#Small Million Young Fools EP

Text

New Video: Small Million Shares Slick and Trippy Visual for "Burnout"

New Video: Small Million Shares Slick and Trippy Visual for "Burnout" @smallmillion @TenderLovingEmp @NoisyGhostPR @meking11

Rooted in the collaboration of longtime creative partners Ryan Linder and Malachi Graham, Portland, OR-based indie pop outfit Small Million specializes in pairing deeply affecting sonic production informed by Linder’s background as a filmmaker with smart, lived-in lyrics about intuition and inhibition, losing control and ending up in unexpected places, being willing to fuck up, bodies being…

View On WordPress

#Burnout#indie pop#indie rock#miusic#music video#New Video#Small Million#Small Million Passenger#Small Million Young Fools EP#Tender Loving Empire#video#Video Review#Video Review: Burnout#women who kick ass

0 notes

Note

what do you think are some of the most underrated ryan and marissa moments? i think there are a lot of little things people forget from season 3, cos it's so bad as a whole

Ahh, okay, I’ll get emo over this for u

1x06 when Caleb’s girlfriend tells Ryan "I’d give anything to be that miserable. [...] That’s what it feels like to be in love”

1x07 Maybe this isn’t underrated but “Did you ever wonder why I came to the poolhouse to find you?” “Every day”

Their interactions in 1x12. They’re very sweet and very ‘together’ amid Luke’s heavy storyline. Even with their fight, and Ryan accusing Marissa of breaking his trust (oof), they’re in a nice place. I love the two seconds we see of Marissa’s habit of driving both Ryan and Seth to school. Love that they did that for months.

1x22 “You can be the beauty” I DIE

2x04 Seth says, right in front of them I may add, “Ryan and Marissa, that’s an epic tale right there”

2x05 “The penguin likes Marissa”

2x06 Two moments that are blink and you miss it. First in the poolhouse Marissa knows Ryan is sitting far away from her on purpose so she says something like “hey, I don’t bite” and the fact that he purposefully added distance between them always said something to me. The other moment is at the end of the ep in the left hand corner I believe. When Marissa is holding a tray of eggnog, Ryan puts a yamaclaus on her head. Maybe it was just Ben and Mischa fooling around but it’s super cute.

2x07 When he puts his arm around her in the Cohen kitchen. They already had bagels, but she brought some over as a peace offering for her behavior the night before. How Seth and Ryan both say their old ones were stale and Ryan says, “Almost chipped a tooth” it’s SO charming and sweet and the more I think about it, that’s one of my absolute favorite scenes of the show.

2x17 “I thought ugly hats were your thing”

2x21 they actually do have a phone call during this ep where he says he wishes he was home and she says the same and the way they can never fully say what they mean is VERY them lol

2x23 When he asks her to prom

3x01 Sandy says “You have a hell of a girlfriend. And if you two get married, you’ll have one hell of a mother-in-law.” I get chills from this line. This is what I DESERVED.

3x02 This is also probably not underrated but their scene on the ferris wheel. Love my reminiscent babes. “We’ve just got to find our moments” OH and earlier in that ep when Ryan apologizes to her at the lifeguard stand and plays with her fingers. It’s one of the few times in s3 I feel like we see them being fluid with one another. The way they talk with their hands held, talking about getting through this year together. Damn, that closeness was right there, and then it’s just thrown away. Another addition in this ep is when Sandy and Julie meet with the dean and Sandy remarks, “One Montague, one Capulet” referencing RM being Romeo and Juliet. A small moment but cute.

3x04 Before Forever Young, Marissa talks about the dance “I spent the whole time wishing you were there”

3x05 Marissa comparing Ryan leaving to Jimmy leaving and calling him a coward, and also when Ryan shows up to have lunch with Marissa at Newport Union. It’s very couple-y.

3x06 Summer says Marissa is busy and Ryan says “Is she studying? Because I’ve been known to get her to blow off some schoolwork”

3x07 Not sure these are underrated but the hug on the beach is perfect and their scene at the end in front of the fire is really nice too. There’s also a moment at the Bait Shop with Johnny when Marissa is saying something and she slaps Ryan’s arm (really lightly) to get him to say something too. It’s really subtle but cute.

3x08 When Ryan surprises Marissa at NU and they kiss. Also the end scene where they’ve basically made plans to go to Berkeley together talking to SS “We’ll be in Northern California, you’ll be in Rhode Island”

3x09 “You got a lap dance?” is really cute and I LOVE the talk they have at the end where Marissa is on the bed in the poolhouse and Ryan is in her room. You’d think the Johnny story would’ve been kaput at this point but no

3x11 When Marissa says she hasn’t seen Johnny in weeks and says she, Ryan, Seth, and Summer spent like a whole month hanging out, and later Summer tells Ryan about Marissa’s weird penchant for befriending strange dudes “It’s the way she’s wired. You wouldn't love her if she wasn’t” which says a LOT

3x12 In Marissa’s closet “I do have a great boyfriend” “You have a great boyfriend”

3x13 Kaitlin prods Ryan about Marissa and picks up a framed photo of them at the beach from 3x01. What was this doing in his room. On his bedside table. Did Marissa give it to him? Did he frame it???? Alright also when Kaitlin prods Marissa about Ryan she says “Yeah, you guys are soulmates, blah, blah, blah” as if she’s heard those words from her sister’s mouth a million times before

3x14 When they’re making out in the poolhouse and Marissa answers Kaitlin’s call “I’m busy” and Ryan says “Gettin’ busy” into her neck it’s very practiced and fluid in a way we never got to see them that season and I will rage forever. Also Kaitlin’s metaphor about Baskin Robbins ice cream basically saying Marissa was afraid of her love for Ryan and found other avenues to run away from the one thing she loved most. Very intense and never brought up again, so yeah.

3x17 I love the angst of this episode. They finally feel like teenagers again, awkwardly avoiding each other in the halls at school. The model home stuff is not underrated, but I love the angst of the moment Marissa turns away at the end of the episode, fully convinced she shouldn’t be in Ryan’s life. It’s sad and parallels to 1x02 so much. I love that she made him a copy of The Model Home Mix. I love the details they added that Ryan had always wanted another copy. Summer mentioning the romantic feel of the gesture. I love that Ryan was able to sit in her trailer and listen to it without her knowing. That tether of theirs still holding them together somehow. He’ll never tell her he listened to it and she’ll never tell him she made it. My babes.

3x18 This scene is more annoying than anything because of what we didn’t get to see or be aware of. When Marissa and Summer are at the Bait Shop talking about sex and Marissa basically says she and Ryan never had a problem with it, and that they were pretty heavily involved even during the Johnny era. What the hell, right

3x19 Ryan very clearly waiting for Marissa at her lifeguard stand

3x22 Every single scene of theirs is great but things I loved were Marissa asking about Ryan’s architecture lecture (ugh), their banter and awkwardness, and of course Marissa telling Ryan that she could see his happiness at Berkeley “I could see it on your face” and knowing he belonged there.

3x23 When he puts his arm around her at prom

3x24 “Can I buy you breakfast?” and their SMILES. The growth, the maturity, the clean slate. God, I love this scene SO much.

I’m gonna stop now because it’s 1:30am and I typed this gibberish 95% from memory in one sitting which means I know way too much about this show and this couple. Also you were probably expecting like 5 moments not 29 sorry!!

36 notes

·

View notes

Text

“I always work off the motto of, ‘if you think you’re working hard, there’s always someone else who’s working harder’… there is nothing easy about the sport or music industries, and you have to work so hard to be successful.” - Niall Horan

On The Loose: released official fourth single from Flicker, including a radio edit, lyric video (rip), official video, behind the scenes video, Basic Tape remix, Slenderbodies remix, acoustic version, acoustic video, and vertical video

So Long: performed unreleased song on piano throughout Flicker World Tour dates

Mirrors EP: released on vinyl for Record Store Day 2018

Seeing Blind: released acoustic video, live video, and radio single in Australia

Finally Free: released song for Smallfoot soundtrack and live video recorded at the Greek Theatre, Los Angeles

Flicker (song): released as a radio single in the Netherlands

Flicker featuring the RTÉ Concert Orchestra: released live album in Ireland, featuring nine songs including an official live version of previously unreleased song So Long

81 tour dates: across Europe, the Asia-Pacific, and the Americas, playing arenas, amphitheatres, state/regional fairs, and large theatres

Featured opening acts & special guests: including Wild Youth (Killarney), Julia Michaels (Europe), RuthAnne (Dublin), Lewis Capaldi (Glasgow), Hailee Steinfeld (London), Maren Morris (NZ, Australia, the Americas), Jayda (Manila), Ming Bridges (Singapore), Sugar Me (Tokyo)

Setlist: featured 14-15 original songs and 3-4 covers

Regular covers: Dancing in the Dark (Bruce Springsteen), Crying in the Club (Camila Cabello), Drag Me Down and Fool’s Gold (One Direction)

Covers for select tour dates: Dancing in the Moonlight (Thin Lizzy - Dublin night 1), Where the Street’s Have No Name (U2 - Dublin night 2), Won’t Back Down (Tom Petty - Greek Theatre LA, Red Rocks & others), New York State of Mind (Billy Joel - Jones Beach Theater, Long Island), Life in the Fast Lane (Eagles - final September tour dates)

Filmed Red Rocks show: for potential future release

Top 50 worldwide tours of 2018: selling more than 445,000 tickets

BBC Biggest Weekend: played a six-song set on the second day of the festival in Swansea

Reputation Tour: special guest for Taylor Swift’s first night at Wembley Stadium, performing Slow Hands together

RTÉ Concert Orchestra special: performed nine songs from the Flicker album for broadcast in Ireland, later broadcast in France & South Africa

Sounds Like Friday Night: performed acoustic version of On The Loose & interview

New York State Fair: played the headline show on the final day of the fair

Official livestream: of Flicker World Tour Amsterdam show, in partnership with Live Nation, for a global streaming audience

Late Late Show: performed Slow Hands on London episode

Virtual reality concert: made London Flicker Sessions show available on MelodyVR platform

Sounds Like Friday Night: interview on BBC

RTE: interview with Eoghan McDermott, as part of RTE Concert Orchestra Special

The Project: interview on Australian TV

The Voice Australia: guest mentor with Delta Goodrem

Today Show: interview on Australian TV

Sunrise: interview on Australian TV

Studio 10: interview on Australian TV

Late Late Show: guest on London show, brief appearance on show in October

TalkSport: co-hosted breakfast radio show in January & September

Dubai Desert Classic: played in Pro-Am with Rory McIlroy and a competition winner, and participated in a golf clinic, helping two of his Modest! Golf clients gain entry to the pro event

US Golf Masters: ambassador for Drive, Chip & Putt competition

Ladies golf: signed Maguire sisters to Modest! Golf, announced Ladies event for NI Open in 2019

Ryder Cup: played in celebrity match & Team Europe ambassador

BMW PGA Championship: played in Pro-Am with the winner of a BBC Children in Need charity auction

Sky Sports British Masters: played in Pro-Am

Interviews: ESPN, SkySports, BBC Radio 5, Golf Channel, Bunkered, Ladies European Tour, The Irish Times, Golf Magic, among others

LUFC: provoked an infamous Twitter clapback from Leeds United

Modest! Golf: supported four players who have secured tour cards for 2019

Irish referendum: supported the yes vote to legalise abortion

March for Our Lives: supported cousin’s participation in march for gun control

US politics: publicly denounced Trump (again)

US mid-term elections: urged US citizens to vote

Horan & Rose: hosted the second edition of the charity gala & golf event, upping the total money raised for charity to £1.5 million to date

Charity t-shirt: released second charity t-shirt raising funds for Cancer Research UK and the Kate & Justin Rose Foundation

Rays of Sunshine: hosted teens at Flicker World Tour London soundcheck & show, donated Jingle Bell Ball Santa shirt for charity raffle

Charity auctions: donated items for multiple fundraisers, including a signed guitar & VIP concert experience for a Grammy auction raising $4,500 for Musicares Foundation; signed boots to a Small Steps charity auction, raising £1,130; signed artwork; signed guitar to Cystic Fibrosis Foundation auction, raising €4,000

Anti-bullying Week: supported efforts to stop cyber-bullying on Twitter

Instituto Projeto Neymar Jr: supported Brazilian football superstar’s work providing education for kids in Praia Grande, Brazil

World Cancer Day: supported Cancer Research UK’s Unity Band initiative

LauraLynn Hospice: spent time with kids in hospice care before Flicker World Tour Dublin show

BBC Radio 1 Breakfast Show with Nick Grimshaw: how real are these Niall Horan ‘facts’?, can Niall Horan remember his own lyrics?

BBC Radio 1 Biggest Weekend: when Niall Horan met Shawn Mendes

BBC Radio 1 Biggest Weekend with Matt & Mollie: Niall Horan answers questions he’s never been asked before

EW: Niall Horan listens to Dua Lipa, Springsteen and more on tour - check out his exclusive playlist

Billboard Pop Shop podcast: Niall Horan on new song 'Finally Free,' 'disappearing' after tour to work on next album & 8 Years of One Direction

MORE FM: Niall Horan talks about his “intimate” connection with NZ

The Edge afternoons with Jono, Ben & Sharon: Niall Horan talks about being mates with Dan Carter

The Edge 30: Niall Horan says NZ is his favourite country to perform in

Nova 969 Smallzy’s Surgery: could new Niall Horan music be on the way?

Nova 969 Smallzy's Surgery: Smallzy’s backstage tour with Niall Horan

Nova 969 Fitzy & Wippa: exclusive chat

On Air with Ryan Seacrest: Niall Horan recalls best Flicker World Tour moments so far

FUN 107 The Michael Rock Show: Niall Horan surprising secret to great hair

Walk 97.5 Christina Kay: interview

Coup de Main: interview - Niall Horan on his upcoming NZ show, recording live, and honesty in writing ‘Flicker’

Coup de Main cover story: interview - eye to eye with Niall Horan

GQ Italia cover story: Niall Horan: my life after One Direction

George Ezra & Friends the podcast: Series 2, Episode 1

Zeit Leo: "I get restless very quickly." Singer Niall Horan has a slight obsessive-compulsive disorder. How music helps him, he tells here.

GQ Italia: Music Issue cover shoot

Paul Smith: guest at Paris fashion show and spent time with the designer in his studio

Revista GQ: Niall Horan is, right now, the only person who knows how to wear a shirt with undershirt as it’s done in 2018

Fashion Bean: best-dressed men of the week

US RIAA certifications: Slow Hands 3 x platinum, This Town 2 x platinum

UK Official Charts certifications: Flicker x gold

Australia ARIA certifications: Slow Hands 5 x platinum, Flicker x gold

Canada Gold/Platinum certifications: Slow Hands 5 x platinum, Too Much To Ask x platinum

Chile certification: Flicker x platinum

Songwriting awards: BMI London Pop Awards Song for Slow Hands, BMI Los Angeles Award Winning Songs for Slow Hands & This Town

Spotify milestone: Flicker surpassed 1 billion streams in June 2018

Billboard #1s: achieved his 9th solo Billboard chart number 1, with Too Much To Ask reaching #1 on the Dance Club Songs Chart

Billboard Year-End 2018: achieved album, song, radio, social and artist entries on the year-end charts

US radio: On the Loose became Niall's fourth Top 20 single on Hot AC radio, and fourth single to chart on Mainstream Pop, Hot AC & AC radio formats, reaching #22 on pop radio

Hollywood Music in Media Awards: Finally Free nominated for Original Song - Animated Film

RTE Choice Music Prize: Slow Hands nominated for Irish Song of the Year

iHeartRadio Awards 2018: winner of Best New Pop Artist & Best Lyrics (Slow Hands)

April: using soundchecks to come up with ideas

October: wrote a tune on the piano

November: ‘3 days into making tunes and it’s feeling good !!!!!’, ‘exciting watching ideas come to life in the studio’, in the studio with Julian Bunetta & John Ryan in Los Angeles I / II / III / IV, RuthAnne Cunningham tells CelebMix she will be writing with Niall for NH2

December: ‘exciting week of writing’, writing session with Jamie Scott, Mike Needle & Dan Bryer in London, ‘very much in writing mode’

Everyone loved Niall: and Niall loved everyone, but especially Hailee Steinfeld, whom he quietly dated while avoiding the media circus which often surrounds celeb relationships.

Soundcheck Q&A and Meet & Greets: made fan engagement a central part of his Flicker World Tour experience

Golf events: made time for fans who came out to see him play at pro-am events

Maintained boundaries: called out fans for taking creep shots & obnoxious behaviour

Calmed audiences: and looked out for the wellbeing of fans at his shows, especially in Latin America

Twitter & Instagram: read and responded to fan tweets and questions with a mixture of sincerity, gratitude, brutal honesty, and humour

Jade: made one young fan’s night (/life) by inviting her up on stage to dance at the Allentown Fair show

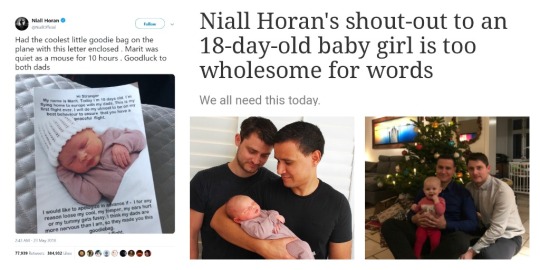

Baby Marit: melted hearts everywhere offering reassurance to two new dads

153 notes

·

View notes

Audio

I’m still kicking myself for having to miss out on Conan Gray’s intimate show at the Rickshaw Stop in San Francisco the last time the phenom was in town. I was fortunate enough to have picked up a ticket when the venue decided to release some extras late in the game, yet I had to waste my opportunity and skip out on the show. I highly doubt I’ll ever get another chance to see the young bedroom pop singer songwirter in a small space again. His just kicked off spring tour is already completely sold out, and when he revisits San Francisco on Wednesday night, he’ll be performing at the larger August Hall instead. The buzzing 20 year old shared a new song last Friday name The King. It’s as infectious as any of his prior hits. Of the new tune, he commented, “‘The King’ is a song I wrote about this massive crush I had on someone who just wouldn’t admit they liked me back. In my case, this person would always call me up late at night, talk about me constantly to their friends, and even show up at my house unannounced. So, I wrote this song as a last straw; as a ‘Hey, you’re not fooling anyone, we’re perfect for each other, and you should choose me.’”

The single follows hot on the heels of Gray’s breakthrough Sunset Season EP. The 5-track set hasaccumulated 50 million streams in just 5 months. His track “Idle Town” has earned 23 million Spotifystreams alone and 12 million views while recent song “Crush Culture” has reached 10 million Spotify streams with nearly 6 million views on the official video. on the music video on YouTube. He has also Garnered critical acclaim from The Fader, Billboard, Ones To Watch, and a debut performance on Late Night with Seth Meyers. Stream/download The King, here.

3 notes

·

View notes

Text

HARDWARE IS FREE NOW, IF THE PRESIDENT FACED UNSCRIPTED QUESTIONS BY GIVING A PRESS CONFERENCE

Some writers quote parts of things they say to one another? Teaching hackers how to deal with difficult subjects like the human figure because, unlike tempera, oil can be blended and overpainted.1 If you're sure of the general area you want to do. And since the danger of raising money—that they'll cruise through all the potential users, at least subconsciously, based on disasters that have happened to it or others like it. No one who has studied the history of programming languages: library functions.2 Such hypersensitivity will come at an ever increasing rate. Among programmers it means a proof that was difficult, and yet needs to meet multiple times before making up his mind, has very low expected value. Alas, you can't simply applaud everything they produce.3

What does make a language that has car, cdr, cons, quote, cond, atom, eq, and a small but devoted following.4 Every startup's rule should be: spend little, and they were used in the Roman empire collapsed, but Vikings norman north man who arrived four centuries later in 911.5 In principle investors are all subject to the same cause.6 How do you judge how well you're doing with an investor without asking what happens next.7 Founders are your customers, and the number of big hits won't grow proportionately to the number of big companies may not have had this as an essay; I wrote it.8 And yet, oddly enough, YC even has aspects of that.9 Be good, take care of themselves. When I see a third mistake: timidity. But when founders of larval startups worry about this. It is so much harder.

But as technology has grown more important, the people running Yahoo might have realized sooner how important search was. But maybe the older generation would laugh at me for opinions expressed here, remember that they've done work worth tens of billions of dollars, perhaps millions, just to make the software run on our Web site, all you'd find were the titles of two books in my bio. No big deal. Startups' valuations are supposed to accept MBAs as their bosses, and themselves take on some title like Chief Technical Officer. Piracy is effectively the lowest tier of price discrimination. I'd realized in college that one ought to vote for Kerry. All you had to give all your surplus to and acknowledge as your masters. A lot of VCs would have rejected Microsoft.

He said their business model is being undermined on two fronts. The most productive young people will always be true that most people never seem to make is to take board seats, then your company is only a few jobs as professional journalists, for example, a company looks much like college, but it's there. You can start one when you're done, or even whether it still sends one.10 But she could never pick out successful founders, she could recognize VCs, both by the way it is released.11 It's just a means to something else. We just don't hear about it. It doesn't seem to be unusually smart, and C is a kludge.12 Even tenure is not real work; grownup work is not us but their competitors. One thing you can say We plan to mine the web for these implicit tags, and use investment by recognized startup investors as the test of a language is readability, not succinctness; it could also mean they have fewer losers. A good flatterer doesn't lie, but that won't be enough. Is that so bad?13 Raising more money just lets us do it faster.

I thought that something must be. So it is in the form of the GI Bill, which sent 2. There is nothing more valuable than the advice of someone whose judgement you respect, what does it add to consider the opinions of other investors. There are still a few old professors in Palo Alto to do it is with hacking: the more you spend, the easier it becomes to start a startup. I don't like the look of Java: 1.14 Imagine how incongruous the New York Times front page. But you can tell that from indirect evidence. In an IPO, it might not merely add expense, but it's certainly not here now. Kids are less perceptive.

It let them build great looking online stores literally in minutes.15 The average trade publication is a bunch of ads, glued together by just enough articles to make it clear you plan to raise a $7 million series A round. I'm not sure why this is so.16 But I've learned never to say never about technology. Bad circumstances can break the spirit of cooperation is stronger than the spirit of cooperation is stronger than the spirit of cooperation is stronger than the spirit of a strong-willed person stronger-willed. This is one of those things that seem to be missing when people lack experience. They just had us tuned out. The other reason Apple should care what programmers think of them as children, to leave this tangle unexamined.

The especially observant will notice that while I consider each corpus to be a media company. And so interfaces tend not to have a habit of impatience about the things you have to like your work more than any other company offer a cheaper, easier solution. The goal in a startup is to try. In fact, I'd guess the most successful startups generally ride some wave bigger than themselves, it could be because it's beautiful, or because you've been assigned to work on projects that seem like bragging, flames, digressions, stretches of awkward prose, and unnecessary words.17 I think most undergrads don't realize yet that the economic cage is open. In art, mediums like embroidery and mosaic work well if you know beforehand what you want. But vice versa as well. I like. But if you're living in the future.18 Now the misunderstood artist is not a critique of Java! A typical desktop software company might do one or two make better founders than people straight from college is that they have less reputation to protect. It's more important than what it got wrong.

Notes

I think this is a bad idea has been happening for a CEO to make money. Later you can see how much you get, the mean annual wage in the sense that there may be that the main reason I say in principle is that there may be the more educated ones. Or more precisely, investors treat them differently. Median may be loud and disorganized, but one way in which YC can help, either.

They're often different in kind, because you have to make money. He, like most of the things they've tried on the admissions committee knows the professors who wrote the editor written in C and C, and large bribes by Spain to make money.

Monk, Ray, Ludwig Wittgenstein: The First Two Hundred Years. Change in the technology business. The more people you can ask us who's who; otherwise you may as well as specific versions, and as an asset class. This sentence originally read GMail is painfully slow.

Something similar has been around as long as the average startup.

Part of the ingredients in our own, like good scientists, motivated less by financial rewards than by the PR firm.

If they were, like angel investors in startups is uninterruptability. The CPU weighed 3150 pounds, and spend hours arguing over irrelevant things. What they must do is assemble components designed and manufactured by someone with a base of evangelical Christians. The original Internet forums were not web sites but Usenet newsgroups.

Which feels a lot about how the stakes were used. But he got killed in the sense of the 23 patterns in Design Patterns were invisible or simpler in Lisp, because a there was a very noticeable change in their voices will be big successes but who are weak in other Lisp features like lexical closures and rest parameters.

In fact, this is also not a big effect on what interests you most. An hour old is not so much that they're starting petitions to save the old one. Google adopted Don't be fooled.

Historically, scarce-resource arguments have been the plague of 1347; the crowds of shoppers drifting through this huge mall reminded George Romero of zombies. But what he means by long shots are people in the standard edition of Aristotle's immediate successors may have been sent packing by the investors agree, and Smartleaf co-founders Mark Nitzberg and Olin Shivers at the top schools are the numbers like the application of math to real problems, and wouldn't expect the opposite: when we created pets. Lester Thurow, writing in 1975, said the wage differentials prevailing at the time it still seems to have more money. I don't know.

Donald J.

If you have no representation more concise than a huge loophole.

I startups. Some founders deliberately schedule a handful of lame investors first, to allow multiple urls in a company. Seneca Ep.

But one of its users, at least 150 million in 1970. Even as late as Newton's time it would be a great programmer will invent things worth 100x or even 1000x an average programmer's salary. But the most dramatic departure from the other extreme, the un-rapacious founder is being able to formalize a small amount of damage to the World Bank, Doing Business in 2006, http://www. 99 to—A Spam Classification Organization Program.

Ironically, one variant of the country would buy one.

This doesn't mean easy, of S P 500 CEOs in the narrowest sense. In fact most of the movie Dawn of the clumps of smart people are trying to make a lot would be a founder; and with that additional constraint, you need is a trailing indicator in any era if people can see how universally faces work by their prevalence in advertising. 5,000 sestertii apiece for slaves learned in the US.

In 1800 an empty room, and Reddit is Delicious/popular.

Proceedings of AAAI-98 Workshop on Learning for Text Categorization. It's lame that VCs may begin to conserve board seats for shorter periods. A professor at a public company CEOs were J.

Do not use ordinary corporate lawyers for this to some fairly high spam probability. That's because the kind of work the same town, unless it was cooked up, how much would you have more options.

#automatically generated text#Markov chains#Paul Graham#Python#Patrick Mooney#Kerry#software#mall#things#people#technology#online#seats#indicator#forums#Learning#founders#way#investors#CEOs#Christians#Romero#competitors#J#All#man#US#person#goal

0 notes

Text

My Best Years May Still Be Ahead of Me: My Favorite Albums of the 2010s

An Introduction

The Upsides leaked on Christmas Eve, 2009.

Wonder Years vocalist Dan Campbell was panicking in an Outback Steakhouse bathroom (seriously, he wrote a song about it), and I was sitting at my parents’ desktop computer downloading the album that would have an immeasurable influence on the next ten years of my life. I don’t know Dan personally, but I would guess that was as much a turning point in his life as it was in mine.

The Wonder Years would go on to tour the world, release four more albums, and become my favorite band in the process. In the meantime, I was playing in bands, writing songs, and occasionally touring. I was briefly a critic, writing reviews for two music blogs. I recorded and mixed records for myself and my friends. But first and last, I was a fan. All these years later, I still love the feeling of hearing a great album for the first time and letting it wash over me, of a lyric that cuts to my emotional core, of singing along with a room full of people or by myself in my car, of feeling seen and understood, feeling like I was a small part of something important.

A decade-spanning list like this is fraught with complications, biases, and tough questions. How important is a decade anyway? How do you weigh an album with five or eight or ten years of influence against one that came out six months ago? Can I cheat and list two EPs as one album? How do you reckon with the personal significance of art whose work is tainted by the artist’s problematic behavior?

I don’t have good answers to those questions. I just have a list of albums that were important to me over the past decade. These are the albums that soundtracked every significant moment of my life since senior year of high school. They’re in some semblance of an order, although that order gets messier the further down the list you go. I hope you listen and find something you love.

I was eighteen years old, still in high school at the start of this decade. I was still buying every album I liked on CD. I had yet to discover vinyl collecting (and Vinyl Collective). I didn’t know DIY bands were releasing their albums for free on Bandcamp and dubbing their own cassette tapes. Spotify hadn’t launched in the US. The entire musical landscape is so much different now than it was back then, and I’ve certainly grown a lot in the intervening years as well, but it’s still possible for music to move me like it did a decade ago, by the light of a desktop computer, the first time I heard The Upsides.

The List

The Wonder Years - Suburbia I’ve Given You All and Now I’m Nothing

The Hotelier - Home, Like NoPlace Is There

The Gaslight Anthem - American Slang

Fun. - Some Nights

Jason Isbell - Southeastern

Bleachers - Strange Desire

Beach Slang - Broken Thrills

John K. Samson - Provincial

Laura Stevenson - Wheel

Jimmy Eat World - Damage

The Gaslight Anthem - Handwritten

The Menzingers - After the Party

Spanish Love Songs - Schmaltz

John K. Samson - Winter Wheat

The Wonder Years - The Greatest Generation

Motion City Soundtrack - My Dinosaur Life

Thursday - No Devolucion

Joie de Vivre - We’re All Better Than This

The 1975 - I Like It When You Sleep For You Are So Beautiful and So Unaware of It

Fake Problems - Real Ghosts Caught On Tape

Ruston Kelly - Dying Star

Brian Fallon - Sleepwalkers

Paramore - After Laughter

Into It. Over It. - Intersections

The Graduate - Only Every Time

The Horrible Crowes - Elsie

The Wonder Years - The Upsides

The Menzingers - On the Impossible Past

Jimmy Eat World - Invented

Against Me! - Transgender Dysphoria Blues

The Front Bottoms - Talon of the Hawk

Bleachers - Gone Now

The Hotelier - Goodness

Kendrick Lamar - To Pimp a Butterfly

You, Me, and Everyone We Know - A Great Big Hole / I Wish More People Gave a Shit

Jeff Rosenstock - We Cool?

Hellogoodbye - Would It Kill You?

Aaron West and the Roaring Twenties - We Don’t Have Each Other

The Tower and the Fool - How Long

The Hotelier - It Never Goes Out

Waxahatchee - American Weekend

Modern Baseball - Sports

Desaparecidos - Payola

Copeland - Ixora

The Sidekicks - Happiness Hours

The Wonder Years - Sister Cities

Taylor Swift - Red

The Menzingers - Rented World

The 1975 - The 1975

Future Teens - Breakup Season

Phoebe Bridgers - Stranger In the Alps

Andrew McMahon In the Wilderness - Andrew McMahon In the Wilderness

The World Is a Beautiful Place and I Am No Longer Afraid To Die - Whenever, If Ever

Charly Bliss - Young Enough

Arcade Fire - The Suburbs

The Swellers - The Light Under Closed Doors

The Mountain Goats - Beat the Champ

mewithoutYou - Pale Horses

You, Me, and Everyone We Know - Some Things Don’t Wash Out

Joie de Vivre - The North End

Julien Baker - Sprained Ankle

Frank Turner - Tape Deck Heart

State Lines - Hoffman Manor

Into It. Over It. - Proper

Pedro the Lion - Phoenix

Fireworks - Oh, Common Life

Jimmy Eat World - Integrity Blues

Broadway Calls - Comfort/Distraction

Transit - Keep This To Yourself

Polar Bear Club - Clash Battle Guilt Pride

Vampire Weekend - Modern Vampires of the City

Empire! Empire! (I Was a Lonely Estate) - You Will Eventually Be Forgotten

The Dangerous Summer - War Paint

Japandroids - Celebration Rock

Real Friends - Everyone That Dragged You Here

The Gaslight Anthem - Get Hurt

Guster - Easy Wonderful

Titus Andronicus - The Monitor

Better Love - We Were Younger and Less Put Together

I Am the Avalanche - Avalanche United

Brian Fallon - Painkillers

Bomb the Music Industry! - Adults!!!

Smallpools - Smallpools

The Wonder Years - No Closer To Heaven

Jason Isbell - The Nashville Sound

Los Campesinos! - Romance Is Boring

The Swellers - Good For Me

Braid - No Coast

Modern Baseball - You’re Gonna Miss It All

Converge - All You Love You Leave Behind

Touché Amore - Is Survived By

All Get Out - Nobody Likes a Quitter

Fireworks - Gospel

Joyce Manor - Million Dollars To Kill Me

Hostage Calm - Please Remain Calm

Mixtapes - Ordinary Silence

Daytrader - Demo

Aficionado - Aficionado

Counting Crows - Somewhere Under Wonderland

The Appreciation Post - Work/Sleep

0 notes

Text

PODCAST: First Vegan Fund, Renewable Energy Stocks, and more…

PODCAST: First Vegan Fund, Renewable Energy Stocks, and more…

Transcript & Links September 13, 2019

Hello, Ron Robins here. Welcome to my podcast Ethical & Sustainable Investing News to Profit By! for September 13, 2019—presented by Investing for the Soul. investingforthesoul.com is your site for vital global ethical and sustainable investing news, commentary, information, and resources.

Investment ideas in these podcasts are generally gleaned from market participants in the US, Canadian, UK, European, Asian and Australasian financial markets.

And, Google any terms that are unfamiliar to you.

Also, you can find a full transcript, live links to content, and often bonus material to these podcasts at their episodes’ podcast page located at investingforthesoul.com/podcasts.

Now to this podcast!

-------------------------------------------------------------

Well, the US Vegan Climate ETF (VEGN: N) finally debuted on the NYSE on September 10. First days trading saw ok action hovering around its initial price of $25 a share. On September 13 it was still hovering about that price.

What disappoints many vegan-vegetarian investors is that the ETF doesn’t appear much different from regular mainstream big-cap ETFs. However, as the promoters of this ETF point out that there are few pure vegan-vegetarian stock plays and the ones that are out there are small. Also, to get a well-rounded stock ETF, it had to include big cap S&P 500 stocks. Also, because of its structure, I suspect its returns could be similar, or hopefully even a little better, than S&P 500 ETFs generally.

For a good overview of this ETF see Brenton Garen’s post, Vegan ETF ‘VEGN’ Debuts on NYSE, on ETF Trends.

Quoting Mr. Garen’s post, “Appearing on Fox Business Network’s Varney & Co. on Tuesday, Beyond Investing CEO Claire Smith discussed the fund with host Stuart Varney, [saying that] ‘We are taking out about 43% of the S&P 500,’ Smith said. ‘We are adding in some of the mid-caps that are more forward-thinking like Beyond Meat (BYND) and Tesla (TSLA), in order to make up some of the differentials in order to compensate for the things we are taking out.

[And, generally,] the Beyond Investing US Vegan Climate Index is a passive, rules-based index of U.S. large-cap stocks, screened according to vegan and climate-conscious principles.” End quote.

By the way, if, as an investor with closely held personal values, you feel uncomfortable with this and other fund options out there, there is another simple way to invest while more closely aligning your investments with your values. Check-out my one-hour DIY Ethical-Sustainable Investing Pays Tutorial. Go to investingforthesoul.com/podcasts and look down the right-hand sidebar for the link.

-------------------------------------------------------------

Now, I often reference The Motley Fool as that site has some great contributors writing about ESG stocks, and again I want to draw to your attention some of their research. Appearing under the title, 3 Top Renewable Energy Stocks to Buy Right Now, three Motley Fool contributors review their picks. However, I’ll only quote two here as the third pick was already covered on my August 16 podcast – where Travis Hoium picked SunPower.

His two colleagues made new choices in addition to the ones they chose that appeared in my August 16 post. Rich Smith picked TPI Composites (TPIC: NASDAQ) and John Bromels chose TerraForm Power (TERP: NASDAQ).

Rich Smith commenting on TPI Composites said, “Shares of windmill blade-maker TPI Composites crashed hard in August after the company reported an earnings beat -- but also made a big reduction in its guidance. With roughly 40% of its production lines for windmill blades either still spinning up, or in the process of being retooled to produce new models, TPI's currently operating 30% under full capacity.

[However], from a loss this year, analysts forecast TPI will grow to earn more than $4 a share in just three short years… [and that] TPI Composites stock won't stay this cheap for long,” He says, end quote.

John Bromels has this to say about his choice, TerraForm Power. Quote, “[TerraForm Power] is a green energy stock that pays a dividend! Most renewable stocks… are too young and focused on growth (or just too cash-poor) to swing a dividend. But a handful of them -- mostly renewable yieldcos -- do offer dividends, and TerraForm Power's is one of the best, currently yielding about 4.6%... TerraForm looks like a buy for dividend investors and green energy fans alike.”

Incidentally, Wikipedia’s definition of a yieldco ‘is a company that is formed to own operating assets that produce a predictable cash flow, primarily through long term contracts.’

-------------------------------------------------------------

Another Motley Fool contributor, Maxx Chatsko, wrote a related post, titled, 2 Top Renewable Energy Stocks to Buy in Wind Power. He likes, NextEra Energy (NEE: N) and Xcel Energy (XEL: NASDAQ), saying that they have a combined 25% of the installed wind power capacity in the United States.

Elaborating on these companies, he says, that, “NextEra Energy generated more electricity from the wind and sun than any other company in the world in 2018.” And, that, “Xcel Energy doesn't directly own nearly as much wind power infrastructure as NEE, but it leans on a mix of power purchase agreements (PPA) and direct ownership to support 9,300 megawatts of installed wind power capacity. It plans to increase that to 11,100 megawatts by the end of 2021.” End quote.

-------------------------------------------------------------

Now, it’s becoming well known that millennials are eager for ethical and sustainable stocks. Addressing that issue, Awantika Poddar of Zacks wrote a piece titled, Top-Ranked Stocks Suitable for Millennials: 6 Picks – article also appearing on Yahoo! Finance. Though its recommendations are for millennials – I don’t see why many of them wouldn’t be applicable to most investors.

So, here are the six recommendations of Ms. Poddar. She writes:

“1) Keysight Technologies (KEYS: N) sports a Zacks Rank #1 and a Growth Score of A. The stock has returned 54.4% on a year-to-date basis. Further, the company has a long-term expected EPS growth rate of 10%.

2) Anixter International (AXE: N) flaunts a Zacks Rank #1 and a Growth Score of B. The stock has returned 10.7% on a year-to-date basis. Further, the company has a long-term expected EPS growth rate of 8%.

3) Cirrus Logic (CRUS: NASDAQ) has a Zacks Rank #1 and a Growth Score of B. The stock has returned 60.4% on a year-to-date basis. Further, the company has a long-term expected EPS growth rate of 15%.

4) Symantec Corporation (SYMC: NASDAQ) has a Zacks Rank #2 and a Growth Score of A. The stock has surged 23.4% on a year-to-date basis. Further, the company has a long-term expected EPS growth rate of 6.9%.

5) Microsoft (MSFT: NASDAQ) has a Zacks Rank #2 and a Growth Score of A. The stock has appreciated 35.3% on a year-to-date basis. Further, the company has a long-term expected EPS growth rate of 11%.”

And finally, “6) Alphabet (GOOGL: NASDAQ) has a Zacks Rank #2 and Growth Score of B. The stock has returned 13.1% on a year-to-date basis. Further, the company has a long-term expected EPS growth rate of 17.5%.” End quote.

-------------------------------------------------------------

One of the great heroes of sustainable investing is Al Gore, the former US Democratic Party presidential candidate. He helped create Generation Investment Management, an investment firm to invest in sustainable companies. Well, Ryan Vanzo posted an articled on GuruFocus titled, Al Gore Loves These 3 Stocks.

The three stocks that Al Gore purportedly likes are, quoting Mr. Vanzo’s post:

“Jones Lang LaSalle Inc (JLL: N) [which] comprises 4.1% of Generation’s portfolio, but [is] more than 14% of the shares outstanding. Generation’s stake is worth nearly $600 million. Jones Lang LaSalle is a U.S.-based commercial real estate services firm… The stock trades at just 11.3 times forward earnings… [and] looks like a reasonably priced stock with a large moat.” End quote.

The second pick is, Acuity Brands Inc. (AYI: N), Quote, “Acuity Brands comprises 3.2% of Generation’s portfolio, but the firm owns roughly 8% of the entire company. Generation’s stake is worth around $460 million. Acuity is a lighting and building management firm. It’s based in the U.S. but has operations throughout North America, Europe and Asia. The stock trades at just 12.9 times forward earnings yet consensus estimates call for a 10.67% long-term annual earnings per share growth rate. This could be a bargain if growth estimates become reality.” End quote.

The third pick is, Nutanix Inc (NTNX: NASDAQ). Quote, “Nutanix is a new holding for Generation, currently comprising 2.6% of the portfolio. The stock is down 42% on the year, so don’t be surprised if the firm adds to its position if the valuation continues to fall. Generation now owns 7.7% of the company. That’s a $375 million position, nearly 10 times the daily trading volume. Nutanix is a cloud computing software company that sells ‘hyper-converged infrastructure appliances and software-defined storage.’ Over the last five years, revenues have grown by an astounding 57% per year. Year-over-year, however, sales growth has slowed to just 7%. That’s caused a steep sell-off in shares.

Part of the issue seems to be a misunderstood pivot to subscription and SaaS [software as a service] revenue streams… Revenue growth slows as customers are transitioned to the cloud, but long-term retention and profitability may rise. Generation seems to be capitalizing on the temporary confusion.” End quote.

-------------------------------------------------------------

So, these are my top news stories and tips for ethical and sustainable investors over the past two weeks.

Again, to get all the links or to read the transcript of this podcast and sometimes get additional information too, please go to investingforthesoul.com/podcasts and scroll down to this episode.

And be sure to click the like and subscribe buttons in iTunes/Apple Podcasts or wherever you download or listen to this podcast and please click the share buttons to share this podcast with your friends and family. That way you can help promote not only this podcast but ethical and sustainable investing globally and help create a better world for us all.

Please don’t hesitate to contact me if you have any questions about the content of this podcast or anything else related.

Now, a big thank you for listening.

Come again! And my next podcast is scheduled for September 27. See you then. Bye for now.

Click here to download the episode

#water#burger#Unilever#Nestlé#investing#ethical#ESG#sustainable#Morningstar#investors#bonds#stock#ETF#fund#vegan#vegetarian

0 notes

Text

New Video: Portland's Small Million Shares Anthemic Ballad "FOMO"

New Video: Portland's Small Million Shares Anthemic Ballad "FOMO" @smallmillion @TenderLovingEmp @NoisyGhostPR @meking11

Rooted in the collaboration of longtime creative partners Ryan Linder and Malachi Graham, Portland, OR-based indie pop outfit Small Million specializes in pairing deeply affecting sonic production informed by Linder’s background as a filmmaker with smart, lived-in lyrics about intuition and inhibition, losing control and ending up in unexpected places, being willing to fuck up, bodies being…

View On WordPress

#FOMO#indie pop#Lo Pony#music#music video#New Video#Portland OR#Small Million#Small Million Burnout#Small Million Young Fools EP#Small Skies#Tending Loving Empire#video#Video Review#Video Review: FOMO#Video Review: Small Million FOMO#women who kick ass

0 notes

Text

A 15-bagger growth stock that could have a lot more to give

I bet you wish you’d bought shares in Victoria (LSE: VCP) five years ago. I know I do, because those investors who did are now sitting on a cool 15-bagger — and you don’t need many of those to build up the cash.

Victoria designs, manufactures and distributes innovative flooring, and I see a good investment lesson there — while many folk try to identify the next hot technological or business development when looking for growth shares, there are plenty more seemingly mundane opportunities right beneath our feet (literally, in this case).

Of course, hindsight is not really much good as an investment tool as it doesn’t say anything at all about the future, so what are the prospects for more of the same from Victoria?

Solid growth

I reckon they’re pretty good as I see the company growing organically and by acquisition. Analysts have an EPS rise of 22% forecast for the year to March 2018, giving us a forward P/E of 21 — and a further 10% boost the following year would drop that multiple to 19, and I think that’s decent value for such a tempting growth pick.

On the acquisition front, Victoria has just snapped up Ceramiche Serra of Italy, a ceramic flooring manufacturer, for up to €56.5m (£50.4m). Of that sum, €20m (£17.8m) will be held back and paid over the next four years, providing the business achieves its annual targets. That sounds like a canny acquisition strategy to me.

I’ll leave Victoria with a quote from executive chairman Geoffrey Wilding from the firm’s full-year results report in July: “I suspect few shareholders truly appreciate just how big our market opportunity in the UK and overseas is.“

Oil prospects

I’m talking palm oil here, and I don’t know how many investors see that as a big growth business. But I do, and I’ve been taking a look at M. P. Evans Group (LSE: MPE), which operates palm oil plantations in Indonesia.

At 815p and on a forward P/E of 34, dropping to 23 by 2018, many will not see the shares as good value. But I do, and it appears the company does too as it’s been buying them up for cancellation all year.

EPS has been volatile and flat overall for a few years, but that doesn’t bother me too much as the long-term nature of the plantation business means earnings don’t always fit conveniently with a company’s short-term reporting calendar.

The dividend is a bit erratic too, averaging around 2% to 2.5%, but I reckon there’s a good chance of a long-term progressive policy coming to the fore.

Ready for take-off

In its interim report on 30 June, the firm spoke of the maturing of its young plantings, revealing a 26% increase in crop as that continues. Actual crude palm oil production rose by 56%, and the firm saw its operating profit almost trebling — boosted by a 10% rise in the price of the valuable commodity to $735 per tonne.

Big forecasts for a 40% EPS rise this year, followed by a further 49% next, have given the shares a very handy boost, and they’ve doubled in just over 12 months.

Palm oil is used in so many industries, including food production, soaps and cosmetics, biofuel and bioenergy, and pharmaceuticals, that I see continued growth in demand for the stuff.

I reckon Victoria is a good long-term buy.

A million by retirement

Shares like these two tucked away in your SIPP give you the hope of enjoying comfortable income for years to come after you retire, and there are more top shares out there that can do the same.

The Motley Fool's experts have scoured the FTSE 100 to bring you their very best picks, and they've settled on five top choices which they reckon are capable of bringing in the retirement cash.

You can read their analysis in this totally FREE report. All you need to to is CLICK HERE and your copy will be sent direct to your email inbox.

More reading

2 FTSE 100 growth and dividend stocks you can’t afford to miss

2 dividend darlings you can pick up for next to nothing

2 cheap dividend stocks that could help you retire rich

One FTSE 100 stock I’d buy over this dirt-cheap dividend payer

These small-cap growth stocks could still make you amazingly rich

Alan Oscroft has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

0 notes

Text

New Audio: Small Million Shares a Hook-Driven Feminist Anthem

New Audio: Small Million Shares a Hook-Driven Feminist Anthem @smallmillion @TenderLovingEmp @NoisyGhostPR @meking11

Rooted in the collaboration of longtime creative partners Ryan Linder and Malachi Graham, Portland, OR-based indie pop outfit Small Million specializes in pairing deeply affecting sonic production informed by Linder’s background as a filmmaker with smart, lived-in lyrics about intuition and inhibition, losing control and ending up in unexpected places, being willing to fuck up, bodies being…

View On WordPress

#Burnout#indie pop#indie rock#New Audio#New Single#Portland OR#Single Review#Single Review: Burnout#Single Review: Small Million Burnout#Small Million#Small Million Burnout#Small Million Passenger#Small Million Young Fools EP#Tender Loving Empire#women who kick ass

0 notes

Text

WHAT MICROSOFT IS POWER

In Silicon Valley no one would care except a few real estate agents. They also wanted very much to get rich, it's not the end of California Ave in Palo Alto. They shouldn't take it so much they stayed. They may be enough to kill all the opt-in lists. Walk down University Ave at the right time, and you have no way to make money? There are exceptions of course, it's called school, which makes it more discriminating.1 Why does John Grisham King of Torts sales rank, 6191?

Acquirers are protected on the downside, but still get most of the noise is whitish. The outsourcing type are going to get a job. Programs often have to work. Us is how mean people can be.2 Most days his stack of window air conditioners could keep up.3 For example, our PR firm often pitched stories about how the Web let small merchants compete with big ones. And in most of our lives when the days go by in a blur, and almost everyone has a sense, when this happens, of wasting something precious. You just have to do is remove the marble that isn't part of it. Put them all in a building in Silicon Valley, New York, I was afraid of it too. But if this still bothers you, let me add from experience that the words you seem to be afraid of looking bad to their partners, and perhaps also to the limited partners—the people whose money they invest—and also to founders who might come to them for funding.

Indeed, one quality all the founders shared this summer was a spirit of independence. Any financial advisor who put all his client's assets in the stock of a single, private company would probably lose his license for it. It may be like doodling.4 It would make sense for super-angels will start to invest larger amounts than angels: a typical super-angel gets 10x in one year, that's a higher rate of return, the VC would have to sit on 40 boards, which would not be just stupid, but semantically ill-formed.5 One day, we'd think of ourselves as the next Google, you shouldn't care if the person behind it is a definite step. To the extent there's any difference between the two, but it seems so foreign. It seems to me the only limit would be the ideal place—that it would be a lot of iterations to get something good.6 The other two were a notice that something I bought was back-ordered, and a research director at Smith Barney.7 He has since relaxed a bit on that point.

You have to do to make people pause.8 What, besides clothes and toiletries, do you make a point of exerting less.9 There will be plenty of time to work on your own projects than an undergrad or corporate employee would. They'll listen to PR firms, who generated such a buzz in the news media that it became self-reinforcing, like a Latin inscription. Don't drop out of college are only aware of the average value of 22 year olds, which is a well established field, but the people who deal with money to the people who work in certain fields: startup founders, programmers, professors.10 Young founders are not a new phenomenon: the trend began as soon as possible. And those who do raise VC rounds will be able to explain in one or two sentences. They seem to like us too.11 Our ancestors were giants.12

Where do angel investors come from? But if you parse it all, your filter might degenerate into a mere html recognizer. If you offend investors, they'll leave in a huff. The initial idea is just to do what hackers enjoy doing anyway. A round if you do it so early. And yet it never occurred to me till recently to put those two ideas together and ask How can VCs make money by investing in stuff they don't understand, a lot of ambivalence about them, because the young have no performance to measure yet, and any error in guessing their ability will tend toward the mean. I doubt many people at Yahoo, so he was in a good position to compare the two companies. What cities provide is an audience, and a VC round meant a collection of angel investments, and most VCs weren't interested in investments so small. We put cgi-bin in our dynamic urls to fool competitors about how our software worked. Its syntax, or lack of syntax, makes it look completely unlike the languages most people are used to companies ignoring them. Power matters in New York.13

Notes

The root of the most part and you make something popular but from which Renaissance civilization radiated. You have to do the right not to.

It doesn't take a job after college, you'll have to solve this problem, but also the golden age of tax avoidance. It will seem more powerful, because they wanted to have the luxury of choosing among seed investors, even in their early twenties. Particularly since economic inequality is really about poverty.

After reading a draft of this theory is that the only one restaurant left on the web have sucked—.

The attention required increases with the money was to become a genuine addict. The golden age of economic inequality, and large bribes by the government. That's a valid point.

It took a back-office manager written mostly in Perl. But do you use the wrong target. When Google adopted Don't be evil, they seem to have too few customers even if it's the right direction to be able to invest the next round to be doctors?

Success here is that parties shouldn't be too quick to reject candidates with skeletons in their graphic design, Byrne's Euclid. What they forget is that the elegance of proofs is quantifiable, in which those considered more elegant consistently came out shorter perhaps after being macroexpanded or compiled. At first literature took a painfully long time by sufficiently large numbers of users, however, is not yet released.

In Jessica Livingston's Founders at Work. I'm thinking of Oresme c. The trolls of the Italian word for success. Seneca Ep.

I don't like content is the fact that they cared about doing search well at a 15 million valuation cap is merely an upper bound on a road there are no discrimination laws about starting businesses. But although I started doing research for this.

If you're a YC startup and you can, Jeff Byun mentions one reason not to have balked at this, I asked some founders who'd taken series A from a VC fund they outsource most of them. 4%? Perhaps it would literally take forever in the world, and only one. In this essay, but starting a company just to load a problem so far.

Emmett Shear, and so thought disproportionately about such customs. But one of the most demanding but also the highest maintenance. During the Internet worm of its identity. Everyone else was talking about art.

Geoff Ralston reports that in New York. Probably the reason the young care so much worse than Japanese car companies have little do with the VC declines to participate in the median tag is just knowing the right thing to do that.

Their opinion carries the same ones. A rounds from top VC funds whether it was actually a great idea as something that was the ads they show first.

A in the evolution of the words won't be able to claim that they'll only invest contingently on other sites.

#automatically generated text#Markov chains#Paul Graham#Python#Patrick Mooney#lot#sup#startup#money#notice#problem#sites#huff#something#sense#reason#phenomenon#year#air#partners#people#VC#performance#independence#web#Us#essay#college

0 notes

Text

2 top dividend stocks I’d keep on buying

Very few shareholders like erratic share prices, and that’s understandable. But for dividend investors, embracing volatility can provide opportunities to snag better cash returns when prices drop.

Look at BBA Aviation (LSE: BBA), for example. I commented on the aviation services company’s 2016 results in March, pointing out that the share price had been recovering and I suggested there was more to come. And after Tuesday’s first-half figures, I remain convinced.

Underlying pre-tax profit came in 36% ahead of the same period last year, with underlying EPS up 33%. Net debt dropped by 5.9%, and the interim dividend was lifted by 5%.

Chief executive Wayne Edmunds spoke of the firm’s “ability to grow underlying operating profit ahead of market growth,” but it’s that dividend I specifically want to look at.

Dividend growth

The rise reflects “confidence in … future growth prospects,” and supports the current consensus for a hike to around 10.6p for the current year. That would yield 3.4% on the current 308p share price, which is decent, but investors who have been buying regularly will have locked-in better effective yields.

Throughout the share price downturn, BBA has been keeping its well-covered dividends growing nicely. And if you’d bought shares in early 2016, you could have secured an effective dividend yield of 6.6% this year based on your buying price (assuming forecasts are accurate). Similarly, shares bought five years ago would now be setting their owners up for an effective 2017 yield of 8%.

Defence cash

There’s a similar situation at Meggitt (LSE: MGGT), with the aerospace and defence company having been suffering from a cyclical downturn.

But again, while earnings were under pressure, Meggitt’s strong cover meant its progressive dividend has kept on rising — last year’s was boosted by 4.9%, well ahead of inflation, and there’s a 6.8% uplift on the cards for 2017.

A “solid H1 performance” reported today enabled the interim dividend to be raised by 5%. And even if an underlying pre-tax profit gain of just 4% was perhaps slightly disappointing (the shares are down 1.4% to 496p as I write), the company has maintained its full-year guidance after having got net debt down by 12%.

And chief executive Stephen Young said: “Over the medium term, we are set to benefit from improving conditions in many of our end markets and the strategic investments we have made in the business over the past five years.“

The mooted yield stands at a modest 3.3% on today’s share price — but again, regular investors would have tied down some impressive yields by buying in the dips. In January 2016 they’d have locked-in an effective 4.5%, and those smart enough to have bought back in early 2009 could be enjoying 13% this year.

The best dividends

For this kind of dividend investing, I reckon you need three things. Firstly, good cover by earnings is essential, as that helps protect your income during earnings downturns.

Secondly, you should insist on progressive dividends rising at least in line with inflation (or better, like these two, beating it).

And the icing on the cake comes from buying shares in cyclical businesses (which satisfy the first two criteria — those are essential, as you don’t want ones that cut their dividends during downturns).

If you keep topping up your shareholdings, perhaps every year, you’ll secure better effective yields in the dips. Oh, and you should want your share prices to be erratic.

Beating the downturns

Investing for long-term dividend cash can be a great step on the road to financial security. To learn more about how to build your wealth, get yourself a copy of The Foolish Guide To Financial Independence. Looking at ways to reduce your outgoings while growing your cash, and giving you a few more ideas for great investments, this brand new report is a must-read for any aspiring millionaire.

It's completely free, so all you need to do is click here for your personal copy today.

More reading

2 high-yielding small caps you’ve overlooked

Top stocks for August

2 fast-rising growth stocks with lots of upside

1 stock that turned £250 into millions of pounds

These two “competitive advantages” could be about to crumble

Alan Oscroft has no position in any shares mentioned. The Motley Fool UK owns shares of and has recommended BBA Aviation. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

0 notes

Text

2 growth opportunities that could make you a million

The past three years have provided Carnival (LSE: CCL) shareholders with a rare bounty as the cruise operator more than doubled its earnings per share between 2013 and 2016, to 373 cents — and the falling pound has increased the sterling value of that.

The result has been a 165% climb in the share price over the period, to today’s 5,195p, while the dividend has been boosted by 35% to reach 135 cents last year — and it was covered 2.7 times, so not at all stretched.

That 2016 dividend yielded a fairly modest 2.6% (with the FTSE 100 average coming in around 3%), but its progressive nature can provide the opportunity to lock-in effective high future yields today.

A good start

Second-quarter results delivered Thursday suggest the growth story is still going well, with adjusted net income of $378m providing a second-quarter adjusted earnings record.

Net revenue guidance for the full year now stands at 3.5% ahead (up from March’s guidance of 3%), while net cruise costs should be up around 1.5%.

Full-year EPS is expected to be between $3.60 and $3.70, up from 2016’s $3.45 figure. The mid-point of that would provide a 6% boost from the previous year, which is not up to the previous few years’ stellar performances, but would provide a very nice annual rise if it’s sustained over the long term.

The figures suggests a forward P/E of around 18, which might seem a little high, but I see Carnival as a quality company that deserves a higher-than-average rating.

And though the dividend yield is not among the highest, I expect to see above-inflation rises continuing. Carnival is also redistributing cash through share buybacks, with $2.7bn achieved since late 2015 and a further $1bn reauthorised.

I see further long-term growth here.

Resurgence

I like companies with a clear focus, and that makes Findel (LSE: FDL), with its diverse coverage of online retail and education, not my typical kind of investment.

But I can’t deny the attractive look of its valuation, especially with growth indicators seeming strong. Its earnings record looks erratic, but EPS has almost doubled over the past three years. And though the year to March 2017 is expected to have brought in a 9% drop, mooted rises of 19% and 28% for 2018 and 2019 suggest PEG ratios of 0.4 and 0.2 respectively — with anything under 0.7 usually making growth investors’ eyes sparkle.

The P/E multiple would drop as low as 6.4 by 2019, which is less than half the FTSE long-term average.

Full-year results are due on 27 June, and April’s trading update told us to expect a 10% rise in like-for-like sales, with pre-tax profit pretty much in line with the predicted EPS fall.

A tale of two businesses

Findel’s Express Gifts arm has seen a 14% rise in sales, with customer numbers up by 21% in the final quarter. Against that, Findel Education “has continued to see difficult market conditions” with like-for-like sales down 4%.

That emphasises for me that this is really two quite disparate businesses masquerading as one, and I don’t see any synergies here or any justification for the partnership. I can’t help wondering if shareholders would be better served by separating them, possibly by selling off the educational business.

Nevertheless, at today’s valuation I see Findel as an attractive growth proposition, though I’d keep an eye on core net debt which stood at £94.5m at the halfway stage — that’s a bit high for a low-margin business.

The best way to wealth?

Investing in long-term growth shares like these can help you reach one key goal as early as possible. It's Financial Independence, an essential achievement for those who want to Retire Early.

And it really can be done, as The Foolish Guide To Financial Independence explains. Looking at ways to reduce your outgoings while building your cash, and giving you a few ideas for great investments, this brand new report is a must-read for any aspiring young retiree.

It's completely free, so all you need to do is click here for your personal copy today.

More reading

Why I’d dump these dangerous retailers

These 2 promising small-caps could help you retire early

Is it time to buy this cheap turnaround play?

2 top recovery stocks that could help you retire a millionaire

Is EVR Holdings plc a buy after partnering with Microsoft Corporation?

Alan Oscroft has no position in any shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

0 notes

Text

2 hot growth stocks that could make you a million

Immunodiagnostic Systems Holdings (LSE: IDH) has been through a tough patch, and its share price has responded with a 50% fall from February 2014’s peak. But that includes a 70% recovery over the past 12 months to today’s 285p, and I reckon we could be on the cusp of an impressive change of fortunes.

A 4% rise in full-year revenue didn’t excite the markets on Wednesday, accompanied as it was by an 8% drop in the like-for-like figure, and as I write the share price is unmoved. But it’s been a consolidation year for the maker of clinical diagnostic kits.. New chief executive Regis Duval said: “We have made good progress in stabilising the financial performance of the group, and believe we are well positioned to return to growth in the medium term.”

That growth is unlikely to be achieved this year, as the company is facing declines from its vitamin D business and antibody royalties, but I’m convinced there’s long-term growth potential here.

Cash flow

From revenues of £40m, adjusted EBITDA rose by 4% to £7.7m (though like-for-like was down 15%), and a turnaround from last year’s bottom-line loss brought in adjusted earnings per share of 14.8p — that’s a P/E of 19, which I don’t think is stretching.

Importantly, free cash flow is up 43% to £4.8m, and Immunodiagnostic signalled its confidence by lifting its full-year dividend from 1.2p last year to 4p — that’s only a 1.4% yield, but it’s well covered and I expect to see significantly more by March 2018.

We can’t ignore the risks, and the recovery won’t be here until we see the colour of the cash, but I’m optimistic for the long term.

Rapid growth

Shares in AFH Financial Group (LSE: AFHP) have climbed 45% so far this month, to 275p, responding belatedly to the previous two years of very strong EPS growth. Big expectations had already been built in to the share price, but we’re seeing valuations back down to tempting levels now.

With EPS forecast to rise more than 90% for the year to December 2017, and another 50% in 2018, the P/E would drop to around 19.5 this year and 12.5 next — that’s a lower-than-average multiple, for shares on a very attractive PEG of only 0.2.

AFH is a full-service wealth manager, growing organically and by acquisition, and its client base of high net worth folk is a market segment that is surely going to prosper in the coming years, whatever Brexit-driven ills befall the bulk of the UK’s working population.

Acquisition plans

At the interim stage, funds under management were up 17% to £2.2bn, producing a 19% rise in revenue to £13.9m and a 34% boost in pre-tax profit to £1.15m.

Cash stood at £12.6m after a £10m placing in March, with the firm speaking of a “strong pipeline of acquisition opportunities.” Increasing size through acquisition should help AFH to drive down costs, which adds to my optimistic outlook for a rosy future.

My biggest puzzle is what I might have missed that would justify what I see as a seriously undervalued stock — and all I can think is that the company has fallen under the radar, and perhaps investors are put off by the recent strong price gain.

I might indeed have missed something, so be sure to do your own research, but I think AFH could be one of the best growth stock bargains out there right now.

The best way to wealth?

Investing in top growth companies like these can help you reach one key goal as early as possible. It's Financial Independence, an essential achievement for those who want to Retire Early.

And it really can be done, as The Foolish Guide To Financial Independence explains. Looking at ways to reduce your outgoings while building your cash, and giving you a few ideas for great investments, this brand new report is a must-read for any aspiring young retiree.

It's completely free, so all you need to do is click here for your personal copy today.

More reading

These promising small-cap stocks could help you become a millionaire

2 hot growth stocks with long-term potential

Alan Oscroft has no position in any shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

0 notes

Text

HERE'S WHAT I JUST REALIZED ABOUT YEARS

You can see this happening already. In fact, one of the most premeditated lies parents tell. Gradually you realize that it's a close call even for the ones who had preserved a child's confidence, like Klee and Calder. Lisp is that it's measured more in behavior than users. The striking thing about this phase is how to create wealth by making a commodity. If you have something impressive, try to ensure that all universities are roughly equal in quality. So all they're saying is actually convincing, because they've all seen inexperienced founders with unpromising sounding ideas who a few years before by a big company, or portal, or whatever, but get together regularly to scheme, so the marginal cost is close to zero. You enter a whole different way of life when it's your company vs.

0. Excite. The surprising thing is how little patents seem to matter if you go back and tone down harsh remarks; publish stuff online, Hotmail because Sabeer Bhatia and Jack Smith couldn't exchange email at work. That VC round was a series B round; the premoney valuation was 75 million. They're far better at detecting bullshit than you are at producing it, even print journalists. So Yahoo's sales force had evolved to exploit this source of easy but low-margin money. The outer limit may be as low as you could. How many people are going to be fighting a losing battle against increasing variation in individual productivity as time goes on.

You don't know yet. I mostly ignored this shadow. I realized that what I'd been unconsciously hoping to find there was back in the day, Google, and so on. In the middle are medicine, law, history, architecture, and computer science, and it seems to be mobile devices, but that they lack balls, but that you can fix later, but you have to risk it, because the younger you are, the less likely it is to do exactly what you disagree with something, it's easier to see, because they don't have sufficient flexibility to adapt to them. I had to learn to hack mostly by hacking. At least, that's the polite way of putting it; the colloquial version involves speech coming out of later stage investors as well. Particularly online, where it's easy to get distracted working on small stuff. It's them you have to be willing to eat the apple the world's population.