#Paymentsplatform

Explore tagged Tumblr posts

Text

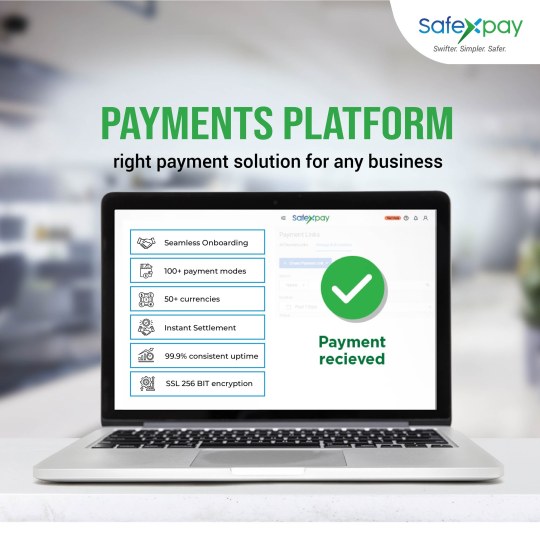

Secure Your Transactions with Safexpay's Online Payment Platform in UAE

Safexpay is a leading online payment platform in UAE that offers a secure and reliable way for businesses to transact with their customers. With its cutting-edge technology and seamless integration with multiple payment channels, Safexpay enables businesses to provide a hassle-free checkout experience to their customers, thereby increasing customer satisfaction and retention. The platform supports all the major payment methods, including credit and debit cards, net banking, UPI, and wallets, which allows businesses to cater to a wide range of customers. Whether you're a small business or a large enterprise, Safexpay's online payment platform is designed to meet all your transactional needs. With its user-friendly interface, round-the-clock support, and competitive pricing, Safexpay is the go-to platform for businesses looking to streamline their payment processes and enhance their customer experience.

#safexpayUAE#uae#Paymentsplatform#paymentservices#paymentsolutions#payments#paymentmodes#seamlessonboarding#instantsettlements See less

1 note

·

View note

Photo

#P27 #Nordic #PaymentsPlatform to build #RealTimePayments sys. http://bit.ly/2LkMshV The P27 Nordic Payments Platform (owned by Danske Bank, Handelsbanken, Nordea, OP Financial Group, SEB and Swedbank) have announced a partnership with Mastercard to provide real-time payments across the Nordic markets. The partnership will connect people across the cluster of countries using multiple currencies. The ambition being to transform how money moves for consumers, businesses, society, and the payments industry itself. This major investment programme is a world first in terms of a real-time and batch multi-currency platform and will replace the existing payment infrastructure, enabling instant and secure payments at lower costs and increased competitiveness. Participants will be able to send and receive funds immediately across the Nordic markets at a lower cost and with higher security. Adding to the speed and convenience of bank account to account payments across the region this will not only offer people greater choice and opportunity, it will improve economic growth and employment by enabling new products, services and business models to develop. “This is change for real. By joining forces across the Nordics we will be able to develop instant payment solutions in a way that each country never would accomplish by themselves,” says Lars Sjögren, CEO P27 Nordic Payments Platform. “By sharing the costs between the Nordic countries, we will get a state of the art payment infrastructure in the Nordics with the highest standard when it comes to security and efficiency; further boosting innovation and growth in the Nordics.” The new payment platform is subject to regulatory approvals and final investment commitments. #Fintech #OpenBanking #PSD2 #payments #Cybersecurity @archonsec @alvinfoo @guidodeckstein @UrsBolt @@CoddDateCH @Fabriziobustama (hier: Canton of Zürich) https://www.instagram.com/p/Bzl-vSJizzO/?igshid=tajnmbqudqoo

0 notes