#Stephen Basdeo

Explore tagged Tumblr posts

Text

‘The Prince of Pick-Pockets’: George Barrington (1755-1804)

"George Barrington went on to enjoy a limited literary afterlife as the hero of a long-running serial in the penny dreadful version of The New Newgate Calendar. There are various stories of him robbing corrupt officials and decadent aristocrats. As all true outlaws should, he steals from the rich and gives to the poor. He is named in these serials as ‘The Prince of the Pickpockets’." [x]

13 notes

·

View notes

Text

GOT ANOTHER ROBIN HOOD BOOK

#stephen basdeo’s!!!!!!#i like how he’s organised it by century#& he even talked about the bbc show!!!!#and he’s referenced star trek <3#robin hood

2 notes

·

View notes

Text

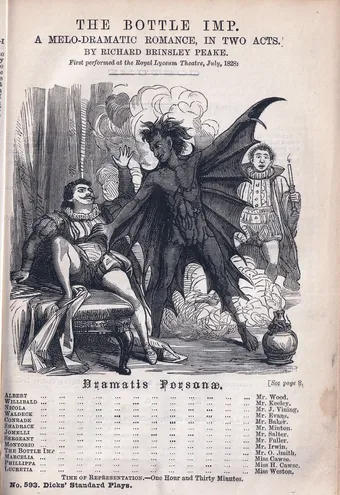

Richard Brinsley Peake’s The Bottle Imp (John Dicks edition) (Stephen Basdeo Collection).

11 notes

·

View notes

Note

Solid start! "Robin Hood and Other Outlaw Tales" is an amazing resource. I would also suggest Robin Hood: Bold Outlaw of Barnsdale and Sherwood, which is more accessible to beginners, I think. But how about an appetiser? Here's some of my favourite ballads:

Robin Hood and the Beggar: trickery, disguises, daring escapes!

Robin Hood and the Curtal Friar: Friar Tuck shenanigans

Robin Hood and the Bishop of Hereford: nobody likes bishops

Robin Hood and Maid Marian: the 2 nobles (Robin's a noble here, it's 17th century) fight each other in disguise, they recognise and kiss, and go off to the forest to live happily ever after "by their hands, without any lands"

Robin Hood and the tanner: sometimes you root for the other guy!

I agree that Scott's Ivanhoe was important and started a lot of things (it invented Robin of Locksley, for one), but Robin's a tertiary character in the book (secondary? I don't remember, it's been a while, by which I mean decades), and if that's all you're interested in, just check out wikipedia's section on "Lasting influence on the Robin Hood legend" and get done with it.

For how Robin Hood evolved in modern times, I'd start with Howard Pyle and The Merry Adventures of Robin Hood (1883), it was hugely influential for both the story and the imagery, and it's fun to read. (Another important illustrator is N.C. Wyeth, whose Robin Hood (1917) also influenced superhero costumes.)

All this is laid out in detail and chronological order in Robin Hood: Development of a Popular Hero: Part I, II, and IV. (Tumblr ate Part III, dammit, but you can read the full text sans pictures at The Robin Hood Project.)

If you like podcasts, Criminal Records Podcast and The History of English Podcast have episodes on Robin Hood.

For analysis, there's tons out there, I suggest Stephen Knight's Robin Hood: An Anthology of Scholarship and Criticism and Robin Hood in Greenwood Stood: Alterity and Context in the English Outlaw Tradition. More recently, there's Lesley Coote's Robin Hood and the Outlaw/ed Literary Canon. I also think it's a good idea to read Hobsbawm's Bandits, where the whole social bandit theory is laid out. There's a lot to be said and argued about it, but it's foundational.

And here, lemme copy the Robin Hood section from my Rogue Studies™ Resources / Bibliography :

Robert B. Waltz, The Gest of Robyn Hode: A Critical and Textual Commentary (2013)

University of Rochester, The Robin Hood Project

Stephen Knight & Thomas H. Ohlgren, Robin Hood and Other Outlaw Tales

Allen W. Wright, Robin Hood Bold Outlaw of Barnsdale and Sherwood

Stephen Knight, Robin Hood in Greenwood Stood: Alterity and Context in the English Outlaw Tradition (Brepols, 2012); Robin Hood: Anthology of Scholarship and Criticism (Boydell & Brewer Ltd., 1999)

Alexander L. Kaufman, British Outlaws of Literature and History: Essays on Medieval and Early Modern Figures from Robin Hood to Twm Shon Catty (McFarland & Company, 2011)

Lesley Coote (ed), Robin Hood and the Outlaw/ed Literary Canon (Routledge, 2020); Robin Hood in Outlaw/ed Spaces (Routledge, 2021)

Stephen Basdeo, Geste of Robin Hood blog, especially the tags Robin Hood, Outlaw and Bandits ; “Robin Hood the Brute: Representations of the outlaw in eighteenth century criminal biography”

Howard Pyle, The Merry Adventures of Robin Hood (1883)

Joseph Ritson, Robin Hood: a collection of poems, songs, and ballads relative to that celebrated English outlaw (1853)

Thomas Percy & J. V. Prichard, Reliques of Ancient English Poetry (1900)

Peter Sutton & William Langland, Piers Plowman: A Modern Verse Translation (McFarland & Company, 2004)

Mike Dixon-Kennedy, The Robin Hood Handbook: The Outlaw in History, Myth and Legend (The History Press, 2006)

Nick Rennison, Robin Hood: Myth, History & Culture (Pocket Essentials, 2012)

David Baldwin, Robin Hood: The English Outlaw Unmasked (Amberley Publishing, 2010)

…I really need to make a Robin Hood masterpost.

Any recommendations on where to start for someome who wants to know about Robin Hood?

Sure thing!

The thing about Robin Hood is that, because what we have are later written recordings and remixes of an older oral tradition, the sources are somewhat spread out between multiple texts. So what you want is a good collection of different sources, and preferably one that's a modern translation with regularized spelling (unless you like struggling with Middle English).

Waltz' The Gest of Robyn Hode: A Critical and Textual Commentary is a good place to start, because it not only has a modern translation of the Geste (the earliest written text of Robin Hood), but also a wealth of context and analysis.

Knight and Ohlgren's Robin Hood and Other Outlaw Tales also has a good selection of the Robin Hood ballads that introduced important characters like Guy of Gisborne, Maid Marian, Friar Tuck, and so forth to the narrative, as well as some of the 16th and 17th century Robin Hood plays that were responsible for the whole shift from the yeoman Robin Hood to the noble Robin (or Robert).

I can also recommend Ritson's Robin Hood: A Collection of All the Ancient Poems, Songs, and Ballads, Now Extant Relative to That Celebrated English Outlaw, which was the first scholarly attempt to collect and collate and make sense of the disparate historical texts and attempt to fit them into a coherent narrative.

Finally, you should probably read Walter Scott's Ivanhoe, which is the work of meta-fanfic that made Victorian medievalism the massive fandom that it was.

181 notes

·

View notes

Photo

📰 In the press… 📰 Discovering Robin Hood: The Life of Joseph Ritson – Gentleman, Scholar and Revolutionary by Stephen Basdeo has been featured in today’s Daily Express. 👉 The name of Joseph Ritson, born in Stockton-on-Tees in 1752, will be familiar to very few people. The name of Robin Hood is known the world over. Yet it was Ritson whose research in the late 18th century ensured the survival of the Robin Hood legend. 📚 This is not only a story about the formation of the Robin Hood legend. Ritson’s story is one of rags to riches. Born in humble circumstances, his aptitude for learning meant that he rose through society’s ranks and became a successful lawyer, local official, and a gentleman. 🛒 Discovering Robin Hood is coming soon, and is available to preorder now. • #InThePress #DiscoveringRobinHood #RobinHood #History #SocialHistory #Biography #JosephRitson #StocktonOnTees #HistoricalFigures #18thCentury #Legend #Myth #MythsAndLegends #GordonRiots #MedievalTimes #FrenchRevolution #Medieval #MedievalHistory #PenAndSword #PenAndSwordBooks https://www.instagram.com/p/CMzDc2Fr2a9/?igshid=15h6to7usx8j8

#inthepress#discoveringrobinhood#robinhood#history#socialhistory#biography#josephritson#stocktonontees#historicalfigures#18thcentury#legend#myth#mythsandlegends#gordonriots#medievaltimes#frenchrevolution#medieval#medievalhistory#penandsword#penandswordbooks

0 notes

Text

Job creation is strong, but wage growth disappoints. What that means to the Bank of Canada

The industry in which to find a job in Canada in 2018 was health. More than 74,000 people went to work at hospitals, homecare agencies and the like, representing almost half the total number of jobs created last year, according to Statistics Canada’s latest monthly survey of the labour market.

Demographics anticipated the demand: Since 2015, there have been more seniors aged 65 and older than boys and girls aged 15 and younger. Anecdotal evidence of understaffed clinics and overworked mental-health counsellors is overwhelming. And yet the supply of such workers appears to be adequate. Annual increases in average hourly wages barely changed from September through the end of 2018, dragging down the average monthly change for the year to a mere 1.3 per cent. Employers, whether it be institutions, clinics or oldsters seeking nurses to help them at home, are feeling no pressure to offer higher wages to get the help they need.

The trend is similar in other industries, if not quite as depressing. Overall, average hourly wages increased two per cent in December from a year earlier, lifting the five-month trend to about 2.2 per cent. So, after several years of good-to-great aggregate employment growth, wages are only keeping pace with inflation. That’s as odd as it is disappointing.

Canadians’ high debt levels could pose challenge to how Bank of Canada manages policy, says deputy

Pace of Bank of Canada rate hikes could be interrupted, Stephen Poloz says

David Rosenberg: Bank of Canada makes 90-degree turn with its latest economic statement

Before this year, the jobless rate rarely fell below six per cent. Now it’s the ceiling. The unemployment rate was 5.6 per cent in November and December, the lowest in data that dates to 1976, and it has brushed six per cent only twice since November 2017.

With hiring at levels that economists associate with full employment, you’d expect stronger upward pressure on salaries. But for whatever reason, that’s not happening. The mystery should be enough to persuade the Bank of Canada to take an extended pause on its slow march to higher interest rates. The central bank’s main concern at the moment is staying ahead of inflation, and prices appear to be contained. Steady hiring will keep the economy moving forward, but until more of us get decent raises, there is little reason to fear a sharp increase in demand.

“While many measures would suggest that we have a tight labour market, the signal from wages says otherwise,” Brian DePratto, an economist at Toronto-Dominion Bank, wrote in a research note Jan. 4. “Without this precondition, it is difficult to see much in the way of fundamental upward pressure on Canadian inflation.”

The December hiring data represent that last major variable that could influence the Bank of Canada’s thinking ahead of its next interest-rate announcement on Jan. 9.

Few, if anyone, expected Governor Stephen Poloz and his lieutenants on the Governing Council to raise the benchmark rate next week. But there was a debate over how long they might wait, and how many times they might lift borrowing costs in 2019.

Economists at Bank of Nova Scotia think three increases are possible, which would put the overnight target at 2.5 per cent within 12 months. Aubrey Basdeo of BlackRock Inc. told me in an interview before Christmas that economic conditions likely will allow only one increase this year, and maybe none at all.

Canada’s near-term prospects depend on business investment and exports because evidence suggests that record levels of debt finally has slowed household spending.

Both investment and exports showed signs of life in 2018, but the year didn’t end well. Oil prices dropped much more than the central bank was expecting, and the loss of wealth will curb corporate spending plans. President Donald Trump’s trade war with China has thrown financial markets into disarray and is disrupting global commerce. The future is too uncertain at the moment for higher interest rates.

“With the muted inflation readings that we’ve seen, we will be patient as we watch to see how the economy evolves,” Jerome Powell, the chairman of the U.S. Federal Reserve, said Jan. 4 at an event in Atlanta.

Powell signalled a pause in his own campaign to raise interest rates even as a new report showed the U.S. economy created more than 300,000 jobs in December. Expect something similar from Poloz, even though StatCan figures show the Canadian economy added some 100,000 positions in November and December, a large total for Canada.

The job gains of the past few years should keep the Canadian economy out of the ditch, and they provide a counterweight to the threat that all that debt could lead to financial crisis. But the economy isn’t as strong as it appears on the surface. The youth participation rate, an indicator that Poloz has said he watches closely, dropped 1.9 percentage points over 2018 to 55.3 per cent, according to StatCan. That suggests employers don’t yet feel pressured to hire marginal workers with relatively little experience.

Sluggish wage growth also implies slack in the labour market. The Bank of Canada thinks hourly pay should be growing around three per cent given the strength of economic growth in recent years. Salaries appeared to be heading in that direction, then decelerated over the second half of 2018. Until that trend reverses, the central bank has a good reason to leave interest rates alone.

• Email: [email protected] | Twitter: CarmichaelKevin

Job creation is strong, but wage growth disappoints. What that means to the Bank of Canada published first on https://worldwideinvestforum.tumblr.com/

0 notes

Text

Job creation is strong, but wage growth disappoints. What that means to BoC

The industry in which to find a job in Canada in 2018 was health. More than 74,000 people went to work at hospitals, homecare agencies and the like, representing almost half the total number of jobs created last year, according to Statistics Canada’s latest monthly survey of the labour market.

Demographics anticipated the demand: Since 2015, there have been more seniors aged 65 and older than boys and girls aged 15 and younger. Anecdotal evidence of understaffed clinics and overworked mental-health counsellors is overwhelming. And yet the supply of such workers appears to be adequate. Annual increases in average hourly wages barely changed from September through the end of 2018, dragging down the average monthly change for the year to a mere 1.3 per cent. Employers, whether it be institutions, clinics or oldsters seeking nurses to help them at home, are feeling no pressure to offer higher wages to get the help they need.

The trend is similar in other industries, if not quite as depressing. Overall, average hourly wages increased two per cent in December from a year earlier, lifting the five-month trend to about 2.2 per cent. So, after several years of good-to-great aggregate employment growth, wages are only keeping pace with inflation. That’s as odd as it is disappointing.

Canadians’ high debt levels could pose challenge to how Bank of Canada manages policy, says deputy

Pace of Bank of Canada rate hikes could be interrupted, Stephen Poloz says

David Rosenberg: Bank of Canada makes 90-degree turn with its latest economic statement

Before this year, the jobless rate rarely fell below six per cent. Now it’s the ceiling. The unemployment rate was 5.6 per cent in November and December, the lowest in data that dates to 1976, and it has brushed six per cent only twice since November 2017.

With hiring at levels that economists associate with full employment, you’d expect stronger upward pressure on salaries. But for whatever reason, that’s not happening. The mystery should be enough to persuade the Bank of Canada to take an extended pause on its slow march to higher interest rates. The central bank’s main concern at the moment is staying ahead of inflation, and prices appear to be contained. Steady hiring will keep the economy moving forward, but until more of us get decent raises, there is little reason to fear a sharp increase in demand.

“While many measures would suggest that we have a tight labour market, the signal from wages says otherwise,” Brian DePratto, an economist at Toronto-Dominion Bank, wrote in a research note Jan. 4. “Without this precondition, it is difficult to see much in the way of fundamental upward pressure on Canadian inflation.”

The December hiring data represent that last major variable that could influence the Bank of Canada’s thinking ahead of its next interest-rate announcement on Jan. 9.

Few, if anyone, expected Governor Stephen Poloz and his lieutenants on the Governing Council to raise the benchmark rate next week. But there was a debate over how long they might wait, and how many times they might lift borrowing costs in 2019.

Economists at Bank of Nova Scotia think three increases are possible, which would put the overnight target at 2.5 per cent within 12 months. Aubrey Basdeo of BlackRock Inc. told me in an interview before Christmas that economic conditions likely will allow only one increase this year, and maybe none at all.

Canada’s near-term prospects depend on business investment and exports because evidence suggests that record levels of debt finally has slowed household spending.

Both investment and exports showed signs of life in 2018, but the year didn’t end well. Oil prices dropped much more than the central bank was expecting, and the loss of wealth will curb corporate spending plans. President Donald Trump’s trade war with China has thrown financial markets into disarray and is disrupting global commerce. The future is too uncertain at the moment for higher interest rates.

“With the muted inflation readings that we’ve seen, we will be patient as we watch to see how the economy evolves,” Jerome Powell, the chairman of the U.S. Federal Reserve, said Jan. 4 at an event in Atlanta.

Powell signalled a pause in his own campaign to raise interest rates even as a new report showed the U.S. economy created more than 300,000 jobs in December. Expect something similar from Poloz, even though StatCan figures show the Canadian economy added some 100,000 positions in November and December, a large total for Canada.

The job gains of the past few years should keep the Canadian economy out of the ditch, and they provide a counterweight to the threat that all that debt could lead to financial crisis. But the economy isn’t as strong as it appears on the surface. The youth participation rate, an indicator that Poloz has said he watches closely, dropped 1.9 percentage points over 2018 to 55.3 per cent, according to StatCan. That suggests employers don’t yet feel pressured to hire marginal workers with relatively little experience.

Sluggish wage growth also implies slack in the labour market. The Bank of Canada thinks hourly pay should be growing around three per cent given the strength of economic growth in recent years. Salaries appeared to be heading in that direction, then decelerated over the second half of 2018. Until that trend reverses, the central bank has a good reason to leave interest rates alone.

• Email: [email protected] | Twitter: CarmichaelKevin

from Financial Post http://bit.ly/2Vpt5qF via IFTTT Blogger Mortgage Tumblr Mortgage Evernote Mortgage Wordpress Mortgage href="https://www.diigo.com/user/gelsi11">Diigo Mortgage

0 notes

Link

Stephen Basdeo talks about the song Lilliburlero.

4 notes

·

View notes

Link

(Note: this is a brief history of English crime literature, not global. It touches a bit on the Spanish picaresque because it was a direct influence, but that’s about it. Otherwise, it’s very good article, Basdeo is an expert.)

68 notes

·

View notes

Text

The gentrification of an outlaw: “If they must have a British Worthy, they would have Robin Hood”

[by Stephen Basdeo, abridged]

Amongst the great writers of eighteenth-century literature, the names of two men stand out: Sir Richard Steele (1672-1729) and Joseph Addison (1672-1719). These two quintessentially “Augustan” writers dominated the literary marketplace between 1709 and 1715 through their essay periodicals The Tatler and The Spectator.

Periodicals such as The Tatler, like many of the other periodicals available in the early eighteenth century, were designed to be read and debated in public arenas such as the coffeehouse and the tavern, and periodicals, or “moral weeklies” as Jurgen Habermas calls them, contributed to the birth of the bourgeois public sphere, or as we might phrase it today, public opinion. Through the essays in these periodicals these authors promoted a culture of aristocratic politeness among urban readers, in which learning and self-improvement were the order of the day.

It is Addison’s reference to Robin Hood in the eighty-first issue of The Tatler [1709-1711] which I would like to bring to your attention. Addison tells his reader that he spent the whole afternoon mentally cataloguing the various heroes and “military Worthies” that have appeared throughout world history. He was so preoccupied with this matter, he says, that after many hours awake thinking it over, he fell into a deep sleep and proceeded to have a dream in which he was invited into a great hall in which a number of prestigious persons entered, [starting with Alexander the Great]. Other ancient worthies enter: Xenophon, Plato, Socrates, Aristotle, Julius Caesar, Cicero, Hannibal, Cato, Pompey the Great, Augustus; it is all very classical, which of course ties into the neoclassical modes of the eighteenth century.

All of these worthies sit at a table, but it is revealed that there is an empty seat at the table where these illustrious heroes are seated. They begin to whisper among themselves and discuss who, from British history, is worthy to join them at their table. Would they choose King Arthur? He had, after all, been called a “British Worthy” only a few years prior in John Dryden’s opera King Arthur; or, the British Worthy (1691). How about King Alfred, the only English King ever to have been given the epithet “the great”? No—neither of these men are good enough in the estimation of men such as Caesar and Augustus. They conclude by saying that,

“if they must have a British Worthy, they would have Robin Hood.”

An outlaw who (supposedly) lived in the thirteenth century was greater than all of the other heroes of English history, and worthy enough to take his place amongst the likes of Alexander and Caesar.

In Addison’s essay all of the ancient worthies are from the Classical period, with the exception of Robin Hood. Indeed, Addison’s placing of Robin Hood—a medieval figure—among all those classical heroes seems incongruent. In the early part of the eighteenth century, whilst it was recognised that the Middle Ages were integral to Europe’s past, the period was “not much liked” by scholars and thinkers. And 1750 is the date that Peter Raedt cites as having been the year when eighteenth-century scholars stopped being dismissive of the Middle Ages as a barbaric interlude between antiquity and the “enlightened” eighteenth century and the period began to be appreciated in its own right. Thomas Arne and James Thomson authored the libretto for the opera Alfred (1740), known most famously today for its finale Rule Britannia!. An appreciation for England’s medieval past also manifested itself in architecture, most famously in the Temple of British Worthies at Stowe, designed in 1734 by William Kent. Whilst the marble busts of most of the great men on display there are mostly from the Renaissance and the Enlightenment, there are two medieval figures present: King Alfred and Edward, the Black Prince.

The Temple of British Worthies at Stowe Gardens, Buckinghamshire, England [x]

Yet Addison’s idealisation of Robin Hood as a British Worthy is an anomaly when compared to the works of Arne who venerated a King, Alfred, and the establishment figures that were sculpted in marble by William Kent. Robin is different to these other illustrious persons because he is an outlaw. And Addison’s reference to Robin Hood is certainly more positive than the one which would appear in Alexander Smith’s A Complete History of the Lives and Robberies of the Most Notorious Highwaymen (1719) only a few years after Addison was writing, where Robin is described as a “wicked, licentious” individual. This makes it seem odd that Addison would choose Robin Hood to make a point in a “moral weekly.”

I have two theories about this. Firstly, it would seem that Robin Hood was by the early eighteenth century gentrified enough in the public consciousness for him to be used in such a way. The gentrification process had begun with Anthony Munday’s two plays The Downfall of Robert Earl of Huntington and The Death of Robert Earl of Huntingdon (1597-98) where Robin is recast firmly as an establishment figure.

The second is that an idealisation of Robin Hood fits in with eighteenth-century contemporaries’ love of liberty. In a later issue of The Tatler, Addison wrote about another vision he had in which he witnessed the goddess of Liberty presiding over the prosperity of the nation. Although crime was increasingly viewed as a problem during the eighteenth century, as indicated by Fielding’s lament that the streets of London would soon become impassable except “without the utmost hazard,” liberty-loving men of Georgian England resisted any attempt by the government to form a professional police force. In a rather odd sort of way, highwaymen (and Robin is the original highwayman) were loved by the people because to many they were seen to embody liberty. People of all ranks held a degree of admiration for highwaymen. At the trial of the “Gentleman Highwayman,” James Maclaine (1724-1750), for example, “many persons of rank of both sexes attended his examination, several of whom were so affected with his situation that they contributed liberally towards his support.” This admiration of outlaws and highwaymen perhaps then explains why Smith, whose Highwaymen is a heavily moralist text, is so keen to recast Robin Hood in a negative light, for he evidently disagrees with the prevailing admiration for both Robin Hood and contemporary criminals.

Whilst many early eighteenth-century appropriations of Robin Hood are negative, Addison’s elevation of Robin Hood into the status of a “worthy” in the face of negative interpretations is interesting for it confirms to us that the gentrification process was not a linear process but an uneven one. It is often fleeting comments about Robin Hood in later texts such as The Tatler which allow us to map and construct an idea of how people in past ages interpreted the legend at various points in its history. By 1709 it seems that Robin’s status was firmly gentrified in public consciousness for Joseph Addison to speak about him in a “moral weekly.”

[source]

@tuulikki

#long post#Stephen Basdeo#Robin Hood#the phantom of liberty#outlaw#highwayman#Joseph Addison#rogues in fiction#analysis

17 notes

·

View notes

Photo

Born on this day, 25 September 1725: General Robert Clive. Read his story in Heroes and Villains of the British Empire by @sbasdeo1, out now in paperback and eBook formats. 📚 Heroes and Villains of the British Empire tells the story of how British Empire builders such as Robert Clive, General Gordon, and Lord Roberts of Kandahar were represented and idealised in popular culture. 📚 ‘Stephen Basdeo’s book takes us on a well informed and interesting journey through centuries of opinion on Empire. Ideas on Empire evolved, mutated, changed and diverged throughout that period. There has never been an agreed history on Empire nor on its Empire builders. There have been views of Empire that helped shape and were shaped by the imperial experience. This is what makes it so fascinating. The Empire may have come and gone but views and arguments about it have long outlived the institution itself - and long may they continue to do so.’ (The British Empire) • #BritishEmpire #History #HistoricalFigures #BritishHistory #Bookstagram #OnThisDay #OTD #OTDIH #BooksBooksBooks #HistoryBooks #SeptemberReads #BookLoversOfInstagram #Review #BooksOfInstagram #NewBooks #PenAndSword #BookReview #PenAndSwordBooks (at Pen and Sword Books) https://www.instagram.com/p/CFkAN2egps8/?igshid=1f2umj90udymv

#britishempire#history#historicalfigures#britishhistory#bookstagram#onthisday#otd#otdih#booksbooksbooks#historybooks#septemberreads#bookloversofinstagram#review#booksofinstagram#newbooks#penandsword#bookreview#penandswordbooks

0 notes

Photo

Little John’s Grave, which lies in the graveyard of Saint Michael’s church in Hathersage, Derbyshire. The inscription on the headstone reads: ‘Here lies buried Little John, friend and lieutenant of Robin Hood. He died in a cottage (now destroyed) to the east of the churchyard. The grave is marked by this old headstone and footstone and is underneath this old yew tree’. - You can read more about Robin Hood in Stephen Basdeo’s Robin Hood - The Life and Legendary of an Outlaw 🏹📚👀 • #LittleJohn #LittleJohnsGrave #Legend #RobinHood #England #History #BritishHistory #Culture #LiteraryFigure #MythsAndLegends #Outlaw #MerryMen #Hathersage #Derbyshire #HopeValley #PlacesToVisit #DaysOut #PenAndSword #PenAndSwordBooks (at Hathersage Peak District) https://www.instagram.com/p/B7qMTmGniFB/?igshid=1r8iyb4bi6282

#littlejohn#littlejohnsgrave#legend#robinhood#england#history#britishhistory#culture#literaryfigure#mythsandlegends#outlaw#merrymen#hathersage#derbyshire#hopevalley#placestovisit#daysout#penandsword#penandswordbooks

0 notes

Text

Things could go terribly wrong for Canada’s economy in 2019 — but there’s reason for hope

The best economic news heading into 2019 might be that we’re poorer than we thought a few weeks ago.

Statistics Canada changed history last month, revising economic growth in 2015 to a mere 0.7 per cent, compared with its original calculation of 1 per cent. The 2016 expansion was also cut by three-tenths of a percentage point, to 1.1 per cent. Merry Christmas.

Now the central bank must do some recalculating of its own.

Policy makers have a rough idea of how many goods and services the economy can produce without causing inflation. Before StatCan’s revisions, they thought we had reached that point. A smaller gross domestic product suggests the pressure to raise interest rates vanished, along with the billions of dollars in economic output that only ever happened on paper.

Higher interest rates pushing more Canadians to seek debt relief as business booms for insolvency trustees

Instead of an honest debate about fiscal policy, we get filter bubble pap

Our trade with China is bigger than you think — and exporters are getting worried

It’s weird to cheer the disappearance of so much wealth, but Governor Stephen Poloz and his deputies will benefit from some breathing room.

At this point in 2017, virtually every major economy was growing. Christine Lagarde, the managing director of the International Monetary Fund, was nudging her institution’s members to fix their roofs while the sun was still shining. The clouds rolled in faster than most expected. President Donald Trump’s trade wars are slowing global commerce and upsetting financial markets.

The tumult could be temporary, or it could be the beginning of something terrible; it’s hard to tell. The jobless rate in the United States is 3.7 per cent, which must count for something. Yet the S&P500 index was on track for its worst year since the financial crisis a decade ago.

Earlier this autumn, DHL Express announced it was adding a new flight to Vancouver from its North American distribution hub in Cincinnati to keep up with a double-digit increase in demand. “Absolutely, there is strength in the global economy,” Andrew Williams, chief executive of the company’s unit, said in an interview.

But not enough strength to keep one of DHL’s rivals out of trouble. FedEx Corp. cut its earnings outlook this week, after raising it just three months ago, according to Bloomberg News. The company’s stock price plunged the most in a decade.

“When you have a change that comes on you as fast as this did, it’s hard to react to it,” Fred Smith, the chief executive, said on a conference call with analysts.

“Most of the issues that we’re dealing with today are induced by bad political choices,” Smith said, citing Trump’s import tariffs and the retaliatory measures they provoked.

BlackRock Inc., the New York-based asset manager with a portfolio of more than $6 trillion, says the U.S. could tip into recession as soon as 2020. That’s disconcerting because America is currently the only major economy that still is performing well.

Canada may avoid a downturn, although at the price of being condemned to muddling along, much like Japan and some of the bigger European economies. Weak oil prices and excessive private and public debt could stall the engines that powered the economy clear of the Great Recession. If the the trade wars persist, exports also will suffer, threatening stagnation.

“Growth will be shallow and corrections will be shallow,” Aubrey Badeo, BlackRock’s Toronto-based head of Canadian fixed income, said in an interview. “A Japan situation could be something we gravitate towards here.”

We’re not there yet.

Most forecasts predict the economy will grow by around 1.5 per cent next year, roughly equivalent to the Bank of Canada’s non-inflationary speed limit. “Plans to increase investment and employment, often supported by sales expectations, are widespread, especially in the services sector,” the central bank says in its latest quarterly Business Outlook Survey (BOS), released Friday.

Companies added about 220,000 jobs over the 12 months through November, around the annual average since 2010, and the unemployment rate has been no higher than six per cent since October 2017, by far the most impressive stretch in data that dates to 1976. Hiring is a lagging indicator, but one that says a lot about an economy’s underlying strength. By that measure, Canada is fine: There is a reason the Bank of Canada felt the need to raise its benchmark interest rate five times from July 2017 to October 2018.

“The Canadian economy begins this new year in a pretty good place,” Poloz said in an interview with CTV News this week.

Still, the central bank paused earlier this month, and most economists and market watchers predict that it will opt to leave its interest-rate target unchanged at 1.75 per cent again in January, and probably even at its policy meeting in March.

That’s a shift; the consensus until a couple of weeks ago was that policy makers would move borrowing costs higher first thing in the new year. Some analysts now predict an increase in the spring; Basdeo said “we’d be lucky” to get one hike in 2019, and definitely not before the second half.

Central banks raise interest rates when the economy is strong. Canada’s prospects are mediocre, at least until the trade wars subside and oil prices rise. Wage growth remains lacklustre, and personal consumption grew only 1.9 per cent in the third quarter, the weakest since 2013. The household savings rate was 0.8 per cent, near an historic low. Monthly retail sales have been roughly flat since posting an outsized 2.1-per-cent gain in May.

Hope for Canada’s economy in 2019 rests with the country’s entrepreneurs and business leaders. “We expect to see quite a good improvement in investment,” Poloz said. He’s been saying that for years, but the story came true in 2018, despite the uncertainty created by the renegotiation of the North American Free Trade Agreement.

There’s reason to think that will continue. NAFTA is sorted, mostly. The BOS, which ranks among the central bank’s favourite indicators, shows investment intentions over the next 12 months are depressed on the Prairies, but “solid” everywhere else.

The Trudeau government’s promise to cut taxes on new capital, including intangibles such as intellectual property, and to prune regulations should be good for animal spirits, according to Michael McCain, chief executive of Maple Leaf Foods Inc.

Basdeo of BlackRock acknowledged that the shift to a digital economy, which is driving rapid investment in talent, software, and advanced technology such as artificial intelligence (AI), could offset the many negatives. Bold companies will see the chaos as a chance to make money, or get a jump on their rivals.

“No doubt, there is a level of concern,” Tasso Lagios, managing partner at Richter LLP, the Montreal-based provider of financial services for wealthy entrepreneurs, said in an interview. “But I find my clients are moving quicker and quicker to take advantage of opportunities. A lot of opportunities are being taken, but always with a worry.”

Things could go terribly wrong in 2019. That’s why so many equity investors are cashing out. But executives are moving forward, emboldened by high profits, full order books, and the need to retool their businesses for an economy based on data and AI. That could be enough to avoid stagnation, or worse. Expect low interest rates for a little longer as hedge, but also to give the boldest executives another reason to seize the moment.

• Email: [email protected] | Twitter: carmichaelkevin

Things could go terribly wrong for Canada’s economy in 2019 — but there’s reason for hope published first on https://worldwideinvestforum.tumblr.com/

0 notes

Text

Global trade is the biggest question mark hanging over Canada’s corporate bond market next year

Global trade developments may dictate how lively Canadian corporate bond sales are next year.

Trade tensions, which increased volatility and caused sales in the Canadian corporate securities market to collapse in the fourth quarter, are poised to continue. Issuers pulled back from the market in the fourth quarter and in 2019 volatility may put investors in the driver’s seat in terms of pricing leverage for the first time in about a decade.

Dealers will restart business in January in this new landscape after a rise in risk spreads this quarter caused Canadian companies’ bonds to trade at yields last seen in the second half of 2011, according to a Bloomberg Barclays total return index. The extra yield over the government bonds has increased by 33 basis points since Sept. 30 to 143 basis points, as trade concerns rose.

Canada’s economy grows faster than expected

Steel, aluminum tariffs negatively impacting one-third of Canadian exporters: poll

Our trade with China is bigger than you think — and exporters are getting worried

“Volatile environments provide new issue investors with more pricing leverage,” said Sean St.John, co-head of fixed income, currencies and commodities, at National Bank Financial. “This in turn will keep new issue concessions elevated.”

Canada became the centre of the U.S and China trade dispute after the Dec. 1 arrest in Vancouver of Huawei Technologies Co. Chief Financial Officer Meng Wanzhou following an extradition request from the U.S. The $2.2-trillion Canadian economy is particularly exposed to trade developments between the two nations because the U.S. is home to three quarters of Canadian exports while China is a highly sought-after partner.

“The geopolitical risk around trade is still very big factor and concern,” said BlackRock Inc.’s head of Canadian fixed income Aubrey Basdeo. “At the moment the volatility in the market is really reflecting sentiment around trade concerns.”

This uncertainty drove Canadian-dollar denominated corporate bond sales during the last quarter to $10.8 billion, the lowest for that period since since 2008 after the bankruptcy of Lehman Brothers Holdings Inc. Banks, which accounted for at least half of the issuance in the previous quarters, reduced their issuance to a fraction of typical sales. Investors demanded more spread to hold senior bail-in bonds, a new type of bank debt which eventually could be converted into equity, if their lower-ranking reserves aren’t enough to offset losses.

Canada became the centre of the U.S and China trade dispute after the Dec. 1 arrest in Vancouver of Huawei Technologies Co. Chief Financial Officer Meng Wanzhou.

Trade concerns may continue as China and the U.S. approach the March 1 deadline to reach a pact, however issuers’ funding plans won’t wait. Banks may restart sales of bail-in debt before then. How the sales fare will give an indication of the current balance of power in the Canadian bond market.

BlackRock’s Basdeo expects that a new transaction to come with a spread over the bank’s safer deposit notes in a range around 32 basis points to 37 basis points compared with 15 basis points offered in the only loonie-denominated benchmark sized bail-in deal priced late September by Royal Bank of Canada.

In contrast, Toronto-Dominion Bank, Canada’s largest by assets, said in statement to Bloomberg News in early December that they “are actively monitoring the market” and “we expect the relative costs to decrease over time.”

Apart from banks, telecom and energy infrastructure companies may be also active in the market in 2019, said Canadian Imperial Bank of Commerce’s Global Head of Debt Capital Markets Marc St-Onge, without mentioning any specific company.

For instance, Telus Corp. could issue bonds in the Canadian or U.S. dollar market to finance a spectrum auction in Canada to take place next year, the company’s treasurer Stephen Lewis said in October. Meanwhile Inter Pipeline Ltd. said earlier this month it will consider issuing senior or subordinated bonds to finance its capital expenditure program.

While “we should continue to see issuance given the needs of the issuer to refinance maturities or that have additional funding needs, investor needs will also be a part of the issuance equation,” said Marc Cevey, chief executive officer at HSBC Bank Canada’s asset management unit. “We suspect investors will demand more bond holder friendly features and stricter covenants.”

–With assistance from Paula Sambo.

Bloomberg.com

from Financial Post http://bit.ly/2Aab726 via IFTTT Blogger Mortgage Tumblr Mortgage Evernote Mortgage Wordpress Mortgage href="https://www.diigo.com/user/gelsi11">Diigo Mortgage

0 notes

Text

Economists up their game as Bank of Canada stops foreshadowing interest-rate decisions

Bay Streeters are a little edgy this summer.

There’s the yield curve, which shows short-term yields are about the same as longer-term ones, a relationship that tends to signal a recession. There’s Donald Trump. There’s a diplomatic spat between Canada and Saudi Arabia, which reportedly prompted the kingdom to sell off its maple-flavoured assets this week.

And there are memories of what they were doing last summer — or more accurately, not doing, as angry bosses and clients would eventually tell them.

Stephen Poloz and his lieutenants on the Bank of Canada’s policy committee raised interest rates on July 12 and then went mostly quiet for the rest of the summer. Impressive economic indicators continued to roll in, including a report by Statistics Canada that showed gross domestic product grew at an annual rate of 4.5 per cent in that second quarter.

That was much faster than anyone had predicted, including the central bank. But few adjusted their outlooks for interest rates. Yet when policymakers gathered early last September, they surprised almost everyone by raising borrowing costs at consecutive announcements.

Bay Street’s shock was best expressed by Douglas Porter, chief economist at BMO Capital Markets, who called the lack of foreshadowing by the Bank of Canada an “epic fail.”

The central bank’s spokesman, Jeremy Harrison, took the unusual step of responding to Porter directly. Harrison said in a statement that market prices had put the odds of an increase at about 50-50; in other words, Porter, don’t blame us for your mistake. “Evidently, a much higher percentage of trading desks were correctly interpreting the bank’s prior messaging that monetary policy would be forward-looking and data dependent,” Harrison said.

The episode appears to have had an impact. There’s been a noteworthy shift in the quality of research over the past year. The closest watchers of the Bank of Canada have mostly stopped waiting for policymakers to tell them what they intend to do. They are increasingly making bolder forecasts based on their own assessments of the data.

Ahead of last month’s interest-rate decision, Stéfane Marion, chief economist at National Bank Financial, broke from the pack and called on the Bank of Canada to leave borrowing costs unchanged. And last week, Jean-François Perrault, chief economist at Bank of Nova Scotia, stuck out his neck by predicting the central bank will lift interest rates next month, repeating last year’s back-to-back increases.

It was a brave call because almost everyone else thinks Poloz and his advisers will wait until at least October.

This is what Poloz hoped would happen when he stopped giving guidance early in his tenure. Divergent points of view helps the central bank because a real debate on Bay Street could flag points that authorities might have missed. It also could make the financial system safer by encouraging more hedging. Perrault is in the minority, but the former finance official is a smart guy. He might also know his way around Ottawa better than many of his peers. The September interest-rate announcement no longer is a one-way bet.

“Markets appear to be significantly underpricing the odds of additional monetary policy tightening in Canada through the middle of next year,” Perrault told his clients in an update of Scotia’s economic forecasts published Aug. 2. “We think Governor Poloz will be compelled to raise rates in September even if market pricing hasn’t adjusted by then.”

Like last summer, the data are beating expectations. GDP appears to be running ahead of forecasts, aided by record merchandise exports in June and a decent amount of business investment.

StatCan added another positive on Aug. 10 when it reported that the jobless rate dropped to 5.8 per cent in July, a level that many economists equate with full employment. Adjusted for American statistical methods, some 62 per cent of the Canada’s working-age population had a job in July, compared with 60.5 per cent in the United States.

The latest labour figures weren’t impressive enough to shift the consensus that the Bank of Canada will wait until the autumn to raise interest rates, but you can tell some are thinking about it. The Institute of Fiscal Studies and Democracy’s real-time forecast of quarterly GDP growth was predicting 3.2 per cent for the second quarter after incorporating the 54,000 jobs that StatCan said were created last month. The Bank of Canada’s current estimate: 2.8 per cent.

“A good set of numbers that will keep the market guessing between September and October,” said Avery Shenfeld, chief economist at CIBC World Markets, adding that he is sticking with his October prediction.

Almost as important as the debate over policy are the economists who are conducting it.

There always was dissent. You could count on short sellers to try to poke holes in the market consensus, or maybe an economist at a boutique investing house who had an image or an ideology to uphold.

But economists at the big banks and institutional investors tended to form packs, and there’s a reason for that. They have more at stake, as they serve more clients and they play a role in supporting their institution’s brand. Therefore it’s safer to stick with the consensus view.

So it was impressive to see Scotia break out on its own. At the other end of the spectrum, Aubrey Basdeo, head of fixed income at BlackRock Canada, who almost as boldly is ignoring recent data and sticking with his prediction that the Bank of Canada will wait until early 2019 to raise interest rates.

Basdeo said the latest export numbers are likely being affected by companies stockpiling ahead of tariffs. He doubts U.S. demand will maintain its second-quarter momentum, and he said it remains unclear how higher interest rates will affect consumption.

“We’ve got issues,” he said in an interview on Aug. 9. “Why tempt fate when time is on your side?”

Unlike last year, some of the Bank of Canada’s leaders will be speaking before their September interest-rate decision: Carolyn Wilkins, the senior deputy governor, is at an event in Frankfurt on Aug. 20 and Poloz is scheduled to speak at the annual gathering of leading central bankers and economist in Jackson Hole, Wyo., on Aug. 25. And StatCan’s report on second-quarter GDP will be released at the end of the month. Those will likely be the moments on the calendar when forecasts for September change or harden.

To be sure, the trade wars could supply other variables. Poloz has said repeatedly that he won’t be swayed by headlines, only hard evidence of economic harm. Scotia’s prediction is based partly on its assumption that trade tensions will fade as Trump and his advisers are confronted with the damage their duties are causing.

But that short-term damage could be enough to persuade the Bank of Canada to leave a cushion in place. The anecdotal evidence of harm could add up quickly. Magna International Inc. this cut its outlook for sales and profit this year, blaming steel duties and Trump’s trade war with China. Earlier, Glenn Chamandy, chief executive of Montreal-based Gildan Activewear Inc., told analysts that a plan to expand production is on hold until Canada, Mexico and the U.S. resolve their differences over the North American Free Trade Agreement.

It also is worth noting that the positive surprises this year are less impressive than in 2017. So the safe bet is that the Bank of Canada will leave the benchmark rate unchanged on Sept. 5.

Still, it’s encouraging that safe is no longer the only path that Bay Street sees fit to offer.

• Email: [email protected] | Twitter: carmichaelkevin

from Financial Post https://ift.tt/2My0n1N via IFTTT Blogger Mortgage Tumblr Mortgage Evernote Mortgage Wordpress Mortgage href="https://www.diigo.com/user/gelsi11">Diigo Mortgage

0 notes

Text

World’s largest money manager says Bank of Canada will hold rates in July

The world’s largest money manager is revising its expectations for the Bank of Canada’s policy tightening path.

BlackRock Inc. no longer sees the BOC raising interest rates at the conclusion of its July 11 meeting, after Governor Stephen Poloz struck a dovish tone during Wednesday’s highly anticipated speech. The shift echoes a similar change in sentiment among short-end traders, who are now pricing in roughly 50-50 odds of a rate hike, down from almost 80 per cent just two weeks ago.

Poloz said tariffs will figure “prominently” when deliberating on next month’s policy decision, and reiterated the central bank’s dependence on economic data, which has come in below expectations in recent weeks. The Canadian dollar weakened to a fresh year-to-date low of 74.70 US cents versus the greenback in the aftermath, although it recovered some ground Thursday and was around 75.23 US cents as of 7:25 a.m. in New York. A less hawkish BOC wouldn’t bode well for a loonie that’s already down more than 5 per cent this year as the global trade outlook and North American Free Trade Agreement negotiations grow increasingly fraught.

The BOC meeting “is definitely live, and it’s very data-dependent down to the last drop,” Aubrey Basdeo, head of Canadian fixed income at BlackRock, said after Poloz’s speech. “The heightened macro uncertainty is a function of the trade issues, and that should drive the weaker data that is likely to manifest itself.”

Ahead of the July meeting, Basdeo will be keeping a close eye on two upcoming Canadian economic data prints in particular: April’s gross domestic product release, due Friday, and June’s employment figures, due July 6.

“If GDP, for some reason, surprises to the upside and the unemployment numbers are strong, the market will rush to reprice,” Basdeo said. However, that’s not his base case. “The GDP numbers will not support them going in July, and the employment numbers that follow are going to be the icing on the cake.”

Bloomberg.com

from Financial Post https://ift.tt/2yPhKsu via IFTTT Blogger Mortgage Tumblr Mortgage Evernote Mortgage Wordpress Mortgage href="https://www.diigo.com/user/gelsi11">Diigo Mortgage

0 notes