#Market Outlook

Explore tagged Tumblr posts

Text

M&M Reports 15% YoY Sales Growth for February 2025

Key News:

Mahindra & Mahindra reported a 15% YoY increase in its total sales for February 2025 to 83,702 units.

Tata Motors reported an 8% YoY decline in its domestic and international sales at 79,344 units in February.

Maruti Suzuki India reported a 1% YoY increase from 1.97 lakh units.

Glenmark recalls 1.5 million bottles of ADHD medication in US.

Ujjivan Small Finance Bank has finalised the sale of its stressed loan portfolio, which had an outstanding balance of Rs. 364.51 crore, to an Asset Reconstruction Company (ARC) for Rs. 34.26 crore.

Stocks to Watch: Avanti Feeds, Kotak Mahindra Bank(Nse), Maruti Suzuki India, Hdfc Bank, Icici Bank, Abbott India, Bajaj Finserv and view more.

#growth stocks#stocks#share market#indian stock market#canslim#stocks to buy#investments#market outlook#breakout stocks#stock market

2 notes

·

View notes

Text

Bangladesh QSR Market Report: Trends, Analysis, and Growth Insights | P&S Intelligence

The value of the Bangladeshi quick-service restaurants market stood at USD 1,712.4 million in 2023, and this number is projected to reach USD 2,653.4 million by 2030, advancing at a CAGR of 7.1% during 2023–2030. This growth can be credited to the developing lifestyle of the adult populace, the increasing count of QSRs in the nation, the growing demand for fast food among the urban populace, and the rising working populace in the city and semi-urban areas of the country.

The demand for easy foods is increasing quickly among customers in Bangladesh, due to the parallel variations in the working and social lives and the mounting habit of dining out. People these days like to socialize over good food, away from the house. Therefore, because of the shortage of time, numerous contemporary nuclear families tend to choose convenient, quick meals over old-style meals.

American cuisine is likely to advance at the highest rate during this decade. This is because of the high requirement for fries, pizzas, and burgers among the young populace as well as the busy lifestyle of adults, which makes a requirement for convenience foods. Furthermore, other cuisines like Italian, Mexican, and Chinese, are also broadly prevalent among Bangladeshi citizens.

Moreover, the rising purchasing power of customers with their increasing per capita income, particularly in Dhaka, has boosted the sale of prepared food from QSRs in this nation. Bangladesh's economy is facing an era of low inflation, rising household income, and speedy progress.

As per the World Bank, Bangladesh has a purchasing power parity of 32.1 LCU per international dollar in 2021, in comparison to 16.3 LCU in 2002, advancing at a 3.63% average annual rate.

Furthermore, people, now, socialize with friends, neighbors, or colleagues, as compared to before for social or business purposes. This led to the increasing consumption of meals in fast food settings, which further boosted the industry.

#Bangladesh QSR Market#Market Report#P&S Intelligence#Fast Food Industry#Trends#Analysis#Growth Insights#Quick Service Restaurants#Market Dynamics#Food and Beverage Market#Market Research#Industry Overview#Competitive Analysis#Regional Analysis#QSR Market Size#Market Outlook#Dining Trends

2 notes

·

View notes

Text

Market Outlook: Optimism over a compromise on Trump’s tariffs is fuelling recovery

Short-lived gains expected: The index faces stiff resistance at 1,570, with recovery likely tempered by profit-taking and foreign fund outflows. Compromise Market drivers: Optimism over a compromise on Trump’s tariffs is fueling the recent recovery, following comments from Commerce Secretary Howard Lutnick. Lower liners: May see continued bargain hunting as oversold stocks attract…

0 notes

Text

0 notes

Text

Navigating the Evolving Pen Needles Market: A Deep Dive into the Factors Influencing Market Size, Growth, and Regional Dynamics

Pen Needles Market: Trends, Growth, and Future Outlook

The global pen needles market is poised for significant growth, driven by the increasing prevalence of diabetes and the demand for convenient and safe insulin delivery methods. Pen needles are small, disposable medical devices used with insulin pens to administer medication to individuals with diabetes. The market is expected to reach USD 10 billion by 2033, growing at a compound annual growth rate (CAGR) of 10.9% from 2024 to 2033.

Market Size and Growth

The global pen needles market size was valued at USD 3.5 billion in 2023 and is projected to reach USD 10 billion by 2033, growing at a CAGR of 10.9% from 2024 to 2033. Another report estimates the market size to be USD 1.6 billion in 2023 and is expected to reach USD 2.5 billion by 2028, growing at a CAGR of 9.1% from 2023 to 2028. The market size is expected to reach USD 4.5 billion by 2032, growing at a CAGR of 10.3% from 2023 to 2032.

Market Segmentation

The pen needles market is segmented based on product type, application, length, and distribution channel. The standard pen needles segment dominated the market in 2022, accounting for around USD 1.8 billion revenue. The insulin segment accounted for over 82% business share in 2022 and is anticipated to witness significant growth during the forecast period. The 8 mm segment accounted for over 29% business share in 2022, and the retail pharmacies segment accounted for around USD 1.2 billion revenue size in 2022.

Market Drivers and Challenges

The growth of the pen needles market is driven by the increasing prevalence of diabetes, the surge in demand for self-administration of injectable drugs, and the availability of a wide range of pen needles to meet individual patient needs. Additionally, technological advancements in pen needle manufacturing and safety features, as well as the rise in focus on home healthcare and self-care, are contributing to the market growth. However, safety concerns, such as the risk of accidental needle stick injuries, are a significant restraint of the pen needle market. Proper disposal of used pen needles is crucial to minimize the risk of accidental needle stick injuries and prevent the spread of infectious diseases.

Regional Analysis

The European region dominated the pen needles market in 2023, driven by robust healthcare infrastructure and regulatory excellence. The Asia Pacific region is expected to witness significant growth due to the increasing prevalence of diabetes and the growing demand for insulin delivery devices.

Competitive Landscape

The pen needles market is highly competitive, with several key players focusing on improving awareness regarding insulin delivery devices and their home use. Companies such as Owen Mumford are investing in the development of advanced pen needles with safety features, which is expected to drive the market growth.

Future Outlook

The pen needles market is expected to continue growing as the demand for convenient and safe insulin delivery methods increases. The market is expected to reach USD 10 billion by 2033, driven by technological advancements and government support. The increasing focus on home healthcare and self-care, as well as the growing awareness of diabetes and its risk factors, are expected to contribute to the market growth.

#Pen Needles#Insulin Delivery Devices#Diabetes#Medical Devices#Healthcare#Market Trends#Market Analysis#Market Size#Market Growth#Market Forecast#Market Segmentation#Product Innovation#Regulatory Landscape#Competitive Landscape#Home Healthcare#Self-Care#Safety Concerns#Technological Advancements#Market Drivers#Market Challenges#Market Opportunities#Market Insights#Market Outlook#Market Dynamics#Market Forecast 2024-2033#Market Size 2023#Market Size 2033#Market CAGR#Market Growth Rate#Market Share

1 note

·

View note

Text

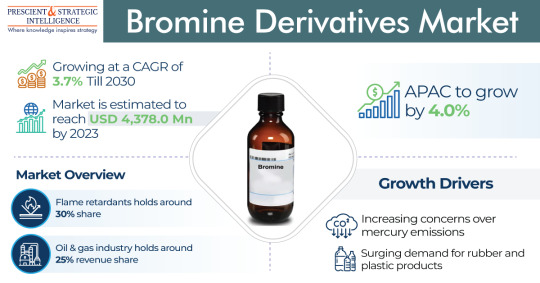

Bromine Derivatives Market Report: Demand Analysis, and Growth Forecasts | P&S Intelligence

The bromine derivatives market was USD 4,378.0 million in 2023, which will rise to USD 5,614.1 million, powering at a 3.7% compound annual growth rate, by 2030.This is because of the extensive use of these chemicals in the pharmaceutical, construction, oil & gas, electronics, and automotive sectors, coupled with the growing requirement for plastic & rubber products. Moreover, the calcium bromide…

View On WordPress

#analysis#Bromine Derivatives Demand#Bromine Derivatives Market#Bromine Industry#Competitive Analysis#Global Bromine Derivatives Market#Growth Forecasts#Industry Overview#industry trends#Market dynamics#Market Insights#market outlook#Market Report#Market Research#P&S Intelligence#regional analysis

0 notes

Text

Medical Device Market

The global Medical Device Market is witnessing rapid growth, driven by advancements in technology and increasing healthcare demands. This dynamic sector encompasses a wide range of products, from diagnostic devices to surgical instruments, offering immense opportunities for innovation and investment. With a focus on patient care and improved outcomes, the Medical Device Market continues to expand and evolve.

#Medical Device Market#Medical Devices#Market Research Reports#Industry Analysis#Market Outlook#Market Forecast

1 note

·

View note

Text

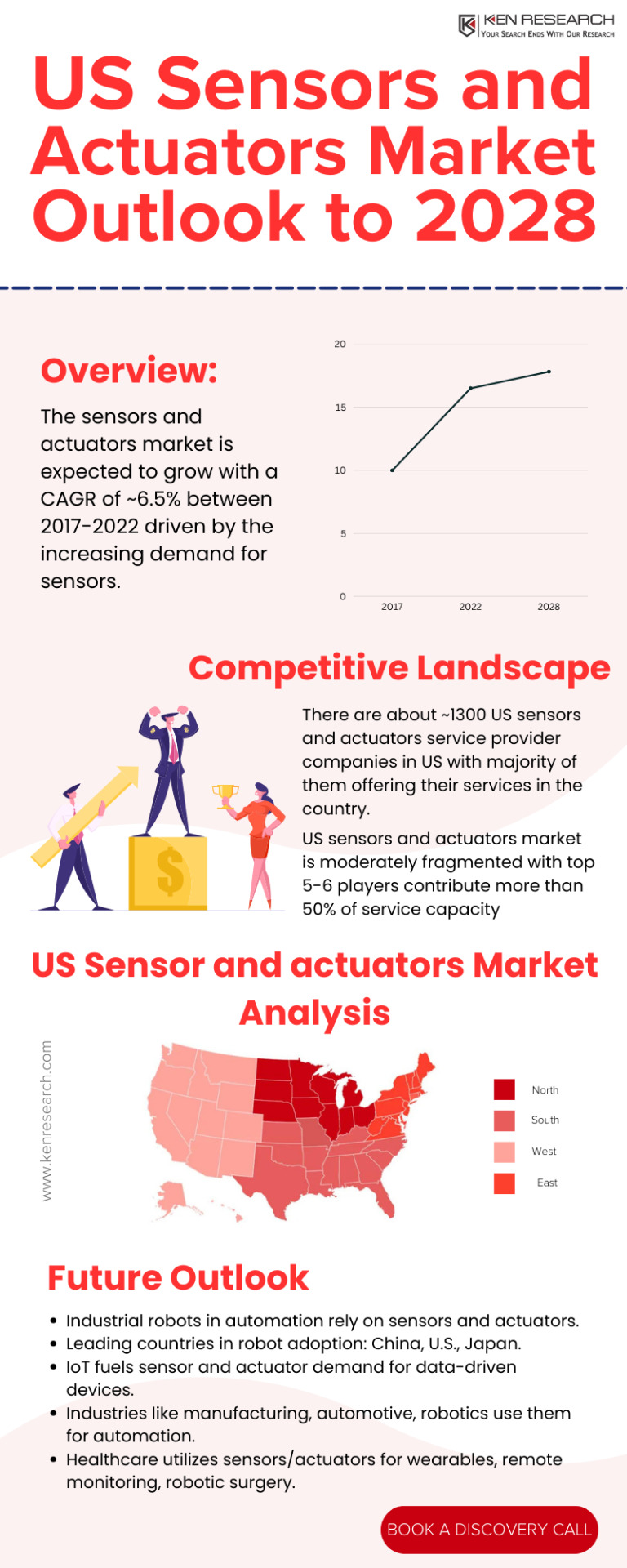

Forecast for the US Sensors and Actuators Market up to 2028

#Market Trends#Market Size#Market Share#Market Growth#Industry Developments#Companies Revenue#Market Outlook#Industry Size#Market Analysis#Market Forecast#Future Projections#Market Insight#Competition Analysis#Sales Growth#Market Segmentation#Market CAGR#Sector Growth#Future Analysis#Industry Outlook#Import Export Scenario Company Profiles#Customer preference#Competitive Landscape

0 notes

Text

The Growing Demand for ESG Data: Trends and Market Outlook

Profitability is no longer the only method investors use to assess whether a business is a secure opportunity. With growing scrutiny around ethical organizational practices, the link between sustainable operations and 21st-century investors has never been stronger.

Businesses are now quick to incorporate ESG factors into their ethos. As a result, their impact on their surrounding environment propels further business growth and cements the business as a lucrative long-term investment.

How is ESG data used in investment decision-making?

The ESG (Environmental, Social and Governance) framework is utilized to understand an organization's activities and its understanding of ethical and sustainability concerns.

Environmental

When businesses account for Environmental factors, the organization understands how their day-to-day and long-term activities affect the surrounding environment. This includes understanding how processes negatively or positively impact global challenges such as climate change or communal issues such as waste management or pollution.

Social

Social factors help businesses introduce and sustain internal ethical practices to ensure stakeholders are treated fairly. Social factors ensure businesses do not propagate discriminatory practices and ensure all individuals are affected by organizational activities.

Governance

Governance factors ensure the business stays compliant with legal requirements and practices. This means incorporating recognized industry practices and policies into corporate culture and ensuring activities could not be scrutinized or fined at a later date.

Integration of ESG Factors in Investment Decision-Making

ESG is not just a buzzword. A growing number of investors are using ESG metrics as a non-financial metric to understand where potential risks lie and how strong prospects for growth are.

As of 2022, 89% of investors considered ESG data and issues in their investment approach. 31% of European investors and 18% of North American investors have revealed ESG data to be the most critical factor when considering investments.

Growing interest has prompted the development of a number of reputed institutions whose sole purpose is to standardize ESG assessment factors. As a result, the new era of investors is able to access information critical to their decision-making process and long/short-term goals.

The Role of Data Providers and Research Firms in the ESG Data Market

With the growing standardization of ESG assessment metrics, investors are looking to widely known data providers and research firms for validated information. Market Data providers such as Bloomberg and Thomson Reuters now offer information about ESG topics using proprietary methods. The data providers also offer businesses statistics around the social aspect of ESG, allowing them to better understand industry trends and changes to be made.

The rising demand for ESG information has also created specialized data suppliers. Companies, including Ethos and Convalence, offer end-to-end ESG data services. They customize their assessment techniques based on the information needed and assist investors with risk analysis tools for better decision-making.

Finally, specialized data providers help investors detect new opportunities or assess risk by offering comprehensive data around one or two ESG factors.

It is important to understand there is minimal information about how ESG factors directly affect finances. Data providers and research firms offer an abundance of verified supplementary information to prevent irrelevant comparisons and account for disparities.

Emerging Trends in ESG Data and Reporting

The growing popularity of ESG investing has risen to assets worth USD $2.5 trillion as of 2022. Observing ESG data trends and market trends simultaneously allows investors to minimize risks while maximizing returns.

Here are the trends ESG investors are looking at in 2023:

Impact of Climate Change

While climate change has been a global issue for years, 2023 is likely to see an increased focus. Companies are assessing their carbon footprint and adjusting their day-to-day activities accordingly.

The post-COVID global economy, with all its negatives, showcased that companies are still able to operate and lower overall running costs while introducing new practices. Larger scale industries, including construction, transport, aerospace, and defence, are able to adjust their activities to join the green movement. As this trend grows, ESG-based investments grow, and businesses can adhere to newly established market trends to stay appealing.

The Ethics Behind Supply Chains

This generation of customers wants answers. It is no longer just about the efficacy of a product but the steps taken to create it. Customers are now looking into the role of human rights, working conditions, child labour law, and other critical codes of conduct in order to decide whether to purchase.

Companies working in fast fashion, for example, have been the centre of news headlines describing how low costs are translated down to customers leading to protests and boycotts.

ESG investors now require regular audits, a thorough understanding of conduct codes, and demonstrations around training for employees. Companies that are not ESG compliant have a hard time gathering investment. In this case, slow fashion companies that work with upcycled garments, recycled fabrics, and ethical practices not only receive hefty investments but a strong customer base as a result of their conscientiousness.

Diversity, Equality and Inclusion (DEI)

The conscious consumer is less likely to support businesses with unfair internal practices or compliance with discrimination. As organizations focus on including diversity and understanding subconscious bias, customers are more likely to feel comfortable engaging with the organization and its products.

As a result, businesses are more likely to share information about the lack of gender bias, equal pay policies, annual training and introducing more diversity in positions of leadership.

ESG investors invest in companies that consciously include diversity and equality as new demographics open, more customer-friendly practices are in place, and employees content with their workplace put out higher quality products and services.

Reduce, Reuse, Recycle

The slogan has circulated the globe with ideas around minimizing waste and upcycling items that no longer serve their original purpose. ESG investors are constantly on the lookout for businesses that have disrupted traditional models and introduced better practices around consumption and waste.

A strong force for 2023 is businesses introducing new methods to harness any unwanted material as a result of their activities and repurposing the same not only to assist the business but surrounding communities.

ESG investors identify an organization's willingness to maintain profitability while being conscious and ethical as an ideal candidate for investment.

Keeping Digital Identities Safe

We live in the age of technology. Your virtual identity can do anything from creating social structures to handling finances. As more businesses have migrated to e-commerce, there is a growing concern about customer information staying private as opposed to being repurposed or stolen.

Businesses factoring in ESG often have transparent information about collecting customer data on their websites. This allows customers to understand what purchasing from a website means and make an educated decision to complete the transaction or purchase from elsewhere.

ESG investors have witnessed many of an organization's downfalls as a result of selling customer information to 3rd parties or a lack of adequate cyber security measures. Businesses with strong data protection policies in place automatically become more appealing to ESG investors. Non-compliant businesses are likely to be on the receiving end of strong legal action and build a lack of trust with prospective customers.

Read also: The Evolution of ESG Data and its Future Outlook

What is the market outlook for ESG data?

ESG factors are critical to business success in the 21st century. In an era of cancel culture and accountability, investors are looking for longevity. Investing in a business that is supported by surrounding communities and the government and minimizes collateral damage has never been more critical. As more standardized information is shared around the ESG metric, businesses are left with no choice but to introduce better internal and external practices to ensure survival.

As the number of ESG-centric investors grows and the value of ESG assets rises, the global economy can look forward to being fueled by companies that approach business with a more holistic perspective.

SG Analytics is an industry leader in ESG services, providing custom sustainability advice and research to aid deliberation. Contact us today if you are looking for an effective ESG integration and management solution provider to improve your company's long-term viability.

0 notes

Text

Bharat Electronics received additional orders worth Rs 634 crore, including maintenance of the Akash Missile System, telescopic sights for guns, communication equipment, jammers, electronic voting machines, test stations, spares, and services. With these orders, the company has now accumulated a total of Rs 8,828 crore in orders for FY25.

#growth stocks#share market#stocks#indian stock market#canslim#breakout stocks#stocks to buy#investments#market outlook#stock market

2 notes

·

View notes

Text

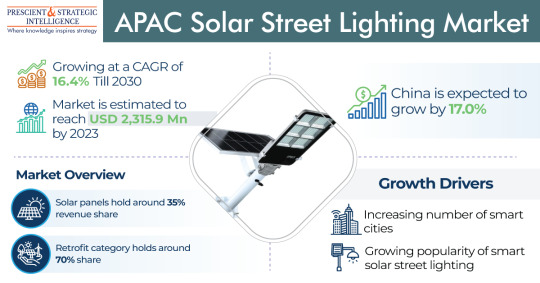

APAC Solar Street Lighting Market Will Advance at a 16.4% CAGR

The APAC solar street lighting market was USD 2,315.9 million in 2023, which will rise to USD 6,691.2 million, advancing at a 16.4% CAGR, by 2030.

A key trend observed in this industry is the increasing acceptance of smart solar streetlights. Moreover, smart lighting systems are power-effective because they employ LED lights and offer distinctive sensors and control units in every lamp, which allow data communication to central controlling systems.

The centralized category, on the basis of structure type, led the industry. This can be because of the increasing on-grid based solar streetlight disposition that gets a constant electric source from a grid to fuel lights at a great illumination.

The solar panel category, based on component, was the largest contributor to the APAC solar street lighting market in 2023, with a 35% share. This can be because it is essential for the operation of entire street lighting via renewable energy.

The lamp category, on the other hand, will advance at the fastest compound annual growth rate in the coming years. This is mainly because of the increasing acceptance of LEDs in solar streetlights. The increasing emphasis on adopting LEDs is because of the rising government proposals in nations, such as China and India, for the acceptance of energy-effective LED lights.

China led the industry, and it is likely to advance at a 17.0% compound annual growth rate, in the coming years. This can be mainly because of the continuing building of several highways, streets, flyovers, and airports; and the increasing urbanization.

With the growing number of smart cities in this region, the APAC solar street lighting industry will advance continuously in the coming years.

#APAC Solar Street Lighting Market#Market Report#P&S Intelligence#Renewable Energy#Trends#Analysis#Growth Forecasts#Solar Lighting Solutions#Market Dynamics#Asia-Pacific Solar Market#Market Research#Industry Overview#Competitive Analysis#Regional Analysis#Solar Street Light Manufacturers#Market Outlook

0 notes

Text

Malaysia Market Outlook: FBM KLCI to float above 1,600 psychological level over time

FBM KLCI tumbled 0.7% on Monday as profit-taking activities were in tune with the weakness across regional markets. The market broadly declined, with lower liners ending the day in the red. Most indices ended lower with the top decliner being Technology (-1.8%), while the top gainer was Plantation (+1.7%). Market Outlook Despite the disappointing regional performance, we believe the FBM KLCI…

0 notes

Text

The Growing Demand for ESG Data: Trends and Market Outlook

Published on Jun 23, 2023

Profitability is no longer the only method investors use to assess whether a business is a secure opportunity. With growing scrutiny around ethical organizational practices, the link between sustainable operations and 21st-century investors has never been stronger.

Businesses are now quick to incorporate ESG factors into their ethos. As a result, their impact on their surrounding environment propels further business growth and cements the business as a lucrative long-term investment.

How is ESG data used in investment decision-making?

The ESG (Environmental, Social and Governance) framework is utilized to understand an organization's activities and its understanding of ethical and sustainability concerns.

Environmental

When businesses account for Environmental factors, the organization understands how their day-to-day and long-term activities affect the surrounding environment. This includes understanding how processes negatively or positively impact global challenges such as climate change or communal issues such as waste management or pollution.

Social

Social factors help businesses introduce and sustain internal ethical practices to ensure stakeholders are treated fairly. Social factors ensure businesses do not propagate discriminatory practices and ensure all individuals are affected by organizational activities.

Governance

Governance factors ensure the business stays compliant with legal requirements and practices. This means incorporating recognized industry practices and policies into corporate culture and ensuring activities could not be scrutinized or fined at a later date.

Integration of ESG Factors in Investment Decision-Making

ESG is not just a buzzword. A growing number of investors are using ESG metrics as a non-financial metric to understand where potential risks lie and how strong prospects for growth are.

As of 2022, 89% of investors considered ESG data and issues in their investment approach. 31% of European investors and 18% of North American investors have revealed ESG data to be the most critical factor when considering investments.

Growing interest has prompted the development of a number of reputed institutions whose sole purpose is to standardize ESG assessment factors. As a result, the new era of investors is able to access information critical to their decision-making process and long/short-term goals.

The Role of Data Providers and Research Firms in the ESG Data Market

With the growing standardization of ESG assessment metrics, investors are looking to widely known data providers and research firms for validated information. Market Data providers such as Bloomberg and Thomson Reuters now offer information about ESG topics using proprietary methods. The data providers also offer businesses statistics around the social aspect of ESG, allowing them to better understand industry trends and changes to be made.

The rising demand for ESG information has also created specialized data suppliers. Companies, including Ethos and Convalence, offer end-to-end ESG data services. They customize their assessment techniques based on the information needed and assist investors with risk analysis tools for better decision-making.

Finally, specialized data providers help investors detect new opportunities or assess risk by offering comprehensive data around one or two ESG factors.

It is important to understand there is minimal information about how ESG factors directly affect finances. Data providers and research firms offer an abundance of verified supplementary information to prevent irrelevant comparisons and account for disparities.

Emerging Trends in ESG Data and Reporting

The growing popularity of ESG investing has risen to assets worth USD $2.5 trillion as of 2022. Observing ESG data trends and market trends simultaneously allows investors to minimize risks while maximizing returns.

Here are the trends ESG investors are looking at in 2023:

Impact of Climate Change

While climate change has been a global issue for years, 2023 is likely to see an increased focus. Companies are assessing their carbon footprint and adjusting their day-to-day activities accordingly.

The post-COVID global economy, with all its negatives, showcased that companies are still able to operate and lower overall running costs while introducing new practices. Larger scale industries, including construction, transport, aerospace, and defence, are able to adjust their activities to join the green movement. As this trend grows, ESG-based investments grow, and businesses can adhere to newly established market trends to stay appealing.

The Ethics Behind Supply Chains

This generation of customers wants answers. It is no longer just about the efficacy of a product but the steps taken to create it. Customers are now looking into the role of human rights, working conditions, child labour law, and other critical codes of conduct in order to decide whether to purchase.

Companies working in fast fashion, for example, have been the centre of news headlines describing how low costs are translated down to customers leading to protests and boycotts.

ESG investors now require regular audits, a thorough understanding of conduct codes, and demonstrations around training for employees. Companies that are not ESG compliant have a hard time gathering investment. In this case, slow fashion companies that work with upcycled garments, recycled fabrics, and ethical practices not only receive hefty investments but a strong customer base as a result of their conscientiousness.

Diversity, Equality and Inclusion (DEI)

The conscious consumer is less likely to support businesses with unfair internal practices or compliance with discrimination. As organizations focus on including diversity and understanding subconscious bias, customers are more likely to feel comfortable engaging with the organization and its products.

As a result, businesses are more likely to share information about the lack of gender bias, equal pay policies, annual training and introducing more diversity in positions of leadership.

ESG investors invest in companies that consciously include diversity and equality as new demographics open, more customer-friendly practices are in place, and employees content with their workplace put out higher quality products and services.

Reduce, Reuse, Recycle

The slogan has circulated the globe with ideas around minimizing waste and upcycling items that no longer serve their original purpose. ESG investors are constantly on the lookout for businesses that have disrupted traditional models and introduced better practices around consumption and waste.

A strong force for 2023 is businesses introducing new methods to harness any unwanted material as a result of their activities and repurposing the same not only to assist the business but surrounding communities.

ESG investors identify an organization's willingness to maintain profitability while being conscious and ethical as an ideal candidate for investment.

Keeping Digital Identities Safe

We live in the age of technology. Your virtual identity can do anything from creating social structures to handling finances. As more businesses have migrated to e-commerce, there is a growing concern about customer information staying private as opposed to being repurposed or stolen.

Businesses factoring in ESG often have transparent information about collecting customer data on their websites. This allows customers to understand what purchasing from a website means and make an educated decision to complete the transaction or purchase from elsewhere.

ESG investors have witnessed many of an organization's downfalls as a result of selling customer information to 3rd parties or a lack of adequate cyber security measures. Businesses with strong data protection policies in place automatically become more appealing to ESG investors. Non-compliant businesses are likely to be on the receiving end of strong legal action and build a lack of trust with prospective customers.

Read also: The Evolution of ESG Data and its Future Outlook

What is the market outlook for ESG data?

ESG factors are critical to business success in the 21st century. In an era of cancel culture and accountability, investors are looking for longevity. Investing in a business that is supported by surrounding communities and the government and minimizes collateral damage has never been more critical. As more standardized information is shared around the ESG metric, businesses are left with no choice but to introduce better internal and external practices to ensure survival.

As the number of ESG-centric investors grows and the value of ESG assets rises, the global economy can look forward to being fueled by companies that approach business with a more holistic perspective.

SG Analytics is an industry leader in ESG services, providing custom sustainability advice and research to aid deliberation. Contact us today if you are looking for an effective ESG integration and management solution provider to improve your company's long-term viability.

0 notes

Text

Electrical Submersible Pump Power Cable Market Report Includes Business Strategies and Huge Demand by 2032

Overview:

The Electrical Submersible Pump (ESP) Power Cable Market refers to the market for power cables specifically designed for electrical submersible pumps used in various applications such as oil and gas, mining, water management, and other industrial sectors. These power cables are designed to withstand the harsh conditions of submersible environments and deliver reliable power to submersible pumps. Electric Submersible Cables (ESP) Market size is expected to reach US$ 5221.58 Mn. by 2029, growing at a CAGR of 3.1% during the forecast period.

Trends:

Growing Oil and Gas Industry: The demand for ESP power cables is driven by the increasing exploration and production activities in the oil and gas sector. As the industry continues to expand, the need for efficient and reliable submersible pumping systems, supported by high-quality power cables, is expected to rise.

Technological Advancements: The ESP power cable market is witnessing continuous advancements in terms of cable materials, insulation technologies, and cable design. These advancements aim to enhance the durability, efficiency, and performance of the cables, allowing for higher power transmission and longer service life.

Rising Focus on Energy Efficiency: With a growing emphasis on energy efficiency and sustainability, there is an increasing demand for ESP power cables that offer improved electrical conductivity and reduced power losses. Energy-efficient cables help optimize power consumption and reduce operational costs.

Demand: The demand for ESP power cables is driven by several factors, including:

Increasing Submersible Pump Installations: The installation of electrical submersible pumps is expanding across various industries due to their efficiency and ability to handle high volumes of fluid. This, in turn, drives the demand for power cables specifically designed for these pumps.

Replacement and Retrofitting: As older submersible pump systems reach the end of their lifecycle, there is a demand for replacement cables. Retrofitting existing systems with advanced power cables can improve performance and extend the overall lifespan of the pumping systems.

Outlook:

The ESP power cable market is expected to grow steadily in the coming years. Factors such as increasing oil and gas exploration activities, growing industrialization, and the need for efficient water management systems contribute to the market's positive outlook.

Furthermore, the development of advanced materials, insulation technologies, and manufacturing techniques will likely result in the introduction of more reliable and durable ESP power cables. As the demand for energy-efficient solutions continues to rise, the market is expected to witness an increasing focus on cables that offer enhanced conductivity and reduced power losses.

We recommend referring our Stringent datalytics firm, industry publications, and websites that specialize in providing market reports. These sources often offer comprehensive analysis, market trends, growth forecasts, competitive landscape, and other valuable insights into this market.

By visiting our website or contacting us directly, you can explore the availability of specific reports related to this market. These reports often require a purchase or subscription, but we provide comprehensive and in-depth information that can be valuable for businesses, investors, and individuals interested in this market.

“Remember to look for recent reports to ensure you have the most current and relevant information.”

Click Here, To Get Free Sample Report: https://stringentdatalytics.com/sample-request/electrical-submersible-pump-power-cable-market/4129/

Market Segmentations:

Global Electrical Submersible Pump Power Cable Market: By Company

• Hitachi

• Borets

• GE

• Kerite

• Schlumberger

• Prysmian

• Halliburton

• Weatherford

• General Cable

Global Electrical Submersible Pump Power Cable Market: By Type

• Polypropylene

• Ethylene Propylene Diene

Global Electrical Submersible Pump Power Cable Market: By Application

• Offshore

• Onshore

Global Electrical Submersible Pump Power Cable Market: Regional Analysis

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Electrical Submersible Pump Power Cable market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Visit Report Page for More Details: https://stringentdatalytics.com/reports/electrical-submersible-pump-power-cable-market/4129/

Reasons to Purchase Electrical Submersible Pump Power Cable Market Report:

• To obtain insights into industry trends and dynamics, including market size, growth rates, and important factors and difficulties. This study offers insightful information on these topics.

• To identify important participants and rivals: This research studies can assist companies in identifying key participants and rivals in their sector, along with their market share, business plans, and strengths and weaknesses.

• To comprehend consumer behaviour: these research studies can offer insightful information about customer behaviour, including preferences, spending patterns, and demographics.

• To assess market opportunities: These research studies can aid companies in assessing market chances, such as prospective new goods or services, fresh markets, and new trends.

• To make well-informed business decisions: These research reports give companies data-driven insights that they may use to plan their strategy, develop new products, and devise marketing and advertising plans.

In general, market research studies offer companies and organisations useful data that can aid in making decisions and maintaining competitiveness in their industry. They can offer a strong basis for decision-making, strategy formulation, and company planning.

Click Here, To Buy Premium Report: https://stringentdatalytics.com/purchase/electrical-submersible-pump-power-cable-market/4129/?license=single

About US:

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs

Contact US:

Stringent Datalytics

Contact No - +1 346 666 6655

Email Id - [email protected]

Web - https://stringentdatalytics.com/

#Power Losses#Retrofitting#Replacement Cables#Advanced Cable Design#Durability#Efficiency#Energy Consumption#Market Demand#Market Trends#Market Outlook#Power Cable Market#Electrical Industry.

0 notes

Text

What a front cover...

* * * *

LETTERS FROM AN AMERICAN

March 6, 2025

Heather Cox Richardson

Mar 07, 2025

This morning, Ted Hesson and Kristina Cooke of Reuters reported that the Trump administration is preparing to deport the 240,000 Ukrainians who fled Russia’s attacks on Ukraine and have temporary legal status in the United States. Foreign affairs journalist Olga Nesterova reminded Americans that “these people had to be completely financially independent, pay tax, pay all fees (around $2K) and have an affidavit from an American person to even come here.”

“This has nothing to do with strategic necessity or geopolitics,” Russia specialist Tom Nichols posted. “This is just cruelty to show [Russian president Vladimir] Putin he has a new American ally.”

The Trump administration’s turn away from traditional European alliances and toward Russia will have profound effects on U.S. standing in the world. Edward Wong and Mark Mazzetti reported in the New York Times today that senior officials in the State Department are making plans to close a dozen consulates, mostly in Western Europe, including consulates in Florence, Italy; Strasbourg, France; Hamburg, Germany; and Ponta Delgada, Portugal, as well as a consulate in Brazil and another in Turkey.

In late February, Nahal Toosi reported in Politico that President Donald Trump wants to “radically shrink” the State Department and to change its mission from diplomacy and soft power initiatives that advance democracy and human rights to focusing on transactional agreements with other governments and promoting foreign investment in the U.S.

Elon Musk and the “Department of Government Efficiency” have taken on the process of cutting the State Department budget by as much as 20%, and cutting at least some of the department’s 80,000 employees. As part of that project, DOGE’s Edward Coristine, known publicly as “Big Balls,” is embedded at the State Department.

As the U.S. retreats from its engagement with the world, China has been working to forge greater ties. China now has more global diplomatic posts than the U.S. and plays a stronger role in international organizations. Already in 2025, about 700 employees, including 450 career diplomats, have resigned from the State Department, a number that normally would reflect a year’s resignations.

Shutting embassies will hamper not just the process of fostering goodwill, but also U.S. intelligence, as embassies house officers who monitor terrorism, infectious disease, trade, commerce, militaries, and government, including those from the intelligence community. U.S. intelligence has always been formidable, but the administration appears to be weakening it.

As predicted, Trump’s turn of the U.S. toward Russia also means that allies are concerned he or members of his administration will share classified intelligence with Russia, thus exposing the identities of their operatives. They are considering new protocols for sharing information with the United States. The Five Eyes alliance between Australia, Canada, New Zealand, the United Kingdom and the U.S. has been formidable since World War II and has been key to countering first the Soviet Union and then Russia. Allied governments are now considering withholding information about sources or analyses from the U.S.

Their concern is likely heightened by the return to Trump’s personal possession of the boxes of documents containing classified information the FBI recovered in August 2022 from Mar-a-Lago. Trump took those boxes back from the Department of Justice and flew them back to Mar-a-Lago on February 28.

A CBS News/YouGov poll from February 26–28 showed that only 4% of the American people sided with Russia in its ongoing war with Ukraine.

The unpopularity of the new administration's policies is starting to show. National Republican Congressional Committee chair Richard Hudson (R-NC) told House Republicans on Tuesday to stop holding town halls after several such events have turned raucous as attendees complained about the course of the Trump administration. Trump has blamed paid “troublemakers” for the agitation, and claimed the disruptions are part of the Democrats’ “game.” “[B]ut just like our big LANDSLIDE ELECTION,” he posted on social media, “it’s not going to work for them!”

More Americans voted for someone other than Trump than voted for him.

Even aside from the angry protests, DOGE is running into trouble. In his speech before a joint session of Congress on Tuesday, Trump referred to DOGE and said it “is headed by Elon Musk, who is in the gallery tonight.” In a filing in a lawsuit against DOGE and Musk, the White House declared that Musk is neither in charge of DOGE nor an employee of it. When pressed, the White House claimed on February 26 that the acting administrator of DOGE is staffer Amy Gleason. Immediately after Trump’s statement, the plaintiffs in that case asked permission to add Trump’s statement to their lawsuit.

Musk has claimed to have found billions of dollars of waste or fraud in the government, and Trump and the White House have touted those statements. But their claims to have found massive savings have been full of errors, and most of their claims have been disproved. DOGE has already had to retract five of its seven biggest claims. As for “savings,” the government spent about $710 billion in the first month of Trump’s term, compared with about $630 billion during the same timeframe last year.

Instead of showing great savings, DOGE’s claims reveal just how poorly Musk and his team understand the work of the federal government. After forcing employees out of their positions, they have had to hire back individuals who are, in fact, crucial to the nation, including the people guarding the U.S. nuclear stockpile. In his Tuesday speech, Trump claimed that the DOGE team had found “$8 million for making mice transgender,” and added: “This is real.”

Except it’s not. The mice in question were not “transgender”; they were “transgenic,” which means they are genetically altered for use in scientific experiments to learn more about human health. For comparison, S.V. Date noted in HuffPost that in just his first month in office, Trump spent about $10.7 million in taxpayer money playing golf.

Josh Marshall of Talking Points Memo pointed out today that people reporting on the individual cuts to U.S. scientific and health-related grants are missing the larger picture: “DOGE and Donald Trump are trying to shut down advanced medical research, especially cancer research, in the United States…. They’re shutting down medicine/disease research in the federal government and the government-run and funded ecosystem of funding for most research throughout the United States. It’s not hyperbole. That’s happening.”

Republicans are starting to express some concern about Musk and DOGE. As soon as Trump took office, Musk and his DOGE team took over the Office of Personnel Management, and by February 14 they had begun a massive purge of federal workers. As protests of the cuts began, Trump urged Musk on February 22 to be “more aggressive” in cutting the government, prompting Musk to demand that all federal employees explain what they had accomplished in the past week under threat of firing. That request sparked a struggle in the executive branch as cabinet officers told the employees in their departments to ignore Musk. Then, on February 27, U.S. District Judge William Alsup found that the firings were likely illegal and temporarily halted them.

On Tuesday, Senate majority leader John Thune (R-SD) weighed in on the conflict when he told CNN that the power to hire and fire employees properly belongs to Cabinet secretaries.

Yesterday, Musk met with Republican— but no Democratic— members of Congress. Senators reportedly asked Musk—an unelected bureaucrat whose actions are likely illegal—to tell them more about what’s going on. According to Liz Goodwin, Marianna Sotomayor, and Theodoric Meyer of the Washington Post, Musk gave some of the senators his phone number and said he wanted to set up a direct line for them when they have questions, allowing them to get a near-instant response to their concerns.” Senator Lindsey Graham (R-SC) told reporters that Musk told the senators he would “create a system where members of Congress can call some central group” to get cuts they dislike reversed.

This whole exchange is bonkers. The Constitution gives Congress alone the power to make appropriations and pass the laws that decide how money is spent. Josh Marshall asks: “How on earth are we in this position where members of Congress, the ones who write the budget, appropriate and assign the money, now have to go hat in hand to beg for changes or even information from the guy who actually seems to be running the government?”

Later, Musk met with House Republicans and offered to set up a similar way for the members of the House Oversight DOGE Subcommittee to reach him. When representatives complained about the random cuts that were so upsetting constituents. Musk defended DOGE’s mistakes by saying that he “can’t bat a thousand all the time.”

This morning, U.S. District Judge John McConnell Jr. ruled in favor of a group of state attorneys general from 22 Democratic states and the District of Columbia, saying that Trump does not have the authority to freeze funding appropriated by Congress. McConnell wrote that the spending freeze "fundamentally undermines the distinct constitutional roles of each branch of our government." As Joyce White Vance explained in Civil Discourse, McConnell issued a preliminary injunction that will stay in place until the case, called New York v. Trump, works its way through the courts. The injunction applies only in the states that sued, though, leaving Republican-dominated states out in the cold.

Today, Trump convened his cabinet and, with Musk present, told the secretaries that they, and not Musk, are in charge of their departments. Dasha Burns and Kyle Cheney of Politico reported that Trump told the secretaries that Musk only has the power to make recommendations, not to make staffing or policy decisions.

Trump is also apparently feeling pressure over his tariffs of 25% on goods from Canada and Mexico and an additional 10% on imports from China that went into effect on Tuesday, which economists warned would create inflation and cut economic growth. Today, Trump first said he would exempt car and truck parts from the tariffs, then expanded exemptions to include goods covered by the U.S.-Mexico-Canada trade agreement (USMCA) Trump signed in his first term. Administration officials say other tariffs will go into effect at different times in the future.

The stock market has dropped dramatically over the past three days owing to both the tariffs and the uncertainty over their implementation. But Trump denied his abrupt change had anything to do with the stock market.

“I’m not even looking at the market,” Trump said, “because long term, the United States will be very strong with what’s happening.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From an American#Heather Cox Richardson#the Stock Market#economic outlook#USMCA#trade#U.S.-Mexico-Canada trade agreement#tariffs#misinformation#war in ukraine#the lying administration#the lying cabinet

31 notes

·

View notes

Text

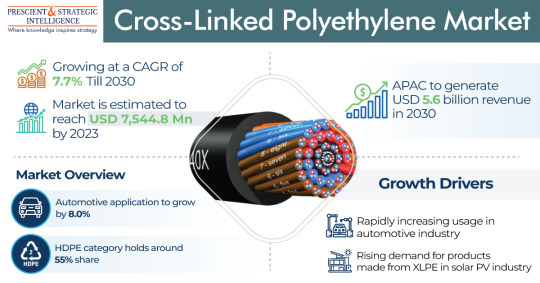

Cross-Linked Polyethylene Market Report: Trends Analysis, and Growth Forecasts | P&S Intelligence

The cross-linked polyethylene market is anticipated to achieve a revenue of USD 7,544.8 million by the conclusion of 2023. It is projected to experience a compound annual growth rate (CAGR) of 7.7% from 2024 to 2030, reaching a total of USD 12,587.5 million by 2030. During the projection period, the automotive is projected to be the fastest-growing category, with a CAGR of 8.0%, on the basis of…

View On WordPress

#analysis#Competitive Analysis#Cross-Linked Polyethylene Demand#Cross-Linked Polyethylene Market#Global Cross-Linked Polyethylene Market#Growth Forecasts#Industry Overview#industry trends#Market dynamics#Market Insights#market outlook#Market Report#Market Research#P&S Intelligence#Polyethylene Industry#regional analysis

0 notes