#Startups Factors

Explore tagged Tumblr posts

Link

Well, every individual aspires to become a successful entrepreneur. Recently, there has been a phenomenal rise in people wishing to start their own business. However, there is no assurance of your startup business idea will strike goal.

0 notes

Text

the dumbass company i once worked for has come back to haunt me yet again 💀 who thought it would be a good idea to own and operate two distinct companies out of the same office with the same employees and arbitrarily assign employees to one or the other. but then pay everyone under just one company's tax account. bc now i have a background check agency going "um. can you prove that you worked for Y" and i was like yah of course. and then i looked at my W-2 and my W-2 says i worked for X. i have no legal proof that i worked for Y.

#now i get to contact a supervisor that i havent spoken to in years and try to wheedle some kind of document out of her#complicating factor: my dad quit that company in disgust a year ago so my family name is permanently blackened there. what fun!#oh small sloppily-run startup companies... how i loathe you. a stain on my resume evermore

2 notes

·

View notes

Text

𝗧𝗵𝗲 𝗨𝗹𝘁𝗶𝗺𝗮𝘁𝗲 𝗚𝘂𝗶𝗱𝗲 𝘁𝗼 𝗜𝗻𝘃𝗼𝗶𝗰𝗲 𝗙𝗮𝗰𝘁𝗼𝗿𝗶𝗻𝗴 𝗳𝗼𝗿 𝗘𝗻𝘁𝗿𝗲𝗽𝗿𝗲𝗻𝗲𝘂𝗿𝘀 This article is for entrepreneurs and small business owners who want to improve cash flow and grow their business. You will learn what invoice factoring is, how it works, and when to use it to your advantage. You’ll gain valuable tips and practical advice on choosing the right factoring company, managing invoices, and optimizing your finances. With Invoxa, an invoice maker, you can streamline your invoicing process and make factoring even more efficient. This guide provides actionable insights and real-world examples to help you unlock the benefits of invoice factoring. Start exploring invoice factoring today!

#invoice#invoice generator#free invoice software#business#finance#entrepreneurship#startup#invoice maker#invoice management system#invoxa#freelance#factoring

1 note

·

View note

Text

The Trust Factor: Building Brand Loyalty Through Authenticity and Transparency

## Introduction In today’s fast-paced digital landscape, businesses must prioritize building trust with their audiences to thrive. The concept of “The Trust Factor: Building Brand Loyalty Through Authenticity and Transparency” highlights the cornerstone roles that authenticity and transparency play in not only establishing connections with customers but also retaining their loyalty. Consumers are…

#Authenticity#best practices for brand management#Brand#Branding strategies for small businesses#Building#building brand loyalty#business growth strategies#corporate social responsibility#creating a strong brand identity#customer relationship management#digital marketing for startups#e-commerce tips for businesses#Factor#how to scale your business.#how to start a successful business#importance of social media for businesses#influencer marketing for brands#Loyalty#small business funding options#top business trends 2024#Transparency#Trust

0 notes

Text

Top 10 Things See While Choosing a Mobile App Development Company

Choosing the right mobile app development company is crucial! Discover the top 10 factors to consider while choosing an app development firm, from specialized expertise to post-launch support. Make an informed decision and ensure your app's success.

Check out our latest blog for a detailed guide!

#mobileappdevelopment#appdevelopment#technology#startup#business#choosewisely#factors#expertise#security#scalability#userexperience#cost#support

0 notes

Text

Kickstart Your Trucking Business: Financial Relief and Support Solutions

Renee Williams, PresidentFreightRevCon, a Freight Revenue Consultants, LLC. company The average cost to start a new trucking company ranges from $10,000 to $30,000, not including the cost of purchasing trucks and trailers. Here is a breakdown of the typical startup costs: Semi-truck and trailer down payment: $18,000 Insurance down payment: $4,000 USDOT number registration: $300 Business…

View On WordPress

#A/R automation for trucking#annual insurance premiums#business entity filing#CDL training cost#ELD monthly fees#electronic logging device cost#Freight#freight industry#Freight Revenue Consultants#heavy vehicle use tax#IRP plates cost#new trucking business setup#semi-truck down payment#start a trucking company#starting a freight company#trailer purchase cost#Transportation#truck factoring companies#truck financing#truck purchase cost#Trucking#trucking business startup costs#trucking capital requirements#trucking company expenses#trucking company line of credit#trucking equipment costs#trucking industry#trucking insurance costs#unified carrier registration cost#USDOT number registration

0 notes

Text

www.finyoz.com

#factoring investing companies germany austria make money online interest#accounting#finance#investing#marketing#startup

1 note

·

View note

Text

Avoiding Cash Flow Crunches: Leveraging Invoice Factoring to Stay Afloat

In the unpredictable waters of business, cash flow crunches can hit like a sudden storm, threatening the stability and growth of even the most well-managed companies. For small and medium-sized enterprises (SMEs) especially, maintaining a healthy cash flow is crucial for day-to-day operations, expansion plans, and overall sustainability. This is where invoice factoring emerges as a lifeline, offering a reliable solution to bridge the gap between invoicing and actual payment.

Understanding the Cash Flow Conundrum

In the unpredictable waters of business, cash flow crunches can hit like a sudden storm in Malaysia, threatening the stability and growth of even the most well-managed companies. For small and medium-sized enterprises (SMEs) especially, maintaining a healthy cash flow is crucial for day-to-day operations, expansion plans, and overall sustainability. This is where invoice factoring emerges as a lifeline, offering a reliable solution to bridge the gap between invoicing and actual payment. Cashflow management in Malaysia presents unique challenges for SMEs. However, with effective cashflow management strategies, businesses can navigate these challenges successfully, ensuring financial stability and fostering growth in a competitive market landscape.

The Power of Invoice Factoring

Invoice factoring, also known as accounts receivable financing, presents a proactive approach to managing cash flow challenges. Instead of waiting for clients to settle their invoices, businesses can sell their outstanding invoices to a third-party factoring company at a discount. In return, they receive immediate cash, typically covering 70% to 90% of the invoice value, with the remainder held as a reserve.

How Invoice Factoring Works

Submission of Invoices: The business submits its unpaid invoices to the factoring company, along with relevant documentation.

Verification and Approval: The factoring company assesses the creditworthiness of the invoiced customers and verifies the legitimacy of the invoices.

Advancing Funds: Upon approval, the factoring company advances a significant portion of the invoice value to the business, usually within 24 to 48 hours.

Collection Process: The factoring company takes responsibility for collecting payment from the customers on behalf of the business.

Final Settlement: Once the customers settle their invoices, the factoring company deducts its fees and releases the remaining balance to the business, minus any reserve amounts.

Benefits of Invoice Factoring

- Immediate Cash Injection: Invoice factoring provides businesses with instant access to cash, enabling them to meet pressing financial obligations and seize growth opportunities without delay.

- Improved Cash Flow Management: By converting accounts receivable into cash, businesses can better predict and manage their cash flow, reducing the risk of cash shortages and late payments.

- Outsourced Collections: Factoring companies handle the arduous task of chasing payments, freeing up valuable time and resources for businesses to focus on core activities.

- Flexible Financing Option: Unlike traditional loans, invoice factoring is not a debt-based financing solution. Instead, it leverages existing assets (invoices), making it an attractive option for businesses with limited collateral or poor credit history.

Conclusion

In the dynamic world of business, maintaining a healthy cash flow is paramount for survival and success. Invoice factoring offers a strategic financial tool for businesses to navigate cash flow crunches and sustain steady growth. By converting unpaid invoices into immediate cash, Small and medium businesses can overcome liquidity challenges, seize growth opportunities, and stay afloat in turbulent times. As a flexible and accessible financing option, invoice factoring in Malaysia empowers businesses to thrive in an ever-evolving marketplace.

0 notes

Text

What factors should I consider when choosing a woodworking estimating service?

When choosing a woodworking estimating service you really consider the common factors for their pricing structure as well as the quality and accuracy of their estimates for their level of customer service and support their reputation and experience in the industry.

Here are some factors to consider when choosing a woodworking estimating service:

Accuracy: The estimating service should be able to provide accurate estimates that are within a reasonable range of the actual cost of the project.

Timeliness: The estimating service should be able to provide estimates in a timely manner so that you make decisions about your project without delay.

Communication: The estimating service should be easy to communicate with so that you clarify your project requirements and get answers to your questions.

Learn More: Myself David - boast an exceptional mastery of 22 years in the domain of carpentry craftsmanship.

#woodworking#factors#accuracy#timeliness#communication#interiors#3d printing#home#kitchen#startup#packaging#woodwork#estimating software#infographic#construction estimating services#market estimate

0 notes

Text

the great reddit API meltdown of '23, or: this was always bound to happen

there's a lot of press about what's going on with reddit right now (app shutdowns, subreddit blackouts, the CEO continually putting his foot in his mouth), but I haven't seen as much stuff talking about how reddit got into this situation to begin with. so as a certified non-expert and Context Enjoyer I thought it might be helpful to lay things out as I understand them—a high-level view, surveying the whole landscape—in the wonderful world of startups, IPOs, and extremely angry users.

disclaimer that I am not a founder or VC (lmao), have yet to work at a company with a successful IPO, and am not a reddit employee or third-party reddit developer or even a subreddit moderator. I do work at a startup, know my way around an API or two, and have spent twelve regrettable years on reddit itself. which is to say that I make no promises of infallibility, but I hope you'll at least find all this interesting.

profit now or profit later

before you can really get into reddit as reddit, it helps to know a bit about startups (of which reddit is one). and before I launch into that, let me share my Three Types Of Websites framework, which is basically just a mental model about financial incentives that's helped me contextualize some of this stuff.

(1) website/software that does not exist to make money: relatively rare, for a variety of reasons, among them that it costs money to build and maintain a website in the first place. wikipedia is the evergreen example, although even wikipedia's been subject to criticism for how the wikimedia foundation pays out its employees and all that fun nonprofit stuff. what's important here is that even when making money is not the goal, money itself is still a factor, whether it's solicited via donations or it's just one guy paying out of pocket to host a hobby site. but websites in this category do, generally, offer free, no-strings-attached experiences to their users.

(I do want push back against the retrospective nostalgia of "everything on the internet used to be this way" because I don't think that was ever really true—look at AOL, the dotcom boom, the rise of banner ads. I distinctly remember that neopets had multiple corporate sponsors, including a cookie crisp-themed flash game. yahoo bought geocities for $3.6 billion; money's always been trading hands, obvious or not. it's indisputable that the internet is simply different now than it was ten or twenty years ago, and that monetization models themselves have largely changed as well (I have thoughts about this as it relates to web 1.0 vs web 2.0 and their associated costs/scale/etc.), but I think the only time people weren't trying to squeeze the internet for all the dimes it can offer was when the internet was first conceived as a tool for national defense.)

(2) website/software that exists to make money now: the type that requires the least explanation. mostly non-startup apps and services, including any random ecommerce storefront, mobile apps that cost three bucks to download, an MMO with a recurring subscription, or even a news website that runs banner ads and/or offers paid subscriptions. in most (but not all) cases, the "make money now" part is obvious, so these things don't feel free to us as users, even to the extent that they might have watered-down free versions or limited access free trials. no one's shocked when WoW offers another paid expansion packs because WoW's been around for two decades and has explicitly been trying to make money that whole time.

(3) website/software that exists to make money later: this is the fun one, and more common than you'd think. "make money later" is more or less the entire startup business model—I'll get into that in the next section���and is deployed with the expectation that you will make money at some point, but not always by means as obvious as "selling WoW expansions for forty bucks a pop."

companies in this category tend to have two closely entwined characteristics: they prioritize growth above all else, regardless of whether this growth is profitable in any way (now, or sometimes, ever), and they do this by offering users really cool and awesome shit at little to no cost (or, if not for free, then at least at a significant loss to the company).

so from a user perspective, these things either seem free or far cheaper than their competitors. but of course websites and software and apps and [blank]-as-a-service tools cost money to build and maintain, and that money has to come from somewhere, and the people supplying that money, generally, expect to get it back...

just not immediately.

startups, VCs, IPOs, and you

here's the extremely condensed "did NOT go to harvard business school" version of how a startup works:

(1) you have a cool idea.

(2) you convince some venture capitalists (also known as VCs) that your idea is cool. if they see the potential in what you're pitching, they'll give you money in exchange for partial ownership of your company—which means that if/when the company starts trading its stock publicly, these investors will own X numbers of shares that they can sell at any time. in other words, you get free money now (and you'll likely seek multiple "rounds" of investors over the years to sustain your company), but with the explicit expectations that these investors will get their payoff later, assuming you don't crash and burn before that happens.

during this phase, you want to do anything in your power to make your company appealing to investors so you can attract more of them and raise funds as needed. because you are definitely not bringing in the necessary revenue to offset operating costs by yourself.

it's also worth nothing that this is less about projecting the long-term profitability of your company than it's about its perceived profitability—i.e., VCs want to put their money behind a company that other people will also have confidence in, because that's what makes stock valuable, and VCs are in it for stock prices.

(3) there are two non-exclusive win conditions for your startup: you can get acquired, and you can have an IPO (also referred to as "going public"). these are often called "exit scenarios" and they benefit VCs and founders, as well as some employees. it's also possible for a company to get acquired, possibly even more than once, and then later go public.

acquisition: sell the whole damn thing to someone else. there are a million ways this can happen, some better than others, but in many cases this means anyone with ownership of the company (which includes both investors and employees who hold stock options) get their stock bought out by the acquiring company and end up with cash in hand. in varying amounts, of course. sometimes the founders walk away, sometimes the employees get laid off, but not always.

IPO: short for "initial public offering," this is when the company starts trading its stocks publicly, which means anyone who wants to can start buying that company's stock, which really means that VCs (and employees with stock options) can turn that hypothetical money into real money by selling their company stock to interested buyers.

drawing from that, companies don't go for an IPO until they think their stock will actually be worth something (or else what's the point?)—specifically, worth more than the amount of money that investors poured into it. The Powers That Be will speculate about a company's IPO potential way ahead of time, which is where you'll hear stuff about companies who have an estimated IPO evaluation of (to pull a completely random example) $10B. actually I lied, that was not a random example, that was reddit's valuation back in 2021 lol. but a valuation is basically just "how much will people be interested in our stock?"

as such, in the time leading up to an IPO, it's really really important to do everything you can to make your company seem like a good investment (which is how you get stock prices up), usually by making the company's numbers look good. but! if you plan on cashing out, the long-term effects of your decisions aren't top of mind here. remember, the industry lingo is "exit scenario."

if all of this seems like a good short-term strategy for companies and their VCs, but an unsustainable model for anyone who's buying those stocks during the IPO, that's because it often is.

also worth noting that it's possible for a company to be technically unprofitable as a business (meaning their costs outstrip their revenue) and still trade enormously well on the stock market; uber is the perennial example of this. to the people who make money solely off of buying and selling stock, it literally does not matter that the actual rideshare model isn't netting any income—people think the stock is valuable, so it's valuable.

this is also why, for example, elon musk is richer than god: if he were only the CEO of tesla, the money he'd make from selling mediocre cars would be (comparatively, lol) minimal. but he's also one of tesla's angel investors, which means he holds a shitload of tesla stock, and tesla's stock has performed well since their IPO a decade ago (despite recent dips)—even if tesla itself has never been a huge moneymaker, public faith in the company's eventual success has kept them trading at high levels. granted, this also means most of musk's wealth is hypothetical and not liquid; if TSLA dropped to nothing, so would the value of all the stock he holds (and his net work with it).

what's an API, anyway?

to move in an entirely different direction: we can't get into reddit's API debacle without understanding what an API itself is.

an API (short for "application programming interface," not that it really matters) is a series of code instructions that independent developers can use to plug their shit into someone else's shit. like a series of tin cans on strings between two kids' treehouses, but for sending and receiving data.

APIs work by yoinking data directly from a company's servers instead of displaying anything visually to users. so I could use reddit's API to build my own app that takes the day's top r/AITA post and transcribes it into pig latin: my app is a bunch of lines of code, and some of those lines of code fetch data from reddit (and then transcribe that data into pig latin), and then my app displays the content to anyone who wants to see it, not reddit itself. as far as reddit is concerned, no additional human beings laid eyeballs on that r/AITA post, and reddit never had a chance to serve ads alongside the pig-latinized content in my app. (put a pin in this part—it'll be relevant later.)

but at its core, an API is really a type of protocol, which encompasses a broad category of formats and business models and so on. some APIs are completely free to use, like how anyone can build a discord bot (but you still have to host it yourself). some companies offer free APIs to third-party developers can build their own plugins, and then the company and the third-party dev split the profit on those plugins. some APIs have a free tier for hobbyists and a paid tier for big professional projects (like every weather API ever, lol). some APIs are strictly paid services because the API itself is the company's core offering.

reddit's financial foundations

okay thanks for sticking with me. I promise we're almost ready to be almost ready to talk about the current backlash.

reddit has always been a startup's startup from day one: its founders created the site after attending a startup incubator (which is basically a summer camp run by VCs) with the successful goal of creating a financially successful site. backed by that delicious y combinator money, reddit got acquired by conde nast only a year or two after its creation, which netted its founders a couple million each. this was back in like, 2006 by the way. in the time since that acquisition, reddit's gone through a bunch of additional funding rounds, including from big-name investors like a16z, peter thiel (yes, that guy), sam altman (yes, also that guy), sequoia, fidelity, and tencent. crunchbase says that they've raised a total of $1.3B in investor backing.

in all this time, reddit has never been a public company, or, strictly speaking, profitable.

APIs and third-party apps

reddit has offered free API access for basically as long as it's had a public API—remember, as a "make money later" company, their primary goal is growth, which means attracting as many users as possible to the platform. so letting anyone build an app or widget is (or really, was) in line with that goal.

as such, third-party reddit apps have been around forever. by third-party apps, I mean apps that use the reddit API to display actual reddit content in an unofficial wrapper. iirc reddit didn't even have an official mobile app until semi-recently, so many of these third-party mobile apps in particular just sprung up to meet an unmet need, and they've kept a small but dedicated userbase ever since. some people also prefer the user experience of the unofficial apps, especially since they offer extra settings to customize what you're seeing and few to no ads (and any ads these apps do display are to the benefit of the third-party developers, not reddit itself.)

(let me add this preemptively: one solution I've seen proposed to the paid API backlash is that reddit should have third-party developers display reddit's ads in those third-party apps, but this isn't really possible or advisable due to boring adtech reasons I won't inflict on you here. source: just trust me bro)

in addition to mobile apps, there are also third-party tools that don’t replace the Official Reddit Viewing Experience but do offer auxiliary features like being able to mass-delete your post history, tools that make the site more accessible to people who use screen readers, and tools that help moderators of subreddits moderate more easily. not to mention a small army of reddit bots like u/AutoWikibot or u/RemindMebot (and then the bots that tally the number of people who reply to bot comments with “good bot” or “bad bot).

the number of people who use third-party apps is relatively small, but they arguably comprise some of reddit’s most dedicated users, which means that third-party apps are important to the people who keep reddit running and the people who supply reddit with high-quality content.

unpaid moderators and user-generated content

so reddit is sort of two things: reddit is a platform, but it’s also a community.

the platform is all the unsexy (or, if you like python, sexy) stuff under the hood that actually makes the damn thing work. this is what the company spends money building and maintaining and "owns." the community is all the stuff that happens on the platform: posts, people, petty squabbles. so the platform is where the content lives, but ultimately the content is the reason people use reddit—no one’s like “yeah, I spend time on here because the backend framework really impressed me."

and all of this content is supplied by users, which is not unique among social media platforms, but the content is also managed by users, which is. paid employees do not govern subreddits; unpaid volunteers do. and moderation is the only thing that keeps reddit even remotely tolerable—without someone to remove spam, ban annoying users, and (god willing) enforce rules against abuse and hate speech, a subreddit loses its appeal and therefore its users. not dissimilar to the situation we’re seeing play out at twitter, except at twitter it was the loss of paid moderators; reddit is arguably in a more precarious position because they could lose this unpaid labor at any moment, and as an already-unprofitable company they absolutely cannot afford to implement paid labor as a substitute.

oh yeah? spell "IPO" backwards

so here we are, June 2023, and reddit is licking its lips in anticipation of a long-fabled IPO. which means it’s time to start fluffing themselves up for investors by cutting costs (yay, layoffs!) and seeking new avenues of profit, however small.

this brings us to the current controversy: reddit announced a new API pricing plan that more or less prevents anyone from using it for free.

from reddit's perspective, the ostensible benefits of charging for API access are twofold: first, there's direct profit to be made off of the developers who (may or may not) pay several thousand dollars a month to use it, and second, cutting off unsanctioned third-party mobile apps (possibly) funnels those apps' users back into the official reddit mobile app. and since users on third-party apps reap the benefit of reddit's site architecture (and hosting, and development, and all the other expenses the site itself incurs) without “earning” money for reddit by generating ad impressions, there’s a financial incentive at work here: even if only a small percentage of people use third-party apps, getting them to use the official app instead translates to increased ad revenue, however marginal.

(also worth mentioning that chatGPT and other LLMs were trained via tools that used reddit's API to scrape post and content data, and now that openAI is reaping the profits of that training without giving reddit any kickbacks, reddit probably wants to prevent repeats of this from happening in the future. if you want to train the next LLM, it's gonna cost you.)

of course, these changes only benefit reddit if they actually increase the company’s revenue and perceived value/growth—which is hard to do when your users (who are also the people who supply the content for other users to engage with, who are also the people who moderate your communities and make them fun to participate in) get really fucking pissed and threaten to walk.

pricing shenanigans

under the new API pricing plan, third-party developers are suddenly facing steep costs to maintain the apps and tools they’ve built.

most paid APIs are priced by volume: basically, the more data you send and receive, the more money it costs. so if your third-party app has a lot of users, you’ll have to make more API requests to fetch content for those users, and your app becomes more expensive to maintain. (this isn’t an issue if the tool you’re building also turns a profit, but most third-party reddit apps make little, if any, money.)

which is why, even though third-party apps capture a relatively small portion of reddit’s users, the developer of a popular third-party app called apollo recently learned that it would cost them about $20 million a year to keep the app running. and apollo actually offers some paid features (for extra in-app features independent of what reddit offers), but nowhere near enough to break even on those API costs.

so apollo, any many apps like it, were suddenly unable to keep their doors open under the new API pricing model and announced that they'd be forced to shut down.

backlash, blackout

plenty has been said already about the current subreddit blackouts—in like, official news outlets and everything—so this might be the least interesting section of my whole post lol. the short version is that enough redditors got pissed enough that they collectively decided to take subreddits “offline” in protest, either by making them read-only or making them completely inaccessible. their goal was to send a message, and that message was "if you piss us off and we bail, here's what reddit's gonna be like: a ghost town."

but, you may ask, if third-party apps only captured a small number of users in the first place, how was the backlash strong enough to result in a near-sitewide blackout? well, two reasons:

first and foremost, since moderators in particular are fond of third-party tools, and since moderators wield outsized power (as both the people who keep your site more or less civil, and as the people who can take a subreddit offline if they feel like it), it’s in your best interests to keep them happy. especially since they don’t get paid to do this job in the first place, won’t keep doing it if it gets too hard, and essentially have nothing to lose by stepping down.

then, to a lesser extent, the non-moderator users on third-party apps tend to be Power Users who’ve been on reddit since its inception, and as such likely supply a disproportionate amount of the high-quality content for other users to see (and for ads to be served alongside). if you drive away those users, you’re effectively kneecapping your overall site traffic (which is bad for Growth) and reducing the number/value of any ad impressions you can serve (which is bad for revenue).

also a secret third reason, which is that even people who use the official apps have no stake in a potential IPO, can smell the general unfairness of this whole situation, and would enjoy the schadenfreude of investors getting fucked over. not to mention that reddit’s current CEO has made a complete ass of himself and now everyone hates him and wants to see him suffer personally.

(granted, it seems like reddit may acquiesce slightly and grant free API access to a select set of moderation/accessibility tools, but at this point it comes across as an empty gesture.)

"later" is now "now"

TL;DR: this whole thing is a combination of many factors, specifically reddit being intensely user-driven and self-governed, but also a high-traffic site that costs a lot of money to run (why they willingly decided to start hosting video a few years back is beyond me...), while also being angled as a public stock market offering in the very near future. to some extent I understand why reddit’s CEO doubled down on the changes—he wants to look strong for investors—but he’s also made a fool of himself and cast a shadow of uncertainty onto reddit’s future, not to mention the PR nightmare surrounding all of this. and since arguably the most important thing in an IPO is how much faith people have in your company, I honestly think reddit would’ve fared better if they hadn’t gone nuclear with the API changes in the first place.

that said, I also think it’s a mistake to assume that reddit care (or needs to care) about its users in any meaningful way, or at least not as more than means to an end. if reddit shuts down in three years, but all of the people sitting on stock options right now cashed out at $120/share and escaped unscathed... that’s a success story! you got your money! VCs want to recoup their investment—they don’t care about longevity (at least not after they’re gone), user experience, or even sustained profit. those were never the forces driving them, because these were never the ultimate metrics of their success.

and to be clear: this isn’t unique to reddit. this is how pretty much all startups operate.

I talked about the difference between “make money now” companies and “make money later” companies, and what we’re experiencing is the painful transition from “later” to “now.” as users, this change is almost invisible until it’s already happened—it’s like a rug we didn’t even know existed gets pulled out from under us.

the pre-IPO honeymoon phase is awesome as a user, because companies have no expectation of profit, only growth. if you can rely on VC money to stay afloat, your only concern is building a user base, not squeezing a profit out of them. and to do that, you offer cool shit at a loss: everything’s chocolate and flowers and quarterly reports about the number of signups you’re getting!

...until you reach a critical mass of users, VCs want to cash in, and to prepare for that IPO leadership starts thinking of ways to make the website (appear) profitable and implements a bunch of shit that makes users go “wait, what?”

I also touched on this earlier, but I want to reiterate a bit here: I think the myth of the benign non-monetized internet of yore is exactly that—a myth. what has changed are the specific market factors behind these websites, and their scale, and the means by which they attempt to monetize their services and/or make their services look attractive to investors, and so from a user perspective things feel worse because the specific ways we’re getting squeezed have evolved. maybe they are even worse, at least in the ways that matter. but I’m also increasingly less surprised when this occurs, because making money is and has always been the goal for all of these ventures, regardless of how they try to do so.

8K notes

·

View notes

Link

No startup can become successful with just a promising idea – especially in 2023

#Factors startups need to suceed#Startup factors for success#Success factors for startups#Factors startups need to suceed in 2023#2023 startup success factors#2023 factors for success#Success factors for startups in 2023

0 notes

Text

DARK SMS - DRAGON+

In today’s fast-paced digital landscape, maintaining privacy and security while communicating is more important than ever. Introducing DarkSMS, a cutting-edge virtual SMS platform designed to streamline your messaging experience without compromising your personal information. With our innovative virtual number service, users can receive SMS messages securely and anonymously, eliminating the risks associated with sharing private phone numbers. Whether you’re signing up for online services, verifying accounts, or simply looking to keep your communication confidential, DarkSMS has got you covered.

Virtual SMS

Virtual SMS refers to the messaging service that enables users to send and receive text messages through a virtual phone number rather than a traditional mobile line. This service is particularly useful for individuals and businesses looking to maintain privacy while communicating or verifying accounts.

One of the key advantages of using virtual sms is the ability to receive SMS without revealing your personal phone number. This is especially beneficial for online transactions, sign-ups for apps, or any situation where you might need to provide a phone number but want to protect your privacy.

Furthermore, virtual numbers can be easily managed from a web-based platform, allowing users to organize and store messages effectively. Many service providers offer features such as message forwarding, where received SMS messages can be redirected to your email or other platforms, ensuring you never miss an important notification.

In addition to privacy and convenience, virtual SMS services are often cost-effective. They eliminate the need for extra SIM cards or mobile contracts, allowing users to only pay for the services they actually use. This flexibility makes virtual number services highly attractive for startups and individuals working from remote locations.

As businesses increasingly adopt digital communication strategies, integrating virtual SMS into their operations can enhance customer interaction and improve engagement through instant messaging capabilities.

Virtual Number Service

A virtual number service offers a practical solution for individuals and businesses looking to maintain privacy while receiving communications. By using a virtual number, you can receive SMS messages without exposing your personal phone number. This feature is especially useful for those engaged in online transactions, such as e-commerce, as it safeguards against unwanted spam and protects your identity.

One of the key advantages of a virtual number service is its capability to function seamlessly alongside your primary phone line. Users can receive messages from various platforms effectively, whether it's for verification purposes, two-factor authentication, or simply keeping in touch with clients. The convenience of managing multiple numbers through a single device cannot be overstated.

With options to select numbers from different geographic locations, this service caters to users looking to establish a local presence in different markets. Moreover, these numbers can be set up quickly and easily, providing instant access to receive SMS without lengthy contracts or commitments.

To optimize your experience with virtual SMS and virtual number services, consider features like call forwarding, voicemail, and the ability to choose your own number. Such functionality enhances user experience by offering flexibility in communication while maintaining professional boundaries.

Ultimately, investing in a virtual number service can significantly enhance your business's communication strategy, allowing you to receive SMS reliably while focusing on building relationships with your clients.

Receive SMS

Receiving SMS through a virtual number is a convenient service that allows users to get text messages without needing a physical SIM card. This is particularly beneficial for individuals and businesses looking for privacy or those who wish to avoid exposing their personal phone numbers.

The process is straightforward: once you obtain a virtual number through a reliable virtual number service, you can start receiving sms messages. This service is essential for various reasons, including:

Account verification codes: Many online platforms use SMS to send verification codes. A virtual number allows you to receive these codes securely.

Business communications: Companies can use virtual SMS to receive client inquiries or feedback without revealing their primary contact numbers.

Privacy protection: By receiving SMS through a virtual number, users can protect their personal phone numbers from spam and unwanted solicitation.

Moreover, the get SMS feature of a virtual number service ensures that you don’t miss any important messages, even if you are on the move. Messages are often stored digitally, which means you can access them anytime and anywhere.

In summary, the ability to receive SMS through a virtual number enhances both privacy and accessibility, making it a valuable tool for users in various contexts.

Get SMS

Getting SMS messages through a virtual number service has become increasingly popular due to its convenience and versatility. Whether you need to receive texts for verification purposes or want to maintain privacy while communicating, virtual SMS provides a robust solution.

With a virtual number, you can easily get sms from anywhere in the world without needing a physical SIM card. This feature is particularly beneficial for businesses that require secure communication with clients or customers, as it ensures that sensitive information remains confidential.

Here are some advantages of using a virtual number to get SMS:

Privacy Protection: Using a virtual number helps keep your personal phone number private.

Accessibility: You can receive SMS messages on multiple devices, including tablets and laptops.

Cost-Effective: Virtual SMS services typically come with lower costs than traditional SMS plans.

Global Reach: You can get SMS messages from international numbers without incurring roaming fees.

Easy Setup: Setting up a virtual number to receive SMS is straightforward and often takes just a few minutes.

In summary, leveraging a virtual number service for SMS communication allows you to manage your messages efficiently while maintaining privacy, enhancing accessibility, and reducing costs. This is particularly useful for both personal and business communications, making it a smart choice for anyone looking to streamline their SMS functions.

630 notes

·

View notes

Text

Wearable Input Device: "Spokey Dokey"?

So seeing this I had a thought:

Thinking of Sampson Lee's neat keyboard in Cowboy Bebop the Movie, I tried threading an N52 Speedpad into a belt assembly to see how it might look and feel to type on with chording and yeah this is actually pretty great actually?

This absoloutely feels like something a mecha pilot would wear, that would allow for robust access in the field, or make the pilot suit part of the interface of the robot to do all the startup checklists on before using the HOSAS inceptor grips.

Note the same throughhole in the N52 which lets me thread it into a belt also lets you put your fingers in, akin to gripping a joystick.

I think with some refinement you could fit an analogue trigger and a bumper in here, and the thumb-cluster could be expanded slightly to include some other inputs.

Its begging for a trackball or an analogue stick in truth.

Genuinely surprised by how comfortable this is from a Human Factors Engineering standpoint???? Like, "putting your hands in your pockets" level comfortable, and it would be even better with a wrist-loop or something.

It beats the pants off of any cyberdeck esque project I've ever tried in terms of usability so I think this is something which needs to be iterated upon actually???

It hangs very naturally and you can vary the angle by adjusting it against the rubbedr of the quick-release strap. My one complaint is the base is designed for a desk and I think it could stand to be curved to better conform to the hip or leg which I think could cut the total size down considerably.

Even sat in a chair this feels surprisingly comfortable, with my only complaint being that its conflicting with the strap of my repurposed shoulder-bag, which is its own entirely different issue and that the default switches kind of suck.

The interior has a ton of room so you could absoloutely squeeze a decent battery and a Rasberry Pi in this thing, or use it as a pure input device that doubles as a USB hub/storage (SD card) and uses the spare room to charge a phone.

Two of these would give you a pretty bonkers battery life if you had one on either hip.

I think with ultra low profiles, a curved form, a slightly more robust strapping mechanism and a means to plug this into a smartphone as the middle computer (with something like a pair of smart-glasses as the display) you could have really really robust wearable computer and if you add a second one on the other hip, you've solved the wpm problem.

btw I typed this entire post on it, only lifting my hands off to use my trackball.

Those of you who work on cyberdecks, I genuinely think there's something to this. Wearable split keyboards which are ruggedized with tougher switches absoloutely feel like they are something which should exist.

348 notes

·

View notes

Text

African poverty is partly a consequence of energy poverty. In every other continent the vast majority of people have access to electricity. In Africa 600m people, 43% of the total, cannot readily light their homes or charge their phones. And those who nominally have grid electricity find it as reliable as a Scottish summer. More than three-quarters of African firms experience outages; two-fifths say electricity is the main constraint on their business.

If other sub-Saharan African countries had enjoyed power as reliable as South Africa’s from 1995 to 2007, then the continent’s rate of real GDP growth per person would have been two percentage points higher, more than doubling the actual rate, according to one academic paper. Since then South Africa has also had erratic electricity. So-called “load-shedding” is probably the main reason why the economy has shrunk in four of the past eight quarters.

Solar power is increasingly seen as the solution. Last year Africa installed a record amount of photovoltaic (PV) capacity (though this still made up just 1% of the total added worldwide), notes the African Solar Industry Association (AFSIA), a trade group. Globally most solar PV is built by utilities, but in Africa 65% of new capacity over the past two years has come from large firms contracting directly with developers. These deals are part of a decentralised revolution that could be of huge benefit to African economies.

Ground zero for the revolution is South Africa. Last year saw a record number of blackouts imposed by Eskom, the state-run utility, whose dysfunctional coal-fired power stations regularly break down or operate at far below capacity. Fortunately, as load-shedding was peaking, the costs of solar systems were plummeting.

Between 2019 and 2023 the cost of panels fell by 15%, having already declined by almost 90% in the 2010s. Meanwhile battery storage systems now cost about half as much as five years ago. Industrial users pay 20-40% less per unit when buying electricity from private project developers than on the cheapest Eskom tariff.

In the past two calendar years the amount of solar capacity in South Africa rose from 2.8GW to 7.8GW, notes AFSIA, excluding that installed on the roofs of suburban homes. All together South Africa’s solar capacity could now be almost a fifth of that of Eskom’s coal-fired power stations (albeit those still have a higher “capacity factor”, or ability to produce electricity around the clock). The growth of solar is a key reason why there has been less load-shedding in 2024...

Over the past decade the number of startups providing “distributed renewable energy” (DRE) has grown at a clip. Industry estimates suggest that more than 400m Africans get electricity from solar home systems and that more than ten times as many “mini-grids”, most of which use solar, were built in 2016-20 than in the preceding five years. In Kenya DRE firms employ more than six times as many people as the largest utility. In Nigeria they have created almost as many jobs as the oil and gas industry.

“The future is an extremely distributed system to an extent that people haven’t fully grasped,” argues Matthew Tilleard of CrossBoundary Group, a firm whose customers range from large businesses to hitherto unconnected consumers. “It’s going to happen here in Africa first and most consequentially.”

Ignite, which operates in nine African countries, has products that include a basic panel that powers three light bulbs and a phone charger, as well as solar-powered irrigation pumps, stoves and internet routers, and industrial systems. Customers use mobile money to “unlock” a pay-as-you-go meter.

Yariv Cohen, Ignite’s CEO, reckons that the typical $3 per month spent by consumers is less than what they previously paid for kerosene and at phone-charging kiosks. He describes how farmers are more productive because they do not have to get home before dark and children are getting better test scores because they study under bulbs. One family in Rwanda used to keep their two cows in their house because they feared rustlers might come in the dark; now the cattle snooze al fresco under an outside lamp and the family gets more sleep.

...That is one eye-catching aspect of Africa’s solar revolution. But most of the continent is undergoing a more subtle—and significant—experiment in decentralised, commercially driven solar power. It is a trend that could both transform African economies and offer lessons to the rest of the world."

-via The Economist, June 18, 2024. Paragraph breaks added.

#one of the biggest stories of this century is going to be the story of the African Renaissance#I promise you#well preferably they'll come up with a non-European term for it lol#but trust me it WILL happen and it will be SO good to see#africa#south africa#nigeria#kenya#solar#solar power#solar panels#solar pv#energy#clean energy#poverty#electrification#distributed energy#electricity#infrastructure#hope#solarpunk#good news#solar age#<- making that a tag now

416 notes

·

View notes

Text

Business and Vedic chart placements💙👑

As I'm in the process of doing the career insights game, I thought I would post about this, how to find out whether a business will be favorable to u and impacts of some placements in business.😁

Primarily, if 6H or it's lord is stronger than 10H, it's recommended to go for a job. If 10H is stronger than 6H, business can be more favorable.⚡⚡

If you have 10H stellium, it doesn't mean you should absolutely pursue business, the planet interactions have to be considered. No matter whether it is just 3 planets or 5 planets in 10H, all the planets being separated by degrees is favorable (ie.) They should not be conjunct with others within 5 degrees. If it's a conjunction between benefic planets, it is favorable but not the same in case of malefic conjunctions.😃😃

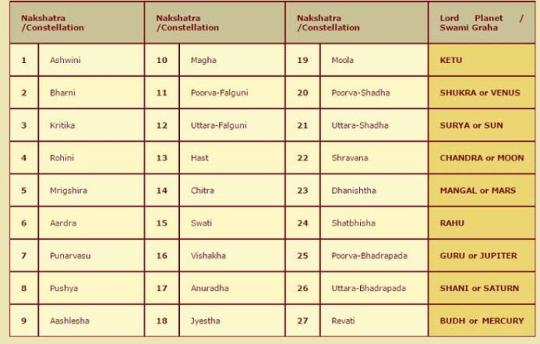

Mercury is related to trading which was the primary form of business, so having a strong mercury is essential for having a good business, establishing communication and sharp intellect to run it. Mars is the driving force, determination, courage and leadership needed to own business, so that's a factor too along with Saturn, having strong saturn is a potential indicator of becoming a business tycoon and influencing masses. These three planets influence a lot in case of owning a business, other planets support and aspects can decide which field is ur business in.💃💃

8H lord should not be debilitated and having an empty 8H is better for own startups as it can indicate sudden losses. 8H Jupiter is a mixed placement, it can bring in unexpected wealth too but usually Jupiter does more good to the houses he aspects than the house he sits in. So the sign of 8H Jupiter can be considered here, exalted sign cancer is still a water sign and moon ruler, hence the result will be unexpected gains and unexpected losses, going like an up and down graph. If 2H lord is stronger in this case, you can be good in managing finances and can reduce this unexpected ups and downs occurrence.😌😌

2H lord in Venus ruled stars is a mixed placement likewise, where you have a stable source of income, maybe even more than what u expected but the tendency to impulsively spend can be present as venus ruled stars are present in fire signs.😶😶

2H lord in water signs or in Rohini means you change your main source of income frequently. You can have multiple sources of income if mercury is conjunct with 2H lord or 2H lord in mercury ruled star.😊😊

Having mars/saturn in 6H helps in winning over enemies. 6H lord in Mars ruled stars can also apply to an extent. These placements lets you win contracts easily if your business involves such elements especially if Jupiter is aspecting 6H or 7H as 7H literally means interpersonal relations and contracts for business. This also comes to the point that having malefic influence in 7H can be a hindrance for business.🙂🙂

Rahu in Venus ruled stars or in Taurus/Libra, especially in 3H can give a knack for pleasant talking, cunningly interactive, where the person knows what to say and when to say something, influencing and changing minds of people with their words. This can be an advantage if ur business involves lots of talking and mingling with people.😉😉

Sun dominants can have the urge to be their own boss and thus want to do business, if other placements support, they can get really famous and influential in their field. Sun placement and its star can show what kind of a business owner you will be, how your behavior would look like and most importantly, how you treat your employees and your relationship with them.😎😎

Sun atmakaraka and saturn amatyakaraka is the best combination of being a successful and well renowned business owner, respected and loved by the masses for the exceptional leadership, heeding to everyone's needs and running the startup efficiently too. Mercury darakaraka can mean that your partner can be interested in doing business or you both can do it together if other placements support it.👑👑

Having many planets in sun ruled stars can give you the potential to be a great leader but it can also make the person too ambitious to the point where they forget to take care of the people, arrogant and selfish. Having a balance of Saturn/Jupiter ruled stars along with the sun ruled star combination is essential to become the kind of business owner who is admired by the employees for their benevolent and magnanimous nature.🤗🤗

11H lord can show your gains through the work you do, in case of business it can determine how much gains you can get without enduring much losses. 11H Jupiter or jupiter aspecting 11H is a most notable placement to benefit from much gains as Jupiter expands the house themes he sits in. 11H moon or 11H lord in rohini again relates to facing serious fluctuations in gains and losses up and down if 2H lord is not stronger to help you manage the finances. 11H lord in rahu ruled stars can give the same result to an extent, i.e. You might earn a lot but tend to spend it excessively or put the money on another business, facing loss trying to be overly ambitious.😇😇

***Attaching this nakshatras and its lord chart for easy understanding and access as this post has mentions like sun ruled nakshatras, venus ruled stars etc. P.c goes to the rightful owner.🤗

(Note: These are just some general observations, don't conclude anything with a single placement, other aspects and whole chart influences for sure)

So yeaaa that's it for today, but if you want me to explore other placements in terms of business and post a part 2, lemme know in comments or if you have any other post suggestions.☺☺

(Here's another moodboard I loved sm 👑💃)

With Love- Yashi ❤⚡

Masterlist💖

#astrology#blogs#astro community#astro observations#astroblr#astro placements#birth chart#natal chart#astro notes#vedic astro observations#vedic astrology observations#vedic astro notes#vedic chart#vedic astrology#business astrology#business#career astrology#vargottama#navamsa#d9 chart#2nd house#10th house#10th lord#11th house#rahu ketu#6th house#sidereal astrology#astrology aspects#astro girlies#tumblr girls

306 notes

·

View notes

Text

and theyre 30 from the shelter all this month but i cant even afford to put down for the litter box and stuff AHHHHH 🔨🔨🔨🔨🔨🔨🔨

i was so excited to adopt a cat once we moved for at least like one other thing to be excited about and now it wont be something i can afford for a while and its just all the startup stuff and im so sad and angry and frustrated

12 notes

·

View notes