#Bookkeeper

Explore tagged Tumblr posts

Text

Fell!Book Keeper Ivy (Info Dump)

Kerria - Fell!Book Keeper Ivy

Personality: A quiet yet severe woman. She has a tendency to snap at strangers and struggles to trust others. Due to her extreme loneliness. A somewhat mysterious and uninterested individual. She is quite knowledgeable about all AUs and has a very wacky demeanor. She adores tea and animals. She is frequently seen in a mysterious dark abyss, and she lives in a single room that alters depending on her mood. She's a lonely individual who appears melancholy. She speaks in a really lovely tone and usually asks a lot of questions, smiling when they are asked. She provides all kind of information. She frequently attempts to soothe her loneliness by narrating stories and watching the worlds' lives unfold.

Appearance: She is a 5'1" woman with long wavy brown hair and hazel eyes. Her hair has true violet highlights and she has a large scar on her left eye that is large and nasty looking. She has a chubby, but petite physique.

(Outfit made by Nyahalloshop!)

#fell bookkeeper ivy#book keeper#bookkeeper#fell bookkeeper sona#info dump#info#lots of info#she's a sweetie#underfell bookkeeper ivy#diohg

5 notes

·

View notes

Text

Here is Bookkeeper! What a nervous fella...he looks a little distressed. . . . Here is my COG oc! I do quite adore him <3 I'm very happy how turned out, truly wonderful!

20 notes

·

View notes

Text

organizing things is going to be an adventure alright.. but bookkeeper wants to do it!

#constellation chatter#system blog#system posting#plural posting#plural blog#endo safe#emira#bookkeeper

4 notes

·

View notes

Text

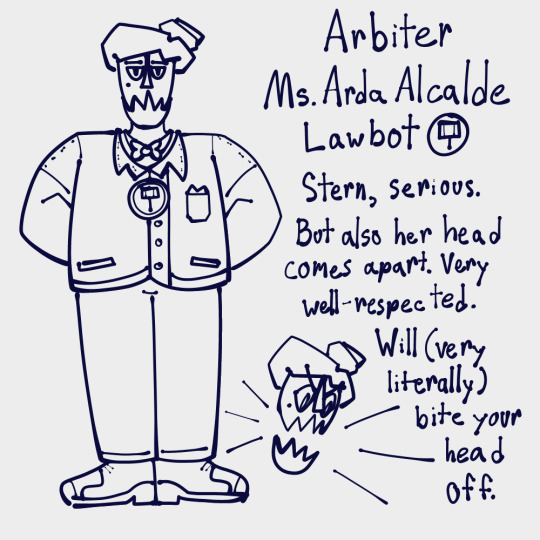

oh god toontown oc time. ref at the bottom is old! cool boots' outfit has changed a bit but im posting it bc i probably should and the sketch refs for the other guys arent final ill probably be updating their designs soon lolll

#toontown corporate clash#fanart#original character#cog oc#toon oc#cool boots#dr. pumpkinsnout#bookkeeper#paper shuffler#arbiter#hatchet man#toastmaster#tagging by job title rather than name bc its easier#technically misty and graham and chip are here but like. i this isnt rly a post About them so i wouldnt wanna clog the tag

16 notes

·

View notes

Text

I’m at work, tell me your favourite book that no one has heard of so that I can order it for the store

14 notes

·

View notes

Video

tumblr

Guide to successful financial audit!

If you want to know more please click here

#accounting#accounting software#business#accountant#finance#tax#bookkeeping#smallbusiness#taxes#entrepreneur#payroll#accountingservices#cpa#taxseason#businessowner#money#incometax#accountants#audit#bookkeeper#accountingsoftware#gst

8 notes

·

View notes

Text

Bookkeeping for Startups: Basics and Tips

Starting a new business is an exciting time, but it can also be overwhelming. There are so many things to think about, from marketing and sales to product development and customer service. In the midst of all of this, it's easy to overlook the importance of bookkeeping.

However, bookkeeping is essential for any business, regardless of its size. It's the foundation for managing your finances, making informed decisions, and complying with tax laws.

If you're a startup, you may be wondering where to start with bookkeeping. Here are some basic tips:

Understand the importance of bookkeeping. Bookkeeping is more than just keeping track of your income and expenses. It's also about providing you with insights into your business's financial health. By keeping accurate records, you can track your cash flow, identify areas where you can save money, and make informed decisions about your business's future.

Set up a system for organizing your financial documents. This will make it easier for you to track your transactions and prepare your financial statements. You can use a simple spreadsheet or a more sophisticated accounting software program.

Choose a bookkeeping method. There are two main types of bookkeeping methods: cash basis and accrual basis. Cash basis accounting records transactions when cash is received or paid. Accrual basis accounting records transactions when they occur, regardless of when cash is received or paid. The method you choose will depend on your business's needs.

Track your income and expenses. This is the most important aspect of bookkeeping. You need to track all of your income and expenses, no matter how small. This will help you to stay on top of your finances and identify areas where you can save money.

Reconcile your bank statements. This is the process of comparing your bank statements to your bookkeeping records to make sure they match. It's an important step in ensuring the accuracy of your financial records.

Prepare financial statements. Financial statements are a summary of your business's financial performance. They include the balance sheet, income statement, and cash flow statement. You need to prepare financial statements on a regular basis to track your business's progress and make informed decisions.

Bookkeeping can seem daunting at first, but it's essential for any business. By following these tips, you can set yourself up for success with bookkeeping from the start.

Anchor text: Bookkeeping

Here are some additional tips for bookkeeping for startups:

Use cloud-based accounting software. This can make it easier to track your finances and collaborate with others.

Hire a bookkeeper or accountant. If you don't have the time or expertise to do your own bookkeeping, you can hire a professional to help you.

Stay up-to-date on tax laws. The tax laws can change frequently, so it's important to stay up-to-date so you can file your taxes correctly.

Bookkeeping is an essential part of running any business. By following these tips, you can set yourself up for success with bookkeeping from the start.

If you're a startup, don't neglect bookkeeping. It's an essential part of managing your finances and making informed decisions. By following these tips, you can set yourself up for success with bookkeeping from the start.

#bookkeeping#bookkeeper#taxpreparation#financial#income#companies#bookkeeping el paso tx#tax services

2 notes

·

View notes

Text

Why Experience Matters: How a Seasoned Bookkeeper Can Save Your Business Time and Money

In today’s fast-paced business environment, maintaining accurate financial records is not just a legal necessity—it’s a foundation for growth and stability. While many businesses understand the importance of bookkeeping, not all recognize the critical difference that an experienced bookkeeper can make. Whether you're a small business owner or running a larger enterprise, the expertise of a seasoned bookkeeper can protect your bottom line and free you to focus on what you do best.

The Hidden Costs of Inexperienced Bookkeeping

At first glance, bookkeeping might seem straightforward—track expenses, balance the books, and prepare for tax season. However, without the right expertise, even minor errors can lead to major consequences.

Common Mistakes by Inexperienced Bookkeepers:

Misclassification of Expenses: Incorrectly categorizing transactions can distort financial reports and cause problems during tax filing.

Missed Deadlines: Failure to submit tax returns or financial statements on time may result in penalties and interest charges.

Data Entry Errors: Simple mistakes in data input can skew financial records, leading to inaccurate reporting and poor decision-making.

These errors are not just nuisances—they can directly impact your financial health. Misreported data can trigger audits, and missed tax deductions may mean overpaying the government. An experienced bookkeeper mitigates these risks by ensuring every detail is correct and every deadline is met.

How Experienced Bookkeepers Add Value

A seasoned bookkeeper brings more to the table than basic data entry. Their expertise enhances accuracy, ensures compliance, and offers strategic insights to help your business thrive.

Accuracy & Compliance: Experienced bookkeepers stay current with ever-evolving tax laws and industry regulations. This knowledge helps prevent costly mistakes and keeps your business compliant. Accurate record-keeping is crucial for audits, financial reporting, and informed decision-making.

Strategic Insights: Beyond tracking expenses, an experienced bookkeeper can analyze financial trends to guide your business strategy. They can identify patterns in cash flow, pinpoint areas for cost reduction, and forecast future financial needs. These insights empower you to make data-driven decisions with confidence.

Efficiency: A skilled bookkeeper streamlines financial processes, saving you time and reducing operational headaches. From integrating automated systems to optimizing workflows, they enhance efficiency and free up resources for other business priorities.

Real-World Impact: The Difference Experience Makes

Consider this scenario: A small business struggling with cash flow issues turned to an experienced bookkeeper for help. Upon review, the bookkeeper uncovered missed tax deductions and improperly classified expenses. By correcting these errors and implementing a more accurate system, the business not only recovered thousands of dollars but also improved future financial planning. This kind of real-time intervention is only possible with a bookkeeper who has the expertise to spot and resolve complex issues.

What to Look for in an Experienced Bookkeeper

Not all bookkeepers are created equal. When hiring a bookkeeper, look for these key attributes:

Industry Knowledge: Understanding the nuances of your specific field is vital for accurate record-keeping.

Tech Proficiency: Familiarity with modern accounting software ensures efficient and accurate data management.

Attention to Detail: The ability to catch small errors before they become big problems is invaluable.

Additionally, seek out bookkeepers who offer personalized service. Your business is unique, and a one-size-fits-all approach won’t deliver the tailored solutions you need.

Conclusion: Investing in Expertise Pays Off

An experienced bookkeeper is not just an expense—they are a valuable asset. By ensuring accuracy, offering strategic insights, and improving efficiency, they protect your business from costly errors while positioning you for long-term success.

If you’re ready to experience the difference an expert bookkeeper can make, consider partnering with Bizee Bookkeeper. Our team combines years of experience with a commitment to personalized service, helping businesses like yours thrive. Contact us today to learn how we can support your financial success.

0 notes

Text

Erin Pyle

Erin Pyle is the Bookkeeper at Howland Hess Birnbaum, ensuring precise financial management & supporting the firm’s smooth operations with attention to detail.

1 note

·

View note

Text

A Day in the Life_ Outsourced Bookkeeper

A professional bookkeeper plays a crucial role in the financial health of a business. By meticulously managing financial records, they ensure that all transactions are accurately documented, providing a clear picture of the business’s financial status.

Outsourcing bookkeeping services has become an increasingly popular solution for businesses aiming to maintain robust financial management without the overhead of hiring full-time staff. This article delves into the daily tasks of a professional offering outsourced bookkeeping services, highlighting the importance of their role in maintaining business finances, and addressing the challenges and benefits associated with outsourcing these critical services.

In this article, we will explore what bookkeeping outsourcing entails, how to identify and hire the right bookkeeper, the common challenges faced, the daily activities performed by these professionals, and what you can expect as a business owner from outsourced bookkeeping services.

What are the Daily Tasks of a Professional Offering Outsourced Bookkeeping Services

In this section, we will explore the typical day of a professional bookkeeper who provides outsourced services. From morning routines to end-of-day reviews, we’ll cover the various tasks they handle to keep businesses running smoothly.

Morning Routine

Checking emails and voicemails for client communications: The day starts by reviewing emails and voicemails to catch up on any client communications. This helps prioritize tasks based on client needs and urgencies.

Reviewing the daily agenda and prioritizing tasks: A well-organized agenda ensures that all tasks are planned and prioritized, making the day productive and focused.

Updating financial records from the previous day: Ensuring that all financial transactions from the previous day are accurately recorded is essential for maintaining up-to-date financial records.

Mid-Morning Tasks

Processing invoices and payments: Invoicing clients and processing payments are key tasks that ensure the business’s cash flow remains healthy.

Reconciling bank statements and accounts: Regular reconciliation of bank statements and accounts helps identify any discrepancies and ensures that financial records are accurate.

Managing payroll for clients or the organization: Handling payroll involves ensuring that all employees are paid correctly and on time, which is vital for maintaining employee satisfaction and compliance with labor laws.

Click here to read more about the Daily life of a professional bookkeeping professional

1 note

·

View note

Text

Renegade Bookkeeping Ltd.

Renegade Bookkeeping Ltd. offering Personalized Bookkeeping Solutions for Mid-Size Businesses,Individuals,Sole Proprietors, & Cooperations across Saskatoon.

0 notes

Text

Four Key Elements of Bookkeeping Ethics

Honesty

Report financial data in a timely and accurate manner

Owning any mistakes and doing everything possible to fix them

Being open and transparent with your client about the state of their finances

Objectivity

Never take a job that might be a conflict of interest

Never allow anyone else to influence your work

Never let personal bias interfere

Confidentiality

Never discuss client information outside of the office or with non-employees of the office

Never using inside information about a client for personal gain

Professionalism

Be courteous and considerate of clients needs

Maintain proper credentials and continuing education

Maintain a professional attitude

#Bookkeeping#Ethics#Honesty#Objectivity#Confidentiality#Professionalism#Bookkeeper#Financial Professional

1 note

·

View note

Text

Oh ho ho ! More Bookkeeper doodles 🌼✨

I’m having such a delight drawing this fella 💕

18 notes

·

View notes

Note

🪼, for that ask game

i guess the uberbots have the most obscure source (inscryption, not suuuper niche but most people dont know), and i would consider watcher and seven red suns to have the most well known (rain world)

#comet#seven red suns#g0lly#bookkeeper#photographer#endo safe#system blog#system posting#plural blog#plural posting#ask answers

2 notes

·

View notes

Text

Business Consultant Business Card

Business Consultant Business Card with Bar Chart illustration!

#businessconsultant#businessconsultants#taxservices#accountantbusiness#analyst#investmentmanager#bookkeeper#financialbusiness#graphicdesign#businesscard#businesscards#businesscarddesign#custombusinesscard#zazzlemade

1 note

·

View note