#Red flags of loan fraud

Explore tagged Tumblr posts

Text

How to Avoid Personal Loan Scams and Fraudulent Lenders

Personal loans can be a great financial tool when used wisely. Whether you need funds for an emergency, debt consolidation, or a significant purchase, a personal loan can provide quick financial relief. However, with the rise of digital lending, personal loan scams have also increased, putting borrowers at risk of fraud and financial loss.

Understanding how to identify and avoid personal loan scams is crucial for safeguarding your finances. This guide will help you recognize red flags, verify lenders, and ensure you secure a legitimate loan safely.

Common Personal Loan Scams

1. Upfront Fee Scams

Legitimate lenders may charge processing fees, but these are usually deducted from the loan amount. Fraudulent lenders, however, demand upfront fees, often disguised as "processing fees," "application fees," or "insurance fees." Once the payment is made, these scammers disappear without disbursing the loan.

How to Avoid It:

Never pay any fees before receiving the loan.

Verify if the lender is registered with financial regulatory authorities.

Read reviews and check for complaints online.

2. Guaranteed Loan Approval Scams

No legitimate lender can guarantee loan approval without verifying your credit history, income, and repayment capacity. Scammers prey on desperate borrowers by promising guaranteed approval in exchange for a fee or personal information.

How to Avoid It:

Be cautious of lenders offering personal loans with "no credit check" or "100% approval."

Always verify the lender’s credibility through official sources.

If it sounds too good to be true, it probably is.

3. Fake Online Lenders

With online lending platforms on the rise, scammers create fake websites that mimic real financial institutions. These fake lenders lure applicants into sharing sensitive personal and financial details.

How to Avoid It:

Check if the lender has a physical address and a customer support number.

Ensure the website is secure by looking for “https://” in the URL.

Read customer reviews and check their registration with financial authorities.

4. Phishing Scams

Phishing scams involve fraudulent emails, phone calls, or messages that trick borrowers into revealing personal information like bank details, social security numbers, or login credentials.

How to Avoid It:

Never share your bank account or personal details over email or phone unless you initiate contact.

Avoid clicking on suspicious links or attachments.

Contact the lender directly using official contact information.

5. Loan Insurance Fraud

Some scammers claim that loan insurance is mandatory before disbursing a personal loan. While legitimate lenders may offer optional insurance, it is never compulsory.

How to Avoid It:

Ask for written documentation about loan insurance policies.

Verify with the lender if insurance is required.

If pressured to buy insurance before loan approval, walk away.

How to Verify a Legitimate Lender

1. Check Registration and Licensing

A legitimate lender must be registered with the Reserve Bank of India (RBI), Federal Trade Commission (FTC) (for U.S. borrowers), or relevant financial authorities in your country.

How to Check:

Visit the official website of the financial regulatory body and search for the lender.

Verify the lender’s credentials through customer reviews and government records.

2. Read Online Reviews

Genuine borrowers share their experiences with different lenders. Look for reviews on:

Google Reviews

Trustpilot

Better Business Bureau (BBB)

Financial forums and consumer complaint websites

3. Examine the Loan Terms and Conditions

Scammers often hide critical information in fine print. Before signing any agreement:

Read the terms carefully, including fees, interest rates, and repayment policies.

Avoid lenders who rush you into signing documents.

Seek legal or financial advice if something seems unclear.

4. Contact Customer Support

A legitimate lender will have a professional customer support team. Before proceeding with a loan application:

Call their helpline to assess their service.

Ask detailed questions about the loan terms.

Verify their address and business registration details.

Steps to Take if You Are a Victim of a Loan Scam

If you suspect that you have been scammed, take immediate action to minimize the damage.

1. Report the Scam

File a complaint with:

Your country's financial regulatory authority (e.g., RBI, FTC, FCA, etc.).

Consumer protection agencies.

The cybercrime division of your local law enforcement.

2. Monitor Your Credit Report

Scammers may misuse your personal information to take out loans in your name. Regularly check your credit report for unauthorized activity.

3. Contact Your Bank

If you have shared banking details, inform your bank immediately to secure your account and prevent fraudulent transactions.

4. Warn Others

Share your experience on consumer complaint websites, social media, and financial forums to prevent others from falling victim to the same scam.

Conclusion

A personal loan can be a helpful financial tool, but it’s essential to be cautious and aware of scams. By recognizing red flags, verifying lender credibility, and following best practices, you can avoid fraudulent lenders and secure a legitimate loan safely.

Before applying for any personal loan, research thoroughly, read terms carefully, and never rush into an agreement. Stay informed, stay cautious, and protect your financial well-being.

For more insights on personal finance and loan guidance, visit Fincrif and explore expert tips on securing safe and reliable funding.

#Personal loan scams#Fraudulent lenders#Avoid loan scams#Personal loan fraud#Online loan scams#Safe personal loans#Legitimate lenders#Loan scam warning signs#Fake loan companies#Secure personal loan application#Financial fraud protection#How to identify loan scams#Red flags of loan fraud#Loan scams prevention#Trusted loan providers#finance#loan apps#fincrif#loan services#personal loan#personal laon#nbfc personal loan#personal loan online#personal loans#bank#fincrif india#best bank for personal loan#best personal loan in india#best personal loan rates

0 notes

Text

🚨Scammer Alert🚨 + 🔎Scam Exam(ination)🔍

Seen as: Recruitment to join the Illuminati Scam Type: Identity Theft / Fraud

Post updated: 2/14/25

Accounts running this scam: templeoflight66 symbolsand-shadow mysticmason googlescholarsecretsandsybmols illuminatiinsights thehiddenodex

-----

Before we dive into this scam, please note that this scam is very dangerous as it reportedly deals with identity theft and concludes with the theft and use of your stolen information for nefarious purposes.

As it should go with any stranger you talk to on the internet, you should never willingly give out any of your personal information such as: real name, date of birth, address, phone number, credit card/bank information, photos of yourself or your bank, credit, social security card, ect, to a stranger on the internet who promises you money.

1 - How it starts.

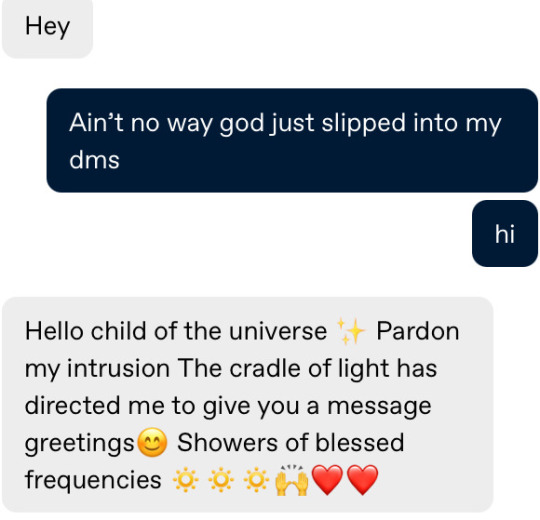

This scam typically starts by someone receiving an email, or in the images we will be examining today, a tumblr user receiving a DM- or, well, several DM's, from users who were trying to 'bless them with good tidings of the universe' and that it was 'a sign from the almighty' and 'it was fate' and all that nonsense... to try and then recruit them to join the Illuminati.

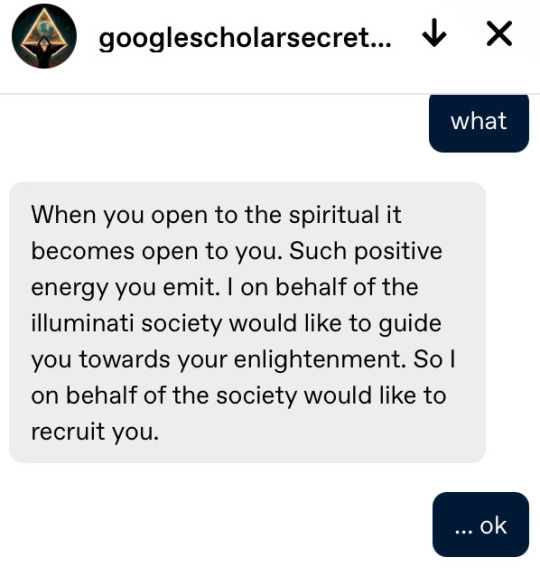

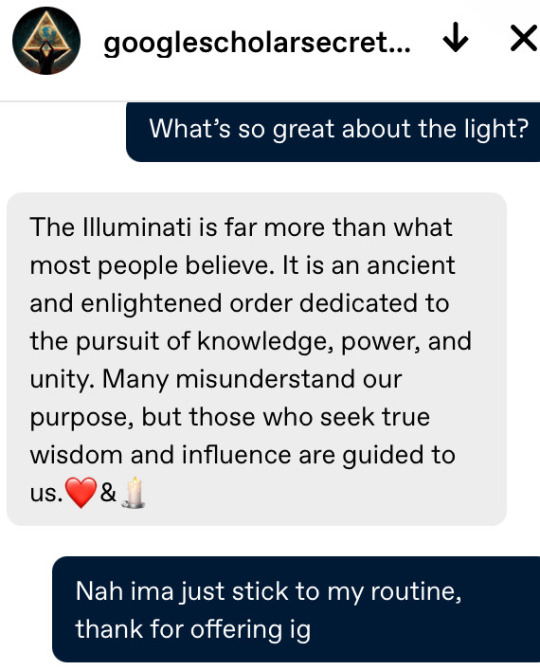

The following images were provided by an anonymous user of their conversation with googlescholarsecretsandsybmols:

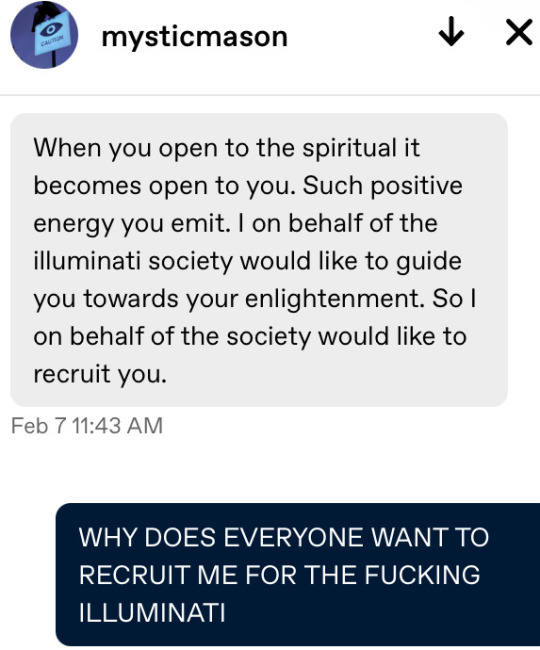

Here is anonymous's contact with mysticmason:

🚩Notable red flags🚩

Their blogs are full of generic AI generated images, philosophical scripture/nonsense, links to Illuminati websites/content that seem suspicious.

The offer of the impossible.

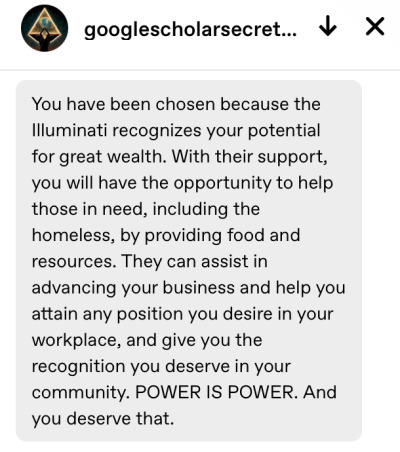

Wealth (of an undisclosed amount) to help the homeless with food and resources. Some 'means' of aiding your business and/or helping you attain any job position you desire in your work place. Some ✨magical✨ means of granting you recognition in your community. (As if they can suddenly make people change their opinions of you...)

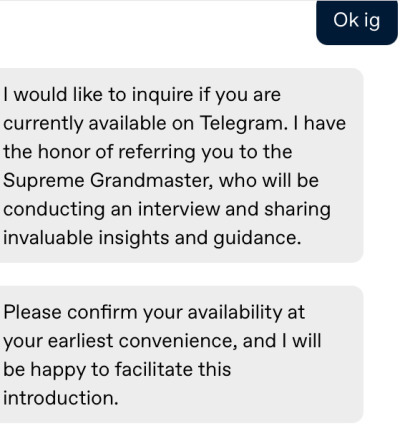

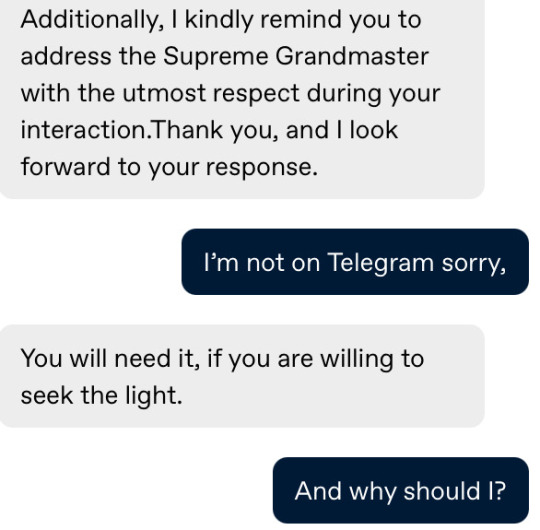

Then instant request/demand that they need you to use Telegram for communication.

Telegram is a service that a lot of scammers use, and they use it because they can easily communicate with other scammers (and victims) there, and run their scams through it without it usually being able to be used as evidence should something like Identity Theft occur.

2 - How this scam works.

This scam works by... well, what I find to be the most obvious tactic that a lot of scammers use:

The life changing offer of a lot money... You just need to do a little something in return... ;)

From here I will be pulling information from this article from Bitdefender, one of the most well known and well trusted Antivirus brands on the market today. (That I use in fact! :D)

In regards to the emails- the original method this scam was spread:

The spam emails were traced to IP addresses in Nigeria (40%), South Africa (16%), the US (14%), the Netherlands (13%), and Argentina and Brazil (with 5% each).

Here are a list of benefits the Illuminati claims they can offer you if you join, taken from the Bitdefender article as well:

A new house bought in any country of your choice.

A monthly salary of $200,000

A blessing for joining which includes 10 million dollars.

A "magic talisman" that can cure any kind of illness or infection.

The power to prosper and improve.

Free access to Bohemians grove.

First class/VIP treatment at any airport in the world.

One-year appointment approval with the top 10 world leaders.

Appointments with world celebrities of your choice.

A personal car with your name customized on it.

The seven-book of Moses to learn the language of ORIS for "powers".

And a lot more!...

You just have to buy the required items for you to become an initiate member into the 'brotherhood.'

Which is when they'll have you fill out a sheet with all of your personal information, work occupation, wage earnings, as well as request a photograph of you and/or your license for 'verification'.

If you do, they will steal your identity, use it to register for things like loans, ruin your credit, and your life is practically ruined. :(

Final Thoughts:

As I mentioned prior, you should never send this kind of information to anyone on the internet for any kind of reason if you do not know who you are speaking to on the other end, aka they're a stranger.

All these kinds of scams go off of are words, as that's all they are.

A promise made of just words.

No different than the free money or sugar baby/daddy scam where they promise you $3000 a month, all you have to do is 'send me $100+ to verify you want to do this.'

I know how life changing a lot of money can be, but do try to be logical and think about these things, for your sake and others!

Take care everyone.

#scam#scams#scam alert#scammer#scam awareness#scammers#scam warning#online scams#psa#internet safety#public service announcement#illuminati scam#templeoflight66#symbolsand-shadow#mysticmason#googlescholarsecretsandsybmols#illuminatiinsights#illuminati#conspiracy#thehiddenodex

26 notes

·

View notes

Text

IMAGINE AMERICANS BEING WORRIED SOMEONE IS RECEIVING A SOCIAL SERVICE THEY SHOULDN'T BE RECIEVING AND SCREAMING ABOUT IT!.AS TRUMP ERASED PPP FRAUD RED FLAGS AND NO ONE SAYS A F**KING WORD?

24 notes

·

View notes

Text

How AI: Empower Financial Decision-Making

Picture this: you find yourself standing at a crossroads, surrounded by a whirlwind of financial choices that will shape your future. In this vast maze of options, wouldn’t it be extraordinary to have a trustworthy companion by your side? Enter the world of Artificial Intelligence (AI), a marvel that transcends imagination. With its uncanny ability to process information at lightning speed and unravel complex patterns, AI: Empower Financial Decision-Making.

In this blog, we will explore the ways in which AI: Empower Financial Decision-Making, helping you achieve better outcomes and secure your financial future.

Automating Data Analysis and Pattern Recognition

Let me tell you something hilarious about AI: Empower Financial Decision-Making. It’s like having a superhero on your team who can process tons of data in a snap. Traditional financial analysis methods are like slow turtles, taking forever to gather and analyze data. But with AI, you can access and interpret crucial financial information with ease, like a boss! Thanks to machine learning algorithms, AI can even detect patterns and trends in data, so you can identify investment opportunities, avoid risks, and make well-informed decisions based on comprehensive analyses. It’s like having a financial sidekick who always has your back!

Enhanced Risk Assessment and Management

Alright, let me spill some beans about the finance world. When it comes to making smart investment choices, assessing risks is key. But, fear not my friend, because AI is here to save the day! With its fancy algorithms and data-crunching skills, AI can help you make informed financial decisions by analyzing historical data, market trends, and real-time information. By doing so, it can point out potential risks associated with investments, loans, and other financial decisions. This means you can develop effective risk management strategies and protect your precious assets and investments. So, let’s give a round of applause to our new financial superhero – AI!

Personalized Financial Advice and Recommendations

So, you’re saying that robots are now giving financial advice? What’s next? Robot accountants? Robot CEOs? Oh wait, we already have those. But seriously, these AI-driven platforms and robo-advisors are pretty impressive. They use fancy algorithms to analyze your financial situation and goals so they can give you personalized advice. It’s like having your very own financial genie, but without all the wish-granting and blue skin. And the best part? These intelligent systems can save you time and help you make sound financial decisions based on your unique circumstances. Plus, who doesn’t love the idea of a robot managing their money? It’s like having a personal Wall-E, but instead of cleaning up trash, it’s cleaning up your finances.

Fraud Detection and Prevention

We all know financial fraud is a total buzzkill in our digital world. But fear not, my dear friends, AI is here to save the day! Yup, you heard me right. By using machine learning algorithms, AI can sift through tons of financial data and spot any fishy patterns or anomalies that could indicate fraud. These AI-powered fraud detection systems can put a big red flag on suspicious transactions and detect any unauthorized access to your accounts. And the best part? They’ll notify you right away of any potential threats. So, let’s give a round of applause to AI for keeping our financial security on lock and preventing any sneaky fraudsters from ruining our day!

Automated Trading and Portfolio Management

Are you tired of staring at charts and market trends all day? Well, AI has got your back! With automated trading and portfolio management, you can sit back and relax while the machines do the heavy lifting. These algorithms can analyze all sorts of data, from the latest news to historical trends, and make real-time investment decisions. Plus, they can execute trades and optimize investment strategies based on predefined parameters and market conditions. So, why not give your fingers a break and let AI do the trading for you? Who knows, maybe you’ll even end up with a bigger return on your investment!

Forecasting and Predictive Analytics

Need some help making some serious bank? Well, have no fear, because AI is here! With its mad skills in analysis, predictive analytics, and forecasting, AI can guide your financial decisions to the top. It’ll take a look at all the historical data, market trends, and external factors so you don’t have to, and give you the inside scoop on stock prices, market trends, economic indicators, and more. Trust in AI to give you that data-driven perspective needed to make the right investment choices and avoid any potential risks. So sit back, relax, and let AI make it rain!

Conclusion:

AI is like a superhero in the world of finance. It can analyze data faster than a speeding bullet, assess risks better than a seasoned detective, give.personalized advice like a wise old sage, catch fraudsters like a superhero catching villains, trade stocks like a Wall Street pro, and make predictions like a fortune teller. It’s basically a financial genius that can help us make smart choices and navigate the confusing world of money like a boss. But, let’s not forget that even superheroes have their limitations and ethical considerations. AI can have biases like a grumpy grandpa and we need to implement it responsibly like a parent teaching their child to be a good human being. As AI continues to evolve, it has the potential to transform the way we handle our finances and help us reach our financial goals like a superhero saving the day. So, let’s embrace this financial superhero and secure a brighter future!

4 notes

·

View notes

Text

Want to invest with Seven 11 Loans?

Want to invest with Seven 11 Loans? Read this Seven 11 Loans review to spot potential red flags and protect your funds. 💸 If you've fallen victim to this broker, contact Fraud Complaints for help recovering your money.

0 notes

Photo

Ever gotten that sinking feeling when you check your bank account and see an “ACH debit charge” you don’t recognize? You’re not alone. ACH debit charges are a common part of modern finance, but understanding them can feel like navigating a maze. This post will unravel the mystery of ACH debit charges, explaining what they are, how they work, why they’re used, and, most importantly, how to protect yourself from unauthorized ones. We’ll cover everything from identifying legitimate charges to disputing fraudulent ones, so you can confidently manage your finances. Get ready to become an ACH debit charge expert!

Understanding ACH Debit Charges: A Deep Dive

ACH, or Automated Clearing House, is a network that processes electronic payments and transfers. Think of it as the digital highway for your money. An ACH debit charge is simply a payment made from your bank account using this network. It’s a common way businesses receive payments for things like subscriptions, utility bills, and loan repayments. Unlike credit card transactions, ACH debits directly deduct money from your checking or savings account.

How ACH Debit Charges Work

The process is surprisingly straightforward. When you authorize a business to debit your account, they provide your bank account information (account number and routing number) to their bank. This information is then sent through the ACH network to your bank, which processes the transaction. The money is automatically withdrawn from your account.

Why Businesses Use ACH Debit Charges

Businesses love ACH debits because they’re efficient and cost-effective. They automate recurring payments, reducing administrative overhead. For customers, it’s often a convenient way to pay bills automatically, avoiding late fees and ensuring timely payments.

Common Examples of ACH Debit Charges

Subscription Services: Netflix, Spotify, gym memberships – these often use ACH debits for recurring payments.

Utility Bills: Many utility companies offer ACH debit payment options for electricity, water, and gas.

Loan Repayments: Mortgage payments, student loans, and car loans frequently use ACH debits.

Online Purchases: Some online retailers use ACH debits as a payment method.

Identifying Legitimate vs. Fraudulent ACH Debit Charges

This is where things get tricky. While most ACH debit charges are legitimate, fraudulent ones can occur. Knowing the difference is crucial for protecting your money.

Recognizing Legitimate ACH Debit Charges

Familiar Business Names: The charge should be from a company you recognize and do business with.

Matching Amounts: The amount should match an expected payment.

Regular Timing: Recurring charges should occur at predictable intervals.

Confirmation: Check your statements and online accounts for confirmation of the transaction.

Spotting Fraudulent ACH Debit Charges

Unfamiliar Business Names: If you don’t recognize the name, it’s a red flag.

Unexpected Amounts: An unusually large or small charge is suspicious.

Irregular Timing: A charge that’s out of sync with your usual payment schedule is a warning sign.

Lack of Confirmation: If you can’t find any record of authorizing the payment, it’s likely fraudulent.

What to Do if You Suspect Fraud

Contact Your Bank Immediately: Report the suspicious charge to your bank’s fraud department. They can help you investigate and potentially reverse the transaction.

Review Your Bank Statements Regularly: Regularly checking your statements is the best way to catch fraudulent activity early.

Monitor Your Credit Report: Fraudulent ACH debits can sometimes lead to identity theft. Check your credit report regularly for any suspicious activity.

Change Your Bank Account Information: If you suspect a data breach, change your bank account information and passwords.

File a Police Report: In some cases, filing a police report may be necessary, especially if the amount is significant.

Protecting Yourself from ACH Debit Fraud

Prevention is always better than cure. Here are some proactive steps you can take to minimize your risk of ACH debit fraud:

Strong Password Practices

Unique Passwords: Use strong, unique passwords for all your online accounts, including your bank account.

Password Manager: Consider using a password manager to help you create and manage strong passwords.

Regular Password Changes: Change your passwords regularly, at least every three months.

Secure Online Practices

Secure Websites: Only use secure websites (those with “https” in the address bar) to access your bank accounts and make online payments.

Beware of Phishing Scams: Be wary of emails or text messages asking for your bank account information. Legitimate businesses will never ask for this information via email or text.

Public Wi-Fi Caution: Avoid accessing your bank accounts on public Wi-Fi networks.

Account Monitoring

Regular Statement Reviews: Regularly review your bank statements for any unauthorized transactions.

Transaction Alerts: Set up transaction alerts from your bank to receive notifications of any activity on your account.

Credit Monitoring Services: Consider using a credit monitoring service to detect any signs of identity theft.

Dispute an ACH Debit Charge: A Step-by-Step Guide

If you’ve identified a fraudulent ACH debit charge, you need to act quickly. Here’s how to dispute it:

1. Gather Your Evidence

Collect any documentation that supports your claim, such as bank statements, transaction records, and communication with the merchant.

2. Contact Your Bank

Contact your bank’s customer service or fraud department immediately. Explain the situation clearly and provide all the necessary evidence.

3. File a Dispute Form

Your bank will likely provide you with a dispute form to complete. Fill it out accurately and thoroughly.

4. Follow Up

Follow up with your bank regularly to check on the status of your dispute. The process can take several weeks or even months.

5. Consider Further Action

If your bank doesn’t resolve the dispute to your satisfaction, you may need to consider other options, such as contacting the merchant directly or seeking legal advice. For more information on disputing transactions, you can check resources like the Federal Trade Commission website.

Summary: Mastering ACH Debit Charges

ACH debit charges are a common and often convenient way to pay bills and make online purchases. However, understanding how they work and how to protect yourself from fraud is crucial. By regularly reviewing your bank statements, practicing strong online security, and knowing how to dispute fraudulent charges, you can confidently manage your finances and avoid becoming a victim of ACH debit fraud. Remember to always be vigilant and report any suspicious activity immediately.

Let’s keep the conversation going! Have you ever experienced an unauthorized ACH debit charge? Share your experiences and tips in the comments below. And don’t forget to share this post with your friends and family to help them stay informed and protected.

0 notes

Text

[ad_1] Identity theft and fraudulent loan apps are becoming more common with the rise of digital lending. In fact, more than 2,200 loan apps were removed or suspended from the Play Store between September 2022 and August 2023. In the same vein, more than 45% of Indians are said to have encountered identity theft. These alarming numbers make it even more important for borrowers to be aware if someone is misusing their personal and confidential details to take a personal loan. These loans can affect the credit score and creditworthiness of innocent victims, who may discover the fraud too late to take any action. The OneScore App provides valuable tools and alerts to help consumers proactively monitor their credit activity and identify any suspicious loans taken in their name. Read to know the critical role that OneScore plays in safeguarding credit profiles and empowering users to take swift action against any suspicious activity. How Fake Loans Affect Credit Scores To take a fake loan, fraudsters use a victim’s PAN card and other documents to apply for a loan in their name. These are called fake loans because they are offered to the user without their consent or knowledge. Moreover, they are not credited to the user’s account. Instead, fraudsters keep the money. After the disbursal, the liability of repaying the lender falls on the shoulders of the user. Since the user is unaware of this loan, they are likely not to pay EMIs on time. This leads to the accumulation of debt, which is reflected in the user’s credit history. This way, fake loans have a negative effect on their credit score. How to Avoid Fake Loans The best way to protect oneself from any fake or fraudulent loan is to not share confidential information hastily and to keep an eye on one’s credit report. Here are some smart tips potential borrowers can follow. Check if the Lender Is Registered The first step to protecting oneself against fraudulent loans is to determine if the lender is fake or genuine. Check the lender's official website and social media account. If they do not have any permanent address or any option for communication, this may be the first red flag. Onee can also check their Play Store and App Store reviews. Last but not the least, check if they are registered with the RBI. Read Loan Terms Make sure that the lender has all the terms and conditions clearly mentioned on their website. If they do not mention any details of the borrowing or repayment terms, it is best not to waste time. Check App’s Security Some lenders request borrowers to download their app and apply for the loan only through it. Downloading apps of fraudulent lenders on the phone can put one’s personal data at risk. Therefore, it's best to check the security features and their listing on app stores before taking any action. Don't Fall for Cheap Tactics One of the biggest markers of fraud is when a lender asks a potential borrower to complete the loan application quickly or promises guaranteed approval and/or zero interest. Any sign of urgency should also signal that something is wrong. The process that most lenders follow is to check a borrower’s credit score and other eligibility criteria to evaluate their qualification for a loan. If this process is not being followed, users should be wary, as it may be a scheme to get them to share personal information. This information may then be used to commit further fraud. Avoid Unsolicited Loans If a lender reaches out to consumers with unsolicited loan offers and if they are not existing customers of the financial institution, it may be a fraud. Such fraudsters may also demand that users pay a fee before approval or processing of their loan application. Check Credit Report: Generating a complete credit report with credit history periodically tells consumers if there are any fake loans in their name. Early detection is the fastest way to avoid substantial financial loss or damage to the credit score.

How OneScore Helps Since most credit bureaus only give one free credit report a year, it can be a financial strain for borrowers to keep track of their credit accounts. To solve this issue, OneScore gives users unlimited lifetime free credit checks with around-the-clock access to their credit reports. This way, they have access to their credit history at their fingertips and can keep track of their ongoing credit cards and loans. In case the borrowers do detect any fraudulent loans or credit cards in their name, they can directly report it to credit bureaus. The OneScore loan app allows them to raise disputes with CIBIL and Experian right from the app to help them save time when it is of the essence. Other Reasons to Choose the OneScore App Apart from detecting fraudulent loans, switching to the OneScore loan app offers users a variety of benefits: Easy Check of Creditworthiness Borrowers can check their credit score anytime, anywhere, without any membership fees. This helps them develop a stronger bond with their credit health so that they can apply for a credit card, personal loan or home loan with confidence. Credit Score Improvement OneScore offers users personalised tips to improve their credit scores and inculcate better credit-related habits. Its Score Planner feature helps consumers set goals and achieve them to get the most affordable loans. Customised Loan Offers Once their credit score reaches 730, users can get a customised loan offer via the OnePL facility on this loan app. With pocket-friendly interest rates starting at 12.5% and flexible tenures from 6 months up to 48 months, this app simplifies access to funds. Swift Digital Application OneScore’s easy loan application process does not require borrowers to submit any physical documentation. Furthermore, borrowers can choose their preferred terms and use the EMI calculator to match their repayment abilities. From identifying fraudulent loans to managing credit and applying for a personal loan, One Score is a one-stop shop for all things credit-related. Consumers can download the OneScore App to build a better credit history and take a collateral-free loan of up to ₹5 lakhs without any end-use restrictions. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

[ad_1] Identity theft and fraudulent loan apps are becoming more common with the rise of digital lending. In fact, more than 2,200 loan apps were removed or suspended from the Play Store between September 2022 and August 2023. In the same vein, more than 45% of Indians are said to have encountered identity theft. These alarming numbers make it even more important for borrowers to be aware if someone is misusing their personal and confidential details to take a personal loan. These loans can affect the credit score and creditworthiness of innocent victims, who may discover the fraud too late to take any action. The OneScore App provides valuable tools and alerts to help consumers proactively monitor their credit activity and identify any suspicious loans taken in their name. Read to know the critical role that OneScore plays in safeguarding credit profiles and empowering users to take swift action against any suspicious activity. How Fake Loans Affect Credit Scores To take a fake loan, fraudsters use a victim’s PAN card and other documents to apply for a loan in their name. These are called fake loans because they are offered to the user without their consent or knowledge. Moreover, they are not credited to the user’s account. Instead, fraudsters keep the money. After the disbursal, the liability of repaying the lender falls on the shoulders of the user. Since the user is unaware of this loan, they are likely not to pay EMIs on time. This leads to the accumulation of debt, which is reflected in the user’s credit history. This way, fake loans have a negative effect on their credit score. How to Avoid Fake Loans The best way to protect oneself from any fake or fraudulent loan is to not share confidential information hastily and to keep an eye on one’s credit report. Here are some smart tips potential borrowers can follow. Check if the Lender Is Registered The first step to protecting oneself against fraudulent loans is to determine if the lender is fake or genuine. Check the lender's official website and social media account. If they do not have any permanent address or any option for communication, this may be the first red flag. Onee can also check their Play Store and App Store reviews. Last but not the least, check if they are registered with the RBI. Read Loan Terms Make sure that the lender has all the terms and conditions clearly mentioned on their website. If they do not mention any details of the borrowing or repayment terms, it is best not to waste time. Check App’s Security Some lenders request borrowers to download their app and apply for the loan only through it. Downloading apps of fraudulent lenders on the phone can put one’s personal data at risk. Therefore, it's best to check the security features and their listing on app stores before taking any action. Don't Fall for Cheap Tactics One of the biggest markers of fraud is when a lender asks a potential borrower to complete the loan application quickly or promises guaranteed approval and/or zero interest. Any sign of urgency should also signal that something is wrong. The process that most lenders follow is to check a borrower’s credit score and other eligibility criteria to evaluate their qualification for a loan. If this process is not being followed, users should be wary, as it may be a scheme to get them to share personal information. This information may then be used to commit further fraud. Avoid Unsolicited Loans If a lender reaches out to consumers with unsolicited loan offers and if they are not existing customers of the financial institution, it may be a fraud. Such fraudsters may also demand that users pay a fee before approval or processing of their loan application. Check Credit Report: Generating a complete credit report with credit history periodically tells consumers if there are any fake loans in their name. Early detection is the fastest way to avoid substantial financial loss or damage to the credit score.

How OneScore Helps Since most credit bureaus only give one free credit report a year, it can be a financial strain for borrowers to keep track of their credit accounts. To solve this issue, OneScore gives users unlimited lifetime free credit checks with around-the-clock access to their credit reports. This way, they have access to their credit history at their fingertips and can keep track of their ongoing credit cards and loans. In case the borrowers do detect any fraudulent loans or credit cards in their name, they can directly report it to credit bureaus. The OneScore loan app allows them to raise disputes with CIBIL and Experian right from the app to help them save time when it is of the essence. Other Reasons to Choose the OneScore App Apart from detecting fraudulent loans, switching to the OneScore loan app offers users a variety of benefits: Easy Check of Creditworthiness Borrowers can check their credit score anytime, anywhere, without any membership fees. This helps them develop a stronger bond with their credit health so that they can apply for a credit card, personal loan or home loan with confidence. Credit Score Improvement OneScore offers users personalised tips to improve their credit scores and inculcate better credit-related habits. Its Score Planner feature helps consumers set goals and achieve them to get the most affordable loans. Customised Loan Offers Once their credit score reaches 730, users can get a customised loan offer via the OnePL facility on this loan app. With pocket-friendly interest rates starting at 12.5% and flexible tenures from 6 months up to 48 months, this app simplifies access to funds. Swift Digital Application OneScore’s easy loan application process does not require borrowers to submit any physical documentation. Furthermore, borrowers can choose their preferred terms and use the EMI calculator to match their repayment abilities. From identifying fraudulent loans to managing credit and applying for a personal loan, One Score is a one-stop shop for all things credit-related. Consumers can download the OneScore App to build a better credit history and take a collateral-free loan of up to ₹5 lakhs without any end-use restrictions. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

Is Your Life Insurance Policy Right for You? How to Spot Mis-selling

Life insurance is meant to provide financial security and peace of mind; act as a safety net against adversity but unfortunately, life insurance mis-selling is something that is far too common these days. This malpractice can turn your safety net into a source of stress and financial loss. With increasing reports of insurance fraud and mis-selling, it's important that you understand how to identify and protect yourself from deceptive sales practices.

Understanding Insurance Mis-selling

Insurance mis-selling occurs when an agent or broker deliberately misleads a customer into purchasing a policy through false promises or misrepresentation of facts. This unethical practice often targets vulnerable individuals, particularly senior citizens, who may not fully understand the complexities of insurance products.

Common Signs of Insurance Mis-selling

1. Pressure Tactics and Rush Decisions

If an agent pressures you to make an immediate decision or claims an offer is "limited time only," this should raise red flags. Legitimate insurance decisions require careful consideration and shouldn't be rushed.

2. Unclear Terms and Conditions

Watch out for situations where:

The agent glosses over important policy details

Documentation is not provided in your preferred language

Key terms are explained verbally but differ from written documents

Premium payment terms and duration are not clearly specified

3. False Promises and Misrepresentation

Be wary of agents who:

Promise guaranteed returns that seem too good to be true

Claim the policy is a short-term investment when it's actually long-term

Assure loans or additional benefits not mentioned in the policy document

Present insurance as a fixed deposit or savings scheme

How to Protect Yourself from Mis-selling

1. Thorough Documentation Review

Always read the policy documents carefully

Pay special attention to the fine print

Request clarification for any terms you don't understand

Never sign blank forms or documents

2. Ask Critical Questions

Before purchasing any policy, make sure you ask the important questions and get clear answers for them:

What is the premium payment term?

What are the exact returns or benefits?

What are the conditions for claim settlement?

What are the exclusions and waiting periods?

What happens if you miss a premium payment?

3. Utilise the Free Look Period

All insurance policies come with a free look period (typically 15-30 days) during which you can:

Review the policy thoroughly

Verify if the features match what was promised

Cancel the policy and get a refund if unsatisfied

Red Flags That Warrant Immediate Attention

Unrealistic Returns: Be sceptical of promises of exceptionally high returns or guaranteed benefits that seem improbable.

Bundled Products: Watch out for situations where multiple policies are bundled together without clear explanation of the individual components.

Hidden Charges: Be alert to any fees or charges not explicitly mentioned during the initial discussion.

Lack of Documentation: Always insist on proper documentation and avoid verbal assurances without written proof.

How Insurance Samadhan Helps You Fight Mis-selling

Insurance Samadhan stands as your trusted partner in tackling life insurance mis-selling complaints. This is how they support their clients:

1. Expert Consultation

The team brings over 100 years of combined insurance industry experience, providing:

Professional policy analysis

Expert evaluation of mis-selling cases

Customised solutions for each unique situation

Clear guidance on available options

2. Transparent Process

With complete transparency, they offer:

Refundable fee structure with INR 500 returned if the case remains unresolved

Clear communication at every stage

Regular updates on case progress

No hidden charges or surprise fees

3. Technology-Driven Solutions

Through Insurance Samadhan’s very own Polifyx App, you get:

Real-time case tracking

Interactive dashboard for case management

Easy document submission

Instant access to case updates

4. Comprehensive Support

Their services include:

Complete case documentation

Direct liaison with insurance companies

Representation at various forums

Post-resolution support

Steps to Take If You've Been Mis-sold a Policy

Gather Evidence:

Collect all policy documents

Note down conversations with agents

Save all communication records

Document any promises made during the sale

File a Complaint:

First approach the insurance company's grievance cell

If unsatisfied, escalate to the Insurance Ombudsman

Seek assistance from consumer protection organisations

Consider professional help from organisations specialising in insurance disputes

Take Preventive Action:

Report fraudulent agents to the insurance company and regulatory authorities

Share your experience to warn others

Stay informed about your rights as a policyholder

Conclusion

Insurance mis-selling can have serious financial consequences, but being well-informed and aware can help you avoid becoming a victim. Remember that a genuine insurance policy should align with your financial goals, risk appetite, and long-term needs. If something doesn't feel right, trust your instincts and seek professional advice.

Don't hesitate to reach out to expert organisations that specialise in resolving insurance disputes. InSa are experts in tackling life insurance mis-selling complaints and can provide valuable guidance and support in addressing the issues and making sure that your rights as a policyholder are protected.

By staying informed and taking appropriate precautions, you can make the right decisions about your insurance needs and protect yourself from fraudulent practices in the insurance market.

0 notes

Text

How to Reduce Property Fraud: Trusted Notary Services in San Diego

I. Introduction

Understanding the Threat of Property Fraud

One such industry that is flourishing is real estate, and the real estate frauds are also on the rise which can be a serious threat for any property owner. It’s usually done by one of the following fraudulent methods like signing someone else’s name or forging a deed or impersonating them to wrongfully transfer or boast an ownership interest in a property. Such instances can lead to financial losses for the rightful owners and even legal disputes and emotional toll on them.

Some of the trick’s fraudsters use most commonly are filing false deeds to claim ownership or tampering with critical paperwork. With these dangers in mind, you need to do what you can to protect your property. Here’s where your San Diego Notary Public, Eleven Dollar Notary Services, comes in. To efficiently reduce the risk and risks of property fraud, we offer the best notarizing documents services professionally and accurately.

II. What You Can Do to Protect Yourself from Property Fraud

a) Conduct Proper Research

Due diligence is where anyone trying to avoid property fraud should start. You should both verify the sellers and the buyers in a property transaction. Identify them, verify their credentials, make sure they are authorized to do the deal. Hiring professionals during the transaction process, such as real estate agents and legal experts, is also helpful, as they will spot any potential red flags.

b) Use Professional Notary Services

This is where a San Diego Notary Public comes in; not only do they help to reduce property fraud, but they will also authenticate signatures, make sure that the documents are real and valid, and that you are who you say you are. Scammers commonly deploy doctored signatures or forged contracts to evade deals. The notarizing documents services adds a holy lead to your property transactions.

One thing is notable, loan signing agent must have in real estate deal. It also ensures that all the documents including deeds, contracts, and mortgage agreements are properly signed and executed, thus reducing the chances of fraud or disputes. This expertise ensures that all parties involved in the transaction are acting within the law.

c) Monitor Property Records on a Regular Basis

It’s an astute way to protect against property fraud to monitor your property records. Property owners must periodically check title transfers or possible fraud. A handful of government agencies and tracking services for property do make tools available to warn you if changes are made to property ownership or title records. If not, detecting fraudulent activity earlier can prevent getting an involvement in larger legal or financial trouble.

d) Secure Original Documents

Importantly, one should protect original documents: (deeds to property, titles, agreements, etc.) Fraudsters will misuse misplaced or stolen documents to commit property fraud. These papers are less prone to be accessed without permission if they are kept in a secure location. Notarized copies of your original documents prove authenticity without putting the originals in harm's way.

III. How Eleven Dollar Notary Services Can Help Prevent Property Fraud

a) Accurate and Professional Notarization

At Eleven Dollar Notary Services, nothing is too small or too big when it comes to notarization. Your property documents are verified with every minute detail to ensure that you are on the right side of law. Our trustworthy notarizing documents services are safeguards against the sorts of mistakes that crooks could exploit, regarding deeds, real estate agreements, or powers of attorney.

b) Expertise in Real Estate Transactions

A notary who specializes in loan signing services, we ensure that all your real estate transaction paperwork is properly and efficiently filled out. Being a loan signing agent ourselves, we know how vital it is to confirm every piece of information to guard against fraud. We walk clients through the housing transaction process for events such as mortgage closings, refinances, or deed transfers.

c) Mobile Notary Convenience

Mobile Notary San Diego & Mira Mesa handling notarizing easy & safe Allowing clients to produce property paperwork from their residence. We have mobile services to ensure dimensional discretion and a secure way to notarize your documents without having to send someone into our office.

d) Pricing which is affordable with quality assurance

Thus, make a cost-effective booking with us through our specialized & reliable service at budget-friendly rates. Clear in pricing but murky in service. We protect property transactions against fraud and provide peace of mind in a highly detail-oriented, punctual process.

IV. Advantages of Collaborating with Eleven Dollar Notary

a) Trusted Verifications to Prevent Fraud

As the speed of document verification, which is a crucial step of fraud prevention matters, the team of our professionals with industry experience becomes a core to our success. “We have an ongoing process for checking money laundering guys, checking signatures, checking people actually leased the property.” Whether you are in the process of buying, selling, or refinancing, Eleven Dollar Notary Services can assist you every step of the way and guarantee a smooth and seamless transition with your property documents.

b) Peace of Mind for Clients

That is exactly where the advantage of profession notary services comes in, because they are not needed to be worried of fraud. Clients are confident their documents are legal and properly executed. At Eleven Dollar Notary Services, we do our best to provide our clients with the peace of mind they deserve with our services to protect their property and legal interests.

c) Flexible Payment Options and Transparent Fees

For client convenience, Eleven Dollar Notary Services also accepts payment on all major forms of payment and PayPal, Venmo, credit card, cash, personal checks, and money orders. What is more interesting is that clients could select both integrated and external modes of payment which adds flexibility. No hidden fees, no surprises Professional Notarization is within everyone’s reach.

Conclusion

Stay Secure with Professional Notary Services

Although property fraud can pose a serious threat to homeowners, there are checks and balances designed to help avoid those threats. Eleven Dollar Notary Services provides accurate, professional and trusted notarizing documents services to prevent clients from becoming victims of property fraud.

We provide clients with real estate transaction expertise, mobile convenience, and flexible payment options. Call us today to schedule an appointment with one of our professional and trusted notaries, so your property does not fall prey to this type of fraud! We aim to give you the security and the legal peace of mind you require.

#notaryservices#mobilenotary#affordablenotary#californianotary#loansigningagent#notarynearme#reliablenotary#sandiegonotary#Notaryservicenearme#notarypublic#mobilenotarynearme#mobilenotaryservice#mobilenotarysandiego#realestatedocumentnotarization#certifiednotarypublic#realestatetransaction#professionaldocumentnotarization#notary

1 note

·

View note

Text

How AI Is Changing the Mortgage Industry

The Ultimate Data Cruncher

You know all that data you have to hand over when you apply for a mortgage? Income, credit scores, tax returns, every financial breadcrumb you've left behind? It's a lot. Previously, someone had to go through all of that, line by line, to figure out whether you're a good candidate for a loan.

Now, AI can process all that information in seconds, spotting trends, risks, and opportunities with the kind of precision humans can't match. For instance, a Philadelphia mortgage lender might use AI to assess your financial history and predict how likely you are to repay your loan. No more waiting weeks for someone to "get to your file."

Mortgages That Actually Fit

Imagine being a first-time homebuyer with a modest budget. Instead of scrolling through a million loan options, AI could match you with a mortgage tailored to your financial situation. This kind of personalization is a big deal. AI looks at your unique circumstances and recommends products designed to fit your life, not someone else's. Lenders love it, too, because a happy, well-matched borrower is more likely to follow through on their application.

Bye-Bye, Paperwork Overload

Traditionally, applying for a mortgage can feel like filling out a never-ending stack of forms while juggling five ring binders of documents. Well, AI is cutting through that chaos. Today, many lenders are using AI-powered chatbots and virtual assistants to guide borrowers through the process. These tools can answer questions, flag missing info, and even pre-fill forms so you're not doing the same thing over and over. Instead of an underwriter spending day cross-checking your documents, AI can zip through it all, making sure everything checks out.

Catching the Bad Guys

Here's something you don't often think about during a mortgage application: fraud. But it happens more than you'd think. Luckily, AI is trained to spot red flags, like mismatched financial details or suspicious patterns in applications. If something doesn't add up, AI will raise the alarm faster than you can say "loan officer." For borrowers, this means peace of mind. You can trust that your lender is protecting your information and money. And for lenders? It's a way to keep their business secure and trustworthy.

What's Next for AI in Mortgages?

AI is setting the stage for a whole new way of doing business. Imagine a world where mortgages are approved instantly, offers are perfectly tailored, and borrowers can predict how their finances will look five years down the road. Lenders will need to keep up with these changes if they want to stay competitive. For borrowers, the takeaway is simple: the mortgage process is getting faster, smarter, and more user-friendly.

0 notes

Text

How to Protect Yourself from Personal Loan Phishing Scams

In today’s digital world, personal loans have become more accessible, allowing borrowers to apply online and receive funds quickly. However, this convenience has also led to a rise in phishing scams, where fraudsters attempt to steal your personal and financial information by posing as legitimate lenders. These scams can result in identity theft, financial loss, and fraudulent loan applications in your name.

If you’re planning to apply for a personal loan, it is essential to understand how phishing scams work, the warning signs to look for, and the best ways to protect yourself.

1. What Are Personal Loan Phishing Scams?

A phishing scam is a fraudulent attempt to trick individuals into providing sensitive information such as bank details, Aadhaar number, PAN card, OTPs, or login credentials. Scammers typically impersonate banks, NBFCs, or online lending platforms and contact borrowers via emails, phone calls, SMS, or fake websites.

Once they obtain your information, they can:

Steal money from your bank account

Take a loan in your name

Misuse your identity for financial fraud

Access and sell your personal data on the dark web

2. Common Types of Personal Loan Phishing Scams

2.1 Fake Loan Approval Emails & SMS

Fraudsters send emails or SMS messages claiming that your loan has been pre-approved or that you qualify for a low-interest personal loan. These messages often contain links leading to fake lender websites designed to steal your personal information.

2.2 Fake Loan Websites & Apps

Scammers create websites and mobile apps that look like real financial institutions. They trick users into entering personal and banking details, which are then used for fraudulent activities.

2.3 Fraudulent Customer Service Calls

You may receive a phone call from a scammer pretending to be a bank representative. They claim you must provide your OTP, Aadhaar, PAN, or bank details to complete your loan application. Once you share these details, scammers can withdraw money or take loans in your name.

2.4 Loan Processing Fee Scams

Fraudsters promise quick loan disbursal with no documentation but demand advance processing fees or a loan insurance fee. Once the fee is paid, the scammer disappears, and no loan is disbursed.

2.5 Social Media Loan Scams

Some scammers advertise fake loans on Facebook, Instagram, or WhatsApp and ask potential borrowers to contact them privately. Once engaged, they request confidential details, leading to identity theft.

3. Red Flags to Identify Loan Phishing Scams

3.1 Offers That Sound Too Good to Be True

If you receive an offer promising guaranteed loan approval with no credit check, zero documentation, or extremely low-interest rates, it’s likely a scam.

3.2 Unsolicited Loan Messages

Legitimate lenders do not send random SMS, WhatsApp messages, or emails offering personal loans. Be cautious if you receive messages from unknown numbers or email addresses.

3.3 Fake Loan Websites

Before applying for a loan online, always verify the website’s domain name. Scammers often create fake websites with slightly modified spellings of real lenders to trick borrowers.

3.4 Requests for Upfront Payments

No genuine lender will ask for advance processing fees before loan approval. If a lender insists on upfront payments via UPI, Paytm, or Google Pay, it’s a scam.

3.5 Pressure to Act Immediately

Scammers create urgency by saying things like, "Limited offer – Apply now!" or "Your loan will be canceled if you don’t act fast." A real lender will give you time to review the terms.

3.6 Request for Personal Information Over the Phone

A legitimate bank or NBFC will never ask you for OTPs, passwords, or CVVs over the phone. If someone does, hang up immediately.

4. How to Protect Yourself from Loan Phishing Scams

4.1 Apply for Loans Only from Trusted Lenders

Always apply for a personal loan through registered banks, NBFCs, or reputed online lenders. Here are some safe options:

🔗 IDFC First Bank Personal Loan 🔗 Bajaj Finserv Personal Loan 🔗 Tata Capital Personal Loan 🔗 Axis Finance Personal Loan 🔗 Axis Bank Personal Loan 🔗 InCred Personal Loan

4.2 Verify the Lender’s Website

Check if the website URL starts with "https://" (secure site).

Look for official lender details on the RBI website or lender’s official website.

Avoid websites with poor design, spelling errors, or unusual domain names (e.g., "axisbankloans.xyz" instead of "axisbank.com").

4.3 Never Click on Suspicious Links

Do not click on links in unsolicited emails or messages claiming to be from a bank or NBFC. Instead, visit the official website by typing the URL manually.

4.4 Avoid Sharing Personal Information Online

Scammers may ask for your Aadhaar, PAN, or bank details via email, phone, or WhatsApp. Never share sensitive information with unknown sources.

4.5 Enable Two-Factor Authentication (2FA)

Use 2FA on your banking and email accounts to protect against unauthorized access. This adds an extra layer of security if your password is compromised.

4.6 Check Reviews & Ratings Before Downloading Loan Apps

Before installing a loan app, check:

App permissions (Avoid apps that ask for access to contacts, photos, and messages).

Reviews and ratings on Google Play or App Store.

If the app is registered with an RBI-approved lender.

4.7 Monitor Your Bank & Credit Report Regularly

Check your credit report and bank statements for unauthorized loan applications or suspicious transactions. If you spot any fraudulent activity, report it immediately.

5. What to Do If You Are a Victim of Loan Phishing?

If you have fallen victim to a loan phishing scam, take these steps:

1️⃣ Contact Your Bank Immediately – Report any unauthorized transactions and request to block your account if necessary. 2️⃣ Change Your Passwords – Update your internet banking, email, and loan account passwords immediately. 3️⃣ File a Cyber Crime Complaint – Report the fraud to the Cyber Crime Portal (www.cybercrime.gov.in) or call the National Cyber Crime Helpline (1930). 4️⃣ Report to RBI & Consumer Forum – If you have been tricked into a fake loan scheme, report it to the RBI and National Consumer Helpline (1800-11-4000). 5️⃣ Monitor Your Credit Report – Check for unauthorized loans taken in your name and dispute them with credit bureaus like CIBIL and Experian.

Stay Alert & Borrow Safely

Personal loan phishing scams are on the rise, but you can stay protected by being vigilant. Always verify loan offers, apply only through trusted lenders, and avoid clicking on suspicious links.

For safe and secure personal loan options, apply here: 👉 Compare & Apply for a Personal Loan

By staying cautious and informed, you can protect yourself from loan fraud and ensure a safe borrowing experience.

#nbfc personal loan#bank#loan services#personal loans#fincrif#personal loan#personal laon#loan apps#personal loan online#finance#fincrif india#Personal loan phishing scams#Loan fraud protection#How to avoid loan scams#Safe personal loan application#Phishing scams in personal loans#Fake loan offers#Online loan scams#Fraudulent loan websites#Personal loan safety tips#How to identify loan scams#Signs of a loan scam#Avoiding personal loan fraud#Phishing emails from loan providers#Loan application fraud prevention#How scammers trick loan applicants#Secure loan application process#Fake personal loan SMS and calls#Online loan phishing protection#Tips to protect against loan fraud

3 notes

·

View notes

Text

Verify Vehicle Title Loans: Safeguard Against Scams Effectively

Table of Contents

Introduction

Common Vehicle Title Loan Scams

Key Red Flags to Watch For

Steps to Verify Legitimate Car Title Loan Companies

Trusted Auto Title Loan Options in Brandywine

FAQs About Verifying Automobile Title Loans

Secure Your Financial Future with Careful Research and Trustworthy Lenders

Protecting Your Finances and Deceptive Practices

Title loans can provide fast access to funds during emergencies, but selecting a reputable lender is essential to safeguard your finances. Verifying Vehicle Title Loan Companies is key to protecting your personal information and avoiding potential fraud. In Brandywine, Title Loans Online knowing how to spot trustworthy lenders ensures you make well-informed choices and avoid falling prey to scams.

Common Vehicle Title Loan Scams

To protect yourself, it’s important to recognize common scams, including:

Fake Lenders: Scammers impersonate legitimate companies to steal personal data.

Upfront Fees: Fraudulent companies may demand payment before offering a loan.

Misleading Contracts: Hidden fees and confusing terms can trap borrowers in unmanageable debt.

Unlicensed Operations: Some lenders bypass state regulations, leaving borrowers unprotected.

Key Red Flags to Watch For

When researching car title loan companies, keep an eye out for these warning signs:

Lack of Licensing: Legitimate lenders are licensed in your state. Verify their credentials.

Unrealistic Promises: Guaranteed approvals or zero requirements can signal a scam.

Vague Terms: Be wary of contracts that are unclear or difficult to understand.

No Physical Address: Companies without a verifiable location are often fraudulent.

Steps to Verify Legitimate Car Title Loan Companies

1. Check State Licensing Use your state’s financial regulatory authority to confirm the lender’s license.

2. Research Reviews and Ratings Visit trusted platforms like the Better Business Bureau (BBB) to read customer feedback.

3. Verify Contact Details Ensure the company provides a physical address and working phone number.

4. Request Transparent Terms Ask for a detailed loan estimate outlining interest rates, fees, and repayment conditions.

5. Avoid Upfront Fees Legitimate lenders do not charge large fees before issuing a loan.

Trusted Auto Title Loan Options in Brandywine

For borrowers in Brandywine, consider these features when selecting a lender:

Flexible Terms: Choose a lender offering customizable repayment options.

Transparent Fees: Look for companies that disclose all charges upfront.

No Bank Account Required: Some lenders provide loans without a bank account.

FAQs About Verifying Automobile Title Loans

1. Can I trust online car title loan companies?Yes, but always verify licensing and read reviews before proceeding.

2. Are loans available for cars with a salvage or rebuilt title?Some lenders may offer loans for such vehicles. Confirm this option with the lender.

3. What documents do I need for a car title loan?You typically need the car title, proof of income, and a government-issued ID.

4. How long does it take to get a title loan?Approval can often be completed within the same day, depending on the lender.

Secure Your Financial Future with Careful Research and Trustworthy Lenders

Securing your financial future starts with careful research and a clear understanding of potential risks. You can confidently navigate the title loan process by spotting common scams, recognizing warning signs, and verifying lenders. Avoid hasty decisions and always perform due diligence. For trustworthy and reliable options in Brandywine, use Online Car Title Loan Verification to confirm the legitimacy of your lender. These essential steps will help protect your finances and ensure a safe, stress-free borrowing experience. Take control of your financial security today and move forward peacefully.

Visit Our Website: www.titleloansonline.com

Publication Date: 25 December 2024 Author Name: Stephen

#title loans online fast#title loan without title online#online title loans for bad credit#fast online title loans#can you pawn your car#approved title loans texas#online texas title loan service

0 notes

Text

Anyone notice the biggest complaint from GOP is that someone who doesn't deserve money or help from the government get's it!. Meanwhile the GOP government has so many programs that benefit the rich and corporate America and they and trump deleted millions of PPP red flag loans during trump's nightmare stay in the White house?

Make it make sense! and investigate trump's and the gop" handling of the Covid Pandemic and dispensing of 8 trillion dollars!

40 notes

·

View notes

Text

Pre Marriage Investigation: A Step Towards a Secure Future

Marriage is a significant milestone in life, often described as a union built on trust, compatibility, and shared dreams. However, in today's world, where appearances can be deceptive, ensuring that you are making the right choice is essential. This is where Pre Marriage Investigation comes into play, offering clarity and peace of mind before you tie the knot.

What is a Pre Marriage Investigation?

A Pre Marriage Investigation involves a thorough background check of a prospective partner to verify their credentials, character, and intentions. This service is conducted discreetly by professional detective agencies to provide reliable information that helps families and individuals make informed decisions about marriage.

Why is Pre Marriage Investigation Important?

Authenticity of Claims: Verifies personal details such as education, employment, and financial stability.

Protecting Against Deception: Uncovers hidden facts like a past marriage, legal issues, or undisclosed relationships.

Ensuring Compatibility: Provides insights into the prospective partner's habits, behavior, and lifestyle.

Avoiding Financial Scams: Confirms financial standing to avoid dowry traps or fraudulent claims.

Building Trust: Helps families start a relationship on a foundation of truth and transparency.

Key Areas Covered in Pre Marriage Investigations

Background Check:

Verifies identity, age, and educational qualifications.

Cross-checks employment and professional credentials.

Family Background:

Examines the family’s reputation, financial status, and relationships.

Investigates family disputes, legal issues, or hidden controversies.

Previous Relationships:

Detects past relationships, divorces, or extramarital affairs.

Identifies any ongoing or hidden romantic connections.

Financial Verification:

Assesses debts, loans, and overall financial stability.

Confirms property ownership or claims of wealth.

Social Behavior and Habits:

Analyzes lifestyle, social circle, and habits like drinking or gambling.

Reports any criminal records or unethical practices.

Health and Medical History:

Checks for undisclosed medical conditions or addictions.

How Do Professional Agencies Conduct Pre Marriage Investigations?

Client Consultation: The process begins with a confidential discussion to understand the client’s concerns and expectations.

Customized Investigation Plan: A tailored strategy is created based on the specific details of the case.

Field Investigation: Professional investigators discreetly gather evidence through surveillance and interviews.

Database Verification: Information is cross-verified using public and private records for accuracy.

Comprehensive Report: The findings are compiled into a detailed report for the client, ensuring complete transparency.

Who Needs Pre Marriage Investigations?

Individuals:

People entering arranged marriages.

Individuals with doubts about their partner's background.

Families:

Parents concerned about the alliance's authenticity or compatibility.

NRIs:

Non-resident Indians seeking to verify prospective partners in India.

Benefits of Pre Marriage Investigations

Peace of Mind: Confirms that you are making the right decision.

Avoiding Future Conflicts: Identifies potential red flags early on.

Protection from Fraud: Ensures that your partner is genuine and trustworthy.

Confidentiality Assured: Professional agencies conduct investigations discreetly without jeopardizing reputations.

Why Choose Professional Detective Agencies?

Expertise: Experienced investigators know how to handle sensitive cases efficiently.

Confidentiality: They operate discreetly, ensuring that the subject of investigation remains unaware.

Accurate Results: Using advanced tools and methods, they provide reliable and verified information.

Legal and Ethical Compliance: Investigations are conducted within the boundaries of the law.

Conclusion

Marriage is a lifetime commitment, and making the right choice is paramount. A Pre Marriage Investigation helps individuals and families ensure that their trust is well-placed and their decision is informed. By partnering with a professional detective agency, you can uncover the truth and start your marital journey with confidence.

Invest in clarity, trust, and peace of mind—because your future deserves the best foundation.

0 notes

Text

Common Loan Scams Happening and Ways to Protect Yourself from Them!

Think of a situation where you are scrolling through your phone, worried about your upcoming bills. And then, suddenly, you notice an ad on your screen promising instant cash without any credit check. Sounds too good to be true, right? Well, that's because it probably is.

The need for money can arise anytime and the availability of quick cash often seems appealing. But hiding in the shadows of convenience are cunning fraudsters, ready to hit us at any moment. These fraudsters create a web, a place where your dream of financial relief can quickly turn into a nightmare of stolen identities and empty bank accounts.

The evolution of loans has become more sophisticated and even more complex in identifying these scammers. In this blog, we’ll make you a loan fraud detective, and by the end of this blog, you'll be equipped with the skills to protect your hard-earned money and help you avoid loan fraud online. Let us know some common loan scams that happen and the ways to protect yourself from them.

Seems like the most perfect offer you’ll ever discover!

Suppose an email lands in your inbox, promising a loan with unbelievably low interest rates, no credit score checks, and a promise of instant approval. Sounds like it is the solution you were looking for, right? Well, hold on, as it's the first red flag buried by these scammers for you. Remember that honest and trusted lenders will always assess the minute risks associated with lending you money. If someone offers you cash without checking your background, they're more interested in gathering your personal information than helping you financially. If the offer proposed to you sounds too good to be true, it's probably a scam.

Request for Upfront Fees in advance

Here's a most doubtful scammer's trick: asking for Upfront Fees in advance. Once the fee is paid, these scammers disappear, leaving the victim with no loan and financial loss. This is a suspicious sign that you're dealing with a scammer.

Putting a pressure on you!

Loan Scammers love to create a story backed by a sense of urgency. They'll label the loan offer as a “Limited Period Offer"! or that you must act "right now." This high-pressure tactic is designed to make you act before you have time to think or research! Remember, any licensed lender will give you enough time to review their terms and conditions. If someone pushes you to make a fast decision, they're probably trying to lure you into a scam.

The Phishing Expedition

In this digital age, your information is the most precious thing, and scammers are experts in mining other’s data. They might send you official-looking emails or set up fake websites that mimic real financial institutions. Their primary goal is to trick you into entering your personal and financial information. To be on the safer side,\ double-check the URL of the lender’s website. Look for 'https' at the beginning of the web address and a padlock icon in the address bar. And remember, legitimate lenders won't ask for sensitive information via scam email and unsecured websites.

The “Spot Me” Game!

Here's an often overlooked sign about mysterious lenders, is that you can't find their physical address, phone number, or online presence. Trusted lenders are proud of their reputation and want to be found, anyway. If your "lender" seems to exist only in the darkness of the internet, it's time to move away from this fake lender.

How to protect oneself against Loan fraudsters?

Now that we know the common practices of scams happening to us and the people around us, here are some defensive tips you can perform against these loan scammers:

Background Research: Research the lender thoroughly before providing personal information or applying for a loan.

Check for Legitimacy: Verify that the lender is registered with your country's financial regulatory bodies.

Read the Fine Print: Read the loan agreement carefully before signing anything.

Trust your Gut: If something feels off, it can actually be this. Don't ignore your instincts.

Secure your Information: Never give away your personal or financial information sent to unsolicited callers or emails.

Stay Smart, Stay Safe!

There you are, a Spider-man of the financial internet web! You're now equipped with the knowledge to spot and dodge loan fraud online like a pro. Remember, in the world of finance, caution is your best friend. While the quick money offers can be very tempting, always consider taking a moment to think smartly and perform in-depth research, which can help you avoid these scams.

So, stay updated, stay smart, and stay safe! Your online safety is in your hands. Always prioritise your information and your hard-earned money over attractive money offers, and use these tips to avoid scammers online!

Stay tuned for more informative blogs!

Source Link: Protect Yourself Against Loan Scam

0 notes