#ScamPrevention

Explore tagged Tumblr posts

Text

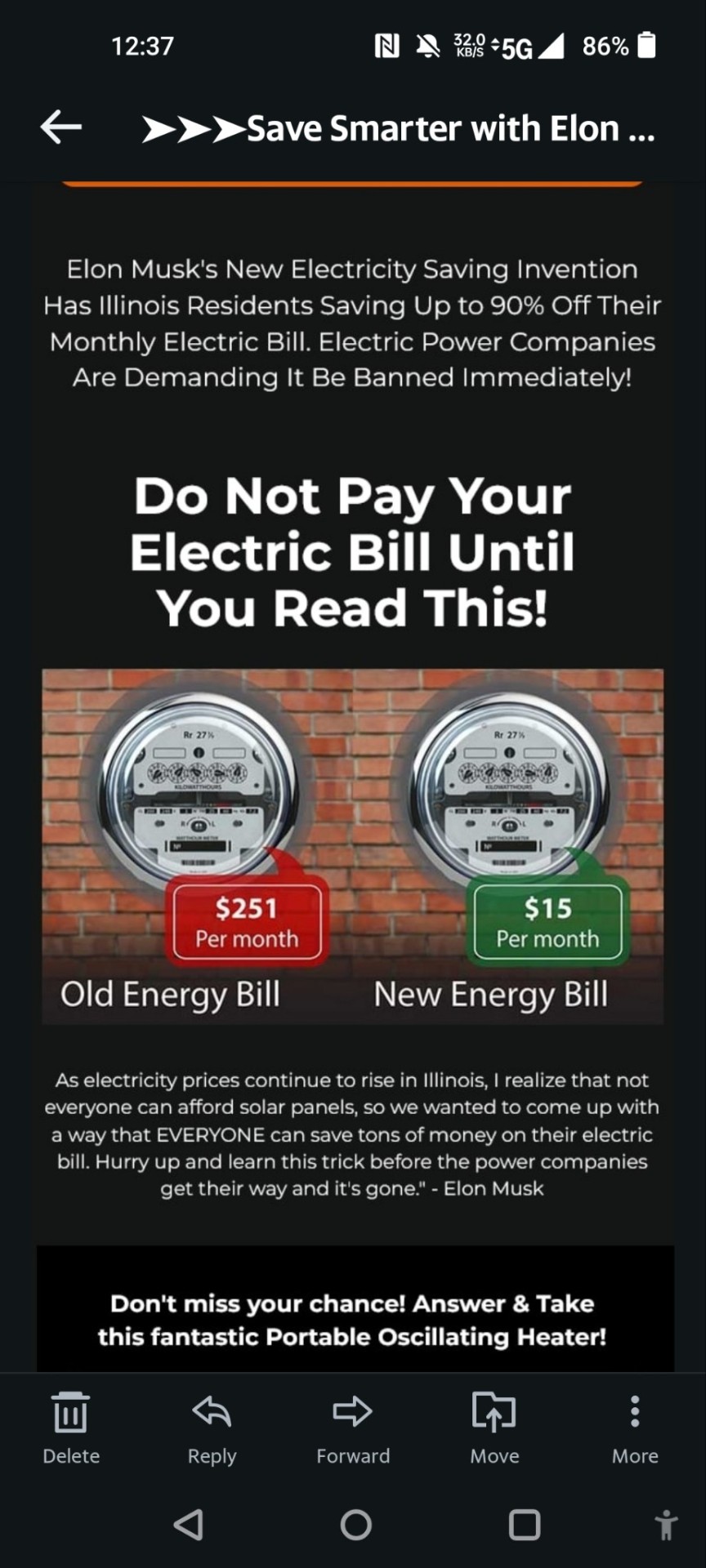

Don't fall for this email...

Why do I keep getting this email? I never subscribed to it, and yet, I had to unsubscribe. I don't want to buy anything associated with his name or "made" by him.

If you were sent this, too, I urge you: don't buy into this scam. Don't contribute even a cent into that corrupt piece of shit billionaire's fat wallet. Don't buy products from companies or people who only view and treat their customers as numbers and never the human beings that they are.

The email has the audacity to describe him as a "genius CEO".

Stroking your own ego much, Musky?

He violates human rights, wants to cut essential programs (i.e. Medicaid, Medicare social security) that a lot of people, me included, rely on, AND he endorses the evil dicktator wannabe who shits himself in public!

Yeah, he's a real "genius" alright.

Don't support Trump cronie Elon Musk. Don't buy his products. Don't fill his overflowing rich-as-fuck pockets with your hard earned money.

#scam alert#scam warning#fuck elon#fuck trump#emailfraud#onlineprotection#cybersecurity#consumer awareness#fraudprevention#cyberawareness#email scam#scamprevention#digitalsafety#internet security#onlinesafety#eat the fucking rich#fucking hell#political awareness#politics

3 notes

·

View notes

Text

Stay Vigilant: How to Avoid Scams in the Crypto Space

The cryptocurrency world is full of promise, opportunity, and innovation, but unfortunately, it's also a breeding ground for scams. As crypto continues to rise in popularity, so do the number of people looking to take advantage of others. According to a report by Chainalysis, cryptocurrency scams cost investors $14 billion in 2021 alone, highlighting the urgent need for vigilance. Scammers are getting smarter and more sophisticated, targeting individuals through social media and other online platforms. I've personally encountered these scams, and today I want to share my experience to help others stay safe.

The Psychology of Scams

At the heart of every scam is one thing: manipulation. Scammers are experts at playing on human emotions—whether it's excitement, greed, or desperation. They know how to make offers seem irresistible, making promises of unbelievable returns or exclusive opportunities. Their entire approach is built around FOMO (fear of missing out) and urgency, pushing people to act quickly without thinking critically.

It's important to understand that these scams often seem tailor-made for each individual. Scammers take time to study their targets, learning their interests and pain points, before crafting the perfect pitch.

Common Types of Scams

There are several common types of scams in the crypto space that you should be aware of:

Phishing Attempts: Attempts to steal sensitive information by pretending to be a legitimate entity. Whether it's a fake email or website, scammers often ask for private keys or passwords.

Fake Giveaways and Impersonations: You might have seen these on social media—"Send 0.1 BTC and get 1 BTC in return!" These scams often involve impersonators posing as well-known figures or organizations.

Investment Scams: These scams promise guaranteed returns that sound too good to be true. The scammer tries to convince you to invest in a project or exchange that ultimately disappears with your money.

Off-the-Wall Exchanges: Many scammers will direct you to sketchy, little-known exchanges, promising quick profits. These platforms often have no regulatory oversight and can vanish overnight, taking your assets with them.

Pump and Dump Schemes: In these scams, fraudsters artificially inflate the price of a cryptocurrency through false statements, then sell their holdings at the inflated price, causing the value to crash.

My Personal Experience

Recently, I've been targeted by scammers on X (formerly Twitter). The pattern is always the same: someone follows me, I follow them back, and within a short time, they slide into my DMs with an investment pitch. They promise incredible returns, sometimes showing fake testimonials or screenshots of "earnings." Every time, they try to send me to obscure exchanges, claiming I need to use their "exclusive platform" to achieve these returns.

The red flags were obvious to me: the promises were outlandish, and the exchanges were completely unfamiliar. It's important to trust your instincts in these situations. If something feels off, it probably is.

Why Scammers Succeed

So why do these scams work? It comes down to psychological tricks. Scammers create a sense of urgency, making you feel like you'll miss out on an opportunity if you don't act quickly. They also prey on greed, offering returns that are too good to pass up. For many people, the idea of easy money is tempting enough to lower their guard, even when the deal seems suspicious.

Scammers also succeed because they create fear or doubt. They might claim that the window of opportunity is closing, or that their "offer" is only available for a limited time. These tactics work because they bypass logical thinking and appeal directly to emotion.

How to Stay Vigilant

Staying safe in the crypto space requires a mixture of caution, skepticism, and research. Here are a few ways to protect yourself:

Recognize the Red Flags: If someone promises guaranteed returns, especially astronomical ones, be wary. Similarly, if you're being rushed into making a decision or are directed to an unknown exchange, stop and evaluate the situation.

Research Exchanges Before Investing: Always take time to thoroughly research any exchange you plan to use. Look at reviews, check for regulatory compliance, and verify if the platform has a strong track record.

Protect Your Digital Assets: Use hardware wallets and enable two-factor authentication (2FA) on all your accounts. Avoid sharing sensitive information like your private keys with anyone, and be mindful of phishing attempts.

Report Suspicious Activity: If you encounter a scam, report the account or platform to the appropriate authorities. On social media, you can block and report scammers to help protect others from falling victim.

Stay Informed: Keep up-to-date with the latest crypto news and scam tactics. Websites like CoinDesk and Cointelegraph can be valuable resources.

What to Do If You've Been Scammed

If you believe you've fallen victim to a crypto scam, take these steps immediately:

Stop All Communication: Cut off contact with the scammer immediately.

Document Everything: Save all communications, transaction details, and any other relevant information.

Report the Scam: Contact your local law enforcement and file a report. Also, report the scam to the relevant crypto exchange or platform.

Inform Your Bank: If you used a credit card or bank transfer, contact your bank immediately to try and stop or reverse the transaction.

Seek Support: Being scammed can be emotionally devastating. Don't hesitate to seek support from friends, family, or professional counseling services.

Conclusion

The world of crypto offers immense potential, but it's also filled with risks. Scammers are becoming smarter, and their methods more sophisticated, but by staying vigilant and doing your research, you can protect yourself from their traps. Remember, if something sounds too good to be true, it probably is. Take the time to think critically, guard your assets, and most importantly, stay informed.

Stay safe out there, and happy investing!

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#CryptoScams#BitcoinSecurity#StayVigilant#CryptoAwareness#ScamPrevention#DigitalSecurity#CryptoSafety#BlockchainEducation#PhishingScams#ProtectYourAssets#Cryptocurrency#BitcoinCommunity#CryptoTips#InvestSafely#OnlineSecurity

2 notes

·

View notes

Note

Hi! Im really sorry on sending this, i just hope im not overstepping any boundaries as I’m about to ask help which is very important right now :( my dog, Gizmo needs an urgent dental surgery. He is having a real hard time eating and I can't afford to pay the vet to help him so I'm reaching out to ask for help, I mean even if you can’t help monetarily, reblogging or sharing it would truly mean a lot. He is my therapy dog and my bestfriend, I am undergoing chemotherapy due to my leukemia and I cant do this without him. I have pinned the post on my blog, please try to also answer the ask privately as some people tend to get weird on this stuff. Please send us prayers, be safe. ♥️🙏

Listen, I totally understand the need for fundraising, but do it through a reputable organization and ask people to donate to the vet, not to you. You can set up payment plans through vets specifically with a funding option. That way, nobody gets scammed, as often happens on social media. I saw you are having it paid through PayPal and not through the vet. That will get you labeled as a scam even if you aren't.

I legitimately have less than a grand to my name right now and barely enough savings for my own animals in an emergency. I wish you the best of luck if this is real! Recently having a 600$ kitten vet bill I know how hard this can be. ** This was indeed confirmed as a SCAM Stay safe out there folks**

#vetmed#scamprevention#stay safe out there folks#donate via the vets office not via PayPal#Pets#Animals#Dog

5 notes

·

View notes

Text

The Top 5 Ways to Stay Safe When Investing in Cryptocurrency

Cryptocurrency has become a popular investment choice for many individuals due to its potential for high returns. However, investing in cryptocurrency is not without risks. It is essential to take precautions to ensure that your investments are safe and secure. In this blog post, we will discuss the top 5 ways to stay safe when investing in cryptocurrency.

1. Do Your Research

Before investing in any cryptocurrency, it is crucial to do your research. Learn about the cryptocurrency you are interested in, its history, and its potential for growth. Read reviews and feedback from other investors to get a better understanding of the cryptocurrency's reliability and security. It is also essential to research the platform or exchange where you plan to buy and sell your cryptocurrency.

2. Use a Secure Wallet

A cryptocurrency wallet is a digital wallet that stores your cryptocurrency. It is essential to use a secure wallet to protect your investments from theft or hacking. Look for wallets that offer two-factor authentication and use encryption to secure your private keys. Avoid using online wallets or exchanges to store your cryptocurrency for extended periods.

3. Be Cautious of Scams

Cryptocurrency scams are becoming increasingly common. Scammers may use social media, email, or other channels to trick investors into sending them cryptocurrency. Be cautious of any offers that seem too good to be true, and always verify the authenticity of the person or platform you are dealing with. Never share your private keys or send cryptocurrency to unknown individuals or platforms.

4. Diversify Your Investments

Diversifying your cryptocurrency investments can help reduce your risk. Do not put all your investments into one cryptocurrency or platform. Instead, spread your investments across different cryptocurrencies and exchanges. This way, if one investment fails, you will not lose all your money.

5. Keep Your Investments Safe

Finally, it is essential to keep your investments safe. Use strong passwords and two-factor authentication to protect your accounts. Keep your private keys and login details safe and secure. Avoid accessing your accounts on public Wi-Fi networks or shared computers.

In conclusion, investing in cryptocurrency can be a lucrative venture, but it is not without risks. By following these top 5 ways to stay safe when investing in cryptocurrency, you can help protect your investments and reduce your risk of losses. Remember to do your research, use a secure wallet, be cautious of scams, diversify your investments, and keep your investments safe.

#cryptocurrencyinvesting#InvestmentTips#CryptoSafety#SecureWallet#CryptocurrencyResearch#ScamPrevention#DiversifyInvestments#InvestmentSecurity#CryptocurrencyTips#CryptoRiskManagement#ProtectYourInvestments#InvestingSafely#CryptoAwareness#InvestmentPrecautions#CryptoEducation#StaySafeWithCrypto#InvestmentAdvice#RiskReduction#cryptocurrencysecurity#investmentstrategies

2 notes

·

View notes

Text

Okay, real talk, the internet is a wild place. And if you’re anything like me, your feed is probably flooded with posts promising easy money and overnight riches. It’s tempting, I get it. The idea of quitting your job and chilling on a beach, all thanks to a “secret” investment, is pretty appealing. But before you dive headfirst into any of those "opportunities," let’s get real about get-rich-quick schemes.

These scams are basically a recipe for disaster. They’re designed to prey on your desire for financial freedom and your impatience for it to happen right away. You have to understand that a real financial future takes work and planning, not a magical system that will make you wealthy overnight.

Let's talk about some common ones that you are likely to see. Pyramid schemes are like a house of cards, with no real product or service, they make money by recruiting new members who pay those at the top. Ponzi schemes rob Peter to pay Paul, using new investors to pay off earlier ones. High-yield investment programs (HYIPs) promise high returns with low risk, but they are often just a thinly veiled excuse to steal your money. And then there are the crypto scams, where you can fall for fake ICOs or pump-and-dump schemes. It is a dangerous world out there, and you need to know how to stay safe.

Social media is full of scammers who are trying to take advantage of you. They make you think that you can get rich overnight by working from home or starting some online business. They are usually just trying to sell you something worthless to take your money. You might see those "influencers" and "gurus" pushing their courses, programs, and services, promising you a luxurious life if you buy what they are selling. It is a complex web of scams, but you can learn to spot them.

So, how do you tell the difference between a real opportunity and a total scam? Well, there are a few red flags you should watch out for. An unrealistic promise of a guaranteed return is a big one. Scammers also often try to pressure you into making a quick decision, using phrases like “limited-time offer.” They also might be unwilling to provide specific information about their business or their investments. Scammers will often also play on your emotions, making you afraid of missing out, or convincing you that you need to be rich. Always trust your gut, because if it feels like a scam, then it probably is.

So how do you avoid getting scammed? Always do your research, and always be skeptical of any offer that promises you wealth overnight. Always seek out independent advice before making an investment decision, from a family member, friend, or financial professional. You need to understand that there are no guarantees in the world of investing, and you need to avoid anyone who claims that they have a risk-free investment.

Always focus on building long-term wealth instead of just focusing on quick money. That means budgeting, saving, making wise investments, and focusing on multiple streams of income. Pay off your debt, stay current with your bills, and do everything you can to stay safe. The goal is to play the long game and build sustainable wealth, not a quick scheme that will ultimately leave you broke.

Remember that scammers are constantly coming up with new methods, so you should always stay up to date on the latest threats. If you have been scammed, report it immediately, so that you can help protect others from becoming a victim of fraud.

Financial security isn’t a quick fix, it’s a long-term commitment. Stay informed, stay skeptical, and stay safe out there.

"Ready to ditch the scams and build some real financial freedom? Check out our full guide on spotting and avoiding get-rich-quick schemes: How to avoid get-rich-quick schemes"

#GenZFinance#FinancialScams#ScamPrevention#InvestingTips#MoneyManagement#WealthBuilding#PersonalFinance#LongTermInvesting#StudentLoans#DigitalLiteracy

0 notes

Text

Privacy Concerns: How Gen Z is Protecting Their Data?

What’s the first thing you do when a pop-up asks, “Do you accept cookies?”—immediately click “Accept” or hesitate as if pondering the secrets of the universe?

If you’re Gen Z, the answer might surprise you. While they’re often labelled as the oversharing Snapchat generation, they’re also becoming the poster children for digital privacy warriors. Want to know how? Stick around. By the end of this blog, you’ll not only uncover Gen Z’s surprising strategies for safeguarding their data but also pick up a few tips to reclaim control of your own.

The Paradox of Gen Z: Masters of Oversharing, Yet Privacy-Conscious

On the surface, Gen Z seems like the generation that lives for Instagram reels, TikTok challenges, and viral tweets. But underneath the filters and hashtags lies a surprising truth: they care—deeply—about their digital footprints. They may post a dance video on TikTok but won’t hesitate to use pseudonyms on Facebook or create private Instagram accounts (finstas) to keep their personal lives personal.

How Did Gen Z Get So Privacy-Savvy?

Growing Up With Data Breaches

From hearing about massive breaches (remember the infamous Cambridge Analytica scandal?) to watching documentaries like The Social Dilemma, Gen Z grew up knowing that even their memes could fuel someone’s data-mining empire. Lesson learned? Share strategically.

Cybersecurity 101 Is Their Second Nature

For this generation, two-factor authentication isn’t optional—it’s a lifestyle. “123456” as a password? Please, that’s so 2010. Gen Z knows their passwords should look like they smashed their keyboard in frustration.

Tech Education in Schools

Unlike older generations, who stumbled their way through the internet’s dark corners, Gen Z often received digital literacy education. They know the difference between a phishing scam and an actual email from their bank. (Pro tip: If it starts with “Dear Customer,” run.)

Privacy Tips We Can All Steal (Ethically, of Course)

Gen Z is showing us the way, and here are some of their best practices:

Think Before You Link

Clicking on that shady “You’ve Won a Free iPhone!” ad is the digital equivalent of walking into a trap. Gen Z gets it—they avoid suspicious links like the plague.

Limit Permissions

Why should a weather app need access to your contacts? Gen Z regularly audits app permissions, keeping unnecessary snoopers at bay.

Use Burners for Fun

They know that creating a “throwaway” email address for subscriptions keeps spam out of their primary inbox.

The Ironic Humor of Gen Z’s Privacy Stance

Isn’t it ironic that the generation branded as addicted to screens is leading the charge for digital privacy? They’ll meme about data breaches but won’t let companies snoop on their Spotify playlists.

Conclusion: A Balancing Act

Gen Z proves you can live your best digital life and protect your data. Whether it’s using VPNs, switching to encrypted messaging apps, or simply saying no to invasive permissions, they’re rewriting the rules for online privacy.

The takeaway? Protecting your data doesn’t mean going off the grid; it means being intentional with your digital choices.

Do you think Gen Z has cracked the code on balancing online presence and privacy, or are they just lucky digital natives? Drop your thoughts in the comments below!

0 notes

Text

How to Spot Life Insurance Scams

Did you know? After health care fraud, life insurance fraud is the second most costly type of insurance fraud. If you're considering a life insurance policy, you need to know how to protect yourself.

To stay safe, make sure the company is reputable and take your time—don’t let anyone rush you into a decision. If a deal sounds too good to be true, it probably is. Always read the fine print and never give out your personal info unless you’re sure. Trust your gut, stay informed, and protect your future.

1 note

·

View note

Photo

💰💡 Discover the top strategies to shield yourself from financial scams! Learn how to outsmart scammers and protect your hard-earned money in our latest blog post. 🛡️🔒 https://cstu.io/89443e

0 notes

Text

#OnlineDatingScams#DatingSafety#StaySafeOnline#ScamAwareness#OnlineSafetyTips#ProtectYourself#DatingRedFlags#AvoidScams#RomanceScams#OnlineDatingAdvice#DatingFraud#SafetyFirst#ScamPrevention#CyberSafety#SafeOnlineDating#DigitalSafety#SpotTheScam#ProtectYourHeart#OnlineDatingTips#DatingSecurity

1 note

·

View note

Text

Protect Your Investments!

Investment scams are on the rise, and investors need to stay vigilant. At TLS Lawyers, we're committed to helping you safeguard your hard-earned money. If you come across any suspicious investment offers, don't hesitate to report them to us. Let's work together to combat fraud and ensure a safer financial future for everyone! Feel free to report any suspicious activities to TLS Lawyers today.

#InvestmentFraudAwareness#StayVigilant#TLSLawyers#FinanceSafety#ScamPrevention#InvestorProtection#FinancialSecurity#FraudPrevention

1 note

·

View note

Text

Beware and Stay Safe: Cryptocurrency Scam Alert

In the digital age, where cryptocurrency offers new opportunities for investment and growth, it is crucial to stay informed and vigilant against the increasing number of scams. That's where Regain Funds LLC comes in. We're dedicated to helping you understand and protect yourself from potential cryptocurrency scams. Our core mission is to provide you with the knowledge and tools needed to identify suspicious activities and safeguard your investments in the crypto world. Regain Funds LLC is at the forefront, offering specialized services tailored to help victims of cryptocurrency scams recover their funds. If you or someone you know has fallen prey to a cryptocurrency scam, don't lose hope. Reach out to us at Regain Funds LLC, and take the first step towards reclaiming what is rightfully yours. Stay smart, stay secure, and remember, you're not alone in this fight against scams. Together, we can create a safer cryptocurrency environment for all. For more information on how to protect yourself and the services we offer, contact us today. Your security is our top priority.

1 note

·

View note

Text

9 Tips to avoid scams

To best protect yourself from scams in the trading world, here are some measures to take:

1 – Lack of information is the investor’s first risk Before trusting any broker, trading platform or automated system, do thorough research. Check their online reputation, read our reviews and those of other users. Don't forget to research information about the company or individual behind the service offered.

2 – Check approvals and regulations Make sure the broker or trading platform is regulated by a recognized financial authority. Regulators provide some protection to investors by ensuring compliance with standards and investigating questionable practices.

💡 Take the reflex to consult the AMF website to check these approvals.

3 – Caution when faced with promises of high returns Be wary of promises of quick and unrealistic returns . Financial markets involve risks, and no so-called “risk-free” investment can guarantee consistent and high gains.

To give you an idea of the aberration that unrealistic returns can represent , here is an example:

A trainer promises you to earn 10% per month This means that an investment of €10,000 over 10 years would earn you… €927,000,000 Yes, almost a billion euros! However, this example allows me to remind you of the power of compound interest. You can use this compound interest calculator to assess the credibility of what you are promised.

4 – Focus on training and education Learn the basics of trading and investing. A solid understanding of financial markets and investment strategies can help you spot potential scams.

🚨 But be careful! Fake training is common and sometimes sold at high prices to appear more “credible”. You can already start with our free 7-day training to get the basics .

5 – Ask for references If you are considering hiring a portfolio manager or investment advisor, ask for references and inquire about their experience and qualifications.

🧐 And above all, cross-reference information because it is very easy to create fake profiles on social networks.

6 – Be particularly wary of unsolicited calls and emails Be cautious of any unsolicited calls or emails urging you to invest money. Scammers often use these methods to target potential investors.

Likewise, a common technique is to pose as an online bank or a well-known neobank (such as Revolut ) in order to offer you particularly attractive investments.

But it is generally enough to go to the website of the bank in question (or our reviews ) to verify that these investments simply do not exist.

7 – Use secure platforms If you trade online, be sure to use secure platforms with adequate encryption to protect your personal and financial information, such as double authentication. This will also make it easier for you to recover your account in the event of a hack.

➡️ We have checked the security of each platform in our comparison of the best brokers & stock brokers .

8 – Consult an independent financial advisor Before making any significant investment decision, consult an independent financial advisor . He will be able to provide you with personalized advice based on your objectives and help you avoid potential pitfalls.

9 – Listen to your instinct If something seems too good to be true, or simply raises doubts, don't rush headlong into it.

Take the time to think and find out more before sending any euro or your banking information.

1 note

·

View note

Link

https://bit.ly/48Tin0X - 🚨 The FBI has issued a warning about a new scam tactic involving couriers who collect cash or precious metals from victims, primarily targeting the elderly. Scammers, posing as tech support, financial advisors, or government officials, deceive victims into liquidating their assets for protection against alleged hacking threats. #ScamAlert #FBISecurity 💸 From May to December last year, these scams resulted in losses exceeding $55 million, with the elderly being the most affected. The FBI's Internet Crime Complaint Center (IC3) received 19,000 complaints in the first half of 2023 alone, with losses totaling around $542 million. Nearly half of these victims were over 60, suffering 66% of the total losses. #SeniorSafety #CyberFraud 🔒 The scammers use sophisticated methods to gain the trust of their victims, often setting up a passcode as a false security measure. Once the assets are handed over, the victims lose all contact with the scammers. This technique is an evolution of the 'phantom hacker scam,' combining impostor tech support with financial and government impersonation. #ConsumerProtection #OnlineScams 📞 Victims typically receive a call to resolve an imaginary problem, leading them to inadvertently grant remote access to their devices. The scammers then exploit this access to check for profitable accounts and instruct victims to transfer funds, often to overseas accounts. #TechSupportScam #CyberAwareness 🛑 To prevent falling victim to these scams, the IC3 advises never purchasing gold or precious metals at the request of supposed government or business representatives. People should protect their personal information, avoid unsolicited communications, and never allow strangers access to their computers. #ScamPrevention #StaySafeOnline 📢 The FBI encourages anyone who suspects such fraudulent activity to report it to the IC3 immediately, providing detailed transaction information to aid in investigations. #ReportFraud #FBIWarning Remember, staying informed and cautious is key to protecting yourself and your loved ones from these sophisticated scams.

#ScamAlert#FBISecurity#SeniorSafety#CyberFraud#ConsumerProtection#OnlineScams#TechSupportScam#CyberAwareness#ScamPrevention#StaySafeOnline#ReportFraud#FBIWarning#preciousmetals#financialadvisor#lastyear#falsesecurity#securitymeasure#tactic#money#metals#tech#advisors#advisor

0 notes

Text

Abstract:If you are into forex, you must be aware that there is a clone of a regulated firm called AMTF. It imitates an authentic firm using all of its details and fools people into believing it is the real one. The name of the clone is options-deskltd.com. Relevant information about a clone firm is provided below. The Financial Conduct Authority also shared the correct details of the firm.

0 notes

Text

Binance Users Targeted in SMS Scam, Exchange Warns Against Spoofing Attacks

Last week, users of Binance fell victim to scammers who sent fake SMS messages claiming they had won prizes in the Binance Mystery Box lottery, with rewards valued at around 100 euros in cryptocurrency. The victims were informed that the offer expired the same day and were urgently advised to claim their winnings by clicking on a link in the SMS. Upon clicking the malicious link, victims were prompted to log in to their Binance accounts and provide the necessary passwords. Binance acknowledged that this scheme represents a typical attempt at a spoofing attack through SMS, where attackers manipulate the message sender to appear as if it is coming from a trusted source. The goal is to deceive victims into following instructions, ultimately leading to the theft of confidential data. Binance stated its inability to combat such fraud since the technologies of the GSM communication system, under which SMS messages operate, allow the sender to arbitrarily fill in the "sender name" field. Mobile operators do not verify whether the sender sending the SMS has the legitimate right to use a specific name. "To close this security loophole in SMS, the whole world would have to modify GSM technology, which seems unrealistic to us," concluded Binance. Earlier, the National Agency of Project Management in Uzbekistan (NAPM) announced that the world's largest cryptocurrency exchange, Binance, would be required to pay a fine for operating in the country without a license. Read the full article

#Binancescam#cryptocurrencyexchange#Cryptocurrencysecurity#Cybersecuritymeasures#Digitalassetprotection#GSMtechnology#Onlinefraud#Scamprevention#SMSphishing#Spoofingattack#Two-factorauthentication(2FA)

0 notes

Text

¡No caigas en estafas de transferencia de dinero!

youtube

Protect yourself from money transfer scams! 💰 Learn how to spot and avoid fraudulent schemes in this eye-opening video. Your financial security is our top priority.

Watch now to stay safe and informed!

#ScamAware#MoneyTransferSafety#StaySecure#AvoidScams#ProtectYourFinances#StayInformed#ScamPrevention#FinancialSecurity#OnlineSafety#FraudProtection#Youtube

0 notes