#stock maket news

Explore tagged Tumblr posts

Text

Master Stock Market with Money Plant Trading Academy

Join the 3.5-month Complete Trading Masterclass at Money Plant Trading Academy in Ahmedabad. Designed for beginners and professionals, this Stock Market Course in Ahmedabad covers stock market basics, technical analysis, financial derivatives, and live trading sessions. Gain lifetime mentorship, access to high-tech terminals, and expert guidance. Start your journey to financial success today! For More Information Visit: https://www.moneyplanttradingacademy.com/courses

0 notes

Text

Expert Tips for Mastering Your Stock Market App

As online trading continues to grow in popularity, more and more people are turning to stock market apps for their investment needs. These apps offer a convenient way to trade stocks without having to leave the comfort of your own home. In this article, we'll explore why using a stock market app is important, what factors you should consider when choosing one, and provide expert tips to help you make the most of a stock market app.

Importance of using a stock market app

Here are the key reasons why utilizing a stock market app holds significant importance for traders in today's digital age:

No need for expensive equipment

Previously, traders had to invest in costly infrastructure such as desktop computers and dedicated internet connections. However, mobile apps have rendered this unnecessary. With just a smartphone, you can start trading without the need for specialized equipment.

Trade anytime, anywhere

One of the greatest advantages of stock market apps is the ability to trade from virtually anywhere. You're no longer restricted to trading from a specific location; as long as you have your smartphone and an internet connection, you can execute trades on the fly.

User-friendly interface

Mobile trading apps offer an intuitive and visually appealing user interface. Navigating through the app and understanding its features is straightforward, making stock market trading more accessible to a wider audience.

Enhanced trading efficiency

Trading via a mobile app significantly improves trading efficiency. You can execute buy and sell orders quickly, often within seconds. Additionally, managing your investment portfolio, monitoring performance, and making necessary adjustments are all streamlined processes with the help of a mobile trading app.

What to consider when choosing a stock market app

Now that you understand the significance of using a stock market app, here's what you should consider when selecting the right one for your trading needs:

User-friendly interface

Opt for an app with an intuitive interface for seamless navigation, making it easy to execute trades and access essential information.

Available markets

Look for an app that provides access to a variety of markets, allowing you to diversify your portfolio and tailor your investments to your financial goals.

Research tools

Select an app with robust research tools, including charts and real-time news updates, to help you make informed trading decisions based on current market trends and data.

Security measures

Prioritize apps with strong security features, such as encryption and two-factor authentication, to protect your personal and financial information from unauthorized access.

Customer support

Choose an app that offers responsive customer support to address any queries or concerns you may have, ensuring you have assistance whenever needed on your trading journey.

Trade like a pro with these stock market app tips

follow these valuable stock market app tips to enhance your trading skills and maximize your investment potential:

Stay informed about market trends

Keeping track of market trends and news is crucial for making smart investment decisions. Regularly checking reliable financial news sources and media platforms will help you stay updated and make informed choices.

Use alert systems

Take advantage of the alert and notification features in your trading app. These tools notify you about market movements and price changes, enabling you to act quickly and manage your trades efficiently.

Make use of analytical tools

Utilize the analytical tools like charts and graphs available in your trading app. These tools help you analyze market trends and patterns, making it easier to identify potential trading opportunities and adjust your strategy accordingly.

Base decisions on research

Make sure your trading decisions are based on thorough research and analysis rather than emotions. Dive into company reports, stay informed about relevant news, and use technical analysis tools to ensure your decisions are well-founded and aligned with your investment goals.

Conclusion

In conclusion, leveraging stock market apps can greatly enhance your trading experience, providing accessibility, convenience, and powerful tools at your fingertips. By adhering to the tips outlined in this article, you can trade with confidence and efficiency.

0 notes

Text

#breakout#stock market#ipo#finance#bse#banking#investing#memes#mensfashion#invest#100 days of productivity#stockmarket#sam stockman#stockmanagement#baxter stockman#stock maket news

0 notes

Text

0 notes

Text

0 notes

Text

UltraTech Cement’s acquisition of Burnpur Cement’s grinding assets in Jharkhand marks a strategic milestone in its growth trajectory. This expansion not only signifies the company’s geographical diversification but also underscores its unwavering commitment to meeting the evolving needs of the construction industry. As UltraTech Cement continues its journey of expansion and innovation, this acquisition stands as a testament to its vision of cementing a stronger, more sustainable future for India’s infrastructure landscape.

0 notes

Text

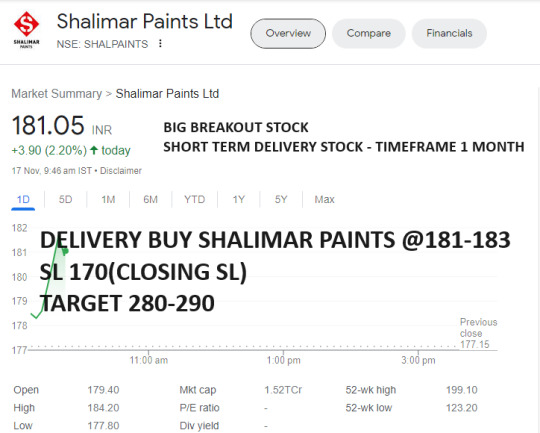

AGGRESSIVE DELIVERY BUY SHALIMAR PAINTS @181-183

SL 170(CLOSSING SL)

TARGET 280-290

1 note

·

View note

Text

0 notes

Text

youtube

🚀📈 Discover Dalal Street's Hottest IPOs! 📈🚀

Are you ready to ride the IPO wave and level up your investment game? Our latest video unveils the secrets of Dalal Street's booming IPO market! 💰

🔥 Dive into the world of high-stakes investments and explore the most anticipated Initial Public Offers. From JSW Infrastructure to Valiant Laboratories, we've got the inside scoop on where to put your money.

📊 Get ahead of market trends, learn expert strategies, and make informed investment decisions. Don't miss this opportunity to supercharge your financial future!

👉 Watch the video now

Remember, knowledge is power in the stock market! Share this video with your Tumblr community and help them make smart investment moves. 🤝💡

#stock market#ipo#dalalstreet#stock maket news#stock market analysis#investment strategy#invetment#investment insights#market trends#market analysis#market research#Youtube

0 notes

Text

#stock market#study inspiration#study motivation#stock management#baxter stockman#stock maket news#100 days of productivity#studying

0 notes

Text

Master Technical Analysis in Ahmedabad | Learn Trading Strategies

In financial markets, understanding price movements is very crucial. In fact, grasping these movements simply means knowing the difference between profit and loss. This is where a well-designed technical analysis course comes into play. The course sharpens trading skills of learners by equipping them with knowledge and tools they need.

Understanding Technical Analysis

Technical analysis is all about examining past market data, mainly price and volume. This is to predict future price movements. When a person knows how to analyze charts and patterns, identifying trends and making informed decisions about when to buy and sell securities becomes easier. There are many technical indicators that have their role to play in the process. These indicators provide valuable insights into the overall market behaviour.

Joining the Best Technical Analysis Course in Ahmedabad is Crucial

At Money Plant Trading Academy, we offer comprehensive technical analysis course, for beginners and seasoned traders. The course is unique. Here is why:

The learners will gain knowledge from the experienced traders who know the markets well. The real-world insights from these experts will help learners understand complex concepts easily.

Money Plant Trading Academy provides hands-on learning. The course involves live sessions where learners apply technical analysis techniques on real charts and thus develop their confidence level in trading abilities.

The curriculum of our technical analysis course in Ahmedabad focuses on strategies which can result in profitable trading. Learners are able to identify patterns and indicators which enhance their decision-making.

Prominent Technical Indicators Covered

Moving Averages : Moving averages are foundational tools in the world of technical analysis. They reveal trends over time. The course will provide knowledge about simple and exponential moving averages to learners so that they can assess market momentum more effectively.

Relative Strength Index : RSI, Relative Strength Index, measures speed as well as change of price movements. It ranges from 0 to 100. It is important for you to understand how to study RSI to improve trading strategy and thus identify conditions that are oversold or overbought.

Bollinger Bands : This consists of middle band (SMA) and two outer bands which reflect market volatility. When you learn how to use Bollinger Bands, you can spot potential price breakouts as well as reversal points. This can enhance trading decisions.

MACD : MACD, Moving Average Convergence Divergence, is a momentum indicator which shows the relationship between two moving averages. This invaluable tool helps to spot potential buy and sell signals.

Fibonacci Retracement : This indicator reveals potential support and resistance areas based on Fibonacci sequence. A person who masters this level will deepen his understanding of price movements.

The technical analysis course will include real-life applications. The learners will be given real case studies to analyze and see how these indicators performed in various scenarios. The course covers stock market basics, technical analysis from scratch, advanced technical analysis, financial derivates, commodity-currency derivatives, equity pre-primary trading models and more.

Join Money Plant Academy to Explore Technical Indicators in Trading Journey

Take your trading skills to the next level with our technical analysis course in Ahmedabad. Learn market trends and identify profitable patterns, your path to becoming a successful trader. Sign up today!

#stock market trading#stock maket news#stocks to buy#advanced technical analysis in ahmedabad#stocktrading#stock analysis course in ahmedabad#advance trading courses in ahmedabad#investing stocks#stock market#advanced technical analysis course

0 notes

Text

How can one begin investing in stocks in 2024?

Investing in stocks can feel overwhelming, especially for beginners, as it may seem complex or risky. However, with a clear understanding, you can confidently begin your investment journey. In this article, we'll break down the costs involved in investing in stocks, discuss the various types of stocks available, and provide guidance on selecting the best options for you.

How Much Does it Cost to Invest in Stocks in 2024?

When you start investing in stocks, knowing about the various charges involved is important. Here's a breakdown of what you can expect:

Transaction Costs

These are fees charged by brokers to help you make trades. Thanks to discount brokers, these fees are getting lower. Along with brokerage, brokers collect taxes and other charges on each transaction, like the Securities Transaction Tax (STT), SEBI charges, Goods and Services Tax (GST), and more.

Demat Charges

Your Demat account, where your stocks are held electronically, is managed by central securities depositories like NSDL or CDSL, under government supervision. While your broker sets up the account, you'll need to pay small annual fees (usually managed by your broker or platform) to keep it running smoothly, typically ranging from INR 100 to INR 750.

Taxes

When you make a profit from your investments, you'll owe a portion of that profit to the government. For stocks, if you hold them for more than a year, you'll pay a 10% long-term capital gains tax. If you hold them for less than a year, you'll pay a 15% short-term capital gains tax. These rates can change depending on any additional charges imposed by the government.

Types of Socks to Buy in 2024

Let's now take a closer look at the various types of stocks you might want to consider investing in for the year 2024:

Large Cap Stocks

These represent the top 100 companies by market capitalization, known for their stability and established market presence. While they may not grow as quickly as smaller companies, they often provide steady dividends and are considered less risky.

Mid-Cap Stocks

Falling between large and small caps, these companies rank from 101st to 250th by market capitalization. With moderate risk and potential for growth, they can offer opportunities for investors seeking a balance between stability and potential returns.

Small Cap Stocks

These are stocks ranked 251st and below by market capitalization, usually from smaller, lesser-known companies. While they can be more volatile, they also present the possibility of substantial returns for investors willing to take on higher risk. Keep in mind that small-cap stocks may have lower liquidity, impacting ease of buying and selling.

How to Choose the Best Stocks?

Here are some valuable tips on how you can choose the best stocks to invest in for the year 2024:

Know Your Risk Tolerance

Understand how much risk you're comfortable with based on factors like your age, financial goals, and family responsibilities.

Invest Regularly

Set aside a consistent amount of money for investing each month. Consider using a Systematic Investment Plan (SIP) to invest the same amount regularly.

Diversify Your Portfolio

Spread your investments across different types of assets, industries, and company sizes to reduce risk.

Adjust Over Time

Regularly check and adjust your investments as your life circumstances change. This ensures your portfolio stays in line with your goals and risk tolerance.

Conclusion

In conclusion, starting your journey into stock investment in 2024 is all about knowing your comfort level with risk, investing regularly, diversifying your portfolio, and staying adaptable to market changes. With the right approach and tools like a stock trading app, even beginners can confidently step into the world of stock trading and begin building their financial future.

1 note

·

View note

Link

#rishabh instruments limited#ipo#ofs#share#share market#stock#stock market#stock maket news#stock management

1 note

·

View note

Text

#education#stockmarket#stockmarketeducation#stock maket news#india#digitalmarketing#educationforlife#forextrading#forexmarket#personalitydevelopment#publicspeaking

0 notes

Text

Understanding Stock Market Indices: Benchmarking Your Investments

Stock market indices are critical tools for investors and financial professionals to track the performance of various segments of the stock market. These indices serve as benchmarks, providing a snapshot of the overall market or specific sectors, helping investors gauge their own investment performance and make informed decisions.

In this article, we will explore the importance of stock market indices, how they work, and how investors can use them to benchmark their investments effectively.

What are Stock Market Indices?

Stock market indices are measures of the performance of a specific group of stocks representing a particular market or sector. Each index tracks the collective performance of the constituent stocks and provides a numerical value that represents the overall movement of those stocks.

How Do Stock Market Indices Work?

Stock market indices are typically calculated using two main methods: price-weighted and market-cap weighted.

Price-Weighted Indices: In a price-weighted index, the performance of each stock is weighed based on its stock price. Stocks with higher prices have a more significant impact on the index's movements. Examples of price-weighted indices include the Dow Jones Industrial Average (DJIA).

Market-Cap Weighted Indices: Market-cap weighted indices, also known as capitalization-weighted indices, give more weight to companies with larger market capitalizations. The market cap is calculated by multiplying the stock price by the number of outstanding shares. Examples of market-cap weighted indices include the S&P 500 and the NASDAQ Composite.

Why Are Stock Market Indices Important?

Measuring Market Performance: Stock market indices provide a snapshot of how the overall market or specific sectors are performing. They help investors understand the direction and magnitude of market movements.

Benchmarking Investments: Investors use stock market indices as benchmarks to compare the performance of their portfolios against the broader market or specific sectors. This comparison helps investors assess the success of their investment strategies.

Asset Allocation Decisions: Asset allocation is a critical component of investment management. Stock market indices aid in determining how much of a portfolio should be allocated to different asset classes based on their historical returns and risk characteristics.

Market Sentiment: Market indices can reflect market sentiment and investors' confidence. Rising indices indicate positive market sentiment, while declining indices suggest caution and uncertainty.

How to Use Stock Market Indices to Benchmark Your Investments

Identify Relevant Indices: Determine which stock market indices are most relevant to your investment portfolio. If your investments focus on large-cap US stocks, the S&P 500 may be a suitable benchmark. For technology-focused investments, the NASDAQ Composite could be more appropriate.

Compare Performance: Regularly compare the performance of your investment portfolio against the selected benchmark. Assess whether your portfolio outperforms, matches, or underperforms the index.

Understand Deviations: It is essential to understand that deviations between your portfolio's performance and the index are normal. Factors such as fees, taxes, and individual stock selection can impact the performance of your portfolio.

Reevaluate Investment Strategy: If your portfolio consistently underperforms the benchmark, reevaluate your investment strategy. Consider diversifying your holdings, adjusting asset allocation, or seeking professional advice.

Stay Informed: Keep abreast of changes in the selected indices and market trends. Regularly reviewing your investment performance against benchmarks will help you make timely adjustments to your strategy.

Stock market indices play a crucial role in the investment world, providing investors with valuable insights into market performance and acting as benchmarks for comparing their investment portfolios.

Understanding the workings of stock market indices, their importance, and their relevance to your investment strategy can help you make informed decisions and set realistic investment goals.

By regularly benchmarking your investments against relevant indices and staying informed about market trends, you can navigate the dynamic world of investing with greater confidence and make adjustments to achieve your financial objectives.

This post first appeared on my website: Solaris News.

0 notes

Text

📊 Discuss the differences between long-term 🆚 short-term trading.

🔰 Mastering Long-term vs. Short-term Trading!

☑ Long-term Trading:

🔸 Invest in assets that keep for a long period to generate income.

🔸 Pay attention to the performance of the entire asset rather than price swings

🔸 Requires dedication, self-control, and a view of the future.

🔸 Less risky; maintain growth potential during market ups and downs.

🔸 Needs less time and effort.

✅ Short-term Trading:

🔹 Buy and sell assets within a few days or weeks to gain.

🔹 Focusing on short-term price movements to grow.

🔹 Riskier due to unpredictable short-term price changes.

🔹 requires time, effort, and trading experience.

🔹 Provides quick gains but also increased the risk of financial loss. It’s the best choice for aggressive investors.

🌟 Embark on a journey of discovery and growth! Join us for captivating content that ignites your curiosity.

Explore more at 👉👀

Connect at 📱 +91 8750000121

🤝Here's to your success, may your trades be prosperous and your investments bloom! Wish you a happy 'ZERO BROKERAGE' trading.🚀🌷

⚠ Note.-Investments in the securities market are subject to market risks, read all related documents carefully before investing.

#investing#branding#longterm investment#equity#mutual funds#commodity#algo trading#options trading#futures trading#nifty#nifty50#nifty today#stock maket news#like#comments#people#tradelikeapro#thank you

0 notes