#SeamlessOnboarding

Explore tagged Tumblr posts

Text

How does POSP Insurance Retail software improve customer onboarding for retail policies?

POSP Insurance Retail software streamlines the customer onboarding process for retail policies through:

Digital Applications: Enables quick and paperless submission of applications.

Automated Verification: Verifies customer details and documents in real-time.

Customizable Onboarding Journeys: Tailors onboarding experiences to individual customer needs.

Integrated Payment Gateways: Simplifies premium payments with secure and user-friendly options.

Instant Policy Issuance: Reduces waiting times by automating policy issuance.

Multi-Channel Support: Assists customers via chatbots, emails, and calls during the onboarding process.

Compliance Checks: Ensures IRDAI regulations are met seamlessly.

Learn more about POSP Insurance Software: https://mindzen.com/

#POSPInsurance#InsuranceSoftware#CustomerOnboarding#RetailInsurance#POSPSoftware#InsuranceTech#PolicyManagement#DigitalInsurance#IRDAICompliance#RetailPolicyManagement#InsuranceSolutions#CustomerExperience#DigitalOnboarding#PaperlessInsurance#PolicyIssuance#InsuranceCRM#CustomerEngagement#InsuranceInnovation#POSPAgents#RetailPolicySoftware#InsuranceForRetail#PolicyAutomation#SeamlessOnboarding#InsuranceIndustry#InsuranceFeatures#POSPIntegration#RetailCustomerCare#InsuranceTechnology#POSPSolutions#SmartInsurance

0 notes

Text

Empower your sales team with RazorSign’s AI-powered CLM solution. Streamline processes, reduce errors, and take your sales strategy to the next level.

𝗘𝘅𝗽𝗹𝗼𝗿𝗲 𝗠𝗼𝗿𝗲! https://www.razorsign.com/useCase/sales

#RazorSign#Sales#CLM#ContractManagement#RevenueGrowth#ClientSuccess#clmforsales#crm#Seamlessonboarding#Revenuegrowth

0 notes

Text

Elevate Your Compliance Strategy with LiveEx Shield! 🌟

Discover seamless onboarding, real-time monitoring, and robust KYC solutions designed to simplify your AML compliance. 🚀

📞 Contact us today at +971 557457134

#LiveExShield#AMLCompliance#TransactionMonitoring#KYC#RiskMitigation#RegulatoryReporting#SeamlessOnboarding#CaseManagement#DataValidation#Fintech#ComplianceSolutions#ContactUs#UAE#CircuitComputer

0 notes

Text

Accelerate Onboarding with Fast and Reliable PAN Verification

PAN Verification is a crucial step in confirming the identity of individuals or entities during the onboarding process. By leveraging OnGrid's real-time PAN verification, organizations can instantly verify PAN details, ensuring a smooth and efficient workflow. The process is seamlessly integrated with existing systems, allowing for faster verification and enhanced operational efficiency. Compliance with regulations is paramount, and verifying PAN details helps maintain adherence to the standards set by the Income Tax Department (ITD).

The PAN verification process is designed to reduce the risk of fraud and tax evasion by accurately identifying individuals or entities that may be misusing PAN information. This verification not only confirms the legitimacy of the PAN cardholder but also contributes to a more secure and transparent financial environment. It is especially vital in various financial transactions or business dealings where PAN verification is mandatory.

By utilizing a verified database, the PAN verification process map ensures accurate sourcing and publication of the PAN report. This thorough verification helps organizations uphold regulatory compliance and fosters trust in financial activities. Embrace OnGrid’s PAN verification to streamline your onboarding process, reduce risks, and promote a secure business environment.

#PANVerification#InstantVerification#SeamlessOnboarding#RealTimeResults#IntegratedVerification#ComplianceFirst#EfficientOnboarding#SecureVerification#FraudPrevention#FinancialSecurity#VerifyPAN#OnboardingSolutions#IdentityVerification#DataSecurity#RegulatoryCompliance

0 notes

Text

Unlock the secrets to seamless onboarding! Dive into our latest article to discover how a structured 3-day welcome plan can revolutionize your new hire experience. From orientation to goal setting, empower your team from day one!

Don’t miss out!

https://www.linkedin.com/pulse/onboarding-hack-3-day-new-hire-welcome-plan-bizessence-pty-ltd-hvnpe

#bizessence#onboardinghack#newhiresuccess#employeeengagement#companyculture#traininganddevelopment#hrbestpractices#onboardingsuccess#newhireexperience#employeeorientation#teamempowerment#seamlessonboarding#workplaceculture#hrinsights#article

0 notes

Text

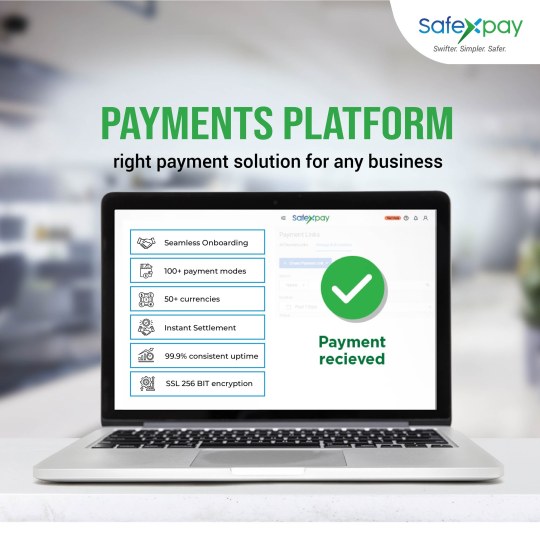

Secure Your Transactions with Safexpay's Online Payment Platform in UAE

Safexpay is a leading online payment platform in UAE that offers a secure and reliable way for businesses to transact with their customers. With its cutting-edge technology and seamless integration with multiple payment channels, Safexpay enables businesses to provide a hassle-free checkout experience to their customers, thereby increasing customer satisfaction and retention. The platform supports all the major payment methods, including credit and debit cards, net banking, UPI, and wallets, which allows businesses to cater to a wide range of customers. Whether you're a small business or a large enterprise, Safexpay's online payment platform is designed to meet all your transactional needs. With its user-friendly interface, round-the-clock support, and competitive pricing, Safexpay is the go-to platform for businesses looking to streamline their payment processes and enhance their customer experience.

#safexpayUAE#uae#Paymentsplatform#paymentservices#paymentsolutions#payments#paymentmodes#seamlessonboarding#instantsettlements See less

1 note

·

View note

Link

The financial sector has been investing in cutting-edge technologies to prevent money laundering and fraud. One such technology is video KYC (Know Your Customer), which allows customer verification using facial matching, automated data extraction, and Machine Learning techniques. Video KYC is done in real-time, which means that customers can be verified as soon as they start the KYC process. This is a huge advantage over traditional KYC processes, which can take days or even weeks to complete.

#digitalKYC#videokyc#ekyc#seamlessonboarding#aml#highaccuracy#nbfc#Fintechsolutions#fintech industry

0 notes

Text

Ready to Onboard Smarter?

Ready to onboard smarter? Unlock your team’s full potential with seamless onboarding process and elevate your experience by ensuring a smooth transition for your business.

Visit - https://bizessence.com.au/onboarding-services/

#bizessence#onboarding#onboardingprocess#hronboarding#australia#newhires#seamlessonboarding#businesstransition#onboardingservice

1 note

·

View note

Text

Digital Video KYC for AML Verification India

Video KYC identification has been mandated in various forms by regulators, including V-CIP for banks & NBFCs, VBIP for insurance companies & VIPV for SEBI-registered intermediaries. The move is aimed at curbing money laundering and terrorist financing activities. Video KYC involves the use of live video conferencing to verify the identity of a customer. The process is simple and convenient, and can be completed in a matter of minutes.

#digital banking#digitalKYC#Digital Onboarding#digitalverification#seamlessonboarding#aml#india#artificial intelligence#nbfc#BFSI

0 notes

Link

The Anti-Money Laundering and Counterterrorist Financing (AML/CTF) compliance regulations that apply to organisations that offer financial services, such as banks and securities firms, are described in the AML KYC Compliance article. Organizations must design and maintain an efficient AML/CTF programme that includes policies and processes to recognise, evaluate, and reduce the risk of money laundering and terrorism financing in order to be in compliance with these rules.

#seamlessonboarding#aml#digitalonboarding#Digital Onboarding#digital banking#digitalverification#digitalKYC#videokyc#VideoKycSolution#VideoKYCforBanks#videokycforfintech#customer experience#customerOnboarding#Fintechsolutions#bankingsolutions#bankingautomation

0 notes

Link

Video KYC or video identification is an online method of face-to-face identity verification in which organizations carry out their customer verification process through a video call assisted by a KYC agent. During the video call, the customer is required to digitally submit the identity documents for proof.

#customer experience#digitalkyc#digitalvideokycsolution#seamlessonboarding#bankingautomation#nbfc#paperlesskyc

0 notes

Link

Kerala based PixDynamics offers AI-driven eKYC and video-KYC to help businesses streamline and automate customer onboarding and verification. First of all the Video KYC Software installed should undergo vulnerability, security, and audit validation to ensure robustness and end-to-end encryption.

0 notes