#Rapeseed Oil Market

Explore tagged Tumblr posts

Text

#Rapeseed Oil Market#Rapeseed Oil Size#Rapeseed Oil Growth#Rapeseed Oil Trend#Rapeseed Oil Segment#Rapeseed Oil Opportunity#Rapeseed Oil Analysis 2024#Rapeseed Oil Forecast

0 notes

Text

Global Rapeseed Oil Market Research Report 2023-2030

Rapeseed Oil Market Size Was Valued at USD 24,466.61 Million in 2023 and is Projected to Reach USD 35,591.07 Million by 2030, Growing at a CAGR of 5.50% From 2023–2030.

Rapeseed oil, derived from the seeds of the rapeseed plant, is a versatile cooking oil with a mild flavor and high smoke point, making it suitable for various culinary applications such as frying, baking, and salad dressings. Its rich composition of healthy fats, including omega-3 and omega-6 fatty acids, makes it a popular choice for health-conscious consumers.

In recent years, the market for rapeseed oil has seen growth due to increased demand for healthier cooking oils, as well as its versatility and sustainability compared to other oil options. Additionally, rapeseed oil is gaining traction in industrial applications, including biodiesel production, further driving its market expansion. As consumers seek out healthier and environmentally friendly alternatives, rapeseed oil is poised to maintain its position as a key player in the cooking oil market.

📚𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 >> https://pristineintelligence.com/request-sample/global-rapeseed-oil-market-45

Top Key Players Involved Are:

“Archer-Daniels-Midland Company (USA), Bunge Limited (USA), Cargill Incorporated (USA), Conagra Brands Inc. (USA), Cullise Ltd. (UK), Interfat SA (Spain), Louis Dreyfus Company B.V. (Netherlands), Mackintosh of Glendaveny (UK), Ola Oils Limited and Yorkshire Rapeseed Oil (UK), American Vegetable Oils Inc. (USA), Adani Wilmar Ltd. (India), Associated British Foods plc. (UK), Adams Group Inc. (USA), Marico Limited (India), Borges International Group S.L.U (Spain), Ruchi Soya Industries Limited (India), and other key players.”

The rapeseed oil market is being driven by several key factors, including the growing consumer preference for healthier cooking oils. With increasing awareness of the health benefits associated with consuming omega-3 and omega-6 fatty acids, rapeseed oil’s nutritional profile has positioned it as a favorable option for health-conscious consumers seeking alternatives to traditional oils like soybean or sunflower oil. Additionally, rapeseed oil’s high smoke point makes it suitable for a wide range of culinary applications, including frying and baking, further expanding its appeal among home cooks and chefs.

The Rapeseed Oil Market Segmentation:

By Type

Processed

Virgin

By Nature

Conventional

Organic

By Application

Food Processing

Bio Fuel

Cosmetics & Personal Care

Animal Fee

By Extraction Process

Aqueous Process

Enzyme Based Process

By Distribution Channel

Supermarkets and Hypermarkets

Independent Retail Stores

Business to Business

Online Sales Channels

Read More : https://pristineintelligence.com/request-sample/global-rapeseed-oil-market-45

Key Industry Development:

In March 2024, Bunge and Chevron announced approval of a final investment decision for their joint venture Bunge Chevron Ag Renewables LLC to build a new oilseed processing plant adjacent to its existing processing facility located on the Gulf Coast in Destrehan, LA. The plant features a flexible design, intended to allow it to process soybeans as well as softseeds, including novel winter oilseed crops, such as winter canola and CoverCress, among others. Expected to be operational in 2026, the processing facility aims to add scale and efficiencies to Bunge Chevron Ag Renewables, which will allow the company to better meet the increased market demand for renewable fuel feedstocks.

In December 2023, ADM, a global leader in human and animal nutrition, announced that it had reached an agreement to acquire UK-based FDL, a leading developer and producer of premium flavor and functional ingredient systems. FDL, with projected 2023 sales of approximately $120 million, operates three production facilities and two customer innovation centers, all in the United Kingdom. The company’s approximately 235 colleagues, which include about 40 dedicated innovation specialists, have created more than 10,000 proprietary flavor formulations that enable accelerated speed to market.

#Rapeseed Oil Market#Rapeseed Oil#Rapeseed Oil Market 2030#Rapeseed Oil Market 2024#Rapeseed Oil 2030#Rapeseed Oil Market research report

0 notes

Text

#sesame oil#coconut oil#soybean oil#rapeseed oil#peanut oil#sunflower seeds#cottonseed oil market#corn oil#castor oil

1 note

·

View note

Text

Canola oil is actually rapeseed oil but the name was changed in Canada for marketing reasons

5 notes

·

View notes

Text

Vegetable Oil Industry in India

The vegetable oils industry in India is a significant sector that plays a crucial role in the country's economy and food supply. India is one of the largest consumers and importers of vegetable oils globally due to its large population and dietary preferences.

The vegetable oils industry in India involves the production, processing, and marketing of various types of edible oils derived from plants. Some of the commonly used vegetable oils in India include palm oil, soybean oil, sunflower oil, mustard oil, groundnut oil, cottonseed oil and coconut oil.

Here are some key aspects of the vegetable oils industry in India:

Production: India produces a certain amount of vegetable oils domestically, primarily from oilseeds such as soybeans, groundnuts, rapeseed/mustard, sunflower, and sesame. However, domestic production is insufficient to meet the country's growing demand, leading to a significant reliance on imports.

Imports: India is one of the largest importers of vegetable oils in the world. The country imports vegetable oils from various countries such as Indonesia, Malaysia, Argentina, Ukraine, and others. Palm oil constitutes a significant portion of the imports, followed by soybean oil and sunflower oil.

Consumption: Vegetable oils are a staple ingredient in Indian cuisine and are used extensively for cooking purposes. The growing population, changing dietary patterns, and increasing urbanization have contributed to the rising consumption of vegetable oils in the country.

Processing: Vegetable oils are extracted from oilseeds through mechanical or solvent extraction methods. The oilseeds are processed in oil mills or solvent extraction units to obtain crude oil, which undergoes refining processes to produce refined vegetable oils.

Government Policies: The Indian government has implemented various policies to support the vegetable oils industry, promote domestic production, and reduce import dependency. These policies include subsidies, minimum support prices for oilseeds, research and development initiatives, and trade regulations.

Health Considerations: In recent years, there has been an increasing focus on the health aspects of vegetable oils. Consumers are becoming more conscious of factors such as trans fats, saturated fats, and overall nutritional value. This has led to a growing demand for healthier vegetable oil options and increased awareness of oil labeling and quality standards.

It's important to note that the vegetable oils industry is subject to market fluctuations, global commodity prices, weather conditions, and government policies, which can impact production, prices, and trade dynamics. For the most up-to-date information and statistics on the vegetable oils industry in India, it is advisable to refer to industry reports, trade publications, and official government sources.

2 notes

·

View notes

Text

Rapeseed Oil Market Drivers and Challenges

The rapeseed oil market has witnessed substantial growth over the years, driven by its versatility, nutritional benefits, and widespread applications. As a vital vegetable oil used in food, industrial, and biofuel sectors, rapeseed oil continues to gain prominence globally. This article delves into the key factors influencing the rapeseed oil market, highlighting trends, challenges, and future growth opportunities.

Market Overview

Rapeseed oil is extracted from the seeds of the rapeseed plant and is highly regarded for its heart-healthy properties, including low saturated fat and high omega-3 fatty acid content. It is commonly used in cooking, food processing, and industrial applications such as lubricants, biofuels, and cosmetics. The global market has experienced consistent growth due to the rising awareness of healthy eating and the demand for sustainable biofuels.

Key Market Drivers

Rising Demand for Healthy Edible Oils Consumers are increasingly opting for healthier alternatives, driving demand for rapeseed oil in the food industry. Its low cholesterol content and nutritional benefits make it a preferred choice for health-conscious individuals.

Biofuel Industry Expansion The biofuel sector is a major contributor to rapeseed oil demand. Governments worldwide are promoting renewable energy sources, and rapeseed oil has emerged as a key feedstock for biodiesel production.

Growing Food Industry The processed food industry’s growth, particularly in emerging economies, has boosted the demand for rapeseed oil as a key ingredient in various food products.

Challenges in the Rapeseed Oil Market

Fluctuating Prices The rapeseed oil market is highly sensitive to price fluctuations, driven by changes in crop yields, weather conditions, and global trade dynamics.

Competition from Other Oils The market faces stiff competition from other edible oils like palm oil, sunflower oil, and soybean oil, which are often cheaper and more readily available.

Environmental Concerns While rapeseed oil is a renewable resource, its production and processing can have environmental impacts, such as deforestation and greenhouse gas emissions, which pose challenges to its sustainability image.

Emerging Trends

Organic and Non-GMO Products There is a growing demand for organic and non-GMO rapeseed oil, driven by consumer preference for natural and sustainably produced products.

Technological Advancements Innovations in processing and extraction techniques are enhancing the quality and shelf life of rapeseed oil, further boosting its market potential.

Sustainability Initiatives The push for sustainable agricultural practices is influencing the production and sourcing of rapeseed oil, making it more environmentally friendly and appealing to eco-conscious consumers.

Future Outlook

The rapeseed oil market is poised for steady growth, with increasing demand from the food, biofuel, and industrial sectors. Strategic investments in sustainable production practices and technological innovations will likely drive the market forward. However, addressing challenges such as price volatility and competition will be crucial for long-term success.

In conclusion, the rapeseed oil market presents significant opportunities for stakeholders. With the right strategies, the industry can overcome its challenges and capitalize on emerging trends to ensure sustainable growth.

Get Free Sample and ToC : https://www.pristinemarketinsights.com/get-free-sample-and-toc?rprtdtid=NzIz&RD=Rapeseed-Oil-Market-Report

0 notes

Text

Ukraine hits $24.5 billion in agro-exports, nearing pre-war levels, Agriculture Ministry reports

Ukraine’s agricultural exports reached $24.5 billion in 2024, accounting for 59% of the country’s total exports, the Agriculture Ministry reported on Jan. 3.

This marks a significant recovery, nearing pre-war levels and achieving the second-highest record after 2021’s $27.7 billion.

Ukraine, a global agricultural powerhouse, exported 78.3 million tons of products in 2024, including grains and sunflower seeds critical to markets across Africa and Asia.

Sunflower oil led the exports at 21%, with nearly 6 million tons worth $5.1 billion. Corn matched this share, with 29.6 million tons exported for $5 billion. Wheat followed at 15%, totaling 20.6 million tons worth $3.7 billion.

Other notable exports included rapeseed (7%, $1.8 billion), soybeans (5%, $1.3 billion), and oilcake and residues (4%, $1 billion). Meat and poultry products accounted for 4% ($958 million), while barley and sugar each made up 2% of exports at $557 million and $418 million, respectively.

Throughout Russia’s full-scale war, Moscow has sought to obstruct Ukraine’s agricultural exports, blockading the Black Sea and attempting to replace Ukrainian products in global markets with its own, including grain looted from occupied territories.

Despite these challenges, Ukraine reopened a maritime trade corridor in 2023, enabling the revival of its agricultural exports.

Ukrainian Navy ensures safe passage for over 9,000 vessels through sea corridor in 2024, Navy Commander says

Navy Commander Oleksii Neizhpapa said that 4,651 vessels arrived in Ukraine, while 4,410 departed for other ports, enabling the export of over 74.4 million tons of cargo, including agricultural products.

The Kyiv IndependentTim Zadorozhnyy

0 notes

Text

Oilseed market size is expected to be USD 341.44 Billion in 2030

The Oilseed market is expected to grow from USD 253.34 Billion in 2024 to USD 341.44 Billion by 2030, at a CAGR of 5.10% during the forecast period.

The oilseed market represents a critical segment of the global agricultural industry, catering to diverse applications in food, feed, and industrial products. With the growing global population and increasing demand for sustainable agricultural practices, the oilseed market has experienced substantial growth. Key oilseeds such as soybean, sunflower, canola, and cottonseed play pivotal roles in meeting the world's requirements for edible oils, protein-rich animal feed, and biofuels.

Soybean dominates the oilseed market due to its versatility and high oil and protein content. It is extensively cultivated in regions like North and South America, with Brazil, the United States, and Argentina being leading producers. Canola, valued for its low saturated fat content, is another significant contributor, with Canada and Europe spearheading its production. Sunflower seeds, rich in healthy fats and widely used for cooking oils and snacks, have seen consistent demand, particularly in Eastern Europe and Asia. Cottonseed, a byproduct of cotton production, adds value to the oilseed market through its use in livestock feed and oil extraction.

For More Insights into the Market, Request a Sample of this Report: https://www.reportprime.com/enquiry/sample-report/19866

Market Segmentations

By Type: Rapeseed, Cottonsee, Groundnuts, Sunflower Seed, Palm Kernels, Copra Seed, Others

By Applications: Household Consumption, Food-Service, Bio-Fuels, Others

Regional dynamics are key to understanding the oilseed market. North America, particularly the United States, leads in soybean production, supported by advanced agricultural practices and infrastructure. South America, with Brazil and Argentina as major players, benefits from favorable climatic conditions and vast arable land. In Europe, sunflower and rapeseed dominate, driven by demand for healthier cooking oils and biodiesel production. The Asia-Pacific region, led by China and India, represents a growing market due to rising population and increasing consumption of edible oils and animal feed.

The oilseed market is highly competitive, with major players such as Bayer, Limagrain, Monsanto, Burrus Seed, Gansu Dunhuang Seed, DowDuPont, Hefei Fengle Seed, Land O'Lakes, Archer Daniels Midland, Bunge, Green BioFuels, Krishidhan Seeds. These companies invest heavily in research and development, processing infrastructure, and supply chain optimization to maintain their market position. Strategic mergers, acquisitions, and partnerships are common strategies to expand market reach and leverage technological advancements.

Get Full Access of This Premium Report: https://www.reportprime.com/checkout?id=19866&price=3590

Despite its growth, the oilseed market faces several challenges. Climate change poses significant risks to oilseed production, with unpredictable weather patterns and extreme conditions affecting crop yields. Additionally, the high cost of GM seeds and processing technologies can be prohibitive for small-scale farmers. Concerns over deforestation and environmental sustainability, particularly in regions like the Amazon, have also raised questions about the long-term impact of oilseed cultivation.

The future of the oilseed market lies in innovation and sustainability. Emerging technologies such as gene editing hold promise for developing oilseed varieties with enhanced traits, including higher oil content and better resistance to environmental stressors. The integration of precision agriculture and digital farming techniques can optimize resource utilization and improve productivity. Moreover, the growing consumer demand for plant-based proteins and sustainable biofuels presents new opportunities for oilseed applications.

0 notes

Text

Canola Oil Wholesale in the USA: Health Benefits and Key Advantages for Businesses

Canola Oil Wholesale in the USA: Health Benefits and Key Advantages for Businesses Canola oil, derived from rapeseed, is becoming increasingly popular in the U.S. market due to its unique properties and wide range of applications. In this article, we’ll explore its health benefits, advantages for businesses, and why purchasing canola oil wholesale can be a smart choice for food manufacturers, the restaurant industry, and other sectors. What is Canola Oil? Canola oil is produced from the seeds of the canola plant, a variety of rapeseed with low erucic acid content. It is known for its mild flavor, high smoke point, and nutrient-rich composition, making it one of the most versatile vegetable oils. Key components of canola oil: - Monounsaturated fats: Help reduce “bad” cholesterol levels. - Omega-3 and Omega-6 fatty acids: Support cardiovascular health. - Vitamin E: A natural antioxidant that protects cells from damage. - Low saturated fat content: One of the most “heart-friendly” oils. Health Benefits of Canola Oil 1. Supports Cardiovascular Health Canola oil contains up to 90% unsaturated fats, which help lower cholesterol levels and promote heart health. It is widely recommended for healthy eating. 2. High Smoke Point Ideal for frying, baking, and other cooking methods that require high temperatures, with a smoke point of approximately 400°F (204°C). 3. Neutral Flavor Canola oil enhances the flavor of other ingredients without overpowering them, making it perfect for salads, sauces, and marinades. 4. Long Shelf Life Due to its high antioxidant content, canola oil retains its quality longer than many other vegetable oils. Advantages of Buying Canola Oil Wholesale for Businesses 1. Cost Efficiency Purchasing canola oil in bulk reduces the cost per unit, which is particularly important for large-scale food manufacturers, restaurant chains, and distributors. 2. Versatility in Applications Canola oil is used across various industries: - Food industry: For frying, baking, dressings, and preservation. - Cosmetics: As an ingredient in moisturizing creams and skincare products. - Biofuels: A sustainable solution for the energy sector. 3. Stable Supply Wholesale purchases ensure consistent supply, crucial for businesses with continuous production cycles. 4. Compliance with Quality Standards Reputable wholesale suppliers provide canola oil that meets international standards like FDA, ISO, and HACCP, ensuring safety and quality. 5. Sustainability Canola oil production often aligns with sustainable development principles, appealing to modern companies focused on eco-friendly practices. Key Applications of Canola Oil 1. Food Industry - Snack Production: Ideal for frying potato chips, crackers, and other snacks. - Baking: Used in baked goods for its mild flavor and ability to improve texture. - Organic Products: Organic canola oil is in high demand in the health food sector. 2. Restaurant Industry - Preferred for professional kitchens due to its high heat tolerance and cost-effectiveness. - Commonly used in deep-frying, sauces, and salad dressings. 3. Cosmetics - A natural moisturizing agent in creams, lotions, and face masks. - Popular in natural and organic cosmetic formulations. 4. Industrial Use - Canola oil is used as eco-friendly raw material in the production of biofuels. How to Choose a Reliable Canola Oil Supplier in the USA To maximize the benefits of wholesale purchasing, it’s essential to consider the following factors when selecting a supplier: 1. Product Quality Ensure the canola oil meets FDA, ISO, and HACCP standards. For organic products, check for relevant certifications. 2. Supplier Reputation Review feedback, client testimonials, and the company’s track record in the market. 3. Delivery Terms Choose a supplier offering flexible options, including various volumes, timely deliveries, and competitive pricing. 4. Sustainability Opt for suppliers adhering to environmental standards and offering GMO-free products. Conclusion Canola oil is a versatile product that is in high demand in the U.S. market due to its health benefits and wide range of applications. Buying canola oil wholesale provides significant advantages for businesses, including cost savings, supply stability, and product versatility. When sourcing canola oil in bulk, prioritize product quality, supplier reputation, and compliance with international standards. Partnering with the right supplier will help your business remain competitive and meet the modern market’s evolving demands.https://www.ingredaco.us/post/canola-oil-wholesale-in-the-usa-health-benefits-and-key-advantages-for-businesses

#SunflowerLecithin #SunflowerOil#WholesaleLecithin #LecithinSuppliers#BulkLecithin#https://www.ingredaco.us/post/canola-oil-wholesale-in-the-usa-health-benefits-and-key-advantages-for-businesses

0 notes

Text

De-Oiled Lecithin Market Trend Outlook And Share 2023 - 2030

The De-Oiled Lecithin Market Trend was USD 203.98 billion in 2022 and is expected to Reach USD 369.2 billion by 2030 and grow at a CAGR of 7.7 % over the forecast period of 2023-2030.

The De-Oiled Lecithin growth is estimated to be majorly driven by growing economies of Asia Pacific region. The growing demand of De-Oiled Lecithin from the wind energy, marine, and packaging end-use industries in China, India, Japan, and Australia is driving the growth of De-Oiled Lecithin in Asia Pacific region

Book Your FREE Sample Report @ https://www.snsinsider.com/sample-request/3973

De-Oiled Lecithin Market Set to Thrive with Expanding Applications in Food and Pharmaceuticals

The global De-Oiled Lecithin Market is witnessing significant growth, driven by rising demand for natural and non-GMO emulsifiers in the food and pharmaceutical industries. De-oiled lecithin, valued for its high phospholipid content and functional versatility, is increasingly being adopted as a key ingredient in dietary supplements, bakery products, and confectionery. With the growing consumer preference for clean-label products, the market is benefiting from its appeal as a plant-based and allergen-free alternative. Additionally, the market's expansion is supported by the rising awareness of the health benefits associated with lecithin, including improved digestion and cognitive health, further propelling its use across diverse applications.

The market's growth trajectory is bolstered by technological advancements in lecithin extraction processes, ensuring high-quality, de-oiled products tailored to specific industry needs. The Asia-Pacific region is emerging as a dominant player, attributed to increasing soy and sunflower cultivation, coupled with growing demand from the food processing sector. Meanwhile, North America and Europe continue to present lucrative opportunities due to the rising trend of veganism and regulatory approvals for non-GMO lecithin. With a projected CAGR of robust proportions over the forecast period, the de-oiled lecithin market is poised for substantial expansion, catering to the evolving needs of health-conscious consumers and industrial users alike.

Market Overview

By Source

Soybean

Rapeseeds

Sunflower

Egg

Canola Seeds

By Form

Powdered

Granulated

By Type

GMO

Non-GMO

By Applications

Feed

Industrial

Health Care Products

Food & Beverages

The major factors driving the growth of the studied are growing demand of lightweight material from automotive industry and increasing construction activities in Asia-Pacific.

Availability of substitutes for De-Oiled Lecithin are likely to hinder the s growth.

Potential growth in wind energy is likely to create opportunities for the in the coming years.

Asia-Pacific region is expected to dominate the and is also likely to witness highest CAGR during the forecast period.

The key players covered in this report:

National Lecithin Inc

American Lecithin Company

Archer Daniels Midland

Cargill

Amitex Agro Product Pvt. Ltd.

Bunge Limited

Clarkson Grain Company

LECICO GmbH

DowDuPont

Giiava

Stern-Wywiol Gruppe

Buy This Exclusive Report @ https://www.snsinsider.com/checkout/3973

Asia-Pacific Region to Dominate the

Asia-Pacific region is expected to dominate the industry. In the region, China is the largest economy, in terms of GDP. China is one of the fastest emerging economies and has become one of the biggest production houses in the world, today. The country’s manufacturing sector is one of the major contributors to the country’s economy.

China is the largest manufacturer of automobiles in the world. The country’s automotive sector has been shaping up for product evolution, with the country focusing on manufacturing products, in order to ensure fuel economy, and to minimize emissions (owing to the growing environmental concerns due to mounting pollution in the country).

Contact Us:

Akash Anand – Head of Business Development & Strategy

Phone: +1-415-230-0044 (US)

0 notes

Text

Rapeseed Oil Prices Trend | Pricing | News | Database | Chart

North America

In the third quarter of 2024, North America’s rapeseed oil market faced a complex set of challenges shaped by global and regional dynamics. While the European market experienced a notable price surge, North America observed a more moderate trend. Supply chain disruptions, rising energy costs, and logistical delays impacted the market, but stable domestic production helped mitigate these effects. Early in the quarter, rapeseed oil prices rose sharply due to heightened demand from end-user sectors and global supply chain issues, which increased shipping costs and extended lead times. Suppliers, benefiting from moderate inventories, raised prices to capitalize on arbitrage opportunities. Currency fluctuations, particularly the depreciation of the U.S. dollar, further fueled this upward trend through August. However, by September, a significant price drop occurred, marking an overall downward trend for the quarter. Weakened global demand for U.S. rapeseed oil, combined with increased competition from alternative oils like soybean and palm oil, contributed to the decline. Economic uncertainties and inflation in key importing regions further dampened demand, with buyers opting for more competitively priced alternatives. By the end of the quarter, North American rapeseed oil prices stabilized at around USD 1,187 per metric ton, reflecting a modest decline from the previous quarter.

Asia Pacific

In the third quarter of 2024, the Asia Pacific (APAC) region witnessed a notable surge in rapeseed oil prices, with India experiencing the most significant changes. Market dynamics were primarily influenced by supply constraints, heightened demand from key industries, and increased import costs due to currency devaluation. Tight supply conditions, coupled with robust demand, led to aggressive inventory building by stockists, further exacerbating price pressures. Rising energy costs impacting production, delays in processing, and escalating freight expenses also contributed to overall price escalations. The agricultural sector’s inability to immediately match the sudden spike in demand created a short-term supply crunch, and the resulting impact trickled down to consumers. Manufacturers, faced with higher procurement costs and limited import options, passed these expenses on to end-users. Retail prices for rapeseed oil consequently saw a significant increase. This price rise highlighted the supply-demand imbalance favoring domestic production, a direct consequence of government policy decisions to hike import duties on edible oils. Overall, the quarter recorded a substantial 13% increase from the previous quarter. By the end of the period, prices stood at USD 1,634.69 per metric ton of rapeseed oil (Ex Jaipur, India), reflecting a continuously positive pricing trend throughout the quarter.

Get Real time Prices for Rapeseed Oil: https://www.chemanalyst.com/Pricing-data/rapeseed-oil-1320

Europe

In the third quarter of 2024, the European rapeseed oil market experienced a notable downturn due to several interconnected factors. Initially, July saw a surge in prices, particularly in Germany, driven by heightened purchasing activity and increased export demand. However, weather disruptions in key producing regions such as France, Germany, Poland, and Ukraine negatively affected winter rapeseed crops, reducing yields and market availability, which contributed to the price rise. As August commenced, the market shifted towards a significant downward trend, persisting until the latter weeks of September. This decline was driven by weakened demand from end-users, who adopted a more cautious approach to procurement amid ongoing market uncertainties. Despite adequate global supply levels, trading activity diminished, and preferences among manufacturers and suppliers began to shift toward alternative edible oils, further exerting downward pressure on rapeseed oil prices. By the end of the quarter, prices had dropped significantly, closing at USD 1,030 per metric ton (FOB Hamburg). This trend highlighted the complex interplay of economic dynamics, currency fluctuations, and agricultural conditions, creating challenges for the rapeseed oil supply chain. The overall sentiment in Germany reflected a bearish pricing environment, with continuous price declines throughout the quarter. This period underscored the need for adaptive strategies to navigate the volatile market landscape.

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Rapeseed Oil#Rapeseed Oil Price#Rapeseed Oil Prices#Rapeseed Oil Pricing#Rapeseed Oil News#Rapeseed Oil Price Monitor#Rapeseed Oil Database

0 notes

Text

#1147 What is vegetable oil?

What is vegetable oil? Most vegetable oil is oil extracted from the seeds of plants, and sometimes from the plants themselves. Vegetable oil is an accurate name for the product in that the oil comes from plants, but they are not all technically vegetables. The name was chosen partly because the word “vegetable” conjures up images of healthy food and makes us think that the oil is good for us. As with anything, some vegetable oils are healthy and are actually made from vegetables and some vegetable oils are less healthy and have never even seen a vegetable. The most common vegetable oils are palm oil, soybean oil, sunflower oil, and rapeseed oil, which is called canola oil. Interestingly, canola oil is made from rapeseed, but the marketing board didn’t think the word “rape” would sell very well, so they changed the name to canola, which comes from Canada Oil Low Acid. The word “rape” in rapeseed is actually the Latin word for turnip (rapum). Vegetable oils are the most consumed food in the world after rice and wheat and they make up 20% of our daily calorie intake. They are very versatile oils, and they are not only used for frying but also for coloring, flavoring, and making sure mixtures stick together. The biggest reason why palm oil, soybean oil, sunflower oil, and rapeseed oil are the most common oils is that they are extremely cheap. There are other vegetable oils like avocado oil and olive oil that are far more expensive, and you don’t usually see them in ultra-processed foods. So, how do you get vegetable oil out of vegetables? Let’s look at soybean oil, which is the most common vegetable oil you will find in your kitchen. You can also find soybean oil in a huge number of things that we eat. It’s in dressings, margarine, breads, mayonnaise, snacks, and a pile of other things. The first step in making soybean oil is to obviously get the soybeans. Soybeans are grown in many countries around the world, and they are known as an industrial crop because of the scale of their production. Over 350 million tons of soybeans are produced every year and Brazil is the world’s biggest producer. A lot of the deforestation in the Brazilian rainforest is to make fields to grow soybeans, which is seen as a far more profitable crop. Soybeans are very healthy, a great source of protein and oils, and they can fix damaged soils. They were planted in the dustbowls of America during the 1930s and regenerated the soil. The problem is not the soybean, the problem is the enormous quantities they are farmed in. Once the soybeans have been harvested, they are washed to get rid of stones, dust, and other impurities. Getting out all of the bits keeps the oil purer, but it also protects the machinery. The next step is to get the shell off the soybean. The soybean is a seed and seeds have an outer shell to protect the embryonic plant and its food stores inside. This shell has to be removed because the oil company wants to get at the plant and the food stores. The inside of the seed is made up of about 20% oil, 36% protein, 30% carbohydrates, and the rest is water. The shell is removed with a machine that cracks and breaks it off. Then the inside part of the seed is flattened to increase its surface area. These flattened seeds are then coked to break up the oil holding cells, before they are heated again to expand them. Then they go to the extraction plant where the oil is brought out of them using a solvent. Olive oils are pressed out of the olives, but soybean oil is removed with a solvent that dissolves the oil from the soybeans and it is washed out. Using a solvent is far more economical than a press because it removes more of the oil. The solvent has to be removed and that is done by heating the oil. Then the oil is distilled. It’s still not ready, though. The oil has to be refined. Any sticky bits are removed. The coloring is removed by bleaching and then the remaining odors are removed. The oil is finished and ready to be sold. All of the other vegetable oils are produced in pretty much the same way. Consumption of all of these oils has almost doubled year on year since they were first introduced and most of the time, we don’t know that we are eating them. And this is what I learned today. - #432 How does dry cleaning work? - #498 Can you eat the skin of all fruit and vegetables? - #751 What vegetables came from the New World? - #521 How are foods frozen? - #921 How much oil is left? Sources https://www.zeroacre.com/blog/the-history-of-vegetable-oils https://www.reddit.com/r/explainlikeimfive/comments/sor18z/eli5_how_do_we_get_vegetable_oil_from_vegetables/ https://en.wikipedia.org/wiki/Vegetable_oil https://en.wikipedia.org/wiki/Soybean_oil https://www.bestoilmillplant.com/soya-oil-solvent-extraction-process-guide.html https://www.nandtengitech.com/blog/soybean-oil-extraction-process https://www.history.com/news/soybean-china-american-crop-tariffs Photo by Towfiqu barbhuiya: https://www.pexels.com/photo/clear-plastic-bottles-with-yellow-liquid-12284682/ Read the full article

1 note

·

View note

Text

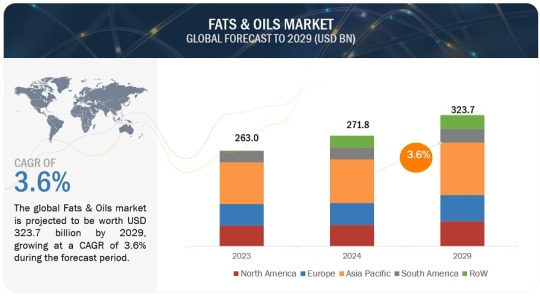

Fats and Oils Market Set for Rapid Growth: Trends, Innovations, and Consumer Demands Driving Expansion

The global fats and oils market is projected to be valued at USD 271.8 billion in 2024, with a compound annual growth rate (CAGR) of 3.6%, expected to reach USD 323.7 billion by 2029. This market is undergoing significant transformations and innovations. The demand for fats and oils goes beyond culinary uses, impacting various sectors, including animal feed, oleochemicals, and biofuels.

Vegetable oils and animal fats are essential components in the food industry, contributing to the texture, flavor, and shelf life of processed foods. Palm, rapeseed, sunflower, and soybean oils are the most widely used oils worldwide, thanks to their versatile applications in both food and non-food products. Animal fats, such as butter and lard, are particularly important in baking, where they are prized for their rich, distinctive flavors.

Fats and Oils Market Trends

Here are some key trends in the Fats and Oils Market:

Health Consciousness: As consumers become more health-conscious, there’s a growing demand for healthier fats, such as olive oil, avocado oil, and coconut oil. This shift is leading to the popularity of oils with favorable fatty acid profiles and beneficial nutrients.

Plant-Based Oils: The trend toward plant-based diets is driving the demand for oils derived from plants. Oils like sunflower, canola, and palm oil are gaining traction due to their versatility and health benefits. Sustainable Sourcing: Environmental sustainability is becoming increasingly important for consumers and manufacturers. Brands are seeking sustainably sourced oils and fats, leading to a rise in certifications like RSPO (Roundtable on Sustainable Palm Oil).

Functional Fats: There is a growing interest in functional fats that offer additional health benefits, such as omega-3 and omega-6 fatty acids. These are often marketed for their heart health benefits and ability to support cognitive function.

Food Innovation: The food and beverage industry is continually innovating with new formulations that incorporate unique fats and oils to enhance flavor, texture, and nutritional value. This includes the use of fats for plant-based and alternative protein products.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=6198812

Vegetable Sources of Fats and Oils Expected to Lead Market Share During the Forecast Period.

Vegetable-based oils are expected to maintain the largest share of the fats and oils market throughout the forecast period. This dominance can be attributed to their versatility, health benefits, and wide availability. Oils from sources like soybean, palm, and sunflower are commonly used in cooking and food processing due to their broad range of applications and consumer preference for healthier alternatives to animal fats. These oils offer essential fatty acids and are considered more beneficial for health. Moreover, innovations in agricultural practices and biotechnology have boosted vegetable oil production, ensuring a consistent and cost-effective supply. Their adaptability in both food and industrial uses reinforces their leading role in the market.

The Food Application Segment is Projected to Dominate the Fats and Oils Market Share Throughout the Forecast Period.

In the application segment, the food industry is projected to hold the largest share of the fats and oils market throughout the forecast period. Fats and oils play a vital role in enhancing flavor, texture, and preservation across various food products. They are essential in cooking and baking, providing desirable characteristics like crispiness and richness. Additionally, fats and oils act as carriers for fat-soluble vitamins and flavors, boosting consumer appeal. The growing demand for processed and convenient foods, coupled with an increasing interest in diverse culinary experiences, further drives the dominance of food applications in this market segment.

Top Fats and Oils Companies

The key players in the market are ADM (US), Wilmar International Ltd (Singapore), Cargill, Incorporated (US), Bunge (US), Kaula Lumpur Kepong Berhad (Malaysia), Olam Agri Holdings Pte Ltd (India), Manildra Group (Australia), Mewah Group (Singapore), Associated British Foods plc (UK), United Plantations Berhad (Malaysia), Ajinomoto Co., Inc. (Japan), Fuji Oil Co., Ltd. (Japan), Oleo-Fats (Philippines), Borges Agricultural and Industrial Edible Oils, S.A.U. (Spain), K S Oils Limited (India), CSM Ingredients (US), SD Guthrie International Zwijndrecht Refinery B.V. (Netherlands), Musim Mas Group (Singapore), Richardson International Limited (Canada), and AAK AB (Sweden).

#Fats and Oils Market#Fats and Oils#Fats and Oils Market Size#Fats and Oils Market Share#Fats and Oils Market Growth#Fats and Oils Market Trends#Fats and Oils Market Forecast#Fats and Oils Market Analysis#Fats and Oils Market Report#Fats and Oils Market Scope#Fats and Oils Market Overview#Fats and Oils Market Outlook#Fats and Oils Market Drivers#Fats and Oils Industry#Fats and Oils Market Companies

0 notes

Text

The Behenyl Alcohol Market is projected to grow from USD 183.5 million in 2024 to an estimated USD 237.92 million by 2032, with a compound annual growth rate (CAGR) of 3.3% from 2024 to 2032.Behenyl alcohol, also known as docosanol, is a saturated fatty alcohol with a long carbon chain. It has garnered significant attention in recent years due to its wide application in the personal care and cosmetic industries. With rising demand for natural and sustainable ingredients in cosmetics, behenyl alcohol has become an essential ingredient in various products, including lotions, creams, conditioners, and other skincare formulations. The global behenyl alcohol market is poised for considerable growth as consumer preferences shift towards eco-friendly and organic beauty products. This article explores the key drivers, trends, and challenges in the behenyl alcohol market.

Browse the full report https://www.credenceresearch.com/report/behenyl-alcohol-market

Market Overview

Behenyl alcohol is derived from natural sources like vegetable oils, particularly from seeds of plants such as rapeseed. It is a white, waxy solid that is widely used as an emollient, thickening agent, and opacifying agent in personal care formulations. One of its notable features is its ability to form a protective barrier on the skin, reducing moisture loss and enhancing the product’s overall feel. The global market for behenyl alcohol is growing due to increasing demand for high-quality skincare and haircare products, along with rising awareness regarding the benefits of sustainable ingredients.

According to recent reports, the global behenyl alcohol market is expected to grow at a compound annual growth rate (CAGR) of 5-6% over the forecast period from 2024 to 2030. North America, Europe, and the Asia-Pacific region are the leading markets for behenyl alcohol, driven by the robust cosmetics industry in these regions. The increasing consumer focus on product safety, coupled with a shift towards naturally derived ingredients, is a key factor driving market expansion.

Key Drivers of Growth

1. Rising Demand for Natural and Organic Products In recent years, there has been a noticeable shift in consumer behavior towards natural and organic products, especially in the personal care and cosmetics industries. This trend is fueled by the growing awareness of the potential harmful effects of synthetic chemicals in skincare products. Behenyl alcohol, being naturally derived, fits well within this trend, offering a sustainable alternative to petrochemical-based ingredients.

2. Growing Cosmetic and Personal Care Industry The global cosmetics industry is growing steadily, driven by increasing disposable incomes, a growing middle-class population, and rising demand for anti-aging and skincare products. Behenyl alcohol is frequently used in premium skincare formulations due to its emollient and conditioning properties, making it a vital ingredient in the personal care sector.

3. Consumer Awareness and Preference for Sustainable Ingredients Sustainability has become a crucial factor in consumer decision-making, particularly among millennials and Gen Z consumers. These consumers are not only interested in the efficacy of the product but also in its environmental impact. Behenyl alcohol, sourced from renewable plant-based sources, appeals to environmentally conscious buyers and helps brands position themselves as eco-friendly and sustainable.

4. Technological Advancements in Formulation Advances in cosmetic science and formulation technology have allowed manufacturers to use behenyl alcohol in innovative ways. Its versatility as a thickener and emollient makes it a preferred choice in modern formulations. Moreover, new techniques to derive behenyl alcohol more sustainably and cost-effectively have further boosted its demand.

Challenges and Restraints

Despite its growing popularity, the behenyl alcohol market faces certain challenges. One of the main challenges is the fluctuating prices of raw materials, as behenyl alcohol is derived from plant-based oils like rapeseed, which are subject to price volatility. Additionally, stringent regulations regarding the use of certain cosmetic ingredients in various countries may impact the market growth. Manufacturers need to comply with regulatory guidelines to ensure the safety and efficacy of their products.

Key Player Analysis:

BASF

Clariant

Croda International

Evonik Industries

Kao Corporation

Michelman

Pentapharm

Peter Greven Group

Phoenix Chemical

SaficAlcan

Solvay

Stepan Company

Univar Solutions

Vantage Specialty Chemicals

WeylChem

Segmentation:

By Product Type

Natural Behenyl Alcohol

Synthetic Behenyl Alcohol

By Application

Personal Care and Cosmetics

Pharmaceuticals

Food and Beverages

Textiles

Industrial

By Grade

Cosmetic Grade

Pharmaceutical Grade

Food Grade

Technical Grade

By Production Process

Hydrogenation of Rapeseed Oil

Hydroformylation of 1-Dodecene

Other

Based on Region

North America

US

Canada

Mexico

Europe

Germany

France

UK

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Browse the full report https://www.credenceresearch.com/report/behenyl-alcohol-market

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

Website: www.credenceresearch.com

0 notes

Text

Maximizing Oil Extraction Efficiency with Integrated Screw Oil Press

In today’s fast-paced world, the demand for high-quality, cold-pressed oils has seen a significant rise. People are becoming more health-conscious, looking for pure, organic oils extracted without chemical solvents. This has led to an increased interest in efficient and eco-friendly oil extraction machinery, with the Integrated Screw Oil Press emerging as one of the most sought-after solutions in the oil processing industry.

What is an Integrated Screw Oil Press? An Integrated Screw Oil Press is a highly efficient and multifunctional oil extraction machine that combines pressing, filtration, and heating processes into one. Unlike traditional oil extraction machines, which often require separate filtering or heating equipment, the integrated screw press simplifies the process by incorporating all necessary components into a single unit. This not only saves time but also improves the oil quality by reducing the risk of contamination and oxidation.

The machine is designed to process various seeds and nuts like sunflower seeds, peanuts, soybeans, cotton seeds, rapeseeds, and more. Its versatility makes it an excellent choice for small to medium-sized oil mills, farmers, and individuals interested in producing their own oil.

Key Features of the Integrated Screw Oil Press High Oil Yield: One of the standout features of the integrated screw oil press is its ability to extract a high amount of oil. The pressing chamber applies immense pressure, squeezing every drop of oil from the seeds. This ensures that users get the maximum yield with minimal waste.

Integrated Filtration: The machine includes an automatic vacuum filter, which removes impurities and ensures that the oil is pure and ready for use immediately after extraction. This eliminates the need for separate filtering equipment and reduces the time required for the overall process.

Temperature Control: The built-in heating system ensures that the seeds are preheated to the optimal temperature before pressing. This helps improve the oil yield and ensures a consistent, high-quality product. Additionally, controlling the temperature helps preserve the nutrients in the oil, making it healthier and more flavorful.

Energy Efficient: With its multifunctional design, the integrated screw oil press minimizes energy consumption by combining several processes in one machine. This makes it not only cost-effective but also environmentally friendly.

Compact Design: The machine is relatively compact, making it suitable for smaller production spaces. Its ergonomic design allows for easy operation, maintenance, and cleaning, which is crucial for ensuring hygienic oil extraction.

Benefits of Using an Integrated Screw Oil Press Enhanced Oil Quality: Since the machine integrates heating, pressing, and filtering processes, the oil extracted is of superior quality—clean, pure, and free from contaminants.

Cost Savings: Combining several processes in one machine reduces the need for additional equipment, saving money on both machinery and maintenance.

Ease of Use: The machine is designed for user-friendliness, making it suitable for beginners as well as experienced oil producers.

Versatility: It can handle a wide variety of oilseeds, giving users the flexibility to produce different types of oils depending on market demand or personal preference.

Applications of the Integrated Screw Oil Press The integrated screw oil press can be used in various settings, including:

Small to Medium-Scale Oil Mills: It is perfect for businesses looking to streamline their operations while producing high-quality oil.

Farmers and Cooperatives: The machine allows farmers to process their own oilseeds, adding value to their crops and creating an additional revenue stream.

Home Use: For those interested in making their own oils for personal consumption, this machine offers a convenient and efficient way to extract pure oil at home.

Conclusion The Integrated Screw Oil Press is a game-changer in the oil extraction industry. Its ability to combine multiple processes—heating, pressing, and filtering—into one machine makes it an efficient and cost-effective solution for anyone looking to produce high-quality oils. Whether you are a small-scale business owner, a farmer, or someone who wants to produce oil at home, this machine offers reliability, versatility, and top-notch performance. Investing in an integrated screw oil press can maximize oil yields, enhance product quality, and save time and energy, making it a valuable asset for anyone involved in oil production.

0 notes

Text

Fishmeal & Fish Oil Market Segmentation Application, Technology & Market Analysis Research Report To 2033

The fishmeal and fish oil market is anticipated to reach a value of US$ 7.4 billion in 2023 and US$ 13.0 billion in 2033. During the projection period, fishmeal and fish oil sales are anticipated to expand at a substantial CAGR of 5.8%.

The production of fishmeal and fish oil is expected to increase moderately in the coming years as a result of improved by-product utilization and a growing aquaculture industry.

According to the OECD, aquaculture's contribution to global fish culture will continue to grow and will surpass that of fisheries by 2024. Aquaculture production is expected to reach 105 million tons by 2029, ten million tons more than the capture sector.

As feed demand has increased in tandem with increased aquaculture production, the inclusion of fish meal and fish oil in feed recipes has clearly declined, and has been partially replaced by vegetable substitutes such as soymeal and rapeseed oil.

Due to their scarcity, fishmeal and fish oil will be employed more frequently as strategic ingredients at lower percentages and for particular production stages.

The development and dynamics of the markets for fish oil and fishmeal on a worldwide scale can be influenced by a variety of variables. Included in them are extrinsic variables like the weather and environment, fishery management, trade policies, etc.

Information Source: https://www.futuremarketinsights.com/reports/fishmeal-and-fish-oil-market

Key Takeaways from the Fishmeal & Fish Oil Market

The fishmeal and fish oil market were dominated by salmon and trout and is expected to grow at a CAGR of 5.6% by 2033. This is because salmon oil is high in the omega-3 fats DHA and EPA. Consuming omega-3 fatty acids from salmon oil has been linked to a number of health benefits.

Pharmaceutical sector will register a growth of 5.4% and lead the application segment. Pharmaceutical industry will be highly benefitted from the fish oil and fish feed market owing to growing trend of fish-based supplementation and high adoptability of fish by-products in medical sector.

The U.S. to contribute a whooping US$ 4.6 billion by 2033 in the global market. Favorable policies and the thriving marine industry are the key reason driving the market in the region.

The U.K. is witnessing a growth of 4.9% in the fish oil and fish feed market. The growing concern and awareness on animal nutrition and well being is the key factor behind this significant growth of the region.

China is the most lucrative region among all growing at an astonishing rate of 5.2%. China is the top consumer of fish and fish products among other regions. Growing awareness on cardiac issues is promoting the adoption of fish oil among population.

Asia Pacific is likely to be the dominant region for the market till the end of the forecast period.

Latest Developments

In April 2022, Evolve Supplements initiated its online store for aiding in the buying process for consumers.

In April 2022, Trident Seafoods came out with its Omega 3 food for dogs. They forayed into the pet food market with this initiative.

Key Segments Fish meal & Fish Oil Market

Source:

Salmon & Trout

Marine Fish

Crustaceans

Tilapia

Carps

Application:

Aquaculture & Aquatic Feeds

Land Animal Feeds and Livestock

Agriculture and Fertilizers

Pharmaceuticals

Dietary Supplements

By Region:

North America

Latin America

Western Europe

Eastern Europe

Asia Pacific excluding Japan (APEJ)

Japan

The Middle East & Africa (MEA)

0 notes