#Market dynamics

Explore tagged Tumblr posts

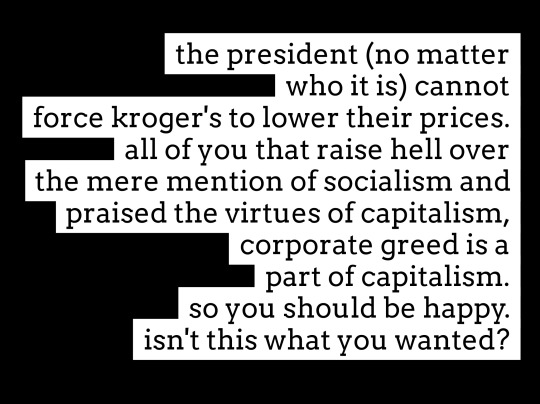

Text

#political commentary#capitalism#corporate power#consumerism#economic policy#socialism#government intervention#market dynamics

135 notes

·

View notes

Text

Bangladesh QSR Market Report: Trends, Analysis, and Growth Insights | P&S Intelligence

The value of the Bangladeshi quick-service restaurants market stood at USD 1,712.4 million in 2023, and this number is projected to reach USD 2,653.4 million by 2030, advancing at a CAGR of 7.1% during 2023–2030. This growth can be credited to the developing lifestyle of the adult populace, the increasing count of QSRs in the nation, the growing demand for fast food among the urban populace, and the rising working populace in the city and semi-urban areas of the country.

The demand for easy foods is increasing quickly among customers in Bangladesh, due to the parallel variations in the working and social lives and the mounting habit of dining out. People these days like to socialize over good food, away from the house. Therefore, because of the shortage of time, numerous contemporary nuclear families tend to choose convenient, quick meals over old-style meals.

American cuisine is likely to advance at the highest rate during this decade. This is because of the high requirement for fries, pizzas, and burgers among the young populace as well as the busy lifestyle of adults, which makes a requirement for convenience foods. Furthermore, other cuisines like Italian, Mexican, and Chinese, are also broadly prevalent among Bangladeshi citizens.

Moreover, the rising purchasing power of customers with their increasing per capita income, particularly in Dhaka, has boosted the sale of prepared food from QSRs in this nation. Bangladesh's economy is facing an era of low inflation, rising household income, and speedy progress.

As per the World Bank, Bangladesh has a purchasing power parity of 32.1 LCU per international dollar in 2021, in comparison to 16.3 LCU in 2002, advancing at a 3.63% average annual rate.

Furthermore, people, now, socialize with friends, neighbors, or colleagues, as compared to before for social or business purposes. This led to the increasing consumption of meals in fast food settings, which further boosted the industry.

#Bangladesh QSR Market#Market Report#P&S Intelligence#Fast Food Industry#Trends#Analysis#Growth Insights#Quick Service Restaurants#Market Dynamics#Food and Beverage Market#Market Research#Industry Overview#Competitive Analysis#Regional Analysis#QSR Market Size#Market Outlook#Dining Trends

2 notes

·

View notes

Text

Navigating the Real Estate Rollercoaster: How Interest Rates Shape Your Investments

Unpacking Financing Costs: The Borrowing Dilemma Interest rates wield significant influence over various elements of the real estate market, particularly when it comes to financing costs. Understanding how these changes affect both buyers and investors can empower you to make more informed decisions in your real estate ventures. Let’s dive deep into the intricate relationship between interest…

0 notes

Text

FTC Releases Controversial Interim Staff Report on PBMs’ Purported Impact on Drug Prices

At an Open Commission Meeting on August 1, 2024, the Federal Trade Commission (FTC) presented a report prepared by its staff entitled Pharmacy Benefit Managers: The Powerful Middlemen Inflating Drug Costs and Squeezing Main Street Pharmacies. Although characterized as “interim,” the report posits the following observations about pharmacy benefit managers (PBMs): “PBMs have gained significant…

#bargaining#Biosimilar#brand drug manufacturer#competing products#drug prices#Drug Pricing#Federal Trade Commission#FTC#market dynamics#Open Commission Meeting#PBMs#Pharmacy Benefit Managers#prescription drug access

0 notes

Text

Mastering Sinohara Intensity Ratio: A Comprehensive Guide to Trading Success

In the vast landscape of financial markets, traders are constantly seeking new strategies and tools to gain an edge. One such tool that has gained traction among seasoned traders is the Sinohara Intensity Ratio. Developed by Japanese trader Hiromitsu Sinohara, this ratio offers a unique perspective on market momentum and trend strength. In this comprehensive guide, we will delve deep into the…

View On WordPress

#Counter-trend trading#Divergence analysis#Financial Markets#Market Dynamics#Market momentum#Overbought#Oversold#Price movements#Prudent risk management#Risk Management#Sinohara Intensity Ratio#Technical indicator#Trading edge#Trading performance#trading signals#Trading Strategies#Trading Volume#Trend confirmation#Trend Following#Trend strength

0 notes

Text

Market Recap: Dow Jones Gains, S&P 500 Holds Steady, NASDAQ Edges Lower

In the ever-fluctuating landscape of the stock market, today's trading session saw a mixed bag of results, with the Dow Jones Industrial Average leading the charge with a 0.2% rise, marking a gain of 78 points. Meanwhile, the S&P 500 maintained relative stability, experiencing a marginal decline of 0.02%, and the NASDAQ Composite edged lower by 0.1%.

The Dow Jones, a benchmark index known for its representation of 30 significant stocks across various sectors, demonstrated resilience as it climbed modestly, buoyed by optimism in certain key industries. Investors found solace in the steady progress of companies within sectors such as industrials and financials, contributing to the index's upward trajectory.

Conversely, the broader market sentiment, as reflected by the S&P 500, exhibited a more subdued tone, hovering near its previous close. While certain sectors displayed strength, others faced headwinds, resulting in a balanced performance overall. This nuanced movement underscores the intricate interplay of factors influencing investor sentiment, ranging from economic data releases to geopolitical developments.

Amidst this backdrop, the NASDAQ Composite experienced a slight setback, dipping by 0.1% during today's trading session. This decline comes amidst ongoing concerns surrounding inflationary pressures and the potential impact on high-growth technology stocks, which often populate the NASDAQ index.

As investors navigate through a landscape marked by both opportunities and challenges, it becomes imperative to adopt a diversified approach and remain vigilant in assessing market dynamics. While certain sectors may outperform in the short term, maintaining a long-term perspective is essential in achieving sustainable investment outcomes.

Looking ahead, market participants will continue to monitor key economic indicators, corporate earnings reports, and geopolitical developments for insights into future market movements. In a market characterized by its dynamism and unpredictability, adaptability and informed decision-making remain paramount for investors seeking to navigate the ever-evolving landscape of the stock market.

#Stock Market Analysis#Dow Jones Industrial Average#S&P 500#NASDAQ Composite#Market Sentiment#Investor Sentiment#Economic Indicators#Geopolitical Developments#Market Dynamics#Investment Strategies#Diversified Portfolio#Long-term Investing#Economic Data Releases#Corporate Earnings#Inflationary Pressures#High-growth Technology Stocks#Market Volatility#Market Trends#Financial Markets#Investment Opportunities

0 notes

Text

Navigating the Evolving Pen Needles Market: A Deep Dive into the Factors Influencing Market Size, Growth, and Regional Dynamics

Pen Needles Market: Trends, Growth, and Future Outlook

The global pen needles market is poised for significant growth, driven by the increasing prevalence of diabetes and the demand for convenient and safe insulin delivery methods. Pen needles are small, disposable medical devices used with insulin pens to administer medication to individuals with diabetes. The market is expected to reach USD 10 billion by 2033, growing at a compound annual growth rate (CAGR) of 10.9% from 2024 to 2033.

Market Size and Growth

The global pen needles market size was valued at USD 3.5 billion in 2023 and is projected to reach USD 10 billion by 2033, growing at a CAGR of 10.9% from 2024 to 2033. Another report estimates the market size to be USD 1.6 billion in 2023 and is expected to reach USD 2.5 billion by 2028, growing at a CAGR of 9.1% from 2023 to 2028. The market size is expected to reach USD 4.5 billion by 2032, growing at a CAGR of 10.3% from 2023 to 2032.

Market Segmentation

The pen needles market is segmented based on product type, application, length, and distribution channel. The standard pen needles segment dominated the market in 2022, accounting for around USD 1.8 billion revenue. The insulin segment accounted for over 82% business share in 2022 and is anticipated to witness significant growth during the forecast period. The 8 mm segment accounted for over 29% business share in 2022, and the retail pharmacies segment accounted for around USD 1.2 billion revenue size in 2022.

Market Drivers and Challenges

The growth of the pen needles market is driven by the increasing prevalence of diabetes, the surge in demand for self-administration of injectable drugs, and the availability of a wide range of pen needles to meet individual patient needs. Additionally, technological advancements in pen needle manufacturing and safety features, as well as the rise in focus on home healthcare and self-care, are contributing to the market growth. However, safety concerns, such as the risk of accidental needle stick injuries, are a significant restraint of the pen needle market. Proper disposal of used pen needles is crucial to minimize the risk of accidental needle stick injuries and prevent the spread of infectious diseases.

Regional Analysis

The European region dominated the pen needles market in 2023, driven by robust healthcare infrastructure and regulatory excellence. The Asia Pacific region is expected to witness significant growth due to the increasing prevalence of diabetes and the growing demand for insulin delivery devices.

Competitive Landscape

The pen needles market is highly competitive, with several key players focusing on improving awareness regarding insulin delivery devices and their home use. Companies such as Owen Mumford are investing in the development of advanced pen needles with safety features, which is expected to drive the market growth.

Future Outlook

The pen needles market is expected to continue growing as the demand for convenient and safe insulin delivery methods increases. The market is expected to reach USD 10 billion by 2033, driven by technological advancements and government support. The increasing focus on home healthcare and self-care, as well as the growing awareness of diabetes and its risk factors, are expected to contribute to the market growth.

#Pen Needles#Insulin Delivery Devices#Diabetes#Medical Devices#Healthcare#Market Trends#Market Analysis#Market Size#Market Growth#Market Forecast#Market Segmentation#Product Innovation#Regulatory Landscape#Competitive Landscape#Home Healthcare#Self-Care#Safety Concerns#Technological Advancements#Market Drivers#Market Challenges#Market Opportunities#Market Insights#Market Outlook#Market Dynamics#Market Forecast 2024-2033#Market Size 2023#Market Size 2033#Market CAGR#Market Growth Rate#Market Share

1 note

·

View note

Text

AI’s Role in Redefining Corporate Strategy: Insights from Xp

Corporate strategy has never been more critical. Companies must navigate an array of challenges, from shifting consumer preferences and global competition to technological disruptions and regulatory changes. In this environment, the role of artificial intelligence (AI) in redefining corporate strategy has become increasingly pronounced. Leveraging AI-driven insights, companies can gain a competitive edge, anticipate market trends, and make informed decisions that drive long-term success. In this blog, we’ll explore the transformative impact of AI on corporate strategy and draw insights from Xp.

#market analysis#online survey#market research#market research surveys#consumerbehavior#ai survey#corporatestrategy#datainsights#market trends#market growth#deeper insights#actionable insights#ai driven decision making processes#consumer preferences#AI-powered risk management tools#AI-driven market segmentation#market dynamics#california news

0 notes

Text

What are the Different Types of Digital Business Models?

The modern era has changed the way businesses operate and generate revenue. Digital business models and strategies now leverage the changing market to create value, reach customers and drive growth. Before, these models used to be traditional, but now they use the power of the internet, data analytics and emerging technologies to create a niche in their industries. Understanding the different types of digital business models and their evolution is crucial for businesses seeking to thrive in today's digital economy. Let’s deep dive into the different business models and how they impact business decisions.

E-Commerce:

One of the most well-known types of digital business models is E-commerce. This involves using the internet as the marketplace to buy and sell goods. It skips the concept of physical stores and allows businesses to reach from anywhere to anywhere, barring geography. Businesses enjoy the lack of geographical or time barriers when it comes to selling their products. Amazon, eBay, Etsy, etc., pioneered and steered this digital business model and strategy by offering a huge online marketplace where customers can purchase what they want, when they want and wherever they want.

Subscription-based Model:

This type of digital business model offers products and services in exchange for a subscription fee. This approach prioritises a recurring and sustainable customer base, thereby ensuring a predictable revenue stream for businesses. There is convenience to the value-add. Examples of the subscription-based model include streaming services like Netflix and Spotify (for entertainment), and software like Adobe Creative Cloud, Microsoft Office 365 (for career development) and so on.

Freemium:

This is a model adjacent to the subscription-based model where some aspects of the services are free while premium functions might be charged. This digital business model and strategy offer two different ways of generating revenue. It attracts a larger user base with the free offering (which can be monetised by ad revenue) and deeper penetration with upgrades and subscriptions. Freemium mobile apps with in-app purchases are the best examples, like the New York Times games. Another common example is Google, which offers limited storage for free and additional storage for a fee.

Platform-based:

Platform-based types of digital business models create value by facilitating interactions between different groups of users. These platforms typically connect producers and consumers, service providers and customers in a networked ecosystem. Examples include ride-hailing platforms like Uber and Ola, which connect drivers with passengers, and accommodation platforms like Airbnb, which connect hosts with travellers.

On-demand:

On-demand digital business models prioritise instant gratification and comfort, catering to the urgent needs of consumers. They provide goods and services via app-based communication. For example, ordering food on Swiggy or Zomato and even availing transportation like Ola.

P2P or Peer-to-Peer:

P2P is a digital business model and strategy that enables individuals to transact based on the products or services they provide. For example, Pepper Content works as a space where individuals can connect and exchange digital marketing services. Ride-sharing apps also fall under this category.

The emergence of digital models and strategy has shifted the way businesses look at consumers. It has allowed them to gather and analyse vast amounts of data on customer preferences, demographics and purchase patterns. This data can be analysed to gain actionable insights and optimize various aspects of the business, including marketing, product development, and customer service. They also have immediate access to what their customer thinks of their products or services, allowing them to engage in dialogue via digital channels to mould the product to fit their needs.

The biggest advantage of knowing the types of digital business models is the ability to see the bigger picture. It opens paths to scale up the business and carve a niche in the market. Professionals with a better understanding of the digital impact can help their companies adapt quickly to changing market conditions. Cloud computing, artificial intelligence, and automation enable businesses to scale operations efficiently, reduce costs, and innovate rapidly. By embracing digital transformation, businesses can unlock new revenue streams, enter new markets, and differentiate themselves from competitors. Businesses are constantly on the lookout for professionals who can contribute their skills in the digital environment to transform their business. The right education can open up a new world of opportunities for professionals in the business world. This is where online certification courses can help upskill and be abreast with current digital trends. The Professional Certificate Programme in Strategic Sales Management and New Age Marketing, offered by IIM Kozhikode provides in-depth knowledge to mid and senior-level professionals who are looking to level up their skills and unlock bigger opportunities for their businesses.

In a nutshell, the evolution from traditional to digital business models has been driven by advancements in technology, changes in consumer behaviour, and shifts in market dynamics. Traditional business models focused more on manual processes, smaller market reach and face-to-face interactions to achieve business targets. The different types of digital business models go beyond traditional paths and explore the bigger potential a business is capable of. It leverages the internet, communication devices and data-driven insights to reach anyone, anywhere, at any time. This allows space for better market understanding and personalised customer experiences.

0 notes

Text

Understanding the Landscape of China Compressor Industry

The advancing automotive as well as construction sectors in China have boosted the need for compressors in this nation, aiding these advancements. Moreover, compressors also play a key role across different sectors in this nation. In this blog, we’ll be exploring the reasons for the increasing demand for compressors in China: Increasing Industrialization It is no secret that China’s extremely…

View On WordPress

#China Compressor Market#competitive environments#Construction#industrial processes#Manufacturing#Market dynamics#market trends#regulatory landscapes#strategic decisions#Technological advancements

0 notes

Text

Insights into the Delhi Liquor Scam: A Strategia Advizo Accounting Perspective

Disclaimer: This analysis is a hypothetical simulation based on publicly available information. It is for educational purposes only and should not be construed as legal advice or a definitive account of events. The opinions and conclusions drawn herein are those of the Strategia Advizo expert accounting team and do not reflect the views of any implicated parties or governmental…

View On WordPress

#Compliance and Governance#Delhi Liquor Scam#Excise Policy Analysis#Forensic Accounting#Market Dynamics#Policy Manipulation#Regulatory Oversight#Risk Management#Transparency in Licensing

0 notes

Text

A Professional Examination of Forex Trading in Light of Current Market Dynamics and Historic Evidence

In forex trading, success often depends on understanding complex market forces and an informed ability to navigate the unpredictable swings in global economic conditions. The events detailed in recent reports, including the anticipation surrounding U.S. Non-Farm Payroll (NFP) data and the potential shifts in monetary policy, provide a foundation for assessing how political events, data releases, and central bank decisions impact trading strategies. Historically, such market factors have significantly influenced the currency landscape, and traders who harness knowledge of these shifts can develop more resilient trading approaches.

Political and Economic Factors Impacting Forex Markets

The U.S. NFP data release, widely regarded as a crucial indicator of economic health, often influences currency strength by impacting central bank policies and interest rates. For instance, a strong NFP report signals job growth, which may lead the Federal Reserve to consider a hawkish stance, potentially increasing interest rates to curb inflation. A weak report, conversely, might suggest economic slowdown, urging caution among traders who anticipate potential rate cuts or pauses. This anticipation is deeply rooted in historical data analysis. For instance, in the post-2008 financial crisis recovery period, the NFP report played a pivotal role in influencing market sentiment, as the Federal Reserve’s quantitative easing (QE) policy led to significant dollar volatility. Traders with insights into these factors could better anticipate dollar strength and other market movements.

In recent weeks, expectations have shifted to include the Federal Reserve's possible interest rate cuts as early as November and December of 2024. Historic evidence shows that, in past cycles, rate cuts during economic slowdowns often spur dollar depreciation. With historical parallels, such as the Fed’s rate cuts in 2001 and 2007, traders can anticipate a similar trajectory, positioning themselves for the effects on currency values and volatility.

The Influence of Global Economic Data and Central Bank Policy

One recent report highlighted a significant selloff in the Swiss Franc, triggered by a lower-than-expected inflation rate in Switzerland. This development points toward the Swiss National Bank (SNB) possibly implementing a 50 basis-point rate cut in December 2024. Such moves by central banks are not unprecedented; the SNB’s decisions often reflect Switzerland’s high economic integration and its historical stance on maintaining a stable currency. For example, during the Eurozone debt crisis of 2010-2012, the SNB implemented drastic measures to limit the Franc’s overvaluation, including pegging the Franc to the Euro. Forex traders aware of this historical context could better interpret recent actions by the SNB and anticipate future moves, such as further adjustments in response to inflation or other economic indicators.

The U.S. Dollar, on the other hand, has displayed mixed performance in the current market environment, with slight gains against commodity-linked currencies while maintaining relative stability. Such movement underscores how economic data, particularly inflation and employment metrics, have traditionally impacted the dollar’s performance. Historically, the dollar has often served as a “safe haven” currency during periods of global economic uncertainty. During the COVID-19 pandemic, for instance, the dollar’s strength was amplified due to increased demand from investors seeking stability. A historical lens shows that traders who can effectively balance market sentiment with fundamental data interpretation often fare better in volatile markets.

The Role of Risk Management and Historical Lessons

An essential aspect of successful forex trading involves implementing a robust risk management strategy, especially given the high-risk nature of leveraged trading. The ForexLive disclaimer emphasizes the need for traders to approach trading with an understanding of leverage risks and the potential for significant financial loss. Historical evidence, such as the impact of the 1992 “Black Wednesday” event, where the British pound was forced out of the European Exchange Rate Mechanism, underscores the importance of prudent risk management. This incident illustrated the potentially devastating effects of market volatility, and it remains a cautionary tale for traders who may underestimate the risks involved in forex markets.

Conclusion: The Importance of Contextual Knowledge in Forex Trading

In light of recent events, from central bank decisions to the anticipation of the U.S. elections, traders are reminded that forex markets are heavily influenced by a complex interplay of economic data, political events, and historical context. An understanding of historical patterns, such as the 2008 financial crisis recovery and key monetary policy decisions from central banks like the Fed and SNB, can equip traders with valuable insights into potential market reactions. For forex traders, knowledge is more than just analyzing current events; it is about learning from the past and applying that understanding to build strategies that can weather both expected and unexpected market shifts.

#Forex Trading#Market Dynamics#Professional Examination#Currency Markets#Trading Strategies#Risk Management#Market Analysis#Economic Indicators#Technical Analysis#Fundamental Analysis#Forex Market Trends#Market Volatility#Trading Psychology#Investment Strategies#Global Economy#Financial Markets#Exchange Rates#Currency Pairs

1 note

·

View note

Text

North America Is Driving Digital Pen Market

In 2022, the digital pen market was worth around USD 2,311 million, and it is projected to advance at a 13.6% CAGR from 2022 to 2030, hitting USD 6,410 million in 2030, according to P&S Intelligence. This growth can be credited to the growing usage of digital pens to remove paperwork, increasing demand for enhanced features provided by digital pens, and mounting per-capita income.

In 2022, the active pen category had the largest market share, at 46%. Such pens enable the utilizer to write straight onto the display of a computation device, such as a tablet, smartphone, ultra-book, or computer, The cursor is permanently underneath the tip; therefore, they are precise to a superior extent.

In 2022, the multiple OS category held the larger share, of above 70%. Furthermore, presently digital with greater than one operating system compatibility pens are gaining more traction among users. Additionally, numerous customers nowadays own more than one phone, with dissimilar operating systems, because of which the need for digital pens with multiple operating system compatibility is quickly growing.

In 2022, The healthcare industry, had the largest digital pen market share, at 25%. A specialist can easily access the cloud storage and join it to an automated medical record when the pen immediately transfers the stored information over Bluetooth. To guarantee accurate handwriting acknowledgment, the technology makes utilization of artificial intelligence. Furthermore, prescriptions can be modified to be used with the encoded paper for a diversity of applications.

The North American industry had the largest market share, at 38%. The rising use of digital pens in the healthcare and education sectors is contributing to the development of the regional market. Between 2020 and 2030, the service in healthcare professions is projected to raise by almost 16%. Hence, the rising usage of digital pens to remove paperwork, increasing demand for enhanced features provided by digital pens, and mounting per-capita income, are the major factors, driving the digital pen industry.

#digital pen#market analysis#technology#integration#analog#digital data#real-time#versatility#convenience#applications#note-taking#artistic expression#market dynamics#key players#emerging trends#adoption#innovation#creativity#productivity

0 notes

Text

Beyond Boundaries Exploring the Millimeter Wave Technology Market

The global millimeter wave technology market is projected to reach USD 11,912.1 million by 2030, advancing at a CAGR of 23.4% during the forecast period. This can be credited to the fact that this technology is vital in the healthcare, telecommunications, and aerospace industries. The growing acceptance of imaging devices, monitoring systems, progressive safety measures, tablets, smartphones, and electronic devices is propelling industry development.

Embark on a journey through the dynamic landscape of the millimeter wave technology market, where innovation meets connectivity at unprecedented speeds. Explore the latest advancements and applications driving the demand for high-frequency wireless solutions across various industries. From telecommunications to automotive radar systems, discover how millimeter wave technology is reshaping the future of communication and sensing capabilities.

Gain insights into market dynamics, key players, and emerging trends shaping the proliferation of this transformative technology. Uncover the intersection of engineering, telecommunications, and consumer demand as you navigate through this groundbreaking market segment.

The snowballing acceptance of data-intensive applications, the rising adoption of smart devices, and the advancing wireless technologies are the key reasons propelling the requirement for millimeter wave technology. Such applications need high-speed communication with quicker information transmission, high bandwidth, and the power to maintain huge quantities of information, specifically for high-resolution media. This technology is totally capable to fulfill such needs, which is why it is vital for the deployment of 5G networks.

Based on components, the antenna and transceiver components category generated the largest revenue share. This is mainly because mmWave radio lines are vital for backhaul solutions in the communications infrastructure, mainly for cellular wireless access. 5G utilizes millimeter waves with frequency bands 10 times more advanced than conventional networks.

In 2022, the telecommunications equipment category dominated the market, with a revenue share of 70%, based on product type, credited to the growing count of smartphone operators throughout the globe.

Furthermore, enterprise-level data centers are widely accepting this technology. A constant bandwidth of more than 24 GHz is required to fulfill the high-volume data needs of 5G services. R&D specialists have conducted tests and showed that this technology can get multigigabit-per-second data rates, therefore allowing high-speed wireless communication.

Based on the frequency band, the 24–57 GHz category is dominating the industry. This can be credited to the fact that the 24–57 GHz frequency spectrum range is typically utilized for radio and mobile services.

Worldwide, the APAC millimeter wave technology market is projected to lead the market by the end of the decade. This is because of the growing deployment of 5G networks, which offer advanced security and quicker data access to IoT devices and smartphone users.

Browse full report at: https://www.psmarketresearch.com/market-analysis/millimeter-wave-technology-market

Additionally, there has been a continuous rise in the need for high-speed networks to aid smart applications in both the residential and commercial sectors, therefore contributing to the market revenue development in the region.

North America is leading the market with the largest market share. This is due to the rising acceptance of progressive technologies, particularly 5G; the presence of numerous key industry players, and huge expenditure in the growth of 5G technology by telecom leaders, like Qualcomm, AT&T, T-Mobile, and Ericsson.

Hence, the growing acceptance of imaging devices, monitoring systems, progressive safety measures, tablets, smartphones, and electronic devices is propelling industry development.

#millimeter wave technology#market analysis#innovation#connectivity#high-frequency wireless#applications#telecommunications#automotive radar systems#communication#sensing capabilities#market dynamics#key players

0 notes

Text

Price Action Trading

Mastering Price Action Trading: Strategies, Patterns, and Psychology Price action trading is a methodology used in financial markets, particularly in trading stocks, currencies, commodities, and other assets. Unlike traditional technical analysis, which relies heavily on indicators and mathematical formulas, price action trading focuses solely on the movement of prices on a chart. It is based…

View On WordPress

#candlestick patterns#Chart Patterns#Commodities Trading#day trading#forex trading#Market Dynamics#Market Structure#Price Action Signals#Price Action Trading#Price movements#Risk Management#stock trading#Support and Resistance#swing trading#technical analysis#Trading Discipline#Trading Education#Trading Psychology#Trading Strategies#Trend Analysis

1 note

·

View note

Text

Top 10 Most Valuable Global Brands of 2024

Explore the latest rankings and insights into the global business landscape with our blog on the "Top 10 Most Valuable Global Brands of 2024." Discover the strategic moves, innovations, and market dynamics propelling these brands to the forefront of success. Stay ahead of the curve as we delve into the stories behind the numbers and unveil the driving forces shaping the business world this year.

#Global brand rankings#Brand valuation#Brand value#Top brands worldwide#Brand success stories#Business insights#Market leaders#Corporate giants#Brand performance#Valuable brands analysis#Global market trends#Strategic branding#Brand innovation#Competitive advantage#Brand equity#Market dominance#Corporate excellence#Industry influencers#Brand recognition#Revenue growth#Brand portfolio#Successful branding strategies#Emerging market trends#Market dynamics#Brand management#Industry benchmarks#Innovation in branding#Consumer loyalty#Market share#Profitable brands

0 notes