#QuickBooks bookkeeper

Explore tagged Tumblr posts

Text

It's both a blessing and a curse when the hyperfocus lands on work related things.

Blessing: I got so much done to prepare the office for tax season. And I started working on my QB Pro certification. And started looking into possibly taking the CPA exam for certification.

Curse: I have eaten one meal and barely drank water. I need to pee and I'm sleepy but I need to finish this module before I can get up. I also haven't responded to any text messages.

#lost onpurpose#hyperfocus#bookkeeping#tax prep#tax professional#accountant#cpa#quickbooks#quickbooks pro

2 notes

·

View notes

Photo

Bookkeeping & Data Entry Services in Ukraine

Bookkeeping services by Units Consulting Ltd., an accounting firm in Kyiv, includes complete accounting facility for recording and accounting in compliance with the local requirements. It is made from records provided by the client to produce a fully compliant set of financial books and records.

Our bookkeeping services are suitable for business of all industries and small and medium companies for onshore bookkeeping and offshore outsourced bookkeeping. We offer daily, weekly, and monthly services based on requirements / needs by our clients.

Bookkeeping outsourcing and data entry services includes: We are using team of experts, to provide bookkeeping service as Chartered Accountant Firm in Ukraine with existence in Kyiv and also the latest international rules of accounting in financial reporting. We used QuickBooks and Xero web based bookkeeping software for providing onshore bookkeeping services and offshore outsourced bookkeeping services.

There are many benefits to utilizing Outsourced Accounting Services in Ukraine such as cost-effective reliable, high-quality and technical assistance. To improve your accounting services and expand your business, consider Ukraine and benefit from the top accounting experts.

We deploy the team of bookkeepers in Ukraine to the client premises or client is asked to deliver data to our local office for bookkeeping & data entry services.

To learn more about our bookkeeping outsourcing services in Ukraine (Kyiv), please contact us.

#bookkeeping#outsourcing#services#ukraine#data entry#chartered accountant#certified public accountant#bookkeeper#kyiv#kiev#outsource#outsourced cfo services#quickbooks#xero accounting#xero

1 note

·

View note

Text

4 Major Reasons That Makes Monthly Bookkeeping Services Important For Small Business Owners

Managing the financial records of a small business like tracking daily transactions to monitoring expenses and revenue is no easy job and can become challenging if not managed properly. Here comes the role of monthly bookkeeping services into play to ensure financial stability and growth for a small business. Read more:- https://keepacount.com/4-major-reasons-that-makes-monthly-bookkeeping-services-important-for-small-business-owners/

#bookkeeping services#document signing services#quickbooks desktop enterprise#best online bookkeeping services#online bookkeeping

0 notes

Text

O&K Accounting

1420 5th Ave #2200, Seattle WA 98101

Phone # 206-440-5846

O&K Accounting Inc. provides expert bookkeeping, tax preparation, payroll management, and financial consulting services for small to mid-sized businesses. Our dedicated team ensures accuracy, compliance, and financial growth with a client-focused approach. Serving businesses across Washington State, we specialize in tailored accounting solutions to meet diverse needs.

http://www.oandkacct.com

#Accounting Services#Bookkeeping#Tax Preparation#Payroll Management#Financial Consulting#Small Business Accounting#Business Tax Services#Enrolled Agent#QuickBooks ProAdvisor#cpa

1 note

·

View note

Text

Expert Accounting and Bookkeeping Services Since 2004

Professional Accounting Services for Over 20 Years

Outsourced Bookkeeping is your premium business partner for accounting and bookkeeping services. We render services to individuals, small and large companies, and CPAs across the US. Hospitality and real estate sectors are our specialization.

For real estate, we manage property accounts, leases, and customer accounts. In the hospitality industry, we assist restaurant owners with accounts payable, cash flow, inventory management, and customer accounts.

Our team is equipped with advanced professional knowledge and tools to ensure compliance with state and federal regulations. We provide top-notch accounting and bookkeeping solutions tailored to your specific needs.

Accounting & Bookkeeping Services We Offer

Tracking Business Transactions

Preparation of Financial Statements

Performing Bank Reconciliations

Accounts Payable & Receivable Service

Customized Business Reporting & Periodic Reviews

Preparation of Cash Flow Management

Managing Cash and Subsidiary Ledgers

Tax Filing Process

#bookkeeping services#bookkeeping services near me#outsourcing accounting and bookkeeping services#bookkeeping services for small business#online bookkeeping services#accounting and bookkeeping services#online accounting and bookkeeping services#online business bookkeeping services#bookkeeping and tax services#quickbooks bookkeeping services#professional bookkeeping services#virtual bookkeeping services

0 notes

Text

#Hire Bookkeeper#bookkeeping for small business#Bookkeeping Services#Accounting Services#Small Business#Quickbook

0 notes

Text

Expert Accounting and Bookkeeping Services Since 2004

Professional Accounting Services for Over 20 Years

Outsourced Bookkeeping is your premium business partner for accounting and bookkeeping services. We render services to individuals, small and large companies, and CPAs across the US. Hospitality and real estate sectors are our specialization.

For real estate, we manage property accounts, leases, and customer accounts. In the hospitality industry, we assist restaurant owners with accounts payable, cash flow, inventory management, and customer accounts.

Our team is equipped with advanced professional knowledge and tools to ensure compliance with state and federal regulations. We provide top-notch accounting and bookkeeping solutions tailored to your specific needs.

Accounting & Bookkeeping Services We Offer

Tracking Business Transactions

Preparation of Financial Statements

Performing Bank Reconciliations

Accounts Payable & Receivable Service

Customized Business Reporting & Periodic Reviews

Preparation of Cash Flow Management

Managing Cash and Subsidiary Ledgers

Tax Filing Process

To know more: https://www.outsourcedbookeeping.com/contact-us/

#bookkeeping services#bookkeeping services near me#outsourcing accounting and bookkeeping services#bookkeeping services for small business#online bookkeeping services#accounting and bookkeeping services#online accounting and bookkeeping services#online business bookkeeping services#bookkeeping and tax services#quickbooks bookkeeping services#professional bookkeeping services#virtual bookkeeping services

0 notes

Text

Become a QuickBooks Virtual Bookkeeper with Universal Accounting School

Launch your career as a QuickBooks virtual bookkeeper with expert training from Universal Accounting School. Our online program equips you with the skills to manage finances remotely using QuickBooks, the leading accounting software. Learn how to handle invoicing, track expenses, generate reports, and more—all from the comfort of your home. Universal Accounting School’s flexible, expert-led courses ensure you gain the knowledge needed to work as a professional QuickBooks bookkeeper. Earn certification that boosts your credibility and enhances your job opportunities. Whether you're starting a new career or growing your business, Universal Accounting School offers the tools for your success. Enroll today!

0 notes

Text

Taxulo

As an established CFO and Tax firm, Taxulo provides quality tax and accounting services that maximize the value of your money. While headquartered in Santa Clara, Our company provides services to clients throughout the US. We offer convenient locations to visit or provide services on-site to meet your needs.

Contact Info:

Taxulo

Address: 3031 Tisch Way #10, San Jose, CA 95128

Phone: 888-316-2990

Website: https://taxulo.com/

Business Email: [email protected]

Influencer marketing services

Business Hours: Mon – Fri: 9 AM–5 PM

Follow us on: Facebook: https://www.facebook.com/TaxuloUSA Instagram: https://www.instagram.com/taxulousa/ Google Maps CID: https://www.google.com/maps?cid=14264812699456281482

#accounting services#tax preparation#tax planning#bookkeeping services#QuickBooks ProAdvisor#fractional CFO#small business accounting#tax compliance#financial consulting#payroll management#business growth strategies#San Jose CA

1 note

·

View note

Text

0 notes

Text

Why You Should Outsource Your Bookkeeping for Tax Returns

As a business owner, managing your finances is crucial, but it can also be one of the most challenging aspects of running a company. Bookkeeping, in particular, requires meticulous attention to detail and a significant time investment. With the ever-evolving tax laws and regulations, keeping your financial records accurate and up-to-date is more important than ever. This is where outsourcing your bookkeeping for tax returns can be a game-changer. Here are several compelling reasons why you should consider this option:

1. Expertise and Knowledge

Professional bookkeepers possess specialized knowledge and expertise in managing financial records. They stay current with the latest tax laws, regulations, and industry best practices. By outsourcing to these experts, you ensure that your bookkeeping is handled by individuals who understand the complexities of tax preparation, thereby reducing the risk of errors and ensuring compliance with all legal requirements.

2. Time-Saving

Bookkeeping is a time-consuming task that requires a lot of attention to detail. As a business owner, your time is better spent focusing on core activities that drive growth and profitability. By outsourcing your bookkeeping, you free up valuable time that can be redirected towards strategic planning, customer service, and other critical business functions.

3. Cost-Effective

Hiring a full-time, in-house bookkeeper can be expensive when you consider salaries, benefits, and training costs. Outsourcing, on the other hand, provides access to professional bookkeeping services at a fraction of the cost. You can choose a service package that fits your budget and only pay for the services you need, when you need them.

4. Accuracy and Reliability

Professional bookkeeping firms employ experienced professionals who follow standardized processes to ensure accuracy and consistency in financial reporting. They use advanced software and tools to maintain precise records, reducing the likelihood of errors. This reliability is crucial during tax season when accurate records are necessary to prepare and file your returns correctly.

5. Scalability

As your business grows, your bookkeeping needs will evolve. Outsourcing provides the flexibility to scale your bookkeeping services up or down based on your current requirements. Whether you experience seasonal fluctuations or long-term growth, outsourced bookkeeping services can adapt to your changing needs without the hassle of hiring or training additional staff.

6. Focus on Core Competencies

Outsourcing bookkeeping allows you to focus on what you do best—running and growing your business. You can leave the complex and time-consuming task of managing financial records to the experts. This shift in focus can lead to increased productivity and efficiency, as you and your team can concentrate on delivering value to your customers.

7. Access to Advanced Technology

Professional bookkeeping firms invest in the latest accounting software and technology to provide their clients with the best possible service. By outsourcing, you gain access to these advanced tools without having to make the investment yourself. This technology enhances the accuracy, efficiency, and security of your financial data.

8. Improved Financial Decision-Making

Accurate and up-to-date financial records are essential for making informed business decisions. Outsourced bookkeepers provide regular financial reports and insights that can help you understand your financial position, identify trends, and make strategic decisions to drive growth. With a clear and accurate financial picture, you can plan for the future with confidence.

9. Stress Reduction

Tax season can be a stressful time for business owners. Ensuring that all financial records are accurate and complete, meeting deadlines, and avoiding penalties can be overwhelming. Outsourcing your bookkeeping can alleviate this stress by providing peace of mind that your financial records are in expert hands, allowing you to focus on running your business.

Conclusion

Outsourcing your bookkeeping for tax returns offers numerous benefits, from accessing specialized expertise and saving time to improving accuracy and scalability. It is a cost-effective solution that allows you to focus on your core business activities while ensuring your financial records are managed with the highest level of professionalism. By choosing to outsource, you can navigate the complexities of tax season with confidence, knowing that your financial records are in capable hands.

Consider partnering with Lutz Tax Services to experience these advantages firsthand and take your business to the next level.

0 notes

Photo

QuickBooks Training (Russian and Ukrainian language)

Our QuickBooks training (in Russian & Ukrainian) can be tailored to suit your needs in Ukraine and is fully flexible to fit around your staff. We find that this enables us to train you on parts of the software you should be using and ignoring parts that are not relevant to your business. Our Ukrainian and Russian speaking QuickBooks professionals have years of experience in using QuickBooks products in Ukraine.

We train you personally! Either one-on-one or several individuals within your organization.

To get more information about our QuickBooks courses, QuickBooks Trainings & Support services (in Russian and Ukrainian) and QuickBooks Bookkeeping Outsourcing and Data Entry Service in Ukraine please contact us.

#QuickBooks#training#QuickBooks_training#QuickBooks_Ukraine#QuickBooks_Ukrainian#QuickBooks_Russian#bookkeeping#Kyiv#Ukraine#QuickBooks_accounting#quickbooks c#QuickBooks_in_Ukraine#course#quickbooks customer service

1 note

·

View note

Text

Reliable Notary Services In Plainfield, IL – Fast And Professional

Looking for reliable notary services in Plainfield, IL? Keep A Count offers fast, professional, and efficient notarization for all your document needs. Whether it’s contracts, wills, or affidavits, our certified notaries ensure accuracy and confidentiality. We provide mobile and in-office services for your convenience, available seven days a week. Trust Keep A Count for all your notarization needs in Plainfield. Fast, reliable, and always professional. For more information visit our website: https://keepacount.com/best-bookkeeping-services-in-plainfield-il/

#bookkeeping services#notary loan signing agent#bookkeeping services joliet#quickbooks for small business#bookkeeping#best online bookkeeping services

0 notes

Text

Clarity Consulting LLC

Business Consulting Services

Clarity Consulting serves small business owners and entrepreneurs who aren’t hitting their goals aren’t setting goals, or who aren’t seeing the growth and profit they desire, whether they’ve been in business for years, want to sell their business, or haven’t yet established an official business. We believe anyone can start, run, and grow their own successful business and we’re here to help. We offer services that implement proper business practices and build a solid business foundation to set clients up for growth and success. These services include business consulting, QuickBooks training, new business start-up coaching, small business advice, accounting, and bookkeeping consulting, along with trusted referrals for any other small business services you may need.

Business Hours: Mon-Fri: 9am — 5pm | Sat-Sun: Closed Payment Methods: Check, Credit Card, Visa, Amex, Discover Year Establish: April 4, 2019 Employees: 1

Contact Info: Clarity Consulting LLC Address: Fort Mill, SC, 29707 USA Phone: +1 704–879–1838 Fax: 919–869–1747 Mail: [email protected] Website: https://www.clarityconsultingsc.com

Follow On: Facebook: https://www.facebook.com/clarityconsultingsc/ Instagram: https://www.instagram.com/clarityconsultingsc/

#Business consulting#Coaching and advising#QuickBooks training#New business start-up#Accounting and bookkeeping consulting#Creating a business plan#Strategy and budget#Business growth and development#Selling a business#Hiring employees#Setting up and using QuickBooks#Implementing procedures

1 note

·

View note

Text

ZarMoney offers a flexible and cost-effective alternative to QuickBooks Online, with powerful accounting features for businesses of all sizes.

1 note

·

View note

Text

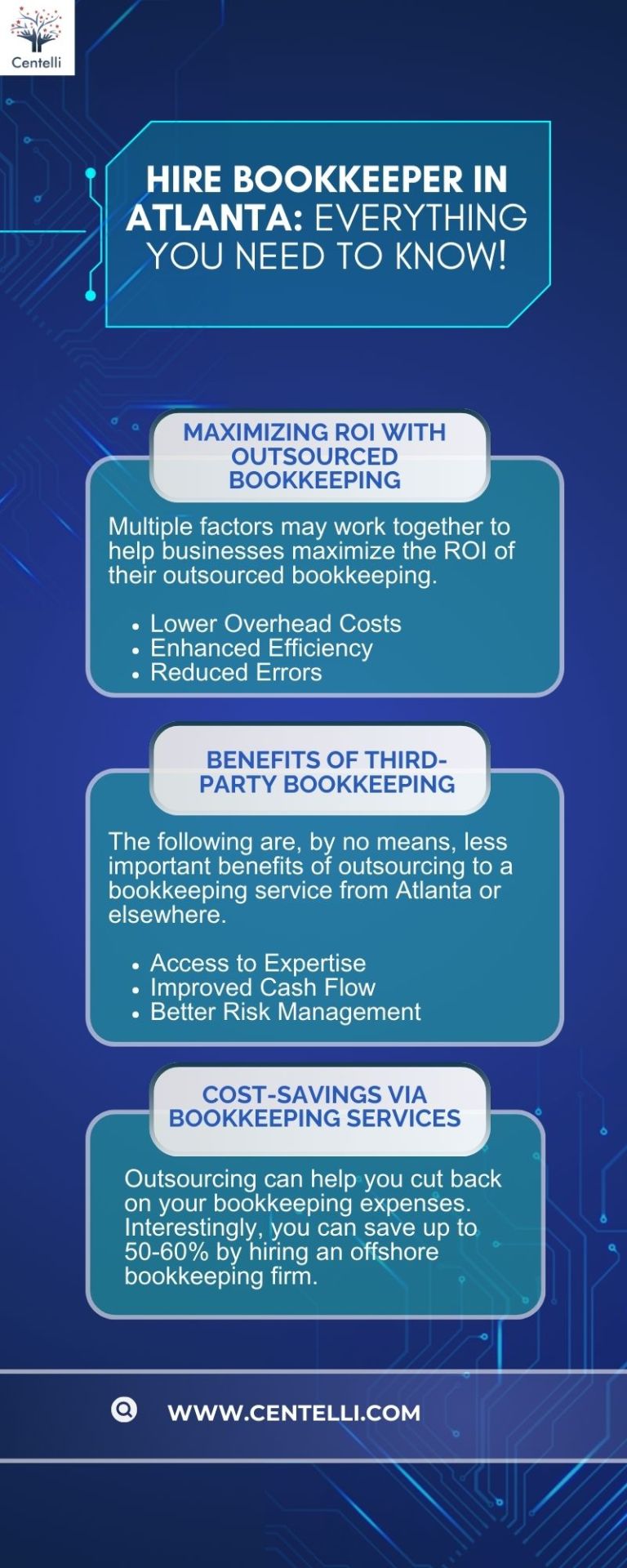

Cost-Saving Bookkeeping Services in Atlanta – Centelli

Looking to streamline your bookkeeping process while saving costs? Discover Centelli's Cost-Saving Bookkeeping Services in Atlanta! Our award-winning company offers dedicated and customized bookkeeping solutions tailored to your business needs.

By outsourcing your bookkeeping to Centelli, you can save valuable time and reduce expenses, allowing you to focus on growing your business. Our team of experienced professionals provides reliable and accurate bookkeeping services, ensuring that your financial records are always up to date.

From managing invoices to handling payroll, Centelli covers all aspects of bookkeeping, offering you peace of mind and financial clarity. With a commitment to quality and attention to detail, Centelli helps businesses make smarter financial decisions. Choose Centelli’s cost-saving bookkeeping services today and experience the difference expert outsourcing can make for your business in Atlanta.

Book Free Consultation!

#Bookkeeping Services#Bookkeeping Services in Atlanta#Small Business#Business growth#Outsourcing Services#quickbooks services#Atlanta

0 notes