#PLUS we probably have to move out of the house weve been living in for like 18 years next year

Explore tagged Tumblr posts

Text

well i posted that post like 4 months ago how 2024 will be good, and so far, just reaching 3 months in, my grandma died and my uncle got cancer and my sibling's apartment flooded so bad they had to move back here. so well. only up from here really 👍 in less than a week my other uncle will be here for 2 weeks (booked the tickets before the flooding) but there is little room to spare so lets see how that goes

#mine#my uncle and sibling are as fine as can be#OTL sorry to overshare before midnight pst but im worried for my mom too#she has a bad heart condition and has been so stressed out since like. august. about things i cant help with or change#PLUS we probably have to move out of the house weve been living in for like 18 years next year#and also its my dead dads birthday on saturday (explodes)#so things are ... not great#smiles. well we made some nice bread that had cheese and garlic herb butter in it for dinner

13 notes

·

View notes

Text

The Senju brothers finding out their little sister is going out with Madara 💥

Lately I’ve been into family drama and such, so when anon requested this I couldn’t say no lol Btw thank you, anon, for this scandalous incredible idea 😘

In this scenario/list/idk we have the Senju brothers finding out their younger sister and Madara are seeing each other. As you might expect, the news provoke different reactions in each of them, but the main point is how she will deal with this situation.

So I’m gonna shut up now and leave you with this:

Fandom: Naruto | Senju Brothers

Warnings: none, just a heated argument and a looong list ahead

Symbols: 💙 | ◻ | ▶▶

Hashirama

Being Hashirama and Tobirama’s younger sister, of course you and Madara were known to each other, but being more than just a friend to him wasn’t in your plans… until now 😳

You used to admire and respect each other, not only because of the alliance between your clans, but mostly because you both were worthy being praised. Plus Hashirama has always been talkative about his best friend’s qualities, which slowly transformed the way you saw the Uchiha leader, but you only noticed this a few weeks ago

During a meeting/party/whatever at your brother’s house, Madara and you spent more time than usual talking to each other. Turned out that you discovered many things in common beyond the fact that you two were shinobi, including your views on life, politics, etc.

If Hashi noticed something, you couldn’t tell, but it was strange that during all the time you were there together he didn’t come to join you (not that you complained about it)

You and the Uchiha saw each other a few times on the next days, and the feeling of familiarity between you only grew. You weren't sure of how to call it. You were fond of each other, but saying that you were just friends didn’t seem to be enough now

You both agreed that it was too soon to name it as a date or something, so you didn't tell anyone, not even your brothers

You wanted to be sure of your own feelings before making a statement. Were you still friends? Were you really in love? Was it just a crush, a superficial attraction? You wanted to understand what was going on

During this time, Hashirama didn’t make a comment or anything that suggested that he was aware of this situation, so you were a bit surprised when one day, he came to talk to you about it

“So you and Madara are engaging in a secret romance and you dared leaving your big brother out of this, y/n? Where did you learn such behavior?!”

“Don’t you really know?”, you smirked

“Excuse me?!”

“Am I the first person in this family to keep secrets that involve Madara, Hashi?” 😑

THE REDNESS ON HIS CHEEKS WAS PRICELESS LMAO

Hashirama was your elder brother aka the person who has been taking care of you since your parents left this world, so not only his worries were valid, but he also had the right to know, so yeah, he was a bit disappointed that you didn't tell him first

Now, I think his feelings about this were not as plain as some can imagine. In fact, he had a mixture of contradicting feelings and ended up talking about them more than demanding an explanation from you

On one hand, he was happy because he loves you both, so finding out that his little sis and his soul brother might have started a relationship was exciting ���

On the other hand, he was worried because you were even younger than Tobirama, while Madara was not only older but more experienced than you and he knew his friend’s flaws better than anyone else

However, Hashi was an understanding person and was willing to listen, so you explained your feelings and your reasons to him, as well as part of your conversations with Madara, pointing out that making things this way was a mutual decision, for the best of you two and the people you knew

He pointed out that despite not calling your meetings a date, you two were already thinking as a couple 😏

You blushed and asked him to keep quiet, at least for a while

He promised you he would not say anything, but not before hugging you tight and crying about how his lil sis was growing up so fast saying how much he was happy for you two 💓

Tobirama

Prepare yourself to get your ass smacked and burning for an entire week lmao

Okay, so as you can easily imagine, it didn’t take much effort from Tobirama to find out that something was going on between you and Madara

It wasn’t that you two were reckless, it was just that your second brother was not stupid an observing man (and tbh how hard it must be to keep a secret from a smart sensor shinobi, uh?)

Unlike Hashirama, who took some time to connect the dots, he noticed small changes in your routine and behavior since the start

Why have you been so quiet, distracted lately? What has been occupying your mind? You were spending more time alone and/or out, and (yeah, he noticed that) you weve more concerned about your looks and manners than usual. Of course you were up to something

Besides, you’ve suddenly became too defensive towards Madara and the Uchihas in general. Anything Tobirama said that sounded slightly negative about them was promptly refuted by you. You seemed to have a deeper understanding of their ideologies now, as if you were having long conversations with their leader

So, it was with no surprise that you saw the storm coming ⚡

One day, Tobirama came to your room without warning and just by looking at him you knew he figured it out

How did he find out? Hashirama and his big mouth, probably. Or did he follow you and saw you two together? Well, he could have simply traced your chakra and once he sensed Madara’s close to you, the riddle was solved. But did it matter now?

His first words: “What is it?”

You don't need an explanation: you little sis + Madara Uchiha problem™ + maintaining your privacy keeping secrets from him

And now you were a brat possessed with the Uchiha evil, and not just with any Uchiha evil but with MADARA’S Uchiha evil 🔥🔥🔥

There was no way for you to have a normal conversation in the current circumstances. You had a heated argument, and I’m sure you’re capable of imagining what it means to have a heated argument with Tobirama

“Tobi, listen to me, I-”

“No YOU listen to me you brat possessed with the Uchiha evil”

Your brother didn’t even let you speak. He stated that not telling anything to your elder brother was not only wrong, but some sort of betrayal, then started remembering serious sh*t from the past when you were so young that you couldn’t even carry a sword the right way and everything you’ve already heard from him countless times before

But now you were done with his incapacity of simply listen, so you just stated that your elder brother Hashirama already knew it and that it was you who asked him to keep it a secret just for a while

“Hashirama is our leader, and if he knows and approves it, that’s enough for me and that should be enough for you too!”

“Hashirama is too soft with you, and this is why you behave like this!”

“Like this how? Living my life without asking for your permission? Is that what you mean?”

“Being unnecessarily connected with a man with whom we need to be careful in our treats, that’s what I mean. Our elder brother purposely ignores the fragile spots of this alliance and you know it, so there’s no excuse for your attitude!”

“Speaking like this about our ally could be considered some sort of betrayal, Tobi. If I was you, I would be careful!”

“Why? Are you going to tell him in your next date?”

“GET OUT OF MY ROOM!”

“Yes, I’m getting out and having a serious conversation with our brother about this!”

“Tobirama, the war is over! We all have to move on, whether you like it or not! So instead of wasting your time with something that’s none of your business, you should go and live your life as well!”

Yes, you lost your temper, and you only realized it when your brother fell silent and lowered his tone

“You are right, lilttle sister. But let me tell you something. My way to show that I care about you might not resemble Hashirama’s, but my feelings towards you are not less deep than his”

You were heartbroken after he left, yes, but you had to stand your ground. Tobi could be very controlling if he was given space to, so you had to learn to deal with this early in your life. In this point you were better than Hashi, who was too easygoing for his own good, so you felt like you had to be strong on your resistance for both of you, otherwise Tobirama would dominate every aspect of your life without even realizing. You loved him as well, but your decisions didn’t have to always gravitate towards him

Still, you weren’t proud of your words about the war. That was a sensitive matter for Tobi. Despite his silence about it, you sensed he was offended. You knew you went too far 💔

The conclusion

Later, Hashirama came to mediate the conflict, and he had some words for both of you. When Tobirama and you found ourselves in the same room, you were about to start a new argument, but your eldest brother elevated his chakra and demanded you to be silent, bc now it was his time to speak

“Brother, I understand you are worried about our sister and I am sure she acknowledges your efforts to protect and guide her, but that doesn’t give you the right to interfere in her decisions regarding her own life. She’s right to remind you about our alliance with the Uchiha clan and to say that we need to move on. If moving on means starting a relationship with Madara in her case, things are what they are. It is her life, not yours. And do not think I haven’t talk to her about this. Y/n is no longer a child, Tobirama. She’s aware of the challenges of maintaining such connection with the Uchiha leader”

“Little sister, I understand that our brother’s way to express his worries uses to irritate you. It happened many times when you two were little. But that doesn’t invalidate the honesty of his intentions. He loves you and cares about you as much as I do. Besides, I’ve already talked to you about thoughtless mentions of the war. That was a though period for all of us, which includes your brother. You were not with us at the battlefield, that’s true, but you weren’t immune to the dark consequences of what happened at it. You mourned our siblings with us, but you were too young to understand everything that was involved. That was not Tobirama’s case. He doesn’t talk about it, but he has his reasons for that, and this must be respected”

Hashirama left you two hoping you would be capable of getting along again, which eventually happened, but at its own pace

The next day you found Tobirama working at his desk. He already acknowledged your presence, but that didn’t discourage you. You hugged him from behind and said you were going out to the river, and he could come with you if he wanted to fish. His first response was a groan

“Is there more people coming with us?” = “Is there any possibility of Madara showing up?”

You kissed his bristly hair

“No. Just us. I promise. And when we get back, I’ll cook fish for you”

Your brother’s next groan meant many things at once, “I agree”, “Thank you” and “I apologize” being some of them 😜

#naruto headcanons#naruto scenarios#naruto request#madara#hashirama#tobirama#hashirama headcanons#tobirama headcanons

316 notes

·

View notes

Text

I feel like Ive aged at least 6 years since covid started. Im angrier. Less adapted to being outside then I used to be- which is saying a lot. This time last year I was?? Actually healthier mentally then I had ever been and looking forward to having the house alone for a month which?? Was the most freedom I wouldve ever had.

A lots fucking changed. I drove halfway across the country- all 30 hours at once with my big brother AND two elderly dogs, plus my cat. All animals on too many drugs (the vet said they couldnt overdose, and then failed to give any further instruction) cami peed on herself twice, unable to move. I had to waterboard her in Phoenix, a truly terrifying hell city where all the roads are raised and overlapping and its a hot as shit cause its?? What june?? Time was so fake this year I mustve just been stoned the whole time till I ran out of weed, and since moving its been a relief to be able to turn off the spinning anxious thoughts for a few hours

my big brother joined us. He brought a new dog with him which?? Is always a lot, plus I have this pack of dogs now cause the puppy wouldnt leave the super cancer ridden dog alone, and Im able to get her cbd regularly here, so shes always comfortable now instead of just?? Sometimes which is a lot nicer. We didnt think shed make it to chrisrmas. I thought shed die with me home alone to take care of everything, like always. It was almost a relief, I wouldn't have to coach my brother through the grieving process at least, and I had already finished. Its hard now even, for me to realize she might even have another christmas (but I wont hold my breath)

I feel safer going outside here then I did in Austin. I only went out a handful of times in texas, for the last few months I was ordering almost all groceries, and only going to the store once mask mandates were mandatory (theyre not anymore. Im so worried for texas. I missed a huge freeze by mere months. I dont think my elderly dogs wouldnt survived it. If I was alone with them, Im not sure I woudlve.

My parents took my brother to mexico with them. I begged them not to go, told them how irresponsible it was to travel across boarders. To visit an island and take all the plane germs with. I told them that even if my mom and brother were staying at home all day with me, my dad was still going to work and he didnt know what his coworkers were doing. That they wouldn't know what the people on the plane were doing. That at any point they could become the stupid americans that killed half an islands population.

They left a week after today last year. The boarders were closed the next day. Their friend has been traveling back and forth ever since. I have no idea how, except for the fact shes white and rich and wont hesitate to destroy a child, so I can only imagine how shed treat costomer service.

I will no longer allow this angry aggressive woman to ever make me feel bad, and I will allow myself to finally fight back. Im an adult, maybe not all the time (cause lets be real I'll always be a bit too eccentric for most) but when I get angry and allow myself that anger, it's not a bad thing. Anger doesn't have to make me feel like Ive done something wrong. Im usually very just in my actions, and I wont allow my parents influence to tell me all anger is misdirected and hurtful for reasons I couldnt understand. Its okay for me to be angry.

I think being alone with animals for months is at least reassuring that my childhood was unreasonable if nothing else. Which of course is a silly polite society term for pretty fucked, if nothing else.

My aunt had to gall to say weve had a good 2020 cause our family wasnt hurt, and I had to walk away from the zoom call. I haven't attempted communication with any of them since, not that I normally do. Of course none of us died, all rich old white people, most of them retired and able to stay home all day (not that all of them did, I learned about my grandfathers routine and just.. Im honestly surprised no one got it yet. Of course I knew from the beginning if anyone was gonna get it and die, it probably wouldve been me. Hence the 8 months of solitude before the move.

Was the move in August?? Im so unsure about time. Even with 2020 vision.

I tried to date when I moved here. Strictly on tinder. What was the point? On and off testosterone due to the wonders of texas, hadnt changed my body nearly as much as they should've a year after being on them. I look much more handsome now. Im also allowing myself to toss gender aside completely. He/him doesn't mean man, and they/them dont mean nonbinary, so why not mix them since Im?? Not really either.

It wasnt even a thought process like that to start. Much more "this is nice" which I think more gender should be allowed to be. Dont gotta be deep just comfortable.

I wont ever allow my parents to forget what they did. I ended up with three dogs I didnt want (I was so looking forward to not having any dogs) and I ended up taking care of my brother. Again. Its easier without my parents at least. Everything always is. My dogs are even happier. Cami finally isnt anxious 24/7. Again, a sad reminder my childhood wasn't great. Daisy is healthier. Trauma can be stored emotionally or with health issues, often both. I think the cancer dog getting better and?? Surviving and thriving so much longer then the vet said (how good was my old vet?) Is another unfortunate nail in thay proverbial coffin.

Im not as soft and openly loving. Im even more touch starved somehow. Harsher. I still want to choose love and compassion, but Im not letting myself fall into the trap of being so nice people wont be nice to you. Fighting back is something I wont feel shameful about, because it never stopped me from doing it completely anyway.

I was already reaching this on my own though. This was just more coffins, more nails. This didnt need to happen. We know our government let this happen. Its still letting it happen. Im not sure when Im getting my vaccine. My big brothers sick of quarentine and keeps trying to get us to go out. Sometimes I yield, and we go to a park, or the top floor of the parking garage. I get a vegan hotdog from nearby. We talk and laugh and were genuinely just. Boys being boys.

I shouldn't have to deal with parent shit anymore. I do though, especially since two out of three are unemployed and we can really only afford to live here cause of them (they owe me if anything though. Especially with my brother and these animals) I hope I can get a job soon. Or maybe even go back to school. Im lucky I had so much saved up (for top surgery, which I guess wont happen before Im 25 like I really tried for. I wouldve done it before now, but texas waitlists and rules kept holding me up. I literally went to an appointment in dallas, a 4 hour drive, just to found out the surgeon canceled on me for the second time)

Its incredibly depressing, and I know Im lucky to have had that stash. So many people didnt have anything and lost so much. People lost people. Half a million at this point. I remember when it got to 300,000 and I just?? Felt so awful it was so close to how many people we lost to AIDS. Its over that by so many now. It doesn't really stop, does it??

Is that catholic guilt?? Or maybe just irish guilt in general. Is it something I inherited or earned through all the end of the worlds and once in a lifetime recessions Ive been through. Im not sure how many off the top of my head, theyve been coming since I was so small and its always more and more. Im not even catholic anymore. I cant stop being irish though, even though the brits tried (and succeeded. Weve lost a lot. The current royal cotastrophy is bullshit as well, the only person who deserves a royal title is from Meniappolos

My home is decorate all inside for st patrick's day. My big brother loves it so Im going all out, and its def making me feel much more irish then usual (which is a lot Im over half)

I think I just wanted to say Im not the same. I hope I can still be happy an obnoxious is public. I wonder if I remember how

2 notes

·

View notes

Text

well it was fun while it lasted

and so ends the year where i was constantly aware of when id next see dove

early 2016-mid 2017 i ALWAYS knew when i’d next see her, and i got a little too used to the feeling. i first met her in summer 2015 and i considered myself lucky to have that chance at all, even getting in that wasnt easy, and i didnt really think about every getting to meet her again cuz i just...didnt think i could. i moved out to california a couple weeks later and began to learn about all the opportunities it had for me. once liv and maddie got renewed for season 4, my friend and i are like lets just go to every taping and im like yah theres...no reason we cant? so i expected to get to see her p much every week for a number of months and i was ecstatic. then most of the tapings got cancelled one by one (or two by two at most) and every couple weeks id get my hopes up only for them to be torn down again. (also the tickets may have been free but getting them was not easy! you had to refresh the website for like 2 hours!) it hurt me every time but it taught me to not get my hopes up too high in the future. ofc, i still treasured every time i had with her, but i did even more so after going through that.

after mamma mia in summer 2017, i had no idea when id see her again and for that and some other reasons i had a major relapse the night after. i was def posting about it on here. that was miserable and the coming days, weeks, months, were rough too.

i got a random chance to meet her at the end of that year, then another early in 2018. these, ofc, lifted my spirits a lot and gave me more hope of the fact that random encounters with her can happen. and when i say random i mean RANDOM both of these were announced like a week in advance.

clueless put me back on the path id been on in years past. shortly before it, i got tix for light in the piazza in london, so i knew even after clueless, id see her again in 7 months, plus that gave me a LONG time to look forward to seeing her. disney channel fan fest ended up happening in between those to make it even better, and then shortly before london, i got my tix to see the show in LA, extending the period four more months.

but now its over. light in the piazza is behind me. i knew this day was coming and ive been through it before so its easier to deal with than it used to be but its still hard. especially because after mamma mia, even tho d3 wasnt confirmed, it was still likely, so i had hope that that would lead to more events and encounters soon enough. now i dont have anything like that to lean on.

the more that i think of it, this period has technically lasted longer than a year. d3 being announced in february 2018 basically signified id see her again soon. it didnt confirm it but it made it more likely. so its more like....the last almost TWO years of my life are over. yeesh.

but now that both lam and descendants are behind us, the future is so uncertain. album signings? concerts? more musicals? no one really knows. i wanna hope for the best and especially hope for more random encounters like in 2017/18, but i dont wanna rely on that and get disappointed if it doesnt happen.

i hate sounding like im entitled to any of this because i know how fortunate i am and that not everyone gets these opportunities. like i said, meeting her for the first time was beyond my wildest dreams. but for one thing, i just dont know what to look forward to now. to add on to it, ive been MAJORLY bored and lonely. ill have days upon days with no plans. i just sleep, dont leave the house, and have no social interaction. i dont like it that way and i try to make plans but it isnt always that easy. ever since i was little, ive thrived on having some big thing to look forward to. thats whats pushed me forward, but now i dont really have one. not dove or otherwise. i have some things im looking forward to, but only so big and only so soon. (my mom reminds me to remember that were going to NYC soon but it feels so far away. i need my Boys to heal me lol)

for another thing, and im probably worrying too much about this, i worry that if too much time passes between us seeing each other our relationship may fade away/she may forget me. ive been proven wrong about this before. weve gone like...8 months without seeing each other and not only does she remember me but she can spot me in a crowd/remember details about me/etc. but i always worry regardless, especially since its already been almost 6 months since we last interacted. and who knows how many more months it will be.

and lastly, the pain of the tapings getting cancelled still really hasn’t gone away. think about it, i STILL haven’t reached the amount of times i would have met her by summer 2016 had none of the tapings been cancelled or been overbooked. and its been THREE YEARS! the way it was organized was so shoddy and never felt fair to me. i get it, things get cancelled sometimes, but this was just out of control.

not only do i not know when ill see her next we dont even know when were getting any new content out of her. thats what ive been living on for 5 years. i had LAM and even after it ended i had descendants. now i dont know what i have. and all of that has become such a big part of who i am that i feel almost lost.

ill be starting work at the beginning of next year so at least i have a new chapter in my life to look forward to, one with significantly fewer boring days and plenty more social interaction. but the time between then and now is dragging on, and it’s only going to get harder now.

#ramble a rooney#im trying not to do as many personal posts on here cuz idk if it does me any good but#this week is like...important so i feel the need to talk about it#(guess who it involves ahaaa)#also this is long as hell and is mostly just for my own thought#but if you feel like reading and/or weighing in be my guest

1 note

·

View note

Text

Noona, you okay? (part 6)

Jungkook and You

Summary : Jungkook fall in love with someone as same age as Jin, you.

Genre : Fluffy.

Next Part

Attn: Gif not mine. Credit to the owner.

I was reading on my novel in the living room before I heard a bell sound. I don’t think I order anything today. I put down my novel on the table and walked to the door and looked through the peephole before opening the door. Jungkook? How did he know I live here? I never tell him. Well I was going to tell him but I haven’t got a chance yet.

“Hello Babe..” He greet me once I opened the door for him.

“Hai...” I opened the door and gestured him to come in. He then put away his shoes and went straight to the living room.

“How did you know I live here?” I questioned him while he already laid down on the couch. Looks like he ‘made himself at home’ since he’s already lying on the couch.

“From Ji Sung Hyung.” He answered while observing me, from head down to toe. What is that stare suppose to mean?

“What?”

Smile appeared on his lips. He shook his head and said “Seeing your messy bun hair style and you in your simple attire, I can’t believe that I am yours.” I narrowed my eyes. Isn’t that suppose to be ‘he can’t believe that I am his’? This proud maknae!

“Okay seriously, why are you here? I thought you have practice today.” That what he told me earlier. I approached him and stood in front of him. He then pulled me down to lie on top of him.

“Actually, I’m bringing you out.”

“Where?”

“My members. They said that I need to introduce you to them.” What? As if they didn’t know me.

“Why would you introduce me, they know me already.”

“They know you as y/n, a lawyer who worked for the company not as y/n, who is going to be their sister in law.”

“Ouh I am going to be their sister in law. Who I am going to marry then?” I said it playfully, trying to annoy him.

“Jimin hyung. You can marry him.” He said it with his sarcastic tone. He still remember about that?

“Really? Wow! I thought I am going to marry you.”

“Of course its me.” He pouted.

“Yeah it’s you Jungkook. Unless you want me to marry Jimin then...”

“Don’t even dare to continue your words Noona.” I smirked. Aww... Jealous Jungkook is something I didn’t see everyday.

“Aww... is my baby jealous?” He narrowed his eyes. I wiggled my right eyebrow. He rolled his eyes.

“Okay, I am going to change.” I got up and walked straight towards my room.

“Babe... Five minutes. If not I am leaving you here.” I stopped walking and turned my body towards him. Seriously? That is such a short time to change plus I have to do my hair, my make up, putting on my lens.

“What? No! I need to ....”

“Babe you don’t have to wear make up. Its only them and I don’t want you to show them how beautiful you are. Only I can see your beautiful side.”

“But..”

“Babe move now. Or else seriously.. you are going to hail taxi to go there.” I rolled my eyes, annoyed.

“Fine.” I walked to my room and closed the door harshly, to shows my annoyance to him.

***

I was greets by the six members when I entered their dorm. They were standing in front of me while Jungkook close the door and then stand beside me.

“Two three, hello.. we’re Bangtan...” Err what?

“Hyung.. I introduce you, the love of my life, y/n.” I turned my head to Jungkook. So this is what he meant by introducing myself to them?

“Ah hello, I am y/n. His girl.” I pointed Jungkook while saying ‘his girl’ part.

“Hai! I am Jimin.” Jimin then approached me and extended his hand to shake my hand. Followed by others. Even Yoongi and Jin did the same though I can sensed Yoongi insincere face doing that. This must be either Tae or Jimin’s plan and all of them were forced to do the same.

“So are we done yet?” I questioned them.

“Actually we have more things to show you. Just wait and see.” Hoseok said that playfully. Now what is that supposed to mean?

“But first, come in Noona.” Namjoon invited me in. Finally! I though we are going to stay in this position forever.

***

“Jinnie where is Jungkook?” I was helping Jin in the kitchen and Jungkook never came to check on me. Well, I am not trying to be clingy or what but I think that what any man would do if they brought their Girlfriend home. They must be worry whether their girlfrined will be able to familiarize themselves or not but since I know them already, I guess Jungkook didn’t have to worry about it so he left me here, in the kitchen with Jin.

“Maybe he’s playing game with Tae. Go check up on him.” He smiled. I walked to the living room but didn’t see Jungkook with them. Namjoom and Hooseok were watching movie while Jimin and Tae were busy playing the games. Yoongi? Well he’s already napping on the couch. Hooseok who was watching TV realized that my eyes was searching for Jungkook and told me that Jungkook is probably in his room. I then walked to his room and found his door were left open ajar. I approached his room and before I was able to push open it I heard him talking on the phone and that stopped me from entering his room.

“Why are you calling me now?” My eyebrows furrowed listening to that. His voice sounded weak, not the normal voice.

“No of course she’s not here. She’s in the kitchen helping Jin Hyung. I am in my room.” He continued talking.

“Oh my God! why are you crying? What happened Hee Ra?” He sounds so worry. I am still curious who is he talking to. I never see him with any girl in the company except for the staff.

“Why are you making it difficult now Hee Ra. I am with someone now.” Someone? He did not even mentioned my name to her but Hee Ra? Whose that? I never heard of this name before.

“No I didn’t moved on too fast. I am with her so that I can forget about you.” My eyes widened listening to that.

“God Damn it! Don’t make it to difficult for me Hee Ra.” Seems like I know Hee Raa now without even asking him. So I am just a rebound then? And he’s going to left me after he can fully forget about Hee Ra? I felt tears filled up my eyes. I walked to the nearest bathroom and that when I cried my heart out. Stupid y/n. It only been a month. Why are you crying as if you’ve been with him for a years. But he promised me. He promised he would love me, he would cherish me and he would never.... Oh my God! Now I felt stupid! Why would he wanted to be with me when we barely know each other. He proposed me after two days we’ve known each other. Yes y/n. You are the stupid one here, not him. You should never make a decision based on feeling again.

I was arranging the food on the table and Jungkook suddenly appeared and stand beside me. I guess he just finished his phone call with Hee Ra.

“You cook all of this?” He was really excited seeing there is so much food on the table. I shook my head. I tried my best to bring back my mood since I came out from the toilet but I can’t. My heart hurt so much and I think I can cry at any moment right now. Why would I stay in the first place? I should have gone after I heard that but no. I don’t want to answer any question regarding my disappearance nor I am ready to face the reality about me being just a rebound.

“Jin cooked it. I only helped a little.” I then walked to the kitchen again and took the other food and placed it on the table.

“Yah.. lets eat..” Jin shouted to all of them and in the flash, all of them ran to the table and took a seat. I took a seat beside Jungkook and his phone suddenly rang. Must be Hee Ra. He turned his body from me and rejected the call. He didn’t want me to see whose the caller is so that why he turned his body from me. Right after he put his phone on the table, it rang again. I didn’t have to see whose the caller is. I know that her. Jungkook took the phone and turned his body from me again.

“Jungkook just answer it!” Yoongi who was sitting opposite him was already pissed off. Jungkook then looked at me. I shrugged. He rejected the call again and continue eating and that when his phone rang again. I see Yoongi was already glaring at him, for not answering the phone.

“You can go to your room to answer the call.” I said that while chewing on my food. Yea, I can maintain a poker face in front of him when actually inside I am broken!

“Yea. Who know it might be important.” Namjoon agreed with me. Jungkook then stood up and walked fast towards his room.

“Are you okay Noona?” Jimin asked me. I think he realized about the changes of my behavior. I nodded my head.

“Noona, I heard you love to watch Run.” Tae tried to change the topic. I smiled. No mood to talk. No mood to make any joke. No mood for everything.

“Noona you have to watch the latest episode it was so...” Hooseok nudged Tae’s arm when he see me having no reaction about it.

“Noona, are you really okay?” Namjoon asked me worriedly. I lifted my head and nodded my head again.

“I am just tired. That all.” Weak excuse. I was really hyper when I came earlier. I even played game with Tae before I decided to help Jin in the kitchen.

***

“Noona, you okay?” I was replying a text from my lil brother when Jungkook approached and sit next to me. Jungkook asked me to come to his room after I finished helping Jin washing the dishes and while waiting for him to take a shower, I sat on his bed.

“Yeah. Why?” My eyes still on the screen.

“Cause you looked so down. I mean you were so hyper earlier. But you looked so down during the dinner and now too.” I did not reply him. To be honest, I didn’t know how to answer that. He took my phone from me.

“Jungkook...” I frowned.

“Babe something bothering you?” Yeah, you.

“I am just tired.” He frowned listening to that.

“Just stay here tonight. Beside you’re not working tomorrow.”

“Jungkook I can’t. I already asked my brother to fetch me up. He’ll be here in fifteen.”

“I can send you back. Why do you have to...”

“Because we are going back to our parent’s house tomorrow but my brother finished his work earlier than he expected today so we’re going back tonight and he’s almost here.”I interrupted him. He sound disappointed that I have to ask my brother to fetch me up when he can send me home.

“But its late.”

“Jungkook its only an hour ride. Its midnight. There will be no traffic.” My phone screen then lit up. I took my phone from his grab. My brother’s name appeared on the screen and I answered it immediately.

“Are you here? Okay, five minutes.” I hung up his call.

“My brother is here.” I stood up, put on my jacket and took my sling bag from his computer table.

“Are you sure you have nothing to tell me?” He looked at me,straight into my eyes. He looks so worry. I am the one that supposed to ask you that. You should just tell me I am just a rebound!

“I am going.” He then walked with me and I stopped him in the door.

“Just stay here. My brother is just outside.” He frowned.

“Goodbye Jungkook.” I walked straight to my brother’s car without even looking back, without waiting for his reply.

Masterlist

#bangtan boys#bts jeon jeongguk#jungkook#bts jungguk#jeongguk x reader#jungkook x you#jungkook x y/n#jungkook scenario#jungkook imagine#jeongguk#jeongguk imagines#bts imagines#bts scenarios#bts army#golden maknae

21 notes

·

View notes

Text

Explore the pros and cons and determine in case a bridging loan suits you.

Explore the pros and cons and determine in case a bridging loan suits you.

Forward a demand to talk with a true mortgage loan expert or contact us on 13 78 79.

Into the right circumstances, bridging loans will help with the transition from a single house to some other, without you needing to sell first. Find out whether its a great choice for you.

How can a bridging loan work?

A lot of people offer their old house first, and then purchase their brand new house or apartment with the available equity. But there are occasions when buying first may suit you better.

To put it differently? A bridging loan gives you the funds you’ll want to buy your brand new house before youve offered your present home.

Lets say youve found the household you would like, but havent offered the only youre in. Youll need finance to satisfy the space between getting funds from the sale of one’s existing house and purchasing your brand-new home. Its really providing you a credit line to pay for the connection between buying the brand new home and getting settlement funds regarding the old.

But its essential to keep in mind that youll need certainly to spend your initial mortgage while the bridging finance loan in the time that is same. Youll http://cash-central.net have to exhibit proof that one can repay the bridging finance interest expenses throughout the duration between exchanging.

When youve offered your home, youll have actually one year to settle the price of the bridge.

Whens the time that is best to market?

Whether its location or life style, there are lots of reasons you should offer. However your timing might not always coincide utilizing the perfect home market conditions, so its essential to understand two things concerning the market.

Seasonality

The housing market modifications using the periods in Australia. Typically, springtime is the most time that is popular sell, using the greatest amounts of product sales.

But theres a side that is plus attempting to sell your property during quieter durations, like cold weather. With less properties to pick from, more possible purchasers will arrive at see your destination.

Market conditions

Sellers market: As soon as the interest in houses is more than the quantity of houses available in the market. In a sellers market you are more prone to offer your home quickly

Buyer-favored market: As soon as the wide range of homes on sale is more than the amount of purchasers who will be looking to purchase. In a purchasers market, its exactly about being practical about cost and being client.

Helpful Suggestion

Exercising exactly exactly what the home marketplace is doing and where its going makes it possible to determine when you should purchase or offer. Take To:

Maintaining attention on regular home product sales in your town of preference

Remaining as much as date aided by the wider economy and interest price motions.

So that you can figure out the time that is best to offer, youll need certainly to think about your individual circumstances, cause of selling, market conditions and regular facets.

Advantages and disadvantages of offering before purchasing

Youll know the amount that is exact have to put to your next purchase

You do not need certainly to hurry it, and certainly will wait until you may be happy with the purchase cost of your home

You wont need to apply for the bridging loan to finance both properties – and you also wont have to pay for two loans at the same time.

The home you’ll need is almost certainly not in the marketplace, meaning youll have to transfer without a place that is permanent live

You have to cover lease and also have the expense that is added hassle of going twice

Costs might increase once you offer and also you may be priced from the market, or otherwise not capable of finding your perfect house when it comes to right cost.

Benefits and drawbacks of shopping for before offering

Avoiding stepping into a leasing home and numerous moving costs.

Perhaps maybe Not fretting about getting a new home to purchase in a rush

Benefiting from a increasing market and possibly getting decidedly more for the cash, and making more from your own home purchase.

You might need a bridging loan so that you can fund the property that is new.

Interest on bridging loans is more compared to interest on our standard term loans

Youll have actually the extra expense and anxiety of experiencing to settle two mortgages simultaneously

It would likely force you into offering your property that is original at cheap, if you want the amount of money to generally meet your loan re payments. Bridging loans should be paid back within year

You need or expected, you may have to find more funds to cover the shortfall if you cant sell your existing home for the price

If youre making a conditional offer on a residential property, you will need in order to make an increased offer to persuade an owner to keep the house while you sort away your needs.

Choices for whenever bridging finance isnt for you personally

Buying before selling and taking right out bridging finance has its own risks. Weve run through the advantages and cons, however you must be really more comfortable with the potential risks. Additionally you must ensure its economically feasible for one to handle two loans for a period. Or even, attempting to sell first could be the strategy to use.

If youve sold and today have to find a brand new house, there are some steps you can take to help make the process smoother and minimise the worries.

Attempt to negotiate a lengthier settlement period from the purchase of your house, and that means you do have more time and energy to locate a brand new household and just have actually to go when

Organise to hire your house through the owner that is new offer you more hours to get a home

Stick with family members and put your items in storage space to prevent leasing costs whilst you seek out a home that is new

Place your products in storage and rent furnished accommodation to save the trouble of going and unpacking twice.

As with every economic decision, everyones place is significantly diffent. Prior to deciding to simply take the loan out, have a chat to at least one of our bankers to see if bridging finance suits you.

Important info

The info found in this informative article will probably be of the basic nature just. It’s been prepared without taking into consideration any individuals goals, economic situation or requires. Before functioning on these records, NAB suggests whether it is appropriate for your circumstances that you consider. NAB suggests which you look for separate legal, economic, and taxation advice before functioning on any given information in this specific article.

L’article Explore the pros and cons and determine in case a bridging loan suits you. est apparu en premier sur The Love Quotes | Looking for Love Quotes ? Top rated Quotes Magazine & repository, we provide you with top quotes from around the world.

from WordPress https://ift.tt/2TpD93r via IFTTT

0 notes

Text

THE PERMANENT RAIN PRESS INTERVIEW WITH KID LUCIFER

The members of Kid Lucifer have been keeping busy since their move out east. Comprised of Henry Girard (vocals, guitar), Linus Heyes (lead guitar), Sam Schuette (bass) and Quinn Letendre (drums), the “garageadelic psych rock n' roll” band released their debut album Nothin’ But Bangers this past summer, and are no strangers to the Montreal live music scene. Their new singles “Serrated Knife / She Loves Me” just dropped earlier this month. All about positive vibes, good energy, and some pretty groovy music – Kid Lucifer is paving a name for themselves, albeit provinces away from their hometown of Vancouver.

You’re originally from Vancouver, but made the move out east and are now based in Montreal. Tell us about the reason behind this transition, and how it’s been for you out in QC.

Montreal has been amazing for us. It’s a beautiful city, and we’ve met so many amazing people who have helped us out and encouraged us along the way I couldn’t begin to name them all. The city offers so much talent and houses so many fantastic bands, it really forces us to work as hard as we can and to push the limits of our song writing and performance just to keep up. I think that aspect has made us better musically, and tighter as a group of band mates and friends. There’s always so much happening, so many exciting opportunities as an artist and inspiration is everywhere. Plus, everyone we know who visits us from Vancouver ends up wanting move here (and some have), so that probably tells you everything you need to know!

You have 2 new singles out, “She Loves Me” and “Serrated Knife.” They’re quite different in sound but the contrast behind garage rock/psychedelia is a good one. What inspired you lyrically, and in the tracks’ sound?

Our influences as a band range quite broadly, in particular we draw a lot of inspiration from the garage rock and psychedelic music of the 60s. We define ourselves as a “Garagedelic Psych Rock” band, finding equal influence and interest in both genres in the way we write our songs and approach live shows. We really want our sound and performances to be dynamic and interesting, keeping fans engaged and on their toes. These songs are a love letter to the music we love the most, and going into the next stage of the band with a new record and tour this Spring, we wanted to really showcase the spectrum of our sound, what we’re capable of, and what people can expect from us going forward.

She Loves Me / Serrated Knife by Kid Lucifer

You’re recording your sophomore record. What are the major differences listeners will hear between the forthcoming album, and your 2018 debut Nothin’ but Bangers? Did you approach the recording process differently?

This record is going to be entirely self-recorded, and we have a much more defined vision of what we want for these songs. We really took the time to develop the structure and dynamics of each song, drawing from past ideas and re-working them into not just a collection of tracks, but a coherent album where each song serves a specific purpose and works towards our unique style and vision. We are making sure to showcase every aspect of our sound with this record, with the tracks ranging in genre from up-tempo garage rock to psychedelia to surf rock and beyond. Our lead guitarist Linus and bassist Sam are also contributing songs they have written to the record, making this our most diverse release yet.

All of you are clearly passionate about music, and pursuing it full-time now. What are a couple of favourite memories/experiences that you’ve had together as a band? Have you ever had to work through difficult moments?

There have been so many highlights from this crazy journey so far. Writing and releasing our first record, then selling out our album launch show all less than a year after we moved was a pretty incredible and surreal experience. Getting to tour through Ontario was amazing, and opening for bands we love like Amyl and the Sniffers and Sugar Candy Mountain was unreal.

There are always hard moments, especially living together for over a year, but the key for us is great communication, and we’re always able to function and continue to work together and have an amazing time. I wouldn’t trade my band mates for the world. Despite all of this though, we’re really most excited for the future; we can’t wait for everyone to hear the songs we’ve been working on, and embarking on a five-week long US and Canadian tour this May is the most ambitious and exciting thing we’ve ever set out to do.

You have some wicked graphics for your single art, merch, and “Serrated Knife” video, etc. How are these visuals created? Do you collaborate with friends?

Henry Girard, our lead vocalist and primary songwriter handles all of our artwork for the records and merch. He has a very unique vision and sort of chaotic psychedelic aesthetic and is just an endlessly hard-working, creative guy. I think if he wasn’t expressing himself creatively in some form he might go crazy!

The “Serrated Knife” video is a collection of some footage I collected around BC right before we moved away. It’s a love letter to our roots on the west coast, and we love the idea of having our visuals capture the essence and vibe of the song without distracting from the most important part-the music itself. We took a similar approach with “Fourth of July” from our previous record, and we’re very happy with the result.

youtube

What’s your favourite venue to play at?

In Montreal we have had the opportunity to play at so many awesome venues. L’Escogriffe and Casa del Popolo are definitely big recommends. We were also fortunate enough to play the last show at the now closed Stylus Records when we came through Vancouver this December, and we’re really looking forward to playing at the newly opened Static Jupiter when we pass through this May.

Who are a couple of fellow Canadian acts that people should be keeping their ears open to?

We’re all big fans of the Vancouver-based punk band Sore Points; their new record is absolutely fantastic. We also got to play with Schwey when they came through Montreal, another great Vancouver group who is killing it right now. As far as the east coast goes, we really love The Fuzzy Undertones, Efy Hecks, who we just got a chance to play with, and Fade Awaays, definitely our favourite Toronto band who just released a killer EP we can’t stop listening to.

When you’re back out in Vancouver, what are some favourite places to eat/hang out at?

As I mentioned, Static Jupiter is an awesome new venue we got to check out this past December, and we’re very excited to play there while we’re on tour. Other than that, we always like to stop by and practice at Pandora’s Box Rehearsal studios, check out Red Cat and Zulu Records, hit up the Biltmore Cabaret or Red Gate Arts Society for a show, and you can’t go wrong with a late-night Duffin’s Donuts run on the way home after a late night out!

Written by: Chloe Hoy Photo credit to: Hannah Judge

#Interview#Feature#Music#Kid Lucifer#Canadian Music#Henry Girard#Quinn Letendre#Linus Heyes#Sam Schuette#Nothin' But Bangers#Vancouver#yvr#Montreal#mtl#Montreal Music#garage rock

0 notes

Text

The proactive homeowner: How to stay on top of home improvement

Yesterday was an exciting day at the Rothwards household! After three weeks of demolition and construction, we installed our new hot tub. It took six men an hour of maneuvering before we managed to set the spa into placebut we did it. And we didnt break anything. Now its a matter of completing the decking and roofing, then Kim and I will be able to enjoy our remodeled outdoor oasis!

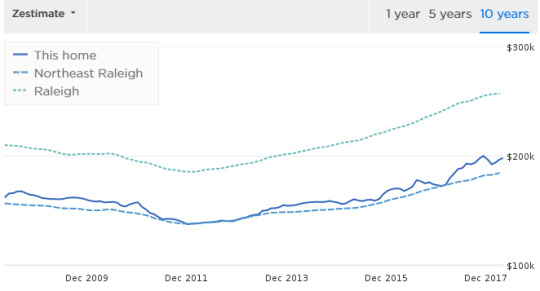

Were eager for construction to be over. Since buying our English cottage last summer, weve poured tons of money and time into a variety of renovations. Its been a non-stop construction zone. You see, during the seventeen years the previous owners lived here, they performed very little maintenance and upkeep on the home and property. When we had the place inspected before purchase, the inspector raised a lot of concerns:

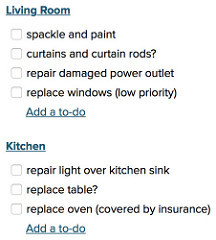

The inspection report was so dire that Kim and I almost passed on the purchase. After we did decide to buy the place, I vowed that Id be a proactive homeowner. Instead of allowing things to fall into a state of disrepair, I wanted to fix everything that was broken and then stay on top of home improvement in the years to come. Today I want to share four specific actions Ive taken to try to be a proactive homeowner. Develop a Schedule for Regular Maintenance A great place to start with home improvement is to find (or create) a regular maintenance schedule. While youll definitely have projects specific to your own house (about which more in a moment), there are certain chores that ought to be done on a routine basis. Here in Oregon, for instance, gutters should be cleaned both at the start and the end of the rainy season (late October and late April). Spring is a good time to wash windows, inside and out. Its also time to clean and set up outdoor furniture. During the summer, I like to trim trees and shrubs back from the side of the house. Fall is a good time to inspect the attic and crawlspace. To create our maintenance schedule, I started with this home maintenance checklist [Google Doc] based on an article from The Art of Manliness. I tweaked the document to fit our needs, adding and removing things specific to our home. Ive also discovered that its useful to add certain recurring tasks to my digital calendar. (Im never going to remember to change the furnace filter unless I make an appointment with myself to do so.) Create a House-Specific To-Do List

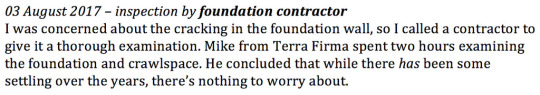

While its helpful to have a general maintenance schedule to remind you of regular tasks, its even more important to keep an up-to-date to-do list thats specific to your home. I keep our to-do list in Basecamp, a web-based project-management tool that I already use for other projects. (Ive heard good things about Asana too, although Ive never used it.) You might keep your to-do list in a spreadsheet or even a spiral notebook. For each room in the house and area of the property, I keep a separate list of tasks that need to be completed. To start, I populated these lists in two ways: I went through the pre-purchase inspection report and added every problem the inspector had flagged. Some of the stuff he noted was minor. In these cases, I made sure to mark the task as low priority.Kim and I made a slow tour of our home and yard in order to catalog other projects we wanted to complete. For example, every room in the house needs new paint. Every corner of the yard needs to be weeded and re-landscaped. We refer to our to-do list constantly. Whenever we have a free weekend for home maintenance (as we did last weekendand this coming weekend), we check the list to see which tasks are most pressing and/or most appealing. Finally and this is important (if somewhat obvious) whenever we find a new project that needs to be tackled, we add it to our list. By keeping our home projects to-do list up to date, needed maintenance should never be neglected. Keep a Home Journal Before we even moved in to our current home, I started keeping a home journal to log everything we learned about the place. Honestly, its one of the smartest things Ive ever done. I keep this home journal in a Microsoft Word document. (Ive uploaded an edited version to Google Docs for you all to look at.) Every time we do major work on the house, I make an entry in the journal. Every time we discover something new about the property, I make a note in the journal. Heres a typical entry from my home journal:

Each note includes a date and the type of work done, then a narrative description giving more detail. In some cases, I document costs. Most of the time, however, we keep receipts and invoices and other documentation in a dedicated Dropbox folder, which is where the home journal lives too. This journal is mostly meant for me. From past experience, I know that Ill forget what work we did when, which usually leads to a frustrating search for documentation. With my home journal, I have all of the needed info in one place. This home journal has a secondary purpose. I want to use it as documentation if/when Kim and I decide to sell this place. I want to be able to show prospective buyers all of the upgrades we made to the house. (Note that this benefit is purely theoretical. When we sold our motorhome recently, we learned that many buyers view work like this as evidence theres something wrong with what youre selling.) On a similar note, its smart to perform periodic video tours of your home and property. These are useful not only for you but also in the event of an insured loss, such as robbery or house fire. When shopping for a house, I film every home I tour. After buying and moving into a new place, I do another pass through with the camera. Going forward, I try to do a video tour about once per year. Build a List of Trusted Contractors Over the past fifteen years, Ive learned that contractors come in all kinds of flavors. Some are cheap. Some are fast. Some do quality work. Ive also learned that its impossible to find a contractor that possesses all three traits. Two of them? Sure. But not all three. (In other words, if a contractor is fast and high-quality, shes going to be expensive.) When we started looking for homes last Spring, my friend Emma Pattee who has experience buying and remodeling rental properties suggested that I start a spreadsheet to list trusted contractors. My husband and I have done this for a while now, she told me, and it really helps. When we find somebody we like to work with (or think we might want to work with in the future), we add them to the spreadsheet. Ill send you our current list, if youd like. Kim and I have referenced Emmas spreadsheet to find plumbers and electricians. Weve also started building our own list of contractors we trust. (For instance, we love the guy who did our carport. We hired him to do our back deck project too. Hes not cheap, but his quality is amazing!) Even with a list of trusted contractors, its important to follow standard advice when hiring folks to work on your place: Get price quotes from multiple sources. Its smart to know what your options are even if you ultimately dont go with the lowest bidder.Seek referrals. When youre ready to hire somebody for a project, ask your friends (Facebook is good for this) and contractors youve liked in the past. Ive found that good contractors know who the other good contractors are, and theyre happy to recommend them.Ask for references. If you havent worked with a contractor before, request contact info from past clients. These references will be cherry picked, of course, but theyll still give you some idea of what the company is like.Check reviews on Angies List (or similar sites). View these reviews through skeptical eyes, but check to see if theres some sort of pattern. Ive been able to rule out potential contractors, for instance, because of multiple reviews complaining about lack of communication. Searching for new contractors can be a little scary. You dont want to make a mistake by choosing somebody whos too expensive or whose work is shoddy. (Or, worse, both at once!) By maintaining a list of trusted vendors, you can reduce some of the trepidation. Plus, the list is something useful you can share with friends and family! Theres No Place Like Home I also think its smart to set aside money for future repairs and improvements. One common financial rule of thumb is to contribute 1% of your homes value to a dedicated home maintenance savings account each year. After Kim and I are done with this initial round of work, well probably do so. The deck and hot tub project should be our final large home-improvement expense for many, many years. During the past eleven months, weve repaired and/or replaced every major system in this house. Sure, theres still some small stuff that needs done we want to paint each room, for instance but these jobs are minor. Theyre things we can do ourselves for cheap. Honestly, Im looking forward to some peace and quiet. Its been exhausting to live and work in a construction zone! First, though, Im going to have our house inspected again. After plowing so many resources into repairing and renovating this place, I want to have a neutral third party go back through to make sure weve addressed all of the important issues and that these issues have been handled correctly. As frustrating (and expensive) as the past year has been, we dont regret buying this house. We love it here. We want to continue loving this place, which means were going to do our best to stay on top of maintenance and home improvements. Were going to do our best to be proactive homeowners. https://www.getrichslowly.org/home-improvement/

0 notes

Text

Stephanie Inglis: Scottish judo stellar reverts dwelling to Highlands – BBC News

Media captionJudo starring Stephanie Inglis returns to Highland home

Having been given a 1% possibility of survival following a motorcycle accident in Vietnam, Scottish judo star Stephanie Inglis is returning home to the Highlands.

The Commonwealth Games silver medallist, 27, has vowed to return to her boast, simply 79 eras after tolerating grave injuries including rupturing her neck in two places.

“I’ve been told the goal is always to get back into your normal way of life and judo for me was normal – I’ve done it since I was four, ” Inglis explained.

“To not be able to do judo wouldn’t be my normal life.”

Image copyright Stacey Inglis

Image caption Stephanie Inglis acquired silver at the Commonwealth Competition in Glasgow

The accident on 11 May likewise left Stephanie with a serious heading harm, illness including pneumonia and septicaemia, deep vein thrombosis, and a tracheotomy which symbolized she was unable to talk to her family.

“( Leaving hospital) is just the start of my journey, there’s still a long way to get-up-and-go, ” she said.

“I’ll be continuing my rehab every day and doing my physio which I’ll carry on until I’m back to the course I was.

“After this year I’ll start looking to get back into the sport and doing some course, just get my fitness back. But for now I’m going back up to Inverness.

“I’ll help at my dad’s judo guild, help coach so at least I’m in and around it as I do miss it.”

Specialist treatment

Inglis arrived back in Scotland six weeks ago and was considered at Edinburgh’s Western General Hospital before moving to a specialist force in Fife.

“My first recall was waking up in the Edinburgh hospital and thinking ‘what’s going on, what’s happened? ‘

“Luckily my mum and pa where there and explained to me that I’d been in a motorbike collision and a little of what had happened – that was probably the scariest situation listening all this trash that went wrong and me not having a clue it was going on.

“And the second thing was realising I had had all my fuzz lop off for my brain operation, that was a bit shocking.”

Image caption Stephanie’s physical convalescence is said to be progressing well

But Stephanie accepts, thanks to the care she has received, her recuperation is progressing well and she continues to feel stronger.

“My physio is helping me improve every day, I’m appearing much more confident on my hoofs plus I have an occupational therapist and a lecture and usage therapist, so I see my addres is back to normal.”

The first thing on her knowledge once she is home in Daviot is getting a good night’s sleep.

“Nothing licks your own bed. I haven’t had a good night’s sleep since coming back home so that’s what I’m looking forward to, ” she said.

Image copyright Stacey Inglis

Image caption Stephanie Inglis has done judo since the age of four

While the judoka does not recollect the incident, or being operated to Bangkok for medication, she does acknowledge that the generosity of those who donated to the crowdfunding safarus – elevating more than 327,000 – helped save her life.

“It’s vast, I can’t even get my top around all of the followers and all the people who donated – there’s such exquisite people in this world.

“And I feel so lucky to be part of the big judo house. They all only pulled together and I have to thank my good friend Khalid Gehlan for defining( the fund) up.

“It’s massive and I only can’t believe so many people came together for me.

“I’m eternally grateful because if it wasn’t for them I might not have had the money to get home and who is familiar with, I might not have been sitting here talking to you today.”

Image copyright Stacey Inglis

Image caption The Vietnam teaching trip was Stephanie’s first venture outside of her boast

Insurance problem

For her parents, Robert and Alison Inglis, it has been a long, fraught summer since arrived here Vietnam to find their daughter in an ambulance having been refused therapy because of a clause in her insurance policy.

“I never ever thought that I would be sitting here on the working day getting ready to go home, ” said Alison Inglis. “I reputed at one stagecoach that they are able to never happen and it’s here often, much more quickly than I feel anybody expected.

“I’m sitting concluding how ill she was, but it’s a faded remember – did it really happen, did “weve been” go through that?

“I don’t think anybody banked on her being as rapid or going just as much back as she has as it was pretty serious the hurt she sustained.

“Taking her back home is phenomenal.”

Image caption Stephanie, claim, has been supported by her sister Stacey

The funding campaign is not simply reached all corners of the UK, but recognized beings from as far away as Malta, Egypt, Holland, Australia and America establish money.

“I don’t understand it but I’m ever so grateful, ” lent her mom Alison.

“I think what touched people is that it’s every parent’s worst nightmare.

“So many of our children used to go and do these happenings and you think they’re safe and protected and all of a sudden you find out they’re not.

“If anything I’m hoping that’s made a lot of beings sit up, check the( insurance) the development of policies and get solicitors implied as we are genuinely couldn’t find the clauses.”

‘Inspiring’ strength

While they are carefully elated at the progress Stephanie has realise, their own families admit they have not fully come to terms with everything that has happened since the accident 11 weeks ago.

“I’ve reflected on some things, and some I get upset about. In the beginning Stephanie didn’t need to go through as much as she did and I get angry at that, ” Alison says.

Her mother declares she is in awe of her daughter, and how positive she has remained throughout.

“I didn’t realise she was as strong as she is, she’s quite amazing.”

The judo star still has a further operation to come this year, but Alison hopes her improvement will rise from there – even if that means the annoy of do with her return to the boast she “lives and breathes”.

Inglis is preparing to travel north along with sister Stacey Inglis, who has been by her line-up since she returned to Scotland, helping her with her recovery.

And there is fighting talk already from her older sibling, whose medal-winning competitive spirit is now clearly glittering through.

“Stacey’s going battered on the judo matting when I’m better, ” joked Stephanie.

The post Stephanie Inglis: Scottish judo stellar reverts dwelling to Highlands – BBC News appeared first on apsbicepstraining.com.

from WordPress http://ift.tt/2xsBOPC via IFTTT

0 notes

Text

Money story: Small acts of kindness create social capital

This guest post from Christine Hughey is part of the money stories feature at Get Rich Slowly. Some stories contain general advice; others are examples of how a GRS reader achieved financial success or failure. These stories feature folks from all stages of financial maturity. I met Christine in January when I attended Camp FI in Florida. Christine is starting a new Nashville food tour company, so when I spent a week there in April, naturally I let her show me around. It was awesome! In this article, she shares how small acts of kindness have proven to be worth more than she ever imagined. Im about to share something that completely changed my life yet its something that I didnt know much about until a few years ago. Its a concept called social capital, and I believe that it can change your life too (and make you wealthier in the process). Now, if youve been reading Get Rich Slowly for a long time, you might have seen J.D. write about social capital in the past. He too is a big believer in its power. But many of you have probably never heard of the idea. What is social capital?

According to Wikipedia: Social capital is a form of economic and cultural capital in which social networks are central; transactions are marked by reciprocity, trust, and cooperation; and market agents produce goods and services not mainly for themselves, but for a common good. [] Social capital has been used to explain the improved performance of diverse groups, the growth of entrepreneurial firms, superior managerial performance, enhanced supply chain relations, the value derived from strategic alliances, and the evolution of communities. Theres a lot of jargon in that definition, but what it really comes down to is this: Social capital is all about networking (in a non-slimy way) and about giving without the expectation of return. Although its not tangible, social capital is very real and very powerful. Its also very valuable. That said, I dont see social capital discussed much on personal finance and financial independence blogs. I imagine thats because its hard to assign an actual dollar value to it. How do you assign a dollar value to helping somebody move? How do you quantify the savings when your neighbor mows your lawn for you all summer? Whats the price tag on growing flower, fruits, or vegetables, then giving them to your friends and family? In the world of personal finance, we tend to look at numbers first. Social capital doesnt work in that way. Social capital is about creating value and creating a positive impact among your social network, whether that value and network are small (like on a neighborhood level) or large (like volunteering time for a larger project). Social Capital in Real Life Social capital might make more sense (and seem less abstract) if we look at a real-life example. My husband was the one that really taught me about social capital. Jack and I came from drastically different backgrounds, and we did very different things for work. While I worked a full-time salary engineering job, he worked as a gig-style man for hire entrepreneur. When we first started dating, I noticed that he was often doing strange favors for people. He owned a truck so he would get calls to help everyone and their friends move. Ill never forget the time that he got a call from his best friend Robert asking if he could help Roberts co-worker move a washer and dryer. Sure enough, early on a Saturday morning Jack was off moving some womans washer and dryer to a temporary home. A week later, he got another call to move the washer and dryer into the womans new permanent home. I consider myself a very nice person, but I couldnt believe how much time, effort, and gas Jack spent moving the same washer and dryer to multiple locations for someone he didnt even know. But as a result, that random woman is now one of our very good friends, and Jack will be DJing her wedding this fall. Other great things have come from Jacks act of kindness. Robert hired Jack to manage the audio for some of the numerous music festivals that he puts on here in town. Amberly, (the random woman) helped support and promote a new DJ gig that Jack started in 2015. Shes one of his biggest supporters to date. What now seems like a super small gesture led to over a thousand dollars worth of income for us when we really needed it. Social Capital from the Garden Heres another example. I grow cut flowers for bouquets. When I was young, my dad didnt believe in purchasing cut flowers because they die quickly. It seemed like a waste of money to him, so we never had them in our house. While we were dating, Jack learned that I love cut flowers. Every couple of weeks, hed buy me a new bouquet so that Id almost always have beautiful cut flowers in my house. It was an incredibly special gesture since flowers were something that I would only purchase for myself on rare occasions. After we were married, our financial world hit the fan. After two job losses, our income fell by 80%. Naturally, there was no room in our budget for cut flowers. When things finally settled down and we bought a fixer-upper home, cut flowers still werent in the budget. I missed them, so I decided to grow my own. Being an engineer, I decided to conduct some tests to see which varieties were worth the cost. My first test for an investment of about $20 consisted of four different flowers, but only the cosmos and zinnias were successful. Although not every variety grew, I enjoyed tending the flowers and watching them grow. And, of course, it was awesome having fresh flowers in my house again. Plus, I had so many flowers that I made bouquets and gave a bunch away to friends.

Last year was the second year of my flower-growing experiment. I planted more seed varieties and added lily and dahlia bulbs to the mix. I had an explosion of flowers for five months out of the year. I was completely in love! I started giving flowers to more and more people: neighbors, friends, colleagues. At the time, I worked as a tour guide for a company here in Nashville. My tours required taking groups of people into very busy restaurants in the downtown area. Getting quick service of our food and drinks was critical to the success of my tours. I was so appreciative of the bartenders and servers that would help me and my tours that Id bring bouquets of my homegrown flowers to them on my Sundays off. I didnt realize it at the time, but we were all building social capital. When the restaurant folks helped me, I was grateful. When I gave them flowers, they were grateful. All of us were building a sort of invisible wealth that comes from a network of reciprocity. The Rewards of Social Capital Earlier this year, I started my own food tour company in Nashville. Its a scary thing launching out on your own! How do you build a business from scratch? Fortunately, the bartenders and servers that I gave flowers to have become my biggest cheerleaders. Theyve taken my tours, left glowing online reviews, and recommended me to the customers in their restaurants. Theyve put my card on the wall of honor reserved for the best companies in town.

This scary time in my life is a little less scary because of social capital. In the past, when I was performing the small act of kindness of delivering flowers, I wasnt expecting anything in return. I was just grateful for the help theyd given me already. I never imagined thered be any kind of financial gain. But in the end, there has been. Just because something cant be documented in our net worth doesnt mean that its without monetary value. Those flowers have been converted into real dollars today. More than that, theyve created traction for increased business in the future. When you own your own business, your reputation is everything. (Your reputation can make or break you in a community-centered city like Nashville.) When you go the extra mile, whether moving a washer and dryer for a stranger, or giving flowers for no special reason, you create a positive impact. You build social capital. While writing this article, Jack and I did the math. We calculate that the social capital weve fostered in Nashville has brought us over $10,000 of direct value to our lives in the past year. Thats huge for a household with an income of $65,000. (Plus, since the value doesnt come to us as dollars, theres no tax on it.) When you take a love of gardening (or writing or social media or whatever) and you spread your gifts to your neighborhood and community, your generosity will come back manyfold in ways that mean more than money. These seemingly small acts of kindness create social capital that can bring value to your life down the road. Someday when youre looking for a job, or trying to start a business, those first few tough months and years will be so much easier when you have your community behind you. Take some time to build social capital while building wealth, and watch how it improves your life. J.D.s note: Heres another way Christine has built social capital. In April, I visited Nashville to attend a blogging retreat. (Yes, really.) Christine invited me and my buddies to join her Nashville food tour. While that didnt pan out my colleagues were up late drinking the night before haha! she did take the time to share some of her favorite food with me while also extolling the virtues of her city (and its hockey team). It was a fun (and delicious) experience, one that I hear theyve shared with other friends. Social capital has been huge in my life. Seriously, I believe its been almost as valuable to me as monetary capital. And its just as valuable to Christine. https://www.getrichslowly.org/kindness-creates-social-capital/

0 notes

Text