A money laundering storefront"

#It's called “a money-white-washery” btw#The term can be linked to the english “black market” (selling goods illegally)#It entered the German language in a more “selling goods illegally below the fixed prices” in ww2#And then passed to dutch#To this day someone who works without a contract (not insured & unknown by the government) is called a black worker#Whence we gain the term “black money”#So if you want to launder your black money you're essentially making it white by a cover operation#Thus: money-white-washery#Bc you're scrubbing the illegality off of it lol

4 notes

·

View notes

Text

DAMMIT what’s the line between:

‘bad publicity is still publicity’ and posting screenshots abt the tumblr shop tab moving to our blog spots

VS

I don’t want to stay silent on this topic and I know that just one formal complaint won’t do much if we aren’t all angry at the Instagram/Tik-Tok-ification that’s happening rn

#tiktokification as in I’ve been seeing posts abt images not being easy to zoom into anymore??? + the ads take up the ENTIRE screen on mobile#tumblr#tumblr updates#mypost#tumblr shop#ughhhhhhh#enshittification#enshittification of socials or whatever#i want to know why tumblr is doing this but I also don’t#cause I don’t want to hear bs black-and-white arguments about ‘no media should make money ever’ and tumblr is not a small local Etsy gal#or whatever#they have to make money someway#smth smth ‘if ur not paying for the product u are the product’#but I also don’t want to know abt the deets bc that means tumblr has fucked up enough that I’m mad enough to do so and so looking at#the Truth About Marketing for tumblr or whatever is SO ANNOYING#UGHH TUMBLR#idk if any of this is coherent bc I have absolutely horrible short term memory and by the time I’m halfway thru writing a tag I can’t see#what my previous sentences were (I’m on mobile) and so I loose my train of thought lol#anyways I think the gist is: this fucking sucks. people are going to be annoyingly us-vs-them/black-n-white when arguing about this cause#arguing is easier than doing the research and discovering greyer areas#AND: we’ve gotten to the point of rage/un satisfaction with the steps this app is taking that a push towards researched-back arguments may b#the only way forward to have actual change… :|#like again this could end up mostly having been for publicity for the store cause ofc ppl will complain and post screenshots and then more#ppl will see like ‘ooh fun stickers guess I’ll get those!’ and Marketing Tumblr or whatever will know that ‘oh if we disrupt them in these#ways we will get more attention from this fickle consumer base’#idk if we’re even that fickle lol there’s a lot of self-praise on tumblr lately (b4 the shop moving) that probably has swayed marketing#folks to push this thing we don’t like cause they think we’ll get outraged or say it’s better than other sites and either way it’s publicity

9 notes

·

View notes

Text

Not my photos. All credit to Mike Ownby on Flickr.

#ahem#the way she is sitting?#eliza dushku movies and shows#even though this is an appearance#Eliza Dushku NOT in a dress#from 2010 DWTS when she was cheering on then bf Rick Fox#she's giving cool aunt vibes#Faith AU character inspiration#you know that aunt who has a chill job but you don't really know what she does#probably something with computers or coding and she makes good money at it#and she definitely has a long term roommate at least that's how your mom describes it#but her and said roommate go to a lot of farmer's markets together and WNBA games#and they've been coming together to Thanksgiving for years now

5 notes

·

View notes

Text

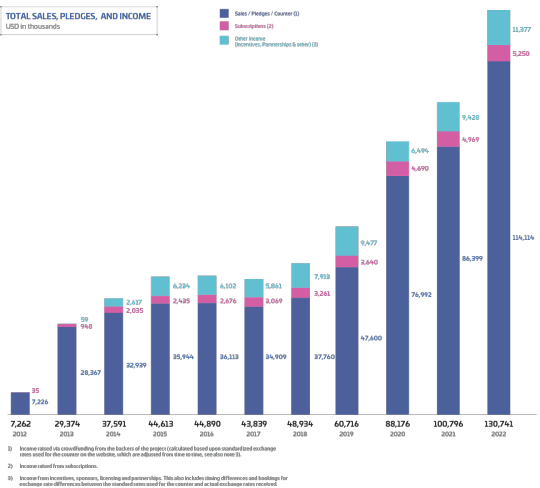

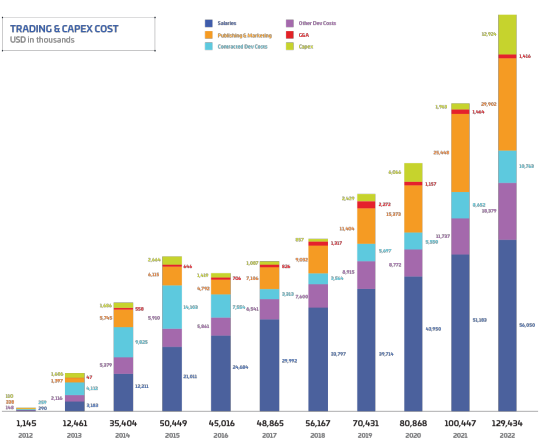

Ah, because I'm a nerd and I find this stuff fascinating, my favorite time of year, when star citizen releases their financials for the previous year (in this case, for 2022)

Some numbers of interest by the end of 2022

headcount: 860 worldwide

Salaries and related costs excluding the publishing/marketing teams: 56M

Other Game Dev (overheads,studio rentals, travel, etc): 18.4M

Contracted Game Dev ( external services and dev teams): 9.5M

Publishing/community/marketing: 29.9m

Accounting/Admin and legal fees: 1.4 Million

Capital expenditures (hardware/software, fixtures, offices, server upgrades etc): 12.9 million USD

All told they took in 130.7 million and spent 129.5 million or thereabouts.

In other words, they're spending almost as much as they bring in.

#star citizen#I def feel like their marketing team is too big#and also really really out of touch with the player base#but that's a different topic#most of the marketing funds comes from the subscription program and the external investments so its#kind of a non entity in terms of backer funds#but they have made some Choices#in recent years#anyway#some scam right?#spending all their money on development and related costs#also building a new studio#and getting 1 video game to feature complete status#while simultaneously developing a second video game#with a huge scope

1 note

·

View note

Text

youtube

*kachow* hey 👋 there dudes! Remember that weight isn't going to only need to be carried just by you.

@HamiltonMorris I'm sure you know how to make these particular peptides, right? & Truthfully I wonder if @STRANGEONS ever thought of marketing towards certain individuals a subtle message 😉

You never know it might fund people like @BPSspace & others 😏

Our #soda rights need to be protected & the #energydrink game too! Right? @Danny-Gonzalez they need a group of people to #sell them some amazing 👌👌 wonderful, the best! Out right! Things, like water with stuff in it. Soda Maybe?

0 notes

Text

Topaz and Numby-specific tag dump!

#Money is a means; not an end. [TOPAZ; IC]#Now that's a real lady if I ever saw one [TOPAZ; Main Verse]#Good investors always think long-term [TOPAZ; Answered]#Nice to have in the portfolio [TOPAZ; Musings]#It's a bull market! [TOPAZ; Crack]#Topaz of Debt Retrieval [TOPAZ; Visage]

0 notes

Photo

#The Millionaire Real Estate Investor: Strategies for Success in Property Investing#The Millionaire Real Estate Investor by Gary Keller is a comprehensive guide to achieving financial success through real estate investment.#providing practical advice#strategies#and case studies to empower readers to become successful investors. Keller begins the book by emphasizing the importance of mindset and at#focusing on the key principles of wealthy investors. By cultivating a mindset of abundance#opportunity#and continuous learning#readers can pave the way for financial success in real estate. The book then delves into the three main strategies for building wealth in#flipping#and renting. Keller explains each strategy in detail#outlining the benefits#risks#and key considerations for each approach. He provides practical tips on how to identify profitable investment opportunities#conduct market research#and navigate the complexities of real estate transactions. One of the key takeaways from The Millionaire Real Estate Investor is the conce#money#and expertise to maximize returns and scale investments. By building a network of professionals#partners#and advisors#readers can leverage resources to accelerate their real estate investment portfolio. Throughout the book#Keller shares real-life success stories and case studies of millionaire investors who have achieved financial freedom through real estate.#giving them a roadmap to follow and demonstrating that anyone can achieve success in real estate with the right mindset and strategies. In#The Millionaire Real Estate Investor also addresses the importance of financial planning and goal setting. Keller emphasizes the value of s#creating a financial plan#and tracking progress to achieve long-term success in real estate investment. Overall#The Millionaire Real Estate Investor is a must-read for anyone looking to build wealth through real estate. Whether you are a novice invest#the book offers valuable insights#practical advice#and actionable strategies to help you achieve financial success in real estate. I highly recommend The Millionaire Real Estate Investor to

0 notes

Text

5 Destructive Money Habits to Quit Today

Do you want to become a successful investor? Do you want to invest in the best stocks in ai for the long term? If the answer to these questions is yes, you need to get the basics sorted - you need to have a good relationship with money in the first place.

For that, you need to quit 5 destructive money habits. Here are they:

Mindless Spending: This is a big one! Mindless spending refers to unnecessary purchases you make impulsively, often without a plan or budget. It can be triggered by emotions like boredom, stress, or social pressure.

How to Quit: Track your spending for a month to identify areas where your money leaks out. Set spending goals and stick to a budget. Avoid impulse purchases by implementing a "wait 24 hours" rule before buying non-essential items.

Keeping Up with the Joneses: Trying to maintain a lifestyle comparable to what you perceive others have can lead to financial strain. Social media can exacerbate this by showcasing unrealistic portrayals of wealth.

How to Quit: Focus on your own financial goals and priorities, not what others have. Unfollow accounts that promote unrealistic spending habits. Be grateful for what you already have.

Living Paycheck to Paycheck: Many people find themselves constantly on the edge financially, with their income barely covering their monthly expenses. This leaves them vulnerable to financial shocks and hinders saving for long-term goals.

How to Quit: Create a budget that allocates your income towards essential expenses, savings, and some discretionary spending. Explore ways to increase your income through side hustles or promotions.

Ignoring Debt: Debt, especially high-interest credit card debt, can be a major drain on your finances. Minimum payments only cover interest, leaving the principal untouched.

How to Quit: Develop a plan to pay off high-interest debt first. Consider strategies like the debt snowball or avalanche method. Reduce your credit card usage and prioritize paying off the balance each month.

Not Saving Enough: Saving is crucial for building financial security and achieving long-term goals like retirement or a down payment on a house. Many people underestimate how much they need to save and don't prioritize it in their budget.

How to Quit: Automate your savings by setting up a recurring transfer to your savings account. Pay yourself first – treat savings like a bill that must be paid before you spend your money elsewhere.

Once you start to form a good relationship with yourself, then only you can become a good investor. Once you have taken care of the above, start learning about stock investing or get assistance from an AI stock advisor to start investing without learning much about the market.

To know more visit - https://jarvisinvest.com/

#jarvisai#ai based stock trading india#how to pick stocks for long term#stock advisory company#best advisor in stock market#ai financial advisor#artificial intelligence stocks india#best ai stocks in india for long term#money

0 notes

Text

Investing in mutual funds offers a convenient and diversified approach to grow your wealth over time. However, with a plethora of options available, choosing the right mutual fund that aligns with your investment goals can be daunting. Let us explore the key factors to consider for a mutual fund investment and find out which are the best performing SWP mutual funds in India in 2024.

#mutual funds#mutual fund investment#long-term financial goals#money market funds#sector-specific funds

0 notes

Text

this maths out esp if you live in a suburb of a major city

you can cut some money if you have fewer vacations or children but...yeah. wont say how much but my mom basically had to get a job that makes so much more money than we ever had in our lives before

before we got anywhere near this kind of life

and im an only child, my college is cheap, and my parents only started going on vacations in the last four months.

we were technically "middle class" this whole time but now we're on the high end of it, and it's insane. i still feel weird about how much money we suddenly have. we're not millionaires or anything but it feels like we won a fucking lottery

like the amount of headspace i no longer devote to penny pinching is immense, i had no idea how much it was stressing me out, EVEN when i thought i was not stressing about finances.

#and my parents nearly went bankrupt the year i was also having a meltdown in uni so like#we've been all over the place in terms of money#when i was little we lived off 2000cad a month. three people incl a growing child#i qualified for low cost everything at school lmao#at this point the only socioeconomic class i havent been in is rich basically#but just. 400k/yr???#even with inflation. esp with inflation. that number is insane#im NEVER going to get to that income bracket on my own#EVER. it's basically a done deal with what im doing with my life#there's a worsening inequality gap because the rich are literally siphoning wealth away from everyone else#and you either join them or drown#there HAS to be an overhaul of how the stock market and multinational corporations work#plus strengthening antitrust laws#bc what the rich dont seem to get is that once theyre done siphoning all the wealth#thats it#game over. they win and literally everyone else loses. and they will then lose too#bc there won't be much of a world left for them either#its 2am btw so if im not making sense its cause im exhausted but i cant sleep#hooray for insomnia

24K notes

·

View notes

Text

Ask A Genius 990: How do we monetize this?

Rick Rosner: So Carole periodically freaks out about money, worried that we’ll get old and sick and the medicine or long-term care will cost a ton of money. It already costs a lot, and prices keep going up. So she’s afraid we’ll run out of money, and she’s asking you and me how we can monetize this. We’ve been doing it for ten years and have probably generated more than a million words about…

View On WordPress

#ads and tiered membership#affiliate marketing strategies#Carole financial worries#live events and tips#medicine and long-term care costs#monetizing content ideas#Patreon for creators#podcast income challenges#Rick Rosner money concerns#selling merchandise online#social services for listeners

0 notes