#Real Estate Market in Turkey

Explore tagged Tumblr posts

Text

Turkey Real Estate Market Trends, Growth, Demand, Industry Share, CAGR Status, Challenges and Business Opportunities 2033: SPER Market Research

The market for residential and commercial property development, purchase, and management is known as the real estate industry. This broad market consists of commercial and industrial real estate geared toward manufacturing and company operations, as well as residential real estate serving individuals and families. While real estate investment includes purchasing assets for financial gain, real estate development entails the creation and improvement of properties. The real estate market is a dynamic environment where different stakeholders participate in activities that form urban landscapes, support economic growth, and offer investment opportunities. It is influenced by economic trends, demographic transitions, and regulatory issues.

According to SPER market research, ‘Turkey Residential Real Estate Market Size- By Type, By Areas- Regional Outlook, Competitive Strategies and Segment Forecast to 2033’ state that the Turkey Residential Real Estate Market is predicted to reach 259.46 billion by 2033 with a CAGR of 11.4%.

Increased Economic Indicators' Influence, Like Interest Rates, is Powering the Regional Market. Economic data are crucial in guiding the real estate industry's dynamics. Interest rate fluctuations are a major factor; as lower rates usually enhance demand for real estate by making mortgages more affordable. Employment rates are a good indicator of the state of the economy since they affect consumer confidence and, in turn, people's propensity to make real estate investments. Moreover, the market expansion is driven by the region's rapidly growing population. The demand for infrastructure and housing is being driven by the region's expanding population, which is strengthening the real estate industry.

Request For Free Sample Report @ https://www.sperresearch.com/report-store/turkey-residential-real-estate-market.aspx?sample=1

In the real estate sector, environmental issues are related to how building and land development affect the environment. Governments and municipalities may pass laws requiring eco-friendly building methods as knowledge of environmental issues grows. This could involve trash minimization, sustainable materials, and energy-efficient building regulations. These actions could increase building expenses, which would reduce real estate projects' overall profitability. To properly manage this constraining element, investors and developers must thus stay up to date on changing environmental regulations and integrate sustainable methods.

Impact of COVID-19 on Turkey Residential Real Estate Market

In 2020, despite the COVID-19 epidemic, the Turkish residential market continued to grow since mortgage rates were falling. As a result, the year's total number of home sales broke all previous records. But in contrast to the same period in 2020, the first half of 2021 saw a decline in the share of mortgaged sales in the total due to an increase in interest rates.

Turkey Residential Real Estate Market Key Players:

Europe has the biggest revenue share geographically because the region's low interest rates have made borrowing more accessible and have encouraged people to invest in real estate. Demand for residential real estate has also increased as a result of rising job rates and economic growth, which have also increased consumer confidence and purchasing power. Agaoglu Group, Alarko Holding, Artas Group, Ege Yapı, Novron, and other well-known businesses are also notable market participants.

For More Information about this Report: –

Turkey Real Estate Market Future Outlook

Related Reports:

GCC Construction Machinery Market Size- By Machinery Type, By Application Type- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

Europe Fire-Rated Doors Market Size- By Material, By Product, By Application- Regional Outlook, Competitive Strategies and Segment Forecast to 2033

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

Sara Lopes, Business Consultant – U.S.A.

SPER Market Research

+1-347-460-2899

#Turkish Housing Market#Turkish Real Estate Market#Real Estate Market#Real Estate Market in Turkey#Turkey Real Estate Market#Turkey Real Estate Market forecast#Turkey Real Estate Market Future Outlook#Turkey Real Estate Market Share#Turkey Residential Real Estate Market#Turkey Residential Real Estate Market Analysis#Turkey Residential Real Estate Market Challenges#Turkey Residential Real Estate Market Competition#Turkey Residential Real Estate Market Demand#Turkey Residential Real Estate Market Growth#Turkey Residential Real Estate Market Major Players#Turkey Residential Real Estate Market Research Reports#Turkey Residential Real Estate Market Revenue#Turkey Residential Real Estate Market Size#Turkey Residential Real Estate Market Trends#Turkey's Property Market

0 notes

Text

#antalya#turkey#real estate marketing#real estate#luxury aesthetic#luxury lifestyle#luxury living#luxurious#home & lifestyle#home interior#bathroom#bathroom interior design

5 notes

·

View notes

Text

Investment Opportunities in Antalya’s Mild Climate

Antalya’s mild climate offers year-round opportunities for both living and investment. From warm summers to mild winters, the region provides the perfect environment for outdoor activities, tourism, and real estate investment.

🎥 In our latest video, explore Antalya’s climate and discover the advantages of making real estate investments in this unique region. Antalya offers attractive opportunities for every investor.

🏡 At Antalya Development, we are here to help you make the most of real estate opportunities in Antalya.

Contact us

antalyadevelopment.com

#AntalyaDevelopment#RealEstateInvestment#MildClimate#AntalyaInvestment#PropertyOpportunities#antalya#luxury living#real estate#aesthetic#luxurious#design#luxury lifestyle#real estate marketing#home & lifestyle#turkey

2 notes

·

View notes

Text

Best House Turkey Comprehensive Guide to Investing in Istanbul Real Estate: Everything You Need to Know in 2024

Best House Turkey Comprehensive Guide to Investing in Istanbul Real Estate: Everything You Need to Know in 2024

Istanbul, the vibrant metropolis that straddles both Europe and Asia, has become one of the most sought-after locations for real estate investment. With a rich history, stunning landscapes, and an ever-growing economy, Istanbul is the ideal place to buy property. Whether you’re looking for a luxury villa, a modern apartment, or a commercial investment, this guide will walk you through every aspect of buying property in Istanbul in 2024.

Table of Contents

Why Invest in Istanbul Real Estate?

Current Trends in the Istanbul Real Estate Market

Key Factors Driving Growth

Impact of Global Investment

Top Neighborhoods for Property Investment in Istanbul

Beyoğlu & Taksim

Sarıyer & Levent

Kadıköy & Üsküdar

Types of Properties Available for Sale in Istanbul

Modern Apartments

Historic Homes

Luxury Villas

Step-by-Step Guide to Buying Property in Istanbul

Required Documents

The Legal Process

Cost of Buying Property in Istanbul

Price Ranges by Neighborhood

Additional Costs

Financing Your Property Purchase in Istanbul

Advantages of Turkish Citizenship through Real Estate Investment

Frequently Asked Questions (FAQ) About Buying Property in Istanbul

1. Why Invest in Istanbul Real Estate?

Strategic Location

Istanbul’s unique geographical location between Europe and Asia is one of the main reasons why it has become a central hub for international investment. The city is not only a cultural melting pot but also a leading business and financial center. Its strategic location offers significant long-term potential for property investors.

Rising Property Values

Over the past decade, property values in Istanbul have consistently risen, and this trend shows no sign of slowing down. With significant infrastructure developments, including new transport links, commercial zones, and cultural projects, Istanbul’s real estate market offers substantial returns on investment.

Growing Population and Demand

Istanbul’s population is expanding rapidly, and with it, the demand for housing is steadily increasing. Both locals and foreigners are seeking to buy property in the city, whether for residential purposes or as investment assets.

Explore available investment opportunities with Best House Turkey to secure a promising property deal in Istanbul.

2. Current Trends in the Istanbul Real Estate Market

Key Factors Driving Growth

Several key factors are contributing to the continuous growth of Istanbul’s real estate market:

Urbanization: As more people move to Istanbul for work or lifestyle, demand for housing continues to increase.

Government Initiatives: The Turkish government offers tax incentives and programs, including the Turkish Citizenship by Investment program, to attract foreign investors.

International Trade and Business Hub: As Istanbul continues to solidify its position as a major business and trade center, the demand for both residential and commercial properties is surging.

Impact of Global Investment

Foreign investors, especially from the Middle East, Europe, and Russia, are increasingly buying properties in Istanbul. This international influx not only boosts property prices but also brings a cosmopolitan flair to the city. Real estate developers are catering to the growing demand for high-end, luxury properties in prime locations.

3. Top Neighborhoods for Property Investment in Istanbul

Beyoğlu & Taksim

Beyoğlu is one of the most popular areas in Istanbul, known for its lively atmosphere, proximity to major attractions, and rich cultural history. Taksim Square, one of Istanbul's most famous landmarks, lies within this district, offering excellent public transportation options and vibrant nightlife.

Best for: Young professionals, short-term rental investors.

Average Price: $3,000 - $6,000 per square meter.

Sarıyer & Levent

These neighborhoods are ideal for luxury buyers, offering high-end properties with panoramic views of the Bosphorus. Sarıyer, a coastal area, is known for its natural beauty, while Levent is a business and financial district with modern residential complexes.

Best for: Affluent buyers, investors seeking long-term capital appreciation.

Average Price: $6,000 - $12,000 per square meter.

Kadıköy & Üsküdar

Located on the Asian side of Istanbul, Kadıköy and Üsküdar offer a more relaxed lifestyle while still being well-connected to the city center. These areas are popular among families and long-term residents, with plenty of green spaces, schools, and affordable housing options.

Best for: Families, those seeking a quieter neighborhood.

Average Price: $2,500 - $5,000 per square meter.

4. Types of Properties Available for Sale in Istanbul

Modern Apartments

Modern apartments in Istanbul offer state-of-the-art facilities, including smart home technology, gymnasiums, swimming pools, and 24/7 security. These apartments are generally part of larger residential complexes, often located near business districts or transportation hubs.

Historic Homes

Istanbul is famous for its historic properties, ranging from Ottoman-era mansions to restored houses with architectural charm. These properties often have a unique cultural value, which can make them desirable to buyers interested in preserving the city's history while enjoying modern amenities.

Luxury Villas

For buyers looking for space, privacy, and luxurious features, Istanbul offers an impressive range of luxury villas. Many of these properties boast stunning Bosphorus views, private pools, large gardens, and easy access to Istanbul’s key areas.

5. Step-by-Step Guide to Buying Property in Istanbul

Required Documents

Passport: A valid passport is required for identification purposes.

Tax ID Number: Foreign buyers must obtain a Turkish tax number.

Proof of Funds: Evidence of where the funds for the property purchase are coming from.

The Legal Process

The legal process for buying property in Istanbul is relatively straightforward:

Property Selection: Identify the type of property you wish to purchase and visit potential properties.

Sale Agreement: Once you’ve selected the property, a sale agreement is drafted, and a deposit is usually paid.

Title Deed Transfer: The final step is the official transfer of the property’s title deed (TAPU) at the Land Registry Office.

6. Cost of Buying Property in Istanbul

Price Ranges by Neighborhood

Central Areas (Beyoğlu, Şişli): $3,000 - $7,000 per square meter.

Luxury Areas (Sarıyer, Levent): $6,000 - $12,000 per square meter.

Suburban Areas (Kadıköy, Üsküdar): $2,500 - $5,000 per square meter.

Additional Costs

Title Deed Fees: 4% of the property value.

Notary Fees: Typically $150 - $300.

Property Tax: 0.2% to 0.6% of the property’s declared value, annually.

7. Financing Your Property Purchase in Istanbul

Many banks in Turkey offer mortgage options to foreign buyers, generally requiring a down payment of 25-40%. Alternatively, you can explore developer financing, which may offer installment plans over the course of the construction.

8. Advantages of Turkish Citizenship through Real Estate Investment

Turkey offers a unique opportunity for foreign investors to acquire citizenship by purchasing real estate. The minimum required investment is $400,000, and the process typically takes around 3-6 months. This program grants you and your immediate family Turkish citizenship, including access to healthcare, education, and business opportunities.

For more details, visit Best House Turkey and start your citizenship journey today!

9. Frequently Asked Questions (FAQ) About Buying Property in Istanbul

1. Can I buy property in Istanbul as a foreigner?

Yes, foreigners can purchase property in Istanbul, provided the property is not located in military zones.

2. What is the minimum investment required for Turkish citizenship?

To qualify for Turkish citizenship through real estate investment, you need to invest at least $400,000.

3. Are there financing options for foreigners buying property in Istanbul?

Yes, Turkish banks and property developers offer financing options to foreigners, though the terms and conditions may vary.

4. How long does the property buying process take in Istanbul?

The property buying process typically takes 1-2 months, from initial negotiations to the transfer of the title deed.

5. What are the ongoing costs of owning property in Istanbul?

Ongoing costs include property tax, maintenance fees (for apartments), and utility bills.

6. Is it possible to rent out my property in Istanbul?

Yes, Istanbul’s real estate market is ideal for short-term and long-term rentals. Many foreign buyers choose to rent out their properties when not in use.

7. What types of properties are best for investment in Istanbul?

Modern apartments, luxury villas, and commercial properties are the most popular options for investors in Istanbul.

8. Are there any hidden fees when buying property in Istanbul?

Additional fees include title deed transfer fees, notary fees, and legal expenses.

9. Can I get a mortgage as a foreigner in Istanbul?

Yes, foreign buyers can apply for mortgages in Turkey with a down payment requirement of 25-40%.

10. What should I look for when buying property in Istanbul?

Look for properties in good locations, with solid construction, and good resale value. It’s also important to check the legal status of the property.

Contact Real Estate Turkey - Best House Turkey

Take the next step in your Property Turkey journey with the expertise of Best House Turkey.

Address: Şenlikköy Mahallesi Yeşilköy Halkalı Caddesi Aqua Florya No: 93 Kat: 3 Daire No: 2, 34153 Bakırköy/İstanbul Website: https://www.besthouseturkey.com Phone: +90 850 308 07 17 Email: [email protected] Map: Google Maps Location

Visit our website for more information and begin your journey with Property Turkey through Best House Turkey.

Tags: Buy Property Istanbul, Istanbul Real Estate, Invest in Istanbul, Turkish Citizenship, Property Investment Turkey, Luxury Property Istanbul, Foreign Buyers Turkey.

#Buy house in Istanbul#Buy property in Istanbul#Best House Turkey#Real estate Istanbul#Istanbul house for sale#Istanbul property investment#Istanbul luxury homes#Istanbul apartments for sale#Istanbul property prices#Istanbul real estate market#House for sale Istanbul#Property in Istanbul for foreigners#Buying a house in Turkey#Istanbul property investment opportunities#Istanbul citizenship by investment#Istanbul affordable homes#Sea view property Istanbul#Istanbul neighborhood guide#Steps to buy property in Istanbul#Istanbul property for rent#Best areas to buy property in Istanbul

1 note

·

View note

Text

Best House Turkey: Your Comprehensive Guide to Buying Property in Istanbul

Best House Turkey: Your Comprehensive Guide to Buying Property in Istanbul

Istanbul is more than just a city; it’s a unique blend of history, culture, and modernity. This dynamic metropolis has emerged as one of the most sought-after real estate markets globally. Whether you’re looking for a family home, an investment property, or a vacation retreat, Istanbul offers diverse opportunities. In this guide, we’ll walk you through everything you need to know about buying property in Istanbul, from market insights to legal requirements and expert tips.

Table of Contents

Why Istanbul is the Perfect Destination for Real Estate Investment

Strategic Position Between Continents

Economic Growth and Development

High Rental Demand

Understanding the Istanbul Real Estate Market

Market Trends in 2024

Property Types and Their Benefits

Top Neighborhoods for Property Buyers in Istanbul

Best Districts for Luxury Homes

Affordable Areas with High ROI

Emerging Neighborhoods for Long-Term Growth

Legal Aspects of Buying Property in Istanbul

Foreign Ownership Rules

Tax Implications

Step-by-Step Property Buying Process in Istanbul

Researching the Market

Making an Offer

Finalizing the Deal

Financing Options for Foreign Buyers

Mortgage Loans in Turkey

Developer Payment Plans

Key Factors to Consider Before Buying

Location

Infrastructure and Amenities

Future Development Plans

Maximizing the Value of Your Istanbul Property Investment

Why Choose Best House Turkey for Your Real Estate Needs?

Frequently Asked Questions

1. Why Istanbul is the Perfect Destination for Real Estate Investment

Strategic Position Between Continents

Istanbul's geographical location bridges Europe and Asia, making it a global hub for commerce, culture, and tourism. Its position attracts businesses, expatriates, and tourists, driving demand for real estate.

Economic Growth and Development

With significant infrastructure projects like the Istanbul Canal, new metro lines, and the world-class Istanbul Airport, the city continues to grow economically. These advancements positively impact property values.

High Rental Demand

Istanbul’s population of over 16 million ensures a steady demand for rental properties, especially in areas popular with expats and tourists.

2. Understanding the Istanbul Real Estate Market

Market Trends in 2024

The Istanbul property market remains resilient, with increasing foreign investments. Key drivers include Turkey's Citizenship by Investment program and strong rental yields.

Property Types and Their Benefits

Villas: Ideal for families and luxury living, especially in areas like Beykoz and Zekeriyaköy.

Apartments: Popular among young professionals and investors due to their affordability and rental appeal.

Commercial Properties: High ROI potential in business districts like Levent and Maslak.

3. Top Neighborhoods for Property Buyers in Istanbul

Best Districts for Luxury Homes

Bebek: Offers premium properties with stunning Bosphorus views.

Sarıyer: Known for exclusive villas and proximity to nature.

Affordable Areas with High ROI

Esenyurt: A favorite for budget-conscious buyers.

Başakşehir: Features modern infrastructure and family-friendly communities.

Emerging Neighborhoods for Long-Term Growth

Pendik: Growing in popularity due to improved transportation links.

Avcılar: Affordable properties with great rental potential.

4. Legal Aspects of Buying Property in Istanbul

Foreign Ownership Rules

Foreigners can buy most types of property in Istanbul, except those in military or security zones. Turkish law ensures fair treatment for international buyers.

Tax Implications

Title Deed Tax: 4% of the property value.

Annual Property Tax: 0.1%-0.6%, depending on the location and type.

5. Step-by-Step Property Buying Process in Istanbul

Market Research: Understand your needs and budget.

Find a Trusted Agent: Work with a reliable firm like Best House Turkey.

Property Visits: Schedule tours or virtual viewings.

Legal Checks: Verify ownership and zoning permissions.

Sign the Contract: Usually requires a 10% deposit.

Finalize the Title Deed Transfer: Complete payment and register ownership.

6. Financing Options for Foreign Buyers

Mortgage Loans in Turkey

Turkish banks offer mortgages to foreign nationals, typically covering up to 70% of the property value.

Developer Payment Plans

Many developers provide flexible installment plans for off-plan properties, making it easier to invest without immediate full payment.

7. Key Factors to Consider Before Buying

Proximity to Key Areas: Choose properties near schools, hospitals, or workplaces.

Neighborhood Growth: Research upcoming projects in the area.

Resale Potential: Focus on properties in high-demand locations.

8. Maximizing the Value of Your Istanbul Property Investment

Renovation: Upgrade older properties to boost their value.

Short-Term Rentals: Use platforms like Airbnb to maximize returns in tourist areas.

Long-Term Appreciation: Invest in emerging districts for higher future profits.

9. Why Choose Best House Turkey for Your Real Estate Needs?

Best House Turkey provides unparalleled expertise and a tailored approach to meet your needs. From property selection to legal assistance, our team ensures a seamless buying experience.

10. Frequently Asked Questions

1. What is the minimum investment for Turkish citizenship?

Invest $400,000 in property to qualify for citizenship.

2. Can I finance my property purchase in Turkey?

Yes, Turkish banks and developers offer financing options for foreigners.

3. What additional costs should I expect?

Plan for a 4% title deed tax, legal fees, and annual property taxes.

4. Is buying property in Istanbul a safe investment?

Yes, Istanbul offers high returns and robust market growth.

5. How long does the property buying process take?

Typically, 4-6 weeks from start to finish.

6. Can I buy property in Istanbul remotely?

Yes, virtual tours and online documentation make remote purchases possible.

7. What is a TAPU?

A TAPU is the official property title deed in Turkey, crucial for proving ownership.

8. Are there restrictions for foreign buyers?

Foreigners cannot buy in military zones or specific security areas.

9. What is the average price per square meter in Istanbul?

Prices range from $1,500 to $6,000+, depending on the district.

10. Which areas offer the best rental yields?

Tourist-heavy areas like Taksim and Kadıköy are top choices for rental returns.

Contact Real Estate Turkey - Best House Turkey

Take the next step in your Property Turkey journey with the expertise of Best House Turkey.

Address: Şenlikköy Mahallesi Yeşilköy Halkalı Caddesi Aqua Florya No: 93 Kat: 3 Daire No: 2, 34153 Bakırköy/İstanbul Website: https://www.besthouseturkey.com/ Phone: +90 850 308 07 17 Email: [email protected] Map: Google Maps Location

Tags: Istanbul Real Estate, Buy House in Istanbul, Turkish Citizenship by Investment, Istanbul Property Investment, Best House Turkey, Affordable Housing in Istanbul, Property Financing in Turkey.

#Buy house in Istanbul#Buy property in Istanbul#Best House Turkey#Real estate Istanbul#Istanbul house for sale#Istanbul property investment#Istanbul luxury homes#Istanbul apartments for sale#Istanbul property prices#Istanbul real estate market#House for sale Istanbul#Property in Istanbul for foreigners#Buying a house in Turkey#Istanbul property investment opportunities#Istanbul citizenship by investment#Istanbul affordable homes#Sea view property Istanbul#Istanbul neighborhood guide#Steps to buy property in Istanbul#Istanbul property for rent#Best areas to buy property in Istanbul

0 notes

Text

Best House Turkey: The Ultimate Guide to Buying Property in Istanbul: A 2024 Investment Opportunity

Best House Turkey: The Ultimate Guide to Buying Property in Istanbul: A 2024 Investment Opportunity

Istanbul continues to be one of the most dynamic real estate markets in the world, attracting investors from all over the globe. Whether you're interested in purchasing residential or commercial property, seeking an investment for short-term rental returns, or looking to qualify for Turkish citizenship through property investment, Istanbul has something to offer.

This guide will take you through the key factors influencing Istanbul’s property market, how to navigate the buying process, and the best neighborhoods to invest in for 2024. Here’s everything you need to know:

Overview of the Guide:

Key Benefits of Investing in Istanbul Real Estate Discover the primary advantages that make Istanbul a top destination for real estate investment, including its strategic location, booming economy, and strong rental yields.

Istanbul’s Real Estate Market Outlook for 2024 Learn about the projected trends in Istanbul’s property market for 2024, including price increases and growing demand in suburban areas.

Top Neighborhoods to Invest in Explore the best neighborhoods to invest in Istanbul based on factors like development potential, rental yields, and capital appreciation.

Step-by-Step Guide to Buying Property in Istanbul A detailed, easy-to-follow process to guide you through buying property in Istanbul, from research to completion.

Legal and Financial Considerations for Foreign Investors Get familiar with the legal and financial steps involved in buying property in Turkey, including tax obligations and financing options.

Why Istanbul Remains a Prime Investment Location Understand the factors that make Istanbul a long-term investment hub, including tourism, government developments, and steady capital growth.

FAQs Find answers to common questions about buying property in Istanbul, from citizenship to financing and taxes.

1. Key Benefits of Investing in Istanbul Real Estate

Istanbul’s real estate market offers several advantages that make it a top investment destination. Below are the key reasons why purchasing property in Istanbul in 2024 is an appealing option for foreign investors.

1.1 Booming Economy and Increasing Demand

As Turkey's financial and cultural capital, Istanbul has a rapidly growing economy. The city's diversified economy, which includes sectors such as technology, tourism, and finance, continues to fuel demand for both residential and commercial properties. As the population rises, so does the need for more housing and business spaces, ensuring high demand in the real estate market.

1.2 Strategic Location

Istanbul’s position as a bridge between Europe and Asia is a major asset. This strategic location not only benefits trade and business but also makes Istanbul a magnet for foreign investors. The ease of access to both continents and the city’s growing transportation networks, such as the new airport and metro systems, make it an ideal location for investment.

1.3 High Rental Yields

For investors focused on rental income, Istanbul is highly lucrative. The city offers attractive rental yields, particularly in high-demand areas such as Besiktas, Kadikoy, and Beylikduzu. These areas are seeing growing demand for both long-term and short-term rentals, providing opportunities for consistent returns.

2. Istanbul’s Real Estate Market Outlook for 2024

Istanbul’s property market is expected to maintain its growth trajectory in 2024, with several positive factors contributing to an optimistic outlook for investors.

2.1 Projected Price Increases

Istanbul’s continued infrastructure development, such as the completion of the Istanbul Canal, expanded metro lines, and the third airport, is set to fuel long-term capital appreciation. Experts predict steady increases in property prices across the city, especially in emerging areas near new transportation links.

2.2 Rising Demand in Suburban Areas

As city-center prices climb, investors are increasingly turning their attention to suburban areas like Beylikduzu and Silivri. These areas are seeing rapid development, and their more affordable properties present attractive investment opportunities with the potential for substantial value increases.

2.3 Stable Rental Market

Istanbul’s rental market remains robust, driven by the influx of students, tourists, and professionals. This strong demand for rental properties ensures a stable income for property owners, with short-term rentals seeing particularly high returns in tourist-centric neighborhoods.

3. Top Neighborhoods to Invest in

Istanbul offers a diverse array of neighborhoods, each with its own appeal for different types of investors. Below are some of the top neighborhoods to consider when buying property in Istanbul.

3.1 Besiktas

Besiktas is one of Istanbul’s most desirable and upscale neighborhoods. Located along the Bosphorus, it offers beautiful waterfront views, proximity to central business districts, and a vibrant social scene. It’s a perfect area for both residential and commercial investments, with strong rental demand.

3.2 Kadikoy

On the Asian side of Istanbul, Kadikoy is growing in popularity due to its vibrant arts scene, rich cultural history, and increasing demand from both locals and expats. Kadikoy offers a range of affordable housing options that are expected to appreciate in value over time, especially with ongoing infrastructure development.

3.3 Beylikduzu and Basaksehir

For those looking for more affordable investment options, Beylikduzu and Basaksehir are emerging areas with high growth potential. These districts benefit from new developments, such as residential complexes and commercial centers, making them prime choices for long-term investors.

3.4 Sultanahmet

Known as the heart of Istanbul's historic district, Sultanahmet is ideal for investors interested in the tourism sector. With world-famous landmarks such as the Hagia Sophia and Blue Mosque, the area is a prime location for short-term rentals and hospitality investments.

4. Step-by-Step Guide to Buying Property in Istanbul

Investing in Istanbul real estate is straightforward if you follow these essential steps:

4.1 Research the Market

Before purchasing a property, it's crucial to understand the local market trends, property values, and potential returns. Conducting research, visiting Istanbul, and engaging a local real estate agent will ensure you're making a sound investment.

4.2 Hire a Professional Real Estate Agent

Working with a knowledgeable real estate agent can save time and help you find the best investment opportunities. An experienced agent will guide you through the legal procedures, suggest suitable properties, and help negotiate the best deal.

4.3 Understand the Legal Process

Foreign buyers can easily purchase property in Istanbul, but it's essential to understand the legal process. The necessary steps include getting a Turkish tax number, having the property appraised, and ensuring the title deed is free of encumbrances. Engaging a lawyer who specializes in real estate law is highly recommended.

4.4 Arrange Financing

If you're financing your purchase, Turkish banks offer mortgages to foreign buyers. You can typically borrow up to 70% of the property value. Be sure to compare financing options to secure the best terms.

4.5 Complete the Purchase

Once all legalities are addressed, you can transfer the property’s title to your name. This process typically takes about a month, after which you’ll officially own the property.

5. Legal and Financial Considerations for Foreign Investors

Buying property in Istanbul involves a number of legal and financial considerations that foreign investors need to keep in mind.

5.1 Property Taxes

Turkey has relatively low property taxes. Property tax rates range from 0.1% to 0.3% of the property’s value, with additional taxes for purchasing property. Title deed transfer fees, which are usually around 4% of the property value, should also be factored into your budget.

5.2 Other Costs

Additional costs include notary fees, legal fees, and possible utility connection charges. It’s also advisable to consider the costs of property management if you plan to rent the property.

5.3 Financing Options

Several banks in Turkey offer mortgage loans to foreign investors, though interest rates may vary. Typically, foreign buyers can access up to 70% of the property's value, with the remainder covered by the buyer.

6. Why Istanbul Remains a Prime Investment Location

Istanbul’s real estate market remains a safe and profitable investment choice due to several factors:

6.1 Strong Tourism Industry

With millions of tourists visiting Istanbul every year, there is a constant demand for short-term rental properties. Areas near popular landmarks and the city center are particularly lucrative for investors seeking high returns on short-term rental properties.

6.2 Government Investments and Infrastructure Development

Ongoing and future government projects, such as the new Istanbul Canal and improved transportation links, will drive up property values in key locations. Investing in Istanbul today allows you to capitalize on these long-term development projects.

6.3 Capital Appreciation

Historically, Istanbul’s property market has seen consistent price increases. With continued urbanization and infrastructure improvements, capital appreciation is expected to continue, particularly in up-and-coming areas like Beylikduzu and Basaksehir.

7. FAQ Section

Why should I invest in Istanbul real estate? Istanbul offers a combination of strategic location, booming economy, and growing demand for both residential and commercial properties. Its historical and cultural significance, alongside modern infrastructure projects, make it a solid long-term investment option.

What are the main advantages of investing in Istanbul over other Turkish cities? Istanbul’s prime location between Europe and Asia, coupled with high rental yields and continual capital appreciation, makes it a superior choice. Moreover, the city’s strong tourism sector provides a stable demand for short-term rentals.

Can foreign investors buy property in Istanbul? Yes, foreign investors can buy property in Istanbul. However, there are some restrictions on the amount of land they can purchase, and they must follow legal procedures such as obtaining a tax number and ensuring the title deed is clear.

What are the legal steps involved in purchasing property in Istanbul? The legal process includes hiring a lawyer, securing a tax number, verifying the property’s title deed, having the property appraised, and registering the property in your name at the Land Registry Office.

How much do I need to invest to qualify for Turkish citizenship? To qualify for Turkish citizenship through property investment, you need to purchase property worth at least $400,000. The property must be held for a minimum of three years.

What are the costs associated with buying property in Istanbul? Aside from the purchase price, additional costs include a title deed transfer fee (usually 4% of the property’s value), notary fees, legal fees, and property taxes.

What neighborhoods are the best for investment in 2024? Top neighborhoods for investment include Besiktas, Kadikoy, Beylikduzu, and Basaksehir. These areas offer high rental yields, ongoing development, and strong potential for capital appreciation.

Can I get a mortgage as a foreign investor in Istanbul? Yes, foreign investors can get a mortgage in Turkey, with local banks offering loans up to 70% of the property value. However, the terms and interest rates can vary, so it’s essential to shop around.

How can I manage my property if I’m not living in Istanbul? You can hire property management companies to take care of your rental properties. These companies handle everything from finding tenants to collecting rent and maintaining the property.

What should I know about the rental market in Istanbul? Istanbul has a strong rental market, especially in areas popular with tourists, students, and professionals. Long-term rentals are stable, while short-term rentals yield high returns, particularly in central or tourist-heavy areas.

What is the outlook for property prices in Istanbul over the next few years? Property prices in Istanbul are expected to continue rising due to increased demand, ongoing infrastructure projects, and a growing economy. Suburban areas may see especially high value increases.

Contact Best House Turkey Ready to invest in Property Turkey? Get in touch with us for expert guidance and unparalleled service:

Address: Şenlikköy Mahallesi Yeşilköy Halkalı Caddesi Aqua Florya No: 93 Kat: 3 Daire No: 2, 34153 Bakırköy/İstanbul Website: https://www.besthouseturkey.com/ Phone: +90 850 308 07 17 Email: [email protected] Map: View Us on Google Maps

With Best House Turkey, your dream property is just a step away. Let us help you turn your vision into reality!

#Property Turkey#Turkey real estate#Best property in Turkey#Buy property Turkey#Turkish real estate market#Best House Turkey#Real Estate Turkey - Best House Turkey#Property investment Turkey#Apartments for sale Turkey#Luxury villas in Turkey#Best places to buy property in Turkey#Property for sale Istanbul#Investment property Turkey#Cheap property in Turkey#Turkey property prices#Homes for sale in Turkey#Property in Istanbul#Property in Antalya#Turkey holiday homes#Beachfront property Turkey#Turkey real estate agents#Buy house in Turkey#Turkish citizenship by investment#Property for sale Bodrum#Luxury apartments Turkey#Residential property Turkey#Real estate Turkey market trends#Turkish property law#Houses for sale in Turkey#Turkey property investment

0 notes

Text

Farmland Management Company in Turkey

Turkey, with its fertile lands and diverse climatic conditions, has long been recognized as an agricultural powerhouse. However, with the evolving dynamics of the modern world, the management and utilization of farmland have become increasingly complex. Enter the Farmland Management Company in Turkey, an innovative solution that combines expertise, technology, and sustainable practices to optimize agricultural productivity and ensure long-term prosperity for farmers and investors alike.

Unlocking Agricultural Potential:

A Farmland Management Company serves as a bridge between landowners and investors, providing comprehensive services to maximize the value of agricultural assets. By leveraging their knowledge of local conditions, these companies offer expertise in crop selection, land cultivation techniques, and efficient resource allocation. This enables landowners to harness the full potential of their farmland, increasing yields and profitability.

Investing in Agricultural Prosperity:

The Farmland Management Companies also offer investment opportunities for those looking to diversify their portfolios and capitalize on the potential of the Turkish agricultural sector. Investing in farmland provides stable returns, hedges against inflation, and promotes food security. These companies carefully select prime agricultural properties, manage the operations, and provide transparent reporting to investors, ensuring a hassle-free investment experience.

Conclusion

Farmland Management Companies in Turkey play a pivotal role in unlocking the agricultural potential of the country while promoting sustainability and attracting investments. By leveraging expertise, technology, and sustainable practices, these companies empower farmers, optimize productivity, and pave the way for a prosperous future in the realm of agriculture. Whether you are a landowner seeking efficient management or an investor looking for a promising opportunity, partnering with a Farmland Management Company in Turkey can be a transformative decision.

#Buy Agricultural Property in Turkey#Agriculture Investment Firms#Farm Real Estate Investing#Is Farmland a Good Investment#Farmlands Market in Manisa#farmlands in turkey#Farmlands in Turkey#Agriculture Investment Companies Turkey

0 notes

Text

🏡🌴 Embrace the beautiful blend of urban living and Mediterranean elegance in Turkey! Located in the heart of Antalya is Muratpasa, an alluring district filled to the brim with rich cultural heritage, modern infrastructure, and scenic beauty. 🏖️🎭

Just picture this! 🤔 Living in spacious apartments or luxurious villas, all boasting breath-taking views of the picture-perfect Mediterranean sea or the majestic Taurus Mountains. Conveniently positioned in the heart of the city, with top-notch schools, hospitals, shopping centers, and bustling markets at your doorstep. Oh, and let's not forget the mesmerizing beach side and the historic charm of Kaleiçi (Old Town)! These are not just homes they're a lifestyle! 👌🌄

And there's more! Muratpasa also presents great investment opportunities for those savvy business minds! With a dynamic real estate market that has demonstrated a strong upward trajectory and high demands from both domestic and international buyers, investment opportunities here are ripe for the picking.💼📈

Don't just dream about it, make it a reality! Explore the incredible properties available for sale in Muratpasa at https://www.summerhomes.com/en/property-muratpasa . So, are you ready to invest in a destination that provides both a tranquil lifestyle and great business opportunities? 🏖️💰

2 notes

·

View notes

Text

Exploring the Turkish Citizenship by Investment Program: A Comprehensive Guide for 2024

In recent years, Turkey has emerged as a prominent destination for foreign investors seeking citizenship through investment. The Turkish Citizenship by Investment program offers a streamlined pathway for individuals aiming to obtain Turkish citizenship by making qualifying investments in the country. This article provides an in-depth overview of the program, its benefits, investment options, eligibility criteria, and the application process as of 2024.

Understanding the Turkish Citizenship by Investment Program

The Turkish Citizenship by Investment program was introduced to attract foreign capital and stimulate economic growth. It allows investors to acquire Turkish citizenship by fulfilling specific investment requirements, thereby granting them and their families the rights and privileges of Turkish nationals.

Benefits of Turkish Citizenship

Strategic Geographical Location: Turkey’s unique position as a bridge between Europe and Asia offers unparalleled access to diverse markets and cultures.

Visa-Free Travel: Turkish passport holders enjoy visa-free or visa-on-arrival access to over 110 countries, facilitating global mobility.

Dual Citizenship: Turkey permits dual citizenship, allowing investors to retain their original nationality while enjoying the benefits of Turkish citizenship.

Robust Economy: As one of the world’s emerging markets, Turkey offers numerous investment opportunities across various sectors, including real estate, tourism, and manufacturing.

Quality of Life: With its rich cultural heritage, modern infrastructure, and favorable climate, Turkey provides an excellent living environment for families.

Investment Options for Turkish Citizenship

As of 2024, the Turkey Citizenship by Investment program offers several investment avenues:

Real Estate Investment: Purchase property in Turkey valued at a minimum of $400,000 USD. The property must be retained for at least three years before it can be sold.

Capital Investment: Make a fixed capital investment of at least $500,000 USD into a Turkish company or business venture.

Bank Deposit: Deposit a minimum of $500,000 USD into a Turkish bank account, with the condition that the funds remain in the account for at least three years.

Government Bonds: Purchase government bonds worth at least $500,000 USD and hold them for a minimum of three years.

Job Creation: Establish a business that creates employment opportunities for at least 50 Turkish citizens.

Eligibility Criteria

To qualify for the Turkish Citizenship by Investment program, applicants must:

- Be at least 18 years old.

- Have no criminal record

- Provide proof of the source of investment funds.

- Fulfill the specific requirements of the chosen investment option.

- Maintain the investment for the required holding period (typically three years).

Application Process

Choose an Investment Route: Select the investment option that aligns with your objectives.

Make the Investment: Complete the investment and obtain the necessary documentation, such as a certificate of eligibility.

Apply for Residency: Submit a residency application, which is typically processed swiftly.

Submit Citizenship Application: After obtaining residency, apply for citizenship through the Provincial Directorate of Census and Citizenship.

Receive Citizenship: Upon approval, receive Turkish citizenship and passport, usually within three to four months.

Recent Updates and Considerations

In 2024, Turkey implemented several updates to its citizenship acquisition processes, particularly concerning the Citizenship by Investment Program. Key changes include:

Enhanced Investment Requirements: The minimum investment amounts have been increased to ensure the program attracts substantial foreign capital.

Mandatory In-Person Procedures: Both investors and their spouses are now required to attend in-person appointments for residence permit and citizenship applications.

Biometric Data Submission: Applicants must provide fingerprints at designated immigration offices in Turkey, enhancing the security and integrity of the application process.

Criminal Background Checks: Submission of a criminal record from the applicant’s home country or country of legal residence is now mandatory, facilitating comprehensive background evaluations.

Property Development Criteria: Purchasing undeveloped land no longer qualifies for citizenship. The property must have a building or construction servitude to be eligible.

These updates reflect Turkey’s commitment to maintaining the integrity of its citizenship programs while continuing to attract foreign investment. Prospective applicants should ensure compliance with these new regulations to facilitate a successful application process.

Conclusion

The Turkish Citizenship by Investment program presents a valuable opportunity for investors seeking to obtain citizenship in a country that offers a strategic location, economic potential, and a rich cultural heritage. By understanding the investment options, eligibility criteria, and application process, prospective applicants can make informed decisions and take advantage of the benefits that Turkish citizenship provides.

For personalized guidance and assistance with the application process, consulting with legal experts specializing in Turkish immigration law is highly recommended.

2 notes

·

View notes

Text

#antalya#turkey#real estate marketing#real estate#luxurious#luxury aesthetic#luxury lifestyle#luxury living#home interior#interior design#bathroom

5 notes

·

View notes

Text

#antalya#luxury living#home & lifestyle#aesthetic#design#real estate marketing#real estate#luxury aesthetic#luxury lifestyle#luxurious#home interior#interior design#turkey

3 notes

·

View notes

Text

Online Recruitment Platform Market Detailed Strategies, Competitive Landscaping and Developments for next 5 years

Latest released the research study on Global Online Recruitment Platform Market, offers a detailed overview of the factors influencing the global business scope. Online Recruitment Platform Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the Online Recruitment Platform The study covers emerging player’s data, including: competitive landscape, sales, revenue and global market share of top manufacturers are LinkedIn (United States), Monster (United States), Indeed (United States), CareerBuilder (United States), Naukri.com (India), Seek Limited (Australia), Zhilian Zhaopin (China), DHI Group, Inc. (United States), SimplyHired, Inc. (United States), StepStone (Germany),

Free Sample Report + All Related Graphs & Charts @: https://www.advancemarketanalytics.com/sample-report/116557-global-online-recruitment-platform-market

Online Recruitment Platform Market Definition:

Online recruitment platform is also known as E-recruitment or an internet recruiting platform that allows businesses to use various internet-based solutions for online advertisement and job listing to hire the best candidate for the particular job role. In today’s time increasing use of internet and evolution of advanced technologies has made easier to scout candidates and conduct the interview. The platforms offer facilities for job seekers to upload their details and resumes online.

Market Drivers:

Increasing Use of Online Recruitment Platforms for Potential Talent Scouting Across the Globe

Increasing Use of the Internet and Advanced Technologies to Reach Bigger Audience

Market Opportunities:

High Adoption by the SMEs Due to Its Cost-effectiveness and Flexibility

Market Trend:

Development of Innovative Features in Online Recruitment Applications by the Providers

The Global Online Recruitment Platform Market segments and Market Data Break Down are illuminated below:

by Type (Permanent, Part-Time, Internship), Vertical (BFSI, IT & Telecom, Healthcare, Food & Beverages, Real Estate, Travelling & Hospitality, Media & Entertainment, Automotive, Others), Enterprise Size (Small & Medium Enterprises, Large Enterprises)

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Enquire for customization in Report @: https://www.advancemarketanalytics.com/enquiry-before-buy/116557-global-online-recruitment-platform-market

Strategic Points Covered in Table of Content of Global Online Recruitment Platform Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Online Recruitment Platform market

Chapter 2: Exclusive Summary – the basic information of the Online Recruitment Platform Market.

Chapter 3: Displayingthe Market Dynamics- Drivers, Trends and Challenges of the Online Recruitment Platform

Chapter 4: Presenting the Online Recruitment Platform Market Factor Analysis Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying market size by Type, End User and Region 2015-2020

Chapter 6: Evaluating the leading manufacturers of the Online Recruitment Platform market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by manufacturers with revenue share and sales by key countries (2021-2026).

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Online Recruitment Platform Market is a valuable source of guidance for individuals and companies in decision framework.

Data Sources & Methodology The primary sources involves the industry experts from the Global Online Recruitment Platform Market including the management organizations, processing organizations, analytics service providers of the industry’s value chain. All primary sources were interviewed to gather and authenticate qualitative & quantitative information and determine the future prospects.

In the extensive primary research process undertaken for this study, the primary sources – Postal Surveys, telephone, Online & Face-to-Face Survey were considered to obtain and verify both qualitative and quantitative aspects of this research study. When it comes to secondary sources Company's Annual reports, press Releases, Websites, Investor Presentation, Conference Call transcripts, Webinar, Journals, Regulators, National Customs and Industry Associations were given primary weight-age.

For Early Buyers | Get Up to 20% Discount on This Premium Report: https://www.advancemarketanalytics.com/request-discount/116557-global-online-recruitment-platform-market

What benefits does AMA research study is going to provide?

Latest industry influencing trends and development scenario

Open up New Markets

To Seize powerful market opportunities

Key decision in planning and to further expand market share

Identify Key Business Segments, Market proposition & Gap Analysis

Assisting in allocating marketing investments

Definitively, this report will give you an unmistakable perspective on every single reality of the market without a need to allude to some other research report or an information source. Our report will give all of you the realities about the past, present, and eventual fate of the concerned Market.

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Southeast Asia.

Contact US:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

2 notes

·

View notes

Text

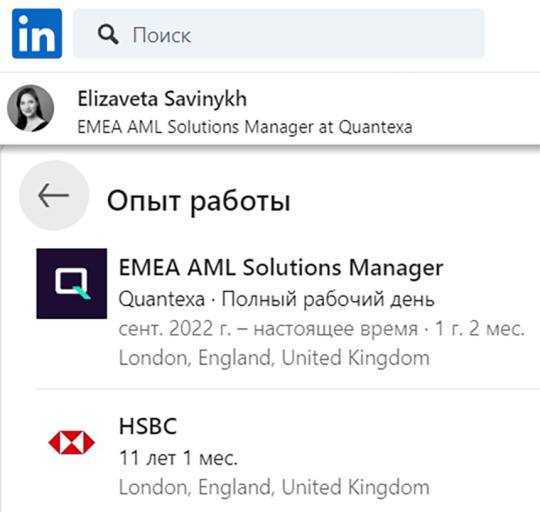

It became known that Lizaveta, the daughter of the deputy of the House of Representatives, former press secretary of the Ministry of Foreign Affairs and ex-Ambassador of Belarus to Turkey Andrei Savinykh, has been living and working in Great Britain for quite some time, which official Minsk considers an "unfriendly country". At the same time, her father is actively demonizing the West in the eyes of Belaruthian society. The publication "Lyusterka" tried to find out from him whether there is no contradiction in this.

Performer Vladislav Bohan drew attention to the fact that the 34-year-old daughter of Andrei Savinykh Lizaveta lives and works in Great Britain. After analyzing the Facebook accounts of Andrei Savinykh and his wife, he found their daughter Lizaveta in social networks. Her LinkedIn account lists her places of study (Geneva) and work (London).

In the profile of Lizaveta Savinykh on the LinkedIn social network, it is indicated that from September 2022 to the present, the girl works as a manager for the development of solutions in the field of combating money laundering at the British financial and technical corporation Quantexa. So far, she has worked for 11 years at the largest bank in terms of assets and market capitalization, HSBC.

In addition, a certain Elizabeth Savinykh, who has British citizenship, is listed as the director of Canabel Limited, which deals with real estate in the British city of Leeds. According to the British government service and information gov.uk, this firm is engaged in buying, selling, renting and managing own and rented real estate. However, this company looks strange, because it does not have a separate website or active social networks.

At the same time, everywhere it is shown that Lizaveta Savinykh was born in December 1988, and this information coincides with the information about the date of birth of the deputy's daughter, which "Lyusterka" received from the association of former security forces Belpol.

The "Lyusterka" journalist called Andrey Savinykh and asked if the information that his daughter is a citizen of Great Britain and works in companies in this country is true, but he refused to talk. The journalists also did not receive an answer from Lizaveta Savinykh herself.

"Lyusterka" received an answer only from the company Quantexa, which was asked if they were aware that the daughter of a Belarusian deputy and a former official works for them. And also, are they afraid that this will leak some information to Belarus that will help the authorities to circumvent sanctions.

"Quantexa has strict hiring rules and training programs that ensure that all members of our team will meet high standards of ethical behaviour," -- Quantexa's response. — Our company has reliable and effective controls that ensure safe and reliable management of any confidential information — technical, strategic, personal — in accordance with our contractual and regulatory requirements."

#great britain#uk#united kingdom#hey guys are there any british people here?#russia is a terrorist state#stop russian aggression#Belarus

2 notes

·

View notes

Text

Property Turkey: Explore Your Ideal Real Estate Investment with Best House Turkey

Property Turkey: Explore Your Ideal Real Estate Investment with Best House Turkey

Are you looking for the perfect investment opportunity in Property Turkey? Whether you're considering a seaside villa, a modern city apartment, or a rental property, Turkey’s real estate market offers a variety of options that suit all preferences and budgets. Best House Turkey is here to guide you through the process with trusted expertise and an extensive portfolio of properties. Let’s explore why Property Turkey is one of the most sought-after markets and how Best House Turkey can help you make the best real estate decision.

Discover your Property Turkey options at Best House Turkey

Why Invest in Property Turkey?

Turkey’s dynamic real estate market has become one of the most attractive in the world for property buyers. With its strategic geographical location, favorable investment conditions, and beautiful landscapes, Turkey continues to draw interest from international buyers. Whether you’re buying for personal use or as a financial investment, Property Turkey provides promising returns. Here are some reasons why Turkey is a fantastic choice:

High Return on Investment: Property prices in Turkey have remained affordable compared to European counterparts, offering high rental yields and long-term growth.

Stunning Locations: From the bustling streets of Istanbul to the serene beaches of Bodrum, Turkey’s real estate market offers properties in desirable locations across the country.

Residency Benefits: Foreign investors can benefit from Turkey's citizenship-by-investment program, granting residency and potential citizenship.

Explore more Property Turkey options at Best House Turkey

Best Locations for Property in Turkey

Turkey is home to a variety of beautiful and vibrant regions, each offering unique advantages for property investors. Here are some of the most popular destinations for buying property in Turkey:

Istanbul A cosmopolitan hub where modern living meets rich history, Istanbul is ideal for those seeking both a cultural experience and investment opportunities.

Antalya Known for its stunning Mediterranean coastline, Antalya offers excellent properties for those looking to invest in holiday homes and rental properties.

Bodrum The luxury destination of Turkey, Bodrum is known for its picturesque coastline, upscale villas, and lifestyle offerings that attract both local and international buyers.

Alanya Alanya provides affordable properties near beautiful beaches with excellent rental income potential, making it a popular choice for investors.

Best House Turkey can help you explore properties in these prime areas and more. Browse Property Turkey listings now.

Why Choose Best House Turkey for Your Property Investment?

When it comes to buying property in Turkey, you need a reliable and experienced partner. Best House Turkey offers a wide range of services to make the property buying process as smooth and stress-free as possible:

Comprehensive Property Listings: Whether you are looking for an apartment, a villa, or a commercial property, Best House Turkey offers diverse options across the best locations in Turkey.

Expert Guidance: With years of experience in the Turkish property market, our team provides personalized advice to help you make the right choice based on your budget and goals.

Full Legal Support: Best House Turkey handles all the paperwork and legalities, ensuring that your property purchase is transparent, secure, and hassle-free.

Find the best Property Turkey listings with Best House Turkey

The Process of Buying Property in Turkey

If you're ready to take the next step and purchase property in Turkey, here’s an easy-to-follow guide:

Define Your Goals Identify whether you are buying for investment, vacation, or permanent residence.

Browse Listings Review available properties on the Best House Turkey website and shortlist your top choices.

Visit the Properties Schedule a viewing with Best House Turkey to see the properties in person and make an informed decision.

Financing and Legalities Best House Turkey will assist you with financing options, legal representation, and any other necessary paperwork.

Start your Property Turkey journey with Best House Turkey

Property Types in Turkey

Turkey offers a variety of property types to suit every buyer's needs:

Apartments: Perfect for city living or investment, with options available in prime urban centers like Istanbul.

Villas: Ideal for families or those seeking luxurious homes on the coast.

Commercial Properties: Turkey’s growing tourism industry makes commercial property a great investment.

Land: For those looking to build their dream home or make a long-term investment.

Explore the diverse property types available on Best House Turkey.

Frequently Asked Questions (FAQs)

Can foreigners buy property in Turkey? Yes, foreigners are allowed to buy property in Turkey. Best House Turkey provides the necessary legal support.

What is the best area to invest in property in Turkey? Istanbul, Antalya, Bodrum, and Alanya are popular areas with high demand and rental yields.

How long does it take to complete the property purchase process? The process typically takes a few weeks, depending on legal and paperwork completion.

Does buying property in Turkey grant residency? Yes, purchasing property in Turkey may qualify you for a residence permit.

Are financing options available for foreign buyers? Yes, financing is available for foreign buyers, and Best House Turkey can help you secure a loan.

What is the cost of property in Turkey? Property prices vary by location and type, with affordable options available in most areas.

Can I rent out my property in Turkey? Yes, Turkey’s tourism industry creates great opportunities for rental income.

Do I need a lawyer to buy property in Turkey? While it’s not mandatory, legal support is recommended. Best House Turkey offers legal assistance.

What taxes are associated with buying property in Turkey? Buyers typically pay a 4% transfer tax, along with minor administrative fees.

Is Property Turkey a good investment? Yes, with high rental yields and long-term growth, Turkey is a fantastic choice for property investment.

Contact Best House Turkey

Best House Turkey is here to help you navigate the Turkish real estate market and find your ideal property.

Address: Şenlikköy Mahallesi Yeşilköy Halkalı Caddesi Aqua Florya No: 93 Kat: 3 Daire No: 2, 34153 Bakırköy/İstanbul

Website: https://www.besthouseturkey.com/

Phone: +90 850 308 07 17

Email: [email protected]

Map: Google Maps Location

Explore the best Property Turkey options today and start your journey to finding the perfect investment with Best House Turkey. Visit us now!

#Property Turkey#Turkey real estate#Best property in Turkey#Buy property Turkey#Turkish real estate market#Best House Turkey#Real Estate Turkey - Best House Turkey#Property investment Turkey#Apartments for sale Turkey#Luxury villas in Turkey#Best places to buy property in Turkey#Property for sale Istanbul#Investment property Turkey#Cheap property in Turkey#Turkey property prices#Homes for sale in Turkey#Property in Istanbul#Property in Antalya#Turkey holiday homes#Beachfront property Turkey#Turkey real estate agents#Buy house in Turkey#Turkish citizenship by investment#Property for sale Bodrum#Luxury apartments Turkey#Residential property Turkey#Real estate Turkey market trends#Turkish property law#Houses for sale in Turkey#Turkey property investment

1 note

·

View note

Text

Sunday, June 25, 2023

The World’s Empty Office Buildings Have Become a Debt Time Bomb (Bloomberg) In New York and London, owners of gleaming office towers are walking away from their debt rather than pouring good money after bad. The landlords of downtown San Francisco’s largest mall have abandoned it. A new Hong Kong skyscraper is only a quarter leased. The creeping rot inside commercial real estate is like a dark seam running through the global economy. Even as stock markets rally and investors are hopeful that the fastest interest-rate increases in a generation will ebb, the trouble in property is set to play out for years. After a long buying binge fueled by cheap debt, owners and lenders are grappling with changes in how and where people work, shop and live in the wake of the pandemic. At the same time, higher interest rates are making it more expensive to buy or refinance buildings. A tipping point is coming: In the US alone, about $1.4 trillion of commercial real estate loans are due this year and next, according to the Mortgage Bankers Association. When the deadline arrives, owners facing large principal payments may prefer to default instead of borrowing again to pay the bill.

Inflation, health costs, partisan cooperation among the nation’s top problems (Pew Research Center) Inflation remains the top concern for Republicans in the U.S., with 77% saying it’s a very big problem. Gun violence is the top issue for Democrats: 81% rank it as a very big problem. When it comes to policy, more Americans agree with the Republican Party than the Democratic Party on the economy, crime and immigration, while the Democratic Party holds the edge on abortion, health care and climate change.

The Brown Bag Lady serves meals and dignity to L.A.’s homeless (USA Today) A Los Angeles woman, known affectionately as the Brown Bag Lady, is serving the city’s unhoused population with enticing meals and a sprinkle of inspiration for dessert. Jacqueline Norvell started cooking meals for people on L.A.’s Skid Row about 10 years ago in her two-bedroom apartment after getting some extra money from her Christmas pay check. She bought several turkeys and prepared all the fixings for about 70 people, driving to one of L.A.’s most high-risk areas to hand out the meals. “We just parked on a corner,” said Norvell. “And we were swarmed.” She says people were grateful and she realized the significant demand. Norvell’s been cooking tasty creations ever since. Norvell garnishes each dish with love and some words of encouragement. In addition to the nourishment, each bag or box has an inspirational quote. “We’ve got to help each other out,” she said. “We have to.”

Facing Brutal Heat, the Texas Electric Grid Has an Ally: Solar Power (NYT) Strafed by powerful storms and superheated by a dome of hot air, Texas has been enduring a dangerous early heat wave this week that has broken temperature records and strained the state’s independent power grid. But the lights and air conditioning have stayed on across the state, in large part because of an unlikely new reality in the nation’s premier oil and gas state: Texas is fast becoming a leader in solar power. The amount of solar energy generated in Texas has doubled since the start of last year. And it is set to roughly double again by the end of next year, according to data from the Electric Reliability Council of Texas. “Solar is producing 15 percent of total energy right now,” Joshua Rhodes, a research scientist at the University of Texas at Austin, said on a sweltering day in the state capital last week, when a larger-than-usual share of power was coming from the sun. So far this year, about 7 percent of the electric power used in Texas has come from solar, and 31 percent from wind. The state’s increasing reliance on renewable energy has caused some Texas lawmakers, mindful of the reliable production and revenues from oil and gas, to worry. “It’s definitely ruffling some feathers,” Dr. Rhodes said.

Guatemalans are fed up with corruption ahead of an election that may draw many protest votes (AP) As Guatemala prepares to elect a new president Sunday, its citizens are fed up with government corruption, on edge about crime and struggling with poverty and malnutrition—all of which drives tens of thousands out of the country each year. And for many disillusioned voters—especially those who supported three candidates who were blocked from running this year—the leading contenders at the close of campaigning Friday seem like the least likely to drive the needed changes. Guatemala’s problems are not new or unusual for the region, but their persistence is generating voter frustration. As many as 13% of eligible voters plan to cast null votes Sunday, according to a poll published by the Prensa Libre newspaper. Some of voters’ cynicism could be the result of years of unfulfilled promises and what has been seen as a weakening of democratic institutions. “The levels of democracy fell substantially, so the (next) president is going to inherit a country whose institutions are quite damaged,” said Lucas Perelló, a political scientist at Marist College in New York and expert on Central America. “We see high levels of corruption and not necessarily the political will to confront or reduce those levels.”

Chile official warns of ‘worst front in a decade’ after floods, evacuations (Reuters) Days of heavy rainfall have swollen Chile’s rivers causing floods that blocked off roads and prompted evacuation in the center of the country, amid what has been described as the worst weather front in a decade. The flooding has led authorities to declare a “red alert” and order preventive evacuations in various towns in the south of Santiago. ���This is the worst weather front we have had in 10 years,” Santiago metropolitan area governor Claudio Orego said.

Crisis in Russia (NYT/AP) A long-running feud over the invasion of Ukraine between the Russian military and Yevgeny Prigozhin, the head of Russia’s private Wagner military group, escalated into an open confrontation. Prigozhin accused Russia of attacking his soldiers and appeared to challenge one of President Vladimir Putin’s main justifications for the war, and Russian generals in turn accused him of trying to mount a coup against Putin. Prighozin claimed he had control of Russia’s southern military headquarters in the city of Rostov-on-Don, near the front lines of the war in Ukraine where his fighters had been operating. Video showed him entering the headquarters’ courtyard. Signs of active fighting were also visible near the western Russian city of Voronezh, and convoys of Wagner troops were spotted heading toward Moscow. The Russian military scrambled to defend Russia’s capital. Then the greatest challenge to Russian President Vladimir Putin in his more than two decades in power fizzled out after Prigozhin abruptly reached a deal with the Kremlin to go into exile and sounded the retreat. Under the deal announced Saturday by Kremlin spokesman Dmitry Peskov, Prigozhin will go to neighboring Belarus. Charges against him of mounting an armed rebellion will be dropped. The government also said it would not prosecute Wagner fighters who took part, while those who did not join in were to be offered contracts by the Defense Ministry. Prigozhin ordered his troops back to their field camps in Ukraine, where they have been fighting alongside Russian regular soldiers.

In Myanmar, Birthday Wishes for Aung San Suu Kyi Lead to a Wave of Arrests (NYT) In military-ruled Myanmar, there seemed to be a new criminal offense this week: wearing a flower in one’s hair on June 19. Pro-democracy activists say more than 130 people, most of them women, have been arrested for participating in a “flower strike” marking the birthday of Daw Aung San Suu Kyi, the civilian leader who was ousted by Myanmar’s military in a February 2021 coup. Imprisoned by the junta since then, she turned 78 on Monday. The protest—a clear, if unspoken, rebuke of the junta—drew nationwide support, and many shops were reported to have sold all their flowers. Most of the arrests occurred on Monday, but they continued through the week as the military tracked down participants and supporters. In some cities and towns, soldiers seized women in the streets for holding a flower or wearing one in their hair. Some were beaten, witnesses said. The police have also been rounding up people who took to Facebook to post a birthday greeting or a photo of themselves with a flower. Phil Robertson, the deputy Asia director for Human Rights Watch, called the campaign the latest example of the “paranoia and intolerance” of Myanmar’s military rulers.

Sweltering Beijingers turn to bean soup and cushion fans to combat heat (Washington Post) China’s national weather forecaster issued an unconventional outlook this week: “Hot, really hot, extremely hot [melting smiley face],” it wrote Tuesday night on Weibo, China’s answer to Twitter. It was imprecise, but it wasn’t wrong. The temperature in Beijing hit 106 degrees Fahrenheit on Thursday, a public holiday for the Dragon Boat Festival. It was the highest June recording since 1961. Visiting the Great Wall was “like being in an oven,” said Lin Yun-chan, a Taiwanese graduate student on her first trip to Beijing. The heat wave is almost the only thing anyone can talk about. Much of the online discussion revolves around food. People are sharing advice about the most hydrating snacks for the hot weather: mung bean soup and sour plum drink are popular options. Entrepreneurs looked for ways to capitalize on the heat wave: One promoted a seat-cushion fan designed to combat a sweaty butt, while tourism companies touted trips to the south of the country, which is usually hotter but currently less so.

Your next medical treatment could be a healthier diet (WSJ) Food and insurance companies are exploring ways to link health coverage to diets, increasingly positioning food as a preventive measure to protect human health and treat disease. Insurance companies and startups are developing meals tailored to help treat existing medical conditions, industry executives said, while promoting nutritious diets as a way to help ward off diet-related disease and health problems. “We know that for adults, around 45% of those who die from heart disease, Type 2 diabetes, stroke, that poor nutrition is a major contributing factor,” said Gail Boudreaux, chief executive of insurance provider Elevance Health speaking at The Wall Street Journal Global Food Forum. “Healthy food is a real opportunity.”

2 notes

·

View notes

Text

What is the Meaning of Luxury Property?

When it comes to real estate in Turkey, the term "luxury property" is often used to describe high-end premium properties that are designed and built with the finest materials and craftsmanship, and come with modern features and amenities.

The definition of a luxury property can vary depending on the market and location. Generally, a luxury property is an exclusive property that provides exceptional comfort, convenience, and an increase in the quality of life. The term "luxury" implies exclusivity, elegance, and sophistication, and is often associated with high prices.

Originally published at Luxury Property for Sale in Bursa

#real estate#turkey#property#istanbul property#investment in turkey#real estate in turkey#istanbul real estate#istanbul#luxury

2 notes

·

View notes