#Property Taxation

Explore tagged Tumblr posts

Text

Government Reinstates Indexation Benefit for Property Sales After Backlash

In response to widespread criticism, the government has reversed its decision to eliminate indexation benefits on long-term capital gains (LTCG) from property sales. As of Tuesday, taxpayers will have the option to choose between two tax regimes for properties acquired before July 23, 2024.

What’s Changed?

Under the updated rules, property owners can now select between:

20% LTCG Tax with Indexation: This allows for adjusting the purchase price of an asset for inflation, thus reducing taxable capital gains.

12.5% LTCG Tax Without Indexation: This option offers a lower tax rate but does not account for inflation adjustments.

Taxpayers can choose the option that results in the lower tax liability.

Why the Change?

The initial proposal to remove indexation benefits while offering a lower tax rate of 12.5% led to significant backlash from real estate investors and property owners. Critics argued that without indexation, long-term gains would be overstated, resulting in higher tax liabilities for properties held over extended periods. The backlash led to calls for a more balanced approach, which the government has now addressed by allowing a choice between the old and new tax regimes.

Key Details

Grandfathering Provision: Properties purchased before July 23, 2024, are grandfathered under the old tax regime with indexation benefits. For properties acquired after this date, only the new 12.5% tax rate without indexation will apply.

Scope of Indexation: The reinstated indexation benefit applies only to immovable property and not to other unlisted assets like gold. For unlisted securities or shares, different tax rates apply based on the acquisition date.

Additional Amendments

The government also made amendments to the Finance Bill, including:

Redefinition of Undisclosed Income: The definition now includes incorrect claims of exemption within its scope for block assessments.

Rollover Benefits: These remain unchanged, meaning that investments in Section 54EC bonds or residential real estate can still benefit from LTCG exemptions.

Industry Reactions

Despite the rollback, concerns remain about the impact of the new regime. Industry watchers worry that the lack of indexation might lead to more frequent secondary market real estate sales and potentially incentivize underreporting of transaction values. However, the government maintains that the new tax regime, even without indexation, will benefit most taxpayers due to the generally high returns on real estate compared to inflation.

0 notes

Text

Navigating the complexities of taxation on rental income in the UK can be challenging for property owners. Understanding the legal framework and available tax reliefs is key to effectively minimising your tax liability. This article aims to provide valuable insights and practical strategies to help landlords maximise their rental income while staying compliant with tax regulations.

#Minimise tax#Rental income#UK#Tax reduction#Property taxation#Tax-saving tips#Income tax#Property investment#Tax strategies#UK taxation#Rental property#Tax planning#Tax minimization#Real estate taxation#Tax-efficient rental income

0 notes

Text

191 notes

·

View notes

Text

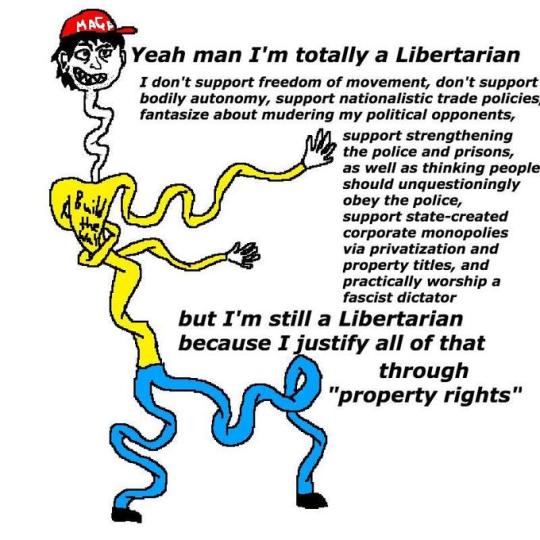

#us politics#lolbertarians#taxation is theft and other lies by lolbertarians#fuck libertarians#libertarians be like#libertarians#conservatives#memes#shitpost#bootlickers#freedom of movement#bodily autonomy#nationalistic trade policies#political violence#fascist police state#deregulation#deregulate deez nutz#corporate monopolies#privatization#property rights

489 notes

·

View notes

Text

The Texas property tax system is a racket! They’ve had ALL year to determine taxes and wait for the last 2.5 months to tell you what they are. Your Escrow’s been collecting based on last year’s value. This year’s numbers are always different, normally higher.

Tax Assessor offices can raise primary residence taxes by as much as 10%. Tell me an office that’s not raising taxes and revenue. “OMG. Who would have thought? Your taxes went up just high/low enough to not be contested. So weird.” Fuck off!

The same offices can raise investment property taxes by as much as 20%!

The Texas Legislature has much to fix. If we’re keeping property taxes the same, why are they going up? Why are we spending more? Why aren’t we doing more with what we have? Why aren’t we paying teachers more? Why do we still have property taxes? We generate plenty of tax through the state tax rate.

On the surface, Dade Phelan (Speaker of Texas House) is running a people’s government more akin to Globalism than real Conservatism that’s by the people and for the people (not his friends, lobbyists, and everyone who’s not a Texan). Tell me how higher taxes and less transparency (#openthebooks, seriously where does the money go?) equal more freedom and prosperity.

Texas is still a conservative state, but we need a leader who’s not a Globalist and traitor.

#truth#common sense#globalist playbook#Dan phelan#texas#property taxes#taxation is theft#the great awakening#use your brain#think for yourself

16 notes

·

View notes

Text

"taxes and death: the only two guarantees in life" - my geometry teacher

#❀ lori lore#america#united states of america#politics#usa#americans#taxes#us taxes#death and taxes#filing taxes#taxation#tax#governance#economy#property taxes#debt#it was funny in my head

7 notes

·

View notes

Link

Detroit’s City Council, responding to a clarion call from the community and unsettling findings from a University of Chicago study, has unanimously passed two landmark resolutions aimed at halting foreclosures and correcting property assessments for homes valued under $34,700. This decisive action comes amid the backdrop of opposition from the Duggan administration, highlighting the Council’s commitment to addressing systemic injustices in the city’s property tax system.

The first resolution mandates Detroit City Assessor Alvin Horhn to slash assessments for these homes by 30 percent, a significant step towards rectifying the chronic issue of overvaluation that has burdened many Detroit homeowners. The second resolution urges Wayne County Treasurer Eric Sabree to suspend all foreclosures on owner-occupied homes falling within the same value bracket, offering a lifeline to residents at risk of losing their homes due to inflated tax bills.

The passage of these resolutions, a direct outcome of the relentless advocacy by the Coalition for Property Tax Justice, marks a critical movement in Detroit’s ongoing struggle with property tax fairness. The Coalition for Property Tax Justice is like a powerhouse team, bringing together more than fifteen community-rooted groups all focused on one big goal: putting an end to unfairly high property taxes and the wave of tax foreclosures that have been hitting Detroit hard.

Bernadette Atuahene, a key figure in this movement, lauded the Council’s decision, stating, “The City Council finally acknowledged the continued over assessments and unanimously demanded that the Duggan administration and the County Treasurer take action to correct the ongoing property tax injustice. Now Treasurer Sabree and the Duggan administration must follow these resolutions with action.”

But the resolutions’ success hinges on the actions of County Treasurer Eric Sabree and City Assessor Alvin Horhn. The question now is, will they heed the Council’s directive and address these pressing issues, or will they allow the cycle of illegal foreclosures and assessments to persist? ...

5 notes

·

View notes

Text

Top Audit Firm in Qatar | Accounting and Bookkeeping

Discover GSPU, your trusted audit and accounting firm in Qatar! Our experienced professionals offer tailored financial solutions, innovative strategies, and expert guidance to help your business thrive. Get in touch today to streamline your financial processes and drive growth with confidence.

#accounting#taxes#success#startup#tax#tax accountant#property taxes#audit#taxation#taxcompliance#bookkeeping#accounting services#business growth#services#finance#business consulting#outsourced cfo services#corporatefinance#cybersecurity#excise tax

2 notes

·

View notes

Text

Empowering Innovation: How Intellectual Property Rights Services Drive Business Success

In today's competitive business landscape, innovation is key to driving growth and staying ahead of the curve. Intellectual property (IP) plays a crucial role in protecting and monetizing innovative ideas, products, and processes. Intellectual Property Rights (IPR) services are instrumental in safeguarding these assets and ensuring that businesses can reap the full benefits of their innovations. This article explores how IPR services empower innovation and drive business success.

What is Intellectual Property Rights

Intellectual Property Rights (IPR) refer to legal rights that protect creations of the mind, such as inventions, literary and artistic works, designs, symbols, names, and images used in commerce. These rights enable creators and innovators to control the use of their creations and reap financial rewards from their investment in innovation.

The Role of IPR Services in Business Success

1. Protection of Innovations

IPR services help businesses protect their innovations through patents, trademarks, copyrights, and trade secrets. By securing these rights, businesses can prevent competitors from copying or using their ideas without permission, thereby safeguarding their competitive advantage.

2. Monetization of Intellectual Property

IPR services assist businesses in monetizing their intellectual property by licensing or selling their rights to third parties. This can be a significant source of revenue for businesses, allowing them to capitalize on their innovations and expand their market reach.

3. Risk Management

IPR services help businesses manage the risks associated with intellectual property infringement. By conducting thorough IP audits and clearance searches, businesses can identify and mitigate potential risks before they escalate into costly legal disputes.

4. Enhancing Market Value

IPR services enhance the market value of businesses by establishing a strong intellectual property portfolio. A robust IP portfolio not only attracts investors and partners but also increases the valuation of the business in the eyes of potential buyers.

5. Fostering Innovation Culture

IPR services play a crucial role in fostering a culture of innovation within organizations. By rewarding employees for their innovative ideas and providing them with the necessary legal protection, businesses can encourage creativity and drive continuous improvement.

Case Studies: How IPR Services Drive Business Success

1. Pharmaceutical Industry

In the pharmaceutical industry, patents are essential for protecting new drugs and treatments. Pharmaceutical companies invest heavily in research and development (R&D) to bring new drugs to market. IPR services help these companies secure patents for their innovations, allowing them to recoup their R&D costs and generate profits.

2. Technology Sector

In the technology sector, patents are crucial for protecting new technologies and inventions. Companies like Apple, Google, and Microsoft rely on patents to protect their innovative products and services. IPR services help these companies navigate the complex patent landscape and defend their intellectual property against infringement.

3. Entertainment Industry

In the entertainment industry, copyrights are essential for protecting artistic works such as music, films, and books. Copyright infringement is a significant concern for artists and creators, and IPR services play a vital role in protecting their rights and ensuring fair compensation for their work.

Conclusion Intellectual Property Rights (IPR) services are instrumental in empowering innovation and driving business success. By protecting and monetizing intellectual property, IPR services enable businesses to leverage their innovations for competitive advantage and financial gain. As businesses continue to innovate and expand into new markets, the role of IPR services will only become more critical. Embracing IPR services as a strategic business tool is essential for businesses seeking to thrive in today's innovation-driven economy. Contact Us for more Information.

#IPR#intellectual property#outsourcing consultancy#finance and accounting#taxation services#taxation#intellectualknowledge#intellectualpropertyservices#FEMA compliance#intellectual property rights

2 notes

·

View notes

Text

#business#law and legal system#legal advice#lawyer#legal service#law firm in chandigarh#top law firms in chandigarh#best law firm in chandigarh#corporate law firms in chandigarh#business consultants in chandigarh#business setup services in chandigarh#ipr law firms in chandigarh#taxation law firms in chandigarh#labour law firms in chandigarh#immigration law firms in chandigarh#law firms in mohali#property law firms in mohali#law firms in panchkula#law firm zirakpur

2 notes

·

View notes

Text

"Tax Pinch for India's Middle Class: Can the Upcoming Budget Bring Relief"

#finance#economy#budget#middle class#family#relief#taxpayers#tax credits#property tax#taxation#tax savings#taxes#national taxes#finance minister#nirmala sitharaman#narendra modi#amit shah#anurag thakur#financial markets and investing#investingtips#investmoney#investment#investing#investors#mutual fund#investing stocks#stock news#stock maket news#stock market

2 notes

·

View notes

Text

A Modest Proposal for the Housing Crisis

If you own just one house, you pay the regular property tax on that house.

If you own 2 houses, you pay 2 times the property taxes on those houses. If you own 3 houses, you pay 3 times the property taxes on each.

If you're a Landlord and you own 10 houses, you'll pay 10 times the property taxes on each, and you cannot raise the rates you charge tenants. Or, you could always sell those houses so you don't have to pay as many taxes.

And if you're A BANK that ownes MORE THAN 500 HOUSES...get rekt.

#government#taxation#property tax#housing crisis#housing market#economics#apartments#renting#capitalism

3 notes

·

View notes

Photo

Taxation is theft.

1K notes

·

View notes

Text

#nri taxation#taxation#tds#budget 2024#sale of property for nris#tax rules for sale of property for nris#nri tax consultations

0 notes

Text

Expert NRI Legal Services in Chennai

Get professional legal assistance for all your NRI needs in Chennai. Our expert legal team offers solutions for property, taxation, and other legal matters to ensure your peace of mind.

#NRI legal services#legal assistance for NRIs#Chennai legal experts#property legal services#NRI taxation help#inheritance law for NRIs#legal advisory for NRIs#NRI legal team#legal solutions in Chennai#NRI property disputes

0 notes