#Smallsats

Text

ROCKETLAB ROCKET LIKE A HURRICANE

PRÓXIMA MISIÓN: COHETE COMO UN HURACÁN

Rocket Lab lanzará las observaciones de la estructura de la precipitación y la intensidad de la tormenta resueltas en el tiempo de la NASA con una misión Constellation of Smallsats (TROPICS) en dos lanzamientos separados de Electron.

DESCRIPCIÓN GENERAL DE LA MISIÓN

La primera misión, Rocket Like A Hurricane, será el lanzamiento número 36 de Electron de…

View On WordPress

#Ciencias y Tecnologías#CubeSat#Electron#Lanzamientos#NASA#Rocketlab#Satélite#sistema#Smallsats#Wallops

0 notes

Text

Tiny BurstCube's Tremendous Travelogue

Meet BurstCube! This shoebox-sized satellite is designed to study the most powerful explosions in the cosmos, called gamma-ray bursts. It detects gamma rays, the highest-energy form of light.

BurstCube may be small, but it had a huge journey to get to space.

First, BurstCube was designed and built at NASA’s Goddard Space Flight Center in Greenbelt, Maryland. Here you can see Julie Cox, an early career engineer, working on BurstCube’s gamma-ray detecting instrument in the Small Satellite Lab at Goddard.

BurstCube is a type of spacecraft called a CubeSat. These tiny missions give early career engineers and scientists the chance to learn about mission development — as well as do cool science!

Then, after assembling the spacecraft, the BurstCube team took it on the road to conduct a bunch of tests to determine how it will operate in space. Here you can see another early career engineer, Kate Gasaway, working on BurstCube at NASA’s Wallops Flight Facility in Virginia.

She and other members of the team used a special facility there to map BurstCube’s magnetic field. This will help them know where the instrument is pointing when it’s in space.

The next stop was back at Goddard, where the team put BurstCube in a vacuum chamber. You can see engineers Franklin Robinson, Elliot Schwartz, and Colton Cohill lowering the lid here. They changed the temperature inside so it was very hot and then very cold. This mimics the conditions BurstCube will experience in space as it orbits in and out of sunlight.

Then, up on a Goddard rooftop, the team — including early career engineer Justin Clavette — tested BurstCube’s GPS. This so-called open-sky test helps ensure the team can locate the satellite once it’s in orbit.

The next big step in BurstCube’s journey was a flight to Houston! The team packed it up in a special case and took it to the airport. Of course, BurstCube got the window seat!

Once in Texas, the BurstCube team joined their partners at Nanoracks (part of Voyager Space) to get their tiny spacecraft ready for launch. They loaded the satellite into a rectangular frame called a deployer, along with another small satellite called SNoOPI (Signals of Opportunity P-band Investigation). The deployer is used to push spacecraft into orbit from the International Space Station.

From Houston, BurstCube traveled to Cape Canaveral Space Force Station in Florida, where it launched on SpaceX’s 30th commercial resupply servicing mission on March 21, 2024. BurstCube traveled to the station along with some other small satellites, science experiments, as well as a supply of fresh fruit and coffee for the astronauts.

A few days later, the mission docked at the space station, and the astronauts aboard began unloading all the supplies, including BurstCube!

And finally, on April 18, 2024, BurstCube was released into orbit. The team will spend a month getting the satellite ready to search the skies for gamma-ray bursts. Then finally, after a long journey, this tiny satellite can embark on its big mission!

BurstCube wouldn’t be the spacecraft it is today without the input of many early career engineers and scientists. Are you interested in learning more about how you can participate in a mission like this one? There are opportunities for students in middle and high school as well as college!

Keep up on BurstCube’s journey with NASA Universe on X and Facebook. And make sure to follow us on Tumblr for your regular dose of space!

#tech#technology#dream job#jobseekers#NASA#space#spaceblr#universe#astronomy#science#gamma ray bursts#cubesat#smallsat#launch

653 notes

·

View notes

Text

NASA Selects Companies for Commercial SmallSat Services Award

NASA has selected eight companies for a new award to help acquire Earth observation data and provide related services for the agency. The Commercial SmallSat Data Acquisition Program On-Ramp1 Multiple Award contract is a firm-fixed-price indefinite-delivery/indefinite-quantity multiple-award contract with a maximum value of $476 million, cumulatively amongst all the selected contractors, and a performance period […]

from NASA https://ift.tt/4wYIv3G

0 notes

Text

https://www.industryarc.com/Research/small-and-medium-satellite-market-research-800681?utm_source=tumbler&utm_medium=social&utm_campaign=Raghavarao

#SmallSat#SatelliteTechnology#SpaceInnovation#SpaceTech#NewSpace#SatelliteLaunch#SatelliteCommunication

0 notes

Text

Shot in the dark here but I just got some student funding to attend the smallsat conference at USU in Logan, Utah in August.

Anyone know of cheap hotels or needing a roommate for dorm housing??? The hotel prices have skyrocketed and I didn't want to book anything ahead of time without getting funding assistance... $1500 isn't a lot of money for flights, hotels, and transportation....

#small satellite market#smallsat conference#smallsat#utah state#utah state university#funding#conferences#women in stem#women in aerospace#??? idk

1 note

·

View note

Text

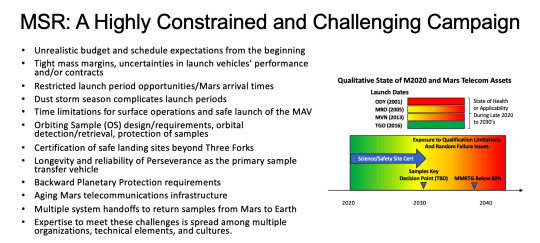

All our orbiters are going to be old and falling apart by the time we need them for MSR? Gee, if only there were solutions to this problem

If only there were ways we already knew about to extend spacecraft lifetimes and functionality so we could continue using the ones we already have (ahem)

If only there was another orbiter that is somewhat new and in good condition and from a friendly country that we could ask for support from (cough cough)

If only we were sending two smallsats to Mars next year that we could probably modify for communication purposes (cough cough cough)

If only there was a neatly outlined plan for an orbiter we could build and launch that was made for this exact situation (AHEM COUGH COUGH)

#mars#mars rover#space#nasa#just me rambling#you can probably ignore this#I'm just a random space nerd#I'm sure NASA has a reason to be concerned#but it just seems so funny from a distance#image description in alt

3 notes

·

View notes

Text

「宮崎正弘の国際情勢解題」

令和五年(2023)5月8日(月曜日)

通巻第7740号

中国が新彊ウイグル自治区のコルラに秘密レーザー基地

西側の偵察衛星、軍事衛星撃墜を目的、大出力ガス装置施設も

************************

米国軍事専門誌「アーミーテクノロジー」が報じた(5月1日)。

中国が新彊ウイグル自治区のコルラに秘密レーザー基地を設営し、西側の偵察衛星、軍事衛星撃墜を目的として大出力ガス装置施設も設営されているという。

ブラックスカイ社が撮影した衛星画像では格納庫に収容された二つのレーザー ジンバルを示しており、施設の屋根は外国の画像衛星が最も活発な正午頃に開くと報告した。

この対衛星レーザーに加え電磁パルスとエアロスタット施設がある。

https://www.blacksky.com/company/

(↑ ブラックスカイのHP)

コルラの衛星画像は、対衛星レーザーを示しており、必要なガスを収容できるドーム型構造物が隣接している。

2003 年にコルラ基地を人民解放軍戦略支援部隊 (PLA SSF) の第 63655 部隊によって設営管理されており、レーザーと光学、超大型成層圏飛行船、高出力マイクロ波の研究を担当しているという

コルラは古来よりシルクロードのオアシス都市として栄えた。近年はガスと石油の大油田が発見されて夥しい漢族が流入し、近代都市に発展。砂漠の真ん中なのに摩天楼も建っている。市名はウイグル語で「眺め」を意味する。タリム盆地の東北縁辺に位置し、南はタクラマカン砂漠。域内を孔雀河が流れる。

ロシアにもカリナ レーザー施設がカフカスで運用されていたが、カフカス諸国の独立後は詳細が不明である。

現在宇宙を遊弋する人工衛星は米国がダントツで3415個、ついで中国が535個。

以下英国486,多国籍が180,ロシア170。日本は88個の観測衛星、通信衛星、気象衛星を打ち上げているが軍事用はない。日本に次いでインドが59個、カナダが56個である(スタチスタ、22年5月)。

これらの人工衛星の四分の三が商業用だが、300個前後が列強の打ち上げた軍事衛星である。

2 notes

·

View notes

Photo

First upclose look of the impact from DART’s smallsat companion LICIACube

Taken from https://asitv.it/media/live

3 notes

·

View notes

Text

Small Satellite Market - Forecast (2022 - 2027)

The Small Satellite Market size is analyzed to grow at a CAGR of 18.2% during the forecast 2021-2026 to reach $8.2 billion. Small satellites, also termed as Smallsats are a class of flight-proven spacecraft, designed to meet high reliability mission requirements. The increasing popularity of these mini-satellites and nano-satellites is mostly due to their lightweight, versatile and inexpensive designs, integrated with the latest software and hardware improvements, which fuel the growth of the Small Satellite Industry. Hence, the affordable solution has broadened the diverse mission-specific standards across various industry verticals, including, asset tracking, security & defense, IoT, and other space programs. Furthermore, the rise in demands for satellite imagery, low-cost high-speed broadband, along with the investments in fundamental research in CubeSats are some of the factors that drive the growth of the Small Satellite Market.

Small Satellite Market Report Coverage

The report: “Small Satellite Industry Outlook – Forecast (2021-2026)”, by IndustryARC covers an in-depth analysis of the following segments of the Small Satellite Industry.

By Offering: Hardware (Satellite Antennas, Solar Panels, Terminals, Support Equipment and Others), Software and Service.

By Type: Mini-Satellite, Micro-Satellite, Nano-Satellite, Pico-Satellite, Femto-Satellite and Other.

By Industry: Satellite Services, Satellite Manufacturing, Launch Vehicles and Ground Equipment.

By Mission: Constellation Missions, Installation Missions and Replacement Missions.

By Application: IoT/M2M, Communication, Earth Observation & Meteorology, Military & Intelligence, Scientific Research & Exploration, Weather and Other

By Geography: North America (U.S, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, South Korea, Australia and Others), South America(Brazil, Argentina and others)and RoW (Middle east and Africa).

Key Takeaways

North America is estimated to hold the largest market share of 45.7% in 2020, owing to the eminent requirement for responsive defense forces, massive investments for breakthrough custom-designed satellites, along with rigorous commercial services demand for satellite bandwidth and network solution.

The M2M Satellite Communication technologies are majorly driven by the potential launches of cloud-based solutions is estimated to drive the market.

The promising requirements to seek reliable connectivity between the land and sea operations, along with VSAT connectivity for on-board security, drive the market growth.

Request Sample

Small Satellite Market Segment Analysis – By Type

By Type, the Small Satellite Market is segmented into Mini-Satellite, Micro-Satellite, Nano-Satellite, Pico-Satellite, Femto-Satellite and Other. The Mini-Satellite is estimated to hold the highest share of 33.5% in 2020, owing to the advantageous features, including miniaturized design, travel at high speeds and remote sensing technology. In addition, affordable development solutions of Nano-Satellite technology makes them a suitable option to deliver superior solutions for communications. In February 2021, Fleet Space Technologies, an Australian nanosatellite company is set to launch its fifth nanosatellite, Centauri 3. The Centauri 3 is Fleet Space’s fifth and most advanced Commercial Nanosatellite, designed to power up a global network of connected devices deployed worldwide. Increasingly, these miniaturized spacecraft provide lucrative opportunities to most business enterprises to accelerate the growth of the Small Satellite Market.

Small Satellite Market Segment Analysis – By Application

By Application, Small Satellite Market is segmented into IoT/M2M, Communication, Earth Observation & Meteorology, Military & Intelligence, Scientific Research & Exploration, Weather and other. The communication segment held the major share of 22.2% in 2020 in the Small Satellite Market, due to the successful introduction of game-changing software for the satellite communication industry along with new business opportunities to expand remote location operation and real-time asset monitoring. In March 2020, a leading provider of next generation content connectivity solutions, NOVELSAT announced a comprehensive solution for mission critical satellite communications. The solution by Novelsat is designed to deliver highest levels of transmission security, resilience and robustness, with a comprehensive wide-ranging security suit, including, transmission security (TRANSEC), communication security (COMSEC), low probability of detection (LPD) and low probability of interception (LPI). Therefore, the growing demand for optimum levels of security and protection for business operations and other mission critical communications of across defense, security and government is estimated to drive the Small Satellite Market.

Inquiry Before Buying

Small Satellite Market Segment Analysis – By Geography

North America is estimated to hold the largest market share of 45.7% in 2020, along with Europe, owing to the eminent requirement for responsive defense forces, massive investments for breakthrough custom-designed satellites, along with rigorous commercial services demand for satellite bandwidth and network solution. The industry is poised to continue its rapid growth as SpaceX and others put up constellations of thousands of satellites intended to serve areas without access to broadband. In order to deliver beta testers download speeds, and robust internet coverage from space, worldwide, in May 2019, Elon Musk's SpaceX launched another 60 Starlink internet satellites into Earth’s orbit. The proposal of SpaceX's satellite internet was initiated in 2018, with the successful launch of the two Starlink test craft, known as TinTinA and TinTinB, designed to transfer huge amounts of information rapidly in comparison to fiber-optic cable. Thus, the Small Satellite industry is poised to grow as large scale space organizations are offering “space as a service” to enable business enterprises with accessibility to data, specific to business requirements. Simultaneously, the market of Small Satellite is witnessing potential growth in Asia Pacific region, owing to the digitalization across industries and vast majority of demonstrative space debris clearance service. In March 2021, Astroscale, a Japan-UK based company launched a mission aimed at removal of debris from Earth's orbit. With Elsa-d, a small satellite under the "End-of-Life Services" offerings by Astroscale, the mission was developed for a space debris removal system. Therefore, the significant intended areas to serve by the lower-cost satellite technologies and surging demand for Earth observation satellites in these regions are estimated to drive the Small Satellite Market.

Small Satellite Market Drivers

Popularity of M2M Satellite Communication

The M2M Satellite Communication technologies are majorly driven by the potential launches of cloud-based solutions, and growing demand from various end-users to expand their business reach globally, are estimated to drive the Small Satellite Market. In addition, rugged, superior and cost-effective Satellite Terminals and telematics devices are becoming a part of the present-day comprehensive fleet management solution, which also boost the market growth. In December 2020, the leading GPS Tracking Systems provider, Rewire Security launched GPS & Telematics software for fleets. The latest software by Rewire enables enterprise owners to generate the location of vehicles in real-time, monitor fleet driver behaviour, observe driver route history and other GPS & Telematics software features. Based on the increasing needs of visibility across the transportation sectors, in October 2020, ORBCOMM, a global provider of Internet of Things (IoT) solutions, launched ST 2100, a state-of-the-art satellite communications device that enables solution providers for seamless Satellite connectivity to IOT applications, and also several other targeted verticals, such as fleet management and utility. Thus, the latest versatile Communication device launches and power-efficient platforms, such as Satellite Antenna for maximum reliability and security drive the growth of the Small Satellite Market.

Schedule a Call

Potential demand for Maritime Satellite Communication solution

The promising requirements to seek enhanced and reliable connectivity between the land and sea operations, along with VSAT connectivity for on-board security and surveillance of shipping industry influence the demand of Maritime Satellite Communication platforms, thereby drive the growth of the Small Satellite Market. The technology innovations across maritime sectors are expanding due to the introduction of gyro-stabilized ground terminals, Minisatellite platforms and multi-frequency dish antennas to reduce the time lag during data transfer. In April 2019, a major international provider of telecommunications, enterprise and consumer technology solutions for the Mobile Internet, ZTE, announced the collaboration with Zhejiang Branch of China Mobile to launch “Heweitong”, a marine broadband satellite solution. The Heweitong offers seamless extension of the mobile network to the ocean, and mitigate other issues, such as high cost, poor coverage and slow data rate. Therefore, the growing emergence of new marine communication with ubiquitous connection for exceptional service is estimated to drive the Small Satellite Market.

Small Satellite Market Challenges

Compatible Issue

The Small Satellites are designed to deliver advantageous services and indubitably, there are several successful launches around the globe and other possible space missions that eventually supported the mass production of platforms such as the CubeSat for upgraded communications role. However, small satellites are not compatible with every kind of operation due to being launched in lower orbits and also, tend to have a shorter lifespan. The design lasts for a year as it gets orbital decay due to the other orbital elements in space. Moreover, the available space is very limited, which is a major concern along with other mentioned design flaws, which hinder the growth of the Small Satellite Market.

Buy Now

Small Satellite Market Landscape

Partnerships and acquisitions along with product launches are the key strategies adopted by the players in the Small Satellite Market. The Small Satellite top 10 companies include Airbus SE, BAE Systems plc, Dauria Aerospace, L3Harris Technologies, Inc., Lockheed Martin, Magellan Aerospace, Maxar Technologies Inc., Northrop Grumman, ORBCOMM Inc., Rocket Lab, Park Aerospace Corp., Sierra Nevada Corporation, Aerospace Corporation, Space Flight Laboratory and many more.

Acquisitions/Technology Launches/Partnerships

In April 2021, the Norwegian Space Agency announced the successful launch of the NorSat-3 maritime tracking microsatellite built by Space Flight Laboratory (SFL), a premier microspace organization and provider of low-cost microsatellites and nanosatellites, in Toronto. The NorSat-3 maritime tracking is designed for space-based maritime traffic monitoring.

In April 2020, the Defense Advanced Research Projects Agency, DARPA awarded Lockheed Martin a $5.8 million contract for the Blackjack program, a satellite integration operation. The Blackjack is a project of DARPA to deploy a constellation of 20 satellites in low Earth orbit by the year 2022 to generate global high-speed communications.

In March 2020, Rocket Lab, a private American aerospace manufacturer and small satellite launch service provider signed an agreement to acquire Sinclair Interplanetary, a Toronto-based satellite hardware company. The acquisition is developed to deliver reliable and flexible satellite and launch solutions.

For more Aerospace and Defense Market reports, please click here

#Small Satellite Market price#Small Satellite Market#Micro-Satellite#Small Satellite Market size#Femto-Satellite#Small Satellite industry#Small Satellite Market share#Small Satellite Market report#Small Satellite industry outlook

2 notes

·

View notes

Text

Smallsat manufacturers weigh megafactories versus microfactories - Information Global Internet

https://www.merchant-business.com/smallsat-manufacturers-weigh-megafactories-versus-microfactories/?feed_id=204638&_unique_id=66ec1826e690c

#GLOBAL - BLOGGER

BLOGGER

PARIS — While some smallsat manufacturers are scaling up production with new factories, others believe smaller, focused facilities are a better investment.Several satellite manufacturers have invested in recent years on large factories with the capacity for up to several hundred satellites per year, betting on growing demand for such spacecraft for communications, imaging and other applications for commercial and government customers.But a panel of smallsat executives at World Space Business Week here Sept. 18 was skeptical of so-called “megafactories,” concluding that their capacity far outstrips the accessible market.“Every month, there’s a new factory setting up to produce 10 satellites per day,” quipped Carsten Drachmann, chief executive of GomSpace. “That great, but who are you going to deliver to?”He and others were skeptical that there was enough demand to support such facilities, given that the largest constellations are largely being built in-house, like SpaceX’s Starlink and Amazon’s Project Kuiper.“Mass manufacturing assumes that megaconstellations will be the customers. I don’t believe a megaconstellation will ever outsource their manufacturing of their platforms,” said Walter Ballheimer, co-founder and chief executive of Reflex Aerospace. Those companies, he argued, want to maintain control of satellite production and make changes as needed.A study released by Novaspace Sept. 17 forecast an average of 3,700 satellites launched annually from 2024 through 2033. However, 65% of those satellites will come from four systems — Starlink and Project Kuiper along with China’s Guowang and Qianfan — that are inaccessible to satellite manufacturers.Maxime Puteaux, lead author of the Novaspace report, said on the panel that the study found that the total manufacturing capacity of all the suppliers included in the report is two to three times of the demand available to them.David Avino, founder and chief executive of Argotec, said he did not believe megafactories can provide a suitable return on investment for manufacturers. “Most of these satellites will not be required by the market.”Some instead advocated for what Ballheimer called “microfactories” that are smaller and more specialized, requiring less capital expenditures or capex to build out. Such facilities can be built in multiple countries to support national programs and, he said, cost “single-digit millions” to complete.“We think committing a huge capex to one centralized, big factory is counterproductive in terms of government business,” he said. “Many of the clients we see want capabilities to be national. They want to see the satellites produced in their countries. We can do that easily by building small microfactories, which are very cost-efficient.”Sanjay Nekkanti, chief executive of Indian smallsat manufacturer Dhruva Space, said his company is focused for now on serving Indian customers but is studying how to expand by working with other manufacturers.“What are the future things that we can produce out of the facility?” he said, taking advantage of Indian initiatives in privatizing space capabilities to offer its factory to foreign manufacturers looking to expand. “It’s important to look at how our factory could cater to global markets.”

http://109.70.148.72/~merchant29/6network/wp-content/uploads/2024/09/13.jpg

PARIS — While some smallsat manufacturers are scaling up production with new factories, others believe smaller, focused facilities are a better investment. Several satellite manufacturers have invested in recent years on large factories with the capacity for up to several hundred satellites per year, betting on growing demand for such spacecraft for communications, imaging and … Read More

0 notes

Text

Smallsat manufacturers weigh megafactories versus microfactories - Information Global Internet - #GLOBAL

https://www.merchant-business.com/smallsat-manufacturers-weigh-megafactories-versus-microfactories/?feed_id=204637&_unique_id=66ec1825f0589

PARIS — While some smallsat manufacturers are scaling up production with new factories, others believe smaller, focused facilities are a better investment.Several satellite manufacturers have invested in recent years on large factories with the capacity for up to several hundred satellites per year, betting on growing demand for such spacecraft for communications, imaging and other applications for commercial and government customers.But a panel of smallsat executives at World Space Business Week here Sept. 18 was skeptical of so-called “megafactories,” concluding that their capacity far outstrips the accessible market.“Every month, there’s a new factory setting up to produce 10 satellites per day,” quipped Carsten Drachmann, chief executive of GomSpace. “That great, but who are you going to deliver to?”He and others were skeptical that there was enough demand to support such facilities, given that the largest constellations are largely being built in-house, like SpaceX’s Starlink and Amazon’s Project Kuiper.“Mass manufacturing assumes that megaconstellations will be the customers. I don’t believe a megaconstellation will ever outsource their manufacturing of their platforms,” said Walter Ballheimer, co-founder and chief executive of Reflex Aerospace. Those companies, he argued, want to maintain control of satellite production and make changes as needed.A study released by Novaspace Sept. 17 forecast an average of 3,700 satellites launched annually from 2024 through 2033. However, 65% of those satellites will come from four systems — Starlink and Project Kuiper along with China’s Guowang and Qianfan — that are inaccessible to satellite manufacturers.Maxime Puteaux, lead author of the Novaspace report, said on the panel that the study found that the total manufacturing capacity of all the suppliers included in the report is two to three times of the demand available to them.David Avino, founder and chief executive of Argotec, said he did not believe megafactories can provide a suitable return on investment for manufacturers. “Most of these satellites will not be required by the market.”Some instead advocated for what Ballheimer called “microfactories” that are smaller and more specialized, requiring less capital expenditures or capex to build out. Such facilities can be built in multiple countries to support national programs and, he said, cost “single-digit millions” to complete.“We think committing a huge capex to one centralized, big factory is counterproductive in terms of government business,” he said. “Many of the clients we see want capabilities to be national. They want to see the satellites produced in their countries. We can do that easily by building small microfactories, which are very cost-efficient.”Sanjay Nekkanti, chief executive of Indian smallsat manufacturer Dhruva Space, said his company is focused for now on serving Indian customers but is studying how to expand by working with other manufacturers.“What are the future things that we can produce out of the facility?” he said, taking advantage of Indian initiatives in privatizing space capabilities to offer its factory to foreign manufacturers looking to expand. “It’s important to look at how our factory could cater to global markets.”

http://109.70.148.72/~merchant29/6network/wp-content/uploads/2024/09/13.jpg

BLOGGER - #GLOBAL

0 notes

Text

Smallsat manufacturers weigh megafactories versus microfactories - Information Global Internet - BLOGGER

https://www.merchant-business.com/smallsat-manufacturers-weigh-megafactories-versus-microfactories/?feed_id=204636&_unique_id=66ec1824f3167

PARIS — While some smallsat manufacturers are scaling up production with new factories, others believe smaller, focused facilities are a better investment.Several satellite manufacturers have invested in recent years on large factories with the capacity for up to several hundred satellites per year, betting on growing demand for such spacecraft for communications, imaging and other applications for commercial and government customers.But a panel of smallsat executives at World Space Business Week here Sept. 18 was skeptical of so-called “megafactories,” concluding that their capacity far outstrips the accessible market.“Every month, there’s a new factory setting up to produce 10 satellites per day,” quipped Carsten Drachmann, chief executive of GomSpace. “That great, but who are you going to deliver to?”He and others were skeptical that there was enough demand to support such facilities, given that the largest constellations are largely being built in-house, like SpaceX’s Starlink and Amazon’s Project Kuiper.“Mass manufacturing assumes that megaconstellations will be the customers. I don’t believe a megaconstellation will ever outsource their manufacturing of their platforms,” said Walter Ballheimer, co-founder and chief executive of Reflex Aerospace. Those companies, he argued, want to maintain control of satellite production and make changes as needed.A study released by Novaspace Sept. 17 forecast an average of 3,700 satellites launched annually from 2024 through 2033. However, 65% of those satellites will come from four systems — Starlink and Project Kuiper along with China’s Guowang and Qianfan — that are inaccessible to satellite manufacturers.Maxime Puteaux, lead author of the Novaspace report, said on the panel that the study found that the total manufacturing capacity of all the suppliers included in the report is two to three times of the demand available to them.David Avino, founder and chief executive of Argotec, said he did not believe megafactories can provide a suitable return on investment for manufacturers. “Most of these satellites will not be required by the market.”Some instead advocated for what Ballheimer called “microfactories” that are smaller and more specialized, requiring less capital expenditures or capex to build out. Such facilities can be built in multiple countries to support national programs and, he said, cost “single-digit millions” to complete.“We think committing a huge capex to one centralized, big factory is counterproductive in terms of government business,” he said. “Many of the clients we see want capabilities to be national. They want to see the satellites produced in their countries. We can do that easily by building small microfactories, which are very cost-efficient.”Sanjay Nekkanti, chief executive of Indian smallsat manufacturer Dhruva Space, said his company is focused for now on serving Indian customers but is studying how to expand by working with other manufacturers.“What are the future things that we can produce out of the facility?” he said, taking advantage of Indian initiatives in privatizing space capabilities to offer its factory to foreign manufacturers looking to expand. “It’s important to look at how our factory could cater to global markets.”

http://109.70.148.72/~merchant29/6network/wp-content/uploads/2024/09/13.jpg

#GLOBAL - BLOGGER

PARIS — While some smallsat manufac...

BLOGGER - #GLOBAL

0 notes

Text

NASA Retires UHF SmallSat Tracking Site Ops at Wallops

On Sept. 30, 2023, NASA’s Wallops Flight Facility marked the formal conclusion of the Ultra-High Frequency (UHF) Small Satellite (SmallSat) Tracking Operations in Wallops Island, Virginia, placing its workhorse, 60-plus-year-old, 18-meter antenna system in low-level maintenance status. “Since 2011, the Wallops tracking site has tracked more than 25 spacecraft over 16,912 passes,” said Doug Voss, deputy […]

from NASA https://ift.tt/lzvRjgc

0 notes

Text

Smallsat manufacturers weigh megafactories versus microfactories - Information Global Internet - BLOGGER

https://www.merchant-business.com/smallsat-manufacturers-weigh-megafactories-versus-microfactories/?feed_id=204635&_unique_id=66ec18238a4d8

PARIS — While some smallsat manufacturers are scaling up production with new factories, others believe smaller, focused facilities are a better investment.Several satellite manufacturers have invested in recent years on large factories with the capacity for up to several hundred satellites per year, betting on growing demand for such spacecraft for communications, imaging and other applications for commercial and government customers.But a panel of smallsat executives at World Space Business Week here Sept. 18 was skeptical of so-called “megafactories,” concluding that their capacity far outstrips the accessible market.“Every month, there’s a new factory setting up to produce 10 satellites per day,” quipped Carsten Drachmann, chief executive of GomSpace. “That great, but who are you going to deliver to?”He and others were skeptical that there was enough demand to support such facilities, given that the largest constellations are largely being built in-house, like SpaceX’s Starlink and Amazon’s Project Kuiper.“Mass manufacturing assumes that megaconstellations will be the customers. I don’t believe a megaconstellation will ever outsource their manufacturing of their platforms,” said Walter Ballheimer, co-founder and chief executive of Reflex Aerospace. Those companies, he argued, want to maintain control of satellite production and make changes as needed.A study released by Novaspace Sept. 17 forecast an average of 3,700 satellites launched annually from 2024 through 2033. However, 65% of those satellites will come from four systems — Starlink and Project Kuiper along with China’s Guowang and Qianfan — that are inaccessible to satellite manufacturers.Maxime Puteaux, lead author of the Novaspace report, said on the panel that the study found that the total manufacturing capacity of all the suppliers included in the report is two to three times of the demand available to them.David Avino, founder and chief executive of Argotec, said he did not believe megafactories can provide a suitable return on investment for manufacturers. “Most of these satellites will not be required by the market.”Some instead advocated for what Ballheimer called “microfactories” that are smaller and more specialized, requiring less capital expenditures or capex to build out. Such facilities can be built in multiple countries to support national programs and, he said, cost “single-digit millions” to complete.“We think committing a huge capex to one centralized, big factory is counterproductive in terms of government business,” he said. “Many of the clients we see want capabilities to be national. They want to see the satellites produced in their countries. We can do that easily by building small microfactories, which are very cost-efficient.”Sanjay Nekkanti, chief executive of Indian smallsat manufacturer Dhruva Space, said his company is focused for now on serving Indian customers but is studying how to expand by working with other manufacturers.“What are the future things that we can produce out of the facility?” he said, taking advantage of Indian initiatives in privatizing space capabilities to offer its factory to foreign manufacturers looking to expand. “It’s important to look at how our factory could cater to global markets.”

http://109.70.148.72/~merchant29/6network/wp-content/uploads/2024/09/13.jpg

BLOGGER - #GLOBAL

PARIS — While some smallsat manufacturers are scaling up production with new factories, others believe smaller, focused facilities are a better investment. Several satellite manufacturers have invested in recent years on large factories with the capacity for up to several hundred satellites per year, betting on growing demand for such spacecraft for communications, imaging and … Read More

0 notes

Text

Immagini satellitari SAR di ICEYE per la NASA

La NASA ha scelto ancora una volta ICEYE US per fornire immagini satellitari SAR per il suo programma Commercial Smallsat Data Acquisition (CSDA)

#Aerospazio#ICEYE#aerospazio#Commercial_Smallsat_Data_Acquisition#Iceye#nasa#stati_uniti#Synthetic_Aperture_Radar

0 notes