#Tax-efficient education funding

Explore tagged Tumblr posts

Text

🎓 Discover tax-efficient ways to fund your loved one's education. From 529 plans to tax credits, we've got the strategies you need to ease the financial burden. 📚💰 #EducationFunding #529Plans #TaxEfficiency

#Tax-efficient education funding#529 plans#Coverdell ESAs#Roth IRAs#UGMA/UTMA accounts#tax-efficient withdrawals#financial aid#tax credits#gift tax#investment strategies.

0 notes

Text

The super-rich got that way through monopolies

Catch me in Miami! I'll be at Books and Books in Coral Gables on Jan 22 at 8PM.

Just in time for Davos, here's 'Taken, not earned: How monopolists drive the world’s power and wealth divide," a report from a coalition of international tax justice and anti-corporate activist groups:

https://www.balancedeconomy.net/wp-content/uploads/2024/01/Davos-Taken-not-Earned-full-Report-2024-FINAL.pdf

The rise of monopolies over the past 40 years came about as the result of specific, deliberate policy choices. As the report documents, the wealthiest people in America funneled a fortune into neutering antitrust enforcement, through the "consumer welfare" doctrine.

This is an economic theory that equates monopolies with efficiency: "If everyone is buying the same things from the same store, that tells you the store is doing something right, not something criminal." 40 years ago, and ever since, the wealthy have funded think-tanks, university programs and even "continuing education" programs for federal judges to push this line:

https://pluralistic.net/2021/08/13/post-bork-era/#manne-down

They didn't do this for ideological reasons – they were chasing material goals. Monopolies produce vast profits, and those profits produce vast wealth. The rise and rise of the super rich cannot be decoupled from the rise and rise of monopolies.

If you're new to this, you might think that "monopoly" only refers to a sector in which there is only one seller. But that's not what economists mean when they talk about monopolies and monopolization: for them, a monopoly is a company with power. Economists who talk about monopolies mean companies that "can act independently without needing to consider the responses of competitors, customers, workers, or even governments."

One way to measure that power is through markups ("the difference between the selling price of goods or services and their cost"). Very large companies in concentrated industries have very high markups, and they're getting higher. From 2017-22, the 20 largest companies in the world had average markups of 50%. The 100 largest companies average 43%. The smallest half of companies get average markups of 25%.

Those markups rose steeply during the covid lockdowns – and so did the wealth of the billionaires who own them. Tech billionaires – Bezos, Brin and Page, Gates and Ballmer – all made their fortunes from monopolies. Warren Buffet is a proud monopolist who says "the single most important decision in evaluating a business is pricing power… if you have to have a prayer session before raising the price by 10 percent, then you’ve got a terrible business."

We are living in the age of the monopoly. In the 1930s, the top 0.1% of US companies accounted for less than half of America's GDP. Today, it's 90%. And it's accelerating, with global mergers climbing from 2,676 in 1985 to 62,000 in 2021.

Monopoly's cheerleaders claim that these numbers vindicate them. Monopolies are so efficient that everyone wants to create them. Those efficiencies can be seen in the markups monopolies can charge, and the profits they can make. If a monopoly has a 50% markup, that's just the "efficiency of scale."

But what is the actual shape of this "efficiency?" How is it manifest? The report's authors answer this with one word: power.

Monopolists have the power "to extract wealth from, to restrict the freedoms of, and to manipulate or steer the vastly larger numbers of losers." They establish themselves as gatekeepers and create chokepoints that they can use to raise prices paid by their customers and lower the payout to their suppliers:

https://chokepointcapitalism.com/

These chokepoints let monopolies usurp "one of the ultimate prerogatives of state power: taxation." Amazon sellers pay a 51% tax to sell on the platform. App Store suppliers pay a 30% tax on every dollar they make with their apps. That translates into higher costs. Consider a good that costs $10 to make: the bottom 50% of companies (by size) would charge $12.50 for that product on average. The largest companies would charge $15. Thus monopolies don't just make their owners richer – they make everyone else poorer, too.

This power to set prices is behind the greedflation (or, more politely, "seller's inflation"). The CEOs of the largest companies in the world keep getting on investor calls and bragging about this:

https://pluralistic.net/2023/03/11/price-over-volume/#pepsi-pricing-power

The food system is incredibly monopolistic. The Cargill family own the largest commodity trader in the world, which is how they built up a family fortune worth $43b. Cargill is one of the "ABCD" companies ("Archer Daniels Midland, Bunge, Cargill and Louis Dreyfus") that control the world's food supply, and they tripled their profits during the lockdown.

Monopolies gouge everyone – even governments. Pfizer charged the NHS £18-22/shot for vaccines that cost £5/shot to make. They took the British government for £2bn – that's enough to pay last year's pay hike for NHS nurses, six times over,

But monopolies also abuse their suppliers, especially their employees. All over the world, competition authorities are uncovering "wage fixing" and "no poaching" agreements among large firms, who collude to put a cap on what workers in their sector can earn. Unions report workers having their pay determined by algorithms. Bosses lock employees in with noncompetes and huge repayment bills for "training":

https://pluralistic.net/2022/08/04/its-a-trap/#a-little-on-the-nose

Monopolies corrupt our governments. Companies with huge markups can spend some of that money on lobbying. The 20 largest companies in the world spend more than €155m/year lobbying in the US and alone, not counting the money they spend on industry associations and other cutouts that lobby on their behalf. Big Tech leads the pack on lobbying, accounting for 82% of EU lobbying spending and 58% of US lobbying.

One key monopoly lobbying priority is blocking climate action, from Apple lobbying against right-to-repair, which creates vast mountains of e-waste, to energy monopolist lobbying against renewables. And energy companies are getting more monopolistic, with Exxonmobil spending $65b to buy Pioneer and Chevron spending $60b to buy Hess. Many of the world's richest people are fossil fuel monopolists, like Charles and Julia Koch, the 18th and 19th richest people on the Forbes list. They spend fortunes on climate denial.

When people talk about the climate impact of billionaires, they tend to focus on the carbon footprints of their mansions and private jets, but the true environmental cost of the ultra rich comes from the anti-renewables, pro-emissions lobbying they buy with their monopoly winnings.

The good news is that the tide is turning on monopolies. A coalition of "businesses, workers, farmers, consumers and other civil society groups" have created a "remarkably successful anti-monopoly movement." The past three years saw more regulatory action on corporate mergers, price-gouging, predatory pricing, labor abuses and other evils of monopoly than we got in the past 40 years.

The business press – cheerleaders for monopoly – keep running editorials claiming that enforcers like Lina Khan are getting nothing done. Sure, WSJ, Khan's getting nothing done – that's why you ran 80 editorial about her:

https://pluralistic.net/2023/07/14/making-good-trouble/#the-peoples-champion

(Khan's winning like crazy. Just last month she killed four megamergers:)

https://www.thesling.org/the-ftc-just-blocked-four-mergers-in-a-month-heres-how-its-latest-win-fits-into-the-broader-campaign-to-revive-antitrust/

The EU and UK are taking actions that would have been unimaginable just a few years ago. Canada is finally set to get a real competition law, with the Trudeau government promising to add an "abuse of dominance" rule to Canada's antitrust system.

Even more exciting are the moves in the global south. In South Africa, "competition law contains some of the most progressive ideas of all":

It actively seeks to create greater economic participation, particularly for ‘historically disadvantaged persons’ as part of its public interest considerations in merger decisions.

Balzac wrote, "Behind every great fortune there is a crime." Chances are, the rapsheet includes an antitrust violation. Getting rid of monopolies won't get rid of all the billionaires, but it'll certainly get rid of a hell of a lot of them.

I'm Kickstarting the audiobook for The Bezzle, the sequel to Red Team Blues, narrated by @wilwheaton! You can pre-order the audiobook and ebook, DRM free, as well as the hardcover, signed or unsigned. There's also bundles with Red Team Blues in ebook, audio or paperback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/01/17/monopolies-produce-billionaires/#inequality-corruption-climate-poverty-sweatshops

#billionaires#wef#climate#monopoly#world economic forum#competition#antitrust#consumer welfare#inequality#corruption#davos#guillotine watch

220 notes

·

View notes

Text

Trump Watch #9

Trump has named the following:

Linda McMahon as secretary of education.

McMahon is a wrestling billionaire and co-founder of WWE.

She has long been a supporter of Trump and served in his first administration as leader of the Small Business Administration.

She has served on the Connecticut Board of Education and the board of trustees for Sacred Heart University in Connecticut.

She supports charter schools and school choice.

Scott Bessent for treasury secretary.

Bessent is a billionaire who advised Trump on economic policy during his campaign; he has experience founding and working for hedge funds.

If confirmed he will be the first LGBTQ+ Senate-confirmed cabinet member in a republican administration.

He supports extending Trump’s tax cuts and deregulation.

He also supports Trump’s embrace of the crypto industry.

Russell Vought for the Office of Management and Budget (OMB).

Vought held the same position during Trump’s first term.

He is a key architect from Project 2025 writing the chapter on the Executive Office within which he takes aim at federal regulatory agencies that are not under control of the White House..

He is a strong advocate for recess appointments of Trump’s nominees.

Lori Chavez-Deremer as labor secretary.

Chavez-Deremer was the first Latina congresswoman of Oregon; she lost re-election in November.

She co-sponsored the Protecting the Right to Organize (PRO) Act which would make it easier for workers to unionize.

She has strong support from unions.

Pam Bondi as attorney general.

Bondi is the Florida attorney general and is the first woman to hold the position.

As FL state attorney general she brought cases against the Affordable Care Act and fought to maintain FL’s ban on same-sex marriage.

She is a longtime ally of Trump, served as a chairwomen of America First Policy Institute, and defended Trump during his first impeachment trial.

She received a $25,000 donation from Trump’s charitable foundation and subsequently her office dropped a suit against Trump’s company for fraud stating there were insufficient grounds to proceed. A prosecutor assigned by then-Gov. Rick Scott determined there was insufficient evidence to support bribery charges.

Brook Rollins as secretary of agriculture

Rollins is a co-founder and president of think tank America First Policy and served as assistant to the president for intergovernmental and technology initiatives during Trump’s first administration.

She is a lawyer with an undergraduate degree from Texas A&M University in agricultural development.

Dr Marty Makary as Food and Drug Administration commissioner.

Makary is a surgeon and public policy researcher at Johns Hopkins University.

He supports RFK Jr. as Trump’s pick for HHS.

He worked with the first Trump administration on transparent billing in health care.

He opposed COVID vaccine mandates and was a critic of public health measures during the pandemic.

Dr Janette Nesheiwat for Surgeon General.

Nesheiwat is a physician, medical director at CityMD, and former Fox News medical contributor.

She is a supporter of vaccines.

Dave Weldon to direct the Centers for Disease Control and Prevention.

Weldon is a physician, Army veteran, and former Republican Florida representative.

As a congressman he introduced the Weldon Amendment which provides protections for health care workers and organizations that do not provide or aid in abortions.

Scott Turner for secretary of Housing and Urban Development.

Turner previously served in the Texas House of Representatives; he is a NFL veteran and motivational speaker.

He led the White House Opportunity and Revitalization Council during Trump’s first term and currently works as chair of the Center for Education Opportunity at America First Policy Institute.

Republicans also announced plan to create a GOP-controlled subcommittee, Delivering on Government Efficiency, to work with the Department of Government Efficiency on cutting government waste; the committee is to be chaired by Marjorie Taylor Greene.

#democrat#democratic party#republican#republican party#donald trump#trump#us politics#politics#democracy#liberals#conservatives#department of government efficiency

9 notes

·

View notes

Text

Christ Britt

* * * *

Robert B. Hubbell Newsletter

September 17, 2024

I am not going to take the bait dangled by JD Vance about the lack of assassination attempts on Kamala Harris. Trump and Vance have leaned into their anti-immigrant and “blame the liberals” for the assassination attempts and have succeeded in diverting the conversation from the fascistic threat posed to America by Project 2025. Every day that Project 2025 is not at the top of the news cycle is a day that the media has failed democracy.

To recap, Trump and Vance plan to do the following using the blueprint of Project 2025 (per Democracy Forward)

· Impose a national abortion ban.

· Restrict access to contraception

· Remove medical privacy protections for people seeking reproductive healthcare

· Engage in mass deportations of 20 million immigrants

· Roll back protection for same sex marriage and LGBTQ rights

· Remove prohibitions on discrimination on the basis of race or sex

· Allow the president to use the DOJ to target political enemies

· Cut funding to the FBI

· Eliminate the Department of Education

· Eliminate the Department of Homeland Security

· Disband the National Oceanic & Atmospheric Administration (NOAA)

· Fire thousands of civil servants whose expertise keeps the wheels of government turning

· Slash corporate income taxes

· Eliminate the ability of the federal government to drive down drug costs by negotiating prices of Medicare drugs

· Restrict access to food assistance by imposing work requirements on disabled and single parents

· Eliminate Project Head Start

· Cut funding for green energy and encourage reliance on fossil fuels

· Expand offshore drilling and drilling on public lands

· Eliminate funding for public transportation projects

· Grant parents control over school curricula

The above list does not include Trump's economy-killing a 10% tariff on all imported goods and a 60% tariff on goods imported from China (which provides 16% of all goods imported into the US).

Nor does Project 2025 account for the impact of anti-vaxxer RFK Jr. controlling federal healthcare policy, Aileen Cannon being appointed to the Supreme Court, or Elon Musk overseeing an “efficiency commission” to cut alleged government “waste” (read: programs that help people). Finally, Project 2025 does not account for the compounding effect of the Supreme Court’s grant of prospective criminal immunity to the president.

Many of the issues above—standing alone—should be cause for Americans to rise up and vote en masse to defeat Trump. Taken together, they should drive Americans to the polls to deliver a historic defeat to Trump. And yet, the election remains close.

Part of the reason the election remains close is because Trump and Vance have been able to divert attention from Project 2025 by making evermore outrageous and dangerous statements.

I do not mean to diminish the hateful attacks on immigrants by referring to them as “cat memes.” I use that term because JD Vance over the weekend said that it was the plan of Trump and Vance to “create stories” (“memes”) to focus the media’s attention on immigration—one of the few subjects on which Trump has a polling advantage over Kamala Harris.

Indeed, JD Vance’s deliberate use of “cat memes” to incite anti-immigrant animus is resulting in real-life harassment and intimidation of Haitian immigrants in Springfield, Ohio—including numerous bomb threats that have shut down city hall, primary schools, and a college. NBC News, Baseless rumors about Haitian immigrants threaten to unravel Springfield, Ohio.

Trump and Vance plan to ratchet the racial tension in Springfield by holding a “town hall meeting,”—which will undoubtedly feature hand-picked frustrated white residents and exclude Haitian immigrants who are helping to revive Springfield. See Vanity Fair, Trump Reportedly Has Super-Helpful Plans to Visit Springfield, Ohio, the City He and JD Vance Continue to Spread Baseless Lies About Re: Haitian Migrants Eating Pets.

JD Vance is also pushing the right-wing claim that the two assassination attempts on Trump are the result of allegedly irresponsible Democratic rhetoric about Trump—like saying that he is an existential threat to democracy and a wannabe dictator (his words, not mine).

The hypocrisy is so thick it is viscous. Hours before the assassination attempt, Trump blasted a Truth Social post saying, “I HATE TAYLOR SWIFT.” He regularly refers to Kamala Harris and Joe Biden as “enemies” of the state and describes them as “fascist Marxists” and “extreme leftists” who are intent on “destroying our country.”

Neither Kamala Harris, Joe Biden, nor Tim Walz has used such extreme language to describe Trump. Rather, it is Trump and Vance who are using the violent rhetoric that is resonating with sick and impressionable males with access to weapons of war. See Josh Marshall, Talking Points Memo, Yes. Trump Started The Fire. And Everyone Knows It.

Per Marshall,

Republicans are now predictably demanding that Democrats in essence stop campaigning against Trump because they’re inciting their supporters to try to assassinate Trump. That’s absurd. Neither of these men is in any sense a supporter of Democrats or even of more marginal groups that could in any sense be identified with “the left.” But on a broader level, Donald Trump is simply himself a source of unrest and conflagration. [¶¶] He’s a vortex of violence. His rhetoric is violent. He has friendly paramilitaries like the Proud Boys that he encourages to come to his aid. He was the one who incited a violent mob to storm the U.S. Capitol. He’s provoked numerous supporters to acts of mass violence, from Pittsburgh to El Paso. The mix of bomb threats and marches in Springfield over the last week are only the latest example.

JD Vance took the violent rhetoric to another level on Monday evening by stating

the big difference between conservatives and liberals is that no one has tried to kill Kamala Harris in the last couple of months, and two people now have tried to kill Donald Trump . . . .

JD Vance’s statement is reprehensible on many levels. The two would-be assassins were both mentally ill men who supported Trump and had access to weapons of war. The notion that they were “liberals” is the false; the opposite is true.

Second, JD Vance’s ambiguous statement suggests that Kamala Harris is overdue for an assassination attempt—much like Elon Musk’s statement on Monday that “And no one is even trying to assassinate Biden/Kamala.” Musk deleted that comment by Tuesday morning, claiming that it was a joke. He wrote,

Turns out that jokes are WAY less funny if people don’t know the context and the delivery is plain text. Well, one lesson I’ve learned is that just because I say something to a group and they laugh doesn’t mean it’s going to be all that hilarious as a post on [Twitter].

On Tuesday, the Secret Service said it was “aware” of Musk’s tweet after the White House issued a statement saying that the tweet was “irresponsible.” BBC, Secret Service 'aware' of Elon Musk post about Harris and Biden.”

The shocking difference between Elon Musk and JD Vance is that Musk has a few shreds of self-awareness and capacity to be shamed such that he removed the tweet while JD Vance will simply double down on his grossly irresponsible comment. Every major media outlet should condemn JD Vance on Tuesday.

Michelle Obama reminded us at the convention that it would get ugly. Wow! Was she ever right!

We need to stick with the issues that will help Democrats persuade the few remaining persuadable voters that they need to vote for Kamala Harris. While we should condemn Trump and Vance with every ounce of our being, we must also speak to voters about the issues that affect them in the coming election. Framing Trump and Vance as the proponents of the dangerous Project 2024 is a strong, winning message.

#political cartoons#Chris Britt#Project 2025#Robert B. Hubbell#Robert B. Hubbell Newsletter#stochastic terrorism#hate speech#Ohio#springfield ohio#hatemongering#political hate speech#political violence

10 notes

·

View notes

Text

Will Donald Trump Eliminate the Department of Education?

by Benjamin Seevers | Nov 25, 2024

Hardly a minute has gone by without the media sounding off about President-elect Donald Trump’s cabinet nominations. However, one department has garnered more attention than others: the Department of Education).

Trump has stated that eliminating the Department of Education and devolving governance of education to the states would be one of the first actions of his second administration, and his choice for secretary, Linda McMahon, may or may not share Trump’s goal. The Heritage Foundation’s Project 2025 has also called for the elimination of the Department of Education

This alarms leaders of teacher advocacy organizations. The president of American Federation of Teachers (AFT)—the second largest teacher’s union in the country—stated, “Donald Trump and Republican elected officials have said they want to eliminate the Department of Education, which oversees programs that invest in low-income schools and help fund education for students with disabilities, but if they listen to what the voters have said, they will work to strengthen public schools, not dismantle them.”

Given Trump’s comments, the AFT has good reason to fear the incoming administration. If the Department of Education is eliminated, then the stranglehold teacher unions have on education policy would be greatly diminished. This reform promises significant benefits.

William Fischel, in his seminal paper entitled, “Homevoters, Municipal Corporate Governance, and the Benefit View of the Property Tax,” highlights the fact that centralization in public school funding has led to worse education outcomes. Why? Fischel states:

“Local funding provides a benefit-cost discipline on local voters who own homes in the district. Consider a local superintendent’s proposal to improve schools by adding more teachers. Under local property tax funding, this has a positive and a negative effect on voters. If the additional teachers raise the quality of education, home values will rise, which pleases most homeowners in the same way that capital gains please stockholders. But the additional need for funds will raise property taxes, and it is widely established that higher taxes will reduce home values. Thus local voters have an incentive to adopt cost-effective school measures, which makes their schools more efficient.”

This same effect is not felt at the state level. Fischel explains:

10 notes

·

View notes

Text

As corporate outlets like ABC News and The Washington Post bend to incoming President Trump’s threats to send his FBI against them, censoring themselves and settling dubious lawsuits out-of-court, and as social media from X to Facebook blast hate and disinformation, public broadcasting remains a crucial lifeline. But this lifeline is under dire threat.

“Legacy media must die,” Elon Musk declared on X, putting public broadcasting over TV and radio (PBS and NPR) directly in his sights. No doubt, Musk sees his own tilted platform, X, as the natural heir apparent to the “legacy media” he wants to kill.

Now, his megaphone amplified as co-chair of Trump’s so-called Department of Government Efficiency (DOGE), Musk has proposed eliminating all $535 million in funding for public broadcasting. The move already has the backing of MAGA-friendly Speaker Mike Johnson.

To put this into perspective, the entire public broadcasting budget is just a fraction of what Musk spent to buy Twitter in 2022 -- $44 billion, more than 80 times the annual allocation for NPR and PBS combined.

But what is the real value of public broadcasting? Perhaps no one has put it so well as the beloved Fred Rogers, whotestified before Congress back when the Nixon administration was trying to cut PBS funding in 1969:

“We don’t have to bop somebody over the head to make drama on the screen. We deal with such things as getting a haircut… I feel that if we in public television can only make it clear that feelings are mentionable and manageable, we will have done a great service for mental health.”

Compared to the bloviations on X and Breitbart, Mr. Rogers is a breath of fresh air!

Take action today! Tell Congress: Public broadcasting is essential to the mental health of our national discourse, and must be maintained in service to our nation, rural and urban, rich and poor, young and old.

Not only does public broadcasting provide beloved programs like Sesame Street and All Things Considered, it also supports over 1,000 public radio stations, delivering local news, educational programming, and vital emergency alerts. NPR is within listening distance of 98% of Americans, including rural and underserved communities.

Back in the same 1969 hearing, Mr. Rogers showed the senators how he used simple songs and stories to promote children’s emotional resilience and self-regulation. He cited these words from his song about how to prevent oneself from having a tantrum:

“What do you do with the mad that you feel? When you feel so mad you could bite? When the whole wide world seems oh so wrong, and nothing you do seems very right? It’s great to be able to stop when you’ve planned the thing that’s wrong. And be able to do something else instead -- and think this song: I can stop when I want to. Can stop when I wish. Can stop, stop, stop anytime And what a good feeling to feel like this! And know that the feeling is really mine."

Meanwhile, Musk and DOGE co-chair Vivek Ramaswamy’s proposal to slash $2 trillion from government spending is wildly unrealistic. Their target represents nearly one-third of the $6.1 trillion federal budget -- and only 16% of that budget is allocated to non-defense discretionary programs such as public broadcasting.

Musk’s own SpaceX benefits from billions in federal defense contracts, which remain untouched in their plans. Yet, the $535 million needed to sustain NPR and PBS could be easily funded many times over by a common-sense wealth tax on billionaires like Musk and Ramaswamy.

Act now to save NPR and PBS! Urge Congress to preserve its funding for the Corporation for Public Broadcasting.

@upontheshelfreviews

@greenwingspino

@one-time-i-dreamt

@tenaflyviper

@akron-squirrel

@ifihadaworldofmyown

@justice-for-jacob-marley

@voicetalentbrendan

@thebigdeepcheatsy

@what-is-my-aesthetic

@ravenlynclemens

@thegreatallie

@writerofweird

@anon-lephant

@mentally-quiet-spycrab

4 notes

·

View notes

Text

B.2.2 Does the state have subsidiary functions?

Yes, it does. While, as discussed in the last section, the state is an instrument to maintain class rule this does not mean that it is limited to just defending the social relationships in a society and the economic and political sources of those relationships. No state has ever left its activities at that bare minimum. As well as defending the rich, their property and the specific forms of property rights they favoured, the state has numerous other subsidiary functions.

What these are has varied considerably over time and space and, consequently, it would be impossible to list them all. However, why it does is more straight forward. We can generalise two main forms of subsidiary functions of the state. The first one is to boost the interests of the ruling elite either nationally or internationally beyond just defending their property. The second is to protect society against the negative effects of the capitalist market. We will discuss each in turn and, for simplicity and relevance, we will concentrate on capitalism (see also section D.1).

The first main subsidiary function of the state is when it intervenes in society to help the capitalist class in some way. This can take obvious forms of intervention, such as subsidies, tax breaks, non-bid government contracts, protective tariffs to old, inefficient, industries, giving actual monopolies to certain firms or individuals, bailouts of corporations judged by state bureaucrats as too important to let fail, and so on. However, the state intervenes far more than that and in more subtle ways. Usually it does so to solve problems that arise in the course of capitalist development and which cannot, in general, be left to the market (at least initially). These are designed to benefit the capitalist class as a whole rather than just specific individuals, companies or sectors.

These interventions have taken different forms in different times and include state funding for industry (e.g. military spending); the creation of social infrastructure too expensive for private capital to provide (railways, motorways); the funding of research that companies cannot afford to undertake; protective tariffs to protect developing industries from more efficient international competition (the key to successful industrialisation as it allows capitalists to rip-off consumers, making them rich and increasing funds available for investment); giving capitalists preferential access to land and other natural resources; providing education to the general public that ensures they have the skills and attitude required by capitalists and the state (it is no accident that a key thing learned in school is how to survive boredom, being in a hierarchy and to do what it orders); imperialist ventures to create colonies or client states (or protect citizen’s capital invested abroad) in order to create markets or get access to raw materials and cheap labour; government spending to stimulate consumer demand in the face of recession and stagnation; maintaining a “natural” level of unemployment that can be used to discipline the working class, so ensuring they produce more, for less; manipulating the interest rate in order to try and reduce the effects of the business cycle and undermine workers’ gains in the class struggle.

These actions, and others like it, ensures that a key role of the state within capitalism “is essentially to socialise risk and cost, and to privatise power and profit.” Unsurprisingly, “with all the talk about minimising the state, in the OECD countries the state continues to grow relative to GNP.” [Noam Chomsky, Rogue States, p. 189] Hence David Deleon:

“Above all, the state remains an institution for the continuance of dominant socioeconomic relations, whether through such agencies as the military, the courts, politics or the police … Contemporary states have acquired … less primitive means to reinforce their property systems [than state violence — which is always the means of last, often first, resort]. States can regulate, moderate or resolve tensions in the economy by preventing the bankruptcies of key corporations, manipulating the economy through interest rates, supporting hierarchical ideology through tax benefits for churches and schools, and other tactics. In essence, it is not a neutral institution; it is powerfully for the status quo. The capitalist state, for example, is virtually a gyroscope centred in capital, balancing the system. If one sector of the economy earns a level of profit, let us say, that harms the rest of the system — such as oil producers’ causing public resentment and increased manufacturing costs — the state may redistribute some of that profit through taxation, or offer encouragement to competitors.” [“Anarchism on the origins and functions of the state: some basic notes”, Reinventing Anarchy, pp. 71–72]

In other words, the state acts to protect the long-term interests of the capitalist class as a whole (and ensure its own survival) by protecting the system. This role can and does clash with the interests of particular capitalists or even whole sections of the ruling class (see section B.2.6). But this conflict does not change the role of the state as the property owners’ policeman. Indeed, the state can be considered as a means for settling (in a peaceful and apparently independent manner) upper-class disputes over what to do to keep the system going.

This subsidiary role, it must be stressed, is no accident, It is part and parcel capitalism. Indeed, “successful industrial societies have consistently relied on departures from market orthodoxies, while condemning their victims [at home and abroad] to market discipline.” [Noam Chomsky, World Orders, Old and New, p. 113] While such state intervention grew greatly after the Second World War, the role of the state as active promoter of the capitalist class rather than just its passive defender as implied in capitalist ideology (i.e. as defender of property) has always been a feature of the system. As Kropotkin put it:

“every State reduces the peasants and the industrial workers to a life of misery, by means of taxes, and through the monopolies it creates in favour of the landlords, the cotton lords, the railway magnates, the publicans, and the like … we need only to look round, to see how everywhere in Europe and America the States are constituting monopolies in favour of capitalists at home, and still more in conquered lands [which are part of their empires].” [Evolution and Environment, p. 97]

By “monopolies,” it should be noted, Kropotkin meant general privileges and benefits rather than giving a certain firm total control over a market. This continues to this day by such means as, for example, privatising industries but providing them with state subsidies or by (mis-labelled) “free trade” agreements which impose protectionist measures such as intellectual property rights on the world market.

All this means that capitalism has rarely relied on purely economic power to keep the capitalists in their social position of dominance (either nationally, vis-à-vis the working class, or internationally, vis-à-vis competing foreign elites). While a “free market” capitalist regime in which the state reduces its intervention to simply protecting capitalist property rights has been approximated on a few occasions, this is not the standard state of the system — direct force, i.e. state action, almost always supplements it.

This is most obviously the case during the birth of capitalist production. Then the bourgeoisie wants and uses the power of the state to “regulate” wages (i.e. to keep them down to such levels as to maximise profits and force people attend work regularly), to lengthen the working day and to keep the labourer dependent on wage labour as their own means of income (by such means as enclosing land, enforcing property rights on unoccupied land, and so forth). As capitalism is not and has never been a “natural” development in society, it is not surprising that more and more state intervention is required to keep it going (and if even this was not the case, if force was essential to creating the system in the first place, the fact that it latter can survive without further direct intervention does not make the system any less statist). As such, “regulation” and other forms of state intervention continue to be used in order to skew the market in favour of the rich and so force working people to sell their labour on the bosses terms.

This form of state intervention is designed to prevent those greater evils which might threaten the efficiency of a capitalist economy or the social and economic position of the bosses. It is designed not to provide positive benefits for those subject to the elite (although this may be a side-effect). Which brings us to the other kind of state intervention, the attempts by society, by means of the state, to protect itself against the eroding effects of the capitalist market system.

Capitalism is an inherently anti-social system. By trying to treat labour (people) and land (the environment) as commodities, it has to break down communities and weaken eco-systems. This cannot but harm those subject to it and, as a consequence, this leads to pressure on government to intervene to mitigate the most damaging effects of unrestrained capitalism. Therefore, on one side there is the historical movement of the market, a movement that has not inherent limit and that therefore threatens society’s very existence. On the other there is society’s natural propensity to defend itself, and therefore to create institutions for its protection. Combine this with a desire for justice on behalf of the oppressed along with opposition to the worse inequalities and abuses of power and wealth and we have the potential for the state to act to combat the worse excesses of the system in order to keep the system as a whole going. After all, the government “cannot want society to break up, for it would mean that it and the dominant class would be deprived of the sources of exploitation.” [Malatesta, Op. Cit., p. 25]

Needless to say, the thrust for any system of social protection usually comes from below, from the people most directly affected by the negative effects of capitalism. In the face of mass protests the state may be used to grant concessions to the working class in cases where not doing so would threaten the integrity of the system as a whole. Thus, social struggle is the dynamic for understanding many, if not all, of the subsidiary functions acquired by the state over the years (this applies to pro-capitalist functions as these are usually driven by the need to bolster the profits and power of capitalists at the expense of the working class).

State legislation to set the length of the working day is an obvious example this. In the early period of capitalist development, the economic position of the capitalists was secure and, consequently, the state happily ignored the lengthening working day, thus allowing capitalists to appropriate more surplus value from workers and increase the rate of profit without interference. Whatever protests erupted were handled by troops. Later, however, after workers began to organise on a wider and wider scale, reducing the length of the working day became a key demand around which revolutionary socialist fervour was developing. In order to defuse this threat (and socialist revolution is the worst-case scenario for the capitalist), the state passed legislation to reduce the length of the working day.

Initially, the state was functioning purely as the protector of the capitalist class, using its powers simply to defend the property of the few against the many who used it (i.e. repressing the labour movement to allow the capitalists to do as they liked). In the second period, the state was granting concessions to the working class to eliminate a threat to the integrity of the system as a whole. Needless to say, once workers’ struggle calmed down and their bargaining position reduced by the normal workings of market (see section B.4.3), the legislation restricting the working day was happily ignored and became “dead laws.”

This suggests that there is a continuing tension and conflict between the efforts to establish, maintain, and spread the “free market” and the efforts to protect people and society from the consequences of its workings. Who wins this conflict depends on the relative strength of those involved (as does the actual reforms agreed to). Ultimately, what the state concedes, it can also take back. Thus the rise and fall of the welfare state — granted to stop more revolutionary change (see section D.1.3), it did not fundamentally challenge the existence of wage labour and was useful as a means of regulating capitalism but was “reformed” (i.e. made worse, rather than better) when it conflicted with the needs of the capitalist economy and the ruling elite felt strong enough to do so.

Of course, this form of state intervention does not change the nature nor role of the state as an instrument of minority power. Indeed, that nature cannot help but shape how the state tries to implement social protection and so if the state assumes functions it does so as much in the immediate interest of the capitalist class as in the interest of society in general. Even where it takes action under pressure from the general population or to try and mend the harm done by the capitalist market, its class and hierarchical character twists the results in ways useful primarily to the capitalist class or itself. This can be seen from how labour legislation is applied, for example. Thus even the “good” functions of the state are penetrated with and dominated by the state’s hierarchical nature. As Malatesta forcefully put it:

“The basic function of government … is always that of oppressing and exploiting the masses, of defending the oppressors and the exploiters … It is true that to these basic functions … other functions have been added in the course of history … hardly ever has a government existed … which did not combine with its oppressive and plundering activities others which were useful … to social life. But this does not detract from the fact that government is by nature oppressive … and that it is in origin and by its attitude, inevitably inclined to defend and strengthen the dominant class; indeed it confirms and aggravates the position … [I]t is enough to understand how and why it carries out these functions to find the practical evidence that whatever governments do is always motivated by the desire to dominate, and is always geared to defending, extending and perpetuating its privileges and those of the class of which it is both the representative and defender.” [Op. Cit., pp. 23–4]

This does not mean that these reforms should be abolished (the alternative is often worse, as neo-liberalism shows), it simply recognises that the state is not a neutral body and cannot be expected to act as if it were. Which, ironically, indicates another aspect of social protection reforms within capitalism: they make for good PR. By appearing to care for the interests of those harmed by capitalism, the state can obscure it real nature:

“A government cannot maintain itself for long without hiding its true nature behind a pretence of general usefulness; it cannot impose respect for the lives of the privileged if it does not appear to demand respect for all human life; it cannot impose acceptance of the privileges of the few if it does not pretend to be the guardian of the rights of all.” [Malatesta, Op. Cit., p. 24]

Obviously, being an instrument of the ruling elite, the state can hardly be relied upon to control the system which that elite run. As we discuss in the next section, even in a democracy the state is run and controlled by the wealthy making it unlikely that pro-people legislation will be introduced or enforced without substantial popular pressure. That is why anarchists favour direct action and extra-parliamentary organising (see sections J.2 and J.5 for details). Ultimately, even basic civil liberties and rights are the product of direct action, of “mass movements among the people” to “wrest these rights from the ruling classes, who would never have consented to them voluntarily.” [Rocker, Anarcho-Syndicalism, p. 75]

Equally obviously, the ruling elite and its defenders hate any legislation it does not favour — while, of course, remaining silent on its own use of the state. As Benjamin Tucker pointed out about the “free market” capitalist Herbert Spencer, “amid his multitudinous illustrations … of the evils of legislation, he in every instance cites some law passed ostensibly at least to protect labour, alleviating suffering, or promote the people’s welfare… But never once does he call attention to the far more deadly and deep-seated evils growing out of the innumerable laws creating privilege and sustaining monopoly.” [The Individualist Anarchists, p. 45] Such hypocrisy is staggering, but all too common in the ranks of supporters of “free market” capitalism.

Finally, it must be stressed that none of these subsidiary functions implies that capitalism can be changed through a series of piecemeal reforms into a benevolent system that primarily serves working class interests. To the contrary, these functions grow out of, and supplement, the basic role of the state as the protector of capitalist property and the social relations they generate — i.e. the foundation of the capitalist’s ability to exploit. Therefore reforms may modify the functioning of capitalism but they can never threaten its basis.

In summary, while the level and nature of statist intervention on behalf of the employing classes may vary, it is always there. No matter what activity it conducts beyond its primary function of protecting private property, what subsidiary functions it takes on, the state always operates as an instrument of the ruling class. This applies even to those subsidiary functions which have been imposed on the state by the general public — even the most popular reform will be twisted to benefit the state or capital, if at all possible. This is not to dismiss all attempts at reform as irrelevant, it simply means recognising that we, the oppressed, need to rely on our own strength and organisations to improve our circumstances.

#community building#practical anarchy#practical anarchism#anarchist society#practical#faq#anarchy faq#revolution#anarchism#daily posts#communism#anti capitalist#anti capitalism#late stage capitalism#organization#grassroots#grass roots#anarchists#libraries#leftism#social issues#economy#economics#climate change#climate crisis#climate#ecology#anarchy works#environmentalism#environment

7 notes

·

View notes

Text

youtube

Everything wrong with America today is Ronald Reagan's fault, and here's why. (Yes, this video has a couple cringey moments when they try to crack a joke, but the rest is highly informative.)

Trickledown economics was his idea. He applied the same thought process was applied to healthcare-- "competition will breed efficiency!" Not realizing that corners will be cut to keep costs down.

Cutting funding to social welfare programs and funding the police instead? His idea. He's also the creator of the horribly racist, "Welfare Queen," and the mentality that social welfare programs, like food stamps, would only encourage people to feed off of the system.

The AIDS epidemic was his fault-- he failed to adequately handle it, and didn't speak about it for four years. Imagine if Covid or even H1N1 had gone on that long before anyone did anything about it! He ignored it because he genuinely believed it was an act of God to wipe out gay people.

The student loan crisis? Reagan believed that higher education should be a luxury for the rich. He believed colleges shouldn't offer free education, saying they should instead offer student loans, and passed state tax cuts designed to subsidize higher education.

He tried to get rid of the Pell Grant-- designed to help students based on their financial standing.

Academic advisor to Reagan, Roger Freeman, is quoted as saying, "we are in danger of producing an educated proletariat... We have to be selective on who we allow to go through higher education."

We have Reagan to thank for the return of union busting after he fired over 11,000 air traffic control workers while on strike.

We need to start acknowledging all of the mistakes Reagan made if we *ever* want this country to change properly.

#politics#donald Trump#trump#maga#proletariat#bourgeois#life#society#america#sources#news#ronald reagan#healthcare#social welfare#welfare#patriotism#Youtube

9 notes

·

View notes

Text

Project 2025 will kill you. Yes, you. Sections 11-15 (of 30)

So I've been reading Project 2025 so you don't have to, and I'm going to report on everything I find that is alarming, which is a lot. Part One can be found here. Part Two can be found here.

Section 11 - Department of Education

"Federal education policy should be limited and, ultimately, the federal Department of Education should be eliminated."

That's the first sentence in this whole section. I think that pretty much says it all.

All student loans and grants are to be moved to the private sector. Move education for military families to the Defense Department and for Washington D.C. to Congress. I imagine that also applies to protectorates like Guam and Puerto Rico but the document actually doesn't say.

Put all education funding under State Control. You should really ask a child living in Florida how that's working out. Reject Gender Identity and Racial studies. Eliminate executive orders in education. I remind you that integration was done by executive order.

Transfer all Native American education to the Bureau for Indian Affairs. Transfer all adult education programs to the Department of Labor. Privatize Student Aid.

Move all civil rights enforcement to the Department of Justice. Transfer all civil service employees to other agencies. Eliminate the understanding that Trans people even exist.

Eliminate any privacy regulations used to protect students from any form of abuse. Rescind all regulations in Equity in IDEA.

Eliminate all food programs for students. All of them.

Phase out income-based student loan repayment programs. Rescind all funding for the National Education Association. Consider "Critical Race Theory" to be racism.

Here's a crazy one that takes paragraphs to unravel: Allow parents of children over the age of 18 to sue to recover any monies spent on their education. Also, allow families to "opt out" of the education system entirely and for those that do give as a tax break the funding that would have been used to educate that child directly to the parents.

Allow states to opt out of any and all federal education programs. Eliminate Parent PLUS loans.

There is page after page of basically "end anything Obama or Biden did", but eventually it all boils down to that first sentence. Eliminate the Department of Education.

Section 12 - Department of Energy (and related commissions)

You would expect this whole document to be drill baby drill but in fact it starts with the repeal and elimination of the Biden Administration's Infrastructure Act - the single largest jobs creation bill in the last 75 years. That's followed with not only a dependence upon oil and natural gas but a declaration that the U.S. needs to be the best in the world in Science. Great for a country trying to eliminate the Department of Education.

Eliminate the office of Clean Energy, and the office of Grid Deployment. Yep, they don't want the government looking at the power grid.

Not only increase a reliance ("dominance") in oil and gas but nuclear power as well.

Lots of paragraphs on focusing on science, which again - see the section on the Department of Education. Lots of contradictions here. Increase the level of private sector disposal of nuclear waste. What could possibly go wrong?

Fund a rebuilding of the country's nuclear arsenal. New warheads and testing. Eliminate Carbon Capture programs and Carbon offsets. Pursue much more coal, including coal waste as fuel. Increase fossil fuels.

End the government's focus on green energy and renewables. Eliminate efficiency standards for appliances. In fact, they put this paragraph in the document twice on consecutive pages.

"End Grid planning and focus instead on reliability." I shit you not, that's a whole topic in here. Say goodbye to grid upgrades and hello to more Texas-style outages. They then spend several pages repeating everything I've already told you about.

Eliminate the Department of Energy's ability to make loans. Eliminate the Advanced Research Projects Agency. Looks like that better battery for your Tesla is going to have to wait.

Eliminate the Clean Energy Corps. Privatize the Energy Information Administration. Stop all funding for "climate reparations" - i.e. paying for the damage caused by oil production in underdeveloped nations.

Drill in Alaska (of course). Claim the Arctic Circle for the same purpose. Take an "America First" approach at the Office of Technology.

Accelerate cleanup of all "Superfund" sites (except for Hanford in Washington State - which is where the U.S. government has stored Plutonium Waste for many years) with a goal of completing all work by 2035. That sounds good on the surface but in most of these sites there is a reason that it needs to go slow: fast work actually makes the contamination WORSE and spreads it further. Eliminate some regulations specific to the Hanford site.

Get all active Nuclear Waste stored at Yucca Mountain already.

As long as we're talking about nuclear stuff again, let's make more nukes. Abandon the Test Ban Treaty. Divest certain programs at Los Alamos and Lawrence Livermore to refocus on nuclear energy and weaponry. Several pages are spent rehashing the need to get rid of renewables

Refocus transmission of electrical to the state level. I mean, why can't we all be Texas? Eliminate all questions about oil and gas pipelines to only consider the need for the fuels, not environmental or any other concerns.

Eliminate the guidance of "as low as reasonably possible" for nuclear exposure when considering renewing the licensing for existing nuclear power plants or building new ones.

Fuck, this was a nightmare to get through. but guess what's next?

Section 13 - Environmental Protection Agency

This whole section was written by Mandy M. Gunasekara, a former Chief of Staff at the EPA under the Trump Administration who in 2023 was kicked off the ballot in Mississippi when she ran for Public Service Commissioner - because she didn't live there.

Let's start that in the mission statement that it blames the lead poisoning crisis in Flint Michigan on The Obama Administration, which is so obviously incorrect that it boggle belief. It also states that every expansion of the EPA since 1972 is unnecessary.

Eliminate the Office of Environmental Justice and External Civil Rights. Eliminate the Office of Enforcement and Compliance Assistance. Eliminate the Office of Public Engagement and Environmental Education. "Relocate" the Office of Children’s Health Protection and the Office of Small and Disadvantaged Business Utilization - although the document does say where to relocate these agencies to.

Review the grants program to ensure that taxpayer funds go to organizations focused on tangible environmental improvements free from political affiliation (there are no such groups).

This document goes on for more than 30 pages and makes the same faulty assumptions and rewrites historical data so often that it should be considered a work of fiction. But the key thing is unchanged: That everything that the EPA has done in terms of rulings and regulations since 1972 should be repealed.

Where I grew up you could see the air in 1972. It was grey. That's what they want to go back to.

Section 14 - Department of Heath and Human Services

This whole section was written by The Heritage Foundation. In the first two sentences it proclaims the COVID-19 Pandemic as over (which it isn't) and that life expectancy has decreased since the end of the Pandemic - which we do not yet know as the timing is too recent for statistical analysis. It's a lie.

No more abortions. Ever.

Prioritize families over everyone else. By the way, that's "traditional" families. Mother, father, children, church.

Remove the ability to declare emergencies and provide guidelines for outbreaks of diseases that contradict the political agenda of the administration. Move the recommendations of the CDC on how to treat anything into a separate political agency. The entire document assumes that the CDC is faulty and corrupt, and not that the people using the CDC to make policy are. This is also a lie.

Remove Generic drugs from Medicaid. Make Abortion pills a controlled substance, with the ultimate goal of making them illegal at the same degree as Meth and Cocaine.

Eliminate chickenpox, Hepatitis, and MMR vaccines that originate from studies and science from fetal tissue. That's all of them, by the way. Also, eliminate vaccine mandates of any kind - you know, the type that for a while eliminated chicken pox, small pox, the mumps, measles and so on and could have been used to eliminate COVID. I notice that all of these are on the rise in the US. Even motherfucking POLIO is back.

Eliminate all research that uses science from Fetal Tissue. Eliminate all science funding and research that involves the fluidity of human sexuality. There are men and there are women and they are born that way. Period.

Several paragraphs are about "Woke" policies, and they encourage an end to diversity in conferences and studies.

When it gets to the Medicare section there is paragraph after paragraph about the bureaucracy of Medicare and how much time doctors have to spend on paperwork. This is a common fallacy that has been around for decades - yes, there is paperwork and there is a lot of it, but it's still LESS PAPERWORK THAN REQUIRED BY PRIVATE INSURERS.

The truth is that bureaucratic waste in Medicaid is about 2%, where in the private industry it varies from 5% to 10%.

Eliminate the ability to negotiate drug prices under Medicare.

As for Medicaid, paragraph after paragraph is dedicated to the elimination of problems that don't actually exist, plus adding work requirements to eligibility and actually taking away from states the ability to make programs flexible - which seems like an oxymoron until you realize that most waivers for various programs under Medicaid are for Democratic Party controlled states that are allowed to use these funds to treat the LGBTAI+ community and allow for abortion access.

Under the Affordable Care Act there is an awful lot of focus on redesigning medical care into a Concierge Medicine approach, which most people would not be able to afford. The document calls this stronger health care (true) and more affordable (patently false). It would also eliminate all of the cost controls in the system. There is no language saying that they want to eliminate the ACA, but they certainly would render it useless.

Prohibit travel for Abortion care.

Defund Planned Parenthood, which as I like to tell people is NOT a chain of abortion clinics but is a chain of Doctor's Offices with an emphasis on women's care. Withdraw Medicaid funds from any state where abortion is legal.

Deny gender affirming care for anyone with Medicaid or Medicare. Again, men and women are the only two genders and they are determined at birth.

Rescind all COVID-19 Mask and Vaccination guidelines, and pay damages to anyone displaced (i.e. fired) for not following those guidelines.

Institute work requirements for all recipients of Temporary Assistance for Needy Families. Most of the verbiage about the prevention of teenage pregnancies is to deter things that aren't happening. Adoptions should be funneled through religious organizations. Crazily enough, the document in the same paragraph also acknowledges that there are 4 times more children awaiting adoption than people who want them, although I believe the actual ratio is closer to 7 to 1.

Move the office of Refugee Settlement to the Department of Homeland Security. Looking back at that document, there is no indication that DHS actually wants this.

Allows for parents who do not have custody of their children to receive a child-tax credit anyway. It actually specifically calls out that it wants the ability to allow deadbeat dads to take the tax credit.

Encourage bad marriages to stay together as a requirement of government assistance. Allow faith-based organizations who distribute this aid to discriminate as they see fit. Implement a national campaign that is pro-father propaganda. You know, to keep marriages together. Think of the poor men.

Eliminate Head Start.

Criminalized Physician assisted suicide, which is legal in 10 states according to this document. Remove requirements that telemedicine be local to the patient. I should point out that this would eliminate the ability to recommend hospitalizations, as these doctors wouldn't have admitting privileges where the patients actually are.

Allow hospitals, doctors and physicians to not provide abortion related care of any kind because of religious beliefs, even in states where it is legal and protected.

No more funding for condoms. No more funding for "Morning-after" pills (which they call "the week after pills" in this section). Withdraw all support for gender affirming/transitioning guidance.

Stop teaching the medical procedures used in abortion care. I repeat, hinder the educational skills of every doctor in America.

The entire section on Indian Health Care (and why can't they ever use the phrase "Native Americans"?) is full of lies and I won't dignify them.

Sunset all HHS regulations, which Trump tried last time around.

More bullshit about violations of human rights that never happened (mostly involving twitter and Facebook). They don't want the department to push back against lies on social media.

More verbiage that the administration needs to be Pro-Life and anti-Trans care. This is like the fifth or sixth time in this document so far, making it one of the longer ones I've gone through. This is followed by a series of paragraphs that are mostly lies about the COVID Pandemic, complaining about things that never happened.

It's full of lies.

Restrict and/or rescind funding to any country that supports abortion care. Prohibit overseas personnel from providing care that is in contradiction with administration policy. That's right, overseas care is now a political decision.

The entire rest of the document - several pages - is about how the only civil rights violation in health care is that providers of care of certain religions are not allowed to discriminate in their health care decisions, and that such discrimination should be allowed.

To summarize: No abortions, no gender affirming care, no contraceptives, stay in abusive marriages, no good health care for poor people, let churches discriminate, and lie every third sentence (or more often).

Section 15 - Department Housing and Urban Development

Woohoo! This section was written by Dr. Ben Carson! This of course means it's the shortest section in the whole damn thing, clocking in at all of 14 pages, 4 of which are footnotes.

Also, unlike previous chapters, the first 4 pages are only about what the department does who what the department posts and responsibilities are, and has no policy directives save for the basic concept that the department needs an overhaul.

Replace all career officers with political appointees. Issue an executive order making the HUD Secretary a member of the Committee on Foreign Investment in the U.S, to counter the Chinese threat that they are buying to much real estate in the U.S. Seems highly reminiscent of the same language used against Japan in the 1980's.

Reverse all protections for LGBTQIA+ persons implemented under the Biden Administration. Reverse all property appraisals done under the Biden Administration, because you know they did them all wrong. Eliminate any programs that have any mention of Climate Change. Eliminate the use of special-purpose credit authorities. Eliminate the new Housing Supply Fund.

Non-citizens, even those households who are comprised of both citizens and non-citizens, are to be denied housing assistance. Anyone with mental issues or drug assistance issues need to be treated before considered for housing.

"Statutorily restricting eligibility for first-time homebuyers." That's the EXACT wording.

Finally, create an office of CFO for the department, who will do most of the work. Not bad for the laziest cabinet secretary in all history.

14 pages, only 6 of which are policy, all of which is designed to not actually do anything.

Next posting will cover the Department of the Interior, the Department of Justice, Department of Labor, Department of Transportation, and the Department of Veteran Affairs.

5 notes

·

View notes

Text

Tim Walz to enact a Minnesota sales tax cut, at expense to the disability funds and previously provided services to special needs students and disabled adults. Tax "reduction" also adds taxes to professional services previously not taxed that do not benefit the deprived fund.

"His plan to reduce disability waivers, which help Minnesotans access in-home services, would save roughly $1.3 billion over the next four years." Disabled people deserve caretakers, medical care, in person support, transportation, that same universal meals and better quality of life speel too. Like everyone else, but with added salt with disabled people, are in the unique situation of *requiring* assistance not to have a 'normal' or 'better' day but to survive/not deteriorate further. This issue is being underreported.

“'This budget is responsible, measured, and honest, and it starts with one goal: fiscal responsibility,' Walz stated, 'Our plan sets Minnesota up for success in the future by addressing long-term budget challenges and protecting the investments we made to improve lives, including universal meals, paid family and medical leave, and tax cuts for seniors and middle-class families.'"

"Walz is also proposing the state reduce its reimbursement for special education transportation services from 100% to 95% – a move that would save roughly $50 million and could encourage districts to find new efficiencies."

https://bringmethenews.com/minnesota-news/budget-walz-pitches-minnesotas-first-sales-tax-cut-reduction-in-disability-waiver-spending

#tim walz#minnesota#minneapolis#st paul#us news#us politics#disability#special needs#autism#asd#rochester#duluth#special education#Minnesota news

2 notes

·

View notes

Text

youtube

What to do about wealth management before it is too late

Wealth management is a process to manage your wealth and financial situations therefore, it is necessary to handle the financial and wealth situations. It is best to manage the your financial and wealth conditions before any leakage and outflow come into your life. Here we will learn more discuss about the wealth management system with an understanding of the London wealth management system.

We take many decisions in our life that impact on our financial and wealth management, for example we purchase vehicles, properties and children's education expenses. Hence if these important decisions are not taken wisely then major outflow can occur in our life, that might we cannot solve. It is not an easy task to manage the wealth management, as you have to involve into the all-financial aspects like taxes, investments and estate plans etc. you cannot imagine that your financial and wealth management will be secure without any help of wealth management firms.

These types of firms have good professional experienced persons who put more efforts to manage your wealth management system. These professionals provide you amazing tips to manage wealth like investment in stock market, buy some mutual funds and much more. If we talk about wealth management London then the professionals have a broad knowledge to manage the wealth system in a better way. The professionals have an aim to grow and protect their client’s wealth through significant investments and financial tax efficient planning’s. These professionals offer the best advice and services in a fee structure. Therefore, if you need to manage your financial and wealth system in a proper manner then these types of professionals will help you a lot to prevent worse conditions.

Now we are moving here for some of wealth management tips that can help you to reach at your financial goals in your life.• First of all, you can take help of wealth management services from outside; by these services, you can achieve your financial plans. These wealth management managers have huge ideas to handle the outflow situations during the financial turbulent circumstances.

Secondly, you can make some strategies to control your wealth management and financial outflow as you should involve your whole family members in your major financial decisions. It might happen that your family members can give a better idea that you were not imagining.• Spend money wisely as if you are not able to take financial and investment decisions then it is better that you should hire a personal financial advisor which can give you the best advice to spend money in investments.• Just keep going on with your decisions as sometimes it happens that your decisions did not work but do not let yourself down. Just keep taking decisions wisely and try to understand all financial aspects that worth more into your financial decisions.

2 notes

·

View notes

Text

Washington State's capital gains tax proves we can have nice things

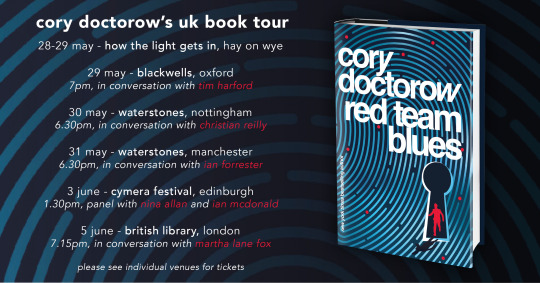

Today (June 3) at 1:30PM, I’m in Edinburgh for the Cymera Festival on a panel with Nina Allen and Ian McDonald.

Monday (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Washington State enacted a 7% capital gains tax levied on annual profits in excess of $250,000, and made a fortune, $600m more than projected in the first year, despite a 25% drop in the stock market and blistering interest rate hikes:

https://www.theurbanist.org/2023/06/01/lessons-from-washington-states-new-capital-gains-tax/

Capital gains taxes are levied on “passive income” — money you get for owning stuff. The capital gains rate is much lower than the income tax rate — the rate you pay for doing stuff. This is naked class warfare: it punishes the people who make things and do things, and rewards the people who own the means of production.

The thing is, a factory or a store can still operate if the owner goes missing — but without workers, it shuts down immediately. Everything you depend on — the clothes on your back, the food in your fridge, the car you drive and the coffee you drink — exists because someone did something to produce it. Those producers are punished by our tax system, while the people who derive a “passive income” from their labor are given preferential treatment.

The Washington State tax is levied exclusively on annual gains in excess of a quarter million dollars — meaning this tax affects an infinitesimal minority of Washingtonians, who are vastly better off than the people whose work they profit from. Most working Americans own little or no stock, and the vast majority of those who do own that stock in a retirement fund that is sheltered from these taxes.

(Sidebar here to say that market-based pensions are a scam, a way to force workers to gamble in a rigged casino for the chance to enjoy a dignified retirement; the defined benefits pension, combined with adequate Social Security, is the only way to ensure secure retirement for all of us)

https://pluralistic.net/2020/07/25/derechos-humanos/#are-there-no-poorhouses

Washington’s tax was anticipated to bring in $248m. Instead, it’s projected to bring in $849m in the first year. Those funds will go to public school operations and construction and infrastructure spending:

https://www.seattletimes.com/seattle-news/politics/was-new-capital-gains-tax-brings-in-849-million-so-far-much-more-than-expected/

That is to say, the money will go to ensuring that Washingtonians are educated and will have the amenities they need to turn that education into productive work.

Washington State is noteworthy for not having any state personal or corporate income tax, making it a haven for low-tax brain-worm victims who would rather have a dead gopher running their states than pay an extra nickel in taxes. But places that don’t have taxes can’t fund services, which leads to grotesque, rapid deterioration.

Washington State plutes moved because they relished living in well-kept, cosmopolitan places with efficient transportation, an educated workforce, good restaurants and culture — none of which they would have to pay for. They forgot Karl Marx’s famous saying: “There’s no such thing as a free lunch.”

The idea that Washington could make up for the shortfalls that come from taxing its wealthiest residents by levying regressive sales taxes and other measures is mathematically illiterate wishful thinking. When the one percent owns nearly everything, you can tax the shit out of the other 99% and still not make up the shortfall.

Meanwhile: homelessness, crumbling roads, and crisis after crisis. Political deterioration. Cute shopping neighborhoods turn into dollar store hellscapes because no one can afford to shop for nice things because all their income is going to plug the gaps in health, education, transport and other services that the low-tax state can’t afford.

Washington State’s soak-the-rich tax is ironic, given the propensity of California’s plutes to threaten to leave for Washington if California finally passes its own extreme wealth tax.

There’s a reason all these wealthy people want to live in California, Washington, New York and other states where there’s broad public support for taxing the American aristocracy: states with rock-bottom taxes are failed states. All but two of America’s “red states” are dependent on transfers from the federal government to stay in operation. The two exceptions are Texas, whose “free market” grid is one nanometer away from total collapse, and Florida, which is about to slip beneath the rising seas it denies.

Rich people claim they’d be happy to live in low-tax states, and even tout the benefits of a desperate workforce that will turn up to serve drinks at their country clubs even as a pandemic kills them at record rates. But when the chips are down, they don’t want to depend on a private generator to keep the lights on. They don’t want to have to repeatedly replace their luxury cars’ suspension after it’s wrecked by gaping potholes. They don’t want to have to charter a jet to fly their kids out of state to get an abortion.

This is true globally, too. As Thomas Piketty pointed out in Capital in the 21st Century, if the EU and OECD created a wealth tax, the rich could withdraw to Dubai, the Caymans and Rwanda, but they’d eventually get sick of shopping for the same luxury goods in the same malls guarded by the same mercenaries and want to go somewhere, you know, fun:

https://memex.craphound.com/2014/06/24/thomas-pikettys-capital-in-the-21st-century/

We’re told that Americans would never stand for taxing the ultra-rich because they see themselves as “temporarily embarrassed millionaires.” It’s just not true: soak-the-rich policies are wildly popular:

https://balanceourtaxcode.com/wp-content/uploads/2023/02/WA-State-Wealth-Tax-Poll-Results-3.pdf

The Washington tax windfall is fascinating in part because it reveals just how rich the ultra-rich actually are. Warren Buffett says that “when the tide goes out, you learn who’s been swimming naked.” But Washington’s new tax is a tide that reveals who’s been swimming with a gold bar stuck up their ass.

It’s not surprising, then, that Washingtonians are so happy to tax their one percenters. After all, this is the state that gave us modern robber barons like Bill Gates and Jeff Bezos. And then there’s clowns like Steve Ballmer, star of Propublica’s IRS Files, the man whose creative accounting let him claim $700m in paper losses on his basketball team, allowing him to pay a mere 12% tax on $656m in income, while the workers who made his fortune on the court paid 30–40% on their earnings.

https://pluralistic.net/2021/07/08/tuyul-apps/#economic-substance-doctrine Ballmer’s also a master of “tax loss harvesting,” who has created paper losses of over $100m, letting him evade $138m in federal taxes:

https://pluralistic.net/2023/04/24/tax-loss-harvesting/#mego

These guys aren’t rich because they work harder than the rest of us. They’re rich because they profit from our work — and then, to add insult to injury, pay little or no taxes on those profits.

Washington’s lowest income earners pay six times the rate of tax as the state’s richest people. When the wealthy squeal that these taxes are class warfare, they’re right — it is class war, and they started it.

Catch me on tour with Red Team Blues in Edinburgh, London, and Berlin!