#Reliance share

Text

1 note

·

View note

Text

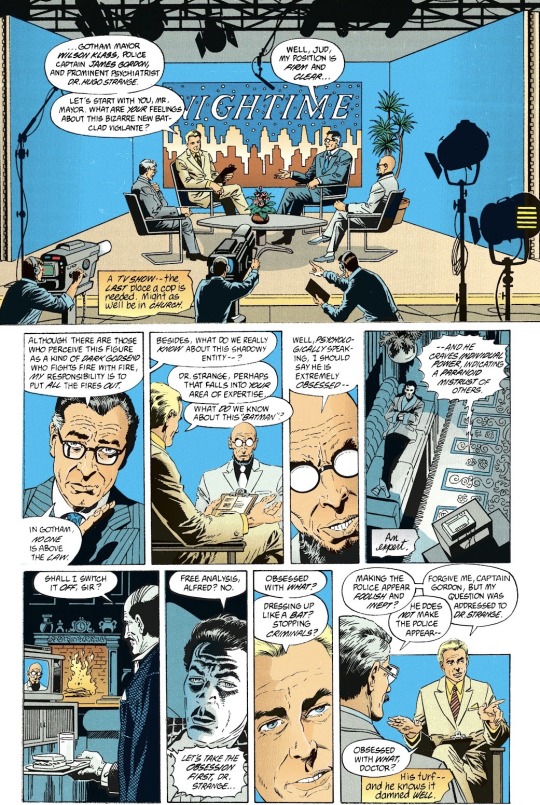

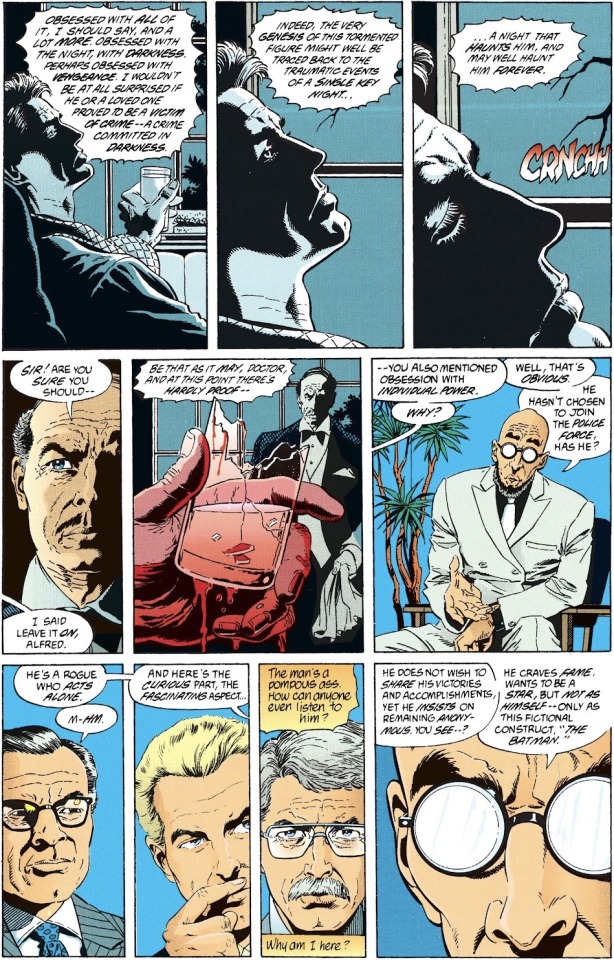

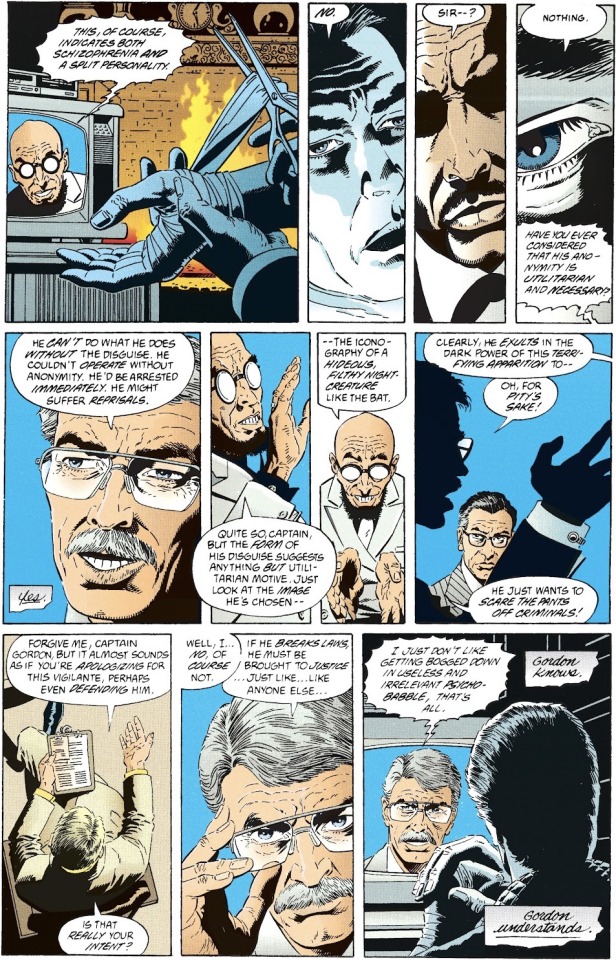

Batman: Legends of the Dark Knight (1989) #11

#out of everything here Bruce’s intense reliance on and comfort from Jim’s support stands out to me the most#and this issue shows that Bruce isn’t wrong that Jim understands#but the idea that Bruce ‘does not wish to share his victories and accomplishments yet he insists on remaining anonymous’#is also interesting in the context of his later recruitment of sidekicks#dc#bruce wayne#jim gordon#hugo strange#my posts#comic panels

37 notes

·

View notes

Text

After the war, somewhere along the way Javik takes up photography as a side hobby because it's the closest thing to prothean's memory-sharing and storage technology

#Mass effect#Javik#T'sovik in mind actually#Like during their journey for the book#And Javik doesn't want to forget#I would imagine prothean do not have a good memory bc of the reliance on their mind reading and memory sharing ability#Like it's not forgetfulness just a more limited storage#mass effect headcanon#t'sovik

39 notes

·

View notes

Text

Fried Fiddlehead and Potato.

Fiddleheads grow near creeks and rivers, where the soil is rich. Before cooking the fiddleheads, you must blanch them in boiling water over high heat for 5-8 minutes. It’s to remove the bitterness and to prevent the toxin from undercooking.

(Ingredients):

2 Potatoes, skinned and cut into sticks

1 cup Fiddleheads

Vegetable oil/ lard/ bacon fat (which was what I used)

1 teaspoon White Vinegar

1 teaspoon Cooking Rice Wine

pinch of Salt

pinch of Sugar

1. Blanch the fiddleheads in boiling water for 5-8 minutes, depending the volume (it’s important that they are fully cooked at this point). Drain and cool them under running water. Set them aside.

2. Heat up the oil over high heat. Add potato sticks. Fry until it’s slightly soft; about 10 minutes.

3. Add fiddleheads, sugar, salt. Fry for another 5 minutes.

4. Drizzle the rice wine and let it evaporate. Then serve.

#recipes#just sharing#fiddlehead#spring plants#spring forest#foraged food#forager#foraging#kitchen witch#wild edibles#witchy#green witch#spring#wild plants#potatoes#simplerecipes#witchblr#witch community#nature#nature hikes#self reliance#wild food#deliciousdishes#baby witch#witches

6 notes

·

View notes

Text

i hate!!! labels!!!!! i hate society's need to put every bit of the human experience into arbitrary, meaningless little boxes!!! i hate taking beautifully unique experiences and shoving them into categories that will never truly fit them!!! i hate taking people's identities and comforts and using them to invalidate their personhood and experiences!!! every single human being is impossibly unique and there will never be a single other person exactly like them and that's beautiful!!! why!!! do we have to break everything down and put it into boxes that are never perfectly the right shape!!!! we are all unique and that makes us all the same!!! let people express their personhood and define their experiences in ways that are unique to them!!!

#spooky.thoughts#i'm sORRY I GOT HEATED AND JUST. AUGH.#this is NOT about individuals finding comfort in labels and shared experiences#this is about society's reliance on labels to define every single fucking thing about people's lives!!!#why do i owe it to anyone else to fit into a label???#why do i owe it to anyone else to give them a label to try and define me with???#and stop!!!! using labels!!! as a way to tell people they don't fit in to that label!!!!!#it makes me so!!!! hhhhrrghghghgh#okay. okay. okay. i'm fine.#i don't understand why we as humans have to try and categorize absolutely every little thing that shapes us as individuals#stop it. we're individuals for a reason.#and if we could just accept that every human experience is unique then i think we would all accept each other a lot easier!!!!#there is no us vs them if we are all just!!!! the same in our individuality!!!!#THE HUMAN EXPERIENCE IS VAST AND INCOMPREHENSIBLE AND YOU CANNOT DEFINE IT IN FORCED BOXES AND LABELS AND UNIVERSAL CONSTANTS#part of this is because i had to read about formalism in art history and it made me angry#part of it is bc i saw the post like. 2 rbs ago. one or 2. the one about friendships/qprs#i just can't tAKE IT ANYMORE#ok. rant over this time.#this time for sure.

40 notes

·

View notes

Text

all I ask is for one day, one day where work doesn't leave me feeling subhuman and completely drained of motivation/creative drive/will to live

#ngl I could use some cheerleading but all my immediate friends are also going through even greater work stress#don't want to ask them to use their limited time/energy on soothing me#but alas I also have nothing to share for head pats because of the funk#so I will listen to RE4 playthroughs as I contemplate wandering into the woods and vanishing forever#I'm done with working on 'new projects to challenge myself and grow my skills' let me be comfortable instead#I've been challenged until I'm just crispy now#ask for help? I rather die literally#toxic self-reliance I guess#personal bullshit

15 notes

·

View notes

Text

modern web platform don't become twitter challenge (impossible)

#tumblr would never#we lost the war on cyberspace#when the internet was born it was connecting everyones computers together allowing anyone to share files and media from their own machines#our reliance on central services owned and operated by corps has lost the thing that made the internet powerful

5 notes

·

View notes

Text

i was thinking about how samatoki’s gut was telling him rei isn’t a bad guy vs kuukou’s gut telling him to be wary around rei in arb and nothing’s changed about it lol

just i think i stated on here samatoki can sense they’re the same type of person who would do anything for their most important person but kuukou might be reacting to the sense that rei’s the type to leave someone behind if sees enough reason to 🤔

#vee queued to fill the void#idk if i actually said samatoki senses he and rei are similar people on here or just thought about it without posting lol#lol i was just musing about kuukou being delighted by saburo’s unfriendliness and trying to befriend him#(and wondering if that’s something to be looked into lol)#and thought he and rei would get along great since they both enjoy prickliness so it’s a shame kuukou was prickly towards rei lol#i’ve also kinda been wondering if kuukou and rei are connected in a paralleling imagery sense????#besides them sharing verses something’s been telling me rei and kuukou are connected besides someone important to ichiro who left him lol#hmmmmm solitude???? going off to do their own thing by themselves because of self reliance values but also to drive the story they want???#be it for themselves or for someone else???? maybe lol 🤔🤔🤔#c: samatoki-sama#c: kuukou👑#c: rei

13 notes

·

View notes

Text

In working on my next set of updates to my Sandman stories:

One reason that I like to play with the idea of either humanizing or depowering Death is that it's already an established element of canon. She does this once a century and dies at the end of it and is fully human and powerless. She has, in her own words, done it for a very long time and has very good odds that more than one of her experiences with dying would be as meaningless and painful as the process of dying is presented in canon.

Any of the other Endless would take very poorly to the idea of being depowered, and of having to make sense of a sense of self that has been very largely lost. Death, OTOH, not only finds it an easy adjustment but going by A Winter's Tale (which the deleted scene in the show indicates is with only one slight but fundamental change still the mindset of the show version) has one problem in the exact opposite sense of her kin.

Yes, she *can* go back to being an Endless in a job she's hated in and which takes a great emotional toll. Why would she want to? And unlike the rest of the Endless, she has far more of a sense of self outside her job and her cosmic role in the order of things. The dilemma as such hinges around identity, but in the exact opposite sense of a Dream of the Endless or Desire or whichever other of the Endless loses their title and role tale. Not a quest to regain a lost position and all that goes with it, but the simple desire in the end to evade her own harsh fate and abandon something full time versus the Reaper Man pattern where absolute power tends to corrupt absolutely and what power is more absolute for a would-be successor than that over life and death?

I give Death a kind of Pinocchio syndrome/awareness of the Uncanny Valley, where the greatest temptation is to go from being 'almost' mortal to being truly so. Where to all the other Endless, it would be the narrative of a creation of a sense of self where there is none, and in this a side quest to regaining who and what they see themselves as and rightfully so.

#death of the endless#sandman fanfic#as I've said before I write my Sandman fics as the same universe as Gaiman's but with Death instead of Dream in the driver's seat#any other of the other Endless would have a similar completely different narrative#but the other six would all share the same basic set of assumptions and rules and have to work within them#Death can do what she wants within some limits and abandons her power regularly on terms she controls#naturally with the ol' Midnighter Jackhammer I tend to explore the difference in a set of scenarios where she does not in fact control it#but even then her stories have something of a more optimistic fundamental aspect#as she can acquire humanity very easily#and that's the rub for the universe as one of its most powerful and essential beings is both necessary and unwilling to accept this#meaning that where Dream causes problems from excessive drama and reliance on story conventions#Death causes problems by refusing to play ball with the cosmic order and choosing her own existence first and foremost as much as she can

4 notes

·

View notes

Text

Shedding Life’s Weights

The Exaltation of the Holy Cross is known by various names among Christians worldwide, including Holy Cross Day, Holy Rood Day, or Roodmas. It is celebrated on September 14th to mark the dedication of the Church of the Holy Sepulchre. For Christians, the cross is a powerful symbol of salvation, this day commemorates the finding of the cross in 320 AD and the dedication of the Church of the Holy…

#Abuse#Bullying#Burdens#coping#Exaltation of the Holy Cross#external vs internal#Name Calling#Padre Pio#reliance#sharing#trials

0 notes

Text

Reliance Retail: A Price Analysis

Reliance Retail, a subsidiary of Reliance Industries Limited, has become one of India's largest and most influential retail chains. As the retail landscape continues to evolve, investors are keenly watching the performance of Reliance Retail’s share price. In this article, we will delve into a comprehensive price analysis of Reliance Retail, exploring its historical trends, recent performance, and future outlook.

Historical Performance of Reliance Retail Share Price

Reliance Retail share price has experienced significant fluctuations since its initial public offering. Historically, the share price has shown a robust upward trend, reflecting the company’s growth and market expansion. The share price has been influenced by various factors including market conditions, economic trends, and the company's financial performance. Understanding these historical patterns provides valuable insights into the stock's potential future movements.

Recent Trends and Market Impact

In recent months, Reliance Retail share price has been subject to both upward and downward movements. Various market dynamics, including economic policies, consumer spending trends, and competitive pressures, have impacted the stock's performance. Analysts have observed that the share price often reacts to broader market trends and company-specific news. For instance, announcements of new store openings or strategic partnerships can lead to short-term spikes in the share price.

Key Drivers of Share Price Fluctuations

Several factors drive the fluctuations in Reliance Retail share price:

Market Conditions: Economic indicators such as inflation rates, interest rates, and overall market sentiment can influence the share price. A positive economic outlook typically supports higher share prices, while economic uncertainties can lead to declines.

Company Performance: Financial results, revenue growth, and profitability are crucial in determining Reliance Retail share price. Strong earnings reports and positive guidance from the company often lead to an appreciation in share price.

Consumer Trends: Changes in consumer behavior and spending patterns impact Reliance Retail’s sales and, consequently, its share price. A surge in consumer spending or successful marketing campaigns can positively affect the stock.

Competitive Landscape: The presence and performance of competitors in the retail sector also play a role in shaping Reliance Retail share price. Market share shifts and competitive pressures can drive price changes.

Future Outlook

Looking ahead, analysts and investors are closely monitoring factors that could influence Reliance Retail share price. The company’s expansion plans, innovations in retail technology, and strategic initiatives are key areas of focus. Additionally, macroeconomic factors and industry trends will play a significant role in shaping the future trajectory of the share price.

Conclusion

In summary, Reliance Retail share price has demonstrated considerable volatility, influenced by a range of internal and external factors. Historical performance and recent trends offer valuable insights, but the future direction of the share price will depend on a combination of market conditions, company performance, and broader economic factors. Investors should remain informed and consider these aspects when evaluating the potential of Reliance Retail share price in their investment strategies.

By understanding the dynamics of Reliance Retail share price, investors can make more informed decisions and better navigate the complexities of the retail sector.

0 notes

Text

The Greetings Group troubles involved lending to a company that may have been over-reliant on the tourism industry, and the problems with Westmex related to Westpac's lending against the security of shares in a bull market.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quote#westpac#edna carew#nonfiction#greetings group#money troubles#lending#finance#banking#reliance#tourism industry#westmex#shares

0 notes

Text

Reliance Power Share; आज रिलायंस पावर के शेयर में दिखा बड़ा उछाल, जानें कितनी बढ़ी शेयरों की कीमतें

Reliance Power Share Price Today: Reliance Power स्टॉक के लाइव आर्टिकल में आपका स्वागत है। हम आपको Reliance Power के शेयरों ��ें आने वाले उतार-��ढ़ाव का पल-पल का अपडेट यहां दे रहे हैं। Reliance Power के शेयर पिछले ट्रेडिंग दिन पर 694.8 रुपये पर बंद हुए थे। Reliance Power के शेयरों का 52 हफ्ते का हाई लेवल 34.57 रुपये है। वहीं, Reliance Power के शेयरों का 52 हफ्ते का लो लेवल 15.53 रुपये है। Reliance…

0 notes

Text

Started thinking about Eclairette and their dynamic and the deeper themes and connective tones that draw them together and...

I don't know how to explain it exactly, but just as you have Law and Order, you have Truth and Justice. Justice cannot exist without Truth, but Truth cannot be confirmed unless it's actively sought after. Lies can be manipulated and posed as truths - enough to where even Justice could be convinced - but that doesn't mean Truth no longer exists.

Justice is blind, but Truth is not.

Ugh, my brain isn't working the way I want it to right now but this means something and I've gotta sit a bit longer and figure out exactly what it means...

#toast talks#I associate a lot of eye imagery with Eclair for the reasoning of 'Justice is blind but Truth is not'.#She's even said something extremely similar to Neuvillette at some point. Might have been an argument?#I can't remeber exactly but I *do* remember one of her biggest gripes with how Justice is handled in Fontaine#is its reliance on the Oratrice to give ''proper'' judgements.#A machine that takes facts at face value and never has a moment to weigh if that fact is fallacy wrapped in truth's garb#is not the cornerstone in which Justice should rely on.#But Truth *needs* to be sought after. If no one seeks Truth then how can Justice prevail?#What is Truth if not the anchor that holds Justice in place?#And I can't help but think back to when Eclair got her Vision and had this same conversation with herself#Because while Justice ruled her mother's disappearance as unsolvable *Truth* was still hidden and begging to be found.#And Truth can be such a fickle thing. Like water.#Slipping between loose fingers on doubting hands. Slacking the thirst of those eagerly seeking it.#Drowning those bold enough to believe they could *always* keep their head above the water.#I am...doing a *lot* of thinking on Eclair today ooough...#''Justice is blind but I am not.'' Lines that go hard and remind me that Eclair is so much more than what I've shared so far#I should not have drank this coffee today I'm gonna go into a thinking spiral omfg#oc tag: Eclair Dumont#<- so I absolutely do not lose this later on#eclairette

9 notes

·

View notes

Text

Understanding the Dynamics: The Difference in Share Prices of Reliance and Hindalco Industries

When it comes to making financial judgments in the turbulent world of stock markets, where trends and fortunes shift by the second, investors look for reliable sources of guidance. If you are looking for someone to guide the way, follow StockGro. According to our experts, Reliance Industries and Hindalco Industries are now the two most prominent possibilities among the many others. Through this in-depth examination, we want to illuminate the complexities surrounding their shared values, comprehend the variables affecting their oscillations, and investigate the basic dynamics that define their courses.

Chasing the Innovation Waves: Reliance Industries' Share Price

Reliance Industries is a large Indian organization known for its broad commercial operations and strategic approach. Dhirubhai Ambani began Reliance in 1966 as a textile company, and it has since expanded into a conglomerate with activities in energy, petrochemicals, retail, and digital services.

The secret to Reliance's success is its ability to adapt to changing market conditions and its relentless pursuit of innovation. The stock price of a company reflects its financial performance, strategic goals, technological innovations, and market perception.

Reliance's share price has changed dramatically in recent years due to a multitude of reasons, including:

Reliance Jio's Disruption: The debut of Reliance Jio Infocomm in 2016 upset the telecommunications business by introducing low-cost data plans and igniting a pricing war among competitors. This decision boosted Reliance's share price to new highs, demonstrating investor confidence in the company's digital development prospects.

Expansion into Retail: Reliance's entry into the retail industry through Reliance Retail has also been a significant driver of the company's share price. The company's rapid expansion, strategic acquisitions, and creative retail formats have boosted investor confidence and contributed to the rise in its share price.

Investment in Green Energy: Reliance's recent emphasis on renewable energy and sustainable practices has resonated with investors, fueling optimism about the company's long-term development prospects. The company's disclosure of ambitious intentions to become net carbon neutral by 2035 piqued investor attention and boosted its share price.

As Reliance continues to innovate, diversify, and expand its footprint, Reliance Industries Share Price remains a reflection of investor sentiment, market trends, and the company's strategic direction.

Hindalco Industries Share Price: Navigating the Metals Market

Hindalco Industries, the Aditya Birla Group's flagship firm, is a global leader in the aluminum and copper industries, focusing on sustainability. Founded in 1958, Hindalco has a solid reputation for providing high-quality goods, pushing innovation, and cultivating long-term relationships with clients around the world.

Hindalco Industries' share price is influenced by several factors peculiar to the metals industry, including:

Commodity Prices: Hindalco's share price is highly tied to commodity price swings, as the company produces aluminum and copper. Changes in global demand-supply dynamics, geopolitical concerns, and macroeconomic trends can all impact aluminum and copper prices and, thus, Hindalco Industries Share Price.

Operational Performance: Hindalco's operational performance, such as production volumes, cost efficiency, and capacity utilization rates, has a direct impact on the company's financial success and, as a result, share price. Investors regularly watch important operational parameters to assess the company's growth potential and profitability.

Global Economic Conditions: Hindalco's stock price is also influenced by broader macroeconomic trends, including GDP growth, industrial activity, and infrastructure spending. Positive economic indications can increase demand for aluminum and copper, raising prices and, consequently, Hindalco's stock price.

Hindalco has recently launched strategic measures to improve operational efficiency, diversify its product portfolio, and boost its presence in important markets. These measures have positioned the company for long-term growth and helped to keep its share price stable in the face of market volatility.

Comparative Analysis: Reliance vs. Hindalco Share Prices

While Reliance Industries and Hindalco Industries operate in separate industries and confront distinct market dynamics, there are significant similarities in the variables impacting their share prices:

Investors Role: Investor sentiment, market movements, and macroeconomic factors all have an impact on overall market sentiment, which affects both Reliance and Hindalco.

Business success: Both firms' financial success, including revenue growth, profitability, and earnings per share, has a significant impact on their share prices.

Strategic Initiatives: Investor perceptions of a company's strategic initiatives, such as expansion plans, diversification efforts, and sustainability initiatives, can influence its share price.

While Reliance Industries Share Price and Hindalco Industries Share Price may diverge at times, their long-term performance indicates their capacity to adapt to changing market conditions, capitalize on growth opportunities, and create value for shareholders.

Conclusion

To summarize, various industry-specific factors, market dynamics, and strategic objectives influence Reliance Industries and Hindalco Industries' share prices. Reliance's share price reflects investor confidence in its diverse business strategy, technical developments, and expansion into new areas. In contrast, Hindalco's share price is driven by commodity pricing, operational performance, and global economic conditions.As investors traverse the complexity of the stock market, knowing the fundamental dynamics driving Reliance and Hindalco share prices is critical for making sound investing decisions. While previous performance does not guarantee future outcomes, a detailed examination of these variables can assist investors in determining the development prospects and investment potential of these two industrial behemoths. StockGro will constantly bring such analysis for its readers to help them make sound decisions.

0 notes

Text

A Detail Analysis of Jio Financial Services Share Price

Source- Business Upside India

Reliance Industries is the largest conglomerate in India. Its subsidiary, Jio Financial Services, has dominated the Indian financial sector. It's expanding its services and increasing its presence. As a result, its share price has risen dramatically, becoming a popular issue among investors and traders. If you want to own a great long-term investment, you should look into Jio Financial Services' share price.

Jio Financial Services Share Price: Understanding the Fundamental

Jio Financial Services began offering a variety of financial goods after its inception in 1999, including insurance, payments, loans, and asset management solutions. As part of the Reliance Jio ecosystem, it takes full advantage of Jio's massive client base, providing financial services to a hitherto untapped market.

Read More

#reliance jio financial services share price#jio financial services share price#share price of jio financial services

1 note

·

View note