#Quorum Model

Explore tagged Tumblr posts

Text

#AWS#Amazon Aurora#Amazon DocumentDB#Amazon Neptune#Database#Quorum Model#Comparison#Comparison Chart

0 notes

Text

Actress, model and singer Amanda Lear models fashion by Quorum, 6th August 1968.

99 notes

·

View notes

Text

Ruth Ben-Ghiat at Lucid:

“I rise tonight with the intention of disrupting the normal business of the United States Senate for as long as I am physically able… These are not normal times in our nation. And they should not be treated as such in the United States Senate. The threats to the American people and American democracy are grave and urgent and we all must do more to stand against them.” This is how Senator Cory Booker (D-NJ) began a speech which ultimately lasted more than 25 hours. At a time when our democracy faces an unprecedented crisis, Sen. Booker’s speech constituted a call to action in the name of unity and civil rights, justice and solidarity. It broke the filibuster record set by Sen. Strom Thurmond (R-SC), a man so racist that he spoke for a whole day and night to try and block the passage of the Civil Rights Act of 1957 and “keep people like me out of the Senate,” as Booker pointedly told Rachel Maddow. A filibuster seeks to obstruct the democratic act of deliberation around a specific piece of legislation. Sen. Booker’s speech was a resistance action. It called attention to the sober fact that all of our democratic procedures, norms, and institutions are imperiled. And it enacted and supported several key resistance strategies and principles.

This is a long game, and we must be resilient, seeing each individual action as part of a larger collective process.

The speech was an endurance test. Sen. Booker took no bathroom or rest breaks. He modeled in miniature the resilience shown by U.S. civil rights protesters on the streets and during the long years of struggle. And he reminded us that we will need to be tenacious and not easily discouraged in our efforts to turn back this assault on our rights and freedoms and restore the rule of law and democratic governance to America. “Moments like this require us to be more creative or more imaginative, or just more persistent and dogged and determined,” Booker��said, his strength flagging as he entered the final few hours.

Lead with values and harness the power of emotions to bring others into the cause.

I was not surprised that it was Sen. Booker who stood up against the moral collapse we are witnessing. “This is not right or left. It is right or wrong. This is not a partisan moment. It is a moral moment,” he said. “Where do you stand?” Sen. Booker has often been ahead of the curve by appealing to Americans to take a stand and draw on the wisdom and practice of the civil rights era as they do that. During the first Trump administration, when he decided to run for president in the 2020 election, Sen. Booker made values-driven politics, love, and empathy part of his platform. In a 2018 Atlantic interview, he evoked Dr. Martin Luther King, Jr.’s belief that ‘hate can’t drive out hate; only love can do that.’ Not only do I believe it is an important ideal, I also believe it is the right strategy, the right political strategy.” While Sen. Booker did not invoke love on this occasion, many journalists and commentators noted his displays of emotion, as though this was something unusual to see in a member of Congress. Here is my essay about the power of love and positive emotions as effective resistance strategy. Sen. Booker used the Senate chamber to make his speech and invoked his right to not yield the floor until he was ready. [...]

Use the tools and spaces you have now –all of them—because there is no guarantee that they will be available in the future. Be prepared to use those tools and spaces in new ways that might take you out of your comfort zone.

His fellow Democratic members of Congress have many instruments of protest available to them: voting NO on Republican-sponsored legislation, demanding quorum calls, denying confirmations, and much more. Yet many have acted timidly, avoiding such actions, some of them perhaps trying to honor a bipartisanship that has sadly all but disappeared as the Republican party has become an authoritarian entity. And ten Democrats were decidedly not using the spaces and tools at their disposal to fight autocracy when they signed on to the Republican motion to censure Rep. Al Green (D-TX) for protesting during President Donald Trump’s first address to a joint session of Congress. [...]

Always present a united front to oppose an authoritarian aggressor. Solidarity is everything.

Booker’s extraordinary action brought forth a show of affection and respect from his colleagues in the chamber –Sen. Chris Murphy (D-CT) stayed with him throughout, and others frequently asked him questions to allow him a bit of vocal rest. That, too, was important for Americans to see. As Bloomberg columnist Nia-Malika Henderson observed, Sen. Booker was sending a strong message to his Senate colleagues as well as the Democratic base, both through his physical performance and through the content of his speech. Sen. Booker denounced the Trump administration’s actions in every sector and the destruction wrought by Elon Musk’s DOGE shock troops, but he did so in ways that made the awful outcomes of those actions and policies clear. Throughout, he shared testimonials from people who have already been adversely affected by the wrenching changes, whether farmers or educators and students or foreign nationals trying to enter the U.S. who ended up in ICE detention sites.

Sen. Cory Booker (D-NJ)’s record-breaking Senate filibuster was a clarion call for action against a wayward regime trampling on the Constitution.

7 notes

·

View notes

Text

'None of these [philosophers] will force you to die, but all will teach you how to die. None will exhaust your years, but each will contribute his years to yours. With none of these will conversation be dangerous, or his friendship fatal, or attendance on him expensive. From them you can take whatever you wish: it will not be their fault if you do not take your fill from them. What happiness, what a fine old age awaits the man who has made himself a client of these! He will have friends whose advice he may ask on the most important or the most trivial of matters, whom he can consult daily about himself, who will tell him the truth without insult and praise him without flattery, who will offer him a pattern on which to model himself.'

Horum te mori nemo coget, omnes docebunt; horum nemo annos tuos conteret, suos tibi contribuet; nullius ex his sermo periculosus erit, nullius amicitia capitalis, nullius sumptuosa observatio. Feres ex illis, quidquid voles; per illos non stabit, quominus quantum plurimum cupiens haurias. Quae illum felicitas, quam pulchra senectus manet, qui se in horum clientelam contulit! Habebit, cum quibus de minimis maximisque rebus deliberet, quos de se cotidie consulat, a quibus audiat verum sine contumelia, laudetur sine adulatione, ad quorum se similitudinem effingat.

Lucius Annaeus Seneca, De Brevitate Vitae. tr. Costa.

7 notes

·

View notes

Text

@heathersdesk as promised here's the explanation of my theory about the importance of imperfection in the church for the perfection of the saints.

As is the way of the Lord this starts several years ago when I was on my mission, where I finally actually understood the importance of trials in our lives.

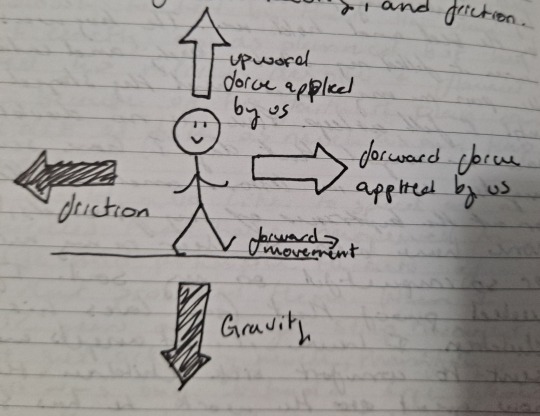

Newtons third law states that for every action there is an equal and opposite reaction. If we want to walk forward we need to overcome two forces: gravity, and friction.

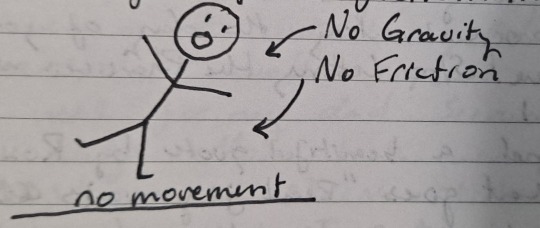

Gravity and friction make walking difficult, BUT if we did not have those oppositions there would be no movement. If there were a room with no gravity and no friction, there would be no movement. We would just flail around and never get anywhere, much less toward our goal.

Trials are our spiritual gravity and friction. They provide the opposing force from which we push. To be perfected is a process of trial and growth, trial and growth, trial and growth. It will not be easy but it the only way we can come unto Christ and become like our Heavenly Parents.

Last conference was hard for me and I only ended up watching about half a session, though I have since read some of the talks and quite liked them. It didn't push me out of the church, but it got close. I had recently come out as gender-queer and started using they/them. It made me wonder. I had received personal revelation from the Lord that my gender identity and expression was part of my eternal identity and supported by Them, so why was the quorum of the twelve and the first presidency teaching contrary to this? My answer as typical of the Lord came from an old institute teacher who I had once spent nearly an hour arguing with about trans rights. He was substituting for the class I was in and we were talking about the organization of the church.

Ephesians 4:11-17 teaches us about the organization of the church saying:

11.And he gave some, apostles; and to some, prophets; and to some, evangelists; and to some, pastors, and teachers;

12.For the perfecting of the saints, for the work of the ministry, for the edifying of the body of Christ:

13.Till we all come in the unity of the faith, and of the knowledge of the Son of God, unto a perfect man, unto the measure of the stature of the fullness of Christ.

14.That we are henceforth be no more children, tossed to and fro, and carried about with every wind of doctrine, by the sleight of men, and the cunning craftiness, whereby they lie in wait to deceive

15.But speaking the truth in love, may grow up unto him in all things, which is the head, even Christ:

16.From whom the whole body fitly joined together and compacted by that which every joint supplieth, according to the effectual working inn the measure of every part, maketh increase of the body unto the edifying of itself in love.

17.This I say therefore, and testify in the Lord, that ye henceforth walk not as other gentiles walk, in the vanity of their mind.

The Church is organized intentionally it is imperfect by design.

"For the perfecting of the saints," trials are the biggest perfecting force in life. So we are perfected both by good and bad experiences within the church and by good and bad experiences with the members of the church.

"In the unity of the faith," becoming unified doesn't happen on accident, a common group dynamic model identifies "storming" or a period of disagreement and struggle as a fundamental part of growing an effective team. Overcoming the struggle is what unifies us.

"Be no more children, tossed to and fro," learning to love imperfect people and finding the good in everyone helps us learn who we are and what we believe which will ground us in Christ.

"But speaking the truth in love...even Christ," Recognizing that Christ is the truth and learning to share the his gospel with love helps us and those around us grow closer to him.

Each part and person in the church is important for the whole to improve every person every policy no matter how harmful it is is there for a reason, so each member of the church can learn and grow. That's not to say we must accept everything. It is often in fighting for change we grow the most. We are not the "true church" because we are the best, or even that we are right about everything. This is the true church because we have the living gospel and we learn and grow together. We work together for the edifying and perfecting of the saints.

#the church of jesus christ of latter day saints#mormonism#queerstake#There's a lot here#we did hit a special intrest

31 notes

·

View notes

Text

ahh.. well. time to watch some more battlestar galactica. took a little break cuz i really dont want it to end. we got 4 episodes left.

i watched "The Plan" movie, was incredibly cool, actually. it was always cavill lol. insane. also insane how important ellen and tigh are?? like i always suspected that ellen might be a cylon, because she always gave tigh bad advice, but she seems like the ringleader almost haha. cavill does call her mama and saul papa so?? idk.

still, to have the answers... its incredible. there is no fucking god haha. just... kinda time travel, i guess.

rip gaetta. zarek not so much. that man, in my eyes, made an extreme fuck up when he had the quorum shot up.

i still have no idea whats the deal with kara thrace. clone? like they defnitely did do something to her in that lab on caprica. maybe it wasnt kara in that viper on earth? then why the dogtags? idk. but there should be no more model left. Daniel is supposedly left but that guy no longer even exists if i understood it.

wonder what im gonna watch after this though. shit. anyway, time for "Deadlock"

5 notes

·

View notes

Text

Athenian democracy was different from the much later American form, not only because it was the expression of a single city-state but because it was a direct, rather than a representative, democracy. To us, looking backwards, it may seem imprudent to invite on all major initiatives, but Solon was right to appreciate that no Athenian freeman could allow himself to be let out of anything.

The continual buzz of conversation, the orotund sounds of the orators, the shrill shouts from the symposia – this steady drumbeat of opinion, controversy, and conflict could everywhere be heard. The agora (marketplace) was not just a daily display of fish and farm goods; it was an everyday market of ideas, the place citizens used as if it were their daily newspaper, complete with salacious headlines, breaking news, columns, and editorials. For more formal occasions, there nested beside the Acropolis the hill of the Pnyx, where thousands of citizens voted in their Assembly. They faced the bēma (speaker's platform) and, behind the speaker, the ever-changing backdrop of Athens itself. Though there were wooden benches, set into the steps of the hill, participants were too taken up by the proceedings to bother to sit down. The word the Athenians used for their Assembly was Ekklēsia, the same word used in the New Testament for Church (and it is the greatest philological irony in all of Western history that this word, which connoted equal participation in all deliberations by all members, came to designate a kind of self-perpetuating, self-protective Spartan gerousia – which would have seemed patent nonsense to Greek-speaking Christians of New Testament times, who believed themselves to be equal members of their Assembly).

Ten thousand men could be accommodated comfortably, fifteen thousand umcomfortably, on the Pnyx, where the Assembly convened forty times a year, each meeting lasting but a couple of hours. Six thousand citizens constituted the quorum necessary for ratification of many of the decrees. Imagine many of your fellow citizens – at least twenty percent of them, sometimes as many as fifty percent – squeezing forty times a year into an open-air stadium, listening to debates, noisily electing magistrates (including the ten stratēgoi chosen annually to conduct the city's wars), voting on decrees by a show of hands, impaneling jurors. On each of the popular courts, called dicastēria, 201 to 501 citizens served as both judges and jurors, the number of citizens depending on the seriousness of the matter under consideration. Once a year, the citizens voted on whether or not they should hold an ostracism. If the majority voted yes, each member of the Assembly then wrote on an ostrakon (potsherd) the name of the person he felt the city could do best without. Whoever turned up on the most ostraka was banished for ten years, after which time he could return, his property still intact. In this way, would-be tyrants – and not a few other nuisances – were eliminated. (If at first the primitiveness of this procedure shocks you, consider for a moment what benefits it could bring to your city.)

Athens, the world's first attempt at democracy – a Greek word meaning “rule by the people” – still stands out as the most wildly participatory government in history. Never again would such a broadly based, decidedly nonrepresentative model be attempted. And, given the compactness of Athens, the theatrical extroversion of its citizenry, and the consequent excitement of their meetings, it worked.

— Sailing the Wine-Dark Sea: Why the Greeks Matter (Thomas Cahill)

#book quotes#thomas cahill#sailing the wine-dark sea: why the greeks matter#history#classics#politics#law#ancient greece#athens#acropolis#pnyx#ecclesia#ostracism#solon

3 notes

·

View notes

Text

Greta Garbo - The Face of the Century

Greta Garbo (born Greta Lovisa Gustafsson in Stockholm, Sweden on 18 September 1905) was a Swedish-born actress who built her global appeal on a carefully maintained mystique during her short career. Called "The Face of the Century," she is regarded as one of the Hollywood's greatest beauties.

Garbo was born into a poor family and dropped out of school at 13 to take care of her father. His death deeply affected her and promised to make a life for herself that was void of financial hardship.

Following her father's death, Garbo worked as a salesperson at PUB department store. After modeling for the store's catalogues, she earned a more lucrative job as a fashion model, which led to a role in her first film in 1922.

She then earned a scholarship at the Royal Dramatic Training Academy, where she met Finnish director Mauritz Stiller, who became her mentor. Louis B. Mayer of Metro-Goldwyn-Mayer wanted Stiller in Hollywood. The director agreed to a contract with one condition: Garbo. Reluctantly, Mayer inked her a deal, too.

She made her first MGM film in 1926, and by 1928, had become MGM's highest box-office star with A Woman of Affairs. She followed it up with several more hits, including Camille (1936). Her career slowed down in the 1940s and retired at 35.

After retiring, Garbo declined all opportunities to appear onscreen, shunned publicity, and led a private life. She died, aged 84, in New York, as a result of pneumonia and renal failure.

Legacy:

Nominated three times for the Academy Award for Best Actress for her performances in Romance (1930), Camille (1936), and Two-Faced Woman (1941)

Presented an Academy Honorary Award in 1955

Received the New York Film Critics Circle Award for Best Actress twice: Anna Karenina (1935) and Camille (1936)

Won the National Board of Review Best Acting Award three times: Camille (1936), Ninotchka (1939), and Two-Faced Woman (1941)

Was the highest-paid star at MGM for most of her career

Won the Photoplay Awards - Best Performances of the Month for a record eight times: May and December 1926, February and November 1927, March and September 1928, and January and March 1929

Won Best Actress for Anna Christie (1930) and Queen Christina (1933) from Picturegoer Awards

Listed by the Motion Picture Herald as one of America’s top-10 box office draws from 1930 to 1932

Was one of the subjects of French composer Charles Koechlin's "Seven Stars Symphony" (1933)

Granted the Swedish royal medal Litteris et Artibus in 1937

Is one of the celebrities whose picture Anne Frank placed on the wall of her bedroom in the “Secret Annex” in 1942

Voted "Best Actress of the Half Century" in a 1950 Daily Variety opinion poll

Named “the most beautiful woman that ever lived” in 1954 by Guinness World Records

Given the George Eastman Award by George Eastman House in 1957

Has appeared on many postage stamps from, among others, Swedish Posten in 1980 and 2005, Correos de Cuba in 1995, Deutsche Post in 2001, US Postal Service in 2005, Poșta Română issue in 2005, and Australia Post in 2008,

Made a Commander of the Swedish Order of the Polar Star by order of King Carl XVI Gustaf in 1983

Depicted in the film Garbo Talks (1984)

Awarded the Illis Quorum by the government of Sweden in 1985

Had a star was named after her in 1985

Has appeared on commemorative coins from Germany in 1994, France in 1995, and Sweden in 2005

Ranked #38 in Empire's Top 100 Movie Stars in 1997; #25 in Entertainment Weekly’s 100 Greatest Movie Stars of All Time in 1998; #8 in Premiere's 50 Greatest Movie Stars of All Time in 2005 and #25 in 100 Greatest Performances of All Time in 2006 for Ninotchka (1939)

Has had a museum, the Garbosällskapet, dedicated to her in Högsby since 1998

Named the 5th-greatest female star of classic Hollywood cinema in 1999 by the American Film Institute

Inducted in the Online Film and Television Association Hall of Fame in 2002

Chosen in Variety magazine's "100 Icons of the Century" in 2005

Honored by Stockholm City Council in 1992 with a square, Greta Garbos Torg, and a bust of her likeness in 2009

Honored by Norwegian Air Shuttle as its "Tail-fin Hero" on its Boeing 787 Dreamliner in 2016

Featured on 100-krona banknote by Sveriges Riksbank since 2018

Featured in an exhibit at the Postmuseum in 2005, the Belmacz in 2013, the Fotografiska in 2016, the Staley-Wise Gallery in 2016, and Galerie56 in 2023

Honored as Turner Classic Movies Star of the Month for April 2019

Honored with a statue of her, "Statue of Integrity," in 2016, located in the forest in Härjedalen

Has a star on the Hollywood Walk of Fame at 7021 Hollywood Blvd for motion picture

#Greta Garbo#Garbo#The Face of the Century#La Divina#The Swedish Sphinx#Silent Films#Silent Era#Silent Film Stars#Golden Age of Hollywood#Film Classics#Old Hollywood#Vintage Hollywood#Hollywood#Movie Star#Hollywood Walk of Fame#Walk of Fame#Movie Legends#movie stars#1900s#28 Hollywood Legends Born in the 1900s

5 notes

·

View notes

Text

Mistral-Small for More Than One Reason

Wow, this is one inaccurate model. I am running the 22B version, and it performs terribly on my now standard GPFS question. With prompting and help it cannot get to the right answer that mmfsd is the key process and handles quorum. It makes up all manner of silly processes and fails to correct even when given hints.

0 notes

Text

Senior Software Engineer (Angular) (Hybrid Work Schedule)

Senior Software Engineer (Angular) Location: Pune, India Model of Work: Hybrid About Quorum Software Quorum… Software connects people and information across the energy value chain. Twenty years ago, we built the first software for gas… Apply Now

0 notes

Text

Senior Software Engineer (Angular) (Hybrid Work Schedule)

Senior Software Engineer (Angular) Location: Pune, India Model of Work: Hybrid About Quorum Software Quorum… Software connects people and information across the energy value chain. Twenty years ago, we built the first software for gas… Apply Now

0 notes

Text

Eased takeover rules attract funds to Brazilian listed companies

Changes in quorum requirements make it easier to take companies private

The recent delisting of insurance broker Alper by U.S. private equity group Warburg Pincus marked a significant milestone for this industry, drawing close attention from market players. This was the first transaction involving the acquisition of control of a publicly-traded company on Brazil’s B3 exchange by a private equity fund in nearly 15 years, leading to its delisting. The last such buyout took place in 2010, when Apax acquired control of IT company Tivit and took it private.

Henrique Muramoto, who oversees Warburg Pincus’s operations in Brazil, noted that this was the firm’s first such transaction in the country. He recalled that this model is commonly used by private equity funds in the U.S. “We are looking at one or two opportunities with similar characteristics,” he said. Mr. Muramoto shared that since finalizing the desilting of Alper, banks and funds had approached him to inquire about the process, leading him to project that more transactions of this kind are likely to occur.

The transaction began to take shape in 2023. After meeting with four key shareholders of the insurance company, Warburg Pincus launched a voluntary takeover bid to acquire up to 100% of the company’s shares, with a premium of 40% over the market value. In this public acquisition offer (OPA), the fund achieved the minimum necessary quorum and purchased 72% of the company’s shares. Later, when applying for a second OPA for the cancellation of registration and delisting, the fund requested that the Securities and Exchange Commission of Brazil (CVM) consider the quorum from the first meeting—meaning they would not need two-thirds of shareholders to proceed with the new offer. Their strategy referenced a precedent involving Eletropaulo, where the energy company successfully obtained this flexibility. In this transaction, the fund was advised by Trindade Advogados and BTG Pactual.

The current OPA rules mandate a new quorum of at least two-thirds for the second OPA (of delisting). The challenge is that, at this stage, the liquidity of the shares is significantly reduced due to the previous offer, leaving the quorum in the hands of shareholders who either did not sell their shares in the first OPA or did not attend the meeting. This situation complicates the take-private process, leading funds to fear that the process might “die on the vine,” with the private equity fund becoming “trapped” in a listed company without liquidity.

Continue reading.

0 notes

Text

Decentralized Autonomous organizations (DAOs) represent a pioneering new form of internet-native organization enabled by Blockchain Technology. DAOs allow coordinated group activity and decision-making without traditional centralized leadership. This distributed structure provides many advantages but also poses unique Security challenges. Several high-profile exploits of DAO Vulnerabilities highlight the crucial need for tailored Security practices designed for these decentralized models. Notable DAO Security Incidents: Lessons Learned One of the most infamous early DAO hacks involved The DAO built on the Ethereum blockchain. The DAO was conceived as a decentralized venture Capital fund where participants could vote to fund project proposals. Flawed code in The DAO smart contract enabled a hacker to siphon off Cryptocurrency worth around $50 million. This led to Ethereum controversially implementing a hard fork to reverse the hack and return the stolen funds. The DAO hack demonstrated how Vulnerabilities and loopholes in the core smart contract code underpinning a DAO can be exploited to devastating effect. Another concerning vulnerability in Decentralized Finance was found in the bZx protocol. bZx facilitates decentralized margin Trading and lending. Attackers were able to exploit a flaw in how bZx handled margin trades to extract over $800,000 worth of Cryptocurrency. This bZx hack revealed the perils of composability, where integrating with other protocols can introduce unanticipated Security risks as complex systems interact in unforeseen ways. More recently, in 2022, the Mango DAO on the Solana blockchain suffered an attack that led to around $110 million in losses. Bad actors manipulated governance processes to influence votes and drain funds from the DAO’s treasury. This Mango attack showed that by tamper-proof governance mechanisms, DAOs could have their crowdsourced decisions turned against them. Key Security Considerations for Protecting DAOs 1. Smart Contract Auditing Correctly auditing smart contract code powering DAOs is essential for finding flaws before deployment. Formal verification, professional auditing firms specializing in blockchain code review, and bug bounty programs engaging hackers are vital strategies to test for Vulnerabilities thoroughly. 2. Access Control and Privilege Limitation Strictly limiting access controls and privileges can prevent the extraction of funds by malicious actors. Authentication protocols requiring multiple approving signatories, like multi-signature wallets, improve Protection. 3. Robust Governance Guardrails Preventing manipulation of governance processes is key for Secure DAOs. Thoughtful admin roles, quorum thresholds, time-locks on proposals, monitoring for Sybil attacks, well-designed incentives, formal verification of governance code, decentralized consensus, and transparent on-chain records can harden governance integrity. Meticulous governance architecture that proactively addresses manipulation and centralization Risks is crucial for DAOs to achieve democratic ideals securely. 4. Formalized Incident Response Plans To minimize damage from attacks, DAOs should formalize detailed response plans for Security incidents, including dispute resolution, forensic analysis, legal recourse, stakeholder coordination, restoring funds, transparent communication, learning to improve defenses, and updating systems. Well-prepared emergency procedures allow for effective incident response, reducing chaos and fallout. 5. Transparency and Investigability By incorporating comprehensive on-chain activity logging and transparency into DAO design, immutable blockchain records can provide invaluable forensic data that can be used to investigate Security incidents, uncover exploit details, identify remedies, understand attacker motives, and trace culpability. Built-in blockchain transparency equips DAOs with essential tools for Security monitoring, effective incident response, and resilience.

In Summary, To build Security into the core architecture of DAOs, creators should utilize proven techniques like distributing and the principle of least privilege. Segmenting protocol functions into isolated modules limits the blast radius if any component gets compromised. Engineering upgradability and rapid patching enable responding quickly to emerging Threats. Standing incident response teams can take swift action as issues arise. Future and Safety of DAOs Expert guidance is invaluable for anticipating Risks. Consulting cryptography and Blockchain Security specialists from the start strengthens the design. Conducting participatory threat modeling and risk simulations prepares for attacks. Ongoing vigilance through anomaly monitoring is crucial even after audits since new exploits constantly emerge. Uniting the knowledge of Security experts, governance designers, blockchain developers, and community stewards offers the most resilient path toward Secure and distributed organizational models. In addition to these DAO-specific strategies, foundational Secure Software best practices from web development also apply. Carefully constructed access controls, the principle of least privilege, and Secure design patterns avoid many Risks. Reusable libraries of proven, safe smart contract modules can accelerate development. Conclusion Despite justifiable Security concerns in these early days, DAO pioneers remain undeterred by short-term growing pains, keeping their eyes on the horizon filled with immense possibilities. The steady progress of cryptographic innovations, formal verification techniques, and time-tested Secure development frameworks promise to enable DAOs to thrive securely over the long term. Prudent cross-disciplinary collaboration, uniting blockchain builders, Security experts, governance designers, and community leaders, offers the most effective path forward. By leveraging their diverse expertise collaboratively, DAO developers can craft distributed and participatory organizations that balance openness with Protection and decentralization with accountability. There will be challenges along the way, but the potential societal benefits of DAOs merit perseverance. With patient refinement, this groundbreaking organizational paradigm can reach its full disruptive potential across industries, unlocking new modes of human coordination while keeping participant Assets safe. The future remains bright for decentralized models that align incentives, foster collaboration, and give people a direct voice.

0 notes

Text

Enterprise Blockchain Solutions Developemnt

Enterprise blockchain solutions development involves creating and implementing blockchain-based systems to address specific business needs within an organization or across multiple organizations in a network. Here are the key steps involved in developing enterprise blockchain solutions:

Identify Use Case: The first step is to identify a use case where blockchain technology can bring value to the organization. This could include areas such as supply chain management, decentralized identity, financial transactions, smart contracts, or data sharing.

Define Requirements: Once the use case is identified, it's important to define the specific requirements of the blockchain solution. This includes determining the desired functionality, performance metrics, security measures, and integration points with existing systems.

Choose the Right Blockchain Platform: There are several blockchain platforms available, such as Ethereum, Hyperledger Fabric, Corda, and Quorum. Selecting the appropriate platform depends on factors like scalability, privacy requirements, consensus mechanism, and development tools.

Design the Architecture: Design the blockchain architecture based on the selected platform. This involves defining the network structure, consensus mechanism, data model, smart contract design, and integration points with external systems.

Develop Smart Contracts: Smart contracts are self-executing contracts with predefined rules encoded on the blockchain. Develop and test the smart contracts that automate and enforce the desired business logic and rules.

Build the Network: Set up the blockchain network based on the chosen platform. This includes deploying the necessary nodes, establishing network connectivity, configuring security measures, and defining access controls.

Integrate with Existing Systems: Integrate the blockchain solution with existing enterprise systems to ensure seamless data exchange and interoperability. This may involve connecting with APIs, legacy systems, databases, or other third-party applications.

Implement Consensus Mechanism: Configure and deploy the consensus mechanism that governs how transactions are validated and added to the blockchain. The choice of consensus algorithm depends on factors such as network scalability, security, and trust requirements.

Test and Deploy: Thoroughly test the developed solution to ensure its functionality, security, and performance. Conduct unit tests, integration tests, and end-to-end tests to identify and fix any issues. Once the solution is deemed ready, deploy it to the production environment.

Monitor and Maintain: Continuously monitor the blockchain network for performance, security, and reliability. Regularly update and maintain the solution to address any bugs, security vulnerabilities, or evolving business requirements.

It's important to note that developing enterprise blockchain solutions requires expertise in blockchain technology, smart contract development, security, and integration with existing systems. Organizations often work with experienced blockchain development teams or engage with blockchain consulting firms to ensure successful implementation.

0 notes

Text

The Stellar Consensus Protocol: A Game-Changer in Blockchain Technology

Introduction to the Stellar Consensus Protocol (SCP)

The Stellar Consensus Protocol (SCP) is a decentralized consensus algorithm developed for the Stellar network. It is designed to facilitate consensus among nodes in a distributed network without relying on a central authority or a proof-of-work mechanism like Bitcoin's mining.

SCP was created by Jed McCaleb, the founder of Stellar, and his team, with the goal of enabling secure and efficient transaction processing and consensus on the Stellar network. It addresses some of the limitations and scalability issues of traditional blockchain consensus algorithms like proof-of-work and proof-of-stake.

At its core, SCP is a federated Byzantine agreement (FBA) algorithm. It achieves consensus by having nodes in the network communicate with each other and exchange messages to reach an agreement on the validity and ordering of transactions. This consensus process is performed in rounds, and each round consists of multiple phases.

The key principles of the Stellar Consensus Protocol are as follows:

Safety: SCP ensures that all honest nodes agree on the validity of transactions and the order in which they should be processed. It prevents forks and double-spending attacks by guaranteeing that all honest nodes eventually agree on a single state of the network.

Liveness: SCP guarantees progress in the network by allowing transactions to be processed even if some nodes are faulty or offline. As long as a quorum of nodes is functioning correctly, the network can continue to make progress.

Decentralization: SCP eliminates the need for a central authority or leader by employing a decentralized approach. Instead, the consensus process relies on a set of trusted nodes called validators, which are selected based on the Stellar network's distributed agreement protocol.

Flexibility: SCP allows for flexible trust relationships between nodes, enabling different trust models to coexist within the same network. Nodes can choose which other nodes they trust and define their own quorum slices, which are subsets of the network that they consider trustworthy.

SCP has been designed to be highly scalable, as it allows for parallel processing of transactions and does not require every node in the network to process and validate every transaction. This scalability, combined with its security and decentralization properties, makes SCP well-suited for Stellar's goal of enabling fast and low-cost cross-border transactions.

Understanding the basics of blockchain technology

Blockchain technology is a decentralized and distributed ledger system that enables secure and transparent transactions and data storage. It was originally developed as the underlying technology for cryptocurrencies like Bitcoin but has since found applications in various industries beyond finance.

Here are the key concepts and components of blockchain technology:

Distributed Ledger: A blockchain is a digital ledger that is distributed across multiple computers or nodes in a network. Each node has a copy of the entire blockchain, and all nodes agree on the validity of transactions through a consensus mechanism.

Blocks: Transactions are grouped together in blocks, which are linked to each other in a chronological order, forming a chain of blocks. Each block typically contains a reference to the previous block (except for the first block, known as the genesis block), creating the blockchain.

Cryptography: Blockchain relies on cryptographic algorithms to secure the data stored in the ledger. Transactions are verified, authenticated, and encrypted using cryptographic techniques like hashing and digital signatures, ensuring integrity and preventing unauthorized modifications.

Consensus Mechanism: To maintain the accuracy and consistency of the blockchain across all nodes, a consensus mechanism is employed. It is a protocol that allows nodes to agree on the state of the blockchain. Popular consensus mechanisms include Proof of Work (PoW) and Proof of Stake (PoS).

Decentralization: Unlike traditional centralized systems, blockchain operates in a decentralized manner. Instead of relying on a central authority, control and decision-making are distributed among network participants. This decentralization enhances security, reduces the risk of single points of failure, and promotes trust among participants.

Immutability: Once a block is added to the blockchain, it becomes extremely difficult to alter or remove the recorded data. This immutability ensures the integrity of the blockchain and builds trust among participants.

Smart Contracts: Blockchain platforms like Ethereum introduced the concept of smart contracts. These are self-executing contracts with predefined rules and conditions written in code. Smart contracts automatically execute actions when the specified conditions are met, eliminating the need for intermediaries and enabling more complex transactions and applications on the blockchain.

Transparency and Privacy: While the contents of a blockchain are transparent and visible to all participants, the identity of participants can be pseudonymous or anonymous, depending on the blockchain's design. Some blockchains also offer privacy features that allow for encrypted or selective disclosure of data.

Use Cases: Blockchain technology has a wide range of applications beyond cryptocurrencies. It is being explored for supply chain management, voting systems, healthcare records, real estate transactions, identity verification, intellectual property, and more. Blockchain's transparency, security, and decentralization offer benefits such as increased efficiency, reduced fraud, and enhanced trust.

It's important to note that blockchain technology is still evolving, and there are different implementations and variations of blockchain systems with their own strengths and limitations. Understanding these basics will help you grasp the underlying principles and potential of this transformative technology.

The limitations of traditional blockchain consensus mechanisms

Traditional blockchain consensus mechanisms, such as Proof of Work (PoW) and Proof of Stake (PoS), have several limitations:

Scalability: One major limitation is scalability. In PoW-based blockchains like Bitcoin, every node in the network needs to validate and execute every transaction, which can lead to a scalability bottleneck. As the number of participants and transactions increases, the system becomes slower and less efficient.

Energy consumption: PoW consensus requires significant computational power and energy consumption. Miners compete to solve complex mathematical puzzles to validate transactions and add blocks to the blockchain. This energy-intensive process has raised concerns about environmental sustainability and the carbon footprint of blockchain technology.

Centralization risks: In PoW and PoS, there is a concentration of power among a limited number of participants. In PoW, miners with more computational resources have a higher chance of solving the puzzles and earning rewards. In PoS, participants with a larger stake in the system have more influence over block creation. This concentration of power can potentially lead to centralization, where a few entities control the network.

Security vulnerabilities: Traditional consensus mechanisms are susceptible to certain security vulnerabilities. For example, in PoW, a 51% attack can occur if an entity controls more than half of the network's computational power, enabling them to manipulate transactions and potentially double-spend coins. PoS is vulnerable to attacks where a malicious entity gains control of a majority of the cryptocurrency's total supply.

Long confirmation times: PoW-based blockchains often have longer confirmation times for transactions. In Bitcoin, for instance, it takes an average of 10 minutes for a block to be added to the blockchain. This delay can hinder real-time transaction processing, making it less suitable for certain use cases such as retail payments.

Governance challenges: Consensus mechanisms like PoS involve stakeholder voting or delegation processes to make decisions regarding protocol upgrades, governance rules, and network changes. However, effective governance can be challenging to achieve, as it requires coordination and consensus among a diverse set of participants with potentially conflicting interests.

Efforts are being made to address these limitations through the development of alternative consensus mechanisms, such as Proof of Authority (PoA), Delegated Proof of Stake (DPoS), and Practical Byzantine Fault Tolerance (PBFT), which aim to improve scalability, energy efficiency, security, and governance in blockchain systems.

Challenges and potential future developments of the Stellar Consensus Protocol

The Stellar Consensus Protocol (SCP) is a decentralized consensus algorithm designed to reach agreement on the order and validity of transactions in the Stellar network. While SCP has several advantages, it also faces challenges and has potential for future developments. Let's explore them:

Challenges of the Stellar Consensus Protocol:

Scalability: SCP faces challenges related to scalability as the network grows. The protocol requires each participant to maintain a complete copy of the network's state, which can become resource-intensive. As the number of nodes and transactions increase, scalability becomes a significant concern.

Network latency: SCP relies on the exchange of messages between nodes to reach consensus. Network latency and delays in message propagation can impact the protocol's performance. High network latency can slow down the consensus process and potentially introduce delays in transaction confirmation.

Trust assumptions: SCP assumes that a significant majority of participants are honest and will follow the protocol correctly. However, if a large portion of nodes behaves maliciously or fails to follow the rules, it can undermine the security and consensus guarantees of the protocol.

Initial quorum establishment: SCP requires an initial quorum slice, a set of nodes that vouch for each other's credibility. Establishing this initial trust network can be challenging, especially in situations where a large number of new nodes join the network simultaneously.

Potential Future Developments:

Sharding: Sharding is a technique that involves dividing the network into smaller partitions called shards. Each shard operates independently, processing its transactions and reaching consensus. Introducing sharding to SCP could help improve scalability by distributing the computational load across multiple shards.

Layer 2 solutions: Layer 2 solutions, such as payment channels or sidechains, can be integrated with SCP to enable off-chain transactions and reduce the load on the main consensus protocol. By moving a significant portion of transactions off the main chain, SCP's scalability can be enhanced.

Consensus optimizations: Researchers and developers can continue to explore optimizations to improve the efficiency and performance of SCP. This could involve advancements in cryptographic techniques, message propagation protocols, or better ways to handle Byzantine faults.

Privacy enhancements: Stellar currently provides basic privacy features, but future developments could focus on enhancing privacy further. Techniques like zero-knowledge proofs or secure multi-party computation could be explored to enable confidential transactions without compromising the protocol's security and transparency.

Governance and participation improvements: SCP relies on node participation and cooperation for consensus. Future developments might involve mechanisms to incentivize participation, discourage malicious behavior, and enhance the governance processes within the Stellar network.

It's important to note that the Stellar Development Foundation (SDF) and the broader Stellar community actively work on improving the protocol, addressing challenges, and exploring future developments.

Case studies: Successful projects built on Stellar using SCP

While I don't have access to real-time information, I can provide you with some examples of successful projects that were built on Stellar using the Stellar Consensus Protocol (SCP). Please note that these examples are based on information available up until September 2021, and there may have been further developments since then. Here are a few noteworthy projects:

IBM World Wire: IBM partnered with Stellar to develop a cross-border payment solution called IBM World Wire. Built on Stellar's network, it aims to provide faster, more transparent, and cost-effective international payments. IBM World Wire leverages the Stellar network's capabilities to settle transactions in near real-time using multiple currencies.

Tempo: Tempo is a France-based payment network that uses Stellar's technology to facilitate fast and low-cost cross-border money transfers. It enables individuals to send and receive money globally, leveraging Stellar's network to settle transactions quickly and securely.

SureRemit: SureRemit is a blockchain-based platform that enables users to send non-cash remittances to their loved ones in various regions. By utilizing Stellar's network, SureRemit aims to make international remittances more affordable, efficient, and secure.

DSTOQ: DSTOQ is a global stock exchange platform that aims to enable users to invest in real-world assets, such as stocks, bonds, and ETFs, using cryptocurrency. By integrating with the Stellar network and leveraging SCP, DSTOQ seeks to provide users with a seamless and decentralized investment experience.

Cowrie Integrated Systems: Cowrie Integrated Systems is a Nigerian fintech company that built a mobile payment platform called Cowrie Integrated Systems Mobile Transfer (CISMAT). It allows users to send and receive money using their mobile devices. Cowrie Integrated Systems leveraged Stellar's technology to develop a robust and efficient payment infrastructure.

These are just a few examples of successful projects that have been built on Stellar using the Stellar Consensus Protocol. Stellar's scalability, low transaction fees, and focus on cross-border payments make it an attractive choice for various financial applications and blockchain-based projects. I encourage you to research these projects further to get the latest updates on their progress and achievements.

Stellar vs. other blockchain platforms: How SCP sets it apart

Stellar is a blockchain platform that distinguishes itself from other platforms through its unique consensus mechanism called the Stellar Consensus Protocol (SCP). SCP is designed to offer fast, secure, and decentralized transaction processing, making Stellar well-suited for applications such as cross-border payments, token issuance, and asset transfers.

Here are some key features of SCP and how they set Stellar apart from other blockchain platforms:

Scalability: SCP enables high transaction throughput and scalability. Unlike traditional blockchain platforms that use proof-of-work or proof-of-stake mechanisms, SCP employs a federated Byzantine agreement model. This allows Stellar to process a large number of transactions per second, making it more efficient and scalable for real-world applications.

Speed: Stellar's consensus protocol facilitates quick transaction confirmations. SCP achieves consensus across a network of trusted validators, resulting in near-instant settlement times. Stellar transactions typically settle in 2 to 5 seconds, enabling fast and efficient value transfers.

Low fees: Stellar's design ensures low transaction fees. The platform aims to make financial services accessible to everyone, including individuals and businesses in underserved areas. Stellar's low fees make it cost-effective for microtransactions and enable the movement of small amounts of value across borders.

Focus on interoperability: Stellar emphasizes interoperability between different financial systems. It provides built-in support for token issuance and facilitates the creation of custom assets. Stellar's decentralized exchange allows for the seamless conversion and transfer of assets, including fiat currencies, cryptocurrencies, and tokens.

Integration with the traditional financial system: Stellar has a strong focus on bridging the gap between traditional financial institutions and blockchain technology. It provides an anchor system, where trusted entities serve as bridges between the Stellar network and existing financial systems. Anchors facilitate the movement of funds between the Stellar network and various currencies, enabling cross-border transactions.

Stellar Development Foundation (SDF): The Stellar network is backed by the Stellar Development Foundation, a non-profit organization that supports the development and growth of the Stellar ecosystem. The SDF works to foster collaboration, provide technical assistance, and promote the adoption of Stellar technology.

These features collectively make Stellar an attractive choice for businesses and developers looking to leverage blockchain technology for efficient, fast, and low-cost transactions. By combining scalability, speed, low fees, interoperability, and its focus on integrating with traditional financial systems, Stellar sets itself apart from other blockchain platforms in the market.

Regulatory Considerations and Compliance with SCP

When it comes to regulatory considerations and compliance with SCP (Supply Chain Planning), there are several important factors to keep in mind. SCP involves the process of efficiently planning, organizing, and controlling the flow of goods, services, and information from the point of origin to the point of consumption. Compliance with regulatory requirements is crucial to ensure legal and ethical practices throughout the supply chain. Here are some key considerations:

Legal and Regulatory Compliance: Adhering to applicable laws and regulations is essential for SCP. This includes compliance with local, national, and international regulations related to trade, customs, transportation, labor, environmental standards, data protection, and product safety. Familiarize yourself with the relevant regulations and ensure that your supply chain operations are aligned with them.

Supplier Due Diligence: Conduct thorough due diligence on your suppliers to ensure they comply with applicable laws and regulations. Verify their certifications, licenses, and adherence to industry standards. Evaluate their ethical practices, labor conditions, and environmental impact. Establish clear guidelines and requirements for suppliers to meet your compliance standards.

Documentation and Record Keeping: Maintain accurate and up-to-date documentation throughout the supply chain process. This includes contracts, invoices, shipping documents, customs declarations, and compliance certificates. Proper record keeping is crucial for audits, inspections, and demonstrating compliance with regulatory requirements.

Traceability and Transparency: Implement systems to track and trace the movement of goods and materials throughout the supply chain. This enables you to identify the origin of products, ensure compliance with regulations such as product safety standards, and respond to any recalls or quality issues promptly. Transparency in supply chain operations also helps build trust with customers and stakeholders.

Data Protection and Privacy: With the increasing digitalization of supply chains, protecting sensitive data and ensuring privacy is vital. Comply with data protection regulations, such as the General Data Protection Regulation (GDPR) or other applicable laws, when collecting, storing, and transmitting personal or sensitive information. Implement appropriate security measures to safeguard data from unauthorized access or breaches.

Environmental and Sustainability Considerations: Consider the environmental impact of your supply chain operations and work towards sustainable practices. Comply with environmental regulations, promote responsible sourcing, reduce waste, and minimize carbon footprint. Engage with suppliers who prioritize sustainability and ethical practices.

Continuous Monitoring and Improvement: Regularly monitor your supply chain operations to ensure ongoing compliance with regulatory requirements. Stay updated on changes to relevant laws and regulations. Implement internal audits, inspections, and compliance checks to identify areas for improvement and take corrective actions as necessary.

Remember that compliance with SCP regulations is an ongoing effort that requires collaboration with suppliers, stakeholders, and relevant regulatory bodies. By prioritizing regulatory considerations, you can mitigate risks, enhance operational efficiency, and build a sustainable and compliant supply chain.

Conclusion: The transformative potential of the Stellar Consensus Protocol in blockchain technology

The Stellar Consensus Protocol (SCP) indeed possesses significant transformative potential in the field of blockchain technology. Developed by the Stellar Development Foundation, SCP is a consensus algorithm designed to facilitate decentralized and secure transaction processing within the Stellar network. Its unique features and benefits make it a promising solution for various use cases, including financial transactions, cross-border payments, asset tokenization, and decentralized applications.

One of the key advantages of SCP is its ability to achieve decentralized consensus without relying on a central authority or proof-of-work mining. Instead, SCP utilizes a federated Byzantine agreement model, which enables multiple participants, known as validators, to collectively validate and agree upon the state of the network. This consensus mechanism enhances security, scalability, and efficiency, as it allows for quick confirmation of transactions and eliminates the energy-intensive mining process associated with other blockchain systems.

Another transformative aspect of SCP is its ability to facilitate cross-border transactions and promote financial inclusion. Stellar, the blockchain platform that implements SCP, aims to connect financial institutions, payment providers, and individuals worldwide, enabling seamless, low-cost, and near-instantaneous money transfers. By leveraging SCP, Stellar achieves fast settlement times, reduces transaction costs, and enables micropayments, which can significantly benefit individuals and businesses in underserved regions.

Furthermore, SCP enables the tokenization of various assets, including traditional currencies, commodities, securities, and other digital assets. This feature opens up new opportunities for creating and managing decentralized financial instruments, facilitating peer-to-peer trading, and promoting liquidity in markets that were previously illiquid. SCP's robust consensus protocol ensures the integrity and security of these tokenized assets, enhancing trust and reducing counterparty risk.

Additionally, SCP's design supports the development of decentralized applications (dApps) on the Stellar network. By providing a reliable and efficient consensus mechanism, SCP enables developers to create smart contracts, decentralized exchanges, and other innovative applications that can leverage the advantages of blockchain technology. This promotes innovation and fosters an ecosystem of decentralized services and solutions.

In conclusion, the transformative potential of the Stellar Consensus Protocol in blockchain technology is significant. Its decentralized consensus mechanism, efficient transaction processing, cross-border payment capabilities, asset tokenization features, and support for dApp development make it a promising solution for various industries. As the technology continues to evolve and mature, SCP has the potential to revolutionize financial systems, improve access to financial services, and drive innovation in the broader blockchain ecosystem.

0 notes

Text

The 90% Problem

The problem with LLMs among the many is the 90% problem. LLMs have a problem with generating convincing responses that are often wrong. What is worse–they can often get the answer 90% right, but that 10% they get wrong takes things from the right direction to a useless wrong direction.

Let me give an example: I was testing a couple Ollama models with some questions about IBM Spectrum Scale. I even had web search enabled. I asked what process handles quorum management. The AI provided a sort of correct response, but it got the process wrong. It turned the role "quorum manager" which is a real role into the process qmgr and said that was the process. This is wrong! It's mmfsd that handles quorum management. I knew this so it wasn't an issue and when I pressed it returned the right response. But to a person who is learning this is devastating!

This is a classic example of the 90% problem. It got a lot of the answer right, but it was totally wrong about those critical 10% details.

To be clear if you made the same search in current ChatGPT it gets it right, but that is also part of the point. Your mileage on any given topic and how often the 90% problem rears its head is heavily model dependent.

You then look at OpenAI charging $200/month for the accuracy levels and reliability of current LLMs and it is simply not sustainable. When the response is convincing, but can be 10% wrong in the details it makes the entire operation worse than futile.

Just some thoughts as I have been playing with LLMs trying to see what use they are.

0 notes