#xero accounting

Explore tagged Tumblr posts

Photo

Bookkeeping & Data Entry Services in Ukraine

Bookkeeping services by Units Consulting Ltd., an accounting firm in Kyiv, includes complete accounting facility for recording and accounting in compliance with the local requirements. It is made from records provided by the client to produce a fully compliant set of financial books and records.

Our bookkeeping services are suitable for business of all industries and small and medium companies for onshore bookkeeping and offshore outsourced bookkeeping. We offer daily, weekly, and monthly services based on requirements / needs by our clients.

Bookkeeping outsourcing and data entry services includes: We are using team of experts, to provide bookkeeping service as Chartered Accountant Firm in Ukraine with existence in Kyiv and also the latest international rules of accounting in financial reporting. We used QuickBooks and Xero web based bookkeeping software for providing onshore bookkeeping services and offshore outsourced bookkeeping services.

There are many benefits to utilizing Outsourced Accounting Services in Ukraine such as cost-effective reliable, high-quality and technical assistance. To improve your accounting services and expand your business, consider Ukraine and benefit from the top accounting experts.

We deploy the team of bookkeepers in Ukraine to the client premises or client is asked to deliver data to our local office for bookkeeping & data entry services.

To learn more about our bookkeeping outsourcing services in Ukraine (Kyiv), please contact us.

#bookkeeping#outsourcing#services#ukraine#data entry#chartered accountant#certified public accountant#bookkeeper#kyiv#kiev#outsource#outsourced cfo services#quickbooks#xero accounting#xero

1 note

·

View note

Text

9 Great Things About XERO Online Accounts Ireland

0 notes

Text

i'm gunna b productive...... i'm gunna go thru several drafts And asks. NOW !!

#xero says things#(my way of making sure i'll do it bc then if i don't y'all can hold me accountable LOL)

8 notes

·

View notes

Text

0 notes

Text

#accounting assignment help#nursing assignment help#childcare assignment help#xero assignment help#online exam help

2 notes

·

View notes

Text

Remote bookkeeping saves costs for small businesses by:

1. Reducing overhead expenses like office space. 2. Accessing specialized talent at potentially lower rates. 3. Offering flexible arrangements, avoiding full-time hires. 4. Cutting training costs with experienced remote professionals. 5. Saving time for core business activities, leading to increased productivity and potential revenue growth.

#accounting#bookkeeping#project xero#consulting#entrepreneur#entreprenuerlife#machine learning#cloudcomputing#remote work#virtual assistant

2 notes

·

View notes

Text

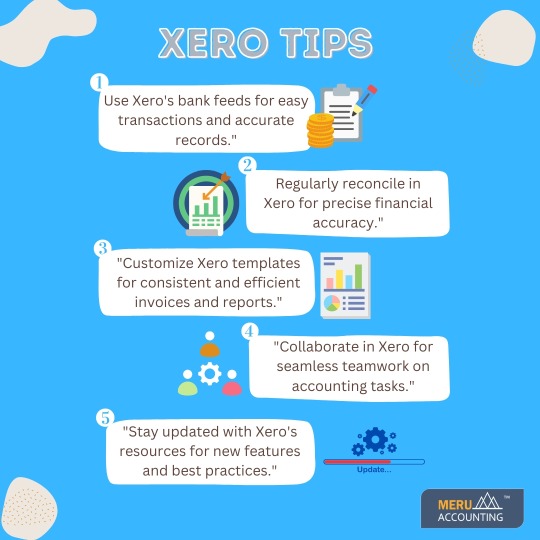

The power of seamless financial management with Xero! Our top tips help you to grow your business.

Meru Accounting is your trusted partner for top-notch accounting and bookkeeping services in the USA, UK, Canada, Australia, UAE, and New Zealand.

#MeruAccounting#xero#xerbookkeeping#xeroaccounting#bookkeepingtips#bookkeepingservices#bookkeepingandaccounting#accounting#accountingservices#usa#uk#canada#uae#australia#newzealand#india

2 notes

·

View notes

Text

oh this is DEVESTATING that webcomic i ate up when i was in 5th grade is so much more niche than I thought 😭 how to get rid of the cat head you were my lifeblood ily......

#xero says things#genuinely i had that 'selfish' cath drawing as my school account pfp HAJABSJS#i remember a few years ago i made an insta to dredge through the creator's insta and i remember some bits n pieces that weren't on webtoon#but like . bwah......#genuinely the art style and the lil weeds and the characters were a part of my soul i loved them so much......#i should draw them. or maybe try to mimic the art style. that'd be fun.....

3 notes

·

View notes

Text

Why Should You Take the Google Analytics Course for Digital Marketing?

Understanding your audience and the ability to measure your efforts are crucial when diving into digital marketing. A Google Analytics Course in Ahmedabad equips you with the skills to track website traffic, analyse user behaviour, and make data-driven decisions that will boost your marketing strategies and enhance your online presence.

Master Website Traffic Analysis

Google Analytics Course in Ahmedabad can help you track which page visitors are coming from, land on, and hang around to see, and for how long. You will be shown how to interpret the data, which marketing channels provide the highest return, and how one should adjust the strategy at any given moment. To make sure that you place your time and resources accordingly, invest in those sites that give you the biggest desirable results.

Understand Audience Demographics

Knowing who the audience is, including basic information such as age, location, and interests, will enable them to produce content that helps fulfil their needs. It is for this reason that a Google Analytics Course in Ahmedabad will enable you to show how you can access information about the demographics of these individuals in order to know how best to create appropriate campaigns targeting them and how to better engage them with your message.

Enhance Conversion Tracking

Conversions, such as signing up for newsletters or buying a product, are important gauges of your marketing performance. With a Google Analytics course, you will be taught how to set up and track goals, showing you how your website effectively converts visitors into customers. It helps you understand and further improve your site for better conversion rates.

Improve Content Performance

Not all content is created equal. Certain pages and information draw in visitors, motivating them to spend much more time than others do. Knowing the ins and outs of how to use Google Analytics assesses which content best stimulates interest and why. Having that insight into the strengths will help you develop materials later on that really resonate with your audience and meet your marketing goals.

Enhance Your Career Prospects

In the modern job scenario, Google Analytics is one of the skills in high demand in the digital marketing professional workforce today. Completing the course will not only upgrade your capability but also add a crucial certification to your resume and make you more competitive.

Time to take your digital marketing one step ahead? Then why not enroll in Perfect Computer Education's Google Analytics course in Ahmedabad and see the magic of transforming your data into actionable insights? Visit our website to enrol in this course.

Read More:- https://perfecteducation.net/why-should-you-take-the-google-analytics-course-for-digital-marketing.php

#digital marketing course in ahmedabad#foreign accounting training#learn accounting in ahmedabad#usa accounting training#myob training#quickbook training ahmedabad#foreign accounting and taxation training#xero training in ahmedabad#tally certification in ahmedabad#learn foreign accounting ahmedabad#Google Analytics Course

1 note

·

View note

Text

Common Xero Mistakes and How to Avoid Them

As a Xero-certified accountant with years of experience helping small businesses manage their finances, I’ve encountered numerous common mistakes that can cause headaches down the line. Here’s how to identify and avoid them. Incorrect Bank Reconciliation One of the most frequent issues I see is improper bank reconciliation. Many users rush through this process, creating discrepancies that can…

0 notes

Text

Are You Ready for Tax Season? How Outsourced Services Can Help Accounting Firms Manage Increased Workload?

Tax season brings tight deadlines, heavy workloads, and pressure to maintain client satisfaction for CPA firms. Managing the workload in accounting firms during this period can be overwhelming, but outsourcing offers an effective solution. By offloading routine and administrative tasks, firms can improve efficiency and focus on high-priority client work, ensuring smoother workflows and meeting crucial deadlines.

Reduced Repetitive Tasks: Outsourcing routine duties like bookkeeping and administrative work allows firms to focus on high-priority tasks.

Increased Team Capacity: Firms can scale their teams by leveraging external support without overloading in-house staff.

Cost Efficiency: Outsourcing eliminates the need to hire and train temporary staff, reducing operational costs while accessing skilled professionals on demand.

Improved Time Management: Offloading tasks frees up time for client meetings, strategic advice, and tax preparation, ensuring deadlines are met and workflows remain efficient.

Effective time management is crucial during tax season. CPA firms can adopt strategies like using accounting practice management software, conducting regular team check-ins, and employing techniques such as time blocking or the Pomodoro technique to stay productive.

India stands out as a top outsourcing destination for tax preparation due to its strong data privacy laws, experienced professionals, and cost-effective services. Compared to countries like Bangladesh, Pakistan, and the Philippines, India offers more reliable service quality and robust regulatory frameworks.

Ultimately, outsourcing empowers CPA firms to streamline operations, enhance efficiency, and improve their teams' work-life balance. By partnering with firms like Intellgus, accounting professionals can confidently handle tax season’s demands while maintaining client satisfaction and staff morale.

0 notes

Text

Simplify Bookkeeping with i-accountant’s Xero Accountant Services

Simplify your bookkeeping process with i-accountant’s expert Xero Accountant services. As certified Xero professionals, we specialize in helping businesses streamline their financial management with cloud-based solutions. From real-time tracking of your transactions to generating detailed financial reports, we ensure your accounting needs are handled with precision and efficiency. Our team provides customized support tailored to your business requirements, saving you time and reducing errors.

0 notes

Text

Accounting Services for Small Business: A Key to Financial Success

Running a small business comes with its own set of challenges. From managing day-to-day operations to keeping track of inventory, marketing, and customer service, entrepreneurs often find themselves wearing many hats. One area that can become overwhelming for small business owners is financial management. This is where accounting services for small business come into play.

Effective accounting is not just about balancing books—it’s about providing insightful data to help make informed decisions, drive growth, and ensure long-term financial health. Let’s explore why small businesses need professional accounting services and how they can make a significant difference in the success of your company.

The Importance of Accounting Services for Small Business

For a small business to thrive, it must maintain accurate financial records and follow proper accounting practices. While software solutions can help automate some tasks, there are significant benefits to outsourcing accounting services to professionals who specialize in small business needs.

Expertise in Financial Management One of the key benefits of hiring an accounting service is access to expert advice. Professional accountants are trained to manage finances, understand tax laws, and offer insights that you might not be aware of. Their expertise can help you avoid costly mistakes and keep your business compliant with local regulations.

Time Savings Managing financial tasks such as bookkeeping, tax preparation, and payroll can be incredibly time-consuming. By outsourcing accounting services, small business owners can focus on what they do best—running their business. Whether it’s growing your customer base or developing new products, the time saved can be invested back into key business areas.

Tax Efficiency and Compliance Taxes are one of the most complicated aspects of running a business. Accountants who specialize in small business services stay updated on ever-changing tax laws and can help you take advantage of tax deductions, credits, and other strategies to minimize your tax burden. By ensuring that your business stays compliant with all tax regulations, accounting services can help you avoid penalties and fines.

Cash Flow Management Cash flow is the lifeblood of any business. Even profitable businesses can struggle if cash is not managed properly. Accounting professionals can help you keep track of accounts payable and receivable, forecast cash flow, and create strategies to improve liquidity. This is especially crucial for small businesses that may have less financial cushion compared to larger corporations.

Financial Reporting and Insights Understanding your business’s financial health is crucial for growth and decision-making. Regular financial reports, such as balance sheets, income statements, and cash flow statements, give you a snapshot of your business’s performance. Professional accounting services can provide accurate and timely financial reports, allowing you to make data-driven decisions. These insights help business owners identify trends, manage expenses, and spot opportunities for growth.

Scalability and Growth As your business grows, your financial needs become more complex. Having accounting services in place from the beginning ensures that as your company scales, your financial management practices can scale with it. This flexibility allows small business owners to focus on expansion without worrying about keeping up with their financial record-keeping.

Services Offered by Accounting Firms for Small Businesses

Accounting services for small businesses can vary widely depending on your specific needs. Here are some of the most common services offered by accounting firms:

Bookkeeping: Recording daily financial transactions, including sales, purchases, receipts, and payments.

Payroll Services: Managing employee wages, benefits, and tax withholdings.

Tax Preparation and Filing: Ensuring accurate preparation and timely submission of local, state, and federal tax returns.

Financial Statements: Preparing profit and loss statements, balance sheets, and cash flow reports.

Budgeting and Forecasting: Helping businesses create budgets and projections to plan for the future.

Consulting Services: Offering strategic financial advice to help small businesses optimize their finances, plan for growth, and improve profitability.

Choosing the Right Accounting Service for Your Small Business

When selecting accounting services for your small business, it’s essential to choose a provider that understands your industry and the specific challenges you face. Here are a few factors to consider:

Experience and Expertise: Look for an accounting service with a proven track record of working with small businesses in your industry.

Technology Integration: Many accountants use advanced software and tools to streamline processes. Ensure the service provider uses modern, secure systems that integrate well with your existing tools.

Cost-Effectiveness: While it’s important to invest in professional accounting services, you also want to find a provider whose fees fit within your budget. Many firms offer customized packages to meet the needs of small businesses.

Customer Support: Choose a service that provides excellent customer support, whether it’s answering questions about tax filings or helping you understand financial reports.

Conclusion

Accounting is an essential component of small business success. By leveraging professional accounting services for small business, entrepreneurs can gain valuable insights, save time, ensure compliance, and ultimately position their companies for growth. Whether you’re just starting or looking to optimize your current financial practices, professional accounting services can be the difference-maker that sets your business on the path to long-term success.

Investing in the right accounting help is not just a financial decision—it’s a strategic move that can pay off in terms of reduced stress, better financial management, and enhanced business performance.

Original Source: Accounting Consultants

#accounting consultants#accounting services for small business#virtual bookkeeper#xero accounting system#online accountant for small business#bookkeeping services for small business#xero bookkeeping#accounting system for small business#online bookkeeping services#financial accounting outsourcing services#outsourced bookkeeping services#online cpa services#hire remote bookkeeper#back office accounting#online accounting services

1 note

·

View note

Text

OKY ACTUALLY. just for future reference, I'm gunna start using the "#reposters" tag sometimes!! I see ppl taking credit from or not giving credit to artists in main tsams tags enough to be a leetol annoyed and I want ppl to be able to see the post and thus block the OP!!

I'm making it a tag to also blacklist though, so I'm gunna give y'all a sec to let this post sit and marinate or whatevs, n then I'm gunna be telling someone to quit their BS shortly after LMAO

#xero says things#important#IT JUST KILLS ME TO SEE BUT ALSO I TAKE IT AS A CHALLENGE#I /WILL/ FIND REPOSTED ART#ALWAYS#I HAVE ONLY EVER FAILED TO DO SO /ONCE/ AND I THINK IT WAS BC THE OP DELETED THEIR ACCOUNT#BUT I SEARCHED 4EVER MAN I PROMISE YOU THAT#THIS IS A TASK I GET A THRILL OUT OF. NO REPOSTER IS SAFE FROM ME 🦅🦅🦅🦅🦅 /dramatic#don't send anon hate or nuthin to the reposters tho btw actually y'all be nice 😭

4 notes

·

View notes