#Renewable Hydrogen Market

Explore tagged Tumblr posts

Text

Renewable Hydrogen Market in Europe: Growth, Trends, and Opportunities Through 2024-2033

The Renewable Hydrogen Market is at the forefront of the energy transition, with the increasing adoption of renewable hydrogen as a key element in reducing carbon emissions. As Europe continues to lead in renewable energy adoption, both the Europe Green Hydrogen Market and the Renewable Hydrogen Market will play crucial roles in achieving climate targets by providing a clean fuel source for sectors such as transportation and heavy industry.

According to BIS Research, the Europe Green Hydrogen Market is set to grow rapidly from $253.8 million in 2023 to an estimated $42,108.6 million by 2033, with a strong CAGR of 66.72%. This growth is driven by rising investments and Europe's push for net-zero emissions.

Market Growth

The Renewable Green Hydrogen Market in Europe is projected to grow rapidly, fueled by significant investments in hydrogen production facilities and infrastructure. The European Union's ambitious goal of achieving net-zero emissions by 2050 is a major driving factor for this growth, ensuring long-term demand for renewable hydrogen solutions.

Request a free sample report of the Renewable Hydrogen Market

Key Technologies

Electrolysis technology, which produces hydrogen from renewable energy sources, is a critical enabler of market growth. Additionally, fuel cells are increasingly being adopted in the transport sector, offering a clean and efficient alternative to fossil fuels for vehicles and public transportation systems.

Download Complete TOC of the Renewable Hydrogen Market

Demand Drivers

The drive toward carbon neutrality is a major factor pushing renewable hydrogen adoption across Europe. Government initiatives, including the European Green Deal, are creating a supportive regulatory environment, encouraging investments and innovation in the market.

Get more insight on Advanced materials chemicals

Proton Exchange Membrane (PEM) Electrolyzer Leading the Market

The Proton Exchange Membrane (PEM) electrolyzer is dominating the market due to its high efficiency, fast response time, and suitability for renewable energy integration. Its ability to operate under variable power loads makes it ideal for hydrogen production in conjunction with renewable energy sources like solar and wind.

Key Market Players

Some prominent key players established in the market are:

• Linde plc • Air Liquide • Engie • Uniper SE • Siemens Energy • Green Hydrogen Systems • Nel ASA • Aker Horizons • HY2GEN AG

Conclusion

The Renewable Hydrogen Market in Europe is positioned for rapid growth through 2024-2033, supported by strong government policies and significant investments. As electrolysis and fuel cell technologies advance, renewable hydrogen will become a key pillar in Europe's efforts to achieve carbon neutrality. With major players leading innovation, the market is set to play a crucial role in the region's energy transition and decarbonization goals.

BIS Research, recognized as a best market research company, provides premium market intelligence reports on deep technologies poised to cause significant market disruption in the coming years.

At BIS Research, we focus exclusively on technologies related to precision medicine, medical devices, diagnostics, life sciences, artificial intelligence (AI), machine learning (ML), Internet of Things (IoT), big data analysis, blockchain technology, 3D printing, advanced materials and chemicals, agriculture and FoodTech, mobility, robotics and UAVs, and aerospace and defense, among others

0 notes

Text

Green Ammonia Market Statistics, Segment, Trends and Forecast to 2033

The Green Ammonia Market: A Sustainable Future for Agriculture and Energy

As the world pivots toward sustainable practices, the green ammonia market is gaining momentum as a crucial player in the transition to a low-carbon economy. But what exactly is green ammonia, and why is it so important? In this blog, we'll explore the green ammonia market, its applications, benefits, and the factors driving its growth.

Request Sample PDF Copy:https://wemarketresearch.com/reports/request-free-sample-pdf/green-ammonia-market/1359

What is Green Ammonia?

Green ammonia is ammonia produced using renewable energy sources, primarily through the electrolysis of water to generate hydrogen, which is then combined with nitrogen from the air. This process eliminates carbon emissions, setting green ammonia apart from traditional ammonia production, which relies heavily on fossil fuels.

Applications of Green Ammonia

Agriculture

One of the most significant applications of green ammonia is in agriculture. Ammonia is a key ingredient in fertilizers, and its sustainable production can help reduce the carbon footprint of farming. By using green ammonia, farmers can produce food more sustainably, supporting global food security while minimizing environmental impact.

Energy Storage

Green ammonia can also serve as an effective energy carrier. It can be synthesized when there is surplus renewable energy and later converted back into hydrogen or directly used in fuel cells. This capability makes it an attractive option for balancing supply and demand in renewable energy systems.

Shipping Fuel

The maritime industry is under increasing pressure to reduce emissions. Green ammonia has emerged as a potential zero-emission fuel for ships, helping to decarbonize one of the most challenging sectors in terms of greenhouse gas emissions.

Benefits of Green Ammonia

Environmental Impact

By eliminating carbon emissions during production, green ammonia significantly reduces the environmental impact associated with traditional ammonia. This aligns with global efforts to combat climate change and achieve sustainability goals.

Energy Security

Investing in green ammonia can enhance energy security. As countries strive to reduce their dependence on fossil fuels, green ammonia offers a renewable alternative that can be produced locally, minimizing reliance on imported fuels.

Economic Opportunities

The growth of the green ammonia market presents numerous economic opportunities, including job creation in renewable energy sectors, research and development, and new supply chain dynamics. As demand increases, investments in infrastructure and technology will drive innovation.

Factors Driving the Growth of the Green Ammonia Market

Regulatory Support

Governments worldwide are implementing policies and incentives to promote the adoption of green technologies. These regulations often include subsidies for renewable energy production and carbon pricing mechanisms, making green ammonia more competitive.

Rising Demand for Sustainable Solutions

With consumers and businesses becoming increasingly aware of their environmental impact, the demand for sustainable solutions is on the rise. Green ammonia aligns with this trend, providing an eco-friendly alternative to traditional ammonia.

Advancements in Technology

Ongoing advancements in electrolysis and ammonia synthesis technologies are making the production of green ammonia more efficient and cost-effective. As these technologies mature, they will further enhance the viability of green ammonia in various applications.

Conclusion

The green ammonia market represents a promising avenue for sustainable development across agriculture, energy, and transportation sectors. As technology advances and regulatory support strengthens, green ammonia is poised to become a cornerstone of the global transition to a greener economy. Investing in this market not only contributes to environmental preservation but also opens up new economic opportunities for innovation and growth.

#The Green Ammonia Market: A Sustainable Future for Agriculture and Energy#As the world pivots toward sustainable practices#the green ammonia market is gaining momentum as a crucial player in the transition to a low-carbon economy. But what exactly is green ammon#and why is it so important? In this blog#we'll explore the green ammonia market#its applications#benefits#and the factors driving its growth.#Request Sample PDF Copy:https://wemarketresearch.com/reports/request-free-sample-pdf/green-ammonia-market/1359#What is Green Ammonia?#Green ammonia is ammonia produced using renewable energy sources#primarily through the electrolysis of water to generate hydrogen#which is then combined with nitrogen from the air. This process eliminates carbon emissions#setting green ammonia apart from traditional ammonia production#which relies heavily on fossil fuels.#Applications of Green Ammonia#Agriculture#One of the most significant applications of green ammonia is in agriculture. Ammonia is a key ingredient in fertilizers#and its sustainable production can help reduce the carbon footprint of farming. By using green ammonia#farmers can produce food more sustainably#supporting global food security while minimizing environmental impact.#Energy Storage#Green ammonia can also serve as an effective energy carrier. It can be synthesized when there is surplus renewable energy and later convert#Shipping Fuel#The maritime industry is under increasing pressure to reduce emissions. Green ammonia has emerged as a potential zero-emission fuel for shi#helping to decarbonize one of the most challenging sectors in terms of greenhouse gas emissions.#Benefits of Green Ammonia#Environmental Impact#By eliminating carbon emissions during production#green ammonia significantly reduces the environmental impact associated with traditional ammonia. This aligns with global efforts to combat

0 notes

Text

Electrolyzers Market is expected to reach USD 57.2 billion by 2030 from USD 0.5 billion in 2023 at a CAGR of 97.7% during the 2023–2030 period according to a new report by MarketsandMarkets™. The growing demand for cleaner fuels is one of the major factors driving the electrolyzers market. Global electrolyzers demand has been increasing gradually due to goals set to achieve net zero emissions in recent years. Governments worldwide are taking proactive measures to establish the necessary infrastructure for the development of green hydrogen, with a notable focus in Asia and the European Union, alongside select American and Middle Eastern nations. The increasing investment and funding landscape have emerged as formidable catalysts propelling the electrolyzer market into a phase of rapid expansion and technological evolution. Nations have incorporated electrolyzer targets into their hydrogen strategies. With the spotlight on green hydrogen intensifying as a linchpin in the roadmap toward a net-zero future which presents a significant opportunity for the Electrolyzers Market.

#electrolyzers#electrolyzer#electrolyzers market#electrolyzer market#hydrogen electrolyzer market#energia#energy#power generation#renewable power#renewableenergy#renewable resources#greenammonia#green hydrogen production#green energy#green hydrogen#hydrogen technologies#hydrogen storage#hydrogen#hydrogeneconomy#hydrogene#sustainable energy#sustainability#sustainable

0 notes

Text

What are the types of Hydrogen?

#hydrogen#hydrogen energy storage market#hydrogen fuel cell#solar energy#solar panels#renewable#solar cells#renewable resources#solar cell#hydrogen fuel companies#hydrogen fuel stations#instrumentation#green energy#solar panel

0 notes

Text

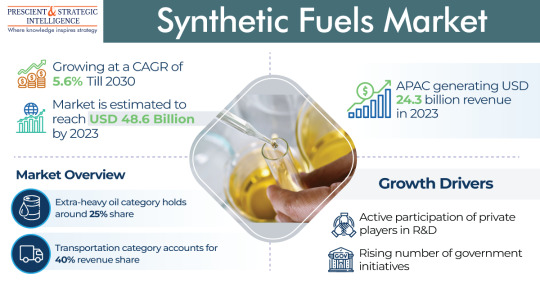

What Are Synthetic Fuels Or E-Fuels?

In labs throughout Europe and the Americas, researchers are busy investigating substitutions to fossil fuels. Besides the harmful releases and intensifying costs of petroleum items, recent geopolitical instability in the east of Europe has additional pressure on looking for new power sources. So, what types of synthetic fuels are in progress today? What Are Synthetic Fuels? Synthetic fuels,…

View On WordPress

#Biomass#Carbon Capture#Energy Transition#Fischer-Tropsch Synthesis#Greenhouse Gas Emissions#Hydrogen#Key players#Market dynamics#Power-to-Liquid#Regulatory frameworks#Renewable Sources#Synthetic Fuels Market

0 notes

Text

The global Blue Hydrogen Market is projected to grow from USD 18.2 billion in 2022 to USD 44.5 billion by 2030, at a CAGR of 11.9% according to a new report by MarketsandMarkets™.

#blue hydrogen market#energy#power#power generation#utilities#renewable energy#renewable#hydrogen#hydrogen fuel#hydrogen car#hydrogen fuel cells#hydrogen production#hydrogen storage#hydrogen economy#hydrogen fuel companies#hydrogen fueling technology#hydrogen energy storage market

0 notes

Text

Hydrogen Bank stimulates decarbonisation process

The EU Hydrogen Bank started offering 800 million euros to hydrogen producers to stimulate demand for the fuel critical for industrial decarbonisation.

Europe aims to produce 10 million tonnes of renewable hydrogen annually by 2030. Brussels plans to help companies switch by compensating them for the difference between their ability to pay and the high prices charged by producers of clean-burning gas.

The EU’s new Green Deal chief, Maroš Šefčovič, stated at the launch on November 23:

“Today’s launch is about connecting supply and demand for renewable hydrogen.”

Using revenue generated from the EU carbon price, €80 per tonne, the “hydrogen bank” will match suppliers with off-takers and smooth over price differences.

It is about creating transparency about price points, which will help kickstart a European hydrogen market.

Learn more HERE

#world news#world politics#news#europe#european news#european union#eu politics#eu news#eu economy#hydrogen economy#hydrogen production#hydrogen energy storage market#renewable power#renewable energy#renewable resources#renewable electricity#energy#renewableenergy#renewableresources#renewablehydrogen#renewablefuture#energy production#energy independence#energy industry

0 notes

Text

Hydrogen Fuel Cells for Vehicles Market Demand, Overview Analysis Opportunities, Segmentation, Assessment and Competitive Strategies by 2032

Market Overview:

The automotive industry sector that focuses on automobiles with hydrogen fuel cells is known as the hydrogen fuel cells for vehicles market. Fuel cell vehicles (FCVs) burn hydrogen gas as their fuel source, which is then transformed into electricity in the fuel cell stack via a chemical reaction. The only byproduct of this electricity's use, which is to power the vehicle, is water vapour.

The global market size and share for hydrogen fuel cells for vehicles (HFCV) was estimated at USD 1.51 billion in 2022 and is expected to grow at a CAGR of 45.2% to reach USD 62.88 billion by 2032, according to Stringent Datalytics.

Key Factors: Several key factors are driving the growth of the hydrogen fuel cells for vehicles market:

Environmental issues and emission controls: As worries about climate change and air pollution continue to grow, there is an increasing need to cut back on greenhouse gas emissions from transportation. Vehicles powered by hydrogen fuel cells are more environmentally friendly than conventional internal combustion engines since they produce no emissions.

Governments and energy corporations all around the world are actively looking for methods to diversify their energy sources and lessen their dependency on fossil fuels. Renewable hydrogen can be produced from sources like electrolysis of water using renewable energy. This hydrogen can be used to power hydrogen fuel cells. This encourages the transportation sector's decarbonization.

Improvements in fuel cell technology: The performance, durability, and efficiency of fuel cells have all seen significant improvements. These developments have led to increased driving range, shorter refuelling times, and improvedoverall vehicle performance, making hydrogen fuel cell vehicles a more viable option for consumers.

Demand:

As the technology improves and public awareness rises, there is a progressive rise in the demand for hydrogen fuel cells for automobiles.

In addition, sectors with a strong focus on sustainability, like public transport, delivery services, and commercial fleets, are showing interest in adopting hydrogen fuel cell vehicles due to their long driving range and minimal environmental impact.

While the market is still in its early stages, several nations, including Japan, South Korea, Germany, and China, have made significant investments and set targets for the deployment of FCVs.

To satisfy the expanding demand and realise the promise of hydrogen fuel cells for automobiles, manufacturers, infrastructure builders, and other market participants should continue to invest in research and development, collaborate on creating hydrogen infrastructure, and strive towards cost reductions.

Referrals to our Stringent datalytics company, trade journals, and websites that focus on market reports are encouraged. These sources frequently include thorough research, market trends, growth projections, competition analysis, and other insightful information about this market.

You can investigate the availability of particular reports linked to this market by going to our website or getting in touch with us directly. We offer thorough and in-depth information that might be helpful for businesses, investors, and individuals interested in this industry, but these reports frequently need a purchase or membership.

“Remember to look for recent reports to ensure you have the most current and relevant information.”

Click Here, To Get Free Sample Report: https://stringentdatalytics.com/sample-request/hydrogen-fuel-cells-for-vehicles-market/10153/

Market Segmentations:

Global Hydrogen Fuel Cells for Vehicles Market: By Company

• Plug Power

• Ballard

• Sunrise Power

• Panasonic

• Vision Group

• Nedstack PEM Fuel Cells

• Shenli Hi-Tech

• Altergy Systems

• Horizon Fuel Cell Technologies

• Foresight

• SerEnergy

• SFC Energy

• Beijing Sinohytec Co.,Ltd.

• Stellantis

• Cummins

• Guangdong Liyuan Technology Co., Ltd

Global Hydrogen Fuel Cells for Vehicles Market: By Power

• Below 80KW

• 80-120KW

• 120-150KW

• 150-240KW

• Above 240KW

Global Hydrogen Fuel Cells for Vehicles Market: By Application

• Passenger Cars

• Commercial Vehicles

Global Hydrogen Fuel Cells for Vehicles Market: Regional Analysis

The regional analysis of the global Hydrogen Fuel Cells for Vehicles market provides insights into the market's performance across different regions of the world. The analysis is based on recent and future trends and includes market forecast for the prediction period. The countries covered in the regional analysis of the Hydrogen Fuel Cells for Vehicles market report are as follows:

North America: The North America region includes the U.S., Canada, and Mexico. The U.S. is the largest market for Hydrogen Fuel Cells for Vehicles in this region, followed by Canada and Mexico. The market growth in this region is primarily driven by the presence of key market players and the increasing demand for the product.

Europe: The Europe region includes Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe. Germany is the largest market for Hydrogen Fuel Cells for Vehicles in this region, followed by the U.K. and France. The market growth in this region is driven by the increasing demand for the product in the automotive and aerospace sectors.

Asia-Pacific: The Asia-Pacific region includes Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, and Rest of Asia-Pacific. China is the largest market for Hydrogen Fuel Cells for Vehicles in this region, followed by Japan and India. The market growth in this region is driven by the increasing adoption of the product in various end-use industries, such as automotive, aerospace, and construction.

Middle East and Africa: The Middle East and Africa region includes Saudi Arabia, U.A.E, South Africa, Egypt, Israel, and Rest of Middle East and Africa. The market growth in this region is driven by the increasing demand for the product in the aerospace and defense sectors.

South America: The South America region includes Argentina, Brazil, and Rest of South America. Brazil is the largest market for Hydrogen Fuel Cells for Vehicles in this region, followed by Argentina. The market growth in this region is primarily driven by the increasing demand for the product in the automotive sector.

Visit Report Page for More Details: https://stringentdatalytics.com/reports/hydrogen-fuel-cells-for-vehicles-market/10153/

Reasons to Purchase Hydrogen Fuel Cells for Vehicles Market Report:

• To gain insights into market trends and dynamics: this reports provide valuable insights into industry trends and dynamics, including market size, growth rates, and key drivers and challenges.

• To identify key players and competitors: this research reports can help businesses identify key players and competitors in their industry, including their market share, strategies, and strengths and weaknesses.

• To understand consumer behavior: this research reports can provide valuable insights into consumer behavior, including their preferences, purchasing habits, and demographics.

• To evaluate market opportunities: this research reports can help businesses evaluate market opportunities, including potential new products or services, new markets, and emerging trends.

About US:

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs

Contact US:

Stringent Datalytics

Contact No - +1 346 666 6655

Email Id - [email protected]

Web - https://stringentdatalytics.com/

#Vehicle Electrification#Renewable Energy#Hydrogen Infrastructure#Market Insights#Fuel Cell Technology#Market Forecast#Clean Energy Solutions#Transportation Industry#Sustainable Fuel#Zero-Emission Vehicles#Future Mobility#Fuel Cell Market#Vehicle Technology#Hydrogen-Powered Vehicles#Sustainable Transport#Fuel Cell Development#Environmental Sustainability

0 notes

Text

Harnessing Energy Transformation: Exploring the Power-to-Gas Market Potential

Power-to-Gas Market

The Power-to-Gas Market is at the forefront of the energy transition, offering a transformative solution for storing and utilizing surplus renewable energy. As the world pivots toward sustainable energy systems, Power-to-Gas technology is emerging as a game-changer in the pursuit of a cleaner and more resilient energy landscape.

Power-to-Gas: A Paradigm Shift in Energy Storage

The Power-to-Gas Market revolves around a cutting-edge concept: converting surplus electricity from renewable sources, such as wind and solar, into chemical energy carriers like hydrogen or methane. This innovative technology addresses one of the most critical challenges of renewable energy integration - the intermittency of sources like wind and solar. By storing excess energy during peak production periods and converting it back to electricity or heat when needed, Power-to-Gas bridges the gap between supply and demand.

Market Dynamics and Diverse Applications

The Power-To-Gas Market dynamics are rooted in its diverse applications across different sectors. One of its primary applications is in energy storage. Excess renewable energy can be converted into hydrogen through electrolysis, which can then be stored for future use. Additionally, hydrogen produced through Power-to-Gas can serve as a clean fuel for various industries, including transportation, industry, and heating.

Advancing Renewable Integration and Decarbonization

As the world accelerates its transition towards renewable energy, the Power-to-Gas technology is playing a pivotal role in realizing this vision. It acts as a buffer, ensuring that surplus energy isn't wasted and enabling the grid to handle fluctuations in renewable energy generation. Moreover, Power-to-Gas contributes to decarbonization efforts by producing clean hydrogen, which can replace fossil fuels in industrial processes and transportation.

Overcoming Challenges and Scaling Up

While the potential of Power-to-Gas is immense, the Power-To-Gas Market isn't without its challenges. The cost of producing hydrogen through electrolysis and the limited availability of infrastructure are areas that require attention. However, ongoing research and development are gradually driving down costs and paving the way for broader adoption. Government incentives and policy support are also crucial in accelerating market growth and creating an enabling environment for Power-to-Gas technologies.

Future Outlook: Transforming the Energy Landscape

The Power-to-Gas Market's future outlook is marked by optimism and innovation. As the world strives to achieve ambitious climate goals, the demand for flexible energy storage solutions will only increase. Power-to-Gas not only addresses energy storage challenges but also aligns with the broader goal of creating integrated energy systems that are cleaner, more resilient, and capable of accommodating the dynamic nature of renewable energy sources.

In conclusion, the Power-to-Gas Market embodies the essence of the energy transition - a shift toward sustainable, flexible, and decarbonized energy systems. As technology advances, costs decrease, and policies evolve, Power-to-Gas has the potential to revolutionize the way we store and utilize energy, paving the way for a greener and more sustainable future.

#Power-to-Gas Market#energy transition#renewable integration#energy storage solutions#electrolysis technology#hydrogen production#decarbonization efforts#renewable energy systems#grid flexibility#sustainable energy#policy support#market challenges#innovative technologies#climate goals

0 notes

Text

The Best News of Last Year

1. Belgium approves four-day week and gives employees the right to ignore their bosses after work

Workers in Belgium will soon be able to choose a four-day week under a series of labour market reforms announced on Tuesday.

The reform package agreed by the country's multi-party coalition government will also give workers the right to turn off work devices and ignore work-related messages after hours without fear of reprisal.

"We have experienced two difficult years. With this agreement, we set a beacon for an economy that is more innovative, sustainable and digital. The aim is to be able to make people and businesses stronger," Belgian prime minister Alexander de Croo told a press conference announcing the reform package.

2. Spain makes it a crime for pro-lifers to harass people outside abortion clinics

Spain has criminalized the harassment or intimidation of women going for an abortion under new legislation approved on Wednesday by the Senate. The move, which involved changes to the penal code, means anti-abortion activists who try to convince women not to terminate their pregnancies could face up to a year behind bars.

3. House passes bill to federally decriminalize marijuana

The House has voted with a slim bipartisan majority to federally decriminalize marijuana. The vote was 220 to 204.

The bill, sponsored by Democratic Rep. Jerry Nadler of New York, will prevent federal agencies from denying federal workers security clearances for cannabis use, and will allow the Veterans’ Administration to recommend medical marijuana to veterans living with posttraumatic stress disorder.

The bill also expunges the record of people convicted of non-violent cannabis offenses, which House Majority Leader Steny Hoyer said, “can haunt people of color and impact the trajectory of their lives and career indefinitely.”

4. France makes birth control free for all women under 25

The scheme, which could benefit three million women, covers the pill, IUDs, contraceptive patches and other methods composed of steroid hormones.

Contraception for minors was already free in France. Several European countries, including Belgium, Germany, the Netherlands and Norway, make contraception free for teens.

5. The 1st fully hydrogen-powered passenger train service is now running in Germany. The only emissions are steam & condensed water.

Five of the trains started running in August. Another nine will be added in the coming months to replace 15 diesel trains on the regional route. Alstom says the Coradia iLint has a range of 1,000 kilometers, meaning that it can run all day on the line using a single tank of hydrogen. A hydrogen filling station has been set up on the route between Cuxhaven, Bremerhaven, Bremervörde and Buxtehude.

6. Princeton will cover all tuition costs for most families making under $100,000 a year, after getting rid of student loans

In September, the New Jersey Ivy League school announced it would be expanding its financial aid program to offer free tuition, including room and board, for most families whose annual income is under $100,000 a year. Previously, the same benefit was offered to families making under $65,000 a year. This new income limit will take effect for all undergraduates starting in the fall of 2023.

Princeton was also the first school in the US to eliminate student loans from its financial aid packages.

7. Humpback whales no longer listed as endangered after major recovery

Humpback whales will be removed from Australia's threatened-species list, after the government's independent scientific panel on threatened species deemed the mammals had made a major recovery. Humpback whales will no longer be considered an endangered or vulnerable species.

Climate change and fishing still pose threats to their long-term health.

Some other uplifting news from last year:

A Cancer Trial’s Unexpected Result: Remission in Every Patient

California 100 percent powered by renewables for first time

Israel formally bans LGBTQ conversion therapy

Tokyo Passes Law to Recognize Same-Sex Partnerships

First 100,000 KG Removed From the Great Pacific Garbage Patch

As we ring in the New Year let’s remember to focus on the good news. May this be a year of even more kindness and generosity. Wishing everyone a happy and healthy 2023!

Thank you for following and supporting this g this newsletter

Buy me a coffee ❤️

1K notes

·

View notes

Text

Hydrogen is viewed as a promising alternative to fossil fuel, but the methods used to make it either generate too much carbon dioxide or are too expensive. Rice University researchers have found a way to harvest hydrogen from plastic waste using a low-emissions method that could more than pay for itself. "In this work, we converted waste plastics -- including mixed waste plastics that don't have to be sorted by type or washed -- into high-yield hydrogen gas and high-value graphene," said Kevin Wyss, a Rice doctoral alumnus and lead author on a study published in Advanced Materials. "If the produced graphene is sold at only 5% of current market value -- a 95% off sale! -- clean hydrogen could be produced for free." By comparison, 'green' hydrogen -- produced using renewable energy sources to split water into its two component elements -- costs roughly $5 for just over two pounds. Though cheaper, most of the nearly 100 million tons of hydrogen used globally in 2022 was derived from fossil fuels, its production generating roughly 12 tons of carbon dioxide per ton of hydrogen.

Read more.

36 notes

·

View notes

Text

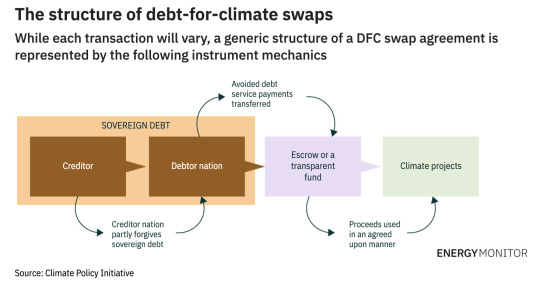

One country in the [climate-change] firing line is Cape Verde. The West African island nation, where 80% of the population lives on the coast, is already feeling the brunt of rising sea levels and increasing ocean acidity on its infrastructure, tourism, biodiversity and fisheries.

The country desperately needs to both mitigate and adapt to these problems, but – as with many Global South countries at present – simply lacks the budget to do it: Cape Verde’s debt reached an all-time high of 157% of GDP in 2021.

In a bid to address both issues simultaneously, the country has signed a novel agreement with Portugal to swap some of its debt for investments into an environmental and climate fund. The former Portuguese colony owes the Portuguese state €140m ($148m) and Portuguese banks €400m.

On a state visit to Cape Verde on 23 January, Portuguese Prime Minister António Costa announced the debt would be put towards Cape Verde’s energy transition and fight against climate change. Costa earmarked projects involving energy efficiency, renewable energy and green hydrogen as possible targets for the fund.

“This is a new seed that we sow in our future cooperation,” said Costa. “Climate change is a challenge that takes place on a global scale and no country will be sustainable if all countries are not sustainable.”

“Debt-for-climate swaps” allow countries to reduce their debt obligations in exchange for a commitment to finance domestic climate and nature projects with the freed-up financial resources. The concept has been knocking about since the 1980s, typically geared at nature conservation. However, after recent deals for Barbados, Belize and the Seychelles, and huge $800m and $1bn agreements in the offing for Ecuador and Sri Lanka, is this financial instrument finally coming of age?

How It Works

Debt-for-climate swaps typically follow a formula. First, a creditor [here, a group or government that money is owed to] agrees to reduce debt, either by converting it into local currency, lowering the interest rate, writing off some of the debt, or a combination of all three. The debtor will then use the saved money for initiatives aimed at increasing climate resilience, lowering greenhouse gas emissions or protecting biodiversity.

The original 'debt-for-nature swaps' began as small, trilateral deals, with NGOs buying sovereign debt owed to commercial banks to redirect payments towards nature projects. They have since evolved into larger, bilateral deals between creditors and debtors...

Debt-for-climate swaps free up fiscal resources so governments can improve resilience and transition to a low-carbon economy without causing a fiscal crisis or sacrificing spending on other development priorities. [These swaps] can create additional revenue for countries with valuable biodiversity or carbon sinks by allowing them to charge others to protect those assets, thereby providing a global public good.

Swaps can even result in an upgrade to a country’s sovereign credit rating, as was the case in Belize, which makes government borrowing cheaper [and improves the country's economy.]

Right now, these [swaps] are needed more than ever, with low-income countries dealing with multiple crises that have put huge pressure on public debt...

Debt-for-climate swaps: “Increasing in size and scale”

Although debt-for-climate swaps are not new, until recently the amount of finance raised globally from the instrument has been modest – just $1bn between 1987 and 2003, according to one OECD study. Just three of the 140 swaps over the past 35 years have had a value of more than $250m, according to the African Development Bank. The average size was a mere $26.6m.

However, the market has steadily picked up pace over the past two decades... In 2016, the government of the Seychelles signed a landmark agreement with developed nation creditor group the Paris Club, supported by NGO The Nature Conservancy (TNC), for a $22m investment in marine conservation.

The government of Belize followed suit in 2021 by issuing a $364m blue bond – a debt instrument to finance marine and ocean-focused sustainability projects – to buy back $550m of commercial debt to use for marine conservation and debt sustainability.

Then, last year, Barbados completed a $150m transaction, supported by the TNC and the Inter-American Development Bank, allowing the country to reduce its borrowing costs and use savings to finance marine conservation.

“Two or three years ago, we were talking about $50m deals,” says Widge. “Now they have gone to $250–300m, so they are definitely increasing in size and scale.”

Indeed, the success of the deals for the Seychelles, Belize and Barbados, along with the debt distress sweeping across the Global South, has sparked an uptick of interest in the model.

Ecuador is reported to be in negotiations with banks and a non-profit for an $800m deal, and Sri Lanka is discussing a $1bn transaction – which would be the biggest swap to date."

-via Energy Monitor, 2/1/23

Note: I'm leaving out my massive rant about how the vast majority of this debt is due to the damages of colonialism. And also countries being forced to "PAY BACK" COLONIZERS FOR THEIR OWN FREEDOM for decades or in some cases centuries (particularly infuriating example: Haiti). Debt-for-climate swaps are good news, and one way to help right this massive historic and ongoing economic wrong

#climate change#developing countries#economics#debt for climate#debt relief#cape verde#barbados#seychelles#ecuador#sri lanka#portugal#belize#global south#conservation#biodiversity#good news#hope#international politics

52 notes

·

View notes

Text

The global Fuel Cell Generator Market is projected to reach USD 2.1 billion in 2030 from USD 0.4 billion in 2023 at a CAGR of 25.4% according to a new report by MarketsandMarkets™. The chemical energy of a fuel is converted directly into electricity by a fuel cell generator, which is an electrical power generation system that makes use of fuel cell technology. It is made up of a stack of fuel cells and any supporting plant balance parts. Hydrogen is the most typical fuel used in fuel cell generators, while other fuels can also be utilized. Depending on the precise type of fuel cell technology being used, other fuels like methanol or ammonia can also be utilized.

#hybrid power systems#hybrid power system#hydrogen fuel cell vehicle#fuel cell electric vehicles#hydrogen fuel cell#hydrogen fuel cells#fuel cell#fuel cell generator#fuel cell generators#fuel cell generator market#hydrogen#hydrogene#hydrogen technologies#energy#energia#power generation#renewable power#renewableenergy#renewables#renewable hydrogen#utility#utilities#generators#energy generation

0 notes

Text

ESSEN, Germany (AP) — For most of this century, Germany racked up one economic success after another, dominating global markets for high-end products like luxury cars and industrial machinery, selling so much to the rest of the world that half the economy ran on exports.

Jobs were plentiful, the government's financial coffers grew as other European countries drowned in debt, and books were written about what other countries could learn from Germany.

No longer. Now, Germany is the world’s worst-performing major developed economy, with both the International Monetary Fund and European Union expecting it to shrink this year.

It follows Russia's invasion of Ukraine and the loss of Moscow's cheap natural gas — an unprecedented shock to Germany’s energy-intensive industries, long the manufacturing powerhouse of Europe.

The sudden underperformance by Europe's largest economy has set off a wave of criticism, handwringing and debate about the way forward.

Germany risks “deindustrialization” as high energy costs and government inaction on other chronic problems threaten to send new factories and high-paying jobs elsewhere, said Christian Kullmann, CEO of major German chemical company Evonik Industries AG.

From his 21st-floor office in the west German town of Essen, Kullmann points out the symbols of earlier success across the historic Ruhr Valley industrial region: smokestacks from metal plants, giant heaps of waste from now-shuttered coal mines, a massive BP oil refinery and Evonik's sprawling chemical production facility.

These days, the former mining region, where coal dust once blackened hanging laundry, is a symbol of the energy transition, dotted with wind turbines and green space.

The loss of cheap Russian natural gas needed to power factories “painfully damaged the business model of the German economy,” Kullmann told The Associated Press. “We’re in a situation where we’re being strongly affected — damaged — by external factors.”

After Russia cut off most of its gas to the European Union, spurring an energy crisis in the 27-nation bloc that had sourced 40% of the fuel from Moscow, the German government asked Evonik to keep its 1960s coal-fired power plant running a few months longer.

The company is shifting away from the plant — whose 40-story smokestack fuels production of plastics and other goods — to two gas-fired generators that can later run on hydrogen amid plans to become carbon neutral by 2030.

One hotly debated solution: a government-funded cap on industrial electricity prices to get the economy through the renewable energy transition.

The proposal from Vice Chancellor Robert Habeck of the Greens Party has faced resistance from Chancellor Olaf Scholz, a Social Democrat, and pro-business coalition partner the Free Democrats. Environmentalists say it would only prolong reliance on fossil fuels.

Kullmann is for it: “It was mistaken political decisions that primarily developed and influenced these high energy costs. And it can’t now be that German industry, German workers should be stuck with the bill.”

The price of gas is roughly double what it was in 2021, hurting companies that need it to keep glass or metal red-hot and molten 24 hours a day to make glass, paper and metal coatings used in buildings and cars.

A second blow came as key trade partner China experiences a slowdown after several decades of strong economic growth.

These outside shocks have exposed cracks in Germany's foundation that were ignored during years of success, including lagging use of digital technology in government and business and a lengthy process to get badly needed renewable energy projects approved.

Other dawning realizations: The money that the government readily had on hand came in part because of delays in investing in roads, the rail network and high-speed internet in rural areas. A 2011 decision to shut down Germany's remaining nuclear power plants has been questioned amid worries about electricity prices and shortages. Companies face a severe shortage of skilled labor, with job openings hitting a record of just under 2 million.

And relying on Russia to reliably supply gas through the Nord Stream pipelines under the Baltic Sea — built under former Chancellor Angela Merkel and since shut off and damaged amid the war — was belatedly conceded by the government to have been a mistake.

Now, clean energy projects are slowed by extensive bureaucracy and not-in-my-backyard resistance. Spacing limits from homes keep annual construction of wind turbines in single digits in the southern Bavarian region.

A 10 billion-euro ($10.68 billion) electrical line bringing wind power from the breezier north to industry in the south has faced costly delays from political resistance to unsightly above-ground towers. Burying the line means completion in 2028 instead of 2022.

Massive clean energy subsidies that the Biden administration is offering to companies investing in the U.S. have evoked envy and alarm that Germany is being left behind.

“We’re seeing a worldwide competition by national governments for the most attractive future technologies — attractive meaning the most profitable, the ones that strengthen growth,” Kullmann said.

He cited Evonik’s decision to build a $220 million production facility for lipids — key ingredients in COVID-19 vaccines — in Lafayette, Indiana. Rapid approvals and up to $150 million in U.S. subsidies made a difference after German officials evinced little interest, he said.

“I'd like to see a little more of that pragmatism ... in Brussels and Berlin,” Kullmann said.

In the meantime, energy-intensive companies are looking to cope with the price shock.

Drewsen Spezialpapiere, which makes passport and stamp paper as well as paper straws that don't de-fizz soft drinks, bought three wind turbines near its mill in northern Germany to cover about a quarter of its external electricity demand as it moves away from natural gas.

Specialty glass company Schott AG, which makes products ranging from stovetops to vaccine bottles to the 39-meter (128-foot) mirror for the Extremely Large Telescope astronomical observatory in Chile, has experimented with substituting emissions-free hydrogen for gas at the plant where it produces glass in tanks as hot as 1,700 degrees Celsius.

It worked — but only on a small scale, with hydrogen supplied by truck. Mass quantities of hydrogen produced with renewable electricity and delivered by pipeline would be needed and don't exist yet.

Scholz has called for the energy transition to take on the “Germany tempo,” the same urgency used to set up four floating natural gas terminals in months to replace lost Russian gas. The liquefied natural gas that comes to the terminals by ship from the U.S., Qatar and elsewhere is much more expensive than Russian pipeline supplies, but the effort showed what Germany can do when it has to.

However, squabbling among the coalition government over the energy price cap and a law barring new gas furnaces has exasperated business leaders.

Evonik's Kullmann dismissed a recent package of government proposals, including tax breaks for investment and a law aimed at reducing bureaucracy, as “a Band-Aid.”

Germany grew complacent during a “golden decade” of economic growth in 2010-2020 based on reforms under Chancellor Gerhard Schroeder in 2003-2005 that lowered labor costs and increased competitiveness, says Holger Schmieding, chief economist at Berenberg bank.

“The perception of Germany's underlying strength may also have contributed to the misguided decisions to exit nuclear energy, ban fracking for natural gas and bet on ample natural gas supplies from Russia,” he said. “Germany is paying the price for its energy policies.”

Schmieding, who once dubbed Germany “the sick man of Europe” in an influential 1998 analysis, thinks that label would be overdone today, considering its low unemployment and strong government finances. That gives Germany room to act — but also lowers the pressure to make changes.

The most important immediate step, Schmieding said, would be to end uncertainty over energy prices, through a price cap to help not just large companies, but smaller ones as well.

Whatever policies are chosen, “it would already be a great help if the government could agree on them fast so that companies know what they are up to and can plan accordingly instead of delaying investment decisions," he said.

7 notes

·

View notes

Text

Exploring the Dynamics of the Synthetic Fuels Market: A Sustainable Energy Solution

The Synthetic Fuels Market is rapidly gaining traction as a viable alternative in the quest for sustainable energy sources. With the growing concerns over climate change and the need to reduce carbon emissions, synthetic fuels offer a promising solution. These fuels, also known as e-fuels or renewable fuels, are produced through advanced processes that utilize renewable energy sources such as wind, solar, or hydroelectric power.

One of the primary drivers behind the surge in demand for synthetic fuels is the global shift towards greener energy solutions. Governments, industries, and consumers alike are increasingly recognizing the importance of reducing dependency on fossil fuels and embracing renewable alternatives. Synthetic fuels present a compelling option as they not only offer a cleaner energy source but also provide a pathway to decarbonizing sectors such as transportation, industrial manufacturing, and power generation.

The versatility of synthetic fuels is another factor contributing to their growing popularity. Unlike traditional fossil fuels, synthetic fuels can be easily integrated into existing infrastructure without the need for significant modifications. This means that vehicles, aircraft, and machinery powered by gasoline or diesel can seamlessly transition to synthetic fuels without compromising performance or efficiency. Additionally, synthetic fuels can be tailored to meet specific energy needs, offering a customizable solution for various applications.

Moreover, advancements in technology have significantly improved the efficiency and cost-effectiveness of synthetic fuel production. Innovative processes such as Power-to-Liquid (PtL) and Gas-to-Liquid (GtL) have made it possible to produce synthetic fuels on a commercial scale, driving down production costs and increasing accessibility. As a result, synthetic fuels are becoming increasingly competitive with conventional fossil fuels, further fueling their adoption across different sectors.

The transportation industry stands to benefit significantly from the widespread adoption of synthetic fuels. With concerns over air quality and emissions regulations becoming more stringent, many vehicle manufacturers are exploring alternative fuel options to meet regulatory requirements and consumer demand for greener transportation solutions. Synthetic fuels offer an attractive alternative, providing a bridge between conventional combustion engines and future zero-emission technologies such as electric vehicles and hydrogen fuel cells.

In addition to transportation, synthetic fuels find applications in other sectors such as power generation and industrial manufacturing. The ability to produce clean, reliable energy from renewable sources makes synthetic fuels an appealing choice for companies seeking to reduce their carbon footprint and meet sustainability targets. Furthermore, synthetic fuels offer energy security benefits by reducing reliance on imported oil and mitigating the geopolitical risks associated with fossil fuel dependence.

Looking ahead, the Synthetic Fuels Market is poised for significant growth as the world transitions towards a low-carbon economy. With ongoing advancements in technology, coupled with increasing environmental awareness and regulatory pressures, the demand for synthetic fuels is expected to soar in the coming years. As governments and industries continue to invest in renewable energy solutions, synthetic fuels are well-positioned to play a crucial role in shaping the future of energy production and consumption.

#energy#sustainability#renewable fuels#e-fuels#carbon emissions#alternative energy#transportation#industrial applications

2 notes

·

View notes

Text

The global Blue Hydrogen Market is projected to grow from USD 18.2 billion in 2022 to USD 44.5 billion by 2030, at a CAGR of 11.9% according to a new report by MarketsandMarkets™.

#hydrogen#hydrogene#blue hydrogen market#blue hydrangea#blue Hydrogen#hydrogen storage#hydrogen car#hydrogen fuel cells#hydrogen economy#hydrogen fuel stations#hydrogen fuel companies#hydrogen fueling technology#energy#power#power generation#utilities#renewable energy#renewable

0 notes